Abstract

Addressing the persistent urban-rural income gap is critical for sustainable and inclusive development. Leveraging panel data from 286 Chinese prefecture-level cities (2005–2022) and a multi-period difference-in-differences design, this study evaluates the impact of China’s Green Finance Reform and Innovation Pilot Zones (GFRIPZ) policy. First, the GFRIPZ policy significantly narrows the urban-rural income gap, with results robust to a range of sensitivity tests. Second, this convergence is driven by curbing conventional transport-infrastructure expansion and enhancing tertiary-sector employment, thereby improving labor quality. Third, policy effectiveness varies geographically and administratively, with the strongest impacts in central and western regions and non-provincial capitals. Fourth, negative spatial spillovers arise as pilot zones draw resources from neighboring non-pilot areas. These findings highlight the transformative potential of targeted green finance reforms for inclusive structural transformation in emerging economies.

1. Introduction

In the accelerating global agenda for sustainable development, the persistent urban-rural income gap remains a critical barrier to inclusive growth, drawing increasing attention from the international community [1,2]. The United Nations’ 2030 Agenda for Sustainable Development explicitly mandates the reduction in inequalities both within and among countries [3]. According to the World Bank’s Poverty and Shared Prosperity Report 2023, the average urban-rural income ratio in developing countries stands at 2.8:1, with Sub-Saharan Africa exhibiting an alarming 4.5:1 disparity [4,5]. The Organization for Economic Co-operation and Development (OECD) highlights that traditional fiscal transfers offer only temporary relief, whereas green finance—by restructuring the allocation of production factors—can generate sustainable, long-term adjustments [6]. For instance, Germany’s Renewable Energy Act has catalyzed a 23% increase in rural household incomes through photovoltaic industry development [7], while Brazil’s Low Carbon Agriculture (ABC) Program has enhanced smallholder productivity by 34% via targeted low-carbon credit schemes [8].

Against the backdrop of coordinated climate governance and sustainable development goals, green finance policies have become pivotal instruments harmonizing environmental benefits with economic returns, profoundly reshaping global income distribution patterns [9]. The United Nations Development Programme’s 2025 report on Ocean and Island Climate Sustainability notes that 89 countries worldwide have integrated green finance into their national strategies, with 63% of developing countries achieving dual objectives of emission reduction and poverty alleviation through innovative financing frameworks [10,11].

Green finance, as an innovative tool balancing economic growth and environmental stewardship, is increasingly recognized by the international community as a key policy lever to mitigate regional development imbalances [12]. The World Bank’s 2023 Inclusive Green Growth Report documents that developed countries have successfully transformed environmental gains into rural economic benefits through instruments such as green bonds and carbon trading—evidenced by Germany’s renewable energy community initiatives that raised farmer incomes [13]. Conversely, developing countries have leveraged World Bank-supported green agricultural credit projects to realize an average annual income growth of 8.5% among smallholder farmers in India and Brazil [14].

As the largest developing country globally, China’s urban-rural income gap encapsulates the dual economic structure typical of emerging economies while reflecting the complex interplay between institutional reforms and market mechanisms amid economic transformation [15]. Although the urban-rural income ratio has declined significantly from 3.33:1 in 2009 to 2.45:1 in 2023, the absolute per capita disposable income gap remains substantial at 18,736 RMB, underscoring the limitations of traditional income redistribution mechanisms.

In this context, exploring the role of green finance as an innovative policy instrument in narrowing the urban-rural income gap is crucial [16]. Such an investigation not only deepens our theoretical understanding of income distribution dynamics in transition economies but also offers practical insights for designing sustainable development models that balance efficiency and equity [17]. Since 2017, the Chinese government has progressively established Green Finance Reform and Innovation Pilot Zones in regionally representative areas: Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang in 2017, followed by the Lanzhou New Area in 2019 and Chongqing in 2022. This phased and regionally differentiated policy experiment provides a valuable quasi-natural experimental setting for rigorously assessing how green finance interventions influence convergence between urban and rural incomes.

This study leverages the GFRIPZ initiative as a quasi-natural experiment to transcend the conventional view of green finance as merely an environmental policy. We systematically uncover the multifaceted mechanisms through which GFRIPZ influences urban-rural income disparities, thereby laying a theoretical foundation for building an inclusive green finance system. Our findings aim to advance the global sustainable development agenda by translating conceptual consensus into institutional innovation and providing actionable pathways for developing countries to overcome entrenched urban-rural dualism.

The specific regions involved are shown in Table 1.

Table 1.

The list of green finance reform and innovation pilot zones.

2. Literature Review

Current research on green finance primarily focuses on two core perspectives: the correlation between policy implementation effects and corporate innovation, and the regional differentiated mechanisms and policy optimization. Synthesizing 146 relevant studies, Desalegn and Tang indicate that while green finance policies can steer capital towards low-carbon sectors and alleviate the global green investment gap, they face challenges such as risk-return trade-offs, insufficient regulatory coordination, and imperfect green project screening mechanisms, with significant variations in policy effects across different regions [18]. Zhou et al., using data from 280 prefecture-level cities from 2008 to 2019 and employing a difference-in-differences (DID) model, confirm that green finance pilot policies significantly enhance total factor energy efficiency by optimizing industrial structure and promoting green technology innovation, with more pronounced effects in cities with stringent environmental enforcement and robust intellectual property protection [19]. Furthermore, studies by Wang et al. corroborate the promotion of green innovation in industrial enterprises within pilot zones, particularly for environmental, non-state-owned, and large-scale enterprises, driven by increased green credit and alleviated financing constraints [20].

Research on the urban-rural income gap concentrates on economic structure and policy orientation. Xie et al. demonstrate an inverted U-shaped relationship between climate change and urban-rural income gap, mediated by differences in urban-rural income levels, urbanization rates, and employment structures, with regional response heterogeneity across eastern, central, and western regions [21]. Su et al. find that urbanization significantly narrows the urban-rural income gap in the eastern region, aligning with the Kuznets curve [22], while Chen and Luo reveal dynamic correlations between urbanization and the urban-rural income gap, with delayed household registration system reforms weakening the poverty reduction effect of urbanization [23]. Wen and Chen point out that green innovation narrows the urban-rural gap by promoting population urbanization, ecological urbanization, and labor transfer to non-agricultural industries, but insufficient environmental regulations may widen the gap due to technological barriers [24]. Similarly, Qu et al. examine the role of education levels and grain production policies, respectively, in influencing urban-rural income gaps, highlighting trade-offs, and regional disparities [25].

Existing studies demonstrate that financial development and green finance affect the urban-rural income gap through multiple, interlinked channels. Improved financial service quality in rural areas reduces transaction costs, enhances risk management, and broadens credit access for households and enterprises, thereby facilitating entrepreneurship and income generation [26,27,28,29]. Expanded rural financial availability strengthens capital accumulation in both agricultural and nonfarm sectors, enabling residents to invest in productivity-enhancing assets, and green finance policies have also been shown to promote industrial structure upgrading by directing resources into low-carbon and higher-value sectors, which diversifies the rural economic base and raises household earnings [30,31]. Spatial analyses further reveal positive spillovers from digital inclusive finance, with neighboring regions benefiting from narrowed financial divides and more integrated development, thus mitigating income disparities [32,33].

While the existing literature provides valuable insights, several gaps remain. First, few studies have focused on the direct impact of China’s GFRIPZ on the urban-rural income gap, particularly using rigorous quasi-natural experimental designs to establish causality. Second, the specific mechanisms through which GFRIPZ affects income disparities, beyond broad channels like financial inclusion or industrial upgrading, warrant further investigation to unpack the policy’s nuanced effects. Third, the heterogeneous effects of GFRIPZ across different regions and administrative levels, considering spatial spillover effects, remain underexplored, limiting the understanding of contextual factors influencing policy effectiveness. To address these gaps, this paper aims to provide a comprehensive analysis of the impact, mechanisms, and heterogeneous effects of GFRIPZ on the urban-rural income gap in China. By employing a quasi-natural experiment and exploring specific transmission channels and spatial dimensions, this study contributes to a more nuanced understanding of the role of green finance in promoting inclusive and sustainable development.

3. Theoretical Analysis and Hypothesis Development

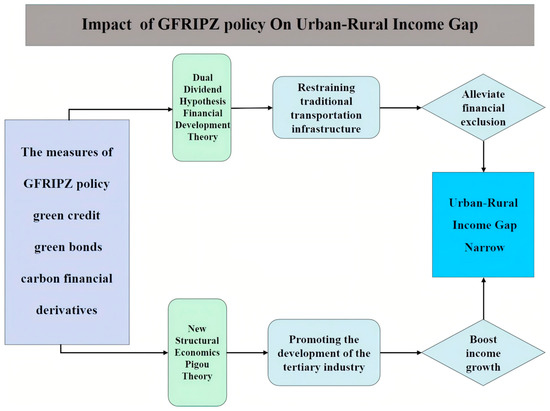

3.1. GFRIPZ Policy and the Reduction in the Urban-Rural Income Gap

The theoretical framework underpinning our analysis of the GFRIPZ policy rests on three complementary channels. First, the double dividend hypothesis in environmental economics provides the normative foundation by demonstrating that institutional arrangements designed for environmental protection can also generate economic benefits through improvements in ecological quality and resource allocation efficiency [34]. Second, New Structural Economics offers the structural transformation perspective, arguing that green finance alleviates rural credit constraints, leverages local factor endowments, and directs industries toward higher value-added and environmentally friendly activities in rural areas [35]. Third, Pigou’s welfare economics contributes to the redistributive mechanism by emphasizing externality internalization and ecological compensation; this channel corrects the environmental harms transferred from urban to rural regions and produces compensatory income flows that benefit rural households [36]. By integrating these three channels, our framework posits that the GFRIPZ policy enhances environmental outcomes, accelerates rural industrial upgrading, and reallocates income in favor of rural areas, thereby reducing the income gap between urban and rural areas. Based on this integrated reasoning, we propose the following hypothesis.

H1:

The GFRIPZ policy can narrow the urban-rural income gap.

As an institutional tool for environmental governance, the GFRIPZ policy reshapes regional capital allocation by prioritizing investment in low-carbon transportation and suppressing funding for conventional highway expansion. By limiting new highway projects in rural areas, the policy frees public resources once devoted to land acquisition and road construction [37]. Those resources are then redirected to electric bus fleets and rural rail extensions, generating demand for local drivers, maintenance technicians, charging-station installers, and renewable-energy grid operators [38]. Simultaneously, incentives for intelligent logistics networks foster the development of rural warehousing facilities, digital platform management services, and eco-friendly packaging enterprises. Together, these initiatives establish a sustainable transport ecosystem that provides stable green employment, raises household incomes in rural regions, and thus narrows the urban-rural income gap.

Concurrently, the GFRIPZ policy couples environmental regulation with financial innovation to transform factor allocation across industries [39]. Instruments such as green credit interest subsidies, environmental-rights mortgages, and emission trading pilots significantly lower financing thresholds for emerging service sectors, including environmental consulting, eco-tourism and green logistics, while also incentivizing traditional manufacturers to invest in cleaner technologies [40]. This dual pressure accelerates industrial upgrading by shifting labor from energy-intensive activities into the tertiary sector [41]. Rural workers, supported by targeted vocational training and certification programs, escape the low value-added trap of agriculture and develop specialized skills within the green service industry chain [42]. As the share of tertiary employment rises, wage incomes increase relative to operating incomes, diversifying rural earnings and narrowing the traditional wage-scissors gap. Together, the suppression of conventional infrastructure investment and the optimization of employment structure operate in sequence to deliver a measurable reduction in the urban-rural income disparity [43].

Based on the above analysis, we propose the following hypothesis:

H2:

The GFRIPZ policy can narrow the urban-rural income gap by suppressing traditional transportation infrastructure construction and optimizing employment structure by improving the number of employments in the tertiary industry.

3.2. Spatial Effects of the GFRIPZ Policy

Hirschman’s “polarization and trickle-down” theory suggests that the agglomeration effects of growth poles can intensify regional disparities through heightened competition for scarce factors [44]. The Green Finance Reform and Innovation Pilot Zones (GFRIPZ), leveraging policy privileges, have created institutional “lowlands” where preferential credit supply and green technology subsidies trigger “policy arbitrage clustering.” This dynamic induces a unidirectional flow of scarce resources—such as green agricultural capital and ecological industry chain support funds—from surrounding counties into the pilot zones.

This asymmetric allocation of factors imposes dual pressures on rural areas outside the pilot zones [45]. First, the monopolistic control of green capital by GFRIPZ weakens the capacity of neighboring rural regions to secure financial support for low-carbon transformation, thereby delaying the modernization of their agricultural systems. Second, the industrial screening driven by elevated environmental standards within pilot zones forces traditional pollution-intensive agricultural enterprises to relocate to adjacent counties with weaker regulatory oversight. These transferred industries often retain their original pollution characteristics, trapping surrounding counties in a vicious cycle of rising environmental governance costs, declining fiscal capacity for agricultural support, and shrinking rural public services.

Furthermore, urban capital’s mergers and acquisitions of these relocated industries further compress the factor income shares of rural residents [46]. Simultaneously, cross-regional savings absorbed by the pilot zones through instruments such as green bonds indirectly drain potential investment sources from neighboring rural areas. Ultimately, this spatial dynamic produces a segmented development pattern characterized by “green finance highlands” juxtaposed with “traditional agricultural lowlands,” perpetuating and even amplifying the urban-rural income gap via a transmission chain of financial exclusion and industrial downgrading.

Based on the above analysis, we propose the following hypothesis:

H3:

The implementation of the GFRIPZ policy generates negative spatial spillover effects, hindering the narrowing of the urban-rural income gap in surrounding non-pilot regions.

The specific mechanism of action is shown in Figure 1.

Figure 1.

Mechanism of GFRIPZ policy in promoting the narrowing of the urban-rural income gap.

4. Sample Selection and Research Design

4.1. Sample Selection and Data Sources

This study investigates the effects of the Green Finance Reform and Innovation Pilot Zone (GFRIPZ) policy by focusing on nine prefecture-level cities designated as pilot sites. These include the first batch of pilot zones established in 2017, covering five provinces (regions) and eight localities, as well as the second batch initiated in 2019, which includes Lanzhou New District. These cities constitute the treatment group. The empirical analysis employs a panel dataset comprising 286 prefecture-level cities across China from 2005 to 2022. Due to significant data deficiencies, Hami City and Changji Hui Autonomous Prefecture in Xinjiang were excluded to ensure data reliability. The dataset was compiled from authoritative sources such as the annual China City Statistical Yearbook, the National Bureau of Statistics, the National Intellectual Property Administration, and the National Basic Geographic Information Center. To address missing observations and maintain data integrity, linear interpolation and regression-based imputation methods were applied, enabling a comprehensive and robust dataset for analysis.

4.2. Variable Description

The dependent variable, urban-rural income gap (Gap), is measured as the absolute difference between per capita disposable income in urban and rural areas, expressed in ten thousand yuan. This measure follows the established methodologies of Chang et al. [47], providing a direct and intuitive indicator of income inequality between urban and rural residents. The core explanatory variable is the GFRIPZ policy (GF_Policy), operationalized as an interaction term between city and year fixed effects (city × year). Cities designated as pilot zones are assigned a value of one, while non-pilot cities are coded zero. The policy implementation is captured by a year dummy, set to zero before and one after the policy enactment year. Chongqing, which became a pilot city in 2022, is excluded from the treatment group due to the anticipated lag in policy effects, ensuring the accuracy of causal inference.

To control for confounding factors influencing urban-rural income disparities, several control variables are incorporated. Industrial structure (Ins) is proxied by the ratio of tertiary sector value-added to secondary sector value-added, reflecting economic modernization and the shift towards service-oriented industries that affect labor market dynamics and income distribution. Urbanization rate (urb), defined as the ratio of urban permanent residents to total population, captures the demographic and economic transformation influencing income inequality. Financial development level (Fina) is measured by the ratio of year-end loan balances of financial institutions to GDP, indicating the depth and accessibility of financial markets. Government support (Gov) is approximated by the ratio of local government general budget expenditures to GDP, reflecting fiscal capacity and policy interventions that may mitigate income disparities. Taxation level (Tax) is represented by the ratio of industrial and commercial tax revenues to GDP, capturing the redistributive effects of tax policies. Human capital level (HC) is measured by the number of university students per 10,000 people, serving as a proxy for workforce skill and potential income mobility.

Furthermore, this study explores two mechanism variables that may mediate the impact of the GFRIPZ policy on income disparities. Labor quality (LA) is proxied by the proportion of employment in the tertiary sector, reflecting the skill composition and productivity of the labor force, which are critical determinants of income levels. Transportation infrastructure (lnTI) is captured by the natural logarithm of total domestic highway length, representing connectivity and accessibility that facilitate economic integration and resource flow between urban and rural areas. Descriptive statistics for all variables are summarized in Table 2.

Table 2.

Descriptive statistics.

4.3. Model Specification

Building on the theoretical framework and considering the staggered timing of the establishment of China’s GFRIPZ, this study employs a multi-period difference-in-differences (DID) approach as a quasi-natural experimental design to rigorously evaluate the causal effect of the GFRIPZ policy on urban-rural income disparities. This methodology effectively exploits the temporal and spatial variation in policy implementation, thereby controlling for unobserved heterogeneity across cities and over time.

Formally, the empirical model is specified as shown in Equation (1):

where the subscripts i and t denote city and year, respectively. The dependent variable Gapi,t measures the urban-rural income gap in city i at year t. The key explanatory variable GF_Policyi,t is an interaction dummy that equals one if city i is designated as a GFRIPZ pilot zone in year t or thereafter, and zero otherwise. This variable captures the treatment effect of the policy. Controli,t represents a vector of control variables that account for other factors influencing income disparity, including industrial structure, urbanization rate, financial development, government support, taxation level, and human capital, as previously described. The term α is the intercept, μi captures city-specific fixed effects controlling for time-invariant characteristics unique to each city, while δt is the Control variable for common shocks or trends affecting all cities in a given year. Finally, εi,t denotes the idiosyncratic error term.

This multi-period DID framework allows for a robust identification of the GFRIPZ policy’s impact by comparing treated and untreated cities before and after policy implementation, while controlling for confounding factors and unobserved heterogeneity. Moreover, the inclusion of city and year fixed effects mitigates potential biases arising from omitted variables that are constant across time or cities. The coefficient β thus provides an unbiased estimate of the average treatment effect of the GFRIPZ policy on narrowing or widening the urban-rural income gap.

5. Empirical Results Analysis

5.1. Baseline Regression

To empirically test the hypotheses proposed in this study, we first estimate the baseline regression model to examine the impact of the Green Finance Reform and Innovation Pilot Zone (GFRIPZ) policy on urban-rural income disparities. The regression results are summarized in Table 3. Specifically, Model 1 and Model 2 present the estimated coefficients under two specifications: both models control for city and year fixed effects, while Model 2 further incorporates a comprehensive set of control variables as described previously.

Table 3.

Benchmark regression results.

The coefficient on the core explanatory variable, GFRIPZ policy, is negative and statistically significant in both models. In Model 1, which excludes control variables, the coefficient is −0.310 and significant at the 1% level. After including control variables in Model 2, the coefficient remains negative at −0.252 and significant at the 5% level. These findings robustly indicate that the establishment of GFRIPZ pilot zones is associated with a significant reduction in the urban-rural income gap, thereby providing strong empirical support for Hypothesis 1 (H1).

This result aligns with the findings of Mushtaq and Bruneau [48], who demonstrate that the development of local financial institutions exerts a significant narrowing effect on both absolute and relative urban-rural income disparities at the county level. The implementation of the GFRIPZ policy has catalyzed new growth opportunities for local financial institutions, facilitating their expansion and deepening financial inclusion. This, in turn, promotes more equitable income distribution between urban and rural residents. Therefore, the observed negative and significant coefficient on the GFRIPZ policy in our baseline regression not only confirms the hypothesized policy effect but also resonates with existing literature on the economic benefits of financial sector development in reducing income inequality.

5.2. Robustness Checks

To ensure the reliability of the baseline findings, a series of robustness tests was conducted to address potential concerns regarding model assumptions, omitted variables, and external shocks.

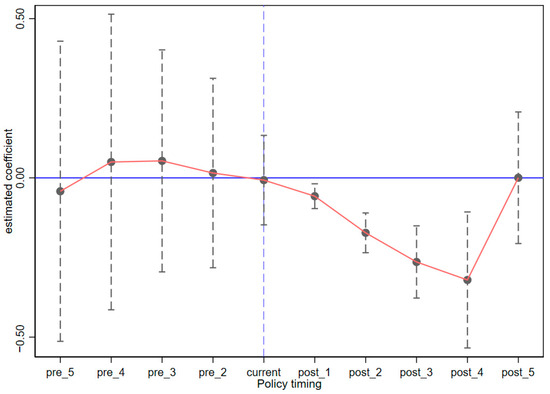

5.2.1. Parallel Trends Assumption

The parallel trends assumption—a critical prerequisite for the validity of the difference-in-differences (DID) approach—was rigorously tested. The results, illustrated in Figure 2, show that prior to the implementation of the GFRIPZ policy, the estimated coefficients for the five years before treatment (aggregated as Pre_5 for all years before 2012) are statistically insignificant and exhibit a relatively flat trend. This indicates no systematic difference in the trajectory of urban-rural income gaps between pilot and non-pilot cities before policy enactment. Importantly, from the policy implementation year (2017) onward, the coefficients become significantly negative and their magnitude grows steadily, suggesting that although the policy effect manifests with some lag, the establishment of GFRIPZ pilot zones exerts a sustained and positive influence in narrowing the urban-rural income gap.

Figure 2.

Results of the balance trend test.

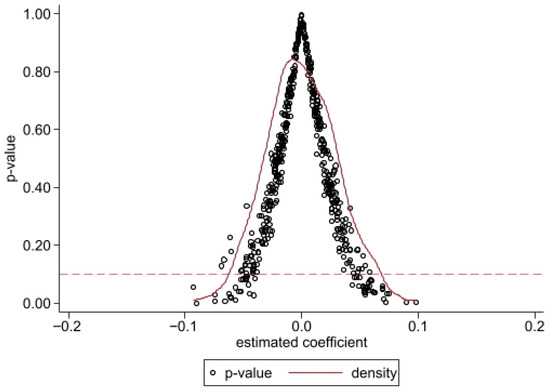

5.2.2. Placebo Test

Building upon the confirmation of parallel trends, a placebo test was performed to exclude the possibility that the baseline results were driven by random shocks or unobserved confounders. By randomly assigning treatment status to cities and re-estimating the baseline model 500 times, the distribution of placebo coefficients clustered tightly around zero with most p-values exceeding 0.1, as shown in Figure 3. This contrasts sharply with the significant negative coefficient (−0.252) obtained in the actual baseline regression, reinforcing the conclusion that the observed policy effect is not a spurious artifact but a genuine causal impact.

Figure 3.

Results of the placebo test.

5.2.3. Eliminate the Impact of COVID-19

Recognizing the profound economic disruptions caused by the COVID-19 pandemic and associated containment measures between 2020 and 2022, which could confound the analysis, the sample was restricted to exclude these years. The re-estimated models (Model 3 and Model 4 in Table 4) confirm that the coefficient on the GFRIPZ policy remains significantly negative (−0.298 and −0.256, respectively), consistent in magnitude and significance with the baseline results. This suggests that the pandemic did not materially bias the estimated effect of the GFRIPZ policy on reducing urban-rural income disparities.

Table 4.

Results of excluding the impact of COVID-19.

5.2.4. Eliminate Significant Policy Interference

To further isolate the policy effect from other contemporaneous interventions, the potential confounding influence of high-speed rail (HSR) openings was controlled for by including a HSR dummy variable (HW) in the regression. The results reported in Table 5 (Models 5 and 6) demonstrate that the inclusion of HW does not materially alter the magnitude or significance of the GFRIPZ policy coefficient. Even after excluding cities with overlapping policy interventions, the GFRIPZ policy’s role in narrowing the income gap remains robust, underscoring the validity of the baseline findings.

Table 5.

Results of eliminating significant policy interference.

5.2.5. Adjust the Research Sample

Addressing concerns about unobserved provincial-level time trends that might bias estimates, the model was extended to include province-by-year fixed effects. As shown in Table 6 (Models 7 and 8), after controlling for these finer-grained temporal variations, the GFRIPZ policy coefficient remains significantly negative (−0.189 and −0.168), confirming that the policy effect is not driven by broader provincial economic cycles or shocks.

Table 6.

Results of the adjustment of the study samples.

5.2.6. Propensity Score Matching Method (PSM-DID)

Given the non-random assignment of the GFRIPZ policy and potential sample selection bias, propensity score matching combined with DID (PSM-DID) was employed to enhance comparability between treated and control cities. Matching was conducted using both kernel and radius methods. Table 7 presents the results, where the GFRIPZ policy consistently exhibits a significant negative effect on the urban-rural income gap at the 5% level across all matching techniques. This consistency further substantiates the robustness of the baseline estimates.

Table 7.

Results of propensity score matching.

5.2.7. Endogenous Processing

Finally, to address potential endogeneity concerns arising from omitted variables or reverse causality, an instrumental variable (IV) approach was implemented. River density (RD) at the prefecture level was selected as an instrument, justified by its exogeneity and relevance: river networks are natural geographic features unrelated to contemporaneous economic factors affecting income disparities, yet ecologically rich areas with dense waterways are more likely to be designated as GFRIPZ pilot zones. The first-stage regression confirms a strong positive association between the interaction of RD and the post-policy period (RD*post) and GF_Policy, while the second-stage results (Table 8) reveal a significantly negative effect of GFRIPZ policy on income disparities at the 1% level. Diagnostic tests for underidentification and weak instruments validate the instrument’s strength and relevance. These IV results provide compelling evidence that the observed policy effects are not driven by endogeneity, thereby reinforcing the causal interpretation of the GFRIPZ policy’s role in reducing the urban-rural income gap.

Table 8.

Results of instrumental variables.

6. Discussion

6.1. Mechanism Analysis

The preceding empirical results have demonstrated a significant effect of the GFRIPZ policy (GF_Policy) in narrowing the urban-rural income gap in pilot regions. Building upon the theoretical framework outlined earlier, this section delves into the underlying transmission mechanisms through which the GF_Policy exerts its influence, focusing specifically on two critical pathways: labor market optimization and improvements in transportation infrastructure. To empirically test these mechanisms, we adopt an approach inspired by Mo et al. [49], specifying the following model as shown in Equation (2):

where i and t denote city and year, respectively, and Mi,t represents the mechanism variables, namely labor quality (LA) and transportation infrastructure level (lnTI). The regression results are presented in Table 9.

Table 9.

Mechanism inspection results.

Model 13 through Model 16 implement a four-step mediation procedure to verify our two proposed channels. Model 13 reveals a statistically significant negative coefficient on GFRIPZ policy for transportation infrastructure level (lnTI) at the 1% significance level. This finding reflects a structural reallocation of resources during the policy implementation process. Model 14 then regresses the urban-rural income gap on both the policy dummy and lnTI. It shows that lnTI has a significant positive effect on the income gap, confirming that reduced highway investment contributes to narrowing the gap. Specifically, the green finance policy steers credit flows preferentially towards low-carbon projects, which inadvertently crowds out traditional transportation infrastructure investments. Concurrently, the stricter environmental standards imposed within pilot zones increase compliance costs for highway construction, thereby slowing infrastructure expansion. By suppressing financing for the expansion of conventional highways, the GFRIPZ policy redirects substantial public and private capital toward rural transport projects with low carbon emissions, such as fleets of electric buses, rural rail services, and intelligent logistics networks. These positions offer rural residents stable and higher-paying employment opportunities outside traditional agriculture, diversifying income sources and increasing household earnings. As these green transport ecosystems take root, average rural incomes rise and the income gap between urban and rural areas narrows.

Complementing this, Model 15, in Table 9, indicates that the GFRIPZ policy exerts a positive and statistically significant effect on labor quality (LA) at the 5% level. Model 16 subsequently includes both the policy dummy and LA in the income-gap regression and finds that LA significantly influences the gap. This suggests that the policy effectively optimizes the labor market by increasing the share of employment in the tertiary sector. Under the policy’s guidance, green service industries such as rural tourism and ecological health care cluster and expand, generating substantial employment opportunities tailored to rural labor. These sectors preferentially absorb surplus rural labor, directly boosting farmers’ incomes. Additionally, the growth of the service sector enhances factor mobility between urban and rural areas and facilitates knowledge spillovers, which promote skill upgrading and diversification of income sources for rural residents. This transformation in employment structure enables rural populations to more fully share in economic development gains, alleviating the entrenched urban-rural divide and fostering a sustainable mechanism for income growth.

Synthesizing the empirical evidence in Table 9 with the theoretical analysis, it is evident that both labor quality (LA) and transportation infrastructure level (lnTI) serve as key mediators through which the GFRIPZ policy narrows the urban-rural income gap. Specifically, the policy’s dual effect of curbing traditional transportation infrastructure expansion while optimizing employment structure—reflected in an increased tertiary sector workforce—is instrumental in driving income convergence between urban and rural areas. These findings provide robust support for Hypothesis 2 (H2), confirming the critical role of these two pathways in the policy’s efficacy.

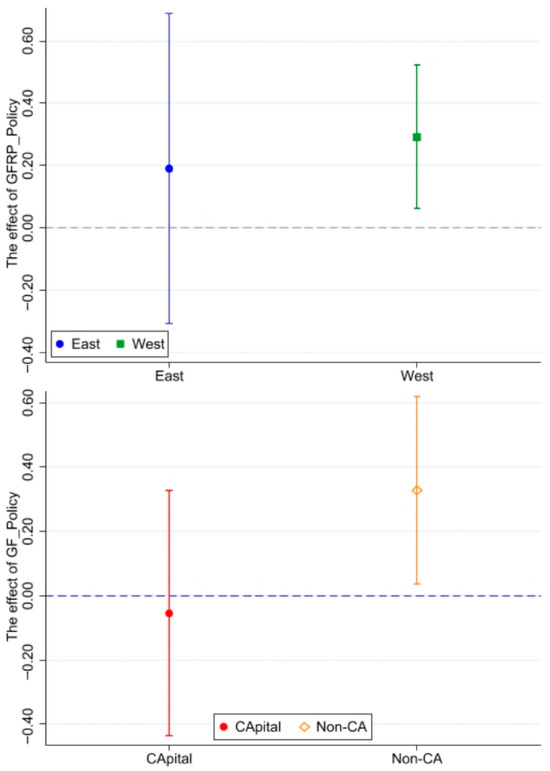

6.2. Heterogeneity Analysis

6.2.1. Geographic Location Heterogeneity

China’s regional disparities in economic development and urban-rural integration create a complex backdrop for assessing the GFRIPZ policy’s effects. The eastern region, benefiting from geographic advantages and early reform initiatives, has developed a relatively mature market economy and exhibits a higher degree of urban-rural integration. In contrast, the central and western regions face natural and historical constraints that have resulted in slower economic growth and a more pronounced urban-rural dual structure, with generally higher income disparities than the eastern provinces.

This pronounced regional heterogeneity implies that the same policy may yield differential impacts across regions. Consistent with Sun et al. [50], who found that green finance significantly promotes common prosperity in eastern and central regions, this study divides the sample into eastern and central-western groups to conduct subgroup regressions. As shown in Table 10 (Models 15 and 16) and Figure 4, the GFRIPZ policy coefficient is negative across regions but statistically significant only in the central/western region at the 5% level. The lack of significance in the eastern region suggests that the policy’s effect on narrowing the urban-rural income gap is more pronounced in the central/western region.

Table 10.

Heterogeneity test results.

Figure 4.

Heterogeneity test results.

This regional disparity can increase due to several interrelated factors. In the eastern region, an advanced economy and mature financial markets have already weakened the urban-rural dual structure, so the marginal impact of the GFRIPZ policy on income convergence is inherently limited. By contrast, the central and western regions face lower levels of economic development and a historical concentration of financial resources in urban centers, which amplifies the effect of channeling green finance into rural green industries and agricultural modernization. Redirected funding in these regions alleviates rural financial exclusion and produces a more pronounced reduction in income disparities. Moreover, local governments in the central and western regions often adopt the GFRIPZ policy with greater rigor and tailor auxiliary measures—such as targeted credit subsidies and technical training—to local conditions, further strengthening its impact. The drivers of urban-rural income differences in the eastern region are more complex, involving factors such as industrial structure transformation and human capital gaps, which dilute the effect of any single policy instrument. In contrast, the primary constraint in the central and western regions remains the uneven allocation of financial resources, making the outcomes of green finance interventions more directly observable and impactful.

6.2.2. Administrative Level Heterogeneity

Another critical dimension of heterogeneity arises from differences in cities’ administrative ranks, which reflect variations in scale, resource endowment, and institutional capacity that may influence the GFRIPZ policy’s effectiveness in reducing urban-rural income disparities. To explore this, the sample is split into provincial capital cities and non-provincial capital cities for subgroup regression analysis. The results, reported in Table 10 (Model 17 and Model 18) and Figure 4, show that while the GFRIPZ policy coefficient is negative in non-provincial capital groups, it is statistically significant only in non-provincial capital cities.

This divergence reflects the interplay between local financial capacity and the binding constraints Green Finance Reform and Innovation Pilot Zones (GFRIPZ) aim to alleviate. Provincial capitals already benefit from mature financial markets, diversified industrial bases, and extensive credit networks, so the marginal impact of funneling additional green finance into rural sectors is attenuated. By contrast, non-provincial capital cities typically exhibit more acute urban-rural duality and tighter rural financing bottlenecks. In these locales, GFRIPZ interventions—through preferential green credit, technical support, and ecological compensation—directly relieve capital shortages in rural green industries and agriculture, yielding measurable reductions in income disparities. Moreover, administrative authorities in non-provincial capitals may deploy pilot-zone resources with greater focus and urgency, concentrating capacity-building efforts where they are most needed and thereby amplifying policy effects. These findings underscore the necessity of tailoring green finance initiatives to local institutional contexts and baseline conditions when assessing and scaling policy interventions.

6.3. Spatial Effects Analysis

6.3.1. Spatial Autocorrelation Test

Following established methodologies, this study employs the global Moran’s I index based on an inverse distance spatial weight matrix to examine the spatial autocorrelation of the urban-rural income gap. As shown in Table 11, the Moran’s I indices from 2005 to 2022 are consistently positive and statistically significant at the 1% level, indicating a pronounced spatial clustering of income disparities. Notably, after the implementation of the GFRIPZ policy in 2017, Moran’s I index exhibits a systematic downward trend. This pattern suggests a gradual weakening of the spatial agglomeration effect of the urban-rural income gap, alongside a narrowing of inter-regional development disparities. Consequently, the spatial distribution of income disparities is transitioning from a concentrated pattern toward a more balanced and equitable regional configuration, reflecting the positive influence of policy interventions on promoting coordinated regional development.

Table 11.

The results of Moran’s test.

6.3.2. Spatial Econometric Model Selection and Testing

To identify the most appropriate spatial econometric framework for analyzing the GFRIPZ policy’s impact, Hausman and likelihood ratio (LR) tests were conducted, with results summarized in Table 12. The Hausman test yielded a negative statistic, which, based on simulation studies and existing literature, indicates that the assumptions underpinning the random effects model are violated. Therefore, a fixed effects specification is preferred. Subsequent LR tests for spatial lag, spatial error, spatial independence, and time effects all reject the null hypotheses at the 1% significance level. These results collectively support the adoption of a spatial Durbin model (SDM) incorporating dual fixed effects for city and year. Furthermore, the LR tests confirm that the SDM cannot be simplified to either the spatial error model (SEM) or the spatial lag model (SLM), underscoring the necessity of modeling both spatial lag and spatial error components to capture the complex spatial dependencies inherent in the data.

Table 12.

Spatial econometric model selection test.

6.3.3. Spatial Econometric Model Results

Table 13 presents the spatial regression outcomes assessing the GF_Policy’s spatial effects on urban-rural income disparities. Model 19 shows that the GF_Policy coefficient is negative and highly significant at the 1% level, providing robust evidence that the policy directly contributes to reducing the urban-rural income gap within pilot regions. Simultaneously, the spatial autoregressive coefficient (rho) is positive and significant at the 1% level, indicating a strong positive spatial dependence or “clustering effect” (often termed the “Matthew effect”). This implies that income disparities in one region tend to be associated with similar disparities in neighboring areas, thereby reinforcing rather than mitigating regional inequalities.

Table 13.

Regression results of spatial effects.

Drawing on Wang et al.’s findings [51]—that beyond a certain spatial threshold, regional coordination becomes more difficult and spillover effects are less effectively absorbed—the negative but statistically insignificant coefficient on the spatial interaction term of GF_Policy suggests that the policy’s beneficial effects are largely confined within pilot zones. This limitation points to a lack of effective cross-regional coordination mechanisms, potentially causing negative spatial spillovers that exacerbate income disparities in adjacent regions.

Recognizing potential biases in interpreting spatial model coefficients, the study further decomposes the GF_Policy effect into direct, indirect, and total impacts (Models 20–22 in Table 13). The direct effect is significantly negative at the 1% level, reaffirming the policy’s efficacy in narrowing income disparities locally. Conversely, the indirect effect is positive, indicating a mild negative spillover on neighboring areas that may hinder their income gap reduction through competitive suppression. Overall, the net effect of GF_Policy on regional urban-rural income disparities is inhibitory: the negative indirect effect offsets the positive direct effect, resulting in a positive total effect coefficient. This pattern reveals that while the policy effectively reduces disparities within pilot zones, it fails to foster coordinated regional development and instead generates a siphoning effect, attracting rural labor, capital, and other resources from surrounding areas. Consequently, resource depletion in neighboring regions limits broader improvements in urban-rural income disparities, thereby confirming Hypothesis 3 (H3).

7. Conclusions

This study utilizes panel data from 286 prefecture-level cities across China spanning 2005 to 2022, leveraging the establishment of GFRIPZ as a quasi-natural experiment. By employing a multi-period difference-in-differences (DID) model, the analysis rigorously examines the impact of the GFRIPZ on urban-rural income disparities. The key findings are as follows: First, the establishment of GFRIPZ pilot zones significantly contributes to narrowing the urban-rural income gap. This conclusion remains robust across a series of rigorous robustness checks, underscoring the policy’s effectiveness in promoting income convergence. Second, the GFRIPZ achieves this reduction by imposing institutional constraints that limit traditional transportation infrastructure expansion while simultaneously optimizing employment structures, notably by increasing the share of tertiary industry employment. This dual mechanism facilitates more balanced economic development and income distribution. Third, the policy’s impact exhibits notable heterogeneity influenced by geographic location and the administrative status of cities. Specifically, the narrowing effect on income disparities is more pronounced in central and western regions and in non-provincial capital cities, reflecting variations in economic development stages, financial market maturity, and policy implementation intensity. Fourth, the GFRIPZ generates negative spatial spillover effects. While it effectively reduces income disparities within pilot zones, it induces a siphoning effect that attracts production factors from neighboring non-pilot regions, thereby exacerbating urban-rural income gaps in those adjacent areas. This spatial imbalance poses challenges to coordinated regional development.

8. Policy Recommendations

Drawing on the empirical findings, a set of strategically targeted recommendations is proposed to amplify the efficacy and scalability of green finance initiatives in mitigating urban-rural income disparities, with relevance to both emerging and developed economies pursuing sustainable and inclusive growth.

First, policymakers should establish an adaptive policy learning framework that integrates dynamic monitoring of spatial spillover indicators and rural income convergence metrics drawn from our DID and spatial econometric analyses. This framework would guide the phased expansion of GFRIPZ into non-provincial capitals and central and western prefectures—regions where our estimates identify the greatest marginal gains in narrowing the urban-rural income gap.

Second, green finance instruments should be embedded within transport infrastructure planning under international standards such as the EU Taxonomy and TCFD guidelines. Project approvals would be conditioned on measurable reductions in conventional highway expansion and predefined targets for increases in rural tertiary employment, thereby operationalizing the infrastructure suppression and labor optimization channels confirmed by our mediation analysis.

Third, financial product design must be tailored to the administrative hierarchy and geographic context. Metropolitan hubs would pilot AI-driven credit platforms to anticipate and manage spatial spillover risks; non-provincial capitals would receive concessional refinancing facilities for rural low-carbon transport projects and grants for vocational training; and central and western regions would issue blue carbon bonds and develop cross-border green investment corridors in line with the heterogeneous policy effects documented.

Fourth, inter-jurisdictional compensation mechanisms should be instituted by levying green bond issuances to capitalize regional equalization funds for neighboring non-pilot areas and by creating market-based platforms for carbon trading, technology diffusion, and ecological asset exchanges. These measures would neutralize the negative spillovers identified in our spatial analysis and promote balanced territorial development in accordance with the global sustainable development goals.

9. Limitations

This study acknowledges certain limitations. First, the data used spans from 2005 to 2022. Due to data availability constraints and to accommodate potential lagged effects of the GFRIPZ policy, we were unable to include recently designated pilot cities such as Chongqing (in 2022) in our analysis; we acknowledge that this omission may limit the precision and external validity of our findings, especially as policy impacts in these newer pilot cities continue to unfold. Second, while this research provides a macro-level analysis of the mechanisms through which the GFRIPZ policy affects the urban-rural income gap, it offers limited insight into the policy transmission pathways at the micro-enterprise level. For instance, the specific ways in which the GFRIPZ policy influences firm-level decisions and resource allocation within the tertiary sector warrant further investigation. Future research should explore these micro-level dynamics to provide a more comprehensive understanding of the policy’s impact. At the same time, further elaboration on the causal mechanisms of spatial contagion can be added in the future.

Funding

This research was funded by the Jiangxi Provincial Social Science Fund Annual Project Youth Project, “The Mechanism and Path of Digital Rural Construction in Promoting the Improvement of Jiangxi Rural Social Governance Effectiveness” (Grant Number: 25GL33) and the Jiangxi Provincial Higher Education Humanities and Social Sciences Research Project, “Research on the Mechanism and Path of Promoting Common Prosperity in Jiangxi Rural Areas through Digital Rural Construction” (Grant Number: JC24225).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data will be made available on request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Zhong, S.; Wang, M.; Zhu, Y.; Chen, Z.; Huang, X. Urban Expansion and the Urban-Rural Income Gap: Empirical Evidence from China. Cities 2022, 129, 103831. [Google Scholar] [CrossRef]

- Wang, Z.; Zheng, X.; Wang, Y.; Bi, G. A Multidimensional Investigation on Spatiotemporal Characteristics and Influencing Factors of China’s Urban-Rural Income Gap (URIG) since the 21st Century. Cities 2024, 148, 104920. [Google Scholar] [CrossRef]

- Kosciejew, M. Public Libraries and the UN 2030 Agenda for Sustainable Development. IFLA J. 2020, 46, 328–346. [Google Scholar] [CrossRef]

- Yusuf, S.; Joseph, P.; Rangarajan, S.; Islam, S.; Mente, A.; Hystad, P.; Brauer, M.; Kutty, V.R.; Gupta, R.; Wielgosz, A.; et al. Modifiable Risk Factors, Cardiovascular Disease, and Mortality in 155 722 Individuals from 21 High-Income, Middle-Income, and Low-Income Countries (PURE): A Prospective Cohort Study. Lancet 2020, 395, 795–808. [Google Scholar] [CrossRef]

- Zeng, Z.; Wang, X. Effects of Domestic Tourism on Urban-Rural Income Inequality: Evidence from China. Sustainability 2021, 13, 9009. [Google Scholar] [CrossRef]

- Sujarwoto, S. Development as Happiness: A Multidimensional Analysis of Subjective Well-Being in Indonesia. Econ. Sociol. 2021, 14, 274–293. [Google Scholar] [CrossRef]

- Zhao, C.; Wu, Q. The Wall between Urban and Rural: How Does the Urban-Rural Electricity Gap Inhibit the Human Development Index. Struct. Change Econ. Dyn. 2024, 71, 289–301. [Google Scholar] [CrossRef]

- Chen, X.; Huang, Z.; Luo, C.; Hu, Z. Can Agricultural Industry Integration Reduce the Rural–Urban Income Gap? Evidence from County-Level Data in China. Land 2024, 13, 332. [Google Scholar] [CrossRef]

- Zheng, F.; Chen, S.; Wang, X. How the Impact and Mechanisms of Digital Financial Inclusion on Agricultural Carbon Emission Intensity: New Evidence from a Double Machine Learning Model. Front. Environ. Sci. 2025, 13, 1549623. [Google Scholar] [CrossRef]

- Wan, S.; Zhou, Y.; Zhou, L.; Chen, S.; Qi, F. The Impact of New Energy Demonstration City Policy on the Mental Health of Middle-Aged and Older Adults. Econ. Hum. Biol. 2025, 58, 101518. [Google Scholar] [CrossRef]

- Prakash, N.; Sethi, M. Green Bonds Driving Sustainable Transition in Asian Economies: The Case of India. J. Asian Finance Econ. Bus. 2021, 8, 723–732. [Google Scholar] [CrossRef]

- Xie, H.; Ouyang, Z.; Choi, Y. Characteristics and Influencing Factors of Green Finance Development in the Yangtze River Delta of China: Analysis Based on the Spatial Durbin Model. Sustainability 2020, 12, 9753. [Google Scholar] [CrossRef]

- Arias, A.; Husiev, O.; Schwaller, C.; Sturm, U. Terminologies and Concepts of Energy Cooperations in Europe: A Systematic Review of Characteristics, Potentials, and Challenges. Energy Res. Soc. Sci. 2025, 122, 104012. [Google Scholar] [CrossRef]

- Yang, H.; Simmons, B.A.; Ray, R.; Nolte, C.; Gopal, S.; Ma, Y.; Ma, X.; Gallagher, K.P. Risks to Global Biodiversity and Indigenous Lands from China’s Overseas Development Finance. Nat. Ecol. Evol. 2021, 5, 1520–1529. [Google Scholar] [CrossRef]

- Liu, K.; Jin, M.; Cheng, L. County Green Transformation: How Does Gross Ecosystem Product Assessment Promote Common Prosperity? Humanit. Soc. Sci. Commun. 2025, 12, 20. [Google Scholar] [CrossRef]

- Mo, Y.; Mu, J.; Wang, H. Impact and Mechanism of Digital Inclusive Finance on the Urban-Rural Income Gap of China from a Spatial Econometric Perspective. Sustainability 2024, 16, 2641. [Google Scholar] [CrossRef]

- Li, M.; Feng, S.; Xie, X. Spatial Effect of Digital Financial Inclusion on the Urban-Rural Income Gap in China—Analysis Based on Path Dependence. Econ. Res.-Ekon. Istraživanja 2023, 36, 2106279. [Google Scholar] [CrossRef]

- Desalegn, G.; Tangl, A. Enhancing Green Finance for Inclusive Green Growth: A Systematic Approach. Sustainability 2022, 14, 7416. [Google Scholar] [CrossRef]

- Zhou, C.; Shaozhou, Q.; Yuankun, L. China’s Green Finance and Total Factor Energy Efficiency. Front. Energy Res. 2023, 10, 1076050. [Google Scholar] [CrossRef]

- Wang, H.; Du, D.; Tang, X.; Tsui, S. Green Finance Pilot Reform and Corporate Green Innovation. Front. Environ. Sci. 2023, 11, 1273564. [Google Scholar] [CrossRef]

- Xie, Y.; Wu, H.; Yao, R. The Impact of Climate Change on the Urban-Rural Income Gap in China. Agriculture 2023, 13, 1703. [Google Scholar] [CrossRef]

- Su, C.-W.; Liu, T.-Y.; Chang, H.-L.; Jiang, X.-Z. Is Urbanization Narrowing the Urban-Rural Income Gap? A Cross-Regional Study of China. Habitat Int. 2015, 48, 79–86. [Google Scholar] [CrossRef]

- Chen, Y.; Luo, P.; Chang, T. Urbanization and the Urban-Rural Income Gap in China: A Continuous Wavelet Coherency Analysis. Sustainability 2020, 12, 8261. [Google Scholar] [CrossRef]

- Wen, J.; Chen, H. Green Innovation and the Urban-Rural Income Gap: Empirical Evidence from China. Sustainability 2025, 17, 2106. [Google Scholar] [CrossRef]

- Qu, Q.; Zhang, K.; Niu, J.; Xiao, C.; Sun, Y. Spatial–Temporal Differentiation of Ecosystem Service Trade-Offs and Synergies in the Taihang Mountains, China. Land 2025, 14, 513. [Google Scholar] [CrossRef]

- Conrad, D.A.; Christianson, J.B. Penetrating the “Black Box”: Financial Incentives for Enhancing the Quality of Physician Services. Med. Care Res. Rev. 2004, 61, 37S–68S. [Google Scholar] [CrossRef] [PubMed]

- Gao, J.; Wu, Y.; Li, H. Digital Inclusive Finance, Rural Loan Availability, and Urban-Rural Income Gap: Evidence from China. Sustainability 2024, 16, 9763. [Google Scholar] [CrossRef]

- Richard, F.; Witter, S.; De Brouwere, V. Innovative Approaches to Reducing Financial Barriers to Obstetric Care in Low-Income Countries. Am. J. Public Health 2010, 100, 1845–1852. [Google Scholar] [CrossRef]

- Huang, C.; Lin, B. Digital Economy Solutions towards Carbon Neutrality: The Critical Role of Energy Efficiency and Energy Structure Transformation. Energy 2024, 306, 132524. [Google Scholar] [CrossRef]

- Ge, F.; Li, Q.; Nazir, S. The Impact of E-Commerce Live Broadcast on Happiness With Big Data Analysis. J. Organ. End User Comput. 2023, 35, 1–14. [Google Scholar] [CrossRef]

- Zheng, L.; Cao, Y.; Umar, M.; Wang, X.; Safi, A. Environmental Policy, Digital Economy, and Green Innovation: Navigating the Low-Carbon Transition in Emerging Seven Economies. Econ. Change Restruct. 2025, 58, 67. [Google Scholar] [CrossRef]

- Wong, Z.; Li, R.; Zhang, Y.; Kong, Q.; Cai, M. Financial Services, Spatial Agglomeration, and the Quality of Urban Economic Growth–Based on an Empirical Analysis of 268 Cities in China. Finance Res. Lett. 2021, 43, 101993. [Google Scholar] [CrossRef]

- Lan, F.; Wu, Q.; Zhou, T.; Da, H. Spatial Effects of Public Service Facilities Accessibility on Housing Prices: A Case Study of Xi’an, China. Sustainability 2018, 10, 4503. [Google Scholar] [CrossRef]

- Bento, A.M.; Jacobsen, M. Ricardian Rents, Environmental Policy and the ‘Double-Dividend’ Hypothesis. J. Environ. Econ. Manag. 2007, 53, 17–31. [Google Scholar] [CrossRef]

- Lin, J.Y. Structural Change and Poverty Elimination. China Agric. Econ. Rev. 2019, 11, 452–459. [Google Scholar] [CrossRef]

- Beaudry, P.; Portier, F. An Exploration into Pigou’s Theory of Cycles. J. Monet. Econ. 2004, 51, 1183–1216. [Google Scholar] [CrossRef]

- Tolliver, C.; Keeley, A.R.; Managi, S. Green Bonds for the Paris Agreement and Sustainable Development Goals. Environ. Res. Lett. 2019, 14, 064009. [Google Scholar] [CrossRef]

- Lee, C.-C.; Song, H.; Lee, C.-C. Assessing the Effect of Green Finance on Energy Inequality in China via Household-Level Analysis. Energy Econ. 2023, 128, 107179. [Google Scholar] [CrossRef]

- Fan, W.; Wu, H.; Liu, Y. Does Digital Finance Induce Improved Financing for Green Technological Innovation in China? Discrete. Dyn. Nat. Soc. 2022, 2022, 6138422. [Google Scholar] [CrossRef]

- Hou, Y.; Yang, M.; Li, Y. Coordinated Effect of Green Expansion and Carbon Reduction: Evidence from Sustainable Development of Resource-Based Cities in China. J. Environ. Manag. 2024, 349, 119534. [Google Scholar] [CrossRef]

- Pan, Y.; Dong, F. Green Finance Policy Coupling Effect of Fossil Energy Use Rights Trading and Renewable Energy Certificates Trading on Low Carbon Economy: Taking China as an Example. Econ. Anal. Policy 2023, 77, 658–679. [Google Scholar] [CrossRef]

- Mills, E. Green Remittances: A Novel Form of Sustainability Finance. Energy Policy 2023, 176, 113501. [Google Scholar] [CrossRef]

- Ge, J.; Zhao, Y.; Luo, X.; Lin, M. Study on the Suitability of Green Building Technology for Affordable Housing: A Case Study on Zhejiang Province, China. J. Clean. Prod. 2020, 275, 122685. [Google Scholar] [CrossRef]

- Hirschman, A.O.; Sirkin, G. Investment Criteria and Capital Intensity Once Again. Q. J. Econ. 1958, 72, 469–471. [Google Scholar] [CrossRef]

- Zhou, L.; Azam, S.M.F. The Impact of Green-Listed Companies on Rural Ecological Environments in China: A Spatial Heterogeneity and Empirical Analysis. J. Environ. Manag. 2024, 356, 120687. [Google Scholar] [CrossRef]

- Majeed, A.; Wang, J.; Zhou, Y. Muniba The Symmetric Effect of Financial Development, Human Capital and Urbanization on Ecological Footprint: Insights from BRICST Economies. Sustainability 2024, 16, 5051. [Google Scholar] [CrossRef]

- Chang, Q.; Sha, Y.; Chen, Y. The Coupling Coordination and Influencing Factors of Urbanization and Ecological Resilience in the Yangtze River Delta Urban Agglomeration, China. Land 2024, 13, 111. [Google Scholar] [CrossRef]

- Mushtaq, R.; Bruneau, C. Microfinance, Financial Inclusion and ICT: Implications for Poverty and Inequality. Technol. Soc. 2019, 59, 101154. [Google Scholar] [CrossRef]

- Mo, L.; Chen, S.; Wan, S.; Zhou, L.; Wang, S. How Can the Protection of Important Agricultural Heritage Sites Contribute to the Green Development of Agriculture: Evidence from China. Agriculture 2025, 15, 166. [Google Scholar] [CrossRef]

- Sun, Y.; Zhou, L.; Wang, D.; Jin, K.; Wu, Q.; Wu, R. How Economic Policy Uncertainty Affects Common Prosperity in China? The Mediating Role of Green Finance and the Moderating Role of Low-Carbon Technology. Finance Res. Lett. 2024, 67, 105701. [Google Scholar] [CrossRef]

- Wang, F.; Wang, R.; He, Z. The Impact of Environmental Pollution and Green Finance on the High-Quality Development of Energy Based on Spatial Dubin Model. Resour. Policy 2021, 74, 102451. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).