1. Introduction

The traditional perception of peripheral areas as secondary to national innovation has been increasingly challenged [

1,

2]. The reconceptualization of the periphery as an autonomous source of innovation [

3] necessitates a reassessment of public policies. However, empirical research on this issue remains inconclusive, and the extent to which innovation contributes to economic growth in peripheral regions remains contested [

4]. Despite extensive literature on regional innovation, the geographical distribution of knowledge creation activities remains debated, with contradictory approaches leading to divergent policy implications. Nevertheless, there is broad agreement that regional innovation dynamics are shaped by distinct ecosystem mechanisms [

5].

This ongoing academic debate creates a significant challenge for policymakers. Governments are increasingly investing in strategies to foster innovation in peripheral regions to promote balanced economic growth and reduce regional disparities. However, these policy efforts often lack clear, evidence-based guidance. Without a nuanced understanding of how different types of startups interact with their local ecosystems, policies risk being generic and ineffective. For instance, financial incentives that successfully attract one type of startup may fail to support another, and attempts to replicate the dense ecosystem of a metropolitan hub may overlook the unique strengths or address the specific barriers present in a peripheral context. This gap between policy ambition and targeted empirical knowledge creates a critical need to identify which specific ecosystem factors are most crucial for different startup typologies in peripheral versus central locations, thereby enabling the design of more effective and efficient regional innovation strategies.

This study contributes to the literature by quantitatively analyzing how different types of startups respond to regional ecosystem conditions. Israel, a global leader in knowledge creation, ranks highly in Research and Development (R&D) and patent applications [

6], yet its innovation activity remains highly concentrated in the metropolitan region, with policy efforts aiming to expand innovation to the periphery. By comparing startups in central and peripheral regions, we examine the extent to which ecosystem factors influence location choices, distinguishing between those shaped by local conditions and those linked to metropolitan advantages.

Our findings offer empirical insights into the spatial dynamics of startup ecosystems, underscoring the need for targeted policy interventions. By identifying how distinct startup types interact with key ecosystem factors, we provide an evidence-based framework for designing regional innovation policies that promote sustainable economic development and spatially balanced entrepreneurship.

2. Literature Review

2.1. Disadvantages of Peripheral Regions

Contrary to some perceptions [

4,

7], the prevailing view holds that startups drive regional innovation, fostering economic growth and long-term sustainability [

8]. Governments globally have implemented policies to stimulate innovation, recognizing that regional innovation capacity is highly dependent on local characteristics [

9,

10]. Peripheral regions, however, face inherent structural challenges, including low population density, economic homogeneity, and weaker access to financial and human resources [

11,

12].

Startups, particularly in resource-constrained environments, struggle with limited access to capital and skilled labor [

13], reinforcing their tendency to cluster in metropolitan centers [

14]. Nevertheless, peripheral hubs may still emerge as focal points of innovation, where agglomeration effects intersect with human capital concentration [

15].

Urban centers provide diverse network opportunities and a higher concentration of skilled labor [

16,

17]. They also benefit from superior infrastructure, university linkages, and supplier access. Conversely, peripheral regions often suffer from limited skilled labor pools [

18,

19,

20] and weaker collaboration networks with nonlocal firms [

21]. At a macro level, inadequate infrastructure and lower academic engagement further constrain regional innovation potential.

Empirical studies highlight the importance of geographic clustering in driving innovation, as firms embedded within dense entrepreneurial ecosystems are more exposed to technological advancements and market opportunities, leading to higher innovation output [

22]. As a result, innovation remains spatially uneven, reinforcing core–periphery disparities.

2.2. An Alternative Concept: Beyond Peripherality—Peripheral Strengths and the Dual Core–Periphery Model

Several studies highlight the potential advantages of peripheral regions for innovation, including lower operational costs, a quieter environment, and improved quality of life [

23,

24]. Advances in communication technologies have facilitated the relocation of digital startups to these areas [

25]. Additionally, universities in peripheral regions enhance local innovation capacity, particularly by attracting talent from urban centers [

26,

27].

The authors of [

1] classify peripheral innovation into three perspectives: dependence on central regions, resilience despite disadvantages, and endogenous drivers of innovation. They propose a dual core–periphery model, categorizing regions by geography and actor networks into four positions, from central actors in core or peripheral locations (e.g., corporate HQs, elite research institutions) to peripheral actors in either setting (e.g., low-tech firms, small food processors). These positions remain fluid, shaping regional innovation dynamics.

In contrast, reference [

3] challenges the assumption that peripheral innovation relies on metropolitan resources, arguing that foundational economy (FE) actors catalyze grassroots innovation. This view is supported by [

28], which emphasizes social innovation in inner peripheries, and by [

29], which examines digitalization’s role in small enterprises.

2.3. Periphery and Dependence on Innovation Ecosystem Factors

A comprehensive understanding of how peripheral regions engage in innovation requires identifying the key ecosystem factors shaping their capacity for innovation. The literature conceptualizes these factors through innovation and entrepreneurial ecosystems [

30,

31].

Research widely supports the greater innovation potential of metropolitan regions compared with peripheral areas [

32]. The author of [

16] highlights spatial proximity as a crucial enabler of innovation, supporting the notion that clustering facilitates knowledge exchange, resource sharing, and business collaboration [

33,

34,

35].

A strong business–academic nexus is also critical for regional innovation. The authors of [

36] found that limited firm–university collaborations weaken overall innovation networks, requiring targeted policy interventions to enhance knowledge transfer [

37].

Government support remains a key but debated factor in fostering peripheral innovation [

38]. While subsidies can stimulate long-term regional growth, short-term financial incentives may be ineffective if firms lack absorptive capacities [

39,

40]. Reference [

41] provides empirical evidence that sustained support fosters entrepreneurial activity and knowledge-based innovation.

2.4. Contribution and Objective

The literature on peripheral innovation presents a fragmented landscape, with research often yielding conflicting conclusions. While innovation is predominantly concentrated in metropolitan centers [

8], some studies suggest that it can also emerge in peripheral regions through distinct mechanisms, such as government intervention, regional specialization, or digital connectivity [

4,

23,

25]. However, the role of ecosystem factors remains debated. Some scholars emphasize the importance of proximity to urban hubs in fostering innovation [

16,

34], while others highlight the potential for autonomous innovation in remote areas [

3]. The diversity of findings, influenced by varying definitions, methodologies, and national contexts, complicates efforts to establish generalizable insights into the relationship between innovation and location.

This study contributes to the literature by focusing on startup activity as a key indicator of knowledge creation, narrowing the scope from broader discussions of innovation [

6,

42]. While previous studies have primarily relied on aggregated data [

15] or firm-specific case studies [

12], our approach employs a statistical analysis of survey data from two startup samples—one in the periphery and one in a central location. This enables a more targeted assessment of how different startup typologies interact with regional conditions.

A central contribution of this study is its examination of the interplay between startup characteristics and ecosystem factors. Existing research has largely analyzed ecosystem factor availability without considering variations in startup responses [

30,

38]. By integrating these dimensions, we identify which startup types are more adaptable to peripheral locations and what policy measures may enhance their success. This perspective provides a novel framework for evaluating the conditions necessary to attract startups to peripheral regions and tailoring innovation policies accordingly.

3. Research Hypotheses

Building on this foundation, we provide insights for policymakers and regional stakeholders to design effective strategies that foster innovation in peripheral regions. Our study is guided by two hypotheses:

Hypothesis 1: Different types of startups rely on ecosystem factors to varying degrees, depending on the availability gap between the periphery and the center.

Hypothesis 2: The relative importance of ecosystem factors in location decisions varies by startup type, influencing whether they prioritize proximity advantages or policy incentives.

These hypotheses involve two key dimensions: startup typology and perceived ecosystem factor availability. While startups can be categorized along various parameters (e.g., industry sector or development stage), data and statistical constraints necessitated a focus on six core characteristics:

Open vs. closed innovation—Open-innovation startups, which depend on external collaboration, may be more prevalent in central locations.

International vs. local orientation—Startups with international links (e.g., multinational branches, global R&D collaborations) may require different ecosystem conditions than locally focused firms.

Science park vs. independent location—Being located in a science park may alleviate constraints associated with peripheral regions.

Radical vs. incremental innovation—Incremental innovation benefits from diverse ecosystems often found in metropolitan areas, while radical innovation may be less location-sensitive.

R&D-based vs. non-R&D-based activity—R&D-intensive startups, requiring access to research infrastructure and skilled labor, may cluster in urban centers.

Disruptive vs. sustaining innovation—No strong evidence links disruptive innovation to peripheral or central locations, but its high-risk nature may favor metropolitan hubs.

Other typology parameters, such as product vs. service innovation, process vs. product innovation, and startup size, were excluded due to insufficient sample representations.

Given similar methodological constraints, nine ecosystem factors were selected based on their relevance to startup location decisions:

As highlighted in the literature review, the role of ecosystem factors remains contested. While proximity to capital, skilled labor, and collaboration networks favor startups in core regions, the effectiveness of government interventions in peripheral areas varies depending on firms’ absorptive capacities and long-term policy support. Hypothesis 1 examines how different startup typologies respond to ecosystem factor availability, while Hypothesis 2 explores the prioritization of these factors in location decisions, distinguishing between firms that favor agglomeration effects and those responsive to policy-driven incentives.

4. Materials and Methods

The literature review covers a wide range of methods used to analyze the locational behavior of innovation activities, including macroeconomic analyses, sectoral studies, case studies, aggregate statistical analyses, and qualitative and quantitative approaches. To the best of our knowledge, no comparison based on field survey data for startups in remote and central regions has been conducted. We adopt a comparative approach, analyzing startups in peripheral and central locations using a structured questionnaire focused on key variables.

We conducted an empirical analysis of responses to structured face-to-face questionnaires administered to 202 startups: 157 in the Tel Aviv metropolitan center and 45 in the peripheral region of Be’er-Sheva. The startups were randomly selected by the student interviewers from a list of firms provided by the supervising professors. To ensure reliability and minimize interviewer bias, the 49 student interviewers received structured training and were accompanied and supervised by the professors throughout the entire data collection process.

The questionnaire was administered face-to-face to owners or major leaders of startups. It comprised two sections. The first included questions related to the startup’s features, such as its size, type of innovation activity (e.g., radical or incremental), whether it was disruptive, and whether it was R&D-based. The second section contained questions concerning ecosystem factors, classified into topics such as finance, market competition, and skills. Participants ranked the perceived importance of each factor for their startup and its actual availability on two five-point Likert scales. For example, a participant could rank the importance of “government financial support” at 5 points and evaluate its availability at 2 points.

We defined a vector of the properties or types of each startup, applying dichotomous values and focusing on six main properties: open innovation or not, a disruptive approach or not, R&D-based or not, located in a science park or not, working on radical or incremental innovation, and linked to an international corporation or not. We construct six binary indicators from the questionnaire as follows: open innovation takes the value one when external partners are used for core innovation activities (e.g., formal R&D partnerships, licensing, incubators/accelerators, or outsourced R&D), zero otherwise; international links take the value one when any cross-border ties are reported with customers, suppliers, investors, or R&D collaborators; science park location takes the value one when the firm is located within a recognized science/technology park; radical innovation takes the value one when the main offering is new to market/technology (zero denotes incremental improvements); R&D-based takes the value one when systematic in-house R&D was conducted during the past year; and disruptive innovation takes the value one when the product/service is intended to displace incumbent solutions or business models (zero denotes sustaining). Thereafter, using chi-square tests, we estimated the extent to which the frequency of startups at the periphery differed from startups at the center for each of the startup types.

Next, we analyzed the perceived importance of each ecosystem factor for each startup. Following the procedure adopted in [

46], we filtered out all ecosystem factors that were rated at a level of importance below 3, which was the median importance value (out of a scale of 5) for the majority of the startups in both the periphery and center. Using this filtering process allowed us to focus on the factors that were considered relevant for the location of the startups. Although all ecosystem factors are important and may significantly influence a startup’s decision on where to locate, it is necessary to filter these factors to prevent overfitting and improve the generalizability and robustness of our models. By carefully considering the most relevant and influential factors, we aimed to create models that were both accurate and applicable to a broader range of situations.

We also examined the significant differences in the importance and availability attributed to each ecosystem factor by periphery and center startups and followed previous research in testing the gap between the perceived importance and availability of these factors [

47] in both the periphery and center locations using Mann–Whitney U tests.

We then investigated the links between the startups’ rankings of the availability of ecosystem factors and their choice to settle in the periphery using logistic regression analysis as follows:

where

is a dummy dependent variable taking the value of 1 if the startup is located in the periphery,

is a vector of

independent variables representing the participants’ ranking for the availability of the ecosystem factors,

is a vector of corresponding coefficients. The additional variables

(measured as the age of the startup) and

(log-transformed number of employees) are included as controls.

denotes the error term.

Given the binary nature of the dependent variable, we estimated the models using logistic regression. Prior to estimation, we employed variance inflation factor (VIF) tests and confirmed that multicollinearity was not a concern among the independent variables. We report both odds ratios (ORs), which capture the relative effect of each factor on the likelihood of locating in the periphery, and average marginal effects (AMEs), which provide a direct interpretation of changes in probability.

Although our methodology effectively tests our hypotheses, it has some limitations, primarily due to statistical and technical constraints. The limited number of startups in peripheral regions imposes severe restrictions on the ability to select appropriate control groups or to select equal samples of startups in the periphery and in the center. Nonetheless, chi-square analyses did not detect any significant differences between the periphery and the center regarding startup age (approximately 50% were less than 4 years) or size (50% had 1–10 workers).

5. The Israeli Case

Israel has experienced significant innovation growth in recent decades, driven by substantial government investment since the 1990s. Key initiatives include the establishment of a venture capital industry, startup accelerators, incubators, and subsidies through Israel Innovation Authority programs [

48]. The Authority continues to monitor national innovation trends through annual reports [

49].

The reputation of Israel as a startup nation [

50] is attributed to its extensive concentration of highly technological companies and its essential role in the economy. At the regional level, venture capital investment is heavily biased toward firms’ place of residence or the location of their additional activities. Consequently, local venture capital funds lead to a heavy concentration of investments in metropolitan areas, increasing peripheral regions’ regional gaps [

44,

51]. In this study, we consider the “center” as the city of Tel Aviv and a few nearby cities (up to approximately 10 km from the Tel Aviv district). The “center” covers approximately 7% of Israel’s total area but is home to approximately 40% of Israel’s approximately 9 million residents. We consider the periphery as the subdistrict of Be’er-Sheva (also called the Negev region), which is home to 8% of the total Israeli population but covers 59% of the country’s area. The city of Be’er-Sheva, sometimes called “the capital of the Negev,” has a population of approximately 200,000 and is located approximately 100 km from Tel Aviv (see

Figure 1).

In terms of innovative activities, the Israel Innovation Authority estimates that 77% of all startups are located in Tel Aviv’s metropolitan area, while only 3% are headquartered in the southern district (where the subdistrict of Be’er-Sheva is located), leading to lower salaries in the periphery. Following national policy, the Israel Innovation Authority supports the advance of startups in the periphery by allocating a third of its budget to the periphery and giving higher priority to establishing technological incubators in peripheral regions.

6. Results

Table 1 presents a descriptive picture of the frequency of the different types of startups in the center and the periphery. Chi-square tests indicated a lower frequency of three types of startups in the periphery: those dealing with open innovation, those with international links, and those located in a science park. No statistically significant differences were found for the other types. It should be noted that this does not yet indicate any location tendency of various types of startups. This may be a result of bias in the sample selection (as explained in the Methodology section) or the impact of various ecosystem factors.

The statistical analysis focused on nine ecosystem factors that startups in both the center and the periphery considered relevant based on a median importance rating of three or more (on a scale of one to five). There were no significant differences between the importance attributed to the ecosystem factors by startups in the periphery and in the center, with the significant exception of government financial support, which was considered most important by peripheral startups.

We analyzed the relationships between the availability of the ecosystem factors and the types of startups using two instruments, as explained in the Methodology section.

Table 2 shows the median availability level of each factor for each startup type (on a scale of one to five), in the center and in the periphery, and

Table 3 reports ORs from the logistic models; an OR of >1 indicates a higher likelihood of locating in the periphery, whereas an OR of <1 indicates the center. Average marginal effects (AMEs, in parentheses) show the corresponding change in probability.

In contrast to the general agreement on the importance of various ecosystem factors, the availability level differed significantly, as expected, between the periphery and the center. One surprising finding was the high level of availability of skilled workers and collaboration with other firms, with no differences observed between the startups in the center and the periphery (

Mdn = 4). This finding contradicts many research analyses [

18,

19,

21] that have identified these factors as essential constraints to innovation. The high level of skilled workers in the periphery may be attributed to the relatively short distance in Israel from the periphery to the center.

The lowest availability was found for foreign investments in the periphery (compared with an average level in the center) and for collaboration with universities and research institutions in both the periphery and the center. The low level of university–industry collaboration is surprising given that such collaboration in Israel is ranked at the highest level by the GII index [

6] and given its contribution to innovation [

26,

27]. However, the analysis of the different types of startups revealed that university–industry collaboration is focused among specific types of startups. Startups located in science parks (mostly adjacent to universities) are naturally more inclined to collaborate. There was also increased collaboration among startups with international links in the periphery, as these startups depended on universities to provide an international network. Moreover, R&D-based startups on the periphery were one type of startup that mostly found collaboration opportunities with academia or that originated from academic research.

The availability of government support was lower than the importance attributed to this factor. However, there was a consistent gap between its median value for peripheral and central startups, which was almost independent of the startup’s typology. A median score of three was found for the availability of government financial support in the periphery, compared with a median score of two in the center.

The availability of collaboration with suppliers and consumers was high (median score of four) for practically all startup types in the center and lower for most startup types in the periphery, as expected. The availability of the other factors was mostly greater in the center than in the periphery, but this difference could not be statistically confirmed.

Overall, the availability of the ecosystem factors significantly influenced the startups’ locations, as demonstrated by the chi-square test results (

Table 3). This held true for the whole group of startups (

p < 0.01) and for most individual startup types, confirming Hypothesis 1. Although the availability of government financial support was not at the top of the available factors, its influence on location in the periphery was critical overall and for almost every startup type individually. In all patients, the OR was much greater than one, and the difference was mostly significant.

Some interesting insights emerged regarding which startup types depend more on government support for their location on the periphery, confirming our second hypothesis:

- a

R&D-based startups show a significant effect (OR = 1.77), whereas startups that do not perform R&D display no significant association.

- b

Open-innovation-oriented startups (OR = 2.31) are more than closed-innovation-oriented startups (OR = 1.94).

- c

Startups with international links (OR = 2.67) are more than those without such links (OR = 1.72).

- d

Startups within clusters in science parks (OR = 2.18) are more than geographically dispersed startups (OR = 1.53).

Overall, the government support needed for location in the periphery was critical for startup types that were usually attracted by the agglomeration benefits of central locations.

A second important factor in location decisions was the availability of collaboration options with suppliers and consumers. The influence of access to suppliers and consumers led to a greater number of startups being located in the center (OR < 1). This influence was statistically supported for all startups, specifically for those with open innovation, located in science parks, and dealing with incremental and sustaining (as opposed to disruptive) innovation. For all other types of startups, the OR was lower than one, although it was not statistically significant.

Finally, access to business finance was also a factor that led startups to locate in the center: this factor was significant for some types of startups, and for almost all others, it had a value lower than one, which was not statistically significant. No statistical support was found for the influence of most of the other ecosystem factors.

7. Discussion

The findings of this study offer a clearer understanding of startup location behavior, addressing ambiguities in the existing literature. This research examines two key determinants of startup location: government support and the influence of proximity and agglomeration. By analyzing the interaction between ecosystem factors and startup typologies, it provides a more nuanced assessment of their impact, contributing to the reconciliation of conflicting perspectives in prior studies.

The clearest result of this analysis is probably the critical importance of the government for the growth of startups in the periphery. This finding is consistent with the previous literature, confirming the traditional perception that government support is essential for establishing innovative activities in peripheral regions [

52]. The Israeli periphery has experienced a recent increase in government support as part of the Encouragement of Capital Investment law and location incentives [

53]. This law awards grants and other benefits to those who establish enterprises or expand existing ones, mainly in peripheral areas, and has resulted in increased investment activities in these areas.

Nonetheless, while the availability of government support (3) was not greater than that of most other factors, it had the most important impact on startup location. This is because it is the only factor for which availability is greater in the periphery than in the center, indicating a policy-sensitive dependence on government support.

Despite the quite constant core–periphery gap in the availability of government support for all startup types, its impact was greater for R&D-based startups and for those that were naturally more sensitive to isolation, such as startups operating with open innovation. Taken together, these patterns suggest a clear triage: peripheral incentives are most effective in attracting R&D-based, open-innovation, and internationally oriented startups. The large marginal effects and high sensitivity of these startups to public support justify their prioritization in regional innovation policy. This finding also reinforces that the efficiency of government support should not be considered a global policy but rather be specific to the conditions of different startup types, clarifying doubts in the literature on this issue [

39].

Against the major positive influence of government support, the strongest factor against the location of startups in the periphery was found to be restricted access to collaboration with suppliers and consumers (extremely low and highly significant OR levels), probably due to proximity constraints or a lack of agglomeration economies. This effect reflects a structural boundary condition of agglomeration forces: collaboration with suppliers and consumers systematically pulls startups toward central locations. Policy can only partially mitigate this constraint—for example, through improved transport infrastructure or ICT-based solutions—but cannot fully eliminate it. Interestingly, this is not the result of an extreme problem of remoteness; the combination of an extremely low OR level with a large average availability gap (at least in the case of Israel) hints at the location of the startup being highly sensitive to proximity. This strongly supports the influence of the proximity factor, in accordance with the literature [

16], and is distinct from contentions that the lack of agglomeration economies leads firms in the periphery to increase their collaboration outside the region [

54,

55].

Another noteworthy finding is that the median reported access to skilled workers is very similar in the center and the periphery. This result runs counter to the widespread assumption that peripheral areas face a shortage of skilled labor. In the Israeli context, this outcome can be explained by the country’s small size and relatively short commuting distances, as well as the strong tendency of employees to commute across regions. This observation is also consistent with the recent literature on labor mobility in Israel [

20]. A further surprising finding concerns university–industry collaboration. Although Israel ranks highly on this dimension in international benchmarks, our results reveal limited collaboration at the regional level, particularly outside established hubs. This highlights the gap between national potential and localized realities and suggests the need for targeted place-based policies to diffuse collaborative opportunities more broadly.

Our analysis enabled a tentative response to the existence of different evaluations in the literature of the influence of the level of proximity or remoteness on the location decisions of startups: the attractiveness of the center amenities is not equal for all types of startups; it is high and significant for startups operating with open-innovation strategies or with incremental or nondisruptive innovation but less critical for those operating with closed innovation or radical or disruptive innovation. Apparently, the high tendency to locate in the center is much weaker (or nonexistent) for more isolated types of startup activities, with fewer interactions with the environment.

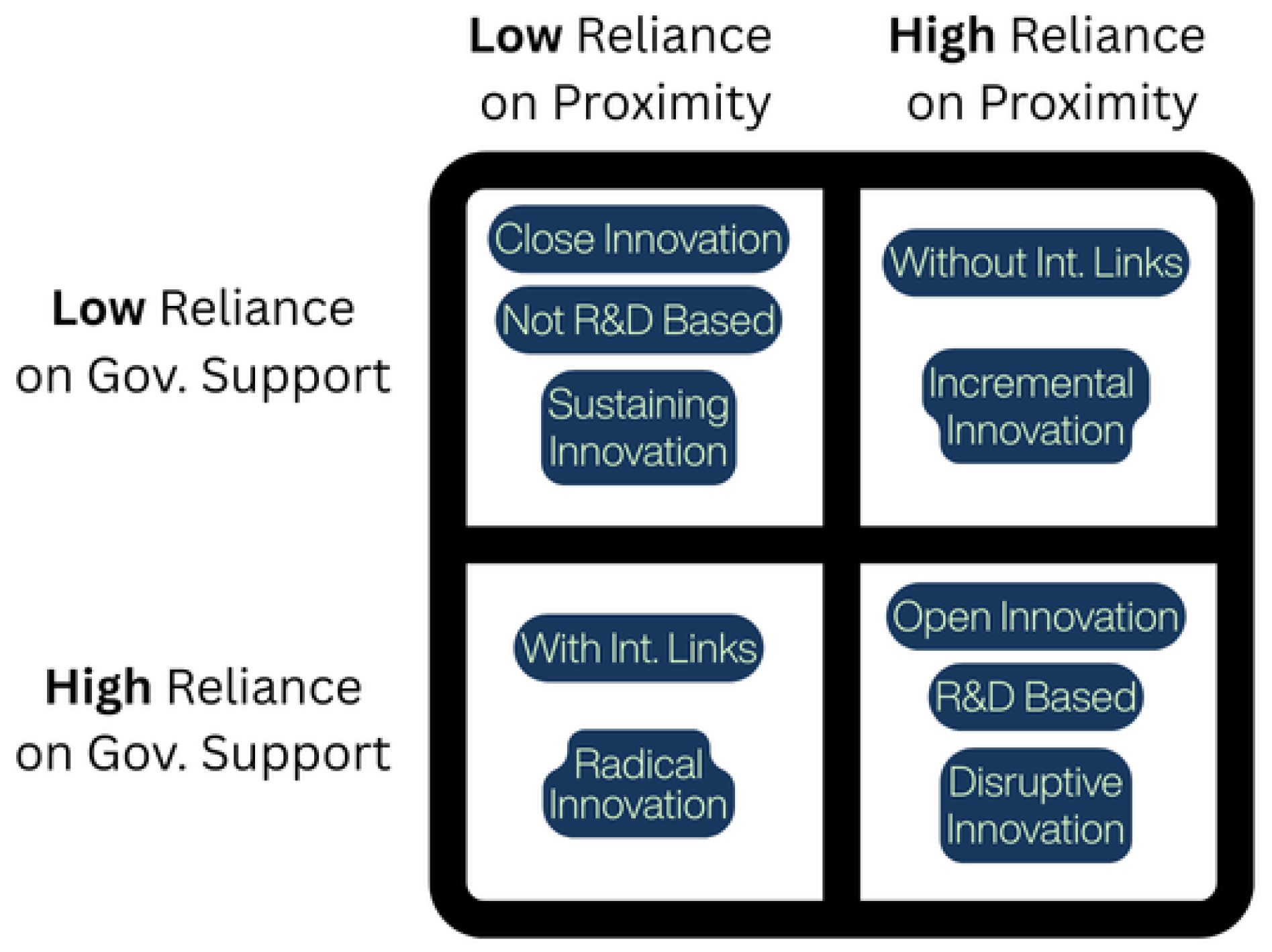

To synthesize the findings, we present a two-dimensional policy map (

Figure 2) that organizes the startup typologies according to their relative reliance on government support and proximity-based ecosystem factors. The map provides a visual summary of the analytical results and serves as a basis for the policy implications discussed below.

8. Conclusions

Although there is consensus about the tendency of startups to locate in central places, some ambiguities have been raised in the literature about the impact of specific ecosystem factors. To address these ambiguities, this study examined the differentiated impacts of various ecosystem factors on different types of startups, using the case of Israel, and implementing various empirical statistical analyses. This approach led us to conclude that the location of startups should not be considered a plain issue: the tendency of a startup to prefer the center or the periphery is determined by the type of innovation in the startup, by the sensitivity of the startup to each ecosystem factor, and by the relative availability of each factor in the center and in the periphery. Our findings complement related evidence on firms’ adaptations to distance [

56].

The results lead to practical implications for policy measures that should be considered or further investigated. A central implication is the need to differentiate government support across startup types. The evidence suggests a clear triage: peripheral incentives are most effective in attracting R&D-intensive firms, open-innovation ventures, and internationally oriented startups. Accordingly, policies should give higher priority to these categories in decisions about financial support allocation, ensuring that resources are directed toward the startups most responsive to peripheral incentives.

A second important implication from the findings is the strong bias toward location in the center resulting from proximity factors, such as the availability of access to suppliers and consumers. Policy measures that could be considered to decrease this effect may include enhancing information and communication technologies and improving transportation infrastructure in more isolated regions.

The findings of this study suggest three key policy implications: (1) Differentiated government support strategies should prioritize R&D-intensive startups, as these firms show the highest reliance on financial incentives in peripheral regions. (2) Investment in regional collaboration networks—including digital innovation hubs and supply chain linkages—could mitigate the adverse effects of geographic isolation. (3) Long-term policy measures should shift from short-term subsidies toward ecosystem-building strategies, fostering self-sustaining innovation environments in peripheral regions. Such support should also be accompanied by a monitoring and evaluation framework (e.g., tracking startup survival, innovation output, and collaboration rates) to assess its effectiveness and allow for policy adjustments.

This study has the following limitations. First, the relatively small and imbalanced sample size, particularly the limited number of startups from the peripheral region (

n = 45), reduces the statistical robustness of the findings. Subgroup analyses in

Table 3 therefore rely on low counts for some typologies, and the results should be regarded as indicative and in need of further validation with larger, more representative samples. Second, the ecosystem factors considered in this study were limited by the constraints of the availability of relevant databases. The literature suggests many more factors that should be considered, such as regional data (infrastructures, distances, development level, etc.). Third, our cross-sectional research design identifies strong associations between ecosystem factors and startup location, but it cannot definitively establish causality. It is possible that location choice influences startups’ perceptions of the ecosystem, just as the ecosystem influences location choice. Future longitudinal studies that track startups over time would be needed to disentangle these causal relationships and provide a more dynamic understanding of location decisions. Additional characteristics of startups, such as their age and size, should also be included.