Abstract

This study examines the interaction effects of green finance and digital platforms on China’s economic growth, employing panel data from 30 provinces spanning the period 2013–2023. Green finance is measured using green bonds and green credit, while digital platforms are proxied by electronic payment and e-commerce penetration. Previous empirical findings indicate that both green finance and digital platforms significantly contribute to economic growth. A 1% increase in the interaction term between green finance and digital platforms, based on fixed effects models with robust standard errors, results in a 0.0204% increase in GDP, supporting the hypothesis of a positive interaction. Control variables including money supply, fiscal expenditure, inflation rate, fixed asset investment, and industrial structure, are included to isolate the net effects of green finance and digital platforms on GDP growth, reinforcing the study’s econometric robustness. This study contributes novel evidence on how the integration of green finance and digital infrastructure fosters sustainable and inclusive economic development.

1. Introduction

In recent years, China has increasingly prioritized economic growth through the integration of green finance and digital platforms. This strategic direction was reaffirmed at the Forum on Sustainable Development and Digital Technology Application Demonstrations, held in Beijing on 6 September 2023. During the event, the Initiative on Digital Technology for Achieving the Sustainable Development Goals was introduced, highlighting the critical role of digital technology in promoting economic development and enhancing resilience. The initiative emphasized the synergy between green finance and digital platforms, advocating for the expansion of China’s green digital finance market and encouraging green foreign direct investment. Such initiatives are designed to strengthen economic resilience and promote sustainable recovery [1].

Existing research highlights the dynamic and interdependent relationship among digital finance, green finance, and economic performance across China’s regional economies. Empirical evidence indicates that the integration of digital finance and green finance can significantly enhance economic outcomes and stimulate growth, particularly when advanced digital technologies are embedded in financial services [2,3,4]. However, the coordinated development of green finance and the digital economy in China remains at an early stage, marked by regional disparities and substantial untapped potential [5]. These observations underscore the need for further empirical investigation into the interaction between green finance and digital platforms, with the goal of promoting sustainable and high-quality economic growth across diverse regions [6,7,8].

China’s remarkable economic growth over the past few decades—driven by industrialization, technological advancement, and global trade integration—has elevated the country to the position of the world’s second-largest economy. However, this rapid expansion has incurred significant environmental costs, including resource depletion and rising carbon emissions [9,10]. In response, China has begun shifting from an export- and investment-led growth model to one focused on sustainability and innovation. The COVID-19 pandemic, which disrupted global economic activity, further underscored the urgency of adopting resilient and sustainable development strategies, such as promoting green finance and accelerating digital transformation [11]. Consequently, the integration of economic development with environmental objectives has become a central pillar of China’s long-term growth strategy.

Digital platforms have become central to the modern economy, fundamentally transforming business operations and financial transactions. They contribute to economic growth and productivity by fostering innovation, expanding market access, and addressing critical challenges such as environmental sustainability [12]. During periods of economic disruption, such as the COVID-19 pandemic, digital platforms have exhibited notable resilience and adaptability, reinforcing their role as essential enablers of economic recovery and sustainable development [13].

While there is a growing body of literature addressing green finance and digital platforms individually [14,15,16,17], empirical studies examining their combined impact on sustainable economic growth, particularly through panel data frameworks within the Chinese context are relatively scarce and insufficiently examined [18,19,20,21]. Although green bonds and green credit are conceptually aligned with the Sustainable Development Goals (SDGs), their empirical contribution to economic growth remains inconclusive and necessitates further investigation [22,23]. Similarly, digital platforms, including electronic payment systems and e-commerce, offer innovative channels for economic activity; however, their interactive effects with green finance on key economic indicators such as GDP remain underexamined.

This study seeks to investigate the contribution of integrating green finance and digital platforms to economic growth in China by addressing the underexplored empirical relationship between these domains. Accordingly, the study addresses the following research question:

Does the interaction between green finance and digital platforms significantly enhance economic growth in China?

By addressing this research gap, the study offers empirical insights into the interactive role of green finance and digital platforms in fostering economic growth. The anticipated findings are expected to advance theoretical discourse in green finance and the digital economy, while providing practical implications for policymakers seeking to design balanced and resilient economic strategies aligned with China’s dynamic development landscape.

2. Literature Review

This study draws upon financial development theory, which offers a conceptual framework for analyzing how financial systems contribute to economic growth through five key functions: (1) mobilizing savings, (2) facilitating risk management, (3) allocating capital efficiently, (4) monitoring investments, and (5) facilitating the exchange of goods and services [24]. The theory posits that well-functioning financial systems lower information and transaction costs, and enhance the efficiency of capital allocation, thereby promoting economic growth.

Building on King and Levine’s (1993) seminal work demonstrating that financial development predicts economic growth, this study extends the framework to explore how contemporary financial innovations, including green finance and digital platforms, that augment traditional financial functions [25]. Green finance constitutes a progression in financial development by integrating environmental criteria into capital allocation, while digital platforms improve the efficiency of financial interactions through technological advancements.

Green finance, encompassing instruments such as green bonds and green credit, aims to direct financial resources toward environmentally sustainable projects, thereby aligning capital flows with global sustainability objectives [26]. Existing research suggests that green finance supports economic growth by funding initiatives that promote environmental protection and stimulate innovation that factors essential to long-term economic resilience and stability [27]. Concurrently, digital platforms (measured by electronic payment systems and e-commerce) that play a critical role in advancing economic growth by lowering transaction costs, improving access to financial services, and enhancing operational efficiency [28]. This impact is particularly evident in China, where digitalization has helped reduce regional economic disparities and expand services to underserved populations, thereby fostering more inclusive and equitable growth.

The convergence of green finance and digital platforms offers transformative opportunities for economic growth by enhancing financial inclusivity, reducing transaction costs, and expanding access to capital across diverse regions. Digital platforms play a critical role in streamlining the allocation, mobilization, and oversight of green financial resources, thereby promoting greater transparency and accountability that both essential for building trust and ensuring the effectiveness of green financial instruments [29,30]. Furthermore, the digitization of financial services contributes to economic expansion by lowering transactional barriers, enabling broader participation, and improving the accessibility of financial products and services [31].

The interaction between green finance and digital platforms holds particular importance for China’s economic growth. Digital financial mechanisms, such as e-commerce and electronic payment systems that have improved financial efficiency, reduced operational costs, and expanded financial inclusion, thereby accelerating the development of green industries [32]. This integration supports the transition toward a low-carbon economy, as digital finance fosters innovations that align economic objectives with environmental sustainability, promoting both economic development and ecological preservation [33].

This interaction also contributes to reducing regional disparities by extending access to green finance in less economically developed areas, thereby promoting more equitable growth across regions [34]. By facilitating investments in green technologies, digital platforms stimulate innovation that not only complies with environmental regulations but also enhances productivity. This dual impact supports GDP growth while strengthening China’s economic resilience, thereby paving the way for a more balanced and sustainable development trajectory.

Drawing on theoretical frameworks and empirical evidence, this study hypothesizes that the interaction between green finance and digital platforms generates a synergistic effect that significantly enhances economic growth. This hypothesis aligns with the expanding body of literature on digital–green convergence, which posits that the combined influence of these domains amplifies their individual contributions, thereby supporting resilient and sustainable economic development [35].

Despite advancements in both theory and empirical research, a notable gap remains in comprehensive studies that examine the combined effects of green finance and digital platforms on economic growth, particularly within China’s unique regulatory and economic context. While green finance instruments, such as green bonds and green credit, have demonstrated effectiveness in supporting sustainable initiatives, their broader impact on economic growth, especially when integrated with digital platforms which has yet to be thoroughly explored [36,37]. Moreover, limited scholarly attention has been directed toward the role of digital platforms in addressing critical challenges associated with green finance, including greenwashing and transparency that factors essential to ensuring that these initiatives meaningfully contribute to environmental sustainability [30].

Most existing studies either focus on single-factor impacts or adopt descriptive approaches. Few have applied panel data regression frameworks to evaluate the interaction effects within a provincial Chinese context. This study addresses this gap by empirically analyzing the interaction between green finance and digital platforms in the context of China’s economic growth. Drawing on financial development theory, the research to examine the interactive between these two factors and their impact on key economic outcomes. In doing so, it provides critical insights for policymakers and stakeholders seeking to foster sustainable and inclusive growth.

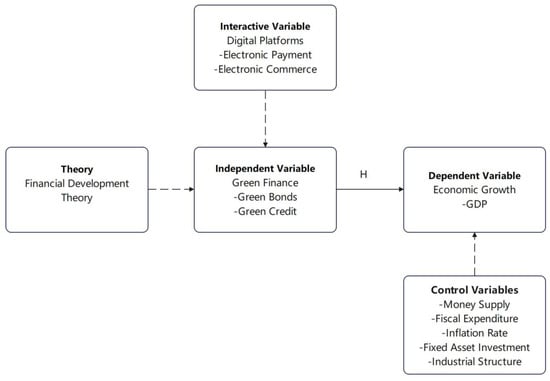

The theoretical framework is constructed in alignment with the research hypothesis and is informed by a review of relevant theories and empirical studies, as illustrated in Figure 1.

Figure 1.

Theoretical Framework.

Figure 1 presents the theoretical framework grounded in financial development theory, which serves as the primary conceptual foundation for this study. Within this framework, the interaction between green finance and digital platforms is defined as the independent variable, while economic growth (measured by GDP) serves as the dependent variable. To ensure the robustness of the analysis, the model incorporates several control variables, including money supply, fiscal expenditure, inflation rate, fixed asset investment, and industrial structure. These variables provide a comprehensive basis for examining the relationships among green finance, digital platforms, and economic growth. The study posits the following hypothesis: the interaction between green finance and digital platforms has a significant positive impact on economic growth in China. ‘H’ is the abbreviation of hypothesis.

This study’s conceptual framework integrates green finance and digital platforms within the broader perspective of financial development theory. The theory underscores the role of financial innovations in fostering inclusive and sustainable growth. Green finance channels resources into environmentally beneficial sectors, while digital platforms improve the reach and efficiency of financial services [38]. Their interaction contributes to better capital mobilization, risk mitigation, and innovation diffusion, which are key channels through which economic growth is promoted.

3. Research Design

3.1. Empirical Model

This study employs a panel data model to examine the impact of green finance and digital platforms on economic growth, with GDP as the dependent variable. The analysis is conducted using data from 30 Chinese provinces spanning the period from 2013 to 2023. STATA 17.0 software is utilized for statistical analysis.

To assess the economic impact of green finance and digital platforms in China, this study adopts a robust panel data regression framework. This methodology enables a comprehensive analysis of data characterized by dual heterogeneity across both cross-sectional and temporal dimensions [39]. Panel data—also referred to as longitudinal data—is structured along two dimensions: a spatial dimension (1 < < N), representing distinct entities such as provinces, and a temporal dimension (1 < < T), representing time periods. Each observation is indexed by both dimensions (, ), thereby allowing for the tracking of specific units over time [40].

For this analysis, panel data from 30 Chinese provinces spanning the years 2013 to 2023 are employed to test the study’s hypotheses. The panel data regression model offers a systematic framework for examining the interaction effects of green finance and digital platforms on economic growth. The general specification of the panel data regression model is expressed as follows:

denotes the dependent variable, while represents the independent variables across the pooled cross-sectional and time-series data. The parameter indicates the intercept, and captures the error term. The indices and refer to the cross-sectional units (provinces) and the temporal dimension of the study (2013–2023), respectively.

This study employs a panel data regression framework to investigate how the interaction between green finance and digital platforms affects economic growth across 30 Chinese provinces over the period 2013–2023. The analysis incorporates pooled ordinary least squares (POLS), fixed effects (FE), and random effects (RE) models to effectively account for unobserved heterogeneity among provinces. The Hausman test is applied to determine the most appropriate model specification, while robust standard errors are used to address potential heteroskedasticity.

By leveraging panel data from 30 provinces, this study provides a detailed assessment of regional variations in the adoption of green finance and digital platforms and their respective impacts on economic growth. To ensure the robustness of the results, diagnostic tests—including the Breusch-Pagan test for heteroskedasticity and the Durbin-Watson test for serial correlation—are conducted. The application of robust standard errors further enhances the reliability of the estimates, thereby ensuring the precision and validity of the conclusions.

This study investigates the role of green finance (measured by green bonds and green credit) and digital platforms (measured by electronic payments and e-commerce) in promoting economic growth by enhancing capital accessibility and market reach. The model incorporates an interaction term between green finance and digital platforms to evaluate their combined effect on economic performance. Key control variables, including money supply (MS), fiscal expenditure (FE), inflation rate (IR), fixed asset investment (FAI), and industrial structure (IS), are included to account for other macroeconomic influences. The core regression equation is specified as follows:

denotes green finance in province at time , serving as the primary variable of interest and encompassing green bonds (GB) and green credit (GC). represents the total value of green bond transactions in province at time , while reflects the total value of green credit transactions for the same province and period. The natural logarithm is applied to both GB and GC to transform the data, a standard approach for linearizing relationships between variables and mitigating skewness, thereby enhancing the robustness of the statistical analysis.

represents digital platforms in province at time , serving as a key variable of interest that integrates both electronic payment (EP) and electronic commerce (EC). captures the total value of electronic payment transactions in province at time , while measures the total value of electronic commerce transactions for the same province and period. To enhance the analytical robustness, the natural logarithm is applied to both and , facilitating the linearization of relationships and reducing data skewness.

Interaction between digital platforms and technological innovation:

represents the natural logarithm of GDP, serving as the dependent variable for measuring economic growth in province at time . denotes the natural logarithm of the money supply for the same province and period, while captures the natural logarithm of fiscal expenditure. Similarly, , , and represent the natural logarithms of the inflation rate, fixed asset investment, and industrial structure, respectively, all within province at time . captures province-specific fixed effects, addressing unobserved characteristics unique to each province that remain constant over time. accounts for time-specific fixed effects, reflecting common influences such as macroeconomic shocks or national policies that simultaneously affect all provinces. represents the error term, encompassing unobserved factors influencing GDP growth in province at time . represents the natural logarithm of the interaction term between green finance (GF) and digital platforms (DPs) for province at time . This term captures the joint influence of green finance and digital platforms on economic growth. The model evaluates the extent to which their interaction affects GDP growth while controlling for key macroeconomic variables such as money supply, fiscal expenditure, inflation rate, fixed asset investment, and industrial structure. The application of the natural logarithmic transformation facilitates coefficient interpretation in percentage terms, providing a clearer understanding of their proportional impacts on GDP growth.

Panel data regression analysis commonly employs three key models: pooled ordinary least squares (POLS), fixed effects (FE), and random effects (RE), each designed to capture both within-entity and between-entity variations [41,42,43,44]. POLS uses ordinary least squares (OLS) estimation to minimize the sum of squared residuals, yielding coefficients that reflect the average effect of independent variables on the dependent variable across all entities [45]. When the assumption of parameter homogeneity holds, POLS produces efficient and unbiased estimates [46].

To address within-group variations, the fixed effects (FE) model is employed, effectively controlling for time-invariant factors that differ across entities and may otherwise introduce bias [47]. The FE model is particularly valued in econometric research for its ability to account for unobserved heterogeneity by isolating entity-specific characteristics that remain constant over time [48,49].

In contrast, the random effects (RE) model is appropriate when unobserved heterogeneity is assumed to be uncorrelated with the explanatory variables. By incorporating both within-entity and between-entity variations, the RE model provides an efficient and unbiased estimation approach, making it a cornerstone of panel data analysis in econometric research [50].

Detecting heteroskedasticity is a critical step, as its presence can result in inefficient parameter estimates and compromised statistical inferences. The Breusch–Pagan test is commonly employed to assess whether the variance of residuals in the POLS model remains constant [51]. Ensuring homoscedastic residuals is essential for improving the accuracy and reliability of POLS estimates, particularly when analyzing the effects of green finance (measured by green bonds and green credit) and digital platforms (measured by electronic payments and e-commerce) on economic growth, as measured by GDP.

The validity of POLS results relies on the assumption of homoscedastic residuals. Applying the Breusch–Pagan test helps verify this assumption, thereby enhancing the credibility and robustness of the study’s conclusions [52,53]. To address potential confounding factors and endogeneity, the analysis incorporates control variables and employs fixed effects models, enabling the identification of causal relationships while reducing the risk of spurious correlations [54].

The Hausman test, developed by Hausman, is a widely used statistical tool for model specification in panel data analysis. Its primary function is to determine whether the fixed effects (FE) or random effects (RE) model is more appropriate for a given dataset [55]. The test evaluates the correlation between individual-specific effects and the explanatory variables, a critical consideration when selecting the appropriate model [56]. A statistically significant Hausman test result leads to the rejection of the null hypothesis, thereby indicating that the fixed effects model is more suitable [57].

All models include control variables, including money supply, fiscal expenditure, inflation rate, fixed asset investment, and industrial structure which are grounded in the theoretical foundations of financial development theory [58,59]. In addition, spatial econometric models are employed to account for spatial dependencies and regional heterogeneity, acknowledging the uneven distribution of economic growth across provinces [41]. This multifaceted methodological approach enhances the rigor of the analysis and ensures that it reflects the complexity and diversity of regional economic dynamics.

3.2. Data and Sample

This study utilizes a panel dataset comprising 30 Chinese provinces from 2013 to 2023, with data sourced from the China Statistical Yearbook, China Banking and Insurance Regulatory Commission and National Bureau of Statistics. Economic growth, measured by GDP, serves as the dependent variable. The independent variables capture the interaction between green finance and digital platforms. To enhance the robustness of the analysis, the model incorporates control variables, including money supply, fiscal expenditure, inflation rate, fixed asset investment, and industrial structure. The data source as show in Table A1.

To maintain scientific rigor, regions with incomplete data, including Hong Kong, Macau, Tibet, and Taiwan that are excluded due to their distinct financial reporting systems [60]. In conclusion, the study employs robust panel data econometric techniques to examine the interaction between green finance and digital platforms and their combined impact on China’s economic growth, with particular attention to both short-term and long-term effects.

4. Empirical Results and Analysis

4.1. Descriptive Statistics

The descriptive statistics offer a detailed summary of the key variables, including the interaction between green finance and digital platforms, economic growth (measured by GDP), and the selected control variables [61].

Table 1 presents the descriptive statistics for the main variables used in this study, which examines the interaction between green finance and digital platforms as drivers of China’s economic growth. The dependent variable, economic growth (measured by GDP), has a mean of 2.299568 and a standard deviation of 0.0890134, indicating moderate variation across observations. The interaction variable between green finance and digital platforms has a mean of 7.386637 and a higher standard deviation of 0.5472032. The relatively high variation in the interaction term suggests diverse regional integration of green finance and digital platforms. The control variables, including money supply (MS), fiscal expenditure (FE), inflation rate (IR), fixed asset investment (FAI), and industrial structure (IS) that also exhibit varying degrees of dispersion. Among them, the inflation rate (IR) demonstrates the highest variability, with a standard deviation of 0.656685, which indicates significant fluctuations across the sample period. This descriptive overview provides a foundational understanding of the dataset, facilitating the subsequent analysis of how the interaction between green finance and digital platforms influences economic growth in China.

Table 1.

Descriptive statistics.

4.2. Empirical Findings

The Breusch–Pagan test is employed to assess the appropriateness of the pooled ordinary least squares (POLS) model relative to alternative panel data models [62]. In contrast, the choice between the fixed effects (FE) and random effects (RE) models is determined using the Hausman test, which ensures that the selected model aligns with the stochastic properties of the dataset [63].

Table 2 presents the results of the Breusch and Pagan Lagrangian Multiplier test for random effects, which evaluates the suitability of a random effects model for analyzing the interaction between green finance and digital platforms in the context of China’s economic growth. The variance of the dependent variable, GDP, is estimated at 0.7435062, with variance components for the idiosyncratic error term (e) and the random intercept (u) estimated at 0.0125553 and 0.0170141, respectively. The corresponding standard deviations are 0.8622681 for GDP, 0.1120503 for the error term, and 0.1304383 for the random intercept, indicating moderate variability with the highest dispersion observed in GDP. That the test statistic chibar2 (01) = 338.68, with a p-value of 0.0000, confirms that the variance of u is significantly different from zero. This result supports the appropriateness of the random effects model, indicating substantial unobserved heterogeneity across provinces and enhancing our understanding of how green finance and digital platforms contribute to regional differences in economic growth.

Table 2.

Breusch and Pagan Lagrangian multiplier test for random effects.

Table 3 reports the results of the Hausman test, which yields a p-value of 0.0000 (p < 0.05), leading to the rejection of the null hypothesis that the random effects model is appropriate. Consequently, the fixed effects model is preferred for analyzing the impact of green finance, digital platforms, and their interaction on economic growth in China. This result underscores the importance of controlling for unobserved heterogeneity across entities, aligning with the study’s objective of capturing the nuanced regional effects of green finance and digital platforms on economic performance. The FE model, supported by the Hausman test, confirms that regional heterogeneity plays a key role in the green-digital growth nexus.

Table 3.

Random versus fixed effects model: Hausman test.

Table 4 presents the results of diagnostic tests for multicollinearity, heteroskedasticity, and serial correlation. These tests are critical to ensuring the robustness and reliability of the econometric model that examines the interaction between green finance and digital platforms, as well as other explanatory factors influencing economic growth. The mean Variance Inflation Factor (mean VIF) of 3.61 is below the commonly accepted threshold of 10, indicating no evidence of multicollinearity. However, the p-value for the heteroskedasticity test is 0.0000, which is less than 0.05, suggesting the presence of heteroskedasticity. In contrast, the p-value for the serial correlation test is 0.2171, exceeding 0.05, indicating no significant serial correlation [64,65]. While multicollinearity and serial correlation are not concerns in this model, heteroskedasticity is present and should be corrected using robust standard errors to ensure the accuracy and validity of the estimation results [63].

Table 4.

Diagnostic checks and serial correlation.

4.3. Estimation Results and Robustness Analysis

To enhance the reliability of the findings, a series of diagnostic tests was conducted to assess multicollinearity, heteroskedasticity, and serial correlation [66]. The Variance Inflation Factor (VIF) analysis revealed no significant multicollinearity, as all VIF values were below the commonly accepted threshold of 10 [67]. Additionally, the Breusch–Pagan test confirmed the presence of heteroskedasticity, while the Durbin–Watson test indicated no evidence of serial correlation [68]. Although multicollinearity and serial correlation do not pose concerns in the estimated models, the presence of heteroskedasticity necessitates the use of robust standard errors to ensure the validity and accuracy of the results.

Table 5 presents the results of four econometric models, including pooled OLS, random effects (RE), fixed effects (FE), and fixed effects with robust standard errors (FE Robust Model), that used to examine the interaction effect between green finance and digital platforms on China’s economic growth. The results show that a 1% increase in the interaction term (green finance × digital platforms) is associated with a 0.0204% increase in GDP. Although modest in magnitude (0.0204%), the interaction effect indicates that digital platforms enhance the marginal contribution of green finance to growth, a result with significant policy relevance over time. The interaction effect is statistically significant and positive, supporting the study’s objective of evaluating how the integration of green finance and digital platforms promotes economic growth. Additionally, fiscal expenditure, money supply, and industrial structure are found to be significant contributors, while the inflation rate does not exhibit a statistically significant effect. Among the models, the FE Robust Model provides the most reliable estimates due to its correction for heteroskedasticity and is thus selected as the preferred model for interpretation.

Table 5.

Use robust standard error estimation.

5. Discussion

This study provides robust empirical evidence of the significantly positive interaction effect of green finance and digital platforms on China’s economic growth, as evidenced by GDP growth. A 1% increase in the interaction term is associated with a statistically significant increase in GDP, supporting the hypothesis of a positive interaction. This result is consistent with Razzaq and Yang (2022), who found that the interaction of digital finance and green innovation significantly boosted green GDP in other Asian economies [29]. China’s experience in green digital finance integration positions the country to lead global efforts in sustainable financial development. By enabling efficient capital allocation and expanding access to financial services, the interplay between green finance and digital platforms promotes economic activity across China’s regions.

Green finance, facilitated by instruments such as green bonds and green credit, exhibits a strengthened impact on economic growth when integrated with digital platforms, including electronic payment systems and e-commerce. This combination enhances financial accessibility, transparency, and inclusivity while simultaneously reducing transaction costs. Digital platforms serve as catalysts, accelerating the adoption of green finance and broadening economic participation, thereby reinforcing their positive effect on GDP. This finding is consistent with recent studies in emerging markets, suggesting that digitalization enhances the developmental impact of green finance [29].

The analysis of control variables, including money supply, fiscal expenditure, inflation rate, fixed asset investment, and industrial structure that reveals varying effects on economic growth. Among them, fiscal expenditure emerges as a primary driver, directing resources toward infrastructure and public services that facilitate the integration of green finance and digital platforms. The significant contributions of money supply and industrial structure underscore the importance of maintaining a stable macroeconomic environment to fully realize the benefits of these interactions. These findings suggest that favorable macroeconomic conditions are essential for enhancing the positive impact of green finance and digital platforms on economic development [69].

Regional disparities in the adoption and economic impact of green finance and digital platforms underscore the need for context-specific policy interventions. Economically advanced regions with well-developed digital infrastructure exhibit stronger responses to green finance initiatives, as their digital ecosystems more effectively support financial transactions and innovation. In contrast, less-developed regions face challenges in realizing similar benefits, highlighting the need to prioritize digital infrastructure development in these areas to promote inclusive growth. Targeted policies aimed at expanding digital financial services and infrastructure in underdeveloped provinces could help mitigate these disparities and contribute to more balanced economic development across China [70].

This study makes a significant contribution to the academic literature by empirically analyzing the interaction between green finance and digital platforms in the context of economic growth. The findings highlight the transformative potential of integrating these two domains to accelerate growth while fostering resilience, innovation, and inclusivity. For policymakers, the results offer actionable insights for leveraging digital and financial policy instruments to support sustainable development, aligning with China’s long-term economic and environmental objectives. Embedding these interactions within policy frameworks could further advance China’s transition toward a low-carbon, innovation-driven economy, thereby enhancing both economic performance and environmental sustainability [71].

6. Conclusions and Policy Implications

This study provides empirical evidence on the interconnected roles of green finance and digital platforms as key drivers of economic growth in China. By analyzing the interaction between green finance (measured by green bonds and green credit) and digital platforms (measured by electronic payments and e-commerce), the research demonstrates their joint positive impact on economic growth, as evidenced by China’s GDP growth. The findings confirm that the integration of green finance and digital platforms, grounded in financial development theory, offers significant potential for promoting economic growth. The evidence-based policy recommendations provide a roadmap for leveraging these synergies while addressing regional disparities and institutional capacity constraints.

A notable observation is that regions with advanced digital infrastructure derive greater benefits from green finance initiatives, underscoring the catalytic role of digital platforms in enhancing the effectiveness of green finance. These platforms reduce transaction costs, improve transparency, and broaden access to financial services, thereby fostering inclusivity and regional economic balance. Digitalization thus emerges as a cornerstone for optimizing the economic impact of green finance across China.

The analysis also highlights the significance of a stable macroeconomic environment, as demonstrated by the influence of control variables, including money supply, fiscal expenditure, inflation rate, fixed asset investment, and industrial structure. In particular, fiscal expenditure and money supply play essential roles in providing the infrastructure and stability necessary for integrating green finance with digital platforms. These findings emphasize the importance of coherent and coordinated macroeconomic policies to unlock the full potential of these synergistic initiatives.

While the fixed effects model accounts for time-invariant provincial heterogeneity, it does not address potential reverse causality or simultaneity bias. Provinces with higher economic output may also be more capable of investing in digital infrastructure and green finance. Although more advanced identification strategies, such as system GMM, could enhance causal inference, data limitations preclude its application in the current study. Future research could explore quasi-experimental designs or dynamic panel models to derive more robust causal insights.

In conclusion, this research advances the literature on finance and the digital economy by empirically validating the combined effects of green finance and digital platforms on China’s economic growth. It offers actionable insights for policymakers, including:

Expanding digital infrastructure in underdeveloped provinces to amplify green finance impacts.

Promoting targeted subsidies that integrate e-payment with green financing tools.

Developing integrated green–digital finance platforms to support SMEs.

Author Contributions

Software, X.D.; Formal analysis, X.X.; Writing—original draft, H.L.; Writing—review & editing, N.A.K.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Data source.

Table A1.

Data source.

| Variables | Indicators | Measurement | Data Source |

|---|---|---|---|

| Economic Growth (EG) |

| China Statistical Yearbook | |

| Green Finance (GF) |

| Issuance volume | China Banking and Insurance Regulatory Commission |

| Total balance of green loans | ||

| Digital Platforms (DPs) |

| Total transaction value | China Banking and Insurance Regulatory Commission |

| Online retail sales | ||

| Money Supply (MS) | China Statistical Yearbook | ||

| Fisal Expenditure (FE) | National Bureau of Statistics | ||

| Inflation Rate (IR) | China Statistical Yearbook | ||

| Fixed Asset Investment (FAI) | National Bureau of Statistics | ||

| Industrial Structure (IS) | National Bureau of Statistics |

References

- Han, J.; Gao, H.Y. Green Finance, Social Inclusion, and Sustainable Economic Growth in OECD Member Countries. Humanit. Soc. Sci. Commun. 2024, 11, 140. [Google Scholar] [CrossRef]

- Sun, Y.; He, M. Does Digital Transformation Promote Green Innovation? A Micro-Level Perspective on the Solow Paradox. Front. Environ. Sci. 2023, 11, 1134447. [Google Scholar] [CrossRef]

- Hao, F. Biden’s Approval, Record Inflation, Economic Recovery, COVID-19 Mortality, and Vaccination Rate among Americans—A Longitudinal Study of State-Level Data from April 2021 to January 2022. Prev. Med. Rep. 2023, 36, 102454. [Google Scholar] [CrossRef]

- Hao, Y.; Wang, C.; Yan, G.; Irfan, M.; Chang, C.P. Identifying the Nexus among Environmental Performance, Digital Finance, and Green Innovation: New Evidence from Prefecture-Level Cities in China. J. Environ. Manag. 2023, 335, 117554. [Google Scholar] [CrossRef]

- Guo, J.; Zhang, K.; Liu, K. Exploring the Mechanism of the Impact of Green Finance and Digital Economy on China’s Green Total Factor Productivity. Int. J. Environ. Res. Public Health 2022, 19, 16303. [Google Scholar] [CrossRef] [PubMed]

- Liu, Z.; Tu, Y. Nexus among Financial Innovation, Natural Resources and Economic Recovery: A Fresh Empirical Insight from China. Resour. Policy 2023, 84, 103646. [Google Scholar] [CrossRef]

- Liu, Z.; Li, R.; Cai, R.; Lan, J. A Nexus of Income Inequality and Natural Resource Utilization Efficiency: Effect on the Road to Green Economic Recovery. Resour. Policy 2023, 85, 103625. [Google Scholar] [CrossRef]

- Liu, G.; Liang, K. The Role of Technological Innovation in Enhancing Resource Sustainability to Achieve Green Recovery. Resour. Policy 2024, 89, 104659. [Google Scholar] [CrossRef]

- Wang, Y.; Zheng, Y. The Significance of Emission Trading System from the Perspective of Environmental Regulation—Based on the Analysis of China’s Environmental Pollution Control Data. In Proceedings of the IOP Conference Series: Earth and Environmental Science; UK, Institute of Physics Publishing: Bristol, UK, 2019; Volume 295. [Google Scholar] [CrossRef]

- Bei, J.; Wang, C. Renewable Energy Resources and Sustainable Development Goals: Evidence Based on Green Finance, Clean Energy and Environmentally Friendly Investment. Resour. Policy 2023, 80, 103194. [Google Scholar] [CrossRef]

- Zuo, Z.; Cao, R.; Teymurova, V. Unlocking Natural Resource Potential: A Balanced Strategies for a Fair and Sustainable Economic Recovery. Resour. Policy 2024, 89, 104518. [Google Scholar] [CrossRef]

- Nerbel, J.F.; Kreutzer, M. Digital Platform Ecosystems in Flux: From Proprietary Digital Platforms to Wide-Spanning Ecosystems. Electron. Mark. 2023, 33, 6. [Google Scholar] [CrossRef]

- Hodson, M.; Lockhart, A.; McMeekin, A. How Have Digital Mobility Platforms Responded to COVID-19 and Why Does This Matter for ‘the Urban’? Urban Stud. 2023, 61, 923–942. [Google Scholar] [CrossRef]

- Chen, K.; Zhao, S.; Jiang, G.; He, Y.; Li, H. The Green Innovation Effect of the Digital Economy. Int. Rev. Econ. Financ. 2025, 99, 103970. [Google Scholar] [CrossRef]

- Shen, Y.; Zhang, L. Research on Green Finance in Support of Green Economic Development. In Proceedings of the ICEMBDA, Tianjin, China, 27–29 October 2023. [Google Scholar]

- Zielonka, R.; Metzler, M.; Mulvenon, J.; Siegel, S.; Yang, C.Z. Technology Innovation and Digital Revolution: Adoption and Diffusion of Digital Network Platforms, 1995–2001, with Implications for Future Development. Ph.D. Thesis, University of Washington, Washington, DC, USA, 2022. [Google Scholar] [CrossRef]

- Ratten, V. Digital Platforms and Transformational Entrepreneurship during the COVID-19 Crisis. Int. J. Inf. Manag. 2023, 72, 102534. [Google Scholar] [CrossRef] [PubMed]

- Xu, Y.; Yuan, L.; Khalfaoui, R.; Radulescu, M.; Mallek, S.; Zhao, X. Making Technological Innovation Greener: Does Firm Digital Transformation Work? Technol. Forecast. Soc. Change 2023, 197, 122928. [Google Scholar] [CrossRef]

- Tan, X.; Cheng, S.; Liu, Y. Green Digital Finance and Technology Diffusion. Humanit. Soc. Sci. Commun. 2024, 11, 389. [Google Scholar] [CrossRef]

- Xiao, Y.; Lin, M.; Wang, L. Impact of Green Digital Finance on Sustainable Development: Evidence from China’s Pilot Zones. Financ. Innov. 2024, 10, 10. [Google Scholar] [CrossRef]

- Wu, B.; Ma, W.; Zhao, Q. Digital Economy and Urban Green Transformation. Int. Rev. Financ. Anal. 2025, 104, 104286. [Google Scholar] [CrossRef]

- Sangiorgi, I.; Schopohl, L. Explaining Green Bond Issuance Using Survey Evidence: Beyond the Greenium. Br. Account. Rev. 2023, 55, 101071. [Google Scholar] [CrossRef]

- Roy, P.K. Enriching the Green Economy through Sustainable Investments: An ESG-Based Credit Rating Model for Green Financing. J. Clean. Prod. 2023, 420, 138315. [Google Scholar] [CrossRef]

- Levine, R. Chapter 12 Finance and Growth: Theory and Evidence. Handb. Econ. Growth 2005, 1, 865–934. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Finance and Growth: Schumpeter Might Be Right. Q. J. Econ. 1993, 108, 717–737. [Google Scholar] [CrossRef]

- Yin, X.; Xu, Z. An Empirical Analysis of the Coupling and Coordinative Development of China’s Green Finance and Economic Growth. Resour. Policy 2022, 75, 102476. [Google Scholar] [CrossRef]

- Fan, W.; Wu, H.; Liu, Y. Does Digital Finance Induce Improved Financing for Green Technological Innovation in China? Discret. Dyn. Nat. Soc. 2022, 2022, 6138422. [Google Scholar] [CrossRef]

- Zhou, R. Sustainable Economic Development, Digital Payment, and Consumer Demand: Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 8819. [Google Scholar] [CrossRef]

- Razzaq, A.; Yang, X. Digital Finance and Green Growth in China: Appraising Inclusive Digital Finance Using Web Crawler Technology and Big Data. Technol. Forecast. Soc. Change 2023, 188, 122262. [Google Scholar] [CrossRef]

- Chueca Vergara, C.; Ferruz Agudo, L. Fintech and Sustainability: Do They Affect Each Other? Sustainability 2021, 13, 7012. [Google Scholar] [CrossRef]

- Zhong, S.; Peng, L.; Li, J.; Li, G.; Ma, C. Digital Finance and the Two-Dimensional Logic of Industrial Green Transformation: Evidence from Green Transformation of Efficiency and Structure. J. Clean. Prod. 2023, 406, 137078. [Google Scholar] [CrossRef]

- Wan, B.; Tian, L. Health-Education-Disaster Green Low-Carbon Endogenous Economic Growth Model and Its New Accompanying Effects. J. Clean. Prod. 2022, 359, 131923. [Google Scholar] [CrossRef]

- Qin, C.; Zhang, M.; Yang, C. Can National Big Data Comprehensive Experimental Zones Boost the Development of Regional Green Finance? Evidence from China. Emerg. Mark. Financ. Trade 2023, 60, 541–556. [Google Scholar] [CrossRef]

- Reza-Gharehbagh, R.; Arisian, S.; Hafezalkotob, A.; Makui, A. Sustainable supply chain finance through digital platforms: A pathway to green entrepreneurship. Ann. Oper. Res. 2023, 331, 285–319. [Google Scholar] [CrossRef]

- Hu, J.; Li, J.; Li, X.; Liu, Y.; Wang, W.; Zheng, L. Will Green Finance Contribute to a Green Recovery? Evidence From Green Financial Pilot Zone in China. Front. Public Health 2021, 9, 794195. [Google Scholar] [CrossRef]

- Tan, X.; Dong, H.; Liu, Y.; Su, X.; Li, Z. Green Bonds and Corporate Performance: A Potential Way to Achieve Green Recovery. Renew Energy 2022, 200, 59–68. [Google Scholar] [CrossRef]

- Yang, C.; Masron, T.A. Impact of Digital Finance on Energy Efficiency in the Context of Green Sustainable Development. Sustainability 2022, 14, 11250. [Google Scholar] [CrossRef]

- Wiles, R.C. Book Reviews. Rev. Soc. Econ. 1970, 28, 123–124. [Google Scholar] [CrossRef]

- Balázsi, L.; Baltagi, B.H.; Mátyás, L.; Pus, D. Random Effects Models. In The Econometrics of Multi-Dimensional Panels; Advanced Studies in Theoretical and Applied Econometrics 50; Springer: Berlin/Heidelberg, Germany, 2017. [Google Scholar] [CrossRef]

- Kelejian, H.; Piras, G. Panel Data Models. In Spatial Econometrics; Elsevier: Amsterdam, The Netherlands, 2017. [Google Scholar] [CrossRef]

- Elhorst, J.P. Spatial Panel Data Models. In Spatial Econometrics: From Cross-Sectional Data to Spatial Panels; Springer: Berlin/Heidelberg, Germany, 2014; pp. 37–93. [Google Scholar] [CrossRef]

- Kang, S.W. A Gibbs Sampling Algorithm for a Changing Regression Model with Pooled Binary Response Data8. Commun. Commun. Stat. Theory Methods 2007, 36, 349–373. [Google Scholar] [CrossRef]

- Baltagi, B.H.; Liu, L. Random Effects, Fixed Effects and Hausman’s Test for the Generalized Mixed Regressive Spatial Autoregressive Panel Data Model. Econom. Rev. 2016, 35, 638–658. [Google Scholar] [CrossRef]

- Halme, A.L.E.; McAlpine, K.; Martini, A. Fixed-Effect Versus Random-Effects Models for Meta-Analyses: Random-Effects Models. Eur. Assoc. Urology. Publ. 2023, 9, 693–694. [Google Scholar] [CrossRef] [PubMed]

- Madsen, J.B. Book Review: Basic Econometrics, Damodar N. Gujarati, McGraw-Hill, New York, 1995, ISBN 0-07-025214-9 (Paperback), pp. 838. Price US$74.95, £23.50 (Paperback). J. Appl. Econom. 1998, 13, 209–212. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Correlated Random Effects Models with Unbalanced Panels. J. Econom. 2019, 211, 137–150. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis, 5th ed.; Prentice Hall International, New York University: New York, NY, USA, 2003; ISBN 0130661899. [Google Scholar]

- Balazsi, L.; Matyas, L.; Wansbeek, T. Fixed Effects Models. In The Econometrics of Multi-Dimensional Panels; Advanced Studies in Theoretical and Applied Econometrics 50; Springer: Berlin/Heidelberg, Germany, 2017. [Google Scholar] [CrossRef]

- Haberfeld, Y. Status Variables in Fixed-Effect Models. Econ. Lett. 1994, 45, 299–303. [Google Scholar] [CrossRef]

- Kim, Y.; Sohn, S.Y. Random Effects Model for Credit Rating Transitions. Eur. J. Oper. Res. 2008, 184, 561–573. [Google Scholar] [CrossRef]

- Verbon, H.A.A. Testing for heteroscedasticity in a model of seemingly unrelated regression equations with variance components (SUREVC). Econ. Lett. 1980, 5, 149–153. [Google Scholar] [CrossRef]

- Cota, B.; Erjavec, N.; Mačkić, V. External Competitiveness and the Role of Fiscal Policy: Does Fiscal Austerity Matter? Croat. Oper. Res. Rev. 2019, 10, 55–64. [Google Scholar] [CrossRef]

- Sener, S.; Karakas, A.T. The Effect of Economic Growth on Energy Efficiency: Evidence from High, Upper-Middle and Lower-Middle Income Countries. Procedia Comput. Sci. 2019, 158, 523–532. [Google Scholar] [CrossRef]

- Úbeda, F.; Javier Forcadell, F.; Suárez, N. Do Formal and Informal Institutions Shape the Influence of Sustainable Banking on Financial Development? Financ. Res. Lett. 2022, 46, 102391. [Google Scholar] [CrossRef]

- Dezhbakhsh, H.; Thursby, J.G. Testing for Autocorrelation in the Presence of Lagged Dependent Variables. A Specification Error Approach. J. Econom. 1994, 60, 251–272. [Google Scholar] [CrossRef]

- Hausman, J.A. Specification Tests in Econometrics. Econometrica 1978, 46, 1251–1271. Available online: https://www.jstor.org/stable/1913827 (accessed on 22 May 2025). [CrossRef]

- Hausman, J.; Pesaran, H. The J-Test as a Hausman Specification Test. Econ. Lett. 1983, 12, 277–281. [Google Scholar] [CrossRef]

- Lachman, D.; Shaw, E.S. Financial Deepening in Economic Development. Econ. J. 1974, 84, 227–228. [Google Scholar] [CrossRef]

- Mckinnon, R.I. Money and Capital in Economic Development; Brookings Institution Press: Washington, DC, USA, 1973; Available online: http://www.jstor.org/stable/10.7864/jj.17497055.1 (accessed on 22 May 2025).

- Donohue, I.; Coscieme, L.; Gellner, G.; Yang, Q.; Jackson, A.L.; Kubiszewski, I.; Costanza, R.; McCann, K.S. Accelerated Economic Recovery in Countries Powered by Renewables. Ecol. Econ. 2023, 212, 107916. [Google Scholar] [CrossRef]

- Oyelami, L.O.; Adebiyi, S.O.; Adekunle, B.S. Electronic Payment Adoption and Consumers’ Spending Growth: Empirical Evidence from Nigeria. Future Bus. J. 2020, 6, 14. [Google Scholar] [CrossRef]

- Breusch, A.T.S.; Pagan, A.R. A Simple Test for Heteroscedasticity and Random Coefficient Variation. Econometrica 1979, 47, 1287–1294. [Google Scholar] [CrossRef]

- Hoechle, D. Robust Standard Errors for Panel Regressions with Cross-Sectional Dependence. Stata J. 2007, 7, 281–312. [Google Scholar] [CrossRef]

- Lee, T.-H.; Tse, Y. Cointegration tests with conditional heteroskedasticity. J. Econom. 1996, 73, 401–410. [Google Scholar] [CrossRef]

- Isnurhadi, I.; Adam, M.; Sulastri, S.; Andriana, I.; Muizzuddin, M. Bank Capital, Efficiency and Risk: Evidence from Islamic Banks. J. Asian Financ. Econ. Bus. 2021, 8, 841–850. [Google Scholar] [CrossRef]

- Carrasco, M.; Nokho, C. Hansen-Jagannathan Distance with Many Assets; Université de Montréal: Montreal, QC, Canada, 2024. [Google Scholar]

- Farley, J.; Burke, M.; Flomenhoft, G.; Kelly, B.; Forrest Murray, D.; Posner, S.; Putnam, M.; Scanlan, A.; Witham, A. Monetary and Fiscal Policies for a Finite Planet. Sustainability 2013, 5, 2802–2826. [Google Scholar] [CrossRef]

- Bilkova, D. The Czech Republic’s Economy since the 1990s and Its Development Forecasts: Selected Macroeconomic Indicators. Eng. Econ. 2023, 34, 370–383. [Google Scholar] [CrossRef]

- Liu, L.; Moon, H.R.; Schorfheide, F. Forecasting with Dynamic Panel Data Models. Econometrica 2020, 88, 171–201. [Google Scholar] [CrossRef]

- Wu, W.T.; Chen, X.Q.; Zvarych, R.; Huang, W.L. The Stackelberg Duel between Central Bank Digital Currencies and Private Payment Titans in China. Technol. Forecast. Soc. Change 2024, 200, 123169. [Google Scholar] [CrossRef]

- Bai, B. Fiscal Stimulus and Natural Resource Efficiency: A Comprehensive Approach to a Green Economic Recovery. Resour. Policy 2023, 86, 104092. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).