From Innovation to Use: Configurational Pathways to High Fintech Use Across User Groups

Abstract

1. Introduction

2. Theoretical Background

2.1. Three Dimensions of Fintech

2.2. Diffusion of Innovation Theory and Information Systems Success Model

2.3. Configurational Theory

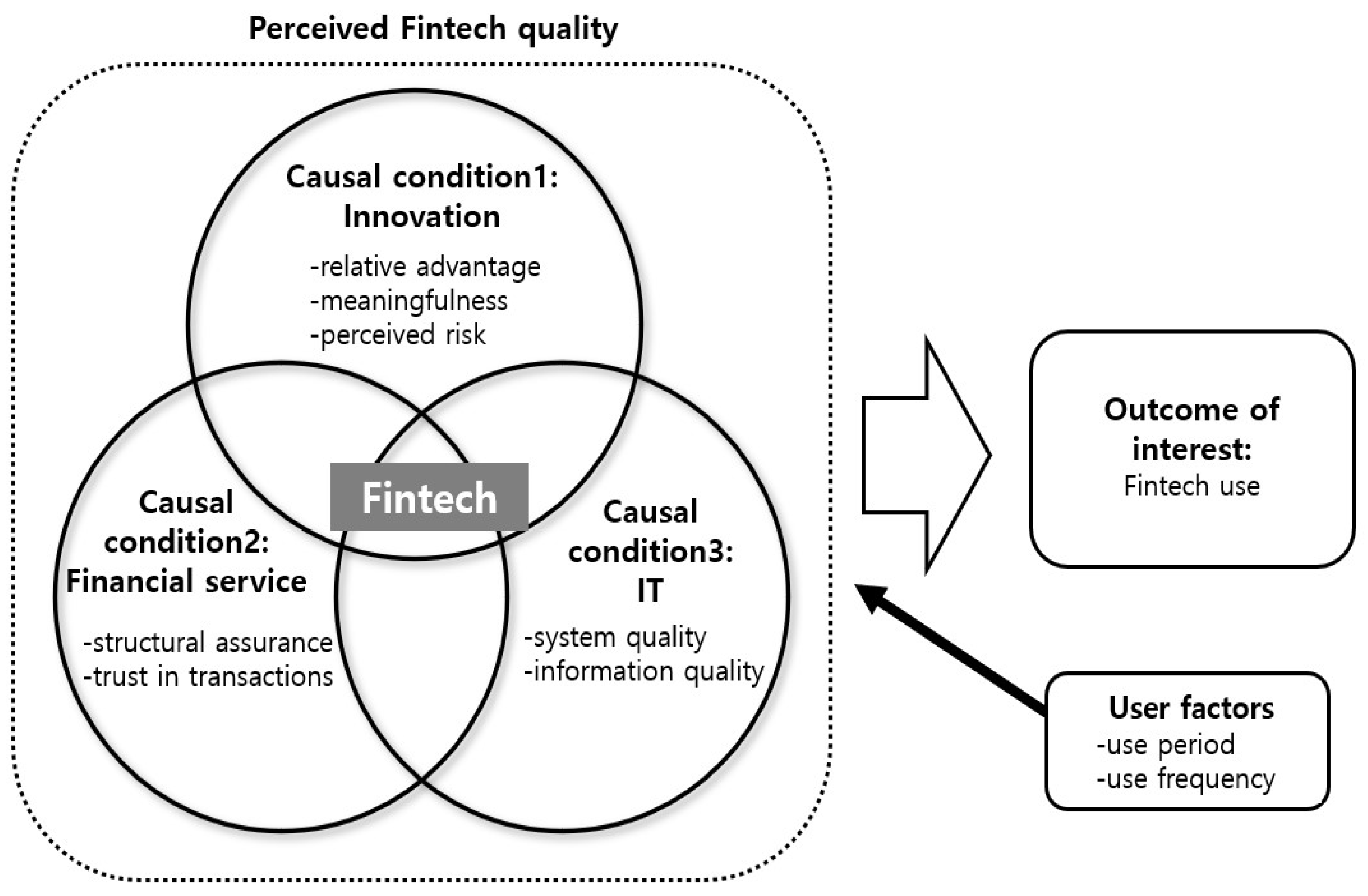

3. Research Model of Fintech

3.1. Causal Condition 1: Three Attributes of Innovation

3.2. Causal Condition 2: Two Attributes of Financial Service

3.3. Causal Condition 3: Two Attributes of IT

3.4. User Factors: Use Period and Use Frequency

4. Research Methodology

4.1. Sample and Data Collection

4.2. Development of Measurement

5. Analysis and Results

5.1. fsQCA Approach and Calibration Process

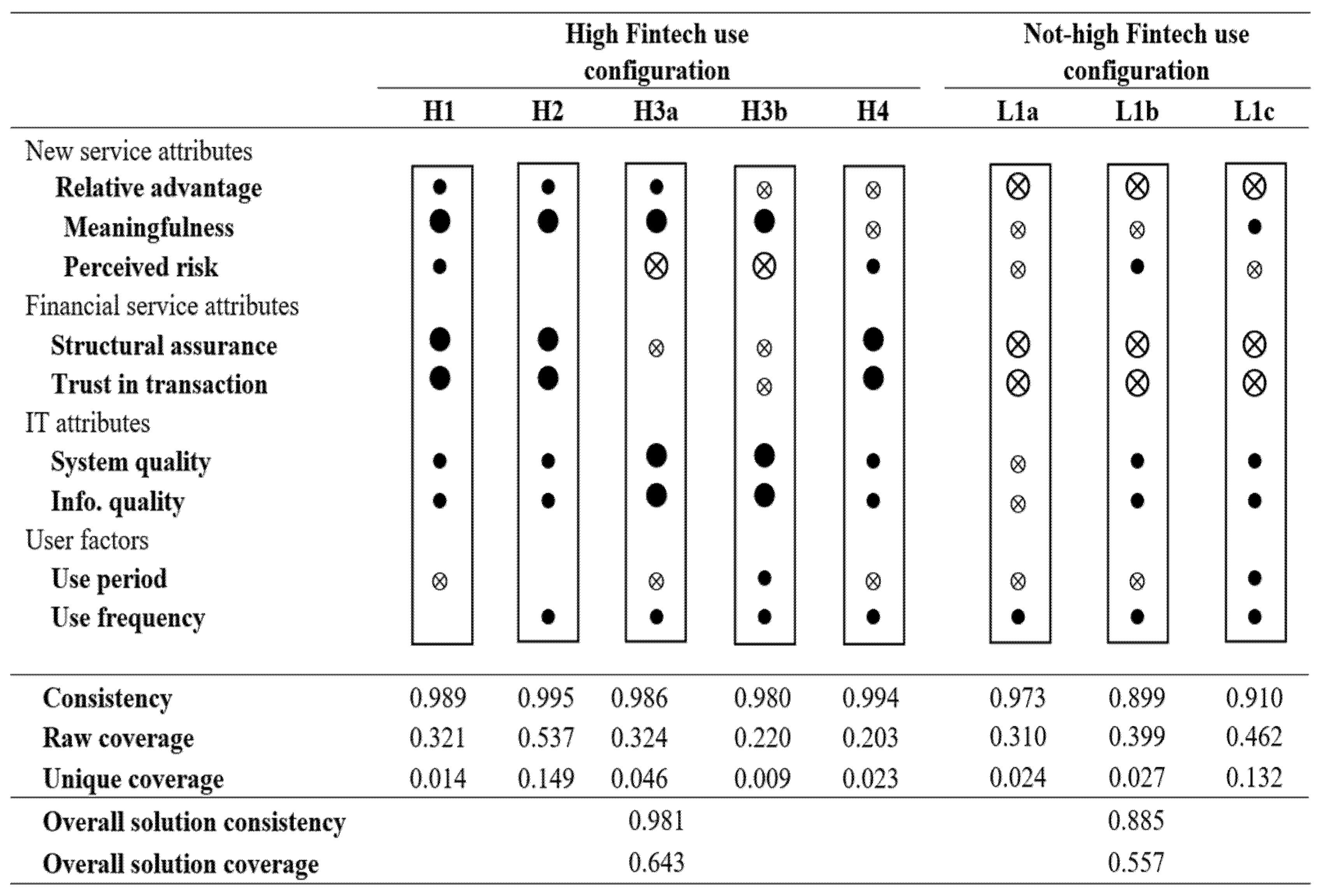

5.2. Results of the fsQCA

6. Discussion and Implications

6.1. Discussion of Findings

6.2. Theoretical and Practical Implications

6.3. Limitations and Future Research Directions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Structure of the Survey Instrument

| Constructs | Questionnaire | Reference |

|---|---|---|

| Relative advantage (RA) |

| Calantone et al. [95], Ordanini et al. [11] |

| Meaningfulness (MF) |

| Cooper and Kleinschmidt [46], Im and Workman Jr [96], Ordanini et al. [11] |

| Perceived risk (PR) |

| Kim et al. [97], Benlian and Hess [19] |

| Structural assurance (SA) |

| Kim et al. [98], Mcknight et al. [99], Zhou [100], Yu et al. [50] |

| Trust in transactions (TRU) |

| Mcknight et al. [99], Zhou [58], Yu et al. [50] |

| System quality (STQ) |

| Delone and McLean [61], Wang [101], Zhou [58] |

| Information quality (IFQ) |

| Delone and McLean [61], Wang [101], Zhou [58] |

| Fintech use (FU) |

| Lee [76] (2009), Ryu [47] |

Appendix B. Test for Common Method Variance Using the Marker Variable Method

| Constructs | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|

| 1. Relative advantage | 0.847 | ||||||||

| 2. Meaningfulness | 0.669 | 0.905 | |||||||

| 3. Perceived risk | −0.223 | −0.217 | 0.880 | ||||||

| 4. Structural assurance | 0.280 | 0.322 | 0.163 | 0.846 | |||||

| 5. Trust in transactions | 0.347 | 0.401 | 0.040 | 0.699 | 0.891 | ||||

| 6. System quality | 0.562 | 0.562 | −0.254 | 0.166 | 0.263 | 0.915 | |||

| 7. Information quality | 0.651 | 0.646 | −0.143 | 0.392 | 0.461 | 0.612 | 0.893 | ||

| 8. Fintech Use | 0.582 | 0.526 | −0.159 | 0.483 | 0.547 | 0.468 | 0.607 | 0.909 | |

| 9. Marker | 0.089 | 0.053 | 0.189 | −0.105 | −0.120 | 0.057 | 0.051 | −0.012 | 1.0 |

Appendix C. Necessary Condition Test

| Condition | High Fintech Use | |

|---|---|---|

| Consistency | Coverage | |

| RA | 0.844 | 0.887 |

| RA1 | 0.815 | 0.923 |

| MF | 0.820 | 0.912 |

| MF1 | 0.801 | 0.944 |

| PR | 0.599 | 0.899 |

| SA | 0.717 | 0.941 |

| TRU | 0.806 | 0.924 |

| STQ | 0.812 | 0.820 |

| STQ1 | 0.795 | 0.915 |

| IFQ | 0.866 | 0.916 |

| UP | 0.575 | 0.851 |

| UF | 0.835 | 0.944 |

References

- Lee, I.; Shin, Y.J. Fintech: Ecosystem, business models, investment decisions, and challenges. Bus. Horiz. 2018, 61, 35–46. [Google Scholar] [CrossRef]

- Kuo Chuen, D.L.; Teo, E.G. Emergence of FinTech and the LASIC principles. J. Financ. Perspect. 2015, 3, 24–36. [Google Scholar]

- Hu, Z.; Ding, S.; Li, S.; Chen, L.; Yang, S. Adoption intention of fintech services for bank users: An empirical examination with an extended technology acceptance model. Symmetry 2019, 11, 340. [Google Scholar] [CrossRef]

- Firmansyah, E.A.; Masri, M.; Anshari, M.; Besar, M.H.A. Factors affecting fintech adoption: A systematic literature review. FinTech 2023, 2, 21–33. [Google Scholar] [CrossRef]

- Tun-Pin, C.; Keng-Soon, W.C.; Yen-San, Y.; Pui-Yee, C.; Hong-Leong, J.T.; Shwu-Shing, N. An adoption of fintech service in Malaysia. South East Asia J. Contemp. Bus. 2019, 18, 134–147. [Google Scholar]

- Singh, S.; Sahni, M.M.; Kovid, R.K. What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Manag. Decis. 2020, 58, 1675–1697. [Google Scholar] [CrossRef]

- Hasan, R.; Ashfaq, M.; Shao, L. Evaluating drivers of fintech adoption in the Netherlands. Global. Bus. Rev. 2021, 25, 1576–1589. [Google Scholar] [CrossRef]

- Werth, O.; Cardona, D.R.; Torno, A.; Breitner, M.H.; Muntermann, J. What determines FinTech success?—A taxonomy-based analysis of FinTech success factors. Electron. Mark. 2023, 33, 21. [Google Scholar] [CrossRef]

- Chan, R.; Troshani, I.; Rao Hill, S.; Hoffmann, A. Towards an understanding of consumers’ FinTech adoption: The case of Open Banking. Int. J. Bank Mark. 2022, 40, 886–917. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Ordanini, A.; Parasuraman, A.; Rubera, G. When the recipe is more important than the ingredients: A qualitative comparative analysis (QCA) of service innovation configurations. J. Serv. Res. 2014, 17, 134–149. [Google Scholar] [CrossRef]

- Szymanski, D.M.; Kroff, M.W.; Troy, L.C. Innovativeness and new product success: Insights from the cumulative evidence. J. Acad. Mark. Sci. 2007, 35, 35–52. [Google Scholar] [CrossRef]

- Arner, D.W.; Barberis, J.; Buckley, R.P. The evolution of Fintech: A new post-crisis paradigm. Geo. J. Int’l L. 2015, 47, 1271. [Google Scholar] [CrossRef]

- Ernst & Young. Landscaping UK Fintech; UK Trade & Investment: London, UK, 2015. [Google Scholar]

- Pawłowska, M.; Staniszewska, A.; Grzelak, M. Impact of FinTech on sustainable development. Financ. Sci. 2022, 27, 49–66. [Google Scholar] [CrossRef]

- Deng, X.; Huang, Z.; Cheng, X. FinTech and sustainable development: Evidence from China based on P2P data. Sustainability 2019, 11, 6434. [Google Scholar] [CrossRef]

- Mhlanga, D. The role of smart technologies in achieving development goals. JAISD 2023, 1, 3–13. [Google Scholar]

- Huarng, K.-H.; Yu, T.H.-K. Causal complexity analysis for fintech adoption at the country level. J. Bus. Res. 2022, 153, 228–234. [Google Scholar] [CrossRef]

- Ryu, H.-S.; Ko, K.S. Sustainable development of Fintech: Focused on uncertainty and perceived quality issues. Sustainability 2020, 12, 7669. [Google Scholar] [CrossRef]

- Schueffel, P. Taming the beast: A scientific definition of fintech. J. Innov. Manag. 2016, 4, 32–54. [Google Scholar] [CrossRef]

- Bureshaid, N.; Lu, K.; Sarea, A. Adoption of Fintech Services in the banking industry. In Applications of Artificial Intelligence in Business, Education and Healthcare; Springer International Publishing: Cham, Switzerland, 2021; pp. 125–138. [Google Scholar]

- Rogers, E.M. Diffusion of Innovations, 4th ed.; The Free Press: New York, NY, USA, 1983. [Google Scholar]

- Schierz, P.G.; Schilke, O.; Wirtz, B.W. Understanding consumer acceptance of mobile payment services: An empirical analysis. Electron. Commer. Res. Appl. 2010, 9, 209–216. [Google Scholar] [CrossRef]

- Lin, H.-F. An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust. Int. J. Inf. Manag. 2011, 31, 252–260. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Sánchez-Fernández, J.; Muñoz-Leiva, F. Antecedents of the adoption of the new mobile payment systems: The moderating effect of age. Comput. Hum. Behav. 2014, 35, 464–478. [Google Scholar] [CrossRef]

- Van Oorschot, J.A.; Hofman, E.; Halman, J.I. A bibliometric review of the innovation adoption literature. Technol. Forecast. Soc. Change 2018, 134, 1–21. [Google Scholar] [CrossRef]

- Lundblad, J.P. A review and critique of Rogers’ diffusion of innovation theory as it applies to organizations. Organ. Dev. J. 2003, 21, 50. [Google Scholar]

- Wisdom, J.P.; Chor, K.H.B.; Hoagwood, K.E.; Horwitz, S.M. Innovation adoption: A review of theories and constructs. Adm. Policy Ment. Health Ment. Health Serv. Res. 2014, 41, 480–502. [Google Scholar] [CrossRef] [PubMed]

- Vargo, S.L.; Akaka, M.A.; Wieland, H. Rethinking the process of diffusion in innovation: A service-ecosystems and institutional perspective. J. Bus. Res. 2020, 116, 526–534. [Google Scholar] [CrossRef]

- El Sawy, O.A.; Malhotra, A.; Park, Y.; Pavlou, P.A. Research commentary—Seeking the configurations of digital ecodynamics: It takes three to tango. Inf. Syst. Res. 2010, 21, 835–848. [Google Scholar] [CrossRef]

- Park, Y.; El Sawy, O.A.; Fiss, P. The role of business intelligence and communication technologies in organizational agility: A configurational approach. J. Assoc. Inf. Syst. 2017, 18, 1. [Google Scholar] [CrossRef]

- Park, Y.; Mithas, S. Organized complexity of digital business strategy: A configurational perspective. MIS Q. 2020, 44, 85–127. [Google Scholar] [CrossRef]

- Fiss, P.C. Building better causal theories: A fuzzy set approach to typologies in organization research. Acad. Manag. J. 2011, 54, 393–420. [Google Scholar] [CrossRef]

- Greckhamer, T.; Misangyi, V.F.; Elms, H.; Lacey, R. Using qualitative comparative analysis in strategic management research: An examination of combinations of industry, corporate, and business-unit effects. Organ. Res. Methods 2008, 11, 695–726. [Google Scholar] [CrossRef]

- Misangyi, V.F.; Acharya, A.G. Substitutes or complements? A configurational examination of corporate governance mechanisms. Acad. Manag. J. 2014, 57, 1681–1705. [Google Scholar] [CrossRef]

- Misangyi, V.F.; Greckhamer, T.; Furnari, S.; Fiss, P.C.; Crilly, D.; Aguilera, R. Embracing causal complexity: The emergence of a neo-configurational perspective. J. Manag. 2017, 43, 255–282. [Google Scholar] [CrossRef]

- Ragin, C.C. Fuzzy-Set Social Science; University of Chicago Press: Chicago, IL, USA, 2000. [Google Scholar]

- Grewal, R.; Chandrashekaran, M.; Johnson, J.L.; Mallapragada, G. Environments, unobserved heterogeneity, and the effect of market orientation on outcomes for high-tech firms. J. Acad. Mark. Sci. 2013, 41, 206–233. [Google Scholar] [CrossRef]

- Koo, Y.; Park, Y.; Ham, J.; Lee, J.-N. Congruent patterns of outsourcing capabilities: A bilateral perspective. J. Strat. Inf. Syst. 2019, 28, 101580. [Google Scholar] [CrossRef]

- Lee, J.-N.; Park, Y.; Straub, D.W.; Koo, Y. Holistic archetypes of IT outsourcing strategy: A contingency fit and configurational approach. MIS Q. 2019, 43, 1201–1225. [Google Scholar] [CrossRef]

- Ryu, H.-S.; Min, J. Innovation recipes for high use on four Fintech types: A configurational perspective. Inf. Manag. 2025, 62, 104058. [Google Scholar] [CrossRef]

- Gatignon, H.; Robertson, T.S. A propositional inventory for new diffusion research. J. Consum. Res. 1985, 11, 849–867. [Google Scholar] [CrossRef]

- Utami, A.F.; Ekaputra, I.A.; Japutra, A. Adoption of FinTech products: A systematic literature review. J. Creat. Commun. 2021, 16, 233–248. [Google Scholar] [CrossRef]

- Farah, M.F.; Hasni, M.J.S.; Abbas, A.K. Mobile-banking adoption: Empirical evidence from the banking sector in Pakistan. Int. J. Bank Mark. 2018, 36, 1386–1413. [Google Scholar] [CrossRef]

- Arts, J.W.; Frambach, R.T.; Bijmolt, T.H. Generalizations on consumer innovation adoption: A meta-analysis on drivers of intention and behavior. Int. J. Res. Mark. 2011, 28, 134–144. [Google Scholar] [CrossRef]

- Cooper, R.G.; Kleinschmidt, E.J. New products: What separates winners from losers? J. Prod. Innov. Manag. 1987, 4, 169–184. [Google Scholar] [CrossRef]

- Ryu, H.-S. What makes users willing or hesitant to use Fintech?: The moderating effect of user type. Ind. Manag. Data Syst. 2018, 118, 541–569. [Google Scholar] [CrossRef]

- Taylor, J.W. The role of risk in consumer behavior: A comprehensive and operational theory of risk taking in consumer behavior. J. Mark. 1974, 38, 54–60. [Google Scholar] [CrossRef]

- Hoffman, D.L.; Novak, T.P.; Peralta, M. Building consumer trust online. Commun. ACM 1999, 42, 80–85. [Google Scholar] [CrossRef]

- Yu, Y.; Li, M.; Li, X.; Zhao, J.L.; Zhao, D. Effects of entrepreneurship and IT fashion on SMEs’ transformation toward cloud service through mediation of trust. Inf. Manag. 2018, 55, 245–257. [Google Scholar] [CrossRef]

- Nangin, M.A.; Barus, I.R.G.; Wahyoedi, S. The effects of perceived ease of use, security, and promotion on trust and its implications on Fintech adoption. J. Consum. Sci. 2020, 5, 124–138. [Google Scholar] [CrossRef]

- Yu, P.K.; Balaji, M.S.; Khong, K.W. Building trust in internet banking: A trustworthiness perspective. Ind. Manag. Data Syst. 2015, 115, 235–252. [Google Scholar] [CrossRef]

- Warren, E. Product safety regulation as a model for financial services regulation. J. Consum. Aff. 2008, 42, 452–460. [Google Scholar] [CrossRef]

- Treleaven, P. Financial regulation of FinTech. J. Financ. Perspect. 2015, 3, 17. [Google Scholar]

- Siau, K.; Shen, Z. Building customer trust in mobile commerce. Commun. ACM 2003, 46, 91–94. [Google Scholar] [CrossRef]

- Lin, J.; Wang, B.; Wang, N.; Lu, Y. Understanding the evolution of consumer trust in mobile commerce: A longitudinal study. Inf. Technol. Manag. 2014, 15, 37–49. [Google Scholar] [CrossRef]

- Gao, L.; Waechter, K.A. Examining the role of initial trust in user adoption of mobile payment services: An empirical investigation. Inf. Syst. Front. 2017, 19, 525–548. [Google Scholar] [CrossRef]

- Zhou, T. Understanding the determinants of mobile payment continuance usage. Ind. Manag. Data Syst. 2014, 114, 936–948. [Google Scholar] [CrossRef]

- DeLone, W.H.; McLean, E.R. Information systems success: The quest for the dependent variable. Info. Syst. Res. 1992, 3, 60–95. [Google Scholar] [CrossRef]

- Liu, C.; Arnett, K.P. Exploring the factors associated with Web site success in the context of electronic commerce. Inf. Manag. 2000, 38, 23–33. [Google Scholar] [CrossRef]

- Delone, W.H.; McLean, E.R. The DeLone and McLean model of information systems success: A ten-year update. J. Manag. Inf. Syst. 2003, 19, 9–30. [Google Scholar]

- Lee, K.C.; Chung, N. Understanding factors affecting trust in and satisfaction with mobile banking in Korea: A modified DeLone and McLean’s model perspective. Interact. Comput. 2009, 21, 385–392. [Google Scholar] [CrossRef]

- McKnight, D.H.; Choudhury, V.; Kacmar, C. The impact of initial consumer trust on intentions to transact with a web site: A trust building model. J. Strateg. Inf. Syst. 2002, 11, 297–323. [Google Scholar] [CrossRef]

- Nelson, R.R.; Todd, P.A.; Wixom, B.H. Antecedents of information and system quality: An empirical examination within the context of data warehousing. J. Manag. Info. Syst. 2005, 21, 199–235. [Google Scholar] [CrossRef]

- McKinney, V.; Yoon, K.; Zahedi, F.M. The measurement of web-customer satisfaction: An expectation and disconfirmation approach. Inf. Syst. Res. 2002, 13, 296–315. [Google Scholar] [CrossRef]

- Zheng, Y.; Zhao, K.; Stylianou, A. The impacts of information quality and system quality on users’ continuance intention in information-exchange virtual communities: An empirical investigation. Decis. Support Syst. 2013, 56, 513–524. [Google Scholar] [CrossRef]

- Gu, B.; Konana, P.; Rajagopalan, B.; Chen, H.-W.M. Competition among virtual communities and user valuation: The case of investing-related communities. Inf. Syst. Res. 2007, 18, 68–85. [Google Scholar] [CrossRef]

- Petter, S.; McLean, E.R. A meta-analytic assessment of the DeLone and McLean IS success model: An examination of IS success at the individual level. Inf. Manag. 2009, 46, 159–166. [Google Scholar] [CrossRef]

- Liu, S.-F.; Liu, H.-H.; Chang, J.-H.; Chou, H.-N. Analysis of a new visual marketing craze: The effect of LINE sticker features and user characteristics on download willingness and product purchase intention. Asia Pac. Manag. Rev. 2019, 24, 263–277. [Google Scholar] [CrossRef]

- Dapp, T.F.; Slomka, L.; AG, D.B.; Hoffmann, R. Fintech–The digital (r) evolution in the financial sector. Dtsch. Bank Res. 2014, 11, 1–39. [Google Scholar]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Hsu, C.-L.; Lin, J.C.-C. What drives purchase intention for paid mobile apps?–An expectation confirmation model with perceived value. Electron. Commer. Res. Appl. 2015, 14, 46–57. [Google Scholar] [CrossRef]

- Ghazarian, A.; Noorhosseini, S.M. Automatic detection of users’ skill levels using high-frequency user interface events. User Model. User-Adapt. Interact. 2010, 20, 109–146. [Google Scholar] [CrossRef]

- Armstrong, J.S.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- Cheng, T.E.; Lam, D.Y.; Yeung, A.C. Adoption of internet banking: An empirical study in Hong Kong. Decis. Support Syst. 2006, 42, 1558–1572. [Google Scholar] [CrossRef]

- Lee, M.C. Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefit. Electron. Commer. Res. Appl. 2009, 8, 130–141. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Tatham, R.L.; William, C. Multivariate Data Analysis, 1st ed.; Prentice Hall Englewood Cliffs: Englewood Cliffs, NJ, USA, 1998. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.-Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef]

- Lindell, M.K.; Whitney, D.J. Accounting for common method variance in cross-sectional research designs. J. Appl. Psychol. 2001, 86, 114. [Google Scholar] [CrossRef] [PubMed]

- Woodside, A.G. Moving beyond multiple regression analysis to algorithms: Calling for adoption of a paradigm shift from symmetric to asymmetric thinking in data analysis and crafting theory. J. Bus. Res. 2013, 66, 463–472. [Google Scholar] [CrossRef]

- Ragin, C.C. Redesigning Social Inquiry: Fuzzy Sets and Beyond; Wiley Online Library: Hoboken, NJ, USA, 2008; Volume 240. [Google Scholar]

- Veríssimo, J.M.C. Enablers and restrictors of mobile banking app use: A fuzzy set qualitative comparative analysis (fsQCA). J. Bus. Res. 2016, 69, 5456–5460. [Google Scholar] [CrossRef]

- Ragin, C.C. Set relations in social research: Evaluating their consistency and coverage. Polit. Anal. 2006, 14, 291–310. [Google Scholar] [CrossRef]

- Ragin, C.C. Fuzzy Sets: Calibration Versus Measurement. In Methodology Volume of Oxford Handbooks of Political Science; Oxford University Press: Oxford, UK, 2007; Volume 2. [Google Scholar]

- Ragin, C.C.; Fiss, P.C. Net Effects Analysis Versus Configurational Analysis: An Empirical Demonstration. In Redesigning Social Inquiry: Fuzzy Sets and Beyond; University of Chicago Press: Chicago, IL, USA, 2008; Volume 240, pp. 190–212. [Google Scholar]

- Fiss, P.C. A set-theoretic approach to organizational configurations. Acad. Manag. Rev. 2007, 32, 1180–1198. [Google Scholar] [CrossRef]

- Woodside, A.G. Embrace. Perform.model: Complexity theory, contrarian case analysis, and multiple realities. J. Bus. Res. 2014, 67, 2495–2503. [Google Scholar] [CrossRef]

- Brandtzæg, P.B. Towards a unified Media-User Typology (MUT): A meta-analysis and review of the research literature on media-user typologies. Comput. Hum. Behav. 2010, 26, 940–956. [Google Scholar] [CrossRef]

- Cai, Y.; Huang, Z.; Zhang, X. FinTech adoption and rural economic development: Evidence from China. Pac.-Basin Financ. J. 2024, 83, 102264. [Google Scholar] [CrossRef]

- Danladi, S.; Prasad, M.; Modibbo, U.M.; Ahmadi, S.A.; Ghasemi, P. Attaining sustainable development goals through financial inclusion: Exploring collaborative approaches to Fintech adoption in developing economies. Sustainability 2023, 15, 13039. [Google Scholar] [CrossRef]

- Nalluri, V.; Chen, L.-S. Modelling the FinTech adoption barriers in the context of emerging economies—An integrated Fuzzy hybrid approach. Technol. Forecast. Soc. Change 2024, 199, 123049. [Google Scholar] [CrossRef]

- Bian, W.; Wang, S.; Xie, X. How valuable is FinTech adoption for traditional banks? Europ. Finan. Manag. 2024, 30, 1065–1093. [Google Scholar] [CrossRef]

- Meijerink, J.; Bondarouk, T. Uncovering configurations of HRM service provider intellectual capital and worker human capital for creating high HRM service value using fsQCA. J. Bus. Res. 2018, 82, 31–45. [Google Scholar] [CrossRef]

- Calantone, R.J.; Chan, K.; Cui, A.S. Decomposing product innovativeness and its effects on new product success. J. Prod. Innov. Manag. 2006, 23, 408–421. [Google Scholar] [CrossRef]

- Im, S.; Workman, J.P., Jr. Market orientation, creativity, and new product performance in high-technology firms. J. Mark. 2004, 68, 114–132. [Google Scholar] [CrossRef]

- Kim, D.J.; Ferrin, D.L.; Rao, H.R. A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decis. Support Syst. 2008, 44, 544–564. [Google Scholar] [CrossRef]

- Kim, G.; Shin, B.; Lee, H.G. Understanding dynamics between initial trust and usage intentions of mobile banking. Inf. Syst. J. 2009, 19, 283–311. [Google Scholar] [CrossRef]

- Mcknight, D.H.; Carter, M.; Thatcher, J.B.; Clay, P.F. Trust in a specific technology: An investigation of its components and measures. ACM Trans. Manag. Inf. Syst. 2011, 2, 1–25. [Google Scholar] [CrossRef]

- Zhou, T. Understanding users’ initial trust in mobile banking: An elaboration likelihood perspective. Comput. Hum. Behav. 2012, 28, 1518–1525. [Google Scholar] [CrossRef]

- Wang, Y.S. Assessing e-commerce systems success: A respecification and validation of the DeLone and McLean model of IS success. Inf. Syst. J. 2008, 18, 529–557. [Google Scholar] [CrossRef]

- Fischer, D.G.; Fick, C. Measuring social desirability: Short forms of the Marlowe-Crowne social desirability scale. Educ. Psychol. Meas. 1993, 53, 417–424. [Google Scholar] [CrossRef]

| Fintech Type | Frequency | Percent | Gender | Frequency | Percent |

| Mobile payment | 69 | 27.2% | Male | 118 | 46.5% |

| Mobile remittance | 66 | 26.0% | Female | 136 | 53.5% |

| P2P lending | 62 | 24.4% | |||

| Crowdfunding | 57 | 22.4% | |||

| Total | 254 | 100% | Total | 254 | 100% |

| Age | Frequency | Percent | Education | Frequency | Percent |

| Under 20 | 0 | 0% | Under high school | 1 | 0.4% |

| 20~29 | 59 | 23.2% | High school | 29 | 11.4% |

| 30~39 | 57 | 22.4% | College/associate | 40 | 15.7% |

| 40~49 | 73 | 28.7% | Bachelor | 155 | 61.0% |

| 50 over | 65 | 25.6% | Master | 25 | 9.8% |

| Ph.D. | 4 | 1.6% | |||

| Total | 254 | 100% | Total | 254 | 100% |

| Use period | Frequency | Percent | Use frequency | Frequency | Percent |

| ~3 mon. or less | 89 | 35.0% | Once in several months | 68 | 26.8% |

| 3 to 6 mon. | 62 | 24.4% | Once in several weeks | 95 | 37.4% |

| 7 to 12 mon. | 39 | 15.4% | Once a week | 22 | 17.3% |

| 13 to 18 mon. | 9 | 3.5% | Several times a week | 44 | 8.7% |

| 19 to 24 mon. | 23 | 9.1% | Once a day | 12 | 4.7% |

| More than 24 mon. | 32 | 12.6% | Several times a day | 13 | 5.1% |

| Total | 254 | 100% | Total | 254 | 100% |

| Construct | Item | Cron’s alpha | CR | AVE | Loading | T-Statistic |

|---|---|---|---|---|---|---|

| Relative advantage (RA) | RA1 | 0.807 | 0.884 | 0.717 | 0.827 ** | 28.634 |

| RA2 | 0.859 ** | 38.233 | ||||

| RA3 | 0.853 ** | 46.946 | ||||

| Meaningfulness (MF) | MF1 | 0.890 | 0.931 | 0.819 | 0.903 ** | 63.483 |

| MF2 | 0.904 ** | 66.870 | ||||

| MF3 | 0.908 ** | 60.583 | ||||

| Perceived risk (PR) | PR1 | 0.854 | 0.911 | 0.774 | 0.858 ** | 7.306 |

| PR2 | 0.905 ** | 9.616 | ||||

| PR3 | 0.875 ** | 8.389 | ||||

| Structural assurance (SA) | SA1 | 0.804 | 0.883 | 0.715 | 0.869 ** | 54.469 |

| SA2 | 0.865 ** | 33.050 | ||||

| SA3 | 0.801 ** | 22.304 | ||||

| Trust in transactions (TRU) | TRU1 | 0.869 | 0.920 | 0.793 | 0.838 ** | 36.119 |

| TRU2 | 0.905 ** | 55.445 | ||||

| TRU3 | 0.927 ** | 78.977 | ||||

| System quality (STQ) | STQ1 | 0.903 | 0.939 | 0.838 | 0.904 ** | 48.159 |

| STQ2 | 0.931 ** | 75.385 | ||||

| STQ3 | 0.910 ** | 56.627 | ||||

| Information quality (IFQ) | IFQ1 | 0.872 | 0.922 | 0.797 | 0.841 ** | 24.867 |

| IFQ2 | 0.927 ** | 97.681 | ||||

| IFQ3 | 0.907 ** | 83.029 | ||||

| Fintech use (FU) | FU1 | 0.894 | 0.934 | 0.826 | 0.916 ** | 87.456 |

| FU2 | 0.933 ** | 99.204 | ||||

| FU3 | 0.877 ** | 53.892 |

| Constructs | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| 1. Relative advantage | 0.847 | |||||||

| 2. Meaningfulness | 0.669 | 0.905 | ||||||

| 3. Perceived risk | −0.223 | −0.217 | 0.880 | |||||

| 4. Structural assurance | 0.280 | 0.322 | 0.163 | 0.846 | ||||

| 5. Trust in transactions | 0.347 | 0.401 | 0.040 | 0.699 | 0.891 | |||

| 6. System quality | 0.562 | 0.562 | −0.254 | 0.166 | 0.263 | 0.915 | ||

| 7. Information quality | 0.651 | 0.646 | −0.143 | 0.392 | 0.461 | 0.612 | 0.893 | |

| 8. Fintech Use | 0.582 | 0.526 | −0.159 | 0.483 | 0.547 | 0.468 | 0.607 | 0.909 |

| Constructs | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| 1. Relative advantage | ||||||||

| 2. Meaningfulness | 0.837 | |||||||

| 3. Perceived risk | 0.255 | 0.204 | ||||||

| 4. Structural assurance | 0.366 | 0.379 | 0.221 | |||||

| 5. Trust in transactions | 0.436 | 0.453 | 0.072 | 0.875 | ||||

| 6. System quality | 0.774 | 0.682 | 0.221 | 0.198 | 0.298 | |||

| 7. Information quality | 0.776 | 0.808 | 0.132 | 0.469 | 0.569 | 0.759 | ||

| 8. Fintech Use | 0.700 | 0.777 | 0.166 | 0.571 | 0.621 | 0.524 | 0.761 |

| Measure | Measure Descriptions | Calibration Value at | ||||||

|---|---|---|---|---|---|---|---|---|

| Mean | S.D | Min | Med | Max | Fully-in | Crossover | Fully-out | |

| Predictors | ||||||||

| Relative advantage | 5.31 | 0.91 | 2.00 | 5.25 | 7.00 | 6 | 4 | 2 |

| Meaningfulness | 5.21 | 0.95 | 2.33 | 5.00 | 7.00 | 6 | 4 | 2 |

| Perceived risk | 3.85 | 1.04 | 1.00 | 4.00 | 6.50 | 6 | 4 | 2 |

| Structural assurance | 4.13 | 0.94 | 2.00 | 4.00 | 6.33 | 6 | 4 | 2 |

| Trust in transactions | 4.39 | 0.88 | 1.67 | 4.33 | 6.67 | 6 | 4 | 2 |

| System quality | 5.25 | 1.03 | 2.00 | 5.00 | 7.00 | 6 | 4 | 2 |

| Information quality | 4.98 | 0.90 | 2.33 | 5.00 | 7.00 | 6 | 4 | 2 |

| Outcome | ||||||||

| Fintech use | 4.65 | 0.92 | 2.25 | 4.50 | 7.00 | 6 | 4 | 2 |

| Context factors | ||||||||

| Use period | 2.64 | 1.75 | 1.00 | 2.00 | 6.00 | - | - | - |

| Use frequency | 4.58 | 1.36 | 1.00 | 5.00 | 6.00 | - | - | - |

| Com. | RA | MF | PR | SA | TRU | STQ | IFQ | Prd | Frq | Freq | High Use | Raw Consistency | PRI Consistency |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 1 | 0.999 | 0.997 |

| C2 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 0 | 1 | 10 | 1 | 0.997 | 0.992 |

| C3 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 9 | 1 | 0.997 | 0.991 |

| C4 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 1 | 6 | 1 | 0.995 | 0.984 |

| C5 | 1 | 1 | 0 | 0 | 1 | 1 | 1 | 0 | 1 | 2 | 1 | 0.991 | 0.969 |

| C6 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 0 | 1 | 4 | 1 | 0.994 | 0.969 |

| C7 | 1 | 1 | 0 | 0 | 0 | 1 | 1 | 0 | 1 | 5 | 1 | 0.991 | 0.967 |

| C8 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 0 | 2 | 1 | 0.989 | 0.964 |

| C9 | 0 | 1 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 2 | 1 | 0.980 | 0.817 |

| C10 | 0 | 0 | 1 | 0 | 0 | 1 | 1 | 0 | 1 | 2 | 0 | 0.966 | 0.746 |

| C11 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 2 | 0 | 0.958 | 0.391 |

| Com. | RA | MF | PR | SA | TRU | STQ | IFQ | Prd | Frq | Freq | Not-High Use | Raw Consistency | PRI Consistency |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 2 | 1 | 0.973 | 0.608 |

| C2 | 0 | 1 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 2 | 1 | 0.910 | 0.154 |

| C3 | 0 | 0 | 1 | 0 | 0 | 1 | 1 | 0 | 1 | 2 | 1 | 0.898 | 0.240 |

| C4 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 0 | 1 | 4 | 0 | 0.823 | 0.030 |

| C5 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 0 | 0.743 | 0.002 |

| C6 | 1 | 0 | 0 | 0 | 0 | 1 | 1 | 0 | 1 | 5 | 0 | 0.737 | 0.032 |

| C7 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 1 | 2 | 0 | 0.724 | 0.035 |

| C8 | 1 | 1 | 0 | 0 | 1 | 1 | 1 | 0 | 0 | 2 | 0 | 0.718 | 0.030 |

| C9 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 9 | 0 | 0.668 | 0.008 |

| C10 | 1 | 0 | 1 | 1 | 1 | 1 | 1 | 0 | 1 | 6 | 0 | 0.666 | 0.002 |

| C11 | 1 | 0 | 0 | 1 | 1 | 1 | 1 | 0 | 1 | 10 | 0 | 0.617 | 0.007 |

| Parsimonious Solution | Intermediate Solution | |

|---|---|---|

| High use | MF + SA + TRU + ~PR*STQ + ~PR*IFQ → High use (FU) | RA*MF*PR*SA*TRU*STQ*IFQ*~ UP + RA*MF*SA*TRU*STQ*IFQ*UF + RA*MF*~PR*~SA*STQ*IFQ*~ UP *UF + ~RA*MF*~PR*~SA*~TRU*STQ*IFQ*UP*UF + ~RA*~MF*PR*SA*TRU*STQ*IFQ*~ UP*UF → High use |

| Not-high use | ~RA*~SA + ~RA*~TRU → Not-high use (~FU) | ~RA*~MF*~PR*~SA*~TRU*~STQ*~IFQ*~UP *UF + ~RA* ~MF*PR*~SA*~TRU*STQ*IFQ*~UP*UF + ~RA*MF*~PR*~SA*~TRU*STQ*IFQ*UP*UF + → Not-high use |

| Use Period | |||

|---|---|---|---|

| Short | Long | ||

| Infrequent users | Lurkers | ||

| Use frequency | Low |

| No configuration found |

| Task-driven users | Power users | ||

| High |

|

| |

| User Type | Key Task | Management Actions |

|---|---|---|

| Infrequent users: High-risk perception (Short-term + Low frequency) | Trust in transaction & structural assurance | Provide strong security and legal safeguards; ensure safe and reliable transaction experiences |

| Task-driven users: Financial benefit-oriented (Short-term + High frequency) | Meaningfulness & IT quality | Maximize financial benefits, improve information quality, and minimize perceived risk |

| Power users: Diverse use pattern (Long-term + High frequency) | Comprehensive attributes | Offer all-in-one services, provide personalization, and strengthen overall IT quality |

| All users: Depending on risk environment | Context-specific response | Low-risk → strengthen IT quality; High-risk → enhance structural assurance and trust in transactions; In all cases → ensure meaningfulness |

| Common factor: IT quality | Multifaceted roles | Integrate IT quality harmoniously as a core, enabling, or coordinating factor |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ryu, H.-S. From Innovation to Use: Configurational Pathways to High Fintech Use Across User Groups. Sustainability 2025, 17, 7762. https://doi.org/10.3390/su17177762

Ryu H-S. From Innovation to Use: Configurational Pathways to High Fintech Use Across User Groups. Sustainability. 2025; 17(17):7762. https://doi.org/10.3390/su17177762

Chicago/Turabian StyleRyu, Hyun-Sun. 2025. "From Innovation to Use: Configurational Pathways to High Fintech Use Across User Groups" Sustainability 17, no. 17: 7762. https://doi.org/10.3390/su17177762

APA StyleRyu, H.-S. (2025). From Innovation to Use: Configurational Pathways to High Fintech Use Across User Groups. Sustainability, 17(17), 7762. https://doi.org/10.3390/su17177762