Abstract

Enhancing capacity utilization (CU, hereinafter referred to as CU) is crucial for effectively solving the overcapacity problem, optimizing industrial structure, and promoting premium economic development. While extensive academic research has been conducted on CU, supply chain finance (SCF, hereinafter referred to as SCF) and its influence on corporate capacity constraints remain largely unexplored. This study carefully examines how SCF affects corporate CU and the transmission mechanism, with a focus on China’s A-share listed businesses (2010–2023). The result shows that SCF improves businesses’ CU. After applying various robustness and endogeneity tests, the findings still hold that SCF largely affects the growth in CU throughby alleviating financing constraints, reducing internal agency costs, enhancing technological innovation, and improving inefficient investment. Further analysis indicates that close supply chain relationships, lower supply chain efficiency and non-state ownership, higher industry competition, a high marketization level, and a high level of financial development all enhance the “de-capacity” effect of SCF. Besides enriching the theoretical framework of SCF’s economic impacts, this research develops an operational solution to mitigate production overcapacity, a long-standing structural issue in China’s manufacturing industries, and provides a solid theoretical support for SCF to strengthen the foundation of the real economy and spearhead the sustainable, productivity-driven development of China’s economic landscape.

1. Introduction

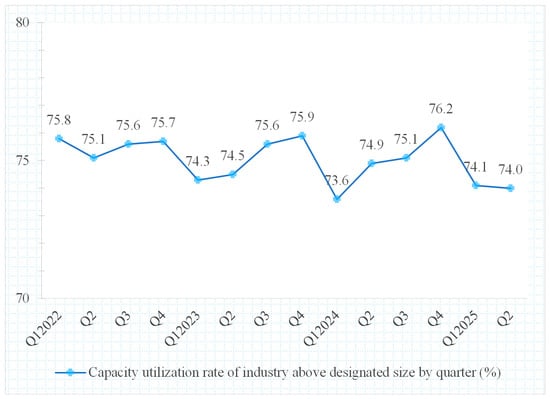

Following the initiation of China’s reform and opening-up, China witnessed leapfrog development and made remarkable achievements. However, despite the speedy economic growth, the problem of underutilization of manufacturing capacity was never effectively solved, which restricts the progress of China’s high-quality economy. As documented by China’s National Bureau of Statistics, this study plots the trend of China’s quarterly above-scale industrial capacity utilization rate from 2022 to 2025 (see Figure 1). Figure 1 shows that the average value of China’s quarterly above-scale industrial capacity utilization rate is 75.03%, the maximum value is 76.2%, and the minimum value is 73.6%, and thus there is still a gap compared with the internationally recognized reasonable range of CU rate (79% to 83%), indicating that China’s capacity utilization rate still has significant room for improvement. The state has always attached great importance to improving the CU rate and has promoted supply-side structural reform since 2015, taking “removing production capacity” as the core task; the analysis of the 20th CPC National Congress indicated the importance of demands for deepening supply-side structural reform. Although the state and local governments have used a set of measures and policies to handle the problem of overcapacity and achieved significant results, the problem of overcapacity has not been eradicated. Therefore, improving the enterprise CU rate and breaking through the dilemma of overcapacity is an essential task to propel structural reforms on the supply side. More importantly, it is essential to realize the advanced development of the economy in China. Thus, this focus has significant theoretical and practical implications for advancing the understanding of corporate CU enhancement mechanisms.

Figure 1.

China’s quarterly above-scale industrial capacity utilization rate from 2022 to 2025.

There are two categories of determinants underlying the formation of overcapacity: cyclical and non-cyclical. Non-cyclical overcapacity can be further divided into structural overcapacity caused by the mismatch between supply and demand and institutional overcapacity caused by government intervention [1]. Cyclical overcapacity can be regulated by market mechanisms, and current research focuses on non-cyclical overcapacity, mainly from the dimensions of “market failure” and “government intervention” [2]. Among them, the typical representative of the theory of “market failure” is the “investment surge phenomenon”, which points out that due to information asymmetry and incompleteness, the optimal capacity decisions made by enterprises with limited market information can easily lead to overheating of investment, which in turn generates overcapacity [3]. However, the theory of government interference suggests that factors such as fiscal decentralization and promotion incentives for officials may lead to unhealthy competition among industries in the region. Local governments may influence the investment choices of enterprises by providing various preferential policies, which may lead to over-investment and overcapacity [4]. In addition to these two mainstream perspectives, scholars have also looked at the issue from the perspective of official turnover [5], human capital expansion [6], corporate technological innovation [7], environmental regulation [8], and green finance policy [9], and common institutional ownership [10,11,12,13], digital infrastructure development [14], deepening of trade networks [15], and other multiple perspectives have been explored to influence CU. However, as a key instrument in supply-side structural reform, SCF has received limited academic attention in relation to its impact on the problem of overcapacity. It is essential to pay more attention to this research area.

SCF, an emerging financial model, offers significant advantages in the comprehensive management of inter-enterprise transactions and capital flows. By integrating the resources of suppliers, producers, and sellers, SCF allows for a more accurate reflection of the actual operating conditions of enterprises. This financial service specializes in anchoring enterprises and supply-side and demand-side partners, providing a set of financial products and services. But supply chain finance also has some negative impacts. First, the financing of SMEs relies on the credit endorsement of the core enterprise, and once the core enterprise runs into problems, the enterprises in the whole chain may lose their ability to finance. Moreover, the risk of the core enterprise will quickly spread to upstream and downstream SMEs, triggering a liquidity crisis. Second, core enterprises conspire with related parties and upstream and downstream enterprises to forge trade contracts, invoices, or warehouse receipts to obtain financing fraudulently. Supply chain finance overly relies on blockchain, IoT, and other technologies, and an attack on the system or data tampering may lead to losses. Third, core enterprises may make SMEs bear financing costs in disguise by extending the billing period and depressing the purchase price. Last but not least, while supply chain finance improves efficiency, it essentially bundles and transfers risks. If the credit of core enterprises collapses, trade background is falsified, or supervision is lacking, it may trigger a chain debt crisis and even affect the stability of the real economy.

As the digital economy becomes increasingly integrated with the real economy, supply chain financial services precisely accelerate the match of supply and demand while strengthening the docking between production and consumption in the supply chain, thus providing an efficient solution to the problem of enterprise overcapacity. Specifically, SCF shows significant effects in two aspects below: on the one hand, it contributes to mitigating the issue of the asymmetry in information between businesses and financial organizations [16,17] and relieves businesses of their financial limitations. When enterprises receive sufficient financial support, they are able to carry out technological innovation, improve product competitiveness, and expand sales channels, thus effectively alleviating the pressure of overcapacity. On the other hand, SCF plays a key role in accelerating the digital transformation of enterprises [18]. Corporations are able to optimize production modes and accurately match product supply with market demand in digital transformation [19], thus reducing supply and demand mismatch and improving CU.

Currently, the economic impacts of SCF have been widely explored in academia, with studies covering the interests of corporate shareholders [20], the level of corporate innovation [21], product market performance [22], financing constraints [23,24], working capital [25], cash holding level [26], capital structure optimization [27], corporate risk-taking [28], the digitization process [5], financial performance [29], investment efficiency [13], and many other aspects. Relying on speedy fintech development, SCF is an essential method used to serve the real economy nowadays, and for core enterprises, it is a strategic choice to stabilize the weak links in the supply chain [22]. However, this important financial tool’s impact on corporate overcapacity has been largely ignored in previous research. Considering this, this study investigates SCF’s effects on corporate CU from a production and supply standpoint. It accomplishes this by looking at the fundamental mechanisms through which SCF affects CU, thereby addressing a gap in the literature.

This study is grounded in the core concept of sustainable development, which seeks long-term harmony and balance among economic, social, and environmental dimensions. Specifically, we emphasize the relevance of Economic Sustainability and Environmental Sustainability to the focus of this research.

Economic Sustainability Perspective: Efficient resource allocation is fundamental to sustainable economic development. Persistent low capacity utilization (CU), a key indicator of physical capital efficiency, signifies not only wasted production potential, diminished profitability, and weakened competitiveness at the micro-enterprise level but also reflects inefficient allocation of societal capital at the macro level, hindering long-term robust growth and resilience. Enhancing CU inherently optimizes scarce capital resources, representing a crucial pathway toward strengthening the sustainability of the economic system.

Environmental Sustainability Perspective: Idle or underutilized capacity often incurs hidden resource consumption and environmental burdens. Maintaining under-loaded equipment and managing idle facilities requires continuous inputs of energy and materials, leading to increased resource intensity and carbon intensity per unit of effective output. Consequently, improving CU is directly linked to enhanced resource efficiency and potential reductions in pollution emissions, aligning with the principles of the circular economy and Low-Carbon Transition, thereby serving as a micro-level driver for Environmental Sustainability.

Within this framework, supply chain finance (SCF), as a critical financial instrument for optimizing supply chain cash flows and alleviating financing constraints, impacts not only short-term corporate liquidity but also fundamentally influences firms’ operational decisions and resource allocation efficiency. This study focuses on exploring the impact mechanism of SCF on corporate CU, and its core logic lies in the following: efficient SCF improves the corporate financing environment, empowers enterprises to optimize their production and operations, and enhances the level of production capacity utilization, which in turn generates potential synergistic effects on Economic and Environmental Sustainability by reducing resource mismatches, enhancing economic efficiency, and lowering the cost of resources and the environment per unit of output.

In order to perform a thorough analysis of the function and influence of SCF on corporate CU, as well as to clarify the underlying channel mechanisms, this study uses a data set that includes listed manufacturing firms in China’s A-share market from 2010 to 2023. The following are some possible contributions to this study:

First, a new research perspective for the enterprise overcapacity issue is offered in this study. This article examines the impact of SCF on enterprise CU and its mechanism in detail, bringing supply-side structural reform and SCF together for the first time in a single research framework from the micro-enterprise level. This offers new ideas to handle overcapacity and enhances the theoretical study of SCF. To assess the beneficial impact of SCF on company CU, this work builds an empirical model using theoretical analysis, in contrast to previous research that mostly focuses on “market failure” and “government intervention.” The channel mechanisms by which supply chain financing affects company CU are further clarified in this paper. This broadens the current body of knowledge regarding the complex factors that influence capacity usage.

Second, the real economy sector may benefit from some of the empirical evidence on SCF presented in this work. This study uses listed manufacturing companies as the research object and performs empirical analysis. The majority of research focuses on how SCF helps to alleviate financing constraints and lower agency costs, and the data sources are primarily restricted to case studies and SMEs’ questionnaires. In addition to improving understanding of SCF’s implications in the microeconomic sphere, this research uses a novel theoretical framework to describe how SCF functions in the actual economy from the standpoint of reducing overcapacity.

Lastly, this work offers fresh viewpoints on the study of production and finance integration. Previous studies have mostly focused on the effects of industry–finance integration on the effectiveness of financial resource allocation achieved through personnel exchange or equity ownership in financial institutions. By analyzing the diverse impacts of SCF on CU rates across different enterprises, this study, on the other hand, integrates SCF into the discussion of the integration of production and financing and offers theoretical and empirical support for how SCF promotes the expansion of the real economy and propels the optimization and upgrading of China’s economic structure.

Furthermore, this study is expected to contribute to the field of sustainability research in the following ways.

Unveiling the Micro-level Transmission Mechanism of Finance Empowering Sustainability: By empirically examining the impact of SCF on CU, this research aims to provide a clear micro-level evidence chain for understanding “how finance promotes sustainability by influencing the operational efficiency of real-economy firms.” Findings are anticipated to substantiate that SCF is not merely a solution to financing difficulties but also a potential lever for enhancing resource allocation efficiency and resource–environmental performance, thereby enriching the practical and theoretical understanding of “Sustainable Finance” at the micro-operational level.

Quantifying the Potential Economic and Environmental Synergies of SCF: Utilizing large-sample data from China’s A-share listed companies, this study will rigorously quantify the effect of SCF on firm-level CU. Given that CU serves as a critical nexus linking operational efficiency and resource efficiency, the results directly illuminate the synergistic contribution SCF may offer in promoting both economic efficiency gains and optimized environmental footprint. This provides a novel perspective for assessing the comprehensive sustainability value of financial innovation.

Providing Evidence-based Insights for Policy and Practice: Conclusions can inform policymakers and regulators in designing financial instruments that foster the synergistic achievement of high-quality economic development and “Dual Carbon” goals. For instance, supporting the development of more efficient, inclusive, and potentially green-oriented SCF models could be a policy tool delivering multiple benefits: “stabilizing growth, restructuring, and promoting emission reduction”. This research underscores the strategic importance for firms to proactively manage and utilize SCF tools, not only for securing supply chain stability and easing financing constraints but also as a potential management lever to enhance operational efficiency (CU) and improve environmental performance, aiding in building competitive advantages within a sustainable business landscape. This study suggests that the health of a firm’s SCF practices could serve as an observable indicator for assessing its potential operational efficiency (CU) and environmental risk, offering new insights for financial institutions in product development, ESG investment analysis, and risk management.

Enriching Research on Sustainability Drivers in Emerging Markets: Focusing on China, the world’s largest emerging economy, this study provides significant localized empirical evidence on how financial innovation influences the sustainable development trajectory by shaping micro-firm behavior. This contributes to a deeper understanding of the unique mechanisms driving sustainability in emerging market contexts, thereby supplementing the global sustainability knowledge base.

The main limitations of this article and suggestions for future research: on the one hand, this paper only discusses the impact of supply chain finance on the capacity utilization of A-share manufacturing listed enterprises, and does not further classify manufacturing enterprises, such as whether there is a difference in the impact of supply chain finance on the upstream and downstream enterprises in the supply chain. Therefore, in the future, this idea can be explored in depth; on the other hand, in the empirical part of this paper, only industry and time effects are fixed, and individual effects are not fixed, although a series of robustness tests are used later to prove the robustness of the results. This may not be able to exclude the interference of the confounding factors of the enterprises themselves that do not change over time; therefore, individual effects of the enterprises can be added to the study in the future.

2. Theoretical Analysis and Research Hypotheses

2.1. SCF and Enterprise CU

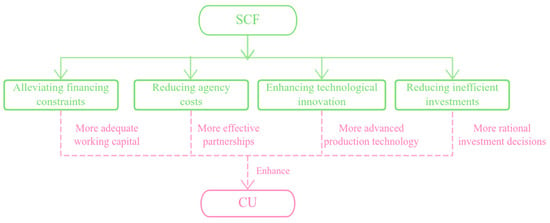

Analyzed from the perspective of enterprises, over-investment in production equipment is the direct cause of enterprise overcapacity. When the enterprise output cannot match the market demand, the enterprise deviates from production at the cost-optimal level. This indicates that enterprises fail to accurately judge and adjust market demand in a timely manner, resulting in low CU. For corporations, the method to improve the CU rate is to enhance output effectively and optimize the supply–demand relationship. In this paper, the four channel mechanisms of financing constraints, agency costs, technological innovation, and inefficient investment are selected to test the mechanism of supply chain finance on enterprise capacity utilization, and the specific channels of action are shown in Figure 2 below. To some extent, SCF effectively resolves the financial issues faced by SMEs. By integrating information, capital, and logistics flows within the supply chain, this approach effectively mitigates information asymmetries and reduces transaction costs among enterprises. As a result, it reduces business financing limitations by increasing the application of credit resources and improving the efficiency of capital allocation. Additionally, by rearranging financial resources, SCF gives businesses access to additional funding sources, increasing their financing efficiency and technological innovation potential. This also offers crucial financial support for increasing production efficiency and further encouraging CU. Conversely, SCF creates a synergistic operational whole by tightly connecting businesses in the supply chain. By continuously optimizing information, logistics, and capital flows, it strengthens cooperation among enterprises and promotes the sharing and dissemination of knowledge and technology. The spillover of resources allows firms to access a greater amount of market and technological information, stimulates the vitality of R&D and innovation, and promotes enterprise technological innovation. In light of the above, this study proposes the following flowchart:

Figure 2.

Mechanism of action chart.

Hypothesis 1.

SCF can enhance enterprise CU.

2.2. SCF, Financing Constraints, and Enterprise CU

The improvement in enterprise CU cannot be achieved without financial support. If enterprises have deficiencies in productive capital and innovation investment, the expansion of their production scale and sales channels is limited [21]. Therefore, solving the problem of enterprise financing shortage is the key to improving CU. The following are a few major factors constraining enterprise financing: first, enterprises may not be able to meet the bank’s lending requirements due to insufficient collateral assets, lack of effective guarantees, or information asymmetry, thus leaving the enterprise’s financing needs unfulfilled; second, the cost of external financing for enterprises is generally high, and relying solely on the enterprise’s own financing ability cannot meet the enterprise’s innovation. Lastly, the information asymmetry between financial institutions and businesses makes it more difficult to assess their inherent worth and possible dangers, which makes enterprise financing even more challenging. SCF is a new financial tool that helps SMEs with their funding challenges. In the supply chain, the model links high-end and low-end businesses. They integrate resources and create a secure, long-term strategic partnership with core businesses. Financial institutions offer comprehensive credit and lending services to businesses in the same supply chain based on the needs of core businesses. This practice reduces the cost of screening enterprises by financial institutions and improves the accessibility of enterprise financing. By leveraging SCF, third-party logistics providers are able to monitor the real-time logistics activities of firms within the supply chain. This facilitates more effective oversight by financial institutions of corporate operations and potential risks, thereby mitigating information asymmetry and further easing the financing constraints faced by enterprises. Based on the above analysis, this paper proposes the following:

Hypothesis 2.

SCF reduces the level of financing constraints of enterprises, which in turn has an effective impact on the improvement in enterprise CU.

2.3. SCF, Agency Costs, and Firm CU

According to the dual principal–agent theory, agents are often driven by personal interests in the course of making a decision, neglecting the long-term consideration of the efficiency and value of corporate investment. This kind of behavior may lead to over-investment and inefficient resource utilization of enterprises and induce the dilemma of overcapacity. On the one hand, constructing and improving the regulatory mechanism is regarded as a key means to alleviate the overcapacity problem. First, by overseeing the core enterprise’s management, the supply chain’s node companies may effectively increase the enterprise’s operational efficiency. At the same time, suppliers’ interests are directly related to the enterprise’s. As a result, they serve in corporate governance and successfully monitor and control management’s actions to lower agency costs. The core businesses can also improve the oversight and administration of the entire supply chain. They successfully manage the ethical risks and opportunistic actions of upstream and downstream businesses by using their knowledge advantage, which lowers transaction costs and boosts operational effectiveness [30]. Moreover, by coordinating supply chain operations and aligning both upstream and downstream partners, core enterprises facilitate efficient information flow and a clearer understanding of market needs. This helps prevent raw material waste caused by supply–demand imbalances while also improving the relevance of new product development and the precision of targeted marketing strategies. Ultimately, these efforts contribute to lowering both procurement and sales costs. According to the principle of cost minimization, with constant revenue, cutting costs will contribute to increasing the enterprise’s operational efficiency and, consequently, CU. Therefore, the author proposes the following:

Hypothesis 3.

SCF promotes firms’ CU by mitigating their agency cost problem, thus promoting their CU.

2.4. SCF, Technological Innovation, and Enterprise CU

Insufficient technological innovation in enterprises is one of the important factors leading to overcapacity. The phenomenon of homogenized products and markets often stems from the lack of technological innovation of enterprises. In this case, competition among enterprises often relies on price advantage and expanding production scale. This strategy usually leads enterprises to gain cost advantages or increase market share by continuously expanding production capacity, which exacerbates the issue of overcapacity in the entire sector. Therefore, to solve overcapacity, it is important for enterprises to strengthen their capacity for technological advancement. However, as competition in the market environment gets fiercer, enterprises face great challenges in carrying out R&D and innovating new products and technologies alone, and there is an urgent need to obtain external resource support [31]. On the one hand, partners in a supply chain build closer cooperative relationships and promote the sharing of key technologies, knowledge, and other resources. This not only reduces the uncertainty and risk in the process of independent R&D but also enhances the possibility of R&D success [21]. On the other hand, SCF produces technological spillover effects during the development, which gives enterprises the opportunity to learn and absorb advanced technologies. Technological innovation helps to save production factor inputs and reduce production costs. Moreover, it enhances production efficiency and technology at the level of CU. In addition, technological innovation can also improve product performance and quality, enhance the competitiveness of enterprises, guide new consumption trends, and expand market share, so it can enhance the CU rate of enterprises in the future. The following hypothesis is proposed in this study based on the analysis above:

Hypothesis 4.

SCF improves enterprises’ CU rate by promoting technological innovation.

2.5. SCF, Inefficient Investment, and Firms’ CU

One of the major triggers of firms’ overcapacity is over-investment by firms. In China’s immature market structure, it is frequently challenging for enterprises to retrieve knowledge and support investment decisions, resulting in frequent over-investment or under-investment [32]. Furthermore, credit funds are frequently allocated inefficiently or not at all because of the information asymmetry that exists between banks and businesses, as well as the distortion of the credit market. This misallocation further distorts the transmission of bank credit information, leading to over-investment in production capacity by enterprises, which ultimately worsens the situation of overcapacity. By conducting SCF operations, businesses can successfully reduce the information asymmetry that exists between banks and firms [19]. During the financial services process, core enterprises engage in in-depth information exchanges with banks, which significantly reduces information asymmetry. These exchanges also reduce the inefficient investment caused by the “surge phenomenon”. This phenomenon illustrates how SCF inhibits businesses’ unproductive investment. Furthermore, SCF can alleviate the principal–agent conflict in the market and strengthen the communication between shareholders and management. This helps to improve the efficiency of external supervision, such as the market and the media; reduce the management’s blind investment behavior based on self-interest; optimize resource deployment; and optimize the efficiency of investment, thus effectively reducing inefficient investment and promoting the enhancement of enterprise CU. Based on the prior discussion, this study proposes the following:

Hypothesis 5.

SCF improves enterprise CU by reducing inefficient investment.

3. Data Sources, Variable Definitions, and Modeling

3.1. Data Source

A-share manufacturing enterprises serve as the paper’s analytical sample. Between 2010 and 2023, these businesses were listed on the Shanghai and Shenzhen Stock Exchanges. During the screening process, this paper excluded companies that were specially treated (including ST and *ST) and PT-marked, as well as samples lacking financial data. In order to weaken the potential interference of outliers on the research conclusions, we implemented the Winsorize treatment of 1% and 99% quantiles for all continuous variables. Ultimately, we obtained 28,347 valid observations for the sample. All information on firms’ CU rates and other financial information was derived from the Cathay Pacific CSMAR database.

3.2. Definition of Variables

3.2.1. Explained Variables

In academics, there is no standard way to gauge capacity use. The peak method, data envelopment analysis method, and stochastic frontier production function approach are among the frequently employed measurement techniques. Because of its accuracy and application, the stochastic frontier production function method, which Li Xuesong et al. (2017) [33] adopted, is generally considered to be among the best ways to assess the CU rate of businesses. Consequently, the CU (CU) is estimated in this paper using the stochastic frontier production function method. In particular, the ratio of the company’s actual output to its maximum output is known as CU. In order to quantify and compute each company’s CU ratio, a stochastic frontier production model is built in this study using three important indicators: revenue, total asset size, and personnel count. Additionally, for robustness testing, this study uses the total asset turnover ratio as a stand-in variable for CU.

3.2.2. Explanatory Variables

Scholars at home and abroad have mostly adopted the proxy variable approach in the indicator measures of SCF—common ones include macro data based on the regional level [24], text analysis data based on the enterprise level [21], and micro continuous proxy variable data based on the enterprise level. However, due to the limited ways in which SCF has been measured in existing studies, these approaches inevitably include a non-SCF component. In addition, existing text analysis metrics, such as the 0–1 variable or word frequency approach, may be difficult to accurately measure a firm’s actual SCF capabilities. Because of this, “the ratio of short-term loans and notes payable to total assets at the end of the year” is used in this study as a stand-in for SCF [28], and sets it as the core explanatory variable. Given that SCF’s “financial attribute” is that it is a short-term financing tool [34], it effectively reduces the financing pressure of SMEs. Consequently, this “financial attribute” of SCF can be more properly reflected by quantitative analysis employing short-term borrowing data in financial data. Additionally, notes payable emphasize the function of creditors and financing intermediaries in supporting the supply chain core businesses’ upstream and downstream operations. Additionally, the intuition of financial data can more accurately depict the level of SCF implementation. The word frequency mode metric and the SCF text analysis metric 0–1 variable are used as backup variables for robustness testing in this study [21].

3.2.3. Control Variables

Referring to the study by Zhu Guoyue and Tao Feng (2024) [35], in this paper, the following control variables were chosen: firm size (Size) is the logarithmic value of the firm’s total assets; firm age (FirmAge) is ln (the current year minus the year of the firm’s establishment + 1); the gearing ratio (Lev) is the ratio of total liabilities to total assets; the firm growth is the ratio of current year’s operating income to operating income − 1; the profitability (ROA) is the ratio of net profit to total assets; the operating cash flow (Cashflow) is the ratio of net fixed assets to total assets; and equity concentration (Top5) is the sum of the percentage of shares held by the top five shareholders. Additionally, time-fixed impacts and industry-fixed effects are taken into account.

The descriptive statistics for the main variables employed in this investigation are shown in Table 1. According to data in Table 1, the average value of corporate CU (CU) is 0.7561, which is less than the standard of 0.79, indicating that listed companies in the manufacturing sector are typically faced with the capacity imbalance balance situation. The maximum value of CU is 0.8565, the minimum value is 0.6066, and the standard deviation is 0.0456. These figures show that listed enterprises in China’s manufacturing sector generally have little fluctuation in CU. The SCF (SCF) mean value is 0.1272, and the standard deviation is 0.1146. This suggests that the general level of SCF development is not very high, and that the amount of development differs across the sampled firms. The remaining control variables’ statistical properties generally match the findings in the body of the current research.

Table 1.

Results of descriptive statistics.

3.3. Model Setting

To seek the connection between SCF and enterprise CU, a designed mode is as follows:

where CUit and SCFit, respectively, denote the CU rate and SCF level of enterprise i in period t; Controls represent the control variables in the model; and , respectively, denote the year fixed effects and industry fixed effects in the model; and denotes the random error term. The coefficients in model (1) are the main concerns of this study; if > 0, it indicates that SCF impacts positively on enterprise CU, and vice versa.

4. Analysis of Empirical Results

4.1. Benchmark Regression Results Analysis

The benchmark regression results of SCF’s effect on firm CU are shown in Table 2. SCF can significantly increase enterprise CU, which is consistent with hypothesis 1, according to column (1) in the table, which shows the regression results without control variables. The core explanatory variable’s (SCF) coefficient is 0.0426, and is statistically significantly positive at the 1% level. Column (2) displays the regression result after the year fixed effect and control variables were added. At this point, the coefficient of the explanatory variable (SCF) is 0.0792, which is also significantly positive at the 1% level. Column (3) displays the regression result after the industry fixed effect was added based on column (2). The result indicates that the coefficient of the explanatory variable (SCF) is reduced, indicating that the key factors affecting CU are some industry-level characteristics that do not change over time. When characteristics are not taken into account, the impact of SCF is overestimated. Characteristics are omitted variables that affect CU. The coefficient of the fundamental explanatory variable (SCF) stays notably positive even after accounting for these endogeneity problems. After controlling for time and industry effects, the key explanatory variable’s coefficient of 0.429 demonstrates its economic impact, showing that businesses’ CU rises by 6.5% for every 1% increase in the SCF standard deviation (the method used in this paper in calculating the economic meaning of the explanatory variables is coefficient of the explanatory variable × standard deviation of the explanatory variable—mean of the explanatory variable.).

Table 2.

Benchmark regression results.

4.2. Robustness Test

4.2.1. Replacement of Key Explanatory Variables

This study uses the SCF 0–1 variable (SCF_Dum) and the method of SCF keyword word frequency statistics (SCF_R) to evaluate the degree of SCF of businesses in order to circumvent the issue of measurement error. It also draws from the research by Ling Runze et al. (2021) [3] and Li Xinli et al. (2023) [20]. Columns (1) and (2) of Table 3 display the regression results following the replacement of the explanatory variables. The results demonstrate that the SCF (SCF_Dum) and SCF (SCF_R) coefficients are both significantly positive, suggesting that the degree of an organization’s participation in SCF has an impact on its CU rate regardless of whether it chooses to provide supply chain financial services.

Table 3.

Robustness test results.

4.2.2. Replace the Explanatory Variables

This study uses the total asset turnover ratio (CU_eff) as a stand-in indicator of CU and performs a re-regression analysis based on model (1) in order to circumvent the additional issue of measurement error. The regression findings are shown in Column (3) of Table 3, where the SCF (SCF) coefficient is 0.1997 and statistically significant at the 1% level, further confirming the validity of the earlier conclusions.

4.2.3. Extending the Time Window

This paper lags one period of the explanatory variables in the baseline regression model in order to investigate whether SCF has a stable and long-term positive impact on enterprise CU. The regression results are displayed in Table 3’s column (4), and the SCF (L.SCF) coefficient is still significantly positive after one period of lagging. This suggests that the impact of SCF on CU is long-term in character, supporting the article’s conclusions.

4.2.4. Incorporating Higher-Order Joint Fixed Effects

To double-check, we added the higher-order joint fixed effect of “year × industry” to the original model based on the Moser and Voena (2012) [19] study. The regression results are displayed in Table 3’s column (5), and the findings are consistent with the earlier publication.

4.2.5. Excluding the Impact of Exogenous Events

This study excludes samples from 2020 and later for regression because the COVID-19 epidemic in 2020 forced most businesses to halt work and production, which may have affected enterprise CU. The results are shown in column (6) of Table 3, and the SCF (SCF) coefficient is still distinctly positive.

4.2.6. Excluding the Sample of Municipalities Directly Under the Central Government

We excluded the sample of listed corporations whose provinces are municipalities for regression because SCF and business activities are bound to influence enterprises, given the unique economic and policy conditions of municipalities. The results are displayed in column (7) of Table 3, and the conclusions are in line with the previous section.

4.2.7. Add Regional Control Variables

The level of regional economic development (lngdp), which is represented by the logarithmic value of regional per capita GDP, and the level of regional financial development (JRFZ), which is represented by the ratio of the balance of various deposits and loans of regional financial institutions to GDP, were added to the original benchmark model in consideration of the possibility that variations in CU may result from differences in regional economic development. Column (8) of Table 3 displays the regression findings with the addition of regional control variables. This paper’s conclusions are solid since the SCF coefficient is significantly positive.

4.3. Endogeneity Test

In order to accurately identify the causal relationship between corporate SCF development and CU, and to cope with the endogeneity bias that may arise in the model due to the omission of variables, this study adopts the following three tests to rule out the potential endogeneity problem in the model.

4.3.1. Instrumental Variables Method

Drawing on Ling Runze et al. (2021) [3], this research uses the natural logarithm of the total number of SCF support policies introduced by provincial governments, municipal governments, and prefectural government departments each year as an instrumental variable for firms’ implementation of SCF programs (SCF_IV) (“Supply Chain Finance”, “Supply Chain Finance”, “Bills Financing”, “Accounts Receivable Financing” are the keywords. Using keywords, we searched the annual supply chain finance support policies issued by provincial governments, municipal governments, and prefectural government departments from Beida Faber). The reason for choosing it as an instrumental variable is that the more relevant policies issued by local governments, the more they can foster innovation in SCF in the domain, which will be more conducive to incentivizing enterprises to implement SCF programs. However, the CU of businesses is not directly impacted by these policies. The instrumental variables approach’s estimation findings are shown in Table 4’s columns (1) through (2). A strong correlation between the instrumental variable and the endogenous explanatory variables is indicated by the estimated coefficient of the instrumental variable (SCF_IV), which is 0.0066 and significant at the 1% level. The results of the first stage of the regression of the instrumental variable method are specifically reported in column (1). The results of the second stage of the instrumental variable method are shown in Column (2). The p-value of the Kleibergen–Paap rk LM statistic is 0.0000, which is significantly less than the typically used significance level of 5%. This indicates that the model was correctly identified and that the null hypothesis of under-identification can be rejected. The reliability of the estimation results is ensured by the instrumental variables providing enough statistical information to estimate the endogenous variables’ coefficients precisely, as evidenced by the Cragg–Donald Wald F-statistic reaching 92.651, which is significantly above the critical value of 16.38. The estimated coefficient of SCF in column (2) is 0.2615 and significant at the 5% statistical level, indicating that the research hypothesis—that is, that an organization with a higher level of SCF tends to contribute more significantly to improving CU—remains valid after the model was tested using the instrumental variable method.

Table 4.

Endogeneity test results.

4.3.2. Propensity Score Matching (PSM) Method

The propensity score matching (PSM) approach was used in this study to further address the endogeneity problem with the model. In particular, this study classifies firms based on the adoption status of an SCF program and separates the sample of firms that have implemented the program into an experimental group and a control group from the sample of firms that have not. Firms in the treatment and control groups were matched using a 1:1 closest neighbor propensity score matching technique, with the control variables from the baseline regression model serving as covariates. Logit modeling was used to estimate propensity scores. There was no discernible difference between the experimental and control groups in the matched samples (the matching effect test results are available upon request). A regression analysis based on model (1) was performed using the matched sample, and the regression results are shown in Table 4’s column (3). The SCF coefficient in column (3) is 0.0501 and significant at the 1% level; this result confirms the robustness of the benchmark regression findings and is consistent with the benchmark regression.

4.3.3. Heckman Two-Stage Model Test

This study uses the Heckman two-stage model for testing in order to address the endogeneity issue brought on by selectivity bias. A dummy variable, “whether the enterprise explicitly carries out supply chain financial services” (abbreviated SCF_Dum), was created as the dependent variable during the first phase of the study. If the enterprise explicitly carries out supply chain financial services, SCF_Dum takes the value of 1; if not, it takes the value of 0. In light of this, we included a dummy variable in the baseline regression model that takes the value of 1: “whether the enterprise explicitly carries out supply chain financial services.” In order to do this, we included the control variables in the benchmark regression model and used the Probit model to estimate the inverse Mills ratio (IMR). The initial step of this paper is the introduction of an instrumental variable for supply chain financing policy (SCF_IV). In order to determine whether selectivity bias affects the benchmark regression findings, IMR was added as a control variable in the second phase of the benchmark regression model (Model 1). The test findings are shown in column (4) of Table 4, where column (4) demonstrates that the estimated coefficients of SCF (SCF) continue to be considerably positive with the addition of IMR as a control variable. This suggests that even after adjusting for selective bias using the Heckman two-stage model, the main findings of this investigation remain valid.

5. Further Analysis

5.1. Mechanism Test

This study aims to further explore the precise processes via which SCF affects company CU, guided by the previous theoretical analysis. Regression analyses were performed on the following intermediary variables in order to achieve this goal: agency cost (Mfee), which is calculated by dividing overhead by operational income; enterprise innovation (RD_dum), which is a dummy variable indicating whether or not company R&D expenditure has risen; and finance restrictions (SA), which are measured using the SA index. The expected investment model put forth by Richardson (2006) [36] serves as the foundation for the quantification of inefficient investment (Inveff) in this research. We use the absolute value of the residuals calculated by this model to measure the level of inefficient investment of the enterprise, where the investment efficiency of an enterprise decreases as the absolute value of the residuals increases.

The regression results of the relationship between corporate SCF (SCF) and financial constraints (SA) are shown in Table 5, column (1). At the 1% level, the SCF coefficient in column (1) is considerably negative. This illustrates how SCF has a detrimental effect on financial restrictions, raising the prospect of lowering the degree of financial limitations faced by businesses. SCF gives businesses access to more reliable and varied funding sources while also extending the reach of conventional financial services. As a result, businesses receive adequate funding and a consistent ability to withstand risk. They also benefit from the “long-tail effect”, which encourages technological innovation and raises businesses’ CU rates, confirming hypothesis 2. SCF has a significant negative impact on financing constraints, suggesting that it can lower the degree of financing limitations. The regression findings of SCF on enterprise innovation (RD_dum) are shown in column (2). The coefficient for finance (SCF) is noticeably positive. Supply chain financing speeds up the flow of resources and fortifies ties between early and end-stage supply chain businesses. Additionally, SCF offers businesses a stable external environment for their innovation endeavors, creating a climate that is conducive to the use of capacity and innovation inputs. Column (3) shows the regression results of the effect of SCF on the agency cost (Mfee) of enterprises. The coefficient of SCF (SCF) is −0.1050, and this result reaches the 1% level of statistical significance, which indicates that SCF has a significant negative effect on the agency cost, i.e., it reduces agency cost for enterprises. SCF facilitates more efficient information exchange between upstream suppliers and downstream firms, reduces information asymmetry, lowers the operating costs of enterprises, realizes the information transparency between principals and agents, and thus reduces inefficient and ineffective investment and enhances the CU of enterprises. Column (4) shows the regression results of SCF on the inefficient investment (Inveff) of enterprises, and the regression coefficient of SCF is significantly negative, which implies that SCF is effective in mitigating enterprises’ inefficient investment. SCF promotes information exchange between enterprises and upstream and downstream producers and customers, reduces inefficient investment, and improves enterprise CU. In summary, SCF enhances enterprise CU by easing financing constraints, fostering innovation, lowering agency costs, and mitigating inefficient investment. These results offer robust empirical support for Hypotheses 2 through 5.

Table 5.

Mechanism test results.

5.2. Heterogeneity Analysis

5.2.1. Supply Chain Relationship Closeness

Referring to the study by Qiang Wu and Yuxiu Yao (2023) [37], the percentage of a company’s sales to its top five customers in the current year and the percentage of purchases from its top five suppliers are the two variables that are averaged in this study to represent the proximity of supply chain linkages. Supply chain closeness (SCC), a binary variable that reflects the strength of supply chain links, was developed based on this measure. The value of SCC is set to 1 if the supply chain relationship between firms is more than the median; on the other hand, the value of SCC is set to 0 if the firms are classified as having tighter supply chain relationships. After adding the SCF × SCC interaction term to the baseline model, the outcomes are shown in Table 6’s column (1). Both the SCF coefficient and the SCF × SCC interaction term’s coefficient are substantially positive. This suggests that enterprises with greater supply chain links benefit more from SCF in terms of CU than those with weaker supply network relationships. In addition to serving as the foundation for the development of strong cooperative ties between the chain’s firms, the close links among the node enterprises serve as the basis for the sharing and transmission of technology, expertise, information, and other resources. The closer the connection and the more stable relationships among companies within the supply chain, the more conducive to cooperation and innovation. Therefore, SCF can significantly promote cooperative product research and increase connections among enterprises, thus enhancing the product competitiveness of these enterprises and further improving their CU.

Table 6.

Results of heterogeneity analysis.

5.2.2. Supply Chain Efficiency

Drawing on Wang et al. (2020) [38], this study builds a supply chain efficiency dummy variable (SCE) and measures supply chain efficiency by dividing 365 by the natural logarithm of inventory turnover. A company is categorized as having high supply chain efficiency and given a value of 1 if its supply chain efficiency is higher than the industry median. On the other hand, 0 is assigned. The baseline model incorporates the interaction term between SCF and SCE (SCF × SCE). The regression results in Table 6’s column (2) show that the interaction term SCF × SCE has a significantly negative coefficient at the 5% level, while the SCF (SCF) coefficient is 0.0481 and significant at the 1% level. This indicates that finance (SCF) plays a more prominent role in enhancing CU of firms with lower supply chain efficiency. Supply chain efficiency is a key indicator of transaction frequency and information exchange efficiency, which is visualized in the flow rate of goods and services. When supply chain operation problems occur, they are specifically manifested as a mismatch between supply and demand, an increase in information asymmetry, and a reduction in the speed of enterprise working capital turnover. Therefore, enterprises with lower supply chain efficiency are more inclined to actively carry out supply chain financial services to alleviate the problems of information asymmetry, financing constraints, and mismatch between supply and demand; thus, SCF has a greater impact on these enterprises.

5.2.3. Nature of Enterprise Ownership

In this research, the sample firms are classified into state-owned enterprises (SOEs) and non-state-owned enterprises (NSOEs) according to the identity of the actual controller and the attribution of equity. A dummy variable for the nature of equity (SOE) is set. SOE assumes a value of 1 when the enterprise is a part of it; otherwise, it assumes a value of 0. After adding the SCF × SOE interaction term to the benchmark model, the outcomes are shown in column (3) in Table 6. While the coefficient of SCF × SOE is significantly negative, the coefficient of SCF (SCF) is 0.0575 and significantly positive at the 1% statistical level, indicating that SCF contributes more to the CU of non-SOEs. This is explained by the special qualities of state-owned businesses, which frequently enjoy more access to credit resources, tax breaks, and policy support. As a result, they tend to respond more slowly to external competitive pressures. Moreover, they typically lack strong incentives for independent innovation and exhibit relatively low demand for SCF. Thus, SCF has a relatively limited effect on improving the CU of SOEs. Conversely, non-state-owned enterprises are exposed to fierce market competition and are more inclined to take the initiative to seek supply chain financial services to promote technological innovation, optimize resource allocation, and strengthen the efficiency of internal control. The more financing constraints faced by non-state-owned enterprises, the more actively they develop SCF business and promote greater transparency of risk information to acquire more credit resources. Therefore, the positive impact of SCF on enterprise CU is more pronounced in non-state-owned enterprises compared to their state-owned counterparts.

5.2.4. Degree of Industry Competition

The Herfindahl Index was chosen to measure the degree of industry competition of the firms in this study. The larger the value, the less competitive the industry is. Specifically, this study classifies firms into high and low degrees of industry competition with reference to the median of the Herfindahl Index and constructs a dummy variable for the degree of industry competition (HHI). If a firm’s Herfindahl Index is higher than its median, it is a firm with a low degree of industry competition, at which time HHI takes the value of 1; otherwise, it takes the value of 0. The SCF × HHI interaction term is added to the baseline model, and the outcomes are presented in column (4) of Table 6. The coefficient of SCF is significantly positive, and the coefficient of the interaction term SCF × HHI is significantly negative, which demonstrates that SCF is more effective in improving CU for firms facing higher levels of industry competition. In a market that is extremely competitive, firms need to continuously upgrade their products to increase their market share, and, therefore, they require a large amount of financial support. In addition, product upgrading requires a strong technological innovation capability, and the technological spillover effect of SCF is more attractive to enterprises, so companies with greater market competitiveness are more active in supply chain financial services.

5.2.5. Marketization Level

This study adopts the Fangang index as a proxy variable for marketization level and uses the median of marketization level to classify the sample according to the degree of marketization into high and low levels. On this basis, this study constructs the marketization level dummy variable (MI). The marketization dummy variable (MI) is set to 1 if the enterprise is located in a region with a marketization level above the median; conversely, it is set to 0. The interaction term between SCF and marketization level dummy variable (SCF × MI) is added to the benchmark regression model. The results are illustrated in column (5) of Table 6. The cross-multiplier term of supply and the SCF (SCF) coefficient are both 0.0359 and significant at the 1% level. The aforementioned data suggest that SCF improves the CU of businesses in highly marketized regions more successfully than it does for businesses in less marketized locations. In areas with a high degree of marketization, businesses can enhance the development of supply chain collaboration platforms and encourage the sharing of resources like technology, information, and knowledge among node businesses to establish a favorable environment for supply chain operations. Therefore, SCF can contribute more significantly to “removing production capacity” under a high level of marketization.

5.2.6. Financial Development Level

On the basis of the median of regional financial development, this study divides the sample enterprises into two categories. They are located in areas that have varying degrees of financial development. A dummy variable for the financial development level (JRFZ) is created in this study. JRFZ takes the value of 1 if the business is situated in an area where the level of financial development is higher than the median; otherwise, it takes the value of 0. The interaction term between SCF and the degree of financial development (SCF × JRFZ) is added to the baseline regression model, and the resulting findings are shown in column (6) in Table 6. Both the SCF coefficient and the interaction term SCF × JRFZ coefficient are significantly positive, indicating that SCF can improve the CU of businesses in areas with higher levels of financial development than in areas with lower levels. In regions with a more developed financial system, there are many high-quality financial institutions, and they have significant advantages in financial technology and financial regulation, which can provide sufficient funds and high-quality financial services for the market. Such an external environment creates a supportive condition for innovation, which can improve the framework of SCF. In addition, enterprises located in developed financial markets can more substantially mitigate information asymmetry and enhance corporate value, thus further reducing the financing cost and the policy information asymmetry for enterprises and thus improving CU. Consequently, SCF exerts a stronger positive impact on enterprise CU in regions with more developed financial development.

6. Conclusions and Policy Recommendations

To explore the impact of SCF on enterprise CU and its mechanism of action, this study employs a dataset comprising listed manufacturing firms in China’s A-share market over the period from 2010 to 2023. SCF has been shown to have a positive impact on businesses’ CU. After mechanism tests, the results show SCF improves CU by alleviating financing constraints, reducing agency costs, promoting technological innovation, and inhibiting inefficient investment. Heterogeneity analysis deeply explains that SCF promotes enterprise CU more significantly in regions with close cooperation relationships, lower supply chain efficiency, non-state-owned enterprises, more business competition, and a higher level of marketization.

The theoretical contribution of this paper is that it breaks through the limitations of traditional financing theory and confirms that SCF enhances capacity utilization through a “quadruple path”: firstly, it alleviates financing constraints, thus reducing the inhibition of production scale caused by the shortage of liquidity; secondly, it reduces the agency cost and optimizes the efficiency of supply chain synergy; thirdly, it promotes technological innovation and drives equipment upgrading and process improvement; fourthly, it inhibits inefficient investment and restrains blind expansion and capacity mismatch. Thirdly, it promotes technological innovation, which drives equipment upgrading and process improvement; fourthly, it inhibits inefficient investment, which restrains blind expansion and capacity mismatch, which provides a micro evidence chain for the theory of “financial empowerment of entities” and reveals the logic of the transmission of SCF from capital allocation to capacity optimization. The practical significance of this paper is that it provides a scientific basis for enterprises to identify suitable scenarios for supply chain finance and for the government to formulate regionalized supply chain finance policies at the enterprise level, industry level, and policy level. It also has direct guiding value for promoting the high-quality development of the manufacturing industry and the implementation of the “supply-side structural reform”.

This study gives the following policy suggestions.

Firstly, supply chain financing ought to be positioned as a crucial starting point for promoting superior economic development. Businesses may expedite the integration of SCF with developing technologies and the Internet of Things, as well as increase their digital economic activity. This would enable supply-side structural reform more successfully by allowing SCF to completely integrate resources and align supply with demand. Furthermore, in order to assist businesses in the development of SCF, our government should create rules that align with the information infrastructure framework for supply chain financing. For instance, it ought to create a talent support system for supply chain innovation, a supply chain innovation investment fund, and a supply chain public service platform. In order to expand the pilot regions and objects, the government should simultaneously compile cutting-edge supply chain innovation experiences and practices. It should also use the leadership-by-example approach.

Secondly, it is essential to maximize the potential of SCF in “removing production capacity” and actively explore multi-dimensional development paths. First, we should fully leverage the information transfer in SCF so that suppliers and customers can obtain accurate and timely market information. At the same time, strengthening data mining and machine learning can help corporations make correct judgments in dynamics market and avoid overcapacity caused by over-investment; secondly, it makes use of the supervisory function to strengthen the tracking and monitoring of the various connections in supply chains (e.g., demand sourcing, order processing, warehousing, logistics, etc.). By utilizing big data technology to analyze resource allocation and adjust it accurately and efficiently, enterprises can continuously optimize supply chain operational efficiency, thereby reducing production costs and improving overall productivity. Thirdly, based on the SCF platform, it breaks the status quo of “information silo”, guides enterprises to actively participate in the research and development among the node enterprises in the supply chain, efficiently integrates all kinds of innovation resources, and improves product quality. At the same time, our government should combine consumer demand with product R&D and design and implement a differentiated product development strategy to meet the needs of different consumers.

Lastly, demand should be matched according to the actual situation, tailored to local conditions and enterprises. First, when innovating supply chain financial products and services, enterprises should consider their own actual situation, the development situation of the region where they are located, and adopt differentiated strategies. For enterprises with low supply chain closeness, they should strengthen cooperation and trust with their business partners in the supply chain so as to reduce information asymmetry. At the same time, the synergy of technology can help raise the degree of technological innovation in businesses. For enterprises with high supply chain efficiency, they should actively explore advancements in supply chain finance products and service offerings, enhance the ability to cope with different market environments, and avoid sticking to the old rut; secondly, private enterprises should actively engage in technical cooperation with third-party logistics enterprises in order to alleviate the information asymmetry, increase the possibility of obtaining loans, and thus stimulate the corporations’ ability to innovate and broaden the market share; for companies with a low degree of competition in the industry, they should take the initiative to establish contact with high-quality enterprises to form a good cooperative relationship. Through cooperation with high-quality enterprises, the technical level of enterprises can be improved, which in turn improves the quality of products. Thirdly, for enterprises in regions with a low level marketization, collaborations among enterprises should be strengthened. Collaborations and trust among enterprises at every supply chain node should be strengthened through the establishment of formal contracts, the establishment of diversified channels for an information communication platform, the promotion of cooperation and trust among supply chain companies, and the promotion of formulating formal contracts. This will help establish diversified information communication channels and information sharing platforms. We should encourage collaboration and innovation among businesses involved, strengthen trust and collaboration among businesses, and optimize the contribution of supply chain financing to the “removal of production capacity.”

Moreover, building upon the robust empirical evidence presented in this study, which demonstrates a significant positive effect of supply chain finance (SCF) on alleviating financing constraints and subsequently improving capacity utilization (CU) among A-share listed companies, this section delves into the critical implications for sustainability improvements and outlines pertinent future challenges. Enhancing CU is not merely an indicator of operational efficiency; it holds profound significance for sustainable economic development across multiple dimensions.

Pathways to Sustainability Improvements:

Economic Sustainability and Resource Efficiency. Improved CU signifies a reduction in idle or underutilized capital assets and labor. This directly translates to enhanced resource efficiency within the firm and, by extension, the broader supply chain. By enabling firms to operate closer to their optimal production scale, SCF contributes to reducing economic waste associated with unused capacity. This more efficient allocation of capital and productive resources strengthens the economic resilience of individual firms and their supply chain networks, fostering a more robust and less resource-intensive economic foundation.

Environmental Sustainability. Higher CU often correlates with lower energy and resource consumption per unit of output. While not directly measured in this study, the pathway exists: firms operating at higher utilization rates can potentially achieve better economies of scale in energy use and material processing, leading to a reduction in their carbon footprint and environmental impact per unit produced. SCF, by facilitating this shift toward fuller utilization, can thus be an indirect enabler of improved environmental performance within industrial sectors, contributing to goals like reduced greenhouse gas emissions and lower resource depletion.

Social Sustainability and Supply Chain Stability. SCF programs often involve core firms providing financing support to their SMEs within the chain. Our findings show that this improves the CU of these supported firms. This enhanced operational stability for SMEs reduces their vulnerability to financial shocks, contributing to greater supply chain resilience and reduced risk of business failure and job losses among smaller, critical players. Furthermore, smoother operations enabled by SCF can lead to more stable employment within participating firms. The focus on optimizing the supply chain’s financial health inherently promotes collaboration and interdependence, fostering a more stable and potentially equitable ecosystem for all participants.

Critical Future Challenges:

Ensuring Equitable Access and Mitigating Power Imbalances. While SCF can benefit the chain, its governance structures are often dominated by powerful core enterprises. A significant challenge is ensuring that the efficiency gains and financial benefits derived from SCF are fairly distributed across the supply chain, particularly reaching vulnerable SMEs. Mechanisms to prevent exploitative practices and promote transparency in SCF terms are crucial for ensuring the social sustainability of these programs.

Integrating Environmental, Social, and Governance (ESG) Criteria. Current SCF practices primarily focus on financial risk and operational efficiency (like CU). The next frontier is the integration of ESG performance metrics into SCF decision making and pricing. Future challenges involve developing robust frameworks to link SCF terms to suppliers’ or buyers’ performance on environmental targets, social responsibility, and governance. This would directly align SCF incentives with broader sustainability goals.

Data Availability and Impact Measurement for Sustainability. Accurately measuring the actual environmental and broader social impact of SCF-driven CU improvements remains a challenge. Future research and practice require enhanced data collection and standardized metrics to quantify the reductions in resource use, emissions, and social risks attributable to SCF adoption. These data are essential for validating the sustainability claims of SCF and guiding its evolution.

Scalability and Inclusion Beyond Listed Firms. This study focused on A-share listed firms, which generally have better access to information and finance. A major future challenge is extending the benefits of SCF-driven CU improvements to the vast ecosystem of non-listed SMEs and micro-enterprises within supply chains, especially in developing regions. This requires innovations in fintech, risk assessment models for smaller players, and supportive regulatory frameworks to promote inclusive SCF solutions.

Balancing Short-term Liquidity with Long-term Sustainable Investments. SCF primarily addresses short-term working capital needs. A challenge is ensuring that the liquidity relief and improved CU provided by SCF do not inadvertently divert attention or resources away from necessary long-term investments in sustainable technologies, circular economy practices, or workforce upskilling, which are vital for enduring sustainability transitions. SCF models need to evolve to support or coexist with financing for these longer-horizon sustainable investments.

Therefore, while our findings highlight SCF as a potent tool for enhancing CU and unlocking significant pathways toward improved economic, environmental, and social sustainability within supply chains, realizing its full potential necessitates proactively addressing the intertwined challenges of equitable governance, ESG integration, robust impact measurement, inclusive access, and alignment with long-term sustainable transformation goals. Future research and policy initiatives should prioritize these areas to maximize the contribution of SCF to truly sustainable supply chain development.

Author Contributions

Writing—original draft, Y.W.; supervision, Z.-H.C.; funding acquisition, M.X. All authors have read and agreed to the published version of the manuscript.

Funding

This work was partially supported by the National Natural Science Foundation of China (No. 72201003) and the Young and Middle-Aged Teacher Training Action Program in Anhui Province Universities, China (No. YQYB2024002).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Huang, Z.; Tao, Y.; Liu, Z.; Ye, Y. How Smart Manufacturing Improves Enterprise Capacity Utilization-Based on the Perspective of Production and Consumption Integration. Manag. World 2024, 40, 40–59. [Google Scholar] [CrossRef]

- Dixit, A. The role of investment in entry-deterrence. Econ. J. 1980, 90, 95–106. [Google Scholar] [CrossRef]

- Ling, R.; Pan, A.; Li, B. Can Supply Chain Finance Enhance Corporate Innovation? J. Financ. Econ. 2021, 47, 64–78. [Google Scholar] [CrossRef]

- Ju, X.; Li, H.; Yao, P.; Liu, J.; Chen, F.; Sriboonchitta, S. Analysis of the Impact of Industrial Land Price Distortion on Overcapacity in the Textile Industry and Its Sustainability in China. Sustainability 2022, 14, 4491. [Google Scholar] [CrossRef]

- An, H.; Chen, Y.; Luo, D.; Zhang, T. Political uncertainty and corporate investment: Evidence from China. J. Corp. Financ. 2016, 36, 174–189. [Google Scholar] [CrossRef]

- Che, Y.; Zhang, L. Human capital, technology adoption and firm performance: Impacts of China’s higher education expansion in the late 1990s. Econ. J. 2018, 128, 2282–2320. [Google Scholar] [CrossRef]

- Marini, G.; Pannone, A. Capital and capacity utilization revisited: A theory for ICT-assisted production systems. Struct. Change Econ. Dyn. 2007, 18, 231–248. [Google Scholar] [CrossRef]

- Han, Z.; Wang, L.; Zhao, F.; Mao, Z. Does low-carbon city policy improve industrial capacity utilization? Evidence from a quasi-natural experiment in China. Sustainability 2022, 14, 10941. [Google Scholar] [CrossRef]

- Cai, X.; Chen, G.; Wang, F. How does green finance policy affect the capacity utilization rate of polluting enterprises? Sustainability 2023, 15, 16927. [Google Scholar] [CrossRef]

- Edmans, A.; Levit, D.; Reilly, D. Governance under common ownership. Rev. Financ. Stud. 2019, 32, 2673–2719. [Google Scholar] [CrossRef]

- Kacperczyk, M.; Sialm, C.; Zheng, L. On the industry concentration of actively managed equity mutual funds. J. Financ. 2005, 60, 1983–2011. [Google Scholar] [CrossRef]

- Kang, J.-K.; Luo, J.; Na, H.S. Are institutional investors with multiple blockholdings effective monitors? J. Financ. Econ. 2017, 128, 576–602. [Google Scholar] [CrossRef]

- Ketchen, D.J., Jr.; Wowak, K.D.; Craighead, C.W. Resource gaps and resource orchestration shortfalls in supply chain management: The case of product recalls. J. Supply Chain Manag. 2014, 50, 6–15. [Google Scholar] [CrossRef]

- Bertschek, I.; Cerquera, D.; Klein, G.J. More bits–more bucks? Measuring the impact of broadband internet on firm performance. Inf. Econ. Policy 2013, 25, 190–203. [Google Scholar] [CrossRef]

- Chaney, T. The network structure of international trade. Am. Econ. Rev. 2014, 104, 3600–3634. [Google Scholar] [CrossRef]

- Fan, Y.; Feng, Y.; Shou, Y. A risk-averse and buyer-led supply chain under option contract: CVaR minimization and channel coordination. Int. J. Prod. Econ. 2020, 219, 66–81. [Google Scholar] [CrossRef]

- Tseng, M.-L.; Lim, M.K.; Wu, K.-J. Improving the benefits and costs on sustainable supply chain finance under uncertainty. Int. J. Prod. Econ. 2019, 218, 308–321. [Google Scholar] [CrossRef]

- Soderbery, A. Estimating import supply and demand elasticities: Analysis and implications. J. Int. Econ. 2015, 96, 1–17. [Google Scholar] [CrossRef]

- Moser, P.; Voena, A. Compulsory licensing: Evidence from the trading with the enemy act. Am. Econ. Rev. 2012, 102, 396–427. [Google Scholar] [CrossRef]

- Li, X.; Yan, J.; Cheng, J.; Li, J. Supply-Chain Finance and Investment Efficiency: The Perspective of Sustainable Development. Sustainability 2023, 15, 7857. [Google Scholar] [CrossRef]

- Liu, J.; Qian, Y.; Chang, H.; Forrest, J.Y.-L. The impact of technology innovation on enterprise capacity utilization—Evidence from China’s Yangtze river economic belt. Sustainability 2022, 14, 11507. [Google Scholar] [CrossRef]

- Bi, G.; Fei, Y.; Yuan, X.; Wang, D. Joint operational and financial collaboration in a capital-constrained supply chain under manufacturer collateral. Asia-Pac. J. Oper. Res. 2018, 35, 1850010. [Google Scholar] [CrossRef]

- Caniato, F.; Gelsomino, L.M.; Perego, A.; Ronchi, S. Does finance solve the supply chain financing problem? Supply Chain Manag. Int. J. 2016, 21, 534–549. [Google Scholar] [CrossRef]

- Fellenz, M.R.; Augustenborg, C.; Brady, M.; Greene, J. Requirements for an evolving model of supply chain finance: A technology and service providers perspective. Commun. IBIMA 2009, 10, 227–235. [Google Scholar]

- Ali, Z.; Gongbing, B.; Mehreen, A. Predicting supply chain effectiveness through supply chain finance: Evidence from small and medium enterprises. Int. J. Logist. Manag. 2019, 30, 488–505. [Google Scholar] [CrossRef]

- Pan, A.; Xu, L.; Li, B.; Ling, R. The impact of supply chain finance on firm cash holdings: Evidence from China. Pac.-Basin Financ. J. 2020, 63, 101402. [Google Scholar] [CrossRef]

- Pan, A.; Xu, L.; Li, B.; Ling, R.; Zheng, L. The impact of supply chain finance on firm capital structure adjustment: Evidence from China. Aust. J. Manag. 2023, 48, 436–462. [Google Scholar] [CrossRef]

- Gelsomino, L.M.; Mangiaracina, R.; Perego, A.; Tumino, A. Supply chain finance: A literature review. Int. J. Phys. Distrib. Logist. Manag. 2016, 46, 348–366. [Google Scholar] [CrossRef]

- Jin, W.; Wang, C. Modeling and simulation for supply chain finance under uncertain environment. Technol. Econ. Dev. Econ. 2020, 26, 725–750. [Google Scholar] [CrossRef]

- Zhang, T.; Zhang, C.Y.; Pei, Q. Misconception of providing supply chain finance: Its stabilising role. Int. J. Prod. Econ. 2019, 213, 175–184. [Google Scholar] [CrossRef]

- Wuttke, D.A.; Blome, C.; Foerstl, K.; Henke, M. Managing the innovation adoption of supply chain finance—Empirical evidence from six European case studies. J. Bus. Logist. 2013, 34, 148–166. [Google Scholar] [CrossRef]

- Jensen, M.C. Agency costs of free cash flow, corporate finance, and takeovers. Am. Econ. Rev. 1986, 76, 323–329. [Google Scholar]

- Li, X.; Zhao, C.; Nie, J. Outward Investment and Firms’ Heterogeneous Capacity Utilization. J. World Econ. 2017, 40, 73–97. [Google Scholar] [CrossRef]

- Dyckman, B. Integrating supply chain finance into the payables process. J. Paym. Strategy Syst. 2009, 3, 311–319. [Google Scholar] [CrossRef]

- Zhu, G.; Tao, F. Supply chain digitization and enterprise capacity utilization. Contemporary Finance and Economics. Contemp. Financ. Econ. 2024, 6, 125–138. [Google Scholar] [CrossRef]

- Richardson, S. Over-investment of free cash flow. Rev. Account. Stud. 2006, 11, 159–189. [Google Scholar] [CrossRef]

- Wu, Q.; Yao, Y. Firm digital transformation and supply chain configuration: Centralization or diversification. China Ind. Econ. 2023, 8, 117. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, Q.; Lai, Y.; Liang, C. Drivers and outcomes of supply chain finance adoption: An empirical investigation in China. Int. J. Prod. Econ. 2020, 220, 107453. [Google Scholar] [CrossRef]