The UAE Net-Zero Strategy—Aspirations, Achievements and Lessons for the MENA Region

Abstract

1. Introduction

2. Climate Change and Climate Action

3. Modern Power System Landscape

4. The UAE’s Net-Zero Perspectives

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| CCUS | Carbon capture utilization and storage |

| CSTP | Concentrating solar thermal power |

| DSM | Demand-side management |

| EV | Electric vehicle |

| GHG | Greenhouse gas |

| HFCV | Hydrogen fuel cell vehicle |

| ICEV | Internal combustion engine vehicle |

| LCoE | Levelized cost of electricity |

| LFP | Lithium iron phosphate |

| Li-ion | Lithium-ion |

| MENA | Middle East and North Africa |

| Na-ion | Sodium-ion |

| NGCC | Natural gas combined cycle |

| PPA | Power purchase agreement |

| P2F | Power to fuel |

| PV | Photovoltaic |

| RO | Reverse osmosis |

| TCO | Total cost of ownership |

| UAE | United Arab Emirates |

| VRE | Variable renewable energy |

References

- Global Monitoring Laboratory, National Ocean and Atmospheric Administration, U.S. Department of Commerce. Trends in Atmospheric Carbon Dioxide. Available online: https://gml.noaa.gov (accessed on 1 July 2025).

- Qasem, R.H.M.; Scholz, M. Climate change impact on resources in the MENA region: A systematic and critical review. Phys. Chem. Earth Parts A/B/C 2025, 139, 103936. [Google Scholar] [CrossRef]

- Elkhalfi, O.; Chaabita, R.; Ghoujdam, M.; Zehraoui, K.; El Alaoui, H.; Belhaj, I. The impact of climate change on food security in the Middle East and North Africa: Challenges and adaptation strategies. J. Agric. Food Res. 2025, 21, 101963. [Google Scholar] [CrossRef]

- Hassan, A.A.; Awad, M.M.; Nasser, M. Towards clean energy independence: Assessing MENA region hybrid PV-wind solutions for green hydrogen generation and storage and 24/7 power production. Sustain. Energy Technol. Assess. 2025, 73, 104158. [Google Scholar] [CrossRef]

- Nasser, M.; Hassan, H. Feasibility analysis and Atlas for green hydrogen project in MENA region: Production, cost, and environmental maps. Sol. Energy 2024, 268, 112326. [Google Scholar] [CrossRef]

- Gado, M.G.; Hassan, H. Potential of prospective plans in MENA countries for green hydrogen generation driven by solar and wind power sources. Sol. Energy 2023, 263, 111942. [Google Scholar] [CrossRef]

- World Data Lab. World Emissions Clock. 2024. Available online: https://worldemissions.io (accessed on 1 July 2025).

- International Energy Agency. Net Zero by 2050; A Roadmap for the Global Energy Sector; IEA: Paris, France, 2021. [Google Scholar]

- UAE Ministry of Energy and Infrastructure. UAE Energy Strategy 2050. Available online: https://u.ae/en/about-the-uae/strategies-initiatives-and-awards/strategies-plans-and-visions/environment-and-energy/uae-energy-strategy-2050 (accessed on 1 July 2025).

- Eveloy, V.; Ahmed, W. Evaluation of low-carbon multi-energy options for the future UAE energy system. Sustain. Energy Technol. Assess. 2022, 53, 102584. [Google Scholar] [CrossRef]

- Copernicus Climate Change Service, European Centre for Medium-Range Weather Forecast. Global Temperature Trend Monitor. Available online: https://cds.climate.copernicus.eu/#!/home (accessed on 1 July 2025).

- United Nations Framework Convention on Climate Change. The Paris Agreement. COP21, Paris, France, 2015. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement (accessed on 1 July 2025).

- Joint Research Centre of the European Commission. GHG Emissions of All World Countries; JRC Science for Policy Report; Joint Research Centre of the European Commission: Brussels, Belgium, 2024. [Google Scholar]

- International Panel on Climate Change. Global Warming of 1.5 °C; IPCC: Geneva, Switzerland, 2019. [Google Scholar]

- International Panel on Climate Change. Climate Change 2023: Synthesis Report; IPCC: Geneva, Switzerland, 2023. [Google Scholar]

- Wang, Y.; Lin, B. Climate change and China’s food security. Energy 2025, 318, 134852. [Google Scholar] [CrossRef]

- Das, A.; Kumar, S.; Kasala, K.; Nedumaran, S.; Paithankar, P.; Kumar, A.; Jain, A.H.; Avinandan, V. Effects of climate change on food security and nutrition in India: A systematic review. Curr. Res. Environ. Sustain. 2025, 9, 100286. [Google Scholar] [CrossRef]

- Omokaro, G.O. Multi-impacts of climate change and mitigation strategies in Nigeria: Agricultural production and food security. Sci. One Health 2025, 4, 100113. [Google Scholar] [CrossRef]

- Ahmed, B. Who takes responsibility for the climate refugees? Int. J. Clim. Change Strateg. Manag. 2017, 10, 5–26. [Google Scholar] [CrossRef]

- International Energy Agency. World Energy Outlook 2024; IEA: Paris, France, 2024. [Google Scholar]

- Eurostat—An Official Website of the European Union for Statistics and Data on Europe. Available online: https://ec.europa.eu/eurostat/web/main/home (accessed on 1 July 2025).

- European Commission—Directorate General for Climate Action. Climate Action—Progress Report 2024; EC: Brussels, Belgium, 2024. [Google Scholar]

- World Bank Group. China—Country Climate and Development Report; World Bank Group: Washington, DC, USA, 2022. [Google Scholar]

- Gielen, D.; Boshell, F.; Saygin, D.; Brazilian, M.D.; Wagner, N.; Gorini, R. The role of renewable energy in the global energy transformation. Energy Strategy Rev. 2019, 24, 38–50. [Google Scholar] [CrossRef]

- Markandya, A.; Sampedro, J.; Smith, S.J.; Van Dingenen, R.; Pizarro-Irizar, C.; Arto, I.; González-Eguino, M. Health co-benefits from air pollution and mitigation costs of the Paris Agreement: A modelling study. Lancet Planet. Health 2018, 2, 126–133. [Google Scholar] [CrossRef] [PubMed]

- Vandyck, T.; Keramidas, K.; Kitous, A.; Spadaro, J.V.; Van Dingenen, R.; Holland, M.; Saveyn, B. Air quality co-benefits for human health and agriculture counterbalance costs to meet Paris Agreement pledges. Nat. Commun. 2018, 9, 4939. [Google Scholar] [CrossRef] [PubMed]

- Di Foggia, G.; Beccarello, M. European roadmaps to achieving 2030 renewable energy targets. Util. Policy 2024, 88, 101729. [Google Scholar] [CrossRef]

- Child, M.; Kemfert, C.; Bogdanov, D.; Breyer, C. Flexible electricity generation, grid exchange and storage for the transition to a 100% renewable energy system in Europe. Renew. Energy 2019, 139, 80–101. [Google Scholar] [CrossRef]

- Zappa, W.; Junginger, M.; Van Den Broek, M. Is a 100% renewable European power system feasible by 2050? Appl. Energy 2019, 233, 1027–1050. [Google Scholar] [CrossRef]

- Chen, J.; Feng, Y.; Zhang, Z.; Wang, Q.; Ma, F. Exploring the patterns of China’s carbon neutrality policies. J. Environ. Manag. 2024, 371, 123092. [Google Scholar] [CrossRef]

- Acharya, G.; Paudel, P.; Arent, D.J.; Gaura, E.; Paudel, S.R. Roadmap to reach global net-zero emissions for developing regions by 2085. Cell Rep. Sustain. 2025, 2, 100306. [Google Scholar] [CrossRef]

- Umer, M.; Abas, N.; Rauf, S.; Saleem, M.S.; Dilshad, S. GHG emissions estimation and assessment of Pakistan’s power sector: A roadmap towards low carbon future. Results Eng. 2024, 22, 102354. [Google Scholar] [CrossRef]

- Pasaoglu, G.; Pardo-Garcia, N.; Zubi, G. A multi-criteria and multi-expert decision aid approach to evaluate the future Turkish power plant portfolio. Energy Policy 2018, 119, 654–665. [Google Scholar] [CrossRef]

- Shah, M.; Singh, V.; Prajapati, M. A roadmap to 2050 for Nepal and Singapore with comparative energy market study for net-zero greenhouse gas emissions. Sustain. Energy Technol. Assess. 2024, 71, 103954. [Google Scholar] [CrossRef]

- Bailie, A.; Pied, M.; Vaillancourt, K.; Bahn, O.; Koasidis, K.; Gambhir, A.; Wachsmuth, J.; Warnke, P.; McWilliams, B.; Doukas, H.; et al. Co-creating Canada’s path to net-zero: A stakeholder-driven modelling analysis. Renew. Sustain. Energy Transit. 2023, 4, 100061. [Google Scholar] [CrossRef]

- Zubi, G.; Bernal-Agustín, J.L.; Fandos-Marín, A.B. Wind Energy (30%) in the Spanish power mix—Technically feasible and economically reasonable. Energy Policy 2009, 37, 3221–3226. [Google Scholar] [CrossRef]

- Zubi, G. Technology mix alternatives wit high shares of wind power and photovoltaics—Case study for Spain. Energy Policy 2011, 39, 8070–8077. [Google Scholar] [CrossRef]

- Kabir, E.; Kumar, P.; Kumar, S.; Adelodun, A.A.; Kim, K.H. Solar Energy: Potential and future prospects. Renew. Sustain. Energy Rev. 2018, 82, 894–900. [Google Scholar] [CrossRef]

- Kavlak, G.; McNerney, J.; Trancik, J.E. Evaluating the causes of cost reduction in photovoltaic models. Energy Policy 2018, 123, 700–710. [Google Scholar] [CrossRef]

- Okorie, D.I. Making hay while the sun shines: Energy security pathway for Africa. Energy Policy 2025, 198, 114512. [Google Scholar] [CrossRef]

- Zubi, G.; Fracastoro, G.V.; Lujano-Rojas, J.M.; El Bakari, K.; Andrews, D. The unlocked potential of solar home systems, an effective way to overcome domestic energy poverty in developing regions. Renew. Energy 2019, 132, 1425–1435. [Google Scholar] [CrossRef]

- Sen, K.K.; Hosan, S.; Karmaker, S.C.; Chapman, A.J.; Saha, B.B. Clarifying the linkage between renewable energy deployment and energy justice: Toward equitable sustainability. Sustain. Futures 2024, 8, 100236. [Google Scholar] [CrossRef]

- McCauley, D.; Heffron, R. Just transition: Integrating climate, energy and environmental justice. Energy Policy 2018, 119, 1–7. [Google Scholar] [CrossRef]

- Wyse, S.M.; Das, R.R. Energy democracy: Reclaiming a unique agenda in energy transitions research. Energy Res. Soc. Sci. 2024, 118, 103774. [Google Scholar] [CrossRef]

- Yan, J.; Li, Y.; Su, B.; Ng, T.S. Contributors and drivers of Chinese energy use and intensity from regional and demand perspectives, 2012-2015-2017. Energy Econ. 2022, 115, 106357. [Google Scholar] [CrossRef]

- Bhatia, P. India’s state-led electricity transition: A review of techno-economic, socio-technical and political perspectives. Energy Res. Soc. Sci. 2023, 102, 103184. [Google Scholar] [CrossRef]

- Zubi, G.; Dufo-Lopez, R.; Pardo, N.; Pasaoglu, G. Concept development and techno-economic assessment for a solar home system using lithium-ion battery for developing regions to provide electricity for lighting and electronic devices. Energy Convers. Manag. 2016, 122, 439–448. [Google Scholar] [CrossRef]

- Zubi, G.; Dufo-Lopez, R.; Pasaoglu, G.; Pardo, N. Techno-economic assessment of an off-grid system for developing regions to provide electricity for basic domestic needs: A 2020–2040 scenario. Appl. Energy 2016, 176, 309–319. [Google Scholar] [CrossRef]

- Zubi, G.; Spertino, F.; Carvalho, M.; Adhikari, R.S.; Khatib, T. Development and assessment of a solar home system to cover cooking and lighting needs in developing regions as a better alternative for existing practices. Sol. Energy 2017, 155, 7–17. [Google Scholar] [CrossRef]

- Dufo-Lopez, R.; Zubi, G.; Fracastoro, G.V. Techno-economic assessment of an off-grid PV-powered community kitchen for developing regions. Appl. Energy 2012, 91, 255–262. [Google Scholar] [CrossRef]

- Zhang, W.; Fang, X.; Sun, C. The alternative path for fossil oil: Electric vehicles or hydrogen fuel cell vehicles? J. Environ. Manag. 2023, 341, 118019. [Google Scholar] [CrossRef]

- Arthur D. Little. Global electric mobility readiness index—GEMRIX 2023. In Examining the Transformation to EV Mobility; Arthur D. Little Report; Arthur D. Little: Brussels, Belgium, 2023; Available online: https://www.adlittle.com/sites/default/files/reports/ADL_Global_EM_readiness_index_2023_0.pdf (accessed on 1 July 2025).

- Tan, K.M.; Yong, J.Y.; Ramachandaramurthy, V.K.; Mansor, M.; Teh, J.; Guerrero, J.M. Factors influencing global transportation electrification: Comparative analysis of electric and internal combustion engine vehicles. Renew. Sustain. Energy Rev. 2023, 184, 113582. [Google Scholar] [CrossRef]

- Abdalla, M.A.; Hossain, S.; Nisfindy, O.B.; Azad, A.T.; Dawood, M.; Azad, A.K. Hydrogen production, storage, transportation and key challenges with applications: A review. Energy Convers. Manag. 2018, 165, 602–627. [Google Scholar] [CrossRef]

- Kim, C.; Cho, S.H.; Cho, S.M.; Na, Y.; Kim, S.; Kim, D.K. Review of hydrogen infrastructure: The current status and roll-out strategy. Int. J. Hydrogen Energy 2023, 48, 1701–1716. [Google Scholar] [CrossRef]

- Deloitte’s 2023 Global Green Hydrogen Outlook. Green Hydrogen: Energizing the Path to Net Zero; Deloitte: London, UK, 2023. [Google Scholar]

- Alsaba, W.; Al-Sobhi, S.A.; Abdul Qyyum, M. Recent advancements in the hydrogen value chain: Opportunities, challenges, and the way forward—Middle East Perspectives. Int. J. Hydrogen Energy 2023, 48, 26408–26435. [Google Scholar] [CrossRef]

- Razi, F.; Dincer, I. Renewable energy development and hydrogen economy in MENA region: A review. Renew. Sustain. Energy Rev. 2022, 168, 112763. [Google Scholar] [CrossRef]

- Kovač, A.; Paranos, M.; Marciuš, D. Hydrogen in energy transition: A review. Int. J. Hydrogen Energy 2021, 46, 10016–10035. [Google Scholar] [CrossRef]

- Sikiru, S.; Oladosu, T.L.; Amosa, T.I.; Olutoki, J.O.; Ansari, M.N.M.; Abioye, K.J.; Rehman, Z.U.; Soleimani, H. Hydrogen-powered horizons: Transformative technologies in clean energy generation, distribution, and storage for sustainable innovation. Int. J. Hydrogen Energy 2024, 56, 1152–1182. [Google Scholar] [CrossRef]

- Ighalo, J.O.; Amama, P.B. Recent advances in the catalysis of steam reforming of methane (SRM). Int. J. Hydrogen Energy 2024, 51, 688–700. [Google Scholar] [CrossRef]

- Patlolla, S.R.; Katsu, K.; Sharafian, A.; Wei, K.; Herrera, O.E.; Mérida, W. A review of methane pyrolysis technologies for hydrogen production. Renew. Sustain. Energy Rev. 2021, 181, 113323. [Google Scholar] [CrossRef]

- Matamba, T.; Iglauer, S.; Keshavarz, A. A progress insight of the formation of hydrogen rich syngas from coal gasification. J. Energy Inst. 2022, 105, 81–102. [Google Scholar] [CrossRef]

- Rubinsin, N.J.; Karim, N.A.; Timmiati, S.N.; Lim, K.L.; Isahak, W.N.R.W.; Pudukudy, M. An overview of the enhanced biomass gasification for hydrogen production. Int. J. Hydrogen Energy 2024, 49, 1139–1164. [Google Scholar] [CrossRef]

- Arregi, A.; Amutio, M.; Lopez, G.; Bilbao, J.; Olazar, M. Evaluation of thermomechanical routes for hydrogen production from biomass: A review. Energy Convers. Manag. 2018, 165, 696–719. [Google Scholar] [CrossRef]

- Akhlaghi, N.; Najafpour-Darzi, G. A comprehensive review on biological hydrogen production. Int. J. Hydrogen Energy 2020, 45, 22492–22512. [Google Scholar] [CrossRef]

- Arsad, S.R.; Arsad, A.Z.; Ker, P.J.; Hannan, M.A.; Tang, S.G.H.; Goh, S.M.; Mahlia, T.M.I. Recent advancement in water electrolysis for hydrogen production: A comprehensive bibliometric analysis and technology updates. Int. J. Hydrogen Energy 2024, 60, 780–801. [Google Scholar] [CrossRef]

- Ghorbani, B.; Zendehboudi, S.; Zhang, Y.; Zarrin, H.; Chatzis, I. Thermochemical water-splitting structures for hydrogen production: Thermodynamic, economic, and environmental impacts. Energy Convers. Manag. 2023, 297, 117599. [Google Scholar] [CrossRef]

- Rojas, J.; Zhai, S.; Sun, E.; Haribal, V.; Marin-Quiros, S.; Sarkar, A.; Gupta, R.; Cargnello, M.; Chueh, W.; Majumdar, A. Technoeconomics and carbon footprint of hydrogen production. Int. J. Hydrogen Energy 2023, 49, 59–74. [Google Scholar] [CrossRef]

- Al Humaidan, F.S.; Halabi, M.A.; Rana, M.S.; Vinoba, M. Blue hydrogen: Current status and future technologies. Energy Convers. Manag. 2023, 283, 116840. [Google Scholar] [CrossRef]

- Diab, J.; Fulcheri, L.; Hessel, V.; Rohani, V.; Frenklach, M. Why turquoise hydrogen will be a game changer for the energy transition. Int. J. Hydrogen Energy 2022, 47, 25831–25848. [Google Scholar] [CrossRef]

- Zainal, B.S.; Ker, P.J.; Mohamed, H.; Ong, H.C.; Fattah, I.M.R.; Rahman, S.M.A.; Nghiem, L.D.; Mahlia, T.M.I. Recent advancement and assessment of green hydrogen production technologies. Renew. Sustain. Energy Rev. 2024, 189, 113941. [Google Scholar] [CrossRef]

- Arsad, S.R.; Ker, P.J.; Hannan, M.A.; Tang, S.G.H.; Norhasyima, R.S.; Chau, C.F.; Mahlia, T.M.I. Patent landscape review of hydrogen production methods: Assessing technological updates and innovations. Int. J. Hydrogen Energy 2024, 50, 447–472. [Google Scholar] [CrossRef]

- Awad, M.; Said, A.; Saad, M.H.; Farouk, A.; Mahmoud, M.M.; Alshammari, M.S.; Alghaythi, M.L.; Abdel Aleem, S.H.E.; Abdelaziz, A.Y.; Omar, A.I. A review of water electrolysis for green hydrogen generation considering PV/wind/hybrid/hydropower/geothermal/tidal and wave/biogas energy systems, economic analysis, and its application. Alex. Eng. J. 2024, 87, 213–239. [Google Scholar] [CrossRef]

- Alabbadi, A.A.; Obaid, O.A.; Alzahrani, A.A. A comparative economic study of nuclear hydrogen production, storage, and transportation. Int. J. Hydrogen Energy 2024, 54, 849–863. [Google Scholar] [CrossRef]

- Hermesmann, M.; Müller, T.E. Green, turquoise, blue or grey? Environmentally friendly hydrogen production in transforming energy systems. Prog. Energy Combust. Sci. 2022, 90, 100996. [Google Scholar] [CrossRef]

- Incer-Valverde, J.; Korayem, A.; Tsatsaronis, G.; Morosuk, T. “Colors” of hydrogen: Definitions and carbon intensity. Energy Convers. Manag. 2023, 291, 117294. [Google Scholar] [CrossRef]

- Farhana, K.; Mahamude, A.S.F.; Kadirgama, K. Comparing hydrogen fuel cost of production from various sources—A competitive analysis. Energy Convers. Manag. 2024, 302, 118088. [Google Scholar] [CrossRef]

- Sakthimurugan, V.; Lakshmikanth, G.; Bali, N.; Roopashree, R.; Kumar, D.; Devarajan, Y. Green hydrogen revolution: Advancing electrolysis, market integration, and sustainable energy transitions towards a net-zero future. Results Eng. 2025, 26, 104849. [Google Scholar] [CrossRef]

- Colelli, L.; Segneri, V.; Bassano, C.; Vilardi, G. E-fuels, technical and economic analysis of the production of synthetic kerosene precursor as sustainable aviation fuel. Energy Convers. Manag. 2023, 288, 117165. [Google Scholar] [CrossRef]

- Sanchez, A.; Martin-Rengel, M.A.; Martin, M. A zero CO2 emissions large ship fueled by an ammonia-hydrogen blend: Reaching the decarbonisation goals. Energy Convers. Manag. 2023, 293, 117497. [Google Scholar] [CrossRef]

- Wang, Y.; Cao, Q.; Liu, L.; Wu, Y.; Liu, H.; Gu, Z.; Zhu, C. A review of low and zero carbon fuel technologies: Achieving ship carbon reduction targets. Sustain. Energy Technol. Assess. 2022, 54, 102762. [Google Scholar] [CrossRef]

- Zubi, G.; Parag, Y.; Wald, S. Implications of large-scale PV integration on grid operation, costs, and emissions: Challenges and proposed solutions. Energies 2025, 18, 130. [Google Scholar] [CrossRef]

- Innovation and Networks Executive Agency—European Commission. Flexible Fossil Power Plants for the Future Energy Market Through New and Advanced Turbine Technologies. Available online: https://cordis.europa.eu/project/id/653941 (accessed on 1 July 2025).

- Gonzalez-Salazar, M.A.; Kristen, T.; Prchlik, L. Review of the operational flexibility and emissions of gas- and coal-fired power plants in a future with growing renewables. Renew. Sustain. Energy Rev. 2018, 82, 1497–1513. [Google Scholar] [CrossRef]

- Ismael, S.M.; Abdel Aleem, S.H.E.; Abdelaziz, A.Y.; Zobaa, A.F. State-of-the-art of hosting capacity in modern power systems with distributed generation. Renew. Energy 2019, 130, 1002–1020. [Google Scholar] [CrossRef]

- Najibi, F.; Apostolopoulou, D.; Alonso, E. TSO-DSO coordination schemes to facilitate distributed resources integration. Sustainability 2021, 13, 7832. [Google Scholar] [CrossRef]

- Joshi, S.; Mittal, S.; Holloway, P.; Shukla, P.R.; Gallachoir, B.; Glynn, J. High resolution global spatiotemporal assessment of rooftop solar photovoltaics potential for renewable electricity generation. Nat. Commun. 2021, 12, 5738. [Google Scholar] [CrossRef]

- An, J.; Hong, T. Energy harvesting using rooftops in urban areas: Estimating the electricity generation potential of PV and wind turbines considering the surrounding environment. Energy Build. 2024, 323, 114807. [Google Scholar] [CrossRef]

- Mariam, L.; Basu, M.; Conlon, M.F. Microgrid: Architecture, policy and future trends. Renew. Sustain. Energy Rev. 2016, 64, 477–489. [Google Scholar] [CrossRef]

- Jiayi, H.; Chuanwen, J.; Rong, X. A review on distributed energy resources and microgrid. Renew. Sustain. Energy Rev. 2008, 12, 2472–2483. [Google Scholar] [CrossRef]

- Badal, F.R.; Das, P.; Sarker, S.K.; Das, S.K. A survey on control issues in renewable energy integration and microgrid. Prot. Control Mod. Power Syst. 2019, 4, 8. [Google Scholar] [CrossRef]

- Hirsch, A.; Parag, Y.; Guerrero, J. Microgrids: A review of technologies, key drivers, and outstanding issues. Renew. Sustain. Energy Rev. 2018, 90, 401–411. [Google Scholar] [CrossRef]

- Zia, M.F.; Elbouchikhi, E.; Benbouzid, M. Microgrids energy management systems: A critical review of methods, solutions, and prospects. Appl. Energy 2018, 222, 1033–1055. [Google Scholar] [CrossRef]

- Heydari, A.; Majidi Nezhad, M.; Keynia, F.; Fekih, A.; Shahsavari-Pour, N.; Astiaso Garcia, D.; Piras, G. A combined multi-objective intelligent optimization approach considering techno-economic and reliability factors for hybrid-renewable microgrid systems. J. Clean. Prod. 2023, 383, 135249. [Google Scholar] [CrossRef]

- Kharrich, M.; Mohammed, O.H.; Alshammari, N.; Akherraz, M. Multi-objective optimization and the effect of the economic factors on the design of the microgrid hybrid system. Sustain. Cities Soc. 2021, 65, 102646. [Google Scholar] [CrossRef]

- Dougier, N.; Garambois, P.; Roucoules, L. Multi-objective non-weighted optimization to explore new efficient design of electrical microgrids. Appl. Energy 2021, 304, 117758. [Google Scholar] [CrossRef]

- Fioriti, D.; Lutzemberger, G.; Poli, D.; Duenas-Martinez, P.; Micangeli, A. Coupling economic multi-objective optimization and multiple design options: A business-oriented approach to size an off-grid hybrid microgrid. Int. J. Electr. Power Energy Syst. 2021, 127, 106686. [Google Scholar] [CrossRef]

- Ramli, M.A.M.; Bouchekara, H.R.E.H.; Alghamdi, A.S. Optimal sizing of PV/wind/diesel hybrid microgrid system using multi-objective self-adaptive differential evolution algorithm. Renew. Energy 2018, 121, 400–411. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Garttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Marzband, M.; Azarinejadian, F.; Savaghebi, M.; Pouresmaeil, E.; Guerrero, J.M.; Lightbody, G. Smart transactive energy framework in grid-connected multiple home microgrids under independent and coalition operations. Renew. Energy 2018, 126, 95–106. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032. [Google Scholar] [CrossRef]

- Deguenon LYamegueu, D.; Kadri, S.M.; Gomna, A. Overcoming the challenges of integrating variable renewable energy to the grid: A comprehensive review of electrochemical battery storage systems. J. Power Sources 2023, 580, 233343. [Google Scholar] [CrossRef]

- Lujano-Rojas, J.M.; Zubi, G.; Dufo-Lopez, R.; Bernal-Agustin, J.L.; Atencio-Guerra, J.L.; Catalao, J.P.S. Embedding quasi-static time series within a genetic algorithm for stochastic optimization: The case of reactive power compensation on distribution systems. J. Comput. Des. Eng. 2020, 7, 177–194. [Google Scholar] [CrossRef]

- Lujano-Rojas, J.M.; Zubi, G.; Dufo-Lopez, R.; Bernal-Agustin, J.L.; Catalao, J.P.S. Novel probabilistic optimization model for lead-acid and vanadium redox flow batteries under real-time pricing programs. Int. J. Electr. Power Energy Syst. 2018, 97, 72–84. [Google Scholar] [CrossRef]

- Pandey, A.; Rawat, K.; Phogat, P.; Shreya Jha, R.; Singh, S. Next-generation energy storage: A deep dive into experimental and emerging battery technologies. J. Alloys Compd. 2025, 104, 178781. [Google Scholar] [CrossRef]

- Dongxu, H.; Xingjian, D.; Wen, L.; Yangli, Z.; Xuehui, Z.; Haisheng, C.; Zhilai, Z. A review of flywheel energy storage rotor materials and structures. J. Energy Storage 2023, 74, 109076. [Google Scholar] [CrossRef]

- Shuja, A.; Khan, H.R.; Murtaza, I.; Ashraf, S.; Abid, Y.; Farid, F.; Sajid, F. Supercapacitors for energy storage applications: Materials, devices and future directions: A comprehensive review. J. Alloys Compd. 2024, 1009, 176924. [Google Scholar] [CrossRef]

- Chen, L.; Wu, Z. Study on effects of EV charging to global load characteristics via charging aggregators. Energy Procedia 2018, 145, 175–180. [Google Scholar] [CrossRef]

- Wu, J.; Li, L.; Zhang, J.; Xiao, B. Flexibility estimation of electric vehicles and its impact on the future power grid. Int. J. Electr. Power Energy Syst. 2025, 164, 110435. [Google Scholar] [CrossRef]

- Rao, S.P.; Olusegun, T.S.; Ranganathan, P.; Kose, U.; Goveas, N. Vehicle-to-grid technology: Opportunities, challenges, and future prospects for sustainable transportation. J. Energy Storage 2025, 110, 114927. [Google Scholar] [CrossRef]

- Zafar, B.; Ben Salma, S.A. PV-EV integrated home energy management using vehicle-to-home (V2H) technology and household occupant behaviors. Energy Strategy Rev. 2022, 44, 101001. [Google Scholar] [CrossRef]

- Zubi, G.; Dufo-Lopez, R.; Carvalho, M.; Pasaoglu, G. The lithium-ion battery; state of the art and future perspectives. Renew. Sustain. Energy Rev. 2018, 89, 292–308. [Google Scholar] [CrossRef]

- Goldman Sachs—Transportation, October 2024. Electric Vehicle Battery Prices Are Expected to Fall Almost 50% by 2026. Available online: https://www.goldmansachs.com/insights/articles/electric-vehicle-battery-prices-are-expected-to-fall-almost-50-percent-by-2025 (accessed on 1 July 2025).

- Zubi, G.; Adhikari, R.S.; Sanchez, N.E.; Acuna-Bravo, W. Lithium-ion battery-packs for solar home systems: Layout, cost and implementation perspectives. J. Energy Storage 2020, 32, 101985. [Google Scholar] [CrossRef]

- Yu, T.; Li, G.; Duan, Y.; Wu, Y.; Zhang, T.; Zhao, X.; Luo, M.; Liu, Y. The research and industrialization progress and prospects of sodium-ion battery. J. Alloys Compd. 2023, 958, 170486. [Google Scholar] [CrossRef]

- Phogat, P.; Dey, S.; Wan, M. Comprehensive review of sodium-ion batteries: Principles, performance, challenges, and future perspectives. Mater. Sci. Eng. B 2025, 312, 117870. [Google Scholar] [CrossRef]

- Guo, W.; Feng, T.; Li, W.; Hua, L.; Meng, Z.; Li, K. Comparative life cycle assessment of sodium-ion and lithium iron phosphate batteries in the context of carbon neutrality. J. Energy Storage 2023, 72, 108589. [Google Scholar] [CrossRef]

- Gupta, P.; Pushpakanth, S.; Haidar, M.A.; Basu, S. Understanding the design of cathode materials for Na-ion batteries. Am. Chem. Soc. Omega 2022, 7, 5605–5614. [Google Scholar] [CrossRef]

- Xu, S.; Dong, H.; Yang, D.; Wu, C.; Yao, Y.; Rui, X.; Chou, S.; Yu, Y. Promising cathode materials for sodium-ion batteries from lab to application. Am. Chem. Soc. Cent. Sci. 2023, 9, 2012–2035. [Google Scholar] [CrossRef] [PubMed]

- Bai, H.; Song, Z. Lithium-ion battery, sodium-ion battery, or redox-flow battery: A comprehensive comparison in renewable energy systems. J. Power Sources 2023, 580, 233426. [Google Scholar] [CrossRef]

- Lujano-Rojas, J.M.; Zubi, G.; Dufo-Lopez, R.; Bernal-Agustin, J.L.; Garcia-Paricio, E.; Catalao, J.P.S. Contract design of direct-load control programs and their optimal management by genetic algorithm. Energy 2019, 186, 115807. [Google Scholar] [CrossRef]

- Good, N.; Ellis, K.A.; Mancarella, P. Review and classification of barriers and enablers of demand response in the smart grid. Renew. Sustain. Energy Rev. 2017, 72, 57–72. [Google Scholar] [CrossRef]

- Liao, W.; Xiao, F.; Li, Y.; Zhang, H.; Peng, J. A comparative study of demand-side energy management strategies for building integrated photovoltaics-battery and electric vehicles (EVs) in diversified building communities. Appl. Energy 2024, 361, 122881. [Google Scholar] [CrossRef]

- Kaur, A.P.; Singh, M. Time-of-Use tariff rates estimation for optimal demand-side management using electric vehicles. Energy 2023, 273, 127243. [Google Scholar] [CrossRef]

- Khamis, A.; Aiman, M.H.; Faizal, W.M.; Khor, C.Y. Charging strategy in electric vehicle chargers by utilizing demand side management scheme. Electr. Power Syst. Res. 2023, 220, 109240. [Google Scholar] [CrossRef]

- Bloess, A.; Schill, W.P.; Zerrahn, A. Power-to-heat for renewable energy integration: A review of technologies, modelling approaches, and flexibility potentials. Appl. Energy 2018, 212, 1611–1626. [Google Scholar] [CrossRef]

- Pardo-Garcia, N.; Zubi, G.; Pasaoglu, G.; Dufo-Lopez, R. Photovoltaic thermal hybrid solar collector and district heating configurations for a Central European multi-family house. Energy Convers. Manag. 2017, 148, 915–924. [Google Scholar] [CrossRef]

- Battaglia, M.; Haberl, R.; Bamberger, E.; Haller, M. Increased self-consumption and grid flexibility of PV and heat pump systems with thermal and electrical storage. Energy Procedia 2017, 135, 358–366. [Google Scholar] [CrossRef]

- Oikonomou, K.; Parvania, M. Optimal participation of water desalination plants in electricity demand response and regulation markets. IEEE Syst. J. 2020, 14, 3729–3739. [Google Scholar] [CrossRef]

- Al-Nory, M.; El-Beltagy, M. An energy management approach for renewable energy integration with power generation and water desalination. Renew. Energy 2014, 72, 377–385. [Google Scholar] [CrossRef]

- Dileep, G. A survey on smart grid technologies and applications. Renew. Energy 2020, 146, 2589–2625. [Google Scholar] [CrossRef]

- Fernández, P.A.; Carús Candás, J.L.; Arboleya, P. Internet of Things (IoT) for power system applications. In Encyclopedia of Electrical and Electronic Power Engineering; Elsevier: Amsterdam, The Netherlands, 2023; pp. 486–496. [Google Scholar]

- Heymann, F.; Quest, H.; Lopez Garcia, T.; Ballif, C.; Galus, M. Reviewing 40 years of artificial intelligence applied to power systems—A taxonomic perspective. Energy AI 2024, 15, 100322. [Google Scholar] [CrossRef]

- Binyamin, S.S.; Ben Slama, S.A.; Zafar, B. Artificial intelligence-powered energy community management for developing renewable energy systems in smart homes. Energy Strategy Rev. 2024, 51, 101288. [Google Scholar] [CrossRef]

- Rajasekaran, A.S.; Azees, M.; Al-Turjman, F. A comprehensive survey on blockchain technology. Sustain. Energy Technol. Assess. 2022, 52, 102039. [Google Scholar] [CrossRef]

- Lazarou, S.; Kotsakis, E. Chapter 13: The integration of dynamic demand in electricity markets: Blockchain 3.0 as an enabler of microgrid energy exchange, demand response and storage. In Mathematical Modeling of Contemporary Electricity Markets; Academic Press: Cambridge, MA, USA, 2021. [Google Scholar]

- Ante, L.; Steinmetz, F.; Fiedler, I. Blockchain and energy: A bibliometric analysis and review. Renew. Sustain. Energy Rev. 2021, 137, 110597. [Google Scholar] [CrossRef]

- Foti, M.; Vavalis, M. What blockchain can do for power grids. Blockchain Res. Appl. 2021, 2, 100008. [Google Scholar] [CrossRef]

- Hasankhani, A.; Hakimi, S.M.; Bisheh-Niasar, M.; Shafie-Khah, M.; Asadolahi, H. Blockchain technology in the future smart grids: A comprehensive review and frameworks. Int. J. Electr. Power Energy Syst. 2021, 129, 106811. [Google Scholar] [CrossRef]

- Sgouridis, S.; Abdullah, A.; Griffiths, S.; Saygin, D.; Wagner, N.; Gielen, D.; Reinisch, H.; McQuee, D. RE-mapping the UAE’s energy transition: An economy-wide assessment of renewable energy options and their policy implications. Renew. Sustain. Energy Rev. 2016, 55, 1166–1180. [Google Scholar] [CrossRef]

- Al Naqbi, S.; Tsai, I.; Mezher, T. Market design for successful implementation of UAE 2050 energy strategy. Renew. Sustain. Energy Rev. 2019, 116, 109429. [Google Scholar] [CrossRef]

- Samour, A.; Shahzad, U.; Mentel, G. Moving toward sustainable development: Assessing the impacts of taxation and banking development on renewable energy in the UAE. Renew. Energy 2022, 200, 706–713. [Google Scholar] [CrossRef]

- Alhammami, H.; An, H. Techno-economic analysis and policy implications for promoting residential rooftop solar photovoltaics in Abu Dhabi, UAE. Renew. Energy 2021, 167, 359–368. [Google Scholar] [CrossRef]

- Metzger, P.; Mendonça, S.; Silva, J.A.; Damasio, B. Battery innovation and the circular economy: What are patents revealing? Renew. Energy 2023, 209, 516–532. [Google Scholar] [CrossRef]

- Soeteman-Hernandez, L.G.; Blanco, C.F.; Koese, M.; Sips, A.J.A.M.; Noorlander, C.W.; Peijnenburg, W.J.G.M. Life cycle thinking and safe-and-sustainable-by-design approached for the battery innovation landscape. iScience 2023, 26, 106060. [Google Scholar] [CrossRef]

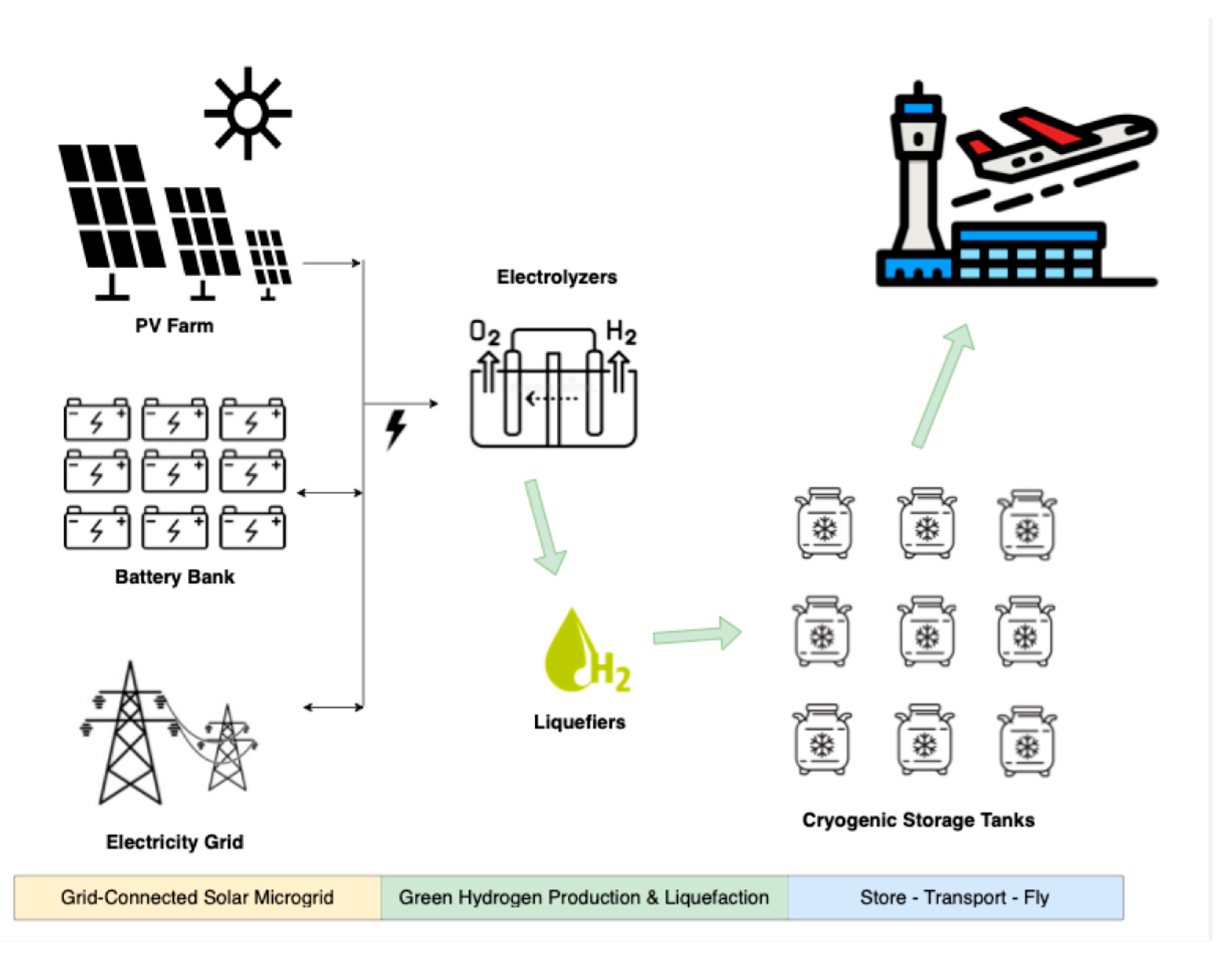

- Zubi, G.; Kuhn, M.; Makridis, S.; Coutinho, S.; Dorasamy, S. Aviation sector decarbonisation within the hydrogen economy—A UAE case study. Energy Policy 2025, 198, 114520. [Google Scholar] [CrossRef]

- Timmons, D.; Terwel, R. Economics of aviation fuel decarbonization: A preliminary assessment. J. Clean. Prod. 2022, 369, 133097. [Google Scholar] [CrossRef]

- Degirmenci, H.; Uludag, A.; Ekici, S.; Karakoc, T.H. Analyzing the hydrogen supply chain for airports: Evaluating environmental impact, cost, sustainability, viability, and safety in various scenarios for implementation. Energy Convers. Manag. 2023, 293, 117537. [Google Scholar] [CrossRef]

- Degirmenci, H.; Uludag, A.; Ekici, S.; Karakoc, T.H. Challenges, prospects and potential future orientation of hydrogen aviation and the airport hydrogen supply network: A state-of-art review. Prog. Aerosp. Sci. 2023, 141, 100923. [Google Scholar] [CrossRef]

- Shahgholian, G. A brief review on microgrids: Operation, applications, modelling, and control. Int. Trans. Electr. Energy Syst. 2021, 31, e12885. [Google Scholar] [CrossRef]

- Arar Tahir, K.; Zamorano, M.; Ordonez Garcia, J. Scientific mapping of optimisation applied to microgrids integrated with renewable energy systems. Int. J. Electr. Power Energy Syst. 2023, 145, 108698. [Google Scholar] [CrossRef]

- Thirunavukkarasu, M.; Sawle, Y.; Lala, H. A comprehensive review on optimization of hybrid renewable energy systems using various optimization techniques. Renew. Sustain. Energy Rev. 2023, 176, 113192. [Google Scholar] [CrossRef]

- Dawoud, S.M.; Lin, X.; Okba, M.I. Hybrid renewable microgrid optimization techniques: A review. Renew. Sustain. Energy Rev. 2018, 82, 2039–2052. [Google Scholar] [CrossRef]

- Davoodi, S.; Al-Shargabi, M.; Wood, D.A.; Rukavishnikov, V.S.; Minaev, K.M. Review of technological progress in carbon dioxide capture, storage and utilization. Gas Sci. Eng. 2023, 117, 205070. [Google Scholar] [CrossRef]

- Zhao, K.; Jia, C.; Li, Z.; Du, X.; Wang, Y.; Li, J.; Yao, Z.; Yao, J. Recent advances and future perspectives in carbon capture, transportation, utilization and storage (CCTUS) technologies: A comprehensive review. Fuel 2023, 351, 128913. [Google Scholar] [CrossRef]

- McLaughlin, H.; Littlefield, A.A.; Menefee, M.; Kinzer, A.; Hull, T.; Sovacool, B.K.; Bazilian, M.D.; Kim, J.; Griffiths, S. Carbon capture utilization and storage in review: Sociotechnical implications for a carbon reliant world. Renew. Sustain. Energy Rev. 2023, 177, 113215. [Google Scholar] [CrossRef]

- Jiang, Y.; Wang, K.; Wang, Y.; Liu, Z.; Gao, X.; Zhang, J.; Ma, Q.; Fan, S.; Zhao, T.S.; Yao, M. Recent advances in thermocatalytic hydrogenation of carbon dioxide to light olefins and liquid fuels via modified Fischer-Tropsch pathway. J. CO2 Util. 2023, 67, 102321. [Google Scholar] [CrossRef]

- Aresta, M.; Dibenedetto, A. Merging the green-H2 production with carbon recycling for stepping towards the carbon cyclic economy. J. CO2 Util. 2024, 80, 102688. [Google Scholar] [CrossRef]

- Zhang, K.; Guo, D.; Wang, X.; Qin, Y.; Hu, L.; Zhang, Y.; Zou, R.; Gao, S. Sustainable CO2 management through integrated CO2 capture and conversion. J. CO2 Util. 2023, 72, 102493. [Google Scholar] [CrossRef]

- Yi, X.; Lu, Y.; He, G.; Li, H.; Chen, C.; Cui, H. Global carbon transfer and emissions of aluminum production and consumption. J. Clean. Prod. 2022, 362, 132513. [Google Scholar] [CrossRef]

- Zaiter, I.; Ramadan, M.; Bouabid, A.; El-Fadel, M.; Mezher, T. Potential utilization of hydrogen in the UAE’s industrial sector. Energy 2023, 280, 128108. [Google Scholar] [CrossRef]

- Le Quesne, F.; Ali, T.S.; Andres, O.; Antonpoulou, M.; Burt, J.A.; Dougherty, W.W.; Edson, P.J.; El Kharraz, J.; Glavan, J.; Mamiit, R.J.; et al. Is the development of desalination compatible with sustainable development of the Arabian Gulf? Mar. Pollut. Bull. 2021, 173, 112940. [Google Scholar] [CrossRef] [PubMed]

- Moossa, B.; Trivedi, P.; Saleem, H.; Zaidi, S.J. Desalination in the GCC countries—A review. J. Clean. Prod. 2022, 357, 131717. [Google Scholar] [CrossRef]

| Country/Region | Total [Gt] | Share in Global [%] | Per Capita Emissions [t] | CAGR (1990–2023) [%] | Net-Zero Target |

|---|---|---|---|---|---|

| China | 15.94 | 30.1 | 11.3 | 4.4 | 2060 |

| United States | 5.96 | 11.3 | 17.8 | −0.1 | 2050 |

| India | 4.13 | 7.8 | 2.9 | 3.4 | 2070 |

| European Union | 3.22 | 6.1 | 7.2 | −1.2 | 2050 |

| Russia | 2.67 | 5.0 | 18.5 | −0.4 | 2060 |

| Brazil | 1.30 | 2.5 | 6.2 | 2.0 | 2050 |

| Indonesia | 1.20 | 2.3 | 4.3 | 3.4 | 2060 |

| Japan | 1.04 | 2.0 | 8.3 | −0.7 | 2050 |

| Iran | 1.0 | 1.9 | 11.0 | 3.4 | NA 1 |

| Saudi Arabia | 0.81 | 1.5 | 24.5 | 3.8 | 2060 |

| World | 52.96 | 100 | 6.6 | 1.5 | 2050 |

| Sector | Emissions [%] | Cause |

|---|---|---|

| Energy Systems | 37 | Processing of fossil fuels and their use in power and heat generation |

| Industry | 24 | Hard-to-abate industries such as steel, cement, chemical, etc. (excluding energy supplied by utilities) |

| Agriculture | 20 | Land use change (e.g., deforestation), methane from livestock and crops, etc. |

| Transport | 14 | Road transport, rail, aviation and shipping |

| Building | 5 | LPG for cooking, space and water heating with gas, etc. |

| Solar Farm (Location) | Owners | Capacity [MW] | Area [km2] | Panels/Structure | Completion | PPA [cUSD/kWh] |

|---|---|---|---|---|---|---|

| Mohammed bin Rashid Al Maktoum Solar Park (Saih Al-Dahal) | DEWA | 3960 1 | 77 | Crystalline Si and CdTe Single-axis tracking | 2030 | 1.7 (Phase 5) 1.63 (Phase 6) |

| Al Dhafra Solar Project | TAQA Masdar EDF Renewables Jinko Power | 2000 | 22 | Bifacial crystalline Si Single-axis tracking | 2023 | 1.34 2 |

| Al Ajban PV Solar Farm | EWEC EDF Renewables KOWEPO | 1500 | 20 | Bifacial crystalline Si Single-axis tracking | 2026 | 1.42 |

| Al Khazna Solar Project | EWEC EDF Renewables KOWEPO | 1500 | 20 | Crystalline Si Single-axis tracking | 2027 | 1.46 |

| Noor Abu Dhabi Solar Power Plant (Sweihan) | TAQA Marubeni Jinko Solar | 1177 | 8 | Crystalline Si Fixed structure | 2019 | 2.42 |

| Battery Cost [USD/kWh] | |||

|---|---|---|---|

| Cycle Life | 200 | 150 | 100 |

| 2000 | 15.4 | 11.6 | 7.8 |

| 3000 | 11.6 | 8.8 | 5.9 |

| 4000 | 9.8 | 7.4 | 5.0 |

| 5000 | 8.7 | 6.6 | 4.4 |

| Hardly competitive (today) | Fairly competitive (short term) | Widely competitive (long term) | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zubi, G.; Kuhn, M.; Makridis, S.; Dorasamy, S. The UAE Net-Zero Strategy—Aspirations, Achievements and Lessons for the MENA Region. Sustainability 2025, 17, 7510. https://doi.org/10.3390/su17167510

Zubi G, Kuhn M, Makridis S, Dorasamy S. The UAE Net-Zero Strategy—Aspirations, Achievements and Lessons for the MENA Region. Sustainability. 2025; 17(16):7510. https://doi.org/10.3390/su17167510

Chicago/Turabian StyleZubi, Ghassan, Maximilian Kuhn, Sofoklis Makridis, and Stanley Dorasamy. 2025. "The UAE Net-Zero Strategy—Aspirations, Achievements and Lessons for the MENA Region" Sustainability 17, no. 16: 7510. https://doi.org/10.3390/su17167510

APA StyleZubi, G., Kuhn, M., Makridis, S., & Dorasamy, S. (2025). The UAE Net-Zero Strategy—Aspirations, Achievements and Lessons for the MENA Region. Sustainability, 17(16), 7510. https://doi.org/10.3390/su17167510