Effects of Supply Chain Digitization on Different Types of Corporate Green Innovation: Empirical Evidence from Double Machine Learning (DML)

Abstract

1. Introduction

2. Literature Review and Theoretical Analysis

2.1. Literature Review

2.2. Theoretical Analysis

2.2.1. Heterogeneous Effects of SCD on Tactical and Substantive Green Innovation

2.2.2. Mediating Effect of ESG Performance

2.2.3. Mediating Effect of the Efficiency of Supply Chain Management

3. Methodology

3.1. Identification Strategies

3.2. Variables

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Mediating Variables

3.2.4. Control Variables

3.3. Data and Samples

- (1)

- Exclusion of financial companies (e.g., banks, insurance companies) due to their distinct regulatory frameworks;

- (2)

- Removal of *ST/ST-classified firms to mitigate biases in innovation activity reporting;

- (3)

- Adjustment for mergers, acquisitions, or name changes to maintain longitudinal continuity;

- (4)

- Continuous financial variables are winsorized at the 1st and 99th percentiles to address extreme values. After these procedures, the final sample comprises 38,548 firm–year observations.

4. Results

4.1. Baseline Regression Results

4.2. Robustness Checks

4.2.1. Resetting Machine Learning Models

4.2.2. Tailing Treatment

4.2.3. Substitution of Explanatory Variables

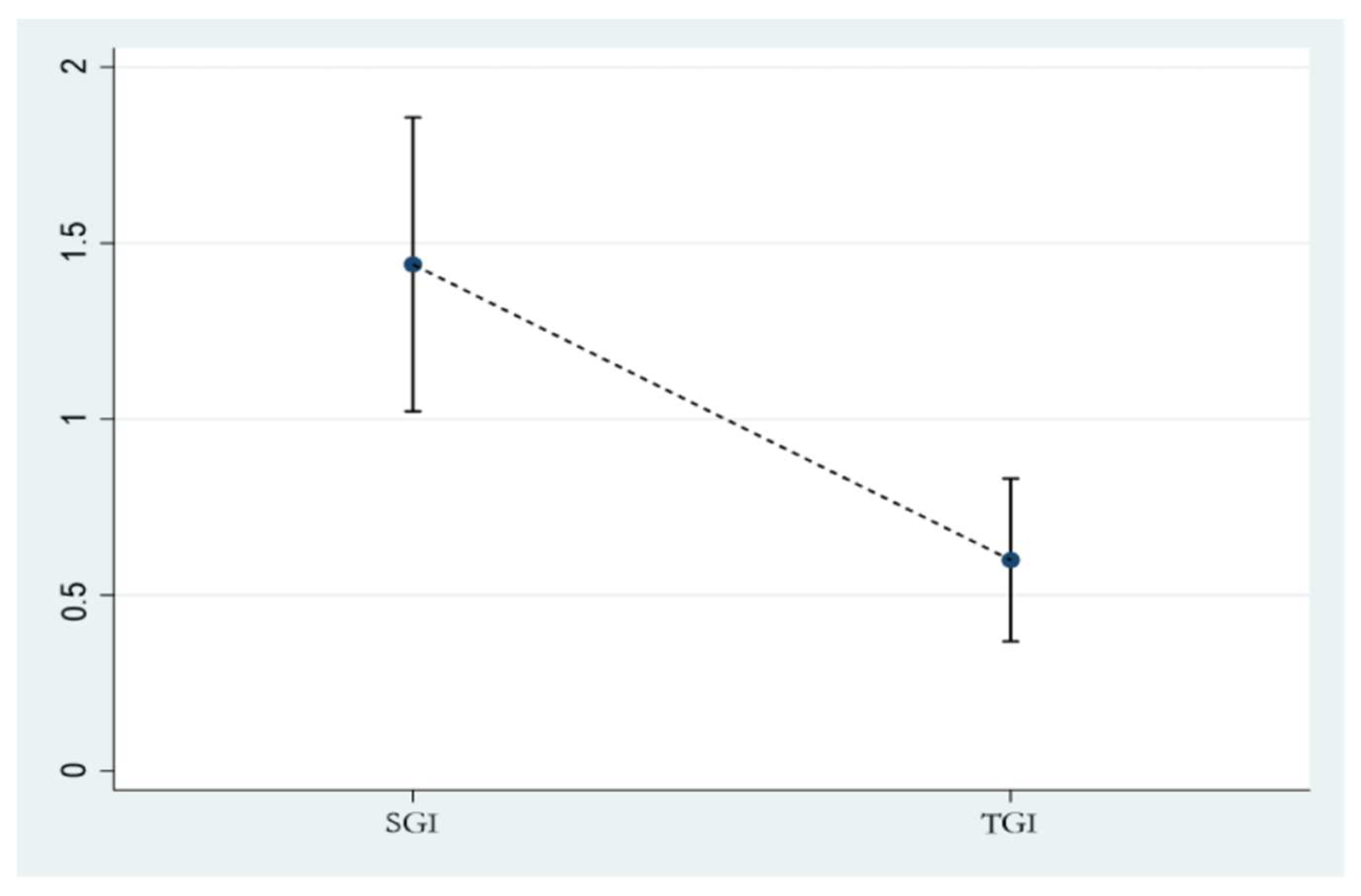

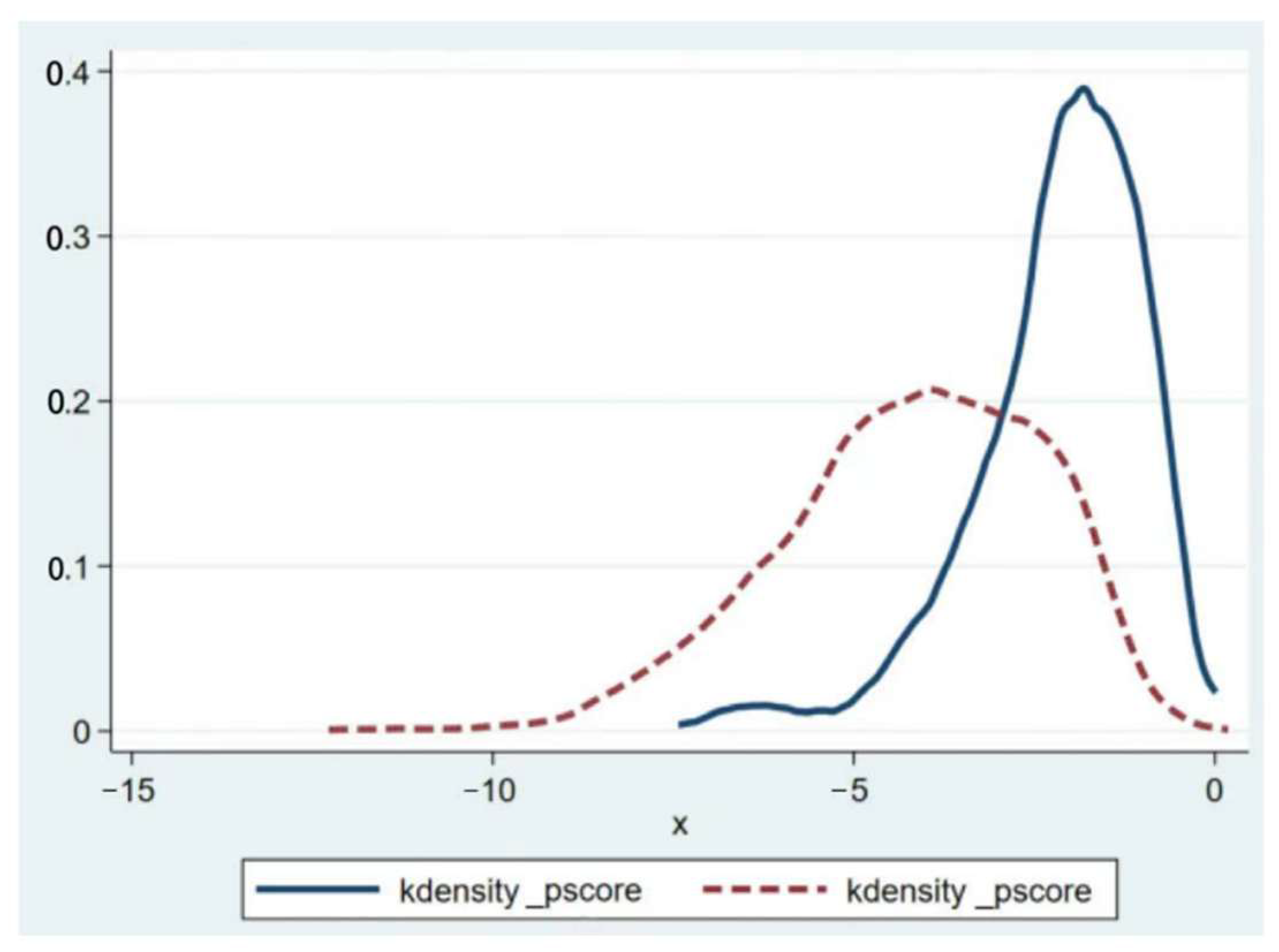

4.2.4. PSM-DML Model

4.2.5. Heckman Two-Stage Treatment Effect Model

4.2.6. Instrumental Variables

5. Further Studies

5.1. Mediating Mechanism Analysis

5.2. Heterogeneity Analysis

5.2.1. Firm Attributes

5.2.2. Corporate Internal Control

5.2.3. Corporate Financial Constraints

6. Conclusions and Discussion

6.1. Conclusions

6.2. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Yang, X.; Zhang, Q. Supply chain digitalization and suppliers’ ESG. Appl. Econ. Lett. 2025, 1–6. [Google Scholar] [CrossRef]

- Liao, F.; Hu, Y.; Chen, M.; Xu, S. Digital transformation and corporate green supply chain efficiency: Evidence from China. Econ. Anal. Policy 2024, 81, 195–207. [Google Scholar] [CrossRef]

- Ning, J.; Jiang, X.; Luo, J. Relationship between enterprise digitalization and green innovation: A mediated moderation model. J. Innov. Knowl. 2023, 8, 100326. [Google Scholar] [CrossRef]

- Li, Q.; Chen, H.; Chen, Y.; Xiao, T.; Wang, L. Digital economy, financing constraints, and corporate innovation. Pac.-Basin Financ. J. 2023, 80, 102081. [Google Scholar] [CrossRef]

- Guiso, L.; Sapienza, P.; Zingales, L. The value of corporate culture. J. Financ. Econ. 2015, 117, 60–76. [Google Scholar] [CrossRef]

- Ma, J.; Li, Q.; Zhao, Q.; Liou, J.; Li, C. From bytes to green: The impact of SCD on corporate green innovation. Energy Econ. 2024, 139, 107942. [Google Scholar] [CrossRef]

- Li, J.; Liu, H. Digital supply chain and green innovation: Evidence from global manufacturing firms. Technol. Forecast. Soc. Change 2021, 163, 120481. [Google Scholar]

- Bigliardi, B.; Filippelli, S.; Petroni, A.; Tagliente, L. The digitalization of supply chain: A review. Procedia Comput. Sci. 2022, 200, 1806–1815. [Google Scholar] [CrossRef]

- Sun, S.; Guo, T.; Zhang, S. Guiding corporate green sustainable development: Insights from green public procurement. Econ. Change Restruct. 2025, 58, 56. [Google Scholar] [CrossRef]

- Biswas, D.; Jalali, H.; Ansaripoor, A.H.; De Giovanni, P. Traceability vs. sustainability in supply chains: The implications of blockchain. Eur. J. Oper. Res. 2023, 305, 128–147. [Google Scholar]

- Yin, S.; Zhang, N.; Li, B. Enhancing the competitiveness of multi-agent cooperation for green manufacturing in China: An empirical study of the measure of green technology. Sustain. Prod. Consum. 2020, 23, 63–76. [Google Scholar] [CrossRef]

- Schniederjans, D.G.; Curado, C.; Khalajhedayati, M. Supply chain digitisation trends: An integration of knowledge management. Int. J. Prod. Econ. 2020, 220, 107439. [Google Scholar] [CrossRef]

- Wang, J.; Liu, Y.; Wang, W.; Wu, H. How does digital transformation drive green total factor productivity? Evidence from Chinese listed enterprises. J. Clean. Prod. 2023, 406, 136954. [Google Scholar] [CrossRef]

- Zhang, S.; Yang, Y.; Gan, H.; Ren, Y. Digital welfare of the value cycle of agribusiness supply chain network: Evidence from China’s listed agriculture-affiliated companies. Technol. Anal. Strateg. Manag. 2024, 1–15. [Google Scholar] [CrossRef]

- Peng, J.; Song, Y.; Tu, G.; Liu, Y. A study of the dual-target corporate environmental behavior (DTCEB) of heavily polluting enterprises under different environment regulations: Green innovation vs. pollutant emissions. J. Clean. Prod. 2021, 297, 126602. [Google Scholar] [CrossRef]

- Zhang, S.; Yang, Y.; Gan, H. Can Cross-Sector Collaboration Contribute to Boundaries Reshaping of Digital Government Platforms? Empirical Evidence Based on Machine Learning and Text Analysis. Public Adm. 2025. [Google Scholar] [CrossRef]

- Wei, J.; Zhang, X.; Tamamine, T. Digital transformation in supply chains: Assessing the spillover effects on midstream firm innovation. J. Innov. Knowl. 2024, 9, 100483. [Google Scholar] [CrossRef]

- Liang, L.; Lu, L.; Su, L. The impact of industrial robot adoption on corporate green innovation in China. Sci. Rep. 2023, 13, 18695. [Google Scholar] [CrossRef]

- Zhou, Y. Natural resources and green economic growth: A pathway to innovation and digital transformation in the mining industry. Resour. Policy 2024, 90, 104667. [Google Scholar] [CrossRef]

- Pranto, T.H.; Noman, A.A.; Mahmud, A.; Haque, A.B. Blockchain and smart contract for IoT enabled smart agriculture. PEERJ Comput. Sci. 2021, 7, e407. [Google Scholar] [CrossRef] [PubMed]

- Rifqi, H.; Zamma, A.; Souda, S.B.; Hansali, M. Positive effect of Industry 4.0 on quality and operations management. Int. J. Online Biomed. Eng. 2021, 17, 133–147. [Google Scholar] [CrossRef]

- Zouari, D.; Ruel, S.; Viale, L. Does digitalizing the supply chain contribute to its resilience? Int. J. Phys. Distrib. Logist. Manag. 2021, 51, 149–180. [Google Scholar] [CrossRef]

- Cai, J.; Sharkawi, I.; Taasim, S.I. How does digital transformation promote supply chain diversification? From the perspective of supply chain transaction costs. Financ. Res. Lett. 2024, 63, 105–399. [Google Scholar] [CrossRef]

- Zhao, A.; Wang, J.; Sun, Z.; Guan, H. Effects of carbon emission trading system on corporate green total factor productivity: Does environmental regulation play a role of green blessing? Environ. Res. 2024, 248, 118295. [Google Scholar] [CrossRef]

- Zhao, N.; Hong, J.; Lau, K.H. Impact of supply chain digitization on supply chain resilience and performance: A multi-mediation model. Int. J. Prod. Econ. 2023, 259, 108817. [Google Scholar] [CrossRef]

- Batwa, A.; Norrman, A. A framework for exploring blockchain technology in supply chain management. Oper. Supply Chain Manag. Int. J. 2020, 13, 294–306. [Google Scholar] [CrossRef]

- Arvidsson, S.; Dumay, J. Corporate ESG reporting quantity, quality and performance: Where to now for environmental policy and practice? Bus. Strategy Environ. 2022, 31, 1091–1110. [Google Scholar] [CrossRef]

- Luo, S.; Xiong, Z.; Liu, J. How does supply chain digitization affect green innovation? Evidence from a quasi-natural experiment in China. Energy Econ. 2024, 136, 107745. [Google Scholar] [CrossRef]

- Fernando, Y.; Wah, W.X. The impact of eco-innovation drivers on environmental performance: Empirical results from the green technology sector in Malaysia. Sustain. Prod. Consum. 2017, 12, 27–43. [Google Scholar] [CrossRef]

- Tian, J.; Dungait, J.A.; Hou, R.; Deng, Y.; Hartley, I.P.; Yang, Y.; Kuzyakov, Y.; Zhang, F.; Cotrufo, M.F.; Zhou, J. Microbially mediated mechanisms underlie soil carbon accrual by conservation agriculture under decade-long warming. Nat. Commun. 2024, 15, 377. [Google Scholar] [CrossRef]

- Liu, Y.; Huang, H.; Mbanyele, W.; Li, X.; Balezentis, T. Harnessing supply chain digital innovation for enhanced corporate environmental practices and sustainable growth. Energy Econ. 2025, 142, 108161. [Google Scholar] [CrossRef]

- Petrovic, D. Simulation of supply chain behaviour and performance in an uncertain environment. Int. J. Prod. Econ. 2001, 71, 429–438. [Google Scholar] [CrossRef]

- Lee, C.C.; He, Z.W.; Yuan, Z. A pathway to sustainable development: Digitization and green productivity. Energy Econ. 2023, 124, 106772. [Google Scholar] [CrossRef]

- Fosso, W.S.; Akter, S. Understanding supply chain analytics capabilities and agility for data-rich environments. Int. J. Oper. Prod. Manag. 2019, 39, 887–912. [Google Scholar] [CrossRef]

- Lerman, L.V.; Benitez, G.B.; Müller, J.M.; de Sousa, P.R.; Frank, A.G. Smart green supply chain management: A configurational approach to enhance green performance through digital transformation. Supply Chain Manag. Int. J. 2022, 27, 147–176. [Google Scholar] [CrossRef]

- Chernozhukov, V.; Chetverikov, D.; Demirer, M.; Duflo, E.; Hansen, C.; Newey, W.; Robins, J. Double/Debiased Machine Learning for Treatment and Structural Parameters. Econom. J. 2018, 21, 61–68. [Google Scholar] [CrossRef]

- Wang, X.; Li, J.; Ren, X.; Bu, R.; Jawadi, F. Economic policy uncertainty and dynamic correlations in energy markets: Assessment and solutions. Energy Econ. 2023, 117, 106475. [Google Scholar] [CrossRef]

- Kshetri, N. Blockchain systems and ethical sourcing in the mineral and metal industry: A multiple case study. Int. J. Logist. Manag. 2022, 33, 1–27. [Google Scholar] [CrossRef]

- Zhu, Y.; Zhang, Z. Supply chain digitalization and corporate ESG performance: Evidence from supply chain innovation and application pilot policy. Financ. Res. Lett. 2024, 67, 105818. [Google Scholar] [CrossRef]

- Khan, M.; Serafeim, G.; Yoon, A. Corporate sustainability: First evidence on materiality. Account. Rev. 2016, 91, 1697–1724. [Google Scholar] [CrossRef]

- Tang, H.; Xiong, L.; Peng, R. The mediating role of investor confidence on ESG performance and firm value: Evidence from Chinese listed firms. Financ. Res. Lett. 2024, 61, 104988. [Google Scholar] [CrossRef]

- Khanuja, A.; Jain, R.K. The mediating effect of supply chain flexibility on the relationship between supply chain integration and supply chain performance. J. Enterp. Inf. Manag. 2021, 35, 1548–1569. [Google Scholar] [CrossRef]

- Gunasekaran, A.; Patel, C.; McGaughey, R.E. A framework for supply chain performance measurement. Int. J. Prod. Econ. 2004, 87, 333–347. [Google Scholar] [CrossRef]

- Wang, C.H.; Juo, W.J. An environmental policy of green intellectual capital: Green innovation strategy for performance sustainability. Bus. Strategy Environ. 2021, 30, 3241–3254. [Google Scholar] [CrossRef]

- Zhang, S.; Han, W.; Wu, X. The Causal Impact of Data Elements on Corporate Green Transformation: Evidence from China. Systems 2025, 13, 515. [Google Scholar] [CrossRef]

- Xu, J.; Yang, B.; Yuan, C. The impact of supply chain digitalization on urban resilience: Do industrial chain resilience, green total factor productivity and innovation matter? Energy Econ. 2025, 145, 108443. [Google Scholar] [CrossRef]

- Al-Khatib, A.W. Big data analytics capabilities and green supply chain performance: Investigating the moderated mediation model for green innovation and technological intensity. Bus. Process Manag. J. 2022, 28, 1446–1471. [Google Scholar] [CrossRef]

- An, S.; Gu, Y.; Pan, L.; Yu, Y. Supply chain digitalization and firms’ green innovation: Evidence from a pilot program. Econ. Anal. Policy 2024, 84, 828–846. [Google Scholar] [CrossRef]

- Li, Z.; Hu, B.; Bao, Y.; Wang, Y. Supply chain digitalization, green technology innovation and corporate energy efficiency. Energy Econ. 2025, 142, 108153. [Google Scholar] [CrossRef]

- Li, F.; Srinivasan, S. Corporate governance when founders are directors. J. Financ. Econ. 2011, 102, 454–469. [Google Scholar] [CrossRef]

- Custódio, C.; Metzger, D. Financial expert CEOs: CEO’s work experience and firm’s financial policies. J. Financ. Econ. 2014, 114, 125–154. [Google Scholar] [CrossRef]

- Smith, J.D. US political corruption and firm financial policies. J. Financ. Econ. 2016, 121, 350–367. [Google Scholar] [CrossRef]

- Zhu, H.; Chao, Y. On corporate total factor productivity: Public procurement. Manag. Decis. 2025, 63, 76–100. [Google Scholar]

- Rajaguru, R.; Matanda, M.J. Role of compatibility and supply chain process integration in facilitating supply chain capabilities and organizational performance. Supply Chain Manag. Int. J. 2019, 24, 301–316. [Google Scholar] [CrossRef]

- Meng, Q.; Wang, Y.; Zhang, Z.; He, Y. Supply chain green innovation subsidy strategy considering consumer heterogeneity. J. Clean. Prod. 2021, 281, 125199. [Google Scholar] [CrossRef]

- Peron, M.; Panza, L.; Demiralay, E.; Talluri, S. Additive manufacturing for spare parts management: Is decentralized production always environmentally preferable? IEEE Trans. Eng. Manag. 2025, 72, 634–650. [Google Scholar] [CrossRef]

- Govindan, K.; Salehian, F.; Kian, H.; Hosseini, S.T.; Mina, H. A location-inventory-routing problem to design a circular closed-loop supply chain network with carbon tax policy for achieving circular economy: An augmented epsilon-constraint approach. Int. J. Prod. Econ. 2023, 257, 108771. [Google Scholar] [CrossRef]

- Kondo, R.; Kinoshita, Y.; Yamada, T. Green procurement decisions with carbon leakage by global suppliers and order quantities under different carbon tax. Sustainability 2019, 11, 3710. [Google Scholar] [CrossRef]

- Panza, L.; Peron, M. The role of carbon tax in the transition from a linear economy to a circular economy business model in manufacturing. J. Clean. Prod. 2025, 492, 144873. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Variable Symbol | Variable Measurement |

|---|---|---|---|

| Dependent variables | Substantive green innovation | SGI | Number of patents for green inventions filed independently during the year |

| Tactical green innovation | TGI | Number of green utility models filed independently during the year | |

| Independent variables | Supply chain digitization | SCD | SCD policy dummy variable |

| Mediating variables | Corporate ESG performance | ESG | ESG score |

| The efficiency of supply chain management | SCE | Ln (365/inventory turnover) | |

| Control variables | The debt-to-equity Ratio | DER | Total liabilities/total assets |

| Company scale | Size | Total assets in logarithms | |

| Asset return | ROA | Net profit/total assets | |

| Tobin’s Q | Tobinq | Market capitalization/total assets | |

| Centralization of ownership | TOP10sh | Sum of shareholdings of the top ten shareholders’ shareholders | |

| Independent director | Ind.Dir | Proportion of independent directors | |

| Corporate sales Margin | NP | Net sales margin | |

| Time fixed effect | Year | Year dummy variable | |

| Firm fixed effect | ID | Firm dummy variable |

| Variables | Obs | Mean | SD | Min | Max. |

|---|---|---|---|---|---|

| SCD | 38,548 | 0.0473453 | 0.2123943 | 0 | 1 |

| SGI | 38,548 | 0.9436929 | 3.544605 | 0 | 23 |

| TGI | 38,548 | 0.569327 | 1.989745 | 0 | 14 |

| ESG | 38,548 | 3.989 | 1.3773 | 0 | 8 |

| SCE | 38,548 | 4.465 | 1.379 | −9.28402 | 12.63707 |

| Size | 38,548 | 22.63473 | 1.348441 | 19.9956 | 26.0627 |

| DAR | 38,548 | 0.4873997 | 0.19668 | 0.057563 | 0.873221 |

| ROA | 38,548 | 0.0473308 | 0.0729296 | −0.272016 | 0.241733 |

| Ind.Dir | 38,548 | 36.91397 | 4.999 | 33.33 | 57.14 |

| NP | 38,548 | 0.0571155 | 0.1495529 | −0.89866 | 0.494229 |

| Tobinq | 38,548 | 1.821334 | 1.139036 | 0 | 7.47242 |

| TOP10sh | 38,548 | 55.23507 | 15.24044 | 23.3735 | 90.272 |

| Panel A: Impact of SCD on SGI | ||||

|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) |

| Partial Linear Model | Interactive Model | |||

| SGI | SGI | SGI | SGI | |

| SCD | 3.388 *** (0.747) | 3.282 *** (0.714) | 0.771 *** (0.226) | 0.794 *** (0.229) |

| Control variable with one term in the hierarchy | Y | Y | Y | Y |

| Quadratic term of the control variable | N | Y | N | Y |

| Time fixed effect | Y | Y | Y | Y |

| Firm fixed effect | Y | Y | Y | Y |

| N | 38,548 | 38,548 | 38,548 | 38,548 |

| Panel B: Impact of SCD on TGI | ||||

| Variables | (1) | (2) | (3) | (4) |

| Partial Linear Model | Interactive Model | |||

| TGI | TGI | TGI | TGI | |

| SCD | 0.967 *** (0.351) | 1.007 *** (0.360) | 0.285 ** (0.118) | 0.297 ** (0.119) |

| Control variables with one term in the hierarchy | Y | Y | Y | Y |

| Quadratic term of the control variables | N | Y | N | Y |

| Time fixed effect | Y | Y | Y | Y |

| Firm fixed effect | Y | Y | Y | Y |

| N | 38,548 | 38,548 | 38,548 | 38,548 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| ES1 | ES2 | ES3 | ES4 | |

| SGI | 0.037 | 0.166 | 0.131 | 0.587 |

| TGI | 0.019 | 0.084 | 0.036 | 0.161 |

| Panel A: Impact of SCD on SGI | |||||||

|---|---|---|---|---|---|---|---|

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

| Changing the Split Ratio | Reinventing Machine Learning Models | Tailing Treatment | Substitution of Explanatory Variables | ||||

| 1:2 | 1:7 | Svm | Gradboost | Nnet | (2, 98) | Substitution Variables | |

| SGI | SGI | SGI | SGI | SGI | SGI | SGI | |

| SCD | 2.655 *** (0.769) | 2.224 ** (0.999) | 2.571 *** (0.430) | 1.127 *** (0.330) | 2.904 *** (0.095) | 2.947 *** (0.657) | 3.947 *** (0.717) |

| Control variables with one term in the hierarchy | Y | Y | Y | Y | Y | Y | Y |

| Quadratic term of the control variables | Y | Y | Y | Y | Y | Y | Y |

| Time fixed effect | Y | Y | Y | Y | Y | Y | Y |

| Firm fixed effect | Y | Y | Y | Y | Y | Y | Y |

| N | 38,548 | 38,548 | 38,548 | 38,548 | 38,548 | 38,548 | 38,548 |

| Panel B: Impact of SCD on TGI | |||||||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) |

| Changing the Split Ratio | Reinventing Machine Learning Models | Tailing Treatment | Substitution of Explanatory Variables | ||||

| 1:2 | 1:7 | Svm | Gradboost | Nnet | (2, 98) | Substitution Variables | |

| TGI | TGI | TGI | TGI | TGI | TGI | TGI | |

| SCD | 0.428 *** (0.133) | 0.433 ** (0.172) | 0.768 *** (0.213) | 0.455 ** (0.202) | 0.685 *** (0.163) | 0.989 *** (0.353) | 0.826 ** (0.373) |

| Control variables with one term in the hierarchy | Y | Y | Y | Y | Y | Y | Y |

| Quadratic term of the control variables | Y | Y | Y | Y | Y | Y | Y |

| Time fixed effect | Y | Y | Y | Y | Y | Y | Y |

| Firm fixed effect | Y | Y | Y | Y | Y | Y | Y |

| N | 38,548 | 38,548 | 38,548 | 38,548 | 38,548 | 38,548 | 38,548 |

| Variables | PSM-DML | |

|---|---|---|

| 1:1 Nearby 0.01 Caliper | ||

| SGI | TGI | |

| SCD | 3.295 *** (0.981) | 2.036 *** (0.574) |

| Control variables with one term in the hierarchy | Y | Y |

| Quadratic term of the control variables | N | Y |

| Time fixed effect | Y | Y |

| Firm fixed effect | Y | Y |

| N | 38,548 | 38,548 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| SCD | SGI | TGI | |

| IV | 6.847 *** (0.357) | ||

| SCD | 2.570 *** (0.434) | 1.142 *** (0.229) | |

| Control variables with one term in the hierarchy | Y | Y | Y |

| Quadratic term of the control variables | N | N | Y |

| Time fixed effect | Y | Y | Y |

| Firm fixed effect | Y | Y | Y |

| N | 38,548 | 38,548 | 38,548 |

| Variables | (1) | (2) |

|---|---|---|

| SGI | TGI | |

| SCD | 4.309 *** (0.691) | 4.037 *** (1.592) |

| Control variables with one term in the hierarchy | Y | Y |

| Quadratic term of the control variables | Y | Y |

| Time fixed effect | Y | Y |

| Firm fixed effect | Y | Y |

| N | 38,548 | 38,548 |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| ESG | SCE | SCI | |

| SCD | 0.362 ** (0.164) | 0.668 *** (0.048) | 0.258 *** (0.048) |

| Control variables with one term in the hierarchy | Y | Y | Y |

| Quadratic term of the control variables | Y | Y | Y |

| Time fixed effect | Y | Y | Y |

| Firm fixed effect | Y | Y | Y |

| N | 38,548 | 38,548 | 38,548 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| High-Tech Companies | Non-High-Tech Companies | High-Tech Companies | Non-High-Tech Companies | |

| SGI | SGI | TGI | TGI | |

| SCD | 1.446 ** (0.717) | 0.813 (0.547) | 2.597 * (1.369) | 0.435 (0.346) |

| Control variables with one term in the hierarchy | Y | Y | Y | Y |

| Quadratic term of the control variables | Y | Y | Y | Y |

| Time fixed effect | Y | Y | Y | Y |

| Firm fixed effect | Y | Y | Y | Y |

| N | 13,877 | 24,671 | 13,877 | 24,671 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| High Internal Control | Low Internal Control | High Internal Control | Low Internal Control | |

| SGI | SGI | TGI | TGI | |

| SCD | 0.701 *** (0.407) | 2.118 (0.84) | 0.985 * (0.652) | 1.127 (0.507) |

| Control variables with one term in the hierarchy | Y | Y | Y | Y |

| Quadratic term of the control variables | Y | Y | Y | Y |

| Time fixed effect | Y | Y | Y | Y |

| Firm fixed effect | Y | Y | Y | Y |

| N | 21,838 | 16,710 | 21,838 | 16,710 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| High Financing Constraints | Low Financing Constraints | High Financing Constraints | Low Financing Constraints | |

| SGI | SGI | TGI | TGI | |

| SCD | 2.737 (1.616) | 1.191 ** (0.502) | 0.865 (0.772) | 0.882 * (0.496) |

| Control variables with one term in the hierarchy | Y | Y | Y | Y |

| Quadratic term of the control variables | Y | Y | Y | Y |

| Time fixed effect | Y | Y | Y | Y |

| Firm fixed effect | Y | Y | Y | Y |

| N | 19,274 | 19,274 | 19,274 | 19,274 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, S.; Niu, Y.; Zhang, J.; Li, J.; Wang, S.; Guan, Y. Effects of Supply Chain Digitization on Different Types of Corporate Green Innovation: Empirical Evidence from Double Machine Learning (DML). Sustainability 2025, 17, 7509. https://doi.org/10.3390/su17167509

Zhang S, Niu Y, Zhang J, Li J, Wang S, Guan Y. Effects of Supply Chain Digitization on Different Types of Corporate Green Innovation: Empirical Evidence from Double Machine Learning (DML). Sustainability. 2025; 17(16):7509. https://doi.org/10.3390/su17167509

Chicago/Turabian StyleZhang, Shaopeng, Yuting Niu, Jiong Zhang, Jiyu Li, Sihan Wang, and Yangyang Guan. 2025. "Effects of Supply Chain Digitization on Different Types of Corporate Green Innovation: Empirical Evidence from Double Machine Learning (DML)" Sustainability 17, no. 16: 7509. https://doi.org/10.3390/su17167509

APA StyleZhang, S., Niu, Y., Zhang, J., Li, J., Wang, S., & Guan, Y. (2025). Effects of Supply Chain Digitization on Different Types of Corporate Green Innovation: Empirical Evidence from Double Machine Learning (DML). Sustainability, 17(16), 7509. https://doi.org/10.3390/su17167509