Abstract

We analyze ESG-related news coverage to examine media attention patterns as a reflection of stakeholders’ perceived salience of ESG issues at both the industry and firm levels, offering insights into the evolving nature of ESG materiality. Using longitudinal data visualization over an 11-year period, we show that media attention to ESG issues varies significantly over time and across firms within the same industry. While some issues receive consistent attention, others exhibit shifting patterns, signaling changing stakeholders’ perceived salience. Focusing on SASB-informed financially material ESG issues, we also show that perceived salience varies even among high-relevance topics. Some firms align with their industry’s patterns, while others diverge markedly, reinforcing the view that ESG materiality is both dynamic and firm-specific. These insights suggest that static ESG materiality assessment frameworks may be insufficient for informing long-term sustainability strategies or corporate disclosure practices. For investors, our results underscore the value of media-based ESG signals in complementing traditional materiality assessments. Acknowledging the evolving nature of ESG materiality is essential for firms and investors aiming to develop ESG strategies that respond to shifts in stakeholders’ perceived salience of ESG issues.

1. Introduction

Materiality is an accounting principle that determines which information about a firm’s current and future transactions or risk exposures is relevant and useful for decision-making. In this study, in this study we define dynamic materiality as the notion that environmental, social, and governance (ESG) risks and opportunities not currently deemed material may become material over time, as a result of evolving stakeholder expectations, regulatory changes, market conditions, or shifts in societal norms [1,2]. Although widely used materiality assessment frameworks, such as those developed by the Sustainability Accounting Standards Board (SASB) and the Global Reporting Initiative (GRI), acknowledge the context-specific nature of ESG issues, they have traditionally relied on sector-based materiality maps that may not fully account for evolving stakeholder expectations or societal shifts prompted by global social movements (GSMs). More recently, both GRI and SASB (now part of the IFRS Foundation’s ISSB) have also acknowledged the concept of dynamic materiality, particularly in discussions on interoperability with European sustainability standards.

Moreover, the evolving nature of ESG materiality is implicitly embedded in several key aspects of the International Financial Reporting Standards (IFRS) S1 and S2 [3,4]. These standards recognize that ESG materiality is both entity-specific and time-dependent, requiring firms to monitor emerging sustainability-related risks and opportunities and to reassess materiality over time. In particular, S1 [3] (pages 58–62) mandates the identification of sustainability-related risks and opportunities over the short, medium, and long term, explicitly acknowledging that these may evolve and affect a firm’s ability to generate value. Complementing this perspective, IFRS guidance on implementation of S1 and S2 emphasizes that sustainability-related risks and opportunities affecting a firm’s prospects—its cash flows, access to finance, or cost of capital—might change over time [5], and that the interactions between the firm and its stakeholders, the society, the economy, and the environment are essential to understanding their materiality. Together, these features signal a forward-looking and adaptive approach to ESG materiality in a way that is consistent with the evolving nature of stakeholder expectations.

Accordingly, this study examines whether and how ESG-related media attention can help capture shifts in stakeholder expectations that influence perceptions of ESG materiality. Motivated by this question, this study builds on the perspective that evolving societal expectations influence stakeholders’ concerns and actions regarding corporate sustainability. These evolving expectations generate observable pressures on firms, which, when amplified or documented by media coverage, offer a window into the perceived salience and dynamic materiality of ESG issues.

To illustrate how news media attention can reflect stakeholder expectations and influence the perceived materiality of ESG issues, high-profile cases in the pharmaceutical industry can be considered. In 2015, Turing Pharmaceuticals provoked public outrage and intense media scrutiny after raising the price of Daraprim—a drug used to treat parasitic infections—by more than 5000%, triggering congressional hearings and significant reputational damage [6]. In 2016, Mylan, a global generic and specialty pharmaceutical company, attracted similar scrutiny for increasing the price of the EpiPen by 488% over seven years [7]. In 2017, Marathon Pharmaceuticals’ pricing of the muscular dystrophy drug Emflaza at a significantly higher price point sparked another public outrage and led to delays in its commercialization. The resulting media attention and stakeholder pressure prompted regulatory discussions and calls for industry-wide oversight [8]. Taken together, these chronologically related cases underscore how stakeholders, by actively voicing concerns through the media, exert pressure that can compel firms and regulators to reassess risks and priorities, thereby reshaping the perceived salience of ESG issues.

Drawing on this perspective, our goal is to explore how attention to different ESG issues evolves over time using news media data and a longitudinal case study approach [9], in order to uncover shifts in stakeholders’ perceived salience of these issues across industries and topics. More precisely, this study analyzes ESG-related news media volume collected from FactSet Truvalue Labs, categorized according to the 26 ESG issues identified in the SASB materiality framework. Our analysis is based on 27 firm-level cases from the S&P 500, spanning six industries over an 11-year period (2014–2024).

The case-based analysis [9] reveals notable variations in news media volume over time, as well as substantial variation in media attention across ESG issues, industries, and among firms within the same industry. Certain ESG issues have attracted heightened media attention at specific moments, only to experience a sharp decline in media attention and perceived relevance to stakeholders thereafter. Conversely, some ESG issues that were previously considered low priority displayed a sudden increase in media attention and gained relevance, reflecting how stakeholders’ perceived salience of ESG issues can evolve over time. Our analysis also revealed that firms may exhibit diverging trends and patterns in terms of news media attention to ESG issues when compared to their industry norms, suggesting that stakeholders exert heightened pressure on firms and on specific ESG issues without necessarily affecting the broader industry. In sum, based on news volume data from 27 S&P 500 firms spanning an eleven-year period, this study documents shifts in stakeholder priorities across ESG issues, industries, and firms, which underscore the dynamic and firm-specific nature of ESG materiality. In doing so, our study contributes to stakeholder theory [10,11] by showing that media coverage of ESG issues can heighten the conditions for stakeholder engagement and generate reputational or legitimacy risks for firms. It also suggests that media attention [12] may play a broader and more influential role in shaping ESG materiality and how firms respond to evolving stakeholder pressures than previously recognized

The remainder of this article is structured as follows: Section 2 provides background and highlights the related literature. Section 3 describes the data and methods used in our analysis. Section 4 presents and discusses our findings, while Section 5 explores their implications. Section 6 concludes the study.

2. Background

In 2004, the term Environmental, Social, and Governance (hereafter referred to as ESG) became official following its first significant appearance in a United Nations (UN) report titled “Who Cares Wins” [13]. This report stressed the importance of firms to integrate ESG factors into their operations and urged corporate decision-makers and stakeholders to embrace the principles and vision of ESG. Today, this vision guides corporate strategies and investments, represents a transformative approach to value creation [10], and drives a leading shift from a shareholder-centric model to a broader consideration of all stakeholders (stakeholder-centric model).

In response, investors increasingly incorporate ESG criteria into their decision-making process to objectively evaluate firms’ non-financial risks and opportunities [14,15], and firms have ramped up their efforts to measure and report on their ESG risks and opportunities [16]. The evolution of ESG data and rating methodologies also played a significant role in this transition. The use of ESG scores has surged over the past decade, driven by the need to provide investors and stakeholders with standardized assessments to evaluate companies’ performance across the ESG dimensions [17]. Managers, investors, and other stakeholders rely on ESG ratings to inform their decisions, as these assessments help align potential investments with their values and long-term objectives, mitigate non-financial risks, estimate risk-adjusted returns, and expand firms’ access to capital [14].

In the context of ESG materiality, stakeholder theory [11,18] offers a valuable lens for understanding why certain ESG issues gain prominence for firms and investors. ESG issues become material when they are perceived by stakeholders as important, urgent, and legitimate, particularly when these perceptions are amplified through channels such as media coverage, civil society activism, or regulatory scrutiny. Because materiality depends on the perceived salience of issues among stakeholders, it should not be assumed to be static or solely determined by financial considerations. Assessing the materiality of ESG risks and opportunities has, therefore, become a critical step. For firms, materiality assessment enables the identification of the ESG issues most likely to affect their operations, financial outcomes, and long-term value creation [19]. Materiality assessments guide firms in prioritizing resource allocation, enhancing risk management, and integrating relevant ESG factors into strategic decision-making. Moreover, by disclosing material ESG information, companies can improve transparency and credibility [20], better align their sustainability initiatives with business goals, and respond more effectively to stakeholder expectations [4]. For investors, materiality assessment is equally essential, as it provides a more accurate understanding of ESG risks and opportunities that are often overlooked in traditional financial reporting [16]. Research shows that investors increasingly rely on ESG information as a forward-looking indicator to evaluate firms’ financial resilience and to inform portfolio risk management strategies [19]. In the same line of reasoning, the study by [21] demonstrates that incorporating financial materiality into ESG rating frameworks significantly alters firm rankings, suggesting that approaches that overlook or inadequately conceptualize materiality considerations may misrepresent the relevance of ESG issues for investors’ decision-making needs.

Having examined how firms and investors assess the materiality of ESG issues as part of performance evaluation, we now turn to the evolving nature of stakeholders’ perceived salience of ESG issues and their implications for ESG assessment. As highlighted by the World Economic Forum [1,2], evolving societal expectations influence stakeholders’ concerns and actions regarding corporate sustainability. In other words, ESG issues that may seem immaterial today can quickly become material or financially material to the focal firm and investors if these evolving concerns generate heightened pressures on firms’ practices. The author of [22], for example, describes materiality assessment as an ongoing developmental process, highlighting that ESG issues can evolve and become salient, driven by shifts in societal values, regulatory changes, or market trends. This evolving nature compels firms to constantly monitor whether their operations and related strategies stay aligned with emerging stakeholders’ concerns. To illustrate, social global movements (SGMs) like #MeToo, Black Lives Matter, and the COVID-19 pandemic have urged businesses to adopt agile strategies to respond to these emerging issues. These events demonstrated how sudden and unexpected shifts can occur in stakeholders’ expectations, creating threats that necessitate quick responses and risk mitigation strategies [23]. Hence, embracing the evolving nature of stakeholders’ perceived salience of ESG issues can enhance firms’ ability to identify and manage emerging risks and opportunities, and respond more effectively to global trends and societal changes [12].

Building on the perspectives discussed above, we contend that stakeholders’ expectations regarding a firm’s sustainable practices, when amplified or documented by media attention, offer a window into the perceived salience and evolving nature of materiality of ESG issues over time. News media attention signals stakeholder interest and serves as an indicator of stakeholder priorities, which in turn impact the perceived salience of ESG risk and opportunities to which the focal firm is exposed. Anticipating shifts in stakeholders’ perceived salience of ESG issues enables firms to more effectively allocate resources, implement appropriate practices, and proactively monitor and mitigate emerging risks. This underscores the relevance of our exploratory study, which aims to reveal such shifts through a case-based analysis of media attention patterns. The authors of [24], for example, provide empirical evidence that on average, firms facing one additional negative ESG-related news, within a high-reach article, could cost the company approximately CAD 3.8 million. Thus, the guiding premise of our study is that ESG-related news media attention reflects stakeholders’ priorities and helps trace shifts in how ESG risks and opportunities are perceived over time. This motivates the analysis presented in the following sections, which draws on 27 firm-level cases and data from FactSet Truvalue Labs that track firm-level media attention across 26 ESG issues identified in the SASB framework. The next section outlines the methods employed.

3. Methods

We adopt a case-based study approach [9] drawing on archival, longitudinal data of ESG-related news media attention, as reported by the FactSet Truvalue Labs database [25], which uses artificial intelligence and natural language processing to extract ESG signals from unstructured data (e.g., media news, NGO reports, stakeholder commentary, and other public documents). These signals are aligned with the SASB Materiality Map, meaning that ESG-related news media are categorized according to the 26 ESG issue categories defined by SASB. The next sections describe the three main steps: selection of firms, data collection, and data analysis.

3.1. Selected Firms

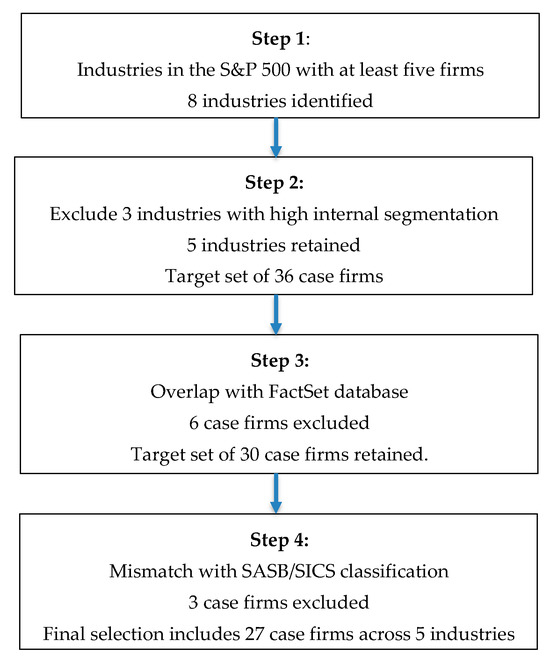

The case firms included in our analysis were identified through a purposeful selection process [9] aimed at capturing variation across industry, ESG profile, and media visibility. This purposeful selection aligns with our exploratory and inductive approach, which does not seek to generalize findings but rather to generate insights into the evolving salience of ESG issues. Our starting point was the list of firms included in the S&P 500 index as of 15 October 2024, as reported by the S&P Global platform. The list provides information about the index’s constituents, such as name, ticker, capitalization, and Global Industry Classification Standards (GICS). The first step was to identify industries that would ensure a sectoral diversity (based on the GICS codes and description), heterogeneous ESG profiles, and a meaningful number of firms for comparative analysis within the industry. This last criterion restricted our selection to industries represented in the S&P500 index, including at least five firms. Given the significant number and variety of internal segments (sub-industries) within certain GICS codes—affecting comparability among firms—three industries were excluded: Semiconductor Materials and Equipment, Health Care Equipment, and Aerospace and Defense. After this exclusion, the target set of cases included 36 firms spanning five distinctive industries: Consumer Staples, Soft Drinks, Diversified Banks, Packaged Foods and Meats, and Pharmaceuticals (see Appendix A for details), reflecting a balanced and diverse representation of industries concerning ESG issues and their respective salience.

3.2. Data Collection

As indicated above, this study relies on data on ESG-related news media attention compiled by the FactSet Truvalue Labs. Thus, our next step is to collect FactSet’s Volume score for the selected firms. The Volume score captures the amount of ESG-related media coverage, that is, the number of news articles mentioning a firm over time, without assessing the tone of the coverage. Unlike FactSet’s sentiment scores, which classify the news coverage as positive, negative, or neutral, the volume score reflects the intensity of media attention and serves as a proxy for stakeholder awareness or scrutiny [25]. As such, a high-Volume score indicates a high level of media attention around an ESG issue. A distinctive feature of the FactSet data is that the Volume score is categorized into 26 ESG issues, as defined by SASB and mapped across 77 industry classifications in its materiality framework. Consequently, the Volume score allows us to explore whether media attention metrics validate the salience of an ESG issue for a specific industry and, more importantly, offer insights into the evolving nature of stakeholders’ expectations. The matching process between the selected cases and FactSet’s database involved cross-checking firms’ International Securities Identification Number (ISIN), ticker, and name in both datasets. During this process, five of the selected cases were found to be missing from the FactSet database. Additionally, scores for the Bank of America (Commercial Banks industry) were missing for several years in our period of analysis, leading to its exclusion. As a result, Volume scores were collected for 30 firms across five industries.

3.3. Financial Materiality of ESG Issues

As mentioned above, FactSet maps the data on media coverage to the 26 ESG issues defined in the SASB’s framework, thereby enabling assessments of media attention that are aligned with industry-specific ESG financial materiality. However, SASB’s Standard Industry Classification System (SICS) [26] groups firms into industries based on the similarities of sustainability issues, which sometimes differ from the GICS classification used by the S&P500 index, initially used in our selection of industries. Therefore, the selected cases were matched with the SASB’s SICS to allow the identification of the ESG issues that are financially material in their respective industry. An important mismatch between GICS and SICS was identified for three firms in our sample. Precisely, JP Morgan Chase & Co. belongs to the GICS industry Diversified Banks, while SASB assigns the firm to Investment Banking and Brokerage. JP Morgan Chase & Co. would be the only firm in this SICS category. Similarly, two other firms classified by SASB under the Meat, Poultry and Dairy industry were excluded because this industry (or GICS) was not part of our initial selection. After excluding these three cases, the final selection comprises 27 firms across five different SASB SICS (see Appendix A for a complete list). Figure 1 summarizes our strategy to select the case firms for the study.

Figure 1.

Step-by-step strategy used to select the case firms for the study.

The next step was mapping the financially material ESG issues across the industries and selected firms included in our analysis. This information was used as a parameter in the subsequent data visualization analysis. Table 1 presents the industries included in our sample according to their GICS and respective SASB SICS. The last two columns present the number of SASB financially material issues for each industry, along with the number of case firms in each industry.

Table 1.

GICS and SASB industry classification.

3.4. Data Visualization and Analysis

To explore the data on news media attention (i.e., Volume score), the analysis relies primarily on data visualization tools suited for longitudinal analysis. While the available FactSet dataset covers a period from 2007 to 2024, the analysis covers an 11-year period, from 2014 to 2024. Our analysis begins in 2014 to align with advancements in data mining technology introduced by FactSet Truvalue Labs [25], along with corresponding improvements in its methodology and coverage, which enhance the accuracy and reliability of the Volume score. It is worth noting that Volume scores are based on daily entries of the number of news articles addressing a particular ESG issue for the focal firm. This count is then expressed as a percentage of all news articles mentioning the firm during the same period (e.g., day, month, or year). As such, the Volume score captures, on a daily basis, the relative share of media attention devoted to each ESG issue, within the full set of 26 SASB-informed topics, for the focal firm. The result is a large dataset comprising approximately a total of 2.8 million daily data entries for the selected 27 firms over the 11-year timeframe and across the 26 ESG issues. We therefore calculated the yearly mean of the Volume score, which is the sum of daily percentages divided by the number of days with entries in that year, across a span of 11 years (2014–2024) for each of the 27 firms and for each of the 26 ESG issues. Given the variation in the daily scores throughout a year, the yearly mean (instead of focusing on the score on a single day) better reflects the average media attention each ESG issue receives over an entire calendar year (e.g., 1 January or 31 December). The result is a dataset with around 10,000 observations. Appendix B illustrates an example of the annual mean Volume Scores for the company Johnson & Johnson, one of the firms included in our analysis. This yearly average calculation was applied consistently across all firms and years to provide a comprehensive multi-year, multi-industry overview.

Based on the yearly average, we created a longitudinal dashboard for each selected firm, to be used in data visualization analysis aimed at identifying and comparing patterns over time, across industries, and among firms within the same industry. It is expected that patterns at the industry- and firm-level will highlight whether stakeholder expectations—and, consequently, the perceived materiality of ESG issues—evolve over time. To pursue this goal, we developed a three-tiered data visualization approach based on the Volume score: (1) ESG Media Attention Over Time at the Industry Level; (2) ESG Media Attention on Financially Material Issues Over Time at the Industry Level; and (3) ESG Media Attention at the Firm Level−Illustrative Cases. In the next sections we discuss the results derived from our analysis.

4. Results

4.1. ESG Media Attention over Time at the Industry Level

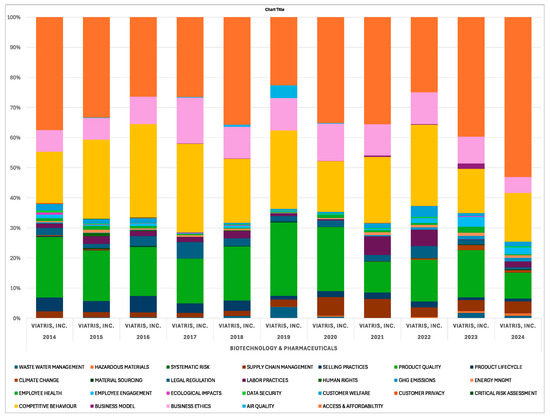

This first approach aims to provide insights into how news media attention across the full set of 26 SASB-informed ESG issues evolved within each industry. To assure comparability we used the SASB industry classification to group the case firms into six distinct industries and calculated an industry-level aggregated volume score over the period under analysis (2014–2024). Thus, the resulting interactive stacked bar charts show the annual percentage of media coverage devoted to each ESG issue. Each colored segment represents a specific ESG issue, providing a clear visualization of shifts in media attention over time. These charts offer a high-level view of cross-issue variation and reveal preliminary insights into the evolving nature of stakeholder expectations.

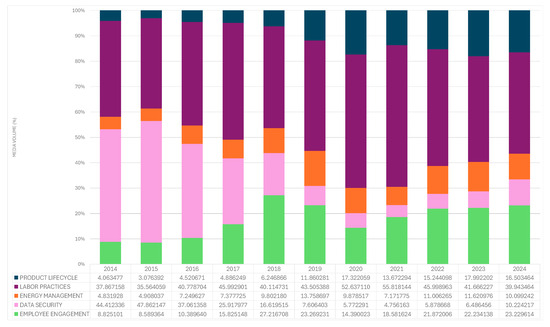

As shown in Figure 2, in the Biotechnology and Pharmaceuticals industry, news media attention varied widely across the 26 SASB-informed ESG issues over time. Notable shifts are observed in Access and Affordability (orange), for which media attention dropped by nearly 42% from 2015 to 2019, then doubled by 2024. Product Quality (yellow) and Business Ethics (green) also experienced a large variation in media attention, underscoring how certain ESG issues rise and fall in salience in the eyes of stakeholders. In contrast, Employee Engagement (blue) and Supply Chain Management (brown) received consistently low and stable attention in this industry.

Figure 2.

ESG media attention at the industry level: all ESG issues—Biotechnology and Pharmaceuticals (2014–2024).

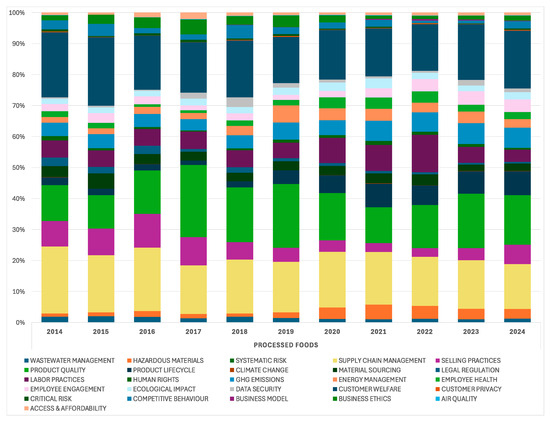

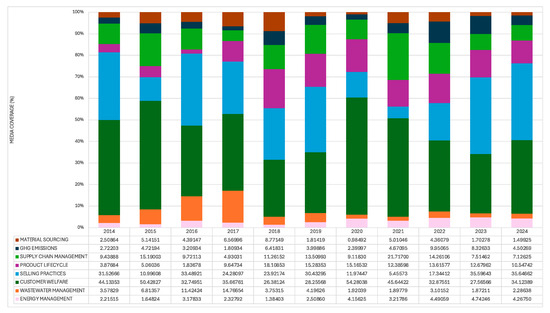

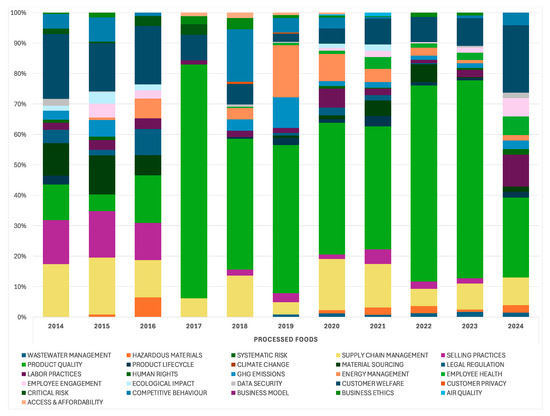

As expected, in the Processed Foods industry (Figure 3), the level of news media attention to Product Quality (green) not only corroborates its salience but also provides evidence of significant variation over the period under analysis, with a 50% decline between 2017 (highest level) and 2021 (lowest level) followed by a 53% increase by 2023—returning to its pre-2021 level. Although less salient when compared to other ESG issues in this industry, we also observe a continuous decline in media attention towards Selling Practices (purple) and Business Ethics (dark green) in this industry. At the same time, Supply Chain Management and Employee Health maintained consistently high levels of media attention over the period, reinforcing their salience and supporting their classification as material issues in this industry.

Figure 3.

ESG media attention at the industry level: all ESG issues—Processed Foods (2014–2024).

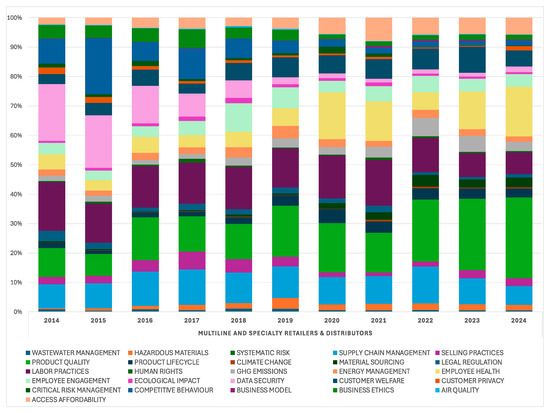

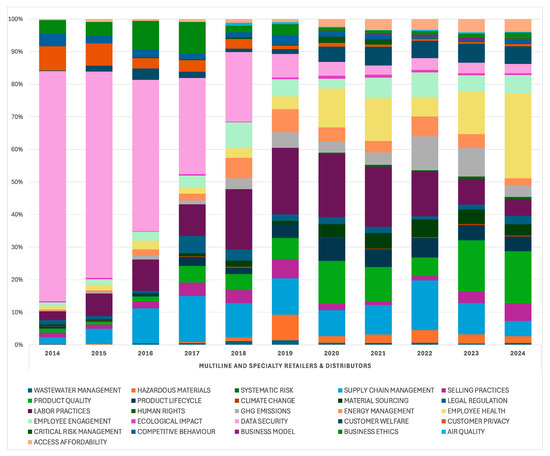

In the case of Multiline and Specialty Retailers (Figure 4), media attention appears broadly distributed across the 26 SASB-informed ESG issues, with no single topic receiving disproportionately high levels of coverage. The most notable variations observed in this industry are a 90% decline in media attention to Data Security (pink) and a 182% rise in Product Quality (light green) over the period under analysis (Figure 4). Stakeholder concerns about Employee Health (yellow) also rose by 75% between 2014 and 2024, while issues related to Supply Chain Management (blue) displayed relatively important salience but minimal variation over the period.

Figure 4.

ESG media attention at the industry level: all ESG issues—Multiline and Specialty Retailers and Distributors (2014–2024).

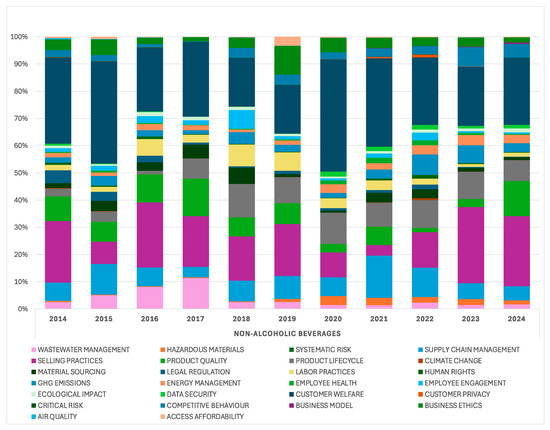

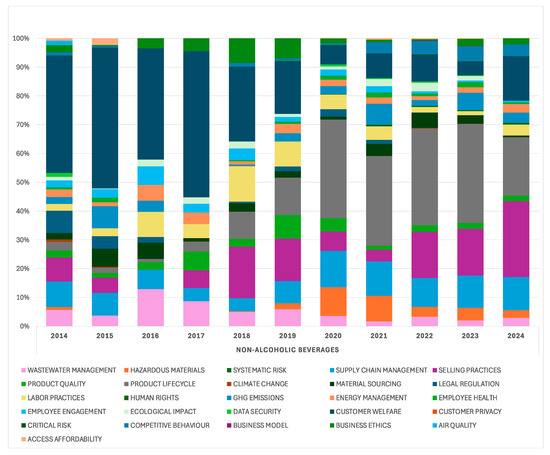

In the Non-Alcoholic Beverages industry, see Figure 5 below, media attention to stakeholder concerns about Customer Welfare (dark blue) and Selling Practices (purple) suggests its higher salience and notable year-to-year variations, compared to other ESG issues in this industry. Surprisingly, media attention to Wastewater Management (pink) is apparently less salient relative to the other ESG issues, but experienced a more than threefold increase (i.e., over 300%) from 2014 to 2017, before declining a year later and returning to its 2014 level (Figure 5). Media attention to other ESG issues, such as Product Quality and Energy Management, was more stable, reflecting steady and relatively lower stakeholder concerns regarding these issues. Notably, these issues are not classified as financially material for the Multiline and Specialty Retail industry according to the SASB framework [26], which lends some support to the alignment between observed attention patterns and established materiality assessments.

Figure 5.

ESG media attention at the industry level: all ESG issues—Non-Alcoholic Beverages (2014–2024).

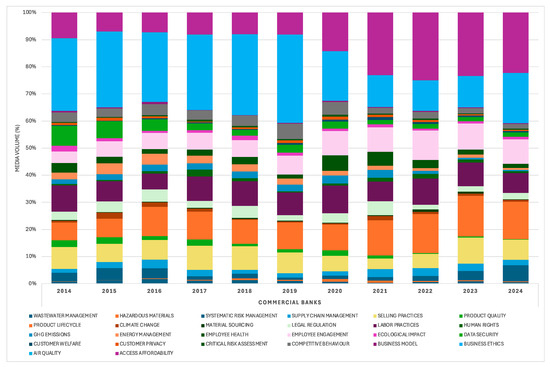

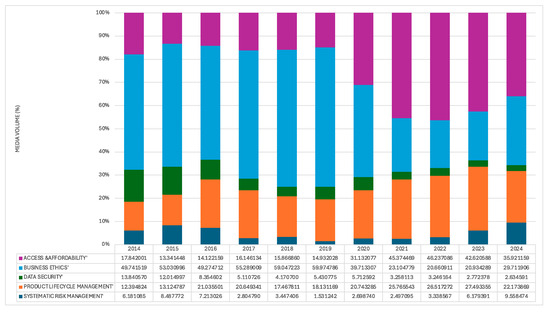

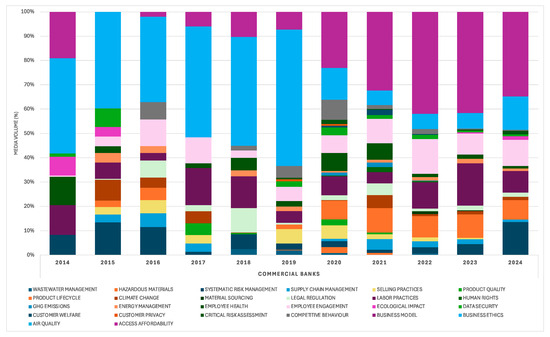

In the Commercial Banks industry, the most salient and volatile ESG issues in terms of media attention are Access and Affordability (dark pink) and Business Ethics (blue). As shown in Figure 6 below, stakeholder expectations about Access and Affordability of financial products more than doubled from 2019 to 2024, while news media attention related to Business Ethics declined by 43% over the same period. Surprisingly, Data Security(green)—an important threat in this industry—appears to be a relatively less salient issue in terms of media attention and shows a sharp drop between 2017 and 2024. It is also worth noting that Employee Engagement (light pink) and Labour Practices (dark purple) demonstrate long-term salience and a stable level of media attention. Overall, the evidence highlights that stakeholders’ perceived salience of ESG issues in this industry can either shift rapidly or remain constant over time.

Figure 6.

ESG media attention at the industry-level all ESG issues—Commercial Banks (2014–2024).

Overall, across the industries analyzed, news media attention to the 26 SASB-informed ESG issues revealed distinct temporal dynamics. Some issues consistently drew sustained media attention, while others experienced a decline in coverage over the period of analysis. Most importantly, several industries exhibited notable intra-industry variation in media attention across the 26 SASB-informed ESG issues, suggesting that stakeholder priorities do shift over time and highlight the importance of periodically reassessing which ESG issues are most salient.

4.2. ESG Media Attention to Financially Material Issues over Time at the Industry Level

The second approach focuses more narrowly on the financially material ESG issues identified by SASB for each industry. For this analysis, we recalculated the yearly average Volume scores using only the subset of issues identified as financially material for the firm’s respective industry. We then reweighted the Volume scores so that their combined total equals 100%, redistributing attention proportions among the subset of financially material ESG issues only. This adjustment ensures comparability and interpretability across firms and industries. Thus, the resulting charts track relative changes in media attention among the most critical ESG issues, enabling an assessment of how stakeholder expectations vary over time among issues expected to remain consistently salient within the same industry. One chart per industry illustrates these dynamics.

In the Biotechnology and Pharmaceuticals industry, Figure 7 below, news media attention to financially material ESG issues reveals both stability and sharp variations over time. As expected, stakeholder expectations about Access and Affordability (orange) of pharmaceutical products dominated media coverage, with an 11-year average of 46.7% (Figure 7). Media attention to this ESG issue nearly doubled between 2019 and 2021, likely driven by COVID-19-related scrutiny in the pharmaceutical industry, before declining again [27]. While this surge may be context-specific and expected, it nonetheless illustrates the shifting salience of ESG issues over time and supports our broader argument about the dynamic nature of stakeholders’ perceived salience of ESG issues. Similarly, media attention to Product Quality and Safety (green), another essential matter in this industry, rose by 62% between 2016 and 2019, followed by a 50% drop when compared to 2021. In comparison, stakeholder concerns about Customer Welfare (blue) and Supply Chain Management (brown) remained salient but relatively stable.

Figure 7.

ESG media attention at the industry level: financially material ESG issues—Biotechnology and Pharmaceuticals (2014–2024).

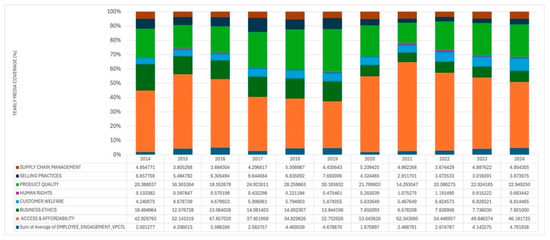

Figure 8 corroborates, through news media attention trends, the SASB-informed financial materiality of Supply Chain (dark blue) and Customer Welfare (dark pink) in the Processed Foods industry over the period under analysis. Although less salient from a media attention perspective, Product Lifecycle (green) and Energy Management (pink) exhibited significant increases in stakeholder expectation, both issues showing a more than twofold increase in media attention during the period under analysis. By contrast, Selling Practices experienced a sharp decline of nearly 70% between 2016 and 2021 (see Figure 8 below). Surprisingly, despite being classified as financial material by SASB, Material Sourcing (brown) and Wastewater Management (orange) remained consistently low and stable in terms of media attention. These trends suggest that while some core issues remain both salient and financially material, others have faded from public scrutiny despite their SASB’s financial materiality designation.

Figure 8.

ESG media attention at the industry level: financially material ESG issues—Processed Foods (2014–2024).

Across the SASB-informed financially material ESG issues in the Multiline and Specialty Retailers and Distributors industry, we observe in Figure 9 below, that Data Security (light pink) dropped by 77% in terms of media attention over the period under analysis, while Product Lifecycle (dark gray) more than quadrupled in terms of news media attention. Stakeholder concerns about Employee Engagement (green) exhibited lower relative media attention overall, but considerable variation, more than doubling in 2018, followed by a substantial decline, and a renewed upward trend through 2024. Labour Practices (purple) consistently attracted high levels of media attention throughout the period, reaching a notable peak in 2020–2021, when it accounted for 56% of total media coverage across SASB-informed material issues in this industry. This surge was likely amplified by COVID-19-related concerns over front-line worker safety, compensation, and working conditions [27]. While partially expected, it reinforces the issue’s high perceived materiality and the evolving salience of stakeholder expectations during crisis periods. Again, Figure 9 highlights the differentiated trajectories that even financially material ESG issues can follow in response to changing stakeholder scrutiny, which shifts in reaction to broader societal or macro-level events.

Figure 9.

ESG media attention at the industry level: financially material ESG Issues—Multiline and Specialty Retailers and Distributors (2014–2024).

Among the eight SASB-informed financially material issues for the Non-Alcoholic Beverages industry, see the list at the bottom of Figure 10. Selling Practices (blue) and Customer Welfare (dark green) were marked by high variability in media attention, including multiple year-over-year changes greater than 50%, as shown in Figure 10. Media attention to Wastewater Management (orange) has been notably modest when compared to other ESG issues in the beverage industry. Although media attention to Wastewater Management more than quadrupled between 2014 (3.5%) and 2017 (14.7%), it subsequently declined and stabilized at levels comparable to those observed in 2014. This trend is surprising given the strategic importance of water in this sector and the increasing visibility of climate-related events affecting water availability and quality. By contrast, media attention to Product Lifecycle (purple) rose significantly in 2018 and remained steady afterward, averaging 12% of total media attention from 2019 to 2024. In the context of this industry, the media attention trend aligns with growing stakeholder concerns with packaging waste, recyclability, and the environmental impact of products beyond the point of sale. These patterns indicate again that even among financially material ESG issues, stakeholder expectations can shift unpredictably.

Figure 10.

ESG media attention at the industry level: financially material ESG issues—Non-Alcoholic Beverages (2014–2024).

Turning to Figure 11, we again corroborate through media attention both the materiality and the substantial shifts over time in the level of stakeholders’ perceived salience regarding the issues of Access and Affordability (purple) and Business Ethics (blue) in the Commercial Banks industry. While media attention about financial products Access and Affordability increased nearly threefold between 2019 and 2023, Business Ethics exhibits a sharp drop over the same period. Notably, media attention to Product Lifecycle Management (orange) more than doubled over the period under analysis. These shifts likely reflect the post-2019 macro context, particularly the COVID-19 crisis, which heightened concerns about equitable access to financial services. As economic insecurity increased, stakeholder scrutiny turned toward banks’ role in supporting vulnerable populations through affordable credit and inclusive financial products. At the same time, earlier concerns about business ethics may have receded, possibly due to prior governance reforms [28] or being temporarily eclipsed by crisis-related priorities. Taken together, these patterns suggest complex and evolving stakeholder dynamics in this highly scrutinized industry.

Figure 11.

ESG media attention at the industry level: financially material ESG issues—Commercial Banks (2014–2024).

The evidence presented and discussed above shows that even SASB-informed financially material ESG issues exhibit evolving patterns over time, reflecting shifting stakeholder expectations. This underscores that financial materiality alone does not necessarily equate to stable salience of stakeholder concerns. More importantly, this evidence complements our earlier analysis of all 26 ESG issues by offering a more focused perspective on how financially material concerns can also be subject to temporal volatility, reinforcing the evolving nature of stakeholders and perceived salience of ESG issues.

4.3. ESG Media Attention over Time at the Firm Level: Illustrative Cases

Our third approach shifts the focus from the industry level to the firm level. Due to space constraints, we selected one firm per industry that exhibited notable media attention patterns. Hence, for each industry, we present a firm-level chart tracking the distribution of news media attention across the 26 ESG issues, allowing direct comparison with industry-level averages previously discussed. It is worth noting that this analysis aims to examine whether stakeholders’ perceived salience of specific ESG issues, proxied by media attention, aligns with, diverges from, or amplifies broader industry patterns. The primary objective is to explore and document whether stakeholder expectations, as reflected in media attention, tend to mimic industry-wide concerns or reveal firm-specific salience profiles. It is also important to note that this study does not seek to explain the causes of firm-level variation in media attention, nor does it investigate whether firm-level events or controversies triggered the observed patterns. Likewise, it does not assess whether or how firms responded to high scrutiny. These questions, while relevant, fall outside the scope of this analysis. As such, our goal is to provide insights into how ESG-related media attention, and, consequently, stakeholders’ perceived salience of ESG issues can manifest idiosyncratically at the firm level.

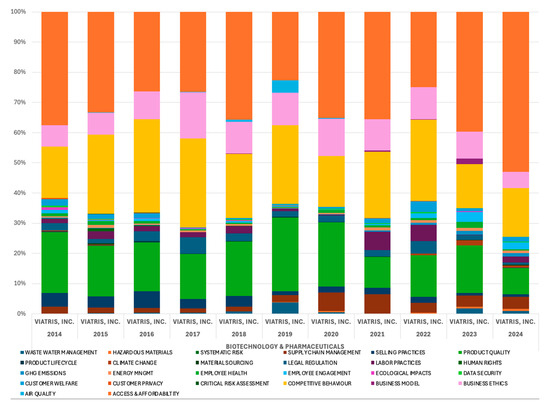

As shown in Figure 12, in the Biotechnology and Pharmaceuticals industry, Viatris (Viatris was formed in 2020 through a merger between Mylan and Upjohn, a former division of Pfizer) exhibits clear divergence from its industry’s media attention trends. While the industry saw a 34% decline in news media attention to Access and Affordability (orange) between 2021 and 2024, Viatris more than doubled its coverage on this issue during the same period, with high relative media attention ranging from 24.8% to 53% over the period under analysis. Viatris also received markedly higher attention on Competitive Behaviour (yellow), with a mean media attention of 23% compared to an industry mean of 9.4%. Moreover, while media attention on Product Quality (green) remained relatively stable at the industry level, Viatris recorded a 64% spike between 2017 and 2019. These patterns underscore that stakeholder priorities can have different patterns at the firm level, emphasizing that ESG materiality is not uniformly experienced within an industry.

Figure 12.

ESG media attention at the firm level: Viatris—Biotechnology and Pharmaceuticals (2014–2024).

Within the Processed Foods industry, J.M. Smucker Co. exhibits notable fluctuations that contrast with the industry’s trends (Figure 13). Concerns about Product Quality (green) attracted significantly more media attention at J.M. Smucker Co., with an average of 41% compared to the industry mean of 15.5%. Further, J.M. Smucker Co. experienced a nearly fourfold increase in media attention to Product Quality between 2016 and 2017. Notably, while Customer Welfare (dark blue) remained stable at the industry level, J.M. Smucker Co. experienced dramatic shifts in media attention to this ESG issue, including an 87% decline in 2018, followed by a sharp rebound in media attention levels from 2.7% to 22.1% from 2019 to 2024. These differences reinforce the view that firms can experience unique trajectories in ESG salience, even within the same industry. This observation underscores a key limitation of static sector-based materiality maps, which may overlook firm-specific stakeholder expectations and the dynamic influence of external societal events.

Figure 13.

ESG media attention at the firm level: J M Smucker Co.—Processed Foods (2014–2024).

Target Corp. stands out with a marked divergence in several ESG issues (Figure 14) when compared to peers in the Multiline and Specialty Retailers and Distributors industry (Figure 4). Its 11-year average level of media attention to Data Security (pink) was 24.5%, far above the industry average of 7%. Moreover, while media attention to Labour Practices (purple) remained steady at the industry level, Target Corp. experienced a sharp and sustained increase in media attention to this issue between 2014 and 2019. These firm-level deviations highlight how stakeholders’ perceived salience over particular ESG issues can intensify for individual firms, regardless of broader industry trends.

Figure 14.

ESG media attention at the firm level: Target Corp.—Multiline and Specialty Retailers and Distributors (2014–2024).

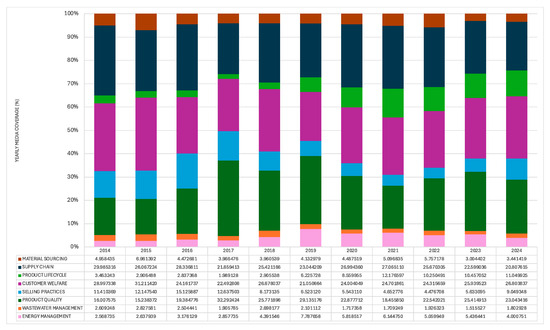

As shown in Figure 15 below, Keurig Dr Pepper Inc. exhibited media attention firm-specific shifts that diverged from its peers in the Non-Alcoholic Beverages industry. Keurig Dr Pepper Inc. experienced a more than threefold increase in media attention on Product Lifecycle (gray) between 2018 and 2023, while industry-level media attention to this issue remained relatively low and stable. Further, while at the industry level, news media attention to Customer Welfare (dark blue) increased over the period and exhibited significant year-to-year fluctuations (see Figure 5 and Figure 10), indicating a volatile pattern, Keurig Dr Pepper Inc. experienced a sharp decline in media attention over this issue during the same period. As shown in Figure 15, at Keurig Dr Pepper Inc., media attention on Wastewater Management (pink) and Product Quality (light green) also diverged from industry means. These patterns further suggest that stakeholder concerns, and consequently perceived salience, can evolve uniquely at the firm level, underscoring again a key limitation of traditional static sector-based materiality maps.

Figure 15.

ESG media attention at the firm level: Keurig Dr Pepper Inc.—Non-Alcoholic Beverages (2014–2024).

Truist Financial Corp. (Figure 16) displayed multiple points of divergence in terms of media attention from its peers in the Commercial Bank industry (Figure 6). Truist Financial Corp. experienced greater media attention to Business Ethics (blue) and Access and Affordability (dark pink) than the industry’s average level of media attention to these ESG issues. Truist Financial Corp. also exhibits important year-to-year fluctuations in media attention to Employee Engagement (light pink), which contrasts with its industry trends over the same period. These differences provide additional support to our argument that ESG materiality is shaped by firm-specific profile and deviations from industry norms.

Figure 16.

ESG media attention at the firm level: Truist Financial Corp.—Commercial Banks (2014–2024).

Taken together, the evidence provided by our firm-level analysis illustrates the evolving nature of stakeholders’ perceived salience of ESG issues and that such salience does not always follow industry-level patterns. Even within the same industry, firms may experience spikes or declines in stakeholder expectations about specific ESG issues, likely due to firm-specific attributes, events, controversies, or governance practices. While identifying the specific events or firm-level determinants that drive these variations falls outside the scope of our study, our findings open unique opportunities for future research to explore the underlying causes of shifting stakeholder expectations. News media attention, therefore, offers a valuable lens for capturing how materiality evolves over time, not only across industries but also within individual firms.

5. Discussion

This study examined whether and how stakeholders’ perceived salience of ESG issues, as captured through news media attention, reflects the evolving nature of ESG materiality. Drawing on longitudinal data (2014–2024) on ESG-related news media attention from the FactSet Truvalue Labs for 27 firms listed in the S&P 500 index across five different industries and focusing on the 26 SASB-informed ESG issues, this study analyzed media attention patterns across ESG issues, across industries, and among firms within the same industry. Overall, our analysis reveals clear patterns indicating that stakeholder concerns evolve over time in response to shifting societal expectations, regulatory developments, and market forces. These patterns, in turn, support the view of the dynamic and firm-specific nature of ESG materiality.

More specifically, at the industry level, our analysis reveals significant temporal variation in media attention across the full set of 26 ESG issues. While some ESG issues maintain consistent levels of relative attention over time within particular industries, others display shifting patterns over time, and these patterns vary substantially across industries. This underscores the evolving and context-specific nature of stakeholder expectations. Our second level of analysis, which focused on media attention to SASB-informed financially material ESG issues, confirmed that even among issues with recognized financial relevance, news media attention varied substantially over time. These patterns reveal that stakeholder expectations are not static, and that firms may face distinct levels of scrutiny even on issues traditionally considered material for the industry. This supports the view that media coverage of ESG issues generates risk by creating conditions that heighten the potential and need for stakeholder engagement, in line with stakeholder theory [11,18]. Moreover, our findings suggest that media coverage may exert a broader and deeper influence on how firms respond to stakeholder interests than previously recognized, pointing to important implications for future research on corporate responsiveness to shifting stakeholder pressures [12]. Our findings also corroborate the idea that market-level perceptions can serve as an intrinsic motivator for firms to fulfill their social responsibilities [15], even in the absence of direct regulatory or financial incentives [29].

Our firm-level analysis deepens the understanding of industry-level patterns by revealing meaningful intra-industry variation. More precisely, while some firms mirrored their industry’s media attention across ESG issues, other firms diverged significantly. For example, Viatris and Truist Financial Corp. experienced increases in media attention to issues that declined at the industry level, indicating firm-specific events or governance practices that altered stakeholder expectations. These deviations underscore the idea that ESG issue salience is not only temporally dynamic but also varies across firms even within the same industry. In this context, the use of news media attention as a proxy for stakeholder expectations and pressure proves valuable for identifying shifts in financial risks [24,30].

Our findings carry important implications. First, they suggest that static ESG materiality maps may be insufficient for guiding long-term sustainability strategies or relevant sustainability disclosure. Our evidence suggests that firms may benefit from adopting a more agile approach to materiality assessment, continuously monitoring changes in stakeholder expectations. Failure to respond to rising stakeholder concerns can result in reputational damage, reduced legitimacy, and eventual regulatory or investor backlash [10,12]. Firms should also recognize that emerging ESG issues, those eventually not yet considered as material, may rapidly become salient due to external pressures.

For investors, our results highlight the usefulness of media-based ESG signals in complementing traditional ESG materiality assessments [5,29,31]. Because ESG ratings and disclosure frameworks often rely on backward-looking data, investors may miss early signals of stakeholder discontent or shifting societal priorities. By tracking media attention to ESG issues over time, investors can identify emerging risks and opportunities, anticipate required changes in corporate behavior, and adjust portfolio strategies accordingly. This forward-looking lens aligns with the broader shift in sustainable finance toward dynamic risk management and active stewardship [16].

At the same time, our findings open several avenues for future research on how stakeholder expectation evolves across firms and industries. While news media attention serves as a useful proxy for shifts in stakeholder expectations, it may be shaped by biases related to firm visibility, size, or notoriety, and may not fully capture the range of stakeholder types or the divergent interests they represent. Future research could triangulate media-based indicators with direct measures of stakeholder engagement, such as shareholder proposals, consumer campaigns, or employee activism, to build a more comprehensive view of what influences perceptions of ESG materiality. Additionally, while this study focuses on 27 purposefully selected cases covering five industries, future research could build and extend our analysis to a broader range of firms and industries to offer additional empirical insights into the evolving nature of stakeholder expectations and the shifting salience of ESG issues.

6. Conclusions

Our study offers compelling evidence about the evolving nature of ESG materiality. The data show that stakeholders’ perceived salience of ESG issues, as reflected in news media attention, vary over time, differ across ESG issues, and are unevenly distributed across industries and even among firms within the same industry (intra-industry differences). These findings highlight that ESG materiality is inherently dynamic, with important implications for both firms and investors. Acknowledging and adapting to this dynamic is crucial for building resilient ESG strategies and maintaining alignment with evolving societal expectations.

In particular, our results underscore the need for more adaptive and forward-looking sustainability disclosure practices. As ESG issues rise or fall in stakeholders’ perceived salience, driven by public discourse, regulatory momentum, and evolving societal concerns, disclosure frameworks must remain responsive. Efforts to normalize sustainability reporting through standardized taxonomies and frameworks must account for this fluidity. A static or uniform approach risks misrepresenting which issues truly matter to stakeholders at a given time or in a specific context. In this light, dynamic materiality should be viewed not only as an analytical lens but also as a guiding principle for designing disclosure frameworks that can accommodate evolving stakeholder priorities and industry-specific transitions.

Our study also opens several avenues for future research. Scholars may expand on our approach by triangulating media-based measures with other sources of stakeholder salience, such as NGO campaigns, shareholder resolutions, or social media engagement. Further studies using larger samples could explore how dynamic materiality correlates with shareholder decisions, or even causally influences investor activism and firm behavior.

We hope our study contributes to a more nuanced understanding of ESG materiality and encourages further research into how firms and investors can better anticipate and respond to this shifting landscape.

Author Contributions

This article is a joint work of both authors. F.S. and E.S. contributed equally to the development of research ideas, the literature review, research methods, data collection, data analysis, and writing the manuscript. Both authors read and approved the published version of the manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available from FactSet Truvalue Labs: “https://www.factset.com/marketplace/catalog/product/factset-truvalue-scores-and-spotlights (accessed on 14 January 2025)”. Restrictions apply to the availability of these data, which were used under license from HEC Montréal, and so are not publicly available. Data are, however, available from the authors upon request.

Acknowledgments

An earlier version of this article was presented at a workshop organized by the International Sustainability Standards Board (ISSB) in Montréal on 12 May 2025, and we are grateful for the valuable feedback provided by the participants and two ISSB members. The authors are also grateful to Mohamed Jabir for his assistance in data accessibility through the Laboratoire de calcul et d’exploitation des données (LACED) of HEC Montréal.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

List of Selected Firms and Their Industry Classification.

Table A1.

List of Selected Firms and Their Industry Classification.

| # | Name | GICS | SASB’ SICS |

|---|---|---|---|

| 1 | Citigroup Inc. | Diversified Banks | Commercial Banks |

| 2 | PNC Financial Services | ||

| 3 | Truist Financial Corp. | ||

| 4 | U.S. Bancorp | ||

| 5 | Wells Fargo & Co. | ||

| 6 | Conagra Brands Inc. | Packaged Foods and Meats | Processed Foods |

| 7 | Campbell Soup Cp. | ||

| 8 | General Mills Inc. | ||

| 9 | Hershey Co. | ||

| 10 | Kellanova | ||

| 11 | Mondelez International | ||

| 12 | McCormick & Co. Inc. | ||

| 13 | J M Smucker Co. | ||

| 14 | Costco Wholesale Corp. | Consumer Staples Merchandise Retail | Multiline and Specialty Retailers and Distributors |

| 15 | Dollar Tree Inc. | ||

| 16 | Target Corp. | ||

| 17 | Walmart Inc. | ||

| 18 | Keurig Dr Pepper Inc. | Soft drinks | Non-Alcoholic Beverages |

| 19 | Coca-Cola Co. | ||

| 20 | Monster Beverage Corp. | ||

| 21 | PepsiCo Inc. | ||

| 22 | Bristol-Myers Squibb Co. | Pharmaceuticals | Biotechnology and Pharmaceuticals |

| 23 | Johnson & Johnson | ||

| 24 | Eli Lilly & Co. | ||

| 25 | Merck & Co. Inc. | ||

| 26 | Pfizer Inc. | ||

| 27 | Viatris, Inc. |

Appendix B

Table A2.

The 2014 Volume Score (%) for Johnson & Johnson—All 26 ESG Issues.

Table A2.

The 2014 Volume Score (%) for Johnson & Johnson—All 26 ESG Issues.

| SASB SICS: | Firm Name: | |

|---|---|---|

| Biotechnology and Pharmaceuticals | Johnson & Johnson | Y: 2014 |

| DIMENSION | SASB-informed ESG Issue | Media Attention (%) |

| SOCIAL | PRODUCT QUALITY | 25.56 |

| SOCIAL | ACCESS AFFORDABILITY | 22.54 |

| GOVERNANCE | BUSINESS ETHICS | 14.50 |

| SOCIAL | SELLING PRACTICES and LABELING | 10.11 |

| GOVERNANCE | COMPETITIVE BEHAVIOUR | 5.99 |

| GOVERNANCE | SUPPLY CHAIN MANAGEMENT | 3.29 |

| GOVERNANCE | MGMT OF THE LEGAL and REGUL. ENV. | 3.20 |

| SOCIAL | EMPLOYEE ENGAGEMENT and EDI | 2.34 |

| SOCIAL | LABOR PRACTICES | 2.04 |

| SOCIAL | CUSTOMER WELFARE | 1.60 |

| SOCIAL | EMPLOYEE HEALTH | 1.44 |

| ENVIRONMENT | ENERGY MANAGEMENT | 1.40 |

| SOCIAL | DATA SECURITY | 1.29 |

| ENVIRONMENT | GHG EMISSIONS | 0.93 |

| ENVIRONMENT | ECOLOGICAL IMPACT | 0.76 |

| ENVIRONMENT | WASTEWATER MANAGEMENT | 0.55 |

| GOVERNANCE | PRODUCT LIFECYCLE | 0.53 |

| ENVIRONMENT | HAZARDOUS MATERIALS | 0.47 |

| GOVERNANCE | MATERIAL SOURCING | 0.46 |

| GOVERNANCE | CRITICAL INCIDENT RISK ASSESS. | 0.31 |

| SOCIAL | CUSTOMER PRIVACY | 0.27 |

| SOCIAL | HUMAN RIGHTS | 0.25 |

| ENVIRONMENT | AIR QUALITY | 0.10 |

| GOVERNANCE | BUSINESS MODEL RESILIENCE | 0.07 |

| GOVERNANCE | SYSTEMATIC RISK MANAGEMENT | 0.00 |

| ENVIRONMENT | CLIMATE CHANGE | 0.00 |

| Total: | 100.00 |

Note: Lines highlighted in gray represent the SASB-identified financially material ESG issues for the Biotechnology and Pharmaceuticals industry.

References

- World Economic Forum. Embracing the New Age of Materiality Harnessing the Pace of Change in ESG. 2020. Available online: https://www3.weforum.org/docs/WEF_Embracing_the_New_Age_of_Materiality_2020.pdf (accessed on 6 March 2025).

- World Economic Forum. 3 Paradigm Shifts in Corporate Sustainability Mark New Era of ESG. 2021. Available online: https://www.weforum.org/stories/2021/09/3-paradigm-shifts-in-corporate-sustainability-to-esg/ (accessed on 6 March 2025).

- International Financial Reporting Standards. IFRS S1 General Requirements for Disclosure of Sustainability-Related Financial Information. 2023. Available online: https://www.ifrs.org/issued-standards/ifrs-sustainability-standards-navigator/ifrs-s1-general-requirements/#standard (accessed on 10 February 2025).

- International Financial Reporting Standards. IFRS S2 Climate-Related Disclosure. 2023. Available online: https://www.ifrs.org/issued-standards/ifrs-sustainability-standards-navigator/ifrs-s2-climate-related-disclosures/ (accessed on 10 February 2025).

- IFRS Sustainability. Sustainability-Related Risks and Opportunities and the Disclosure of Material Information: Educational Material. 2024. Available online: https://www.ifrs.org/content/dam/ifrs/supporting-implementation/issb-standards/issb-materiality-education-material.pdf (accessed on 10 February 2025).

- Pollack, A. Drug Goes From $13.50 a Tablet to $750, Overnight. The New York Times, 20 September 2015. Available online: https://www.nytimes.com/2015/09/21/business/a-huge-overnight-increase-in-a-drugs-price-raises-protests.html (accessed on 7 May 2025).

- Crow, D. Mylan Chief Comes Under Fire Over Cost of EpiPen. Financial Times, 21 September 2016. Available online: https://www.ft.com/content/64f0cb22-8040-11e6-bc52-0c7211ef3198 (accessed on 9 May 2025).

- Johnson, C.Y. An Old Drug Gets a New Price to Fight a Rare Disease: $89,000 a Year. The Washington Post, 10 February 2017. Available online: https://www.washingtonpost.com/news/wonk/wp/2017/02/10/an-old-drug-gets-a-new-price-to-fight-a-rare-disease-89000-a-year/ (accessed on 10 May 2025).

- Yin, R.K. Case Study Research: Design and Methods, 3rd ed.; SAGE Publications: London, UK, 2003. [Google Scholar]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The Impact of Corporate Sustainability on Organizational Processes and Performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Parmar, B.L.; Freeman, R.E.; Harrison, J.S.; Wicks, A.C.; Purnell, L.; De Colle, S. Stakeholder theory: The state of the art. Acad. Manag. Ann. 2010, 4, 403–445. [Google Scholar] [CrossRef]

- Shipilov, A.V.; Greve, H.R.; Rowley, T.J. Is all publicity good publicity? The impact of direct and indirect media pressure on the adoption of governance practices. Strateg. Manag. J. 2019, 40, 1368–1393. [Google Scholar] [CrossRef]

- International Finance Corporation (IFC). Who Cares Wins: Embedding Environmental, Social and Governance Issues in Investment Markets (2004–2008); International Finance Corporation: Washington, DC, USA, 2008; Available online: https://documents1.worldbank.org/curated/en/444801491483640669/pdf/113850-BRI-IFC-Breif-whocares-PUBLIC.pdf (accessed on 12 May 2025).

- CFA Institute. The Role and Rise of ESG Ratings. 23 December 2024. Available online: https://www.cfainstitute.org/insights/articles/the-role-and-rise-of-esg-ratings (accessed on 21 April 2025).

- Wang, Y.; Sun, G.; Yan, X.; Zhang, Y. Interest rate marketization and corporate social responsibility. Financ. Res. Lett. 2025, 83, 107745. [Google Scholar] [CrossRef]

- Amel-Zadeh, A.; Serafeim, G. Why and how Investors Use ESG Information: Evidence from a global survey. Financ. Anal. J. 2018, 74, 87–103. [Google Scholar] [CrossRef]

- Eccles, R.G.; Stroehle, J. Exploring Social Origins in the Construction of ESG Measures. SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The stakeholder theory of the corporation: Concepts, evidence, and implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Busco, C.; Consolandi, C.; Eccles, R.G.; Sofra, E. A preliminary analysis of SASB reporting: Disclosure topics, financial relevance, and the financial intensity of ESG materiality. J. Appl. Corp. Financ. 2020, 32, 117–125. [Google Scholar] [CrossRef]

- Schiehll, E.; Kolahgar, S. Common ownership and investor-focused disclosure: Evidence from ESG financial materiality. Bus. Strategy Environ. 2025, 34, 497–515. [Google Scholar] [CrossRef]

- Madison, N.; Schiehll, E. The Effect of Financial Materiality on ESG Performance Assessment. Sustainability 2021, 13, 3652. [Google Scholar] [CrossRef]

- Calace, D. Double and Dynamic: Understanding the Changing Perspectives on Materiality. 2 September 2020. Available online: https://sasb.ifrs.org/blog/double-and-dynamic-understanding-the-changing-perspectives-on-materiality/ (accessed on 5 January 2025).

- Clark, C.; Arora, P.; Gabaldón, P.; Jain, T. Global Social Movements and the Governance of the Firm: Past, Present, and Future. Corp. Gov. Int. Rev. 2024, 33, 782–795. [Google Scholar] [CrossRef]

- Kolbel, J.F.; Busch, T.; Jancso, L.M. How media coverage of corporate social irresponsibility increases financial risk. Strateg. Manag. J. 2017, 38, 2266–2284. [Google Scholar] [CrossRef]

- FactSet. ESG Data and Analytics from Truvalue Labs. 2024. Available online: https://go.factset.com/hubfs/Website/Resources%20Section/Brochures/esg-data-and-analytics-from-truvalue-labs-brochure.pdf (accessed on 7 December 2024).

- SASB. Sustainable Industry Classification System (SICS). Available online: https://sasb.ifrs.org/wp-content/uploads/2018/11/SICS-Industry-List.pdf (accessed on 9 January 2025).

- Piwowar-Sulej, K.; Malik, S.; Shobande, O.A.; Singh, S.; Dagar, V. A contribution to sustainable human resource development in the era of the COVID-19 pandemic. J. Bus. Ethics 2024, 191, 337–355. [Google Scholar] [CrossRef] [PubMed]

- Ikäheimo, S.; Schiehll, E.; Sinha, V.K. Board response to transnational regulation on corporate governance: A case study on EU banking regulation. Risks 2024, 12, 2. [Google Scholar] [CrossRef]

- Wu, S.R.; Shao, C.; Chen, J. Approaches on the screening methods for materiality in sustainability reporting. Sustainability 2018, 10, 3233. [Google Scholar] [CrossRef]

- International Federation of Accountants (IFAC). FAQ—Explaining Materiality in Corporate Reporting; International Federation of Accountants (IFAC): New York, NY, USA, 2024; Available online: https://www.ifrs.org/news-and-events/news/2024/05/ifrs-foundation-and-efrag-publish-interoperability-guidance/ (accessed on 6 January 2025).

- KPMG International. The Essentials of Materiality Assessment; KPMG International: Amstelveen, The Netherlands, 2014; Available online: https://assets.kpmg.com/content/dam/kpmg/pdf/2014/10/materiality-assessment.pdf (accessed on 7 January 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).