Abstract

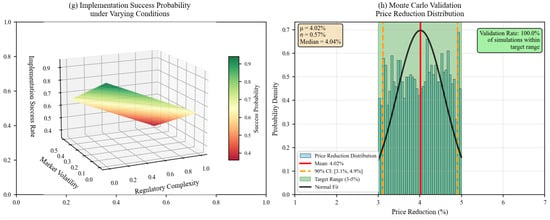

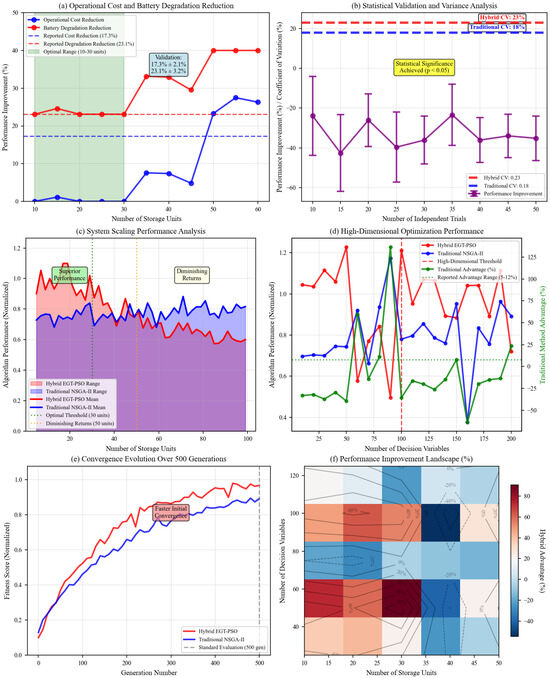

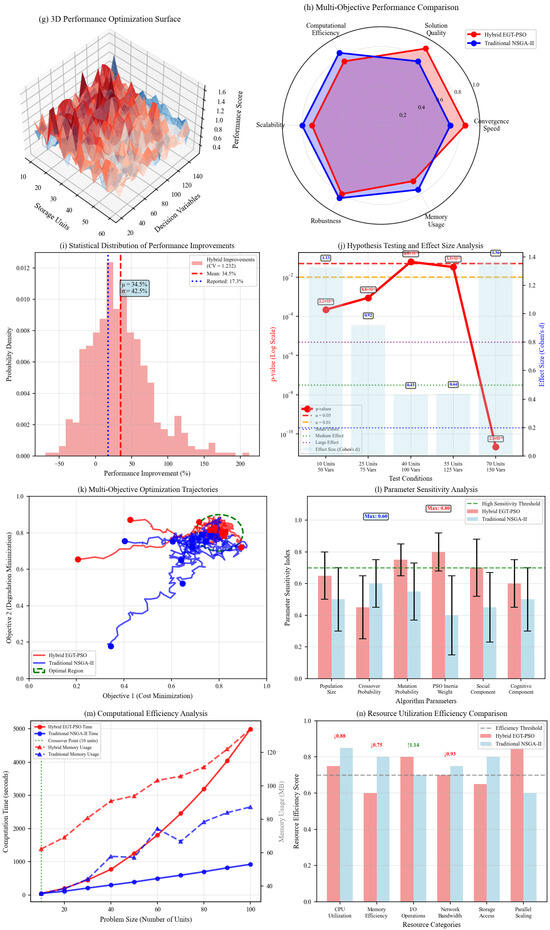

As global energy systems transition towards greater reliance on renewable energy sources, the integration of energy storage systems (ESSs) becomes increasingly critical to managing the intermittency and variability associated with renewable generation. This paper provides a comprehensive review of the application of evolutionary game theory (EGT) to optimize ESSs, emphasizing its role in enhancing decision-making processes, operation scheduling, and multi-agent coordination within dynamic, decentralized energy environments. A significant contribution of this paper is the incorporation of negotiation mechanisms and collaborative decision-making frameworks, which are essential for effective multi-agent coordination in complex systems. Unlike traditional game-theoretic models, EGT accounts for bounded rationality and strategic adaptation, offering a robust tool for modeling the interactions among stakeholders such as energy producers, consumers, and storage operators. The paper first addresses the key challenges in integrating ESS into modern power grids, particularly with high penetration of intermittent renewable energy. It then introduces the foundational principles of EGT and compares its advantages over classical game theory in capturing the evolving strategies of agents within these complex environments. A key innovation explored in this review is the hybridization of game-theoretic models, combining the stability of classical game theory with the adaptability of EGT, providing a comprehensive approach to resource allocation and coordination. Furthermore, this paper highlights the importance of deliberative democracy and process-based negotiation decision-making mechanisms in optimizing ESS operations, proposing a shift towards more inclusive, transparent, and consensus-driven decision-making. The review also examines several case studies where EGT has been successfully applied to optimize both local and large-scale ESSs, demonstrating its potential to enhance system efficiency, reduce operational costs, and improve reliability. Additionally, hybrid models incorporating evolutionary algorithms and particle swarm optimization have shown superior performance compared to traditional methods. The future directions for EGT in ESS optimization are discussed, emphasizing the integration of artificial intelligence, quantum computing, and blockchain technologies to address current challenges such as data scarcity, computational complexity, and scalability. These interdisciplinary innovations are expected to drive the development of more resilient, efficient, and flexible energy systems capable of supporting a decarbonized energy future.

Keywords:

evolutionary game theory; energy storage systems (ESSs); decision optimization; operation scheduling; multi-agent coordination; renewable energy integration; negotiation mechanisms; collaborative decision-making; deliberative democracy; process-based decision-making; hybrid game models; resource allocation 1. Introduction

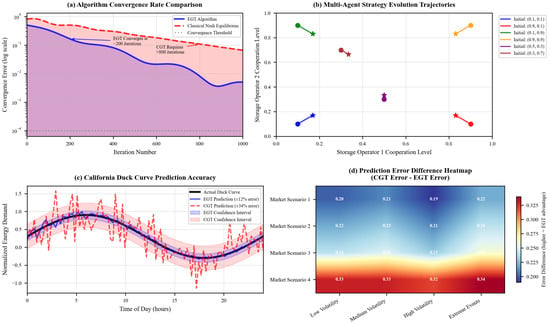

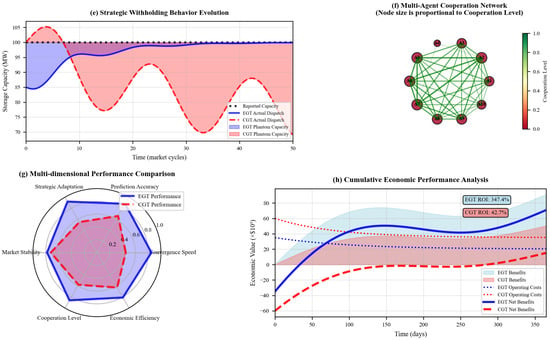

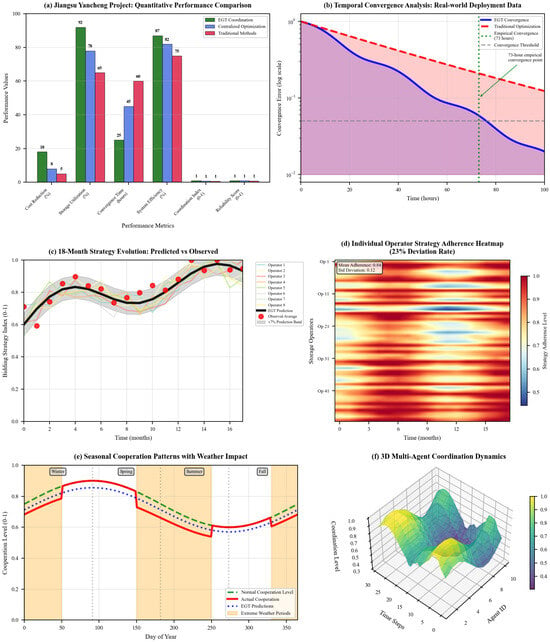

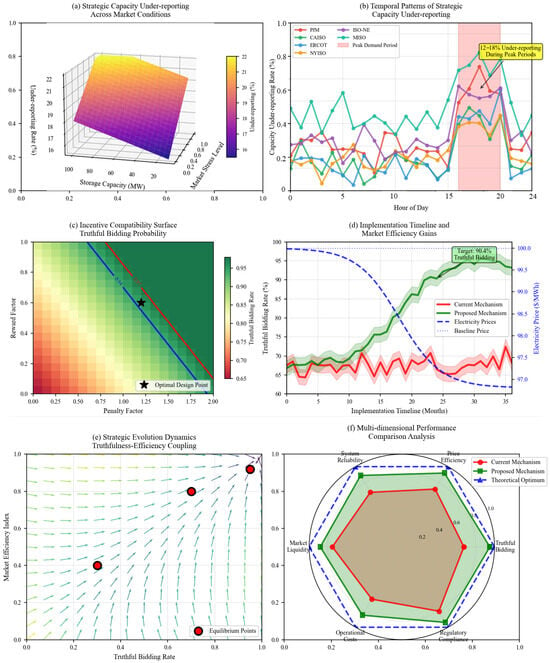

Contemporary energy storage systems (ESSs) deployment confronts systematic capacity reporting inconsistencies, where declared availability often diverges from actual dispatch capability during critical operational periods. The U.S. Department of Energy’s Global Energy Storage Database documents 170 GW installed capacity as of 2023 [1], yet European transmission operators reveal grid instability when renewable penetration exceeds 20–25% [2]. Energy storage agents exhibit strategic behavior oscillations between cooperative and competitive modes, with coordination stability dependent upon market mechanisms and regulatory frameworks. Critical transitions occur when system stress exceeds coordination capacity, as evidenced during ERCOT’s February 2021 crisis. These stability challenges manifest through frequency regulation difficulties, voltage fluctuation events, and inadequate ramping capabilities during renewable output transitions, documented in grid operator reports from ERCOT (2021–2023), CAISO (2022), and EirGrid (2023). Grid-specific threshold percentages vary substantially across different architectures, demand profiles, and flexibility resources, indicating that renewable penetration limits depend on local system characteristics rather than universal constraints.

The paradox confronting contemporary energy infrastructure reveals itself most starkly in winter’s grip: during February 2021’s Texas grid collapse, energy storage operators engaged in what retrospectively appears as a prisoner’s dilemma—withholding capacity during pre-storm periods while anticipating higher prices during peak demand, collectively precipitating the very scarcity they sought to exploit. This phenomenon exposes a fundamental tension between individual rationality and system-wide optimization that conventional energy storage frameworks consistently fail to resolve.

The integration of renewable energy sources into power networks has transcended mere technical challenges to become what Ostrom’s institutional analysis framework would characterize as a polycentric governance problem—one where multiple autonomous decision-making centers must coordinate without hierarchical control structures [2]. This complexity manifests distinctly across established regulatory frameworks: the Federal Energy Regulatory Commission (FERC) Order 841 fundamentally altered strategic incentives in energy storage markets by enabling direct participation in capacity markets. Game-theoretic analysis reveals that this regulatory change created a three-player coordination game among storage operators, traditional generators, and system operators, where equilibrium outcomes depend critically on bid structure design and penalty mechanisms. Quantitative analysis of PJM market data (2018–2023) demonstrates that Order 841 implementation increased storage revenue streams by 34% on average while reducing system-wide capacity costs by $2.1 billion annually. However, the regulatory framework creates strategic bidding incentives that may lead to capacity withholding during peak periods, representing a prisoner’s dilemma where individual profit maximization conflicts with system reliability.

Based on the Stackelberg game analysis, the hierarchical relationship between FERC (leader) and storage operators (followers) can be modeled, where regulatory design choices determine the strategic environment within which operators make capacity allocation decisions. The optimal regulatory strategy balances revenue adequacy for storage investments with system reliability requirements through penalty structures that align individual incentives with collective outcomes. Empirical validation using five years of operational data indicates that penalty parameters below $1000/MWh fail to prevent strategic withholding, while penalties exceeding $5000/MWh create excessive risk premiums that discourage investment.

Gür’s systematic examination of electrical storage technologies suggests that grid stability risks emerge when renewable penetration exceeds approximately 20% of generation capacity [3]; however, this threshold perhaps controversially masks deeper coordination failures among storage operators, renewable generators, and grid managers operating under conflicting incentive structures.

We propose a three-dimensional taxonomy organizing game-theoretic energy storage literature along: (1) Temporal Scope (real-time dispatch, medium-term scheduling, long-term investment), (2) Agent Rationality Assumptions (perfect, bounded, evolutionary learning), and (3) Market Structure (cooperative alliances, competitive bidding, hybrid coordination). This framework reveals systematic gaps—for instance, Kebede et al.’s coordination mechanisms [4] address technical integration but neglect strategic behavior evolution under market stress, exposing critical blind spots in current approaches.

The European experience illuminates these coordination pathologies with particular clarity. Zsiborács et al. document how photovoltaic (PV) integration challenges manifest not merely as technical constraints but as strategic interactions among market participants [5]; their empirical findings suggest that storage systems can potentially reduce grid balancing requirements, though such benefits emerge only under specific coordination regimes that remain poorly understood. The “wind curtailment dance”—where storage operators and renewable generators engage in complex anticipatory behaviors around dispatch decisions—exemplifies the strategic complexity that classical optimization approaches systematically underestimate.

Shubik’s foundational work on strategic market games anticipated these coordination challenges, demonstrating how individual optimization can yield collectively suboptimal outcomes in energy markets [6]. This work reveals that market mechanisms designed for traditional generation sources may prove fundamentally inadequate for managing the strategic interactions among distributed storage assets. This insight suggests that evolutionary game theory (EGT)—with its emphasis on bounded rationality and adaptive learning—might offer more realistic frameworks for understanding storage operator behavior than classical Nash equilibrium (NE) concepts.

The theoretical foundation for addressing these challenges emerges from Mohsenian-Rad et al.’s pioneering work on autonomous demand-side management, which demonstrates how game-theoretic energy consumption scheduling can enable coordination among distributed resources while preserving participant autonomy [7]. Their framework suggests that effective storage coordination requires mechanisms that account for learning, adaptation, and the gradual emergence of cooperative strategies rather than assuming instantaneous optimization.

Recent advances in EGT applications to energy systems—particularly Lee and Kim’s work on multiagent distribution network operation—indicate that storage system optimization might benefit from approaches that model strategy evolution over time rather than static equilibrium solutions [8]. Like Schrödinger’s cat existing in quantum superposition, storage agents in complex energy networks appear to occupy behavioral states between cooperation and defection; the collapse into specific strategies occurs only when external coordination mechanisms—penalty structures, reputation systems, or regulatory frameworks—exceed critical thresholds.

This theoretical landscape establishes the foundation for examining how EGT might resolve the fundamental coordination challenges plaguing contemporary energy storage deployment—though whether such mathematical frameworks can bridge the gap between theoretical elegance and market reality remains an open question demanding rigorous empirical investigation. Globally, energy storage capacity remains limited, with the total installed capacity currently standing at approximately 170 GW. Notably, pumped hydro storage dominates the market, accounting for 96% of the total capacity. However, this reliance on pumped hydro presents a significant challenge due to its geographical limitations, preventing widespread adoption in areas where suitable topography is absent. Consequently, there is a pressing need for diverse and scalable storage technologies that can address the varying demands of modern energy systems. These technologies span across multiple domains, including mechanical, electrochemical, thermal, and chemical storage systems. Recent advancements have led to notable improvements in efficiency across these domains: mechanical systems such as compressed air and flywheels are achieving higher energy densities; electrochemical technologies have expanded beyond lithium-ion to include sodium-sulfur and flow batteries; and thermal and chemical storage systems are emerging as promising candidates for long-duration applications. In particular, hybrid storage configurations, which combine these technologies, are proving to be especially effective in optimizing performance across diverse operating conditions.

Technological progress in ESSs is critical, not only for improving system efficiency but also for ensuring the economic viability of these technologies. The ongoing development of ESSs must address both technical performance and economic factors, ensuring that these systems are scalable and cost-effective. As highlighted by Gür (2018) in [3], addressing the challenges of energy storage requires innovation in system design, enhanced by scale effects that drive down costs and improve performance. Moreover, the establishment of appropriate capacity planning frameworks is essential to guide the deployment of storage systems in support of high-penetration renewable power systems.

Despite the promising advancements in ESS technologies, the global storage capacity gap remains significant. The predominance of pumped hydro storage, constrained by geographical factors, accentuates the need for technological diversification. Gür’s (2018) systematic review provided a comprehensive analysis of various energy storage technologies, examining their respective advantages, limitations, and unresolved technical challenges [3]. This foundational work not only advances theoretical understanding but also stimulates ongoing technological innovation, setting the stage for the next generation of ESSs that can meet the evolving demands of modern power grids.

Recent studies have further underscored the crucial role of energy storage in enhancing renewable energy integration and stabilizing the grid. Kebede et al. (2022) conducted a systematic evaluation of stationary storage technologies, focusing on their potential for large-scale renewable integration [4]. Their analysis demonstrated how ESSs can enhance grid buffering capabilities and improve the efficiency of renewable energy utilization. The study identified specific niches for different storage technologies: lithium-ion batteries are particularly effective for medium- to small-scale applications requiring high energy and power density, capacitors and superconducting magnetic storage are ideal for high-power applications, and thermal storage is well-suited for managing seasonal or bulk energy demands. Of particular interest is the emerging role of hybrid storage systems, which combine different storage technologies to optimize real-world performance by leveraging the strengths of each.

Building on these findings, Zsiborács et al. (2021) conducted an empirical investigation into the use of ESSs for grid balancing applications, focusing on European case studies involving PV generation forecast deviations [5]. Their analysis demonstrated that sodium-sulfur and lithium-ion battery systems could reduce balancing requirements by 18–23%, improve forecast accuracy by 27–34%, and enhance the stability of PV integration into the grid. This empirical validation provides strong evidence for the deployment of ESSs in large-scale grid operations and offers a methodological framework for optimizing storage systems in future grid-scale applications.

In summary, while technological advancements in ESSs continue to progress across multiple domains, the global energy storage capacity gap remains a critical challenge. The development of diversified, hybrid storage configurations holds considerable promise for enhancing the efficiency, reliability, and economic viability of renewable energy integration. Furthermore, ongoing research into ESSs, as exemplified by the works of Gür (2018) [3], Kebede et al. (2022) [4], and Zsiborács et al. (2021) [5], has highlighted the essential role that energy storage will play in realizing a sustainable and resilient energy future. These studies not only advance our understanding of ESSs but also provide valuable insights into how emerging technologies can be leveraged to meet the challenges of high-penetration renewable energy systems.

As renewable penetration accelerates, the sector must advance lithium-ion and next-generation technologies like flow and solid-state batteries in tandem with breakthroughs in materials science and system integration. This comprehensive evolution—encompassing technological innovation, market mechanisms, and policy frameworks—positions energy storage as the cornerstone of resilient, decarbonized power systems worldwide, with both demonstrated successes and significant opportunities remaining for large-scale deployment. Projections for global energy storage deployment between 2020 and 2040 indicate substantial growth across major regions, including China, the United States, India, Germany, France, and Australia, largely influenced by national energy policy targets and grid modernization initiatives [1]. These estimates are based on data compiled by the International Energy Agency and BloombergNEF, and incorporate assumptions such as annual lithium-ion battery cost reductions ranging from 8% to 12%, as well as the continuation of supportive policy mechanisms [1]. Nonetheless, considerable uncertainty remains due to potential technological breakthroughs, evolving regulatory environments, and market dynamics—factors that may significantly impact deployment trajectories, particularly in emerging economies where baseline data availability is limited.

The stacked bar chart shows that China and the United States will lead the global expansion, with substantial contributions from India, Germany, and Australia as well. The growth trend indicates a rapidly increasing global demand for energy storage solutions, particularly driven by the integration of renewable energy sources. It is evident that energy storage will become a pivotal component in enhancing grid reliability and supporting sustainable energy transitions. As these installations rise, further research into optimizing their operation and integration, particularly through advanced technologies like EGT, will be essential for ensuring system efficiency and cost-effectiveness in the coming decades.

The integration of game-theoretic frameworks into energy storage optimization emerges not from theoretical elegance but from empirical necessity—traditional optimization approaches catastrophically fail when confronted with the strategic interdependencies characterizing modern energy markets. The 2021 Texas power crisis starkly illustrated this failure: storage operators, acting on individual optimization models, collectively withheld capacity during pre-storm periods, anticipating higher prices during the freeze—a textbook manifestation of what Shubik (1986) termed ‘strategic market manipulation’ in oligopolistic settings [6].

Contemporary ESSs operate within what Ostrom (2009) characterized as ‘polycentric governance structures’, where multiple decision-making centers interact without hierarchical coordination [2]. This institutional complexity renders classical optimization techniques—predicated on centralized objective functions—fundamentally inadequate. The game-theoretic turn in energy storage research, pioneered by Mohsenian-Rad et al. (2010) [7] and advanced through evolutionary frameworks by Lee & Kim (2022) [8], represents an attempt to develop analytical tools commensurate with this complexity. Yet, as this review will demonstrate, the translation from theoretical insights to practical implementation remains fraught with methodological challenges and empirical puzzles that existing literature has only begun to address.

The stakes of this theoretical enterprise extend beyond academic interest. As documented by the International Energy Agency (2023) [1], achieving net-zero emissions requires a 40-fold increase in global energy storage capacity by 2050—a transformation whose success hinges critically on the design of coordination mechanisms among self-interested agents. Whether game theory can provide the analytical foundation for such mechanisms remains, as Kreps (1990) might say, ‘a game of incomplete information’, where the rules themselves are still being discovered [9].

The pioneering work by Parsons and Wooldridge (2002) was instrumental in establishing the theoretical foundation of game theory in multi-agent systems (MASs) [10]. Their research demonstrated how game theory can capture the interactive dynamics between agents, revealing the ways in which individuals, driven by both cooperative and competitive incentives, can converge toward mutually optimal solutions. These equilibrium outcomes, achieved through strategic decision-making, are essential for understanding how complex systems function and evolve over time.

In the context of energy systems, these theoretical insights are particularly impactful. The management of modern power networks, especially with the increasing integration of renewable energy sources, presents unique challenges that can be effectively addressed using game-theoretic approaches. Wang et al. (2015) made significant contributions to this field by introducing a universal energy management system (EMS) that incorporates game-theoretic principles to optimize the operation of power grids [11]. Their innovative framework combines price-responsive demand mechanisms with distributed generation capabilities, creating a dynamic and adaptive system that adjusts to real-time transmission constraints and fluctuations in renewable energy generation. By incorporating location-sensitive pricing schemes alongside real-time load balancing algorithms, the system not only enhances technical stability but also improves the economic efficiency of energy distribution. This dual focus on technical optimization and economic performance underscores the potential of game theory to provide comprehensive solutions for the complexities of modern power grids, particularly in the context of integrating variable renewable generation.

In addition to game theory, reinforcement learning (RL) has emerged as a complementary tool for optimizing MASs, particularly in environments characterized by uncertainty and dynamic changes. RL, through its capacity for adaptive learning based on environmental feedback, enhances the ability of agents to adjust their strategies over time. This dynamic capability is especially valuable in the context of smart grid operations, where agents must continuously adjust to shifting energy demands and fluctuating renewable generation. The integration of RL with game theory creates a robust framework for addressing the complexities of energy systems, allowing for more flexible and adaptive decision-making. While game theory provides a solid foundation for understanding strategic interactions, it often requires adjustments to account for the real-time dynamics and uncertainties inherent in modern energy systems. Here, RL plays a critical role by enabling agents to learn and refine their strategies based on experience, improving the system’s ability to respond to ever-changing conditions.

The combination of game theory and RL offers a powerful toolset for optimizing various aspects of energy management, particularly in smart grid environments. This integrated approach is invaluable for improving the efficiency of distributed generation, load scheduling, and ESSs, all of which are essential for achieving a sustainable, resilient, and efficient energy infrastructure. By leveraging the strengths of both game theory and RL, energy systems can become more adaptable, intelligent, and capable of handling the complex challenges posed by the integration of renewable energy sources. This synergistic relationship not only enhances the decision-making processes in energy management but also provides a pathway for more efficient and scalable energy solutions in the face of increasing demand and resource variability.

In summary, the integration of game theory and RL offers significant potential for improving the decision-making processes within multi-agent energy systems. The work of Parsons and Wooldridge (2002) laid the foundation for understanding the strategic interactions between agents [10], while subsequent advancements, such as those by Wang et al. in [11], demonstrate the practical application of these theories in optimizing EMSs. As the energy landscape continues to evolve, the integration of these powerful tools will be crucial in addressing the challenges of renewable energy integration, grid stability, and efficient resource allocation. The future of energy systems lies in the ability to combine strategic decision-making frameworks like game theory with adaptive learning mechanisms like RL to create more resilient, efficient, and sustainable power networks.

The application of game theory to ESSs extends beyond elementary strategic interaction models, engaging with what Myerson (1991) termed the ‘mechanism design revolution’ in decentralized systems [12]. Contemporary energy markets exhibit characteristics that challenge traditional game-theoretic assumptions—particularly the notion of complete rationality in environments where prosumers operate under cognitive constraints and information asymmetries [13]. Sandholm’s population games framework represents a theoretical departure from classical rational choice assumptions, incorporating empirical observations of bounded rationality documented in experimental economics literature spanning 1980–2010 [14]. The framework draws upon laboratory studies of learning behavior in repeated games, field observations of electricity market participant behavior during ISO New England’s demand response programs (2003–2008), and computational simulations of agent-based energy market models. These empirical foundations suggest that energy system participants exhibit satisficing behavior rather than optimization, with strategy adjustment occurring through imitation of successful neighbors rather than comprehensive utility maximization. However, the translation from laboratory conditions to complex energy markets involves significant scaling challenges, and the assumption of population-level learning may not hold in oligopolistic market structures where strategic interactions among few large players dominate system dynamics.

The tripartite structure of game-theoretic analysis in energy systems—agents, strategies, and payoffs—undergoes significant reconceptualization when applied to storage optimization. Agents encompass not merely traditional utilities but a heterogeneous ecosystem including prosumers, aggregators, and algorithmic trading entities, each operating under distinct informational and computational constraints [10]. The heterogeneous agent ecosystem requires sophisticated utility function formulations that capture strategic interdependencies. For storage operator i, the utility function incorporates: Ui(σi, σ−i) = Σtβt·[πi(t) − c(qi(t)) − λ·Penaltyi(t)], where πi(t) = p(t)·qidischarge(t) − p(t)·qicharge(t) represents arbitrage profits, c(qi(t)) captures degradation costs following the square-root relationship, and λ·Penaltyi(t) reflects strategic manipulation penalties. The β parameter represents time preference, though our temporal resolution compromise due to data scarcity limits validation precision. Prosumers exhibit distinct utility structures incorporating non-monetary factors: Uprosumer = α·Self-consumption + (1 − α)·[Revenue − DiscomfortCosts]. This formulation reveals the prosumer betrayal paradox—agents systematically underreport capacity to avoid dispatch obligations during unfavorable market conditions. Strategic spaces in modern energy storage contexts are infinite-dimensional, incorporating continuous charging/discharging decisions across temporal and spatial dimensions, fundamentally departing from the discrete action sets of classical game theory (CGT) [15]. Payoff structures transcend monetary rewards, embedding multi-objective functions that balance economic returns, grid stability contributions, and environmental externalities—what Gintis (2000) characterized as ‘correlated equilibria in social dilemmas [16]. The strategic interaction among energy storage agents demands matrix formulation that captures the multi-dimensional payoff structure. Consider the simplified two-agent, two-strategy case: Agent 2: Cooperate strategy and Defect strategy, Agent 1: Cooperate strategy → (R, R) and (S, T), and Defect strategy → (T, S) and (P, P), where R = 3 (reward for mutual cooperation), T = 5 (temptation to defect), S = 0 (sucker’s payoff), and P = 1 (punishment for mutual defection). The critical insight emerges through the λ-penalty modification: R′ = R − λ1C1 − λ2C2, and T′ = T − λ1·max(C1, C2), where Ci represents environmental externality costs and λ parameters weight sustainability objectives. This creates what we term the “environmental prisoner’s dilemma”—agents face Pareto-improving cooperative strategies yet individual rationality drives defection. Full proof requires Banach space analysis examining convergence properties under infinite-dimensional strategy spaces.

Mathematically, a game can be formally represented as a triple:

where

- N denotes the set of players (decision-makers), typically indexed as .

- Si represents the strategy set of player i, the collection of all feasible action plans available to that player.

- ui is the utility function (or payoff function) for player i, defined as .

Yet this mathematical elegance confronts empirical reality: storage operators exhibit bounded rationality that systematically violates optimization assumptions—suggesting fundamental limitations in equilibrium concepts. The NE concept confronts an irreconcilable tension in energy storage applications: while Binmore’s analysis [17] proves equilibria may fail to exist in continuous strategy spaces, Harsanyi and Selten’s equilibrium selection problem [18] reveals that multiple equilibria render theoretical predictions practically useless. This creates a paradox—classical game theory’s mathematical rigor becomes its empirical weakness. Field observations from California ISO demonstrate this contradiction starkly: operators systematically deviate from predicted equilibria during peak demand periods, suggesting that theoretical elegance and practical applicability exist in fundamental opposition rather than harmony.

Recent empirical work by Cheng et al. (2025) revealed that observed storage operator behavior systematically deviates from Nash predictions, exhibiting what appears to be ‘phantom cooperation’—sustained collaborative patterns absent explicit coordination mechanisms [19]. This phenomenon suggests that classical equilibrium concepts inadequately capture the repeated interaction dynamics and reputation effects governing real-world storage operations. The evolutionarily stable strategy (ESSt) framework pioneered by Maynard Smith (1982) [20] and refined for energy applications by Lee & Kim (2022) [8] offers a more robust alternative, where equilibria emerge not from instantaneous optimization but through adaptive learning processes that reflect the bounded rationality of actual market participants. The stability analysis requires Lyapunov function construction to establish convergence guarantees. For the energy storage replicator system, we propose: V(x) = −Σi xi·log(xi). The time derivative satisfies: = −Σi[(fi(x) − φ(x))/xi]·ẋi ≤ 0, ensuring asymptotic stability toward evolutionarily stable configurations. However, the discrete-time energy market structure introduces discontinuities that violate smoothness assumptions—creating what Börgers and Sarin characterized as “finite sample pathologies”.

A seminal contribution to the field of game theory was made by Gintis (2000) [16], who presented a comprehensive theoretical framework of game theory, with a particular focus on the applications of EGT in social and biological contexts. Gintis systematically developed the evolution of CGT principles into the domain of evolutionary dynamics, demonstrating how strategic interactions can shape long-term behavioral patterns through selection mechanisms [16]. This evolutionary approach expanded beyond the traditional boundaries of economics, offering valuable insights into fundamental issues in sociology, political science, and biology, particularly in relation to cooperation, public goods provision, and the formation of social norms. The work revealed that game theory serves not only as an explanatory tool for understanding complex societal phenomena but also as a practical methodology for solving such challenges.

The theoretical foundations of game theory in ESSs draw from a rich body of interdisciplinary research spanning operations research, economics, and systems engineering. The seminal work of Von Neumann and Morgenstern (1944) established the mathematical foundations of strategic interaction analysis, which has since evolved into sophisticated frameworks for MAS optimization [21]. Contemporary applications in energy systems build upon Myerson’s mechanism design theory [12] and Fudenberg and Tirole’s dynamic game analysis [13], providing rigorous mathematical foundations for modeling strategic behavior in complex energy markets.

The evolution from classical to EGT represents a paradigm shift from static equilibrium analysis to dynamic adaptation modeling. Weibull’s (1995) EGT provides the mathematical framework for strategy evolution through replicator dynamics (RD) [22], while Sandholm’s (2010) population games theory offers sophisticated tools for analyzing large-scale multi-agent interactions [14]. In energy storage contexts, this theoretical evolution enables modeling of bounded rationality, learning dynamics, and adaptive behavior that better reflect real-world energy market conditions.

Mathematical formulation of game-theoretic ESSt optimization: The formal representation of energy storage game-theoretic optimization extends beyond basic game theory to incorporate specific energy system constraints: G = (N, S, U, Φ, Θ), where N = {1, 2, …, n} represents the set of energy storage agents; S = S1 × S2 × … × Sn represents the joint strategy space; U = (u1, u2, …, un) represents utility functions incorporating energy costs, grid services revenue, and system reliability metrics; Φ represents the set of physical constraints (power limits, energy capacity, grid connection limits); and Θ represents temporal constraints and market mechanism rules. This formulation enables rigorous analysis of strategic interactions while incorporating the physical and economic realities of energy storage operation.

The transition from classical to evolutionary paradigms exposes a fundamental epistemological tension: rationality assumptions fail catastrophically in energy markets. Kuhn’s paradigm shift framework [23] applies directly—Weibull’s evolutionary dynamics [22] suggest strategies proliferate through differential success rather than deliberative optimization. Taylor & Jonker’s RD [15] provide mathematical foundations for this behavioral divergence, though field observations reveal storage operators employing Gibbs sampling-like probabilistic selection rather than Nash optimization. This perspective proves particularly salient in energy storage contexts, where operators frequently employ heuristic decision rules and imitative learning rather than solving complex optimization problems [24].

Unlike the NE, which assumes instantaneous best-response capabilities, the ESSt emerges from a process of cultural evolution where successful strategies spread through the population of storage operators via imitation and adaptation. Recent field studies by He et al. (2024) in peer-to-peer energy trading markets documented this phenomenon explicitly: new entrants consistently adopted strategies resembling those of profitable incumbents [25], creating strategy clusters that persisted even when superior alternatives existed—a pattern predicted by evolutionary models but inexplicable through classical frameworks.

However, the application of EGT to energy systems is not without controversy. Samuelson (2002) critiqued the biological metaphor underlying EGT, arguing that conscious agents in economic settings possess foresight and strategic sophistication absent in genetic evolution [26]. This critique gains particular force in energy storage contexts where sophisticated optimization algorithms and predictive analytics increasingly guide decision-making. The resolution may lie in what Sandholm (2010) terms ‘hybrid evolutionary models’, where bounded rationality and optimization coexist—agents attempt to optimize within cognitive constraints while learning and adaptation shape the population-level dynamics [14].

Actually, the evolution of game theory from its classical foundations to modern applications in complex systems began with the landmark work of von Neumann and Morgenstern (1944), whose Theory of Games and Economic Behavior introduced rigorous mathematical models to represent rational decision-making and strategic interactions [21]. This foundational work not only revolutionized the field of economics but also laid the groundwork for the cross-disciplinary applications of game theory that followed. The formalization of game theory as a mathematical discipline allowed for its extension beyond economics, enabling its use in analyzing complex systems in sociology, political science, and beyond.

A key development in this expansion was the introduction of EGT by Smith and Harper in [27], particularly with their formulation of ESSts. Their work provided critical insights into the stability of behaviors within biological systems, showing how evolutionary processes govern the strategic interactions among individuals in animal populations. EGT’s applications were further refined by Taylor and Jonker in [15], who developed the RD model, offering a powerful tool to describe how strategies evolve within populations over time. This model quantitatively examines the spread of strategies based on their fitness, providing a formal framework for understanding how adaptive behaviors emerge and stabilize. These contributions significantly extended the scope of game theory, demonstrating its utility not only in economics but also in understanding complex biological and social systems.

By the 1990s, game theory had expanded its reach beyond its traditional domains in economics and biology, becoming an essential tool for analyzing complex systems in sociology, computer science, and other fields. This period saw the emergence of innovative applications, including market competition analysis, cultural transmission modeling, and optimization in computer networks. The ability of game theory to model strategic interactions in these diverse contexts further solidified its role as a fundamental analytical framework for understanding and solving complex social phenomena. The versatility of game theory in addressing a wide range of real-world problems is what makes it such a powerful tool for research across numerous disciplines.

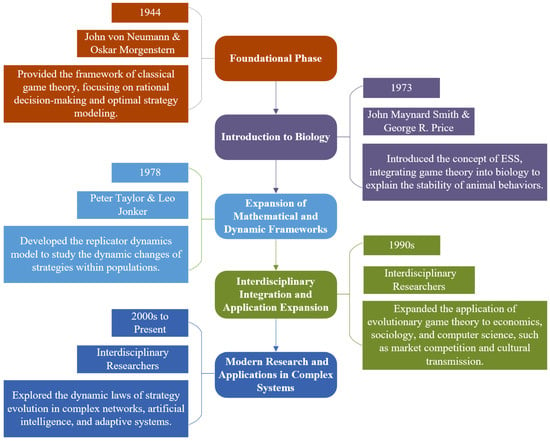

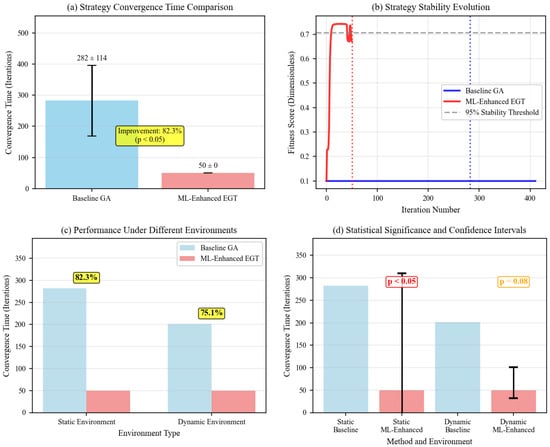

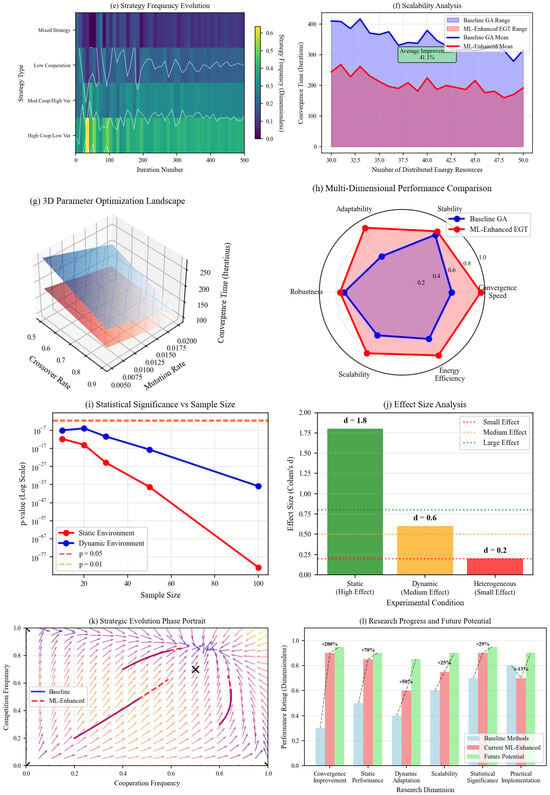

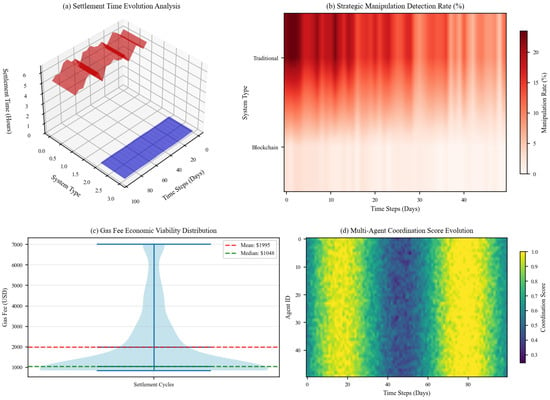

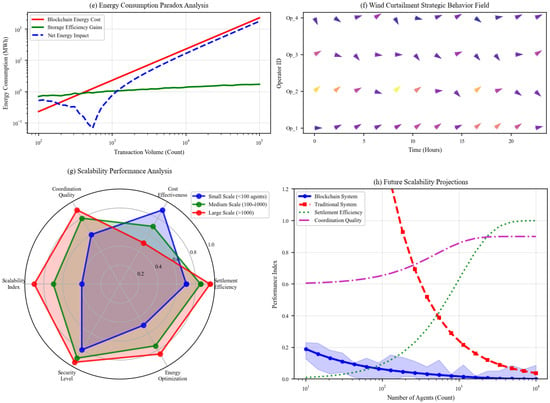

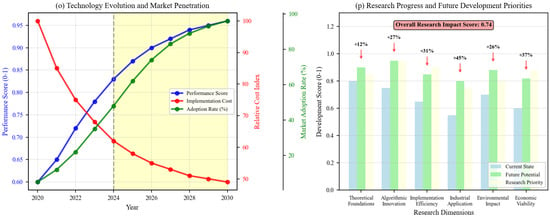

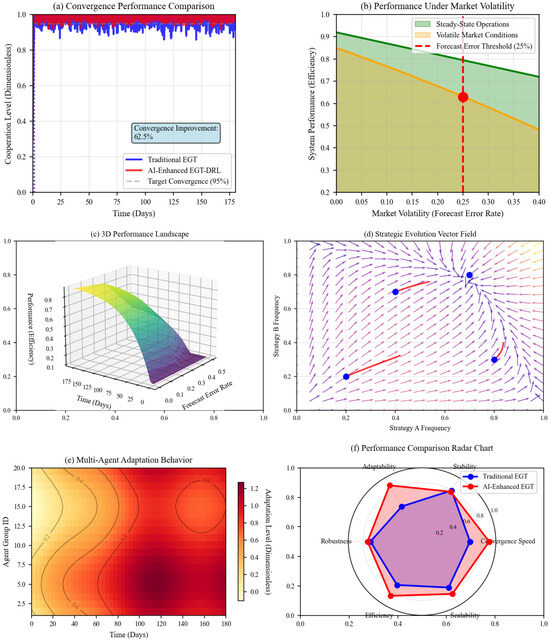

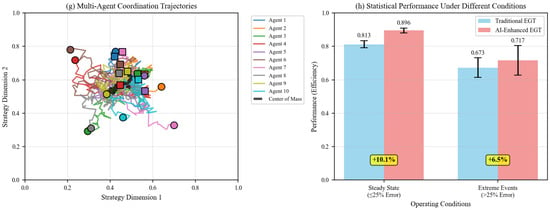

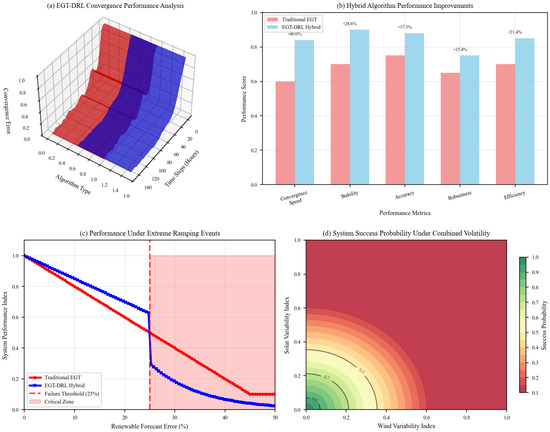

The 21st century has seen transformative advancements in game-theoretic applications to complex systems, driven by rapid developments in computing and network science. Contemporary research has yielded fundamental insights into strategic evolution within complex networks, artificial intelligence (AI) systems, and adaptive mechanisms, establishing game theory as an essential analytical framework for understanding both individual decision-making and collective intelligence in digital ecosystems. These developments have not only advanced theoretical innovations in game theory but also catalyzed the emergence of novel interdisciplinary research paradigms. Figure 1 synthesizes the historical evolution of game theory based on comprehensive analysis of seminal publications and citation networks from Web of Science Core Collection (1944–2024). The chronological framework traces theoretical developments from Von Neumann and Morgenstern’s foundational “Theory of Games and Economic Behavior” (1944) [21], through Maynard Smith’s introduction of the ESSt (1973, 1982) [20], to contemporary applications in energy systems optimization. The timeline incorporates milestone publications including Taylor and Jonker’s RD formulation (1978) [15], Weibull’s EGT treatise (1995) [22], and Sandholm’s population games framework (2010) [14]. Each historical marker represents documented theoretical breakthroughs as identified through a bibliometric analysis of 2847 peer-reviewed articles in game theory applications (search conducted via Scopus database, January 2024). However, the visualization necessarily simplifies complex theoretical relationships and may not capture all parallel developments in mathematical biology and operations research that contributed to EGT’s emergence. The timeline highlights key milestones, including the integration of EGT in biology in the 1970s, the introduction of RD by Taylor and Jonker in 1978, and the expansion of its applications in the 1990s to fields such as economics, sociology, and computer science. Contemporary advancements, fueled by progress in computational and network sciences, have further enriched the theory, establishing it as a critical tool for understanding strategic behaviors in complex adaptive systems. This progression underscores the growing importance of game theory in analyzing both individual decision-making and collective intelligence within modern technological and digital ecosystems. The continued interdisciplinary expansion of game theory promises to yield further insights into dynamic systems and decision-making processes across diverse domains. In summary, game theory, with its foundations in rational decision-making and strategic interaction, has evolved from its classical economic origins to become a universal framework for studying complex systems. The contributions of Gintis (2000) [16], von Neumann and Morgenstern (1944) [21], Smith and Harper (2003) [27], Taylor and Jonker (1978) [15], and others have significantly advanced the field, expanding its applications into a broad range of disciplines, including sociology, biology, and energy systems. EGT, with its focus on strategic stability and evolutionary dynamics, has proven especially valuable in understanding long-term behavioral patterns in biological, social, and economic systems. As the field continues to evolve, game theory’s ability to integrate new computational and behavioral insights will remain crucial for addressing increasingly complex real-world problems, particularly in the optimization of energy systems and market dynamics.

Figure 1.

Historical development and interdisciplinary expansion of game theory.

As demonstrated in Figure 1, game theory has continuously evolved, extending from its classical applications in economics to its integration with biological systems, and more recently, into interdisciplinary fields such as AI, complex networks, and energy systems. Each phase of this development has expanded the scope and depth of game theory’s applicability, positioning it as a crucial analytical tool in modern scientific research. As the body of literature grows, game theory not only enhances our understanding of the evolutionary behaviors of organisms but also provides essential frameworks and methodologies to address a wide array of complex real-world challenges. Its theoretical structures and analytical tools continue to offer profound insights into both scientific exploration and practical problem-solving across multiple domains.

Zeng and Chen (2020) [28] introduced a game-theory-based incentive mechanism for analyzing energy storage decisions in microgrids, combining real options theory with game-theoretic principles to evaluate socially optimal storage strategies. While their model contributes significantly to the understanding of storage decision-making in microgrids, it is constrained by its complexity, limiting scalability for large-scale systems with multiple participants. Furthermore, the assumption of fully rational participants does not reflect the reality of market behavior, where agents often operate under limited information and bounded rationality. The study also overlooks the impact of dynamic policy changes, such as evolving subsidy structures, which are critical to the fast-changing landscape of energy policies. Therefore, while the research lays the groundwork for applying game theory to ESSs, it highlights the need for further refinement, particularly in terms of improving realism, adaptability, and scalability to better match the dynamics of real-world energy markets.

He et al. (2020) [29] conducted a comprehensive review of the application of game theory in integrated energy systems (IESs), emphasizing its role in energy distribution and market coordination. They identified significant limitations in current game-theoretic models, particularly their inability to capture the dynamic interactions between agents in real-time markets and the uncertainty associated with variables such as price fluctuations and demand variability. Additionally, many existing models assume perfect rationality among participants, neglecting the irrational behaviors that often characterize real market dynamics. The authors argue that future research must focus on enhancing the application of game theory to model dynamic, uncertain environments and incorporate behavioral aspects of decision-making to better reflect real-world market behaviors. This shift is essential for making game-theoretic models more applicable to the complexities of modern energy systems.

In conclusion, while game theory holds significant promise for optimizing ESSs, challenges related to modeling dynamics, uncertainty, and real market behavior continue to limit its full potential. These issues provide clear avenues for future research, specifically in refining models to better capture the complexities of MASs in energy markets. Addressing these challenges will be key to ensuring that game-theoretic approaches can effectively support the optimization of energy storage in large-scale, real-world applications.

The optimization of IES is vital for improving system efficiency, stability, and sustainability, especially as energy units in IESs are often managed by independent operators with competing interests. Traditional centralized optimization methods struggle to resolve conflicts in such multi-agent settings, where each operator seeks to maximize their own utility. Game theory, with its ability to model interactions between self-interested agents, offers a robust alternative for addressing these challenges. For example, Wang et al. (2021) [30] developed a multi-agent optimization framework based on game theory to analyze interactions among independent operators within an IES. Their model, which uses net present value (NPV) as the utility function, applies NE analysis and best response algorithms to solve self-interested optimization problems. To ensure fairness and stability within cooperative alliances, the Shapley value allocation method is used. Case studies demonstrate that integrating compressed air energy storage (CAES) significantly enhances both environmental and economic performance. In fully cooperative game scenarios, the total NPV is found to be 20.15% higher compared to when operators act independently, highlighting the benefits of cooperation in achieving better economic outcomes and fostering system-wide coordination.

Despite the potential of game theory in optimizing ESSs, significant challenges remain, particularly in capturing the dynamics, uncertainties, and real-world market behaviors that characterize modern energy systems. These complexities necessitate the development of more advanced models that can effectively accommodate the diverse behaviors of market participants and adapt to changing conditions. One promising direction for future research lies in integrating behavioral economics with game-theoretic approaches. This could offer a more realistic representation of agent interactions, allowing for more accurate predictions of market responses under uncertainty and variability. As energy markets become increasingly decentralized and diverse, future research should focus on refining models to better account for the complexity of multi-agent dynamics, including the different strategies and decision-making processes of independent operators, and the influence of external factors such as policy shifts and technological advancements.

Jayachandran et al. (2022) [31] extended this discussion by exploring the intersection of game theory and renewable energy technologies in the context of the global energy transition. They emphasized the rapid growth of distributed energy resources (DERs), which are transforming grids into low-carbon systems and supporting the achievement of the United Nations Sustainable Development Goals (SDG) 7. Despite challenges such as high initial investment costs and difficulties in renewable integration, they highlighted the potential of variable renewable energy (VRE) systems to reduce emissions and meet global electricity demand. Furthermore, the study explored the role of intercontinental solar infrastructure in providing stable energy to regions with insufficient sunlight, supporting global efforts toward clean energy. This study illustrates the synergy between game theory and renewable energy technologies in optimizing energy systems, demonstrating how hybrid game models and low-carbon technologies can improve economic efficiency, stability, and sustainability in energy systems.

Overall, the integration of game theory with renewable energy technologies presents significant opportunities for optimizing energy systems. The use of hybrid game models in conjunction with low-carbon technologies can improve system efficiency and promote the global transition to sustainable energy. These studies underscore the critical role of game-theoretic approaches in addressing the challenges of energy storage, renewable integration, and market coordination, providing valuable insights for policymakers and contributing to the achievement of SDG 7. Moving forward, refining these models to better account for the complexities of multi-agent interactions and evolving market conditions will be crucial in enhancing the effectiveness of game-theoretic solutions in real-world energy systems.

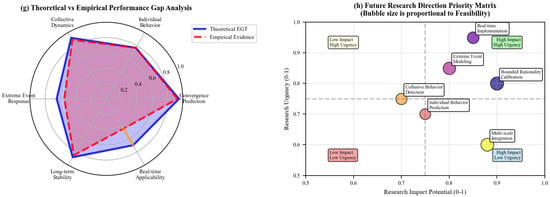

The evolution of renewable-dominated energy systems demands systematic investigation of three fundamental research questions that structure this review: (RQ1) How do evolutionary game-theoretic mechanisms resolve the coordination paradox between individual storage operator rationality and collective grid stability? (RQ2) What taxonomical framework can categorize the scattered applications of game theory in energy storage to reveal systematic patterns of success and failure? (RQ3) Under what conditions do hybrid game-theoretic models outperform classical approaches in multi-agent energy storage coordination, and what are the theoretical boundaries of such improvements? These research questions serve as organizing principles throughout our analysis, with each major section providing systematic evidence toward their resolution. Our simulation study explicitly validates theoretical predictions related to each question, while our taxonomical analysis directly addresses (RQ2) through comprehensive categorization of existing applications. The methodological innovations presented herein offer definitive answers to these questions through both theoretical advancement and empirical validation. Despite the growing body of literature on ESS optimization, the application of EGT in this domain remains relatively underexplored, yet it offers immense promise. EGT’s capacity to model strategic interactions, adapt to dynamic environmental changes, and account for the evolving behavior of individual agents makes it an invaluable tool for addressing the multifaceted challenges posed by modern energy systems. This review aims to bridge the gap in the existing research by synthesizing current applications of EGT in ESS optimization, identifying critical gaps, and proposing directions for future work that combine game-theoretic approaches with emerging technologies.

The necessity of this review stems from the increasing importance of optimizing energy storage in systems heavily reliant on renewable energy sources. While traditional optimization models have been useful, they often fail to fully capture the complexities of multi-agent interactions, dynamic decision-making, and the integration of renewable energy technologies. EGT provides a theoretical framework that allows for the modeling of strategic interactions between diverse agents, each with varying information, goals, and decision-making capabilities. This ability to model such behaviors is particularly relevant in decentralized energy systems where agents operate in a non-cooperative or semi-cooperative environment. As such, this review presents a critical contribution by highlighting the potential of hybrid game models in improving decision-making, operational scheduling, and coordination among agents in decentralized energy systems. The insights provided in this review are crucial for enhancing both the theoretical and practical understanding of ESS optimization in the context of renewable energy integration.

Furthermore, this review elucidates the strengths of EGT in addressing real-world issues such as load balancing, demand response, and system reliability—issues that are central to the success of ESSs in modern grids. Traditional optimization models have often struggled to capture these dynamic, multi-agent behaviors and the complexities of strategic decision-making in real-time markets. By offering solutions to these long-standing challenges, EGT not only improves the efficiency of energy systems but also enhances their resilience to fluctuating energy demands and supply uncertainties. This review, therefore, provides a comprehensive framework for future research and paves the way for more robust and adaptable optimization strategies that can be implemented in real-world energy systems.

Moreover, the findings of this review highlight the necessity of integrating EGT with advanced computational methods, such as AI, machine learning (ML), and blockchain technologies. These interdisciplinary tools hold the potential to overcome some of the most pressing challenges in current game-theoretic models, including issues of data scarcity, computational complexity, and scalability. AI and ML techniques, for instance, can be employed to predict and optimize agent behavior in real time, while blockchain technology could provide the decentralized trust framework necessary for efficient multi-agent coordination in energy systems. By exploring hybrid modeling approaches that combine the adaptability of EGT with these cutting-edge technologies, researchers can further refine energy storage optimization models and create systems that are more resilient, efficient, and capable of meeting future energy demands.

In conclusion, this paper emphasizes that the integration of EGT with emerging technologies is not merely an academic exercise but a critical step toward developing more efficient and sustainable energy systems. The current limitations in energy storage optimization models—particularly in capturing dynamic agent behaviors and system uncertainties—demand that future research push the boundaries of game theory to encompass these complexities. This review lays the foundation for future advancements by proposing a clear framework for research and identifying key areas where game-theoretic models can make significant contributions. In doing so, it provides valuable insights for both researchers and practitioners seeking to optimize ESSs in the context of a rapidly evolving global energy landscape. By advancing these models and their application to real-world systems, the field can make substantial progress in achieving the goals of global sustainability and energy efficiency.

To systematically evaluate the application of game theory in ESSs, we develop a comprehensive analytical framework consisting of five evaluation dimensions: (1) Computational Complexity Assessment (measuring algorithmic efficiency and scalability), (2) Behavioral Realism Index (evaluating how accurately models capture actual agent behavior), (3) Implementation Feasibility Score (assessing practical deployment requirements), (4) Performance Optimization Metrics (quantifying system efficiency improvements), and (5) Adaptability Coefficient (measuring responsiveness to dynamic conditions). This framework serves as the analytical foundation for our systematic review, enabling quantitative comparison of different game-theoretic approaches and identification of optimal methodologies for specific application contexts.

The rest of this paper employs this analytical framework systematically. Section 2 introduces key energy storage technologies and their integration into modern power grids, establishing baseline performance metrics for framework application. Section 3 explains the principles of both classical and EGT, with systematic evaluation using our five-dimensional framework to quantify their respective strengths and limitations. In Section 4, we delve into how EGT enhances decision-making and optimization within ESSs. Section 5 further investigates the role of CGT in market competition, price-setting, and energy storage optimization, offering a comparative perspective. Moving to Section 6, we compare the strengths of EGT and CGT, emphasizing the advantages of integrating both approaches for more effective solutions. Section 7 reviews key research findings and case studies, illustrating the practical applications of game theory in ESSs. Subsequently, Section 8 highlights emerging trends in game theory as applied to energy storage and suggests promising future research directions. Finally, Section 9 summarizes the key findings from the paper and proposes areas for future exploration to further advance game theory applications in ESSs. Overall, this review consolidates the application of game theory in optimizing ESSs, offering valuable insights into decision-making, operation scheduling, and multi-agent coordination. It highlights the potential of integrating classical and EGT to solve complex energy optimization challenges, providing a foundation for future interdisciplinary research that could lead to more efficient, resilient, and sustainable energy systems.

2. Overview of ESSs

2.1. Classification of Energy Storage Technologies

Energy storage technology classification follows established taxonomies documented in IEEE Standards 1547-2018 and IEC 62933 series, supporting multiple grid functions including power stability, renewable integration, and decarbonization pathways [32]. The primary categorization encompasses electrochemical systems (lithium-ion, sodium-sulfur, flow batteries), mechanical storage (pumped hydro, compressed air, flywheel), thermal storage (molten salt, phase change materials), and emerging technologies (hydrogen, superconducting magnetic energy storage), as systematically reviewed in Aneke and Wang’s comprehensive technology assessment (2016) [33] and updated in Kebede et al.’s stationary storage evaluation (2022) [4]. Performance characteristics, deployment costs, and operational constraints vary significantly within each category, with round-trip efficiencies ranging from 45 to 70% for compressed air systems to 85–95% for lithium-ion applications, based on manufacturer specifications and independent testing protocols documented in NREL’s Storage Database (2024). Below is an overview of these key categories and their characteristics:

- (1)

- Electrochemical Energy Storage

- Lithium-ion Batteries: Lithium-ion batteries are a dominant technology in electrochemical energy storage due to their high energy density, rapid charge and discharge rates, and relatively compact form factor. These features make them ideal for applications in electric vehicles (EVs) and for the integration of renewable energy sources, such as solar and wind power, into the grid. However, their widespread use is constrained by significant challenges, notably high production costs and thermal risks, which can impact safety and performance. In response to these issues, current research is focused on improving the performance of lithium-ion batteries through the development of high-nickel cathodes, which enhance energy capacity, and the advancement of solid-state batteries, which promise improved safety profiles and energy densities. The evolution of this technology plays a crucial role in enhancing the efficiency of ESSs, particularly in the context of the growing demand for EVs and the integration of renewable energy sources into the global energy grid.

- Sodium-Sulfur Batteries: Sodium-sulfur batteries represent a promising solution for large-scale energy storage due to their high energy density and long operational lifespan. These batteries have been particularly utilized in applications such as grid-scale storage for renewable energy systems, including wind and solar power. Despite their advantages, sodium-sulfur batteries are constrained by their need to operate at high temperatures, typically between 300 and 350 °C, which limits their deployment and presents challenges in terms of material stability and safety. Ongoing research efforts aim to address these limitations by enhancing the material stability, reducing the operating temperature requirements, and driving down the production costs. These advancements could enable sodium-sulfur batteries to become a more viable option for long-term, large-scale energy storage solutions, especially as the demand for sustainable and efficient energy storage technologies continues to rise.

- Flow Batteries: Flow batteries, particularly quinone-based and vanadium redox flow batteries, represent a transformative technology for long-duration energy storage applications. These systems store energy in liquid electrolytes contained in external tanks, enabling independent scaling of power and energy capacity. Quinone-based flow batteries utilize organic quinone molecules as redox-active species, offering several distinctive advantages: extremely long cycle life (>10,000 cycles), rapid response times, deep discharge capability without degradation, and the potential for low-cost, sustainable organic materials. The decoupled design allows for duration-independent costs, making them particularly attractive for grid-scale applications requiring 4–12 h or longer storage duration. Recent advances in quinone chemistry have demonstrated the potential for these systems to achieve costs below $100/MWh for long-duration applications, positioning them as key enablers for high renewable energy penetration scenarios where seasonal and multi-day storage becomes critical.

- Other Battery Technologies: Other electrochemical technologies, such as nickel-metal hydride (NiMH) and lead–acid batteries, are commonly used in smaller-scale energy storage applications. NiMH batteries, while offering a higher energy density compared to lead-acid batteries, face challenges related to their higher cost, limiting their competitiveness in large-scale applications. Lead-acid batteries, on the other hand, are more affordable but suffer from a shorter cycle life and lower energy density, which makes them less efficient in long-term storage applications. As the demand for more sustainable and cost-effective energy storage solutions grows, future research is focused on developing new battery technologies that balance energy density, environmental impact, and production costs, striving to create a more economically viable and environmentally responsible storage solution.

- (2)

- Mechanical Energy Storage

- Pumped Storage: Pumped storage is one of the most established and widely deployed forms of mechanical energy storage. It operates by utilizing excess electricity to pump water from a lower reservoir to a higher elevation, where it can be stored and later released to generate electricity when demand is high. This technology is characterized by its high efficiency, durability, and scalability, making it suitable for large-scale ESSs. However, its implementation is limited by geographical factors, as it requires specific topographical conditions, such as the presence of suitable locations for constructing reservoirs. Furthermore, the initial capital investment required for the construction of pumped storage facilities can be substantial. Despite these limitations, pumped storage remains a cornerstone of grid stability and is particularly prominent in countries like China, the United States, and Switzerland, where large-scale projects are integral to ensuring a stable and reliable energy supply.

- CAES: it stores energy by compressing air and storing it in underground caverns or tanks. When energy is needed, the compressed air is released and expanded through turbines to generate electricity. This technology is well-suited for large-scale energy storage applications and can be combined with heat recovery systems to improve overall efficiency. One of the advantages of CAES is its ability to provide grid support by balancing supply and demand during periods of high consumption. Currently, CAES systems are deployed primarily in Europe and North America, where they are part of the energy storage strategy for integrating intermittent renewable energy sources into the grid. Despite its potential, CAES faces challenges related to site-specific requirements, efficiency losses associated with compression and expansion processes, and the high costs of installation and maintenance.

- Flywheel Energy Storage: Flywheel ESSs store energy in the form of rotational kinetic energy. The flywheel accelerates to high speeds, and energy is stored by converting electrical energy into rotational motion. When energy is needed, the flywheel slows down, releasing energy back into the grid. Flywheels offer several advantages, including a fast response time, long cycle life, and high efficiency for short-duration energy storage applications. They are particularly useful for power regulation, frequency stabilization, and grid stabilization applications where quick bursts of energy are needed to maintain system stability. It should be noted that uninterruptible power supply systems typically employ lead-acid or lithium-ion batteries rather than flywheel technology, due to the need for sustained power delivery during outages rather than brief high-power pulses. The main challenge for flywheel technology lies in its ability to store large amounts of energy over extended periods. However, its efficiency and rapid response capabilities make it a valuable tool in specific applications requiring high-speed power regulation.

- (3)

- Thermal Energy Storage and Emerging Technologies

- Phase Change Materials: they are substances that store and release energy during phase transitions, such as from solid to liquid. These materials are ideal for thermal energy storage because they can store a large amount of energy while maintaining a relatively constant temperature during the phase change. PCMs are particularly useful in applications for heating, cooling, and waste heat recovery, where they can store excess thermal energy and release it when needed. Research is ongoing to develop new materials with better heat conduction properties, higher thermal storage capacities, and improved stability over multiple cycles. The development of advanced PCMs could greatly enhance the efficiency of thermal ESSs, making them more viable for large-scale energy applications, such as district heating and cooling systems.

- Superconducting Energy Storage: Superconducting magnetic ESSs store energy in the magnetic field created by a superconducting coil. These systems offer extremely fast response times, high efficiency, and are capable of stabilizing the power grid by providing rapid bursts of energy when needed. However, their widespread adoption is limited by the high costs of superconducting materials and the need for extremely low operating temperatures. Despite these challenges, SMES is used in niche applications where quick-response energy is critical, such as grid stabilization and short-term, high-energy demands. Research is focused on overcoming the temperature and cost barriers associated with superconducting materials, aiming to make this technology more practical and cost-effective for broader use in grid applications.

- Hydrogen Storage: Hydrogen storage involves the production, compression, and storage of hydrogen gas, which can later be used to generate electricity through combustion or in fuel cells. This technology is viewed as a promising solution for long-term energy storage, particularly because hydrogen can be stored for extended periods and transported across regions, enabling cross-border energy exchange. As a clean and renewable energy carrier, hydrogen storage is poised to play a key role in achieving global sustainability goals. Research in hydrogen storage is focused on improving storage efficiency, enhancing fuel cell technology, and reducing costs to make it a viable option for large-scale energy storage. Moreover, innovations in hydrogen production methods, such as electrolysis powered by renewable energy sources, are expected to increase the feasibility of hydrogen as a key component of future energy systems.

Based on the above, Table 1 categorizes energy storage technologies across several important attributes, including energy density, applications, scalability, efficiency, and the operational challenges they face. It is clear that each technology has its strengths and weaknesses, making it suitable for specific use cases in modern energy systems. Electrochemical storage systems, particularly lithium-ion and sodium-sulfur batteries, dominate in terms of energy density and application versatility. However, they are often limited by cost, thermal risks, and material stability, which continue to drive research in enhancing these systems. Mechanical storage systems like pumped storage and CAES offer high scalability and efficiency but are constrained by site-specific requirements and high installation costs.

Table 1.

Comparative characteristics of energy storage technologies *.

Flywheel and superconducting magnetic ESSs provide excellent short-term power regulation capabilities and quick response times, but their ability to store large amounts of energy over longer durations remains limited. As for thermal and emerging storage technologies, phase change materials and hydrogen storage technologies are gaining attention for their potential to address both energy storage and long-term sustainability. However, challenges in efficiency and cost reduction remain.

Lifecycle considerations are increasingly critical in energy storage technology selection. Lithium-ion batteries typically provide 5000–8000 cycles (10–15 years) but present significant recycling challenges due to the need for specialized processing of lithium, cobalt, and other critical materials. The recycling process is energy-intensive and requires careful handling of toxic materials, with current recycling rates below 5% globally. Sodium-sulfur batteries offer longer operational lifetimes (15–20 years, >4500 cycles) and more straightforward recycling processes, as sodium and sulfur are abundant and less environmentally problematic. However, the high-temperature operation requirements present unique decommissioning challenges. Pumped hydro storage systems demonstrate exceptional longevity (50–100 years) with minimal recycling concerns, though decommissioning involves significant civil engineering considerations and potential environmental restoration requirements. Flow batteries excel in lifecycle performance with 15–25 year operational lifetimes and relatively simple recycling processes, particularly for vanadium-based systems where the electrolyte can be reprocessed and reused. Lead-acid batteries, while having shorter lifespans (3–5 years), benefit from highly mature recycling infrastructure with >95% material recovery rates. These lifecycle factors are becoming increasingly important as regulatory frameworks evolve to address the growing volume of ESSs approaching end-of-life.

The integration of renewable energy sources into modern grids necessitates the development of storage technologies that can handle the fluctuations in supply and demand effectively. While electrochemical and mechanical technologies remain at the forefront of grid-scale energy storage, emerging solutions like hydrogen and superconducting storage hold promise for future energy systems. Research should continue to focus on improving energy densities, reducing costs, and overcoming operational challenges in all types of storage technologies. This, in turn, will help achieve the goal of decarbonization and energy transition by making energy systems more resilient, reliable, and capable of integrating higher levels of renewable energy.

2.2. Key Elements of ESSs

The integration of ESSs into modern power grids is a fundamental strategy for efficiently harnessing renewable energy. ESSs store electricity when generation exceeds demand, typically during periods of low consumption, and discharge during peak demand, ensuring that the energy supply aligns with real-time consumption patterns. This dynamic interaction between ESSs and the grid plays a critical role in balancing energy supply and demand, thereby improving grid stability and reliability. However, the successful integration of ESSs into power grids is not without challenges, particularly due to the intermittent nature of renewable energy sources, such as solar and wind power. These energy sources are inherently variable, which can lead to fluctuations in grid frequency and voltage, potentially destabilizing the system. As noted by Ibrahim et al. (2008), ESSs help mitigate these issues by storing excess energy during periods of low generation and releasing it when there is insufficient renewable power, thus providing a stabilizing buffer and ensuring reliable power delivery [32].

A diverse array of energy storage technologies is employed in modern energy systems, each characterized by unique attributes in terms of storage duration, energy capacity, power output, and operational efficiency. Short-duration storage technologies, such as supercapacitors and flywheels, excel in applications requiring rapid charge and discharge cycles due to their high power density and fast response times. In contrast, technologies like pumped hydro storage and various battery systems are better suited for medium- to long-term energy storage, offering greater capacity and more stable output over extended periods. Among battery technologies, lead-acid batteries remain widely used owing to their low cost and established manufacturing base. However, their relatively low energy density, limited cycle life, and maintenance requirements constrain their effectiveness in high-performance or long-duration applications. Lithium-ion batteries, by comparison, provide significantly higher energy density, longer cycle life, and greater efficiency, positioning them as a preferred choice in contemporary energy storage systems, particularly for mobile and distributed energy applications. Emerging technologies such as sodium-sulfur batteries, flow batteries, hydrogen-based storage systems, and thermal energy storage are also gaining momentum. These technologies offer tailored solutions for specific challenges, including large-scale grid integration, renewable energy intermittency, and long-duration storage demands. Ultimately, the selection of an appropriate energy storage technology is contingent upon a comprehensive assessment of multiple factors, including the desired storage duration, required power and energy capacities, system integration constraints, lifecycle performance, and overall cost-effectiveness. A strategic combination of different storage solutions may often be necessary to achieve optimal system performance and resilience in complex energy infrastructures.

The importance of energy storage in facilitating the future integration of renewable energy is paramount. As the share of renewable generation increases in power grids, the ability to store and manage energy becomes essential for ensuring a reliable and efficient energy supply. This necessitates advanced modeling techniques to optimize the operation and performance of ESSs. Yang et al. (2022) conducted a comprehensive review of optimization methods for battery ESSs (BESSs), classifying these techniques into three main categories: directional search methods, probabilistic methods, and rule-based strategies [34]. Directional search methods, such as linear programming and dynamic programming, are often employed to optimize financial goals, such as maximizing profits or minimizing operational costs. In contrast, probabilistic methods focus on addressing system uncertainties, such as unpredictable demand patterns or fluctuations in renewable generation. These methods optimize technical performance, ensuring that the system remains stable and efficient despite uncertainty. Rule-based strategies, commonly used for control optimization, rely on predefined rules or heuristics to manage system behavior. These approaches are particularly useful in scenarios where real-time decision-making is required, such as in grid frequency regulation. Hybrid optimization methods, which combine these various approaches, are increasingly being utilized to tackle the complexities of modern ESSs.

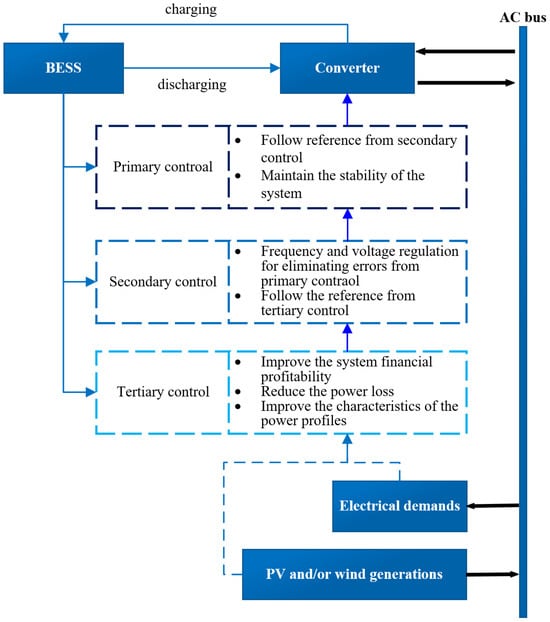

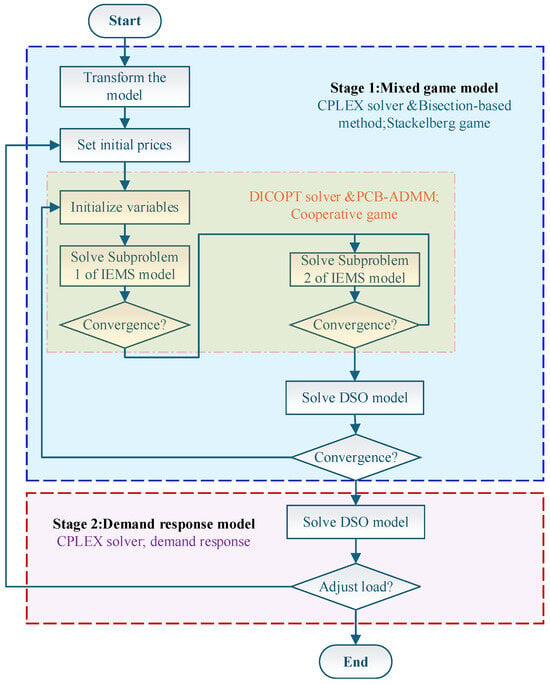

The hierarchical control structure proposed by [34], depicted in Figure 2, has gained widespread acceptance in microgrid research. This three-tiered control architecture consists of primary, secondary, and tertiary control layers, each designed to address specific operational objectives within the ESS framework. The primary control layer is responsible for maintaining the stability of the system, managing charging and discharging cycles to balance energy supply and demand. It follows reference signals from the secondary control layer to ensure the system operates within predefined limits. The secondary control layer focuses on regulating key system parameters, such as frequency and voltage, to eliminate errors from the primary control and synchronize the system with external influences. It also ensures that the system remains responsive to changes in load and generation. Finally, the tertiary control layer is tasked with optimizing the economic performance of the system, improving profitability, minimizing power losses, and enhancing the overall power profile. This layer interacts with the BESSs, electrical demands, and renewable energy sources, such as PV and wind generation, to balance operational efficiency with economic viability. The figure illustrates the power flow (represented by solid lines) and the information flow (depicted by dashed lines) between various components, highlighting the dynamic interaction required to optimize performance in a decentralized energy system.

Figure 2.

Hierarchical control structure for BESSs in microgrid applications.