Does Digital Transformation Improve Manufacturing ESG Performance: Evidence from China

Abstract

1. Introduction

- (1)

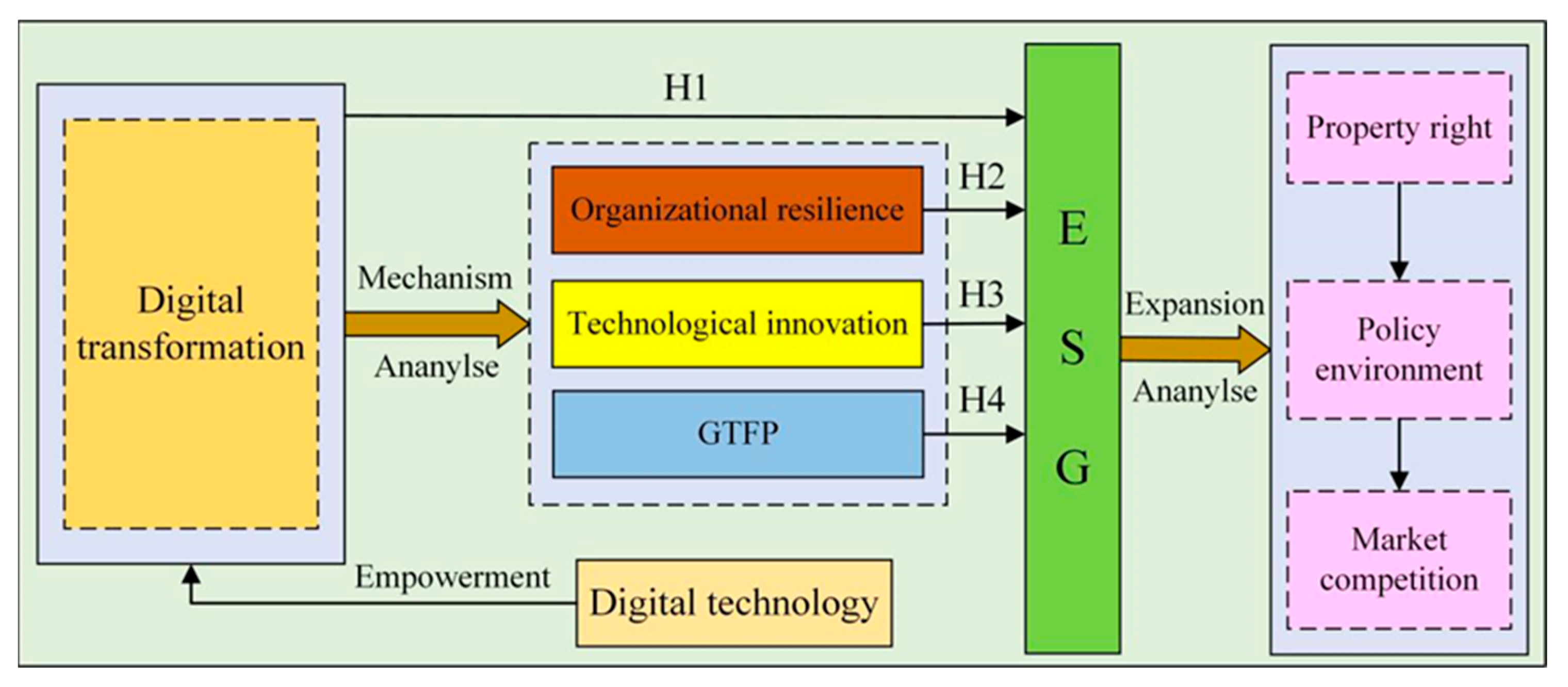

- It not only established a unified framework integrating environmental, social, and governance dimensions, but it also conducted explorations in each dimension to assess the impact of digitalization on the ESG of manufacturing enterprises.

- (2)

- It identifies three main transmission mechanisms, through which digitalization enhances ESG performance.

- (3)

- It explores the heterogeneous effects of digital transformation across different ownership structures, policy environments, and industry competition levels.

2. Theoretical Analysis

2.1. DT and ESG Performance in the Manufacturing Industry

2.2. The Mechanism of Organizational Resilience

2.3. The Mechanism of Technological Innovation

2.4. The Mechanism of Green Total Factor Productivity

3. Research Design

3.1. Models

3.2. Variables

3.2.1. Explained Variable

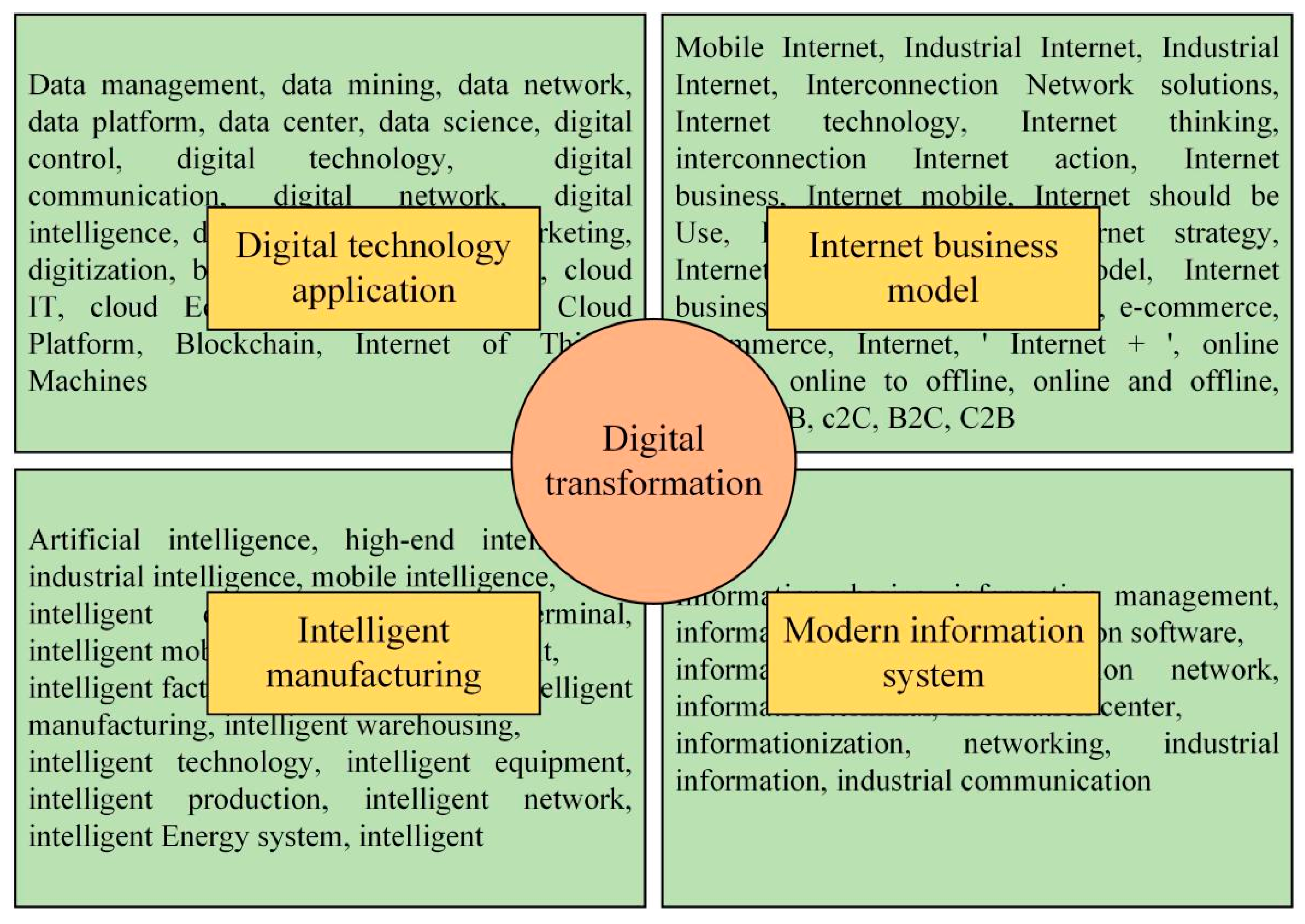

3.2.2. Explanatory Variable

3.2.3. Mechanism Variables

3.2.4. Control Variables

3.3. Descriptive Statistics of Variables

4. Analysis of Empirical Results

4.1. Benchmark Regression

4.2. Robustness Tests

4.2.1. Endogeneity Tests

4.2.2. Replacement of Explanatory Variables

4.2.3. Modification of the Clustering Standard Error

4.2.4. Adjust the Sample Size

4.3. Mechanism Tests

4.3.1. Mechanism Effects of Organizational Resilience

4.3.2. Mechanism Effects of Technological Innovation

4.3.3. Mechanism Effects of GTFP

4.4. Heterogeneity Tests

4.4.1. Nature of Property Rights

4.4.2. Policy Environment

4.4.3. Industry Competition

5. Discussion

5.1. The Role of Digital Transformation in Enhancing ESG Performance in Manufacturing

5.2. Causes of Heterogeneous Impacts

6. Conclusions and Limitations

6.1. Conclusions and Implications

6.2. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Olabi, A.G.; Abdelkareem, M.A. Renewable Energy and Climate Change. Renew. Sustain. Energy Rev. 2022, 158, 112111. [Google Scholar] [CrossRef]

- Liu, H.; Cai, X.; Zhang, Z.; Wang, D. Can Green Technology Innovations Achieve the Collaborative Management of Pollution Reduction and Carbon Emissions Reduction? Evidence from the Chinese Industrial Sector. Environ. Res. 2025, 264, 120400. [Google Scholar] [CrossRef]

- Feng, R.; Chen, B.; Liu, S.; Wang, F.; Wang, K.; Zhengchen, R.; Wang, D. Future Inequality of Human Exposure to Greenspace Resource and Spatial Utilization Strategy in China. Resour. Conserv. Recycl. 2025, 218, 108231. [Google Scholar] [CrossRef]

- Zhao, D.; Gao, Y.; Wu, Z.; Shabaz, M. Harnessing Robotics for Environmental Economics and Energy Strategy: Advancing Global Economic Policies towards Green Growth. Energy Strategy Rev. 2024, 55, 101504. [Google Scholar] [CrossRef]

- Wang, D.; Gong, Z.; Wang, Y. Stock Market Development and the Global Value Chain Position of Manufacturing Industry. Res. Int. Bus. Financ. 2025, 75, 102739. [Google Scholar] [CrossRef]

- Leng, J.; Guo, J.; Xie, J.; Zhou, X.; Liu, A.; Gu, X.; Mourtzis, D.; Qi, Q.; Liu, Q.; Shen, W.; et al. Review of Manufacturing System Design in the Interplay of Industry 4.0 and Industry 5.0 (Part I): Design Thinking and Modeling Methods. J. Manuf. Syst. 2024, 76, 158–187. [Google Scholar] [CrossRef]

- Kunkel, S.; Neuhäusler, P.; Matthess, M.; Dachrodt, M.F. Industry 4.0 and Energy in Manufacturing Sectors in China. Renew. Sustain. Energy Rev. 2023, 188, 113712. [Google Scholar] [CrossRef]

- Khaled, R.; Ali, H.; Mohamed, E.K.A. The Sustainable Development Goals and Corporate Sustainability Performance: Mapping, Extent and Determinants. J. Clean. Prod. 2021, 311, 127599. [Google Scholar] [CrossRef]

- Chen, S.; Song, Y.; Gao, P. Environmental, Social, and Governance (ESG) Performance and Financial Outcomes: Analyzing the Impact of ESG on Financial Performance. J. Environ. Manag. 2023, 345, 118829. [Google Scholar] [CrossRef] [PubMed]

- Zhang, N.; Han, H. The New Environmental Protection Law, Political Connections and Corporate ESG Performance. Int. Rev. Financ. Anal. 2025, 102, 104110. [Google Scholar] [CrossRef]

- Li, W.; Mao, Z.; Ren, X.; Liang, J. Retail Investor Attention: Guardian of Corporate ESG Integrity or Catalyst for Greenwashing? Energy Econ. 2025, 144, 108361. [Google Scholar] [CrossRef]

- Yan, N.; Xue, Y.; Xu, M.; Sun, Y.; Yang, Y. Sentiment Tendency of ESG Coverage, Public Concern, and Corporate Environmental Performance. Financ. Res. Lett. 2025, 76, 106918. [Google Scholar] [CrossRef]

- Hallioui, A.; Herrou, B.; Santos, R.S.; Katina, P.F.; Egbue, O. Systems-Based Approach to Contemporary Business Management: An Enabler of Business Sustainability in a Context of Industry 4.0, Circular Economy, Competitiveness and Diverse Stakeholders. J. Clean. Prod. 2022, 373, 133819. [Google Scholar] [CrossRef]

- Behl, A.; Singh, R.; Pereira, V.; Laker, B. Analysis of Industry 4.0 and Circular Economy Enablers: A Step towards Resilient Sustainable Operations Management. Technol. Forecast. Soc. Change 2023, 189, 122363. [Google Scholar] [CrossRef]

- Oliveira-Dias, D.; Maqueira-Marín, J.M.; Moyano-Fuentes, J. The Link between Information and Digital Technologies of Industry 4.0 and Agile Supply Chain: Mapping Current Research and Establishing New Research Avenues. Comput. Ind. Eng. 2022, 167, 108000. [Google Scholar] [CrossRef]

- Choi, T.-M.; Siqin, T. Can Government Policies Help to Achieve the Pollutant Emissions Information Disclosure Target in the Industry 4.0 Era? Ann. Oper. Res. 2024, 342, 1129–1147. [Google Scholar] [CrossRef]

- Wang, Y.; Guo, Y. Firm Digital Transformation and ESG Performance: Evidence from Chin’s A-share Listed Firms. J. Financ. Econ. 2023, 49, 94–108. (In Chinese) [Google Scholar] [CrossRef]

- Cai, C.; Tu, Y.; Li, Z. Enterprise Digital Transformation and ESG Performance. Financ. Res. Lett. 2023, 58, 104692. [Google Scholar] [CrossRef]

- Chen, Y.; Pan, X.; Liu, P.; Vanhaverbeke, W. How Does Digital Transformation Empower Knowledge Creation? Evidence from Chinese Manufacturing Enterprises. J. Innov. Knowl. 2024, 9, 100481. [Google Scholar] [CrossRef]

- Zhang, W.; Zhao, Y.; Meng, F. ESG Performance and Green Innovation of Chinese Enterprises: Based on the Perspective of Financing Constraints. J. Environ. Manag. 2024, 370, 122955. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Iranmanesh, M. Digital Transformation Success under Industry 4.0: A Strategic Guideline for Manufacturing SMEs. J. Manuf. Technol. Manag. 2021, 32, 1533–1556. [Google Scholar] [CrossRef]

- Song, C.; Han, M.; Yuan, H. The Impact of Digital Transformation on Firm Productivity: From the Perspective of Sustainable Development. Financ. Res. Lett. 2025, 75, 106912. [Google Scholar] [CrossRef]

- Jonathan, G.M.; Perjons, E.; Rusu, L. Untangling the Link between Digital Transformation and Information Security Management. Procedia Comput. Sci. 2024, 239, 575–582. [Google Scholar] [CrossRef]

- Guerra, J.M.M.; Valle, I.D.-D. Exploring Organizational Change in the Age of Digital Transformation and Its Impact on Talent Management: Trends and Challenges. J. Organ. Change Manag. 2024, 37, 1273–1294. [Google Scholar] [CrossRef]

- Yang, G.-Z.; Si, D.-K.; Ning, G.-J. Does Digital Transformation Reduce the Labor Income Share in Enterprises? Econ. Anal. Policy 2023, 80, 1526–1538. [Google Scholar] [CrossRef]

- Jubault Krasnopevtseva, N.; Thomas, C.; Kaminska, R. Organizing for Resilience in High-Risk Organizations: The Interplay between Managerial Coordination and Control in Resolving Stability/Flexibility Tensions in a Nuclear Power Plant. J. Bus. Res. 2025, 189, 115120. [Google Scholar] [CrossRef]

- Huang, J.; Yang, B.; Zhou, B.; Ran, B. Sustainable Knowledge Integration: Enhancing Green Development Resilience. J. Innov. Knowl. 2025, 10, 100671. [Google Scholar] [CrossRef]

- Nardella, G.; Surdu, I.; Brammer, S. What Happens Abroad, Stays Abroad? Exploring How Corporate Social Irresponsibility in Domestic and International Markets Influences Corporate Reputation. J. World Bus. 2023, 58, 101420. [Google Scholar] [CrossRef]

- Ma, B.; Zhang, J. Tie Strength, Organizational Resilience and Enterprise Crisis Management: An Empirical Study in Pandemic Time. Int. J. Disaster Risk Reduct. 2022, 81, 103240. [Google Scholar] [CrossRef]

- Irfan, I.; Sumbal, M.S.U.K.; Khurshid, F.; Chan, F.T.S. Toward a Resilient Supply Chain Model: Critical Role of Knowledge Management and Dynamic Capabilities. Ind. Manag. Data Syst. 2022, 122, 1153–1182. [Google Scholar] [CrossRef]

- Hussain, M.; Papastathopoulos, A. Organizational Readiness for Digital Financial Innovation and Financial Resilience. Int. J. Prod. Econ. 2022, 243, 108326. [Google Scholar] [CrossRef]

- Zhan, Y.; Li, W. Has Digital Transformation Enhanced the Resilience of Manufacturing Enterprises? Int. Rev. Econ. Financ. 2024, 96, 103688. [Google Scholar] [CrossRef]

- Liu, Q.; Wang, H. Digital Transformation, Innovation Capability, and ESG Performance. Financ. Res. Lett. 2025, 78, 107166. [Google Scholar] [CrossRef]

- Arzo, S.; Hong, M. A Roadmap to SDGs-Emergence of Technological Innovation and Infrastructure Development for Social Progress and Mobility. Environ. Res. 2024, 246, 118102. [Google Scholar] [CrossRef]

- Gao, B.; Qin, M.; Xie, J. Does Corporate Digital Transformation Improve Capital Market Transparency? Evidence from China. N. Am. J. Econ. Financ. 2025, 76, 102363. [Google Scholar] [CrossRef]

- Lin, B.; Ma, R. How Does Digital Finance Influence Green Technology Innovation in China? Evidence from the Financing Constraints Perspective. J. Environ. Manag. 2022, 320, 115833. [Google Scholar] [CrossRef] [PubMed]

- Xu, Y.; Yuan, L.; Khalfaoui, R.; Radulescu, M.; Mallek, S.; Zhao, X. Making Technological Innovation Greener: Does Firm Digital Transformation Work? Technol. Forecast. Soc. Change 2023, 197, 122928. [Google Scholar] [CrossRef]

- Ma, X.; Zhou, A.; Chi, C. ESG Performance and Green Total Factor Productivity. Financ. Res. Lett. 2025, 73, 106630. [Google Scholar] [CrossRef]

- Wang, J.; Liu, Y.; Wang, W.; Wu, H. How Does Digital Transformation Drive Green Total Factor Productivity? Evidence from Chinese Listed Enterprises. J. Clean. Prod. 2023, 406, 136954. [Google Scholar] [CrossRef]

- Su, J.; Wei, Y.; Wang, S.; Liu, Q. The Impact of Digital Transformation on the Total Factor Productivity of Heavily Polluting Enterprises. Sci. Rep. 2023, 13, 6386. [Google Scholar] [CrossRef] [PubMed]

- Yang, S.; Chen, Y.; Chen, H.; Ye, B.; Shao, S. Digital Enterprise Distribution and Green Total Factor Productivity: A Spatial Agglomeration Perspective. Environ. Impact Assess. Rev. 2025, 112, 107832. [Google Scholar] [CrossRef]

- Avramov, D.; Cheng, S.; Lioui, A.; Tarelli, A. Sustainable Investing with ESG Rating Uncertainty. J. Financ. Econ. 2022, 145, 642–664. [Google Scholar] [CrossRef]

- Wu, Y.; Li, Z. Digital Transformation, Entrepreneurship, and Disruptive Innovation: Evidence of Corporate Digitalization in China from 2010 to 2021. Humanit. Soc. Sci. Commun. 2024, 11, 163. [Google Scholar] [CrossRef]

- Li, X.; Kong, M. Research on the Impact of Digital Transformation on Organizational Resilience—Based on the Moderating Effect of Environmental Uncertainty. J. Jilin Bus. Technol. Coll. 2023, 39, 49–55. (In Chinese) [Google Scholar] [CrossRef]

- Li, P.P.; Zhu, J. A Literature Review of Organizational Resilience. Foreign Econ. Manag. 2021, 43, 25–41. (In Chinese) [Google Scholar] [CrossRef]

- Stoverink, A.C.; Kirkman, B.L.; Mistry, S.; Rosen, B. Bouncing Back Together: Toward a Theoretical Model of Work Team Resilience. Acad. Manag. Rev. 2020, 45, 395–422. [Google Scholar] [CrossRef]

- Feng, S.; Zhang, R.; Li, G. Environmental Decentralization, Digital Finance and Green Technology Innovation. Struct. Change Econ. Dyn. 2022, 61, 70–83. [Google Scholar] [CrossRef]

- Zhang, J.; Chen, S. Financial Development, Environmental Regulations and Green Economic Transition. J. Financ. Econ. 2021, 47, 78–93. [Google Scholar] [CrossRef]

- Amini, S.; Kumar, R.; Shome, D. Product Market Competition and Corporate Investment: An Empirical Analysis. Int. Rev. Econ. Financ. 2024, 94, 103405. [Google Scholar] [CrossRef]

- Sheehan, N.T.; Vaidyanathan, G.; Fox, K.A.; Klassen, M. Making the Invisible, Visible: Overcoming Barriers to ESG Performance with an ESG Mindset. Bus. Horiz. 2023, 66, 265–276. [Google Scholar] [CrossRef]

- Meng, T.; Li, Q.; He, C.; Dong, Z. Research on the Configuration Path of Manufacturing Enterprises’ Digital Servitization Transformation. Int. Rev. Econ. Financ. 2025, 98, 103952. [Google Scholar] [CrossRef]

- Liu, X.; Ma, C.; Ren, Y.-S. How AI Powers ESG Performance in China’s Digital Frontier? Financ. Res. Lett. 2024, 70, 106324. [Google Scholar] [CrossRef]

- Wei, C.; Li, C.-Z.; Löschel, A.; Managi, S.; Lundgren, T. Digital Technology and Energy Sustainability: Recent Advances, Challenges, and Opportunities. Resour. Conserv. Recycl. 2023, 190, 106803. [Google Scholar] [CrossRef]

- Li, W.; Zhang, M. Digital Transformation, Absorptive Capacity and Enterprise ESG Performance: A Case Study of Strategic Emerging Industries. Sustainability 2024, 16, 5018. [Google Scholar] [CrossRef]

- Fang, C.; Wang, Z.; Zhao, L. Environmental Regulations and the Greenwashing of Corporate ESG Reports. Econ. Anal. Policy 2025, 87, 1469–1481. [Google Scholar] [CrossRef]

- Chen, Y.; Ren, J. How Does Digital Transformation Improve ESG Performance? Empirical Research from 396 Enterprises. Int. Entrep. Manag. J. 2024, 21, 27. [Google Scholar] [CrossRef]

| Types | Variables | Notations | Definitions |

|---|---|---|---|

| Explained variable | ESG | ESG | The standardized mean ESG score across the five institutions |

| Explanatory variable | Digital transformation | DT | The word frequency of relevant texts in the annual reports |

| Mechanism variables | Organizational resilience | OR | The standardized mean values of the indicators under the rebound and surpassing dimensions |

| Technological innovation | TI | Logarithm of (the number of granted patents + 1) | |

| Green total factor productivity | GTFP | The calculation of the super-efficient SBM model | |

| Control variables | Firm size | Size | Logarithm of total business assets |

| Fixed assets | Fixed | Logarithm of fixed assets of the enterprise | |

| Debt-to-asset ratio | Asset | Total liabilities/total business assets | |

| Marginal profit margin | Profit | (Sales revenue − variable costs)/sales revenue | |

| Earnings per share | Roa | (Net income − preferred stock dividends)/average shares outstanding | |

| CEO duality | Dual | If the chairman and general manager are the same person take 1; alternatively, take 0 | |

| Board size | Board | Total number of board members at the end of the year + 1 to take natural logarithms | |

| Ownership concentration | Top5 | Natural logarithm of the percentage of shares held by the top five shareholders | |

| Firm age | Age | Logarithm of years of business establishment |

| Variable | Observation | Mean | Standard Deviation | Min | Max |

|---|---|---|---|---|---|

| ESG | 9997 | 0.343 | 0.245 | 0.010 | 0.940 |

| DT | 9997 | 0.010 | 0.014 | 0.000 | 0.084 |

| Size | 9997 | 22.405 | 1.225 | 20.061 | 25.888 |

| Fixed | 9997 | 20.799 | 1.421 | 17.539 | 24.609 |

| Asset | 9997 | 0.425 | 0.196 | 0.057 | 0.910 |

| Profit | 9997 | 1.007 | 0.064 | 0.776 | 1.351 |

| Roa | 9997 | 0.401 | 0.673 | −1.261 | 3.621 |

| Dual | 9997 | 0.752 | 0.432 | 0.000 | 1.000 |

| Board | 9997 | 2.262 | 0.159 | 1.792 | 2.708 |

| Top5 | 9997 | 0.494 | 0.148 | 0.184 | 0.852 |

| Age | 9997 | 2.532 | 0.603 | 0.693 | 3.367 |

| Variable | ESG | E | S | G | ||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| DT | 1.806 *** (10.22) | 1.534 *** (8.57) | 1.271 *** (6.49) | 39.855 *** (7.20) | 32.120 *** (4.92) | 13.542 *** (2.70) |

| Size | 0.04 *** (8.52) | 0.045 *** (8.94) | 0.989 *** (6.90) | 1.437 *** (8.50) | 1.276 *** (9.82) | |

| Fixed | 0.023 *** (6.11) | 0.02 *** (4.8) | 0.838 *** (7.23) | 0.233 * (1.70) | 0.068 (0.65) | |

| Asset | −0.235 *** (−17.08) | −0.227 *** (−15.52) | −0.568 (−1.38) | −1.772 *** (−3.54) | −12.040 *** (−32.16) | |

| Profit | −0.04 (−1.11) | −0.054 (−1.45) | −1.609 (−1.54) | −5.292 *** (−4.29) | −1.331 (−1.40) | |

| Roa | 0.032 *** (8.04) | 0.028 *** (6.95) | 0.244 ** (2.13) | 1.124 *** (8.32) | 0.850 *** (8.19) | |

| Dual | 0.015 *** (2.74) | 0.017 *** (3.11) | 0.644 *** (4.16) | 0.037 (0.20) | 0.544 *** (3.88) | |

| Board | 0.02 (1.33) | 0.026 * (1.68) | 1.348 *** (3.10) | 1.779 *** (3.47) | −1.542 *** (−3.91) | |

| Top5 | −0.003 (−0.2) | −0.008 (−0.47) | −0.137 (−0.28) | −3.545 *** (−6.07) | 0.631 (1.41) | |

| Age | −0.05 *** (−11.26) | −0.033 *** (−5.95) | 0.236 (1.52) | −2.799 *** (−15.30) | 0.455 *** (3.24) | |

| Constant | −0.844 *** (−12.29) | −0.933 *** (−12.88) | 19.442 *** (9.66) | 46.449 *** (19.56) | 56.722 *** (31.06) | |

| Year/Ind/Place | NO | NO | YES | YES | YES | YES |

| Observations | 9997 | 9997 | 9997 | 9997 | 9997 | 9997 |

| Adj-R2 | 0.0102 | 0.1266 | 0.1657 | 0.2339 | 0.2157 | 0.2270 |

| Variable | Instrumental Variable | Heckman Two-Stage | PSM | ||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| Stage 1 DT | Stage 2 ESG | Stage 1 DT_H | Stage 2 ESG | ||

| DT | 2.268 *** (3.41) | 1.148 *** (5.67) | 0.959 *** (2.93) | ||

| IV_DT | 0.007 *** (29.98) | 0.125 ** (2.46) | |||

| IMR | 0.015 ** (2.52) | ||||

| Constant | −0.036 *** (−9.62) | −0.818 *** (−10.99) | −6.853 *** (−14.30) | −0.928 *** (−12.40) | −0.992 *** (−6.71) |

| Controls | Yes | Yes | Yes | Yes | Yes |

| Year/Ind/Place | Yes | Yes | Yes | Yes | Yes |

| Observations | 9997 | 9997 | 9997 | 9997 | 3983 |

| R2/Adj-R2 | 0.2069 | 0.1147 | 0.2687 | 0.1629 | 0.2517 |

| Variable | Replacement of Digital Transformation Measurement | Clustering Standard Error | Excluding Municipalities | Reduced Timeframe | ||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| DT | 0.016 *** (6.77) | 1.169 *** (5.88) | 0.003 *** (10.23) | 1.271 *** (3.58) | 1.208 *** (5.83) | 1.252 *** (5.74) |

| Constant | 0.045 *** (8.76) | 4.817 *** (11.29) | −0.948 *** (−13.18) | −0.933 *** (−5.07) | 0.966 *** (−11.96) | 0.961 *** (−10.89) |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year/Ind/Place | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 9997 | 9997 | 9997 | 9997 | 8605 | 6151 |

| Adj-R2 | 0.1661 | 0.9541 | 0.1610 | 0.1657 | 0.1591 | 0.1925 |

| Variable | OR | TI | GTFP |

|---|---|---|---|

| (1) | (2) | (3) | |

| DT | 2.840 *** (11.92) | 13.292 *** (10.81) | 0.170 *** (4.34) |

| Constant | −0.470 *** (−5.14) | −14.106 *** (−31.53) | −0.422 *** (−29.6) |

| Controls | Yes | Yes | Yes |

| Year/Ind/Place | Yes | Yes | Yes |

| Observations | 9997 | 9997 | 9997 |

| Adj-R2 | 0.1737 | 0.4646 | 0.5274 |

| Variable | Nature of Property Rights | Policy Environment | Industry Competition | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| State-Owned | Non-State-Owned | Strict | Lenient | Intense | Lenient | |

| DT | 1.43 *** (4.04) | 1.208 *** (5.07) | 1.322 *** (5.86) | 0.86 ** (2.22) | 1.101 *** (4.16) | 1.561 *** (5.24) |

| Constant | −0.835 *** (−7.48) | −0.887 *** (−8.42) | −1.165 *** (−13.29) | −0.51 *** (−3.92) | −0.942 *** (−9.49) | −0.981 *** (−8.17) |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Year/Ind/Place | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 4373 | 5624 | 6408 | 3589 | 6048 | 3949 |

| Adj-R2 | 0.2 | 0.19 | 0.173 | 0.176 | 0.159 | 0.207 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, P.; Wang, X.; Jiang, H.; Meng, X. Does Digital Transformation Improve Manufacturing ESG Performance: Evidence from China. Sustainability 2025, 17, 7278. https://doi.org/10.3390/su17167278

Guo P, Wang X, Jiang H, Meng X. Does Digital Transformation Improve Manufacturing ESG Performance: Evidence from China. Sustainability. 2025; 17(16):7278. https://doi.org/10.3390/su17167278

Chicago/Turabian StyleGuo, Puhao, Xiangqian Wang, Huaiyin Jiang, and Xiangrui Meng. 2025. "Does Digital Transformation Improve Manufacturing ESG Performance: Evidence from China" Sustainability 17, no. 16: 7278. https://doi.org/10.3390/su17167278

APA StyleGuo, P., Wang, X., Jiang, H., & Meng, X. (2025). Does Digital Transformation Improve Manufacturing ESG Performance: Evidence from China. Sustainability, 17(16), 7278. https://doi.org/10.3390/su17167278