Abstract

Intelligent manufacturing is the inevitable path for China to achieve its strategy of becoming a manufacturing power. Exploring how intelligent manufacturing policies can promote green innovation, which refers to promoting innovative technologies aimed at improving resource utilization efficiency, is of great significance for promoting the green transformation of enterprises. Based on the data of A-share listed enterprises from 2010 to 2023, this study regards the intelligent manufacturing demonstration project pilot as a quasi-natural experiment and explores its policy spillover effects and mechanism. The research findings indicate that the intelligent manufacturing policy can greatly improve firms’ green innovation, and non-state-owned and non-high-pollution enterprises are more sensitive to intelligent manufacturing policies. It has a significant spatial spillover effect in both the district and industry dimensions. In addition, the mechanism analysis indicates that alleviating enterprises’ financing constraints and environmental uncertainty are important ways to promote enterprises’ green innovation. This study empirically designs to fill the theoretical gap in the association between intelligent manufacturing policies and green innovation in the body of knowledge, and innovatively verifies the spatial spillover effect of intelligent manufacturing policies from both the district and industry dimensions. At the practical level, its conclusion provides an operational decision-making toolbox for multiple entities such as the government, enterprises, and financial institutions to jointly promote green transformation.

1. Introduction

The fundamental approach to achieving the “Dual Carbon” goals lies in promoting sustainable development through green innovation [1,2]. However, green innovation has an externality feature, which poses numerous challenges for enterprises when they independently carry it out, leading to insufficient willingness [3,4]. Therefore, stimulating the green innovation impetus of firms is a critical issue that requires immediate attention. Although their strategic choices are the core factors in promoting green innovation, external policy support is also indispensable. In 2015, the Chinese government issued the “Implementation Plan for the Special Action on Pilot Demonstration of Intelligent Manufacturing” and launched the special action on pilot demonstration of intelligent manufacturing. As the core strategy of the industrial revolution, the implementation of the intelligent manufacturing policy (IMP) has had a profound impact on enterprises’ production operations and innovation activities. Against this background, how to jointly promote green innovation through policy guidance and the efforts of enterprises has become the key to achieving sustainable development. Therefore, we attempt to answer the following questions: (1) Can the intelligent manufacturing policy generate an innovation dividend, stimulating the intrinsic motivation of enterprises’ green innovation? (2) Does this kind of innovation dividend have a spatial spillover effect? (3) What is the internal mechanism involved? (4) Are there any differences in the roles of intelligent manufacturing policies?

In this study, green innovation is defined as innovative technologies aimed at reducing environmental pollution and improving resource utilization efficiency [5]. In line with the recent literature, we conceptualize it as innovative activities aimed at significantly reducing environmental burdens, which can help enterprises achieve a balance between economic benefits and sustainable development. In recent years, many studies have focused on the green innovation of enterprises. For instance, Kim et al. [6] explored the correlation between open innovation and green innovation from the perspective of resource reorganization in open ecological innovation; Zhao et al. [7] studied the role of substantive green innovation in regulating environmental policies and foreign direct investment. These studies provide rich insights into the field of green innovation. However, at present, research on the impact of intelligent manufacturing policies on green innovation is still relatively scarce, and this field urgently needs further exploration.

The intelligent manufacturing policy serves the dual functions of industrial upgrading and environmental governance. It not only optimizes the traditional manufacturing development model but also supplements environmental protection policies. Promoting advanced smart manufacturing technologies, it facilitates the manufacturing industry toward high-end and intelligent directions [8]. This not only enhances production efficiency and reduces resource consumption, but also guides capital toward technological innovation and green production areas, thereby promoting enterprises’ green innovation activities [9,10]. Moreover, the IMP can send positive signals to parties in the market, thereby alleviating enterprises’ financing constraints. Guiding enterprises to use digital technologies, it can alleviate the environmental uncertainty caused by the information gap. Therefore, exploring the actual impact of IMP on enterprises’ green innovation not only helps to stimulate the intrinsic motivation for green innovation, but also provides policy guidance for enterprises on the path of sustainable development. The central motivation of this paper is to elucidate the intrinsic influence mechanism between IMP and enterprises’ green innovation.

However, it is still unclear how intelligent manufacturing policies affect firms’ green innovation. Existing studies mostly adopt indicators such as industrial robots, the application degree of artificial intelligence, and the frequency of keywords in firms’ reports when measuring the level of intelligent manufacturing [11,12]. However, these indicators have certain limitations. For instance, the number of keywords in the annual reports of enterprises also significantly differs from the concept of intelligent manufacturing, making it impossible to accurately measure the intelligence level [13,14]. Therefore, this paper regards the intelligent manufacturing pilot as a quasi-natural experiment, examines the exogenous shock of intelligent manufacturing on enterprises’ green innovation and its spillover effects, and further enriches the theoretical research in related fields.

Therefore, employing data from Chinese A-share listed enterprises from 2010 to 2023, this paper deeply examines the impact of IMP on enterprises’ green innovation. We demonstrate that the IMP has markedly improved firms’ green innovation. This policy has demonstrated remarkable spillover effects, effectively promoting the green innovation of other enterprises within the same district and industry. Research reveals that the intelligent manufacturing policy mainly promotes green innovation through two channels: alleviating financing constraints and reducing environmental uncertainties. Heterogeneity analysis indicates that non-state-owned and non-highly polluting enterprises are more sensitive to the response of intelligent manufacturing policies.

The primary contribution of this study can be summarized as follows. First, by focusing on the unique context of green innovation in micro enterprises, we clarify the causal relationship between intelligent manufacturing policies and enterprise-level green innovation. While the existing literature has predominantly examined topics such as low-carbon transformation [15], ESG performance [16], and asset pricing [17], these studies have primarily explored the short-term impacts of intelligent manufacturing from various perspectives. However, the influence of intelligent manufacturing on enterprise green innovation—particularly its heterogeneous effects on both the quantity and quality—has been largely overlooked. Second, we investigate the spatial spillover effects of intelligent manufacturing policies on green innovation performance from both the county- and industry-level perspectives. Most existing studies, such as Zhou et al. [18], Tan et al. [19], and Liu and Zuo [20], focus solely on the direct effects of these policies. Research on their spatial spillover effects remains scarce. Given the externalities associated with green innovation, spatial correlation must be considered when analyzing enterprise-level green innovation. Third, we further explore the mechanisms and pathways through which intelligent manufacturing facilitates green innovation by incorporating factors such as financing constraints and environmental uncertainty. Although a substantial body of literature has examined the mechanisms underlying enterprise green innovation [21,22], the roles of environmental uncertainty and financing constraints as transmission channels within the context of intelligent manufacturing policies remain underexplored. Therefore, this study serves as a valuable addition to the existing literature on intelligent manufacturing and its broader economic implications, offering new insights into the interplay between intelligent manufacturing and enterprise green innovation.

The subsequent structure is arranged as follows: The second part systematically reviews the relevant literature. The third part puts forward research hypotheses based on theoretical analysis. Part four constructs the econometric model and explains the variables and data sources. The fifth part reports the empirical results and conducts discussions. The sixth part summarizes the conclusions and puts forward targeted policy suggestions.

2. Literature Review

There are four categories of the literature closely related to this study. The first category of literature centers on the conceptual definition and measurement of green innovation. Green innovation is commonly defined as a technological advancement that reduces environmental pollution and enhances resource utilization efficiency [23,24]. A majority of existing studies classify green innovation into two types: “substantive green innovation” and “strategic green innovation.” The former typically involves substantial investment and improvements in the quality of green innovation, yet it generates significant environmental and economic benefits. In contrast, the latter requires relatively lower investment and delivers quicker outcomes, but often emphasizes low-complexity, easily implementable “light green” improvements in the quantity of green innovations. For example, Su et al. [23] found that chief executive officers with specific professional backgrounds are more likely to support strategic green innovation. Conversely, Zhao et al. [7] examined the moderating effect of substantive green innovation in the relationship between environmental regulation and foreign direct investment, thereby underscoring its long-term strategic value. The existing studies predominantly utilize the number of green patent applications or authorizations [25] or the questionnaire method [26] to measure green innovation, or employ data envelopment analysis to calculate the green innovation efficiency [27].

The second category focuses on the influencing factors of green innovation. Existing research mainly explores the influencing factors of green innovation in micro enterprises from both internal and external perspectives. Concerning external influencing factors, the degree of marketisation [28], green finance [29], views of local media on pollution [30], the degree of digitalization [31], and institutional pressure [32]. For instance, He et al. [30] indicate that positive emotions in local media can significantly promote the green innovation of micro enterprises, suggesting that the media environment has a significant influence on the innovative behaviors of enterprises. With regard to internal influencing factors, corporate environmental [33] social responsibility [3], stakeholder pressure [34], and the presence of returning directors have been shown to impact firms’ green innovation [35]. Yuan and Cao [3] found that corporate environmental social responsibility has a significant positive promoting effect on green innovation. This indicates that internal governance and values of enterprises have a promoting effect on innovative behaviors.

The third category focuses on the measurement and economic effects of intelligent manufacturing policies on micro enterprises. Firstly, the existing research mainly adopts two methods to measure the development level of intelligent manufacturing. One approach is rooted in pivotal technologies or frameworks of intelligent manufacturing, including artificial intelligence and industrial robots [36,37]. A study by Liu et al. [36] examined the impact of industrial robot density on technological innovation, revealing a substantial positive correlation. However, industrial robots are merely one of the technologies covered by intelligent manufacturing and cannot fully reflect it. Another approach is to adopt the text analysis method [13,20], that is, to measure the development level of intelligent manufacturing in the form of annual report keywords. However, the number of keywords in the annual reports of enterprises also significantly differs from the concept of intelligent manufacturing, making it impossible to accurately measure the level of intelligence. Furthermore, existing studies have confirmed that intelligent manufacturing can significantly enhance enterprise value creation [38], promote the upgrading of enterprise human capital [21], and optimize the factor allocation ability of enterprises [39]. Intelligent manufacturing policies can also enhance enterprises’ investment capabilities [40] and management capabilities [41]. Zhu et al. [38] suggest that intelligent manufacturing policies can significantly reduce carbon emissions by promoting green innovation among enterprises.

The fourth category focuses on the green effects brought about by intelligent manufacturing policies. In terms of the green effect, existing studies have found that intelligent manufacturing policies can have a significant impact on enterprises’ ESG performance [42], sustainable performance [43], etc. However, the existing research has not yet reached a unanimous conclusion. On the one hand, some studies have pointed out that intelligent manufacturing policies can facilitate enterprises’ low-carbon transformation [15] and enhance their environmental performance [22], thereby generating positive environmental effects. On the other hand, some studies have also found that as the application scale of robots expands, their potential impact on the environment may exhibit dynamic changes. For instance, the research of Zhou et al. [18] pointed out that intelligent manufacturing policies are affected by the environmental impact of robot systems in terms of energy absorption and release. This change mainly stems from the rebound effect that technological progress may trigger, which in turn leads to an increase in energy consumption [44,45].

In conclusion, although intelligent manufacturing and green innovation in enterprises have received extensive attention, there are still two issues that urgently need in-depth exploration and further research. Firstly, the majority of extant research in the field of intelligent manufacturing focuses exclusively on a singular index, whether that be artificial intelligence or industrial robots. However, this cannot comprehensively and accurately measure the overall development level. Moreover, the utilization of text analysis as a metric to gauge the extent of an enterprise’s intelligent or digital transformation entails a substantial conceptual discrepancy from the essence of intelligent manufacturing. This discrepancy impedes the precise reflection of the actual progression. The present study adopts an industrial policy perspective on intelligent manufacturing, conceptualizing it as an exogenous shock that can comprehensively enhance the intelligent manufacturing level of enterprises. To a certain extent, it also addresses the challenge of measuring. Secondly, the environmental impacts of intelligent manufacturing continue to be a contentious issue within the prevailing academic discourse. The extant research in this area has not yet reached a unanimous conclusion. The efficacy of intelligent manufacturing policies in effectively releasing the dividends of green innovation remains to be verified. Concurrently, the mechanism through which intelligent manufacturing policies influence enterprises’ green innovation warrants further elucidation.

3. Theoretical Analysis and Research Hypotheses

Compared with the traditional manufacturing paradigm, intelligent manufacturing represents a deep integration of new-generation information technology and advanced manufacturing techniques. Its policy objective extends beyond enhancing the fundamental capabilities of enterprises, aiming instead to propel them toward low-carbon development along an intelligent trajectory [21]. In this context, intelligent manufacturing policies (IMPs) enhance corporate green innovation momentum through two complementary mechanisms.

Firstly, the signal effect elucidates the external incentive mechanism of the IMP as “credible commitment devices.” According to signal theory [46], obtaining IMP demonstration qualifications constitutes a high-cost, difficult-to-imitate signal. Only enterprises with a robust digital infrastructure for green transformation can successfully pass the rigorous evaluation process. Rational external stakeholders—such as investors, customers, and regulators—who are often constrained by limited information, interpret this certification as an indicator of high-quality firms. Consequently, these stakeholders tend to offer more favorable financing conditions and more lenient regulatory expectations. To safeguard their reputation and organizational legitimacy, enterprises are thus incentivized to increase their investment in green innovation, thereby establishing a positive feedback loop of “signal–resource acquisition–innovation.”

Secondly, based on the attribute effect of intelligent manufacturing policies, this study posits that the implementation of such policies can effectively promote green innovation within enterprises. Specifically, the attribute effect indicates that through inherent characteristics, intelligent manufacturing policies guide enterprises to leverage emerging digital technologies for collecting and processing large volumes of data throughout the green innovation process. This, in turn, shortens the R&D cycle, mitigates R&D risks, and thereby enhances enterprise-level green innovation [47]. On one hand, the IMP encourages enterprises to adopt technologies such as the Internet of Things and big data analytics to enable real-time data collection and monitoring of green-related metrics, including energy consumption and pollutant emissions during production. These extensive datasets allow enterprises to more accurately identify the direction and focus of green innovation, thereby providing critical data support for green product development and process optimization [48,49]. On the other hand, the IMP drives enterprises to establish intelligent R&D platforms, accelerating the design and development of green innovative products through the application of artificial intelligence [50]. For example, industrial robots—being a core component of artificial intelligence and a fundamental technology in intelligent manufacturing—have transformed industrial production patterns through their integrated deployment, thereby offering new competitive advantages for green innovation. Specifically, robots can collect and analyze masses of production data, creating a digital environment for the design and testing of green technologies. This reduces the time and resource costs associated with offline experimentation, minimizes decision-making errors, and ultimately enhances the efficiency of green innovation. Therefore, we propose the following:

Hypothesis 1.

The intelligent manufacturing policy empowers enterprises’ green innovation.

Green innovation integrates the principles of “economic efficiency” and “positive social and environmental externalities.” It not only facilitates energy conservation and productivity enhancement through technological advancement but also contributes to pollution reduction, aligning with increasingly societal expectations. For example, Soori et al. [51] argue that the effectiveness of intelligent manufacturing policies still hinges on the balanced deployment of robotic systems, and digital twin technologies enable iterative optimization of green design schemes. As a result, green innovation has been widely acknowledged as a critical pathway for enterprises to achieve long-term sustainable development [52,53]. Nevertheless, green innovation initiatives often entail substantial initial investments, prolonged payback periods, and significant technological uncertainties, which deter traditional financing institutions from providing funding, thereby creating notable financial constraints [54]. Based on resource-based theory and signaling theory, this paper argues that the IMP alleviates the financing constraints of enterprises and promotes green innovation.

According to RBV, a firm’s competitive advantage originates from valuable, rare, inimitable, and non-substitutable resources [55]. Intelligent manufacturing, through technologies such as big data and cloud computing, enhances the information processing capabilities and transparency of enterprises. These information resources enable enterprises to collect and analyze market information more efficiently, optimize production processes, and reduce information risks. This information advantage can enhance the confidence of financial institutions in enterprises and improve the financing capacity of enterprises. Signaling theory posits that under conditions of information asymmetry, high-quality firms are inclined to incur significant costs to convey credible, observable, and difficult-to-imitate signals to distinguish themselves from their lower-quality counterparts [56]. The selection criteria for the IMP’s “demonstration factory” designation involve rigorous benchmarks related to digital maturity, environmental performance, and sustained investment commitment. This process generates a credible signal that is recognized by rational financial institutions, supply chain partners, and customers, thereby mitigating external financing constraints [57]. Therefore, we propose the following:

Hypothesis 2.

The intelligent manufacturing policy promotes green innovation by mitigating financing constraints.

The resource dependence theory points out that enterprises cannot be self-sufficient in all the key resources needed for their survival and development [58,59]. They must continuously exchange with the external environment, thus forming a chain of “dependence–power–uncertainty”. This is especially true for green innovation: enterprises need both external green capital and real-time access to demand, regulation, and technological trends. When environmental uncertainty (EU) increases—manifested as sharp fluctuations in demand, sudden changes in investor sentiment, or disruptions to suppliers—the stability of the resource supply is weakened, and enterprises will compress high-risk and long-term green innovation investment due to the “resource dependence gap” [60]. The IMP weakens the above-mentioned dependencies and buffers uncertainties through a dual intervention of “resource injection + information governance”.

On the one hand, resource injection, such as government subsidies, public data platforms, shared computing power, etc., directly reduces the intensity of enterprises’ reliance on a single external entity. On the other hand, information governance such as policies mandate or encourage enterprises to deploy IoT and AI platforms, integrating unstructured/structured data on policies, markets, and supply chains in real time, and enhancing the speed of perception and response to external changes. According to the information processing theory [61], when the information gap narrows, the negative impact of the EU on strategic decisions decreases accordingly, thereby releasing resources and psychological space for green innovation. The demonstration project of intelligent manufacturing, through automated and intelligent systems, optimizes the encoding and processing of information, which can significantly reduce the environmental uncertainty of enterprises. Specifically, the intelligent manufacturing demonstration project encourages enterprises to install intelligent systems that can automatically identify and clean noise and errors in data, ensuring the accuracy and reliability of input information. For instance, abnormal data can be automatically identified and corrected through machine learning algorithms. Therefore, the government-led intelligent manufacturing policy has effectively alleviated the inhibitory effect of environmental uncertainty on green innovation through the dual approaches of resource supply and information governance. Therefore, we propose the following:

Hypothesis 3.

Intelligent manufacturing policies can influence green innovation by reducing environmental uncertainty.

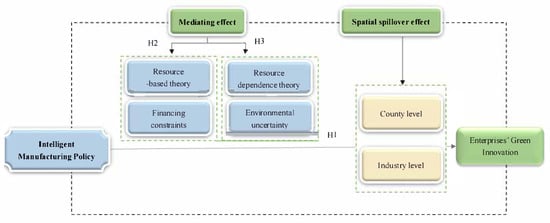

The structure of how intelligent manufacturing policies affect businesses’ green innovation is shown in Figure 1. The IMP exerts influence on different county and industry levels through spatial spillover effects and affects enterprises’ green innovation through mediating effects (financing constraints and environmental uncertainty). This framework highlights the complex relationship between policies, governance factors, and enterprises’ innovation behaviors.

Figure 1.

The framework diagram of this paper.

4. Model Construction

4.1. Model

4.1.1. Benchmark Model

This paper adopts the difference-in-difference (DID) model to verify the effect of intelligent manufacturing policies. Based on keeping other factors unchanged, the DID method can test whether there are significant differences in the green innovation ability between the control and treatment groups before and after the implementation of the intelligent manufacturing policy [8]. Therefore, the benchmark model is constructed in this paper as follows:

where represents the enterprise i green innovation in year t, and we adopt to represent the quality of green innovation and to represent the quantity of green innovation. represents the pilot policy of intelligent manufacturing, represents other control variables that affect the green innovation at the enterprise level, and are two-way fixed effects, and is the residual error.

The above model has a prerequisite assumption, that is, that the effects produced by the intelligent manufacturing policy have no spillover effect. The existence of the peer effect makes it impossible to ignore the existence of the spillover effect. Referring to Li et al. [37], we examine how the treatment group affects the green innovation of control group firms in the same district or industry. The specific model is as follows:

where, among them, represents the proportion of treatment group enterprises in the same district or industry c within the same district or industry in year t.

4.1.2. Mediating Effect Model

4.2. Variable

4.2.1. Explained Variable

The explained variable is the enterprise’s green innovation, including the quantity and the quality aspects. Referring to Tolliver et al. [62], we utilize the aggregate amount of green utility and design patent applications from firms as a metric, while employing the green invention patent applications to assess the green innovation quality. To eliminate the right-biased distribution problem, we take the natural logarithm of the total number of green patents plus one.

4.2.2. Explanatory Variable

Against the backdrop of the return of high-end manufacturing industries from abroad and sluggish domestic growth, the Chinese government has issued the “Special Plan for Pilot Demonstration of Intelligent Manufacturing”, aiming to enhance the level of intelligent production and promote the innovative development of enterprises. This has had a significant impact on the production and innovation activities of enterprises. The explanatory variable of this paper is to take the intelligent manufacturing pilot policy as the proxy variable. Specifically, if enterprise i is listed among the intelligent manufacturing pilots in year t, then the value of for this enterprise in year t and the following years is 1; otherwise, it could be 0.

4.2.3. Mediating Variables

Financing constraints: Enterprise financing constraints refer to Glavas [63] and are measured by the SA index. We use the financing constraint coefficient Sa to represent the financing constraint problem faced by the firm. The construction formula of the entity is Sa = −0.737 × Scale + 0.043 × Scale 2 − 0.04 × Age. In the above formula, “Scale” is expressed as the natural logarithm of the total assets of an enterprise and is measured in millions. “Age” is the term used to describe the operating years of an enterprise. The Sa index is usually negative. It is clear that the larger the absolute value, the higher the degree of financing constraints on the enterprise. This index’s key advantage is its independence from corporate financial indicators, making it a robust and reliable metric [64].

Environmental uncertainty: The root cause of environmental uncertainty lies in the external environment. Changes in the external environment will cause fluctuations in the core business activities of enterprises and eventually lead to fluctuations in the sales revenue of enterprises [65]. Therefore, environmental uncertainty can be measured by fluctuations in corporate performance [66]. Referring to Wang et al. [67], the fluctuation of company performance is adopted for measurement. Specifically, this paper uses the standard deviation of the enterprise’s sales revenue over the past five years, excluding the normal growth portion and adjusted for the industry, to measure the environmental uncertainty of the enterprise.

4.2.4. Control Variable

To achieve an objective assessment of the effect of the IMP, we follow Li et al. [37] and control for enterprise-level variables that may influence green innovation. Specifically, these include the following: the shareholding ratio of institutional investors (Inst), asset–liability ratio (Lev), the proportion of independent directors (Indep), the cash flow ratio (Cashflow), the fixed asset proportion (Fixed), the firm size (Size), the enterprise age (Firmage), the number of directors on the board (Board), and the revenue growth rate (Growth). For example, the larger the enterprise’s scale, the stronger its green innovation ability. For enterprises that have been established for a long time, they often accumulate rich operational experience and abundant human resources, which gives them an edge in the field of research and enables them to achieve a higher level of green innovation results. When the Indep is relatively high, it indicates that the independence of the board of directors is relatively strong, which helps enterprises improve performance and promote green innovation [68]. The Board is also positively correlated with the green innovation of enterprises, usually manifested as the larger the Board size, the stronger the promoting effect on green innovation [14]. Therefore, it is of great significance to incorporate the above variables as control variables into the regression model, which to a certain extent alleviates the endogeneity problem caused by omitted variables.

4.3. Data Source

This study utilized the data of A-share listed companies in China from 2010 to 2023. The sample involved 2125 enterprises, and after presenting missing values and interpolation, a total of 28,989 samples were obtained. Among them, the data related to the intelligent manufacturing policy comes from the Information Technology and Industry Ministry. The enterprises’ green innovation is from the National Intellectual Property Administration of China. Additionally, enterprise-level data was obtained via the Wind database. Table 1 reports the descriptive statistics. It is not difficult to see that the mean values of the enterprises’ green innovation quantity and quality are 0.311 and 0.365, and the standard deviations are 0.686 and 0.778, respectively. This suggests that there are substantial disparities in the extent of green innovation among various enterprises.

Table 1.

Descriptive statistics.

5. Empirical Analysis

5.1. Benchmark Regression

Table 2 shows the benchmark regression results. Columns (1) and (2) are the results that only control for individual and time-fixed effects. The results indicate that, without adding control variables, enterprises that were affected by intelligent manufacturing policies, on average, have a higher quantity and quality of green innovation. Columns (3) and (4) show the results of the intelligent manufacturing policy on green innovation after adding control variables and controlling for individual and time-fixed effects. This outcome indicates that compared with enterprises that have not been affected by the IMP, the number of green innovations in enterprises affected by the IMP increased by an average of 38.3%, and the quality of green innovations increased by an average of 68.8%. That is, the IMP can positively promote enterprises’ green innovation. Hypothesis 1 holds, and this outcome is similar to Gao et al. [8].

Table 2.

Baseline regression results.

The reason might lie in that intelligent manufacturing is intricately intertwined with information and modern manufacturing technologies, and strengthening basic capabilities [21]. Specifically, the intelligent manufacturing policy guides enterprises to utilize technologies like big data to gather real-time data on energy usage and pollutant emissions during production, thereby offering accurate guidance and data support for green innovation [49]. Meanwhile, policies encourage enterprises to build intelligent R&D platforms, conduct simulation tests and optimizations with the aid of artificial intelligence, and reduce physical trials, thereby promoting green innovation in enterprises. In addition, through comprehensive analysis of various data, including market trends and technological maturity, big data technology enables enterprises to identify potential market risks, technological risks, and policy risks in the process of green innovation in advance, and thus take corresponding risk response measures to reduce uncertainties in the R&D process.

We also found that other control variables exert a considerable role in green innovation, whether measured in terms of quantity or quality. The cash ratio (Cashflow) and size (Size) of enterprises have a particularly strong boosting effect on the quantity, and this promoting effect still exists when green innovation quality is used as the measurement standard. This might be because when enterprises reach a certain scale and have abundant cash flow, they pay more attention to research and development, which is similar to the conclusion of Yin et al. [69]. On the contrary, the revenue growth rate (Growth) of enterprises inhibits green innovation investment and R&D. Its significantly negative coefficient indicates that enterprises may lack the motivation for green transformation, and their operational strategies may be short-sighted, focusing only on immediate benefits and neglecting long-term development.

5.2. Spatial Spillover Effect

Due to green innovation’s externality, spatial correlation must be examined while researching firms’ green innovation [37]. Therefore, the spatial spillover effects of intelligent manufacturing policies on enterprises’ green innovation are examined from the county and industry dimensions based on Equation (2). Table 3’s columns (1)–(2) provide the spatial spillover on the quantity of enterprises’ green innovation at the county and industry levels, respectively, while columns (3)–(4) report the spatial spillover effects on the quality of enterprises’ green innovation at the county and industry levels, respectively. The results show that, at the county and industry levels, intelligent manufacturing policies have significant spatial spillover effects on enterprises’ green innovation. Specifically, the analysis reveals that for every one percent increase in the proportion of treated enterprises in a county, the green innovation quantity of control enterprises in the same county increases by 7.2%, and the quality increases by 8.7%. In the industry, for each one percentage point boost to the proportion of treated enterprises, the green innovation quantity of control enterprises in the same industry increases by 19.8%, and the quality increases by 29%.

Table 3.

Spatial spillover effect.

5.3. Mediating Effect

Columns (1)–(3) of Table 4 show the effects of financing constraints, and columns (4)–(6) show the effects of environmental uncertainty. The regression in column (1) is for a relationship between the IMP and enterprises’ financing constraints. The coefficient of the intelligent manufacturing policy is significantly negative at the 1% significance level, indicating that it can alleviate the financing constraints. The coefficients of the IMP are considerably positive at the 1% significance level and slightly smaller than the benchmark results, as indicated by the regression results in columns (2) and (3). This indicates that the IMP can produce a partial mediating effect by alleviating financing constraints and thereby promoting the quantity and quality of green innovation of enterprises. This result verifies Hypothesis 2. One possible reason for this finding is that the IMP can help businesses make better use of capital allocation and improve the efficiency of capital use through advanced technologies such as artificial intelligence, thereby reducing operating costs. This internal optimization mechanism helps enterprises to be more efficient in capital management and alleviates the financing constraints caused by tight funds from the source [56]. In addition, through intelligent transformation, enterprises can enhance their market competitiveness. This improvement in competitiveness not only helps enterprises gain more market share and profits but also enhances their attractiveness in the capital market, further alleviating financing constraints.

Table 4.

Mediating effect.

Similarly, the results in columns (4)–(6) show that the intelligent manufacturing policy can promote the quantity and quality of green innovation by alleviating the environmental uncertainty of enterprises. This result verifies Hypothesis 3. As mentioned above, the intelligent manufacturing policy promotes the adoption of technology, including artificial intelligence, for real-time monitoring of critical production data, thereby furnishing firms with accurate operational information. This helps enterprises identify potential problems in advance and adjust strategies promptly, reducing uncertainties caused by equipment failures or production abnormalities [33]. In addition, intelligent manufacturing policies can direct firms to employ digital and intelligent technologies to collect and analyze unstructured and structured information from all parties in the market, thereby alleviating the environmental uncertainty brought about by the information gap.

5.4. Robustness Test

5.4.1. Parallel Trend Test

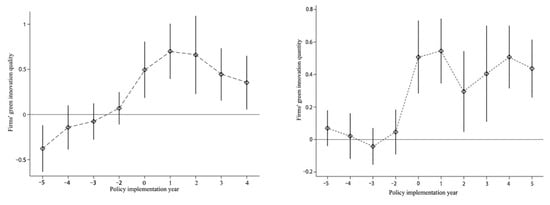

Before the implementation of the intelligent manufacturing policy, the trend of green innovation in the treatment and the control group ought to stay constant. We conduct the parallel trend test. The specific construction is as follows:

Among them, DID is a dummy variable indicating whether the enterprise is a pilot enterprise for intelligent manufacturing. The value range of k is −5 ≤ k ≤ 4, which, respectively, represents the five years before the enterprise is included in the pilot enterprises for intelligent manufacturing, the year of the pilot enterprise, and the four years after the implementation of the policy. To avoid causing multicollinearity problems, phase-1 is excluded in this paper. The test results are shown in Figure 2. Both the left graph (quality of green innovation) and the right graph (quantity of green innovation) show that before the policy intervention (periods T-5 to T-2), the confidence intervals of the estimated coefficients all cover zero values. Before being impacted by the intelligent manufacturing policy, there is no substantial disparity. However, during the implementation stage of the pilot policy for intelligent manufacturing and the subsequent years of its continuation, the policy has demonstrated a very significant promoting effect on green innovation. Whether in terms of quality improvement or quantity increase, it has shown a clear positive promoting effect. This discovery strongly proves that the use of multiple DID models to evaluate the effectiveness of pilot policies for intelligent manufacturing is scientific and effective. Through this method, we can accurately identify the dynamic impact at different stages, thereby providing strong empirical support for the continuous optimization and promotion of policies.

Figure 2.

Parallel trend tests of green innovation quality (left) and quantity (right).

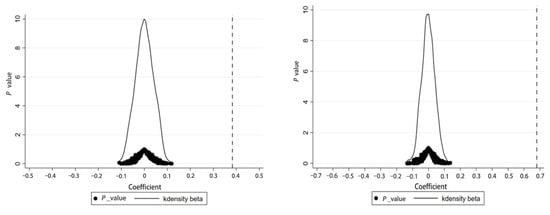

5.4.2. Placebo Test

To further lessen the influence of additional random influencing causes on the regression outcomes, we conduct a placebo test by randomly selecting enterprises as the policy treatment group for the intelligent manufacturing pilot program while keeping the policy time unchanged. A total of 1000 random simulations are conducted in Figure 3. As it illustrates, the coefficients of the policy treatment groups selected at random form a kernel density curve. The fictitious treatment effects are concentrated around the zero value. The estimated coefficients of the actual policy treatment groups of the IMP pilot enterprises, represented by the black vertical lines, differ significantly from those of the randomly selected policy treatment groups. Furthermore, the majority of the p-values are higher than 0.1, indicating a lack of significance at the 10% level. This further indicates that the impact of the IMP on enterprises’ green innovation is robust.

Figure 3.

Placebo tests of the green innovation quantity (left) and quality (right).

5.4.3. Entropy Balance Test

To alleviate the sample selection bias between the treatment group and the control group, referring to McMullin et al. [70], the entropy balance test is conducted in this paper. Table 5 shows the intelligent manufacturing policy’s results for firms’ green innovation quantity in columns (1) and (3), before and after control variables are added, respectively. The results show that regardless of whether control variables are added or not, the coefficient is still significantly positive. Similarly, Table 5’s columns (2) and (4) show the results of the intelligent manufacturing policy for the enterprise’s green innovation quality after entropy balance matching without adding control variables and after adding control variables. The regression coefficients are significantly positive at the 1% level. This conclusion further proves the robustness of the results in this paper.

Table 5.

Entropy balance test.

5.5. Heterogeneity Test

To further verify whether the IMP’s effects are heterogeneous due to different ownership natures, this paper divides the samples into two major categories for regression: state-owned (SOEs) and non-state-owned enterprises (non-SOEs). The results of the intelligent manufacturing policy on the green innovation quantity and quality in SOEs are shown in columns (1) and (3) of Table 6, respectively. Columns (2) and (4) of Table 6 represent the results of the quantity and quality in non-SOEs. It is not difficult to find that, although the IMP positively influences green innovation in both SOEs and non-SOEs, the non-SOE coefficients are significantly higher than those for SOEs, indicating that non-SOEs exhibit greater sensitivity to the intelligent manufacturing policy. This outcome may be attributed to the fact that, compared with SOEs, non-SOEs often need to obtain the funds and resources required for innovation through their own efforts and market mechanisms. The implementation of intelligent manufacturing policies has provided non-SOEs with more financing channels and resource support, which is more conducive to their achieving green innovation.

Table 6.

Equity heterogeneity.

This paper further divides the samples into heavily polluting and non-heavily polluting enterprises to explore the heterogeneous impact of the IMP on enterprises’ green innovation, as according to Gao et al. [16]. The results are displayed in Table 7’s columns (1) and (3), respectively. The rest of Table 7 represents the results of the quantity and quality of green innovation in non-heavily polluting enterprises. Green innovation in non-heavily polluting firms is greatly increased by the IMP, and its coefficient is positive at the 1% level. This result can be attributed to the fact that non-heavily polluting enterprises typically exhibit more adaptable management structures and experience reduced environmental pressures, which enables non-heavily polluting enterprises to respond to intelligent manufacturing policies more quickly and transform them into actual green innovation practices. Heavily polluting enterprises often face stricter environmental protection requirements and higher transformation costs. Although the intelligent manufacturing policy provides these enterprises with a direction and support for transformation, due to multiple factors such as technological bottlenecks and capital shortages, heavily polluting enterprises may encounter greater challenges in achieving green innovation.

Table 7.

Industry nature heterogeneity.

In conclusion, non-heavily polluting enterprises being selected for the pilot projects of intelligent manufacturing can, through multiple advantages such as optimizing resource allocation, more easily achieve green innovation. Meanwhile, the policy support, exemplary leadership, and enhanced market competitiveness of the pilot projects have further encouraged enterprises to actively engage in green innovation practices, promoting sustainable development.

5.6. Discussion

Based on the data of A-share listed enterprises in China from 2010 to 2023, this study systematically evaluates the causal effects, spatial spillover mechanisms, and heterogeneous impacts of the intelligent manufacturing pilot policy on enterprise green innovation using the DID method. Building upon the empirical findings, this section presents an in-depth analysis from the following four perspectives.

First, the IMP has led to an average increase of 38.3% in the number of green innovations by enterprises and an average improvement of 68.8% in the quality of green innovations. This study provides quantitative evidence at the micro level for the causal chain of how intelligent manufacturing policies affect green innovation in the context of China. Although Zhu et al. [15] found that intelligent manufacturing demonstrations can enhance the green innovation level of enterprises, they only confirmed the positive correlation between intelligent manufacturing policies and the green innovation of enterprises. The underlying mechanism requires further analysis. By leveraging patent data, this study directly captured the “innovation effect” and conducted an in-depth analysis of its underlying mechanism.

Second, at the county level, for every one-percentage-point increase in the proportion of pilot enterprises, the number of green innovations by non-pilot enterprises in the same region grows by 7.2%, and the quality of green innovation improves by 8.7%. At the industry level, the spillover effect is more pronounced, reaching 19.8% and 29%, respectively. This study expands the relevant research results by incorporating both regional and industrial dimensions. Little of the literature has focused on the spillover effects of intelligent manufacturing policies [18]. However, the externality of green innovation determines that when examining the issue of green innovation in enterprises, spatial correlation must be paid attention to.

Third, alleviating financing constraints and reducing environmental uncertainty are identified as two key mediating pathways. Unlike the existing literature, including Kim et al. [6], who emphasize the promoting effect of open ecological innovation on green innovation, this study explores how intelligent manufacturing policies affect enterprises’ green innovation under the background that the transformation and upgrading of intelligent manufacturing is the inevitable path for China to achieve its strategy of becoming a manufacturing power, with a focus on the internal mechanism of action. This provides a theoretical basis and empirical evidence for the formulation of relevant policies.

Fourth, the responsiveness of non-state-owned enterprises and non-highly polluting enterprises to the policy is significantly higher than that of state-owned enterprises and highly polluting firms. This discovery reveals the heterogeneous constraints that enterprise ownership and pollution levels impose on the relationship between intelligent manufacturing policies and green innovation. These findings align with existing studies [71].

In fact, China’s institutional and market background provides a unique context for the aforementioned findings. On one hand, the “Manufacturing Power” strategy and the “Dual Carbon” objectives are being pursued concurrently. The government has integrated environmental governance into a unified policy framework and subsequent pilot initiatives, thereby establishing a dual incentive mechanism combining “industrial policy” and “green regulation.” This represents a marked contrast to the singular environmental regulation tools employed in Europe and the United States, such as carbon taxes [36]. On the other hand, the qualification for intelligent manufacturing pilot programs is perceived as a form of endorsement by the “national team” in the capital market, significantly lowering debt financing costs and thereby enhancing the signaling effect [25].

In conclusion, this paper examines China’s unique composite scenario of “industrial policy combined with green transformation” as a case study. It not only confirms the significant positive impact of intelligent manufacturing policies on enterprises’ green innovation capabilities but also reveals the underlying mechanisms through which such policies generate amplification effects via financing relief, uncertainty reduction, and spatial spillover. In the future, the government can take targeted measures from the following perspectives. For instance, in the next round of demonstration selections, the Ministry of Industry and Information Technology could include “the proportion of green invention patents” as an evaluation criterion to prevent enterprises from prioritizing hardware development over green innovation solely for subsidy acquisition. Differentiated financial support should also be provided: for non-state-owned pilot enterprises, local industrial funds could be encouraged to offer matching investments at a 1:1 ratio; for highly polluting enterprises, interest subsidies for “transformation loans” could be implemented. This study thus offers a “Chinese model” that provides actionable insights for emerging economies worldwide striving to achieve both industrial upgrading and climate governance objectives.

6. Conclusions and Policy Implications

Promoting China’s transformation from a manufacturing giant to a manufacturing power is the key path to achieving high-quality development. This paper takes the intelligent manufacturing pilot policy as an exogenous shock and examines its green innovation effect and spillover effect. This research shows that the IMP may boost companies’ green innovation quantity and quality, with strong geographical spillover effects in district and industry dimensions. Furthermore, after examining the channels through which the IMP affects enterprises’ green innovation, it is found that financing constraints and environmental uncertainties are important factors. In addition, the heterogeneity analysis indicates that non-state-owned and non-highly polluting enterprises are more sensitive to the intelligent manufacturing policy. This study enriches the conceptual understanding of green innovation at the theoretical level, emphasizing that green innovation is not only a manifestation of an enterprise’s competitiveness but also an important driving force for regional sustainable development. This research is theoretically significant because it broadens the perspective on how intelligent manufacturing policies can encourage green innovation within enterprises. Based on a detailed elaboration of these principles, this paper quantifies the effects of intelligent manufacturing policies and analyzes their role in empowering green innovation in enterprises, considering enterprise financing constraints and external environmental uncertainties. This provides a new theoretical perspective for enterprises to enhance their green innovation levels. Furthermore, this study has practical significance. We have proposed specific policies to help Chinese enterprises achieve institutional designs that balance environmental protection and innovation.

We propose the following policy recommendations: Firstly, considering that the intelligent manufacturing policy has significant spatial spillover effects at both the county and industry levels, the government can leverage this characteristic to enhance collaboration and exchanges among areas, thereby facilitating the pooling and optimal deployment of green innovation resources. Meanwhile, in light of the characteristics of different industries and regions, differentiated policy measures should be formulated to better leverage the guiding and motivating role of policies. Specifically, the government should implement a cooperative framework for intelligent manufacturing across districts and counties, improve the exchange of policies, technologies, and experiences among regions, and consolidate regional innovation resources by establishing regional innovation alliances to leverage complementary advantages. In addition, the government needs to design policies in a way that suits local conditions and industries. It should formulate targeted policy contents based on the industrial structures and resource endowments of different districts and counties, as well as the characteristics of different industries, to ensure that the policies can precisely meet the development needs of enterprises and industries. Through these measures, the government can promote coordinated development and enhance the overall green innovation capacity and competitiveness of the region.

Secondly, the government should intensify environmental regulation and improve the environmental protection law and standards system. By improving the standards system, clear green development goals and constraints should be set for enterprises. For instance, the government should, in light of the characteristics of different industries, formulate more detailed and strict environmental protection regulations and standards and clearly define quantitative indicators for enterprises in terms of pollutant emissions and resource utilization efficiency, and it is suggested that the Ministry of Industry and Information Technology incorporate “energy consumption of robot systems/proportion of renewable energy” into the evaluation standards for smart factories. Furthermore, the government should utilize advanced information technology to enhance its production efficiency and innovation capabilities, and enable enterprises to achieve more precise resource optimization in the production process, thereby providing a solid technical foundation and innovative impetus for green innovation. Through efforts in these two aspects, the government can effectively promote positive interaction between intelligent manufacturing policies and enterprises’ green innovation, helping enterprises achieve green and sustainable development on the path of intelligent development, and enhancing their core competitiveness and market adaptability.

Thirdly, the government should formulate targeted support strategies based on the characteristics and demands of different enterprises. For non-state-owned enterprises, the government needs to enhance its support and, through policy incentives and resource allocation preferences, encourage them to actively engage in green innovation practices. For highly polluting enterprises, the government should strictly enforce environmental protection supervision and rectification requirements, promote their accelerated green transformation, reduce environmental pollution, and embark on a path of sustainable development. In addition, we suggest that the government raise the “pre-tax deduction ratio for green R&D investment” from the current 75% to 100%, and allow highly polluting enterprises to enjoy technological transformation subsidies in addition. Through differentiated policy design and precise measures, the government can effectively stimulate the innovation vitality of all types of enterprises, promote the optimization and upgrading of the industrial structure, and ultimately achieve the coordinated progress of high-quality economic development and ecological and environmental protection.

Finally, intelligent manufacturing is crucial for enhancing enterprises’ green innovation, and enterprises should take multiple approaches, such as technological upgrading and integration. At the implementation level, the government has established a closed loop of “central and local co-construction–third-party verification–dynamic subsidies” to avoid subsidy mismatch and enhance policy accuracy. Enterprises should introduce technologies such as the Internet of Things to achieve intelligent monitoring and optimization of the production process and reduce energy consumption and pollution emissions. For instance, they could utilize intelligent design software to optimize product structure, reduce material usage, and enhance performance and service life. In addition, enterprises need to strengthen green supply chain management, establish a green supplier evaluation system, and give priority to choosing suppliers of environmentally friendly materials to reduce the environmental impact of the supply chain from the source. At the same time, they can collaborate with partners such as suppliers and distributors to carry out green innovation projects, promoting the intelligent and green transformation of the entire supply chain.

This paper still has certain limitations. (1) There are limitations regarding the index measurement. Although patent data is widely used, it may not fully reflect non-patent innovation or process improvement. Future research could supplement patent-based measures with survey or case study data. Additionally, R&D investment in green technologies and market share of green products can be used to provide a more comprehensive assessment of enterprises’ green innovation levels. (2) There are limitations regarding the method. The primary prerequisite for using the DID model is satisfying the parallel trend assumption. However, this assumption is essentially counterfactual and thus cannot be directly tested. Therefore, we can only provide indirect support for this assumption through the similarity of prior trends. Future research could involve constructing comprehensive indicators for intelligent manufacturing and examining the impact of intelligent manufacturing on green innovation and the ESG performance of enterprises using models such as system GMM. (3) There are limitations regarding the mechanism. This paper examines two key mechanisms by which intelligent manufacturing policies affect enterprises’ green innovation. However, it does not reveal whether there are other channels of action. Future research can further exploit more impact channels. This may include the supply chain collaboration channel, where the IMP may indirectly promote green innovation by enhancing the digitalization level of the supply chain, and for the talent flow channel, the IMP may supply “green + digital” compound talents to non-pilot enterprises to promote green innovation.

Author Contributions

Conceptualization, S.C. and D.G.; Methodology, D.G.; Software, D.G. and L.T.; Formal analysis, D.G.; Investigation, L.T.; Resources, D.G. and L.T.; Data curation, S.C. and L.T.; Writing—original draft, S.C. and L.T.; Supervision, S.C. and D.G.; Project administration, D.G. and L.T.; Funding acquisition, S.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by General Scientific Research Project of Department of Education of Zhejiang Province (No: 2023JYTYB03).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Wang, M.; Li, Y.; Li, J.; Wang, Z. Green process innovation, green product innovation and its economic performance improvement paths: A survey and structural model. J. Environ. Manag. 2021, 297, 113282. [Google Scholar] [CrossRef] [PubMed]

- Bary, G. Analysis of chaos-coherence peculiarities within the chaotic phenomena of fluid at finite temperature. Chaos Solitons Fractals 2022, 164, 112572. [Google Scholar] [CrossRef]

- Yuan, B.; Cao, X. Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 2022, 68, 101868. [Google Scholar] [CrossRef]

- Roh, T.; Noh, J.; Oh, Y.; Park, K.S. Structural relationships of a firm’s green strategies for environmental performance: The roles of green supply chain management and green marketing innovation. J. Clean. Prod. 2022, 356, 131877. [Google Scholar] [CrossRef]

- Chen, F.; Zeng, X.; Guo, X. Green finance, climate change, and green innovation: Evidence from China. Financ. Res. Lett. 2024, 63, 105283. [Google Scholar] [CrossRef]

- Kim, Y.; Roh, T.; Boroumand, R.H. Resource recombination perspective on open eco-innovation: Open innovation type, strategic orientation, and green innovation. Bus. Strategy Environ. 2024, 33, 6207–6220. [Google Scholar] [CrossRef]

- Zhao, J.; Li, A.; Roh, T.; Su, M. Escaping regulation or embracing innovation? Substantive green Innovation’s role in moderating environmental policy and outward foreign direct investment. Energy 2025, 316, 134547. [Google Scholar] [CrossRef]

- Gao, D.; Tan, L.; Chen, Y. Smarter is greener: Can intelligent manufacturing improve enterprises’ ESG performance? Humanit. Soc. Sci. Commun. 2025, 12, 529. [Google Scholar] [CrossRef]

- Sun, Y. Digital transformation and corporates’ green technology innovation performance–The mediating role of knowledge sharing. Financ. Res. Lett. 2024, 62, 105105. [Google Scholar] [CrossRef]

- Liu, X.; Liu, F.; Ren, X. Firms’ digitalization in manufacturing and the structure and direction of green innovation. J. Environ. Manag. 2023, 335, 117525. [Google Scholar] [CrossRef]

- Zhao, C.; Li, Y.; Liu, Z.; Ma, X. Artificial intelligence and carbon emissions inequality: Evidence from industrial robot application. J. Clean. Prod. 2024, 438, 140817. [Google Scholar] [CrossRef]

- Wen, H.; Shang, J.; Nghiem, X.H. Does artificial intelligence matter for the population aging-inclusive growth nexus? International evidence. Telecommun. Policy 2025, 49, 102932. [Google Scholar] [CrossRef]

- Weng, M. Green innovation through artificial intelligence technology: Enhancing environmental, social, and governance performance. Financ. Res. Lett. 2025, 75, 106921. [Google Scholar] [CrossRef]

- Liu, L.; Dong, H.; Qi, L. How Directors with Green Backgrounds Drive Corporate Green Innovation: Evidence from China. Sustainability 2025, 17, 6944. [Google Scholar] [CrossRef]

- Zhu, H.; Bao, W.; Yu, G. How can intelligent manufacturing lead enterprise low-carbon transformation? Based on China’s intelligent manufacturing demonstration projects. Energy 2024, 313, 134032. [Google Scholar] [CrossRef]

- Gao, D.; Tan, L.; Duan, K. Forging a path to sustainability: The impact of Fintech on corporate ESG performance. Eur. J. Financ. 2024, 1–19. [Google Scholar] [CrossRef]

- Wen, H.; Zhao, Z. How does China’s industrial policy affect firms’ R&D investment? Evidence from Made in China 2025. Appl. Econ. 2021, 53, 6333–6347. [Google Scholar]

- Zhou, P.; Han, M.; Shen, Y. Impact of intelligent manufacturing on total-factor energy efficiency: Mechanism and improvement path. Sustainability 2023, 15, 3944. [Google Scholar] [CrossRef]

- Tan, L.; Gao, D.; Liu, X. Can environmental information disclosure improve energy efficiency in manufacturing? Evidence from Chinese enterprises. Energies 2024, 17, 2342. [Google Scholar] [CrossRef]

- Liu, Y.; Zuo, Y. Implementing intelligent manufacturing policies to increase the total factor productivity in manufacturing: Transmission mechanisms through construction of industrial chains. Int. J. Prod. Econ. 2025, 279, 109468. [Google Scholar] [CrossRef]

- Li, X.; Wang, Q.; Kong, D.; Tao, Y. Intelligent manufacturing and corporate human capital upgrade in China. J. Asian Econ. 2025, 97, 101886. [Google Scholar] [CrossRef]

- Wei, X.; Jiang, F.; Chen, Y.; Hua, W. Towards green development: The role of intelligent manufacturing in promoting corporate environmental performance. Energy Econ. 2024, 131, 107375. [Google Scholar] [CrossRef]

- Su, Y.; Liu, Z.; Liang, S. Does CEO information technology background promote substantive green innovation or strategic green innovation? Technol. Anal. Strateg. Manag. 2025, 37, 253–266. [Google Scholar] [CrossRef]

- Liu, M.; Liu, L.; Feng, A. The impact of green innovation on corporate performance: An analysis based on substantive and strategic green innovations. Sustainability 2024, 16, 2588. [Google Scholar] [CrossRef]

- Huang, J.; Ma, L. Substantive green innovation or symbolic green innovation: The impact of fintech on corporate green innovation. Financ. Res. Lett. 2024, 63, 105265. [Google Scholar] [CrossRef]

- Lee, M.J.; Kim, Y.; Roh, T. Exploring the role of digital servitization for green innovation: Absorptive capacity, transformative capacity, and environmental strategy. Technol. Forecast. Soc. Change 2024, 207, 123614. [Google Scholar] [CrossRef]

- Zhao, T.; Zhou, H.; Jiang, J.; Yan, W. Impact of green finance and environmental regulations on the green innovation efficiency in China. Sustainability 2022, 14, 3206. [Google Scholar] [CrossRef]

- Huang, H.; Wang, F.; Song, M.; Balezentis, T.; Streimikiene, D. Green innovations for sustainable development of China: Analysis based on the nested spatial panel models. Technol. Soc. 2021, 65, 101593. [Google Scholar] [CrossRef]

- Yuan, L.; Chen, X.; Yang, E. Riding the Climate Surge: How Climate Change Dynamics Drives Green Innovation—Evidence from China. Organ. Environ. 2025, 38, 3–28. [Google Scholar] [CrossRef]

- He, Y.; Lu, S.; Wei, R.; Wang, S. Local media sentiment towards pollution and its effect on corporate green innovation. Int. Rev. Financ. Anal. 2024, 94, 103332. [Google Scholar] [CrossRef]

- Lee, M.J.; Pak, A.; Roh, T. The interplay of institutional pressures, digitalization capability, environmental, social, and governance strategy, and triple bottom line performance: A moderated mediation model. Bus. Strategy Environ. 2024, 33, 5247–5268. [Google Scholar] [CrossRef]

- Lee, M.J.; Choi, H.; Roh, T. Is institutional pressure the driver for green business model innovation of SMEs? Mediating and moderating roles of regional innovation intermediaries. Technol. Forecast. Soc. Change 2024, 209, 123814. [Google Scholar] [CrossRef]

- Gao, D.; Cai, J.; Wu, K. The smart green tide: A bibliometric analysis of AI and renewable energy transition. Energy Rep. 2025, 13, 5290–5304. [Google Scholar] [CrossRef]

- Singh, S.K.; Del Giudice, M.; Chiappetta Jabbour, C.J.; Latan, H.; Sohal, A.S. Stakeholder pressure, green innovation, and performance in small and medium-sized enterprises: The role of green dynamic capabilities. Bus. Strategy Environ. 2022, 31, 500–514. [Google Scholar] [CrossRef]

- Tawiah, V.; Gyapong, E.; Usman, M. Returnee directors and green innovation. J. Bus. Res. 2024, 174, 114369. [Google Scholar] [CrossRef]

- Liu, J.; Chang, H.; Forrest, J.Y.L.; Yang, B. Influence of artificial intelligence on technological innovation: Evidence from the panel data of China’s manufacturing sectors. Technol. Forecast. Soc. Change 2020, 158, 120142. [Google Scholar] [CrossRef]

- Li, C.; Xu, Y.; Zheng, H.; Wang, Z.; Han, H.; Zeng, L. Artificial intelligence, resource reallocation, and corporate innovation efficiency: Evidence from China’s listed companies. Resour. Policy 2023, 81, 103324. [Google Scholar] [CrossRef]

- Zhu, Z.Z.; Chen, Y.; Zhao, J.; Yu, Z.Y. Intelligent manufacturing and value creation in enterprises: Lessons from a quasi-natural experiment in a Chinese demonstration project. Sustainability 2023, 15, 116. [Google Scholar] [CrossRef]

- Zhong, Y.; Xu, F.; Zhang, L. Influence of artificial intelligence applications on total factor productivity of enterprises—Evidence from textual analysis of annual reports of Chinese-listed companies. Appl. Econ. 2024, 56, 5205–5223. [Google Scholar] [CrossRef]

- Wang, L.; Chen, Y. Artificial intelligence and corporate investment efficiency: Evidence from China. Emerg. Mark. Rev. 2025, 68, 101314. [Google Scholar] [CrossRef]

- Zhao, N.; Chen, W. How can artificial intelligence adoption enhance manufacturing firms’ green management capability? Financ. Res. Lett. 2025, 81, 107475. [Google Scholar] [CrossRef]

- Zhang, W.; Li, H.; Qian, L.; Wang, X. How intelligent manufacturing improves corporate ESG performance: A three-dimensional analysis based on “Environment,” “Society,” and “Governance”. J. Environ. Manag. 2025, 380, 125171. [Google Scholar] [CrossRef]

- Lee, M.J.; Roh, T. Digitalization capability and sustainable performance in emerging markets: Mediating roles of in/out-bound open innovation and coopetition strategy. Manag. Decis. 2023. [Google Scholar] [CrossRef]

- Sorrell, S.; Dimitropoulos, J. The rebound effect: Microeconomic definitions, limitations and extensions. Ecol. Econ. 2008, 65, 636–649. [Google Scholar] [CrossRef]

- Wang, L.; Chen, Q.; Dong, Z.; Cheng, L. The role of industrial intelligence in peaking carbon emissions in China. Technol. Forecast. Soc. Change 2024, 199, 123005. [Google Scholar] [CrossRef]

- Connelly, B.L.; Certo, S.T.; Ireland, R.D.; Reutzel, C.R. Signaling theory: A review and assessment. J. Manag. 2011, 37, 39–67. [Google Scholar] [CrossRef]

- Gao, D.; Tan, L.; Chen, Y. Unlocking carbon reduction potential of digital trade: Evidence from China’s comprehensive cross-border e-commerce pilot zones. Sage Open 2025, 15, 21582440251319966. [Google Scholar] [CrossRef]

- Zheng, Y.; Zhang, Q. Digital transformation, corporate social responsibility and green technology innovation-based on empirical evidence of listed companies in China. J. Clean. Prod. 2023, 424, 138805. [Google Scholar] [CrossRef]

- Yuan, S.; Pan, X. Inherent mechanism of digital technology application empowered corporate green innovation: Based on resource allocation perspective. J. Environ. Manag. 2023, 345, 118841. [Google Scholar] [CrossRef]

- Xu, C.; Lin, B. The AI-sustainability Nexus: How does intelligent transformation affect corporate green innovation? Int. Rev. Financ. Anal. 2025, 102, 104107. [Google Scholar] [CrossRef]

- Soori, M.; Dastres, R.; Arezoo, B.; Jough, F.K.G. Intelligent robotic systems in Industry 4.0: A review. J. Adv. Manuf. Sci. Technol. 2024, 2024007. [Google Scholar] [CrossRef]

- Hu, D.; Jiao, J.; Tang, Y.; Xu, Y.; Zha, J. How global value chain participation affects green technology innovation processes: A moderated mediation model. Technol. Soc. 2022, 68, 101916. [Google Scholar] [CrossRef]

- Dian, J.; Song, T.; Li, S. Facilitating or inhibiting? Spatial effects of the digital economy affecting urban green technology innovation. Energy Econ. 2024, 129, 107223. [Google Scholar] [CrossRef]

- Jin, M.; Chen, Y. Has green innovation been improved by intelligent manufacturing?—Evidence from listed Chinese manufacturing enterprises. Technol. Forecast. Soc. Change 2024, 205, 123487. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Chang, L.; Taghizadeh-Hesary, F.; Mohsin, M. Role of artificial intelligence on green economic development: Joint determinates of natural resources and green total factor productivity. Resour. Policy 2023, 82, 103508. [Google Scholar] [CrossRef]

- Tian, H.; Zhao, L.; Yunfang, L.; Wang, W. Can enterprise green technology innovation performance achieve “corner overtaking” by using artificial intelligence?—Evidence from Chinese manufacturing enterprises. Technol. Forecast. Soc. Change 2023, 194, 122732. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G. External control of organizations—Resource dependence perspective. In Organizational Behavior; Routledge: Oxfordshire, UK, 2015; pp. 355–370. [Google Scholar]

- Roh, T.; Yu, B. Paving a way toward green world: Two-track institutional approaches and corporate green innovation. IEEE Trans. Eng. Manag. 2023, 71, 9244–9257. [Google Scholar] [CrossRef]

- Wang, W.; Sun, Z.; Wang, W.; Hua, Q.; Wu, F. The impact of environmental uncertainty on ESG performance: Emotional vs. rational. J. Clean. Prod. 2023, 397, 136528. [Google Scholar] [CrossRef]

- Galbraith, J.K. Power and the useful economist. Am. Econ. Rev. 1973, 63, 1–11. [Google Scholar]

- Tolliver, C.; Fujii, H.; Keeley, A.R.; Managi, S. Green innovation and finance in Asia. Asian Econ. Policy Rev. 2021, 16, 67–87. [Google Scholar] [CrossRef]

- Glavas, D. Do green bond issuers suffer from financial constraints? Appl. Econ. Lett. 2023, 30, 1887–1890. [Google Scholar] [CrossRef]

- Ayyagari, M.; Demirgüç-Kunt, A.; Maksimovic, V. Formal versus informal finance: Evidence from China. Rev. Financ. Stud. 2010, 23, 3048–3097. [Google Scholar] [CrossRef]

- Bergh, D.; Lawless, M.W. Portfolio Restructuring and Limits to Hierarchical Governance. The Effects of Environmental Uncertainty and Diversification Strategy. Organ. Sci. 1998, 9, 87–102. [Google Scholar] [CrossRef]

- Cheng, J.L.C.; Kesner, I.F. Organizational Slack and Response to Environmental shifts: The Impact of Resource Allocation Patterns. J. Manag. 1997, 23, 1–18. [Google Scholar] [CrossRef]

- Wang, H.; Jiao, S.; Bu, K.; Wang, Y.; Wang, Y. Digital transformation and manufacturing companies’ ESG responsibility performance. Financ. Res. Lett. 2023, 58, 104370. [Google Scholar] [CrossRef]

- Hu, Y.; Li, Z.; Guo, J. Does independent directors’ interlocking network position affect green innovation? Sustainability 2024, 16, 1089. [Google Scholar] [CrossRef]

- Yin, L.; Tan, L.; Wu, J.; Gao, D. From risk to sustainable opportunity: Does climate risk perception lead firm ESG performance? J. Int. Financ. Manag. Account. 2025. [Google Scholar] [CrossRef]

- McMullin, J.L.; Miller, B.P.; Twedt, B.J. Increased mandated disclosure frequency and price formation: Evidence from the 8-K expansion regulation. Rev. Account. Stud. 2019, 24, 1–33. [Google Scholar] [CrossRef]

- Liu, Y.; Shen, F.; Guo, J.; Hu, G.; Song, Y. Can artificial intelligence technology improve companies’ capacity for green innovation? Evidence from listed companies in China. Energy Econ. 2025, 143, 108280. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).