1. Introduction

The global energy transition emphasizes the integration of distributed energy generation (DG), changing the traditional paradigms of energy consumption and generation. In this evolving landscape, households equipped with photovoltaic (PV) systems that both consume and generate electricity, known as “prosumers”, are playing an increasingly important role in the power system. While PV systems offer significant benefits, such as reduced electricity bills and environmental advantages, their volatility poses a challenge to grid stability and the efficient management of energy surpluses. Battery energy storage systems (BESSs) are proving to be a key solution to these challenges by balancing the fluctuations of PV systems, improving self-consumption and self-sufficiency for consumers and supporting the grid. By intelligently controlling their charging and discharging cycles, BESS units can actively stabilize grid operation by balancing supply and demand, mitigating negative impacts on the grid. Consequently, a growing body of research has focused on the feasibility and optimal operation of such integrated systems, analyzing both their technical performance and their economic costs and benefits [

1].

Numerous studies have been conducted on the optimization of prosumer energy management and on the effects of integrating BESSs. A double-layer microgrid energy management system was proposed for strategic short-term planning of microgrid operation scheduling in [

2]. This system utilizes two interconnected optimization layers: an upper layer to maximize profit and a lower layer to minimize corrective measures due to forecast errors, integrating an advanced BESS model for uncertainty mitigation. In [

3], a mixed integer linear programming (MILP) model was proposed for home energy management system (HEMS) optimization, which focuses on minimizing electricity costs while integrating battery cycle degradation considerations. Energy management systems (EMSs) have been addressed with approaches that integrate load shifting and household BESSs, with an objective function that minimizes a weighted sum of energy costs and user discomfort [

4]. A stochastic two-stage optimization model with mixed integer nonlinear programming (MINLP) was proposed for an energy community (EC) with a local electricity market to ensure optimal grid operation and minimum prosumer costs, incorporating an electric vehicle charging model and considering uncertain input data [

5]. A resident-centric distributed EC’s EMS is presented in [

6]. This system allows households to schedule their appliances autonomously while a central controller optimizes the EC’s DG resources, utilizing distributed optimization and MILP. A HEMS was investigated in [

7], where a hybrid architecture integrating a PV system and a BESS was proposed. This system, which utilizes real-time pricing (RTP) and the Whale Optimization Algorithm (WOA), aims to minimize grid consumption and energy costs, with its effectiveness validated by experimental results [

7]. In [

8], the optimal sizing of PV and a BESS for a smart household was investigated. The proposed HEMS is structured as a bi-level model. The upper level optimization determines the optimal sizing of the PV and BESS system to minimize annual comprehensive costs, while the lower level optimization focuses on the optimal operation of the HEMS to minimize the annual operating costs. The study takes into account different electricity price mechanisms, PV subsidies and uncertainties in PV output and seasonal load profiles [

8]. A HEMS capable of optimally scheduling behind-the-meter resources under different tariffs, including export rates, is presented in [

9]. This HEMS uses a multi-objective model predictive control formulation that aims to minimize costs and increase self-consumption. Its effectiveness is demonstrated by simulations comparing different tariff structures and control strategies.

In [

10], a method for calculating losses in smart distribution grids was proposed using K-Means clustering to classify feeders and estimate grid losses based on the similarity of feeders. An analysis of the voltage profile and active power losses in low-voltage distribution grids with connected PV prosumers was carried out in [

11]. In this study, conventional and optimal power flows were compared in different scenarios of PV active and reactive power generation [

11]. A novel heuristic algorithm, the Grey Wolf Equilibrium Optimizer, was developed and applied to solve the multi-objective problem of optimal power flow in distribution grids, taking into account in particular active power losses, voltage deviation and PV curtailment rates [

12]. A multi-stage optimal power flow-based model has been proposed for optimizing the operation of PV-rich low-voltage distribution grids, with the second stage specifically designed to minimize active power losses using the reactive power capabilities of PV inverters [

13].

In [

14], a cost–benefit analysis for energy storage in a distribution grid is performed, quantifying its economic impact by considering the owner’s profits from time-of-use (TOU) price arbitrage and grid benefits from congestion mitigation and investment deferral using a long-term incremental cost pricing model. In [

15], a framework for a cost–benefit analysis to evaluate the impact of residential PV systems with a BESS on distribution grid planning is proposed, considering the economic benefits for both private investors (residential customers) and utility through a two-layer optimization model. In [

16], a master–slave optimization approach is proposed for the cost-effective integration and operation of BESS in active distribution grids. This approach aims to minimize the total system costs, including power import from the grid, investment, maintenance and replacement costs over a 20-year time horizon, by optimally selecting the location, type and hourly operation scheme of the BESS, taking into account the variability of DG and fluctuating power consumption patterns [

16]. In [

17], a cost–benefit optimization model is presented to analyze the economic viability of PV systems with a BESS for different residential customer groups in Switzerland, differentiated by annual electricity consumption, roof size, annual solar irradiation and location. This model minimizes the total investment and operating costs over a time horizon of 30 years, taking into account detailed cost and yield parameters as well as legal framework conditions and performing a comprehensive sensitivity analysis for key factors, such as costs, load profiles and electricity prices. In [

18], a comprehensive cost–benefit tool for analyzing and optimal sizing of small PV systems and a BESS is proposed. The model includes detailed considerations of capital investment, maintenance and replacement costs as well as electricity imports from the grid over a 20-year period. System sizing is performed by maximizing the net present value (NPV), with a detailed battery degradation model and a thorough assessment of different tariff structures and their impact on system profitability. In [

19], an operational simulation and economic analysis for households with PV and BESS are performed under an improved TOU mode, which proposes a new three-level rate TOU to increase economic benefits and optimize energy use. The viability of such systems is demonstrated through cost–benefit analysis and MATLAB simulations, focusing on equipment cost recovery and selection of optimal BESS size for low-voltage distribution lines. In a Norwegian case study presented in [

20], profitability analyses for investments in home batteries are performed to determine the feasibility of using batteries to reduce electricity costs through implicit flexibility. An optimization model based on classical linear programming is used to minimize prosumers’ annual electricity costs, taking into account the electricity price, a power-based grid tariff and potential revenues from exporting electricity to the grid, all validated with real historical price and consumption data from 20 households in Norway. A cost–benefit analysis framework was used to assess the economic feasibility of grid disconnection for prosumer households in Germany, with a focus on PV-battery hybrid systems. This framework employs an optimization method to determine the most profitable PV- battery system size combination that enables full self-consumption of electricity. Various cost components and revenue streams (including grid feed-in and peer-to-peer trading) are considered and the net present value and levelized cost of electricity (LCOE) are used for the evaluation [

21].

Based on the observed gap in the literature, this paper presents a comprehensive cost–benefit framework that evaluates the effects of BESS integration at both the prosumer level and within the distribution grid. While existing MILP-based optimization studies [

2,

3,

8] have investigated aspects of energy management, this approach clearly stands out by emphasizing a dual perspective framework within the specific Croatian market context. The proposed approach includes detailed modelling of all relevant cost components, such as investment, operational, maintenance and decommissioning costs, which are often simplified or omitted in related work. In addition to analyzing savings at the household level, the framework also quantifies the changes in grid losses. The optimization of the BESS dispatch is based on an MILP formulation, and the resulting operational profiles are used in time domain power system simulations to assess the impact on the distribution grid. This holistic integration and combined analysis of prosumer economic viability and quantifiable distribution grid impacts allows for a more realistic evaluation of the overall value of BESS. The results show that storage deployment, when optimized from the prosumer side, can generate measurable financial benefits to prosumers and simultaneously improve the performance of the distribution grid. This integrated perspective enables a more realistic evaluation of the overall value of BESS and provides a solid basis for future planning and policy decisions. The unique contributions of this paper are highlighted in

Table 1, which provides a comparative overview of this study against selected MILP-based papers from the literature.

The remainder of this paper is organized into five distinct sections to provide a comprehensive understanding of the research conducted. The

Section 1 sets the global context, introduces key concepts, provides an overview of the relevant literature and clearly defines the aims and contributions of the study. The

Section 2 provides a detailed description of the mathematical models, the optimization framework and the simulation procedures applied. Subsequently,

Section 3, which focuses on the results, systematically presents and analyses the main findings, including the input data, the case study setup and the relevant performance indicators. The discussion in

Section 4 provides a broader interpretation of the results and their practical implications. In addition, suggestions for future research are made by identifying new opportunities and potential avenues for further investigation. The concluding

Section 5 summarizes the key findings and highlights the overall implications of the study.

2. Methodology

The methodological framework employed in this study describes all phases of implementation, extending from the initial definition of the prosumer model to the comprehensive cost–benefit analysis. Its explicit aim is to demonstrate the significant potential for both economic savings and grid loss reduction, benefits brought about by the effective integration of BESSs together with residential PV systems. The entire research procedure, which includes the optimal management of the prosumer’s BESS, the analysis of grid losses and the comprehensive cost–benefit analysis, is illustrated in

Figure 1. The overall research process starts systematically with the input data collection phase, in which all relevant information deemed crucial for the accurate modelling of the observed energy system is collected. Furthermore, certain key parameters derived from this initial input data are also fed directly into the subsequent cost–benefit analysis phase. Ultimately, this critical input data forms the basis for the implementation of the primary optimization algorithm, whose central objective is to optimally manage the BESS systems of the observed prosumer households with respect to a clearly defined objective function.

The results generated by this optimization algorithm are divided into two distinct and important information flows: firstly, the generation of the detailed BESS operating profile and secondly, the determination of the optimal operating costs for each observed household. The generated BESS operating profile is then used in a dedicated power system simulation tool to accurately assess the corresponding impact of BESS integration on the overall power grid. Once this simulation phase is complete, the research process leads directly to the calculation of system losses. In this phase, the total energy losses that occur in the observed grid are accurately determined for each operating scenario analyzed. This specific phase then leads directly to the comprehensive calculation of system loss costs, explicitly quantifying the financial savings resulting from the reduction of energy losses through BESS integration. All accumulated results, including the optimal economic results observed at the household level and the economic benefits resulting from the overall grid loss reduction, are then consolidated in the overarching cost–benefit analysis phase.

The core optimization model specifically designed for prosumers was developed to effectively optimize the energy operation of prosumer households equipped with PV systems and integrated BESS units. This mathematical model is formulated as an MILP problem, where the main objective is to minimize the total annual operating costs of the household. The scope of this optimization broadly includes coordinated BESS charging and discharging strategies and optimal energy exchange with the distribution grid, continuously over a comprehensive one-year period. Significantly, all calculations in this study are performed on the basis of hourly data that accurately cover the entire observed one-year period.

The proposed methodological framework is designed for high transferability, comprising a universal optimization core and a set of context-dependent parameters. The universal core consists of the MILP formulation, the fundamental power balance equation, the technology-specific operational constraints for the BESS and PV systems, and the NPV-based cost–benefit analysis. This core is parameterized by context-specific inputs, such as the electricity tariff models, national regulatory charges and taxes, and local datasets, including the meteorological data. The specific formulations for these context-dependent components are detailed in the subsequent subsections. This parametric design ensures the model’s adaptability to differing technical, market, and regulatory configurations, as the fundamental optimization logic remains intact while local parameters can be readily substituted.

2.1. Formulation of Prosumer Economic Model and Objective Function

The prosumer economic model is created with the aim of accurately calculating household operational costs and income over the observed period. The calculation of the total monthly electricity bill for prosumers is based on existing household tariffs with a one-month billing period in Croatia. The final bill amount depends on the net electricity consumption from the grid, the fixed monthly metering point and supply fees, the renewable energy sources (RESs) incentive fee and value-added tax (

VAT). Based on the prosumer cost calculation methodology, the objective function of the optimization problem is defined as described in (1):

where

t is the time index;

T is the total number of time intervals in the observed period;

Chouse is minimized total annual operational costs of the household;

Cnet,grid (

t) is the net cost of energy exchange with the grid in time interval

t; and

Cfix,annual represents the total annual fixed costs of the household.

Cnet,grid (

t) is further defined in (2) as follows:

where

Pgrid,buy (

t) is the power imported from the grid in time interval

t;

Pgrid,sell (

t) is the power exported to the grid in time interval

t;

CRES,fee is the incentive fee for RES; and

VAT is the value-added tax rate for electricity.

The unit price of electricity purchased from the grid

Cgrid,buy (

t) consists of the electricity price, transmission fee, and distribution fee, and depends on the tariff (high or low). It is defined as in (3):

where

Cel,HT and

Cel,LT are electricity prices for high tariff (HT) and low tariff (LT);

Ctrans,HT and

Ctrans,LT are transmission fees for HT and LT; and

Cdist,HT and

Cdist,LT are distribution fees for HT and LT. Tariff dependence is expressed by binary indicator variables

δHT (

t) (equal to 1 for HT, 0 otherwise) and

δLT (

t) (equal to 1 for LT, 0 otherwise).

The unit price of electricity sold to the grid

Cgrid,sell is defined in (4) as a fixed value, calculated based on a weighted average of

Cel,HT and

Cel,LT. The weights reflect the assumed prosumer consumption distribution (30% in HT, 70% in LT).

Cfixed,annual includes fixed monthly fees paid to the system operator, as defined in (5):

where

CMPF,monthly is the fixed monthly fee for the Metering Point; and

Csupply,monthly is the fixed monthly fee for electricity supply.

The procedure for calculating the prosumer’s electricity bill, as described by Equations (2)–(5), is adopted from [

22,

23], as this framework defines the subject ‘Customer with own generation’ in Croatia.

Beyond the minimization of household operational costs, the study quantifies specific economic benefits derived from BESS integration. The annual cost savings (

ANCs) represent the absolute monetary difference in total annual household costs between the Reference case and the Full BESS integration scenario. This is defined in (6) and (7) as follows:

where

Chouse,ref represents the total annual household costs in the Reference case;

Chouse,BESS represents the total annual household costs in the Full BESS integration scenario;

ANCabs represents the annual cost savings in absolute monetary terms; and

ANCperc represents the annual cost savings in percentage terms.

2.2. Modeling of PV Systems, BESS and Power Balance

The power generation profile of the PV system is one of the most important input data for the optimization model. For all observed prosumers, the generation profile is calculated based on real meteorological data and standard test conditions (STC), which define a cell temperature of 25 °C and solar irradiance of 1000 W/m

2 [

24]. The output power

PPV (

t) in each time interval

t depends on solar irradiance, ambient temperature, and specific PV system parameters. It is calculated according to the following expression, as defined in (8):

where

PPV,STC is the nominal power of the PV system under STC;

G (

t) is the solar irradiance on PV panels in time interval

t;

GSTC is solar irradiance under STC;

γ is the power temperature coefficient of the PV panel;

Tcell (

t) is the PV cell temperature in time interval

t;

TSTC is the cell temperature under STC; and

ηinv is the inverter efficiency.

Tcell (

t) depends on ambient temperature and solar irradiance, and is calculated using the Nominal Operating Cell Temperature (

NOCT) parameter as defined in (9):

where

Tamb (

t) is the ambient temperature in time interval

t.

Accurate modelling of BESS is crucial for optimizing prosumer operating costs. The BESS represents an important flexible resource within the prosumer system and offers significant opportunities to optimize consumption, generation and energy exchange with the grid. Its ability to store surplus energy generated by PV systems and supply energy during periods of high demand enables efficient reduction of electricity purchase costs and maximization of revenue from sales. BESS enables a higher level of PV self-consumption, which has a positive impact on the distribution grid by reducing the current-voltage impact of PV systems. The basis of optimized BESS management lies in the precise calculation of the battery state of charge (

SOC) and strict compliance with all relevant operating and safety constraints of the system. Other BESS parameters used in the optimization model are presented in

Table 2.

SOC (

t) in each time interval

t is calculated based on the previous state of charge

SOC (

t − 1), and the charging and discharging power, considering BESS efficiency. It is expressed as defined in (10):

where

PBESS,ch (

t) is the BESS charging power in time interval

t;

PBESS,disch (

t) is the BESS discharging power in time interval

t;

ηch is the BESS charging efficiency;

ηdisch is the BESS discharging efficiency; Δ

t is the duration of the time interval.

BESS operation is governed by specific technical and operational constraints. The BESS

SOC serves as a key constraint linking energy flows with stored energy and must remain within limits, as defined in (11):

To prevent simultaneous charging and discharging, a binary variable

δBESS (

t) is introduced for each time interval

t. This logical constraint, implemented with generalized disjunctive programming (GDP) formulation, ensures that the BESS can only operate in one mode at any given time. The charging (

PBESS,ch(

t)) and discharging (

PBESS,disch(

t)) powers are limited by their respective maximum values,

PBESS,chmax and

PBESS,dischmax, as defined in (12) and (13):

where

δBESS (

t) is a binary variable indicating the BESS operational mode (1 for charging, 0 otherwise), defined as in (14):

Additionally, a constraint is imposed to ensure that the

SOC at the end of the optimization horizon (

T) meets a predefined final value (

SOCfinal), which is crucial for managing the BESS state over consecutive periods, as expressed in (15):

It should be noted that, for the scope of this study, a simplified BESS model is adopted which does not include a dynamic battery degradation model based on operational patterns. The BESS lifetime is considered as a fixed parameter in the long-term cost–benefit analysis.

The fundamental constraint in the model is the power balance, which ensures energy conservation in each time interval

t. This implies that the total generated power must be balanced with the total power consumption. The mathematical formulation of this constraint is defined in (16):

The interaction with the distribution grid is defined by constraints on the prosumer’s energy exchange. The imported power from the grid (

Pgrid,buy(

t)) and the power exported to the grid (

Pgrid,sell(t)) is limited by the maximum contracted power,

Pcon. To enforce the disjunctive nature of these operations, preventing simultaneous import and export, a binary variable

δgrid (

t) is introduced. This constraint is ensured by a GDP formulation within the optimization model, as defined in (17) and (18):

where

δgrid (

t) is a binary variable that controls the grid interaction mode (1 for import, 0 otherwise), defined as in (19):

Following the detailed modeling of individual prosumer system components, including PV systems and BESS, it is crucial to define indicators reflecting their integrated efficiency. One such indicator, important for evaluating the prosumer system’s performance, is the self-consumption rate (

SCR) of the PV system. The PV system’s

SCR represents the share of total PV energy generated that is directly consumed within the household or stored in the BESS, instead of being fed into the grid. This rate is calculated post-optimization, based on modeled PV system generation profiles, household consumption, and BESS operation.

SCR is calculated on an annual level as defined in (20):

where

EPV,SC (

t) is the energy produced by the PV system and self-consumed in time interval

t.

Another important performance indicator of integrated prosumer systems, which complements

SCR, is the cumulative annual self-sufficiency rate (

SSR). While

SCR quantifies the share of produced energy used locally,

SSR measures the share of total household consumption met by its own resources (PV generation and BESS discharge) throughout the year, reducing reliance on the external grid.

SSR is defined in (21):

where

Pload (

t) is the electricity consumption in time interval

t.

2.3. Power System Simulation Model

The analysis of the impact of BESS integration on the distribution grid is performed through simulation using specialized power system simulation tools. Software enables the determination of total energy losses in the observed system, which enables the grid performance to be assessed under various operating scenarios.

For power system simulation, specialized software is used, in which a real radial distribution feeder in Croatia is modeled, aiming for a realistic representation of grid conditions. Located on this feeder are 10 prosumer households. Annual profiles obtained from the optimization model are used as input data for the simulation. This includes PV system generation profiles, household electricity consumption profiles, and, for BESS scenarios, optimized BESS charging and discharging profiles.

A time-sweep analysis is conducted throughout the entire year (8760 h) for various operating conditions. This type of simulation allows for the assessment of quasi-dynamic grid behavior under continuous changes in load and generation. The primary goal of the time-sweep analysis is the precise determination of total system energy losses (

Eloss). The energy losses

Eloss (

t) in each time interval

t represent the product of instantaneous active power losses (

Ploss (

t)) in lines and transformers within the modeled distribution feeder and the duration of that time interval Δ

t. The total annual energy losses

Eloss,annual for each observed scenario are obtained by summing

Eloss (

t) throughout the year. Based on the determined

Eloss at an annual level, savings are quantified, representing an economic benefit for the distribution system operator (DSO) resulting from a reduced need for electricity generation and supply due to decreased grid losses. In this context, the BESS plays a crucial role by storing surplus of locally produced energy and delivering it during periods of high demand, thereby directly reducing power flows through the grid and consequently minimizing losses. The monetary value of total annual losses (

Closs,annual) is calculated as defined in (22):

2.4. Comprehensive Cost–Benefit Analysis Model

A comprehensive cost–benefit analysis model is outlined to assess the economic viability of BESS integration over the entire life cycle from the perspective of both the prosumer and the system. This model integrates the investment, operating and decommissioning costs with the benefits resulting from optimized energy management and the mitigation of grid impacts.

The prosumer profit (

PP) quantifies the net economic benefit for all prosumers on the observed feeder over the BESS lifetime, representing the NPV of direct costs and benefits. It is calculated as defined in (23):

where

i is the prosumer index;

np is the total number of prosumers (10);

k is the year index;

LT is the BESS lifetime;

DR is the deflation rate;

INCBESS,i,0 is the BESS investment cost for prosumer

i in year 0;

ANCabs,i,k is the annual net savings from electricity costs for prosumer

i in year

k; and

OMCi,k is the annual operation and maintenance cost for BESS of prosumer

i in year

k.

Social profit (

SP) provides a broader, societal perspective on the economic viability of BESS integration, and differs from

PP by accounting for costs and benefits external to the individual prosumer’s direct financial flows.

SP includes the total cumulative decommissioning costs of the BESS systems, which represent a societal burden, and quantifies the economic savings derived from reduced grid losses, and benefit for the overall electricity system.

SP is calculated as defined in (24):

where

Closs,annual,k represents the annual monetary value of total grid losses for year

k; and

DCBESS,i,LT is the decommissioning cost of the BESS for the

i-th prosumer incurred in the final year

LT.

3. Results

In this Section, the results obtained by applying the methodology described in the previous Section are presented and analyzed in detail. It begins by presenting the main input data and configuration settings used in the models. It then presents the system performance at prosumer level, taking into account optimized operating profiles and economic savings. Furthermore, the impact of BESS integration on the distribution grid is analyzed by quantifying the losses. Finally, the cumulative results of the comprehensive cost–benefit analysis are presented.

3.1. Input Data

This subsection systematically presents all essential input data utilized for solving the optimization problem, calculating grid losses and ultimately conducting the comprehensive cost–benefit analysis.

3.1.1. Economic Parameters for Prosumer Optimization and Cost–Benefit Analysis

The economic calculations are based on the two-tariff system in Croatia, which differentiates between HT and LT depending on the time of day. All prices are expressed in EUR.

The daily tariff schedule, based on [

25], is defined as follows:

Winter Time calculation: HT applies from 07:00 to 21:00, and LT applies from 21:00 to 07:00.

Summer Time calculation: HT applies from 08:00 to 22:00, and LT applies from 22:00 to 08:00.

The procedure for calculating the prosumer’s electricity bill is thoroughly described by Equations (2)–(5). The specific tariff rates for electricity price, transmission fee, and distribution fee, for both HT and LT, are presented in

Table 3.

VAT for electricity in Croatia is 13% [

26]. According to Equation (4) and the data presented in

Table 3, the calculated value for

Cgrid,sell is 0.07341462 EUR/kWh.

Beyond the operational costs and revenues, the comprehensive cost–benefit analysis also incorporates specific BESS-related economic input data crucial for evaluating the long-term feasibility. The lifetime of the BESS is assumed to be 12 years.

INCBESS is set at 720 EUR/kWh based on [

27]. Furthermore,

OMCBESS is defined as EUR 5 per kW of

PBESS,dischmax per year, according to [

28]. This cost is specifically applied based on the maximum discharge power (

PBESS,dischmax) of each BESS unit.

DCBESS is set at 80 EUR/kWh based on [

29]. For the financial analysis,

DR of 3% is assumed. Additionally, to achieve more realistic results by accounting for expected future price increases, an inflation rate of 2.6% is also considered for relevant future costs and revenues.

3.1.2. Prosumer Input Characteristics

The analysis comprises ten prosumer households with different consumption characteristics and PV system configurations. The electricity consumption profiles were created using the PV*SOL premium 2024 software, which provides representative daily and annual load profiles for different household types. Hourly meteorological data from Osijek, Croatia, for the year 2018 was used to realistically simulate PV system generation. This specific year was selected as it represents a recent period for which a complete and validated set of high-resolution data was available, serving as a representative baseline for the region’s typical solar irradiance and temperature conditions. These data comprise solar irradiance and ambient temperature values, allowing accurate modeling of PV output throughout the year. Four distinct household types are considered:

Type 1: Single-person household

Type 2: Two-person household

Type 3: Two-person household with one child

Type 4: Two-person household with two children

The study comprises 10 different prosumer households, each characterized by a specific consumption profile type, annual electricity consumption, and contracted power with the grid. The maximum contracted power values

Pcon for grid connection are set in accordance with the possible connection capacities defined by [

22]. The installed PV system power for each prosumer is also specified. These characteristics are summarized in

Table 4.

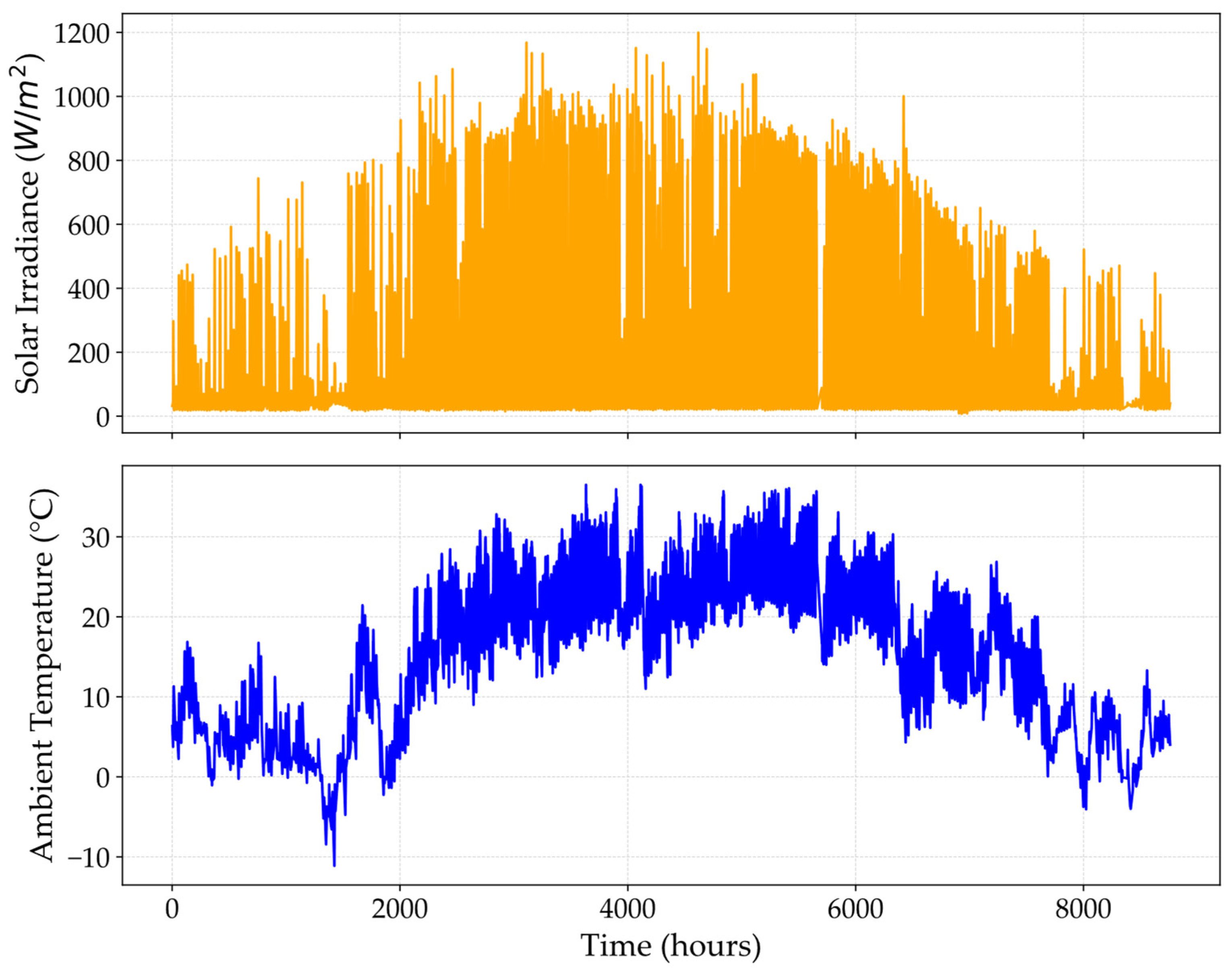

Figure 2 presents the

G (

t) and

Tamb (

t) profiles applicable to all prosumers, while

Figure 3 details the consumption and PV system generation profiles specifically for Prosumer 3 (P3), with PV generation calculated using Equations (8) and (9). For these calculations, the

NOCT is 43 °C, the

γ is −0.4%/°C, and

ηinv is 0.985.

The technical specifications of the BESS integrated in each prosumer household are crucial for its optimal operation. For the purposes of this study, these specifications are not based on actual BESS units, but have been modelled by the authors to represent different BESS configurations. These characteristics, which include capacity, power limits and operating state parameters, are detailed for each prosumer in

Table 5.

3.2. Simulation Settings and Case Study Definition

The specific settings and parameters adopted for the simulation and optimization analyses are described in this Subsection. It includes a description of the computational environment and the tools employed, followed by a detailed definition of the case studies analyzed in this research.

3.2.1. Computational Environment and Tools

The optimization model was developed using the Pyomo framework [

30], implemented in Python 3.12.3. The optimization problem was solved by the Gurobi 12.0.1 solver. Household consumption profiles, derived from the typical load patterns provided by PV*SOL premium 2024 software, were scaled to match the specific annual consumption requirements of each prosumer. Power system analysis was performed using DIgSILENT PowerFactory 2025. The computations were carried out on a personal computer running Windows 11 Home with an AMD Ryzen 5 7520 U processor and 16 GB of RAM.

3.2.2. Case Study and Scenario Definition

To evaluate the impact of BESS integration on prosumer level economics and grid performance, two distinct scenarios are defined. These scenarios serve to quantify the benefits arising from the deployment of BESS units in residential settings equipped with PV systems.

The defined scenarios are as follows:

In the Reference case, all 10 observed prosumer households operate with PV systems only, with any surplus PV generation directly fed into the distribution grid. This scenario establishes a baseline for operation without local energy storage. Conversely, in the Full BESS integration Scenario, all 10 prosumer households integrate optimally managed BESS units. BESS deployment enables the quantification of benefits, as units actively manage energy flow to minimize household operating costs and influence grid exchange.

In order to carry out a comprehensive cost–benefit evaluation, three additional economic analysis cases are defined. These cases aim to determine the maximum acceptable BESS investment costs or to assess the impact of different financial parameters to ensure economic viability (cumulative NPV equals or exceeds zero).The defined cost–benefit analysis cases are as follows:

Case A: Baseline economic scenario

Case B: Prosumer investment break-even

Case C: Prosumer investment sensitivity to inflation

Case A uses default economic parameters as a reference. Case B aims to determine the maximum INCBESS at which the cumulative cash flow (represented by PP) equals zero under baseline financial conditions. This analysis provides insight into the highest acceptable investment for individual prosumers to make BESS integration economically viable. In case C, the impact of a change in the inflation rate on the prosumer’s break-even point is assessed. In this case, the cumulative cash flow (represented by PP) is determined to be zero with an assumed variation in the inflation rate.

These two primary scenarios for the simulation analysis and the three cases of the cost–benefit analysis serve as the basis for assessing the overall impact of BESS integration on prosumer economic efficiency for prosumers and grid performance.

3.3. Prosumer-Level Results

Based on the results of the applied optimization model, optimized operating profiles and economic performance results are presented at the level of individual prosumers. The analysis starts with a detailed examination of a representative prosumer (P3), which provides insights into the optimized power flows and the BESS SOC. In addition, a comprehensive summary of economic indicators such as cost savings and energy balance metrics is provided for all prosumers assessed.

3.3.1. Prosumer 3 Operational Performance

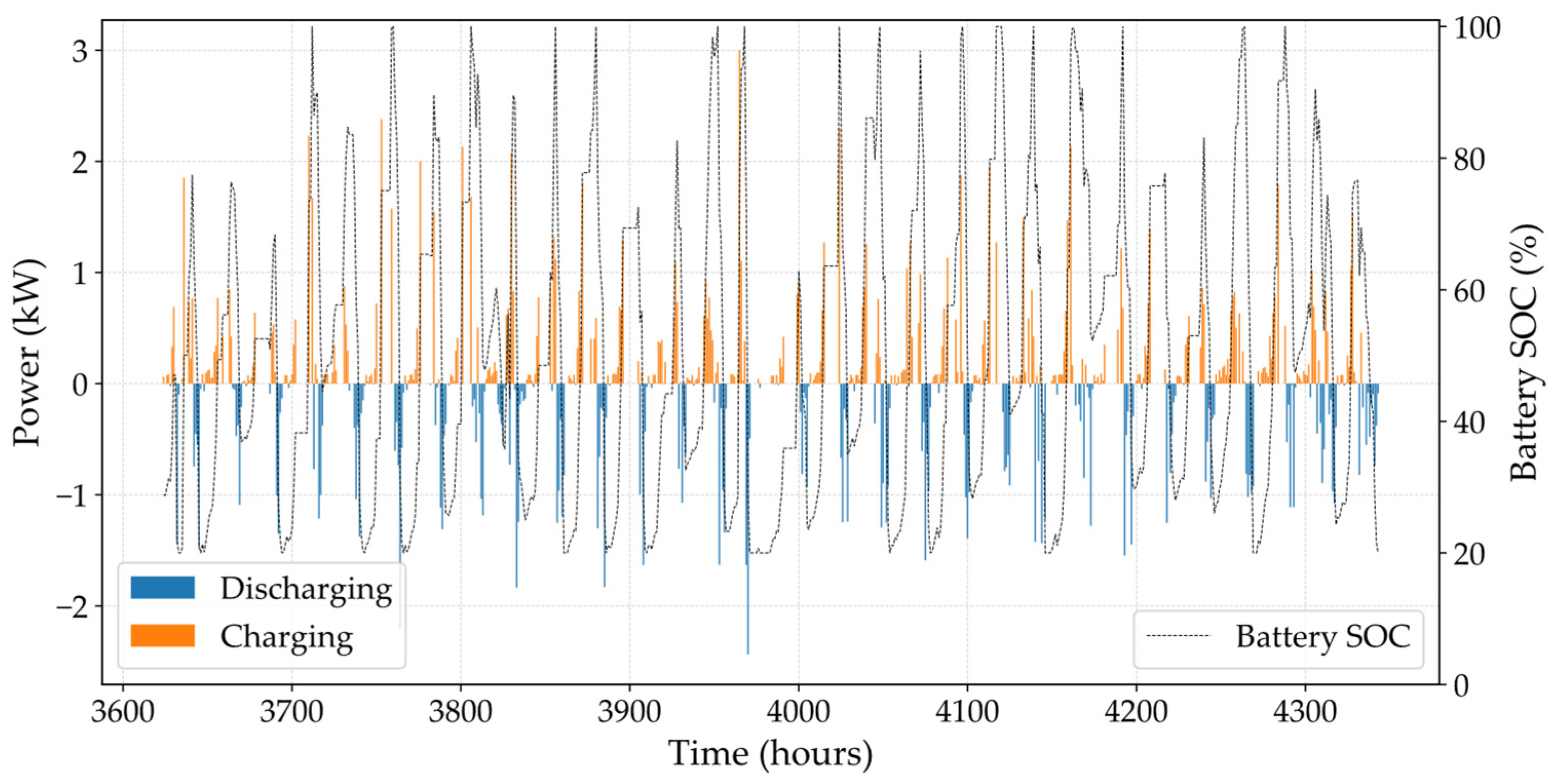

In order to gain a detailed insight into the optimized operating behavior of a prosumer, P3 was selected as a representative example. The key operating profiles for P3 are presented specifically for the month of June to provide clarity and a detailed visual analysis. The profiles presented include the optimized power balance (PV generation, load consumption, grid exchange and BESS charge/discharge) and the BESS SOC profile.

The annual operational results for Prosumer 3 are quantified based on the mathematical formulations and constraints outlined in Equations (1)–(21).

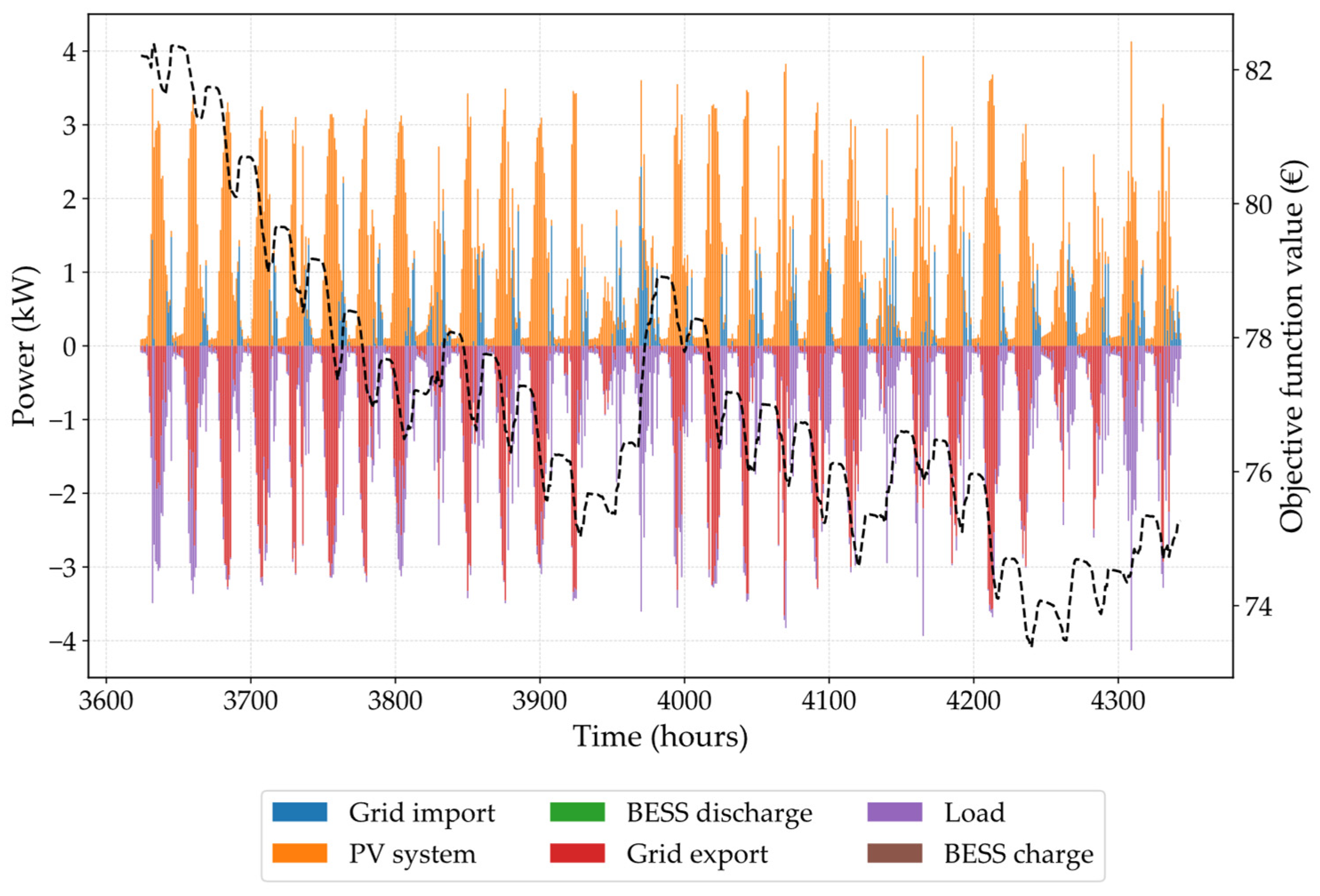

Figure 4 illustrates the operating dynamics of the BESS for P3 during the June. The plot clearly displays the P

BESS,ch (

t) and P

BESS,disch (

t), alongside the corresponding BESS

SOC levels. This visual representation gives an insight into the daily cycling behavior of the BESS, demonstrating its active role in managing energy flows by storing surplus PV generation and discharging to meet household demand or optimize energy exchange with the grid.

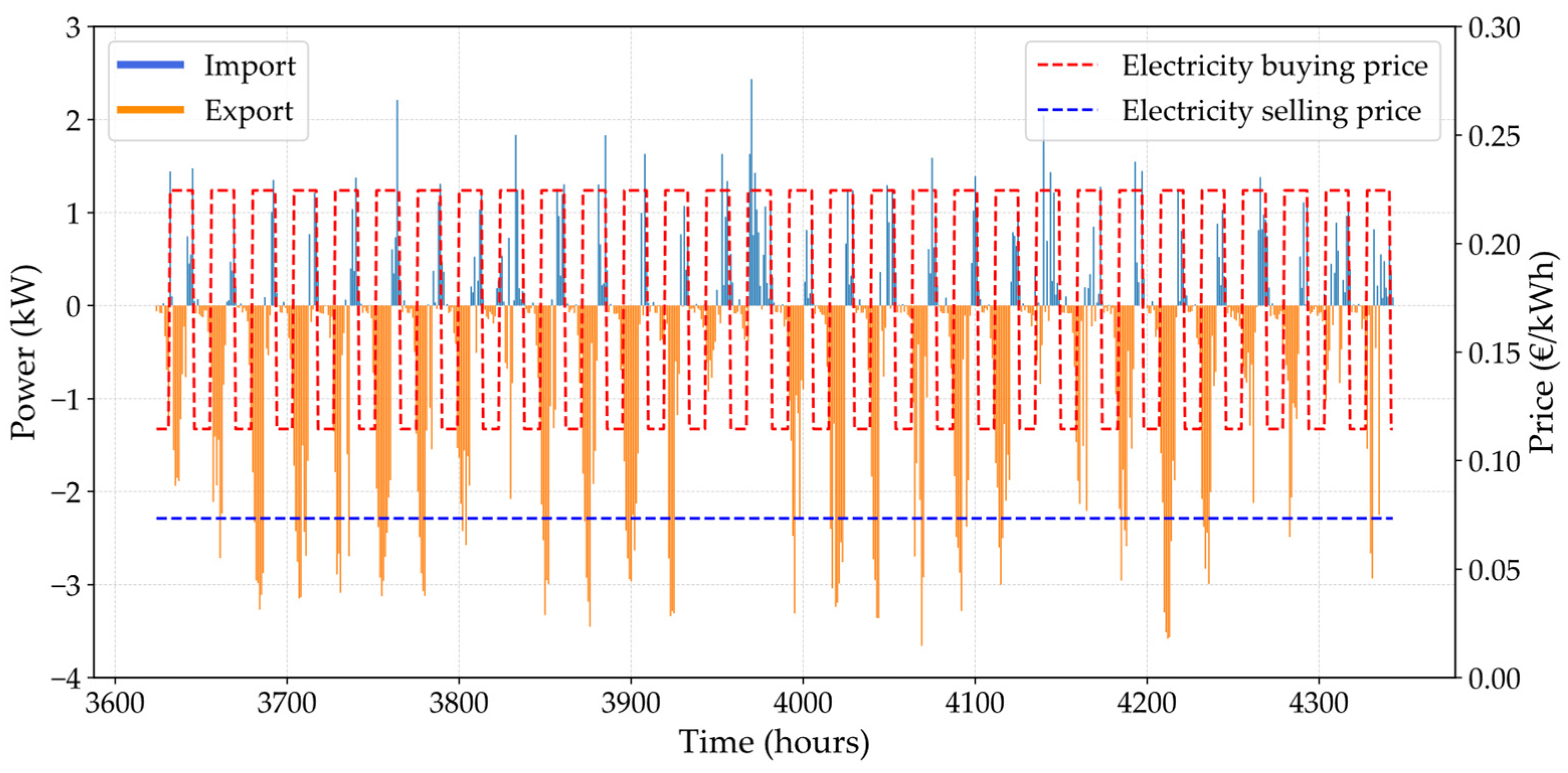

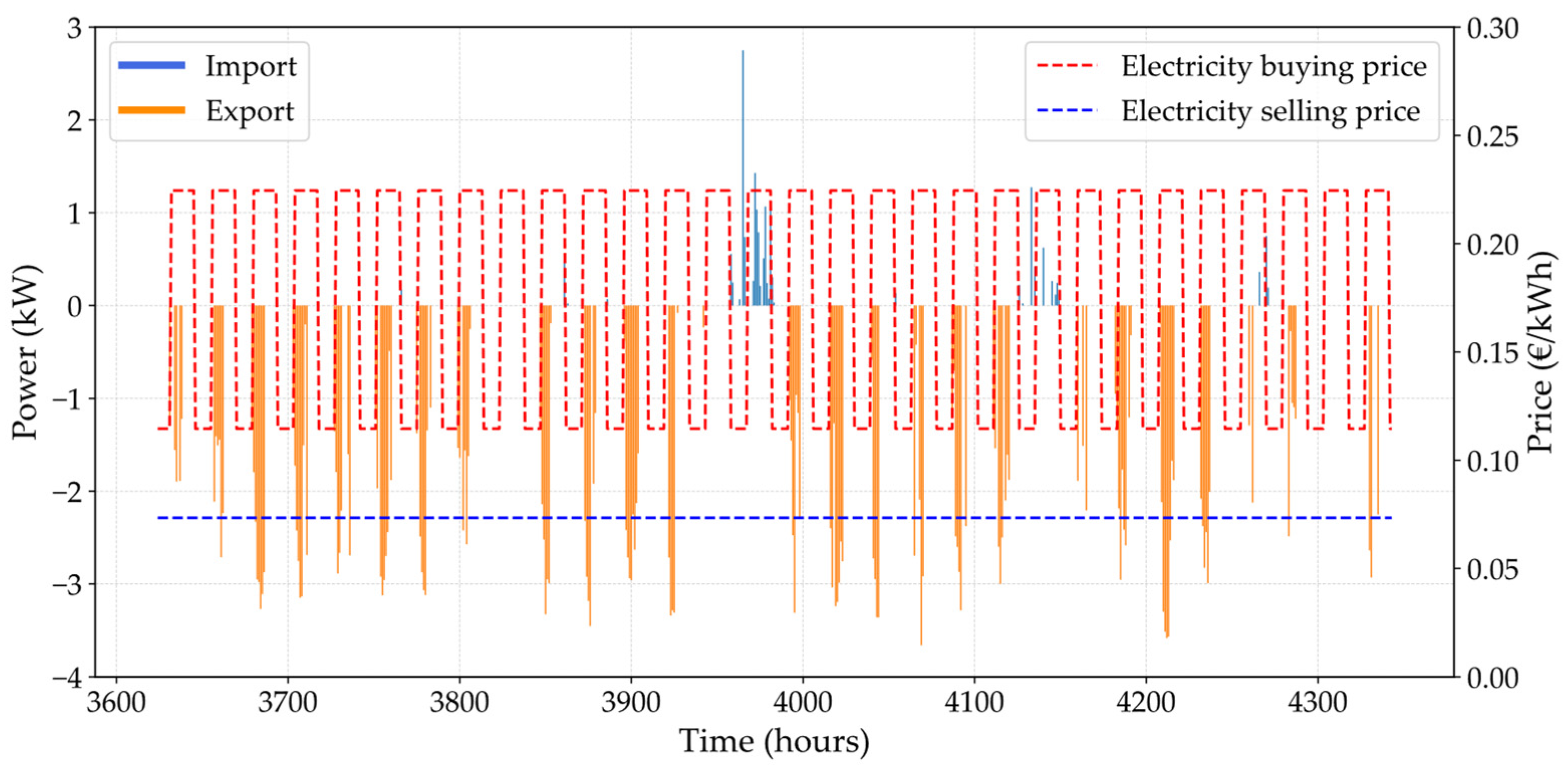

Figure 5 illustrates the energy exchange with the P3 grid in the reference case in June. Significant electricity imports from the grid characterize times when household consumption exceeds PV generation, while significant electricity export occurs when PV generation exceeds immediate consumption. This illustrates the direct dependence of the prosumer on the grid for both the supply and absorption of the PV surplus in a PV-only configuration. Conversely,

Figure 6 shows that in the scenario of full BESS integration, both grid import and export are significantly reduced. The BESS actively manages the prosumer’s energy balance by storing and discharging excess PV systems to meet demand, which significantly reduces import needs. Periods of grid export still persist, however, occurring when high PV generation exceeds both immediate consumption and BESS charging capacity. This behavior is to be expected in June due to the high solar radiation and the associated PV generation.

Table 6 provides a quantitative monthly comparison of the energy exchange with the grid, contrasting Scenario 1 with Scenario 2 for both tariff periods. The results highlight the primary impact of BESS integration: a significant reduction in energy imports during HT periods. An example of this is June, when HT imports fall by 92.5% from 119.24 kWh to 8.88 kWh, a trend that can be observed throughout the year. Conversely, a strategic shift is noted in LT imports, which increase in Scenario 2, particularly during winter months. This shift, coupled with prioritized self-consumption, also leads to a systematic reduction in energy exported to the grid.

The BESS operational strategy that enables the grid exchange dynamics shown in

Table 6 is detailed in

Table 7. The data reveal a clear energy arbitrage pattern, where the BESS is predominantly discharged during expensive high-tariff (HT) periods (1570.52 kWh annually) to cover household demand. This discharging activity directly displaces the need to purchase high-cost energy from the grid.

BESS is charged from two primary sources: by capturing surplus PV generation during HT periods (1164.63 kWh annually), which would have otherwise been exported, and by strategically importing cheaper energy from the grid during LT periods (645.52 kWh annually). The minimal discharging during LT periods (64.85 kWh annually) further confirms that the optimization model preserves stored energy for periods of higher economic value.

Figure 7 illustrates the optimized power balance for Prosumer 3 in June in the Reference case. This plot shows significant reliance on grid import to cover demand when PV generation is insufficient, alongside substantial export of surplus PV. The cumulative objective function value, represented by the dashed line, reflects the economic outcome of these energy flows.

Conversely,

Figure 8 presents the optimized power balance in the Full BESS integration scenario. This figure clearly demonstrates BESS’s role in absorbing PV surplus (BESS charge) and meeting load demand (BESS discharge), leading to a marked reduction in both grid import and export. The cumulative objective function value, represented by the dashed line, reflects the economic outcome of these optimized energy flows.

3.3.2. Prosumer Economic and Performance Results

Based on the results of the optimization model, the quantified economic and operational performance metrics for the ten prosumer households connected to the radial feeder are presented. These results, derived using the mathematical formulations and constraints defined in Equations (1)–(21), provide a comprehensive overview of the benefits achieved through BESS integration, with all key indicators summarized in

Table 8.

Following the optimization and BESS integration, a clear economic benefit is observed across all prosumer households. Chouse is significantly reduced in Scenario 2 for all prosumers, with several achieving negative costs, indicating a net profit. Specifically, P10 shows the highest ANCabs of EUR 226.18 and the highest ANCperc of 178.26%, moving from a cost to a significant profit. P9 also demonstrates remarkable performance with 182.40% in percentage savings. This substantial improvement is primarily driven by the efficient utilization of the BESS for self-consumption and strategic grid exchange. The integration of BESS also significantly increases household self-sufficiency and self-consumption. The average SCR across all prosumers increases from around 30.5% in Scenario 1 to 52.5% in Scenario 2. Similarly, the SSR increases from around 45.5% in Scenario 1 to 74.5% in Scenario 2, indicating a reduced reliance on the external grid. P4, for instance, achieves one of the highest total annual energy discharged from BESS (EBESS,disch,annual) values at 1846.63 kWh, reflecting a high degree of battery utilization to cover internal demand. The variation in performance among prosumers can be attributed to differences in their consumption profiles, PV system sizes, and BESS capacities, as optimized by the model to maximize individual economic benefits.

3.4. Grid Impact Analysis Results

This section presents the results of the power system simulations performed to assess the impact of BESS integration on the distribution grid. Conducted using DIgSILENT PowerFactory 2025, these simulations quantify Closs,annual and evaluate system reliability for both defined scenarios.

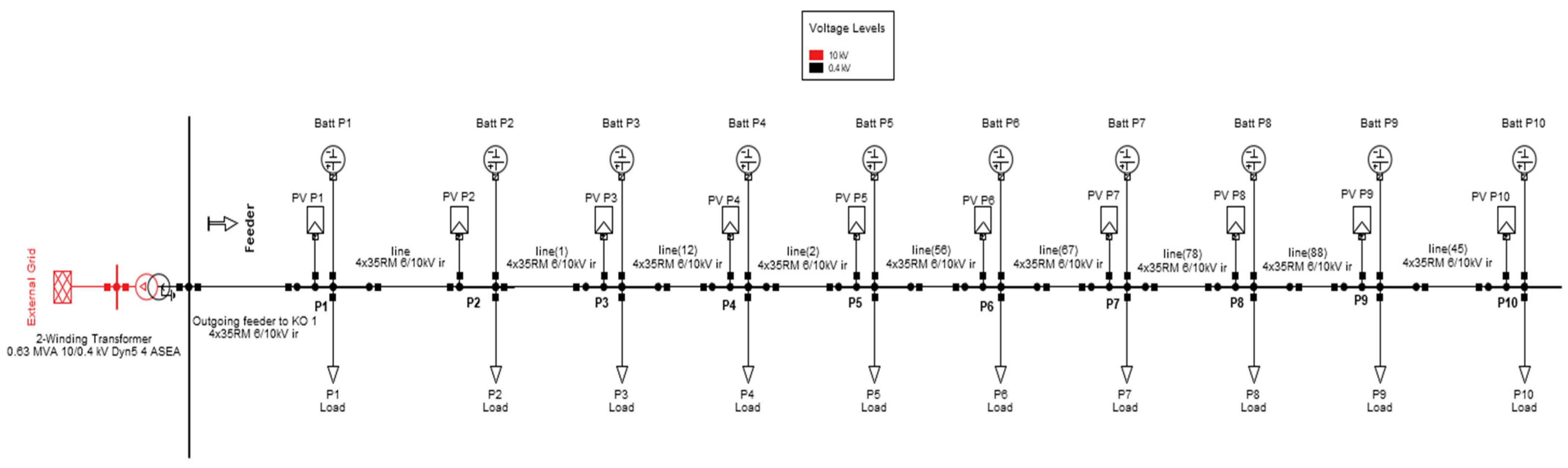

Prior to presenting the quantified results,

Figure 9 illustrates the single-line diagram of the radial distribution feeder model used for these power system simulations. This model represents a realistic configuration of a distribution feeder in Tenja, Croatia, equipped with 10 prosumer households, each potentially integrating PV systems and BESS units.

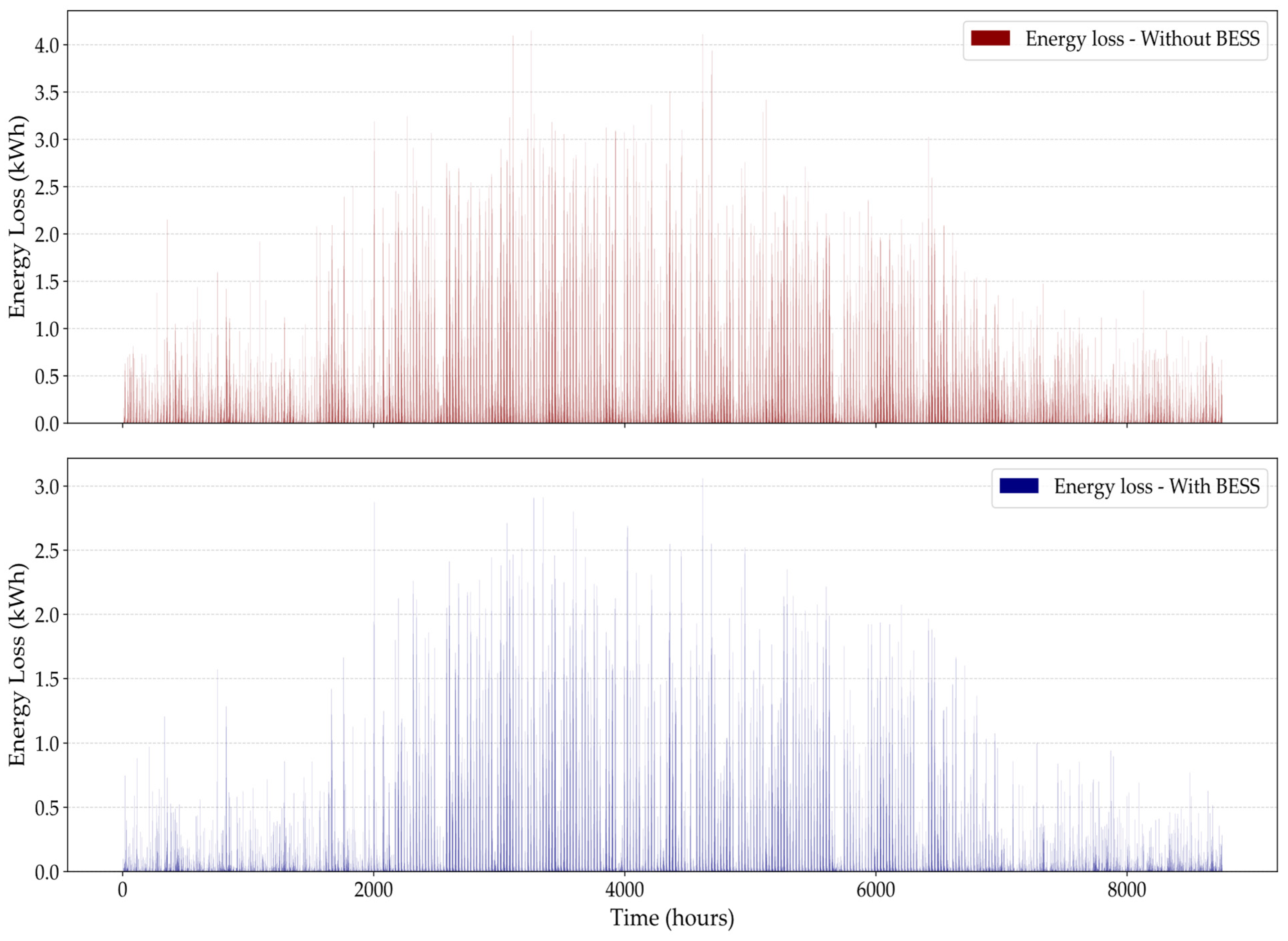

Figure 10 illustrates the annual electricity losses on the observed feeder in Tenja, Croatia. The calculation of hourly losses over the year is the result of a time-sweep analysis performed using DIgSILENT PowerFactory 2025.

Eloss,annual for Scenario 1 amount to 2650.27 kWh while, for Scenario 2, where BESS units are integrated, they are 1477.69 kWh. Consequently, grid losses are reduced by 1172.52 kWh following BESS integration. The calculation of the

Closs,annual was performed according to Equation (22) for each hour of the year.

Closs,annual for Scenario 1 amounts to EUR 477.27, while for Scenario 2, it is EUR 261.02, indicating a cost saving of EUR 216.25 after BESS integration.

In order to verify the significance of the reduction in energy losses, a statistical analysis of the 8760 hourly energy loss data was carried out for both scenarios. The mean hourly energy loss in Scenario 1 was 0.302 kWh with a standard deviation of 0.556 kWh, while in Scenario 2 the mean hourly loss was reduced to 0.169 kWh with a standard deviation of 0.396 kWh. A paired t-test was performed to compare the two scenarios and the results showed that the reduction in grid losses with BESS integration is statistically significant

3.5. Comprehensive Cost–Benefit Analysis Results

This subsection presents the results of the comprehensive cost–benefit analysis, providing a holistic evaluation of the economic viability of BESS integration. The analysis utilizes essential input data, defined in

Section 3.1.1, and is based on the formulations presented in Equations (23) and (24). The analysis is conducted for three distinct cases, which are defined in

Section 3.2.2.

Figure 11 illustrates the cumulative cash flow dynamics for BESS integration in Case A, representing the Baseline Economic Scenario.

It is clearly visible that, throughout its lifetime, BESS integration is not economically viable for prosumers on the observed feeder. The Cumulative Prosumer Cash flow line consistently remains negative, indicating that the accumulated savings from optimized energy management are insufficient to offset the initial investment and ongoing operational costs. From a broader societal perspective, the investment is also not profitable, as reflected by the Cumulative Social Cash Flow line. This is primarily due to the inclusion of decommissioning costs, which, although not directly borne by the individual prosumer, represent a societal burden and further diminish the overall economic viability at the end of the BESS’s lifecycle. The primary reason for unprofitability is the high initial BESS investment. The total investment in BESS in this scenario amounted to EUR 37,440 corresponding to installation of 52 kWh of BESS capacity across the feeder resulting in specific investments of 720 EUR/kWh. Under current Croatian market conditions, the operational savings achieved (through electricity bill reduction and grid benefits from loss reduction) are not high enough to justify the significant upfront investment costs over the lifetime of the BESS, limiting widespread adoption and emphasizing the need for an expected significant reduction in market costs or the introduction of targeted incentives (Case B) or an expected increase in electricity market or tariff prices (Case C) to increase the economic attractiveness of BESS integration.

Figure 12 illustrates the cumulative cash flow dynamics in Case B, which determines the break-even investment cost from the prosumer’s perspective.

In this scenario, the investment cost was strategically reduced to 340 EUR/kWh, resulting in a total BESS investment of EUR 17,680 for the 52 kWh installed capacity on the feeder. At this reduced investment level, the Cumulative Prosumer Cash Flow reached a positive value of EUR 175.324 at the end of the BESS’s lifetime, demonstrating that BESS integration can become edgingly profitable for prosumers with significantly reduced investment costs. However, from an overall societal perspective, the investment remains unprofitable primarily due to the inclusion of decommissioning costs, which amount to EUR 3954.81 and are borne by society at the end of the BESS’s lifecycle. This analysis also reveals that, under current Croatian electricity market and low prices conditions (compared to many EU countries), the investment price of BESS must fall by over 52% compared to the initial investment cost in Case A.

Figure 13 illustrates the cumulative cash flow dynamics for BESS integration in Case C. This scenario determines the necessary increase in electricity prices over time through the inflation rate, for which the prosumer’s investment in BESS becomes economically viable over its lifetime. The analysis reveals that prices along with an

OMC annual increase inflation rate of 4.87% is required for the prosumer’s cumulative cash flow to reach zero. At this rate, the Cumulative Prosumer Cash Flow at the end of the BESS’s lifetime amounts to a near positive value of EUR 73.84, indicating minimal profitability. However, from a broader societal perspective, the investment still remains close to unprofitable at EUR −296.21, attributed to the decommissioning costs, which also increase with inflation to EUR 5256.20 at the end of the BESS’s lifetime. This scenario, involving a consistent 4.87% annual increase in costs and revenues, represents a significant inflationary pressure and may not reflect realistic long-term economic projections for the Croatian or broad European context.

3.6. Sensitivity Analysis

To further assess the robustness of the economic findings and the generalizability of the project, a sensitivity analysis was carried out. This analysis examines the impact of two critical parameters on the NPV of the project from both the prosumer and society’s perspective: the BESS investment costs and the BESS lifetime.

The sensitivity to the BESS investment cost was evaluated at three distinct levels: the baseline cost of 720 EUR/kWh, a 40% cost reduction to 432 EUR/kWh, which could represent a potential incentive framework, and the previously determined prosumer break-even cost of 340 EUR/kWh. Secondly, the sensitivity to the BESS operating lifetime was examined across three scenarios: a conservative 10-year lifetime, the baseline 12-year lifetime, and an optimistic 15-year lifetime reflecting potential technological improvements. The results of this analysis are summarized in

Table 9.

The results of the sensitivity analysis, summarized in

Table 9, underscore the critical factors influencing the economic viability of BESS integration.

The sensitivity analysis of the BESS investment cost highlights its dominant role. The baseline scenario (720 EUR/kWh) results in a negative Cumulative Prosumer Cash Flow of EUR −19,584.68. A 40% cost reduction to 432 EUR/kWh, representing a potential incentive, substantially improves this result to EUR 4608.68. This cost reduction also significantly improves the Cumulative Social Cash Flow, although it remains negative. The analysis confirms that the break-even point for prosumers, with a positive Cumulative Prosumer Cash Flow of EUR 175.32, is reached at 340 EUR/kWh.

Similarly, the lifetime of the BESS is a key factor in profitability. A conservative 10-year lifetime results in the most unfavorable cumulative prosumer cash flow of EUR −22,104.38. In contrast, extending the lifetime to an optimistic 15 years improves this result to EUR −16,262.26. BESS lifetime extension also delivers the best result for the Cumulative Social Cash Flow (EUR −17,427.99) among the lifetime scenarios. However, it is noteworthy that the Cumulative Social Cash Flow remains negative in all scenarios analyzed, although profitability for prosumers can be achieved under certain conditions, primarily due to the impact of BESS decommissioning costs.

4. Discussion

In this paper a comprehensive economic analysis was carried out to evaluate the economic viability of BESS integration for prosumers, assessing its impact from both the prosumer’s perspective and the distribution grid’s standpoint. A MILP optimization model was developed to simulate and optimize prosumer energy management, integrating household economics with grid impact considerations. Power system simulations were performed using a specialized tool to quantify grid losses under observed operational scenarios The results clearly show that the costs for the individual prosumers can be significantly reduced and that the total annual costs for households are considerably lower. For the collective of 10 prosumers on the observed feeder, these savings amount to EUR 1798.78. Some prosumers even record a net profit, primarily driven by efficient self-consumption and strategic energy exchange with the grid. This aligns with findings in numerous studies that emphasize BESS’s role in enhancing prosumer profitability through optimized energy management [

3,

4,

8].

Beyond individual prosumer benefits, BESS integration yields measurable positive impacts on the distribution grid. Specifically, energy losses are substantially reduced, decreasing from 2650.27 kWh in the Reference case to 1477.69 kWh in the Full BESS integration scenario, representing a reduction of 1172.52 kWh. Monetarily, this translates to an annual saving of EUR 216.25 for the DSO. This saving, while quantified at the feeder level, indicates a significant potential when extrapolated to an entire distribution grid, underscoring the immense value of BESS for grid operational efficiency and broader societal benefits.

Despite these clear benefits at both prosumer and grid levels, the comprehensive cost–benefit analysis for the Croatian context reveals that BESS integration is not profitable over its estimated 12-year lifetime under current market conditions. This conclusion aligns with findings in other studies that also observed the unprofitability of BESS systems under certain market conditions, such as the analysis of off-grid systems in Germany [

21]. This is primarily influenced by the Croatian market context, which, in addition to high BESS investment costs, is characterized by relatively low retail electricity prices and a small spread between high and low tariff rates, limiting the potential for cost savings through energy arbitrage. Furthermore, the current lack of dedicated incentives for prosumer-level BESS integration in Croatia significantly hinders its economic viability. It is important to note that in the final cost–benefit analysis, decommissioning costs were not included in the PP calculation, as their management and financial responsibility are currently undefined for prosumers in Croatia. However, these costs were incorporated into the SP calculation, reflecting their broader societal impact. For these analyses, an inflation rate was also considered to ensure more realistic financial projections of future costs and revenues. The break-even analyses were crucial in determining the investment thresholds required for BESS profitability. Case B revealed that, for prosumers to achieve break-even (zero cumulative cash flow) under baseline financial conditions, the BESS investment cost would need to fall by 52.78% compared to Case A, reducing the total investment to EUR 17,680 (340 EUR/kWh) and resulting in a Cumulative Prosumer Cash Flow of EUR 175.324 at the end of the BESS’s lifetime. However, the Cumulative Social Cash Flow would remain negative at EUR −1453.80 due to the inclusion of decommissioning costs. Case C further demonstrated that achieving prosumer profitability, with a Cumulative Prosumer Cash Flow of EUR 73.84 at the end of the BESS’s lifetime would require a sustained inflation rate of 4.87%; even then, the Cumulative Social Cash Flow would remain negative at EUR −296.21 due to decommissioning costs of EUR 5256.20. This suggests that current BESS investment costs, operational expenses, or market structures may still present barriers to widespread adoption, necessitating policy support or technological cost reductions. Furthermore, the sensitivity analysis investigated the impact of BESS lifetime, revealing that, while an optimistic 15-year lifetime improves the economic outlook, it is insufficient on its own to render the investment profitable under current market conditions. Notably, the Cumulative Social Cash Flow remained negative in all analyzed scenarios, further highlighting the existing barriers to widespread adoption and underscoring the necessity for policy support or technological cost reductions.

The findings of this cost–benefit case study analysis from a solid basis for future research directions. One promising direction involves expanding the scope of the study from a single feeder in this paper to a distribution areas or entire grid levels, which would enable the quantification of even more substantial loss savings and other benefits for the system operator. Additionally, future work should address the limitations of the BESS model. This study assumes a fixed lifetime, whereas a dynamic degradation model that links operational patterns to battery health, as explored in [

3], would provide a more precise lifetime economic assessment. Similarly, the assumption of perfect forecasting for PV generation and demand represents a simplification, and future studies could incorporate stochastic or robust optimization methods to account for these real-world uncertainties. Future research should also consider the benefits that prosumer-level BESS can bring in terms of reliability improvements, specifically by quantifying savings from avoided customer interruption (outage) costs. Furthermore, optimizing the planning and placement of large-scale central BESS units by DSO could present a significant market economic opportunity. Such systems offer lower per-unit investment costs and potentially faster returns on investment, leading to considerable social benefits through reduced losses and the provision of ancillary services (e.g., frequency regulation). Moreover, performing calculations based on dynamic tariffs is essential to explore their impact on BESS profitability. Exploring the viability of alternative business models, such as prosumer participation in peer-to-peer (P2P) trading platforms or virtual power plants (VPPs), also represents a promising direction for future research. Such frameworks could unlock additional revenue streams by enabling prosumers to offer ancillary services to the grid, which would significantly enhance the economic case for BESS adoption. Furthermore, BESS incentives for households could result not only in prosumer benefits but also in the potential benefits these systems can bring to the entire distribution grid.

5. Conclusions

The cost–benefit analysis of the prosumer energy management system focusing on the reduction of grid losses performed and presented in the study revealed significant economic benefits at the prosumer level, resulting in a substantial cost reduction for individual households and a remarkable reduction in total annual household costs for the collective of 10 prosumers at the observed feeder.

However, the comprehensive cost–benefit analysis for the Croatian context indicated that BESS integration is currently not inherently profitable over its estimated 12-year lifetime under prevailing market conditions. This unprofitability is largely attributed to the relatively low electricity prices in Croatia and the high initial investment costs associated with BESS deployment. A detailed sensitivity analysis confirmed these findings, demonstrating that, for BESS to become profitable for prosumers, investment costs would need to fall by 52.78%. Furthermore, the analysis showed that, while an optimistic 15-year BESS lifetime improves the economic outlook, it is insufficient by itself to reach profitability under current market conditions. Although BESS integration contributes to grid operational efficiency and broader societal benefits, the current economic landscape and lack of dedicated incentives restrict its widespread adoption.

Finally, while BESSs offer clear technical and economic advantages in energy management and grid support, their financial viability for prosumers in specific market contexts such as Croatia remains a challenge. Addressing these financial barriers through cost reductions or policy interventions, such as targeted incentives, is essential to realize the full potential of BESS for a sustainable and efficient energy transition.