1. Introduction

Global climate crises and ecological deterioration are intensifying. The Porter Hypothesis [

1] posits that appropriate environmental regulation can stimulate corporate innovation and enhance long-term competitiveness. Environmental taxes correct pollution behaviors through policy signals, theoretically improving ecological conditions, stimulating green technology innovation, and promoting economic growth [

2,

3]. As a crucial policy tool balancing economic growth and ecological protection, environmental taxes are widely regarded as vital pathways for sustainable development [

4,

5]. From the 1990s environmental tax reforms pioneered by Nordic countries to China’s implementation of the environmental protection tax law (EPT) in 2018, replacing its previous pollutant discharge fee system, significant variations in policy effectiveness have emerged since EPT’s 2018 enactment. Its potential multiple benefits and drawbacks have attracted extensive academic attention. Research shows divergent views on EPT’s “inhibitive effect” and “promotive effect” [

6]. Environmental taxation’s inhibitory effect on carbon emissions is widely confirmed [

7]. Chenghao et al. [

8] verified EPT’s promotive effect on China’s regional economy. Deng et al. [

9] identified a double dividend achieved through enhanced corporate resilience and carbon reduction. Kettner et al. [

10] studied Austria’s carbon pricing revenue recycling mechanisms, demonstrating their potential for achieving a triple dividend: emission reduction, economic growth, and consumption equity. Pereira et al. [

11] noted that appropriately using tax revenues for tax reductions and energy efficiency investments can achieve a triple dividend: emission reduction, economic promotion, and fiscal improvement. However, actual schemes miss opportunities by failing to optimize revenue usage.

The concept of the “double dividend effect” was proposed [

12]. Its continuous development led to exploring the “triple dividend effect” [

13,

14]. Based on the above practical and theoretical backgrounds, this study defines EPT as achieving three simultaneous objectives: improving environmental quality (environmental dividend), promoting corporate green technology innovation (innovation dividend), and advancing economic development (economic dividend).

Current research limitations highlight the complexity of studying triple dividend mechanisms. There are three theoretical gaps: First, most studies focus solely on one or two dividend dimensions, fragmenting the intrinsic linkages among environmental, innovation, and economic effects. Second, traditional models over-rely on linear assumptions; most research examines only emission reduction effects [

15,

16], neglecting cross-period impacts on innovation quality (e.g., patent complexity) and firm value. Threshold effect research is fragmented [

17,

18], ignoring EPT’s threshold effects—for instance, the Porter Hypothesis cannot explain innovation effects when tax burden exceeds critical points. Third, research on industrial heterogeneity lags, lacking quantitative evidence on regulatory response differences between heavily and non-heavily polluting industries. Studies on policy transmission mechanisms remain fragmented, failing to establish a unified analytical framework for environmental taxes’ synergistic effects on pollution control, technological innovation, and value creation.

In practical research, theoretical shortcomings manifest in two aspects: First, existing studies simplistically treat EPT policy effects as exogenous shocks for empirical analysis [

3,

8,

19,

20], without constructing multidimensional empirical and robustness analyses. Second, policy implementation is studied as a “one-size-fits-all” strategy with singular evaluation dimensions. This theory–practice gap urgently necessitates building an integrated micro-mechanism analysis system.

China’s EPT, implemented in 2018, adopts differentiated tax rates and tax reduction measures. This design enhances the policy flexibility of EPT and provides a unique environment for studying corporate triple dividend mechanisms.

This study proposes five sets of hypotheses. H1-H3 verify the micro-level triple dividends of EPT (environmental emission reduction/green innovation/economic performance improvement), H4 reveals the nonlinear threshold effect of the triple dividends (environmental/innovation/economic dimensions critical points), and H5 confirms that the threshold responses of non-heavily polluting industries and heavily polluting industries are significantly different.

The distinctive contribution lies in establishing the first integrated analytical framework combining triple dividends, threshold effects, and industrial heterogeneity, providing a micro-empirical engine for precision regulation of environmental policy transitions.

This study is structured as follows:

Section 1: EPT theory and practical background, research gaps, research questions, and innovations.

Section 2: Developing the analytical framework and proposing research hypotheses.

Section 3: Data sources (Chinese listed company panel data), variable definitions, model specification.

Section 4: Analysis of triple dividend effects and threshold effects, robustness checks, and heterogeneity analysis.

Section 5: Hypothesis validation, theoretical and practical contributions, limitations, and future research directions.

Section 6: Summary of findings.

3. Research Design

3.1. Data

The raw data comes from annual reports of listed companies. It was compiled and calculated by the “PPMANDATA” platform, sourced from the PPMANDATA database. Second, EPT data was collected. This involved selecting and extracting EPT data published by China’s A-share listed companies. The data covers the period from 2018 to 2022. Companies were classified based on whether they belong to heavily polluting industries. Companies with excessive missing values were excluded. Some missing values were filled using a regression prediction model. Some variables were sourced from the CSMAR database. Invention patent data came from the China National Intellectual Property Administration. Companies classified as (ST), (PT), and (*ST) were also excluded. Finally, a sample of 872 companies was obtained, totaling 4360 observations.

3.2. Variables

Table 1 contains the names of the variables, their explanations and calculation methods, and the data source used. As introduced and demonstrated by Rao et al. [

56], Shen & Zhang [

57], and Zhou et al. [

58], the study incorporates a comprehensive set of control variables that are carefully selected to summarize the operating and financial health of listed companies. The selection of these control variables is well supported in the literature.

This study uses the quality of patent applications as a proxy variable for the innovation dividend. It innovates in measuring both applied patent quality and granted patent quality. First, this study collects the main classification codes of patents held by listed companies. China uses the IPC patent classification system. The format is “Section—Class—Subclass—Main Group—Subgroup,” for example, “A01B01/00.” Simply counting the number of unique main classification codes in a firm’s patents does not accurately reflect internal differences in patent quality. It may overestimate patent quality. For example, Company A has three patents with main classification codes: A01B01/01, A01B01/02. Company B has three patents with main classification codes: A01B02/00, B02C03/00. Both companies have the same number of unique classification codes. However, Company A’s patents only utilize variations within the single main group A01B01. Company B’s patents utilize two distinct main groups: A01B02 and B02C03. Clearly, Company B’s patents demonstrate a broader and likely more advanced application of technology. Therefore, Company B has higher patent quality.

To address this, this study defines corporate patent quality at the main group level, drawing on the calculation concept of the Herfindahl Index:

where

Xmit is the cumulative number of invention and utility model patent applications by firm

i in main group

m up to year

t;

Xit is the cumulative number of all patent applications by firm

i across all main groups up to year

t.

A higher value of Patentit indicates a higher quality of the firm’s patent applications. The same logic applies to measuring the quality of granted patents. In data processing for this metric, we only included invention patents and utility model patents. This is for two reasons: 1. Design patents use a completely different classification system from invention and utility model patents. They cannot be calculated using the same method. 2. Compared to invention and utility model patents, design patents reflect relatively lower independent innovation capability. They do not adequately represent the complexity of knowledge applied during patent creation. Therefore, design patents were excluded.

3.3. Descriptive Statistics of Variables

Table 2 contains 4360 observations. The number of observations for all variables is 4360. This indicates the dataset is complete with no missing values. The data is described in detail as follows:

Water Pollution Equivalents: Comprehensive water pollution equivalent and total pollution equivalent show very low volatility.

Patent Quality: High quality but contains zero values. The relatively small standard deviation indicates overall high patent quality among sample listed companies, with a relatively concentrated distribution.

Financial Scale: Operating revenue, total profit, and net profit are substantial. The mean values of the logarithms of operating revenue, total profit, and net profit, when converted back to original values, are very large. This shows the sample mainly consists of large- and medium-sized enterprises. The relatively large standard deviations indicate significant size differences between Chinese listed companies.

Environmental Tax Burden: The mean actual paid EPT (14.519) is slightly lower than the mean payable EPT (14.698). This suggests that sample Chinese listed companies, overall, exhibit slight tax avoidance or benefit from tax incentives. The large standard deviation indicates significant differences in environmental tax burden between Chinese listed companies. The wide range between max and min values further confirms substantial variation in EPT burden across Chinese listed companies.

Financial Performance and Risk: The OPGR fluctuates greatly, and there are significant differences between different companies. Cash ratio, average cash short-term debt repayment capacity is acceptable, there are tax incentives/penalties in the comprehensive tax rate, and R&D investment is relatively concentrated. ROA: Mean 0.030, standard deviation 0.081. Min −1.856, Max 0.759. Overall profitability is low and highly volatile, with significant losses in some Chinese listed companies.

Financial Leverage and Risk: Financial Leverage: Mean 1.525 appears acceptable, but the standard deviation is very large (4.634). Min −6.365 indicates negative shareholder equity with a large absolute value. Max 270.994 shows liabilities far exceeding assets.

Asset–Liability Ratio: Mean 47.2%, within the commonly considered reasonable range of 40–60%.

Financial Expenses: Mean 18.148, standard deviation 1.612, indicating significant variation in interest burdens among Chinese listed companies.

These descriptive insights lay the foundation for a more detailed examination of the impact of EPT on corporate micro-performance and preliminarily reveal the mysteries of corporate environmental management, financial stability, and operations, laying the foundation for in-depth empirical exploration.

3.4. Triple Dividend Effect Model Construction

The two-way fixed effects (TWFE) model is a robust empirical tool for testing policy effects. It is a standard and powerful method for handling panel data. It controls unobservable time-invariant heterogeneity and time trends. This makes it highly suitable for evaluating the effect of the EPT, effectively mitigating omitted variable bias.

Therefore, this study directly uses the TWFE model to verify the triple dividend effect of the EPT. It also controls for firm, year, and whether the firm belongs to a heavily polluting industry. Three TWFE models are constructed as follows:

where

Yijt is the dependent variable for firm

i in industry

j in year

t; α is the constant term;

EPTit is the core explanatory variable (EPT);

μi represents the individual fixed effect (firm-specific);

λt represents the time fixed effect (year-specific);

θj represents the fixed effect for whether the firm belongs to a heavily polluting industry; and

εijt is the random error term.

Based on the above models, empirical analysis is conducted. Regressions are run both with and without control variables.

3.5. Threshold Effect Model Construction

This study models based on Hansen’s static panel threshold regression model. It explores the nonlinear relationship between the EPT and the triple dividend effects on Chinese listed companies. Existing studies confirm divergent impacts of GDP and industrialization on emission distributions [

59]. According to the empirical evidence of Deng et al. [

17], pollution emissions are used as the nonlinear threshold of taxation and green technology. The theoretical mechanism stems from compliance cost-to-profit elasticity. In this study, pollution equivalent directly determines EPT’s tax base (Article 7 of China’s environmental protection tax law). When pollution equivalent resides in the transition zone, EPT compels clean production to achieve cost savings, ultimately enhancing corporate profits. Therefore, this study uses the total pollution emission equivalent as the threshold of all dividend effects, with the symbol LnTPE. Hypothesis: For a specific threshold value γ,

,

, when LnTPE ≤

and when LnTPE >

, the impact of EPT on the triple dividends is significantly different. The econometric model is constructed as shown in Equations (5)–(7).

where

,

, and

represent the environmental dividend threshold effect, innovation dividend threshold effect, and economic dividend threshold effect for firm

i in period

t, respectively;

,

, and

represent the individual effect;

I(·) is the indicator function (it equals 0 if the inequality inside the brackets is false and 1 if it is true. Threshold Value One:

,

,…,

. Threshold Value Two:

,

,…,

. Threshold Value Three:

,

,…,

. These threshold values are unknown and are estimated during the regression process);

represents the control variables;

is the random disturbance term;

,

,…,

;

,

,…,

; and

,

,…,

represent the coefficients of the EPT’s effect on the firm’s triple dividends when the threshold variable falls into different threshold value intervals.

5. Discussion

5.1. Triple Dividend Hypothesis Validation Analysis

This study uses panel data from 872 Chinese listed companies (2018–2022). It verifies the triple dividend effect and threshold effect of the EPT using two-way fixed effects and threshold models. The results fully support hypotheses H1 to H5. They reveal the synergy mechanism between environmental regulation and corporate development.

Environmental Dividend (H1): The EPT significantly suppresses the LnTPPE. The coefficient is −0.0250 (

p < 0.01). A 1-unit tax increase reduces LnTPPE by 2.5%. This aligns with Porter’s Hypothesis [

1]. It shows that EPT strengthens emission reduction incentives. This matches studies finding that environmental taxes suppress pollution [

3,

21,

22,

23].

Innovation Dividend (H2): The elasticity of QAP to EPT is 0.0079 (

p < 0.01). A 1-unit tax increase raises patent technological complexity by 0.79%. This breaks the traditional “pollution avoidance” theory. It reveals the micro-mechanism of the innovation compensation effect. It aligns with studies finding that EPT promotes innovation [

31,

34,

35,

65]. High-tax industries file cross-group patents (e.g., “B02C03 solid waste treatment” and “A01B02 emission reduction”). This diversifies risk.

Economic Dividend (H3): The elasticity of LnTOI to EPT is 0.381 (

p < 0.01). A 1-unit tax increase raises LnTOI complexity by 38.1%. This confirms the “pollution control—market competitiveness” transformation path. It matches studies finding that EPT promotes economic growth and firm performance [

10,

11,

43,

44,

45].

Robustness tests strengthen the conclusions. After replacing core variables and conducting placebo tests, the triple dividend effects remain significant. After instrumental variable methods, endogeneity issues did not distort the results. Therefore, H1, H2, and H3 have been confirmed.

5.2. Triple Dividend Threshold Effect Hypothesis Analysis

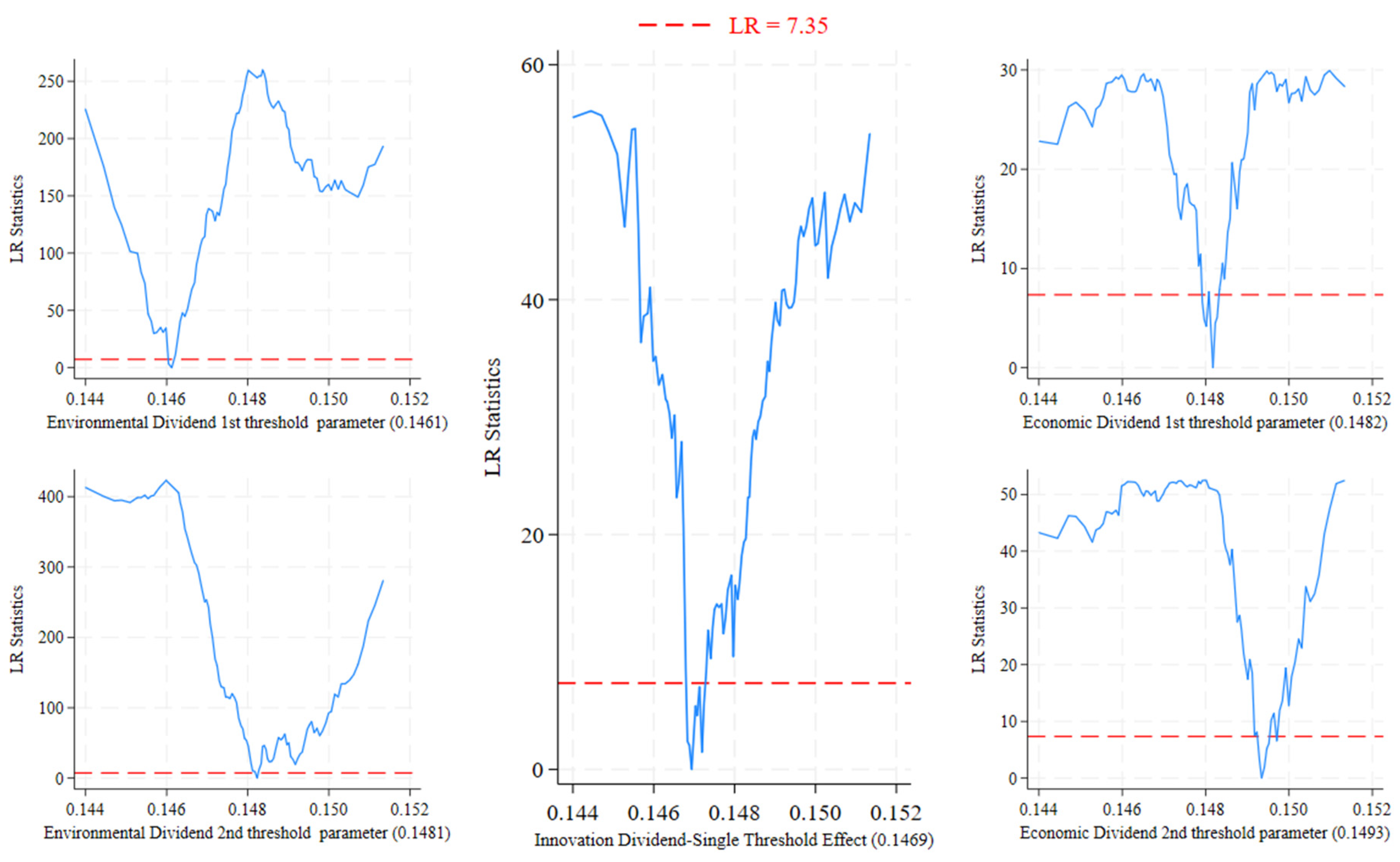

Using Hansen’s panel threshold model, significant threshold effects exist for the triple dividends. This verifies the nonlinear nature of H4a, H4b, and H4c.

Environmental Dividend Threshold: When LnTPE ≤ 0.1461, EPT exerts its strongest inhibitory effect. The emission reduction effect progressively weakens across the subsequent intervals of 0.1461 < LnTPE ≤ 0.1481 and LnTPE > 0.1481. This demonstrates that EPT generates significant emission reduction effects for enterprises at all pollution levels, with the magnitude diminishing as firms’ own pollution intensity increases. Enterprises with lower pollution levels exhibit greater sensitivity to EPT, resulting in stronger emission reduction outcomes. Conversely, heavily polluting firms demonstrate reduced sensitivity and weaker inhibitory effects. This pattern aligns with the marginal abatement cost theory in environmental economics [

66], whereby low-pollution firms achieve cost-effective reductions through operational adjustments, while high-pollution enterprises face steep cost curves for substantial abatement due to technological constraints and infrastructure lock-in [

18].

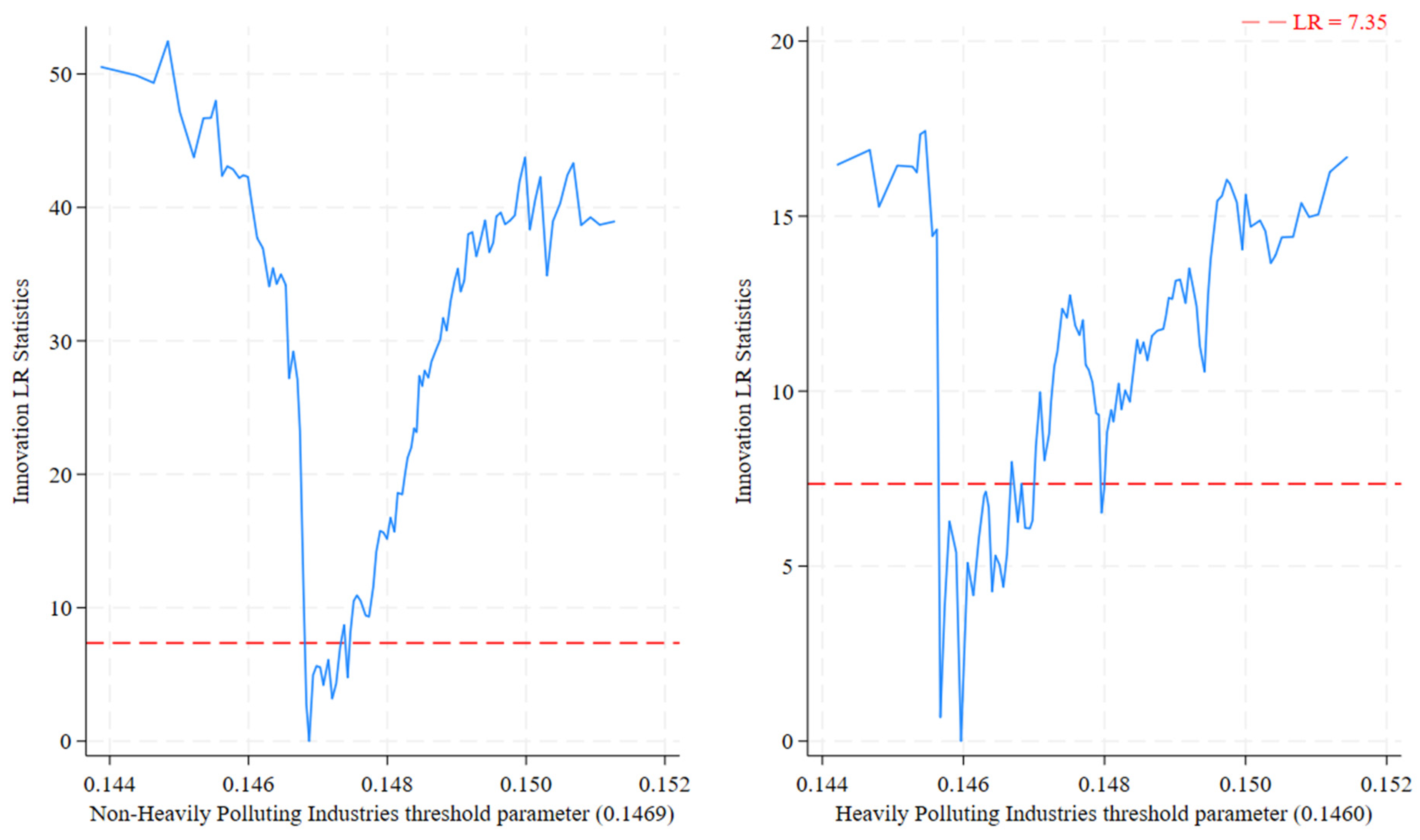

Innovation Dividend Threshold: When LnTPE ≤ 0.1469, EPT significantly enhances QAP for low-pollution enterprises. For firms with LnTPE > 0.1469, the innovation-stimulating effect becomes marginally stronger. Specifically, EPT exerts a statistically significant positive impact on corporate innovation quality, with a slightly more pronounced incentive effect observed in highly polluting firms. This phenomenon arises because heavily polluting enterprises face greater environmental compliance pressure. To ensure operational viability and meet emission standards, they exhibit stronger motivation to pursue breakthrough innovations that offset rising compliance costs [

36]. These findings substantiate the positive aspect of the Porter Hypothesis, wherein properly designed environmental regulations can stimulate innovation competitiveness.

Economic Dividend Threshold: When LnTPE ≤ 0.1482, EPT’s coefficient exhibits statistical significance with a positive sign. This positive effect progressively strengthens across the intervals 0.1482 < LnTPE ≤ 0.1493 and LnTPE > 0.1493, where the average marginal effect increases from 1.0% to 1.6%. The enhancement effect reaches its most pronounced magnitude when LnTPE exceeds 0.1493. EPT demonstrates statistically significant positive impacts on corporate operating revenue. Critically, this revenue-enhancing effect intensifies monotonically as firms’ own pollution levels increase. This “strong nonlinearity” shows that low-pollution industries gain market premiums via green certification. High-pollution industries experience “suppress first, boost later.” Short-term pollution control costs rise, but long-term circular economy optimizes cost structure, enhancing performance [

2,

3,

17,

49,

50]. For enterprises with pollution equivalent below 0.1493, provide interest-subsidized technology transition loans, including partial People’s Bank of China relending rate reductions. For medium–high polluters exceeding industry-average pollution intensity per unit output, activate tiered tax rates, penalties for exceeding thresholds, and reductions for compliance.

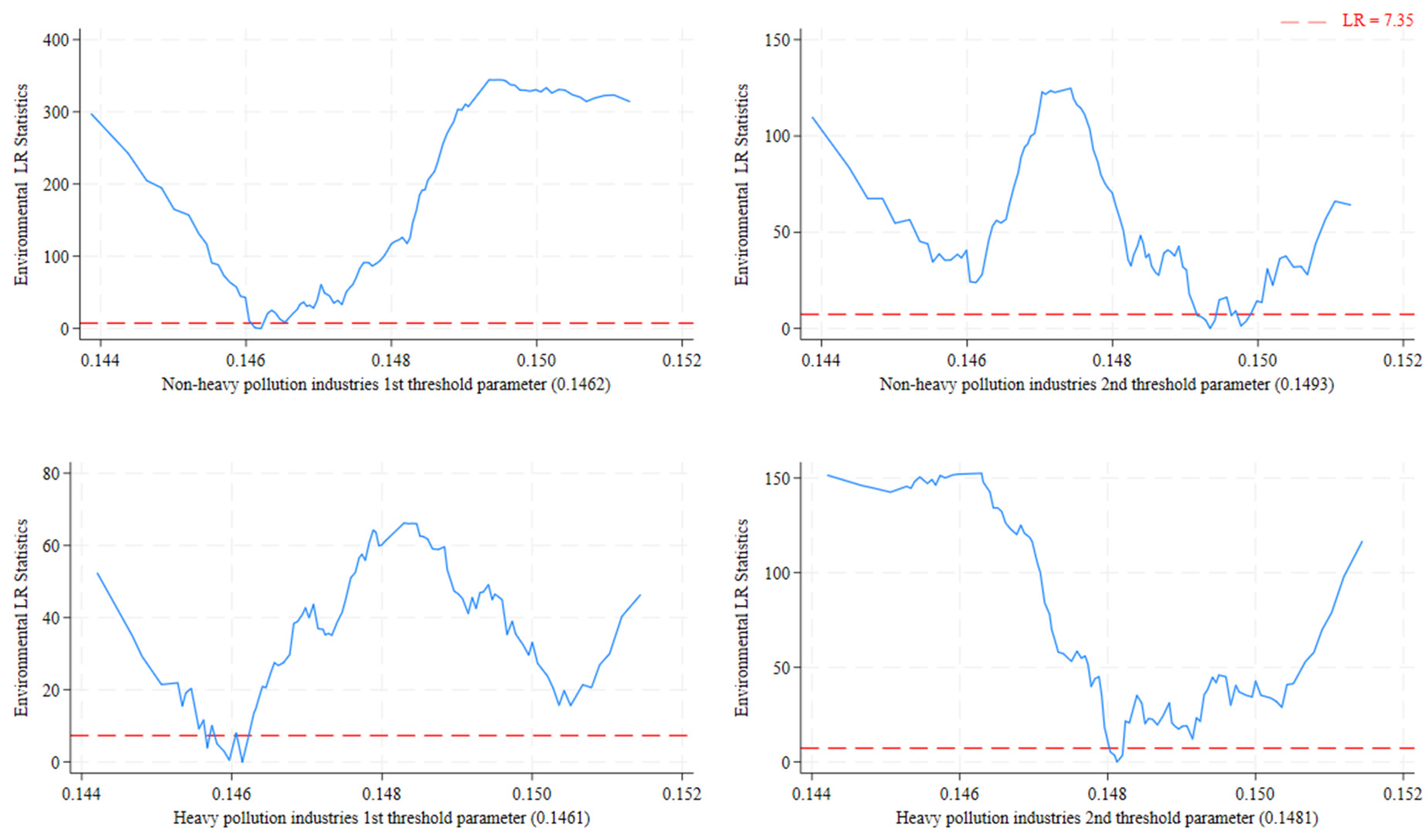

Heterogeneity analysis shows that the environmental dividend threshold effect is more significant for heavily polluting industries. Its threshold (0.1461, 0.1481) is lower than non-heavily polluting industries (0.1462, 0.1493). This reflects their urgency for pollution control. The threshold effect of the innovation dividend is also more reflected in heavily polluting industries. EPT is more sensitive to heavily polluting industries, with a lower threshold (0.1460) than that of non-heavily polluting industries (0.1469), and a stronger stimulating effect. However, the threshold effect of economic dividends is reflected in non-heavy pollution industries. EPT has a single threshold effect on non-heavy pollution industries, but no threshold effect on heavy pollution industries.

This study provides evidence that significantly different coefficients, significantly different threshold points, and passed statistical tests robustly support the existence of substantial, statistically significant differences in the mechanisms by which EPT affects environmental, innovation, and economic benefits between heavily polluting and non-heavily polluting industries.

Clear and economically logical potential mechanisms underlie these differences: First, pollution emission intensity constitutes the core mechanism for the environmental benefit difference. Second, sectoral disparities in technological opportunities and absorptive capacity are key to the innovation benefit difference. Third, the economic benefit difference primarily stems from the Porter effect (innovation compensation and efficiency enhancement).

This study effectively confirms the significant heterogeneity of EPT effects across different industries. Understanding these differences and their underlying mechanisms is crucial for formulating more targeted and effective environmental–economic policies.

5.3. Theoretical Contributions

This study achieves groundbreaking advances in environmental taxation theory:

Develops an analytical framework examining EPT’s nonlinear threshold effects on the triple dividend (environmental pollution reduction, innovation stimulation, economic enhancement). This model deciphers the micro-mechanisms through which EPT influences the triple dividend, transcending the traditional “cost-performance” dichotomy of the Porter Hypothesis. It incorporates novel dimensions—technological complexity and knowledge spillovers—into EPT theory.

Empirically validates the marginal abatement cost theory and environmental policy incentive theory in environmental economics, pioneering a nonlinear policy evaluation paradigm distinct from conventional linear assessment models.

Establishes an industry heterogeneity model revealing statistically distinct thresholds. China-specific classification of non-heavily/heavily polluting enterprises exhibits significant nonlinear threshold differentials. This uncovers industry-specific patterns of environmental policy efficacy, providing quantitative evidence for environmental taxation theory while advancing environmental regulation from “universal policy” toward “precision governance” frameworks.

5.4. Practical Contributions

This study’s findings will provide policymakers with three practical tools:

Policy Implementation: Establish a “Dynamic Threshold Adjustment Mechanism.” Increase tax intensity for high-value-added polluters to enhance emissions reduction sensitivity. Implement an “EPT-Carbon Trading” linkage mechanism for large labor-intensive polluters to achieve precise matching of policy instruments and strengthen innovation linkages. Continuously raise tax intensity for high-pollution, high-emission industries to drive dual improvements in pollution reduction and performance. Specifically, implement stepped EPT rates for heavily polluting industries above the threshold. This enables precise regulatory control, reduces enforcement costs (avoiding “one-size-fits-all” enforcement), creates channels for green supply chain certification services, and leverages policy steering effects.

Enterprise Management: Create a “Green Technology Investment Decision Model.” Guide industries to identify optimal technological pathways. Prioritize end-of-pipe treatment technologies for low-emission industries. Implement circular economy models for enterprises exceeding thresholds. Strategic advice for managers in heavily polluting industries is as follows: deploy abatement technologies (e.g., cleaner production equipment) proactively as EPT approaches the environmental threshold to avoid sharp cost increases from stricter regulation; increase green technology investments after exceeding the threshold; develop by-product recycling technologies; and pursue green certifications to enhance market premiums. Strategic advice for managers in non-heavily polluting industries: accelerate green technology R&D when EPT surpasses the innovation benefit threshold; establish joint ESG innovation labs with universities; patent environmental technologies; and for economic benefit strategies, develop environmental management tools to gain returns through asset-light models.

Regulatory agencies can implement the following measures to optimize EPT design: Implement differentiated threshold-based supervision: Strengthen enforcement intensity for heavily polluting industries, while focusing on innovation guidance for non-heavily polluting industries. Establish dynamic policy instruments: For heavily polluting industries, introduce stepped pollution discharge fees linked with carbon trading mechanisms. For non-heavily polluting industries, distribute innovation vouchers (redeemable for R&D subsidies when EPT exceeds thresholds). Create cross-industry collaboration mechanisms: Establish technology alliances between heavily polluting and non-polluting enterprises, permitting the purchase of innovation-driven emission reductions. Provide targeted incentives: Offer green credit and certification channels to enterprises achieving the economic threshold.

5.5. Research Limitations

The empirical analysis has limitations: Methodologically, this study employs conventional panel threshold models, where the non-adoption of dynamic threshold models may cause dynamic bias in estimation. Instrumental variables are not sought in historical and geographical conditions, and only lagged explanatory variables in the time series are used as instrumental variables, which may not completely solve the endogeneity problem. Data: Limited by listed company disclosure, emerging variables like ESG investment and digital tech penetration were not included. This may underestimate EPT’s effect. Mechanism Analysis: Tech transmission paths rely on secondary patent data. Lacks field observation of micro-behaviors like R&D personnel flow and industry–university–research collaboration. Policy Evaluation: Does not distinguish regional environmental capacity differences. May overestimate policy dividends. Industry Classification: Industries are simply classified as heavily/non-heavily polluting. Does not consider sub-industries (e.g., new vs. traditional energy) and their heterogeneous responses. Duration: The long-term persistence of EPT effects needs more than 5 years of observation. This may affect the completeness of policy impact assessment.

5.6. Future Research Directions

Build a dynamic threshold model. Study how EPT can enhance the efficiency of tax collection and administration.

Use satellite remote sensing (e.g., night light data) and IoT sensors to build real-time monitoring networks. Develop minute-level policy effect assessment systems.

Conduct cross-country comparative studies. Analyze optimal EPT–carbon price linkage ratios in OECD countries. Explore “Pollution Equivalent Banking” systems. Allow industries to accumulate emission reduction credits through tech upgrades. Provide a Chinese solution for the sustainable development of global climate governance.