1. Introduction

The economic viability of small and medium-sized enterprises (SMEs) depends on their ability to maintain sustainability. Their overall competitiveness is enhanced by the interaction of social and environmental dimensions that foster new sources of competitive advantage [

1]. Understanding how SMEs’ operations affect the economy, society, and environment is thus critical for understanding the broader implications of SME sustainability.

Following current regulations and policies, SMEs strive to implement corporate sustainability by using lean manufacturing and green manufacturing practices [

2]. Resilience emerges as a critical factor, allowing organizations to respond quickly to threats, devise effective alternative strategies, and capitalize on unfavorable circumstances [

3]. Given their inherent advantages in size and adaptability to changing conditions, the resilience of SMEs has become a major focus for academics and policymakers [

4].

Recognizing that SMEs, particularly those that focus on market orientation and continuous learning, exhibit increased resilience and innovation in intense competition [

5] underscores the importance of resilience in these enterprises. Resilient organizations can navigate crises and operate within dynamic systems, contributing to long-term business sustainability. The positive impacts of sustainability practices—such as enhanced energy efficiency, waste reduction, employee engagement, and compliance with environmental regulations—also contribute significantly to the long-term cost-effectiveness of SMEs [

6].

Regarding sustainable business, SMEs have shown resilience during global economic crises, such as changing market conditions, technological advancements, and evolving management strategies to influence their competitiveness and sustainability [

7]. Indeed, the resource-based view (RBV) theory, which focuses on a company’s valuable, rare, inimitable, and non-substitutable (VRIN) resources, provides a solid theoretical foundation for understanding how capabilities, resources, and performance interact. Importantly, the RBV also helps to conceptualize resilience as a strategic resource that shapes sustainability outcomes.

According to the literature on organizational resilience, micro, small, and medium-sized businesses may be less capable of anticipating threats and, therefore, more vulnerable to crises than larger organizations [

8]. However, the effectiveness of resilience under dynamic external conditions remains underexplored. In particular, it is unclear how environmental turbulence—specifically market and technological turbulence— may shape the impact of resilience on sustainability performance.

This study addresses two key questions: (1) how does organizational resilience capacity impact sustainability performance? and (2) how does environmental turbulence (technological and market turbulence) impact the relationship between organizational resilience capacity and sustainability performance? The findings herein add to the existing body of knowledge by providing key insights into the complex relationships between organizational resilience, sustainability performance, and the moderating effects of environmental turbulence.

This study contributes to the existing literature by addressing critical gaps in our current understanding of how organizational resilience capabilities influence sustainability performance, particularly in the context of SMEs. First, it extends the application of the resource-based view (RBV) and dynamic capabilities theory by demonstrating that organizational resilience is a key capability that enhances SMEs’ ability to respond to crises and drives sustainability outcomes. Second, it offers a novel contribution by examining the moderating role of market and technological turbulence, highlighting how these external forces may either amplify or constrain the benefits of resilience. By identifying how these external forces can negatively moderate this relationship, this research provides a nuanced understanding of the specific conditions under which resilience can help or hinder sustainability performance.

Further still, this study offers practical implications by highlighting the need for SMEs to develop adaptive strategies that take into account fluctuating market conditions and rapid technological change. This will help policymakers and business leaders to design effective resilience-building initiatives. This research provides actionable insights for enhancing both competitiveness and sustainability in SMEs, thereby contributing to the broader discourse on sustainable business practices in dynamic environments.

2. Supporting Theories

This study is anchored in two foundational theoretical frameworks: the resource-based view (RBV) theory [

9] and the dynamic capabilities theory [

10]. These theories collectively elucidate the mechanisms through which organizational resilience capacity enhances sustainability performance in SMEs, particularly under conditions of environmental turbulence.

2.1. Resource-Based View (RBV) Theory

The RBV posits that sustained competitive advantage derives from a firm’s control over valuable, rare, inimitable, and non-substitutable (VRIN) resources [

9]. Within the SME context, resilience functions as a strategic intangible resource that enables firms to absorb disruptions, recover efficiently, and sustain long-term viability. Unlike large corporations, SMEs often operate with limited tangible assets, rendering their adaptive managerial practices, organizational agility, and human capital critical determinants of resilience [

11].

The RBV further suggests that resilient SMEs optimize resource allocation to align with triple-bottom-line sustainability objectives: economic stability, environmental stewardship, and social responsibility [

12]. For instance, lean and green manufacturing practices reduce waste and enhance cost efficiency, illustrating how resilience-driven resource management fosters sustainability [

13]. Moreover, resilience operates as a meta-capability within the RBV, allowing SMEs to dynamically reconfigure resources amid crises, ensuring operational continuity and ecological compliance [

14].

2.2. Dynamic Capabilities Theory

Dynamic capabilities theory extends the RBV by emphasizing a firm’s capacity to sense, seize, and transform resources in response to volatile environments [

14]. For SMEs, resilience transcends static resource possession; it embodies proactive adaptability, enabling rapid pivots in business models, adopting disruptive technologies, or restructuring supply chains during crises [

15].

This theory is particularly salient in turbulent markets, where SMEs must continuously innovate to mitigate risks (e.g., technological obsolescence and demand fluctuations). For example, SMEs with robust dynamic capabilities may integrate renewable energy solutions or circular economy principles, thereby converting sustainability challenges into competitive advantages [

16]. Crucially, dynamic capabilities frame resilience as an iterative process requiring constant environmental scanning, strategic flexibility, and stakeholder collaboration to uphold sustainable performance [

17].

2.3. Theoretical Integration

The synergy between the RBV and dynamic capabilities theory offers a comprehensive lens through which to dissect SME resilience. While the RBV underscores the resource foundations of resilience (e.g., a skilled workforce and efficient processes), dynamic capabilities theory explains how SMEs orchestrate these resources amid external shocks [

18]. Environmental turbulence—whether from market volatility or technological disruption—moderates this relationship, as SMEs with superior dynamic capabilities are better equipped to convert resilience into sustainability gains [

19].

By bridging these theories, this study advances scholarly discourse by positioning resilience as a strategic resource (RBV) and an adaptive capacity (dynamic capabilities) critical for SME sustainability in uncertain landscapes.

3. Literature Review

The resource-based theory (RBV) serves as a theoretical foundation for comprehending and explaining how attributes of an organization, such as capability and/or management initiatives, affect long-term company growth. The RBV’s primary focus is realizing that internal firm resources generate competitive advantage [

20]. In addition to becoming capable of learning and applying both internal and external firm resources and skills, dynamic capabilities may also enable organizations to improve their competencies and their skills to respond and adapt well to continuously changing business landscapes [

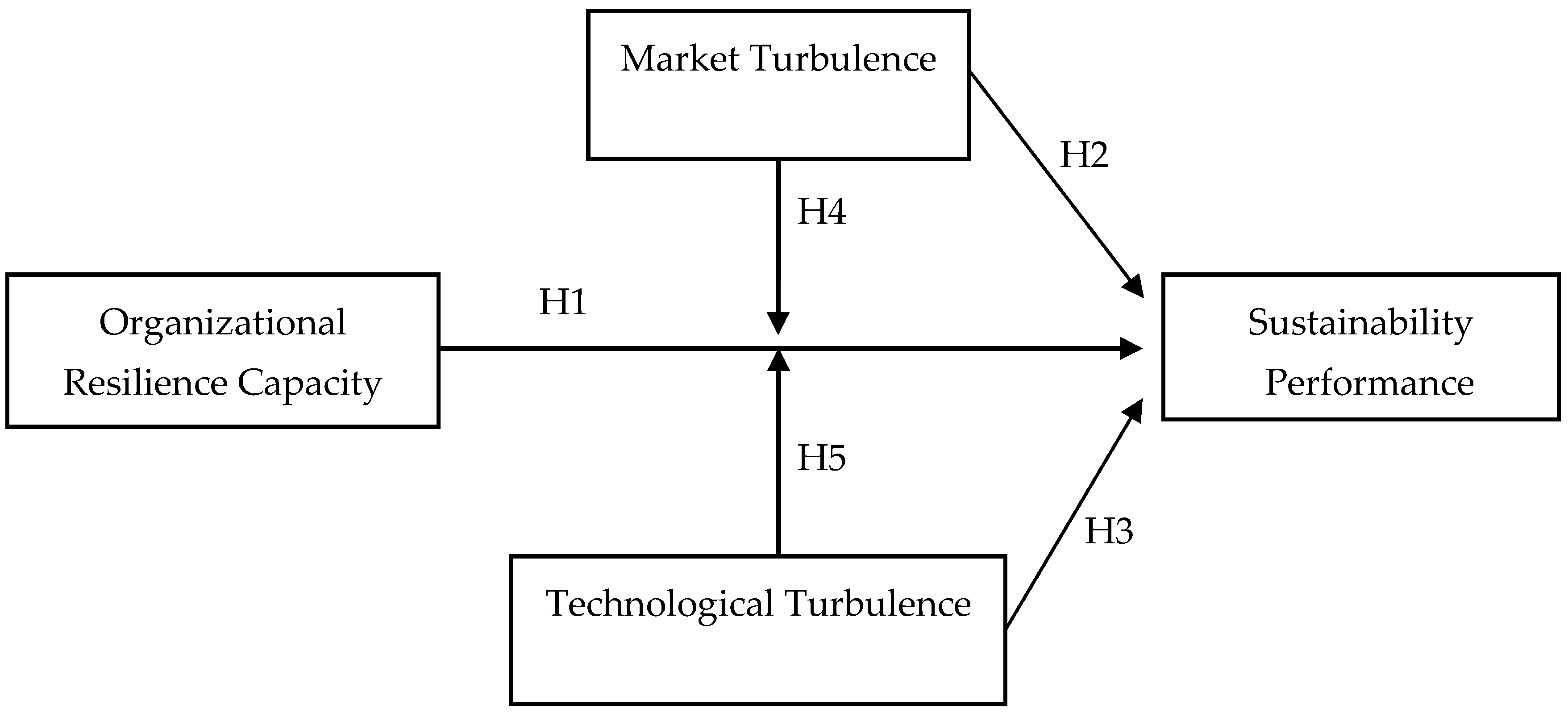

10]. As shown in

Figure 1 below, we explain the relationship between organizational resilience capacity, sustainability performance, market turbulence, and technological turbulence using the theoretical underpinnings of RBV and DCV. RBV describes how valuable and hard-to-imitate resources can be replicated to reveal firm performance [

21]. It is an important theory for understanding how competitive advantage and organizational performance are achieved by using resources and capacities well [

22,

23].

3.1. Environmental Turbulence

Research on environmental turbulence has long been conducted. Scholars in management and marketing first theorized in the 1970s and 1980s how significant, sudden, or unforeseen environmental changes lead to certain businesses’ success while causing the failure of others [

24,

25]. Based on recent studies, for businesses to succeed and gain a competitive edge, they must consider and adapt to the forces in their external environments [

26]. Nonetheless, a dynamic, unpredictable, and turbulent environment is still recognized as one that influences business operations [

27]. Environmental turbulence (ET) refers to the dynamic and variable conditions resulting from unpredictable changes, increased complexity, and intense competition that firms encounter in their external environment. Environmental turbulence consists of subdimensions, each of which significantly impacts the environment in which firms operate. The degree of these effects varies depending on the firm’s industry, size, and competitive position [

28].

This study breaks down environmental turbulence into market and technological turbulence. An unstable technological environment causes current technology to become obsolete and causes the development of new ones. A company that operates in a volatile technological environment typically invests more in external technology because that technology can accelerate the obsolescence of its current technological knowledge and products. Organizations that lack technological expertise should quickly acquire new knowledge and integrate it with their current technological expertise [

29]. To remain competitive, firms operating in turbulent markets must be able to react very quickly to unanticipated changes and find numerous alternative avenues to satisfy their existing customer requirements. Because the company may rely on seeking new technology to meet customers’ evolving needs or pioneering a new product to stay ahead of the competition, the role of technological knowledge in generating profits in a highly turbulent market environment should never be underestimated [

30]. Kohli and Jaworski (1990) defined market turbulence as “the rate of change in the composition of customers and their preferences” ([

31], p. 57) and technological turbulence as “the rate of technological change” [

31], p. 57), thereby breaking down the concept of turbulence into two distinct categories. We can summarize the difference between market turbulence and technological turbulence as follows.

Market turbulence involves rapid changes in customer demands, needs, and expectations. It also includes sudden changes in market conditions and increased or decreased demand for new products or services. In sectors where market turbulence is intense, companies must adapt quickly to the market’s needs, as customer preferences and expectations are constantly changing [

28].

Technological turbulence is related to the sector’s speed and variety of technological innovations. It encompasses the emergence of new technologies, the rapid obsolescence of existing technologies, and the need of firms to keep up with these technologies. During intense technological turbulence, firms need to invest rapidly in new technologies and constantly update their existing technological infrastructure to remain competitive [

28].

3.2. Organizational Resiliency Capacity

A variety of terms can be used to characterize organizational resilience. These include capability, characteristics, outcomes, processes, behaviors, strategies or approaches, types of performance, or a combination of all these terms [

32]. Resilience is a multifaceted concept that deals with how an organization responds to uncertainty [

33]. Organizational resilience capacity is regarded as a critical strategic capability that allows businesses to anticipate, adapt to, respond to, and recover quickly from unexpected events [

34]. Organizational resilience capacity also indicates how well prepared a company is for facing disasters in today’s unsettling and turbulent world [

35]. According to [

36], resilient companies can respond rapidly to minimize setbacks and create new paths for greater growth. Thus, businesses must build a resilience capacity that will allow them to capitalize on events that may threaten their organization’s survival and respond appropriately to unexpected events [

37].

3.3. Sustainability Performance

According to [

38], corporate sustainability is regarded as both a business and investment strategy that aims to use best business practices to meet and balance the needs of current and future stakeholders. Corporate sustainability is conceptually categorized into social, environmental, and economic factors [

39]. Therefore, the degree to which a company incorporates economic, environmental, social, and governance factors into its operations and, ultimately, the effects these factors have on that company and society are measured by the metric of corporate sustainability performance, or CSP [

40].

Companies are expected to generate sustainable, long-term value for all their stakeholders in the modern world. This goal will be achievable only when business operations and decision-making procedures align with economic, environmental, and social considerations. Triple-bottom-line reporting (TBL), which is the reporting of economic, social, and environmental performance taken together, was the original term for this strategy, and it is now known as corporate sustainability [

41].

Sustainability performance includes how well an organization performs in its natural resource conservation and emission levels, other environmental activities and initiatives, employment-related factors, occupational health and safety, community relations, stakeholder involvement, and the organization’s economic impact as well as the financial measures used in its financial accounting [

42].

4. Hypothesis Development

4.1. Organizational Resilience Capacity and Sustainability Performance

According to [

43], resilient businesses can navigate and endure crises over time. This highlights the importance of resilience in enabling businesses to function as intricate, dynamic systems within larger systems, ultimately fostering sustained business sustainability. Resilience refers to an organization’s ability to survive unexpected events, adapt to changing conditions, and turn challenges into opportunities. This concept allows businesses to not only withstand disruptions but also position themselves for long-term success in the face of adversity, especially unexpected adversity.

Specifically, when it comes to small and medium-sized enterprises (SMEs), their inherent characteristics contribute to a higher level of agility and openness to their stakeholders than their larger counterparts. Small and medium-sized enterprises (SMEs) frequently have more direct and close relationships with their stakeholders, allowing them to respond quickly to changing circumstances and foster sustainable and responsible business practices [

44]. This responsiveness is especially useful in maintaining stability in key stakeholder relationships and improving the SMEs’ overall reputation.

Businesses’ organizational resilience capacity is positively related to their sustainability performance. This hypothesis predicts that organizations with strong resilience will better weather environmental and operational challenges and demonstrate a greater commitment to sustainable practices [

7]. This commitment is expected to improve sustainability performance across all economic, social, and environmental dimensions.

Resilient businesses, particularly SMEs, are well positioned to use their adaptive capabilities to promote sustainable and responsible business practices and thus improve their overall sustainability performance. This hypothesis establishes a clear framework for investigating the complex interplay between organizational resilience and sustainability in SMEs. We thus propose the following hypothesis:

H1. Organizational resilience capacity positively affects sustainability performance.

4.2. Market Turbulence and Sustainability Performance

Market turbulence—characterized by rapid and unpredictable changes in customer preferences, competitive actions, and demand fluctuations [

45]—presents significant challenges for firms striving to maintain strong sustainability performance. While sustainability initiatives typically require long-term investments, strategic consistency, and stakeholder engagement [

46], turbulent markets force firms to prioritize short-term survival over long-term sustainability goals, weakening sustainability performance. We hypothesize that market turbulence negatively affects sustainability performance through three key mechanisms:

Under market turbulence, firms face pressure to reallocate limited resources away from sustainability initiatives toward immediate operational needs. For example, sudden demand drops may lead to cost-cutting measures, such as reducing investments in energy-efficient technologies or sustainable supply chain partnerships [

47]. Similarly, competitive threats may force firms to redirect R&D budgets from eco-innovation to rapid product adaptations, thus delaying progress on sustainability targets [

48]. This short-term focus undermines the financial and operational stability required for meaningful sustainability progress.

Sustainability performance thrives under stable strategic conditions, where firms can systematically implement environmental and social policies [

49]. However, high market turbulence disrupts long-term planning, forcing firms into reactive decision making. For instance, frequent shifts in consumer preferences may lead firms to abandon sustainable product lines in favor of fast-moving trends, eroding their sustainability commitments [

50]. Additionally, volatile markets increase managerial uncertainty, making it difficult to justify long-term sustainability investments when immediate profitability is at risk [

51].

Sustainability performance depends on strong stakeholder relationships (e.g., suppliers, employees, and regulators). However, market turbulence strains these relationships by creating conflicting priorities. Suppliers pressured to meet abrupt demand changes may compromise ethical sourcing practices [

52], while employees facing job insecurity may disengage from sustainability initiatives [

53]. Furthermore, regulatory compliance becomes more challenging when firms must rapidly adapt to market shifts, potentially leading to lapses in environmental or social standards [

54].

Evidence suggests that market turbulence weakens sustainability outcomes. A longitudinal study by [

43] found that firms in highly turbulent industries (e.g., retail, technology) exhibited 23% slower progress on sustainability goals compared to stable sectors (e.g., utilities).

Based on these arguments, we formally hypothesize the following:

H2. Market turbulence negatively affects sustainability performance.

4.3. Technological Turbulence and Sustainability Performance

Technological turbulence, characterized by rapid and unpredictable changes in industry-relevant technologies [

45], presents significant challenges for organizations striving to maintain strong sustainability performance. We hypothesize that technological turbulence negatively affects sustainability performance through three primary mechanisms: the resource diversion effect, the capability obsolescence effect, and the strategic misalignment effect.

The resource diversion effect suggests that frequent technological changes force firms to reallocate resources from sustainability initiatives to technological adaptation. For instance, companies facing disruptive innovations may need to shift investments from renewable energy projects to mandatory system upgrades [

55]. This reallocation directly reduces available resources for environmental and social programs, weakening sustainability performance [

56].

The capability obsolescence effect occurs when the knowledge and routines supporting sustainability practices become outdated due to rapid technological change. Ref. [

18] argue that dynamic capabilities have limited effectiveness in hyper-turbulent environments. For example, a manufacturer implementing sustainable production methods may find its processes obsolete when new automation technologies emerge, requiring complete system overhauls that disrupt sustainability continuity [

57].

The strategic misalignment effect emerges as technological turbulence forces organizations to prioritize short-term technological adaptation over long-term sustainability goals. Ref. [

58] found that in high-tech industries, frequent technology shifts create a “fire-fighting” mentality that undermines strategic focus on sustainability. This effect is particularly strong in SMEs, with limited managerial attention [

59].

Empirical evidence supports these arguments. A longitudinal study by [

60] demonstrated that firms in technologically turbulent sectors made 27% slower progress on sustainability metrics than those in stable industries. Similarly, another study [

42] revealed that technological turbulence reduced the effectiveness of sustainability investments by 18–22% across multiple industries.

Our hypothesis is therefore presented:

H3. Technological turbulence negatively affects sustainability performance.

4.4. The Moderating Effect of Market Turbulence

In stable business environments, centralized decision making and standardized routines often enhance operational efficiency by reducing variability and costs [

18]. However, under conditions of market turbulence—characterized by rapid shifts in demand, volatile consumer preferences, and unpredictable competitive actions—these same rigid structures can impede adaptability [

19]. While organizational resilience capacity (ORC) equips firms to absorb disruptions, its effectiveness in driving sustainability performance is contingent on external stability. Market turbulence acts as a negative moderator by disrupting the alignment between resilience efforts and long-term sustainability goals through three key mechanisms.

- 1.

Short-Term Survival vs. Long-Term Sustainability

Turbulent markets force firms to prioritize immediate survival (e.g., cash flow management and demand fluctuations) over strategic investments in sustainability (e.g., circular production and employee wellbeing programs). Resilient SMEs may reallocate resources away from eco-innovation or stakeholder engagement to address urgent market threats, thereby decoupling resilience from sustainability outcomes [

61].

- 2.

Erosion of Strategic Focus

Frequent market disruptions fragment managerial attention, compelling firms to adopt reactive “save-the-day” tactics [

62]. For example, a resilient SME facing sudden demand drops might pivot to cost-cutting (e.g., layoffs, cheaper, non-sustainable materials), undermining its social and environmental commitments. This temporal myopia weakens the translation of resilience into sustained sustainability performance.

- 3.

Dynamic Capability Overload

Although resilience enables SMEs to reconfigure resources [

14], excessive turbulence strains their limited dynamic capabilities. When market conditions change too rapidly, firms exhaust their capacity to adapt to shocks and maintain sustainability initiatives simultaneously [

17]. For instance, constant supply chain redesigns to mitigate supplier instability may divert efforts from carbon footprint reduction.

Studies confirm that high turbulence reduces the ROI of resilience-building activities. Ref. [

42] found that firms in volatile industries (e.g., fast fashion) achieved fewer sustainability gains from resilience investments compared to stable sectors (e.g., utilities), as turbulence forced repeated short-term recalibrations.

Thus, we hypothesize the following:

H4. Market turbulence negatively moderates the relationship between organizational resilience capacity and sustainability performance.

4.5. The Moderating Effect of Technological Turbulence

Technological turbulence—characterized by rapid technological change and uncertainty in industry standards [

45]—presents a unique challenge for organizations seeking to translate resilience into sustainable performance. While organizational resilience capacity typically enhances sustainability outcomes, technological turbulence weakens this relationship through three key mechanisms.

First, the resource allocation paradox suggests that frequent technological disruptions force organizations to divert investments from long-term sustainability initiatives to short-term technological adaptation [

57]. For instance, funds earmarked for energy efficiency improvements may need to be redirected to mandatory system upgrades, thereby diluting sustainability efforts [

56].

Second, the institutionalization barrier occurs when the knowledge and routines underlying resilient sustainability practices become obsolete before they can be fully implemented [

18]. A case study by [

63] demonstrated how rapid IoT advancements rendered a manufacturer’s newly developed sustainable production systems outdated within 18 months.

Third, the cognitive overload effect shows that constant technological changes shift managerial focus from strategic sustainability planning to reactive adaptation [

59]. This creates a “fire-fighting” mentality, prioritizing immediate technological compatibility over long-term sustainability goals [

63].

Empirical evidence supports this moderating effect. A meta-analysis by [

60] found that in high-tech industries, the positive correlation between resilience and sustainability performance was significantly weaker (β = −0.21,

p < 0.01) than in more stable sectors.

We therefore hypothesize the following:

H5. Technological turbulence negatively moderates the relationship between organizational resilience capacity and sustainability performance.

5. Methodology

5.1. Sample and Research Procedure

SMEs play a substantial role in the Turkish economy. According to SME regulations, small and medium-sized enterprises (SMEs) are defined as those with fewer than 250 employees, an annual net sales revenue of less than TRY 500 million, or a balance sheet with less than TRY 500 million. Micro, small, and medium-sized enterprises are also included in this category. According to [

64] records, the number of businesses in this category reached 3.17 million in 2023. Our sample consists of 423 small and medium-sized companies in Türkiye.

Data collection for this study started on 6 May 2024 and ended on 28 June 2024, a recruitment period that ensured comprehensive and timely information collection from participating SMEs. All participants in this study gave informed consent. Specifically, verbal consent was obtained from each participant before they could be included in the study. The consent process included informing participants about the purpose of the study, the procedures involved, the voluntary nature of their participation, and their right to withdraw at any time without negative consequences. All statistical analyses were performed using SPSS 22.

The Ethics Committee’s full name is the “Human Research Ethics Committee”, the ethics approval number is E-43633178-199-150068, and the approval date is 2 May 2024. The ethics committee overseeing this research reviewed and approved these consent procedures. However, no exceptions to consent were requested or granted for this current study. We also ensured that all respondents knew that their answers would stay anonymous during the data collection process to increase their willingness to participate fully in the research.

In this study, the respondent departments were marketing (3%), engineering and design (10%), manufacturing (24%), finance and accounting (40%), human resources (4%), and other departments (19%). The respondents included senior president/owner (22%), general manager (20%), product/project manager (2%), department manager (27%), engineer and technician (5%), and other positions (23%). Most respondents came from the production sector (86%), and all were over 18 years old (

Table 1).

5.2. Construct Measures

All established measures initially created in English and used in this study were later translated into Turkish using the suggested back-translation procedure. The scale items were initially translated into Turkish by two field experts. Subsequently, the Turkish translated items were back-translated into English by two other experts. Finally, a different expert compared this back-translated version with the original scale to verify accuracy [

65]. A pilot study was conducted prior to the data collection phase. The pilot study administered the survey in person to 30 employees enrolled in the GTÜ MBA program. Participants were asked to rate the comprehensibility of each survey item on a five-point Likert scale (“1: Strongly Disagree” to “5: Strongly Agree”). Initial validity and reliability analyses were performed using the collected data.

The questions about environmental turbulence were adapted from [

45] and taken from [

66]. Three questions were asked regarding market and technological turbulence. The market turbulence question items revealed shifts in customer composition and preferences, while the technology turbulence question items revealed changes related to new product technologies.

To measure organizational resilience capacity, 17 items in four dimensions—namely, learned resourcefulness, original/unscripted agility, practical habits, and behavioral preparedness—were selected from the [

66] study. Seven items (based on [

67]’s study, which asked the respondents to rate how well they believed their company was performing in terms of realizing sustainability) were utilized to assess each company’s sustainability performance.

Since the data for multiple variables in the study were collected from a single source, it was necessary to test for the potential presence of common method bias. For this purpose, Harman’s single-factor test was applied [

68]. If common method bias exists, an unrotated factor analysis is expected to yield a single dominant factor [

69]. The results of the unrotated factor analysis revealed that the first factor accounted for 30.87% of the total variance. Since this value falls below the 50% threshold, it was concluded that common method bias was not a significant concern in this study [

70].

The suitability of the data obtained from the sample group for exploratory factor analysis was assessed using the Kaiser–Meyer–Olkin (KMO) measure and bartlett’s test of sphericity. Within this framework, Bartlett’s test of sphericity is expected to be significant [

71], while the Kaiser–Meyer–Olkin (KMO) measure should exceed 0.50 [

72]. The KMO value was calculated as 0.87, indicating that the sample size was adequate for factor analysis. Furthermore, the results of Bartlett’s test of sphericity revealed a statistically significant chi-square value (X

2 (378) = 8187.684;

p < 0.01) (

Table 2). These findings suggest that the data are suitable for exploratory factor analysis.

The items were loaded onto eight factors due to the factor analysis. The lowest loading value was 0.517, while the highest was 0.933. The total explained variance was 70.60%.

Table 3 presents the descriptive statistics, Cronbach’s alpha coefficients, and correlation analysis values for the variables. The reliability test results ranged between 0.65 and 0.82, indicating that the scale items were reliable [

73]. The mean values of the variables ranged from 3.82 to 3.98, while the standard deviation values varied between 1.03 and 1.76. According to the correlation analysis results, there was a positive and significant relationship (r = 0.539,

p < 0.01) between organizational resilience capacity and sustainability performance at the 1% significance level. Additionally, technological turbulence showed a moderate positive correlation (r = 0.336), while market turbulence exhibited a positive correlation (r = 0.380). Overall, the correlation coefficients ranged between 0.321 and 0.611.

5.3. Hypothesis Testing

Regression analysis was conducted to test the research hypothesis. The findings obtained from the regression model analysis are reported below. As seen in

Table 4, when examining the effect of organizational resilience capacity on sustainability performance, the model was statistically significant (F = 65.519,

p < 0.01), with an explanatory power of R

2 = 0.31. According to the analysis results, organizational resilience capacity (β = 0.465;

p < 0.01), market turbulence (β = 0.106;

p < 0.05), and technological turbulence (β = 0.100;

p < 0.05) have a statistically significant and positive effect on sustainability performance. In line with this finding, our hypothesis H1 was supported, but H2 and H3 were not supported. A multicollinearity analysis was performed to examine the presence of multicollinearity due to the high correlation values among the variables included in the regression model. The analysis assessed the variance inflation factor (VIF), condition index (CI), and tolerance factor (TF). The obtained values were within acceptable thresholds, confirming that no multicollinearity issue was present [

74].

Using AMOS, hypotheses regarding the moderating effects of market and technological turbulence on the relationship between organizational resilience capacity and sustainability performance were tested. The analysis results are presented in

Table 5 and

Table 6.

Table 5 displays the results of the moderating effect analysis of market turbulence on the relationship between organizational resilience capacity and sustainability performance. The analysis indicates that both organizational resilience capacity and market turbulence significantly affect sustainability performance (

p < 0.01). The moderating variable (Int1) has a statistically significant negative effect on sustainability performance (

p < 0.01). Based on these findings, hypothesis H

4 is supported.

Table 6 displays the results of the moderating effect analysis of technological turbulence on the relationship between organizational resilience capacity and sustainability performance. The analysis indicates that both organizational resilience capacity and technological turbulence significantly affect sustainability performance (

p < 0.01). The moderating variable (Int2) has a statistically significant negative effect on sustainability performance (

p < 0.01). Based on these findings, hypothesis H

5 is supported.

6. Discussion

Small and medium-sized enterprises (SMEs) operate in highly uncertain and turbulent environments, where resource constraints often limit their ability to anticipate disruptions and implement robust administrative planning systems. While prior research has established that SMEs’ resilience can be disrupted by market and technological turbulence [

75,

76], this study advances the discourse by empirically testing and validating the moderating mechanisms through which these external forces influence the resilience–sustainability relationship. Unlike previous studies focusing on resilience as a standalone capability, our findings provide nuanced insights into how different forms of turbulence (market vs. technological) asymmetrically moderate this relationship, offering a more granular understanding of SME adaptability in dynamic environments. These findings contribute to the growing body of literature that emphasizes the contingent nature of dynamic capabilities in volatile settings.

The hypothesis results reveal nuanced insights that align with and challenge the existing literature, offering a deeper understanding of SME adaptability. Our support for H1 (resilience → sustainability performance) aligns with the RBV theory [

1,

4], which posits that resilience, as a dynamic capability, enables firms to reconfigure resources for long-term viability. However, we advance this literature by demonstrating that resilience in SMEs is not merely about survival but actively drives sustainability outcomes (e.g., waste reduction and energy efficiency). This contrasts with studies like [

8], which argue that SMEs’ limited resources constrain their resilience efficacy. Our findings suggest that even resource-scarce SMEs can leverage resilience for sustainability if they prioritize strategic flexibility (e.g., lean practices [

2]) over rigid planning.

The lack of support for H2 and H3 (market/technological turbulence → sustainability performance) contradicts earlier work (e.g., [

7]), which posits that turbulence directly harms SME performance. However, this aligns with recent studies showing that SMEs mitigate turbulence’s direct effects through improvisational capabilities [

77] or absorptive capacity [

78]. Our results imply that turbulence alone does not determine sustainability; rather, its interaction with resilience (H4–H5) is more critical.

The support for H4 and H5 (turbulence weakens resilience’s impact) resonates with [

71,

72] but offers finer-grained insights:

Market turbulence (H4): While [

79] argues that market shifts directly hurt SMEs, we show they primarily undermine resilience’s ability to sustain performance. This suggests SMEs must pair resilience with market-sensing tools (e.g., customer analytics [

5]) to offset turbulence’s moderating effect.

Technological turbulence (H5): Our findings support [

80]’s claim that rapid tech changes disrupt SME capabilities. However, we uniquely highlight that technological turbulence erodes resilience’s sustainability benefits more severely than market turbulence, likely due to SMEs’ limited R&D capacity. This echoes [

81]’s call for SMEs to adopt open innovation to compensate.

These results reconcile conflicting views in the literature. For instance, while [

8] asserts that SMEs are inherently vulnerable to turbulence, we demonstrate that resilience can partially buffer these effects, but only if SMEs tailor strategies to the type of turbulence. This aligns with [

82]’s contingency perspective, which argues that resilience’s efficacy depends on external conditions. In summary, this study extends the practical relevance of resilience by illustrating when and how it matters most under varying external conditions.

7. Conclusions

This study investigated the relationship between organizational resilience capacity, sustainability performance, and environmental turbulence (including market and technological turbulence) in small and medium-sized enterprises (SMEs). Its key findings show a positive relationship between firms’ resilience capacity and sustainability performance. However, this study also identified an important moderating factor: environmental turbulence, including market and technological turbulence, weakens the positive relationship between resilience and sustainability.

This study investigated the relationship between organizational resilience capacity, sustainability performance, and environmental turbulence (including market and technological turbulence) in small and medium-sized enterprises (SMEs). Its key findings show that while resilience positively impacts sustainability performance, this relationship is significantly weakened by high levels of environmental turbulence.

Theoretically, these findings contribute to the resource-based view and dynamic capabilities theory by revealing how external market and technological conditions shape the effectiveness of internal capabilities such as organizational resilience and sustainability performance. In doing so, they highlight how external conditions influence the performance of internal capabilities.

From a practical perspective, the study offers clear recommendations for SMEs. Firms should prioritize building adaptive strategies such as agile planning, workforce upskilling, and diversified market approaches to mitigate the negative impact of turbulence.

These actionable insights make the findings directly applicable to real-world SME environments, offering pathways for improved sustainability performance despite uncertainty. Future studies could deepen these findings through cross-sectoral or international comparative research, helping to refine strategies under varying environmental conditions.

To further enrich the interpretation of our findings and provide a more comprehensive understanding of their scholarly and managerial significance, we elaborate on theoretical contributions, practical implications, and directions for future research in the following subsections.

7.1. Theoretical Implications

This study makes three key theoretical contributions:

Extension of the RBV and dynamic capabilities theory: While prior research applies RBV to resilience [

1,

4], we empirically validate that organizational resilience operates as a dynamic capability that mitigates crises and actively enhances sustainability performance under specific conditions. This bridges a critical gap in RBV literature, which has largely overlooked resilience as a sustainability-enabling mechanism in SMEs.

Differential moderating effects of turbulence: Unlike [

75,

76], which treats turbulence as a uniform disruptor, we theorize and test how market vs. technological turbulence distinctively moderates the resilience–sustainability link. Our findings show that technological turbulence has a stronger inhibitory effect on resilience’s efficacy, suggesting that SMEs must prioritize technology-adaptive resilience strategies (e.g., digital agility) over market-reactive ones.

Contextualizing SME resilience: By focusing on SMEs—a segment often underexplored in the literature on resilience—we challenge assumptions that resilience functions identically across firm sizes. Our results imply that SMEs’ resource-scarce, high-velocity environments necessitate resilience strategies that are distinct from those of larger firms, advancing context-aware theorizing in dynamic capabilities research.

7.2. Practical Implications

The findings of this research study further suggest that SMEs should prioritize the development of organizational resilience capacity to enhance sustainability performance, as supported by [

82]. This finding implies a need for strategic planning that considers the organization’s adaptive capacity to cope with disruptions and uncertainties in both the market and in technological aspects. SMEs are encouraged to tailor their strategies by focusing on distinct approaches through which to address the challenges that these two types of turbulence pose. Organizations operating in turbulent environments must carefully allocate their resources to build and enhance organizational resilience [

83]. This study indicates that investments in resilience-building efforts may yield greater returns in sustainability performance, especially during periods of lower turbulence.

Given the dynamic nature of turbulence, SMEs should take a continuous monitoring and adjustment approach. To maintain optimal sustainability performance, organizational resilience strategies must be adjusted regularly to account for market and technological turbulence. In light of these findings, SMEs are encouraged to pursue collaborative ventures with partners who can help them build organizational resilience. These could include strategic alliances or partnerships with entities that have complementary resources or capabilities that increase the organization’s overall resilience.

7.3. Limitations and Future Research

The SME sample herein may not represent all industries/regions. Future studies should compare resilience dynamics across sectors (e.g., manufacturing vs. services). Objective metrics (e.g., ESG scores) should complement perceptual data. A large firm comparison would clarify whether resilience operates differently in resource-abundant contexts. Tracking resilience and sustainability over time could reveal causal pathways obscured in cross-sectional data. Future work should incorporate supplier, customer, and regulator perspectives to triangulate sustainability performance.

Author Contributions

Writing—original draft, A.S.İ. and H.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by the Human Research Ethics Committee of Gebze Technical University (protocol code 2024/07-02 and date of approval 19 April 2024).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Prashar, A. A bibliometric and content analysis of sustainable development in small and medium-sized enterprises. J. Clean. Prod. 2020, 245, 118665. [Google Scholar] [CrossRef]

- Witjes, S.; Vermeulen, W.J.; Cramer, J. MExploring corporate sustainability integration into business activities. Experiences from 18 small and medium-sized enterprises in the Netherlands. J. Clean. Prod. 2017, 153, 528–538. [Google Scholar]

- Do, H.; Budhwar, P.; Shipton, H.; Nguyen, H.D.; Nguyen, B. Building organizational resilience, innovation through resource-based management initiatives, organizational learning and environmental dynamism. J. Bus. Res. 2022, 141, 808–821. [Google Scholar] [CrossRef]

- Saad, M.H.; Hagelaar, G.; van der Velde, G.; Omta, S.W.F. Conceptualization of SMEs’ business resilience: A systematic literature review. Cogent. Bus. Manag. 2021, 8, 1938347. [Google Scholar] [CrossRef]

- Salavou, H.; Baltas, G.; Lioukas, S. Organisational innovation in SMEs: The importance of strategic orientation and competitive structure. Euro. J. Mark. 2004, 38, 1091–1112. [Google Scholar] [CrossRef]

- Taghizadeh, S.K.; Rahman, S.A.; Nikbin, D.; Radomska, M.; Maleki Far, S. Dynamic capabilities of the SMEs for sustainable innovation performance: Role of environmental turbulence. J. Organ. Eff. People Perform. 2023, 11, 767–787. [Google Scholar] [CrossRef]

- Gunasekaran, A.; Rai, B.K.; Griffin, M. Resilience and competitiveness of small and medium size enterprises: An empirical research. Int. J. Prod. Res. 2011, 49, 5489–5509. [Google Scholar] [CrossRef]

- Marcazzan, E.; Campagnolo, D.; Gianecchini, M. Reaction or anticipation? Resilience in small and medium-sized enterprises. J. Small Bus. Enterp. Dev. 2022, 29, 764–788. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Hollnagel, E.; Pariès, J.; Woods, D.D.; Wreathall, J. Resilience Engineering in Practice: A Guidebook; Ashgate: Farnham, UK, 2011. [Google Scholar]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone: Farnham, UK, 1997. [Google Scholar]

- Kleindorfer, P.R.; Singhal, K.; Van Wassenhove, L.N.V. Sustainable operations management. Prod. Oper. Manag. 2005, 14, 482–492. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Demmer, W.A.; Vickery, S.K.; Calantone, R. Engendering resilience in small- and medium-sized enterprises (SMEs): A case study of Demmer Corporation. Int. J. Prod. Res. 2011, 49, 5395–5413. [Google Scholar] [CrossRef]

- Hart, S.L.; Dowell, G. A natural-resource-based view of the firm: Fifteen years after. J. Manag. 2011, 37, 1464–1479. [Google Scholar] [CrossRef]

- Wilden, R.; Gudergan, S.P.; Nielsen, B.B.; Lings, I. Dynamic capabilities and performance: Strategy, structure and environment. Long Range Plan. 2013, 46, 72–96. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D. Managing firm resources in dynamic environments to create value: Looking inside the black box. Acad. Manag. Rev. 2007, 32, 273–292. [Google Scholar] [CrossRef]

- Wright, P.M.; Dunford, B.B.; Snell, S.A. Human resources and the resource-based view of the firm. J. Manag. 2001, 27, 701–721. [Google Scholar] [CrossRef]

- Terjesen, S.; Patel, P.C.; Covin, J.G. Alliance diversity, environmental context and the value of manufacturing capabilities among new high technology ventures. J. Oper. Manag. 2011, 29, 105–115. [Google Scholar] [CrossRef]

- Corbett, L.M.; Claridge, G.S. Key manufacturing capability elements and business performance. Int. J. Prod. Res. 2002, 40, 109–131. [Google Scholar] [CrossRef]

- Chavez, R.; Yu, W.; Jacobs, M.A.; Feng, M. Data-driven supply chains, manufacturing capability and customer satisfaction. Prod. Plan. Control. 2017, 28, 906–918. [Google Scholar] [CrossRef]

- Ansoff, H. Strategic Management; Palgrave Macmillan: London, UK, 1979. [Google Scholar]

- Grant, R.M. Strategic planning in a turbulent environment: Evidence from the oil majors. Strat. Manag. J. 2003, 24, 491–517. [Google Scholar] [CrossRef]

- Galbraith, J.R. Organizing to deliver solutions. Organ. Dynamic. 2002, 31, 194. [Google Scholar] [CrossRef]

- Gyedu, S.; Tang, H.; Ntarmah, A.H.; Manu, E.K. The moderating effect of environmental turbulence on the relationship between innovation capability and business performance. Int. J. Innov. Sci. 2021, 13, 456–476. [Google Scholar] [CrossRef]

- Arici, T.; Gok, M.S. Examinig Environmetal Turbulence Intensity: A Strategic Agility and Innovativeness Approach on Firm Performance in Environmental Turbulence Situations. Sustainability 2023, 15, 5364. [Google Scholar] [CrossRef]

- Hung, K.P.; Chou, C. The impact of open innovation on firm performance: The moderating effects of internal R&D and environmental turbulence. Technovation 2013, 33, 368–380. [Google Scholar] [CrossRef]

- DeSarbo, W.S.; Anthony Di Benedetto, C.; Song, M.; Sinha, I. Revisiting the Miles and Snow strategic framework: Uncovering interrelationships between strategic types, capabilities, environmental uncertainty, and firm performance. Strat. Manag. J. 2005, 26, 47–74. [Google Scholar] [CrossRef]

- Kohli, A.K.; Jaworski, B.J. Market orientation: The construct, research propositions, and managerial implications. J. Mark. 1990, 54, 1–18. [Google Scholar] [CrossRef]

- Hillmann, J.; Guenther, E. Organizational resilience: A valuable construct for management research? Int. J. Manag. Rev. 2021, 23, 7–44. [Google Scholar] [CrossRef]

- Lee, A.V.; Vargo, J.; Seville, E. Developing a tool to measure and compare organizations’ resilience. Nat. Hazards Rev. 2013, 14, 29–41. [Google Scholar] [CrossRef]

- Williams, T.A.; Gruber, D.A.; Sutcliffe, K.M.; Shepherd, D.A.; Zhao, E.Y.F. Organizational response to adversity: Fusing crisis management and resilience research streams. Acad. Manag. Ann. 2017, 11, 733–769. [Google Scholar] [CrossRef]

- Xie, X.; Wu, Y.; Palacios-Marqués, D.; Ribeiro-Navarrete, S. Business networks and organizational resilience capacity in the digital age during COVID-19: A perspective utilizing organizational information processing theory. Technol. Forecast. Soc. Change 2022, 177, 121548. [Google Scholar] [CrossRef]

- Liu, Y.; Cooper, C.L.; Tarba, S.Y. Resilience, wellbeing and HRM: A multidisciplinary perspective. J. Int. Hum. Res. Manag. 2019, 30, 1227–1238. [Google Scholar] [CrossRef]

- Duchek, S.; Geithner, S.; Kalwa, T. How teams can develop resilience: A play-oriented approach to foster resilience capabilities. Acad. Manag. Proc. 2021, 28, 1943652. [Google Scholar] [CrossRef]

- World Commission on Environment and Development. Our Common Future; Oxford University Press: Oxford, UK, 1987; Available online: https://www.un-documents.net/our-common-future.pdf (accessed on 11 March 2025).

- Goyal, P.; Rahman, Z.; Kazmi, A.A. Corporate sustainability performance and firm performance research: Literature review and future research agenda. Manag. Decis. 2013, 51, 361–379. [Google Scholar] [CrossRef]

- Artiach, T.; Lee, D.; Nelson, D.; Walker, J. The determinants of corporate sustainability performance. Account. Financ. 2010, 50, 31–51. [Google Scholar] [CrossRef]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of the 21st Century; New Society Publishers: Stoney Creek, CT, USA, 1998. [Google Scholar]

- AAdams, C.; Muir, S.; Hoque, Z. Measurement of sustainability performance in the public sector. Sustain. Account. Manag. Policy J. 2014, 5, 46–67. [Google Scholar] [CrossRef]

- Ortiz-de-Mandojana, N.; Bansal, P. The long-term benefits of organizational resilience through sustainable business practices. Strat. Mgmt. J. 2016, 37, 1615–1631. [Google Scholar] [CrossRef]

- Nekhili, M.; Nagati, H.; Chtioui, T.; Rebolledo, C. Corporate social responsibility disclosure and market value: Family versus nonfamily firms. J. Bus. Res. 2017, 77, 41–52. [Google Scholar] [CrossRef]

- Jaworski, B.J.; Kohli, A.K. Market orientation: Antecedents and consequences. J. Mark. 1993, 57, 53–70. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Hahn, T.; Figge, F.; Pinkse, J.; Preuss, L. Cognitive frames in corporate sustainability: Managerial sensemaking with paradoxical and business case frames. Acad. Manag. Rev. 2015, 40, 378–401. [Google Scholar] [CrossRef]

- Bocken, N.M.; Short, S.W.; Rana, P.; Evans, S. A literature and practice review to develop sustainable business model archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef]

- Aragón-Correa, J.A.; Sharma, S. A contingent resource-based view of proactive corporate environmental strategy. Acad. Manag. Rev. 2003, 28, 71–88. [Google Scholar] [CrossRef]

- Luchs, M.G.; Naylor, R.W.; Irwin, J.R.; Raghunathan, R. The sustainability liability: Potential negative effects of ethicality on product preference. J. Mark. 2010, 74, 18–31. [Google Scholar] [CrossRef]

- Slawinski, N.; Bansal, P. Short on Time: Intertemporal Tensions in Business Sustainability. Organ. Sci. 2015, 26, 531–549. [Google Scholar] [CrossRef]

- Gualandris, J.; Klassen, R.D.; Vachon, S.; Kalchschmidt, M. Sustainable evaluation and verification in supply chains: Aligning and leveraging accountability to stakeholders. J. Oper. Manag. 2015, 38, 1–13. [Google Scholar] [CrossRef]

- Rousseau, D.M.; Batt, R. Global Competition’s Perfect Storm: Why Business and Labor Cannot Solve Their Problems Alone. Acad. Manag. Perspect. 2007, 21, 16–23. [Google Scholar] [CrossRef]

- Delmas, M.A.; Toffel, M.W. Organizational responses to environmental demands: Opening the black box. Strateg. Manag. J. 2008, 29, 1027–1055. [Google Scholar] [CrossRef]

- Bogers, M.; Zobel, A.K.; Afuah, A.; Almirall, E.; Brunswicker, S.; Dahlander, L. The open innovation research landscape: Established perspectives and emerging themes across different levels of analysis. Ind. Innov. 2018, 25, 8–40. [Google Scholar] [CrossRef]

- Wu, L.; Liu, H.; Zhang, J. Bricolage effects on new-product development speed and creativity: The moderating role of technological turbulence. J. Bus. Res. 2020, 110, 327–336. [Google Scholar] [CrossRef]

- Branzei, O.; Vertinsky, I. Strategic pathways to product innovation capabilities in SMEs. J. Bus. Ventur. 2006, 21, 75–105. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L. The dark side of technological turbulence: How it weakens the resilience-sustainability link. J. Manag. Stud. 2021, 58, 689–721. [Google Scholar] [CrossRef]

- Obal, M.; Lancioni, R.A. Maximizing buyer-supplier relationships in the digital era: Concept and research agenda. Ind. Mark. Manag. 2013, 42, 851–854. [Google Scholar] [CrossRef]

- Roberts, J.A.; Grover, V. Investigating firm’s customer agility and firm performance: The importance of aligning sense and respond capabilities. J. Bus. Res. 2012, 65, 579–585. [Google Scholar] [CrossRef]

- Helfat, C.E.; Winter, S.G. Untangling dynamic and operational capabilities. Strateg. Manag. J. 2011, 32, 1243–1250. [Google Scholar] [CrossRef]

- Bundy, J.; Pfarrer, M.D.; Short, C.E.; Coombs, W.T. Crises and crisis management: Integration, interpretation, and research development. J. Manag. 2017, 43, 1661–1692. [Google Scholar] [CrossRef]

- Bogers, M.; Hadar, R.; Bilberg, A. Additive manufacturing for consumer-centric business models: Implications for supply chains in consumer goods manufacturing. Technol. Forecast. Soc. Change 2018, 131, 156–171. [Google Scholar] [CrossRef]

- Turkish Statistical Institute (TurkStat). Official Website. Available online: https://www.tuik.gov.tr/ (accessed on 23 June 2025).

- Brislin, R.W. Back-translation for cross-cultural research. J. Cross-Cult. Psychol. 1970, 1, 185–216. [Google Scholar] [CrossRef]

- Akgün, A.E.; Keskin, H. Organizational resilience capacity and firm product innovativeness and performance. Int. J. Prod. Res. 2014, 52, 6918–6937. [Google Scholar] [CrossRef]

- Kähkönen, A.K.; Lintukangas, K.; Hallikas, J. Sustainable supply management practices: Making a difference in a firm’s sustainability performance. Supply Chain. Manag. 2018, 23, 518–530. [Google Scholar] [CrossRef]

- Harman, H.H. Modern Factor Analysis; University of Chicago Press: Chicago, IL, USA, 1976. [Google Scholar]

- Podsakoff, P.; Organ, D. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.-Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef] [PubMed]

- Bartlett, M.S. The effect of standardization on a chi-square approximation in factor analysis. Biometrika 1951, 38, 337–344. [Google Scholar]

- Field, A. Discovering statistics using SPSS for Windows; Sage Publications: Thousand Oaks, CA, USA, 2000. [Google Scholar]

- Nunnally, J.C., Jr. Introduction to Psychological Measurement, McGraw-Hill: New York, NY, USA, 1970.

- Belsley, D.A.; Kuh, E.; Welsch, R.E. Regression Diagnostics: Identifying Influential Data and Sources of Collinearity; John Wiley & Sons: Hoboken, NJ, USA, 1980. [Google Scholar] [CrossRef]

- Ferreira, J.; Coelho, A.; Moutinho, L. Market turbulence, organizational resilience, and innovation in SMEs: The moderating role of absorptive capacity. J. Bus. Res. 2020, 116, 94–104. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Technological turbulence and organizational resilience: The role of strategic flexibility and organizational learning. Strateg. Manag. J. 2002, 23, 1107–1121. [Google Scholar] [CrossRef]

- Beck, T.; Demirgüç-Kunt, A. Small and medium-size enterprises: Access to finance as a growth constraint. J. Bank. Finance. 2006, 30, 2931–2943. [Google Scholar] [CrossRef]

- Bacon, N.; Hoque, K.; Siebert, S. HRM in small and medium-sized enterprises (SMEs): A systematic review of the literature. Int. J. Manag. Rev. 2013, 15, 452–476. [Google Scholar] [CrossRef]

- Ghobadian, A.; Gallear, D. TQM and organization size. Int. J. Oper. Prod. Manag. 1997, 17, 121–163. [Google Scholar] [CrossRef]

- Hervas-Oliver, J.-L.; Albors-Garrigos, J. Are Technology Gatekeepers Renewing Clusters? Understanding Gatekeepers and Their Dynamics Across Cluster Life Cycles. Entrep. Reg. Dev. 2014, 26, 431–452. [Google Scholar] [CrossRef]

- Nambisan, S.; Wright, M.; Feldman, M. The digital transformation of innovation and entrepreneurship: Progress, challenges, and key themes. Res. Policy 2019, 48, 103773. [Google Scholar] [CrossRef]

- Ozanne, L.K.; Chowdhury, M.; Prayag, G.; Mollenkopf, D.A. SMEs navigating COVID-19: The influence of social capital and dynamic capabilities on organizational resilience. Ind. Mark. Manag. 2022, 104, 116–135. [Google Scholar] [CrossRef]

- Kurtz, D.J.; Varvakis, G. Dynamic capabilities and organizational resilience in turbulent environments. In Competitive Strategies for Small and Medium Enterprises: Increasing Crisis Resilience, Agility and Innovation in Turbulent Times; Springer: Cham, Switzerland, 2016; pp. 19–37. [Google Scholar]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).