1. Introduction

During the 19th National Congress of the Communist Party of China, the green development concept was formally established, emphasizing that “lucid waters and lush mountains are invaluable assets.” In 2024, this concept was further elevated to a national strategic level with the aim of steadily and systematically advancing carbon peaking and carbon neutrality targets. This initiative will act as a catalytic driver for high-quality economic growth, developing eco-conscious and sustainable competitive advantages that propel coordinated socioeconomic and environmental advancement. Within this context, enterprises—as primary actors in microeconomic and social development—demonstrate pivotal significance through their ESG (environmental, social, and governance) performance. Corporate ESG performance not only constitutes the foundation for implementing green development, but also provides an essential safeguard for promoting sustainable, high-quality, and resilient socioeconomic advancement [

1]. As a comprehensive evaluation metric system, ESG performance assesses corporate sustainable development potential and long-term economic value through three core dimensions: environmental stewardship, social responsibility, and governance efficacy [

2]. On a global scale, ESG performance has become an essential benchmark for assessing corporate non-financial disclosures, with a growing number of investors and financial entities integrating ESG factors into their investment decision-making frameworks and risk assessment. However, China’s exploration and implementation of ESG started comparatively later than the international forefront, with some domestic enterprises still in the early stages of environmental stewardship, social responsibility compliance, and corporate governance [

3]. Given the prominent role of ESG performance in driving corporate sustainable development and strengthening market competitiveness, alongside the persistent gap between domestic and international ESG practices, conducting in-depth research on effective approaches to elevate the ESG performance of China’s firms has become particularly imperative.

The upper echelons theory posits that executives progressively develop distinctive attentional foci, multidimensional cognitive schemata, and intrinsic value schemata throughout their careers. These characteristics then exert a prominent influence on an organization’s strategic positioning, decision-making trajectories, and performance manifestations. The CEO’s green experience—encompassing involvement in environmental protection projects, green technology research and development, or related educational backgrounds—exerts a profound influence on corporate strategic decision-making and implementation through personal value systems and behavioral patterns [

4]. CEOs with green experience not only significantly heighten their environmental consciousness and corporate social responsibility commitment [

5], but also profoundly shape strategic decision-making processes through their distinctive competencies in attentional focus allocation and cognitive capital deployment, ultimately reconfiguring organizational strategic formulation and implementation paradigms [

6].

Prior research has delved into the driving factors of ESG performance, focusing predominantly on three dimensions: the external environment, stakeholders, and internal resources. In the external environment dimension, policies and regulations constrain and incentivize enterprises while simultaneously guiding them to deepen their awareness of environmental protection and social responsibility [

7], thereby enhancing their ESG performance [

8]. At the stakeholder level, empirical research has revealed the impact of attention from financial intermediaries (such as institutional investors) [

9], shareholder engagement [

10], and investor attention [

11] on corporate ESG ratings. At the level of internal corporate resources, prior research has demonstrated that corporate characteristics, such as corporate culture [

3], corporate scale [

12], and the advancement of digital transformation [

13], all bear an impact upon corporate ESG performance to some extent. Furthermore, the characteristics of the top management team (TMT) are also regarded as a significant factor that cannot be ignored, serving as prominent elements in the development and execution of corporate ESG strategies [

14].

While the existing studies have offered multidimensional perspectives on the factors influencing corporate ESG performance, a research gap persists regarding the mechanisms through which the CEO’s personal attributes—as principal strategic decision-makers—influence corporate ESG outcomes. However, particularly noteworthy is the scarcity of research systematically examining the impact pathways and effect magnitudes of the CEO’s green experiential capital—a distinctive biographical characteristic—on organizational ESG performance within the current academic discourse. Building upon this foundation, the present study endeavors to elucidate how the CEO’s green experience influences an organization’s ESG performance and further delves into the fundamental mechanisms underlying this relationship. By analyzing the relationship between the CEO’s green experience and corporate ESG performance, this research not only underscores the importance of executives’ personal experiences in shaping corporate ESG strategies, but also offers new perspectives for advancing sustainable corporate development.

2. Theoretical Analysis and Research Hypothesis

2.1. The Direct Impact of the CEO’s Green Experience on Corporate ESG Performance

From the vantage point of the upper echelons theory, the individual characteristics of senior corporate executives, especially chief executive officers (CEOs), are pivotal in shaping the strategic orientation of the firm. These characteristics include their distinct attentional tendencies, complex cognitive frameworks, and deeply embedded value systems, shaped over their careers, and they steer the firm’s decision-making processes and influence performance outcomes [

15]. Green experiences not only shape CEOs’ environmental awareness and sense of social responsibility, but also refine their attention allocation patterns and cognitive resource utilization, thereby influencing corporate strategic decision-making [

16]. In terms of attention allocation, CEOs with green experience are more likely to prioritize green transformation and sustainable development, thereby driving improvements in the company’s ESG performance [

17]. Such CEOs are adept at identifying opportunities and challenges associated with green development, enabling them to allocate resources effectively and foster investment in green innovation [

18]. Moreover, the CEO’s green experience fosters ethical standards and an elevated sense of social responsibility, impelling CEOs to place greater weight on the needs and aspirations of diverse stakeholders [

6]. Under the stewardship of CEOs with green experience, firms are better equipped to adopt proactive measures to mitigate environmental impacts, augment employee welfare, and offer superior products and services. These endeavors not only cater to the multifaceted needs of stakeholders, but also fortify the corporate reputation and brand equity.

ESG practices are commonly accompanied by challenges, including high resource consumption, extended payback durations, and substantial implementation expenditures, which are particularly pronounced for resource-constrained firms [

19]. In this context, CEOs with green experience, by leveraging their extensive social networks and human capital, can forge pathways for integrating external resources. This capability helps alleviate the resource constraints that impede the implementation of ESG strategies. On the one hand, CEOs with green experience facilitate access to green credit resources for their companies by reducing information asymmetry and enhancing the acceptance and dissemination of the companies’ green strategies in the capital markets through their social networks and social influence. This not only attracts greater volumes of external capital, but also diversifies financing channels and mitigates the costs and barriers associated with external financing [

20]. On the other hand, CEOs with green experience demonstrate an acute awareness of shifts in evolving regulatory landscapes, empowering their firms to promptly identify opportunities and preemptively tackle ecological hurdles.

CEOs with green experience are instrumental in augmenting corporate ESG performance. Their mental models, strategic acumen, profound sense of social responsibility, and heightened awareness of environmental policy shifts not only shape the strategic distribution of internal resources, but also nurture green development initiatives and socially responsible behaviors across the broader market landscape. In view of this, the following hypothesis is formulated:

Hypothesis H1: The CEO’s green experience exerts a notable and positive influence on corporate ESG performance.

2.2. CEO’s Green Experience, Green Innovation, and Corporate ESG Performance

Green experience fosters CEOs’ development of an environment–economy symbiosis cognitive framework, compelling them to integrate “sustainable development” into corporate missions and prioritize resource allocation for green technology R&D [

21]. Such CEOs are more inclined to institutionalize green innovation in strategic planning, thereby transforming external pressures (e.g., regulatory compliance) into endogenous strategic objectives that directly shape corporate innovation trajectories. Additionally, green experience equips CEOs with familiarity with technological trajectories and market dynamics in sustainability-related fields, enabling rational expectations about the long-term value of green innovation while mitigating excessive short-term risk aversion [

22]. Through hands-on participation in green projects, they accumulate experiential knowledge that corrects misperceptions of green innovation as “high-risk.” This emboldens them to tolerate short-term investment burdens, while their green risk-taking behaviors signal a commitment to innovation to stakeholders, attracting capital and talent [

23]. Collectively, these mechanisms drive corporate green innovation.

Green innovation, serving as the cornerstone of the corporate pursuit of sustainable development, not only directly bolsters environmental performance, but also provides the technological backbone for fulfilling social responsibilities and optimizing governance structures [

24]. Corporations can effectively mitigate carbon emissions and resource consumption through the application of eco-friendly technologies and green production modes, thereby achieving sustainability objectives and enhancing ESG performance in the environmental dimension [

25]. Furthermore, green innovation demonstrates a sense of responsibility to stakeholders, especially in terms of employee, customer, and community well-being, and strengthens the enterprise’s ESG by increasing social contributions [

26]. By strengthening corporate risk management capabilities, green innovation aids in identifying and addressing potential risks in environmental and social dimensions, thereby nurturing the creation and safeguarding of sustainable long-term value. In light of these insights, the following hypothesis is proposed:

Hypothesis H2: The CEO’s green experience significantly elevates the firm’s ESG performance through the facilitation of green innovation.

2.3. CEO’s Green Experience, Discretion, and Corporate ESG Performance

Managerial discretion denotes the autonomy that managers possess within the organizational context to make independent decisions and execute actions, drawing upon their professional expertise, judgment, and understanding of organizational goals [

27]. This discretionary power, serving as a pivotal resource for top executives, equips CEOs with the agility to respond dynamically to external market shifts and formulate and adjust strategies in accordance with their organizations’ long-term aspirations [

28]. Within this framework, the CEO’s green experience can be effectively translated into actionable green strategies, fostering ongoing enhancements in the company’s ESG performance [

20]. When CEOs wield high levels of discretion, their green experience is more seamlessly integrated into resource allocation and strategic implementation, enabling the swift and efficient transformation of green initiatives into tangible corporate actions, thereby bolstering corporate ESG performance [

29]. An augmentation in discretionary power not only amplifies CEOs’ decision-making autonomy, but also imparts greater flexibility in executing green innovation and environmental strategies, allowing them to harness their green experience to catalyze sustainable corporate development.

Furthermore, CEOs endowed with discretionary power are better positioned to swiftly respond to market, policy, and environmental shifts, ensuring seamless implementation of green strategies through agile strategic adjustments [

30]. When confronted with challenges pertaining to environmental and social responsibilities, CEOs with elevated discretionary authority can spearhead proactive strategic initiatives, such as investing in green technologies, refining production processes, and augmenting employee training programs. Leveraging flexible resource allocation and strategic recalibration, CEOs possessing substantial discretionary power can fortify their firms’ performance across ESG dimensions and enhance the execution of green strategies [

31]. Consequently, a notable synergy emerges between the CEO’s green experience and their discretionary power. The former furnishes green concepts and strategic insights, while the latter affords the latitude and flexibility requisite for effective strategy implementation. In this dynamic interplay, discretion acts as a catalyzing factor that amplifies the beneficial effects of the CEO’s green experience, rendering its practical application more potent. Based on these considerations, the following hypothesis is proposed:

Hypothesis H3: The CEO’s discretionary power positively moderates the relationship between the CEO’s green experience and corporate ESG performance.

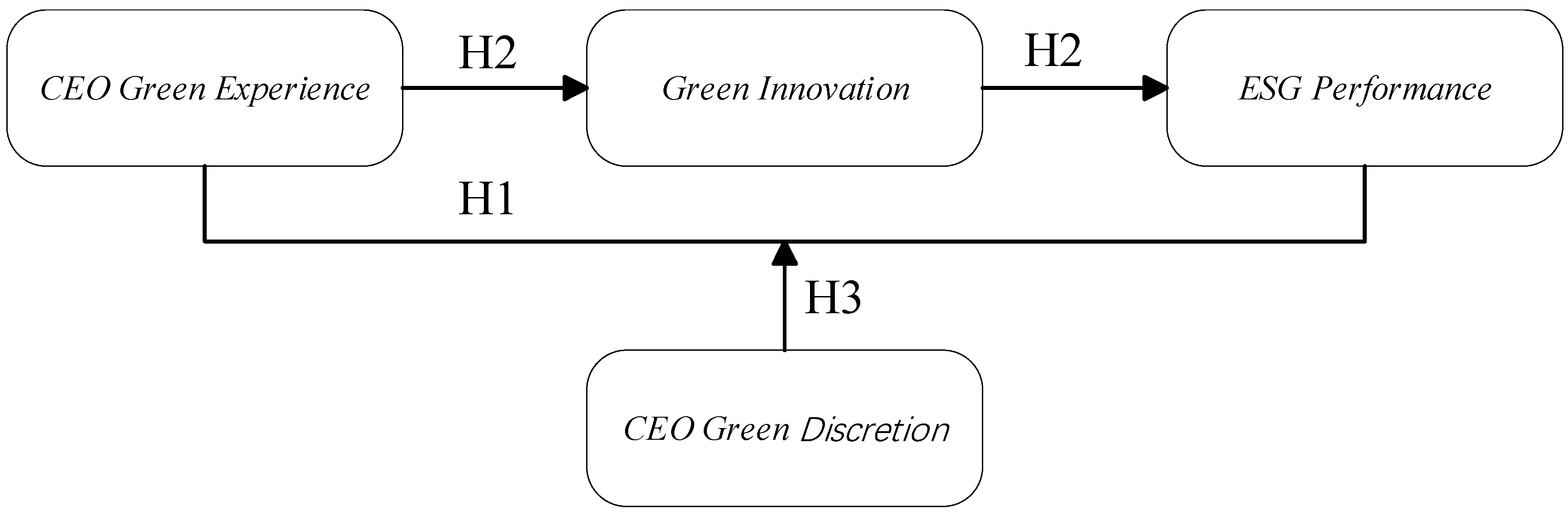

Building upon the core logic of the upper echelons theory, this study constructs an integrated “cognitive priming–behavioral translation–contextual empowerment” framework (

Figure 1). First, Hypothesis 1 (H1) establishes the direct driving effect of the CEO’s green experience on corporate ESG performance. Second, Hypothesis 2 (H2) reveals green innovation as the key mediating mechanism: the CEO’s green experience lowers perceived risks of green technologies and integrates social network resources, converting external pressures into endogenous innovation momentum. This subsequently elevates ESG performance through dual pathways: technical leverage (e.g., enhanced carbon reduction efficiency) and signaling effects (e.g., fortified stakeholder trust). Finally, Hypothesis 3 (H3) defines the moderating boundary of managerial discretion. Discretion amplifies the main effect via dual enabling mechanisms: overcoming institutional constraints at the organizational level and reinforcing decision-making autonomy at the individual level. Consequently, it catalyzes the positive impact of the CEO’s green experience on ESG performance.

3. Research Design

3.1. Sample Selection and Data Sources

This study leveraged data from listed companies in China’s A-share market from 2011 to 2023, and the following screening and processing procedures were applied to the data samples. First, the ST and *ST companies were excluded; second, samples with incomplete data were omitted; third, companies in the financial industry were excluded; finally, samples of firms with fewer than three years of observations were excluded. Based on the above screening criteria, an unbalanced panel dataset of 3101 listed companies covering 26,199 sample observations was identified. To mitigate the impact of outliers, continuous variables were winsorized at the 1% and 99% percentiles. The ESG performance data were mainly obtained from the Shanghai China Securities Index Information Service Co., Ltd. (Shanghai, China). The CEO’s green experience data were collected using a Python-based (version 3.11) web scraping technology. In addition, the green innovation data came from the China Research Data Service Platform (CNRDS), and the CEO discretionary data was obtained via organization and analysis based on the Cathay Pacific database (CSMAR). Data for other variables were obtained from the Cathay Pacific database. In order to ensure the consistency and accuracy of the industry classification, the industry to which the company belongs was carefully determined according to the two-digit industry code specified in the Guidelines for Industry Classification of Listed Companies (2012 Revision) issued by the China Securities Regulatory Commission (CSRC). All data were statistically analyzed using Stata 16.0 software.

3.2. Empirical Model

The empirical model presented below was constructed to test the research hypotheses outlined in this paper:

where GE represents the CEO’s green experience, which is the explanatory variable in this study, ESG refers to the company’s composite ESG score, the core explanatory variable in this study, and Control denotes the set of control variables. Drawing on previous studies, this paper controls for a range of factors that may influence a company’s ESG performance, including the ratio of the largest shareholder’s ownership (Top1), debt-to-asset ratio (Lev), firm size (Size), Tobin’s Q (TobinQ), firm age (ListAge), board size (Board), management fees (Mfee), audit opinion (Opinion), separation of powers (Seperate), return on assets (ROA), and board shareholding ratio (ChairHold). Further, μ

i denotes the firm’s individual fixed effects, η

t represents the time-fixed effects, and ε

it represents the random disturbance term.

Building on this foundation, green innovation is incorporated to examine its mediating effect on the relationship between the CEO’s green experience and corporate ESG performance:

where GIit serves as a proxy for the mediating variable “green innovation,” and the other variables are consistent with the above.

Model of the moderating effect of CEO discretion on the CEO’s green experience and the firm’s ESG performance.

where DISit denotes the moderator variable “CEO discretion,” and the other variables are consistent with the above.

The primary aim of Model (1) is to examine the influence of the CEO’s green experience on the firm’s ESG performance, with a specific emphasis on the regression coefficient α1. If α1 is found to be greater than zero, the CEO’s green experience positively enhances the firm’s ESG performance. Conversely, if α1 is less than zero, it suggests that the CEO’s green experience exerts a detrimental impact on ESG performance. Furthermore, Models (2) and (3) are designed to investigate whether green innovation serves as a mediator between the CEOs’ green experience and the firm’s ESG performance. Additionally, Model (4) seeks to explore the moderating role of CEO discretion in this relationship, examining how the influence of the CEO’s green experience on ESG performance varies across different levels of discretion.

3.3. Variable Description

3.3.1. Dependent Variable: ESG Performance (ESG)

The ESG performance of companies has drawn increasing attention from both industry and academia globally. Currently, ESG data are primarily derived from third-party evaluation organizations, including the Huazheng ESG Database, SynTao Green Finance, Bloomberg, and Wind, among others. This study adopts the Huazheng ESG data as the indicator for corporate ESG performance. The Huazheng ESG Database has been assessing the ESG performance of listed companies since 2009, and its rating system is widely recognized in both industry and academic circles. The Huazheng ESG rating system incorporates publicly disclosed information, data from government and regulatory websites, and news reports. It assigns ratings across nine levels (from C to AAA). In this study, these ratings are converted to a numerical scale from 1 to 9 to facilitate the quantitative analysis of corporate ESG performance.

3.3.2. Independent Variable: CEO’s Green Experience (GE)

Building on the existing research, this study employed a Python-based web scraping technology to identify whether a CEO has undertaken education or professional experience related to “green” fields. Data on executive biographies were sourced from the Cathay Pacific database. Green-related education was defined as having a major in fields such as pulp and paper, environmental science, environmental engineering, or related professions. Green work experience was determined by searching for keywords such as “green,” “environmental,” “sustainability,” “recycling,” “pollution,” “ecology,” and others in the CEO resume data [

32]. If a CEO had relevant green experience, the value of GE was set to 1; if not, it was set to 0.

3.3.3. Mediating Variable: Green Innovation (GI)

To operationalize eco-innovation, the volume of green patents secured by a company was used as an indicator, consistent with the approach in previous studies. The total count of green invention patents and utility model patents was summed to obtain a holistic assessment of green innovation. To address the typically inherent right-skewness of green patent data, the natural logarithm of the total patent count plus one was used.

3.3.4. Moderating Variable: CEO Discretion (DIS)

In this study, CEO discretion was defined from the perspective of the “authorization and incentive mechanism” within corporate governance structures. Specifically, CEO discretion referred to the formal authority granted to the CEO by the board of directors, which was based on the CEO’s position and did not encompass informal influences stemming from personal characteristics [

33]. This power structure reflected the degree of authorization and the boundaries of trust placed in the CEO within the organization. Accordingly, drawing on prior studies and grounded in the definition of managerial discretion, this study—guided by the logic of the upper echelons theory—constructed a composite measure of CEO discretion based on four dummy variables. The variables, measurement approaches, and theoretical justifications are outlined below.

First, the shareholding ratio of the largest shareholder was coded as a dummy variable. If the largest shareholder’s equity stake was below the annual industry median, the variable was assigned a value of 1; otherwise, it was coded as 0. This variable reflected ownership concentration on the CEO’s decision-making autonomy. Second, a dummy variable was constructed for CEO duality. If the CEO concurrently served as the chair of the board, the value was 1; otherwise, it was 0. Duality may enhance the CEO’s influence and authority within the organization. Third, CEO shareholding was included as a dummy variable, with a value of 1 if the CEO held shares in the firm and 0 otherwise. Equity ownership reflected the degree of interest alignment between the CEO and the firm, potentially influencing the CEO’s autonomy and incentive structure. Fourth, CEO compensation was coded as 1 if the CEO’s annual remuneration exceeded the industry median and 0 otherwise. The compensation level may reflect the CEO’s organizational status and bargaining power. These four dummy variables were used collectively to construct a multidimensional measure of CEO discretion.

The variables are defined as shown in

Table 1.

4. Empirical Results and Analysis

4.1. Descriptive Statistics

Table 2 presents the descriptive statistics for corporate ESG performance, CEO’s green experience, green innovation, CEO discretion, and the control variables. Regarding the dependent variable, corporate ESG performance (ESG), among the 26,199 sample observations, the minimum ESG score was 1 and the maximum was 8, with a mean of 4.122 and a standard deviation of 1.074. These statistics suggest that, while the ESG performance scores of the sampled firms are relatively balanced, they generally tend to be low. The mean value for the CEO’s green experience (GE) was 0.046, accompanied by a standard deviation of 0.209. This indicates that the proportion of CEOs with green experience within the sampled companies is generally low. The preliminary statistical analysis offers a quantitative foundation for subsequent, more in-depth investigations into strategic associations.

4.2. Regression Results

To test the stability and robustness of Hypothesis H1 (which posits that the CEO’s green experience positively influences the firm’s ESG performance), we present regression results in

Table 3. Column (1) reports the baseline test of H1 with only the core explanatory variable (GE). The estimated coefficient of 0.125 is statistically significant at the 1% level, indicating a positive relationship between the CEO’s green experience and ESG performance. This magnitude indicates that CEOs with green experience enhance their firms’ ESG performance by 12.5 percentage points relative to their counterparts lacking such experience, providing preliminary evidentiary support for H1. To enhance the empirical rigor of our analysis, Column (2) incorporates control variables into the model. The coefficient for GE remains positive and statistically significant at the 1% level, further substantiating H1 that the CEO’s green experience elevates ESG performance. Finally, to address potential omitted variable bias, Column (3) introduces firm and year-fixed effects to mitigate the unobserved heterogeneity concerns. The persistently significant positive coefficient (β = 0.088,

p < 0.05) demonstrates that a one-unit increase in the CEO’s green experience corresponds to an 8.8% elevation in ESG performance net of time-invariant firm characteristics and temporal trends. The stability of the coefficient magnitude across specifications underscores the structural robustness of this relationship, thereby conclusively validating Hypothesis H1.

4.3. Endogeneity Tests

This study acknowledges potential endogeneity in the CEO’s green experience–ESG performance relationship, including bidirectional causality and omitted variable bias. To address endogeneity, we employed two approaches: instrumental variables (IV) and propensity score matching (PSM). The IV approach required instruments correlated with the CEO’s green experience but uncorrelated with the error term, eliminating endogeneity in the explanatory variable. PSM constructed counterfactual controls using observable firm and executive characteristics, mitigating sample selection bias. Operational details of both methods are described below.

4.3.1. Instrumental Variables

Referring to Li and Wang’s (2023) study, this paper selects the number of firms with green-experienced CEOs in the annual industry as an instrumental variable. On the one hand, there is a significant relationship between the number of CEOs with green experience at the industry level and the likelihood that individual firms have a CEO with such experience. On the other hand, although the industry-level presence of green-experienced CEOs correlates with the green experience of CEOs in individual firms, it is unlikely to directly influence the ESG performance of these firms. This exogeneity condition ensures that the instrumental variable does not directly affect firms’ ESG performance, thereby preventing potential endogeneity from biasing the results. To re-estimate the relationship between the CEO’s green experience and ESG performance, we applied a two-stage least squares (2SLS) regression. The validity of the instrumental variable was confirmed using the Lagrange multiplier test, with a

p-value of 0.000, indicating adequate identification and ruling out under-identification. Additionally, the Cragg-Donald Wald F-statistic value of 150.11 exceeded the standard threshold, demonstrating the strength of the instrumental variable and eliminating concerns over weak instruments. The results presented in Column (1) of

Table 3 further support the validity of the instrumental variable. In the second stage of the 2SLS regression, the results in Column (2) of

Table 4 show that the CEO’s green experience continues to significantly influence the firm’s ESG performance. Hypothesis 1 still holds after excluding two-way causal endogeneity interference.

4.3.2. Propensity Score Matching

The propensity score matching (PSM) method is effective in controlling outcome errors resulting from sample selection bias. Considering the research focus of this paper, we formed the treatment and control groups based on whether CEOs had green experience [

34]. The treatment group consisted of firms with CEOs having green experience, while the control group included those without. We matched firms based on the key characteristics, including leverage ratio (Lev), size (Size), return on assets (ROA), firm age (ListAge), board size (Board), Tobin’s Q (TobinQ), and the first shareholder’s shareholding (Top1), using a 1:1 nearest-neighbor matching method. The regression results in Column (3) of

Table 4, based on the matched sample, demonstrated that the CEO’s green experience continues to have a significant positive effect on ESG performance. These results further reinforce the robustness of Hypothesis H1.

4.4. Robustness Tests

To assess the robustness of the regression results for Hypothesis H1, this study employed four distinct methods to verify the reliability of the core findings.

First, the dependent variable was replaced. Although both the Huazheng ESG score and the ESG ratings provided by the CNRDS database aim to assess corporate ESG performance, their evaluation frameworks differ in emphasis and methodological design. To test the generalizability of the results, the original dependent variable (Huazheng ESG score) was replaced with the ESG rating from the CNRDS database, while all other variables were held constant. The regression results are reported in Column (1) of

Table 5. The coefficient of the CEO’s green experience remained significantly positive (β = 0.516,

p < 0.1), consistent with the main findings, indicating that the conclusion is robust across different ESG rating systems.

Second, the key independent variable was lagged by one period. This approach served two purposes: it examined the persistence of the impact of the CEO’s green experience on ESG performance and further mitigated potential endogeneity concerns. The regression was re-estimated using the lagged value of the independent variable (GE). As shown in Column (2) of

Table 5, the coefficient of the lagged CEO’s green experience remained significantly positive (β = 0.096,

p < 0.05), suggesting a sustained effect over time and reinforcing the validity of the initial conclusion.

Third, to eliminate the potential impact of public health events, the sample was restricted to the pre-pandemic period (2011–2019) by excluding observations from 2020 to 2023. This robustness test assessed whether the findings were affected by short-term disruptions such as the COVID-19 pandemic and ensured the temporal generalizability of the results. As shown in Column (3) of

Table 5, the coefficient of the CEO’s green experience remained significantly positive (β = 0.099,

p < 0.05), indicating that the conclusion is robust to the exclusion of public health shocks.

Fourth, additional control variables are introduced. Drawing on previous literature, digital transformation [

15], institutional ownership, and financing constraints [

35] have been identified as significant determinants of ESG performance. Therefore, beyond the existing controls, this study further incorporated three variables: digital transformation (Digital), institutional investor ownership (INST), and financing constraints (SA). The regression results, presented in Column (4) of

Table 5, show that the coefficient of CEO green experience remains significantly positive (β = 0.083,

p < 0.05), thereby providing further support for the robustness of the findings.

Collectively, the results of these robustness checks demonstrate that the positive effect of the CEO’s green experience on corporate ESG performance remains consistently significant across a range of model specifications. These include alternative dependent variable measurements, lagged independent variables, exclusion of pandemic-affected periods, and the inclusion of additional control variables. The core conclusion is not materially altered by changes in model structure, sample selection, or control settings. Therefore, the empirical support for Hypothesis 1 can be regarded as highly robust.

4.5. Mechanism Tests

4.5.1. The Mediating Effect of Green Innovation

To elucidate the underlying mechanisms through which the CEO’s green experience influences ESG performance, this study examined the mediating effect outlined in Hypothesis H2. Building on the empirically validated positive relationship between the CEO’s green experience and corporate ESG performance, Models (2) and (3) were employed to further investigate the impact of the CEO’s green experience on the mediating variable, green innovation, and the combined effect on ESG performance when green innovation was considered as the mediator. The regression results in

Table 6 show that the CEO’s green experience has a significant positive effect on the level of green innovation, with a coefficient of 0.089, which is statistically significant at the 1% level. This finding underscores the pivotal role of CEOs with green experience in catalyzing green innovation within firms. Moreover, when green innovation was included as a mediating variable in the model, the results in Column (3) of

Table 6 indicate that the coefficient for the CEO’s green experience on ESG performance adjusted to 0.082, a decrease from the value in Column (1), but still significant at the 5% level. This suggests that green innovation mediates the relationship between the CEO’s green experience and ESG performance. The Sobel test results, with a z-value of 7.993 that is statistically significant at the 1% level, corroborate the presence of a mediating effect. Thus, Hypothesis H2 is supported.

4.5.2. The Moderating Effects of CEO Discretion

To test Hypothesis H3—CEO discretionary power positively moderates the relationship between CEO green experience and corporate ESG performance—this study conducted empirical analysis based on a pre-established research model (4). The regression results in Column (4) of

Table 6 demonstrate that CEO discretion and its interaction with the CEO’s green experience (GI×DIS) both exhibit statistically significant positive correlations. This suggests CEO discretion positively moderates the relationship between green experience and ESG performance, where the beneficial effect of green experience becomes more pronounced when CEOs exercise greater discretion. These findings not only support Hypothesis H3, but also provide managerial implications for enhancing ESG performance through structural empowerment of executive decision-making authority.

4.6. Heterogeneity Analysis

Building on the established positive association between the CEO’s green experience and corporate ESG performance, this study further analyzed heterogeneity across three dimensions, including industry type, competitive intensity, and regional trust levels.

4.6.1. Industry Heterogeneity Analysis

Drawing upon Peng Hongxing et al.’s (2017) categorization criteria for high-tech industries, this study classified firms into high-tech and non-high-tech enterprises. The objective was to examine the heterogeneous effects of CEOs with green experience on ESG performance across varying high-tech industry characteristics. The results, presented in Columns (1) and (2) of

Table 7, reveal that the CEO’s green experience significantly enhances ESG performance exclusively in high-tech firms (β = 0.091,

p < 0.05). In contrast, the regression coefficients for ESG performance in non-high-tech firms are statistically insignificant at conventional levels. High-tech firms typically prioritize technological innovation and sustainable development, resulting in strategic alignment with ESG frameworks. These firms are more likely to adhere to stringent environmental standards, institutionalize stakeholder accountability mechanisms, and align with investor demands for long-term value, thereby incorporating ESG considerations into their strategies. CEOs possessing green competencies can effectively leverage their sustainability-oriented leadership capital, turning it into competitive advantages for their firms. On the other hand, non-high-tech firms may lack a comprehensive understanding of ESG principles and have fewer resources, which can impede their CEOs’ ability to effectively drive green initiatives. Furthermore, the business models and profitability of non-high-tech firms may conflict with ESG goals, increasing resistance to adopting ESG practices.

4.6.2. Heterogeneity Analysis of Market Environment

Market competition significantly influences firms’ competitive pressures, resource allocation, and strategic flexibility. By stratifying firms by competitive intensity quintiles, the results presented in Columns (3) and (4) of

Table 7 show that the CEO’s green experience has a more pronounced effect on ESG performance in moderately competitive environments compared to highly competitive ones (β = 0.114,

p < 0.05). In less competitive markets, the CEO’s green experience is more effective at driving ESG improvements, as firms operate under reduced isomorphic pressures while maintaining strategic plasticity in adopting sustainable practices. In contrast, in highly competitive markets, the impact of the CEO’s green experience alone on ESG performance is attenuated. In such environments, firms need to augment the positive influence of the CEO’s green experience through additional initiatives, such as strengthening internal management processes, optimizing resource allocation strategies, and innovating ESG management practices.

4.6.3. Heterogeneity Analysis of Regional Trust

In this paper, we referred to the social trust indicators established by Zhang Weiying and Ke Rongzhu (2002) and grouped regions based on regional differences in the level of social trust to study the geographic differences in the impact of the CEO’s green experience on ESG performance. The results, shown in Columns (5) and (6) of

Table 7, reveal significant differences. In regions with high social trust, the CEO’s green experience significantly contributes to improved ESG performance (β = 0.094,

p < 0.05), whereas in low-trust regions, the effect is statistically insignificant. In high-trust regions, firms are better positioned to garner support from various stakeholders, including government agencies, community groups, investors, and consumers. These regions benefit from smoother information flow and stronger monitoring mechanisms, which facilitate the implementation of green initiatives and enhance ESG outcomes. In contrast, in low-trust regions, firms face greater challenges in building trust and credibility. The prevalence of information asymmetry exacerbates opportunistic behaviors among stakeholders, compelling firms to allocate disproportionate resources toward compliance verification rather than substantive improvements. Concurrently, the interplay between local protectionism and rent-seeking activities induces selective enforcement of environmental policies, where environmental regulations are frequently subordinated to short-term economic growth targets. These structural constraints create institutional barriers that diminish the efficacy of CEOs’ green expertise, rendering their environmental decisions prone to symbolic adoption rather than driving substantive organizational change.

5. Discussion

In the pursuit of sustainable high-value development, systematically optimizing and elevating corporate ESG performance has become a pivotal concern and an imperative in corporate sustainability strategies. Based on the upper echelons theory analysis framework, this study focused on data from A-share listed companies between 2011 and 2023, utilizing a two-way fixed-effects model to explore the impact of the CEO’s green experience on corporate ESG performance and the underlying mechanisms behind this relationship. The results indicate the following.

The CEO’s green experience significantly contributes to ESG performance, with this result remaining robust after addressing potential endogeneity concerns and conducting several robustness tests. This highlights the pivotal role of a CEO’s personal characteristics in shaping the firm’s sustainability strategy.

The CEO’s green experience enhances corporate ESG performance through green innovation. By using a stepwise regression approach, the study investigated the relationship between the CEO’s green experience, green innovation, and ESG performance. The results clarify the mediating role of green innovation in translating the CEO’s green experience into improved ESG outcomes.

CEO discretion moderates the relationship between the CEO’s green experience and the firm’s ESG performance. This study found that when CEOs possess higher discretionary power, they can more effectively leverage their green experience and values to make decisions that boost ESG performance, thereby amplifying the positive impact of their green background.

Heterogeneity analysis revealed differentiated effects of the CEO’s green experience across various contexts. The contribution of the CEO’s green experience to ESG performance is more pronounced in high-tech firms, in moderately competitive markets, and in regions with higher levels of social trust. These findings not only deepen our understanding of how CEOs’ personal characteristics influence ESG performance, but also provide empirical evidence for firms to tailor their sustainable development strategies based on different market environments.

The theoretical contributions encompassed within this paper might be summarized as follows. Primarily, we broaden the horizon of academic inquiry into the ramifications of CEOs’ past experiences on corporate performance. Past scholarship focused on the organizational impact of military service background, academic experience, and overseas experience. Notwithstanding this burgeoning interest in sustainable development strategies globally, research on the mechanisms through which CEOs’ green experiences—as an emerging strategic leadership attribute—influence corporate sustainability performance remains in its nascent stage. This study enriches the extant literature with novel perspectives through rigorous inquiry into this emerging domain. Second, by interrogating the managerial trait perspective, this investigation delineates the mechanisms through which CEOs’ sustainability-oriented experiential capital shapes ESG performance and identifies critical boundary conditions moderating these relationships. This research advancement extends the scholarly inquiry into antecedents of sustainable value creation while providing organizations with an evidence-based framework for leadership-driven ESG optimization. Finally, through the novel application of the upper echelons theory to ESG strategic governance, this study examines how the dynamic interplay between CEO trait configurations and managerial discretion co-evolves to influence ESG implementation efficacy. The resultant theoretical insights not only demystify the “black box” of sustainability strategic decision-making, but also yield actionable implications for developing ESG-embedded leadership architectures.

6. Conclusions

From the perspective of practical value, the research results in this paper are of great significance to enterprises. They not only help enterprises to improve ESG performance and accelerate the implementation of green and sustainable development strategies, but also highlight the key leading role of CEOs and bring the following important insights for enterprise management. Firstly, companies should select and develop leaders with green experience. The study concludes that CEOs with green experience significantly enhance corporate ESG performance. Therefore, companies should prioritize candidates with environmental expertise or a strong commitment to sustainability when selecting and training top management. By appointing CEOs with a green background, firms can infuse their leadership with sustainability-driven values, thereby fostering continuous improvements in corporate ESG performance. Secondly, companies should optimize corporate governance and empower CEOs with decision-making autonomy. This study found that the CEO’s discretionary power influences how their personal traits and experiences shape the firm’s strategic decisions. As such, companies should optimize their governance structure to empower CEOs with the autonomy necessary to leverage their personal experiences and values in strategic decision-making. By enhancing the CEO’s decision-making authority, the positive impact of the CEO’s green experience on the firm’s ESG performance can be more effectively harnessed, ultimately supporting the implementation of sustainable development strategies. Finally, companies should focus on tailored strategies for different contexts. The heterogeneity analysis reveals that the contribution of the CEO’s green experience to corporate ESG performance varies across different contexts. Firms should customize their ESG strategies based on their specific circumstances to achieve optimal results. For example, high-tech companies should prioritize investments in green technologies, while firms in moderately competitive markets should focus on social responsibility and environmental protection initiatives. In regions with high social trust, companies can strengthen stakeholder engagement, including with policymakers and communities, to foster collaborative efforts that enhance overall ESG performance.

While this study achieved certain findings in exploring the impact of the CEO’s green experience on corporate ESG performance, several limitations remain that warrant further refinement and exploration in subsequent research. First, the analysis relied on sample data from A-share listed companies in China during the 2011 to 2023 period. The dataset was confined to Chinese listed firms, whereas significant variations may exist across countries and regions in terms of economic development levels, regulatory environments, cultural values, and societal expectations regarding corporate ESG performance. Furthermore, listed companies typically represent large, well-established enterprises across industries whose ESG practices and governance models may substantially differ from those of small and medium-sized enterprises. Lastly, the measurement of CEO discretion currently lacks standardized methodologies. The operationalization approach adopted in this study may fail to comprehensively and accurately capture CEOs’ actual decision-making autonomy in corporate governance processes. Future research should prioritize expanding the geographical scope of data collection, refining measurement instruments, and enhancing the generalizability of conclusions across institutional contexts.

Author Contributions

Y.Z.: conceptualization, methodology, software, data curation, writing—original draft preparation. J.L.: conceptualization, supervision, methodology, resources, investigation, writing—review and editing. T.M.: writing—review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This study was supported by the Social Science Foundation of China, Grant Number 22BJY227, Project Manager, Jinke Li. Project Name, Research on the Mechanisms, Pathways, and Countermeasures for Data-Driven Green Transformation of Manufacturing Under the “Dual Carbon”.

Data Availability Statement

The ESG performance data were mainly obtained from the WIND database, while the CEO’s green experience data were collected through the Python-based web scraping technology. In addition, the green innovation data came from the China Research Data Service Platform (CNRDS), and the CEO discretionary data were obtained via organization and analysis based on the Cathay Pacific database (CSMAR). Data for other variables were obtained from the Cathay Pacific database. Link to the CNRDS official website:

https://www.cnrds.com/, accessed on 3 April 2024. Link to the CSMAR official website:

https://data.csmar.com/, accessed on 3 April 2024.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Arvidsson, S.; Dumay, J. Corporate ESG Reporting Quantity, Quality and Performance: Where to Now for Environmental Policy and Practice? Bus. Strateg. Environ. 2022, 31, 1091–1110. [Google Scholar] [CrossRef]

- Qian, S. The Effect of ESG on Enterprise Value under the Dual Carbon Goals: From the Perspectives of Financing Constraints and Green Innovation. Int. Rev. Econ. Financ. 2024, 93, 318–331. [Google Scholar] [CrossRef]

- Bai, F.; Shang, M.; Huang, Y. Corporate Culture and ESG Performance: Empirical Evidence from China. J. Clean Prod. 2024, 437, 140732. [Google Scholar] [CrossRef]

- Li, X.; Guo, F.; Wang, J. A Path towards Enterprise Environmental Performance Improvement: How Does CEO Green Experience Matter? Bus. Strateg. Environ. 2024, 33, 820–838. [Google Scholar] [CrossRef]

- Zhang, C.; Yu, J.; Bai, Y.; Ho, K.-C. The Impact of CEO’s Green Experience on Digital Transformation. Pac.-Basin Financ. J. 2024, 85, 102397. [Google Scholar] [CrossRef]

- Chen, S.; Bu, M.; Wu, S.; Liang, X. How Does TMT Attention to Innovation of Chinese Firms Influence Firm Innovation Activities? A Study on the Moderating Role of Corporate Governance. J. Bus. Res. 2015, 68, 1127–1135. [Google Scholar] [CrossRef]

- He, X.; Jing, Q.; Chen, H. The Impact of Environmental Tax Laws on Heavy-Polluting Enterprise ESG Performance: A Stakeholder Behavior Perspective. J. Environ. Manag. 2023, 344, 118578. [Google Scholar] [CrossRef] [PubMed]

- Zahid, R.M.A.; Taran, A.; Khan, M.K.; Chersan, I.-C. ESG, Dividend Payout Policy and the Moderating Role of Audit Quality: Empirical Evidence from Western Europe. Borsa Istanb. Rev. 2023, 23, 350–367. [Google Scholar] [CrossRef]

- Wang, Y.; Lin, Y.; Fu, X.; Chen, S. Institutional Ownership Heterogeneity and ESG Performance: Evidence from China. Financ. Res. Lett. 2023, 51, 103448. [Google Scholar] [CrossRef]

- Barko, T.; Cremers, M.; Renneboog, L. Shareholder Engagement on Environmental, Social, and Governance Performance. J. Bus. Ethics 2022, 180, 777–812. [Google Scholar] [CrossRef]

- Gu, J. Investor Attention and ESG Performance: Lessons from China’s Manufacturing Industry. J. Environ. Manag. 2024, 355, 120483. [Google Scholar] [CrossRef] [PubMed]

- Drempetic, S.; Klein, C.; Zwergel, B. The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings Under Review. J. Bus. Ethics 2020, 167, 333–360. [Google Scholar] [CrossRef]

- Wang, H.; Jiao, S.; Bu, K.; Wang, Y.; Wang, Y. Digital Transformation and Manufacturing Companies’ ESG Responsibility Performance. Financ. Res. Lett. 2023, 58, 104370. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, X. Top Management Team Functional Diversity and ESG Performance. Financ. Res. Lett. 2024, 63, 105362. [Google Scholar] [CrossRef]

- Aabo, T.; Giorici, I.C. Do Female CEOs Matter for ESG Scores? Glob. Financ. J. 2023, 56, 100722. [Google Scholar] [CrossRef]

- Tang, Y.; Qian, C.; Chen, G.; Shen, R. How CEO Hubris Affects Corporate Social (Ir)Responsibility: CEO Hubris and CSR. Strat. Manag. J. 2015, 36, 1338–1357. [Google Scholar] [CrossRef]

- Cho, T.S.; Hambrick, D.C. Attention as the Mediator between Top Management Team Characteristics and Strategic Change: The Case of Airline Deregulation. Organ Sci. 2006, 17, 453–469. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P. The Power of One to Make a Difference: How Informal and Formal CEO Power Affect Environmental Sustainability. J. Bus. Ethics 2017, 145, 293–308. [Google Scholar] [CrossRef]

- Zhang, J.; Li, Y.; Xu, H.; Ding, Y. Can ESG Ratings Mitigate Managerial Myopia? Evidence from Chinese Listed Companies. Int. Rev. Financ. Anal. 2023, 90, 102878. [Google Scholar] [CrossRef]

- Deng, M.; Tang, H.; Luo, W. Can the Green Experience of CEO Improve ESG Performance in Heavy Polluting Companies? Evidence from China. Manag. Decis. Econ. 2024, 45, 2373–2392. [Google Scholar] [CrossRef]

- Ren, S.; Wang, Y.; Hu, Y.; Yan, J. CEO Hometown Identity and Firm Green Innovation. Bus. Strateg. Environ. 2021, 30, 756–774. [Google Scholar] [CrossRef]

- Khanchel, I.; Lassoued, N.; Khiari, C. Watch Me Invest: Does CEO Narcissism Affect Green Innovation? CEO Personality Traits and Eco-Innovation. Bus. Ethics Environ. Responsib. 2024, 33, 486–504. [Google Scholar] [CrossRef]

- Wang, L.; Li, Y.; Lu, S.; Boasson, V. The Impact of the CEO’s Green Ecological Experience on Corporate Green Innovation-The Moderating Effect of Corporate Tax Credit Rating and Tax Burden. Front. Environ. Sci. 2023, 11, 1126692. [Google Scholar] [CrossRef]

- Wu, J.; Xia, Q.; Li, Z. Green Innovation and Enterprise Green Total Factor Productivity at a Micro Level: A Perspective of Technical Distance. J. Clean Prod. 2022, 344, 131070. [Google Scholar] [CrossRef]

- Du, K.; Li, J. Towards a Green World: How Do Green Technology Innovations Affect Total-Factor Carbon Productivity. Energy Policy 2019, 131, 240–250. [Google Scholar] [CrossRef]

- Singh, S.K.; Del Giudice, M.; Chiappetta Jabbour, C.J.; Latan, H.; Sohal, A.S. Stakeholder Pressure, Green Innovation, and Performance in Small and Medium-Sized Enterprises: The Role of Green Dynamic Capabilities. Bus. Strateg. Environ. 2022, 31, 500–514. [Google Scholar] [CrossRef]

- Johns, G. Advances in the Treatment of Context in Organizational Research. Annu. Rev. Organ. Psychol. Organ. Behav. 2018, 5, 21–46. [Google Scholar] [CrossRef]

- Janani, S.; Christopher, R.M.; Nikolov, A.N.; Wiles, M.A. Marketing Experience of CEOs and Corporate Social Performance. J. Acad. Mark. Sci. 2022, 50, 460–481. [Google Scholar] [CrossRef]

- Wangrow, D.B.; Schepker, D.J.; Barker, V.L. Managerial Discretion: An Empirical Review and Focus on Future Research Directions. J. Manag. 2015, 41, 99–135. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Quigley, T.J. Toward More Accurate Contextualization of the CEO Effect on Firm Performance. Strateg. Manag. J. 2014, 35, 473–491. [Google Scholar] [CrossRef]

- Panda, D.K. The Green Identity and Green Strategy: An Interplay. Technol. Anal. Strateg. Manag. 2023, 35, 1437–1452. [Google Scholar] [CrossRef]

- Sang, S.; Yan, A.; Ahmad, M. CEO Experience and Enterprise Environment, Social and Governance Performance: Evidence from China. Sustainability 2024, 16, 4403. [Google Scholar] [CrossRef]

- Li, J.; Tang, Y. CEO Hubris and Firm Risk Taking in China: The Moderating Role of Managerial Discretion. Acad. Manag. J. 2010, 53, 45–68. [Google Scholar] [CrossRef]

- Hu, J.; Zou, Q.; Yin, Q. Research on the Effect of ESG Performance on Stock Price Synchronicity: Empirical Evidence from China’s Capital Markets. Financ. Res. Lett. 2023, 55, 103847. [Google Scholar] [CrossRef]

- Zhang, W.; Zhao, Y.; Meng, F. ESG Performance and Green Innovation of Chinese Enterprises: Based on the Perspective of Financing Constraints. J. Environ. Manag. 2024, 370, 122955. [Google Scholar] [CrossRef] [PubMed]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).