Enterprise Architecture for Sustainable SME Resilience: Exploring Change Triggers, Adaptive Capabilities, and Financial Performance in Developing Economies

Abstract

1. Introduction

- (1)

- What types of change events are recognized within the context of enterprise architecture (EA) in SMEs and how can these events be systematically classified?

- (2)

- How do improvisational capabilities impact SMEs’ financial performance during times of environmental uncertainty?

- (3)

- What role do flexible IT systems play in mediating the relationship between improvisational capabilities and financial performance?

- (4)

- How does organizational culture mediate the impact of improvisational capabilities on SMEs’ financial performance?

2. Literature Review

2.1. Enterprise Architecture and Change Events

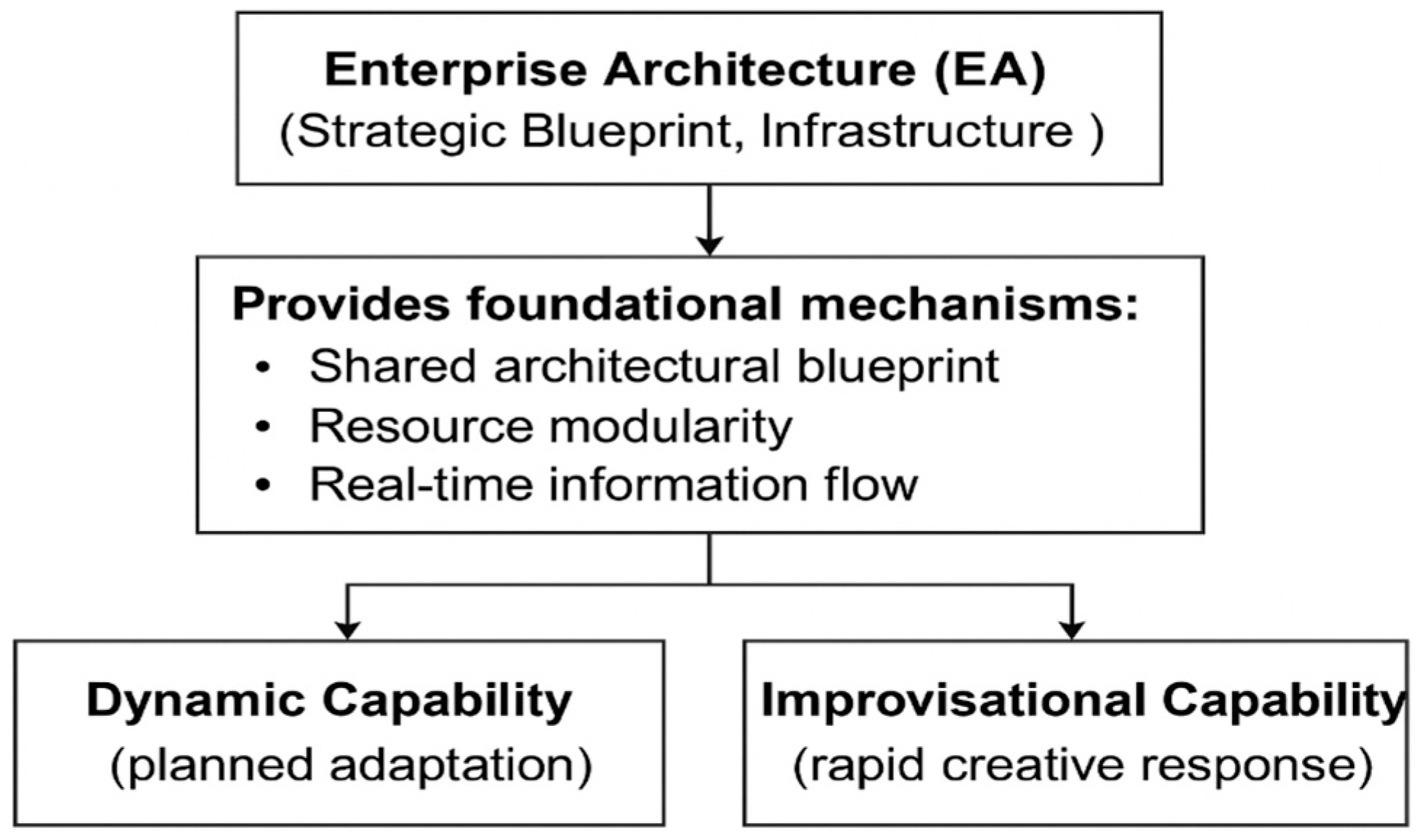

2.2. EA-Driven Capabilities and Organizational Adaptability

2.3. EA-Enabled Sustainability

3. Conceptual Framework and Hypotheses Development

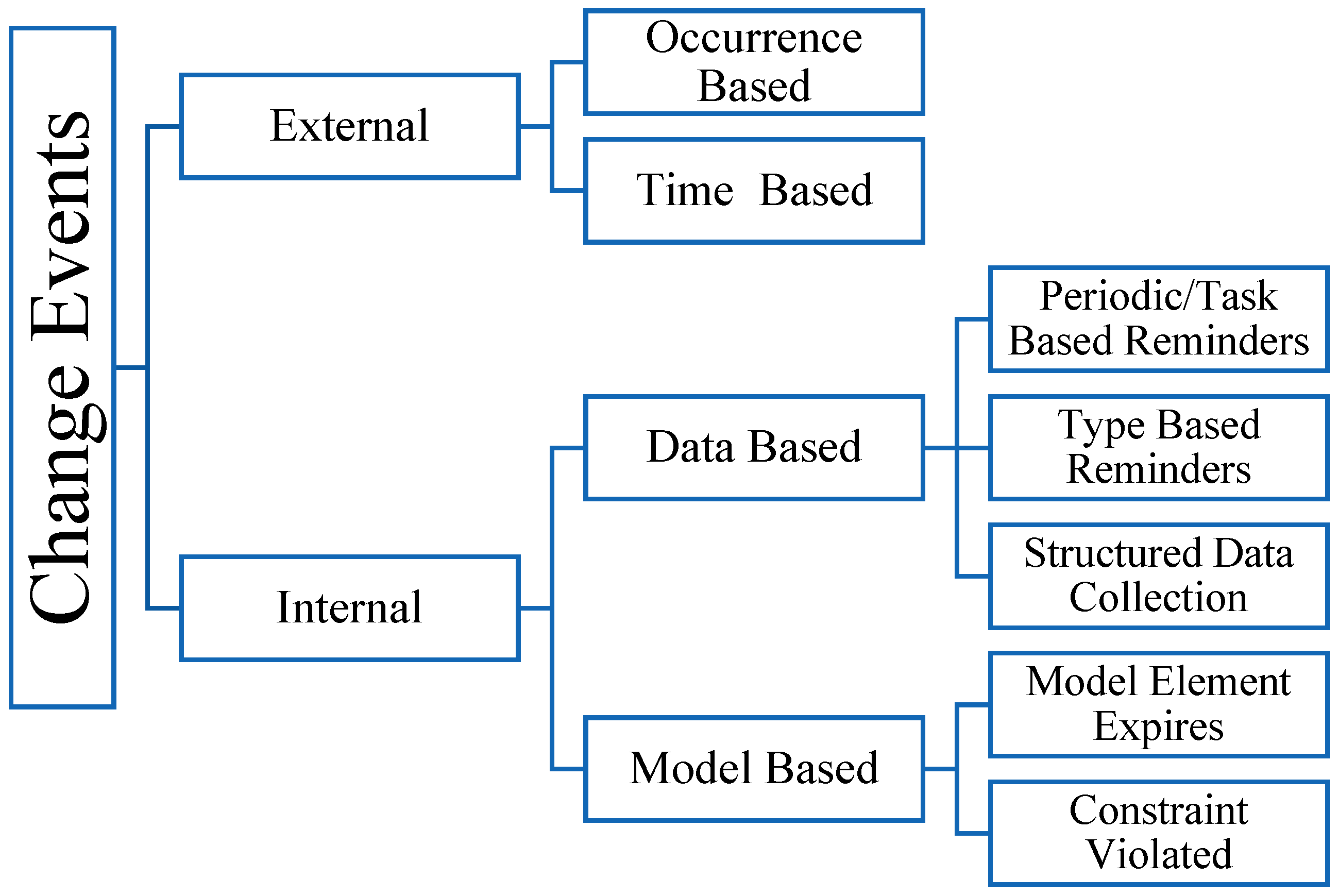

3.1. EA-Driven Change Events

3.1.1. External Change Events

- (a)

- Occurrence-based events

- These events emerge due to external turbulence, including technological innovations, changing market landscapes, and global crises, such as the COVID-19 pandemic, compelling organizations to adapt swiftly. Such phenomena are often described as manifestations of environmental dynamism. The triggers for these adaptive responses can be systematically categorized according to various dimensions:

- Frequency: Time span between event occurrences.

- Amplitude: Magnitude of deviation from the initial conditions caused by the event.

- Predictability: Degree of irregularity in the overall pattern of events.

- Velocity: The rate of change to be adopted as a result of the event.

- (b)

- Time-based events

- These triggers are activated at predetermined intervals aligned with the organization’s operational or strategic cycles. Often arising from scheduled activities, such as periodic strategic planning sessions, they systematically assess and realign the organization’s direction, serving as catalysts for change within the enterprise architecture.

3.1.2. Internal Change Events

- (a)

- Data-based events

- These originate from data sources and necessitate updates to the EA model to reflect new or changed data. Following the framework by Farwick et al. [17], these events prompt manual, semi-automated, or fully automated updates.

- Periodic/task-based reminders:

- These reminders are meant to prompt manual data collection from stakeholders at regular intervals in order to initiate the change process. A specific person is responsible for certain parts of the model. The frequency is also set to update the data and, if necessary, to check for model changes. Finally, the EA team or a supporting tool will trigger the change process at a predefined frequency.

- Type-based reminders:

- This approach activates the change process through events identified within information systems. For instance, a change in architecture signaled by a project within a project portfolio management tool could be a catalyst. This is particularly valuable in scenarios where structured data sources are not suited to address EA modifications. This method proves beneficial in organizations where specific event sources are configured to detect and act upon EA-relevant changes, ensuring the architecture remains current and aligned with organizational objectives.

- Structured data collection:

- The initiation of the change process occurs upon the commencement of importing data, facilitated either through a structured data source initiating a push or an EA tool executing a pull operation. This method leverages automated data collection mechanisms, utilizing sources such as enterprise service buses (ESBs) and configuration management databases (CMDBs), which furnish structured, EA-pertinent data directly applicable to the model. However, it is essential to note that the accessibility and applicability of such data sources might vary, rendering this approach infeasible for specific organizations due to their unavailability.

- (b)

- Model-based events

- These events are internally triggered by the EA model elements. Change is initiated in these situations under two circumstances.

- Model Element Expires:

- EA artifacts possess varying lifespans. Identifying the impending expirations of model elements facilitates the generation of model expiration events. These events serve as triggers to commence the change cycle. Specifically, a model expiry event is activated when the elapsed time since a model element’s last review or modification surpasses its designated lifespan, signaling the need for updates or revisions.

- Constraint Violation:

- This method involves applying specific constraints to model elements within the EA. Change events are triggered when any of these constraints are breached, effectively initiating the change cycle. This process ensures the EA model remains compliant and up-to-date by identifying and addressing violations promptly.

3.2. Adaptive Capabilities in the EA Context

- (1)

- Improvisational Capability: The ability of an organization to spontaneously develop novel responses under time pressure and ambiguity. It involves real-time learning and action without pre-existing procedures.

- (2)

- Flexible IT Systems: IT systems that are modular, scalable, and capable of supporting rapid reconfiguration when new environmental demands arise.

- (3)

- Organizational Culture: Shared values and behavioral norms that facilitate or hinder strategic responsiveness and employee-level improvisation.

3.3. Conceptual Model

3.4. Hypothesis Development

3.4.1. Improvisational Capability and Organization’s Financial Performance in Sudden Environmental Change

3.4.2. Organizational Culture Mediates the Link Between Improvisation Capability and Organizational Financial Performance Under Natural Uncertainties

3.4.3. Flexible IT Mediates the Link Between Improvisation Capability and Organizational Financial Performance During Natural Uncertainties

3.4.4. Role of Organizational Culture in Showing Better Financial Performance When Dealing with Environmental Change

3.4.5. Effect of Flexible IT Systems on Organization Financial Performance During Environmental Changes

4. Empirical Study: Testing the Model Under COVID-19 Context

4.1. Research Methodology and Sampling Approach

4.1.1. Sample Demographics

4.1.2. Data Collection and Analysis

4.1.3. Variable Measurement

- (a)

- Independent variable

- Improvisational capability was measured using a seven-item scale reflecting three interrelated dimensions:

- Speedy response: the ability to minimize the time lag between planning and execution.

- Reconfigurability: the capacity to rapidly recombine and reuse available resources.

- Novel solutions: the ability to generate creative, context-specific responses to unpredictable disruptions.

- These items capture the organization’s capacity to act flexibly and effectively during high-uncertainty conditions.

- (b)

- Mediating variable

- Two mediating variables, organizational culture and flexible IT systems, were considered in the analysis.

- Flexible IT systems were measured using a seven-item scale reflecting the following dimensions:

- Modularity: the ease of decoupling and recombining digital infrastructure.

- Connectivity: the extent to which IT systems can communicate and exchange data across functional boundaries.

- Compatibility: the alignment between IT systems and operational processes.

- Organizational culture was measured using an eight-item scale comprising three dimensions:

- Top Management Support: leadership commitment to responsiveness and innovation.

- Innovation Orientation: organizational openness to novel ideas and experimentation.

- Employee Learning and Training: the cultivation of skills that support adaptability.

- (c)

- Dependent Variable

- Organizational financial performance was treated as the dependent variable, measured through four items designed to assess the construct. These items were designed to evaluate the firm’s self-reported financial outcomes during the COVID-19 period, emphasizing stability, profitability, and goal attainment. The final items were as follows:

- OP1: Our financial performance has remained stable during the pandemic.

- OP2: Our profitability has been higher than that of our competitors.

- OP3: Our organization achieved its revenue targets during the pandemic.

- OP4: Our sales and profitability levels met or exceeded expectations.

4.2. Analysis and Results

5. Discussion

6. Limitations and Future Research

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Institute of Electrical and Electronics Engineers; IEEE Computer Society; Software Engineering Standards Subcommittee; IEEE Standards Association; IEEE Standards Board. IEEE Recommended Practice for Architectural Description; Institute of Electrical and Electronics Engineers: New York, NY, USA, 2000. [Google Scholar]

- Kotusev, S. Enterprise Architecture: What Did We Study? Int. J. Coop. Inf. Syst. 2017, 26, 1730002. [Google Scholar] [CrossRef]

- Van de Wetering, R. Dynamic enterprise architecture capabilities and organizational benefits: An empirical mediation study. arXiv 2021. [Google Scholar] [CrossRef]

- Ettahiri, I.; Rassam, L.; Doumi, K.; Zellou, A. An Overview Towards the Assessment and Measurement of Enterprise Architecture Dynamics. Procedia Comput. Sci. 2025, 256, 300–307. [Google Scholar] [CrossRef]

- Van de Wetering, R. Dynamic Enterprise Architecture Capabilities: Conceptualization and Validation. In Business Information Systems; Abramowicz, W., Corchuelo, R., Eds.; Lecture Notes in Business Information Processing; Springer International Publishing: Cham, Switzerland, 2019; pp. 221–232. [Google Scholar] [CrossRef]

- Buonasera, A.; Noto, G.; Rappazzo, N. Integrating sustainability into PMM systems of small businesses: Some future research directions. Meas. Bus. Excell. 2025, 29, 18–41. [Google Scholar] [CrossRef]

- Edobor, F.; Sambo-Magaji, A. Small and Medium Enterprises (SMEs) and Sustainable Economic Development. In Digital Transformation for Business Sustainability and Growth in Emerging Markets; Emerald Publishing Limited: Leeds, UK, 2025; pp. 197–222. [Google Scholar] [CrossRef]

- Abraham, R.; Aier, S.; Winter, R. Two Speeds of EAM—A Dynamic Capabilities Perspective. In Trends in Enterprise Architecture Research and Practice-Driven Research on Enterprise Transformation; Aier, S., Ekstedt, M., Matthes, F., Proper, E., Sanz, J.L., Eds.; Lecture Notes in Business Information Processing; Springer: Berlin/Heidelberg, Germany, 2012; Volume 131, pp. 111–128. [Google Scholar] [CrossRef]

- Pavlou, P.A.; Sawy, O.A.E. The “Third Hand”: IT-Enabled Competitive Advantage in Turbulence Through Improvisational Capabilities. Inf. Syst. Res. 2010, 21, 443–471. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Buckl, S. Developing Organization-Specific Enterprise Architecture Management Functions Using a Method Base; Technische Universität München: München, Germany, 2011. [Google Scholar]

- Fischer, R.; Aier, S.; Winter, R. A Federated Approach to Enterprise Architecture Model Maintenance. Enterp. Model. Inf. Syst. Archit. (EMISAJ) 2007, 2, 14–22. [Google Scholar] [CrossRef]

- Mannapur, S.B. Event-Driven Architectures: A Technical Deep Dive into Scalable AI And Data Workflows. Int. J. Comput. Eng. Technol. IJCET 2025, 16, 316–328. [Google Scholar] [CrossRef]

- Dam, H.K.; Lê, L.-S.; Ghose, A. Managing changes in the enterprise architecture modelling context. Enterp. Inf. Syst. 2016, 10, 666–696. [Google Scholar] [CrossRef]

- de Boer, F.S.; Bonsangue, M.M.; Groenewegen, L.P.J.; Stam, A.W.; Stevens, S.; van der Torre, L. Change impact analysis of enterprise architectures. In Proceedings of the IRI—2005 IEEE International Conference on Information Reuse and Integration, Conf, 2005, Las Vegas, NV, USA, 15–17 August 2005; IEEE: Piscataway, NJ, USA, 2005; pp. 177–181. [Google Scholar] [CrossRef]

- Winter, K.; Buckl, S.; Matthes, F.; Schweda, C. Invenstigating the state-of-the-art in enterprise architecture management methods in literature and practice. In MCIS 2010 Proceedings; Association for Information Systems: Atlanta, GA, USA, 2010. [Google Scholar]

- Farwick, M.; Schweda, C.M.; Breu, R.; Hanschke, I. A situational method for semi-automated Enterprise Architecture Documentation. Softw. Syst. Model. 2016, 15, 397–426. [Google Scholar] [CrossRef]

- Weber, M.; Engert, M.; Schaffer, N.; Weking, J.; Krcmar, H. Organizational Capabilities for AI Implementation—Coping with Inscrutability and Data Dependency in AI. Inf. Syst. Front. 2023, 25, 1549–1569. [Google Scholar] [CrossRef]

- Van Riel, J.; Poels, G.; Koutsopoulos, G.; Calhau, R.F.; Bider, I.; Perjons, E.; Wautelet, Y.; Tsilionis, K. Advancing the Domain of Strategy Planning and Implementation through Enterprise Architecture: A Research Agenda for Capability-Based Management. Commun. Assoc. Inf. Syst. 2025, 56, 155–166. [Google Scholar] [CrossRef]

- Pathak, S.; Krishnaswamy, V.; Sharma, M. A dynamic capability perspective on the impact of big data analytics and enterprise architecture on innovation: An empirical study. J. Enterp. Inf. Manag. 2025, 38, 532–563. [Google Scholar] [CrossRef]

- Pattij, M.; Van De Wetering, R.; Kusters, R. Enhanced digital transformation supporting capabilities through enterprise architecture management: A fsQCA perspective. Digit. Bus. 2022, 2, 100036. [Google Scholar] [CrossRef]

- Van De Wetering, R. The role of enterprise architecture-driven dynamic capabilities and operational digital ambidexterity in driving business value under the COVID-19 shock. Heliyon 2022, 8, e11484. [Google Scholar] [CrossRef] [PubMed]

- Carvalho, A. A Duality Model of Dynamic Capabilities: Combining Routines and Improvisation. Adm. Sci. 2023, 13, 84. [Google Scholar] [CrossRef]

- Zhang, J.; Chen, Y.; Li, Q.; Li, Y. A review of dynamic capabilities evolution—Based on organisational routines, entrepreneurship and improvisational capabilities perspectives. J. Bus. Res. 2023, 168, 114214. [Google Scholar] [CrossRef]

- van de Wetering, R.; Dijkman, J. Enhancing digital platform capabilities and networking capability with EA-driven dynamic capabilities. In Proceedings of the Twenty-Seventh Americas Conference on Information Systems, Proceedings of the 27th Americas Conference on Information Systems, Montreal, QC, Canada, 9–13 August 2021; AIS Electronic Library: Atlanta, GA, USA, 2021. [Google Scholar]

- Van De Wetering, R.; Kurnia, S.; Kotusev, S. The Effect of Enterprise Architecture Deployment Practices on Organizational Benefits: A Dynamic Capability Perspective. Sustainability 2020, 12, 8902. [Google Scholar] [CrossRef]

- Leybourne, S.A. Culture and Organizational Improvisation in UK Financial Services. J. Serv. Sci. Manag. 2009, 02, 237–254. [Google Scholar] [CrossRef]

- Kim, S.-H.; Shim, J.-S. The Impact of Organizational Improvisation on Market Orientation. Int. J. Contents 2012, 8, 82–87. [Google Scholar] [CrossRef]

- Liao, Z.; Huang, C.; Yu, Y.; Xiao, S.(Simon); Zhang, J.Z.; Behl, A.; Pereira, V.; Ishizaka, A. Linking experimental culture, improvisation capability and firm’s performance: A theoretical view. J. Knowl. Manag. 2023, 27, 2671–2685. [Google Scholar] [CrossRef]

- Nogueira, E.; Gomes, S.; Lopes, J.M. Financial Sustainability: Exploring the Influence of the Triple Bottom Line Economic Dimension on Firm Performance. Sustainability 2024, 16, 6458. [Google Scholar] [CrossRef]

- Linger, H. Building Sustainable Information Systems: Proceedings of the 2012 International Conference on Information Systems Development; Springer: New York, NY, USA, 2013. [Google Scholar]

- Thirasakthana, M.; Kiattisin, S. Sustainable Government Enterprise Architecture Framework. Sustainability 2021, 13, 879. [Google Scholar] [CrossRef]

- Liao, M.-H.; Wang, C.-T. Using Enterprise Architecture to Integrate Lean Manufacturing, Digitalization, and Sustainability: A Lean Enterprise Case Study in the Chemical Industry. Sustainability 2021, 13, 4851. [Google Scholar] [CrossRef]

- Hussein, S.S.; Ramly, N.; Ahmad, W.A.Z.W.; Ridzuan, M.I.A.M.; Salehen, P.M.W.; Dang, D. Achieving Sustainable Digital Transformation in TVET Institutionsthrough Enterprise Architecture. JTET 2024, 16, 51–62. [Google Scholar] [CrossRef]

- Kamalabai, N.E.; Donoghue, I.; Hannola, L. Sustainable Enterprise Architecture: A Critical Imperative for Substantiating Artificial Intelligence. In Proceedings of the 2024 Portland International Conference on Management of Engineering and Technology (PICMET), Portland, OR, USA, 4–8 August 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1–12. [Google Scholar]

- Goodman, P.S.; Kurke, L.B. Studies of Change in Organizations: A Status Report; Organizational Effectiveness Research Group, Office of Naval Research: Arlington, VA, USA, 1982. [Google Scholar]

- Farwick, M.; Schweda, C.M.; Breu, R.; Voges, K.; Hanschke, I. On Enterprise Architecture Change Events. In Trends in Enterprise Architecture Research and Practice-Driven Research on Enterprise Transformation; Aier, S., Ekstedt, M., Matthes, F., Proper, E., Sanz, J.L., Eds.; Lecture Notes in Business Information Processing; Springer: Berlin/Heidelberg, Germany, 2012; Volume 131, pp. 129–145. [Google Scholar] [CrossRef]

- Kung, L.; Kung, H.-J. Organization Improvisational Capability: Scale Development and Validation. SIGMIS Database 2019, 50, 94–110. [Google Scholar] [CrossRef]

- Jun, W.; Nasir, M.H.; Yousaf, Z.; Khattak, A.; Yasir, M.; Javed, A.; Shirazi, S.H. Innovation performance in digital economy: Does digital platform capability, improvisation capability and organizational readiness really matter? Eur. J. Innov. Manag. 2022, 25, 1309–1327. [Google Scholar] [CrossRef]

- Ma, H.; Lang, C.; Sun, Q.; Singh, D. Capability development in startup and mature enterprises. Manag. Decis. 2021, 56, 1442–1461. [Google Scholar] [CrossRef]

- e Cunha, M.P.; Clegg, S. Improvisation in the learning organization: A defense of the infra-ordinary. Learn. Organ. 2019, 26, 238–251. [Google Scholar] [CrossRef]

- Gao, P.; Song, Y.; Mi, J. Organizational improvisation and product innovation performance: A meta-analysis. Metall. Min. Ind. 2015, 7, 221–232. [Google Scholar]

- Zeb, A.; Akbar, F.; Hussain, K.; Safi, A.; Rabnawaz, M.; Zeb, F. The competing value framework model of organizational culture, innovation and performance. Bus. Process Manag. J. 2021, 27, 658–683. [Google Scholar] [CrossRef]

- Brown, S.L.; Eisenhardt, K.M. The Art of Continuous Change: Linking Complexity Theory and Time-Paced Evolution in Relentlessly Shifting Organizations. Adm. Sci. Q. 1997, 42, 1–34. [Google Scholar] [CrossRef]

- Galbraith, C.S. Transferring Core Manufacturing Technologies in High-Technology Firms. Calif. Manag. Rev. 1990, 32, 56–70. [Google Scholar] [CrossRef]

- Orlikowski, W.J. Improvising Organizational Transformation Over Time: A Situated Change Perspective. Inf. Syst. Res. 1996, 7, 63–92. [Google Scholar] [CrossRef]

- Nelson, K.M.; Nelson, H.J.; Ghods, M. Technology flexibility: Conceptualization, validation, and measurement. In Proceedings of the Thirtieth Hawaii International Conference on System Sciences, Wailea, HI, USA, 7–10 January 1997; IEEE Computer Society Press: Washington, DC, USA, 1997; Volume 3, pp. 76–87. [Google Scholar]

- Bocij, P.; Greasley, A.; Hickie, S. Business Information Systems: Technology, Development and Management for the Modern Business, 6th ed.; Pearson: New York, NY, USA, 2018. [Google Scholar]

- Milliman, J.; Glinow, M.A.V.; Nathan, M. Organizational Life Cycles and Strategic International Human Resource Management in Multinational Companies: Implications for Congruence Theory. Acad. Manag. Rev. 1991, 16, 318–339. [Google Scholar] [CrossRef]

- Ahmadi, J. The Impact of I.T. Capability on Company Performance: The Mediating Role of Business Process Management Capability and Supply Chain Integration Capability. J. Sci. Manag. Tour. Lett. 2021, 16, 1–16. [Google Scholar]

- Ness, L.; Fullerton, T. Information technology flexbility: A synthesized model from existing literature. J. Inf. Technol. Manag. 2010, 21, 51–59. [Google Scholar]

- Cui, X.; Hu, J. A Literature Review on Organization Culture and Corporate Performance. Int. J. Bus. Adm. 2012, 3, 28–37. [Google Scholar] [CrossRef]

- Imran, M.; Ismail, F.; Arshad, I.; Zeb, F.; Zahid, H. The mediating role of innovation in the relationship between organizational culture and organizational performance in Pakistan’s banking sector. J. Public Aff. 2022, 22, e2717. [Google Scholar] [CrossRef]

- Coyne, K.P. Sustainable competitive advantage—What it is, what it isn’t. Bus. Horiz. 1986, 29, 54–61. [Google Scholar] [CrossRef]

- Ira, L.; Gottlieb, Z. Jonathan Realigning Organization Culture for Optimal Performance: Six principles & eight practices. Organ. Dev. J. 2009, 27, 31–46. [Google Scholar]

- García-Morales, V.J.; Matías-Reche, F.; Verdú-Jover, A.J. Influence of Internal Communication on Technological Proactivity, Organizational Learning, and Organizational Innovation in the Pharmaceutical Sector. J. Commun. 2011, 61, 150–177. [Google Scholar] [CrossRef]

- Tarba, S.Y.; Ahammad, M.F.; Junni, P.; Stokes, P.; Morag, O. The Impact of Organizational Culture Differences, Synergy Potential, and Autonomy Granted to the Acquired High-Tech Firms on the M&A Performance. Group Organ. Manag. 2019, 44, 483–520. [Google Scholar] [CrossRef]

- Calori, R.; Sarnin, P. Corporate Culture and Economic Performance: A French Study. Organ. Stud. 1991, 12, 049–074. [Google Scholar] [CrossRef]

- Duncan, N.B. Capturing Flexibility of Information Technology Infrastructure: A Study of Resource Characteristics and Their Measure. J. Manag. Inf. Syst. 1995, 12, 37–57. [Google Scholar] [CrossRef]

- Gupta, Y.P.; Goyal, S. Flexibility of manufacturing systems: Concepts and measurements. Eur. J. Oper. Res. 1989, 43, 119–135. [Google Scholar] [CrossRef]

- Davenport, T.; Harris, J. Competing on Analytics: Updated, with a New Introduction: The New Science of Winning; Harvard Business Press: Brighton, MA, USA, 2017. [Google Scholar]

- Goldman, S.L.; Nagel, R.N.; Preiss, K. Agile Competitors and Virtual Organizations: Strategies for Enriching the Customer; Van Nostrand Reinhold: New York, NY, USA, 1995. [Google Scholar]

- Han, J.H.; Wang, Y.; Naim, M. Reconceptualization of information technology flexibility for supply chain management: An empirical study. Int. J. Prod. Econ. 2017, 187, 196–215. [Google Scholar] [CrossRef]

- Fiegenbaum, A.; Karnani, A. Output flexibility—A competitive advantage for small firms. Strat. Mgmt. J. 1991, 12, 101–114. [Google Scholar] [CrossRef]

- Hitt, L.M.; Brynjolfsson, E. Productivity, Business Profitability, and Consumer Surplus: Three Different Measures of Information Technology Value. MIS Q. 1996, 20, 121–142. [Google Scholar] [CrossRef]

- Grover, V.; Teng, J.; Segars, A.H.; Fiedler, K. The influence of information technology diffusion and business process change on perceived productivity: The IS executive’s perspective. Inf. Manag. 1998, 34, 141–159. [Google Scholar] [CrossRef]

- Sethi, V.; King, W.R. Development of Measures to Assess the Extent to Which an Information Technology Application Provides Competitive Advantage. Manag. Sci. 1994, 40, 1601–1627. [Google Scholar] [CrossRef]

- Hair, J.F. (Ed.) A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Sage: Los Angeles, CA, USA, 2017. [Google Scholar]

- Preacher, K.J.; Hayes, A.F. SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behav. Res. Methods Instrum. Comput. 2004, 36, 717–731. [Google Scholar] [CrossRef] [PubMed]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef] [PubMed]

- Lohmöller, J.-B. Latent Variable Path Modeling with Partial Least Squares; Springer: Berlin/Heidelberg, Germany, 1989. [Google Scholar]

- Stevens, J.P. Applied Multivariate Statistics for the Social Sciences, 5th ed.; Taylor and Francis: London, UK, 2009. [Google Scholar]

- Cheung, G.W.; Cooper-Thomas, H.D.; Lau, R.S.; Wang, L.C. Reporting reliability, convergent and discriminant validity with structural equation modeling: A review and best-practice recommendations. Asia Pac. J. Manag. 2024, 41, 745–783. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 8th ed.; Cengage: Andover, UK, 2019. [Google Scholar]

- Joreskog, K.; Sorbom, D. PRELIS 2 User’s Reference Guide; Scientific Software: Chapel Hill, NC, USA, 1996. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Cameron, K.S.; Quinn, R.E. Diagnosing and Changing Organizational Culture: Based on the Competing Values Framework, 3rd ed.; The Jossey-Bass Business & Management Series; Jossey-Bass: San Francisco, CA, USA, 2011. [Google Scholar]

- Denison, D.R. Corporate Culture and Organizational Effectiveness; Wiley Series on Organizational Assessment and Change; Wiley: New York, NY, USA, 1990. [Google Scholar]

| Change Event | Description | Sources |

|---|---|---|

| Event-based | Triggered by events that occur outside the EA model. | Abraham, Aier, and Winter [8]; Buckl [11], Pavlou and Sawy [9]; Eisenhardt & Martin [10]; Winter [16]. |

| Time-based | Triggered due to activities conducted after a predetermined amount of time. | Fischer, et al. [12], Buckl [11] |

| Data-driven | Triggered by data sources. | Mannapur [13]; Farwick et al. [17], Fischer, et al. [12]. |

| Internal Model Events | Internally triggered by the EA model | Farwick et al. [17], Dam et al. [13], Lê, and Ghose [14], and de Boer et al. [15]. |

| Criteria | Dynamic Capabilities | Improvisational Capabilities |

|---|---|---|

| Type of Event | Predictable, expected, planned environmental events (“waves”) | Unpredictable, novel, sudden environmental events (“storms”) |

| Organizational Response Required | Strategic, long-term reconfiguration efforts | Short-term, spontaneous adaptations using current resources |

| Process Structure | Systematic and guided by planned frameworks | Informal, often intuitive, unstructured. |

| Time requirements | Adequate time available for planning evaluation and execution. | Requires immediate response. |

| Type of Environmental Turbulence | Frequency | Amplitude | Predictability | Velocity |

|---|---|---|---|---|

| Waves | High | High | High | Low |

| Storms | Low | High | Low | High |

| Event Type | Origin | Predictability | Nature of Response | Example |

|---|---|---|---|---|

| Occurrence-based | External | Low/Variable | Dynamic/Improvisational | Pandemic outbreak, sudden market shift, emergence of IoT/AI technologies |

| Time-based | External | High | Proactive and planned | Annual strategic planning cycle |

| Data-based | Internal | High/Moderate | Routine updating | Regular data input from CRM or ESB system |

| Model-based | Internal | High | Compliance driven updating | Expiry of an architecture element, constrain violation |

| Category | Subcategory | Number of Employees | Percentage (%) |

|---|---|---|---|

| Years in Operation (Years) | 10 | 154 | 52.92% |

| 15 | 106 | 36.43% | |

| 20 and above | 31 | 10.65% | |

| Firm Size (Employees) | >50 | 58 | 46.05% |

| >100 | 53 | 19.93% | |

| >150 | 46 | 18.21% | |

| >200 | 121 | 15.81% | |

| Employee Experience (Years) | 5~10 | 121 | 41.58% |

| 11~15 | 60 | 20.62% | |

| 16~20 | 71 | 24.40% | |

| Above 20 | 39 | 13.40% | |

| Educational Level | Higher secondary school (12 years) | 105 | 36.08% |

| Bachelor’s degree (14 years) | 115 | 39.51% | |

| Master’s or higher degree | 71 | 24.39% |

| Latent Variable | Indicator | F-L | AVE | CR |

|---|---|---|---|---|

| Improvisational Capability (IC) | IC1 | 0.763 | ||

| IC2 | 0.907 | |||

| IC3 | 0.747 | |||

| IC4 | 0.699 | 0.515 | 0.860 | |

| IC5 | 0.603 | |||

| IC6 | 0.591 | |||

| IC7 | 0.539 | |||

| Organization IT architecture flexibility (OIT) | OIT1 | 0.549 | ||

| OIT 2 | 0.761 | |||

| OIT 3 | 0.744 | |||

| OIT 4 | 0.632 | 0.5068 | 0.8769 | |

| OIT 5 | 0.613 | |||

| OIT 6 | 0.760 | |||

| OIT 7 | 0.821 | |||

| Organizational Culture (OC) | OC1 | 0.787 | ||

| OC 2 | 0.735 | |||

| OC 3 | 0.835 | |||

| OC 4 | 0.826 | |||

| OC 5 | 0.652 | 0.537 | 0.902 | |

| OC 6 | 0.622 | |||

| OC 7 | 0.610 | |||

| OC 8 | 0.793 | |||

| Organizational Performance (OP) | OP1 | 0.863 | ||

| OP 2 | 0.626 | 0.601 | 0.856 | |

| OP 3 | 0.798 | |||

| OP 4 | 0.763 | |||

| χ2 | DF | χ2/DF | GFI | AGFI | CFI | RMSEA | RMR |

|---|---|---|---|---|---|---|---|

| 420.545 | 240 | 1.745 | 0.901 | 0.89 | 0.907 | 0.072 | 0.704 |

| Variables | IC | OIT | OC | OP |

|---|---|---|---|---|

| Improvisational Capability (IC) | 0.718 | |||

| Organization IT architecture flexibility (OIT) | 0.570 | 0.711 | ||

| Organizational Culture (OC) | 0.554 | 0.698 | 0.733 | |

| Organizational Performance (OP) | 0.616 | 0.540 | 0.463 | 0.775 |

| Hypothesis | Relationship | Beta-Value | S.E. | Z2 | p-Value | Remarks |

|---|---|---|---|---|---|---|

| H1 | Imp capability → Org financial Performance. | 0.758 | 0.226 | 3.361 | 0.001 | Supported |

| H4 | Org Culture → Org financial Performance. | 0.101 | 0.131 | 0.766 | 0.444 | Not-Supported |

| H5 | Flexible IT systems → Org financial Performance. | 0.614 | 0.131 | 4.672 | p < 0.001 | Supported |

| Hypothesis | Relation | Indirect Effect | 95% Bootstrapped CI | p-Value | Remarks |

|---|---|---|---|---|---|

| H2 | Imp capability → Org Culture → Org financial Performance | 0.260 | −0.041, 0.511 | 0.112 | No-mediation |

| H3 | Imp capability → Flexible IT → Org financial Performance | 0.03 | 0.011, 0.064 | 0.018 | Partial mediation |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hamidani, J.Y.; Ali, H. Enterprise Architecture for Sustainable SME Resilience: Exploring Change Triggers, Adaptive Capabilities, and Financial Performance in Developing Economies. Sustainability 2025, 17, 6688. https://doi.org/10.3390/su17156688

Hamidani JY, Ali H. Enterprise Architecture for Sustainable SME Resilience: Exploring Change Triggers, Adaptive Capabilities, and Financial Performance in Developing Economies. Sustainability. 2025; 17(15):6688. https://doi.org/10.3390/su17156688

Chicago/Turabian StyleHamidani, Javeria Younus, and Haider Ali. 2025. "Enterprise Architecture for Sustainable SME Resilience: Exploring Change Triggers, Adaptive Capabilities, and Financial Performance in Developing Economies" Sustainability 17, no. 15: 6688. https://doi.org/10.3390/su17156688

APA StyleHamidani, J. Y., & Ali, H. (2025). Enterprise Architecture for Sustainable SME Resilience: Exploring Change Triggers, Adaptive Capabilities, and Financial Performance in Developing Economies. Sustainability, 17(15), 6688. https://doi.org/10.3390/su17156688