Financial Technology Expenditure and Green Total Factor Productivity: Influencing Mechanisms and Threshold Effects

Abstract

1. Introduction

2. Literature Review

2.1. Research on GTFP

2.1.1. Measurement of GTFP

2.1.2. Influencing Factors of GTFP

2.2. Financial Technology Expenditure and GTFP

2.3. Research Gaps and Contribution

3. Theoretical Framework

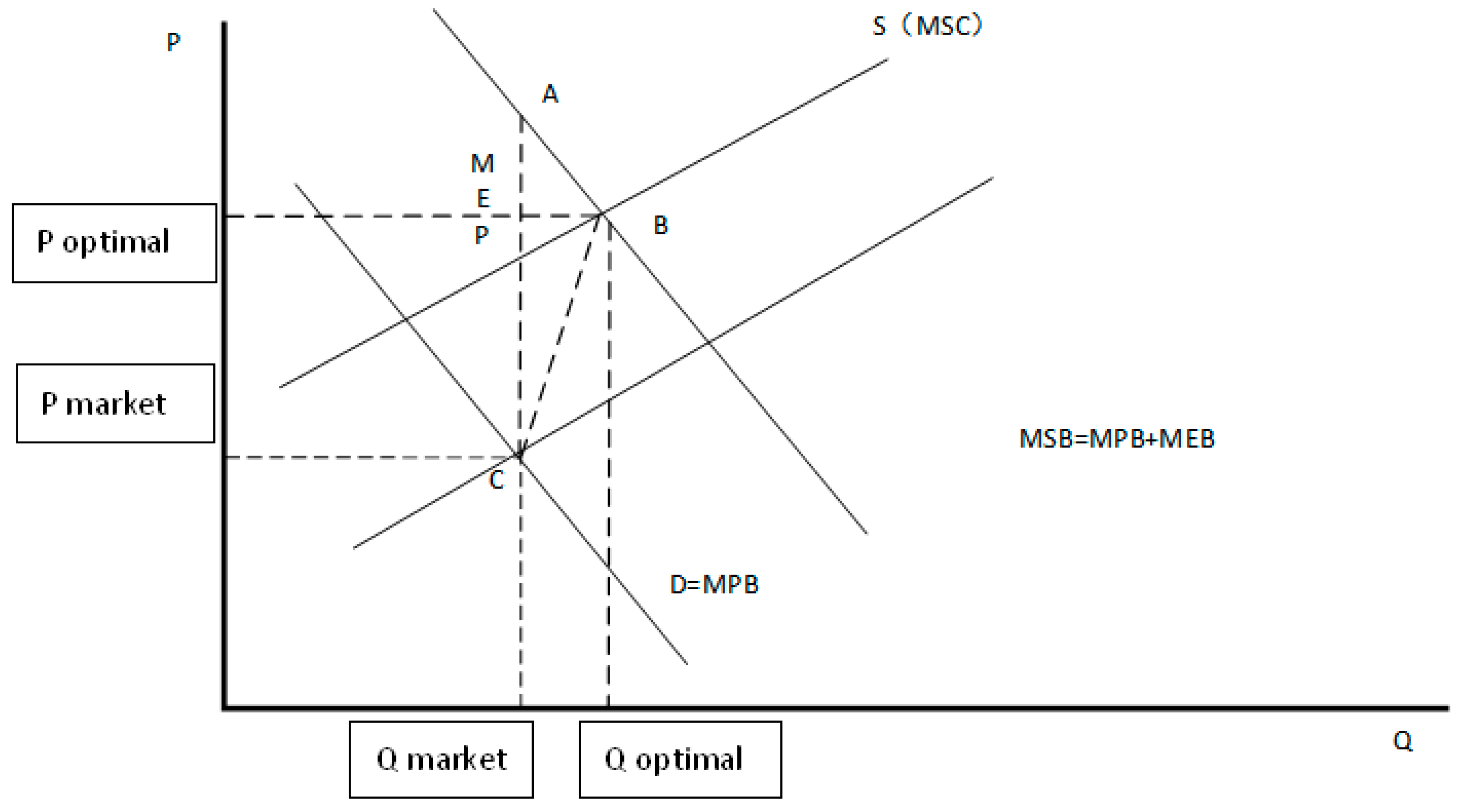

3.1. The Impact of Financial Technology Expenditure on GTFP

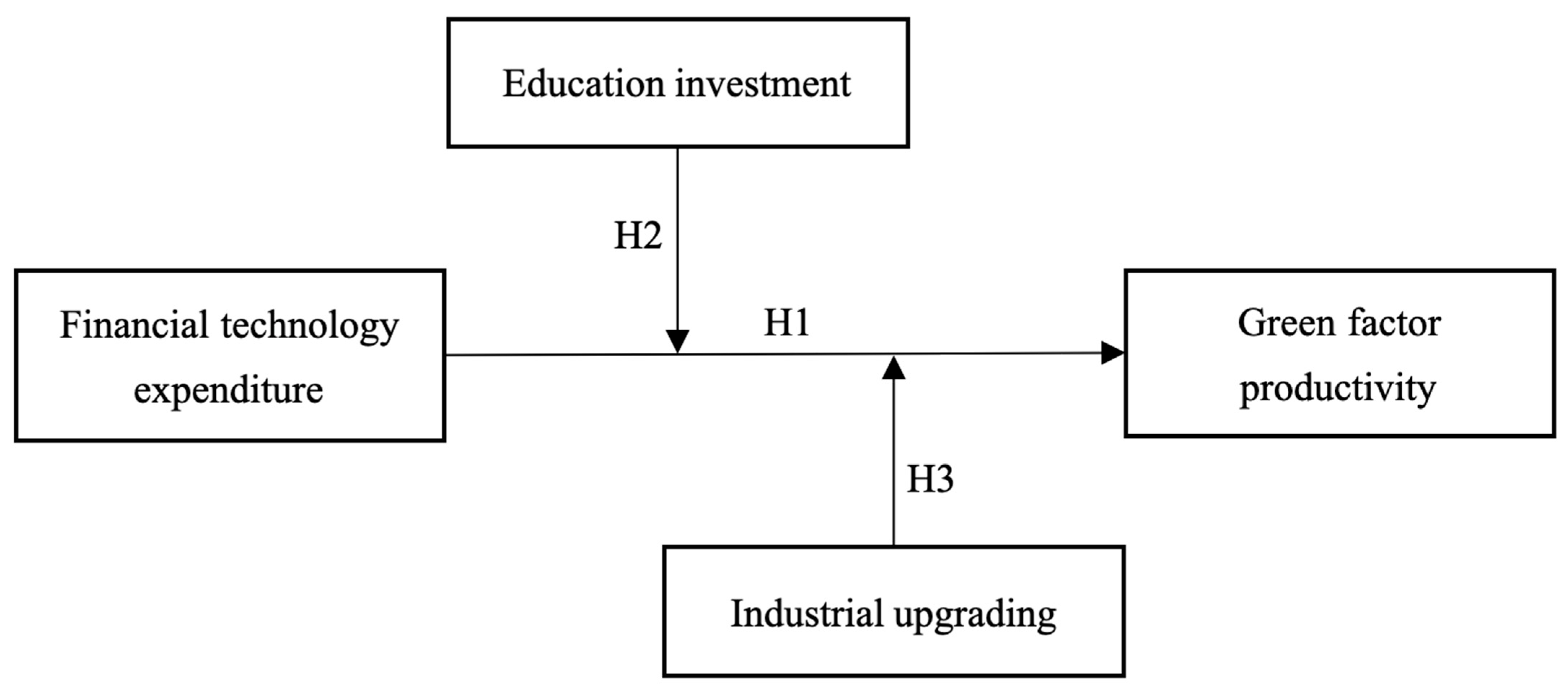

3.2. Transmission Mechanism of Financial Technology Expenditures Promoting the Growth of GTFP

4. Framework Design

4.1. Econometric Model

4.2. Variable Description

4.3. Data Description

5. Empirical Analysis

5.1. Stationarity Test

5.2. Cointegration Test

5.3. Determination of the Optimal Lag Order

5.4. GMM Parameter Estimation

5.5. Granger Causality Test

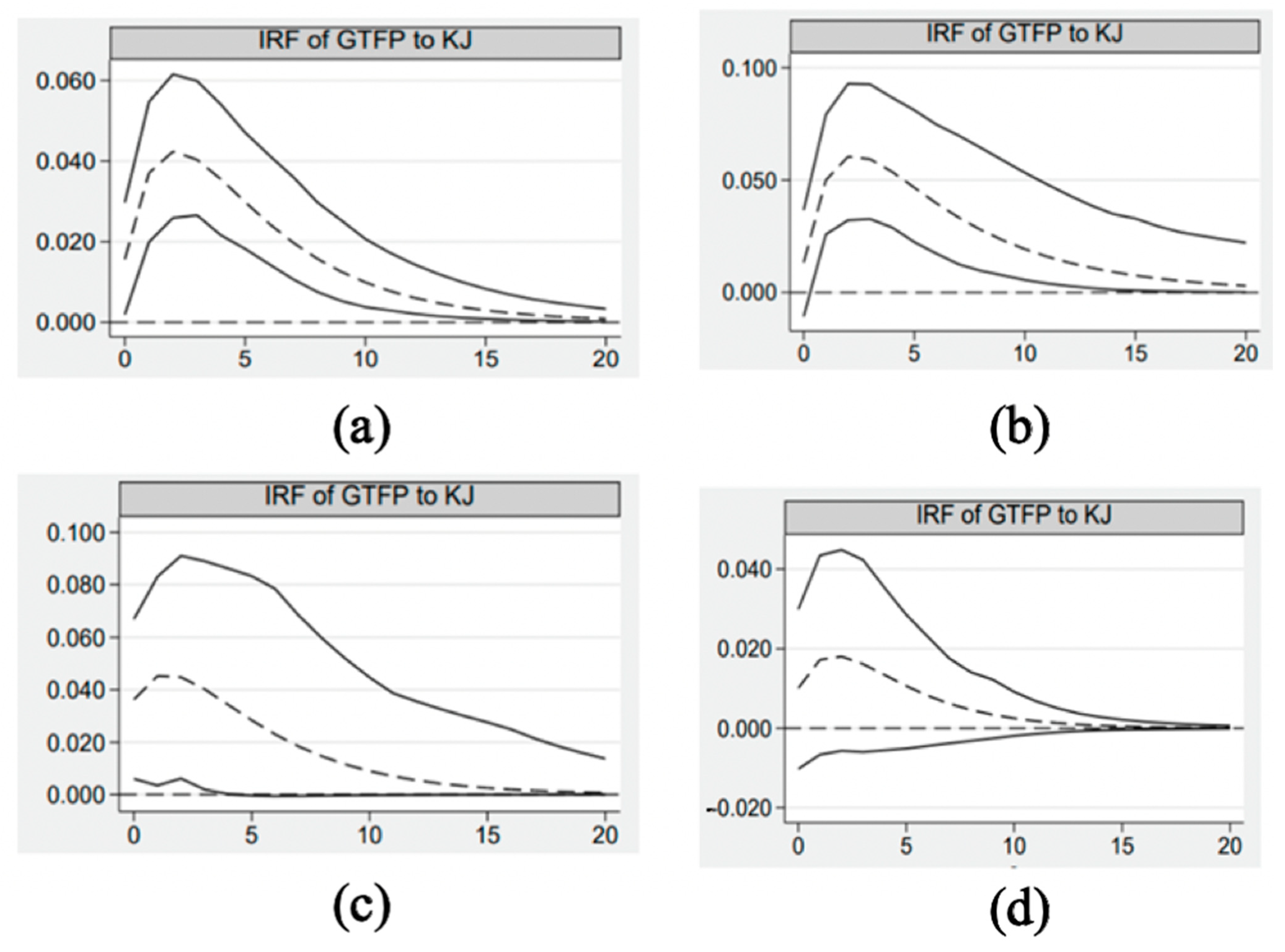

5.6. Impulse Response

6. Further Analysis: Moderating Effects and Threshold Effects

6.1. Moderating Effects

6.2. Threshold Effects

7. Discussions and Conclusions

7.1. Discussions

7.2. Conclusions

7.3. Practical Implications

7.4. Limitations and Future Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Xu, K.; Zhao, P. Does Green Finance Promote Green Total Factor Productivity? Empirical Evidence from China. Sustainability 2023, 15, 11204. [Google Scholar] [CrossRef]

- Fan, F.; Lian, H.; Liu, X.; Wang, X. Can Environmental Regulation Promote Urban Green Innovation Efficiency? An Empirical Study Based on Chinese Cities. J. Clean. Prod. 2021, 287, 125060. [Google Scholar] [CrossRef]

- Tao, R.; Su, C.-W.; Naqvi, B.; Rizvi, S.K.A. Can Fintech Development Pave the Way for a Transition towards Low-Carbon Economy: A Global Perspective. Technol. Forecast. Soc. Chang. 2022, 174, 121278. [Google Scholar] [CrossRef]

- Fu, H.; Ge, R.; Huang, J.; Shi, X. The Effect of Education on Health and Health Behaviors: Evidence from the College Enrollment Expansion in China. China Econ. Rev. 2022, 72, 101768. [Google Scholar] [CrossRef]

- Arrow, K.J. Economic Welfare and the Allocation of Resources for Invention. In Readings in Industrial Economics; Macmillan Education: London, UK, 1972; pp. 219–236. ISBN 978-0-333-10973-1. [Google Scholar]

- Stiglitz, J.E. Knowledge as a Global Public Good. In Global Public Goods; Oxford University Press: New York, NY, USA, 1999; pp. 308–325. ISBN 978-0-19-513052-2. [Google Scholar]

- You, X.; Li, Z.; Yi, Y. Carbon Constraints, Industrial Structure Upgrading, and Green Total Factor Productivity: An Empirical Study Based on the Yangtze River Economic Belt. J. Water Clim. Chang. 2023, 14, 3010–3026. [Google Scholar] [CrossRef]

- Cazzavillan, G.; Donadelli, M.; Persha, L. Economic Growth and Poverty Traps in Sub-Saharan Africa: The Role of Education and TFP Shocks. Res. Econ. 2013, 67, 226–242. [Google Scholar] [CrossRef]

- Jiang, Y.; Ramzan, M.; Awosusi, A.A.; Adebayo, T.S. Moderating Role of Green Innovation and Fiscal Expenditure towards Achieving the Sustainable Development Agenda 2030 at Provincial-Level in China: Policy Implication from Green Total Factor Productivity. Environ. Sci. Pollut. Res. 2023, 30, 102818–102838. [Google Scholar] [CrossRef]

- Chen, S.; Golley, J. ‘Green’ Productivity Growth in China’s Industrial Economy. Energy Econ. 2014, 44, 89–98. [Google Scholar] [CrossRef]

- Ahmed, E.M.; Elfaki, K.E. Enhancing Environmental Quality and Economic Growth through Potential Effects of Energy Efficiency and Renewable Energy in Asian Economies. Sci. Rep. 2024, 14, 22914. [Google Scholar] [CrossRef]

- Cui, H.; Wang, H.; Zhao, Q. Which Factors Stimulate Industrial Green Total Factor Productivity Growth Rate in China? An Industrial Aspect. Greenh. Gases Sci. Technol. 2019, 9, 505–518. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the Efficiency of Decision Making Units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Chung, Y.H.; Färe, R.; Grosskopf, S. Productivity and Undesirable Outputs: A Directional Distance Function Approach. J. Environ. Manag. 1997, 51, 229–240. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Pasurka, C.A., Jr. Accounting for Air Pollution Emissions in Measures of State Manufacturing Productivity Growth. J. Reg. Sci. 2001, 41, 381–409. [Google Scholar] [CrossRef]

- Tone, K. A Slacks-Based Measure of Super-Efficiency in Data Envelopment Analysis. Eur. J. Oper. Res. 2002, 143, 32–41. [Google Scholar] [CrossRef]

- Oh, D. A Global Malmquist-Luenberger Productivity Index. J. Prod. Anal. 2010, 34, 183–197. [Google Scholar] [CrossRef]

- Zhang, H.; Geng, C.; Wei, J. Coordinated Development between Green Finance and Environmental Performance in China: The Spatial-Temporal Difference and Driving Factors. J. Clean. Prod. 2022, 346, 131150. [Google Scholar] [CrossRef]

- Chen, C.; Lan, Q.; Gao, M.; Sun, Y. Green Total Factor Productivity Growth and Its Determinants in China’s Industrial Economy. Sustainability 2018, 10, 1052. [Google Scholar] [CrossRef]

- Liu, Y.; Wu, A.; Wang, J.; Taghizadeh-Hesary, F.; Dong, X. Green Growth in the Global South: How Does Metallic Minerals Affect GTFP Enhancement? Resour. Policy 2024, 88, 104505. [Google Scholar] [CrossRef]

- Wang, X.; Wu, X.; Chu, N.; Zhang, Y.; Wang, L. Coupling Relationship between Urbanization and Green Total Factor Productivity in the Context of Population Shrinkage: Evidence from the Rust Belt Region of China. Sustainability 2024, 16, 1312. [Google Scholar] [CrossRef]

- Fan, M.; Yang, P.; Li, Q. Impact of Environmental Regulation on Green Total Factor Productivity: A New Perspective of Green Technological Innovation. Environ. Sci. Pollut. Res. 2022, 29, 53785–53800. [Google Scholar] [CrossRef]

- Zhou, Y.; Lin, Z.; Zhang, Y.; Sun, W.; Lei, F.; Gao, W. Impact of Changes in Energy Structure and Industrial Structure on Green Total Factor Productivity in the Context of Environmental Protection—Evidence from China. Environ. Sci. Pollut. Res. 2024, 31, 17097–17114. [Google Scholar] [CrossRef]

- Derbentsev, V.; Pasichnyk, Y.; Tulush, L.; Pozhar, I. Analysis of the Impact of Expenditures on Education and R&D on GDP in Central European Countries. Stat. Stat. Econ. J. 2021, 101, 383–405. [Google Scholar] [CrossRef]

- Ma, C.; Ma, Y.; Wu, W. A Pathway to Sustainable Development in China: The Impact of Local Higher Education Expenditure on Green Total Factor Productivity. Heliyon 2024, 10, e34415. [Google Scholar] [CrossRef]

- Lu, Y.; Ahmad, M.; Zhang, H.; Guo, J. Effects of Science and Technology Finance on Green Total Factor Productivity in China: Insights from an Empirical Spatial Durbin Model. J. Knowl. Econ. 2023, 15, 7280–7306. [Google Scholar] [CrossRef] [PubMed]

- Zhao, J.; Yan, J. The Impact of Public Fiscal Expenditure on Industrial Transformation and Upgrading: An Inverted U-Shape Evidence from China. Heliyon 2024, 10, e38456. [Google Scholar] [CrossRef] [PubMed]

- Wei, L.; Lin, B.; Zheng, Z.; Wu, W.; Zhou, Y. Does Fiscal Expenditure Promote Green Technological Innovation in China? Evidence from Chinese Cities. Environ. Impact Assess. Rev. 2023, 98, 106945. [Google Scholar] [CrossRef]

- Hou, S.; He, J.; Song, L. Fiscal Science and Technology Expenditure and the Spatial Convergence of Regional Innovation Efficiency: Evidence from China’s Province-Level Data. Econ. Res.-Ekon. Istraž. 2023, 36, 1848–1866. [Google Scholar] [CrossRef]

- Zhou, C.; Zhang, X. Measuring the Efficiency of Fiscal Policies for Environmental Pollution Control and the Spatial Effect of Fiscal Decentralization in China. Int. J. Environ. Res. Public Health 2020, 17, 8974. [Google Scholar] [CrossRef]

- Popović, M.; Savić, G.; Kuzmanović, M.; Martić, M. Using Data Envelopment Analysis and Multi-Criteria Decision-Making Methods to Evaluate Teacher Performance in Higher Education. Symmetry 2020, 12, 563. [Google Scholar] [CrossRef]

- Nelson, R.R. The Simple Economics of Basic Scientific Research. J. Political Econ. 1959, 67, 297–306. [Google Scholar] [CrossRef]

- Yuan, B.; Xiang, Q. Environmental Regulation, Industrial Innovation and Green Development of Chinese Manufacturing: Based on an Extended CDM Model. J. Clean. Prod. 2018, 176, 895–908. [Google Scholar] [CrossRef]

- Rehman, F.U.; Islam, M.M. Financial Infrastructure—Total Factor Productivity (TFP) Nexus within the Purview of FDI Outflow, Trade Openness, Innovation, Human Capital and Institutional Quality: Evidence from BRICS Economies. Appl. Econ. 2023, 55, 783–801. [Google Scholar] [CrossRef]

- Sun, X. Analysis of Green Total Factor Productivity in OECD and BRICS Countries: Based on the Super-SBM Model. J. Water Clim. Chang. 2022, 13, 3400–3415. [Google Scholar] [CrossRef]

- Zhang, J.; Lu, G.; Skitmore, M.; Ballesteros-Pérez, P. A Critical Review of the Current Research Mainstreams and the Influencing Factors of Green Total Factor Productivity. Environ. Sci. Pollut. Res. 2021, 28, 35392–35405. [Google Scholar] [CrossRef] [PubMed]

- Zhou, Y.; Chen, G.; Huang, L.; Lin, Z.; Jin, J.; Lu, F. Empirical Analysis of the Impact of Green Finance and Technological Progress on Total Factor Productivity in China’s Industrial Sector. Proc. Bus. Econ. Stud. 2023, 6, 39–44. [Google Scholar] [CrossRef]

- Tan, R.; Pan, L.; Xu, M.; He, X. Transportation Infrastructure, Economic Agglomeration and Non-Linearities of Green Total Factor Productivity Growth in China: Evidence from Partially Linear Functional Coefficient Model. Transp. Policy 2022, 129, 1–13. [Google Scholar] [CrossRef]

- Sheng, P.; He, Y.; Guo, X. The Impact of Urbanization on Energy Consumption and Efficiency. Energy Environ. 2017, 28, 673–686. [Google Scholar] [CrossRef]

- Lee, C.-C.; Lee, C.-C. How Does Green Finance Affect Green Total Factor Productivity? Evidence from China. Energy Econ. 2022, 107, 105863. [Google Scholar] [CrossRef]

- Sung, B. Do Government Subsidies Promote Firm-Level Innovation? Evidence from the Korean Renewable Energy Technology Industry. Energy Policy 2019, 132, 1333–1344. [Google Scholar] [CrossRef]

- Baldos, U.L.C. Impacts of US Public R&D Investments on Agricultural Productivity and GHG Emissions. J. Agric. Appl. Econ. 2023, 55, 536–550. [Google Scholar] [CrossRef]

| First-Level Indicator | Second-Level Indicator | Third-Level Indicator | Unit | Data Source |

|---|---|---|---|---|

| Input indicator | Labor capital | Year-end employment | 10,000 people | China Statistical Yearbook |

| Material capital | Fixed asset investment | RMB 100 million | China Statistical Yearbook | |

| Resource consumption | Water supply | 100 million cubic meters | China Statistical Yearbook | |

| Urban construction Land area | Square kilometers | China Statistical Yearbook | ||

| Energy consumption | 10,000 tons of standard coal | China Energy Statistical Yearbook | ||

| Desirable output indicator | Economic development level | Gross domestic product | RMB 100 million | China Statistical Yearbook |

| Undesirable output indicator | Pollutant discharge | Sulfur dioxide emissions | 10,000 tons | China Environmental Protection Yearbook |

| Smoke and dust emissions | 10,000 tons | China Environmental Protection Statistical Yearbook | ||

| Industrial wastewater (COD) | 10,000 tons | China Energy Statistical Yearbook | ||

| Carbon dioxide emissions | Million tons | China Statistical Yearbook |

| Variable Name | Variable Definition | Mean | Standard Deviation | Minimum | Maximum | |

|---|---|---|---|---|---|---|

| Explained Variable | Green total factor productivity (GTFP) | Calculated by undesirable output super-efficiency SBM method | 0.293 | 0.602 | −1.858 | 1.065 |

| Explanatory Variable | Financial technology expenditure (KJ) | Financial technology expenditure | 4.356 | 1.042 | 1.971 | 7.064 |

| Mediating Variables | Education investment (EDU) | Fiscal education expenditure | 2.837 | 0.419 | 2.074 | 4.130 |

| Industrial upgrading (IND) | Tertiary industry/secondary industry | 0.162 | 0.178 | −0.168 | 0.827 | |

| Control Variables | Urbanization level (CZH) | Number of urban permanent residents/total population | 4.033 | 0.201 | 3.554 | 4.495 |

| Financial development level (JR) | Financial added value/GDP | 7.153 | 0.921 | 4.559 | 9.212 | |

| Transportation infrastructure (TRI) | Highway mileage/provincial area | −0.260 | 0.765 | −2.390 | 0.791 |

| Region | Variable | LLC Test | IPS Test | ADF Test | PP Test | Conclusion |

|---|---|---|---|---|---|---|

| National | KJ | −12.5137 −0.6336 | −0.21045 (0.4167) | 74.5604 (0.0978) | 149.38 *** (0.0000) | Nonstationary |

| D_KJ | −12.1446 *** (0.0000) | −8.1133 *** (0.0000) | 141.849 *** (0.0000) | 217.068 *** (0.0000) | Stationary | |

| GFTP | −4.21253 *** (0.0000) | −2.86153 *** (0.0021) | 87.7694 *** (0.0008) | 86.1054 *** (0.0012) | Nonstationary | |

| D_GFTP | −11.6626 *** (0.0000) | −4.30073 *** (0.0000) | 157.466 *** (0.0000) | 220.812 *** (0.0000) | Stationary | |

| East | KJ | −4.45812 *** (0.0000) | 0.78488 (0.6833) | 16.3131 (0.8000) | 32.8585 * (0.0639) | Nonstationary |

| D_KJ | −7.0327 *** (0.0000) | −1.3474 *** (0.0458) | 36.0838 ** (0.0297) | 28.002 *** (0.0011) | Stationary | |

| GFTP | −2.0561 *** (0.0000) | −1.2296 (0.1402) | 29.3319 (0.1356) | 24.6116 ** (0.0417) | Nonstationary | |

| D_GFTP | −7.63402 *** (0.0000) | −3.42337 *** (0.0000) | 65.1455 *** (0.0000) | 84.1528 *** (0.0000) | Stationary | |

| Central | KJ | −10.7349 *** (0.0000) | −0.3481 (0.2326) | 56.7536 ** (0.0257) | 114.68 *** (0.0000) | Stationary |

| D_KJ | −15.347 *** (0.0000) | −5.162 *** (0.0000) | 103.832 *** (0.0000) | 176.703 *** (0.0000) | Stationary | |

| GFTP | −7.51495 *** (0.0000) | −2.67317 *** (0.0038) | 69.3391 ** (0.0014) | 23.9847 *** (0.0052) | Stationary | |

| D_GFTP | −11.8048 *** (0.0000) | −2.5646 *** (0.0000) | 96.7376 *** (0.0000) | 144.196 *** (0.0000) | Stationary | |

| West | KJ | −5.3244 *** (0.0000) | 0.0363 *** (0.5145) | 18.6038 *** (0.2897) | 49.4342 ** (0.0009) | Stationary |

| D_KJ | −7.83248 *** (0.0000) | −1.4858 *** (0.0035) | 36.5365 *** (0.0024) | 68.4536 *** (0.0000) | Stationary | |

| GFTP | −5.81119 *** (0.0000) | −1.2221 ** (0.0276) | 30.5798 ** (0.0152) | 29.8228 ** (0.0189) | Stationary | |

| D_GFTP | −9.23452 *** (0.0000) | −2.80252 *** (0.0025) | 24.0016 *** (0.0011) | 33.3011 *** (0.0000) | Stationary |

| Region | Kao Test | Pedroni | ||

|---|---|---|---|---|

| T Value | p Value | T Value | p Value | |

| National | −1.1909 | 0.0046 | −7.0339 | 0.0000 |

| East | −1.9940 | 0.0011 | −3.5352 | 0.0000 |

| Central | −1.1901 | 0.0123 | −1.7864 | 0.0027 |

| West | −3.3195 | 0.0000 | −4.1152 | 0.0000 |

| Lag Order | National | East | Central | West | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AIC | BIC | HQIC | AIC | BIC | HQIC | AIC | BIC | HQIC | AIC | BIC | HQIC | |

| 1 | −4.82 * | −3.38 * | −5.36 * | −4.17 * | −3.52 * | −4.17 * | −5.42 * | −4.69 * | −5.20 * | −7.22 * | −6.31 * | −6.87 * |

| 2 | −1.26 | 0.10 | −0.61 | −3.34 | −2.18 | −3.21 | −1.93 | −1.86 | −1.53 | −5.90 | −5.72 | −5.48 |

| 3 | −0.22 | 1.15 | 0.16 | −2.31 | −0.73 | −2.22 | −3.40 | −3.05 | −3.61 | −5.50 | −4.00 | −5.02 |

| Region | Variable | h_dKJ | h_dGFTP | ||

|---|---|---|---|---|---|

| b_GMM | t | b_GMM | t | ||

| National | L.h_dKJ | −0.1457 * | 0.2422 | −0.3218 *** | 0.0079 |

| L.h_dGFTP | −0.1264 | 0.0751 | 0.7721 *** | 0.0206 | |

| East | L.h_dKJ | 0.2291 ** | 0.1268 | 0.1071 * | 0.0127 |

| L.h_dGFTP | 0.3809 | 0.7628 | 0.2724 * | 0.1354 | |

| Central | L.h_dKJ | −0.1125 * | 0.3295 | −0.2647 *** | 0.0947 |

| L.h_dGFTP | 0.1324 | 0.2273 | 0.7239 *** | 0.0711 | |

| West | L.h_dKJ | −0.1536 * | 0.1329 | −0.0003 | 0.0125 |

| L.h_dGFTP | −0.9381 | 8.0557 | 0.0601 | 0.6472 | |

| Region | Variable | Null Hypothesis | F Value | Conclusion |

|---|---|---|---|---|

| National | GFTP | KJ is not the cause | 1.2363 ** | Reject |

| KJ | GFTP is not the cause | 7.4583 | Accept | |

| East | GFTP | KJ is not the cause | 0.2835 ** | Reject |

| KJ | GFTP is not the cause | 0.4522 *** | Reject | |

| Central | GFTP | KJ is not the cause | 0.2787 *** | Reject |

| KJ | GFTP is not the cause | 7.0347 | Accept | |

| West | GFTP | KJ is not the cause | 0.5643 | Accept |

| KJ | GFTP is not the cause | 4.222 *** | Reject |

| (1) | (2) | |

|---|---|---|

| GTFP | GTFP | |

| KJ | 0.614 ** | 0.092 * |

| (0.016) | (0.071) | |

| EDU | 0.101 ** | 0.274 ** |

| (0.021) | (0.018) | |

| IND | 0.272 * | 1.028 ** |

| (0.056) | (0.026) | |

| KJ*EDU | 0.059 ** | |

| (0.050) | ||

| KJ*IND | 0.206 * | |

| (0.049) | ||

| N | 270.000 | 270.000 |

| R2 | 0.028 | 0.024 |

| Model | RSS | MSE | F Value | p Value | |

|---|---|---|---|---|---|

| Education investment | Single threshold | 88.875 | 0.3405 | 6.3 | 0.016 |

| Double threshold | 86.1567 | 0.3301 | 8.23 | 0.03 | |

| Triple threshold | 83.8072 | 0.3211 | 7.32 | 0.75 | |

| Industrial upgrading | Single threshold | 88.6228 | 0.3396 | 7.06 | 0.001 |

| Double threshold | 84.277 | 0.3229 | 13.46 | 0.17 | |

| Triple threshold | 82.3821 | 0.3156 | 6.00 | 0.93 |

| Variable | (1) | (2) |

|---|---|---|

| INN | IND | |

| Threshold type | Single threshold | Single threshold |

| Threshold value | 9.3674 | 0.0814 |

| ) | 0.061 ** (0.016) | 0.214 *** (0.001) |

| ) | 0.151 ** (0.014) | 0.310 ** (0.019) |

| Constant term | 9.313 ** (0.036) | 6.969 ** (0.045) |

| Sample size | 270.000 | 270.000 |

| Time/region fixed effect | Yes | Yes |

| Control variables | Controlled | Controlled |

| R2 | 0.047 | 0.060 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qi, Y.; Lu, Y.; Xu, H.; Sheng, G. Financial Technology Expenditure and Green Total Factor Productivity: Influencing Mechanisms and Threshold Effects. Sustainability 2025, 17, 6653. https://doi.org/10.3390/su17146653

Qi Y, Lu Y, Xu H, Sheng G. Financial Technology Expenditure and Green Total Factor Productivity: Influencing Mechanisms and Threshold Effects. Sustainability. 2025; 17(14):6653. https://doi.org/10.3390/su17146653

Chicago/Turabian StyleQi, Yalin, Yanlin Lu, Huanyu Xu, and Gang Sheng. 2025. "Financial Technology Expenditure and Green Total Factor Productivity: Influencing Mechanisms and Threshold Effects" Sustainability 17, no. 14: 6653. https://doi.org/10.3390/su17146653

APA StyleQi, Y., Lu, Y., Xu, H., & Sheng, G. (2025). Financial Technology Expenditure and Green Total Factor Productivity: Influencing Mechanisms and Threshold Effects. Sustainability, 17(14), 6653. https://doi.org/10.3390/su17146653