Modeling a Financial Controlling System for Managing Transfer Pricing Operations

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

- general scientific methods—analysis and synthesis, induction and deduction, concretization, formalization, abstraction, modeling, and analogy (applied in the process of formulating research questions);

- component analysis—used to identify the characteristic features of transfer pricing control systems and to develop a quality metrics system for the company’s transfer pricing policy and internal control system;

- optimization—employed in developing a managerial accounting model for transfer pricing operations based on tax compliance and the alignment of stakeholder interests;

- computer programming—applied in the development of automation schemes for preparing transfer pricing documentation and the company’s tax profile (presented as a dashboard) within the transfer pricing tax control system.

4. Results

- -

- firstly, serving as a tool for informational support in decision-making;

- -

- Business Unit 1 “agricultural production”: by selling sunflower seeds and soybeans at a specified transfer price, Business Unit 1 generates revenue. In turn, Business Unit 4 incurs raw material expenses (which are included in the cost of goods sold) when purchasing these sunflower seeds and soybeans to produce sunflower oil and soybean meals.

- Business Unit 2 “sugar production”:

- 2.1

- By selling molasses and dry distiller’s grains at a defined transfer price, Business Unit 2 earns revenue. Business Unit 5 incurs raw material and energy costs (also included in the cost of goods sold) when purchasing these products to produce bioethanol and biogas.

- 2.2

- By selling granulated distiller’s grains at a specific transfer price, Business Unit 2 earns additional revenue. Business Unit 4 incurs energy-related expenses (reflected in the cost of goods sold) when purchasing these granulated distiller’s grains for use in the production of sunflower oil and soybean meal.

- Business Unit 4 “oil extraction production”: by selling rapeseed meals, Business Unit 4 earns revenue. Business Unit 3 then incurs feed-related costs (accounted for in the cost of goods sold) when purchasing this rapeseed meal for use in livestock farming [24].

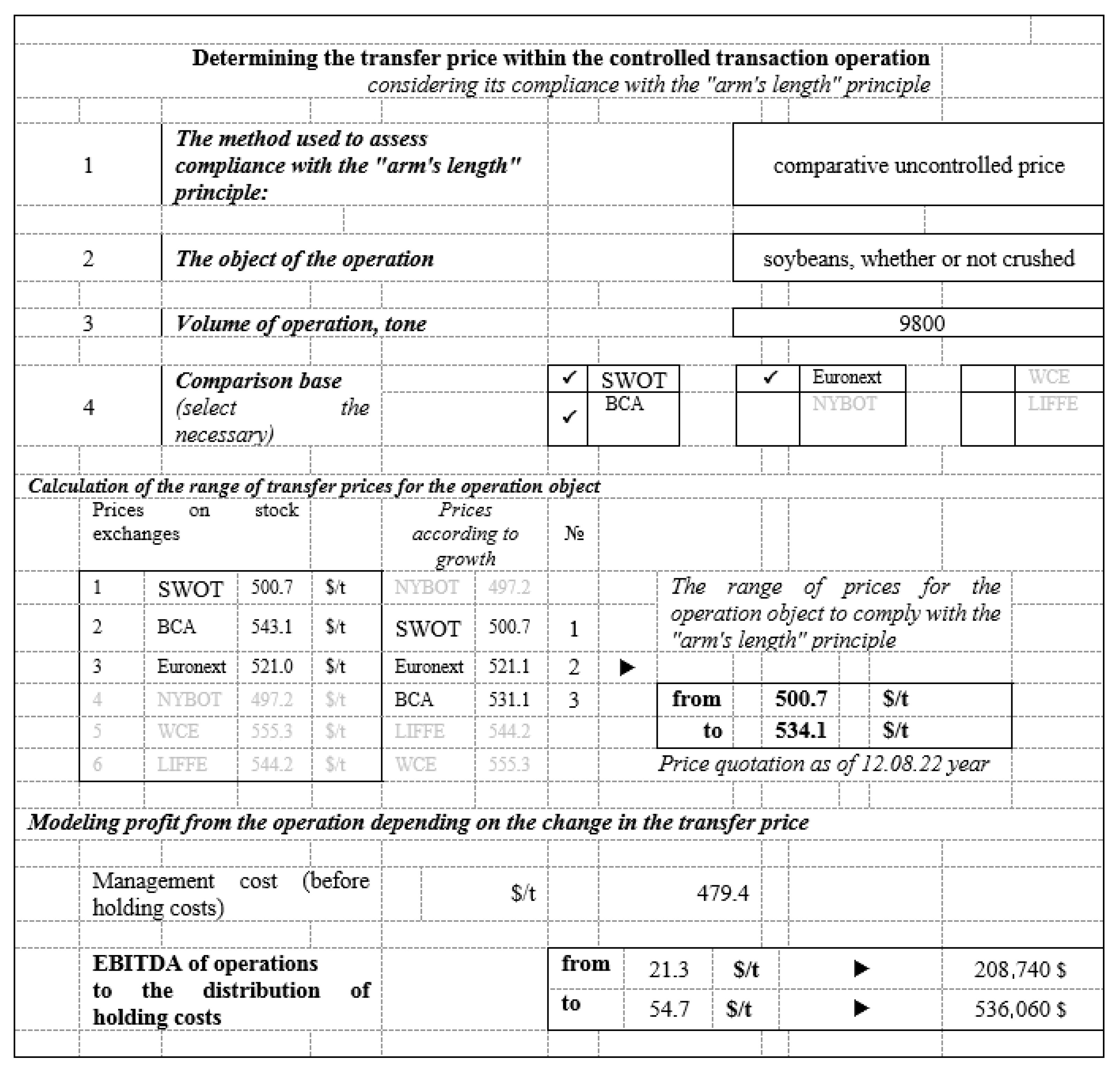

4.1. Business Operation 1

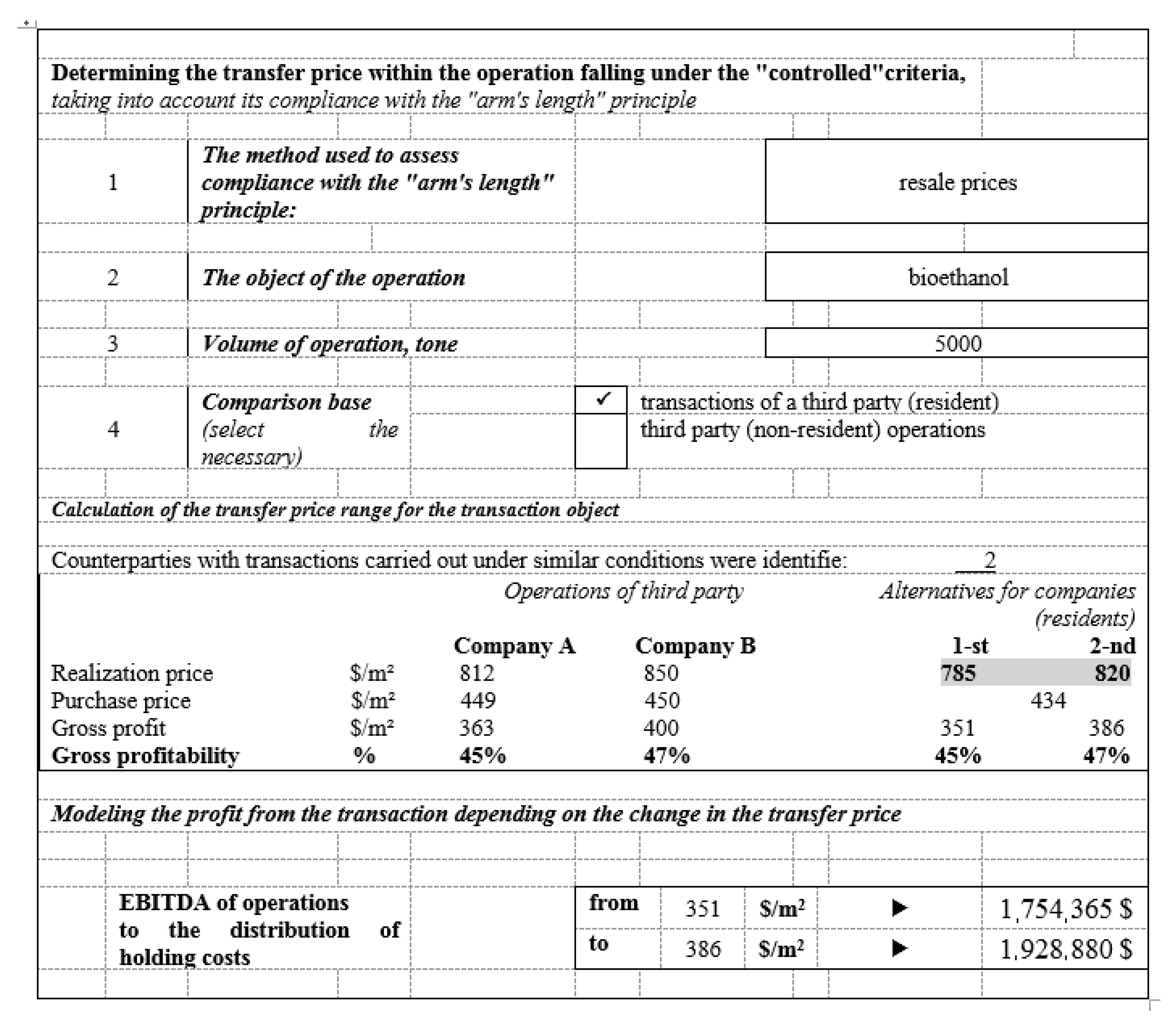

4.2. Business Operation 2

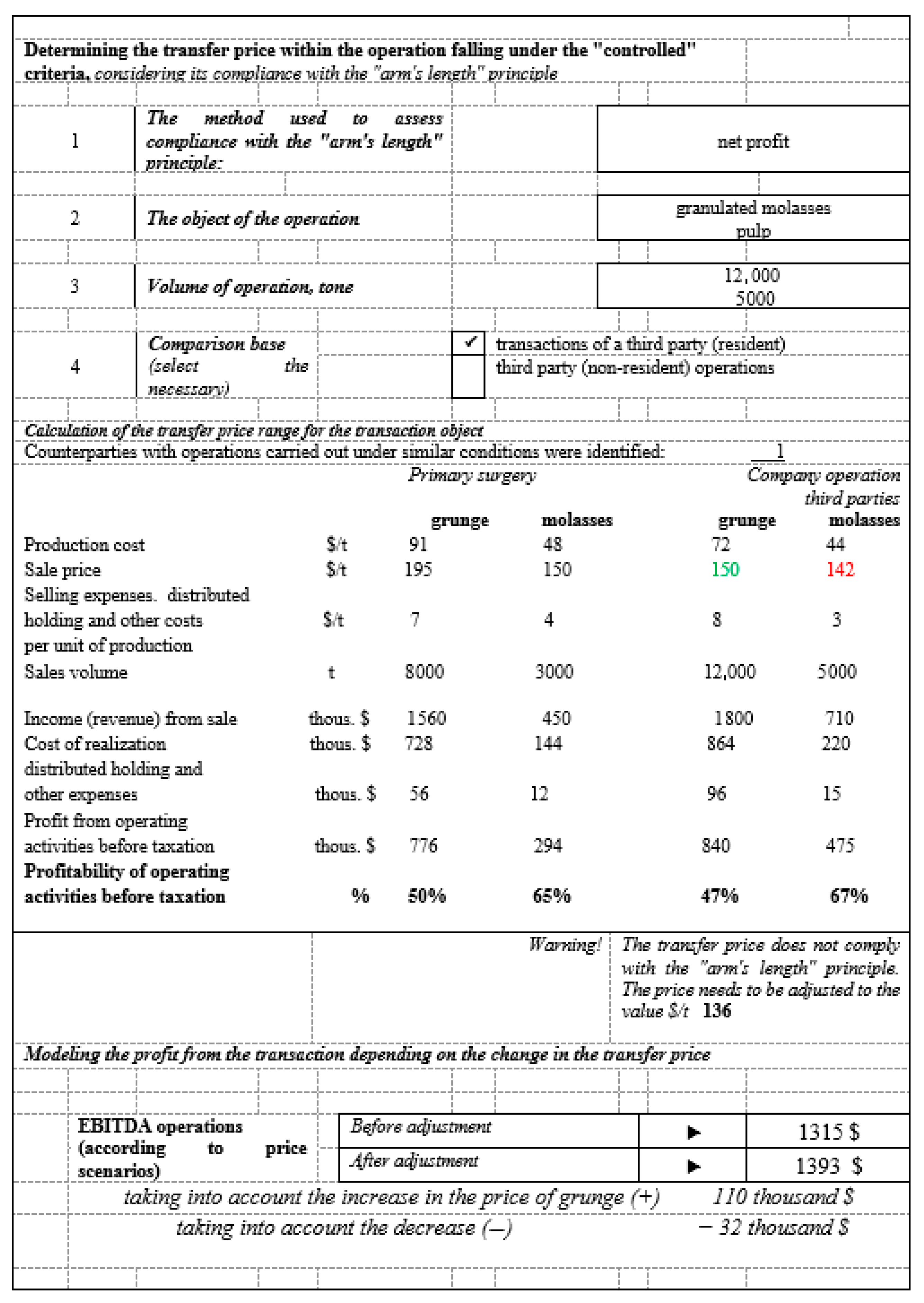

4.3. Business Operation 3

4.4. Business Operation 4

4.5. Business Operation 5

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bouwens, J.; Steens, B. Full-Cost Transfer Pricing and Cost Management. J. Manag. Account. Res. 2016, 28, 63–81. [Google Scholar] [CrossRef]

- Cools, M. Transfer Pricing: Insights from the Empirical Accounting Literature. In Management Control and Uncertainty; Palgrave Macmillan: London, UK, 2014. [Google Scholar] [CrossRef]

- EY Global. How Do You Drive Transfer Pricing Certainty in Uncertain Times? 2024. Available online: https://www.ey.com/en_gl/insights/tax/international-tax-and-transfer-pricing-survey (accessed on 15 May 2025).

- Fatenok-Tkachuk, A.; Kulynych, M.; Safarova, A.; Bukalo, N. Analysis of chicken production trends in Ukraine. Probl. Perspect. Manag. 2017, 15, 302–316. [Google Scholar] [CrossRef]

- OECD. Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations; OECD: Paris, France, 2022. [Google Scholar] [CrossRef]

- Pavone, P. Transfer pricing: Business or tax process? Difficult equilibrium between two dimensions. Rev. Espac. 2020, 41. Available online: https://www.revistaespacios.com/a20v41n05/20410521.html#iden4 (accessed on 15 May 2025).

- Grigoroi, L.; Grosu, V.; Melega, A. Financial-accounting model for transfer pricing based on standardised accounting policies. Eur. J. Account. Financ. Bus. 2023, 11, 3–11. [Google Scholar] [CrossRef]

- Storozhuk, T.; Morhunenko, A. Methodological aspects of transfer pricing in the context of forming the accounting policy of mne group. Ukr. Econ. J. 2024, 117–124. [Google Scholar] [CrossRef]

- Tytenko, L.; Bohdan, S. Transfer pricing as a management accounting tool. Galician Econ. J. 2020, 64, 87–95. [Google Scholar] [CrossRef]

- Kucherenko, S. Problems of tax risks assessment of business entities. Ukr. Econ. J. 2024, 31–38. [Google Scholar] [CrossRef]

- Lekar, S.; Ryzhenkova, K. Administrative and legal regulation of the tax field during the martial law. Ukr. Econ. J. 2023, 41–45. [Google Scholar] [CrossRef]

- Shevchuk, K.V. Application of transfer pricing to evaluate the activity of the responsibility centers. [Zastosuvannya transfertnogo cinoutvorennya dlya ocinyuvannya diyalnosti centriv vidpovidalnosti]. Finans. Oblik I Audyt 2012, 65–73. (In Ukranian) [Google Scholar]

- Fahlevi, M.; Aziz, A.L.; Aljuaid, M.; Saniuk, S.; Grabowska, S. Seasonal Income Effects on Financial Awareness, Capability, and Risky Behavior in Agro-Industrial MSMEs in East Java. Agriculture 2025, 15, 709. [Google Scholar] [CrossRef]

- Zhang, H.; Jiang, W.; Mu, J.; Cheng, X. Optimizing Supply Chain Financial Strategies Based on Data Elements in the China’s Retail Industry: Towards Sustainable Development. Sustainability 2025, 17, 2207. [Google Scholar] [CrossRef]

- Geng, N.; Wang, M.; Liu, Z. Farmland Transfer, Scale Management and Economies of Scale Assessment: Evidence from the Main Grain-Producing Shandong Province in China. Sustainability 2022, 14, 15229. [Google Scholar] [CrossRef]

- Poppe, K.; Vrolijk, H.; Bosloper, I. Integration of Farm Financial Accounting and Farm Management Information Systems for Better Sustainability Reporting. Electronics 2023, 12, 1485. [Google Scholar] [CrossRef]

- Źróbek-Różańska, A.; Nowak, A.; Nowak, M.; Źróbek, S. Financial Dilemmas Associated with the Afforestation of Low-Productivity Farmland in Poland. Forests 2014, 5, 2846–2864. [Google Scholar] [CrossRef]

- Pedolin, D.; Six, J.; Nemecek, T. Assessing between and within Product Group Variance of Environmental Efficiency of Swiss Agriculture Using Life Cycle Assessment and Data Envelopment Analysis. Agronomy 2021, 11, 1862. [Google Scholar] [CrossRef]

- Zaruk, N.F.; Kagirova, M.V.; Kharitonova, A.E.; Romantseva, Y.N.; Kolomeeva, E.S. Analysis of trends and location of organic crop production in European countries. IOP Conf. Ser. Earth Environ. Sci. 2023, 1206, 012009. [Google Scholar] [CrossRef]

- Witt, N.; Thorsøe, M.H.; Graversgaard, M. ESG reporting meets farmer—Implications of the European corporate sustainability reporting directive for the agrifood sector. Br. Food J. 2025, 127, 264–283. [Google Scholar] [CrossRef]

- Anguiano-Santos, C.; Salazar-Ordóñez, M. Sustainability reporting as a tool for fostering sustainable growth in the agri-food sector: The case of Spain. J. Environ. Plan. Manag. 2024, 67, 426–453. [Google Scholar] [CrossRef]

- Krachunova, T.; Geppert, F.; Lemke, N.; Bellingrath-Kimura, S.D. Digital technologies commercially available in Germany in the context of nature conservation and ecosystem service provisioning in agriculture. Front. Sustain. Food Syst. 2025, 9, 1464020. [Google Scholar] [CrossRef]

- Kraevskyi, V.M.; Muravskyi, O.Y. Information Support of Accounting-Analytical and Control Systems for Managing Transfer Pricing Operations. Digit. Econ. Econ. Secur. 2023, 7, 32–40. [Google Scholar] [CrossRef]

- Nosenko, D. From double taxation elimination to harmful tax competition: Historical context and further development. Ukr. Econ. J. 2024, 80–86. [Google Scholar] [CrossRef]

- Schuster, P. Cost and Management Accounting. In Transfer Prices and Management Accounting; Springer Briefs in Accounting; Springer: Cham, Switzerland, 2015; Available online: https://link.springer.com/chapter/10.1007/978-3-319-14750-5_1 (accessed on 15 May 2025).

- Veres, T.G. Accounting Aspects of Pricing and Transfer Pricing. Ann. Univ. Petrosani Econ. 2011, 11, 289–296. Available online: https://www.upet.ro/annals/economics/pdf/2011/part2/Veres-2.pdf (accessed on 15 May 2025).

- Tsarov, O. Designation of the control function in the system of international data exchange in the conditions of global tax integration. Ukr. Econ. J. 2024, 129–134. [Google Scholar] [CrossRef]

- Talutto, D. Implications on Transfer Pricing Rules in Adopting IFRS. SSRN Electron. J. 2009. [Google Scholar] [CrossRef]

- Lemishko, O. Formation of analytical tools of capital reproduction in the agricultural sector of Ukraine. Agric. Resour. Econ. 2020, 6, 64–79. [Google Scholar] [CrossRef]

- Lemishko, O.; Shevchenko, N. Lending in the agricultural sector of Ukraine: Challenges and solutions. Econ. Ann. XXI 2021, 192, 74–87. [Google Scholar] [CrossRef]

- Kalivoshko, O.; Kraevsky, V.; Payanok, T. Assessment of Factors Influencing the Volume of Personal Income Tax Revenues. In Proceedings of the 2020 IEEE International Conference on Problems of Infocommunications, Science and Technology (PIC S&T), Kharkiv, Ukraine, 6–9 October 2020; pp. 279–282. [Google Scholar]

- Kalivoshko, O.; Kraevsky, V.; Burdeha, K.; Lyutyy, I.; Kiktev, N. The Role of Innovation in Economic Growth: Information and Analytical Aspect. In Proceedings of the 2021 IEEE 8th International Conference on Problems of Infocommunications, Science and Technology (PIC S&T), Kharkiv, Ukraine, 5–7 October 2021; pp. 120–124. [Google Scholar]

- Smolarski, J.M.; Wilner, N.; Vega, J.G. Dynamic transfer pricing under conditions of uncertainty—The use of real options. J. Account. Organ. Change 2019, 15, 535–556. [Google Scholar] [CrossRef]

- Kucherenko, S. The essence and principles of the tax risk management process of business entities. State Reg. Ser. Econ. Bus. 2024, 31–38. (In Ukrainian) [Google Scholar] [CrossRef]

- Kukharets, V.; Čingiene, R.; Juočiūnienė, D.; Kukharets, S.; Blažauskas, E.; Szufa, S.; Muzychenko, A.; Belei, S.; Lahodyn, N.; Hutsol, T. Regression Analysis of the Impact of Foreign Direct Investments, Adjusted Net Savings, and Environmental Tax Revenues on the Consumption of Renewable Energy Sources in EU Countries. Energies 2024, 17, 4465. [Google Scholar] [CrossRef]

- Kucher, O.; Hutsol, O.; Prokopchuk, L.; Hutsol, T.; Vasylyshen, Y.; Tryhuba, A.; Gajda, J.; Kornas, R.; Borusiewicz, A. Application of Marketing Tools in the Bioeconomic Sector. Sustainability 2025, 17, 3590. [Google Scholar] [CrossRef]

- Tryhuba, A.; Hutsol, T.; Glowacki, S.; Tryhuba, I.; Tabor, S.; Kwasniewski, D.; Sorokin, D.; Yermakov, S. Forecasting Quantitative Risk Indicators of Investors in Projects of Biohydrogen Production from Agricultural Raw Materials. Processes 2021, 9, 258. [Google Scholar] [CrossRef]

- Kalivoshko, O.M.; Kalivoshko, M.F. Technological Essence of Carbon Production Sorbents Based on Vegetable Raw Materials and Their Economic Efficiency. Mach. Energet. 2021, 12, 21–27. [Google Scholar] [CrossRef]

- Kalivoshko, O.; Myrvoda, A.; Kraevsky, V.; Paranytsia, N.; Skoryk, O.; Kiktev, N. Accounting and Analytical Aspect of Reflection of Foreign Economic Security of Ukraine. In Proceedings of the 2022 IEEE 9th International Conference on Problems of Infocommunications, Science and Technology (PIC S&T), Kharkiv, Ukraine, 10–12 October 2022; pp. 405–410. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. Strategy Maps: Converting Intangible Assets into Tangible Outcomes; Harvard Business School Press: Cambridge, MA, USA, 2004. [Google Scholar]

| No. | Model Parameters | Symbolic Notation | Source/Calculation |

|---|---|---|---|

| 1 | The method applied | #method | Functional module of the ISMCT “Legislation”/handbook “Transfer Pricing Methods” |

| 2 | Operation object | #object | Functional module of the ISMCT “Legislation”/handbook “Raw Materials” |

| 3 | Operation volume | #volume | Manual input by the manager (based on information from the commercial department) |

| 4 | Comparison basis | #exchange | Functional module of the TPCMIS “Benchmarking”/database “Exchanges” |

| 5 | Calculation of the transfer price range | #calculation | LARGE (1:n, COUNTIF (#exchange, “✔”)) → COUNT (LARGE (1:n, COUNTIF (#exchange, “✔”))) × 0.25 → COUNT (LARGE (1:n, COUNTIF (#exchange, “✔”))) × 0.75 → from #lowest_price to #highest price |

| 6 | Management cost (before holding expenses) | #cost | Functional module of the TPCMIS “Analysis and Analytics”/tool “Data Export from CIS”/module “Management Accounting”/segment “Agricultural Production”/Analytics by Crops/Management Cost |

| 7 | EBITDA operations | #ebitda_op | from (#lowest_price − #cost) × #volume to (#highest_price − #cost) × #volume |

| No. | Model Parameters | Symbolic Notation | Source/Calculation |

|---|---|---|---|

| 1 | The method applied | #method | Functional module of the ISMCT “Legislation”/handbook “Transfer Pricing Methods” |

| 2 | Operation object | #object | Functional module of the ISMCT “Legislation”/handbook “Final product” |

| 3 | Operation volume | #volume | Manual input by the manager (based on information from the commercial department) |

| 4 | Comparison basis | #exchange | Functional module of the TPCMIS “Benchmarking”/database “Residents” |

| 5 | Calculation of the transfer price range | #calculation | for the comparison database: gross_margin0 = (#sale_price0 − #purchase_price0)/#sale_price0 for the company: #sale_price1 = #purchase_price1/(1 − gross_margin0) |

| 6 | EBITDA operations | #ebitda_op | (#sale_price1 − #purchase_price1) × #volume |

| No. | Model Parameters | Symbolic Notation | Source/Calculation |

|---|---|---|---|

| 1 | The method applied | #method | Functional module of the ISMCT “Legislation”/handbook “Transfer Pricing Methods” |

| 2 | Operation object | #object | Functional module of the ISMCT “Legislation”/handbook “Final product” |

| 3 | Operation volume | #volume | Manual input by the manager (based on information from the commercial department) |

| 4 | Comparison basis | #exchange | Functional module of the TPCMIS “Benchmarking”/database “Residents” |

| 5 | Calculation of the transfer price range | #calculation | for the comparison database: #sale_price0 = #cost0 × (1 + #prem%0) for the company: #sale_price1 = #cost1 × (1 + #prem%0) |

| 6 | EBITDA operations | #ebitda_op | (#sale_price1 − #cost1) × #volume |

| No. | Model Parameters | Symbolic Notation | Source/Calculation |

|---|---|---|---|

| 1 | The method applied | #method | Functional module of the ISMCT “Legislation”/handbook “Transfer Pricing Methods” |

| 2 | Operation object | #object | Functional module of the ISMCT “Legislation”/handbook “Final product” |

| 3 | Operation volume | #volume | Manual input by the manager (based on information from the commercial department) |

| 4 | Comparison basis | #exchange | Functional module of the TPCMIS “Benchmarking”/database “Residents” |

| 5 | Calculation of the transfer price range | #calculation | for the comparison database: #profitability0 = (#sale_price0 − #cost0 − #other_cost0)/#sale_price0 for the company: #sale_price1 = (#cost1 − #other_cost1)/(1 − #profitability0) |

| 6 | EBITDA operations | #ebitda_op | (#sale_price1 − #cost1 − #other_cost1) × #volume |

| No. | Model Parameters | Symbolic Notation | Source/Calculation |

|---|---|---|---|

| 1 | The method applied | #method | Functional module of the ISMCT “Legislation”/handbook “Transfer Pricing Methods” |

| 2 | Operation object | #object | Functional module of the ISMCT “Legislation”/handbook “Final product” |

| 3 | Operation volume | #profit | Manual input by the manager (based on information from the commercial department) |

| 4 | Comparison basis | #exchange | Functional module of the TPCMIS “Benchmarking”/database “Residents” |

| 5 | Calculation of EBITDA operation | #ebitda_op | for the comparison database: #d01(profit0) = #profit01/(#profit01 + #profit02); #d02(profit0) = #profit02/(#profit01 + #profit02) for the company: #profit11 = #profit1 × #d01(profit0) #profit12 = #profit1 × #d02(profit0) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kalivoshko, O.; Kraievskyi, V.; Hnatkivskyi, B.; Savchenko, A.; Kiktev, N.; Borkovska, V.; Kliopova, I.; Mudryk, K.; Pysz, P. Modeling a Financial Controlling System for Managing Transfer Pricing Operations. Sustainability 2025, 17, 6650. https://doi.org/10.3390/su17146650

Kalivoshko O, Kraievskyi V, Hnatkivskyi B, Savchenko A, Kiktev N, Borkovska V, Kliopova I, Mudryk K, Pysz P. Modeling a Financial Controlling System for Managing Transfer Pricing Operations. Sustainability. 2025; 17(14):6650. https://doi.org/10.3390/su17146650

Chicago/Turabian StyleKalivoshko, Oleksii, Volodymyr Kraievskyi, Bohdan Hnatkivskyi, Alla Savchenko, Nikolay Kiktev, Valentyna Borkovska, Irina Kliopova, Krzysztof Mudryk, and Pawel Pysz. 2025. "Modeling a Financial Controlling System for Managing Transfer Pricing Operations" Sustainability 17, no. 14: 6650. https://doi.org/10.3390/su17146650

APA StyleKalivoshko, O., Kraievskyi, V., Hnatkivskyi, B., Savchenko, A., Kiktev, N., Borkovska, V., Kliopova, I., Mudryk, K., & Pysz, P. (2025). Modeling a Financial Controlling System for Managing Transfer Pricing Operations. Sustainability, 17(14), 6650. https://doi.org/10.3390/su17146650