Comprehensive Evaluation of the Resilience of China’s Oil and Gas Industry Chain: Analysis and Thinking from Multiple Perspectives

Abstract

1. Introduction

2. Materials and Methods

2.1. Comprehensive Evaluation Index System for Resilience of OGI

2.2. Evaluation Method

2.2.1. Resilience Comprehensive Evaluation Model

2.2.2. Obstacle Factor Diagnosis Model

2.2.3. Coupling Coordination Degree Model (CCD Model)

2.3. Data Sources and Processing

3. Results Analysis

3.1. Analysis of the Results of the Resilience Evaluation of China’s OGI Chain

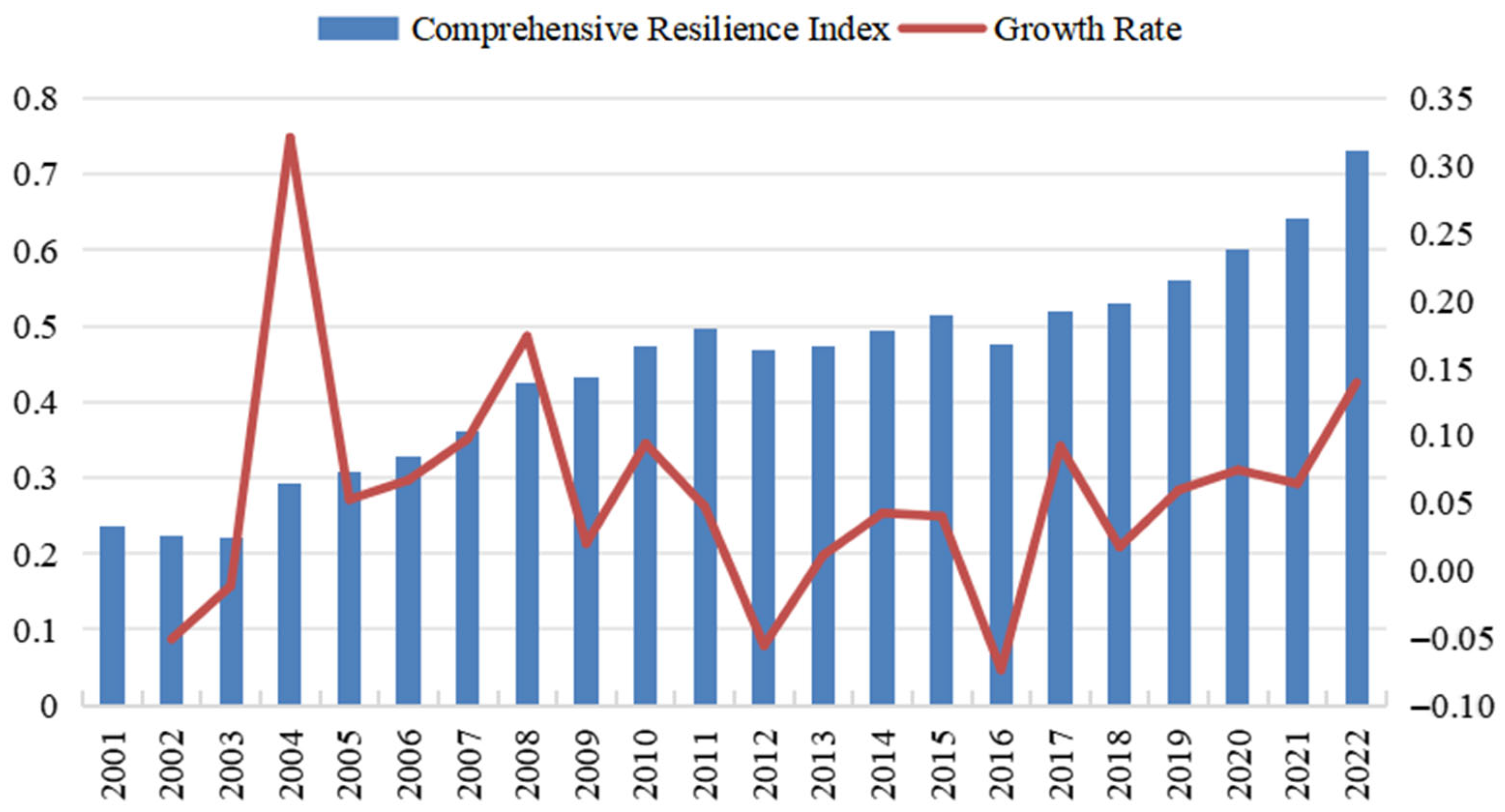

3.1.1. Comprehensive Index Analysis

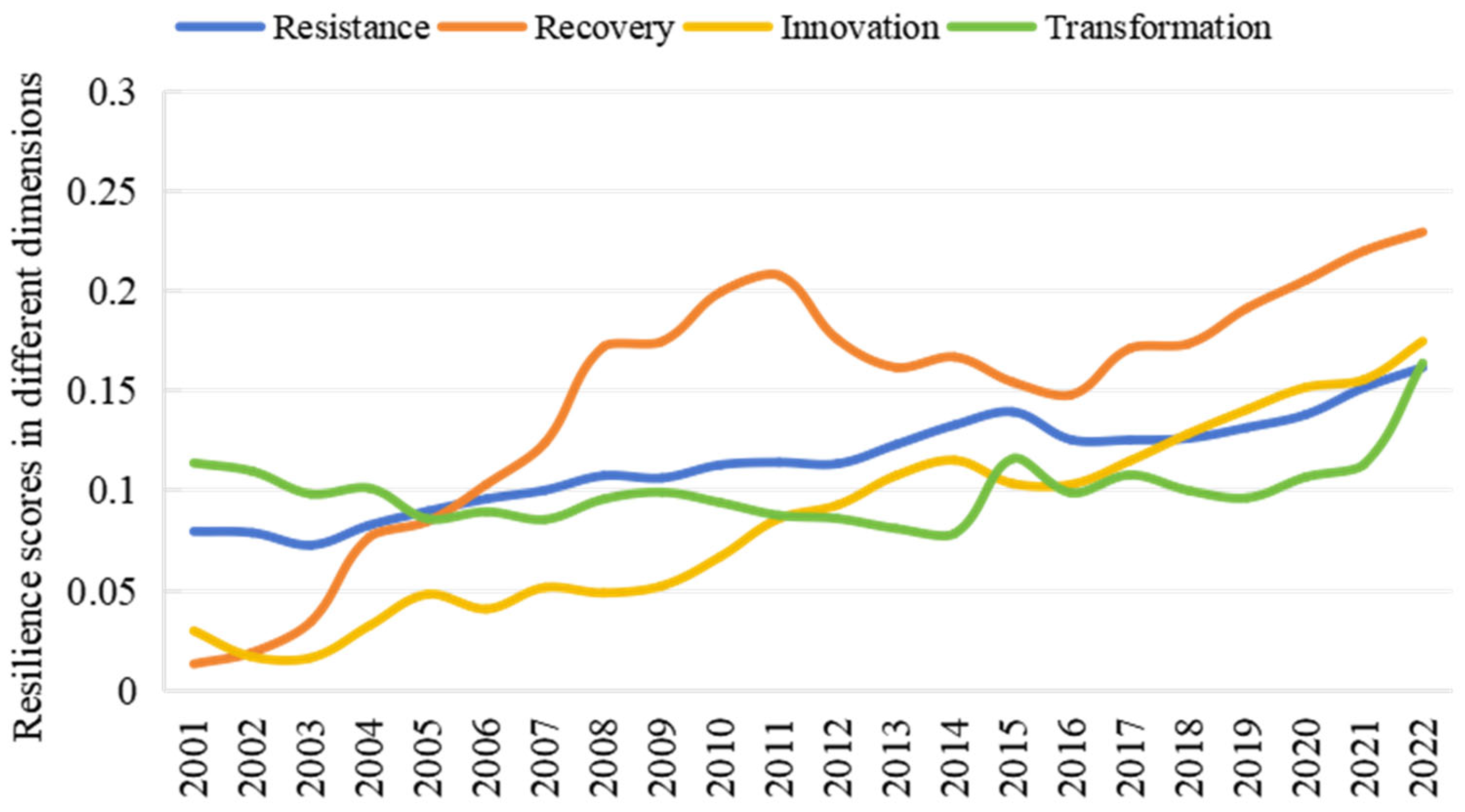

3.1.2. Multidimensional Index Analysis

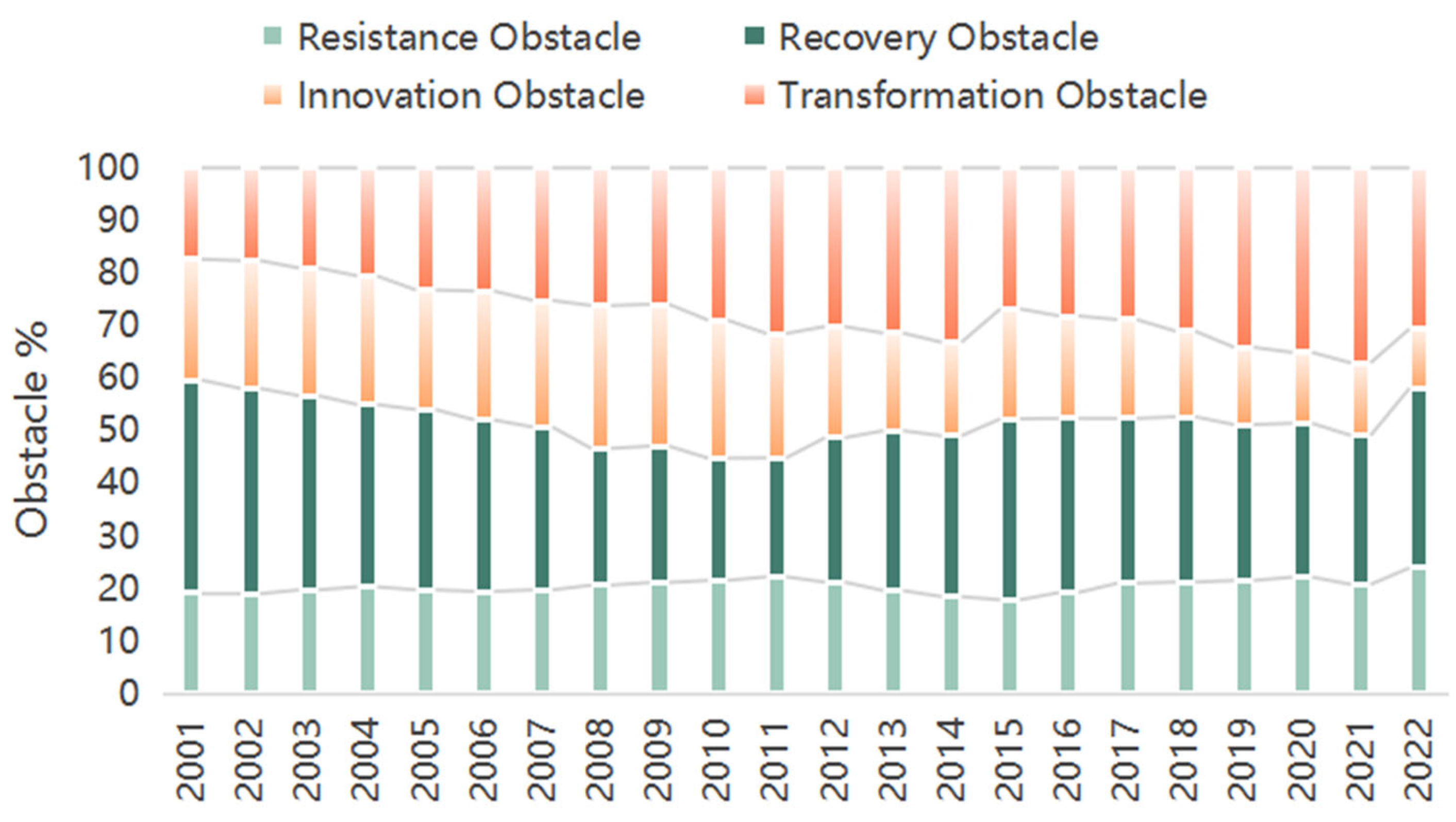

3.2. Key Obstacle Factor Analysis

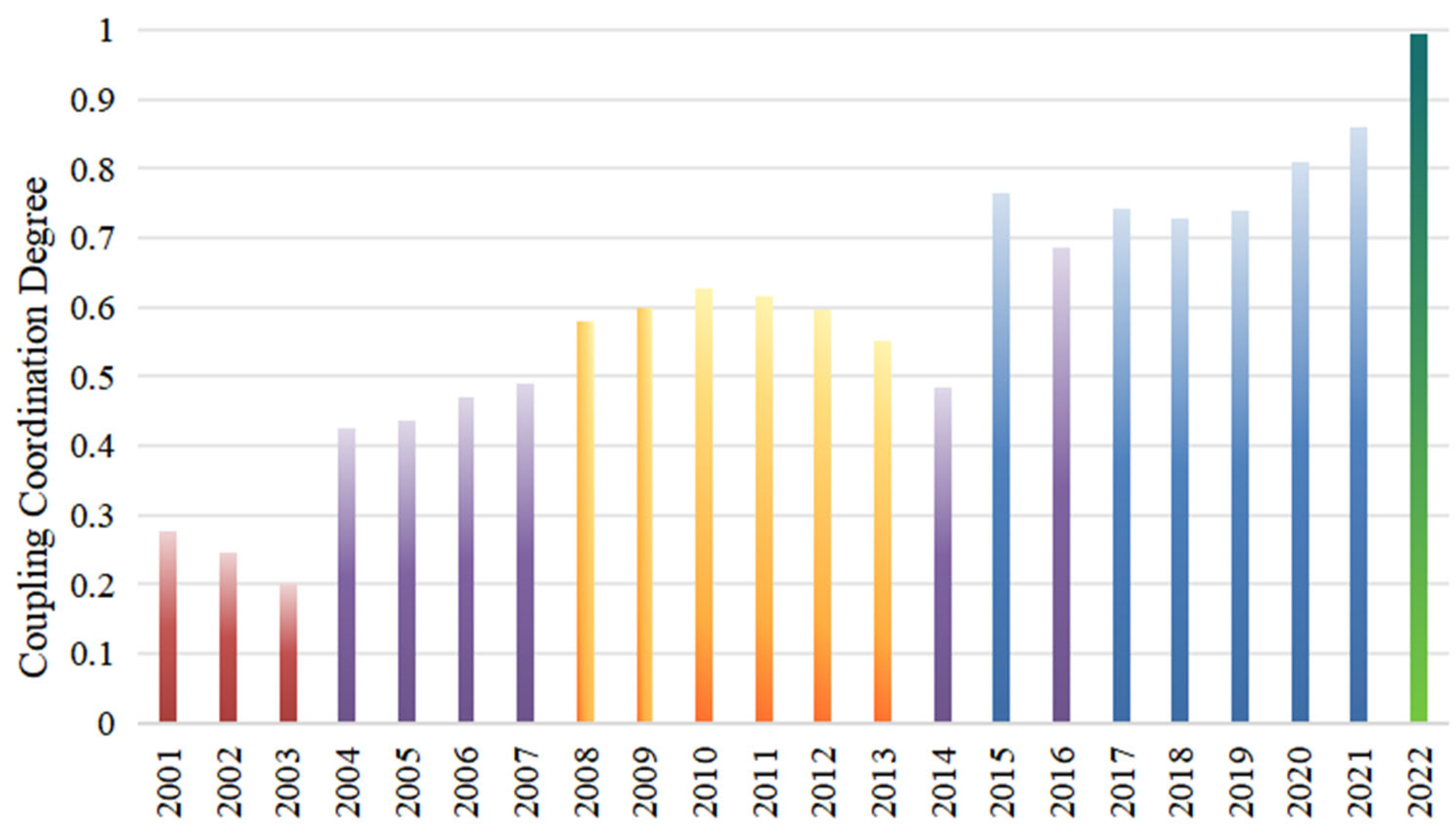

3.3. Coupling Coordination Analysis

4. Discussion

5. Conclusions and Implications

5.1. Research Conclusions

- (1)

- The overall resilience of China’s OGI chain exhibited a sustained upward trend during the study period, rising from 0.23652 in 2001 to 0.72977 in 2022, with an average annual growth rate of 5.51%. Despite experiencing multiple internal adjustments and external shocks, the system’s capacity to absorb and adapt to risks has significantly improved.

- (2)

- Distinct stage-based patterns emerged in alignment with China’s Five-Year Plan cycles. A “V-shaped” resilience trajectory was observed during the 10th Plan, while the 11th and 12th Plans saw steady gains. Although setbacks occurred in the early years of the 13th and 14th Plans, long-term growth momentum was maintained. These variations highlight the system’s adaptability amid oil price fluctuations, economic transitions, and global crises such as the COVID-19 pandemic.

- (3)

- Significant differences in resilience performance were observed across dimensions. Recovery showed the greatest improvement, innovation followed a steady growth path, resistance remained relatively stable, and transformation accelerated after 2019 due to low-carbon development policies. These results reflect advances in technological and structural adjustment, though the capacity to withstand external shocks requires further reinforcement.

- (4)

- Key obstacles constraining resilience improvement were identified. Recovery capacity remains the most critical bottleneck, particularly in relation to the underdevelopment of CCUS technologies and insufficient innovation in the downstream sector. In addition, rising dependence on natural gas imports and inadequate economic returns across the value chain continue to impede overall resilience enhancement.

- (5)

- The coupling coordination among resilience subsystems has progressively improved. From 2001 to 2022, the CCD between resistance, recovery, innovation, and transformation evolved from mild imbalance to moderate coordination, indicating enhanced internal synergy and an improved capacity for integrated response to complex and evolving risks.

5.2. Research Implications

- (1)

- Technology-driven upgrading: Foster an integrated upstream and downstream R&D ecosystem, with a particular focus on carbon capture, utilization, and storage (CCUS), digital oilfield technologies, and the development of low-carbon materials.

- (2)

- Diversification of supply sources: Strategically reduce dependence on imports by expanding domestic reserves and diversifying international procurement channels.

- (3)

- Governance and policy optimization: Incorporate resilience assessment mechanisms into national energy planning and implement early warning systems for supply chain risks.

5.3. Future Research Directions

- (1)

- The Advancement of Resilience Measurement Methods: The current study primarily uses entropy weight-based composite evaluation. However, given the complex networked nature of the OGI chain, future research could incorporate network analysis tools such as network density, centrality, and robustness indicators. The dynamic trade network model proposed by Liu et al. (2025) in the context of agricultural trade offers methodological inspiration [36].

- (2)

- The Identification of Core Resilience Drivers: Current models focus on multidimensional indicators but lack a statistical identification of causality. Future studies may consider applying the Temporal Exponential Random Graph Model (TERGM) or panel structural equation modeling to identify key internal and external factors influencing resilience [37].

- (3)

- The Exploration of Differentiated Resilience Enhancement Paths: The OGI chain’s resilience performance varies across different economic cycles. Thus, exploring targeted policy and industrial responses under different scenarios—e.g., demand surges, supply disruptions, or geopolitical shocks—could yield tailored strategies. Comparative case studies or scenario simulations would be valuable.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| OGI | Oil and Gas Industry |

| CCD | Coupling Coordination Degree |

References

- Holling, C.S. Resilience and Stability of Ecological Systems. Annu. Rev. Ecol. Syst. 1973, 4, 1–23. [Google Scholar] [CrossRef]

- Farley, J.; Voinov, A. Economics, Socio-Ecological Resilience and Ecosystem Services. J. Environ. Manag. 2016, 183, 389–398. [Google Scholar] [CrossRef]

- Stadtfeld, G.M.; Gruchmann, T. Dynamic Capabilities for Supply Chain Resilience: A Meta-Review. Int. J. Logist. Manag. 2024, 35, 623–648. [Google Scholar] [CrossRef]

- Pisano, U. Resilience and Sustainable Development: Theory of Resilience, Systems Thinking and Adaptive Governance; ESDN Quarterly Report N°26; European Sustainable Development Network (ESDN): Vienna, Austria, 2012; pp. 1–50. Available online: https://api.semanticscholar.org/CorpusID:15862869 (accessed on 10 July 2025).

- Walker, B.W.; Holling, C.S.; Carpenter, S.R.; Kinzig, A. Resilience, Adaptability and Transformability in Social-Ecological Systems. Ecol. Soc. 2004, 9, 5. [Google Scholar] [CrossRef]

- Martin, J.; Henrichs, T.; Francis, C.; Hoogeveen, Y.; Kazmierczyk, P.; Pignatelli, R.; Speck, S. Environmental Indicator Report: Ecosystem Resilience and Resource Efficiency in a Green Economy in Europe; European Environment Agency: Copenhagen, Denmark, 2012; Available online: https://www.eea.europa.eu/publications/environmental-indicator-report-2012 (accessed on 10 July 2025).

- Pu, G.; Zhang, J.; Wang, Y.; Li, S. Effect of Supply Chain Resilience on Firm’s Sustainable Competitive Advantage: A Dynamic Capability Perspective. Environ. Sci. Pollut. Res. 2022, 30, 4881–4898. [Google Scholar] [CrossRef]

- Shishodia, A.; Sharma, R.; Rajesh, R.; Munim, Z.H. Supply Chain Resilience: A Review, Conceptual Framework and Future Research. Int. J. Logist. Manag. 2023, 34, 879–908. [Google Scholar] [CrossRef]

- Guo, Y.; Xie, L.; Du, X. Evaluation on Food Security Resilience: System Construction, Development Disparities, and Obstacle Analysis. Nongcun Jingji (Rural. Econ.) 2025, 1, 29–37. (In Chinese) [Google Scholar]

- Ma, L.; Li, X.; Pan, Y. Global Industrial Chain Resilience Research: Theory and Measurement. Systems 2023, 11, 466. [Google Scholar] [CrossRef]

- Wang, Y.F.; Yang, H.F.; Wang, X.S. Constructing the Dual Circulation New Development Pattern from the Perspective of Industrial Chain and Supply Chain Security—Based on a Macro Model of Open Economies. Stud. Int. Financ. 2024, 22–35. (In Chinese) [Google Scholar] [CrossRef]

- Zhang, M. Research on the Measurement and Influencing Factors of Resilience of China’s High-Tech Industrial Chain. Stat. Decis. 2025, 41, 118–123. (In Chinese) [Google Scholar] [CrossRef]

- Wu, A.; Sun, Y.; Zhang, H.; Sun, L.; Wang, X.; Li, B. Research on Resilience Evaluation of Coal Industrial Chain and Supply Chain Based on Interval Type-2F-PT-TOPSIS. Processes 2023, 11, 566. [Google Scholar] [CrossRef]

- Wang, S.W.; Guo, R.; Wang, S.B. Coordinated Evolution and Influencing Factors of China’s Energy Resilience and Technological Innovation. China Soft Sci. 2025, 208–224. (In Chinese). Available online: https://link-cnki-net-s.webvpn.nepu.edu.cn/doi/10.16475/j.cnki.1006-1029.2024.12.003 (accessed on 10 July 2025).

- Ouyang, M.; Dueñas-Osorio, L.; Min, X. A Three-Stage Resilience Analysis Framework for Urban Infrastructure Systems. Struct. Saf. 2012, 36–37, 23–31. [Google Scholar] [CrossRef]

- Wang, Z.Y.; Tang, Y.Q.; Han, Z.L.; Wang, Y. Resilience Measurement and Influencing Factors of the Marine Ship Industry Chain in China’s Coastal Areas. Econ. Geogr. 2022, 42, 117–125. (In Chinese) [Google Scholar] [CrossRef]

- Zuo, Z.L.; Cheng, J.H.; Guo, H.X.; Zhan, C. Evolution and Evaluation of the Structural Resilience of the Lithium Industry Chain Trade Network. China Popul. Resour. Environ. 2024, 34, 155–166. (In Chinese) [Google Scholar]

- Guan, W.; Xu, H.; Wu, W.; Hui, Z.; Lianxia, W. Comprehensive Urban Resilience and Dynamic Prediction of Nanjing City Based on the New Development Concept. Geogr. Sci. 2024, 44, 681–692. (In Chinese) [Google Scholar] [CrossRef]

- Chang, X.; Han, P. Measurement, Spatio-Temporal Evolution, and Regional Differences of Digital Industrial Chain Resilience in China. Stat. Decis. 2024, 40, 28–32. (In Chinese) [Google Scholar] [CrossRef]

- Zhu, Y.G.; Zhang, W.F.; Wang, D.; Dou, S.Q.; Xun, D.Y. Evaluation of the Resilience of the Supply Chain of China’s Copper Resource Industry. Resour. Sci. 2023, 45, 1761–1777. (In Chinese) [Google Scholar]

- Zhao, Y.; Ye, S.Q.; Yang, C.H.; Hong, Y.M. Measurement, Correlation and Attribution of Industrial Chain Resilience from the Perspective of Big Data. China Ind. Econ. 2025, 61–79. (In Chinese) [Google Scholar] [CrossRef]

- Andrews-Speed, P. China’s Oil and Gas Industry: Stranded between the Plan and the Market. In States and Markets in Hydrocarbon Sectors; Belyi, A.V., Talus, K., Eds.; Palgrave Macmillan: Houndmills, UK, 2015; pp. 214–239. [Google Scholar]

- Vermeer, E.B. The Global Expansion of Chinese Oil Companies: Political Demands, Profitability and Risks. China Inf. 2015, 29, 3–32. [Google Scholar] [CrossRef]

- Chen, L.; Dui, H.; Zhang, C. A Resilience Measure for Supply Chain Systems Considering the Interruption with the Cyber-Physical Systems. Reliab. Eng. Syst. Saf. 2020, 199, 106869. [Google Scholar] [CrossRef]

- Kong, Z.Y.; Dong, X.C.; Jiang, Q.Z. Analysis of Energy Return on Investment of China’s Oil and Gas Production. IOP Conf. Ser. Earth Environ. Sci. 2018, 146, 012052. [Google Scholar] [CrossRef]

- Liu, C.; Wang, Y.; Li, Y.; Cui, S.; Li, L. Energy Eco-Efficiency in China’s Oil and Gas Resource-Based Enterprises and Its Influencing Factors: A Data Envelopment Analysis from Static and Dynamic Perspectives. Polish J. Environ. Stud. 2023, 32, 2825–2837. [Google Scholar] [CrossRef]

- Chen, K.-S. Interlinkages between Bitcoin, Green Financial Assets, Oil, and Emerging Stock Markets. Data Sci. Finance Econ. 2024, 4, 160–187. [Google Scholar] [CrossRef]

- Chen, S. Study on Resilience of China’s Oil Energy System under Import Shortage Scenario. Ph.D. Thesis, China University of Mining and Technology, Xuzhou, China, 2022. (In Chinese). [Google Scholar] [CrossRef]

- Xiao, X.Z.; Li, S.L. Industrial Chain Resilience under Great Changes: Generating Logic, Practical Concerns and Policy Orientation. Reform 2022, 1–14. (In Chinese). Available online: https://link-cnki-net-s.webvpn.nepu.edu.cn/urlid/50.1012.F.20221219.0957.001 (accessed on 10 July 2025).

- Wu, W.J.; Feng, W.Y. Evaluation of the Resilience of the Oil Industry Chain and Supply Chain in China. J. Xi’an Shiyou Univ. (Soc. Sci. Ed.) 2024, 33, 23–30. (In Chinese) [Google Scholar]

- Cai, W.G.; Xu, F.G. Research on the Measurement and Characteristics of the Spatial-Temporal Evolution of Industrial Resilience in China. Reform Econ. Syst. 2022, 90–97. (In Chinese) [Google Scholar]

- Li, Y. Improving the Resilience and Security of China’s Industrial Chain Supply Chain in the Context of Building the New Development Paradigm. Econ. Rev. J. 2023, 51–58. (In Chinese) [Google Scholar] [CrossRef]

- Xiang, K.; Zheng, N.; Chen, J.; Gao, W. Evaluation and Obstacle Degree Analysis of Low-Carbon Development Level in Fujian Province-Based on Entropy Weight TOPSIS Method. Front. Energy Res. 2022, 10, 948893. [Google Scholar] [CrossRef]

- Wang, B.; Tang, S. A Study on the Evaluation of the Degree and Diagnosis of Obstacle Factors of Intensive Use Arable Land Resources in China. Macroeconomics 2023, 117–127. (In Chinese) [Google Scholar] [CrossRef]

- Xiao, C. Research on Comprehensive Evaluation of Urban Resilience of China. Ph.D. Thesis, Jiangxi University of Finance and Economics, Nanchang, China, 2021. (In Chinese). [Google Scholar] [CrossRef]

- Liu, Y.; Zhang, L.; Failler, P.; Wang, Z. The Dynamic Evolution of Agricultural Trade Network Structures and Its Influencing Factors: Evidence from Global Soybean Trade. Systems 2025, 13, 279. [Google Scholar] [CrossRef]

- Sheng, D.; Guyot, O. Market Power, Internal and External Monitoring, and Firm Distress in the Chinese Market. Data Sci. Financ. Econ. 2024, 4, 285–308. [Google Scholar] [CrossRef]

| First-Level Indicators | Second-Level Indicators | Third-Level Indicators | Type | Weight | |

|---|---|---|---|---|---|

| Resistance | Resource Guarantee Capability | Ultimate Recoverable Reserves of Oil | A1 | Maximum | 0.0297 |

| Ultimate Recoverable Reserves of Natural Gas | A2 | Maximum | 0.0292 | ||

| Oil Import Dependence | A3 | Minimum | 0.0269 | ||

| Natural Gas Import Dependence | A4 | Minimum | 0.0394 | ||

| Product Supply Capability | Crude Oil Production | A5 | Maximum | 0.0181 | |

| Natural Gas Production | A6 | Maximum | 0.0341 | ||

| Pipeline Cargo Turnover | A7 | Maximum | 0.0365 | ||

| Price Buffer Capability | Price Buffer Capability of Upstream Industry Chain | A8 | Median | 0.0067 | |

| Price Buffer Capability of Downstream Industry Chain | A9 | Median | 0.0058 | ||

| Recovery | Industrial Base | Pipe Length | B1 | Maximum | 0.0295 |

| Number of Upstream Enterprises in the Industry Chain | B2 | Maximum | 0.0352 | ||

| Number of Downstream Enterprises in the Industry Chain | B3 | Maximum | 0.0474 | ||

| Element Base | Upstream Capital Stock of the OGI | B4 | Maximum | 0.0284 | |

| Downstream Capital Stock of the OGI | B5 | Maximum | 0.0342 | ||

| Upstream Labor Stock of the OGI | B6 | Maximum | 0.0289 | ||

| Downstream Labor Stock of the OGI | B7 | Maximum | 0.0296 | ||

| Investment Capacity | Upstream Investment in the OGI | B8 | Maximum | 0.0278 | |

| Downstream Investment in the OGI | B9 | Maximum | 0.0272 | ||

| Economic Foundation | Main Operating Revenue per 100 Yuan of Assets of Large-Scale Enterprises | B10 | Maximum | 0.0177 | |

| Return on Total Assets of Industrial Enterprises Above Designated Size | B11 | Maximum | 0.0159 | ||

| Innovation | Innovation Investment | Funding for R&D Investment in the Upstream OGI to Develop New Products | C1 | Maximum | 0.0212 |

| Funding for R&D Investment in the Downstream OGI to Develop New Products | C2 | Maximum | 0.0380 | ||

| Innovation Output | Number of Invention Applications from Upstream Oil and Gas Companies | C3 | Maximum | 0.0370 | |

| Number of Invention Applications from Downstream Oil and Gas Companies | C4 | Maximum | 0.0663 | ||

| Technology Improvement | Refining Rate | C5 | Maximum | 0.0270 | |

| Efficiency of Energy Conversion | C6 | Maximum | 0.0158 | ||

| Transformation | Structural Transformation | The Proportion of Crude Oil Consumption in the Chemical Raw Materials and Chemical Products Manufacturing Industries | D1 | Maximum | 0.0183 |

| Low-carbon Transformation | CO2 Emissions—Oil | D2 | Minimum | 0.0239 | |

| CO2 Emissions—Natural Gas | D3 | Minimum | 0.0176 | ||

| Carbon Emission Intensity of Oil | D4 | Minimum | 0.0174 | ||

| Carbon Emission Intensity of Natural Gas | D5 | Minimum | 0.0305 | ||

| Sulfur Dioxide Emissions from Upstream of the Industrial Chain | D6 | Minimum | 0.0059 | ||

| Sulfur Dioxide Emissions from Downstream of the Industrial Chain | D7 | Minimum | 0.0448 | ||

| Annual Storage of CO2 by CCUS | D8 | Maximum | 0.0719 | ||

| Extension and Integration of The Industrial Chain | Number of Downstream Enterprises in the Industrial Chain | D9 | Maximum | 0.0162 | |

| Title 1 | NO. 1 | NO. 2 | NO. 3 | NO. 4 | NO. 5 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Index | Obstacle | Index | Obstacle | Index | Obstacle | Index | Obstacle | Index | Obstacle | |

| 2001 | D8 | 9.41 | C4 | 8.63 | B3 | 6.20 | C2 | 4.95 | C3 | 4.85 |

| 2002 | D8 | 9.27 | C4 | 8.48 | B3 | 6.09 | C2 | 4.89 | C3 | 4.72 |

| 2003 | D8 | 9.24 | C4 | 8.42 | B3 | 6.02 | C2 | 4.88 | C3 | 4.65 |

| 2004 | D8 | 10.17 | C4 | 9.03 | B11 | 6.32 | D7 | 5.33 | C3 | 5.05 |

| 2005 | D8 | 10.39 | C4 | 9.19 | B11 | 6.49 | D7 | 5.68 | C3 | 4.85 |

| 2006 | D8 | 10.44 | C4 | 9.81 | B11 | 6.59 | D7 | 5.46 | C2 | 4.85 |

| 2007 | D8 | 10.97 | C4 | 10.38 | B11 | 6.77 | D7 | 5.68 | C3 | 4.78 |

| 2008 | D8 | 12.16 | C4 | 11.39 | B11 | 6.81 | D7 | 6.06 | C3 | 5.25 |

| 2009 | D8 | 12.34 | C4 | 11.23 | B11 | 6.77 | C2 | 5.86 | C7 | 5.22 |

| 2010 | D8 | 13.30 | C4 | 11.68 | B11 | 7.11 | D7 | 6.69 | C2 | 6.06 |

| 2011 | D8 | 11.46 | C4 | 10.87 | D7 | 8.89 | B11 | 7.72 | C2 | 5.49 |

| 2012 | D8 | 10.86 | C4 | 9.32 | D7 | 8.36 | B11 | 6.99 | B10 | 5.23 |

| 2013 | D8 | 10.39 | C4 | 9.00 | D7 | 8.35 | B11 | 6.65 | B5 | 5.40 |

| 2014 | D8 | 10.80 | D7 | 8.62 | C4 | 8.08 | B11 | 6.38 | A4 | 5.56 |

| 2015 | D8 | 10.93 | C4 | 8.87 | B11 | 6.30 | B5 | 5.82 | A4 | 5.80 |

| 2016 | D8 | 10.14 | C4 | 8.51 | A4 | 6.07 | B5 | 5.65 | B11 | 5.60 |

| 2017 | D8 | 11.06 | A4 | 7.31 | C4 | 6.82 | B10 | 6.10 | D5 | 5.87 |

| 2018 | D8 | 11.18 | A4 | 8.34 | B10 | 6.56 | D5 | 6.47 | C4 | 6.37 |

| 2019 | D8 | 11.98 | A4 | 8.79 | B10 | 6.83 | D5 | 6.45 | C5 | 6.13 |

| 2020 | D8 | 13.24 | A4 | 9.33 | B10 | 7.21 | C5 | 6.78 | A3 | 6.75 |

| 2021 | D8 | 12.53 | A4 | 10.96 | B4 | 7.78 | B10 | 7.33 | C5 | 7.19 |

| 2022 | A4 | 13.22 | B4 | 10.70 | B10 | 9.43 | C2 | 9.15 | A3 | 8.87 |

| Grade | Extremely Incoordination | Mild Incoordination | Primary Coordination | Mild Coordination | High-Quality Coordination |

|---|---|---|---|---|---|

| CCD | [0.0, 0.3) | [0.3, 0.5) | [0.5, 0.7) | [0.7, 0.9) | [0.9, 1.0) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Yao, L.; Li, X.; Qin, Z. Comprehensive Evaluation of the Resilience of China’s Oil and Gas Industry Chain: Analysis and Thinking from Multiple Perspectives. Sustainability 2025, 17, 6505. https://doi.org/10.3390/su17146505

Wang Y, Yao L, Li X, Qin Z. Comprehensive Evaluation of the Resilience of China’s Oil and Gas Industry Chain: Analysis and Thinking from Multiple Perspectives. Sustainability. 2025; 17(14):6505. https://doi.org/10.3390/su17146505

Chicago/Turabian StyleWang, Yanqiu, Lixia Yao, Xiangyun Li, and Zhaoguo Qin. 2025. "Comprehensive Evaluation of the Resilience of China’s Oil and Gas Industry Chain: Analysis and Thinking from Multiple Perspectives" Sustainability 17, no. 14: 6505. https://doi.org/10.3390/su17146505

APA StyleWang, Y., Yao, L., Li, X., & Qin, Z. (2025). Comprehensive Evaluation of the Resilience of China’s Oil and Gas Industry Chain: Analysis and Thinking from Multiple Perspectives. Sustainability, 17(14), 6505. https://doi.org/10.3390/su17146505