From Metrics to Meaning: Research Trends and AHP-Driven Insights into Financial Performance in Sustainability Transitions

Abstract

1. Introduction

2. Preliminary Review of the Literature

- (1)

- Why are the research findings on the assessment of financial performance in the context of sustainability still inconsistent?

- (2)

- How can diverse approaches to financial performance in the pursuit of sustainable development goals (measurement, theory, integration, etc.) be prioritized based on expert judgment?

3. Materials and Methods

Sample Collection and Processing

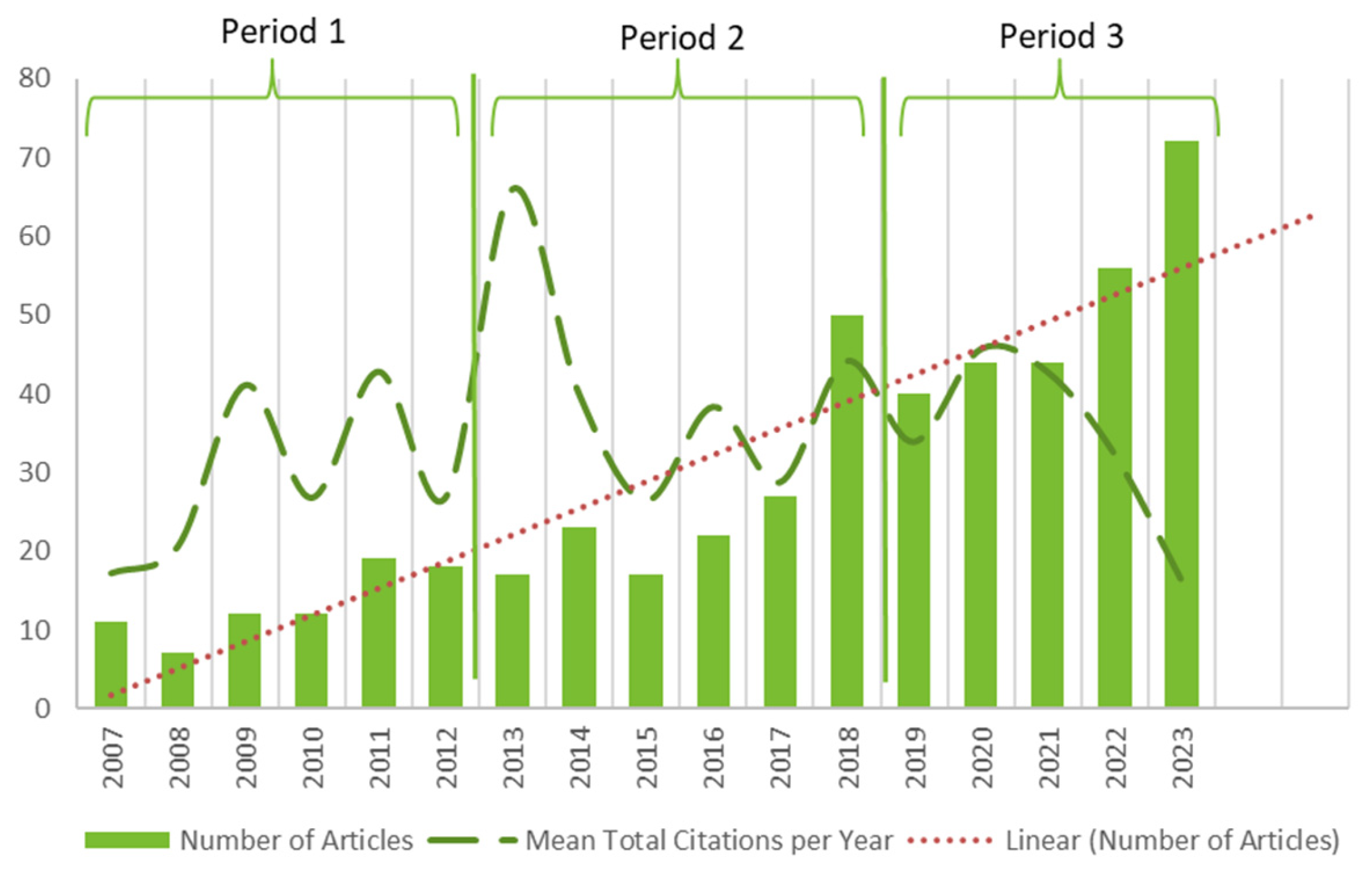

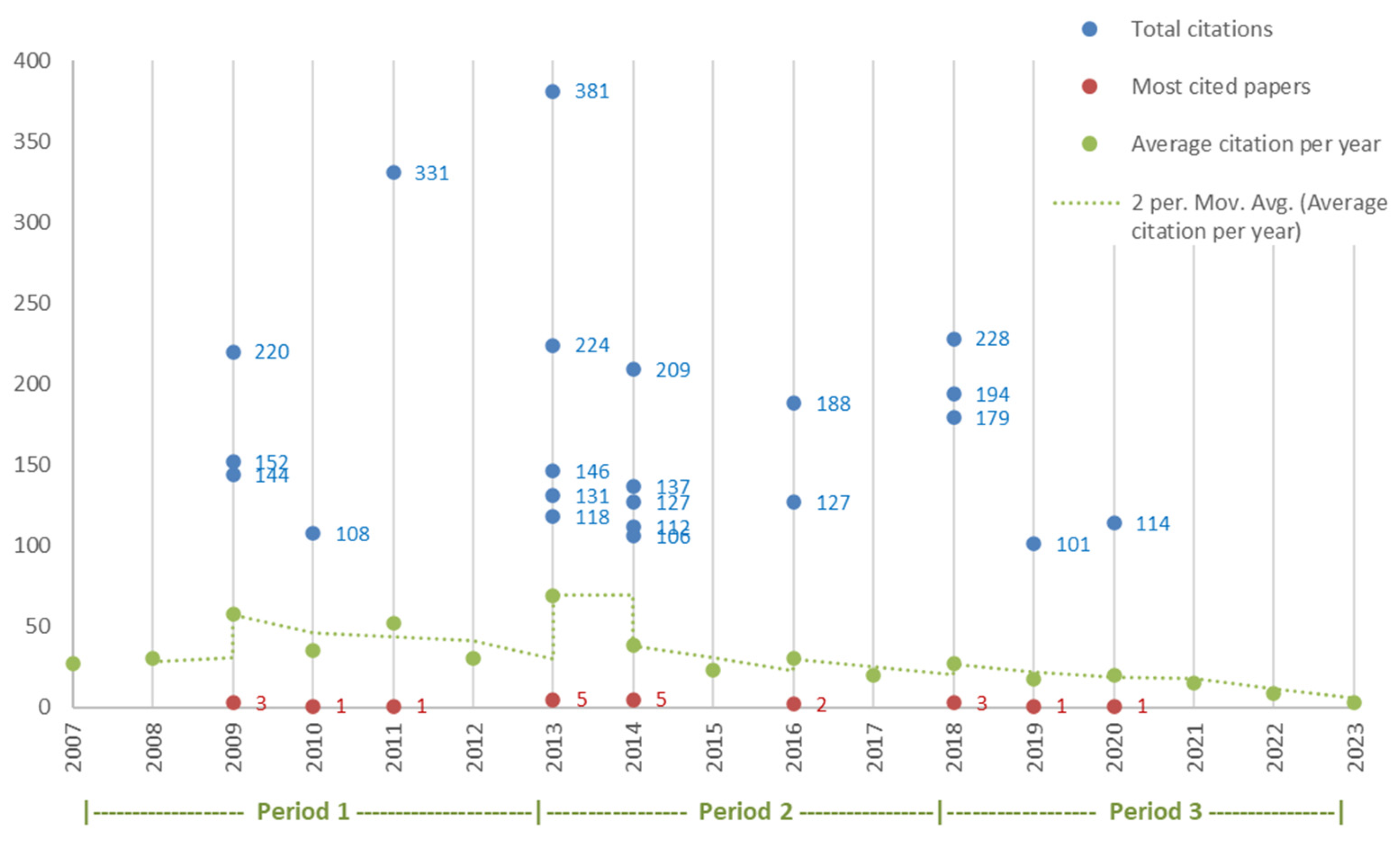

4. Bibliometric Analysis

4.1. Scientific Productivity Explored with Lotka’s Law

4.2. Scientific Productivity Based on Authors’ Contributions

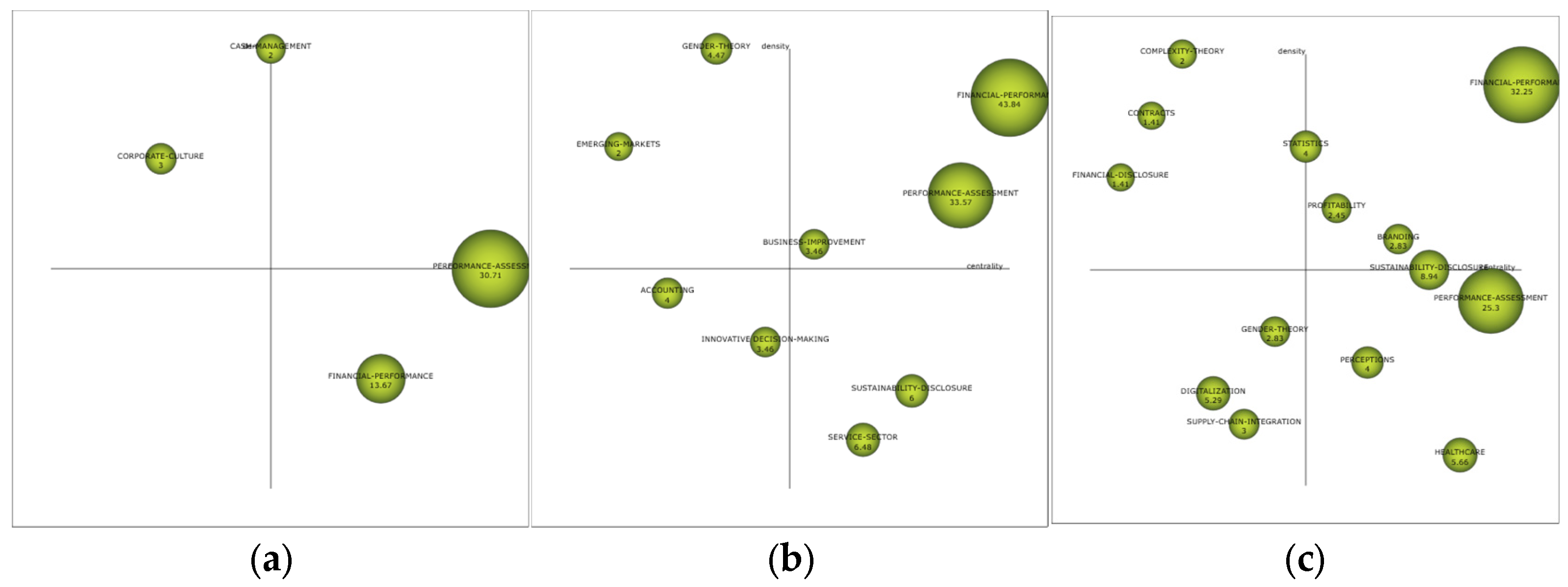

4.3. Co-Word Analysis

4.4. Science Mapping Financial-Performance Research

4.5. Analysis by Period

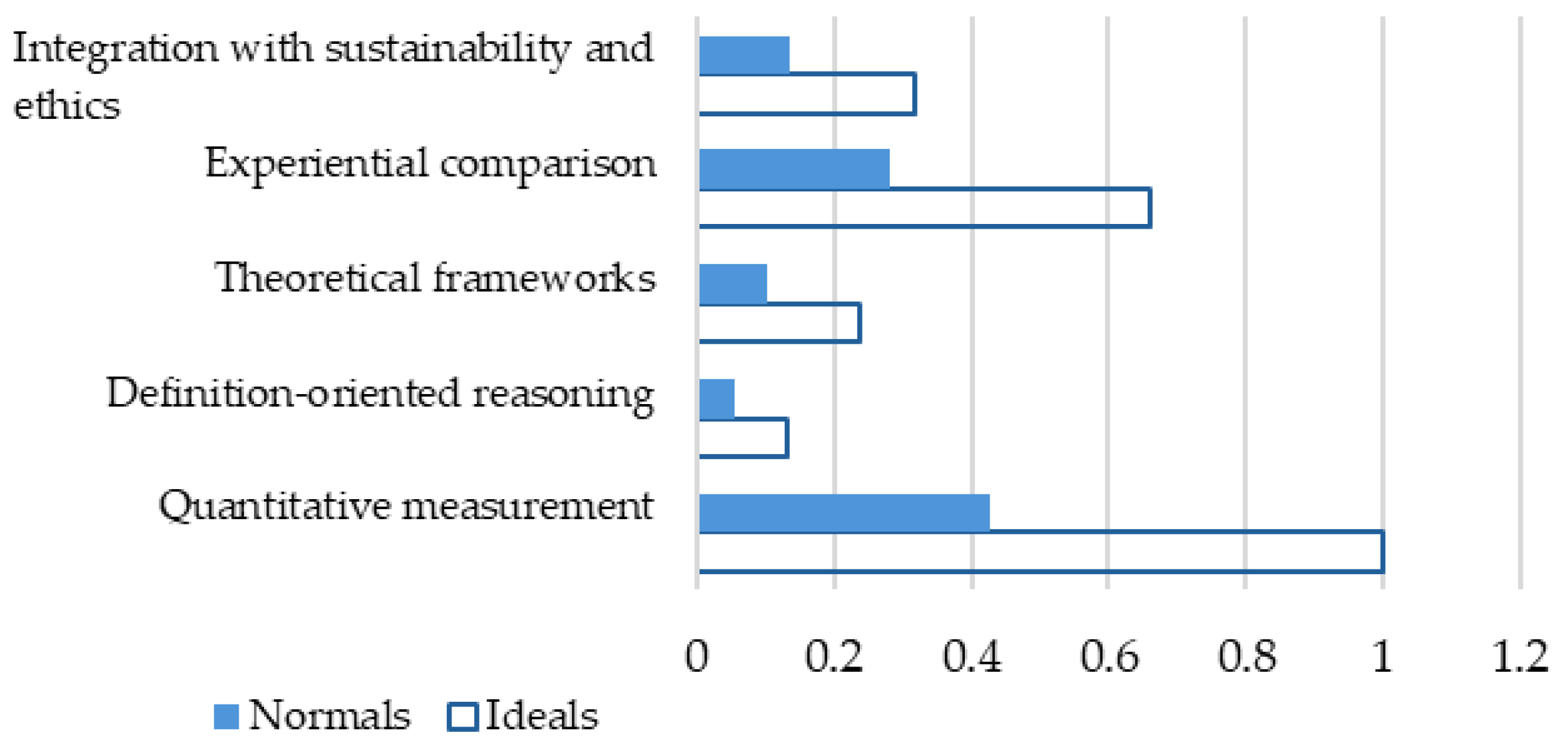

4.6. Conceptual Evolution of Performance Perspectives

4.7. AHP Framework Structure

5. Conclusions

Proposal for Research Agenda Development

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Authors | Title of Manuscript | Year of Publication | Total Citations | Purpose of Study | Approach and Sample | Main Findings |

|---|---|---|---|---|---|---|

| [71] | The Role of the Board in the Dissemination of Integrated Corporate Social Reporting | 2013 | 381 | Demonstrate the influence of the Board of Directors on the integrated dissemination of information. | Quantitative: 568 non-financial multinational companies from 15 countries during 2008–2010 | The main factors motivating integrated dissemination of information are growth opportunities, the size of the company, its management bodies, and gender diversity. |

| [5] | Do CFOs Have Style: An Empirical Investigation of the Effect of Individual CFOs on Accounting Practices | 2011 | 331 | Explore the impact of the individual philosophy or “style” of Chief Financial Officers (CFOs) on corporate accounting decisions. | Quantitative: 359 CFOs across different firms | Limited evidence has been discovered concerning the influence of CFO characteristics on accounting decisions, indicating that general CFO characteristics only encompass a fraction of CFO styles. |

| [72] | Innovation with Limited Resources: Management Lessons from the German Mittelstand | 2018 | 228 | Investigate how innovative firms thrive and attain superior innovation performance, even when confronted with significant constraints on financial and human capital. resources in comparison to larger corporations. | Qualitative: focus on German Mittelstand innovative firms | A model identifying and integrating six key traits of the focus firms is presented, enabling them to effectively leverage resources for innovation and competitive advantage, thereby transforming weaknesses into strengths in the global market. |

| [15] | Is Integrated Reporting Determined by a Country’s Legal System? An Exploratory Study | 2013 | 224 | Explore the impact of the legal system as one significant institutional factor on the evolution of integrated reports. | Quantitative: 750 international companies during 2008–2010 | Companies in civil law jurisdictions with strong indicators of legal order are inclined to produce and disseminate diverse integrated reports, facilitating decision-making for various stakeholders. |

| [3] | Risk Management and Calculative Cultures | 2009 | 220 | Analyze how enterprise risk management (ERM) can achieve organizational significance. | Qualitative: the focus is on the cases of two large banking organizations | The paper proposes a “risk-management mix” to enterprises containing four risk-management ideal types, among which two stand out: ERM by the numbers (concerning shareholder value imperative), and holistic ERM (regarding the demands of the risk-based internal control imperative). |

| [6] | Lean Manufacturing and Firm Performance: The Incremental Contribution of Lean Management Accounting Practices | 2014 | 209 | Explore how lean Manufacturing Accounting and Performance (MAP) aids internal decision-making for operation personnel and supports operation executives and business leaders in enhancing lean operations performance as part of a holistic enterprise strategy. | Qualitative: survey of 244 US manufacturing companies | Significant financial control and organizational performance are enhanced by lean MAP. |

| [73] | A New Holistic Conceptual Framework for Green Supply Chain Management Performance Assessment Based on Circular Economy | 2018 | 194 | Analyze the contribution of a holistic approach to Green Supply-Chain Management (GSCM) to improve consumption patterns. | Theoretical | Effective GSCM is based on a three-dimensional hierarchy including the main criteria, sub-criteria, and measures for the GSCM performance assessment. |

| [74] | City Energy Analyst (CEA) Integrated Framework for Analysis and Optimization of Building Energy Systems in Neighborhoods and City Districts | 2016 | 188 | Develop a holistic approach of the City Energy Analyst (CEA) for optimum infrastructure solutions. | Qualitative: the focus is on the downtown area in Switzerland | The City Energy Analyst (CEA) contributes to urban planning improvement and to balanced distribution of social, environmental, and economic criteria, including cost efficiency of photovoltaic sources and potential emissions savings. |

| [75] | Corporate Social Responsibility and Financial Performance: An Empirical Analysis of Indian Banks | 2018 | 179 | Examine the relationship between corporate social responsibility (CSR) and financial performance. | Quantitative: 28 Indian listed commercial banks | CSR positively influences the financial performance of Indian banks. |

| [76] | A Multidimensional Approach to the Influence of Environmental Marketing and Orientation on the Firm’s Organizational Performance | 2009 | 152 | Examine how incorporating ecological concerns into a company’s marketing strategy and orientation affects organizational outcomes. | Qualitative: survey of Spanish manufacturing firms | Environmental marketing enhances firms’ operational and commercial performance, ultimately impacting their economic results while also serving as a potent strategy for gaining competitive advantages in cost and product differentiation. |

| [4] | Antecedents of Proactive Supply Chain Risk Management—A Contingency Theory Perspective | 2013 | 146 | Explore how supply-chain risk management (SCRM) mitigates the risk of insolvency. | Qualitative: 63 interviews in the automotive industry | A holistic approach to risk management can mitigate the risk of insolvency for suppliers. |

| [77] | Incorporating Environmental Impacts and Regulations in a Holistic Supply Chain: Modeling an LCA Approach | 2009 | 144 | Improve the supply-chain (SC) planning in the context of economic and environmental issues. | Quantitative: 2 focus groups: product/raw material production and electricity production | Environmental metrics are significantly connected to economic performance measurements. |

| [78] | The Relationships Between Soft–Hard TQM Factors and Key Business Results | 2014 | 137 | Analyze the link between TQM and business outcomes. | Quantitative: 116 private firms | Key business outcomes are influenced by management and HR, the strategic management of partnerships and resources, and process management. |

| [79] | A Multidimensional Approach for CSR Assessment: The Importance of the Stakeholder Perception | 2013 | 131 | Investigate CSR activities in the stakeholders’ context using GRI and BSC. | Qualitative: fuzzy linguistic variables in sustainability reporting | The hierarchy of CSR components influences the responsible perception of a company. |

| [74] | Corporate Governance, Responsible Managerial Behaviour and CSR: Organizational Efficiency Versus Organizational Legitimacy? | 2014 | 127 | Explore the link between governance mechanisms of financial control and responsible managerial behavior or CSR strategies. | Theoretical | The link between CSR strategies and corporate governance is influenced by regulatory or geopolitical factors. |

| [13] | The Impact of Implementing Green Supply Chain Management Practices on Corporate Performance | 2016 | 127 | Analyze how Green Supply-Chain Risk Management (GSRM) influences corporate performance (CP). | Quantitative: 117 firms in the manufacturing industry in the UAE | Economic performance can be improved by green purchasing, while reverse logistics correlate with social performance. |

| [7] | Socially Responsible Investing: An Investor Perspective | 2013 | 118 | Find a consensus on the definition of Socially Responsible Investing (SRI). | Qualitative: survey of 5000 investors | Environmental and sustainability issues are paramount in socially responsible investing for investors who prioritize holistic considerations over exclusionary formats. |

| [16] | How Do Firms Achieve Sustainability Through Green Innovation Under External Pressures of Environmental Regulation and Market Turbulence? | 2020 | 114 | Investigate the impact of environmental policy and market distress on green innovation. | Quantitative: 472 Chinese listed firms during 2006–2017 | The way companies pursue green innovation and sustainability may be better understood through a proposed holistic framework. |

| [17] | The Anatomy of Corporate Fraud: A Comparative Analysis of High Profile American and European Corporate Scandals | 2014 | 112 | Investigate fraud cases in the firm-specific and environmental contexts. | Qualitative: the focus is set on 3 American and 3 European corporate failures | Ethical dilemmas are linked to ineffective boards, faulty corporate governance mechanisms, or the fraud triangle perspective. |

| [80] | The Effects of Organizational Factors on Green New Product Success: Evidence from High-tech Industries in Taiwan | 2010 | 108 | Investigate the factors and impact of new green product development and financial performance. | Quantitative: 181 high-tech companies in Taiwan | Financial performance is significantly and positively linked to green product innovation, corporate environmental commitments, and cross-functional integration. |

References

- Ciocoiu, C.N.; Radu, C.; Colesca, S.E.; Prioteasa, A. Exploring the link between risk management and performance of MSMEs: A bibliometric review. J. Econ. Surv. 2024. [Google Scholar] [CrossRef]

- Corby, J. Failing to Think: The Promise of Performance Philosophy. Perform. Philos. 2018, 4, 576–590. [Google Scholar] [CrossRef]

- Mikes, A. Risk Management and Calculative Cultures. Manag. Account. Res. 2009, 20, 18–40. [Google Scholar] [CrossRef]

- Grötsch, V.M.; Blome, C.; Schleper, M.C. Antecedents of Proactive Supply Chain Risk Management—A Contingency Theory Perspective. Int. J. Prod. Res. 2013, 51, 2842–2867. [Google Scholar] [CrossRef]

- Weili, G.E.; Matsumoto, D.; Zhang, J.L. Do CFOs Have Style? An Empirical Investigation of the Effect of Individual CFOs on Accounting Practices*. Contemp. Account. Res. 2011, 28, 1141–1179. [Google Scholar] [CrossRef]

- Fullerton, R.R.; Kennedy, F.A.; Widener, S.K. Lean Manufacturing and Firm Performance: The Incremental Contribution of Lean Management Accounting Practices. J. Oper. Manag. 2014, 32, 414–428. [Google Scholar] [CrossRef]

- Berry, T.; Junkus, J. Socially Responsible Investing: An Investor Perspective. Journal of Business Ethics 2013, 112, 707–720. [Google Scholar] [CrossRef]

- Aivaz, K.-A.; Vancea, D.-P.C. A study of the Black Sea tourism companies efficiency using envelope techniques. Transform. Bus. Econ. 2009, 8, 217–230. [Google Scholar]

- Volpentesta, T.; Spahiu, E.; De, G.P. A Survey on Incumbent Digital Transformation: A Paradoxical Perspective and Research Agenda. Eur. J. Innov. Manag. 2023, 26, 478–501. [Google Scholar] [CrossRef]

- Martínez-Costa, M.; Choi, T.Y.; Martínez, J.A.; Martínez-Lorente, A.R. ISO 9000/1994, ISO 9001/2000 and TQM: The Performance Debate Revisited. J. Oper. Manag. 2009, 27, 495–511. [Google Scholar] [CrossRef]

- Brown, M.E.; Mitchell, M.S. Ethical and Unethical Leadership: Exploring New Avenues for Future Research. Bus. Ethics Q. 2010, 20, 583–616. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Does it really pay to be green? Determinants and consequences of proactive environmental strategies. J. Account. Public Policy 2011, 30, 122–144. [Google Scholar] [CrossRef]

- Younis, H.; Sundarakani, B.; Vel, P. The Impact of Implementing Green Supply Chain Management Practices on Corporate Performance. Compet. Rev. 2016, 26, 216–245. [Google Scholar] [CrossRef]

- Diez-Cañamero, B.; Bishara, T.; Otegi-Olaso, J.R.; Minguez, R.; Fernández, J.M. Measurement of Corporate Social Responsibility: A Review of Corporate Sustainability Indexes, Rankings and Ratings. Sustainability 2020, 12, 2153. [Google Scholar] [CrossRef]

- Frías-Aceituno, J.V.; Rodríguez-Ariza, L.; García-Sánchez, I.M. Is Integrated Reporting Determined by a Country’s Legal System? An Exploratory Study. J. Clean. Prod. 2013, 44, 45–55. [Google Scholar] [CrossRef]

- Qiu, L.; Hu, D.; Wang, Y. How Do Firms Achieve Sustainability through Green Innovation under External Pressures of Environmental Regulation and Market Turbulence? Bus. Strategy Environ. 2020, 29, 2695–2714. [Google Scholar] [CrossRef]

- Soltani, B. The Anatomy of Corporate Fraud: A Comparative Analysis of High Profile American and European Corporate Scandals. J. Bus. Ethics 2014, 120, 251–274. [Google Scholar] [CrossRef]

- Coelho, R.; Jayantilal, S.; Ferreira, J.J. The Impact of Social Responsibility on Corporate Financial Performance: A Systematic Literature Review. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1535–1560. [Google Scholar] [CrossRef]

- Herghiligiu, I.V.; Dicu, R.M.; Aevoae, G.-M.; Sahlian, D.N.; Popa, A.F.; Robu, I.-B. Circular causality analysis of corporate performance and accounting quality in M&As. PLoS ONE 2024, 19, e0308608. [Google Scholar] [CrossRef]

- Jula, D.; Mastac, L.; Vancea, D.P.C.; Aivaz, K.-A. A Deep Dive into Institutional and Economic Influences on Poverty in Europe. Risks 2025, 13, 104. [Google Scholar] [CrossRef]

- Verma, S.; Sheel, A. Blockchain for Government Organizations: Past, Present and Future. J. Glob. Oper. Strateg. Sourc. 2022, 15, 406–430. [Google Scholar] [CrossRef]

- Kumar, S.; Lim, W.M.; Sureka, R.; Jabbour, C.J.C.; Bamel, U. Balanced Scorecard: Trends, Developments, and Future Directions. Rev. Manag. Sci. 2024, 18, 2397–2439. [Google Scholar] [CrossRef]

- Malesios, C.; De, D.; Moursellas, A.; Dey, P.K.; Evangelinos, K. Sustainability Performance Analysis of Small and Medium Sized Enterprises: Criteria, Methods and Framework. Socio-Econ. Plan. Sci. 2021, 75, 100993. [Google Scholar] [CrossRef]

- Trapczynski, P. Determinants of Foreign Direct Investment Performance—A Critical Literature Review. Oeconomia Copernic. 2013, 4, 117–132. [Google Scholar] [CrossRef]

- Mariappanadar, S. Human Capital to Implement Corporate Sustainability Business Strategies for Common Good. Sustainability 2025, 17, 4559. [Google Scholar] [CrossRef]

- Saaty, R.W. The analytic hierarchy process—What it is and how it is used. Math. Model. 1987, 9, 161–176. [Google Scholar] [CrossRef]

- van Leeuwen, T. The Application of Bibliometric Analyses in the Evaluation of Social Science Research. Who Benefits from It, and Why It Is Still Feasible. Scientometrics 2006, 66, 133–154. [Google Scholar] [CrossRef]

- Erne, R. On the Use and Abuse of Bibliometric Performance Indicators: A Critique of Hix’s ‘Global Ranking of Political Science Departments’. Eur. Political Sci. 2007, 6, 306–314. [Google Scholar] [CrossRef]

- Aria, M.; Cuccurullo, C. bibliometrix: An R-tool for comprehensive science mapping analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Cobo, M.J.; López-Herrera, A.G.; Herrera-Viedma, E.; Herrera, F. SciMAT: A New Science Mapping Analysis Software Tool. J. Am. Soc. Inf. Sci. Technol. 2012, 63, 1609–1630. [Google Scholar] [CrossRef]

- Sofyan, D.; Abdullah, K.H.; Hafiar, H. The Philosophy of Sport and Physical Education: Four Decade Publication Trends via Scientometric Evaluation. Phys. Educ. Theory Methodol. 2022, 22, 437–449. [Google Scholar] [CrossRef]

- López-Robles, J.R.; Cobo, M.J.; Gutiérrez-Salcedo, M.; Martínez-Sánchez, M.A.; Gamboa-Rosales, N.K.; Herrera-Viedma, E. 30th Anniversary of Applied Intelligence: A Combination of Bibliometrics and Thematic Analysis Using SciMAT. Appl. Intell. 2021, 51, 6547–6568. [Google Scholar] [CrossRef]

- Lotka, A.J. The Law of Evolution as a Maximal Principle. Hum. Biol. 1945, 17, 167–194. [Google Scholar]

- Potter, W.G. Lotka’s Law Revisited. Libr. Trends 1981, 30, 21–39. [Google Scholar]

- Coile, R.C. Lotka’s frequency distribution of scientific productivity. J. Am. Soc. Inf. Sci. 1977, 28, 366–370. [Google Scholar] [CrossRef]

- Gibbons, J.D.; Chakraborti, S. Nonparametric Statistical Inference: Revised and Expanded; CRC Press: Boca Raton, FL, USA, 2014. [Google Scholar]

- Kumar, A. An Examination of Lotka’s Law & Author’s Productivity in the Field of Supply Chain Management. Logforum 2019, 15, 50–520. [Google Scholar] [CrossRef]

- Wang, Z.; Shahid, M.; An, N.; Shahzad, M.; Abdul-Samad, Z. Does green finance facilitate firms in achieving corporate social responsibility goals? Econ. Res.-Ekon. Istraz. 2022, 35, 5400–5419. [Google Scholar] [CrossRef]

- Puigjaner, L.; Guillén-Gosálbez, G. Towards an integrated framework for supply chain management in the batch chemical process industry. Comput. Chem. Eng. 2008, 32, 650–670. [Google Scholar] [CrossRef]

- Khan, P.; Johl, S.; Akhtar, S. Vinculum of Sustainable Development Goal Practices and Firms’ Financial Performance: A Moderation Role of Green Innovation. J. Risk Financ. Manag. 2022, 15, 96. [Google Scholar] [CrossRef]

- Shah, S.A.A.; Jajja, M.S.S.; Chatha, K.A. Antecedents and Consequences of Effective Customer Participation: The Role of Customer Education and Service Modularity. J. Serv. Theory Pract. 2023, 33, 697–720. [Google Scholar] [CrossRef]

- Guillén, G.; Badell, M.; Puigjaner, L. A Holistic Framework for Short-Term Supply Chain Management Integrating Production and Corporate Financial Planning. Int. J. Prod. Econ. 2007, 106, 288–306. [Google Scholar] [CrossRef]

- Patiar, A. MCG Davidson, and Y. Wang. Competition, Total Quality Management Practices, and Performance: Evidence from Upscale Hotels. Tour. Anal. 2012, 17, 195–211. [Google Scholar] [CrossRef]

- Callon, M.; Courtial, J.P.; Laville, F. Co-Word Analysis as a Tool for Describing the Network of Interactions between Basic and Technological Research: The Case of Polymer Chemsitry. Scientometrics 1991, 22, 155–205. [Google Scholar] [CrossRef]

- Gibbin, R.V.; Sigahi, T.F.A.C.; de Souza Pinto, J.; Rampasso, I.S.; Anholon, R. Thematic Evolution and Trends Linking Sustainability and Project Management: Scientific Mapping Using SciMAT. J. Clean. Prod. 2023, 414, 137753. [Google Scholar] [CrossRef]

- Küster, I.; Vila, N. Consumer Ethics: An Extensive Bibliometric Review (1995–2021). Bus. Ethics Environ. Responsib. 2023, 32, 1150–1169. [Google Scholar] [CrossRef]

- Paule-Vianez, J.; Gómez-Martínez, R.; Prado-Román, C. A Bibliometric Analysis of Behavioural Finance with Mapping Analysis Tools. Eur. Res. Manag. Bus. Econ. 2020, 26, 71–77. [Google Scholar] [CrossRef]

- Alonso, S.; Cabrerizo, F.; Herrera-Viedma, E.; Herrera, F. Hg-Index: A New Index to Characterize the Scientic Output of Researchers Based on the h- and g-Indices. Scientometrics 2009, 82, 391–400. [Google Scholar] [CrossRef]

- Cobo, M.J.; López-Herrera, A.G.; Herrera-Viedma, E.; Herrera, F. Science Mapping Software Tools: Review, Analysis, and Cooperative Study among Tools. J. Am. Soc. Inf. Sci. Technol. 2011, 62, 1382–1402. [Google Scholar] [CrossRef]

- Aivaz, K.-A.; Teodorescu, D. The impact of the coronavirus pandemic on medical education: A case study at a public university in Romania. Sustainability 2022, 14, 542. [Google Scholar] [CrossRef]

- Pelikánová, R.M.; Nemecková, T.; MacGregor, R.K. CSR Statements in International and Czech Luxury Fashion Industry at the Onset and during the COVID-19 Pandemic-Slowing Down the Fast Fashion Business? Sustainability 2021, 13, 3715. [Google Scholar] [CrossRef]

- Zhang, R.; George, A.; Kim, J.; Johnson, V.; Ramesh, B. Benefits of Blockchain Initiatives for Value-Based Care: Proposed Framework. J. Med. Internet Res. 2019, 21, e13595. [Google Scholar] [CrossRef] [PubMed]

- Martinussen, P.E.; Davidsen, T. ‘Professional-Supportive’ versus ‘Economic-Operational’ Management: The Relationship between Leadership Style and Hospital Physicians’ Organisational Climate. BMC Health Serv. Res. 2021, 21, 825. [Google Scholar] [CrossRef] [PubMed]

- Puppatz, M.; Wang, M.; Deller, J. A Configurational Approach to Investigating the Relationship Between Organizational Culture and Organizational Effectiveness Using Fuzzy-Set Analysis. Group Organ. Manag. 2025, 50. [Google Scholar] [CrossRef]

- Fierro, D.; Haddud, A. Value Creation via Supply Chain Risk Management in Global Fashion Organizations Outsourcing Production to China. J. Glob. Oper. Strateg. Sourc. 2018, 11, 250–272. [Google Scholar] [CrossRef]

- García Sánchez, I.-M.; Domínguez, L.R.; Álvarez, I.G. Corporate Governance and Strategic Information on the Internet: A Study of Spanish Listed Companies. Account. Audit. Account. J. 2011, 24, 471–501. [Google Scholar] [CrossRef]

- Micu, A.; Aivaz, K.; Capatana, A. Implications of Logistic Service Quality on the Satisfaction Level and Retention Rate of an E-Commerce Retailer’s Customers. Econ. Comput. Econ. Cybern. Stud. Res. 2013, 47, 147–155. [Google Scholar]

- Sánchez-Gutiérrez, J.; Cabanelas, P.; Lampón, J.F.; González-Alvarado, T.E. The Impact on Competitiveness of Customer Value Creation through Relationship Capabilities and Marketing Innovation. J. Bus. Ind. Mark. 2019, 34, 618–627. [Google Scholar] [CrossRef]

- Balasubramanian, N.; Balaji, M. Organisational Sustainability Scale-Measuring Employees’ Perception on Sustainability of Organisation. Meas. Bus. Excell. 2022, 26, 245–262. [Google Scholar] [CrossRef]

- Kordecki, G.S.; Grant, D.M. Sustainability Gains through Enhanced Reporting Requirements. Int. J. Bus. 2023, 28, 1–26. [Google Scholar] [CrossRef]

- Klassen, M.; Kalagnanam, S.; Vasal, V.K. Managing Values and Financial Accountability: The Case of a Large NGO. Int. J. Indian Cult. Bus. Manag. 2019, 19, 103–127. [Google Scholar] [CrossRef]

- Gromark, J.; Melin, F. The Underlying Dimensions of Brand Orientation and Its Impact on Financial Performance. J. Brand Manag. 2011, 18, 394–410. [Google Scholar] [CrossRef]

- Martínez, R.; Nishiyama, N. Enhancing Customer-Based Brand Equity through CSR in the Hospitality Sector. Int. J. Hosp. Tour. Adm. 2019, 20, 329–353. [Google Scholar] [CrossRef]

- Xu, Z. On consistency of the weighted geometric mean complex judgement matrix in AHP1. Eur. J. Oper. Res. 2000, 126, 683–687. [Google Scholar] [CrossRef]

- Treepongkaruna, S.; Sarajoti, P.; Korphaibool, V. Unlocking Synergies: Sufficiency Economy Philosophy for Sustainability. Bus. Strategy Environ. 2025, 34, 3446–3468. [Google Scholar] [CrossRef]

- Cosenz, F.; Noto, G.; Cavadi, G.; Bivona, E.; Scirè, G. Pursuing sustainable performance in healthcare organizations: A sustainable business model perspective. J. Health Organ. Manag. 2024, 38, 741–759. [Google Scholar] [CrossRef]

- Aldogan Eklund, M.; Pinheiro, P. The determinants of corporate social responsibility (CSR) committee: Executive compensation, CSR-based incentives and ESG performance. Soc. Responsib. J. 2024, 20, 1240–1255. [Google Scholar] [CrossRef]

- Javed, M.Y.; Hasan, M.; Aqil, M.; Ziaur Rehman, M.; Salar, S.A.A. Exploring Sustainable Investments: How They Drive Firm Performance in Indian Private and Publicly Listed Companies. Sustainability 2024, 16, 7240. [Google Scholar] [CrossRef]

- Omer, M.A.E.; Mahmoud Ibrahim, A.M.; Elsheikh, A.H.; Hegab, H. A framework for integrating sustainable production practices along the product life cycle. Environ. Sustain. Indic. 2025, 26, 100606. [Google Scholar] [CrossRef]

- Sánchez-García, E.; Martínez-Falcó, J.; Marco-Lajara, B.; Abraham, L. Leading the Way Towards Greener Business Models in the Wine Industry. Bus. Strategy Environ. 2025. [Google Scholar] [CrossRef]

- Frias-Aceituno, J.V.; Rodriguez-Ariza, L.; Garcia-Sanchez, I.M. The Role of the Board in the Dissemination of Integrated Corporate Social Reporting. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 219–233. [Google Scholar] [CrossRef]

- De Massis, A.; Audretsch, D.; Uhlaner, L.; Kammerlander, N. Innovation with Limited Resources: Management Lessons from the German Mittelstand. J. Prod. Innov. Manag. 2018, 35, 125–146. [Google Scholar] [CrossRef]

- Kazancoglu, Y.; Kazancoglu, I.; Sagnak, M. A New Holistic Conceptual Framework for Green Supply Chain Management Performance Assessment Based on Circular Economy. J. Clean. Prod. 2018, 195, 1282–1299. [Google Scholar] [CrossRef]

- Filatotchev, I.; Nakajima, C. Corporate Governance, Responsible Managerial Behaviour and CSR: Organizational Efficiency versus Organizational Legitimacy? Acad. Manag. Perspect. 2014, 28, 289–306. [Google Scholar] [CrossRef]

- Maqbool, S.; Zameer, M.N. Corporate Social Responsibility and Financial Performance: An Empirical Analysis of Indian Banks. Future Bus. J. 2018, 4, 84–93. [Google Scholar] [CrossRef]

- Fraj-Andrés, E.; Martinez-Salinas, E.; Matute-Vallejo, J. A Multidimensional Approach to the Influence of Environmental Marketing and Orientation on the Firm’s Organizational Performance. J. Bus. Ethics 2009, 88, 263–286. [Google Scholar] [CrossRef]

- Bojarski, A.D.; Laínez, J.M.; Espuña, A.; Puigjaner, L. Incorporating Environmental Impacts and Regulations in a Holistic Supply Chains Modeling: An LCA Approach. Comput. Chem. Eng. 2009, 33, 1747–1759. [Google Scholar] [CrossRef]

- Calvo-Mora, A.; Picón, A.; Ruiz, C.; Cauzo, L. The Relationships between Soft-Hard TQM Factors and Key Business Results. Int. J. Oper. Prod. Manag. 2014, 34, 115–143. [Google Scholar] [CrossRef]

- Costa, R.; Menichini, T. A Multidimensional Approach for CSR Assessment: The Importance of the Stakeholder Perception. Expert Syst. Appl. 2013, 40, 150–161. [Google Scholar] [CrossRef]

- Huang, Y.-C.; Wu, Y.-C.J. The Effects of Organizational Factors on Green New Product Success: Evidence from High-tech Industries in Taiwan”edited by D. Lamond and R. Dwyer. Manag. Decis. 2010, 48, 1539–1567. [Google Scholar] [CrossRef]

| Number of Articles | Number of Authors | Observed Frequency | Sn(X) | Theoretical Frequency (Lotka) | Fo(X) | KS Statistic (MD) |

|---|---|---|---|---|---|---|

| 1 | 1327 | 0.96298 | 0.96298 | 0.57638 | 0.57638 | 0.38660 |

| 2 | 46 | 0.03338 | 0.03338 | 0.25000 | 0.25000 | 0.21661 |

| 3 | 4 | 0.00290 | 0.00290 | 0.11111 | 0.11111 | 0.10820 |

| 4 | 1 | 0.00072 | 0.00072 | 0.06250 | 0.06250 | 0.06177 |

| Total | 1378 | 1 | 100 | 1 | 1 | 1 |

At the 0.01 level of significance, MD > 0.0439 Therefore, data from financial-performance abstracts do not fit Lotka’s law. | ||||||

| Authors | Articles | Total Citations |

|---|---|---|

| Wang Z [38] | 4 | 129 |

| Puigjaner L [39] | 3 | 148 |

| Khan P [40] | 3 | 93 |

| Kumar A [37] | 3 | 44 |

| Shah S [41] | 3 | 8 |

| Badell M [42] | 2 | 106 |

| Theme | Period 1 (2007–2012) | Period 2 (2013–2018) | Period 3 (2019–2023) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Doc. Count | Citations | h-Index | hg-Index | Doc. Count | Citations | h-Index | hg-Index | Doc. Count | Citations | h-Index | hg-Index | |

| Accounting | - | - | - | - | 4 | 136 | 4 | 4 | - | - | - | - |

| Branding | - | - | - | - | - | - | - | - | 5 | 30 | 2 | 2.828 |

| Business improvement | - | - | - | - | 4 | 164 | 3 | 3.464 | - | - | - | - |

| Cash management | 2 | 109 | 2 | 2.000 | - | - | - | - | - | - | - | - |

| Complexity theory | - | - | - | - | - | - | - | - | 2 | 39 | 2 | 2.000 |

| Contracts | - | - | - | - | - | - | - | - | 2 | 59 | 1 | 1.414 |

| Corporate culture | 3 | 142 | 3 | 3.000 | - | - | - | - | - | - | - | - |

| Digitalization | - | - | - | - | - | - | - | - | 7 | 63 | 4 | 5.292 |

| Emerging markets | - | - | - | - | 2 | 22 | 2 | 2.000 | - | - | - | - |

| Financial disclosure | - | - | - | - | - | - | - | - | 4 | 17 | 1 | 1.414 |

| Financial performance | 17 | 652 | 11 | 13.675 | 104 | 4121 | 31 | 43.841 | 204 | 2573 | 26 | 32.249 |

| Gender theory | - | - | - | - | 5 | 93 | 4 | 4.472 | 5 | 43 | 2 | 2.828 |

| Healthcare | - | - | - | - | - | - | - | - | 14 | 75 | 4 | 5.657 |

| Innovative decision-making | - | - | - | - | 4 | 284 | 3 | 3.464 | - | - | - | - |

| Perceptions | - | - | - | - | - | - | - | - | 5 | 92 | 4 | 4.000 |

| Performance assessment | 43 | 1739 | 23 | 30.708 | 68 | 2456 | 23 | 33.571 | 126 | 1419 | 20 | 25.298 |

| Profitability | - | - | - | - | - | - | - | - | 3 | 24 | 2 | 2.449 |

| Service sector | - | - | - | - | 7 | 241 | 6 | 6.481 | - | - | - | - |

| Statistics | - | - | - | - | - | - | - | - | 6 | 48 | 4 | 4.000 |

| Supply-chain integration | - | - | - | - | - | - | - | - | 3 | 25 | 3 | 3.000 |

| Sustainability disclosure | - | - | - | - | 6 | 663 | 6 | 6.000 | 11 | 364 | 8 | 8.944 |

| Conceptual Area with Key Themes | Document Count | Citations | h-Index | hg-Index |

|---|---|---|---|---|

| Theoretical frameworks | ||||

| Financial performance | 325 | 7346 | 68 | 89.765 |

| Performance assessment | 237 | 5614 | 66 | 89.577 |

| Integration with other domains such as sustainability and ethics | ||||

| Sustainability disclosure | 17 | 1027 | 14 | 8.950 |

| Service sector | 7 | 241 | 6 | 6.481 |

| Healthcare | 14 | 75 | 4 | 5.657 |

| Branding | 5 | 30 | 2 | 2.828 |

| Quantitative measurement | ||||

| Accounting | 4 | 136 | 4 | 4.000 |

| Cash management | 2 | 109 | 2 | 2.000 |

| Statistics | 6 | 48 | 4 | 4.000 |

| Profitability | 3 | 24 | 2 | 2.449 |

| Experiential comparison | ||||

| Business improvement | 4 | 164 | 3 | 3.464 |

| Corporate culture | 3 | 142 | 3 | 3.000 |

| Gender theory | 10 | 136 | 6 | 7.300 |

| Perceptions | 5 | 92 | 4 | 4.000 |

| Digitalization | 7 | 63 | 4 | 5.292 |

| Definition-oriented reasoning | ||||

| Innovative decision-making | 4 | 284 | 3 | 3.464 |

| Complexity theory | 2 | 39 | 2 | 2.000 |

| Contracts | 2 | 59 | 1 | 1.414 |

| Supply-chain integration | 3 | 25 | 3 | 3.000 |

| Emerging markets | 2 | 22 | 2 | 2.000 |

| Financial disclosure | 4 | 17 | 1 | 1.414 |

| Philosophic | Holistic | Multidisciplinary | Priorities | |

|---|---|---|---|---|

| Philosophic | 1 | 1/5 | 1/4 | 0.09739 |

| Holistic | 5 | 1 | 2 | 0.56954 |

| Multidisciplinary | 4 | 1/2 | 1 | 0.33307 |

| Criteria | Philosophic | Holistic | Multidisciplinary | |

|---|---|---|---|---|

| Alternatives | ||||

| Quantitative measurement | 0.181123 | 0.450215 | 0.45693 | |

| Definition-oriented reasoning | 0.074087 | 0.054655 | 0.051644 | |

| Theoretical frameworks | 0.065011 | 0.115741 | 0.085684 | |

| Experiential comparison | 0.415246 | 0.29038 | 0.227309 | |

| Integration with sustainability and ethics | 0.264533 | 0.089009 | 0.178433 | |

| Theme | Future Research Avenues |

|---|---|

| Healthcare |

|

| |

| |

| |

| |

| Sustainability disclosure on performance |

|

| |

| |

| |

| |

| Branding |

|

| |

| |

| |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Munteanu, I.; Ionescu-Feleagă, L.; Ionescu, B.Ș.; Condrea, E.; Romanelli, M. From Metrics to Meaning: Research Trends and AHP-Driven Insights into Financial Performance in Sustainability Transitions. Sustainability 2025, 17, 6437. https://doi.org/10.3390/su17146437

Munteanu I, Ionescu-Feleagă L, Ionescu BȘ, Condrea E, Romanelli M. From Metrics to Meaning: Research Trends and AHP-Driven Insights into Financial Performance in Sustainability Transitions. Sustainability. 2025; 17(14):6437. https://doi.org/10.3390/su17146437

Chicago/Turabian StyleMunteanu, Ionela, Liliana Ionescu-Feleagă, Bogdan Ștefan Ionescu, Elena Condrea, and Mauro Romanelli. 2025. "From Metrics to Meaning: Research Trends and AHP-Driven Insights into Financial Performance in Sustainability Transitions" Sustainability 17, no. 14: 6437. https://doi.org/10.3390/su17146437

APA StyleMunteanu, I., Ionescu-Feleagă, L., Ionescu, B. Ș., Condrea, E., & Romanelli, M. (2025). From Metrics to Meaning: Research Trends and AHP-Driven Insights into Financial Performance in Sustainability Transitions. Sustainability, 17(14), 6437. https://doi.org/10.3390/su17146437