Abstract

It is increasingly recognized that the twin transitions of digitalization and green transformation are pivotal to achieving sustainable development. This study examines how digital trade affects corporate green total factor productivity (GTFP), using panel data from Chinese A-share listed firms and 287 prefecture-level cities in Mainland China from 2012 to 2022. The results demonstrate that digital trade exerts a significant positive impact on GTFP, primarily through improvements in technical efficiency, with heterogeneous effects across different stages of the corporate life cycle. Endogeneity concerns are carefully addressed through instrumental variable estimation and quasi-experimental designs, and robustness checks confirm the reliability of the findings. Mechanism analyses further reveal that digital trade enhances GTFP by stimulating green technological innovation and optimizing supply chain management. Importantly, threshold regression reveals non-linear effects. Both the level of digital trade and institutional factors, such as environmental regulation, intellectual property protection, and market integration, moderate the relationship between digital trade and GTFP in U-shaped, N-shaped, and other positive non-linear patterns. These insights enhance the understanding of how digitalization interacts with institutional contexts to drive sustainable productivity growth, providing practical implications for policymakers seeking to optimize digital trade strategies and complementary regulatory frameworks.

1. Introduction

In the context of accelerating global climate change and technological transformation, the pursuit of a green and sustainable economy has become a central policy agenda worldwide. International frameworks such as the Paris Agreement and the United Nations’ 2030 Sustainable Development Goals emphasize the need to achieve low-carbon and innovation-driven growth. In China, national strategies including the “dual carbon” goals, the “Digital China” initiative, and the “14th Five-Year Plan” for green development reflect a strong national commitment to aligning economic modernization with environmental sustainability. To measure firms’ ability to achieve both economic efficiency and environmental responsibility, green total factor productivity (GTFP) has become a widely accepted indicator [1,2,3]. Unlike traditional productivity indicators, GTFP considers undesirable outputs, such as carbon and pollutant emissions, and balances economic growth with ecological sustainability [4]. Improving GTFP not only helps firms enhance operational efficiency under resource constraints, but also aligns with rising investor and societal expectations for corporate sustainability. Moreover, rising investor attention to corporate environmental performance underscores the practical value of improving GTFP. In micro markets, the increased significance of information plays a crucial role in influencing investor behavior [5]. Studies show that as firms disclose more green-related information, investors tend to reward companies with higher sustainability ratings through enhanced stock valuations [6]. In this context, increasing GTFP not only helps companies maximize economic efficiency but also aligns with broader societal expectations for sustainable development, thus providing a strategic “win–win” for both enterprises and stakeholders.

Within this broader context, digital trade (DT) has emerged as a transformative force, reshaping how firms operate, compete, and pursue sustainable growth [7,8]. Defined as the provision of goods and services through digital channels and technologies such as big data, cloud computing, and the Internet of Things, digital trade reduces transaction costs, enhances information transparency, and facilitates global market access [9]. In China, supportive policy frameworks and infrastructure investments have accelerated the development of digital trade, providing new avenues for firms to enhance their GTFP [10]. Emerging studies suggest that digital trade may promote GTFP through various channels, such as improving digital financial inclusion, enhancing trade openness, and attracting foreign direct investment [3,11].

Although the relationship between the digital economy and sustainability has received increasing attention, there are still some key gaps in the literature. First, the existing literature has examined the positive linear impact of digital trade on GTFP [11] and the U-shaped and inverted U-shaped non-linear impacts of the digital economy on GTFP and TFP [12,13,14]. However, research on the non-linear effects of digital trade on GTFP is lacking. Second, previous studies have not comprehensively examined the potential mediating role of green technology R&D and supply chain management, particularly concerning their impact at different stages of the corporate life cycle. Third, regarding external institutional factors, while existing research has demonstrated the positive effects of government environmental regulations, innovation-encouraging policies, and market integration on GTFP [15,16,17], the potential non-linear and threshold effects of digital trade on GTFP when these factors are treated as threshold variables have not been widely analyzed.

In order to address this research gap, this paper makes the following innovative contributions. First, we developed a more refined measurement of digital trade development. We constructed a city-level digital trade index that integrates digital financial inclusion metrics and captures the industrial foundation of regional digital trade systems. This provides a more refined, context-sensitive assessment than prior province-level proxies [11]. Second, from the perspective of the enterprise life cycle, we analyze the impact of digital trade on the GTFP of enterprises at different stages of growth, maturity, and decline and reveal their heterogeneous characteristics, so as to provide more targeted theoretical guidance for enterprises to formulate reasonable transformation strategies in different development stages. Third, we select two unique perspectives, namely green technology efficiency and supply chain management efficiency, to study the transmission mechanism by which digital trade affects GTFP. Fourth, this paper investigates the non-linear multiple threshold effects of digital trade on firms’ GTFP, taking digital trade, environmental regulatory constraints, intellectual property protection, and market integration as threshold variables, to explore the intrinsic law, provide policymakers with a scientific and prospective decision-making basis, and promote the simultaneous enhancement of digital trade and GTFP. China is a particularly relevant context for this research because its rapid development of digital trade, coupled with an ambitious green policy agenda, can provide empirical insights that can inform both emerging and developed economies.

The layout of this paper is as follows: Section 2 constructs the theoretical framework of the research. Section 3 analyzes the direct and indirect mechanisms of digital trade on firms’ GTFP. Section 4 lists the econometric model, variables, and data sources. Section 5 and Section 6 present the results and analysis of the empirical evidence. Section 7 concludes the paper.

2. Theoretical Foundation

2.1. Sustainable Development Theory

Sustainable development theory emphasizes the need to strike a balance between economic growth, environmental protection, and social welfare [18,19]. At the core of this paradigm is the concept of “decoupling”, which aims to maximize productivity while minimizing ecological degradation. Data envelopment analysis (DEA) is gaining popularity for modeling sustainable development applications because it quantifies the overall efficiency of complex systems in a data-driven manner. DEA is particularly effective at addressing multi-objective conflicts, such as those between economic growth and environmental protection [20]. DEA is widely used to measure energy efficiency, carbon total factor productivity, and other metrics [16,21]. The SBM-DEA model can address undesirable outputs by incorporating pollution into efficiency calculations, thereby accurately reflecting green productivity. GTFP is a key indicator of green productivity and is widely used in environmental research [22,23]. In this context, digital trade, an emerging, digitally driven business model, has the potential to transform production and consumption patterns to achieve more sustainable outcomes [8]. Digital trade can catalyze clean production processes, resource efficiency, and green innovation by reducing information asymmetry, facilitating knowledge exchange, and optimizing cross-border transactions. These factors are key drivers of GTFP improvement.

2.2. Innovation Diffusion Theory and Technology–Organization–Environment Theory

The theory of innovation diffusion supplements this viewpoint by detailing how new technologies and sustainable practices disseminate throughout businesses and industries [24]. Digital trade platforms accelerate the dissemination of green technologies and practices through greater trade liberalization, financial deepening, and knowledge spillovers due to their global reach and real-time data capabilities [25]. Additionally, businesses can use digital platforms to more effectively coordinate their supply chains, achieving the seamless integration of environmental standards and resource optimization across multiple stakeholders [9]. Conversely, digital service trade barriers hinder the development of production specialization [26], further highlighting digital trade’s role in enhancing production efficiency. The Technology–Organization–Environment (TOE) framework [27] further elucidates how these dynamics unfold at the firm level. It categorizes the factors influencing a firm’s or organization’s implementation of technological innovation into technological, organizational, and environmental dimensions. The TOE framework has the capacity to examine the manner in which technological, organizational, and environmental factors interact to influence the relationship between digital trade and GTFP.

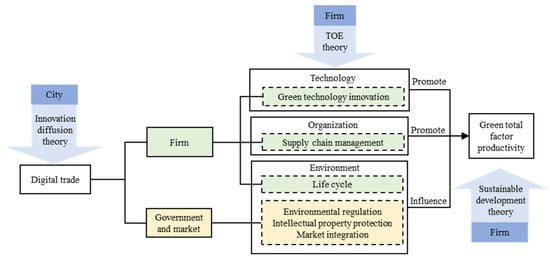

This study examines three dimensions: technology, organization, and environment. Technology represents an enterprise’s green technological innovation capabilities. Organization represents its supply chain management capabilities. The environment dimension is divided into two categories: internal and external. The internal environment is indicative of the enterprise’s life cycle stage (growth, maturity, or decline), while external environmental factors encompass government regulations, the extent of intellectual property protection, and the degree of market integration. Technology serves as an agent of change, while organizational capabilities delineate the degree of adoption. Internal environmental factors determine the enterprise’s primary strategic direction, and external environment factors influence the broader institutional context. The study posits that DT primarily impacts GTFP through two channels: stimulating green technology innovation and improving supply chain management efficiency. These mechanisms are moderated by firm life cycle factors and environmental factors from government and market sources, ultimately driving the heterogeneity of the digital trade–GTFP relationship between firms and the environment. Figure 1 illustrates the theoretical framework based on sustainability, innovation diffusion, and TOE theories, showing how urban digital trade influences GTFP.

Figure 1.

The theoretical framework of derivation.

3. Literature Review and Hypothesis Development

3.1. Digital Trade and GTFP

The relationship between digital trade and GTFP is increasingly recognized as a critical research frontier in sustainable economic development. While both traditional and digital trade fundamentally involve the transfer of production factors, goods, and services to generate new spillover effects, digital trade demonstrates unique advantages through its platform-mediated exchanges. It enhances GTFP through dual mechanisms: improving operational efficiency while reducing output redundancies inherent in conventional trade practices.

The direct mechanisms operate through three primary channels: First, digital trade facilitates substantive reductions in production costs. Enterprises leveraging smart production systems and digital technologies can effectively minimize resource expenditure and emissions. Specifically, the deployment of big data analytics, cloud computing, and IoT solutions empowers dynamic process optimization, systematically lowering energy demands and waste outputs. This synergistic integration of pollution control and productivity enhancement represents a transformative efficiency paradigm central to GTFP advancement [28]. Second, digital trade reduces non-operational costs through market restructuring. The digital economy diminishes transaction costs while improving market access for green products. Lowering entry barriers and empowering firms to participate in global value chains fosters competitive ecosystems that incentivize sustainable innovation. This heightened market competition creates strategic imperatives for firms to differentiate through environmental stewardship, thereby generating endogenous momentum for GTFP improvement [29]. Third, digital trade establishes data-driven governance frameworks critical to GTFP enhancement. The inherent requirements for data transparency and algorithmic accountability in digital ecosystems compel firms to adopt lifecycle sustainability management [30]. Building on this analysis, we propose the following hypothesis:

Hypothesis 1.

The development of city digital trade exerts a positive influence on corporate GTFP.

3.2. The Indirect Impact of Digital Trade on GTFP

3.2.1. The Role of Green Technology Innovation

Digital trade enhances GTFP through two evolutionary mechanisms in green technology innovation: First, it catalyzes green technology innovation through knowledge spillover effects. The borderless nature of digital trade enables enterprises to access global green technology repositories and innovation ecosystems [31]. The advanced digital network facilitates instant knowledge sharing of sustainable best practices, leading to increased adoption of green technologies in emerging industries. Cross-border innovation clusters formed through cloud-based collaboration platforms allow firms to co-develop carbon capture systems and renewable energy solutions with international research institutions [25]. However, digital trade barriers such as data localization requirements can fragment the innovation ecosystem and potentially reduce the efficiency of cross-border R&D [32]. Second, digital trade can enhance GTFP through green transformation. Green transformation generates a cost premium [33], but digital trade can compress marginal costs through in-house artificial intelligence, realize a circular economy through IoT resource tracking in the supply chain, and promote green transformation by relying on the government’s construction of various types of digital infrastructure such as the broadband China strategy and financial policies such as green credit [34]. Therefore, we propose the following hypothesis:

Hypothesis 2a.

Digital trade development positively influences corporate GTFP enhancement through green technology innovation.

3.2.2. The Role of Supply Chain Management

Digital trade enhances GTFP through two supply chain mechanisms: First, it elevates supply chain transparency via digital traceability systems. Digital transformation improves the overall efficiency of the supply chain process, from the origin of goods to their delivery. It enables a smart supply chain and enhances competitive performance [35,36,37]. Empirical evidence from China indicates that supply chain digitization can promote urban resilience by improving GTFP [38]. Furthermore, supply chain digitization has been shown to positively impact GTFP at the corporate level, thereby contributing to environmental sustainability [39].

Next, it minimizes supply chain coordination costs through cyber–physical integration. Digitalization within client companies can spill over to upstream suppliers, encouraging them to adopt cleaner technologies and more environmentally friendly practices. This impact is particularly evident in state-owned enterprises, where digital supply chain management has been shown to improve suppliers’ GTFP by streamlining processes and minimizing emissions [30,40]. Digital platforms and intelligent technologies have enhanced process efficiency, reduced resource waste, saved costs, strengthened collaboration, and supported green innovation, thereby promoting GTFP across the entire industry. Based on these findings, we propose the following hypothesis:

Hypothesis 2b.

Digital trade development positively influences corporate GTFP enhancement through supply chain management.

3.3. Institutional Thresholds and Non-Linear Effects

Although digital trade can promote the improvement of GTFP, the magnitude and direction of these effects vary depending on the institutional environment. According to institutional theory [41], external institutional factors, such as regulatory frameworks, intellectual property protection, and market structure, fundamentally shape the incentives and constraints that firms face when adopting new technologies and sustainable practices. Previous research has shown that these institutional factors can produce non-linear effects, or threshold dynamics, whereby the relationship between digital trade and GTFP varies under different institutional conditions [12,13,14].

3.3.1. Environmental Regulation

Environmental regulation (ER) is an important external driver of green innovation and sustainable production. According to the Porter hypothesis [42], appropriately designed ER can stimulate innovation, enhance competitiveness, and improve environmental performance. However, the relationship between regulatory strictness and environmental productivity is often non-linear [43]. Research indicates that moderate environmental regulations incentivize firms to adopt cleaner technologies and optimize production, thereby enhancing GTFP [44]. Conversely, overly lenient regulations may fail to provide sufficient incentives for green innovation, and overly strict regulations may impose excessive compliance costs, hindering productivity [43]. In the context of digital trade, interactions with environmental regulations become more complex. Digital trade promotes green innovation and process optimization; however, the extent to which these benefits translate into GTFP improvements depends on environmental costs. Research indicates that high environmental taxes may inhibit corporate green innovation [45]. Under moderate regulatory pressure, firms are more likely to use digital tools to improve compliance and efficiency. However, under overly strict or overly lenient regimes, the potential benefits of digital trade may be suppressed. Therefore, we propose the following hypothesis:

Hypothesis 3a.

The relationship between digital trade and GTFP is subject to a threshold effect based on the strictness of environmental regulation.

3.3.2. Intellectual Property Protection

Intellectual property protection (IPP) is another key institutional factor influencing corporate innovation incentives. A robust IPP regime stimulates innovation by encouraging disclosure and technology transfer [46]. A study on green innovation shows that IPP can stimulate innovation through intellectual property sharing strategies and accelerate the transition to sustainability [47]. However, the impact is non-linear. Extremely weak intellectual property systems fail to incentivize innovation, and overly stringent intellectual property protection hinders the cross-company and cross-border dissemination of green technologies [48]. Therefore, we propose the following hypothesis:

Hypothesis 3b.

The relationship between digital trade and GTFP is subject to a threshold effect based on the strength of intellectual property protection.

3.3.3. Market Integration

Market integration (MI) is defined as the degree to which local markets are connected to broader national and global markets. MI plays a key role in shaping companies’ growth and innovation opportunities. Higher levels of MI promote resource flows, knowledge exchange, and competitive pressures, which can accelerate the adoption of digital trade and its associated benefits [49]. Research indicates that, in highly integrated markets, firms can enhance GTFP by leveraging economies of scale, structural effects, and spillover effects [50]. However, as with other institutional factors, this relationship may exhibit threshold effects. In less integrated markets, moderate competition enhances innovation incentives. Conversely, intense competition can hinder innovation efforts when markets are overly integrated [51]. Therefore, we propose the following hypothesis:

Hypothesis 3c.

The relationship between digital trade and GTFP is subject to a threshold effect based on the degree of market integration.

4. Materials and Methods

4.1. Data Sources

This study examines the green total factor productivity (GTFP) of enterprises listed on the Shanghai and Shenzhen stock exchanges from 2012 to 2022. Firms under special treatment (ST and *ST), delisted firms, and those with missing data during the sample period were excluded. To ensure the integrity of digital trade data, cities with a high proportion of missing values were removed, resulting in a final sample of 287 prefecture-level cities in Mainland China. By matching city-level digital trade data with the registered locations of listed enterprises, a final sample of 1625 firms was obtained. This yielded an unbalanced panel dataset comprising 17,875 firm–year observations. Digital trade and related regional data were primarily obtained from the China City Statistical Yearbook, the China Economic and Social Big Data Research Platform, provincial government work reports, the Digital Finance Research Center of Peking University, and other publicly available municipal sources. Firm-level data were mainly sourced from the CSMAR, Wind, and CNRDS databases.

4.2. Empirical Model Design

We constructed the baseline regression model to investigate the impact of digital trade on GTFP, which is shown as Equation (1):

where denotes the firm, is the year, means the city, is the explained variable of the model, and is the core explanatory variable. The control variable encompasses covariates that potentially influence corporate GTFP, systematically accounting for confounding factors beyond the core explanatory mechanism. captures time-invariant firm heterogeneity through entity fixed effects, while absorbs period-specific shocks common to all observational units. The stochastic disturbance term follows a white noise process with zero autocorrelation.

Next, in order to further investigate the mediation () influence mechanism of digital trade on the GTFP of enterprises, the mediation effect model is constructed as shown in Equation (2):

Finally, to examine the non-linear impact of digital trade on GTFP, similar to the methodology designed by Hansen [52], a non-linear multiple panel threshold model is constructed as shown in Equation (3):

4.3. Variable Definition

4.3.1. Explained Variable: Corporate GTFP

The GTFP is considered an accurate indicator that takes into account both economic performance and the ecological environment [3]. Drawing on the calculation method of Wu et al. [53], the SBM-ML model in data envelopment analysis is used to measure GTFP. Specifically, the model uses capital, labor, and energy consumption as input factors and divides the output into expected output, represented by annual enterprise revenue, and unexpected output, represented by enterprise emissions of waste gas (SO2), wastewater, and dust. The GTFP index can be decomposed into green technology efficiency (GEC) and green technology progress (GTC) through linear programming [53]. GEC stems from efficiency changes brought about by improvements in the production system, economies of scale, and experience accumulation. In contrast, GTC stems from efficiency changes resulting from improvements in production technology and process innovation. The measurement of input and output indicators of enterprise GTFP is shown in Table 1.

Table 1.

Construction of GTFP indicators for enterprises.

4.3.2. Explanatory Variable: City Digital Trade

Due to the limited availability of corporate digital trade data, measuring digital trade at the corporate level is a challenging task. Therefore, this study proposes constructing a city-level digital trade index and matching it with cities where listed companies are registered. This enables us to investigate the effect of a city’s digital trade level on the GTFP of companies based in that city. The construction of the city-level digital trade index in this study employs the entropy method, drawing on the work of Ma et al. [10] based on the WITS e-trade indicator system and referring to other studies on the research of evaluation index systems for digital trade at the provincial level in China [11,54]. The existing indicator system was improved in two aspects: first, given the significant role of digital finance in enhancing digital trade efficiency [55], digital finance factors were introduced into the evaluation; second, the measurement of the regional digital trade industrial foundation was strengthened and improved. Based on the above research, the digital trade development evaluation indicator system at the city level in China is presented in Table 2.

Table 2.

Construction of city-level digital trade index.

4.3.3. Corporate Life Cycle

Existing research generally agrees that enterprise development goes through a life cycle process [56,57,58]. This study is based on the widely used corporate life cycle measurement method proposed by Anthony and Ramesh [59], with adjustments made to account for the actual differences between industries in China. It draws on the approach adopted by Li et al. [60], which categorizes the business life cycle into growth, maturity, and decline stages based on a composite score of indicators such as revenue growth rate, retained earnings, capital expenditures, and firm age. The reason why this study did not adopt variables such as dividend payments, which appear in the life cycle literature, is primarily because Chinese listed companies generally prefer to pay few dividends or no dividends at all, resulting in a weak correlation between dividend payments and company growth. Therefore, this indicator is not suitable for use [60]. In practical implementation, industry differences were considered. The total sample was sorted by industry based on the total score of the four indicators. Each industry sample was then divided into three parts based on total score. The top third with the highest scores were classified as growth-stage companies; the bottom third with the lowest scores were classified as decline-stage companies; and the middle third were classified as mature-stage companies. Finally, the classification results for each industry were aggregated to obtain the classification results for the entire life cycle of all listed companies. The specific classification criteria are shown in Table 3.

Table 3.

Criteria for dividing the stages of a company’s life cycle.

4.3.4. Mechanism and Threshold Variables

The mechanism variables include green technology innovation and supply chain management. To confirm the robustness of green technological innovation as a mediating mechanism, this study incorporates a measure of enterprise greening transition (GreTrans) in addition to using the variable of firms filing green patents (EnvrPat). (1) Green technological innovation is measured by the proportion of green patent applications filed by listed companies, or the ratio of green patents applied for by a company to the total number of patents applied for in a given year. (2) Green transition refers to Zhou et al.’s [61] research on corporate green transition using textual information disclosed in annual reports. Based on relevant policy documents, 113 keywords related to corporate green transition were selected across five dimensions: promotional initiatives, strategic concepts, technological innovation, pollution control, and monitoring and management. Then, the frequency with which each keyword appeared in the text of the annual reports of listed companies was counted to create a green transformation keyword frequency count. The natural logarithm of this frequency plus one was used to characterize the company’s green transformation.

To validate the role of supply chain management as a mediating mechanism, this study employs the variable of supply chain transparency (SCT) and adopts supply chain coordination costs (Recover) as an alternative mediating variable to verify robustness. (1) Supply chain transparency is represented by the number of large suppliers and customers whose names are explicitly disclosed by the firm; larger values indicate greater transparency. (2) Supply chain coordination cost reflects the supply chain’s ability to stabilize after deviating from its original trajectory when hit by an external shock. Since measuring the cost of supply and demand coordination in the supply chain cooperation process directly is difficult, from the supply and demand perspective, when the supply chain is subject to external shocks, the original production and demand volumes of the upstream and downstream enterprises are affected. This causes an imbalance between supply and demand in the short term. Referring to the research of Shan et al. [62], this paper adopts the degree to which production fluctuations deviate from demand fluctuations to measure the accuracy of supply and demand matching in the enterprise supply chain. The calculation formula is shown in Equations (4) and (5). Production signifies the enterprise’s output, whereas demand denotes the enterprise’s demand quantity. This is measured by the cost of sales. Inventory, in turn, represents the enterprise’s net inventory value at the end of the fiscal year. Recover represents the deviation between supply and demand. If Recover is greater than 1, it indicates that the fluctuation between supply at the beginning of the supply chain and demand at the end is relatively large and that the cost of supply chain coordination is high.

The threshold variables include digital trade (DT), environmental regulation (ER), intellectual property protection (IPP), and market integration (MI). In detail, considering that the coordinated development of digital trade and enterprises’ GTFP may be subject to the government and the market, (1) green environmental regulation (ER) indicators characterize external environmental constraints, and they are obtained by multiplying the share of heavy industry in the GDP of each city in the province with the frequency of environmental protection related terms in the work reports of the provincial government. (2) Intellectual property protection (IPP) indicators characterize the degree of importance attached to scientific and technological innovation. IPP draws on the explicit comparative advantage index proposed by Balassa [63] to construct a city-level IPP index as shown in Equation (6); represents the intensity of intellectual property protection at the city level, and represent the number of intellectual property trial settlements of the city and China in period t; and represent the GDP of the city and China in year . (3) Market integration (MI) indicators characterizing enterprises’ production efficiency are introduced as threshold variables. MI is based on the algorithm of Parsley and Wei [64], which uses the market segmentation index to represent the market integration index. The lower the market segmentation index, the higher the degree of domestic market integration.

4.3.5. Control Variables

The control variables are referred to in the work of Liu and Zhao [65]. In detail, we include firm size (logarithm of annual total assets), firm age (logarithm of firm’s duration in the market), return on assets (net profit/average balance of total assets), leverage (total listed firms’ leverage on total assets), cash flow (net profit of listed firms on total assets), the increase rate of main business revenue (current year’s operating income/previous year’s operating income −1), state ownership status (1 for state-controlled enterprises, 0 for others), the number of directors (logarithm of the number of directors), duality (number of instances of the chairman of the board of directors and the general manager being the same person), and the shareholding ratio of the largest shareholder.

4.4. Descriptive Statistics

Table 4 presents the descriptive statistics for the variables used in the analysis. The sample consists of 17,875 observations from Chinese A-share listed firms and 287 cities in Mainland China between 2012 and 2022. The mean GTFP value is 1.011, with a standard deviation of 0.088, indicating variation in GTFP across firms and years. The mean value of DT is 0.057, but the standard deviation is large, and the data are discrete. Among the moderating variables, the mean values of EnvrPat, GreTrans, SCT, and Recover are 0.479, 3.391, 1.591, and −0.049, respectively, and for the threshold variables, the mean values of ER, IPP, and MI are 0.008, 0.583, and 17.038, respectively.

Table 4.

Summary statistics.

4.5. Panel Unit Root Tests

Since this study uses a balanced short-panel dataset, we performed panel unit root tests using the Harris–Tzavalis (HT) method [66], which is suitable for panels with large cross-sectional and short time-series dimensions. The test results in Table 5 confirm that all variables are stationary at the level across the sample period. The stationarity of the variables mitigates concerns about spurious regression and supports the validity of subsequent fixed-effect estimations.

Table 5.

Stationarity test.

5. Results and Discussion

5.1. Baseline Regression Results and Discussion

As evidenced in the baseline regression results shown in Table 6, digital trade exerts a statistically significant positive impact on corporate GTFP. After the incorporation of control variables, the regression coefficient for digital trade is 0.004, significant at the 5% level. This indicates that a 1-unit increase in urban digital trade development corresponds to an average 0.004-unit improvement in corporate GTFP. This finding aligns with Hypothesis 1 and is consistent with the research results of Dai et al. [11] at the provincial level. The research suggests that digital trade at the city level can enhance firms’ ability to produce more efficiently under environmental constraints, contributing to both economic performance and environmental compliance.

Table 6.

Baseline estimation results.

To disentangle transmission channels, we decompose GTFP into technical efficiency change (GEC) and technological progress change (GTC). Columns 3–4 of Table 4 reveal that digital trade predominantly drives GTFP improvement through GEC elevation (β = 0.003, p < 0.05), while its effect on GTC remains statistically insignificant (β = 0.001, p > 0.1). Interestingly, this result contrasts with the findings of Lyu et al. [13], who report that the positive impact of the digital economy on GTFP is primarily driven by improvements in green technological progress (GTC), rather than technical efficiency (GEC). This divergence can be explained by the fundamental distinction between the digital economy and digital trade. The digital economy encompasses a broad spectrum of digital infrastructure, platforms, and innovation systems, which are often embedded within long-term industrial upgrading policies. In contrast, digital trade focuses more narrowly on the digitization of transactions, supply chains, and commercial interfaces. Consequently, the digital economy may stimulate frontier green innovation through deeper integration of R&D, data-driven manufacturing, and cross-sectoral knowledge spillovers. In contrast, digital trade tends to produce immediate gains in operational coordination, market access, and resource reallocation efficiency, which are more directly reflected in GEC rather than GTC. This distinction highlights the need to differentiate between types of digital transformation when evaluating their environmental and productivity effects.

These findings align with the TOE framework’s propositions [27], which hypothesize that digital technology adoption initially drives organizational performance through efficiency gains and incremental innovations, with more radical technological advancements occurring over longer timeframes. Li et al. [67] and Wang et al. [68] also explain the positive impact of digital trade on GTFP in terms of efficiency in terms of digital technology’s ability to optimize resource allocation, reduce environmental footprints, and promote sustainable production processes. The current research results provide additional empirical evidence demonstrating how these effects are achieved through enhanced technical efficiency.

5.2. Heterogeneity Effects Across Corporate Life Cycle Stages

To examine how firms respond differently to external digital trade environments, we investigate the heterogeneous effects of digital trade across corporate life cycle stages. Firms in different phases of the life cycle, such as growth, maturity, and decline, face distinct constraints and opportunities regarding resource availability, innovation focus, risk appetite, and strategic flexibility. This perspective aligns with the TOE framework [27] and dynamic capability theory [69], which jointly suggest that the success of technology adoption depends on the interaction between external environmental conditions and firms’ internal dynamic capabilities across different stages of their life cycle. By incorporating the life cycle perspective into our empirical strategy, we aim to reveal how firm maturity influences the extent to which digital trade contributes to GTFP, as well as to identify the channels through which this contribution occurs. This approach addresses intra-city firm heterogeneity that is not captured by city-level indices alone.

As reported in Table 7, the responsiveness of GTFP to digital trade varies significantly across different stages of the corporate life cycle. The results show that GTFP’s responsiveness to digital trade varies significantly depending on a firm’s organizational maturity. Specifically, digital trade has a significantly positive effect on GTFP for growth-stage and declining firms, while its impact on mature firms is statistically insignificant. These results suggest that the effectiveness of digital trade as a lever for green upgrading varies depending on a firm’s internal development stage and strategic orientation.

Table 7.

Heterogeneity across corporate life cycle stages.

For firms in the growth stage, the coefficient for digital trade is positive and statistically significant, indicating that digital trade substantially enhances overall GTFP during this phase. However, neither the technical efficiency change (GEC) channel nor the technological progress change (GTC) channel is statistically significant. This finding echoes the prior literature on absorptive capacity [70], suggesting that growth-stage firms, though highly dynamic, may lack the organizational routines necessary to fully internalize and exploit advanced digital technologies for green innovation. Moreover, consistent with innovation diffusion theory [24], firms in the early stages may focus their digital efforts on market expansion and customer acquisition, resulting in more indirect sustainability outcomes. The positive aggregate GTFP gains likely stem from favorable external conditions, such as supportive policy environments and superior access to green subsidies [71], rather than from deliberate internal green innovation strategies.

During the maturity stage, the net effect of digital trade on GTFP is slightly negative, though not statistically significant. Decomposition analysis shows a positive impact on GEC and a negative, significant impact on GTC. This pattern suggests that mature firms primarily use digital trade to optimize existing processes through lean inventory, predictive maintenance, and energy efficiency. The negative GTC effect aligns with findings on technological path dependence and organizational inertia [72,73], where entrenched routines and legacy IT systems hinder firms’ ability to adopt disruptive green technologies despite exposure to digital trade. These dynamics underscore the limitations of digital trade as a purely technological solution when organizational readiness for transformative innovation is lacking.

Among declining firms, digital trade has a positive and significant influence on GTFP, which is driven almost entirely by improvements in technical efficiency. Firms in this phase tend to adopt digital trade reactively and for survival purposes, prioritizing short-term gains such as resource pooling, platform-based cost savings, and tactical arbitrage. Consistent with crisis-driven innovation theory [74], these firms avoid long-term R&D commitments due to capital constraints and risk aversion, focusing digital strategies on immediate operational efficiencies. This further supports the argument that the organizational life cycle stage strongly shapes the scope and depth of digital trade’s contribution to GTFP.

In summary, the heterogeneous impacts observed reflect a dynamic interplay of five key factors: (1) differential returns to efficiency (GEC) versus innovation (GTC); (2) capital constraints and debt pressures in mature and declining firms; (3) shifting strategic priorities across life cycle stages; (4) path dependency effects in mature firms; (5) policy-driven advantages for growth-stage enterprises. These findings contribute to the literature on digital trade and sustainability by demonstrating that life cycle stage is a critical moderator of digital trade’s contribution to GTFP. They also reinforce the idea that digital transformation strategies must be tailored to a firm’s developmental context to achieve sustainable productivity gains.

5.3. Addressing Endogeneity Concerns

To mitigate potential endogeneity issues, such as omitted variables, reverse causality, or firm-level self-selection, this study adopts a multi-faceted identification strategy that combines an instrumental variable (IV) approach, a quasi-experimental difference-in-differences (DID) design, and enhanced fixed effects.

First, this paper employs the instrumental variable method. We adopt a Bartik-style instrumental variable (IV), also known as a shift-share instrument. Originally proposed by Bartik [75], this method has been widely applied in empirical research where direct firm-level instruments are unavailable. Specifically, the IV is constructed by interacting a firm’s lagged city-level digital trade index (which captures initial exposure to digital infrastructure) with the national-level growth rate of digital trade (which represents an exogenous, macro-level shock). This interaction generates variation in local digital trade development that is plausibly exogenous and not directly driven by firm-level productivity shocks. The rationale is that, although national trends in digital trade evolve due to broader technological and policy dynamics, the extent to which these trends affect a given firm depends on its initial regional exposure to digital trade conditions. This approach offers a credible identification strategy when firm-level digitalization measures are not directly observable.

In this paper, the Bartik IV formula is the product of the digital trade index with a lag of one order of multiplied by the first difference of the digital trade index in time , as shown in Equation (7), and the fixed-effect 2SLS model is used for re-estimation. It can be seen that the Bartik instrumental variable is highly correlated with the independent variable digital trade development index, but is not correlated with the residual term of the firm GTFP index after the fixed effects of cities and years are controlled. Therefore, possible endogeneity problems can be effectively solved. As shown in columns 1–2 of Table 8, the F value is greater than 10, and the problem of weak instrumental variables is excluded; the regression results are all significant at the 1% level, and the development of digital trade effectively promotes the GTFP of enterprises.

Table 8.

Endogeneity and robustness checks.

Second, we use a quasi-experimental, difference-in-differences (DID) design based on the staggered establishment of China’s Cross-Border E-Commerce Comprehensive Pilot Zones (CBEC Pilot Zones). Since 2015, the Chinese government has introduced CBEC Pilot Zones in selected cities in several phases with the goal of promoting digital trade and facilitating cross-border e-commerce. Only one city, Hangzhou, was established as part of the first group of test zones in 2015. In 2016, the second batch of pilot zones was successively established in Tianjin, Shanghai, Chongqing, and 12 other cities. Since the policy has a time lag in taking effect, we set 2017 as the effective year of the policy. The selection of pilot cities is largely driven by national-level strategic considerations rather than firm-level characteristics, providing a valuable source of exogenous variation. By comparing firms in pilot cities (the treatment group) with firms in non-pilot cities (the control group) before and after the introduction of the CBEC policy, we can identify the causal impact of exogenous digital trade shocks on GTFP outcomes. This design helps mitigate reverse causality and omitted variable bias. The staggered timing of policy implementation across regions further strengthens the identification, as it creates variation in exposure over time and space. This is a widely accepted approach in applied quasi-experimental studies [21]. Column 3 of Table 8 shows that establishing pilot zones can significantly improve enterprises’ GTFP. This DID framework complements the Bartik IV strategy by leveraging a different exogenous source of variation, thus providing additional robustness to the causal interpretation of our results.

Finally, controlling for individual and year fixed effects, as well as the interaction term between city and year, can solve the endogeneity problem caused by missing variables to a certain extent. The regression results in column 4 of Table 8 demonstrate the robustness of the baseline regression results.

5.4. Robustness Check

To ensure the reliability of the aforementioned conclusions, the robustness of the model was estimated in three aspects. First, samples were excluded from the five autonomous regions (Inner Mongolia, Guangxi, Ningxia, Xinjiang, and Tibet). The level of digital trade development in these regions is relatively low, and the quality of the data, particularly the digitalization and environmental indicators at the enterprise level, is often incomplete or inconsistent. Furthermore, cross-border trade in these regions is often highly policy-driven rather than market-driven, which may lead to deviations in the estimation of market effects. Therefore, these samples might interfere with the estimation results and were removed for regression reanalysis. Second, provincial-level clustering was added. Multilevel clustering captures spatial correlations and enhances regression robustness. It was added based on individual and urban clustering. Finally, the propensity score matching (PSM) method was used. This method was adopted for robustness tests to reduce estimation bias interference. Specifically, 1:1 nearest neighbor matching was used to re-estimate the model. As shown in columns 5–7 of Table 8, the regression results remained significantly positive after these robustness tests, indicating the validity of the basic conclusions.

5.5. Mechanism Impact Analysis

This section examines the underlying mechanisms through which digital trade enhances firms’ GTFP. It focuses on two key channels: green technological innovation and supply chain management.

First, digital trade promotes GTFP by encouraging firms to research and develop green technologies, thereby accelerating their green transformation processes. As shown in Column 1 of Table 9, the coefficient of digital trade on firms’ green R&D is 0.056 and is significant at the 5% level. This indicates that digital trade serves as a catalyst for firms’ investments in green innovation. This finding aligns with the innovation diffusion theory [9] and the TOE framework [27], which suggest that digital technologies lower information barriers, facilitate knowledge transfer, and stimulate firms’ technological upgrading. Green technological innovation has been proven to promote the GTFP of enterprises [53]. Therefore, Hypothesis 2 can be proven to be effective.

Table 9.

Green technology innovation and digital trade.

When analyzing heterogeneity across life cycle stages (columns 2–4), the positive effect of digital trade on green innovation is most significant during the maturity stage. This pattern may reflect the greater responsiveness of mature firms to market signals and consumer demand for sustainable products. With their established resources and organizational capabilities, mature firms are better positioned to leverage digital trade platforms for green product innovation and process improvements [71].

Furthermore, digital trade contributes to a broader green transformation of firms. Column 5 of Table 9 shows that the coefficient of digital trade on firms’ green transformation is 0.116, which is also significant at the 5% level. Examining the heterogeneous effects across life cycle stages (columns 6–8) reveals that the relationship evolves from negative in the growth phase to positive in the maturity and decline stages. This evolution likely stems from varying strategic priorities: growth-stage firms typically prioritize expansion and market penetration, while mature and declining firms shift their focus toward sustainability and innovation as part of long-term competitiveness and survival strategies [73,74]. These results also support prior findings that green innovation and transformation significantly enhance GTFP and generate positive externalities for regional sustainability [39,44].

These results yield several meaningful implications. For instance, they empirically confirm that green innovation and transformation serve as effective channels through which digital trade enhances GTFP. In addition, the results demonstrate that digital trade’s environmental benefits are contingent on firms’ capacity to integrate digital tools into strategic innovation and process change, rather than merely adopting them passively. Finally, they suggest that targeted support for green R&D and transformation, especially in mature-stage firms, may unlock the sustainability potential of digital trade, providing co-benefits for environmental goals and firm performance.

Second, digital trade improves firms’ GTFP by enhancing supply chain transparency and reducing coordination costs, thereby boosting overall supply chain efficiency. Columns 1–4 of Table 10 show that digital trade positively affects supply chain transparency at every stage of the life cycle, though the effect is weaker during the growth phase. Columns 5–8 show that digital trade significantly reduces supply chain coordination costs, especially for firms in the maturity and decline stages. These findings imply that digital trade contributes to both greater supply chain transparency and lower coordination costs, which in turn improve firms’ overall resource efficiency and environmental performance. Within the TOE framework, this reflects the organizational condition that enables firms to reconfigure operational routines in response to digital opportunities. Existing studies have shown that the digitalization of the supply chain can increase GTFP [38]. Therefore, we can reasonably draw Hypothesis 2b that digital trade can optimize supply chain management capabilities and thereby enhance GTFP.

Table 10.

Green supply chain management and digital trade.

The asymmetry of effects across life cycle stages can be explained by the differing supply chain configurations and complexity. Mature and declining firms typically operate larger, more rigid supply networks, which are more prone to inefficiencies and coordination bottlenecks. These firms also face stronger external pressure to comply with green supply chain regulations and ESG disclosure requirements. Consequently, the adoption of digital trade tools such as blockchain traceability, IoT-based monitoring, and platform-based procurement can generate more substantial efficiency gains in later stages of the corporate life cycle. In contrast, growth-stage firms often maintain more flexible and less fragmented supply chains, which may limit the marginal benefit of digital coordination at early stages. These findings are supported by prior studies that underscore the role of digital technologies in reducing transaction frictions, lowering information asymmetry, and facilitating real-time collaboration among supply chain partners [76,77].

From a practical perspective, the supply chain management mechanism offers several important implications. Primarily, it emphasizes that digital trade should be viewed not only as a tool for external market expansion but also as a means of optimizing internal value chains. Also, suggests that supply chain–oriented digital strategies are particularly beneficial for firms in the maturity and decline stages, where coordination costs and operational rigidities are more pronounced. Equally, it implies that policymakers aiming to promote green productivity should prioritize digital infrastructure and standards that enable interoperable, transparent, and low-friction supply networks.

6. Further Non-Linear Impact Explorations

6.1. Non-Linear Dynamic Effects of Digital Trade

To further explore the non-linear relationship between digital trade and firms’ GTFP, this study employs a threshold regression model to evaluate the impact of various levels of digital trade development on GTFP outcomes. As shown in Table 11, significant single and double thresholds were identified at 0.0100 and 0.1226, respectively. This indicates that the impact of digital trade on GTFP is not constant, but varies across different stages of digital trade penetration.

Table 11.

Threshold effect significance results.

The regression estimation in column 1 of Table 12 shows that the marginal impact of digital trade on gross territorial factor productivity (GTFP) increases non-linearly. At low levels of digital trade (below 0.0100), the effect on GTFP is negative (β = −1.186), suggesting that premature exposure to digital trade may impose adjustment burdens on firms. As digital trade penetration increases (0.010 ≤ DT ≤ 0.1226), the marginal impact becomes strongly positive (β = +0.526). This reflects the phase in which digital technologies effectively integrate with green innovation and resource optimization. Beyond the second threshold, when digital trade exceeds 0.1226, the positive impact remains significant (β = +0.398), though with diminishing marginal returns. This implies a typical U-shaped non-linear effect, where productivity benefits are initially suppressed but subsequently enhanced with digital maturity, before tapering off due to coordination frictions or digital redundancy [78]. In practical terms, these findings suggest that digital trade can significantly enhance green productivity, but only when firms reach a certain level of digital maturity.

Table 12.

Threshold regression results.

These findings suggest that the impact of digital trade on GTFP is non-linear, with diminishing marginal returns at higher penetration levels. This finding has important implications for firms and policymakers. For firms, it emphasizes the need to synchronize digital trade strategies with internal capability building, particularly in green innovation and supply chain integration, to avoid early-stage pitfalls or late-stage saturation. For policymakers, the results highlight the importance of phased and targeted digital infrastructure investment, capacity-building support, and coordinated governance to maximize the green productivity returns of digital trade. In particular, attention should be paid to identifying firms or regions that are stuck below the first threshold, where intervention can yield the greatest marginal effect.

6.2. Non-Linear Dynamic Effects of the External Environment

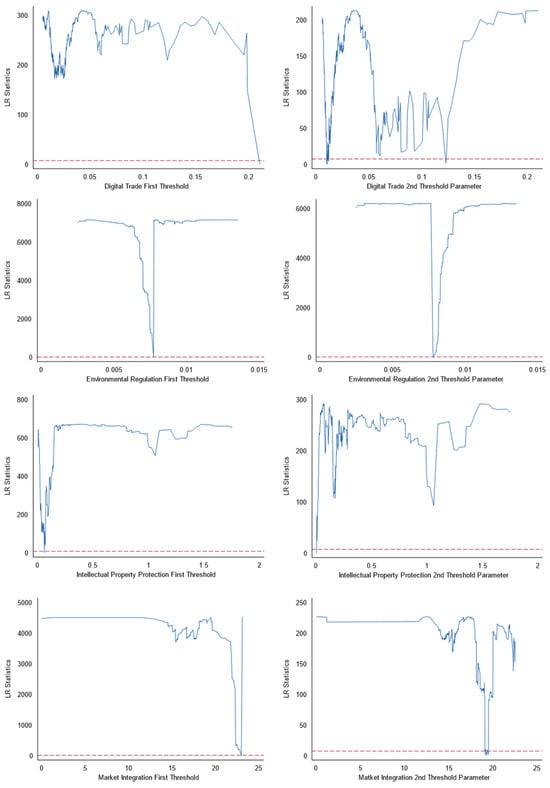

To further examine how external institutional factors moderate the relationship between digital trade and firms’ GTFP, this study uses threshold regression models with three key variables: environmental regulation (ER), intellectual property protection (IPP), and market integration (MI). As shown in Table 11, all three threshold variables exhibit statistically significant double thresholds, 0.0058 and 0.0077 for ER, 0.0607 and 0.0924 for IPP, and 15.3850 and 19.1530 for MI. Figure 2 provides key support for this conclusion. The LR graph visually confirms the inflection point of the relationship turn, and the confidence interval validates the robustness of the threshold. This result proves the validity of Hypothesis 3a, Hypothesis 3b, and Hypothesis 3c and suggests that institutional quality is not only a background condition but also a dynamic determinant of digital trade effectiveness. This finding aligns with the environmental dimension of the TOE framework, highlighting that external institutional conditions, such as regulatory strictness, intellectual property regimes, and market openness, play a critical role in shaping how firms absorb and translate digital trade opportunities into green productivity gains.

Figure 2.

The LR map corresponding to the first and the second threshold estimate of the threshold variable.

Columns 2–4 of Table 12 present the corresponding regression estimates. A pronounced non-linear moderating effect is observed in all cases: favorable institutional conditions significantly enhance the positive impact of digital trade on GTFP compared to the benchmark model in column 1.

When ER is used as the threshold variable, the impact of digital trade on GTFP is always positive. This supports the conclusion of Chen et al. [15] that ER can promote GTFP. However, the threshold analysis in this paper reveals that, as the ER constraint increases, the impact of digital trade on GTFP exhibits a positive non-linear relationship: first increasing and then decreasing. At low levels of regulation (below 0.0058), digital trade has a modest positive effect on GTFP. As regulation strengthens (0.0058 ≤ ER ≤ 0.0077), the positive impact peaks, aligning with the Porter hypothesis [42], which suggests that well-designed legislation can promote green innovation and productivity. However, when regulation grows more severe (ER > 0.0077), the marginal advantage of digital trade declines, most likely due to resource constraints and compliance obligations that hinder enterprises from fully using digital capabilities. These findings show that moderate, market-friendly regulation works together with digital trade to optimize GTFP gains.

When IPP is used as the threshold variable, the connection follows an “N-shaped” non-linear pattern. This is a further exploration based on the research of Mao and Failler [79], who found that the IPP policy can promote the GTFP of Chinese cities. However, we found that under low IPP levels (<0.0607), digital trade has a positive impact on GTFP. Then, at intermediate IPP levels (0.0607 ≤ IP ≤ 0.0924), the effect becomes negative, possibly due to adjustment costs, reduced knowledge spillovers, or limited technological diffusion under stricter IP regimes [46]. At higher levels of IPP (>0.0924), the beneficial effect returns, as firms benefit from secure innovation environments and more incentives to invest in green technologies. These findings demonstrate that, while robust IPP is ultimately helpful, transitional phases may present temporary barriers to green innovation spread.

When MI is used as the threshold variable, the impact of digital trade on GTFP is consistently positive. This corroborates Hou and Song’s [80] conclusion that MI can promote provincial GTFP in China. However, this paper’s threshold analysis further reveals that, as the degree of market integration improves, the marginal promoting effect of digital trade on GTFP exhibits a weak non-linear relationship: first increasing and then decreasing. At lower market integration levels (<15.385), digital trade increases GTFP by creating new market channels and facilitating access to green technologies. As market integration increases (15.385 ≤ MI ≤ 19.153), the favorable impact grows due to increased network effects and economies of scale [49]. However, at the upper threshold (>19.153), marginal gains are marginally reduced, possibly due to market saturation or competitive crowding, which restricts further productivity advances.

Overall, these findings illustrate that digital trade does not operate in an institutional vacuum. The nature and strength of external environmental constraints significantly shape their productivity-enhancing effects. Importantly, the results confirm that moderate environmental regulation, mature IP protection, and optimal market integration jointly form a “supportive institutional window” where the impact of digital trade on GTFP is maximized.

These insights offer key policy implications. Policymakers should avoid both under- and over-regulation, adopting adaptive, staged environmental policies that align digital development with sustainability goals. IP systems should strike a balance between protection and openness to avoid innovation bottlenecks, while market integration efforts must avoid monopolization or over-consolidation. Most critically, institutional reforms should be coordinated with digital trade policy to realize system-wide green productivity gains.

7. Conclusions

This study systematically investigates the nexus between digital trade and corporate GTFP through a life cycle perspective, employing panel data from Chinese A-share listed firms and 287 cities in Mainland China from 2012 to 2022. The empirical results show the following: First, digital trade exerts a robust positive impact on GTFP, predominantly mediated by technical efficiency improvements (GEC). Second, the GTFP effects diverge across corporate maturity stages. Enterprises operating within a recession cycle have increased their focus on efficiency-oriented strategies due to technology lock-in and resource constraints. The role of digital trade in promoting GTFP is particularly evident in this context. Third, digital trade enhances GTFP through dual channels: promoting green technological innovation and optimizing supply chain coordination. Fourth, our analysis also highlights two layers of non-linear threshold effects: on the one hand, the marginal benefit of digital trade on GTFP shows a U-shaped non-linear dynamic; on the other hand, institutional factors such as environmental regulation, intellectual property protection, and market integration further regulate this relationship. According to their levels at different stages, they consistently and dynamically amplify or limit the impact of digital trade on GTFP. These findings underscore the importance of aligning digital trade strategies with supportive and adaptable institutional environments to fully realize their sustainability potential.

These insights yield several managerial and policy implications. First, the non-linear effects of digital trade suggest that regions at different stages of digital development require phased strategies. These strategies should include basic infrastructure and capacity building in lagging areas, as well as platform integration and risk governance in digitally saturated zones. This approach contributes to the prevention of diminishing returns and maximizes productivity. Second, green innovation is most responsive to digital trade in mature firms. To support green upgrading, especially in firms with higher absorptive capacity, governments should offer targeted innovation subsidies, patent-sharing mechanisms, or digital R&D tax credits. Third, digital trade improves supply chain efficiency, particularly in the latter stages of the product life cycle. Policies should promote the adoption of digital supply chains, such as IoT-enabled logistics or blockchain traceability, through procurement standards or financial incentives. Fourth, institutional thresholds in areas such as regulation, IP protection, and market integration significantly impact the GTFP effects of digital trade. Policymakers should calibrate these frameworks to avoid over-regulation or underprotection and ensure that digital transformation aligns with green policy goals. Finally, firm managers should adapt digital–green strategies to match life cycle stages while monitoring regulatory shifts to align transformation efforts with the evolving external environment. This could promote sustainable digital-trade-driven green productivity across different contexts.

Compared with the existing literature, this study has made progress in both the theoretical and empirical aspects. First, Lyu et al.’s [13] previous research also found that the digital economy has a U-shaped non-linear impact on GTFP. This finding is consistent with our conclusion that digital trade has a U-shaped non-linear impact on GTFP. However, Lyu et al. emphasized the role of green technological progress (GTC) in the digital economy’s impact on GTFP. In contrast, our research results show that digital trade mainly enhances GTFP through technological efficiency (GEC), especially at the enterprise level. Second, unlike Dai et al. [11], who adopted provincial digital trade indicators, we constructed a digital trade index at the city level. This index integrates digital inclusive finance and industrial foundation indicators, enabling more accurate identification of regional heterogeneity. Furthermore, this paper analyzes enterprise life cycle heterogeneity, compensating for the inability of regional digital trade indicators to identify the degree to which enterprises in the same region utilize digital trade at different development stages. Finally, this paper introduces environmental factors into the TOE framework through the threshold model. Compared to the studies of Chen et al. [15], Mao and Failler [79], and Hou and Song [80], which examined the linear impact of environmental regulations, intellectual property rights, and market integration on GTFP, this paper further explores the non-linear impact of environmental factors on digital trade and GTFP. The research reveals the significant non-linear relationship between digital trade and GTFP. The research results align with sustainable development theory, technology diffusion theory, and the TOE framework. These results emphasize that promoting GTFP through digital trade requires an institutional background and enterprise maturity. These findings meaningfully contribute to the implementation of global sustainability frameworks, such as the Paris Agreement and the United Nations’ 2030 Sustainable Development Goals, by demonstrating how digitalization can enable low-carbon productivity growth. The study also provides empirical support for China’s dual carbon targets and “Digital China” initiative. The study suggests that coordinated development of digital trade and green transformation is essential for achieving high-quality, sustainable economic development.

Despite its contributions, this study has several limitations. First, while our digital trade index captures city-level digital trade development, it does not fully reflect firm-specific digital trade intensity, which may introduce measurement bias. Second, our analysis is based on Chinese listed firms, which may limit how generalizable the findings are to other institutional contexts or small, nonlisted enterprises. Third, although we examined two key mechanisms—green innovation and supply chain management—other potential pathways require further investigation. Future research could address these limitations by developing more granular, firm-level digital trade indicators, conducting cross-country comparative studies, and exploring additional mediating mechanisms. Additionally, longitudinal case studies could provide deeper insight into how digital trade influences GTFP over time.

Author Contributions

J.H.: Conceptualization, Methodology. W.C.: Data Curation, Writing—Original draft preparation. Y.S.: Project Administration, Funding Acquisition. F.D.: Writing—Review and Editing. All authors have read and agreed to the published version of the manuscript.

Funding

Guizhou Provincial Department of Education Higher Education Scientific Research Project (Youth Project), No. 181[2022] of Guizhou Education Technology: A study on the Path to Promoting High-Quality Development of Digital Trade in Guizhou under RCEP.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Zhao, X.; Nakonieczny, J.; Jabeen, F.; Shahzad, U.; Jia, W. Does green innovation induce green total factor productivity? Novel findings from Chinese city level data. Technol. Forecast. Soc. Change 2022, 185, 122021. [Google Scholar] [CrossRef]

- Feng, Y.; Gao, Y.; Hu, S.; Sun, M.; Zhang, C. How does digitalization affect the green transformation of enterprises registered in China’s resource-based cities? Further analysis on the mechanism and heterogeneity. J. Environ. Manag. 2024, 365, 121560. [Google Scholar] [CrossRef] [PubMed]

- Meng, Y.; Yu, J.; Yu, Y.; Ren, Y. Impact of green finance on green total factor productivity: New evidence from improved synthetic control methods. J. Environ. Manag. 2024, 372, 123394. [Google Scholar] [CrossRef] [PubMed]

- Liu, H.; Fang, W.; Yuan, P.; Dong, X. How does climate change affect green total factor productivity? Clim. Change 2025, 178, 112. [Google Scholar] [CrossRef]

- Mugerman, Y.; Steinberg, N.; Wiener, Z. The exclamation mark of Cain: Risk salience and mutual fund flows. J. Bank. Financ. 2022, 134, 106332. [Google Scholar] [CrossRef]

- Hartzmark, S.M.; Sussman, A.B. Do investors value sustainability? A natural experiment examining ranking and fund flows. J. Financ. 2019, 74, 2789–2837. [Google Scholar] [CrossRef]

- Hu, F.; Qiu, L.; Xi, X.; Zhou, H.; Hu, T.; Su, N.; Zhou, H.; Li, X.; Yang, S.; Duan, Z.; et al. Has COVID-19 Changed China’s Digital Trade?—Implications for Health Economics. Front. Public Health 2022, 10, 831549. [Google Scholar] [CrossRef] [PubMed]

- OECD. OECD Digital Economy Outlook 2020; OECD Publishing: Paris, France, 2021. [Google Scholar] [CrossRef]

- Banker, R.D.; Mitra, S.; Sambamurthy, V.; Mitra, S. The Effects of Digital Trading Platforms on Commodity Prices in Agricultural Supply Chains. MIS Q. 2011, 35, 599–611. [Google Scholar] [CrossRef]

- Ma, S.; Guo, J.; Zhang, H. Policy Analysis and Development Evaluation of Digital Trade: An International Comparison. China World Econ. 2019, 27, 49–75. [Google Scholar] [CrossRef]

- Dai, S.; Tang, D.; Li, Y.; Lu, H. Digital trade, trade openness, FDI, and green total factor productivity. Int. Rev. Financ. Anal. 2025, 97, 103777. [Google Scholar] [CrossRef]

- Zhou, X.; Ji, J. The nonlinear effects of digital economy on the low-carbon green total factor productivity: Evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 91396–91414. [Google Scholar] [CrossRef] [PubMed]

- Lyu, Y.; Wang, W.; Wu, Y.; Zhang, J. How does digital economy affect green total factor productivity? Evidence from China. Sci. Total Environ. 2023, 857, 159428. [Google Scholar] [CrossRef]

- Suo, X.; Zhang, L.; Guo, R.; Lin, H.; Yu, M.; Du, X. The inverted U-shaped association between digital economy and corporate total factor productivity: A knowledge-based perspective. Technol. Forecast. Soc. Change 2024, 203, 123364. [Google Scholar] [CrossRef]

- Chen, L.; Lu, Y.; Meng, Y. The impact of environmental regulation on green total factor productivity: Evidence from China’s provincial level. Process Saf. Environ. Prot. 2025, 198, 107106. [Google Scholar] [CrossRef]

- Ren, Y.; Yu, J.; Zhang, G.; Yu, Y. Towards low-carbon development through innovation: Empirical evidence from China. Cities 2024, 152, 105197. [Google Scholar] [CrossRef]

- Liang, B. Digital allocation effect, market integration, and low-carbon development. Environ. Dev. Sustain. 2025, 27, 1–34. [Google Scholar] [CrossRef]

- World Commission on Environment and Development (WCED). Our Common Future. In Proceedings of the Special Working Session, Berlin, Germany, 29–31 January 1987; Volume 17, pp. 1–91. [Google Scholar]

- Sachs, J.D. The Age of Sustainable Development; Columbia University Press: New York, NY, USA, 2015. [Google Scholar] [CrossRef]

- Zhou, P.; Ang, B.W.; Poh, K.L. A survey of data envelopment analysis in energy and environmental studies. Eur. J. Oper. Res. 2008, 189, 1–18. [Google Scholar] [CrossRef]

- Tang, J.; Li, W.; Hu, J.; Ren, Y. Can government digital transformation improve corporate energy efficiency in resource-based cities? Energy Econ. 2025, 141, 108043. [Google Scholar] [CrossRef]

- Li, Y.; Chen, Y. Development of an SBM-ML model for the measurement of green total factor productivity: The case of pearl river delta urban agglomeration. Renew. Sustain. Energy Rev. 2021, 145, 111131. [Google Scholar] [CrossRef]

- Chen, Y.; Miao, J.; Zhu, Z. Measuring green total factor productivity of China’s agricultural sector: A three-stage SBM-DEA model with non-point source pollution and CO2 emissions. J. Clean. Prod. 2021, 318, 128543. [Google Scholar] [CrossRef]

- Rogers, E.M.; Singhal, A.; Quinlan, M.M. Diffusion of innovations. In An Integrated Approach to Communication Theory and Research; Routledge: Oxfordshire, UK, 2014; pp. 432–448. [Google Scholar] [CrossRef]

- Wen, H.; Chen, W.; Zhou, F. Does digital service trade boost technological innovation?: International evidence. Socio-Econ. Plan. Sci. 2023, 88, 101647. [Google Scholar] [CrossRef]

- Liu, Y.; Jiang, R.; Zhang, Y.; Dai, J.; Cheng, J. Mitigating digital trade barriers: Strategies for enhancing national value chains performance. Int. Rev. Econ. Financ. 2024, 95, 103485. [Google Scholar] [CrossRef]

- Tornatzky, L.G.; Fleischer, M. The Processes Oftechnological Innovation; Lexington Books: Lexington, MA, USA, 1990. [Google Scholar]

- Cao, X.; Deng, M.; Li, H. How does e-commerce city pilot improve green total factor productivity? Evidence from 230 cities in China. J. Environ. Manag. 2021, 289, 112520. [Google Scholar] [CrossRef]

- Guidi, G.; Mastrandrea, R.; Facchini, A.; Squartini, T.; Kennedy, C. Tracing two decades of carbon emissions using a network approach. Sci. Rep. 2024, 14, 7251. [Google Scholar] [CrossRef] [PubMed]

- Huang, Y.S.; Ho, J.W.; Kao, W.Y. Availability and reliability of information transmission for supply chain coordination with demand information sharing. Comput. Ind. Eng. 2022, 172, 108642. [Google Scholar] [CrossRef]

- Huang, Y.; Chen, Z.; Li, H.; Yin, S. The impact of digital economy on green total factor productivity considering the labor-technology-pollution factors. Sci. Rep. 2023, 13, 22902. [Google Scholar] [CrossRef]

- Yan, M.; Liu, H. The Impact of Digital Trade Barriers on Technological Innovation Efficiency and Sustainable Development. Sustainability 2024, 16, 5169. [Google Scholar] [CrossRef]

- Ouyang, X.; Li, Q.; Du, K. How does environmental regulation promote technological innovations in the industrial sector? Evidence from Chinese provincial panel data. Energy Policy 2020, 139, 111310. [Google Scholar] [CrossRef]

- Guo, B.; Hu, P.; Lin, J. The effect of digital infrastructure development on enterprise green transformation. Int. Rev. Financ. Anal. 2024, 92, 103085. [Google Scholar] [CrossRef]

- Al Mashalah, H.; Hassini, E.; Gunasekaran, A.; Bhatt, D. The impact of digital transformation on supply chains through e-commerce: Literature review and a conceptual framework. Transp. Res. Part E Logist. Transp. Rev. 2022, 165, 102837. [Google Scholar] [CrossRef]

- Enrique, D.V.; Lerman, L.V.; de Sousa, P.R.; Benitez, G.B.; Santos, F.M.B.C.; Frank, A.G. Being digital and flexible to navigate the storm: How digital transformation enhances supply chain flexibility in turbulent environments. Int. J. Prod. Econ. 2022, 250, 108668. [Google Scholar] [CrossRef]

- Ning, L.; Yao, D. The impact of digital transformation on supply chain capabilities and supply chain competitive performance. Sustainability 2023, 15, 10107. [Google Scholar] [CrossRef]

- Xu, J.; Yang, B.; Yuan, C. The impact of supply chain digitalization on urban resilience: Do industrial chain resilience, green total factor productivity and innovation matter? Energy Econ. 2025, 145, 108443. [Google Scholar] [CrossRef]

- Xue, R.; Ong, T.S.; Di Vaio, A. Environmentally Sustainable Development: The Role of Supply Chain Digitalization in Firms’ Green Productivity. Sustain. Dev. 2025, 0, 1–19. [Google Scholar] [CrossRef]

- Jin, H.; Jiang, N.; Su, W.; Dalia, S. How does customer enterprise digitalization improve the green total factor productivity of state-owned suppliers: From the supply chain perspective. Omega 2025, 133, 103248. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.V.D. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Wang, Y.; Shen, N. Environmental regulation and environmental productivity: The case of China. Renew. Sustain. Energy Rev. 2016, 62, 758–766. [Google Scholar] [CrossRef]

- Pan, A.; Jiang, P.; Wang, C.; Wang, F. Does environmental regulation promote green technological innovation of companies? Evidence from green patents of Chinese listed companies. Int. J. Low-Carbon Technol. 2024, 19, ctad078. [Google Scholar] [CrossRef]