Optimal Strategies in a Manufacturer-Led Supply Chain Under Hybrid Carbon Policies and Retailer’s Fairness Concerns

Abstract

1. Introduction

- (1)

- What is the optimal strategy for the manufacturer’s efforts in green technology and remanufacturing, as well as the retailer’s effort in low-carbon promotion, considering low-carbon preference, hybrid carbon policies, and retailer’s fairness concerns?

- (2)

- How do hybrid carbon policies, retailer’s fairness concerns, and low-carbon preference influence the optimal strategies utilized by supply chain participants?

- (3)

- How can the downstream retailer with fairness concerns collaborate more effectively with the leading manufacturer to promote low-carbon initiatives?

2. Literature Review

3. Problem Description

4. Model and Results

4.1. Case D: Decentralized Decision-Making

4.2. Case C: Centralized Decision-Making

5. Comparative Analysis

6. Numerical Analysis

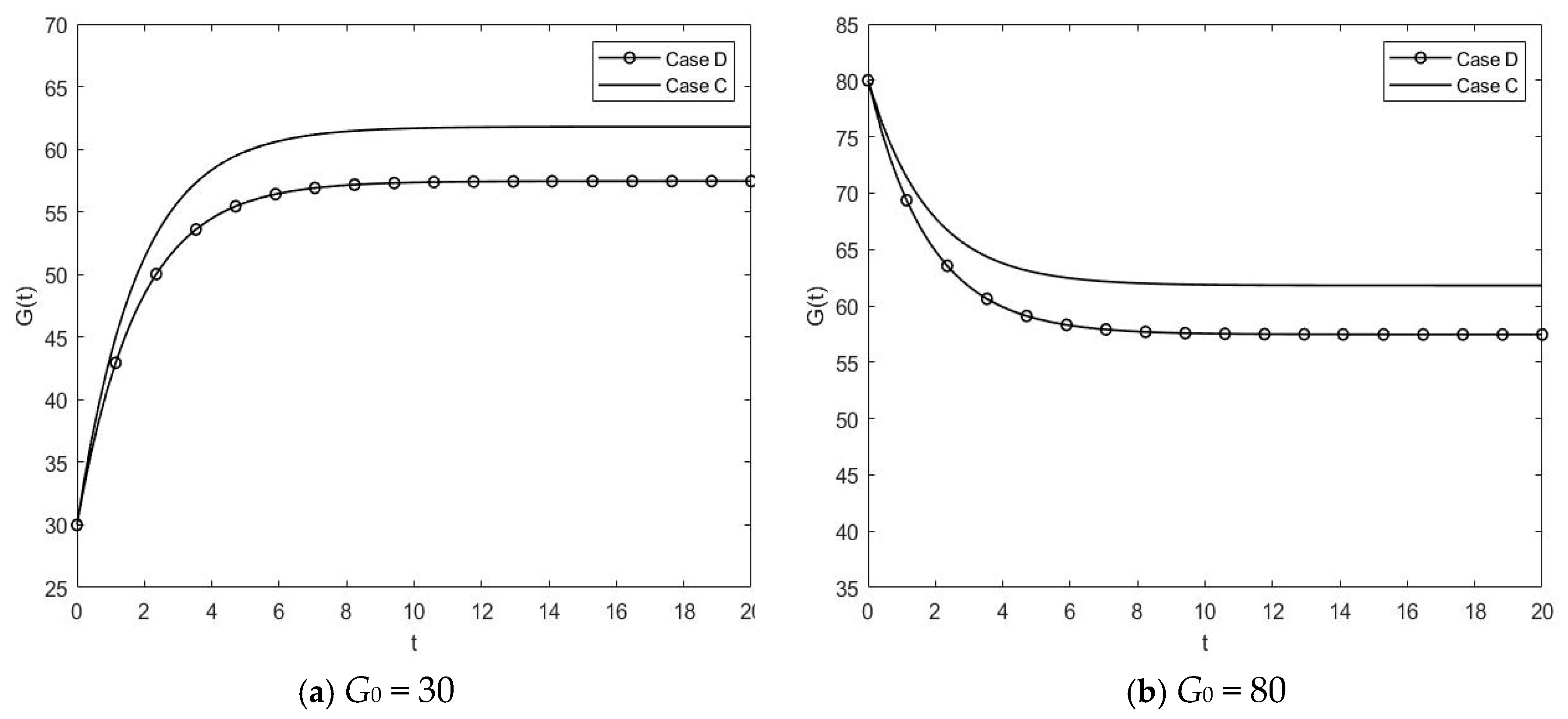

6.1. Trajectories of Low-Carbon Goodwill

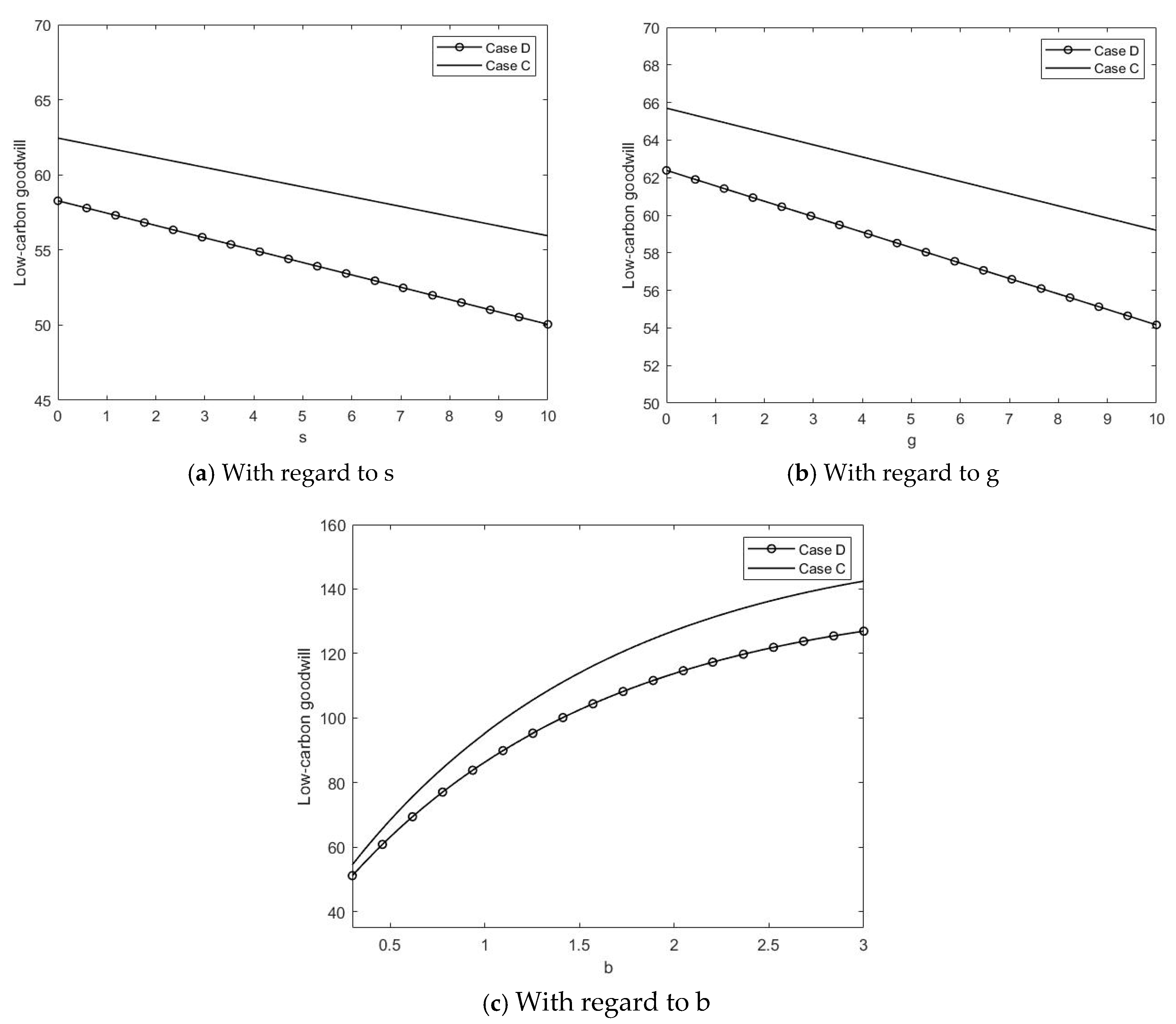

6.2. Impacts of Major Parameters on Low-Carbon Goodwill

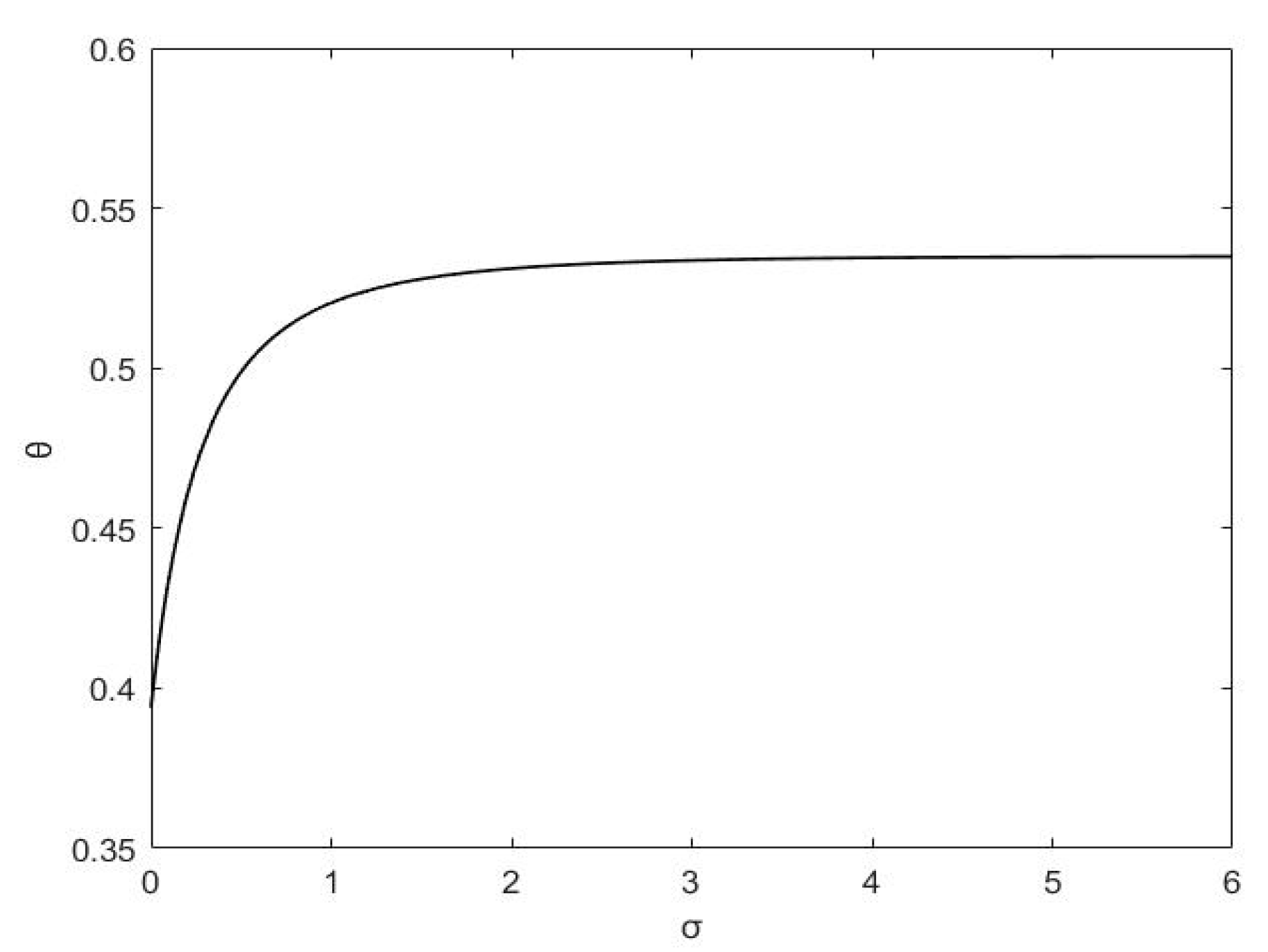

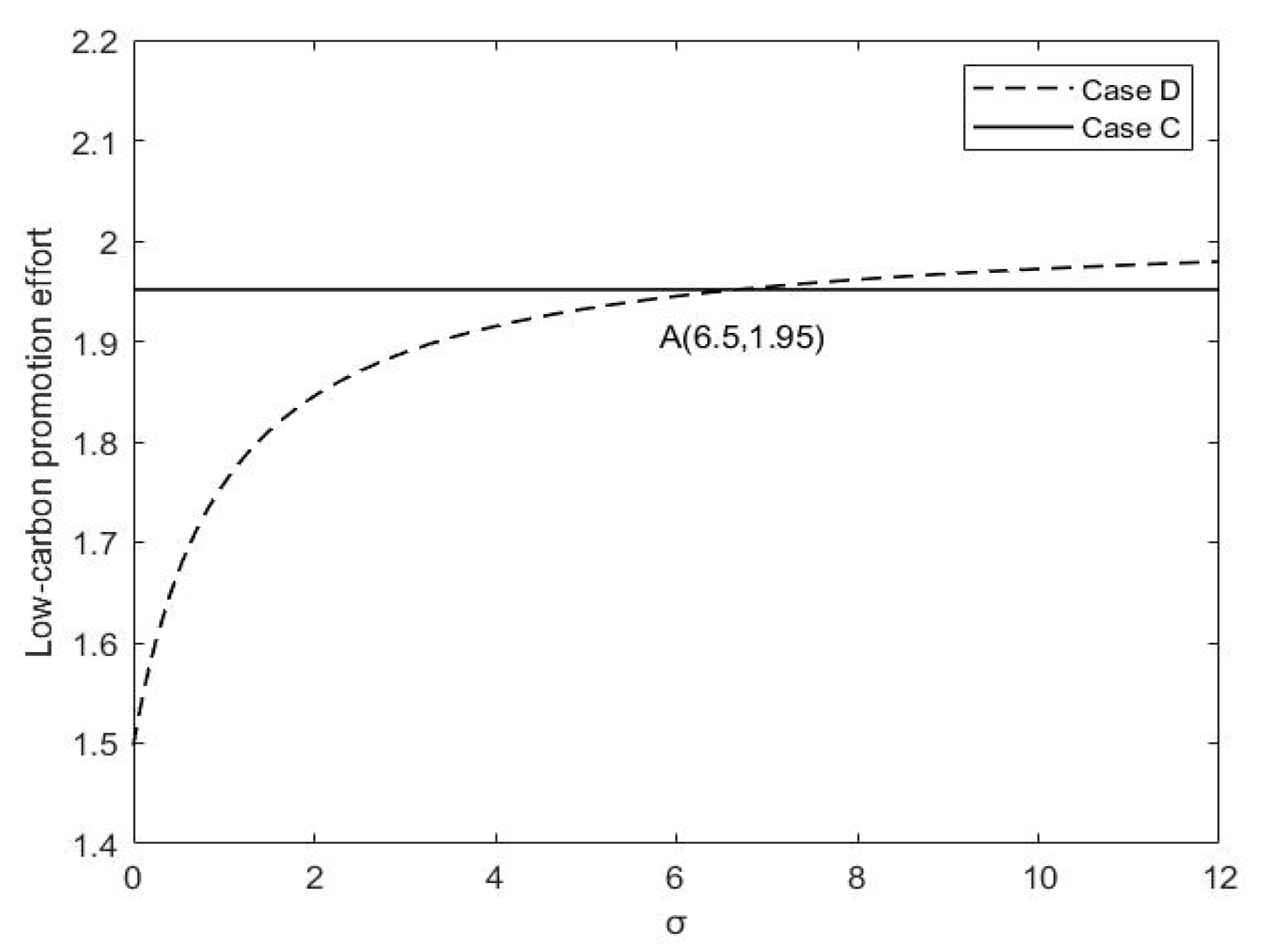

6.3. Influences of Retailer’s Fairness Concerns on Promotion and Cost-Sharing

7. Discussion

7.1. Main Conclusions

- (1)

- Under the centralized case, the chain’s overall profits and low-carbon goodwill are higher than those under the decentralized case. Therefore, adopting centralized decision-making can optimize both the economic and environmental performances of channel members.

- (2)

- The manufacturer’s low-carbon efforts remain uninfluenced by retailer’s fairness concerns, but they do augment the retailer’s initiatives in low-carbon advocacy. Additionally, when retailer’s fairness concerns fall below three, the cost-sharing ratio for low-carbon marketing will rise swiftly in response to an increase in fairness concerns. However, when retailer’s fairness concerns surpass three, the cost-sharing ratio stabilizes. Therefore, in order to raise the low-carbon advertising cost-sharing ratio, the retailer should address fairness issues within an ideal range and express these concerns effectively to the manufacturer.

- (3)

- The increased low-carbon preference is driving supply chain participants to put more efforts in low-carbon operations and marketing. Moreover, regardless of the decentralized or centralized method, the producer persists in intensifying efforts towards low-carbon operations as hybrid carbon policies become increasingly stringent. However, the retailer is expected to reduce its low-carbon promotional efforts in response to stricter hybrid carbon policies and serve as a moderator in maintaining an adequate low-carbon goodwill and sustain the supply chain’s low-carbon transition. Therefore, this partnership is essential for cultivating increased low-carbon goodwill, boosting product demand, and ultimately improving profits in the supply chain.

7.2. Managerial Insights

- (1)

- Improve low-carbon awareness: Governments and corporations should intensify efforts to promote education on low-carbon knowledge. Specifically, governments can institute inclusive finance policies to incentivize the purchasing of low-carbon products. Additionally, a well-targeted low-carbon promotion subsidy policy can significantly contribute to low-carbon initiatives, thereby increasing consumer awareness about low-carbon options.

- (2)

- Pay attention to fairness concerns in promotion cost-sharing: Downstream retailers ought to evaluate the implications of fairness concerns and proactively convey this information to upstream manufacturers during negotiations. Moreover, formulating and establishing open and equitable cost-sharing agreements that balance the interests of manufacturers and retailers can incentivize retailers to participate more actively in low-carbon marketing initiatives.

- (3)

- Leverage different carbon policies effectively: Governments should take proactive steps to enhance existing carbon policies and leverage the complementary aspects of various carbon strategies to accelerate the transition to low-carbon operations. A coordinated approach can amplify the impacts of these policies on environmental and economic outcomes.

7.3. Research Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- IPCC. Climate Change 2023: Synthesis Report; IPCC: Geneva, Switzerland, 2023; pp. 35–115. [Google Scholar]

- Konur, D.; Campbell, J.F.; Monfared, S.A. Economic and environmental considerations in a stochastic inventory control model with order splitting under different delivery schedules among suppliers. Omega 2017, 71, 46–65. [Google Scholar]

- Xu, S.; Govindan, K.; Wang, W.; Yang, W. Supply chain management under cap-and-trade regulation: A literature review and research opportunities. Int. J. Prod. Econ. 2024, 271, 109199. [Google Scholar]

- Wang, J.; Peng, W.; Ke, C.; Wang, Z.; Zhang, S.; Rui, Z.; Shi, X. Renewable energy investment under carbon trading mechanism: The impact of green financing and carbon emission quota. Environ. Dev. Sustain. 2025. [Google Scholar] [CrossRef]

- Liao, H.; Wu, D.; Wang, Y.; Lyu, Z.; Sun, H.; Nie, Y.; He, H. Impacts of carbon trading mechanism on closed-loop supply chain: A case study of stringer pallet remanufacturing. Soc. Econ. Plann. Sci. 2022, 81, 101209. [Google Scholar]

- Cai, J.; Jiang, F. Decision models of pricing and carbon emission reduction for low-carbon supply chain under cap-and-trade regulation. Int. J. Prod. Econ. 2023, 264, 108964. [Google Scholar]

- Jiang, K.; Wang, D.; Xu, L.; Wang, F. Assessing the impact of carbon quota allocation in enhancing supply chain members emission reduction and advertising efforts. Soc. Econ. Plann. Sci. 2024, 95, 102033. [Google Scholar]

- Zhou, X.; Wei, X.; Lin, J.; Tian, X.; Lev, B.; Wang, S. Supply chain management under carbon taxes: A review and bibliometric analysis. Omega 2021, 98, 102295. [Google Scholar]

- Wang, L.; Peng, K. Carbon reduction decision-making in supply chain under the pledge financing of carbon emission rights. J. Clean. Prod. 2023, 428, 139381. [Google Scholar]

- Palsule-Desai, O.D.; Tirupati, D.; Chandra, P. Stability issues in supply chain networks: Implications for coordination mechanisms. Int. J. Prod. Econ. 2013, 142, 179–193. [Google Scholar]

- Cao, J.; Ho, M.S.; Jorgenson, D.W.; Nielsen, C.P. China’s emissions trading system and an ETS-carbon tax hybrid. Energy Econ. 2019, 81, 741–753. [Google Scholar]

- World Bank Group. State and Trends of Carbon Pricing 2019 (English); World Bank Group: Washington, DC, USA, 2019. [Google Scholar]

- Liu, Z.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar]

- Du, S.; Hu, L.; Wang, L. Low-carbon supply policies and supply chain performance with carbon concerned demand. Ann. Oper. Res. 2017, 255, 569–590. [Google Scholar]

- Wen, W.; Zhou, P.; Zhang, F. Carbon emissions abatement: Emissions trading vs consumer awareness. Energy Econ. 2018, 76, 34–47. [Google Scholar]

- Yao, F.; Parilina, E.; Zaccour, G.; Gao, H. Accounting for consumers’ environmental concern in supply chain contracts. Eur. J. Oper. Res. 2022, 301, 987–1006. [Google Scholar]

- De Angelis, T.; Tankov, P.; Zerbib, O.D. Climate impact investing. Manag. Sci. 2022, 69, 7669–7692. [Google Scholar]

- Xing, E.; Shi, C.; Zhang, J.; Cheng, S.; Lin, J.; Ni, S. Double third-party recycling closed-loop supply chain decision under the perspective of carbon trading. J. Clean. Prod. 2020, 259, 120651. [Google Scholar]

- Lv, X.; Zhang, S.; Zhang, T. Subsidy or not? Research on remanufacturing strategy under the influence of consumers’ preferences. Environ. Dev. Sustain. 2024. [Google Scholar] [CrossRef]

- Govindan, K.; Soleimani, H.; Kannan, D. Reverse logistics and closed-loop supply chain: A comprehensive review to explore the future. Eur. J. Oper. Res. 2015, 240, 603–626. [Google Scholar]

- Dye, C.Y.; Hsieh, T.P. A sustainable dynamic optimization model of pricing and advertising in the presence of green innovation investment. Eur. J. Oper. Res. 2024, 315, 654–667. [Google Scholar]

- Hong, Z.; Guo, X. Green product supply chain contracts considering environmental responsibilities. Omega 2019, 83, 155–166. [Google Scholar]

- Li, Z.; Pan, Y.; Yang, W.; Ma, J.; Zhou, M. Effects of government subsidies on green technology investment and green marketing coordination of supply chain under the cap-and-trade mechanism. Energy Econ. 2021, 101, 105426. [Google Scholar]

- Zhou, Y.; Bao, M.; Chen, X.; Xu, X. Co-op advertising and emission reduction cost sharing contracts and coordination in low-carbon supply chain based on fairness concerns. J. Clean. Prod. 2016, 133, 402–413. [Google Scholar]

- Gong, Y.; Kai, J.; Wang, Z. Research on closed loop supply chain strategy considering fair preference and green innovation. Chin. J. Manag. Sci. 2024, 1–14. (In Chinese) [Google Scholar] [CrossRef]

- Zhu, C.; Xi, X.; Goh, M. Differential game analysis of joint emission reduction decisions under mixed carbon policies and CEA. J. Environ. Manag. 2024, 358, 120913. [Google Scholar]

- Cheng, P.; Ji, G.; Zhang, G.; Shi, Y. A closed-loop supply chain network considering consumer’s low carbon preference and carbon tax under the cap-and-trade regulation. Sustain. Prod. Consum. 2022, 29, 614–635. [Google Scholar]

- Zhu, C.; Ma, J.; Li, J. Dynamic production and carbon emission reduction adjustment strategies of the brand-new and the remanufactured product under hybrid carbon regulations. Comput. Ind. Eng. 2022, 172, 108517. [Google Scholar]

- Li, Q.; Xiao, T.; Qiu, Y. Price and carbon emission reduction decisions and revenue-sharing contract considering fairness concerns. J. Clean. Prod. 2018, 190, 303–314. [Google Scholar]

- Xia, L.; Bai, Y.; Ghose, S.; Qin, J. Differential game analysis of carbon emissions reduction and promotion in a sustainable supply chain considering social preferences. Ann. Oper. Res. 2022, 310, 257–292. [Google Scholar]

- Wang, Y.; Yu, Z.; Jin, M.; Mao, J. Decisions and coordination of retailer-led low-carbon supply chain under altruistic preference. Eur. J. Oper. Res. 2021, 293, 910–925. [Google Scholar]

- Du, K.; Cheng, Y.; Yao, X. Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Econ. 2021, 98, 105247. [Google Scholar]

- Qi, X.; Wu, Z.; Xu, J.; Shan, B. Environmental justice and green innovation: A quasi-natural experiment based on the establishment of environmental courts in China. Ecol. Econ. 2023, 205, 107700. [Google Scholar]

- Xu, X.; He, P.; Xu, H.; Zhang, Q. Supply chain coordination with green technology under cap-and-trade regulation. Int. J. Prod. Econ. 2017, 183, 433–442. [Google Scholar]

- Krass, D.; Nedorezov, T.; Ovchinnikov, A. Environmental taxes and the choice of green technology. Prod. Oper. Manag. 2013, 22, 1035–1055. [Google Scholar]

- Luo, R.; Zhou, L.; Song, Y.; Fan, T. Evaluating the impact of carbon tax policy on manufacturing and remanufacturing decisions in a closed-loop supply chain. Int. J. Prod. Econ. 2022, 245, 108408. [Google Scholar]

- Yang, L.; Hu, Y.; Huang, L. Collecting mode selection in a remanufacturing supply chain under cap-and-trade regulation. Eur. J. Oper. Res. 2020, 287, 480–496. [Google Scholar]

- Bendoly, E. Incorporating behavioral theory in OM empirical models. J. Oper. Manag. 2006, 24, 735–736. [Google Scholar]

- Haitao Cui, T.; Raju, J.S.; Zhang, Z.J. Fairness and channel coordination. Manag. Sci. 2007, 53, 1303–1314. [Google Scholar]

- Ho, T.-H.; Zhang, J. Designing pricing contracts for boundedly rational customers: Does the framing of the fixed fee matter? Manag. Sci. 2008, 54, 686–700. [Google Scholar]

- Loch, C.H.; Wu, Y. Social preferences and supply chain performance: An experimental study. Manag. Sci. 2008, 54, 1835–1849. [Google Scholar]

- Wang, K.; Zeng, H.; Yuan, Y.; Zhang, C.; Liu, L. Green or non-green: A game to introduce decision making under fairness concerns. Technol. Forecast. Soc. Change. 2022, 185, 122050. [Google Scholar]

- Yang, H.; Chen, X.; Li, L.; Sun, Y. Supply chain decision-making of green products considering a retailer’s fairness concerns under a pre-sale model. J. Clean. Prod. 2023, 414, 137457. [Google Scholar]

- Luan, X.; Kang, K.; Yin, J. Research on selection of manufacturer’s sales mode considering product greenness. Comput. Eng. App. 2023, 59, 280–288. (In Chinese) [Google Scholar]

- Zu, Y.; Chen, L.; Fan, Y. Research on low-carbon strategies in supply chain with environmental regulations based on differential game. J. Clean. Prod. 2018, 177, 527–546. [Google Scholar]

- Gui, L. Recycling infrastructure development under extended producer responsibility in developing economies. Prod. Oper. Manag. 2020, 29, 1858–1877. [Google Scholar]

- Ilgin, M.A.; Gupta, S.M. Environmentally conscious manufacturing and product recovery (ECMPRO): A review of the state of the art. J. Environ. Manag. 2010, 91, 563–591. [Google Scholar]

- Govindan, K.; Popiuc, M.N. Reverse supply chain coordination by revenue sharing contract: A case for the personal computers industry. Eur. J. Oper. Res. 2014, 233, 326–336. [Google Scholar]

- Jørgensen, S.; Martín-Herrán, G.; Zaccour, G. Dynamic games in the economics and management of pollution. Environ. Model. Assess. 2010, 15, 433–467. [Google Scholar]

- André, F.J.; Sokri, A.; Zaccour, G. Public Disclosure Programs vs. traditional approaches for environmental regulation: Green goodwill and the policies of the firm. Eur. J. Oper. Res. 2011, 212, 199–212. [Google Scholar]

- Liang, L.; Futou, L. Differential game modelling of joint carbon reduction strategy and contract coordination based on low-carbon reference of consumers. J. Clean. Prod. 2020, 277, 123798. [Google Scholar]

- Marc, N.; Kenneth, J.A. Optimal Advertising Policy under Dynamic Conditions. Economica 1962, 29, 129–142. [Google Scholar]

- He, L.; Yuan, B.; Bian, J.; Lai, K.K. Differential game theoretic analysis of the dynamic emission abatement in low-carbon supply chains. Ann. Oper. Res. 2023, 324, 355–393. [Google Scholar]

- Kang, Y.; Dong, P.; Ju, Y.; Zhang, T. Differential game theoretic analysis of the blockchain technology investment and carbon reduction strategy in digital supply chain with government intervention. Comput. Ind. Eng. 2024, 189, 109953. [Google Scholar]

- El Ouardighi, F.; Pasin, F. Quality improvement and goodwill accumulation in a dynamic duopoly. Eur. J. Oper. Res. 2006, 175, 1021–1032. [Google Scholar]

| Authors | Type of Carbon Policy | Structure of the Supply Chain | Fairness Concerns | Remanufacturing | Differential Game | |

|---|---|---|---|---|---|---|

| Cap-and-Trade | Carbon Tax | |||||

| Zhou et al. [24] | × | × | a manufacturer, a retailer | √ | × | × |

| Xu et al. [34] | √ | × | a manufacturer, a retailer | × | × | × |

| Li et al. [29] | × | √ | a manufacturer, a supplier | √ | × | √ |

| Yang et al. [37] | √ | × | a manufacturer, a retailer or a third party | × | √ | × |

| Li et al. [23] | √ | × | a manufacturer, a retailer | √ | × | × |

| Luo et al. [36] | × | √ | a manufacturer, a retailer | × | √ | × |

| Cheng et al. [27] | √ | √ | a manufacturer, a retailer | × | √ | × |

| Xia et al. [30] | × | × | a manufacturer, a retailer | √ | × | √ |

| Yang et al. [43] | × | × | a manufacturer, a retailer | √ | × | × |

| Cai et al. [6] | √ | × | a manufacturer, a supplier | × | × | √ |

| Zhu et al. [26] | √ | √ | a manufacturer, a retailer | × | √ | √ |

| This paper | √ | √ | a manufacturer, a retailer | √ | √ | √ |

| Parameters | Implication |

|---|---|

| D(t) | Market demand of products |

| Dr(t) | Recycling quantity of products |

| ES(t) | Carbon emission surplus |

| Cm, Cr | Unit production cost of new/remanufactured product |

| P | Retail price per unit of products |

| W | Wholesale price per unit of products |

| s, g | Unit carbon tax price/carbon emissions rights trading price |

| Em, Er | Unit carbon emissions of new/remanufactured products |

| E | Allocated carbon emissions rights |

| Q | Market size of products |

| k, l, f | Investment cost coefficient of green technology/recycling/low-carbon promotion |

| a, b | Influence coefficient of retail price/low-carbon good will |

| h | Influence coefficient of recycling effort |

| μ, γ | Influence coefficient of carbon emissions surplus/low-carbon promotional effort |

| δ | Decay rate of low-carbon goodwill |

| ρ | Discount factor |

| σ | Fairness concerns of the retailer |

| θ | Cost-sharing ratio for low-carbon promotion |

| Decision Variables | |

| em(t) | Emissions reduction from green technology effort |

| τ(t) | Recycling effort for remanufacturing |

| u(t) | Low-carbon promotional effort |

| State Variable | |

| G(t) | Low-carbon goodwill |

| Notations | |

| Jm, Jr, Jsc | Objective function of the manufacturer/retailer/entire supply chain |

| Vm, Vr, Vsc | Value function of the manufacturer/retailer/entire supply chain |

| Superscripts | |

| D | Decentralized decision-making |

| C | Centralized decision-making |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, P.; Ai, S.; Zeng, Y. Optimal Strategies in a Manufacturer-Led Supply Chain Under Hybrid Carbon Policies and Retailer’s Fairness Concerns. Sustainability 2025, 17, 6309. https://doi.org/10.3390/su17146309

Li P, Ai S, Zeng Y. Optimal Strategies in a Manufacturer-Led Supply Chain Under Hybrid Carbon Policies and Retailer’s Fairness Concerns. Sustainability. 2025; 17(14):6309. https://doi.org/10.3390/su17146309

Chicago/Turabian StyleLi, Ping, Shuxuan Ai, and Yangmei Zeng. 2025. "Optimal Strategies in a Manufacturer-Led Supply Chain Under Hybrid Carbon Policies and Retailer’s Fairness Concerns" Sustainability 17, no. 14: 6309. https://doi.org/10.3390/su17146309

APA StyleLi, P., Ai, S., & Zeng, Y. (2025). Optimal Strategies in a Manufacturer-Led Supply Chain Under Hybrid Carbon Policies and Retailer’s Fairness Concerns. Sustainability, 17(14), 6309. https://doi.org/10.3390/su17146309