Evaluating the Impact of Green Manufacturing on Corporate Resilience: A Quasi-Natural Experiment Based on Chinese Green Factories

Abstract

1. Introduction

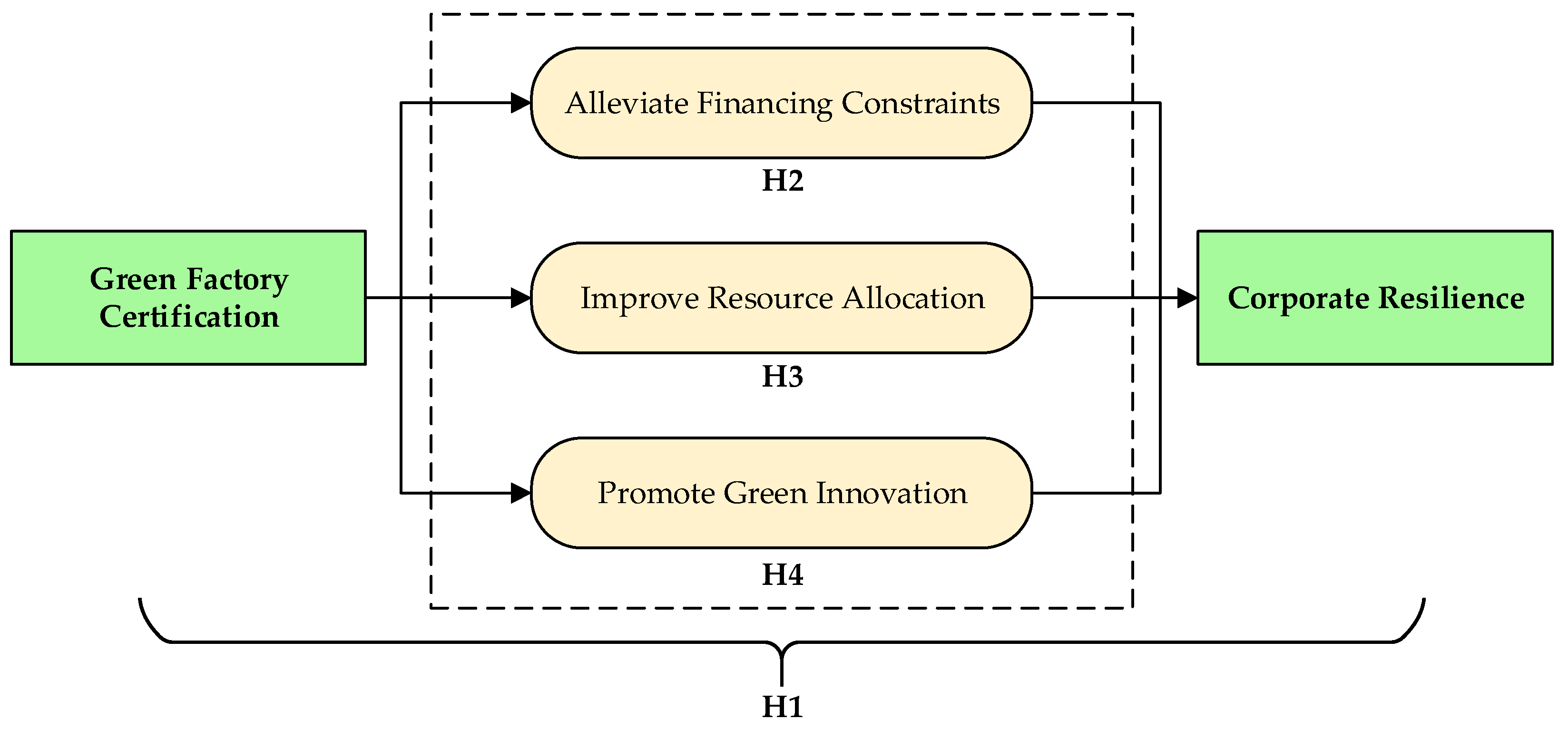

2. Theoretical Analysis and Research Hypotheses

3. Research Design

3.1. Data Sources

3.2. Model Design and Variable Definitions

4. Empirical Results and Analysis

4.1. Descriptive Statistics

4.2. Baseline Regression

4.3. Robustness Test

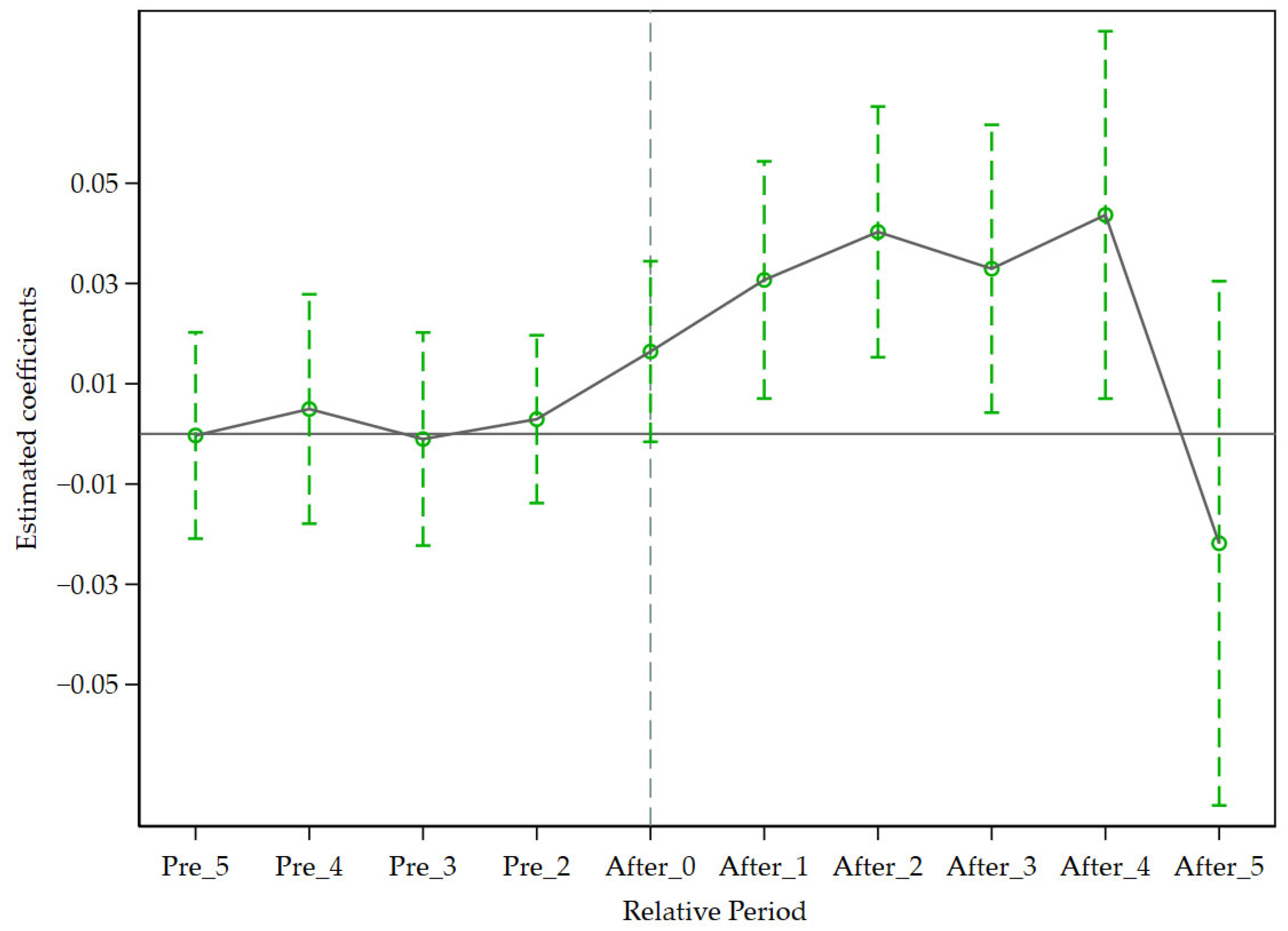

4.3.1. Parallel Trend Test

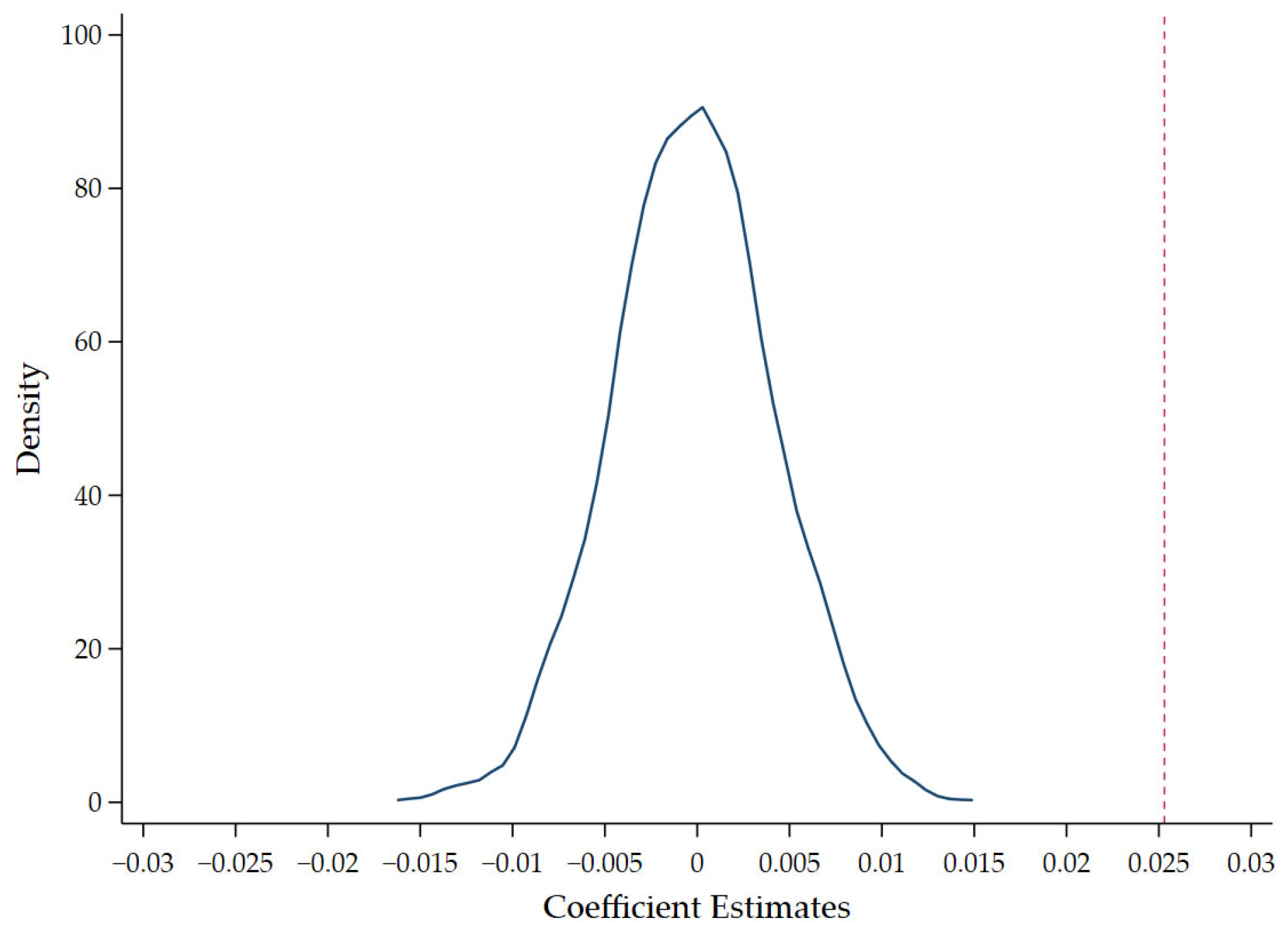

4.3.2. Placebo Test

4.3.3. Propensity Score Matching and Entropy Balancing Matching

4.3.4. Lagged Explanatory Variables and Control Variables

4.3.5. Adding Control Variables and Changing Fixed Effects

4.3.6. Excluding Interference from Other Policies

4.3.7. Adjusting the Sample Period

4.3.8. Changing the Explained Variable

4.3.9. Heterogeneous Treatment Effect Test for Multi-Time-Point DID

4.4. Impact Mechanism Testing

4.4.1. Alleviating Financing Constraints

4.4.2. Improving Resource Allocation

4.4.3. Promoting Green Innovation

5. Further Research

5.1. Heterogeneity Analysis

5.1.1. Pollution Attribute

5.1.2. Reputational Pressure

5.1.3. Managerial Myopia

5.2. Spillover Effect Test

6. Conclusions, Suggestions, and Prospects

6.1. Main Conclusions

6.2. Suggestions

6.3. Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Information Related to China’s Green Factory Certification

Appendix A.1. Green Factory Certification Process

- (1)

- Enterprise Self-assessment and Application Stage: Enterprises independently conduct pre-construction work for green factories, prepare a Self-assessment Report, and submit applications to MIIT.

- (2)

- Third-party Evaluation Stage: Enterprises commission MIIT-registered third-party institutions to review self-assessment reports and conduct on-site evaluations, forming a Third-party Evaluation Report.

- (3)

- National Assessment, Confirmation, and Public Notification Stage: Competent authorities at county/city levels conduct preliminary reviews, with qualified applications recommended to provincial departments for confirmation. Provincial authorities recheck materials and third-party reports before submitting recommendations to MIIT. MIIT organizes expert reviews and public notifications, and spot checks to finalize the national green factory list. The assessment process is illustrated in Figure A1.

Appendix A.2. Certification Indicators for Green Factories

- (1)

- Infrastructure (20% of total score)

- (2)

- Management System (15%)

- (3)

- Energy and Resource Input (15%)

- (4)

- Products (10%)

- (5)

- Environmental Emissions (10%)

- (6)

- Performance (30%)

Appendix A.3. Statistics on Certification and Revocation

- -

- 9 batches of assessments completed as of 2025

- -

- Cumulative total: 6527 certified green factories

- -

- 98 revocations recorded, leaving 6429 valid certifications

| Batch | Year | Number of Certifications in Each Batch | Number of Final Certifications | Number of Revocations in Each Batch |

|---|---|---|---|---|

| 1 | 2017 | 201 | 188 | 13 |

| 2 | 2018 | 208 | 197 | 11 |

| 3 | 2018 | 391 | 369 | 22 |

| 4 | 2019 | 602 | 577 | 25 |

| 5 | 2020 | 719 | 705 | 14 |

| 6 | 2021 | 662 | 657 | 5 |

| 7 | 2022 | 874 | 870 | 4 |

| 8 | 2023 | 1488 | 1484 | 4 |

| 9 | 2024 | 1382 | 1382 | 0 |

| Total | 6527 | 6429 | 98 | |

Appendix A.4. Post-Assessment Verification Mechanism

- -

- Irregular spot checks to ensure compliance with green manufacturing standards

- -

- Revocation for non-compliant factories

- -

- Exemption from checks for 5 years after three consecutive validations

Appendix B

| Variable | Skewness | Kurtosis |

|---|---|---|

| Resilience | 0.946 | 9.568 |

| GreenFactory | 3.013 | 10.08 |

| Size | 0.185 | 3.176 |

| Lev | 0.149 | 2.260 |

| Roa | −1.510 | 8.858 |

| Cashflow | −0.614 | 7.910 |

| Fixed | 0.885 | 3.266 |

| Board | −0.0403 | 3.166 |

| Indep | 0.740 | 3.281 |

| Top1 | 0.546 | 2.680 |

| Separation | 1.529 | 4.240 |

| Mfee | 2.572 | 11.77 |

| Inst | −0.111 | 2.044 |

| Soe | 0.473 | 1.224 |

| Listage | −0.292 | 2.006 |

Appendix C

| Variable | VIF | 1/VIF |

|---|---|---|

| GreenFactory | 1.171 | 0.854 |

| Size | 1.399 | 0.715 |

| Lev | 1.545 | 0.647 |

| Roa | 1.503 | 0.665 |

| Cashflow | 1.162 | 0.860 |

| Fixed | 1.175 | 0.851 |

| Board | 1.156 | 0.865 |

| Indep | 1.075 | 0.930 |

| Top1 | 1.517 | 0.659 |

| Separation | 1.173 | 0.853 |

| Mfee | 1.325 | 0.755 |

| Inst | 1.961 | 0.510 |

| Soe | 1.683 | 0.594 |

| Listage | 1.467 | 0.681 |

References

- Ding, W.Z.; Levine, R.; Lin, C.; Xie, W.S. Corporate immunity to the COVID-19 pandemic. J. Financ. Econ. 2021, 141, 802–830. [Google Scholar]

- Bashir, M.F.; Shahbaz, M.; Malik, M.N.; Ma, B.; Wang, J. Energy transition, natural resource consumption and environmental degradation: The role of geopolitical risk in sustainable development. Resour. Policy 2023, 85, 103985. [Google Scholar]

- Xie, X.; Jin, X.; Wei, G.; Chang, C.T. Monitoring and early warning of SMEs’ shutdown risk under the impact of global pandemic shock. Systems 2023, 11, 260. [Google Scholar] [CrossRef]

- Ortiz-de-Mandojana, N.; Bansal, P. The long-term benefits of organizational resilience through sustainable business practices. Strateg. Manag. J. 2016, 37, 1615–1631. [Google Scholar]

- Grøgaard, B.; Colman, H.L.; Stensaker, I.G. Legitimizing, leveraging, and launching: Developing dynamic capabilities in the MNE. J. Int. Bus. Stud. 2022, 53, 636–656. [Google Scholar]

- Linnenluecke, M.K. Resilience in business and management research: A review of influential publications and a research agenda. Int. J. Manag. Rev. 2017, 19, 4–30. [Google Scholar]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar]

- Liu, Y.; Huang, H.Y.; Mbanyele, W.; Wei, Z.X.; Li, X. How does green industrial policy affect corporate green innovation? Evidence from the Green Factory identification in China. Energy Econ. 2025, 141, 108047. [Google Scholar]

- Nie, S.C.; Wang, G.X. The Impact of Government-Led Green Certification on Enterprise Green Transformation—Evidence from Green Factory Recognition. Sustainability 2025, 17, 2271. [Google Scholar]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependence Perspective; Harper & Row, Publishers, Inc.: New York, NY, USA, 1978. [Google Scholar]

- Akerlof, G.A. The market for ‘lemons’: Quality uncertainty and the market mechanism. Q. J. Econ. 1970, 84, 488–500. [Google Scholar]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D.; Gilbert, B.A. Resource orchestration to create competitive advantage: Breadth, depth, and life cycle effects. J. Manag. 2011, 37, 1390–1412. [Google Scholar]

- Teece, D.; Leih, S. Uncertainty, innovation, and dynamic capabilities: An introduction. Calif. Manag. Rev. 2016, 58, 5–12. [Google Scholar]

- Tang, R.; Huang, J.H. The influence of digital transformation on the resilience of tourism companies under the shock of the COVID-19 pandemic. Asia Pac. J. Tour. Res. 2023, 28, 827–840. [Google Scholar]

- Chen, Y.H.; Cai, Q.F.; Wang, Z.K.; Xu, Z.F. Has digital transformation enhanced the corporate resilience in the face of COVID-19? Evidence from China. Int. Rev. Financ. Anal. 2024, 96, 103709. [Google Scholar]

- Browder, R.E.; Dwyer, S.M.; Koch, H. Upgrading adaptation: How digital transformation promotes organizational resilience. Strateg. Entrep. J. 2024, 18, 128–164. [Google Scholar]

- Zhang, B.Z.; Zhang, J.J.; Chen, C.R. Digital technology innovation and corporate resilience. Glob. Financ. J. 2024, 63, 101042. [Google Scholar]

- Wang, K.D.; Yu, S.S.; Mei, M.; Yang, X.; Peng, G.; Lv, B.F. ESG performance and corporate resilience: An empirical analysis based on the capital allocation efficiency perspective. Sustainability 2023, 15, 16145. [Google Scholar] [CrossRef]

- Yahya, H. The role of ESG performance in firms’ resilience during the COVID-19 pandemic: Evidence from Nordic firms. Glob. Financ. J. 2023, 58, 100905. [Google Scholar]

- Wang, H.J.; Jiao, S.P.; Ma, C. The impact of ESG responsibility performance on corporate resilience. Int. Rev. Econ. Financ. 2024, 93, 1115–1129. [Google Scholar]

- Wu, H.; Zhang, K.; Li, R.Y. ESG score, analyst coverage and corporate resilience. Financ. Res. Lett. 2024, 62, 105248. [Google Scholar]

- Gama, M.A.; Casnici, C.V.C.; Bassi-Suter, M.; Gonzalez-Perez, M.A.; Fleury, M.T.L. The impact of corporate social responsibility in home countries on the financial resilience of emerging-market multinationals: An analysis on Brazilian MNEs. J. Bus. Res. 2025, 192, 115290. [Google Scholar]

- Buyl, T.; Boone, C.; Wade, J.B. CEO narcissism, risk-taking, and resilience: An empirical analysis in US commercial banks. J. Manag. 2019, 45, 1372–1400. [Google Scholar]

- Sajko, M.; Boone, C.; Buyl, T. CEO greed, corporate social responsibility, and organizational resilience to systemic shocks. J. Manag. 2021, 47, 957–992. [Google Scholar]

- Zhang, X.M.; Liu, D.Q.; Chen, J. Managerial overconfidence and corporate resilience. Financ. Res. Lett. 2024, 62, 105087. [Google Scholar]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar]

- Mokhtar, A.R.; Anindita, M.; Suhaimi, Z.S. Leveraging Supply Chain Leadership for Dynamic Capabilities and Organisational Resilience. Adv. Soc. Sci. Res. J. 2023, 10, 54–66. [Google Scholar]

- Zhang, C.; Song, X.X.; Wang, C.C. The bright side of analyst coverage: Evidence from stock price resilience during COVID-19. Res. Int. Bus. Financ. 2025, 73, 102583. [Google Scholar]

- Sun, H.F.; Liu, C.; Guo, J.J. Environmental incentive effect and spillover effect of the government’s green certification system on manufacturing enterprises. China Popul. Resour. Environ. 2024, 34, 76–87. [Google Scholar]

- Wang, M.B.; Ye, T.; Kong, D.M. Green Manufacturing and Corporate Environmental Information Disclosure:Evidence from the Policy Experiment of “Creation of Green Factories” in China. Econ. Res. J. 2024, 59, 116–134. [Google Scholar]

- Wang, W.N.; Zhang, Q.; Hao, J. How Does Green Factory Certification Affect Corporate Sustainability Performance: Evidence from China. Sustainability 2025, 17, 61. [Google Scholar]

- Wei, X.H.; Jiang, F.; Su, Y.Q. More green, less labor gains? Green factory and labor income share in China. Energy Econ. 2024, 133, 107481. [Google Scholar]

- Kahn, W.A.; Barton, M.A.; Fisher, C.M.; Heaphy, E.D.; Reid, E.M.; Rouse, E.D. The geography of strain: Organizational resilience as a function of intergroup relations. Acad. Manag. Rev. 2018, 43, 509–529. [Google Scholar]

- Gittell, J.H.; Cameron, K.; Lim, S.; Rivas, V. Relationships, layoffs, and organizational resilience: Airline industry responses to September 11. J. Appl. Behav. Sci. 2006, 42, 300–329. [Google Scholar]

- Madsen, P.; Desai, V.; Roberts, K.; Wong, D. Mitigating hazards through continuing design: The birth and evolution of a pediatric intensive care unit. Organ. Sci. 2006, 17, 239–248. [Google Scholar]

- Williams, T.A.; Shepherd, D.A. Building resilience or providing sustenance: Different paths of emergent ventures in the aftermath of the Haiti earthquake. Acad. Manag. J. 2016, 59, 2069–2102. [Google Scholar]

- Ministry of Industry and Information Technology of the People’s Republic of China. Notice on the Development of a Green Manufacturing System; Ministry of Industry and Information Technology of the People’s Republic of China: Beijing, China, 2016.

- Wu, W.Q.; An, S.T.; Wu, C.H.; Tsai, S.B.; Yang, K.L. An empirical study on green environmental system certification affects financing cost of high energy consumption enterprises-taking metallurgical enterprises as an example. J. Clean. Prod. 2020, 244, 118848. [Google Scholar]

- Chen, L.; Wang, W.J.; Gao, T. One Firm’s Green, Another Firm’s Mean: Green Factory Certification and Corporate Debt Costs. J. Clean. Prod. 2025, 509, 145378. [Google Scholar]

- Yang, C.; Song, D.; Su, Y.H. The Low-carbon city pilot policy and trade credit financing: Evidence from China. Financ. Res. Lett. 2024, 66, 105663. [Google Scholar]

- Hu, M.Y.; Hu, Z.L.; Wu, Q.Y. Green Policies, Greener Wallets: How Cap-and-Trade Regulation Affects Cost of Capital. Bus. Strategy Environ. 2025, 34, 2882–2896. [Google Scholar]

- Chen, Y.Y.; Yu, Q.H.; Liu, J.K. Can Green Industrial Policy Form Effective Linkage with the Capital Market—Evidence from Green Factory Identification. China Ind. Econ. 2022, 12, 89–107. [Google Scholar]

- Xia, Y.C.; Qiao, Z.L.; Xie, G.H. Corporate resilience to the COVID-19 pandemic: The role of digital finance. Pac.-Basin Financ. J. 2022, 74, 101791. [Google Scholar]

- Tian, Y.; Feng, C. The internal-structural effects of different types of environmental regulations on China’s green total-factor productivity. Energy Econ. 2022, 113, 106246. [Google Scholar]

- Li, Q.Y.; Wu, X.Y.; Liu, Y.Q.; Ge, J.X.; Yang, L. Environmental regulation, factor flow, and resource misallocation. J. Environ. Manag. 2025, 373, 123197. [Google Scholar]

- Deng, Y.; You, D.; Zhang, Y. Research on improvement strategies for low-carbon technology innovation based on a differential game: The perspective of tax competition. Sustain. Prod. Consum. 2021, 26, 1046–1061. [Google Scholar]

- Ma, B.; Sharif, A.; Bashir, M.; Bashir, M.F. The dynamic influence of energy consumption, fiscal policy and green innovation on environmental degradation in BRICST economies. Energy Policy 2023, 183, 113823. [Google Scholar]

- Singh, R.K.; Gupta, A.; Gunasekaran, A. Analysing the interaction of factors for resilient humanitarian supply chain. Int. J. Prod. Res. 2018, 56, 6809–6827. [Google Scholar]

- Polgreen, L.; Silos, P. Capital-skill complementarity and inequality: A sensitivity analysis. Rev. Econ. Dyn. 2008, 11, 302–313. [Google Scholar]

- Wei, X.H.; Jiang, F.; Chen, Y. Who pays for environmental protection? The impact of green tax reform on labor share in China. Energy Econ. 2023, 125, 106862. [Google Scholar]

- Huang, J.F.; Yang, B.; Zhou, B.; Ran, B. Sustainable knowledge integration: Enhancing green development resilience. J. Innov. Knowl. 2025, 10, 100671. [Google Scholar]

- Sanchez, R. Strategic flexibility in product competition. Strateg. Manag. J. 1995, 16, 135–159. [Google Scholar]

- DesJardine, M.; Bansal, P.; Yang, Y. Bouncing back: Building resilience through social and environmental practices in the context of the 2008 global financial crisis. J. Manag. 2019, 45, 1434–1460. [Google Scholar]

- Linnenluecke, M.K.; Griffiths, A.; Winn, M. Extreme weather events and the critical importance of anticipatory adaptation and organizational resilience in responding to impacts. Bus. Strategy Environ. 2012, 21, 17–32. [Google Scholar]

- Markman, G.M.; Venzin, M. Resilience: Lessons from banks that have braved the economic crisis—And from those that have not. Int. Bus. Rev. 2014, 23, 1096–1107. [Google Scholar]

- Zhang, P.Y.; Liu, W.G.; Tang, Y.H. Enhancing corporate export resilience amid trade frictions: The role of digital transformation. China Ind. Econ. 2023, 5, 155–173. [Google Scholar]

- Luo, L.W.; Zhang, L.; Wang, C. Digital transformation and enterprise resilience: Evidence from China’s A-share listed companies. Reform 2024, 5, 64–79. [Google Scholar]

- Ren, G.Q.; Zhao, M.J.; Li, J.C. How Does Reverse Mixed Reform Affect Private Enterprises’ Resilience—A Study Based on Director Relationship Network Perspective. Financ. Econ. 2023, 5, 92–110. [Google Scholar]

- Beck, T.; Levine, R.; Levkov, A. Big bad banks? The winners and losers from bank deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar]

- Callaway, B.; Sant’Anna, P.H. Difference-in-differences with multiple time periods. J. Econom. 2021, 225, 200–230. [Google Scholar]

- Hainmueller, J. Entropy balancing for causal effects: A multivariate reweighting method to produce balanced samples in observational studies. Political Anal. 2012, 20, 25–46. [Google Scholar]

- Zhang, Z.; Jin, G. Spatiotemporal differentiation of carbon budget and balance zoning: Insights from the middle reaches of the Yangtze River Urban Agglomeration, China. Appl. Geogr. 2024, 167, 103293. [Google Scholar]

- Liu, G.; Yang, Z.; Zhang, F.; Zhang, N. Environmental tax reform and environmental investment: A quasi-natural experiment based on China’s Environmental Protection Tax Law. Energy Econ. 2022, 109, 106000. [Google Scholar]

- De Chaisemartin, C.; D’Haultfoeuille, X. Two-way fixed effects estimators with heterogeneous treatment effects. Am. Econ. Rev. 2020, 110, 2964–2996. [Google Scholar]

- Baker, A.C.; Larcker, D.F.; Wang, C.C. How much should we trust staggered difference-in-differences estimates? J. Financ. Econ. 2022, 144, 370–395. [Google Scholar]

- Wen, Z.L.; Ye, B.J. Analyses of Mediating Effects: The Development of Methods and Model-s. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar]

- Kaplan, S.N.; Zingales, L. Do investment-cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 1997, 112, 169–215. [Google Scholar]

- Olley, S.; Pakes, A. The dynamics of productivity in the telecommunications equipment industry. Econometrica 1996, 64, 1263–1297. [Google Scholar]

- Long, L.; Wang, C.Z.; Zhang, M. Does social media pressure induce corporate hypocrisy? Evidence of ESG greenwashing from China. J. Bus. Ethics 2025, 197, 311–338. [Google Scholar]

- Zhang, J.W.; Li, Y.; Xu, H.W.; Ding, Y. Can ESG ratings mitigate managerial myopia? Evidence from Chinese listed companies. Int. Rev. Financ. Anal. 2023, 90, 102878. [Google Scholar]

- Hofer, C.; Cantor, D.E.; Dai, J. The competitive determinants of a firm’s environmental management activities: Evidence from US manufacturing industries. J. Oper. Manag. 2012, 30, 69–84. [Google Scholar]

- Leary, M.T.; Roberts, M.R. Do peer firms affect corporate financial policy? J. Financ. 2014, 69, 139–178. [Google Scholar]

| Variable Type | Variable Name | Symbol | Variable Measurement |

|---|---|---|---|

| Dependent Variable | Corporate Resilience | Resilience | Entropy-weighted score of stock price volatility and performance growth rate. |

| Independent Variable | Green Factory certification | GreenFactory | Dummy variable that equals 1 if the firm is certified as a “Green Factory” in year t, and 0 otherwise. |

| Control variables | Firm size | Size | Natural logarithm of the number of employees. |

| Asset–liability ratio | Lev | Total liabilities divided by total assets at fiscal year-end. | |

| Return on assets | Roa | Net profit divided by total assets | |

| Cash flow ratio | Cashflow | Net cash flow from operating activities divided by operating revenue. | |

| Fixed asset ratio | Fixed | Net fixed assets divided by total assets at period-end. | |

| Board size | Board | Natural logarithm of number of directors on the board. | |

| Independent directors | Indep | Proportion of independent directors. | |

| Largest shareholder ownership | Top1 | Percentage of shares held by the largest shareholder. | |

| Separation rate of ownership and control rights | Separation | Difference between the ultimate controller’s control rights and ownership rights in the listed firm. | |

| Management expense ratio | Mfee | Management expenses divided by operating revenue. | |

| Institutional investor ownership | Inst | Percentage of shares held by institutional investors. | |

| Nature of property rights | Soe | Dummy variable that equals 1 for state-owned enterprises, and 0 otherwise. | |

| Firm listing age | Listage | Natural logarithm of years since IPO. |

| Variable | Sample | Average | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| Resilience | 39,596 | 56.70 | 0.802 | 27.41 | 99.82 |

| GreenFactory | 39,596 | 0.083 | 0.277 | 0 | 1 |

| Size | 39,596 | 7.620 | 1.274 | 4.357 | 11.08 |

| Lev | 39,596 | 0.444 | 0.204 | 0.062 | 0.916 |

| Roa | 39,596 | 0.030 | 0.067 | −0.277 | 0.196 |

| Cashflow | 39,596 | 0.090 | 0.195 | −0.759 | 0.709 |

| Fixed | 39,596 | 0.215 | 0.161 | 0.002 | 0.698 |

| Board | 39,596 | 2.282 | 0.253 | 1.609 | 2.890 |

| Indep | 39,596 | 0.382 | 0.074 | 0.250 | 0.600 |

| Top1 | 39,596 | 0.340 | 0.148 | 0.090 | 0.740 |

| Separation | 39,596 | 4.755 | 7.390 | 0 | 28.81 |

| Mfee | 39,596 | 0.087 | 0.0742 | 0.008 | 0.469 |

| Inst | 39,596 | 44.30 | 24.06 | 0.435 | 90.87 |

| Soe | 39,596 | 0.385 | 0.487 | 0 | 1 |

| Listage | 39,596 | 2.421 | 0.613 | 1.099 | 3.434 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Resilience | Resilience | Resilience | |

| GreenFactory | 0.1307 *** | 0.0349 *** | 0.0253 *** |

| (12.8778) | (3.5299) | (2.6269) | |

| Size | 0.0316 *** | ||

| (8.2129) | |||

| Lev | 0.0266 * | ||

| (1.7569) | |||

| Roa | 0.3087 *** | ||

| (9.3941) | |||

| Cashflow | −0.0247 *** | ||

| (−3.3935) | |||

| Fixed | −0.0347 * | ||

| (−1.6498) | |||

| Board | −0.0076 | ||

| (−1.0592) | |||

| Indep | 0.0013 | ||

| (0.0606) | |||

| Top1 | −0.0016 | ||

| (−0.0514) | |||

| Separation | 0.0003 | ||

| (0.6907) | |||

| Mfee | −0.2758 *** | ||

| (−8.6678) | |||

| Inst | 0.0009 *** | ||

| (4.3334) | |||

| Soe | −0.0117 | ||

| (−1.1573) | |||

| Listage | 0.0028 | ||

| (0.2584) | |||

| _cons | 56.6702 *** | 56.6782 *** | 56.4253 *** |

| (20,927.6009) | (68,662.3811) | (1264.8777) | |

| Observations | 39,596 | 39,596 | 39,596 |

| Adj R2 | 0.0160 | 0.3971 | 0.4091 |

| Year | No | Yes | Yes |

| Id | No | Yes | Yes |

| Variable | PSM-DID | EBM-DID | |

|---|---|---|---|

| (1) | (2) | (3) | |

| Resilience | Resilience | Resilience | |

| GreenFactory | 0.0304 *** | 0.0211 ** | 0.0213 ** |

| (2.8750) | (2.0591) | (2.0577) | |

| Size | 0.0458 *** | 0.0416 *** | |

| (7.4967) | (6.1284) | ||

| Lev | 0.0436 ** | 0.0559 ** | |

| (1.9614) | (2.1657) | ||

| Roa | 0.4646 *** | 0.5363 *** | |

| (7.7490) | (8.2196) | ||

| Cashflow | −0.0239 | −0.0368 ** | |

| (−1.6348) | (−2.2370) | ||

| Fixed | −0.0252 | 0.0069 | |

| (−0.8493) | (0.2064) | ||

| Board | −0.0018 | 0.0060 | |

| (−0.1645) | (0.5328) | ||

| Indep | −0.0088 | −0.0083 | |

| (−0.2994) | (−0.2639) | ||

| Top1 | 0.0090 | −0.0094 | |

| (0.2054) | (−0.1994) | ||

| Separation | 0.0001 | −0.0000 | |

| (0.1234) | (−0.0363) | ||

| Mfee | −0.5994 *** | −0.6068 *** | |

| (−8.7098) | (−7.8852) | ||

| Inst | 0.0010 *** | 0.0009 *** | |

| (3.7357) | (3.4743) | ||

| Soe | −0.0260 * | −0.0291 * | |

| (−1.6722) | (−1.6662) | ||

| Listage | −0.0037 | 0.0027 | |

| (−0.2430) | (0.1540) | ||

| _cons | 56.7036 *** | 56.3298 *** | 56.3239 *** |

| (41,285.7996) | (880.7769) | (818.2251) | |

| Observations | 24,301 | 24,301 | 39,596 |

| Adj R2 | 0.3872 | 0.4041 | 0.4109 |

| Year | Yes | Yes | Yes |

| Id | Yes | Yes | Yes |

| Variable | Resilience | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Lagged Explanatory Variables and Control Variables | Adding Control Variables | Changing Fixed Effects | Excluding Interference from Other Policies | |

| L.GreenFactory | 0.0301 *** | |||

| (2.8404) | ||||

| GreenFactory | 0.0305 ** | 0.0252 *** | 0.0221 ** | |

| (2.4831) | (2.5840) | (2.2816) | ||

| L_Size | −0.0018 | |||

| (−0.4095) | ||||

| L_Lev | 0.0613 *** | |||

| (3.9515) | ||||

| L_Roa | 0.5230 *** | |||

| (15.7364) | ||||

| L_Cashflow | 0.0064 | |||

| (0.8431) | ||||

| L_Fixed | 0.0003 | |||

| (0.0134) | ||||

| L_Board | 0.0110 | |||

| (1.3351) | ||||

| L_Indep | 0.0228 | |||

| (0.9181) | ||||

| L_Top1 | −0.0847 *** | |||

| (−2.6148) | ||||

| L_Separation | 0.0004 | |||

| (0.7290) | ||||

| L_Mfee | −0.1163 *** | |||

| (−3.4548) | ||||

| L_Inst | 0.0009 *** | |||

| (4.2842) | ||||

| L_Soe | −0.0027 | |||

| (−0.2400) | ||||

| L_Listage | 0.0230 * | |||

| (1.8792) | ||||

| Size | 0.0314 *** | 0.0318 *** | 0.0319 *** | |

| (7.5002) | (8.6509) | (8.3047) | ||

| Lev | 0.0268 | 0.0236 | 0.0286 * | |

| (1.5153) | (1.5198) | (1.8886) | ||

| Roa | 0.3123 *** | 0.3024 *** | 0.3018 *** | |

| (8.5387) | (9.0850) | (9.1955) | ||

| Cashflow | −0.0246 *** | −0.0242 *** | −0.0242 *** | |

| (−3.0315) | (−3.2383) | (−3.3352) | ||

| Fixed | −0.0261 | −0.0340 * | −0.0368 * | |

| (−1.0881) | (−1.6476) | (−1.7659) | ||

| Board | −0.0050 | −0.0062 | −0.0080 | |

| (−0.6137) | (−0.8523) | (−1.1165) | ||

| Indep | −0.0009 | −0.0025 | 0.0012 | |

| (−0.0369) | (−0.1188) | (0.0583) | ||

| Top1 | −0.0634 * | −0.0161 | −0.0024 | |

| (−1.7604) | (−0.4993) | (−0.0766) | ||

| Separation | 0.0005 | 0.0004 | 0.0003 | |

| (0.9508) | (0.7300) | (0.6910) | ||

| Mfee | −0.2765 *** | −0.2727 *** | −0.2809 *** | |

| (−8.3152) | (−8.8467) | (−8.8129) | ||

| Inst | 0.0009 *** | 0.0008 *** | 0.0009 *** | |

| (4.3813) | (4.4203) | (4.3816) | ||

| Soe | −0.0138 | −0.0084 | −0.0116 | |

| (−1.4109) | (−0.9765) | (−1.1480) | ||

| Listage | −0.0015 | 0.0055 | 0.0039 | |

| (−0.1219) | (0.5084) | (0.3623) | ||

| GDP_Growper | 0.0020 | |||

| (0.0915) | ||||

| CM2025 | −0.0130 * | |||

| (−1.6979) | ||||

| EI | −0.0319 *** | |||

| (−3.5542) | ||||

| ETL | 0.0503 *** | |||

| (5.2876) | ||||

| _cons | 56.5673 *** | 56.4471 *** | 56.4231 *** | 56.4214 *** |

| (1133.2634) | (1193.5241) | (1338.4887) | (1267.5966) | |

| Observations | 34,191 | 33,426 | 39,596 | 39,596 |

| Adj R2 | 0.4083 | 0.4235 | 0.4124 | 0.4097 |

| Year | Yes | Yes | Yes | Yes |

| Id | Yes | Yes | Yes | Yes |

| Ind × Pro | No | No | Yes | No |

| Variable | Resilience | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Excluding the Financial Crisis | Excluding the Stock Market Crash | Excluding the COVID-19 Pandemic | Excluding All the Aforementioned | |

| GreenFactory | 0.0231 ** | 0.0279 *** | 0.0501 *** | 0.0503 *** |

| (2.4287) | (2.9519) | (2.7321) | (2.8387) | |

| Size | 0.0311 *** | 0.0309 *** | 0.0351 *** | 0.0323 *** |

| (7.3723) | (8.1648) | (7.9609) | (6.3297) | |

| Lev | 0.0259 | 0.0249 | 0.0645 *** | 0.0687 *** |

| (1.6029) | (1.6066) | (3.4504) | (3.2744) | |

| Roa | 0.3114 *** | 0.3183 *** | 0.3373 *** | 0.3848 *** |

| (9.1449) | (9.6806) | (8.9648) | (9.8736) | |

| Cashflow | −0.0251 *** | −0.0207 *** | −0.0305 *** | −0.0256 *** |

| (−3.2166) | (−2.8327) | (−3.7613) | (−2.7876) | |

| Fixed | −0.0504 ** | −0.0264 | −0.0548 ** | −0.0607 ** |

| (−2.2182) | (−1.2322) | (−2.3137) | (−2.1884) | |

| Board | −0.0072 | −0.0059 | −0.0036 | 0.0011 |

| (−0.9940) | (−0.7915) | (−0.4042) | (0.1135) | |

| Indep | 0.0004 | −0.0066 | 0.0156 | 0.0010 |

| (0.0170) | (−0.3077) | (0.6090) | (0.0385) | |

| Top1 | −0.0006 | −0.0034 | 0.0180 | −0.0023 |

| (−0.0162) | (−0.1057) | (0.4883) | (−0.0526) | |

| Separation | 0.0002 | 0.0003 | 0.0008 | 0.0005 |

| (0.2910) | (0.5253) | (1.4786) | (0.7813) | |

| Mfee | −0.2905 *** | −0.2700 *** | −0.2622 *** | −0.2655 *** |

| (−8.7426) | (−8.4576) | (−7.0913) | (−6.7097) | |

| Inst | 0.0009 *** | 0.0010 *** | 0.0010 *** | 0.0012 *** |

| (4.1716) | (4.8045) | (4.3620) | (4.8961) | |

| Soe | −0.0127 | −0.0154 | −0.0243 * | −0.0359 ** |

| (−1.2193) | (−1.5406) | (−1.7114) | (−2.1714) | |

| Listage | 0.0084 | −0.0040 | −0.0097 | −0.0070 |

| (0.7414) | (−0.3747) | (−0.6908) | (−0.4493) | |

| _cons | 56.4289 *** | 56.4615 *** | 56.3805 *** | 56.4408 *** |

| (1161.0657) | (1278.4231) | (1075.0248) | (948.3058) | |

| Observations | 37,121 | 37,264 | 24,984 | 20,177 |

| Adj R2 | 0.4057 | 0.3712 | 0.4835 | 0.4194 |

| Year | Yes | Yes | Yes | Yes |

| Id | Yes | Yes | Yes | Yes |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Res_dec | Res_dec | Res_rec | Res_rec | |

| GreenFactory | 0.0413 ** | 0.0350 ** | 0.0474 * | 0.0490 * |

| (2.2341) | (1.9784) | (1.6473) | (1.7614) | |

| Size | 0.0637 *** | −0.0665 *** | ||

| (4.3981) | (−2.7575) | |||

| Lev | −0.0129 | 0.2232 *** | ||

| (−0.2537) | (2.6938) | |||

| Roa | 0.5475 *** | 0.8096 *** | ||

| (9.4146) | (6.6597) | |||

| Cashflow | 0.0355 ** | −0.0445 | ||

| (2.2637) | (−1.2134) | |||

| Fixed | −0.3805 *** | −0.4715 *** | ||

| (−5.1409) | (−3.7157) | |||

| Board | 0.0158 | 0.0176 | ||

| (1.3012) | (0.6752) | |||

| Indep | 0.0270 | 0.0838 | ||

| (0.6894) | (1.0506) | |||

| Top1 | −0.2355 *** | −0.4587 *** | ||

| (−2.5867) | (−2.6819) | |||

| Separation | −0.0022 * | −0.0014 | ||

| (−1.7248) | (−0.7150) | |||

| Mfee | −0.1763 ** | −0.2674 | ||

| (−2.0931) | (−1.2532) | |||

| Inst | 0.0049 *** | 0.0056 *** | ||

| (8.5997) | (5.5743) | |||

| Soe | −0.0556 ** | −0.1079 ** | ||

| (−2.0353) | (−2.0400) | |||

| Listage | −0.4052 *** | −0.7680 *** | ||

| (−8.5769) | (−8.0257) | |||

| _cons | −0.3747 *** | 0.0900 | 0.5279 *** | 2.8703 *** |

| (−116.4119) | (0.5681) | (105.3209) | (9.5629) | |

| Observations | 9764 | 9764 | 9764 | 9764 |

| Adj R2 | 0.6007 | 0.6294 | 0.4662 | 0.4858 |

| Year | Yes | Yes | Yes | Yes |

| Id | Yes | Yes | Yes | Yes |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| KZ | Resilience | TFP | Resilience | GreenInno | Resilience | |

| GreenFactory | −0.1763 *** | 0.0209 ** | 0.0804 *** | 0.0152 * | 0.0617 *** | 0.0251 *** |

| (−4.4709) | (2.1807) | (5.1762) | (1.6534) | (2.6899) | (2.6197) | |

| KZ | −0.0221 *** | |||||

| (−16.6784) | ||||||

| TFP | 0.1318 *** | |||||

| (19.1801) | ||||||

| GreenInno | 0.0084 ** | |||||

| (2.1869) | ||||||

| Size | −0.1123 *** | 0.0289 *** | 0.0119 | 0.0303 *** | 0.0393 *** | 0.0315 *** |

| (−5.2705) | (7.4033) | (0.9622) | (8.0948) | (5.4463) | (8.1622) | |

| Lev | 5.6616 *** | 0.1540 *** | 0.5511 *** | −0.0437 *** | 0.0159 | 0.0259 * |

| (52.1774) | (8.8696) | (12.6267) | (−2.9057) | (0.5074) | (1.7089) | |

| Roa | −5.7938 *** | 0.1845 *** | 1.0061 *** | 0.1816 *** | 0.1029 * | 0.3071 *** |

| (−28.6357) | (5.7671) | (14.1452) | (5.6170) | (1.8432) | (9.3348) | |

| Cashflow | −3.8180 *** | −0.1097 *** | −0.0195 | −0.0225 *** | −0.0413 *** | −0.0246 *** |

| (−46.4422) | (−12.8901) | (−1.0352) | (−2.8651) | (−3.1802) | (−3.3595) | |

| Fixed | 2.8092 *** | 0.0259 | −1.0100 *** | 0.0973 *** | −0.0398 | −0.0345 |

| (19.4213) | (1.1884) | (−14.6224) | (4.5486) | (−0.8882) | (−1.6240) | |

| Board | −0.0258 | −0.0081 | 0.0485 *** | −0.0141 ** | −0.0215 | −0.0079 |

| (−0.6475) | (−1.1184) | (3.4425) | (−1.9787) | (−1.2920) | (−1.0958) | |

| Indep | 0.1127 | 0.0045 | −0.0335 | 0.0027 | 0.0128 | −0.0005 |

| (0.9973) | (0.2197) | (−0.8437) | (0.1321) | (0.2703) | (−0.0258) | |

| Top1 | −0.4400 ** | −0.0103 | −0.1680 ** | 0.0267 | −0.0906 | −0.0019 |

| (−2.4646) | (−0.3289) | (−2.1027) | (0.8919) | (−1.2834) | (−0.0593) | |

| Separation | 0.0000 | 0.0003 | −0.0010 | 0.0005 | 0.0017 * | 0.0003 |

| (0.0113) | (0.6880) | (−0.8460) | (1.0833) | (1.6800) | (0.6426) | |

| Mfee | 0.3949 | −0.2677 *** | −4.7657 *** | 0.3415 *** | −0.2460 *** | −0.2765 *** |

| (1.4396) | (−8.4885) | (−39.3979) | (7.4327) | (−3.5111) | (−8.5995) | |

| Inst | −0.0042 *** | 0.0008 *** | 0.0046 *** | 0.0003 | −0.0009 ** | 0.0009 *** |

| (−3.7046) | (3.9743) | (9.5951) | (1.4033) | (−2.2436) | (4.3743) | |

| Soe | 0.0180 | −0.0111 | −0.0862 *** | 0.0012 | 0.0195 | −0.0123 |

| (0.2990) | (−1.1035) | (−3.3336) | (0.1267) | (0.8585) | (−1.2168) | |

| Listage | 1.1217 *** | 0.0297 *** | 0.1305 *** | −0.0152 | −0.0509 * | 0.0046 |

| (16.3623) | (2.7299) | (4.7138) | (−1.4392) | (−1.7094) | (0.4269) | |

| _cons | −2.8033 *** | 56.3587 *** | 6.4621 *** | 55.5724 *** | 0.2680 *** | 56.4208 *** |

| (−11.1727) | (1239.4499) | (57.0335) | (831.9848) | (2.6465) | (1257.5594) | |

| Observations | 38,889 | 38,889 | 38,629 | 38,629 | 39,330 | 39,330 |

| Adj R2 | 0.7874 | 0.4156 | 0.8820 | 0.4306 | 0.6517 | 0.4095 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Id | Yes | Yes | Yes | Yes | Yes | Yes |

| Variable | Resilience | |||||

|---|---|---|---|---|---|---|

| Pollution Attribute | Reputational Pressure | Managerial Myopia | ||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Heavily Polluting | Non-Heavily Polluting | High Reputational Pressure | Low Reputational Pressure | High Managerial Myopia | Low Managerial Myopia | |

| GreenFactory | 0.0404 *** | 0.0090 | 0.0432 *** | 0.0139 | 0.0439 *** | 0.0139 |

| (2.8641) | (0.6765) | (2.6276) | (1.5290) | (3.6702) | (1.0574) | |

| Size | 0.0264 *** | 0.0298 *** | 0.0428 *** | 0.0251 *** | 0.0295 *** | 0.0335 *** |

| (4.0246) | (7.1931) | (7.2678) | (5.9732) | (5.6039) | (6.1136) | |

| Lev | 0.0066 | 0.0420 ** | 0.0679 *** | 0.0115 | 0.0137 | 0.0457 ** |

| (0.2175) | (2.3065) | (2.6012) | (0.6899) | (0.6936) | (2.1197) | |

| Roa | 0.3532 *** | 0.2855 *** | 0.4778 *** | 0.0599 * | 0.3055 *** | 0.2978 *** |

| (5.4225) | (7.5048) | (8.9122) | (1.7422) | (7.0135) | (6.1390) | |

| Cashflow | −0.0431 ** | −0.0220 *** | −0.0242 ** | −0.0341 *** | −0.0208 ** | −0.0302 ** |

| (−2.1937) | (−2.7754) | (−1.9702) | (−4.0218) | (−2.1131) | (−2.4892) | |

| Fixed | −0.0027 | −0.0331 | −0.0473 | −0.0265 | −0.0336 | −0.0083 |

| (−0.0792) | (−1.2988) | (−1.4018) | (−1.0860) | (−1.2462) | (−0.2698) | |

| Board | 0.0082 | −0.0120 | 0.0010 | −0.0037 | −0.0071 | −0.0045 |

| (0.6247) | (−1.4043) | (0.0800) | (−0.4667) | (−0.7166) | (−0.4066) | |

| Indep | 0.0348 | −0.0080 | −0.0278 | 0.0033 | 0.0012 | −0.0026 |

| (0.8190) | (−0.3345) | (−0.7525) | (0.1409) | (0.0420) | (−0.0814) | |

| Top1 | 0.0482 | −0.0236 | −0.0724 | 0.0960 *** | −0.0124 | 0.0009 |

| (0.7682) | (−0.6661) | (−1.5360) | (2.6064) | (−0.2809) | (0.0229) | |

| Separation | 0.0003 | 0.0002 | 0.0006 | −0.0004 | 0.0005 | 0.0000 |

| (0.3922) | (0.3394) | (0.7822) | (−0.7529) | (0.7213) | (0.0729) | |

| Mfee | −0.2149 *** | −0.2948 *** | −0.2357 *** | −0.2879 *** | −0.2908 *** | −0.2747 *** |

| (−2.8692) | (−8.7909) | (−4.6763) | (−7.4545) | (−7.3808) | (−5.5986) | |

| Inst | 0.0005 | 0.0007 *** | 0.0013 *** | 0.0003 | 0.0009 *** | 0.0009 *** |

| (1.5773) | (3.5051) | (4.3203) | (1.5134) | (3.5627) | (3.0251) | |

| Soe | 0.0089 | −0.0080 | −0.0309 ** | −0.0088 | −0.0074 | −0.0179 |

| (0.4822) | (−0.8597) | (−2.3489) | (−0.8714) | (−0.5053) | (−1.3115) | |

| Listage | 0.0159 | −0.0021 | 0.0421 ** | 0.0034 | −0.0003 | 0.0103 |

| (0.7662) | (−0.1695) | (2.1421) | (0.3042) | (−0.0207) | (0.6648) | |

| _cons | 56.3732 *** | 56.4716 *** | 56.2068 *** | 56.4788 *** | 56.4519 *** | 56.3800 *** |

| (736.6603) | (1166.1551) | (759.6760) | (1210.8096) | (962.5342) | (855.1982) | |

| Difference between groups (p-Value) | 0.000 | 0.000 | 0.000 | |||

| Observations | 11,515 | 28,081 | 19,610 | 18,449 | 19,383 | 19,944 |

| Adj R2 | 0.3731 | 0.4358 | 0.4208 | 0.4391 | 0.4119 | 0.4171 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Id | Yes | Yes | Yes | Yes | Yes | Yes |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Res_spillInd | Res_spillInd | Res_spillCity | Res_spillCity | |

| GreenFactory | 0.0090 *** | 0.0072 ** | 0.0059 ** | 0.0059 ** |

| (2.7823) | (2.2602) | (2.0121) | (2.0259) | |

| Size | 0.0009 | −0.0002 | ||

| (0.6605) | (−0.1669) | |||

| Lev | 0.0114 ** | 0.0012 | ||

| (1.9623) | (0.2183) | |||

| Roa | 0.1012 *** | 0.0047 | ||

| (8.3332) | (0.4401) | |||

| Cashflow | 0.0058 ** | −0.0018 | ||

| (2.0351) | (−0.7886) | |||

| Fixed | 0.0278 *** | −0.0187 ** | ||

| (3.2255) | (−2.3767) | |||

| Board | −0.0015 | −0.0009 | ||

| (−0.5636) | (−0.3756) | |||

| Indep | 0.0107 | −0.0116 | ||

| (1.3448) | (−1.5680) | |||

| Top1 | −0.0189 * | −0.0070 | ||

| (−1.7493) | (−0.6886) | |||

| Separation | 0.0002 | 0.0001 | ||

| (0.9623) | (0.3873) | |||

| Mfee | −0.0066 | 0.0143 | ||

| (−0.5366) | (1.1680) | |||

| Inst | 0.0001 | 0.0000 | ||

| (1.0895) | (0.3911) | |||

| Soe | 0.0004 | −0.0069 * | ||

| (0.1066) | (−1.8863) | |||

| Listage | −0.0079 * | −0.0012 | ||

| (−1.9399) | (−0.3087) | |||

| _cons | 56.6805 *** | 56.6795 *** | 56.6811 *** | 56.6977 *** |

| (208,803.0667) | (3243.2786) | (231,498.0972) | (4107.1628) | |

| Observations | 39,520 | 39,520 | 37,439 | 37,439 |

| Adj R2 | 0.7174 | 0.7190 | 0.6996 | 0.6997 |

| Year | Yes | Yes | Yes | Yes |

| Id | Yes | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Long, L.; Wang, H. Evaluating the Impact of Green Manufacturing on Corporate Resilience: A Quasi-Natural Experiment Based on Chinese Green Factories. Sustainability 2025, 17, 6281. https://doi.org/10.3390/su17146281

Long L, Wang H. Evaluating the Impact of Green Manufacturing on Corporate Resilience: A Quasi-Natural Experiment Based on Chinese Green Factories. Sustainability. 2025; 17(14):6281. https://doi.org/10.3390/su17146281

Chicago/Turabian StyleLong, Li, and Hanhan Wang. 2025. "Evaluating the Impact of Green Manufacturing on Corporate Resilience: A Quasi-Natural Experiment Based on Chinese Green Factories" Sustainability 17, no. 14: 6281. https://doi.org/10.3390/su17146281

APA StyleLong, L., & Wang, H. (2025). Evaluating the Impact of Green Manufacturing on Corporate Resilience: A Quasi-Natural Experiment Based on Chinese Green Factories. Sustainability, 17(14), 6281. https://doi.org/10.3390/su17146281