1. Introduction

As e-commerce continues to experience rapid expansion, consumer preferences have significantly shifted towards online shopping, promoting the widespread emergence of the O2O (online-to-offline) retail model, which seamlessly integrates digital and physical commerce channels [

1]. According to the latest data from China’s National Bureau of Statistics, online retail sales reached 1.403 trillion yuan in 2024, marking a 7.4% increase compared to the previous year [

2]. Physical goods accounted for 1.1806 trillion yuan, reflecting a year-on-year growth rate of 6.8%. Prominent Chinese enterprises such as JD.com, Suning, Ele.me, and Meituan have proactively adopted the O2O retail strategy, emphasizing not only convenience but also sustainability through green business practices. Concurrently, the General Office of the State Council explicitly advocated enhancing sustainable interactions between online and offline retail channels in its strategic document, “Guidelines on Promoting Online-Offline Interaction to Accelerate Innovation, Development, and Upgrading of Business and Trade”. Consequently, the O2O retail model, particularly within the framework of sustainable and green e-business models, has received heightened attention from both industry stakeholders aiming for long-term competitive advantages and policymakers striving to foster environmentally responsible economic growth in China.

Meanwhile, in response to intensifying climate challenges and increasing international commitment to carbon neutrality, the transition to a low-carbon economy has become a global imperative [

3]. Achieving this goal requires not only technological innovation and greener production but also consumption-side transformations that promote the market penetration of low-carbon products. As frontline agents of consumer interaction, retailers—particularly those operating in O2O models—are well positioned to observe and respond to consumers’ growing preference for eco-friendly products [

4], thereby facilitating carbon reduction across the entire supply chain.

However, the commercial promotion and diffusion of low-carbon products within O2O supply chains face several systemic challenges. In particular, multi-channel O2O structures typically involve both self-pickup and delivery fulfillment formats, each with distinct cost structures, service attributes, and carbon footprints. These differences directly affect the pricing, channel decisions, and emission-reduction efforts of upstream manufacturers. Existing studies have recognized that fulfillment structures significantly influence operational cost and carbon emissions [

5,

6], but few have systematically analyzed how different fulfillment strategies impact green product pricing and carbon-efficiency equilibrium decisions in a dynamic, channel-integrated context.

This study aims to fill this research gap by investigating how different O2O fulfillment formats—package self-pickup, nearby delivery, and hybrid modes—affect upstream manufacturers’ emission-reduction decisions, pricing strategies, and profit outcomes, in collaboration with newly established O2O retailers. We construct a Stackelberg game in which the manufacturer acts as the channel leader and the retailer as a follower. Based on consumer green preference and service-distance sensitivity, we derive closed-form solutions and conduct comparative-static analysis to evaluate how fulfillment structure interacts with carbon-abatement and pricing incentives.

This study seeks to address the following core questions: (1) How do different O2O fulfillment structures influence the manufacturer’s voluntary emission-reduction decisions and pricing strategies? (2) Under what conditions does a hybrid fulfillment mode outperform single-mode strategies in both carbon efficiency and economic returns? (3) How do consumer green preference intensity and distance sensitivity jointly shape the optimal channel configuration and profit distribution?

This study contributes to the literature in the following aspects: (1) We enrich the literature on low-carbon e-commerce by introducing a structured comparison of three fulfillment formats (self-pickup, delivery, and hybrid) within an O2O framework, a topic largely neglected in existing research focused on centralized or single-channel supply chains [

7]. (2) By integrating carbon-abatement behavior into a Stackelberg pricing model, we provide novel insights into how emission-reduction incentives and fulfillment modes co-determine optimal decisions. This multi-layered modeling approach bridges green production and channel management decisions, which are often treated in isolation. (3) Our results demonstrate that consumer green preferences and distance sensitivity jointly affect the optimal fulfillment strategy. We identify threshold effects (e.g., when delivery costs or emission-abatement costs exceed certain bounds) that prompt firms to switch between fulfillment modes—findings that provide actionable guidance for platform managers and manufacturers seeking to reduce emissions through service design.

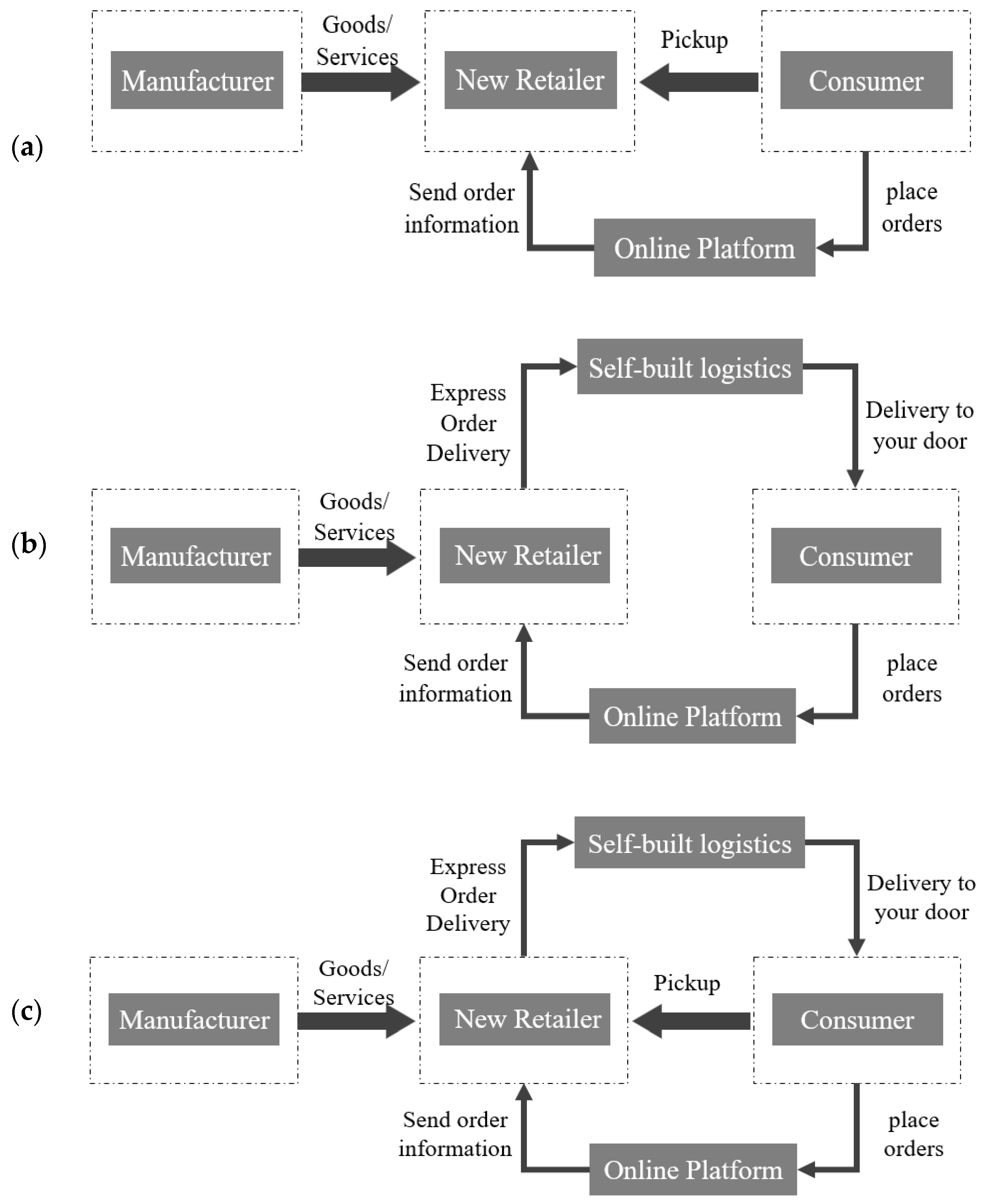

To investigate the sustainable decision-making mechanisms under different O2O sales models, this study constructs a Stackelberg game model to capture the pricing and carbon-reduction interactions between a manufacturer and a new retailer, as shown in

Figure 1. The remainder of this paper is structured as follows:

Section 2 reviews the related literature on green e-business and sustainable O2O supply chains.

Section 3 presents the problem description, basic assumptions, and model construction for the three sales strategies.

Section 4 develops the Stackelberg game models for the package self-pickup, nearby delivery, and hybrid modes and derives the corresponding analytical results.

Section 5 conducts a series of numerical simulations and robustness analyses to evaluate the impact of key parameters.

Section 6 discusses the theoretical insights and interprets the role of different model settings under realistic conditions.

Section 7 provides managerial implications for sustainable channel design and green pricing. Finally,

Section 8 concludes the study and suggests avenues for future research.

4. Model Construction and Solution

The following combines the characteristics of the package self-pickup model, nearby delivery model, and hybrid model to construct game models for the three sales models. In this model, the low-carbon manufacturer acts as the market leader while the new retailer takes the follower role. Their decision-making is structured as a two-stage Stackelberg game, with each party aiming to maximize their respective profits. The game proceeds in a specific order: the manufacturer first gives the product’s wholesale price

w and the unit emission reduction

L, and then the new retailer confirms the sales price based on

w, leading to the optimal decisions and maximum profits for them under different models. The superscripts

Z,

S, and

H represent the package self-pickup model, nearby delivery model, and hybrid model, respectively. The subscripts

m and

e respectively denote the manufacturer and the new retailer. Additionally, the asterisk “*” indicates the optimal solution.

C1, and

C2 denote the inconvenience cost and logistics cost, respectively; m denotes the additional processing cost; k is the emission-reduction cost coefficient; and

L is the emission reduction per unit product. By solving the models corresponding to fulfillment strategies P1, P2, and P3, we derive the following propositions. The complete derivations and solution procedures are presented in

Appendix A.

Proposition 1. Under the package self-pickup model, the optimal wholesale price, emission reduction, and profit of the manufacturer are , , and , respectively; the optimal sales price and profit of the new retailer are and , respectively.

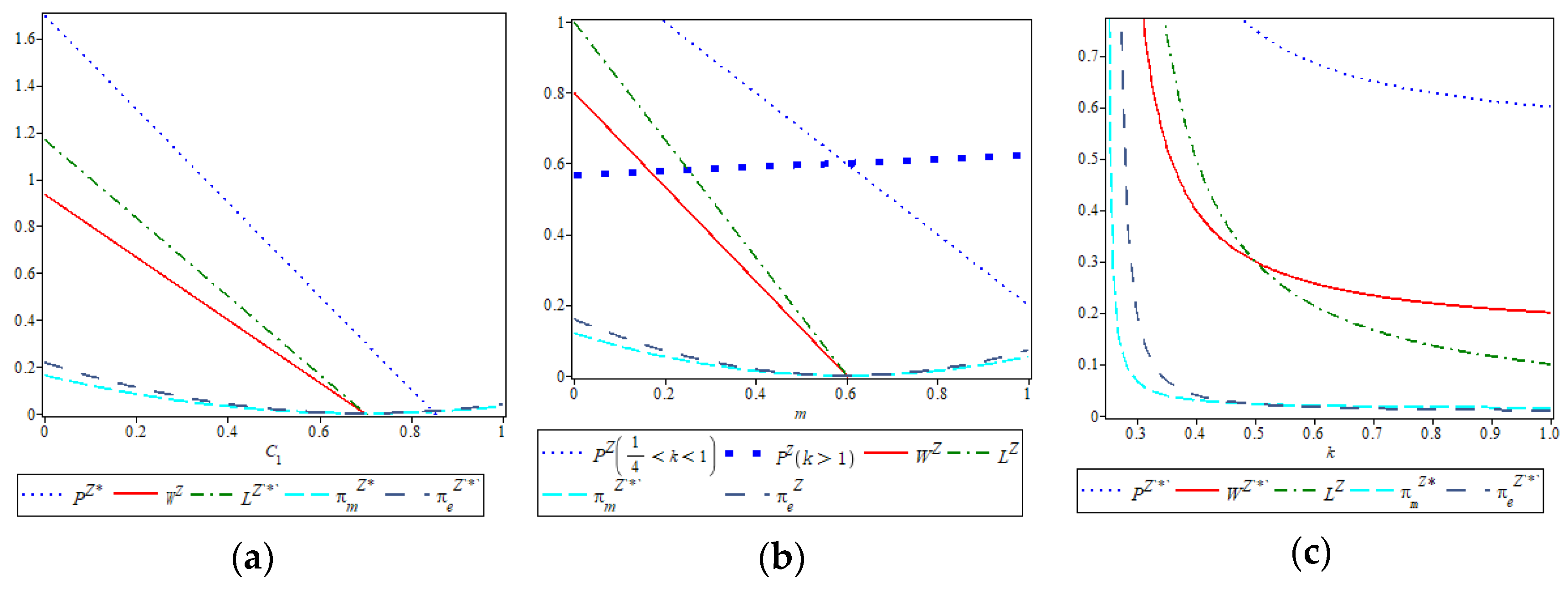

Proposition 1 indicates that under the package self-pickup model, the optimal wholesale price of the manufacturer and the optimal sales price of the new retailer are influenced by the inconvenience cost C1, the additional processing cost m, and the emission-reduction cost coefficient k. Specifically, as these costs increase, both the wholesale and retail prices tend to decrease due to pressure on consumer willingness to pay and rising marginal costs. Importantly, the analysis reveals a structural relationship: the optimal wholesale price is exactly twice the emission-reduction level, reflecting a proportional trade-off between environmental effort and pricing power. This relationship offers intuitive insight into how cost-side sustainability burdens directly shape supply chain pricing decisions, making the model not only analytically rigorous but also practically interpretable for decision-makers seeking to balance profitability with low-carbon goals.

Proposition 2. Under the package self-pickup model, the optimal wholesale price , optimal emission reduction , and optimal sales price all present a negative relevance to C1 or k; and both present a negative relevance to m; presents a negative relevance to m when , and a positive relevance when k > 1.

Proof. Taking the derivatives of Equations (A6)–(A8) against

C1, m, and k, we get

when

,

, and when

,

. □

Proposition 2 reveals that as the inconvenience cost C1 increases, fewer consumers are willing to adopt the package self-pickup model, leading to a decline in total market demand. In response, new retailers must reduce their sales prices to retain consumers, which in turn pressures manufacturers to lower their wholesale prices in order to maintain downstream order volumes. Similarly, when the emission-reduction cost coefficient k rises, the cost burden on the manufacturer increases, prompting a reduction in the emission-reduction level, which subsequently diminishes the attractiveness of low-carbon products. To stimulate demand, both wholesale and retail prices are further reduced. Additionally, as the processing cost mmm increases—due to expenses such as equipment, space, and labor for operating the pickup point—the manufacturer again responds by cutting wholesale prices and emission efforts to sustain profitability. A particularly noteworthy insight is that the effect of mmm on the retailer’s sales price is non-monotonic: when k is relatively low, increases in m lead to a decrease in the sales price due to intensified cost pressures; however, when k is high, the retailer may instead raise the sales price to offset the compounded cost burden. These nuanced interactions illustrate how cost structure and emission-reduction behavior jointly shape pricing strategies under the package self-pickup model.

Proposition 3. In the package self-pickup model, both the manufacturer’s optimal profit and the new retailer’s optimal profit exhibit a negative relevance to k, m, and C1.

Proof. Taking the derivatives of Equations (A7) and (A8) against C1, m, and k, we obtain ; ; ; ; ; and . □

According to Proposition 3, increases in the emission-reduction cost coefficient k, additional processing cost mmm, and inconvenience cost C1 will all lead to a decline in the profits of both supply chain members under the package self-pickup model. A higher k means that emission reduction becomes more expensive for the manufacturer, directly lowering its profit margins. To offset this, the manufacturer reduces the emission level, which negatively affects product appeal and results in fewer consumer purchases, thus also reducing the new retailer’s profit. Similarly, an increase in m raises the retailer’s cost of maintaining the pickup infrastructure, weakening the economic incentive to promote this model. Finally, as C1 grows, consumers perceive more inconvenience, causing overall market demand to shrink and thereby reducing revenue and profit for both parties. This proposition underscores the sensitivity of sustainable fulfillment profitability to operational cost pressures and consumer perception factors.

Proposition 4. In the nearby delivery model, the manufacturer’s optimal wholesale price, optimal emission reduction, and optimal profit are , , and , respectively; the new retailer’s optimal sales price and optimal profit are and , respectively.

Proposition 4 reveals that in the nearby delivery model, both the manufacturer’s optimal wholesale price and the new retailer’s sales price decrease as C2 and k increase. This is because higher logistics costs diminish consumer utility and suppress demand, prompting the new retailer to reduce prices. In turn, the manufacturer lowers the wholesale price to maintain downstream sales volume. Moreover, the analytical solution suggests that the manufacturer’s wholesale price is exactly twice the emission-reduction level, reflecting a cost-sharing mechanism where the emission-reduction burden is proportionally internalized into pricing. This relationship offers clear managerial intuition: when sustainability costs rise, coordinated price reductions become necessary to preserve supply chain viability.

Proposition 5. In the nearby delivery model, the optimal wholesale price , optimal emission reduction , and optimal sales price are all negatively correlated with C2 and k.

Proof. Taking the derivatives of Equations (A16)–(A18) against C2 and k yields ; ; ; ; ; and . □

According to Proposition 5, increases in both the logistics cost C2 and the emission-reduction cost coefficient k lead to declines in the manufacturer’s optimal wholesale price and the new retailer’s sales price under the nearby delivery model. This pricing adjustment stems from the rising service burden on consumers—higher delivery costs reduce consumer willingness to purchase, which then lowers the retailer’s sales volume and consequently diminishes the manufacturer’s order volume. To sustain demand and mitigate losses, both supply chain members are incentivized to reduce prices. The influence of k mirrors that observed in the package self-pickup model: rising abatement costs suppress emission-reduction efforts, weaken product attractiveness, and reduce overall profits. These effects highlight how increased downstream costs can trigger a pricing chain reaction that impacts the sustainability and viability of nearby delivery operations.

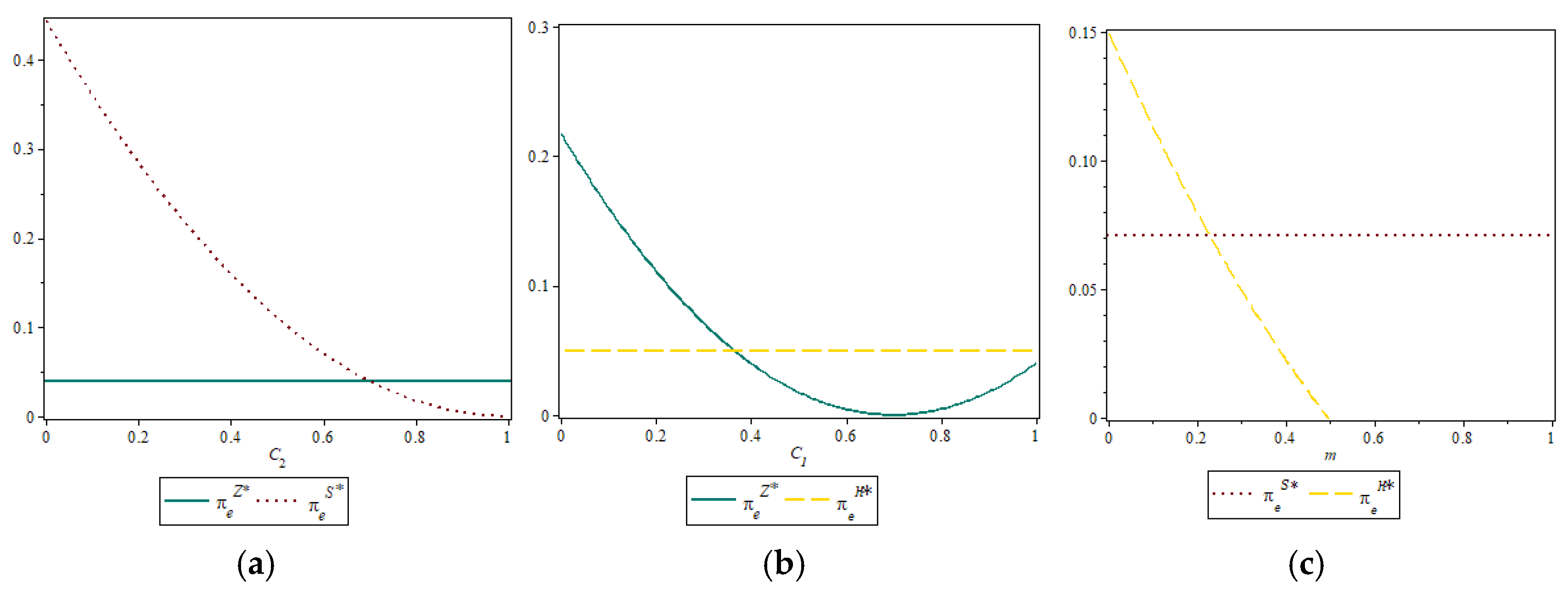

Proposition 6. In the nearby delivery model, both the manufacturer’s optimal profit πmS∗ and the new retailer’s optimal profit are negatively correlated with C2 and k.

Proof: Taking the derivatives of Equations (A19) and (A20) against C

2 and k yields

□

Proposition 6 shows that as logistics cost C2 and emission-reduction cost coefficient k rise, the profits of both the manufacturer and the new retailer decline under the nearby delivery model. The key mechanism lies in how these costs influence consumer utility and operational expenses. Higher logistics costs reduce consumer willingness to pay, shrinking overall market demand. At the same time, a larger k significantly increases the cost burden of emission-reduction investments, further compressing profit margins. Thus, both parameters act as profit dampeners—C2 by eroding demand and k by raising upstream costs—jointly undermining the economic viability of sustainable delivery strategies.

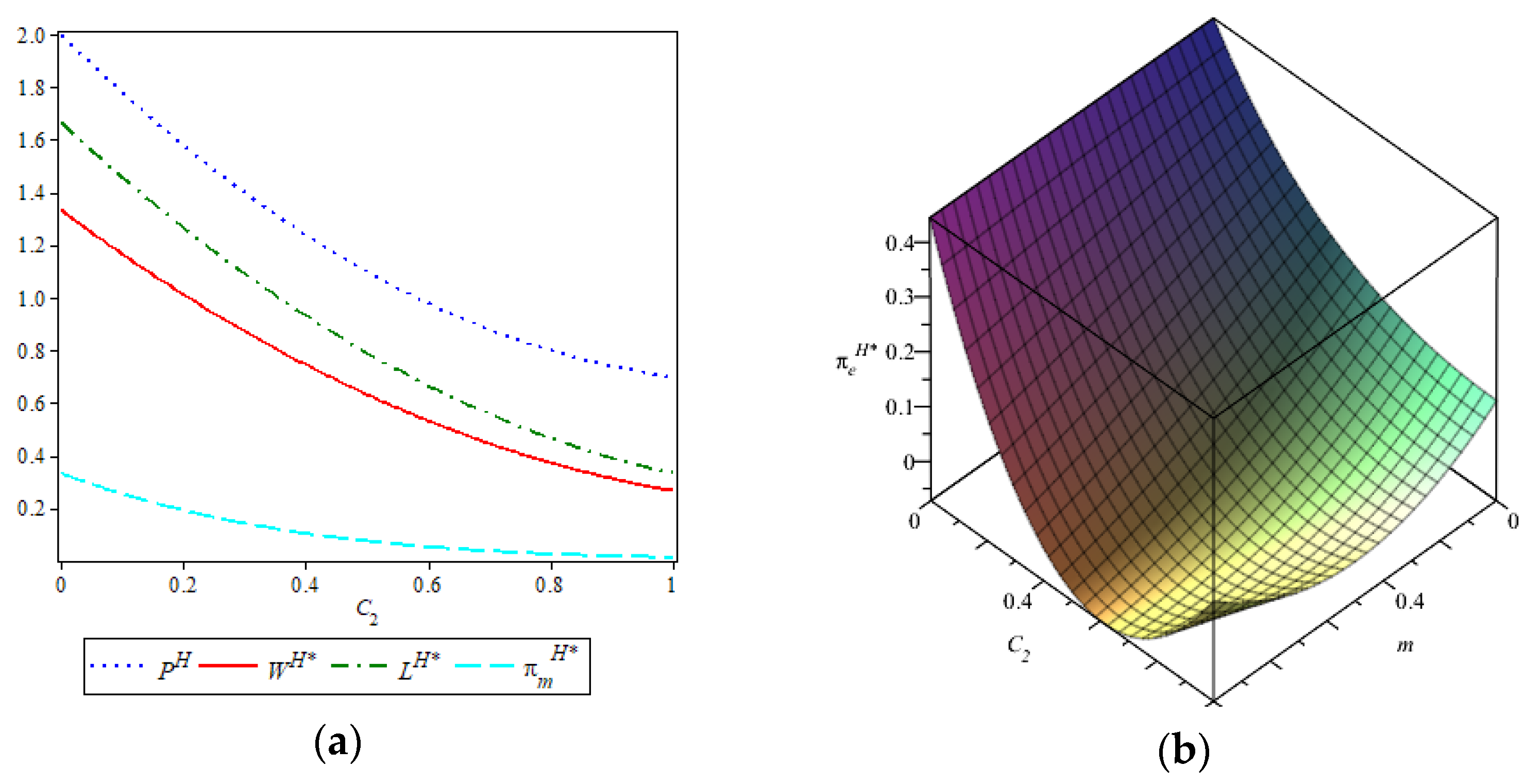

Proposition 7. In the hybrid model, the optimal wholesale price, optimal emission reduction, and optimal profit of the manufacturer are , , and , respectively; the optimal sales price and optimal profit of the new retailer are and , respectively.

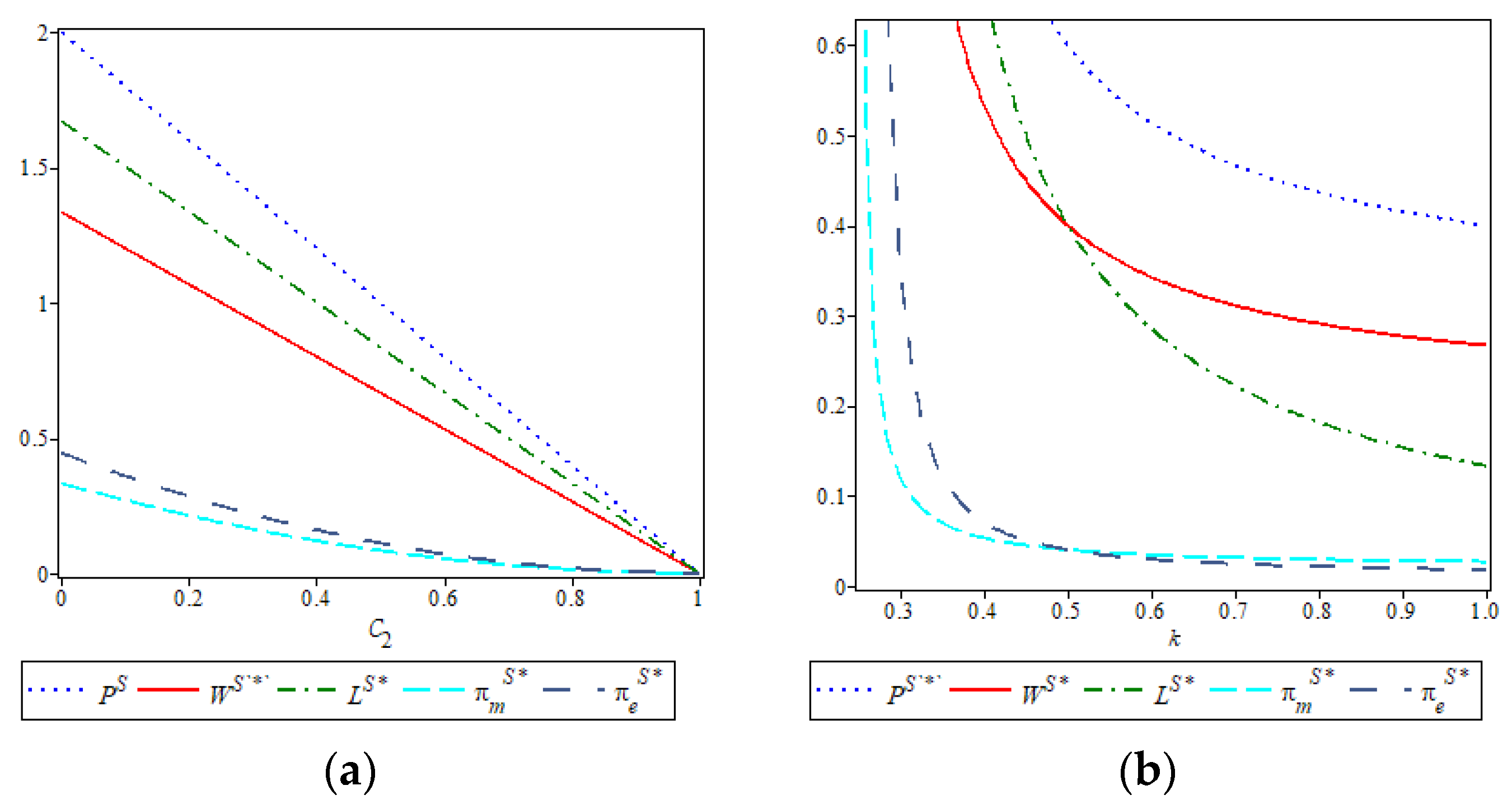

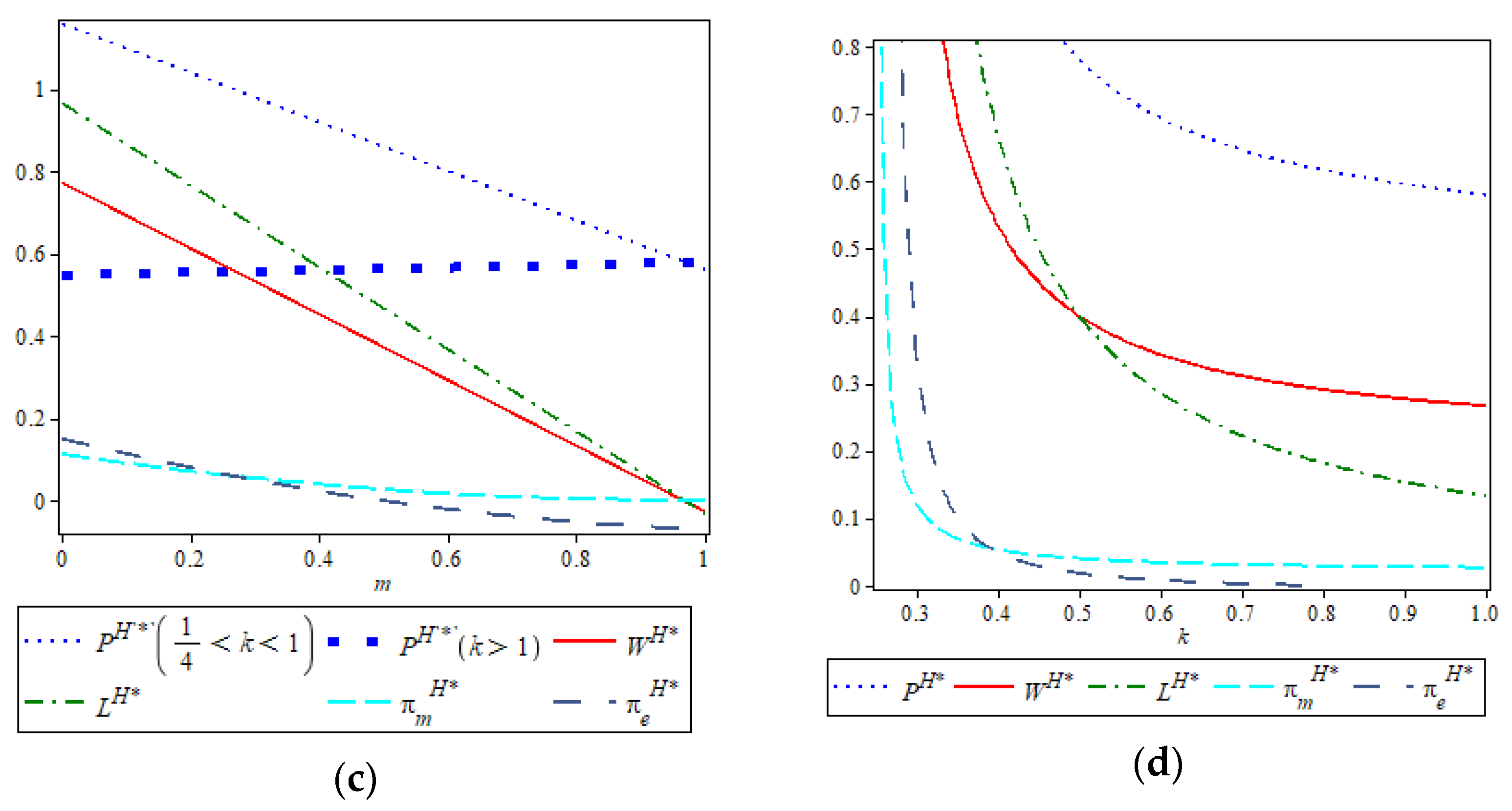

Proposition 7 shows that under the hybrid model, the manufacturer’s optimal wholesale price and the new retailer’s optimal sales price are jointly influenced by C2, k, and m. As these costs increase, the manufacturer tends to reduce both the emission-reduction effort and the wholesale price to maintain margin levels, while the new retailer adjusts the sales price in response to rising operational burdens. Notably, the manufacturer’s wholesale price remains proportional to emission reduction, specifically equal to 2k, indicating that as the cost of sustainability rises, the manufacturer internalizes this into pricing at a fixed multiple. This highlights the hybrid model’s sensitivity to cross-cost interactions and suggests that managing processing and logistics costs is essential for preserving profitability under dual-channel service formats.

Proposition 8. In the hybrid model, the optimal wholesale price and the optimal emission reduction both exhibit a negative relevance to C2, k, and m; the optimal sales price is negatively correlated with C2 and k; when , is negatively correlated with m, and when , is positively correlated with m.

Proof. Taking the derivatives of Equations (A26)–(A28) against

C2, m, and

k, we get

when

,

; when

,

. □

Proposition 8 demonstrates that in the hybrid model, as C2, k, and m increase, the manufacturer’s optimal wholesale price and emission-reduction effort both decline. For the new retailer, a rise in C2 and k leads to lower sales prices, reflecting reduced consumer willingness to pay under higher service and carbon costs. Interestingly, the impact of m on the retailer’s pricing decision exhibits a threshold effect based on the value of k: when k is relatively low, an increase in m suppresses the retail price; but when k is high, the retail price rises with m. This suggests that under high carbon costs, retailers may transfer additional processing burdens into pricing, whereas under low carbon costs, they are more inclined to absorb them. This nuanced interaction between k and m offers valuable insight for managing dual-channel pricing strategies under varying carbon and service cost structures.

Proposition 9. In the hybrid model, the manufacturer’s optimal profit exhibits a negative relevance to C2, m, or k. When , the new retailer’s optimal profit is negatively correlated with C2; otherwise, the situation is reversed. When , is negatively correlated with m; otherwise, the situation is reversed. is negatively correlated with k.

Proof. Taking the first-order partial derivatives of Equations (A29) and (A30) against

C2, we get

;

;

. When

,

; when

,

; when

,

; and when

,

.

, where

□

Proposition 9 indicates that as C2, k, and m increase, not only will the manufacturer’s reduction cost increase, but consumer demand will also decrease due to the increase in C2, thereby directly reducing the manufacturer’s profit. For the new retailer, its profit decreases with the increase in k, but when m is within varying threshold ranges, m and C2 will affect the new retailer’s optimal profit to different extents. This highlights the importance of context-specific cost control and pricing flexibility in hybrid low-carbon retail strategies.

Sales Model Comparison Analysis

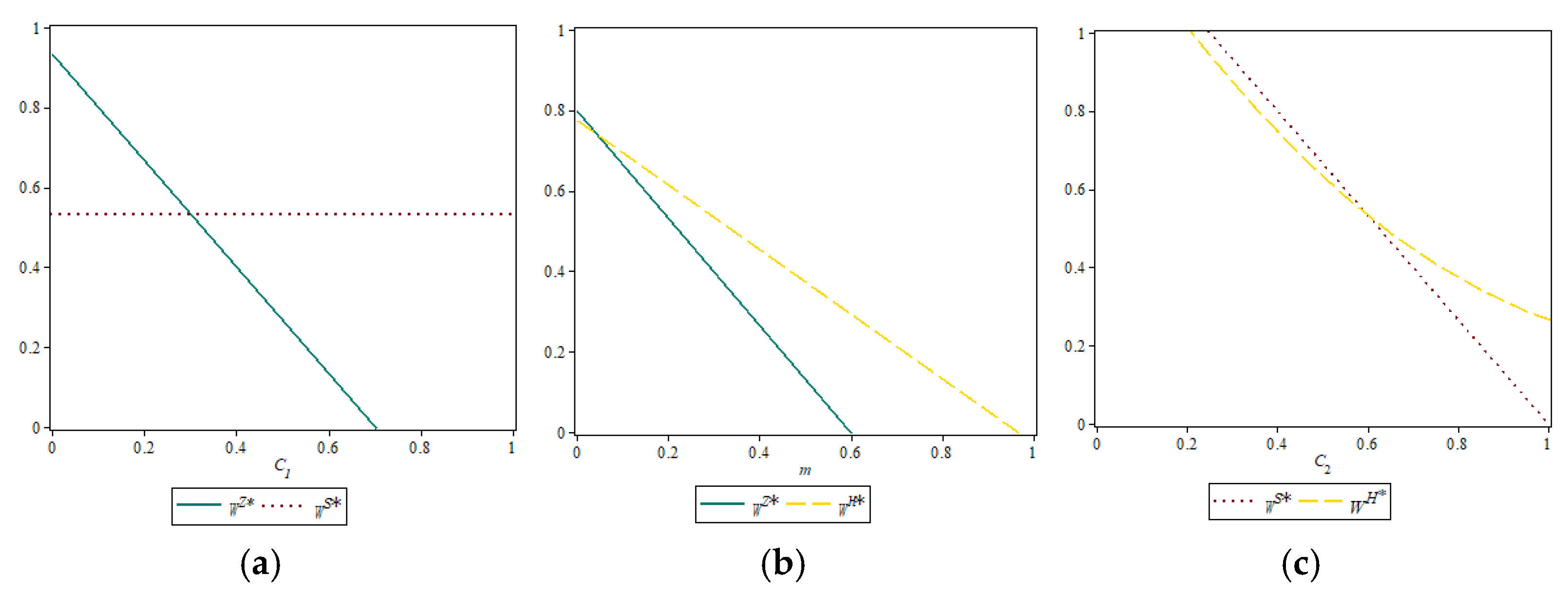

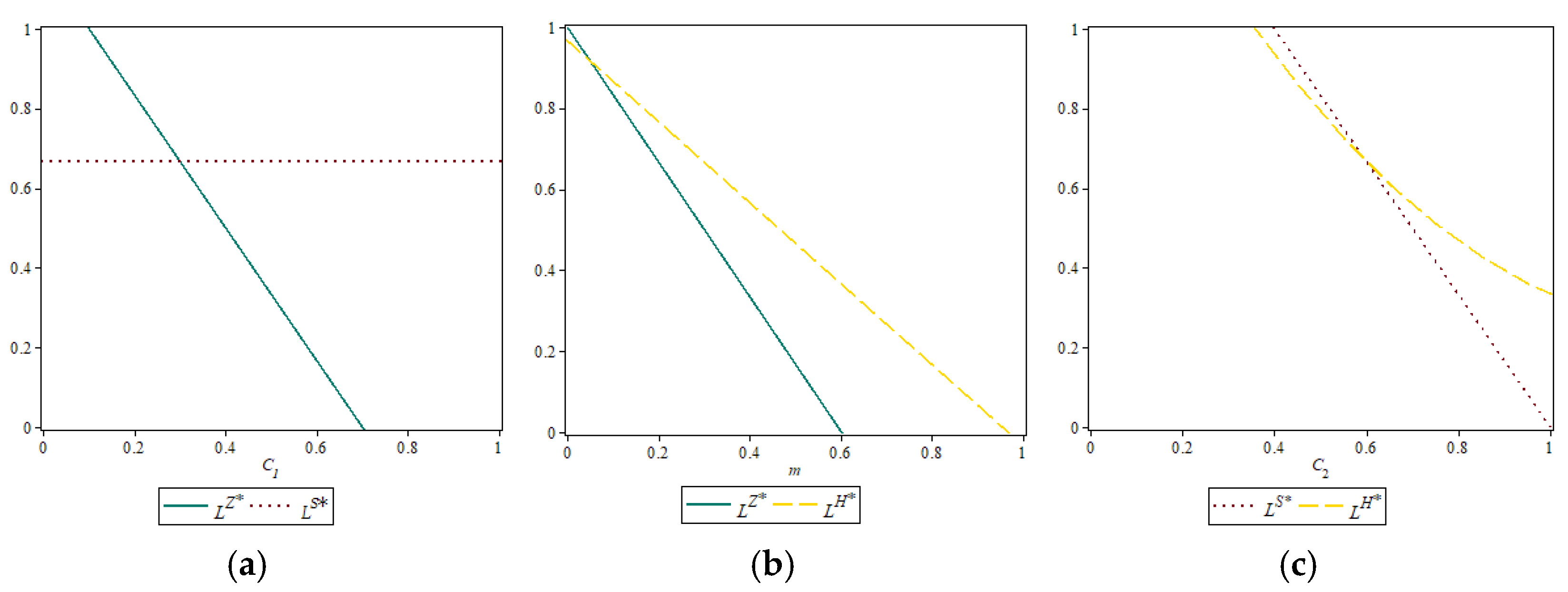

First, the optimal pricing decision-making under varying models are analyzed. By comparing the optimal solutions under the package self-pickup model, nearby delivery model, and hybrid model, the following propositions can be obtained:

Proposition 10. In the three sales models, the relationship between the new retailer’s optimal sales prices is the following: (1) When , ; otherwise, the situation is reversed. (2) When , ; otherwise, the situation is reversed. (3) When , ; otherwise, the situation is reversed.

According to Proposition 10, in the case of C1 being below a certain threshold, the nearby delivery model is accompanied by a higher optimal sales price versus the package self-pickup model; in the case of C2 being below a certain threshold, the nearby delivery model is accompanied by a higher optimal sales price versus the hybrid model; in the case of m being above a certain threshold, although the cost of opening the package self-pickup increases, the hybrid model still sets a higher product price compared to the package self-pickup model.

Proposition 11. In the three sales models, the relationship between the manufacturer’s emission reductions is as follows: (1) When , ; otherwise, the situation is reversed. (2) When , ; otherwise, the situation is reversed. (3) When , ; otherwise, the situation is reversed.

Proposition 11 indicates that when the consumer’s C1 is below a certain threshold, the package self-pickup model shows a higher manufacturer’s emission reduction versus the nearby delivery model; when C2 is below twice the m, the emission reduction under the nearby delivery model is higher compared to the hybrid model; in the case of m being above a certain threshold, the emission reduction under the package self-pickup model is lower compared to the hybrid model.

Proposition 12. In the three sales models, the relationship between the manufacturer’s wholesale prices is as follows: (1) When , ; otherwise, the situation is reversed. (2) When , ; otherwise, the situation is reversed. (3) When , ; otherwise, the situation is reversed.

Proposition 12 indicates that in the case of C1 being below a certain threshold, the package self-pickup model sets a higher manufacturer’s wholesale price versus the nearby delivery model; when C2 is below twice the m, the wholesale price under the nearby delivery model is lower compared to the hybrid model; with m above a certain threshold, the wholesale price under the package self-pickup model is always lower compared to the hybrid model. These comparative insights offer intuitive guidance for fulfillment model selection based on real-world cost parameters.

Proposition 13. In the three sales models, the relationship between the new retailer’s profits is as follows: (1) As shown in regions III, VIII, X, and X of Figure 3, when and or and , always . (2) As shown in regions XI and VIII of Figure 3, when , and or , C1<C1′ and , always . (3) As shown in region VI of Figure 3, when , and , always . (4) As shown in regions IV and V of Figure 3, when and , always . (5) As shown in Region I of Figure 3, when conditions , and or , and or , and or , and are satisfied, there is always . (6) As shown in Region II of Figure 3, when conditions , and or , and are satisfied, there is always . Proposition 13 indicates that the optimal sales model for the new retailer shifts as the relationship among the logistics cost

C2, inconvenience cost

C1, and additional processing cost

m changes. As illustrated in

Figure 3, when the inconvenience cost

C1 is below a specific threshold—corresponding to regions I and II—the new retailer maximizes profit by selecting the package self-pickup model. In regions IV, V, VII, and XI, where processing and logistics costs are moderate while inconvenience costs are higher, the hybrid model becomes optimal. In contrast, in regions VI, III, VIII, IX, and X—characterized by higher inconvenience costs and lower logistics and processing costs—the nearby delivery model is the most profitable choice.

These threshold effects reflect realistic trade-offs observed in O2O retail settings. For example, C1 is generally low in densely populated urban areas with well-developed transportation and pickup infrastructure, making self-pickup models viable. In contrast, C2 is higher in suburban and rural regions, where last-mile delivery coverage is sparse or expensive, thereby favoring hybrid or self-pickup models. Additionally, the additional processing cost mmm—including equipment, labor, and shelf organization—varies significantly across retail formats. In fresh food and FMCG retail (e.g., Yonghui Life, Hema Fresh), offline setup costs are moderate due to scale, allowing hybrid models to operate efficiently. When these costs become too high, as in new market entries with limited offline presence, the retailer may pivot toward delivery-dominant models. In sum, empirical patterns from Chinese O2O retail platforms suggest that each model corresponds to specific, observable cost environments. These findings affirm that the conditions described in Proposition 13 are not only theoretically valid but also align with market realities across geographic and operational contexts.