Advancing Cosmetic Sustainability: Upcycling for a Circular Product Life Cycle

Abstract

1. Introduction

2. Methodology

3. Sustainability in the Cosmetics Industry

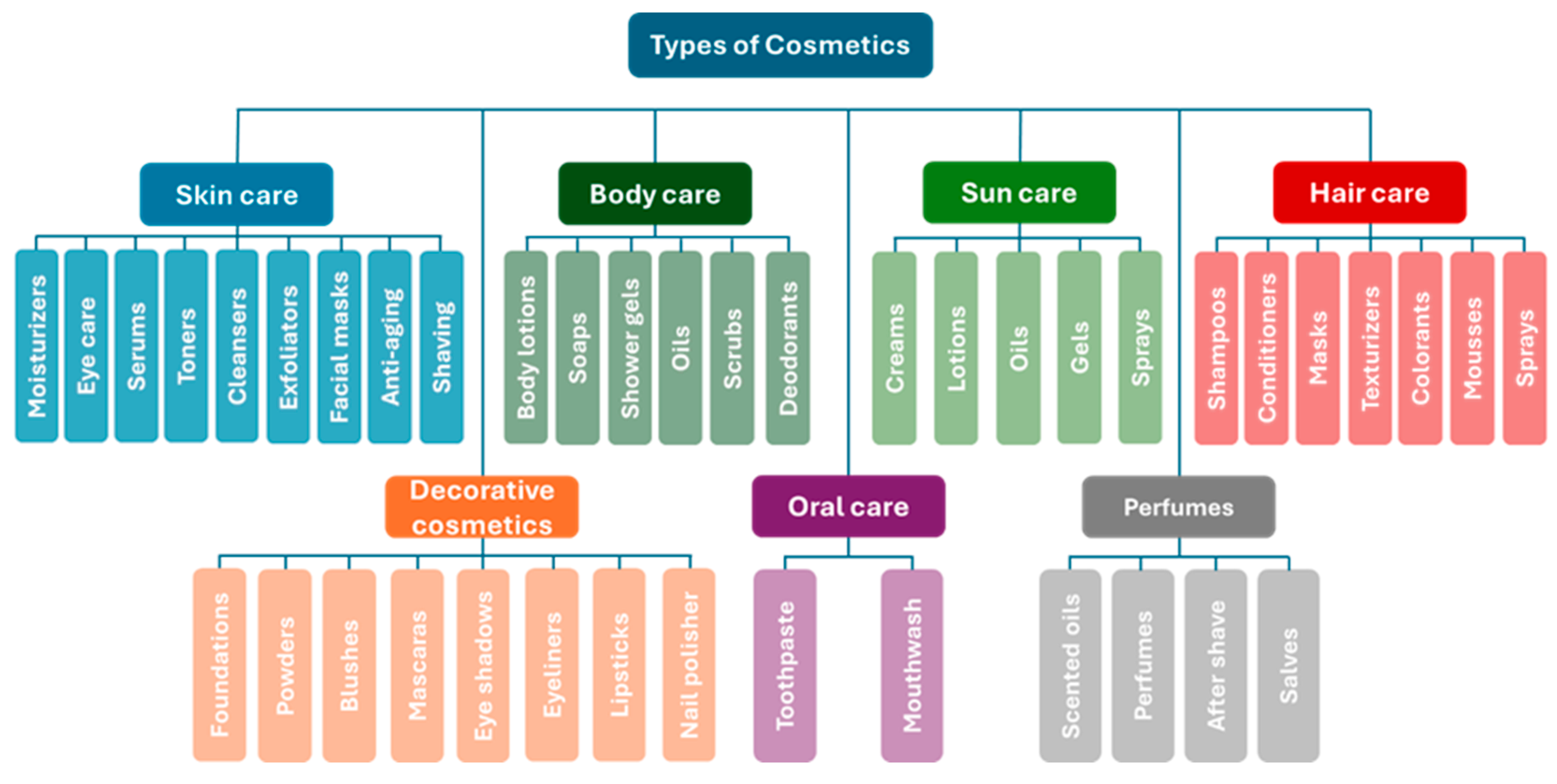

3.1. Cosmetic Products

3.1.1. Cosmetic Regulatory Framework

3.1.2. Cosmetic Claims

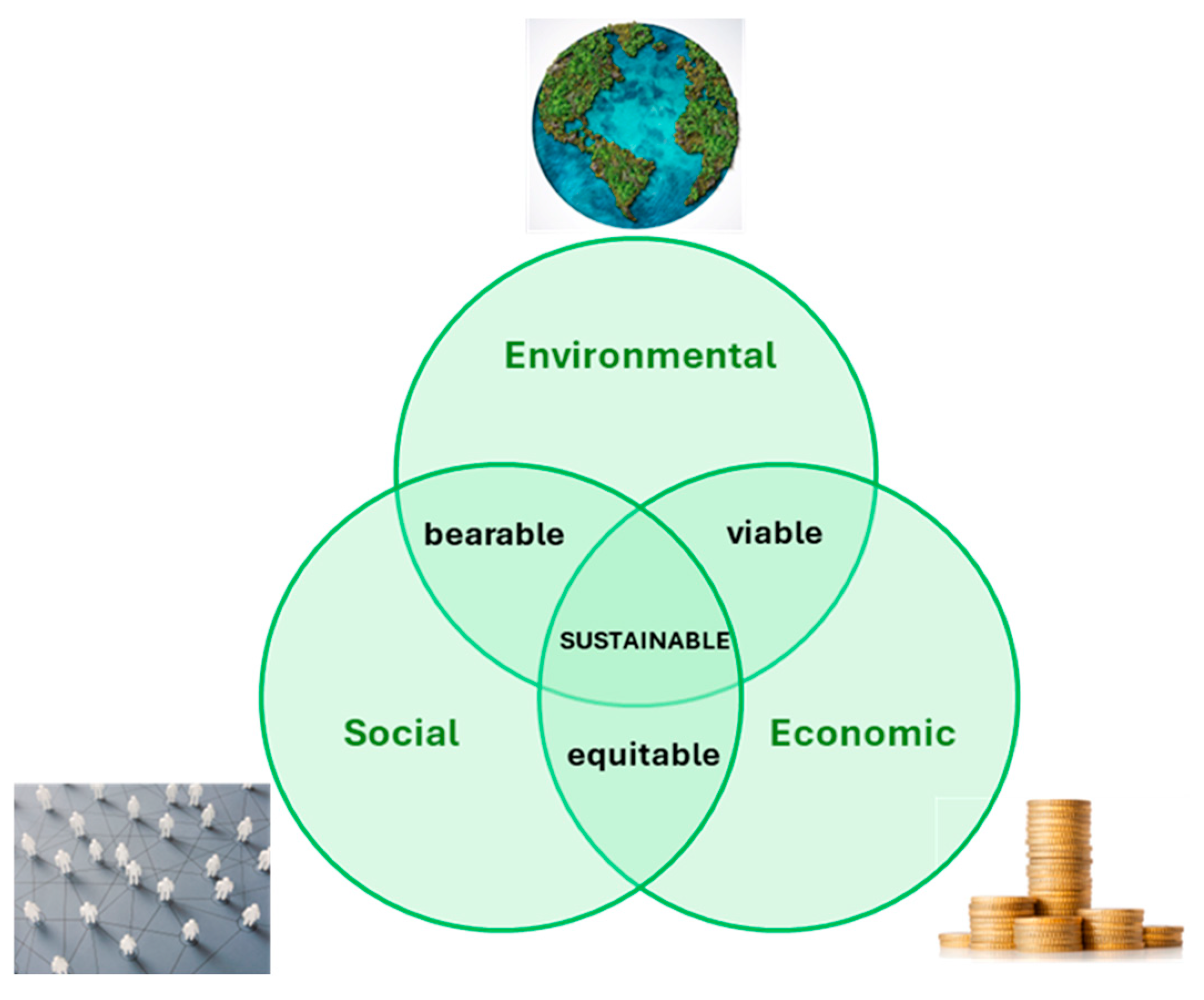

3.2. Sustainability

3.3. Sustainable Cosmetics

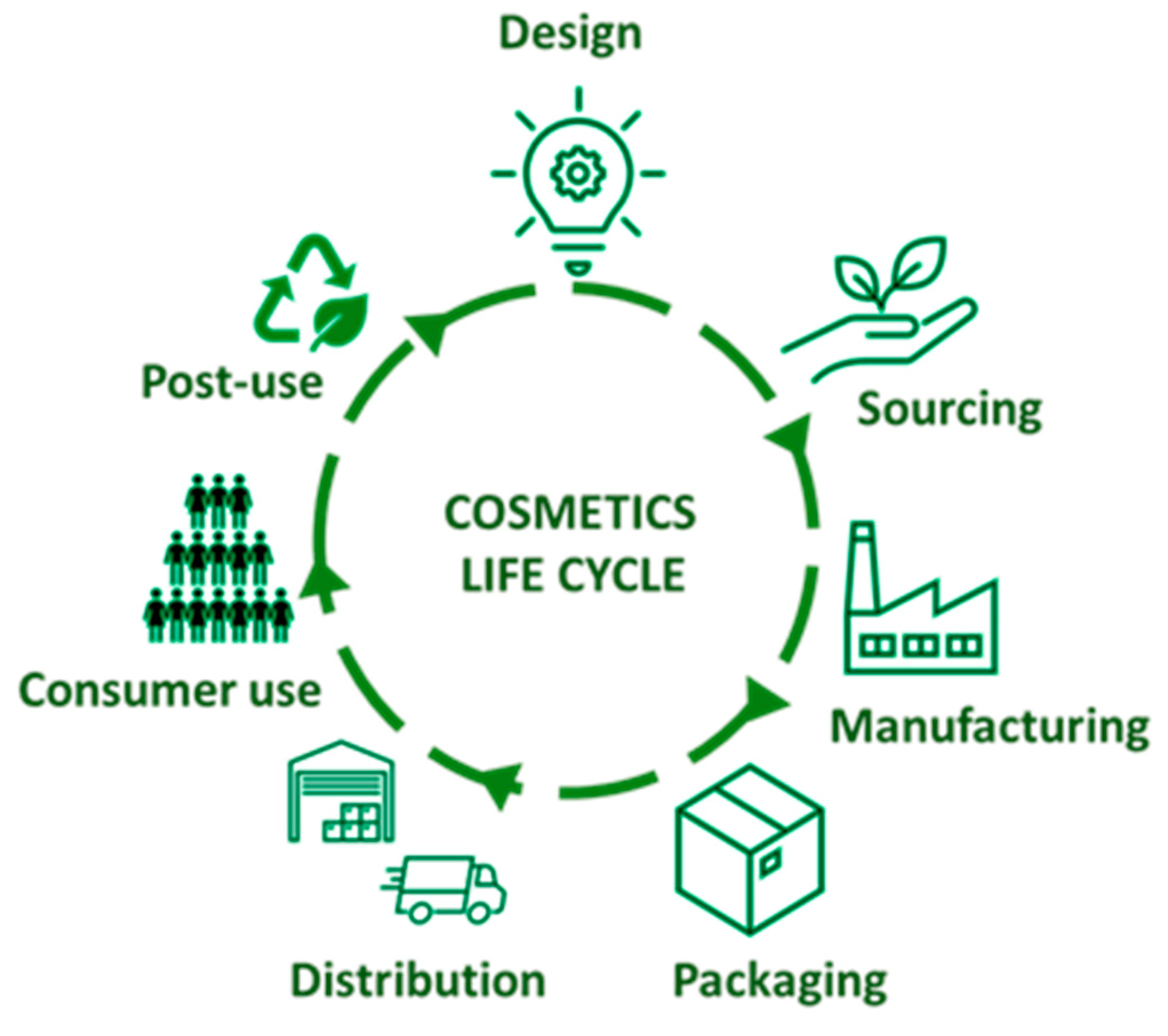

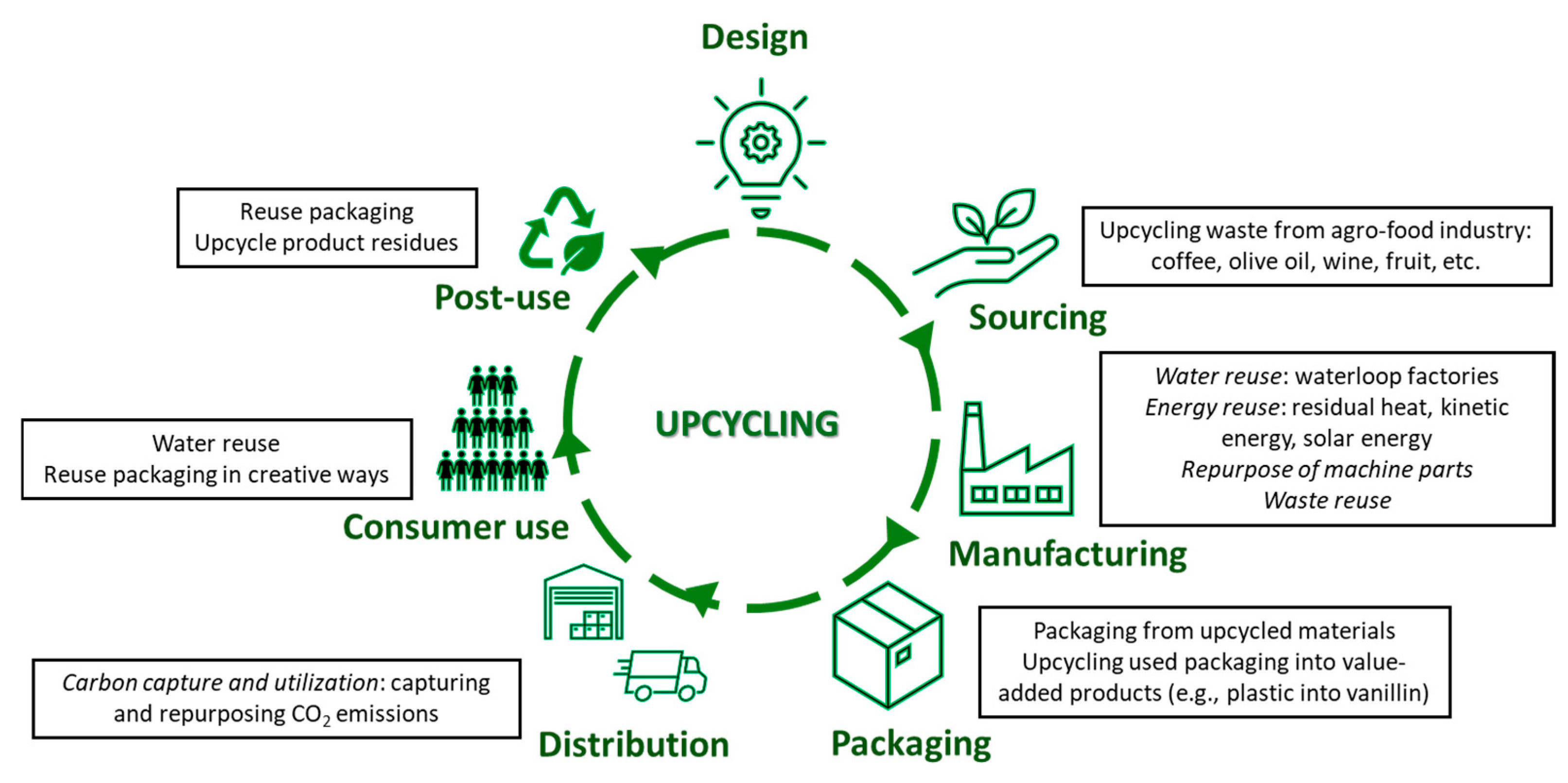

4. Upcycling Across the Cosmetic Life Cycle: Strategies and Opportunities

4.1. Design

4.2. Sourcing

4.2.1. Coffee Industry

4.2.2. Olive Oil Industry

4.2.3. Grape Industry

4.2.4. Fruit Industry

4.3. Manufacturing Process

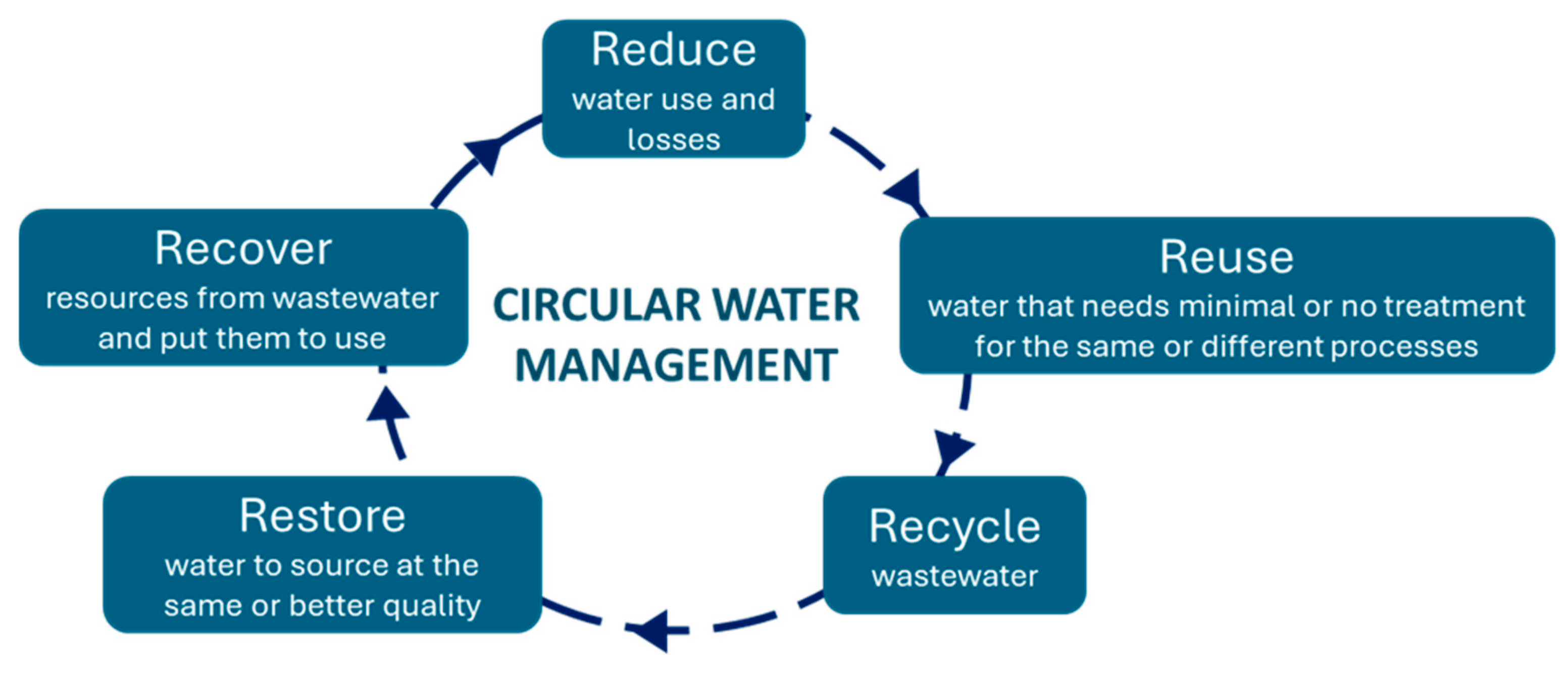

4.3.1. Water Reuse—“Waterloop” Factories

4.3.2. Energy

4.3.3. Other Strategies

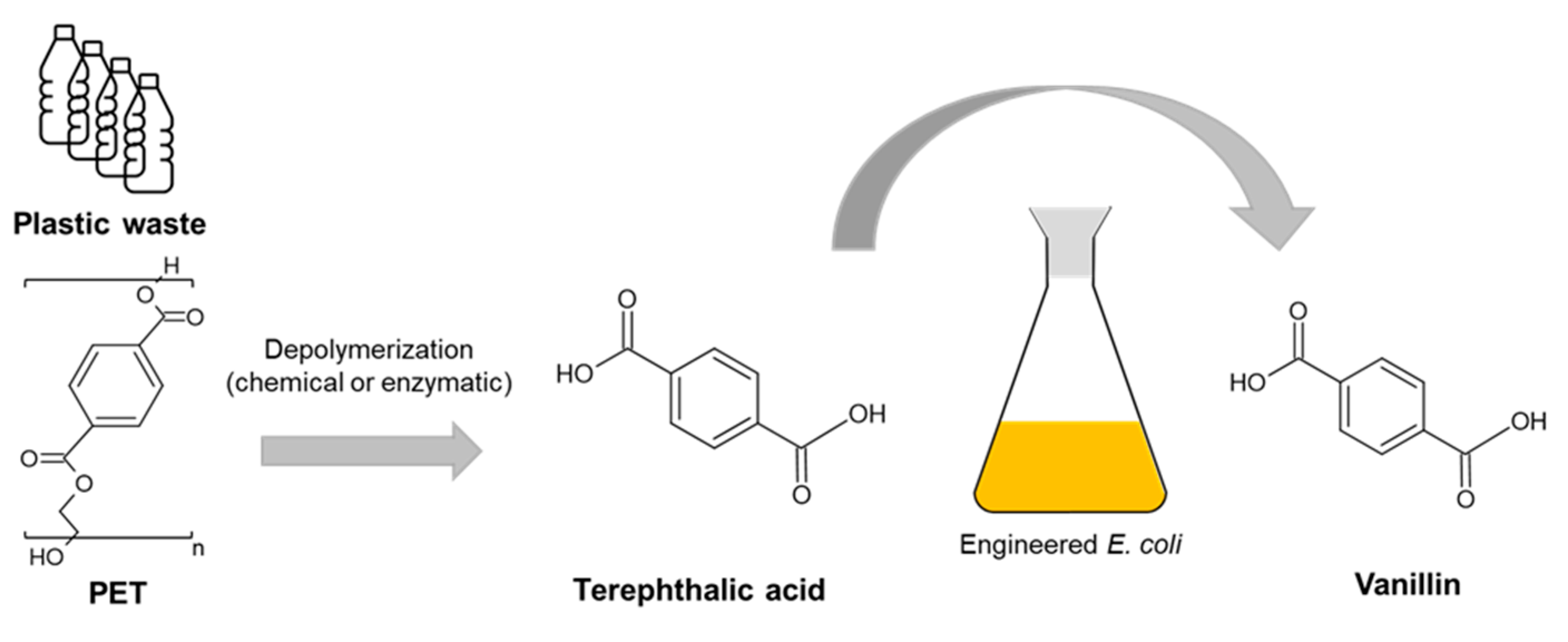

4.4. Packaging

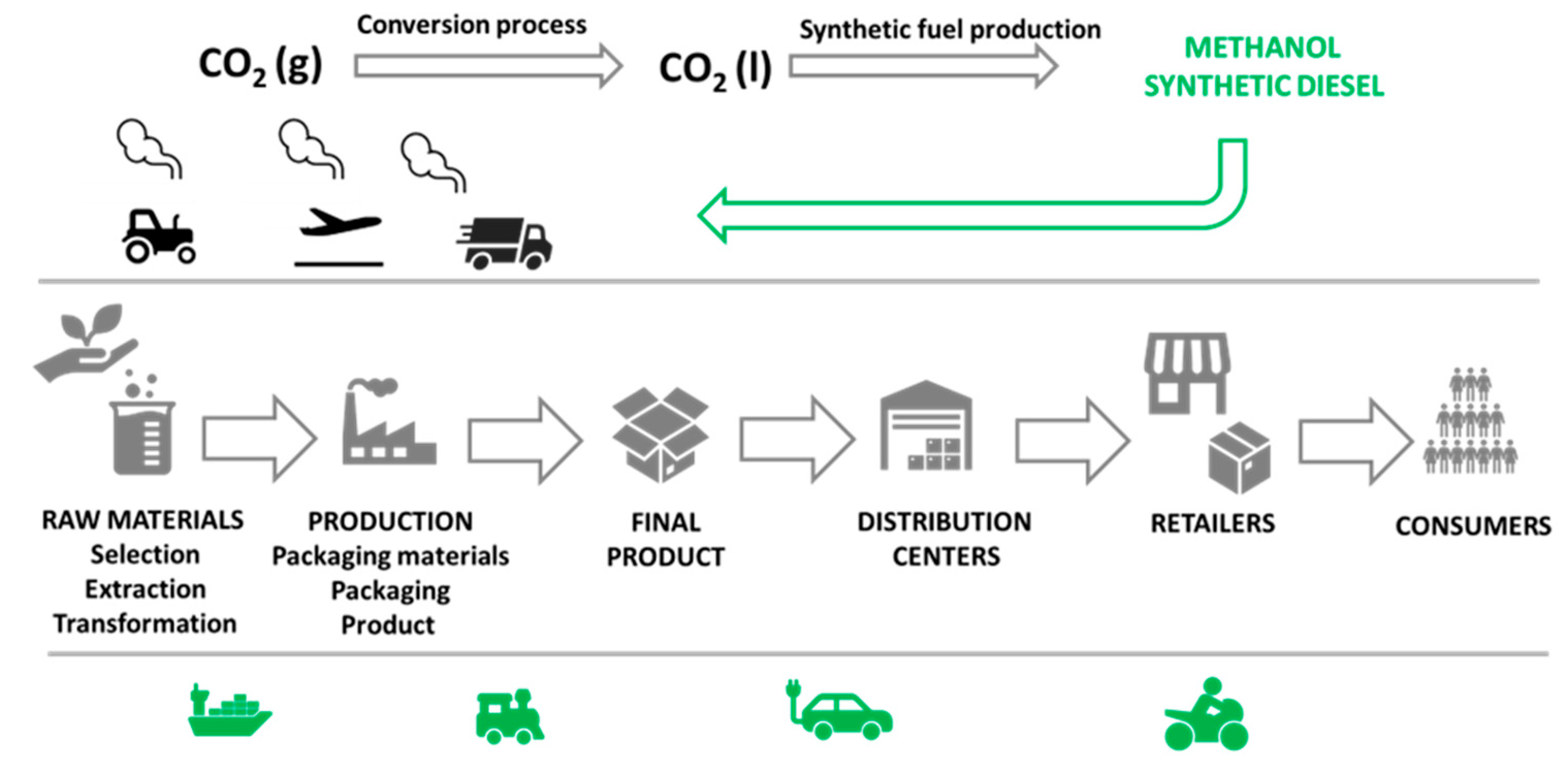

4.5. Distribution

4.6. Consumer Use

4.7. Post-Use Phase

4.7.1. Refillable and Reusable Packaging

4.7.2. Modular Packaging Systems

4.7.3. Upcycling Packaging

4.7.4. DIY Packaging Upcycling

4.7.5. Upcycling Product Residues

5. Economic Challenges and Opportunities

6. Conclusions and Perspectives

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| CES | Consumer Electronics Show |

| CPNP | Cosmetic Products Notification Portal |

| DIY | Do-It-Yourself |

| EU | European Union |

| GLAM | Green Last Mile |

| GMPs | Good Manufacturing Practices |

| GP | Grape pomace |

| GS | Grape seed |

| OMWW | Olive mill wastewater |

| OP | Olive pomace |

| PA | Poly(amide) |

| PE | Poly(ethylene) |

| PIF | Product information file |

| PP | Poly(propylene) |

| PS | Poly(styrene) |

| PVC | Poly(vinyl chloride) |

| R&D | Research and Development |

| SCG | Spent coffee grounds |

| TEWL | Transepidermal water loss |

References

- Cosmetics Europe. The Basics. Available online: https://cosmeticseurope.eu/cosmetic-products/the-basics/ (accessed on 20 June 2025).

- European Commission Regulation (EC) No 1223/2009 of the European Parliament and the Council. Official Journal of the European Communities. 2009. Available online: https://eur-lex.europa.eu/eli/reg/2009/1223 (accessed on 10 January 2025).

- Cosmetics Europe. Our Industry. Economic Value of the Cosmetics and Personal Care Industry. 2025. Available online: https://cosmeticseurope.eu/our-industry/ (accessed on 20 June 2025).

- Petruzzi, D. Cosmetics market in Europe—Statistics & facts. Statista, 12 September 2024. Available online: https://www.statista.com/topics/7382/cosmetics-market-in-europe/#topicOverview (accessed on 3 February 2025).

- Cosmetics Europe. How We Make Your Products. Research and Development (R&D). 2025. Available online: https://cosmeticseurope.eu/cosmetic-products/how-we-make-your-products/ (accessed on 20 June 2023).

- Verneeck, N. Europe’s beauty companies reinvesting 5% of sales in R&D for Green Deal goals. Euractiv, 10 December 2024. Available online: https://www.euractiv.com/section/eet/news/europes-beauty-companies-reinvesting-5-of-sales-in-rd-for-green-deal-goals/ (accessed on 3 February 2025).

- Lagarde, E. Sustainable Beauty and Skincare Market will Expand USD 326.8 Billion to 2031. Re-Sources, 31 July 2024. Available online: https://re-sources.co/sustainable-beauty-and-skincare-market-will-expand-usd-326-8-billion-to-2031-says-latest-insightace-analytic-pvt-ltd-survey/ (accessed on 28 May 2025).

- Personal Care Product Council (PCPC) 2019 Sustainability Report. Creating a More Beautiful World. 2019. Available online: https://www.personalcarecouncil.org/wp-content/uploads/2021/03/PCPC_Report_2019_March-2021.pdf (accessed on 16 March 2023).

- Bom, S.; Jorge, J.; Ribeiro, H.M.; Marto, J. A step forward on sustainability in the cosmetics industry: A review. J. Clean. Prod. 2019, 225, 270–290. [Google Scholar] [CrossRef]

- Cosmetics Europe. Driving Sustainability. 2025. Available online: https://cosmeticseurope.eu/key-actions/driving-sustainability/ (accessed on 20 June 2025).

- Givaudan. Upcycled Vetiver Roots Deliver Sustainable Beauty Ingredients. 2018. Available online: https://www.givaudan.com/sustainability/creations/heritage-action/upcycled-vetiver-roots-delivery-sustainable-beauty-ingredients (accessed on 22 March 2023).

- European Parliament. Circular Economy: Definition, Importance and Benefits. 2023. Available online: https://www.europarl.europa.eu/topics/en/article/20151201STO05603/circular-economy-definition-importance-and-benefits (accessed on 20 June 2025).

- Tiscini, R.; Martiniello, L.; Lombardi, R. Circular economy and environmental disclosure in sustainability reports: Empirical evidence in cosmetic companies. Bus. Strategy Environ. 2022, 31, 892–907. [Google Scholar] [CrossRef]

- Silva, A.S.; Costa, E.C.; Reis, S.; Spencer, C.; Calhelha, R.C.; Miguel, S.P.; Ribeiro, M.P.; Barros, L.; Vaz, J.A.; Coutinho, P. Silk Sericin: A promising sustainable biomaterial for biomedical and pharmaceutical applications. Polymers 2022, 14, 4931. [Google Scholar] [CrossRef]

- Buzzi, R.; Gugel, I.; Costa, S.; Molesini, S.; Boreale, S.; Baldini, E.; Marchetti, N.; Vertuani, S.; Pinelli, P.; Urciuoli, S.; et al. Up-cycling of Olea europaea L. ancient cultivars side products: Study of a combined cosmetic–food supplement treatment based on leaves and olive mill wastewater extracts. Life 2023, 13, 1509. [Google Scholar] [CrossRef]

- Dauber, C.; Parente, E.; Zucca, M.P.; Gámbaro, A.; Vieitez, I. Olea europea and by-products: Extraction methods and cosmetic applications. Cosmetics 2023, 10, 112. [Google Scholar] [CrossRef]

- Dini, I. The potential of algae in the nutricosmetic sector. Molecules 2023, 28, 4032. [Google Scholar] [CrossRef]

- Rego, L.; Mota, S.; Torres, A.; Pinto, C.; Cravo, S.; Silva, J.R.; Páscoa, R.N.M.J.; Almeida, A.; Amaro, F.; Pinho, P.G.; et al. Quercus suber bark as a sustainable source of value-added compounds: Experimental studies with cork by-products. Forests 2023, 14, 543. [Google Scholar] [CrossRef]

- Rodrigues, R.; Oliveira, M.B.P.P.; Alves, R.C. Chlorogenic acids and caffeine from coffee by-products: A review on skincare applications. Cosmetics 2023, 10, 12. [Google Scholar] [CrossRef]

- Faggian, M.; Lucchetti, S.; Ferrari, S.; De Nadai, G.; Francescato, S.; Baratto, G.; De Zordi, N.; Stanic, S.-M.; Peron, G.; Sut, S.; et al. An integrated approach to develop innovative, sustainable, and effective cosmetic ingredients: The case report of fatty-acids-enriched wild strawberry waste extract. Appl. Sci. 2024, 14, 10603. [Google Scholar] [CrossRef]

- Grasso, F.; Martínez, M.M.A.; Turrini, F.; Méndez Paz, D.; Vázquez Sobrado, R.; Orlandi, V.; Jenssen, M.; Lian, K.; Rombi, J.; Tiso, M.; et al. Antioxidant marine hydrolysates isolated from tuna mixed byproducts: An example of fishery side streams upcycling. Antioxidants 2024, 13, 1011. [Google Scholar] [CrossRef]

- Saorin Puton, B.M.; Demaman Oro, C.E.; Lisboa Bernardi, J.; Exenberger Finkler, D.; Venquiaruto, L.D.; Dallago, R.M.; Tres, M.V. Sustainable valorization of plant residues through enzymatic hydrolysis for the extraction of bioactive compounds: Applications as functional ingredients in cosmetics. Processes 2025, 13, 1314. [Google Scholar] [CrossRef]

- Silva, A.; Pinto, C.; Cravo, S.; Mota, S.; Rego, L.; Ratanji, S.; Quintas, C.; Silva, J.R.; Afonso, C.; Tiritan, M.E.; et al. Sustainable skincare innovation: Cork powder extracts as active ingredients for skin aging. Pharmaceuticals 2025, 18, 121. [Google Scholar] [CrossRef]

- Malik, N.; Kumar, P.; Shrivastava, S.; Ghosh, S.B. An overview on PET waste recycling for application in packaging. Int. J. Plast Technol. 2017, 21, 1–24. [Google Scholar] [CrossRef]

- Schaerer, L.G.; Wu, R.; Putman, L.I.; Pearce, J.M.; Lu, T.; Shonnard, D.R.; Ong, R.G.; Techtmann, S.M. Killing two birds with one stone: Chemical and biological upcycling of polyethylene terephthalate plastics into food. Trends Biotechnol. 2023, 41, 184–196. [Google Scholar] [CrossRef] [PubMed]

- Martins, A.M.; Marto, J.M. A sustainable life cycle for cosmetics: From design and development to post-use phase. Sustain. Chem. Pharm. 2023, 35, 101178. [Google Scholar] [CrossRef]

- Cosmetics Europe. Cosmetic Products. 2025. Available online: https://cosmeticseurope.eu/cosmetic-products/ (accessed on 10 January 2025).

- European Commission. Internal Market, Industry, Entrepreneurship and SMEs—Cosmetics, Legislation. 2025. Available online: https://single-market-economy.ec.europa.eu/sectors/cosmetics/legislation_en (accessed on 10 January 2025).

- European Commission. Regulation (EU) No 655/2013. Official Journal of the European Communities. 2013. Available online: https://eur-lex.europa.eu/eli/reg/2013/655/oj/eng (accessed on 10 January 2025).

- European Commission. Technical Document on Cosmetic Claims. 2017. Available online: https://ec.europa.eu/docsroom/documents/24847 (accessed on 10 January 2025).

- Keeble, B.R. The Brundtland report: ‘Our common future’. Med. War 1988, 4, 17–25. [Google Scholar] [CrossRef]

- United Nations. United Nations Conference on Environment & Development. 1992. Available online: https://sustainabledevelopment.un.org/content/documents/Agenda21.pdf (accessed on 14 May 2023).

- Jaouhari, Y.; Travaglia, F.; Giovannelli, L.; Picco, A.; Oz, E.; Oz, F.; Bordiga, M. From industrial food waste to bioactive ingredients: A review on the sustainable management and transformation of plant-derived food waste. Foods 2023, 12, 2183. [Google Scholar] [CrossRef] [PubMed]

- The World Counts. Food Waste Statistics 2025. 2025. Available online: https://www.theworldcounts.com/challenges/people-and-poverty/hunger-and-obesity/food-waste-statistics (accessed on 10 January 2025).

- Dell’Acqua, G. Garbage to glamour: Recycling food by-products for skin care. Cosmetics and Toiletries, 6 February 2017. Available online: https://www.cosmeticsandtoiletries.com/research/methods-tools/article/21836720/garbage-to-glamour-recycling-food-byproducts-for-skin-care (accessed on 30 January 2025).

- Galanakis, C.M. Food Waste Recovery: Processing Technologies, Industrial Techniques, and Applications, 2nd ed.; Academic Press: Amsterdam, NL, USA, 2020. [Google Scholar] [CrossRef]

- The Upcycled Beauty Company. Zero Waste Beauty Report. 2025. Available online: https://www.upcycledbeauty.com/zero-waste-beauty-report (accessed on 10 January 2025).

- Cullor, R. What Upcycling, Waste Reduction Looks like with Cosmetic Products Today. Cosmetics Design USA, 8 November 2022. Available online: https://www.cosmeticsdesign.com/Article/2022/11/08/upcycling-in-cosmetics-ingredients-and-formulation (accessed on 22 May 2023).

- Oleaf4Value. OLEAF4VALUE, Olive Leaf Multi-Product Cascade Based Biorefinery. 2025. Available online: https://oleaf4value.eu/ (accessed on 20 January 2025).

- Bindra, J. 10 Upcycled Beauty Brands that are Giving Discarded Food Waste a New Life. Sustainably Chic, 22 April 2023. Available online: https://www.sustainably-chic.com/blog/upcycled-beauty-brands (accessed on 28 May 2023).

- Stern, C. ‘Coffee Silverskin’ and ‘Spent Coffee Grounds’ Show Promise in Cosmetic Applications, States Review. Cosmetics Design USA, 2023. Available online: https://www.cosmeticsdesign.com/Article/2023/01/24/review-supports-upcycled-coffee-potential-for-cosmetics (accessed on 27 May 2023).

- Byroe New York. Tomato Firming Serum. 2025. Available online: https://byroe.com/products/tomato-serum?variant=28344596037718 (accessed on 15 January 2025).

- Caudalie. Resveratrol de Sarmentos da Videira. 2025. Available online: https://pt.caudalie.com/a-marca/ingredientes-e-patentes/resveratrol (accessed on 13 January 2025).

- Culliney, K. Smashed Avocado: French Firm Develops Eye Care Active from By-Product. Cosmetics Design Europe, 14 April 2020. Available online: https://www.cosmeticsdesign-europe.com/Article/2020/04/14/Laboratoires-Expanscience-develops-avocado-by-product-active-for-eyes (accessed on 3 June 2023).

- Culliney, K. Beautiful bananas: French Caribbean brand Kadalys extends mission to tackle food waste. Cosmetics Design Europe, 27 April 2022. Available online: https://www.cosmeticsdesign-europe.com/Article/2022/04/27/upcycled-banana-beauty-brand-kadalys-expanding-into-supply-research-to-tackle-climate-crisis (accessed on 3 June 2023).

- Cullor, R. Coffee cup to cosmetics: Colombian company introduces coffee cherry ingredient with big protective claims. Cosmetics Design USA, 24 November 2021. Available online: https://www.cosmeticsdesign.com/Article/2021/11/24/Colombian-coffee-antioxidant-ingredients-hits-beauty-market (accessed on 28 May 2023).

- Expanscience Laboratoires. Number 6, an Anti-Eyebag Active. 2025. Available online: https://www.expanscience-ingredients.com/en/our-active-sensorial-ingredients/number-6 (accessed on 13 January 2025).

- Givaudan. Givaudan Active Beauty Presents Omegablue®, an Upcycled Ingredient Dedicated to Skin Repair. 2021. Available online: https://www.givaudan.com/media/trade-media/2021/givaudan-active-beauty-presents-omegablue (accessed on 2 June 2023).

- Cosmetics Business. Coffee Silverskin for Skin Protection. 2024. Available online: https://cosmeticsbusiness.com/coffee-silverskin-for-skin-protection (accessed on 13 January 2025).

- Pai Skincare. Best Vitamin C Face Cream for Sensitive Skin. 2025. Available online: https://www.paiskincare.ie/blogs/products/vitamin-c-cream (accessed on 13 January 2025).

- Kadalys. Organic Cosmetics Recycled and Vegan Thanks to the Recycling of Banana. 2025. Available online: https://kadalys.com/en/blogs/green/des-cosmetiques-bio-recycle-et-vegan-grace-au-recyclage-de-peaux-de-banane (accessed on 13 January 2025).

- Roelmi.HPC. Olifeel® E-NAT W/O WO Emulsifier. 2025. Available online: https://www.roelmihpc.com/portfolio/olifeel-e-nat-w-o/ (accessed on 13 January 2025).

- Thompson, L. 12 Beauty Brands That Upcycle Food Waste into Sustainable Skincare Options. Glam, 19 April 2023. Available online: https://www.glam.com/1262311/beauty-brands-upcycle-food-waste-sustainable-skincare/ (accessed on 6 June 2023).

- International Coffee Organization. Coffee Development Report 2022–23. Available online: https://www.icocoffee.org/documents/cy2024-25/coffee-development-report-2022-23.pdf (accessed on 19 January 2025).

- Bessada, S.M.F.; Alves, R.C.; Oliveira, M.B.P.P. Coffee silverskin: A review on potential cosmetic applications. Cosmetics 2018, 5, 5. [Google Scholar] [CrossRef]

- Johnson, K.; Liu, Y.; Lu, M. A review of recent advances in spent coffee grounds upcycle technologies and practices. Front. Chem. Engineer. 2022, 4, 838605. [Google Scholar] [CrossRef]

- Kaffe Bueno. Ingredients. 2025. Available online: https://www.kaffebueno.com/ (accessed on 13 January 2025).

- Rodrigues, F.; Pimentel, F.B.; Oliveira, M.B.P.P. Olive by-products: Challenge application in cosmetic industry. Ind. Crop. Prod. 2015, 70, 116–124. [Google Scholar] [CrossRef]

- Nunes, A.; Marto, J.; Gonçalves, L.; Martins, A.M.; Fraga, C.; Ribeiro, H.M. Potential therapeutic of olive oil industry by-products in skin health: A review. Int. J. Food Sci. Technol. 2022, 57, 173–187. [Google Scholar] [CrossRef]

- Food and Agriculture Organization (FAO). Crop Production Statistics: Grapes. FAOSTAT. 2014. Available online: http://www.fao.org/faostat/en/#data/QCL (accessed on 13 January 2025).

- Kalli, E.; Lappa, I.; Bouchagier, P.; Tarantilis, P.A.; Skotti, E. Novel application and industrial exploitation of winery by-products. Bioresour. Bioprocess. 2018, 5, 46. [Google Scholar] [CrossRef]

- Chowdhary, P.; Gupta, A.; Gnansounou, E.; Pandey, A.; Chaturvedi, P. Current trends and possibilities for exploitation of Grape pomace as a potential source for value addition. Environ. Pollut. 2021, 278, 116796. [Google Scholar] [CrossRef] [PubMed]

- Ferreira, S.; Santos, L. A potential valorization strategy of wine industry by-products and their application in cosmetics—Case study: Grape pomace and grapeseed. Molecules 2022, 27, 969. [Google Scholar] [CrossRef]

- Wang, C.; You, Y.; Huang, W.; Zhan, J. The high-value and sustainable utilization of grape pomace: A review. Food Chem. X 2024, 24, 101845. [Google Scholar] [CrossRef]

- Castro, M.L.; Ferreira, J.P.; Pintado, M.; Ramos, O.L.; Borges, S.; Baptista-Silva, S. Grape by-products in sustainable cosmetics: Nanoencapsulation and market trends. Appl. Sci. 2023, 13, 9168. [Google Scholar] [CrossRef]

- Ganesh, K.; Sridhar, A.; Solaiappan, V. Utilization of fruit and vegetable waste to produce value-added products: Conventional utilization and emerging opportunities. A review. Chemosphere 2021, 287, 132221. [Google Scholar] [CrossRef]

- Andrade, M.A.; Barbosa, C.H.; Shah, M.A.; Ahmad, N.; Vilarinho, F.; Khwaldia, K.; Sanches-Silva, A.; Ramos, F. Citrus by-products: Valuable source of bioactive compounds for food applications. Antioxidants 2022, 12, 38. [Google Scholar] [CrossRef]

- Pacheco, M.T.; Moreno, F.J.; Villamiel, M. Chemical and physicochemical characterization of orange by-products derived from industry. J. Sci. Food Agric. 2019, 99, 868–876. [Google Scholar] [CrossRef]

- Aguiar, J.B.; Martins, A.M.; Almeida, C.; Ribeiro, H.M.; Marto, J. Water sustainability: A waterless life cycle for cosmetic products. Sustain. Prod. Consum. 2022, 32, 35–51. [Google Scholar] [CrossRef]

- Stuchtey, M. Rethinking the Water Cycle. McKinsey & Company. 2015. Available online: http://www.mckinsey.com/business-functions/sustainability/ourinsights/rethinking-the-water-cycle?reload (accessed on 7 February 2025).

- United Nations. The United Nations World Water Development Report 2020: Water and Climate Change. 2020. Available online: https://reliefweb.int/report/world/world-water-development-report-2020-water-and-climate-change?gclid=EAIaIQobChMIz-SNruX1_gIVBP93Ch1q3AxQEAAYAiAAEgI7KfD_BwE (accessed on 14 May 2023).

- US EPA—United States Environmental Protection Agency. Basic Information About Water Reuse. 2024. Available online: https://www.epa.gov/waterreuse/basic-information-about-water-reuse (accessed on 20 January 2025).

- WateReuse. Industrial & Commercial Reuse. 2023. Available online: https://watereuse.org/educate/types-of-reuse/industrial-reuse/ (accessed on 20 January 2025).

- L’Oréal. 2019 Progress Report—Sharing Beauty with All. 2019. Available online: https://www.loreal-finance.com/system/files/2020-06/EN_2019%20L%27Oreal%20Progress%20Report.pdf (accessed on 14 May 2023).

- L’Oréal. Water Report 2021—Managing Water Sustainably. 2021. Available online: https://www.loreal.com/-/media/project/loreal/brand-sites/corp/master/lcorp/documents-media/publications/commitments/2022/water-report-2021.pdf (accessed on 14 May 2023).

- Zhang, L.; Akiyama, T. How to recuperate industrial waste heat beyond time and space. Int. J. Exergy. 2009, 6, 214. [Google Scholar] [CrossRef]

- Stubender, K. Skeleton: Harnessing Kinetic Energy for Efficiency in Industrial Robots. 2024. Available online: https://www.skeletontech.com/skeleton-blog/harnessing-kinetic-energy-for-efficiency-in-industrial-robotics (accessed on 10 January 2023).

- Tayefeh, A.; Aslani, A.; Zahedi, R.; Yousefi, H. Reducing energy consumption in a factory and providing an upgraded energy system to improve energy performance. Clean. Energy Syst. 2024, 8, 100124. [Google Scholar] [CrossRef]

- L’Oréal. L’Oréal Committed to a Low-Carbon Economy. 2015. Available online: https://www.loreal-finance.com/eng/news-event/loreal-committed-low-carbon-economy (accessed on 4 June 2025).

- The Renewable Energy Institute. L’Oréal Achieves 100% Renewable Energy Across Europe. 2024. Available online: https://www.renewableinstitute.org/loreal-achieves-100-renewable-energy-across-europe/ (accessed on 4 June 2025).

- L’Oréal. L’Oréal Opens First 100% Green Energy Plant in Libramont (Belgium). 2009. Available online: https://www.loreal.com/-/media/project/loreal/brand-sites/corp/master/lcorp/press-releases/group/loral-opens-first-100-green-energy-plant-in-libramont-belgium/tt3ntc1214pz-1-553.pdf?rev=af7730be0fc846ebbe4bd8764bbedd46 (accessed on 4 June 2025).

- L’Oréal. Stepping Up the Deployment of Renewable Energy. 2017. Available online: https://www.loreal.com/en/articles/l-oreal-for-the-future/stepping-up-the-deployment-of-renewable-energy/ (accessed on 6 June 2025).

- Ries, C. Transforming Manufacturing: The Potential of ‘Old’ Equipment. 2023. Available online: https://blog.siemens.com/2023/08/transforming-manufacturing-the-potential-of-old-equipment/ (accessed on 19 January 2025).

- Winkler, H. Closed-loop production systems—A sustainable supply chain approach. CIRP J. Manuf. Sci. Tec. 2011, 4, 243–246. [Google Scholar] [CrossRef]

- Oyenuga, A.A.; Bhamidimarri, R. Upcycling ideas for sustainable construction and demolition waste management: Challenges, opportunities and boundaries. Int. J. Innov. Res. Sci. Eng. Technol. 2017, 6, 4066–4079. [Google Scholar]

- Conesa, J.A.; Tomás, E. Production of acoustic insulating materials from viscoelastic mattress waste. Sci 2022, 4, 48. [Google Scholar] [CrossRef]

- US EPA—United States Environmental Protection Agency. Managing, Reusing, and Recycling Used Oil. 2024. Available online: https://www.epa.gov/recycle/managing-reusing-and-recycling-used-oil (accessed on 20 January 2025).

- Greenway Metal Recycling. Turning Trash into Treasure: How Industrial Metal Recycling Helps Reduce Landfill Waste. 2023. Available online: https://greenwaymetalrecycling.com/how-industrial-metal-recycling-helps/ (accessed on 20 January 2025).

- Plastic Pollution Coalition. The Ugly Side of Beauty: The Cosmetics Industry’s Plastic Packaging Problem. 2022. Available online: https://www.plasticpollutioncoalition.org/blog/2022/1/25/the-ugly-side-of-beauty-the-cosmetics-industrys-plastic-packaging-problem (accessed on 20 January 2025).

- European Parliament, Council of the European Union. European Parliament and Council Directive 94/62/EC of 20 December 1994 on Packaging and Packaging Waste. Official Journal of the European Communities. 1994. Available online: https://eur-lex.europa.eu/eli/dir/1994/62/oj/eng (accessed on 10 January 2025).

- Cantelo, S.; Wharton, K. These are the Beauty Brands Working Towards Better Packaging. Beauticate, 2025. Available online: https://www.beauticate.com/how-to/go-green/these-are-the-beauty-brands-working-towards-better-packaging/ (accessed on 30 January 2025).

- L’Oréal. Lanzatech, Total and L’Oréal: The First Cosmetic Plastic Bottle Made from Industrial Carbon Emissions. 2025. Available online: https://www.loreal.com/en/news/group/lanzatech-total-and-loreal/ (accessed on 10 February 2025).

- Cosmetics Europe. Environmental Sustainability: The European Cosmetics Industry’s Contribution 2017–2019. 2019. Available online: https://cosmeticseurope.eu/resources/ (accessed on 14 May 2023).

- Proximus Group. Proximus and L’Oréal Partner up for the Delivery of Telecom and Hair Salon Products by Electric Bicycle. 2019. Available online: https://www.proximus.com/news/2019/proximus-and-loreal-partner-up-for-the-delivery-of-telecom-and-hair-salon-products-by-electric-bicycle.html (accessed on 29 May 2023).

- Ambition4Climate. Delivering L’Oréal Products by Electric Bicycle. 2020. Available online: https://ambition4climate.com/en/delivering-loreal-products-by-electric-bicycle/ (accessed on 29 May 2023).

- Sharma, S.; Maréchal, F. Carbon dioxide capture from internal combustion engine exhaust using temperature swing adsorption. Front. Energy Res. 2019, 7, 143. [Google Scholar] [CrossRef]

- IEA—International Energy Agency. CO2 Capture and Utilization. 2025. Available online: https://www.iea.org/energy-system/carbon-capture-utilisation-and-storage/co2-capture-and-utilisation (accessed on 3 February 2025).

- Shatzman, C. Two Beauty Brands that are Trying to Save the Planet. Forbes, 2018. Available online: https://www.forbes.com/sites/celiashatzman/2018/04/16/two-beauty-brands-that-are-trying-to-save-the-planet/ (accessed on 1 June 2023).

- Head & Shoulders. Ways to Save Water. 2025. Available online: https://headandshoulders.com/en-us/healthy-hair-and-scalp/about-other/ways-to-save-water (accessed on 13 January 2025).

- Culliney, K. L’Oréal Unveils Smart Water Saver Hair Care System at CES 2021: ‘Every Drop of Water is Precious’, Says Exec. Cosmetics Design USA, 20 January 2021. Available online: https://www.cosmeticsdesign.com/Article/2021/01/20/L-Oreal-Water-Saver-launches-at-CES-2021-for-salons-with-at-home-device-launch-set-for-later-date (accessed on 1 June 2023).

- LUSH. Bring It Back: The LUSH Way to Recycle. 2023. Available online: https://www.lush.com/uk/en/a/bring-it-back-our-new-look-recycling-scheme (accessed on 12 May 2023).

- M.A.C. Cosmetics. Back to M.A.C. 2025. Available online: https://www.maccosmetics.com/back-to-mac (accessed on 13 January 2025).

- Meisel, M. MAC Cosmetics Brings Back Improved ‘Back-To-MAC’. Happi, 30 March 2023. Available online: https://www.happi.com/contents/view_breaking-news/2023-03-30/mac-cosmetics-brings-back-new-improved-back-to-mac-takeback-program/2023 (accessed on 13 May 2023).

- O Boticário. Boti Recicla—Programa de Reciclagem. 2023. Available online: https://www.boticario.com.br/boti-recicla/ (accessed on 4 June 2023).

- TerraCycle. Murad Free Recycling Program. 2023. Available online: https://www.terracycle.com/en-US/brigades/murad (accessed on 4 June 2023).

- Jean Bouteille. Single Use Keeps a Low Profile with Mustela: The Brand is Rolling out Bulk in Pharmacies! 2021. Available online: https://jeanbouteille.fr/en/2021/11/18/mustela-se-lance-dans-le-vrac-en-pharmacies/ (accessed on 4 June 2023).

- Cinelli, P.; Coltelli, M.; Signori, F.; Morganti, P.; Lazzeri, A. Cosmetic Packaging to Save the Environment: Future Perspectives. Cosmetics 2019, 6, 26. [Google Scholar] [CrossRef]

- Sadler, J.C.; Wallace, S. Microbial synthesis of vanillin from waste poly(ethylene terephthalate). Green Chem. 2021, 23, 4665–4672. [Google Scholar] [CrossRef]

- Reinsberg, H. 14 Esay Ways to Recycle, Repurpose, and Revive Your Old Makeup. Buzzfeed, 2012. Available online: https://www.buzzfeed.com/hillaryreinsberg/14-easy-ways-to-recyle-repurpose-and-revive-your#.yxZ4jA1r (accessed on 10 February 2025).

- CAS Science Team. Evolving Beauty: The Rise of Sustainable and Natural Ingredients for Cosmetics. 2024. Available online: https://www.cas.org/resources/cas-insights/the-rise-of-natural-ingredients-for-cosmetics (accessed on 6 June 2025).

- Granato, G.; Fischer, A.R.H.; van Trijp, H.C.M. The price of sustainability: How consumers trade-off conventional packaging benefits against sustainability. J. Clean. Prod. 2022, 365, 132739. [Google Scholar] [CrossRef]

- Gutierrez, L. Beauty at What Cost? The Environmental Impact of Cosmetic Ingredients and Materials. Sustainable Earth, 30 March 2023. Available online: https://sustainable-earth.org/cosmetic-ingredients/ (accessed on 6 June 2025).

- Sahu, A. Beauty Reimagined: How the Circular Economy is Transforming Cosmetics. 2025. Available online: https://iprd.evalueserve.com/blog/beauty-reimagined-how-the-circular-economy-is-transforming-cosmetics/ (accessed on 6 June 2025).

- Gomes, S.; Lopes, J.M.; Nogueira, S. Willingness to pay more for green products: A critical challenge for Gen Z. J. Clean. Prod. 2023, 390, 136092. [Google Scholar] [CrossRef]

- Munonye, W.C. Integrating Circular Economy Principles in Business Strategies: A Policy-Driven Approach. Circ. Econ. Sust. 2025. [Google Scholar] [CrossRef]

| Source | Company | Upcycled Ingredient | Properties | Applications |

|---|---|---|---|---|

| Spent coffee grounds | UpCircle Beauty | Coffee oil | Hydrates, nourishes, and repairs the skin barrier | Face and body care |

| Givaudan and Kaffe Bueno | Koffee’Up™ (coffee oil) | Addresses early signs of aging, improves skin hydration, and strengthens the skin barrier against external aggressors | Face care | |

| Coffee bean silverskin | Mibelle Biochemistry | SLVR’Coffee™ | Increases skin hydration and protects the skin from stressors | Active ingredient for skin care cosmetics |

| Coffee cherry | Sanam and Flora Reserve | Naox® Derma | Antioxidant, anti-inflammatory, and anti-aging properties | Active ingredient for skin care products |

| Byproducts of olive oil industry | Circumference | Extracts of olive leaves | Skin regenerative effects | Facial cleansing products |

| Roelmi-HPC | Olifeel® E-NAT W/O | Pleasant skin-feel, protects skin from water loss and environmental stress | Emulsifier for the formulation of W/O emulsions | |

| Grape pomace | Caudalie | Resveratrol | Anti-aging, anti-wrinkle, and firming properties | Face care |

| Bilberry seed | Givaudan | Omegablue® | Hydration and skin barrier restoration | Face and body care |

| Pai Skincare | Billberry seed extract | Strengthens the skin barrier and soothes the skin | Face care | |

| Downgraded avocados | Laboratoires Expanscience | Number 6 (avocado polyphenols concentrate) | Reduces dark circles and depuffs under-eye bags | Solid bar for eye contour |

| Damaged or misshapen bananas (yellow, pink, and green bananas) | Kadalys | Yellow banana bioactive | Addresses early signs of aging, enhancing lifting, firming, and regenerating properties | Face, body and hair care |

| Pink banana bioactive | Boosts the skin’s radiance and promotes a more unified complexion | |||

| Green banana bioactive | Purifies and balances, improving skin texture | |||

| Tomato | Byroe’s | Three different types of upcycled tomatoes | Anti-aging, improves deep wrinkles, firmness, and sagging | Face serum |

| Plum kernel | Le Prunier | Plum oil | Plumps, hydrates, and brightens the skin | Face, body, and hair care |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Martins, A.M.; Silva, A.T.; Marto, J.M. Advancing Cosmetic Sustainability: Upcycling for a Circular Product Life Cycle. Sustainability 2025, 17, 5738. https://doi.org/10.3390/su17135738

Martins AM, Silva AT, Marto JM. Advancing Cosmetic Sustainability: Upcycling for a Circular Product Life Cycle. Sustainability. 2025; 17(13):5738. https://doi.org/10.3390/su17135738

Chicago/Turabian StyleMartins, Ana M., Ana T. Silva, and Joana M. Marto. 2025. "Advancing Cosmetic Sustainability: Upcycling for a Circular Product Life Cycle" Sustainability 17, no. 13: 5738. https://doi.org/10.3390/su17135738

APA StyleMartins, A. M., Silva, A. T., & Marto, J. M. (2025). Advancing Cosmetic Sustainability: Upcycling for a Circular Product Life Cycle. Sustainability, 17(13), 5738. https://doi.org/10.3390/su17135738