The Impact of Green Finance and Financial Globalization on Environmental Sustainability: Empirical Evidence from Türkiye

Abstract

1. Introduction

2. Green Finance: Conceptual Framework

3. Green Finance Applications in Türkiye

4. Econometric Analysis on Türkiye

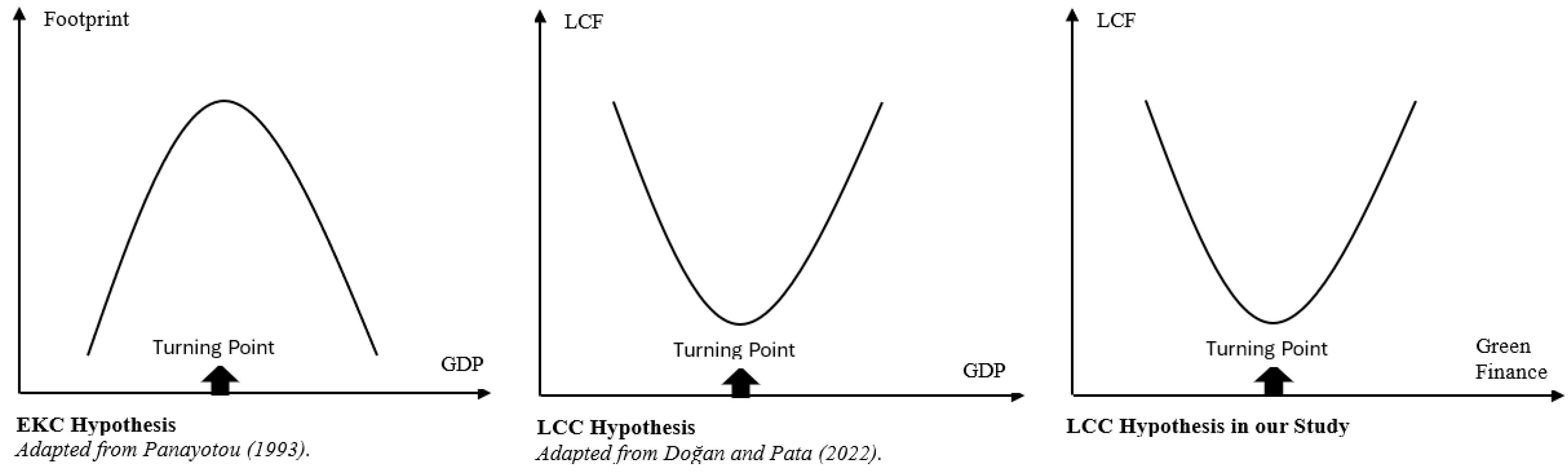

4.1. Theoretical and Empirical Literature

4.2. Theoretical Justification of the Model

4.3. Data

4.4. Model Specification

- L denotes the natural logarithmic transformation of the variables;

- LLCF is the logarithm of the LCF, representing environmental sustainability;

- LYEF is the logarithm of YEF (green finance);

- LYEF2 is the squared term of green finance, included to capture potential non-linear (U-shaped) effects;

- LKOFFI is the logarithm of the KOF Financial Globalization Index;

- μt is the error term.

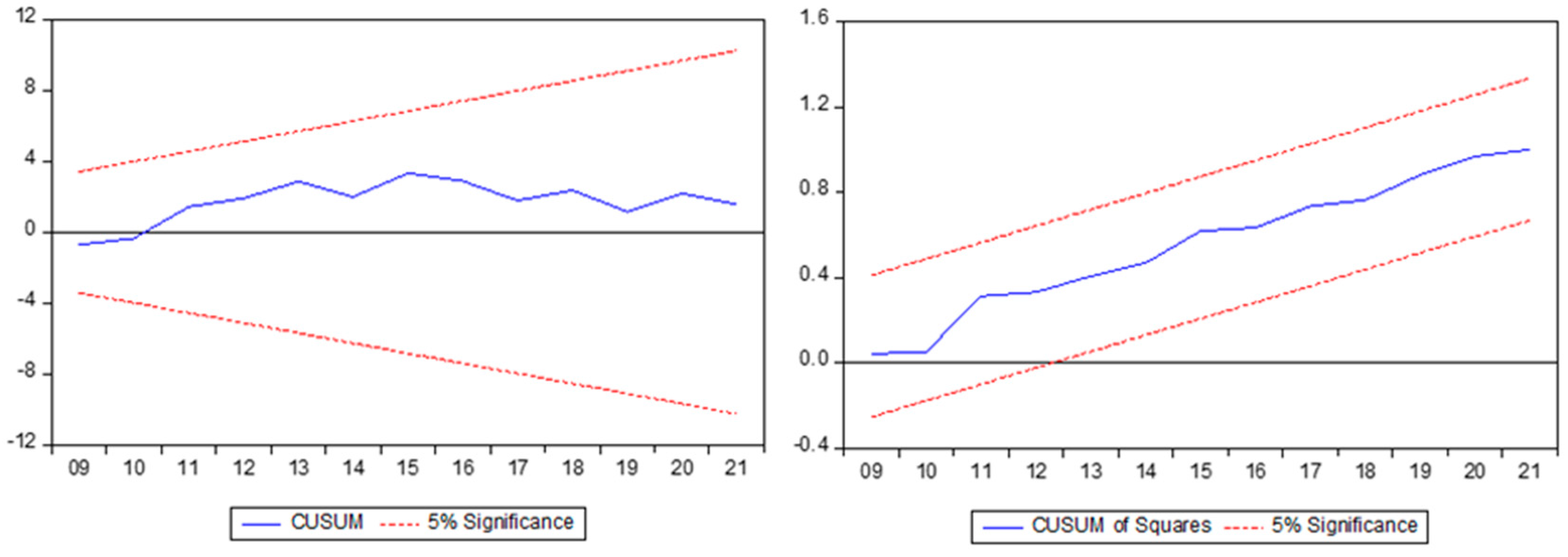

4.5. Methodology

- Δ refers to the first-difference operator;

- p, m, n, and r represent the optimal lag lengths;

- μt denotes the error term.

- FMOLS (Fully Modified OLS): adjusts for endogeneity and serial correlation, yielding unbiased long-run parameter estimates.

- DOLS (Dynamic OLS): incorporates leads and lags of differenced regressors, thereby correcting for simultaneity bias.

- CCR (Canonical Cointegrating Regression): minimizes bias and standard errors through adjustments for long-run endogeneity.

4.6. Empirical Results

5. Discussion and Comparative Analysis

5.1. Comparative Analysis of Empirical Findings

5.2. Green Finance, Adaptive Capacity, and Sustainability in Developing Economies

5.3. Role of ODA in Sustainable Development Transitions

5.4. Türkiye-Specific Policy Implications

5.5. Summary of Findings and Theoretical Contributions

6. Conclusions and Evaluation

- (i)

- Financial globalization policies should be accompanied by green finance strategies to enhance environmental carrying capacity.

- (ii)

- Climate-related ODA flows should prioritize investments that simultaneously promote structural economic transformation and ecological regeneration.

- (iii)

- National development plans should integrate green finance mechanisms with sustainable development strategies to maximize the environmental benefits of globalization.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ye, X.; Rasoulinezhad, E. Assessment of Impacts of Green Bonds on Renewable Energy Utilization Efficiency. Renew. Energy 2023, 202, 626–633. [Google Scholar] [CrossRef]

- Vohra, K.; Vodonos, A.; Schwartz, J.; Marais, E.A.; Sulprizio, M.P.; Mickley, L.J. Global Mortality from Outdoor Fine Particle Pollution Generated by Fossil Fuel Combustion: Results from GEOS-Chem. Environ. Res. 2021, 195, 110754. [Google Scholar] [CrossRef] [PubMed]

- United Nations Environment Programme (UNEP). Global Resources Outlook 2024: Pathways to Sustainable Resource Use. 2024. Available online: https://www.resourcepanel.org/reports/global-resources-outlook-2024 (accessed on 15 November 2024).

- Bhutta, U.S.; Tariq, A.; Farrukh, M.; Raza, A.; Iqbal, M.K. Green Bonds for Sustainable Development: Review of Literature on Development and Impact of Green Bonds. Technol. Forecast. Soc. Change 2022, 175, 121378. [Google Scholar] [CrossRef]

- Weitzman, J.; Filgueira, R. The Evolution and Application of Carrying Capacity in Aquaculture: Towards a Research Agenda. Rev. Aquac. 2020, 12, 1297–1322. [Google Scholar] [CrossRef]

- Galli, A.; Iha, K.; Moreno Pires, S.; Mancini, M.S.; Alves, A.; Zokai, G.; Lin, D.; Murthy, A.; Wackernagel, M. Assessing the Ecological Footprint and Biocapacity of Portuguese Cities: Critical Results for Environmental Awareness and Local Management. Cities 2020, 96, 102442. [Google Scholar] [CrossRef]

- Narter & Partners Yeşil Finansmanın Tarihçesi 2022. Available online: https://www.narterlaw.com/yesil-finansmanin-tarihcesi/ (accessed on 10 November 2024).

- Rasoulinezhad, E.; Taghizadeh-Hesary, F. Role of Green Finance in Improving Energy Efficiency and Renewable Energy Development. Energy Effic. 2022, 15, 14. [Google Scholar] [CrossRef]

- Jain, K.; Gangopadhyay, M.; Mukhopadhyay, K. Prospects and Challenges of Green Bonds in Renewable Energy Sector: Case of Selected Asian Economies. J. Sustain. Financ. Invest. 2024, 14, 708–731. [Google Scholar] [CrossRef]

- BloombergNEF. Renewable Energy Investment Tracker 2024; Bloomberg Finance L.P: New York, NY, USA, 2024; Available online: https://about.bnef.com/insights/finance/energy-transition-investment-trends/ (accessed on 12 November 2024).

- International Renewable Energy Agency (IRENA). Renewable Capacity Statistics 2023; IRENA: New York, NY, USA, 2023; Available online: https://www.irena.org/Statistics/View-Data-by-Topic/Capacity-and-Generation/Technologies (accessed on 8 October 2024).

- BloombergNEF. Power Transition Trends 2024; Bloomberg Finance L.P: New York, NY, USA, 2024; Available online: https://about.bnef.com/insights/finance/energy-transition-investment-trends/ (accessed on 12 November 2024).

- International Renewable Energy Agency (IRENA). World Energy Transitions Outlook 2023: 1.5 °C Pathway; IRENA 2023b: Medinat Masdar, United Arab Emirates, 2023; Available online: https://www.irena.org/publications/2023/Jun/World-Energy-Transitions-Outlook-2023 (accessed on 9 November 2024).

- International Monetary Fund (IMF). Fiscal Monitor: Climate Crossroads: Fiscal Policies in a Warming World; International Monetary Fund: Washington, DC, USA, 2023; Available online: https://www.imf.org/en/Publications/FM/Issues/2023/10/10/fiscal-monitor-october-2023 (accessed on 4 January 2025).

- Li, T.; Yue, X.-G.; Qin, M.; Norena-Chavez, D. Towards Paris Climate Agreement Goals: The Essential Role of Green Finance and Green Technology. Energy Econ. 2024, 129, 107273. [Google Scholar] [CrossRef]

- Ulfah, I.F.; Sukmana, R.; Laila, N.; Sulaeman, S. A Structured Literature Review on Green Sukuk (Islamic Bonds): Implications for Government Policy and Future Studies. JIABR 2024, 15, 1118–1133. [Google Scholar] [CrossRef]

- Lee, C.-C.; Wang, F.; Lou, R.; Wang, K. How Does Green Finance Drive the Decarbonization of the Economy? Empirical Evidence from China. Renew. Energy 2023, 204, 671–684. [Google Scholar] [CrossRef]

- Tolliver, C.; Keeley, A.R.; Managi, S. Drivers of Green Bond Market Growth: The Importance of Nationally Determined Contributions to the Paris Agreement and Implications for Sustainability. J. Clean. Prod. 2020, 244, 118643. [Google Scholar] [CrossRef]

- Chen, J.M.; Umair, M.; Hu, J. Green Finance and Renewable Energy Growth in Developing Nations: A GMM Analysis. Heliyon 2024, 10, e33879. [Google Scholar] [CrossRef] [PubMed]

- Zheng, G.-W.; Siddik, A.B.; Masukujjaman, M.; Fatema, N. Factors Affecting the Sustainability Performance of Financial Institutions in Bangladesh: The Role of Green Finance. Sustainability 2021, 13, 10165. [Google Scholar] [CrossRef]

- Ren, X.; Shao, Q.; Zhong, R. Nexus between Green Finance, Non-Fossil Energy Use, and Carbon Intensity: Empirical Evidence from China Based on a Vector Error Correction Model. J. Clean. Prod. 2020, 277, 122844. [Google Scholar] [CrossRef]

- Xu, X.; Li, J. Asymmetric Impacts of the Policy and Development of Green Credit on the Debt Financing Cost and Maturity of Different Types of Enterprises in China. J. Clean. Prod. 2020, 264, 121574. [Google Scholar] [CrossRef]

- Gilchrist, D.; Yu, J.; Zhong, R. The Limits of Green Finance: A Survey of Literature in the Context of Green Bonds and Green Loans. Sustainability 2021, 13, 478. [Google Scholar] [CrossRef]

- Organisation for Economic Co-Operation and Development (OECD). Development Finance for Climate and Environment. 2024. Available online: https://www.oecd.org/en/topics/sub-issues/development-finance-for-climate-and-the-environment.html (accessed on 21 October 2024).

- World Bank Emerging Market Green Bonds: IFC–Amundi Joint Report. 2024. Available online: https://documents1.worldbank.org/curated/en/099734005282477873/pdf/IDU1f7d580db1e4541458918c591cb45dd4f3eb9.pdf (accessed on 26 October 2024).

- Gabr, D.H.; Elbannan, M.A. Green Finance Insights: Evolution of the Green Bonds Market. MSAR 2024, 3, 274–297. [Google Scholar] [CrossRef]

- International Capital Market Association (ICMA). Green Bond Principles: Voluntary Process Guidelines for Issuing Green Bonds (With June 2022 Appendix 1). 2021. Available online: https://www.icmagroup.org/assets/documents/sustainable-finance/2022-updates/green-bond-principles_june-2022-280622.pdf (accessed on 25 January 2025).

- Türkiye İstatistik Kurumu (TÜİK). Sera Gazı Emisyon İstatistikleri, 1990–2022. 2024. Available online: https://data.tuik.gov.tr/Bulten/Index?p=Sera-Gazi-Emisyon-Istatistikleri-1990-2023-53974 (accessed on 20 December 2024).

- Dinçel, G. Yeşil Yeni Düzen Bağlamında Türkiye’de Enerji Dönüşümünün Finansmanı; SHURA Enerji Dönüşümü Merkezi: Karaköy, Türkiye, 2022; Available online: https://shura.org.tr/wp-content/uploads/2022/06/ANA_Rapor-1.pdf (accessed on 14 October 2024).

- Bağ Güllü, A.; Aksoy, H.; Serhadlıoğlu, S.; Taranto, Y.; Çalışkan, R.Y.; De Vita, A.; Karakousis, V.; Rogner, M.; Godron, P.; Dinçel, V.G. Net Sıfır 2053: Türkiye Elektrik Sektörü Için Yol Haritası; SHURA Enerji Dönüşümü Merkezi: Karaköy, Türkiye, 2023; Available online: https://shura.org.tr/wp-content/uploads/2023/05/SHURA-2023-02-Rapor-Net-Sifir-2053_04052023.pdf (accessed on 8 December 2024).

- i-SPK 128.18, 10/296; Guidelines on Green Debt Instruments, Sustainable Debt Instruments, Green Lease Certificates and Sustainable Lease Certificates. Sermaye Piyasası Kurulu (SPK): Dumlupınar Bulvarı, Türkiye, 2022.

- Resmi Gazete. 12. Kalkınma Planı (2024–2028). Vol. (Karar No. 1396). (32356, Mükerrer). 2023. Available online: https://www.resmigazete.gov.tr/eskiler/2023/11/20231101M1-1-1.pdf (accessed on 16 November 2024).

- Oluç, İ.; Güzel, İ. Finansal Küreselleşme ve Çevre İlişkisi: Türkiye Örneği. Pamukkale Univ. J. Soc. Sci. Inst. 2022, 50, 127–143. [Google Scholar] [CrossRef]

- TurSEFF. Türkiye Sürdürülebilir Enerji Finansman Programı (TurSEFF). European Bank for Reconstruction and Development. 2024. Available online: https://www.turseff.org/assets/frontend/uploads/c5fddac3f13a5c9dc8b3bc3dea6b628e.pdf (accessed on 20 November 2024).

- Ritchie, H.; Roser, M.; Rosado, P. Renewable Energy. Our World Data, 2024; published online. [Google Scholar]

- Turguttopbaş, N. Sürdürülebilirlik, Yeşil Finans ve İlk Türk Yeşil Tahvil İhracı. Finans. Araştırmalar Ve Çalışmalar Derg. 2020, 12, 267–283. [Google Scholar] [CrossRef]

- Esma Karabulut. Sürdürülebilir Kalkınmada Yeşil Sukukun Türkiye’deki Önemi ve Politika Önerileri; İkam Araştırma Raporları. 2024. Available online: https://ikam.org.tr/images/yesil_sukuk/ikam_arastirma_raporu.pdf (accessed on 6 October 2024).

- Kuznets, S. Economic Growth and Income Inequality. Am. Econ. Rev. 1955, 45, 1–28. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Economic Growth and the Environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Grossman, G.; Krueger, A. Environmental Impacts of a North American Free Trade Agreement; National Bureau of Economic Research: Cambridge, MA, USA, 1991; p. w3914. [Google Scholar]

- Panayotou, T. Empirical Tests and Policy Analysis of Environmental Degradation at Different Stages of Economic Development; ILO Working Papers; International Labour Organization: Genève, Switzerland, 1993. [Google Scholar]

- Pata, U.K. Renewable and Non-Renewable Energy Consumption, Economic Complexity, CO2 Emissions, and Ecological Footprint in the USA: Testing the EKC Hypothesis with a Structural Break. Env. Sci. Pollut. Res. 2021, 28, 846–861. [Google Scholar] [CrossRef] [PubMed]

- Balsalobre-Lorente, D.; Ibáñez-Luzón, L.; Usman, M.; Shahbaz, M. The Environmental Kuznets Curve, Based on the Economic Complexity, and the Pollution Haven Hypothesis in PIIGS Countries. Renew. Energy 2022, 185, 1441–1455. [Google Scholar] [CrossRef]

- Sethi, L.; Behera, B.; Sethi, N. Do Green Finance, Green Technology Innovation, and Institutional Quality Help Achieve Environmental Sustainability? Evidence from the Developing Economies. Sustain. Dev. 2024, 32, 2709–2723. [Google Scholar] [CrossRef]

- Vardar, G.; Aydoğan, B.; Gürel, B. Investigating the Ecological Footprint and Green Finance: Evidence from Emerging Economies. JEAS, 2023; ahead of print. [Google Scholar] [CrossRef]

- Li, N.; Shi, B.; Wu, L.; Kang, R.; Gao, Q. Climate-Related Development Finance, Energy Structure Transformation and Carbon Emissions Reduction: An Analysis from the Perspective of Developing Countries. Front. Environ. Sci. 2022, 9, 778254. [Google Scholar] [CrossRef]

- Carfora, A.; Scandurra, G. The Impact of Climate Funds on Economic Growth and Their Role in Substituting Fossil Energy Sources. Energy Policy 2019, 129, 182–192. [Google Scholar] [CrossRef]

- Mumuni, S.; Hamadjoda Lefe, Y.D. Greening the Environment: Do Climate-Related Development Finances and Renewable Energy Consumption Matter? An African Tale. Carbon. Manag. 2023, 14, 2251934. [Google Scholar] [CrossRef]

- Wu, X.; Pan, A.; She, Q. Direct and Indirect Effects of Climate Aid on Carbon Emissions in Recipient Countries. J. Clean. Prod. 2021, 290, 125204. [Google Scholar] [CrossRef]

- Chin, M.-Y.; Ong, S.-L.; Ooi, D.B.-Y.; Puah, C.-H. The Impact of Green Finance on Environmental Degradation in BRI Region. Env. Dev. Sustain. 2022, 26, 303–318. [Google Scholar] [CrossRef]

- Jahanger, A.; Balsalobre-Lorente, D.; Ali, M.; Samour, A.; Abbas, S.; Tursoy, T.; Joof, F. Going Away or Going Green in ASEAN Countries: Testing the Impact of Green Financing and Energy on Environmental Sustainability. Energy Environ. 2024, 35, 3759–3784. [Google Scholar] [CrossRef]

- Siche, R.; Pereira, L.; Agostinho, F.; Ortega, E. Convergence of Ecological Footprint and Emergy Analysis as a Sustainability Indicator of Countries: Peru as Case Study. Commun. Nonlinear Sci. Numer. Simul. 2010, 15, 3182–3192. [Google Scholar] [CrossRef]

- Pata, U.K. Do Renewable Energy and Health Expenditures Improve Load Capacity Factor in the USA and Japan? A New Approach to Environmental Issues. Eur. J. Health Econ. 2021, 22, 1427–1439. [Google Scholar] [CrossRef]

- Dogan, A.; Pata, U.K. The Role of ICT, R&D Spending and Renewable Energy Consumption on Environmental Quality: Testing the LCC Hypothesis for G7 Countries. J. Clean. Prod. 2022, 380, 135038. [Google Scholar] [CrossRef]

- Pata, U.K.; Ertugrul, H.M. Do the Kyoto Protocol, Geopolitical Risks, Human Capital and Natural Resources Affect the Sustainability Limit? A New Environmental Approach Based on the LCC Hypothesis. Resour. Policy 2023, 81, 103352. [Google Scholar] [CrossRef]

- Erdogan, S. Linking Natural Resources and Environmental Sustainability: A Panel Data Approach Based on the Load Capacity Curve Hypothesis. Sustain. Dev. 2024, 32, 3182–3194. [Google Scholar] [CrossRef]

- Yurtkuran, S.; Güneysu, Y. Financial Inclusion and Environmental Pollution in Türkiye: Fresh Evidence from Load Capacity Curve Using AARDL Method. Env. Sci. Pollut. Res. 2023, 30, 104450–104463. [Google Scholar] [CrossRef]

- Güneysu, Y. Türkiye’de Finansal Gelişme, Küreselleşme ve Sanayileşmenin Yük Kapasite Faktörü Üzerindeki Etkisi. Gümüşhane Üniversitesi Sos. Bilim. Derg. 2023, 14, 934–946. [Google Scholar]

- Dai, J.; Ahmed, Z.; Alvarado, R.; Ahmad, M. Assessing the Nexus between Human Capital, Green Energy, and Load Capacity Factor: Policymaking for Achieving Sustainable Development Goals. Gondwana Res. 2024, 129, 452–464. [Google Scholar] [CrossRef]

- Ximei, K.; Javaid, M.Q.; Shams, T.; Sibt-e-Ali, M. Information and Communication Technology, Economic Globalization, and Environmental Sustainability in APEC Nations: Insights from LCC and EKC Hypotheses Testing. Sustain. Dev. 2025, 33, 878–903. [Google Scholar] [CrossRef]

- Pata, U.K.; Madureira, L.; Fareed, Z. Investigating the LCC Hypothesis for Portugal: The Role of Renewable Energy and Energy Related R&D Technologies. Int. J. Environ. Sci. Technol. 2024, 21, 10145–10154. [Google Scholar] [CrossRef]

- Ulussever, T.; Kartal, M.T.; Pata, U.K. Environmental Role of Technology, Income, Globalization, and Political Stability: Testing the LCC Hypothesis for the GCC Countries. J. Clean. Prod. 2024, 451, 142056. [Google Scholar] [CrossRef]

- Hashmi, N.I.; Alam, N.; Jahanger, A.; Yasin, I.; Murshed, M.; Khudoykulov, K. Can Financial Globalization and Good Governance Help Turning Emerging Economies Carbon Neutral? Evidence from Members of the BRICS-T. Env. Sci. Pollut. Res. 2023, 30, 39826–39841. [Google Scholar] [CrossRef]

- Chen, T.; Gozgor, G.; Koo, C.K.; Lau, C.K.M. Does International Cooperation Affect CO2 Emissions? Evidence from OECD Countries. Env. Sci. Pollut. Res. 2020, 27, 8548–8556. [Google Scholar] [CrossRef]

- Behera, B.; Behera, P.; Sethi, N. Decoupling the Role of Renewable Energy, Green Finance and Political Stability in Achieving the Sustainable Development Goal 13: Empirical Insight from Emerging Economies. Sustain. Dev. 2024, 32, 119–137. [Google Scholar] [CrossRef]

- Boujedra, F.; Ben Jebli, M.; Aloui, A. The Effect of Public Funding and Government Effectiveness on CO2 Emissions in Developing Countries: Evidence from Panel Quantile Analysis. Nat. Resour. Forum 2024. [Google Scholar] [CrossRef]

- Uzar, U.; Eyuboglu, K. Does Income Inequality Increase the Ecological Footprint in the US: Evidence from FARDL Test? Env. Sci. Pollut. Res. 2022, 30, 9514–9529. [Google Scholar] [CrossRef]

- Aslam, B.; Zhang, G.; Amjad, M.A.; Guo, S.; Guo, R.; Soomro, A. Towards Sustainable Initiatives: Evidence from Green Finance Mitigating Ecological Footprint in East Asia and Pacific Nations. Energy Environ. 2024; published online. [Google Scholar] [CrossRef]

- Aquilas, N.A.; Atemnkeng, J.T. Climate-Related Development Finance and Renewable Energy Consumption in Greenhouse Gas Emissions Reduction in the Congo Basin. Energy Strategy Rev. 2022, 44, 100971. [Google Scholar] [CrossRef]

- Dreher, A. Does Globalization Affect Growth? Evidence from a New Index of Globalization. Appl. Econ. 2006, 38, 1091–1110. [Google Scholar] [CrossRef]

- Rodrik, D. Why Is There Multilateral Lending? National Bureau of Economic Research: Cambridge, MA, USA, 1995; p. w5160. [Google Scholar]

- Global Footprint Network (GFN). Ecological Footprint and Biocapacity Data 2024. Available online: https://data.footprintnetwork.org/#/ (accessed on 21 October 2024).

- KOF. Swiss Economic Institute KOF Globalization Index 2024. Available online: https://kof.ethz.ch/en/forecasts-and-indicators/indicators/kof-globalisation-index.html (accessed on 21 October 2024).

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds Testing Approaches to the Analysis of Level Relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Narayan, P.K. The Saving and Investment Nexus for China: Evidence from Cointegration Tests. Appl. Econ. 2005, 37, 1979–1990. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica 1981, 49, 1057. [Google Scholar] [CrossRef]

- Phillips, P.C.B.; Perron, P. Testing for a Unit Root in Time Series Regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Tang, C.F. Multivariate Granger Causality and the Dynamic Relationship between Health Care Spending, Income, and the Relative Price of Health Care in Malaysia. Hitotsubashi J. Econ. 2011, 52, 199–214. [Google Scholar]

- Narayan, P.; Smyth, R. Trade Liberalization and Economic Growth in Fiji. An Empirical Assessment Using the ARDL Approach. J. Asia Pac. Econ. 2005, 10, 96–115. [Google Scholar] [CrossRef]

- Lee, C.-C.; Xuan, C.; Wang, F.; Wang, K. Path Analysis of Green Finance on Energy Transition under Climate Change. Energy Econ. 2024, 139, 107891. [Google Scholar] [CrossRef]

- Rauniyar, S.K.; Shiiba, N.; Yamasaki, L.; Tomoi, H.; Tomoi, H.; West, M.K.; Watanabe, A.; Nomura, S. Climate-Related Bilateral Official Development Assistance (ODA) and Vulnerability: A Comparative Study of Allocation and Effectiveness. PLOS Clim. 2025, 4, e0000382. [Google Scholar] [CrossRef]

- Wang, Q.; Guo, J.; Li, R. Official Development Assistance and Carbon Emissions of Recipient Countries: A Dynamic Panel Threshold Analysis for Low- and Lower-Middle-Income Countries. Sustain. Prod. Consum. 2022, 29, 158–170. [Google Scholar] [CrossRef]

- Horrocks, P.; Marshall, C.; Thomas, C.; Venon, T.; Portmann, D.; Okuwobi, W. Unlocking Local Currency Financing in Emerging Markets and Developing Economies: What Role Can Donors, Development Finance Institutions and Multilateral Development Banks Play? 117th ed.; OECD Development Co-operation Working Papers; OECD Publishing: Paris, France, 2025. [Google Scholar]

| Variable | Symbol | Unit of Measurement | Source |

|---|---|---|---|

| Load Capacity Factor | LCF | Biocapacity/Ecological Footprint | (GFN) [72] |

| Green Finance | YEF | USD | (OECD) [24] |

| Financial Globalization | KOFFI | Index | (KOF) [73] |

| LLCF | LYEF | LYEF2 | LKOFFI | |

|---|---|---|---|---|

| Mean | −0.665465 | 12.95199 | 171.1936 | 3.910349 |

| Median | −0.713350 | 13.52779 | 183.0010 | 3.951244 |

| Maximum | −0.342490 | 15.00823 | 225.2470 | 4.043051 |

| Minimum | −0.820981 | 9.375974 | 87.90890 | 3.688879 |

| Std. Dev. | 0.140308 | 1.900364 | 46.91482 | 0.108421 |

| Skewness | 0.792981 | −0.681865 | −0.528574 | −0.593261 |

| Kurtosis | 2.519846 | 2.151365 | 1.940870 | 2.153453 |

| Jarque–Bera | 2.402594 | 2.257447 | 1.959405 | 1.858915 |

| Probability | 0.300804 | 0.323446 | 0.375423 | 0.394768 |

| Variables | Level | First Difference | ||

|---|---|---|---|---|

| ADF | PP | ADF | PP | |

| LLCF | −2.350 | −3.080 | −5.729 | −7.487 |

| (0.390) | (0.137) | (0.001) | (0.000) | |

| LYEF | −1.844 | −1.686 | −5.805 | −9.860 |

| (0.644) | (0.719) | (0.000) | (0.000) | |

| LYEF2 | −2.105 | −2.003 | −6.084 | −10.573 |

| (0.512) | (0.564) | (0.000) | (0.000) | |

| LKOFFI | −1.999 | −2.369 | −4.550 | −11.445 |

| (0.566) | (0.382) | (0.009) | (0.000) | |

| Model LLCF = (LYEF, LYEF2, LKOFFI) | ||||

| Bound Test Null Hypothesis = No Cointegration | ||||

| Narayan (2005) [75] | k | F ist. | I(0) * | I(1) * |

| 3 | 6.50 | 5.33 | 7.06 | |

| Pesaran, Shin, and Smith (2001) [74] | t ist. | I(0) * | I(I) * | |

| −4.79 | −3.43 | −4.37 | ||

| Diagnostic Tests | ||||

| F-stat. | p-value | |||

| Diagnostic Tests (Ramsey RESET) | 0.316 | 0.584 | ||

| Normality (Jarque–Bera) | 0.353 | 0.837 | ||

| Autocorrelation (Breusch–Godfrey LM) | 2.749 | 0.107 | ||

| Heteroskedasticity (Breusch–Pagan–Godfrey) | 0.078 | 0.997 | ||

| Dependent Variable LLCF | |||

|---|---|---|---|

| Variables | Coefficient | Std. Error | p-Value |

| Long-Run | |||

| LYEF | −0.291910 | 0.091447 | 0.0071 * |

| LYEF2 | 0.008750 | 0.003584 | 0.0297 ** |

| LKOFFI | 0.183575 | 0.103700 | 0.1001 |

| Short-Run | |||

| D (LYEF) | −0.246194 | 0.040345 | 0.0000 * |

| D (LKOFFI) | 0.387718 | 0.087318 | 0.0007 * |

| HDM (−1) | −0.967919 | 0.170992 | 0.0001 * |

| Dependent Variable LLCF | |||

|---|---|---|---|

| Method/Variables | Coefficient | Std. Error | p-Value |

| FMOLS | |||

| LYEF | −0.266962 | 0.076411 | 0.0030 * |

| LYEF2 | 0.007716 | 0.002992 | 0.0202 ** |

| LKOFFI | 0.182151 | 0.091159 | 0.0630 *** |

| DOLS | |||

| LYEF | −0.492838 | 0.080874 | 0.0002 * |

| LYEF2 | 0.016744 | 0.003159 | 0.0005 * |

| LKOFFI | 0.339108 | 0.091746 | 0.0049 * |

| CCR | |||

| LYEF | −0.251871 | 0.062632 | 0.0010 * |

| LYEF2 | 0.007170 | 0.002552 | 0.0126 ** |

| LKOFFI | 0.162838 | 0.074500 | 0.0440 ** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yardımcı, P.; Oskay, C. The Impact of Green Finance and Financial Globalization on Environmental Sustainability: Empirical Evidence from Türkiye. Sustainability 2025, 17, 5696. https://doi.org/10.3390/su17135696

Yardımcı P, Oskay C. The Impact of Green Finance and Financial Globalization on Environmental Sustainability: Empirical Evidence from Türkiye. Sustainability. 2025; 17(13):5696. https://doi.org/10.3390/su17135696

Chicago/Turabian StyleYardımcı, Pınar, and Cansel Oskay. 2025. "The Impact of Green Finance and Financial Globalization on Environmental Sustainability: Empirical Evidence from Türkiye" Sustainability 17, no. 13: 5696. https://doi.org/10.3390/su17135696

APA StyleYardımcı, P., & Oskay, C. (2025). The Impact of Green Finance and Financial Globalization on Environmental Sustainability: Empirical Evidence from Türkiye. Sustainability, 17(13), 5696. https://doi.org/10.3390/su17135696