1. Introduction

The concept of sustainable development was formally recognized by international organizations more than three decades ago [

1], although it has gained substantial relevance only in recent years [

2]. Within this context, the building industry has been broadly identified as a major consumer of resources and a significant generator of waste and emissions [

3]. However, research efforts in sustainability, as well as public policies related to the real estate sector and Green Public Procurement—including construction and building operations—have predominantly focused on reducing the operational energy consumption of assets [

3], resulting in corresponding reductions in their carbon footprint while largely overlooking other key sustainability issues.

The global health and economic crisis triggered by the Coronavirus disease 2019 (COVID-19) led public organizations worldwide to establish immediate priorities, primarily focused on addressing critical social and economic impacts [

4], while also attempting to preserve the environmental benefits that emerged during the pandemic [

5]. Concurrently, initiatives from the European Commission, such as the development of conceptual frameworks to regulate the sustainability of economic activities through the EU Taxonomy [

6] and the establishment of criteria for sustainable buildings throughout the Level(s) Framework [

7], have driven changes in management models and decision-making processes across both public and private sectors. These shifts have also been formalized through new regulatory requirements in the EU 27 + UK, including regulations and delegate acts linked to the Green Public Procurement Guidelines [

8] and the directives and regulations affecting the building industry, playing a major role in the fields of environmental, social, and economic sustainability [

9].

From the previously outlined perspective, the efficient management of limited resources, including financial resources, for the achievement of diverse objectives is intrinsically connected to the principles of circular economy and sustainable development. As a pertinent example in this context, the successful implementation of energy efficiency regulations in several Western countries may have been facilitated by the anticipated reductions in operation and maintenance costs projected by public authorities. This, in turn, has led to the development of new methods for assessing public investment over the life cycle, with life-cycle cost assessment emerging as an initial approach [

10,

11,

12]. Nowadays, these efforts are further enhanced with the implementation of the “adaptative reuse” of buildings as a common practice to reduce the obsolescence of the building stock, improving the material circularity of the built environment and the cost-effective consumption of resources.

Regarding the later joint political action of EU member states in the field of life-cycle cost assessment (LCC), various projects and research initiatives were undertaken at the beginning of the 21st century aimed at developing probabilistic methods to support the prediction of life-cycle costs and the performance of buildings and civil infrastructure. Among these initiatives, EuroLifeForm stood out by introducing not only probabilistic life-cycle cost models but also deterioration models, decision support applications, and a basic framework for environmental impact analysis [

13]. Additional studies conducted within the EU, such as those developed by the European Commission’s Task Group 4 (2003), contributed to a clearer understanding of the impact of technical decisions on the life cycle of buildings and the urban environment [

14]. As a result of these efforts, unified initiatives were promoted to develop common methodologies, with limited success so far. At the outset of the 21st century, the building stock was characterized by operational costs accounting for approximately 70% of total life-cycle costs in a context still lacking a standardized methodology to guide public organizations toward sustainable construction practices [

15]. These and other trends related to the assessment of the environmental impact of human activity led to the continuous and increasingly prominent development of life-cycle assessment methodologies in Western countries, as is shown later in this study.

Life-Cycle Assessment as Decision-Making Tool: Costs, Intangible Values, and Externalities

Life-cycle assessment (LCA) and life-cycle cost assessment (LCC) are the most known methodologies for sustainability assessment now. The application of the LCA is limited to the performance evaluation or environmental sustainability of an activity or product, while that of the LCC is limited to the performance, efficiency, or economic sustainability of said product of human action. The development of these two complex tools has been carried out mainly in a theoretical framework, with significant difficulties for its comparison by the diversity of methodologies [

16] and scopes in their application [

17]. This is due to significant limitations that include the difficulty of understanding the used indicators, which can often be contradicted due to their independence, and the inexistence of a common unit of measure [

18]. Additionally, oversimplification to economic unit in LCC [

19] might lead to biases, like being able to bear with the costs allows compensation for the loss of environmental quality of the projects [

20]. However, while this matter is still a problem in decision-making processes, new studies claim the relevance of economic compensation after environmental quality has already been achieved [

21].

Other related tools are also employed, such as cost–benefit assessment (CBA), which seeks to link costs with both tangible (monetary) and intangible benefits [

22], although terminological confusion regarding the methodologies and their scopes is frequent. This type of assessment focuses on the qualitative aspects of decision-making while maintaining consideration of economic factors, making it a fundamental tool for public investment [

23]. A similar objective has driven the emergence of other indicators aimed at integrating economic and environmental dimensions, such as life-cycle costing and assessment (LCC+A) developed through the CILECCTA project [

24], or life-cycle sustainability assessment (LCSA), both of them with challenges around functional units, applicability, or comprehensive coverage of social and environmental impacts [

25].

The latter-mentioned LCSA surges in an effort to integrate the three pillars of true sustainable development under a unified European methodology by UNEP [

26], combining LCC, LCA, and Social-LCA. This framework has inspired the European standard EN 15643 and shares similarities with the Whole Life Costing (WLC) indicator defined in ISO 15686-5:2017 [

19] and the CBA defined by EU Guidelines [

23]. It should be noted that this integrated perspective is necessary because traditional LCC methodologies have been unable to incorporate non-quantifiable elements such as intangible values and externalities. In fact, judgments regarding return on investment that fail to account for external and intangible costs often overlook the economic implications that developers’ decisions may have on social and environmental impacts as well as on future profitability. Therefore, it is essential to assess risks and rewards associated with these variables through scenario analysis and the application of non-deterministic methods such as sensitivity analysis or the Monte Carlo Method.

Stochastic methods and sensitivity analysis are underutilized in practice due to perceived complexity and lack of expertise, showing shortcomings in the development of tools. On the other hand, the main limitation of deterministic models lies in their reliance on exact data. Considering that building processes can often be assimilated to VUCA (Volatility, Uncertainty, Complexity, Ambiguity) environments [

27], at best, it is possible to generate value ranges based on hypotheses supported by the experience, information, and knowledge of qualified professionals [

28]. This fact has led to further methodological standardization gaps and data quality inconsistencies.

Although there is an inherent risk of error in the measurement or determination of life-cycle cost (LCC), this does not diminish its value as a tool for assessing sustainability and supporting decision-making, both within the developer’s field of action and among regulatory authorities aiming to establish future standards and improve public incentive distribution. In fact, Orhangazi [

29] asserts that the incorporation of intangible assets enables companies to enhance profitability without necessarily requiring a proportional increase in investment. If this profitability growth is interpreted as a long-term cost reduction, it follows that the exclusion of intangible factors from LCC assessments compromises the integrity and effectiveness of the resulting decisions.

Externalities, the direct and indirect effects that an activity has on other activities, connect in this context with the concept of intangibles, and at the same time, with the elementary costs stated previously. Intangible costs could be defined as all the costs and revenues that can be foreseen and assumed but do not occur until a new practice or policy is implemented. Similarly, intangible impacts can be seen as direct economic impacts on the customer’s organization in terms of asset management, which, in some cases, could result in improvements for users’ well-being, bringing further economic implications. According to the International Accounting Standards Board (IASB) [

30], intangible assets are identifiable, non-monetary assets without physical substance that are expected to provide probable future economic benefits to an entity. Such is the case of concepts linked to functionality, flexibility, or even aesthetics, which can influence the evaluation and play a major role in the investment profit puzzle [

29]. A significant example is the social factors that influence the redistribution of the population in the territory, with important economic consequences in the medium and long term for the different regions and their local businesses.

The measurement of intangibles presents several challenges, primarily due to their immaterial nature, and it has traditionally been recognized in the literature as inherently difficult to quantify. Intangibles are often conceptualized as future income streams that may be inseparable from tangible assets, represent the right to obtain certain benefits, and as such, must be classified as capital [

30]. Considering that life-cycle cost (LCC) assessments entail not only economic but also environmental, social, political, legislative, and regulatory implications, the role of all stakeholders involved—building agents, owners, and users, among others—is crucial in promoting the sustainability of projects. Consequently, intangible values arising from diverse sources can be systematically studied and quantified.

Although its theoretical value has been widely acknowledged, LCC remains underutilized in both design and asset management practice due to a range of practical limitations, as stated previously. This persistent gap between academic development and real-world application highlights the pressing need for context-aware, digitally integrated, and uncertainty-informed approaches to LCC.

This study investigates the state of the art in LCC assessment by reviewing its conceptual evolution, current limitations, and methodological gaps in prevailing practices. It contributes to the literature by offering a comprehensive and integrative review. In response to existing terminological inconsistencies, the review also aims to consolidate relevant knowledge by accounting for synonyms, abbreviations, and alternative designations associated with LCC tools. A structured methodology underpins the analysis to ensure rigor and reproducibility.

2. Materials and Methods

An integrative literature review was conducted to examine existing research on life-cycle cost assessment (LCC) in the building sector, with particular emphasis on its applicability to real estate (RE) and Green Public Procurement (GPP) decision-making processes.

Integrative literature reviews, known by their comprehensive nature, enable the inclusion of diverse research methodologies and address broader phenomena of interest compared with systematic reviews. This approach facilitates a wider scope of exploration, encompassing concept definition, theoretical framework analysis, and the examination of methodological issues. An integrative review, as a more comprehensive approach, allows for the inclusion of diverse methodologies, with a research scope focused more broadly at a phenomenon of interest rather than a systematic review. Therefore, it supports a wider range of inquiry, such as defining concepts, reviewing theories, analyzing methodological issues, etc. Its main goal is to synthesize and integrate findings from various sources to provide a holistic understanding of a topic.

Given the nature of the topic, the most relevant publications and authors from recent years were examined, specifically focusing on identifying emerging trends, gaps, and areas of interest in the literature rather than conducting a systematic review. We adhered to PRISMA methodology and its principles to the extent necessary to meet our objectives, as it was not mandatory in our research. The main reason is that PRISMA strengthens the transparency, consistency, and completeness of the reporting, making it easier for others to further extend the research. This strategic approach allowed us to effectively contextualize the topic, explore key contributions, and gain a deeper understanding of the evolution on the field.

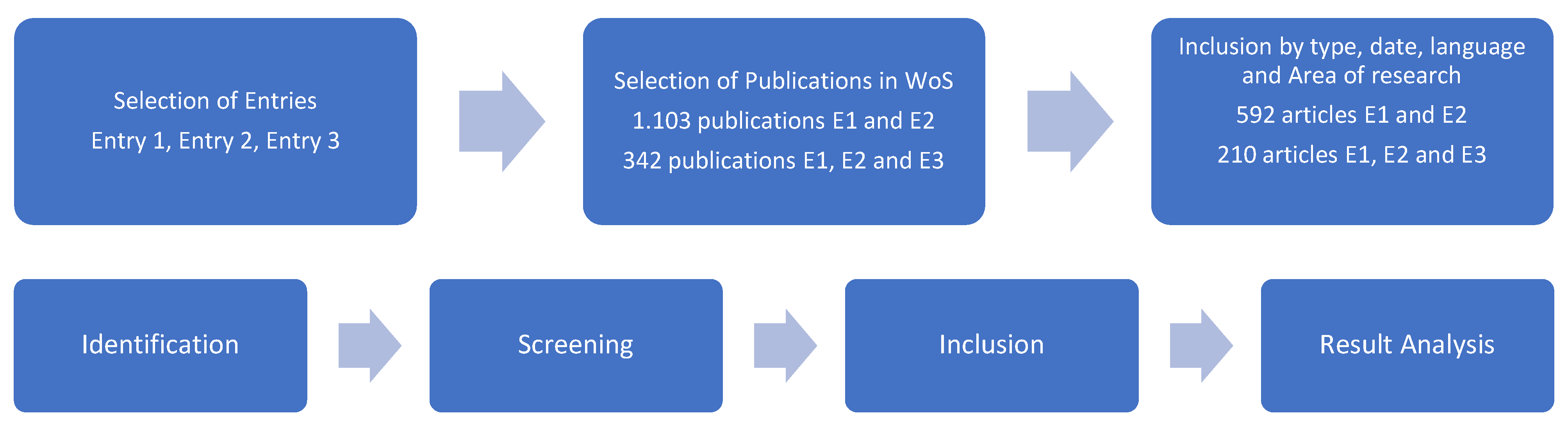

The stages of this integrative review included the identification of publications based on defined search criteria and the screening of sources to ensure the accuracy of the information, as illustrated in

Figure 1; the selection of studies to guarantee consistency and comparability of results; and the quantitative–qualitative analysis of the findings.

An initial stage involving the selection of keywords was conducted in which different data fonts were consulted (WoS). The keywords and acronyms used to denominate life-cycle cost assessment included “Life cycle Cost”, “LCC”, “Total Costs”, “Cost Benefit”, and their variations in spelling throughout different techniques for searching, including Boolean searching, question marks, and proximity searches:

Entry 1: “life* NEAR/3 cost*” OR “cost* NEAR/3 benefit*” OR “LCC”

Entry 2: inclusion Search for Screening: “build*” OR “civil” OR “Real Estate”

Entry 3: inclusion Search for Screening: “sustainab*”

The search reflected different numbers of results depending on the aforementioned keywords used during searching and additional inclusion, exclusion, or screening criteria, as stated in

Table 1.

Inclusion and Screening Criteria

Inclusion criteria:

Screening words can appear in the title of the article, in its abstract, or in the indexation of the publication (keywords), since using the title as the main screening criterion is considered unrepresentative due to the number of synonyms used by the research community;

Articles considered were published in the Web of Science (WoS) or Scopus databases, being accessible owing to the Spanish Foundation for Science and Technology (FECYT) under the Ministry of Science and Innovation of Spain;

Language, namely, that the articles were written in English;

Additional records identified through other sources: from citation searching, authors’ previous studies (expert networks).

Exclusion criteria:

Publication date, excluding any articles published previously to 2010 or after 2024.

Quality, excluding conference proceedings, extended summaries, presentations, and conferences. However, secondary literature such as book chapters, guidelines, and standards were included.

Subject areas not related to the building industry, such as “Health”, “Food Science”, “Microbiology”, “Robotics”, and others were not included in the research.

Conclusions not matching the abstract.

Screening criteria included the following questions:

Construction Industry Focus: Does the study refer to real estate projects within the construction industry?

Cost assessment methodology: Does the research refer to and discuss life-cycle cost assessment or cost–benefit assessment methodologies? Does the study refer to limitations, challenges, or barriers in CBA or LCC implementation?

Decision-making analysis: Does the study refer to decision-making processes in real estate development or building management?

Cost analysis scope: Does the study include comprehensive cost considerations beyond just initial construction costs?

3. Results

3.1. Quantitative Analysis Results

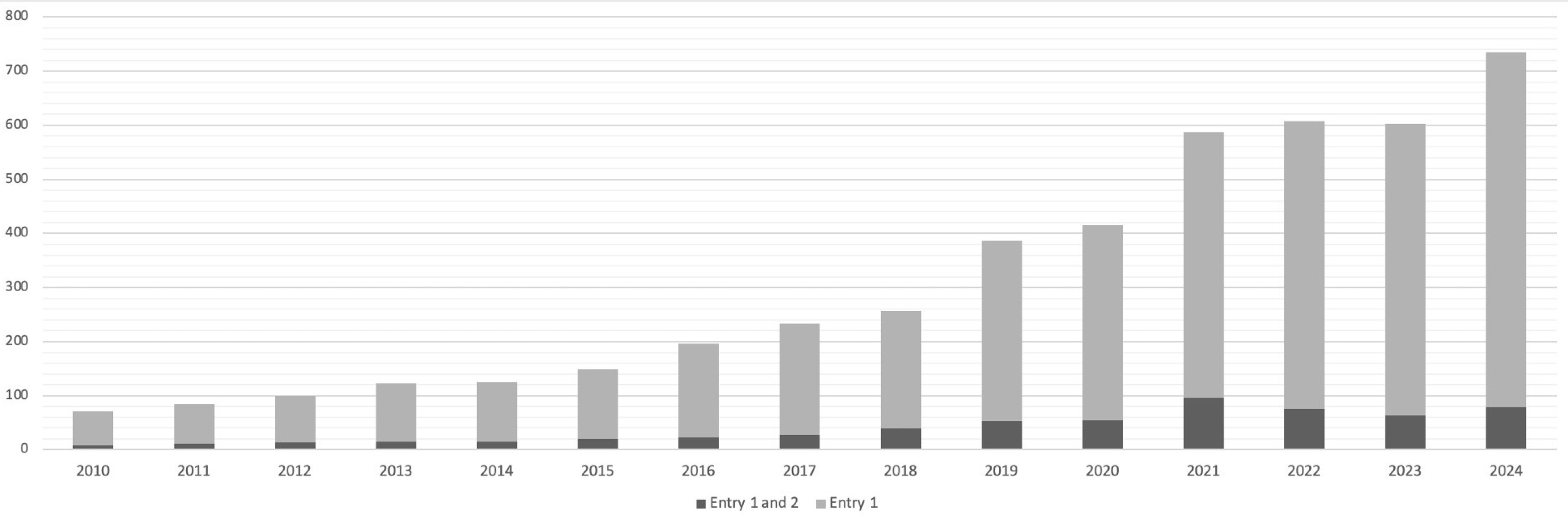

The quantitative analysis was based on the results of the searches conducted in the Web of Science (WoS) and Scopus databases using the criteria described above, resulting in the inclusion of 1.103 articles using “Entry 1” and “Entry 2” as topics. After using “Entry 3”, the number of articles was reduced to 342. The inclusion and exclusion criteria applied reduced the number of documents to 592 and 210, respectively, not accounting for articles from other sources.

Figure 2 presents the distribution of these articles by year of publication, highlighting the growing scientific interest in the research on sustainability measurement tools related to LCC and decision-making methods. It also illustrates that while there were few publications in the early years, the number increased notably over the past decade, with a significant rise observed in the last five to seven years. This notable increase in publications in recent years is also correlated with the growing interest in research on sustainability and its assessment in projects.

In order to better assess the main authors contributing to LCC development,

Table 2 shows the 20 authors with the greatest number of publications in the field according to data from WoS.

A list of the 20 most-cited articles according to data from WoS database was generated, showing that the higher number of citations does not come from authors with the highest number of publications found in this study. In this regard, the most productive author in terms of number of articles (Balasbaneh, 2018) can be found in 29th position in the list of most-cited articles, with the topics related to production in the field of comparative building material systems [

31]. Regarding these publications, Sher and Yeoh appear as coauthors in several of the articles. On the other hand, Silvestre and Santos have at least two articles in the top ten most-cited articles, with most of their production related to BIM-based applications [

32].

The most-cited articles in this study, according to

Table 3, include researches into the applicability of methodologies [

33], gaps on scopes [

34], technological approaches from BIM methodological applicability [

32,

35,

36,

37,

38], muti-criteria approaches to sustainability assessments [

39,

40,

41], or LCA evolution among public policies [

42]. Other studies are related to system comparison and previous reviews on LCC [

43,

44,

45] as well as other integrative methodologies like LCSA [

41,

46].

The results of the quantitative study show the relevance of LCC tools in the measurement of projects’ sustainability and decision-making in the building sector.

3.2. Qualitative Analysis Results

This section includes an in-depth evaluation linked to classifications and subject areas of the 15 most-cited publications. For that matter, five specific ranges of applicability of the studies were defined:

As it can be found in

Table 4, it is important to note that three articles referred to general frameworks, while six were linked to methodological developments or applied methods and four referred tools and others developments linked to building information models (BIMs).

3.3. Qualitative Analysis Results Regarding LCC Definition and Methods

The existence of methodological variations or sub-methodologies in relation to the main tools (LCA, LCC, or CBA), as well as efforts in the integration between them (LCSA or LCC+A) by researchers and practitioners has led to inconsistencies in their definition and scope that are currently unresolved [

34]. Generally, building LCC includes total investment cost, annual operational cost, and cost of maintenance and disposal, accounting for the life cycle; while under CBA, lifetime is a secondary matter and externalities are key points to account for.

Although the term commonly used in the scientific literature is life-cycle cost (LCC or LCCA), English-language sources and ISO Standard 15686 maintain a distinction between LCC and Whole Life Costing (WLCC). The primary conceptual difference lies in the scope of their assessments, with some ambiguities evident in the standard’s wording [

19], particularly regarding intangible costs, external costs, and environmental costs, among others. Both terms are treated often as synonyms, with LCC used to assess either “elemental” or “integral” life-cycle costs depending on the developer’s or practitioner’s requirements.

According to ISO 15686, environmental costs can be included under WLCC under the integration of LCA methodologies. However, upstream and downstream greenhouse gas (GHG) emissions are rarely included in building LCC [

47]. Thus, building climate impacts are not included in the economic building design assessment. In the case of refurbishment, LCC should take into account the “avoided burden approach” so that impacts avoided as a result of reuse, recycling, and recovery are credited in the studied products. Following Hasik et al., only newly added components should be included in the building impact assessment, since they burden the assessment [

48].

Finally, regarding methods to be applied on LCC assessment, depending on the scope and requirements, researchers and practitioners might apply and focus on different ones, including discounting, payback, internal rate of return, benefit-to-cost, or scenario probabilistic analysis (Monte Carlo), among others. Specific indicators like return on investment (ROI) or Net Present Value (NPV) are common to CBA in this context as well as Multi-Criteria Decision-Making (MCDM) methods.

3.4. Qualitative Analysis Results Regarding Methodological Limitations

Studies in the building industry show that LCC methodologies have inherent limits in real estate decision-making. Often used as part of case studies and theoretical analyses, long-term forecasting challenges still remain after years of development [

49]. These include unpredictable future cash flows and fluctuating interest rates, which are often over-estimated or conservatively reduced, with high influence on the obtained results. The lack of general agreement on money value for environmental impacts and discount rates for environmental costs is highly recalled in the last years as well [

50]. As energy prices are volatile and conversion factors for environmental and social impacts are highly dependent on public policies, significant risks are recognized in the assessment and decision-making process around LCC [

17,

18,

19,

20,

51].

Additional long-term forecasting challenges include uncertainty in future payment flows, rising prices and interest rates, the need for well-defined probabilistic distributions and simulations, and difficulties in rational decision-making within specific contexts [

34]. Moreover, identifying appropriate functional units and targets is crucial, as these elements significantly influence how technological tools manage and integrate information—an area that still requires further development to enable robust LCA, LCC, and CBA analysis under BIM-based environments [

32].

When integrating social or environmental values—often considered externalities or intangible impacts—traditional cost–benefit assessments (CBA) frequently overlook or underestimate several key benefits [

34]. As a result, multidimensional life-cycle analyses tend to exhibit imbalances further exacerbated by inconsistencies in system boundaries across different LCA tools [

32], highlighting once again the need for a common unit of measurement. Currently, definitions and frameworks for externalities and intangible values are primarily developed within the context of Green Public Procurement (GPP) [

23], where specific decision-making processes aim to optimize investment ratios relative to the objectives pursued and the opportunity costs of alternative investments. However, to date, no standardized methodology exists for the evaluation and integration of intangibles into LCC analysis within the building process. Existing standards and the scientific literature continue to fall short in providing clear and actionable guidance for incorporating environmental impacts [

52].

From the point of view of applied methods, probabilistic tools such as Mote Carlo are often used with uncertainties in the input parameters modeled, using realistic probability distributions with high sensitivity analysis to investigate the impact of changes in the input parameters on the result [

49]. Other methods with greater ease of application, both static and dynamic, tend to generate distortions or biases in the valuation that can be appreciated only through expert judgment, without common frames of reference for homogenization [

52].

In general, methods suffer from data limitations, with input data frequently lacking in comparability and completeness, especially for late life-cycle stages [

17,

18,

19,

20,

34,

51]. Intangible impacts, externalities, and other accountable “values” linked to social and environmental concerns are not approached easily (Osinski et al., 2017) [

53]. The management and quality of data sources for the quantification of intangible values face significant challenges even for neural network models in life-cycle assessments. The diversity and subjectivity inherent in these values make standardizing data collection and analysis methods difficult. Thus, greater efforts must be made to achieve their definition, development, and integration.

Additionally, the lack of comprehensive and reliable databases hampers the ability to perform robust temporal and spatial comparisons, compounded by variability in the quality of collected information, which may be influenced by cultural, political, and social biases. This is an area common to other real estate valuation methodologies that have a long history of research, with great potential for horizontal application. On the first hand, the scarcity of data represents a significant obstacle in the effective implementation of common LCC methodologies in the real estate and GPP sector, even when accompanied by AI tools. This point is common to life-cycle assessment (LCA) methodologies that are to be applied as well [

18]. Large datasets are required in order to correctly assess LCC by Automated Valuation Models (AMV) or AI models for accurate predictions. However, the availability of historical and current data may be limited in the case of less-developed markets, unique real estate assets, historical heritage, buildings of cultural value, and even settlements or constructions linked to local collective memory.

The evaluation and interpretation of results derived from the measurement of these intangible values also present considerable challenges: their qualitative nature requires interpretative approaches, complicating communication and understanding of the findings. In this field, there are several researches that try to taxonomize indicators or values as well as methods for their homogeneous quantification and transformation to common indicators. The taxonomies linked to the GPP and to the promotion activities of public administrations are the most important [

6,

7,

8,

23], with significant limitations in applicability in the private sector.

3.5. Qualitative Analysis Results Regarding Implementation Barriers and Results Interpretation

Despite the sustained years of effort developing comprehensive LCC tools to assist decision-making processes, the usual increase in capital costs continues to be a major barrier to the incorporation of full life-cycle scope for practitioners. Sensitivity analyses tend to require large data processing efforts, which further increase when varying the life span of scenarios, discount rates, growth rate of energy prices, and other monetary values.

Biases in life-cycle cost (LCC) assessments frequently arise from practitioners’ perceived lack of value relative to the high cost and complexity of the evaluation process [

54]. Interoperability issues such as data loss and the complexity resulting from the use of multiple tools represent significant limitations, particularly during the early stages of building design, when decisions critically affect the perceived value of projects [

55]. Collecting accurate data on investment and operational costs at these early stages is inherently challenging, especially for investors managing small portfolios, where the process becomes increasingly time-consuming, resource-intensive, and costly. Moreover, the fragmented environment of LCC methodologies, requiring the use of diverse tools without a unified framework, further complicates access to reliable input data and limits practitioner experience. Although risk certainty should be incorporated into life-cycle evaluations, the integration of risk assessment methodologies remains complex and expensive [

54], posing particular challenges for smaller projects or organizations with limited assessment capacities.

In this context, the underrepresentation of risks in decision-making highlights the need for new risk assessment methodologies and improved communication of risk factors to stakeholders. Nidahl, Andersson, Åstrand, and Olofsson [

56] propose the adoption of Extended Life-Cycle Cost Assessment (ELCCA) to provide a more holistic framework, facilitating informed decision-making during the design stages of both renovation and new construction projects. However, their study emphasizes that assumptions, estimations, and the application of Estimated Emission Factor Charges (EFC) significantly influence the outcomes. The substitution of the Social Cost of Carbon (SCC) with GHG taxes could further support the integration of ELCCA and similar tools into policy instruments aimed at achieving climate change mitigation targets. In the absence of such mechanisms, artificially imposed costs should be considered carefully in decision-making, recognizing their indicative, rather than definitive, nature. To advance toward a more comprehensive sustainability assessment, environmental taxes could be extended beyond GHG emissions to other environmental impact categories, utilizing standards such as ISO 14008:2019 [

57]. Other efforts should be taken as well in the taxonomy of these impacts, as the use of environmental and social impacts commonly appears to be contingent on economic performance or capacity [

58,

59].

There is also a pressing need for further research in life-cycle assessment and its related fields [

60], particularly regarding its integration into building management practices, the development of automated tools [

32,

35,

36], and the establishment of systematic assessment processes incorporating advanced technological frameworks for investment decision-making. Nevertheless, LCC methodologies are progressively leading to more comprehensive economic analyses through the inclusion of factors such as inflation, cash flows, and future benefits and costs. The monetary evaluation of climate risks—driven by initiatives like the EU Taxonomy—has the potential to significantly influence investment decisions toward more sustainable alternatives [

56]. As intangibles increasingly become monetizable through emerging public policies and private investment trends, significant opportunities remain to incorporate additional yet-unquantified values into comprehensive assessment frameworks [

22,

30].

4. Discussion

The results obtained align with the criteria established for the identification, selection, and analysis of the reviewed literature. While broadening these criteria might have yielded a wider set of findings, this does not constitute a significant limitation or shortcoming; the present scope was adequate for the intended objective: to generate a critical synthesis and identify key directions for future research on life-cycle cost (LCC) assessment.

The findings highlight several strategic challenges and research opportunities in the current application of LCC methodologies. First, the evolving definition and scope of LCC suggest the need for clearer methodological frameworks, particularly in distinguishing its applications across public procurement and private real estate. This includes not only cost quantification but also how LCC supports long-term investment decision-making under uncertain conditions.

Second, despite the theoretical robustness of LCC, its methodological development remains constrained by technical barriers such as limited integration with digital platforms (e.g., BIM), fragmented data environments, and the absence of tools adapted to manage qualitative or intangible impacts. These shortcomings hinder the operationalization of LCC in the early design and investment phases, where its strategic value would be most impactful.

Third, the increasing relevance of decision-making frameworks that incorporate social and environmental externalities necessitates the development of hybrid approaches. These should combine LCC with complementary evaluation tools that address stakeholder values and policy-driven sustainability goals. However, without adequate data quality, standardized taxonomies, and interoperable digital environments, such integrative models are difficult to implement effectively.

Lastly, the study underlines the growing importance of probabilistic modeling and risk-based assessment in enhancing the reliability of LCC outputs. Despite their potential, these methods remain underutilized, mainly due to the lack of accessible datasets and computational resources.

This study could be expanded by means of sector-specific surveys of project managers, facility managers, designers, and other stakeholders with open-ended responses, even with the limitations that this type of study presents.

5. Conclusions

The review has identified a set of critical limitations and opportunities in current LCC practices that define a clear research agenda.

Intrinsic Limitations of LCC Methodologies: Life-cycle cost (LCC) methodologies present inherent limitations in real estate decision-making, primarily due to the challenges associated with long-term forecasting, such as unpredictable cash flows, fluctuating interest rates, and volatile energy prices.

Lack of Standardization: Discrepancies in discount rates, conversion factors, and system boundaries across studies and tools highlight the absence of standardized frameworks, particularly for integrating environmental and social externalities.

Challenges in Integrating Intangibles: Traditional cost–benefit analyses often overlook or underestimate social and environmental benefits, indicating the need for common definitions, functional units, and quantification methods for externalities.

Difficulties in Evaluating Intangible Impacts: The qualitative nature of intangible impacts complicates result interpretation and communication. Current taxonomies, mainly developed within Green Public Procurement (GPP) frameworks, show limited applicability to the private sector.

Probabilistic Methods and Data Uncertainty: While probabilistic tools like Monte Carlo simulations enhance LCC robustness, input data uncertainties, incomplete datasets, and lack of comparability—especially for late life-cycle stages—remain major obstacles.

Data Limitations and Quality Issues: Scarcity of reliable and comprehensive databases hinders robust temporal and spatial comparisons. Data management is particularly challenging for unique assets (e.g., historical buildings) and in emerging markets.

Barriers to LCC Implementation: High initial capital costs, large data-processing requirements, and lack of practitioner-perceived value significantly limit the adoption of LCC approaches, particularly during early design stages.

Interoperability and Tool Integration Issues: Employing multiple non-integrated tools leads to data loss and added complexity, creating additional challenges for decision makers, especially in projects with limited resources.

Opportunities through Technological Advancements: There is a critical need for automated tools, systematic assessment processes, and technological integration to improve LCC application and enhance decision-making reliability.

Need for Risk Integration: Risk assessment is often underrepresented in LCC evaluations, requiring the development of new methodologies that can be systematically integrated without imposing prohibitive costs.

Influence of Climate Risk Monetization: Recent developments, such as the EU Taxonomy, have facilitated the monetization of climate-related risks, potentially shifting investment decisions toward more sustainable options. However, further efforts are needed to monetize other intangible impacts not yet captured.

Taken together, these findings emphasize the need for methodological innovation, cross-disciplinary integration, and technological advancement to fully unlock the potential of LCC in real estate and infrastructure decision-making.

Author Contributions

Conceptualization, methodology, formal analysis, investigation, writing—original draft preparation, visualization, S.D.G.; investigation, writing—review and editing, visualization, supervision, G.R.P.; writing—review and editing, visualization, supervision, project administration, funding acquisition, S.A.d.l.R. All authors have read and agreed to the published version of the manuscript.

Funding

This work has been supported by the Madrid Government (Comunidad de Madrid-Spain) under the Multiannual Agreement 2023–2026 with Universidad Politécnica de Madrid in the Line A, Emerging PhD researchers.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| LCA | Life-cycle assessment |

| LCA-e | Economic LCA |

| LCA-s | Social LCA |

| LCC | Life-cycle cost / Life-cycle cost assessment / life-cycle costing |

| WLCC | Whole Life-Cycle Cost / Whole Life Cost / Whole Life-Cycle Costing |

| CBA | Cost–benefit assessment / cost–benefit analysis |

References

- World Commission on Environment and Development. Our Common Future; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- United Nations Department of Economic and Social Affairs. The Sustainable Development Goals Report 2021; United Nations: New York, NY, USA, 2021. [Google Scholar] [CrossRef]

- Ness, D.; Xing, K. Toward a Resource-Efficient Built Environment: A Literature Review and Conceptual Model. J. Ind. Ecol. 2017, 21, 572–592. [Google Scholar] [CrossRef]

- United Nations. United Nations Development Programme (2022–2025); United Nations: New York, NY, USA, 2022. [Google Scholar]

- Mousazadeh, M.; Paital, B.; Naghdali, Z.; Hashemi, M.; Niaragh, E.K.; Aghababaei, M.; Ghorbankhani, M.; Lichtfouse, E.; Sillanpää, M.; Hashim, K.S.; et al. Positive environmental effects of the coronavirus 2020 episode: A review. Environ. Dev. Sustain 2021, 23, 12738–12760. [Google Scholar] [CrossRef] [PubMed]

- European Commission. Communication on the EU Taxonomy; COM(2020) 316 Final; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- European Comission. Level(s), A Common Language for Building Assessment; European Commission: Brussels, Belgium, 2021. [Google Scholar]

- European Commission: Directorate-General for Environment; ICLEI–Local Governments for Sustainability. Buying Green!: A Handbook on Green Public Procurement. 2016. Available online: https://data.europa.eu/doi/10.2779/246106data.europa.eu (accessed on 16 June 2025).

- Caldatto, F.C.; Bortoluzzi, S.C.; de Lima, E.P. The Role of Public Administration in Sustainable Development. In International Business, Trade and Institutional Sustainability; Leal Filho, W., Borges de Brito, P., Frankenberger, F., Eds.; World Sustainability Series; Springer: Cham, Switzerland, 2020. [Google Scholar] [CrossRef]

- Departament of Industry-Comitte for Terotechnology. Life Cycle Costing in the Management of Assets: A Practical Guide; H.M. Stationery Office: London, UK, 1977. [Google Scholar]

- Ruegg, R.; McConnaughey, J.S.; Thomas-Sav, G.; Hockenbery, K.A. Life-Cycle Costing: A Guide for Selecting Energy Conservation Projects for Public Buildings; Building Science Series, 113; National Bureau of Standards: Washington, DC, USA, 1978. [Google Scholar]

- Fuller, S.K.; Petersen, S.R. Life-Cycle Costing Manual for the Federal Energy Management Program; U.S. Department of Commerce, Technology Administration, National Institute of Standards and Technology: Washington, DC, USA, 1995. [Google Scholar]

- Kirkham, R.; Alisa, M.; Pimenta-da Silva, A.; Grindley, T.; Brondsted, J. EUROLIFEFORM: An Integrated Probabilistic Whole Life Cycle Cost and Performance Model for Buildings and Civil Infrastructure; RICS Foundation: London, UK, 2004. [Google Scholar]

- Task Group 4. Life-Cycle Cost in Construction. Final Report. UE: 3rd Tripartite Meeting Group on the Competitiveness of the Construction Industry. July 2003. Available online: https://onlinebookshop.villareal.fi/docs/LifeCycleCostsinConstruction.pdf (accessed on 16 June 2025).

- Davis Langdon Management Consulting. Life Cycle Costing (LCC) as a Contribution to Sustainable Construction: A Common Methodology. Final Report. 2007. Available online: http://www.brita-in-pubs.eu/toolbox/LCC_files/LCC-methodology%20Rev1%205-3-07%20(2).pdf (accessed on 16 June 2025).

- Košir, M. Climate Adaptability of Buildings: Bioclimatic Design in the Ligh of Climate Change; Springer: Ljubljana, Eslovenia, 2019. [Google Scholar] [CrossRef]

- Bahramian, M.; Yetilmezsoy, K. Life cycle assessment of the building industry: An overview of two decades of research (1995–2018). Energy Build. 2020, 219, 109917. [Google Scholar] [CrossRef]

- Schneider-Marin, P.; Lang, W. Environmental costs of buildings: Monetary valuation of ecological indicators for the building industry. Int. J. Life Cycle Assess. 2020, 25, 1637–1659. [Google Scholar] [CrossRef]

- ISO 15686-5:2017; Building and Constructed Assets—Service life planning—Part 5: Life-Cycle Costing. ISO: Geneva, Switzerland, 2017.

- Rennings, K.; Wiggering, H. Steps towards indicators of sustainable development: Linking economic and ecological concepts. Ecol. Econ. 1997, 20, 25–36. [Google Scholar] [CrossRef]

- Cao, H.; Li, M.; Qin, F.; Xu, Y.; Zhang, L.; Zhang, Z. Economic Development, Fiscal Ecological Compensation, and Ecological Environment Quality. Int. J. Environ. Res. Public Health 2022, 19, 4725. [Google Scholar] [CrossRef]

- Chen, Z.; Wang, F.; Feng, Q. Cost-benefit evaluation for building intelligent systems with special consideration on intangible benefits and energy consumption. Energy Build. 2016, 128, 484–490. [Google Scholar] [CrossRef]

- European Commission: Directorate-General for Regional and Urban Policy. Guide to Cost-Benefit Analysis of Investment Projects: Economic Appraisal Tool for Cohesion Policy 2014–2020. 2015. Available online: https://data.europa.eu/doi/10.2769/97516 (accessed on 9 June 2025).

- CILECCTA—A User-Oriented, Knowledge-Based Suite of Construction Industry LifE Cycle CosT Analysis Software for Pan-European Determination and Costing of Sustainable Project Options. Available online: https://cordis.europa.eu/project/id/229061/reporting/es (accessed on 9 June 2025).

- Guinée, J. Life Cycle Sustainability Assessment: What Is It and What Are Its Challenges? In Taking Stock of Industrial Ecology; Clift, R., Druckman, A., Eds.; Springer: Cham, Switzerland, 2016. [Google Scholar] [CrossRef]

- UNEP. Towards a Lyfe Cycle Sustainability Assessment: Making Informed Choices on Products; UNEP/SETAC Life Cycle Initiative: Paris, France, 2011. [Google Scholar]

- Schick, A.; Hobson, P.R.; Ibisch, P.L. Conservation and sustainable development in a VUCA world: The need for a systemic and ecosystem-based approach. Ecosyst. Health Sustain. 2017, 3, e01267. [Google Scholar] [CrossRef]

- García-Erviti, F.; Armengot-Paradinas, J.; Ramírez-Pacheco, G. El análisis del coste del ciclo de vida como herramienta para la evaluación económica de la edificación sostenible. Estado de la cuestión. Inf. La Construcción 2015, 67, e056. [Google Scholar] [CrossRef]

- Orhangazi, Ö. The role of intangible assets in explaining the investment–profit puzzle. Camb. J. Econ. 2019, 43, 1251–1286. [Google Scholar] [CrossRef]

- Zéghal, D.; Maaloul, A. The accounting treatment of intangibles—A critical review of the literature. Account. Forum 2011, 35, 262–274. [Google Scholar] [CrossRef]

- Balasbaneh, A.T.; Marsono, A.K.B.; Khaleghi, S.J. Sustainability choice of different hybrid timber structure for low medium cost single-story residential building: Environmental, economic and social assessment. J. Build. Eng. 2018, 20, 235–247. [Google Scholar] [CrossRef]

- Santos, R.; Costa, A.A.; Silvestre, J.D.; Pyl, L. Integration of LCA and LCC analysis within a BIM-based environment. Autom. Constr. 2019, 103, 127–149. [Google Scholar] [CrossRef]

- Sala, S.; Farioli, F.; Zamagni, A. Life cycle sustainability assessment in the context of sustainability science progress (part 2). Int. J. Life Cycle Assess. 2013, 18, 1686–1697. [Google Scholar] [CrossRef]

- Hoogmartens, R.; Van Passel, S.; Van Acker, K.; Dubois, M. Bridging the gap between LCA, LCC and CBA as sustainability assessment tools. Environ. Impact Assess. Rev. 2014, 48, 27–33. [Google Scholar] [CrossRef]

- Liu, S.; Meng, X.; Tam, C. Building information modeling based building design optimization for sustainability. Energy Build. 2015, 105, 139–153. [Google Scholar] [CrossRef]

- Marzouk, M.; Azab, S.; Metawie, M. BIM-based approach for optimizing life cycle costs of sustainable buildings. J. Clean. Prod. 2018, 188, 217–226. [Google Scholar] [CrossRef]

- Santos, R.; Costa, A.A.; Silvestre, J.D.; Vandenbergh, T.; Pyl, L. BIM-based life cycle assessment and life cycle costing of an office building in Western Europe. Build. Environ. 2020, 169, 106568. [Google Scholar] [CrossRef]

- Zhuang, D.; Zhang, X.; Lu, Y.; Wang, C.; Jin, X.; Zhou, X.; Shi, X. A performance data integrated BIM framework for building life-cycle energy efficiency and environmental optimization design. Autom. Constr. 2021, 127, 103712. [Google Scholar] [CrossRef]

- Pombo, O.; Allacker, K.; Rivela, B.; Neila, J. Sustainability assessment of energy saving measures: A multi-criteria approach for residential buildings retrofitting—A case study of the Spanish housing stock. Energy Build. 2016, 116, 384–394. [Google Scholar] [CrossRef]

- Sharif, S.A.; Hammad, A. Developing surrogate ANN for selecting near-optimal building energy renovation methods considering energy consumption, LCC and LCA. J. Build. Eng. 2019, 25, 100790. [Google Scholar] [CrossRef]

- Ekener, E.; Hansson, J.; Larsson, A.; Peck, P. Developing Life Cycle Sustainability Assessment methodology by applying values-based sustainability weighting—Tested on biomass based and fossil transportation fuels. J. Clean. Prod. 2018, 181, 337–351. [Google Scholar] [CrossRef]

- Sala, S.; Amadei, A.M.; Beylot, A.; Ardente, F. The evolution of life cycle assessment in European policies over three decades. Int. J. Life Cycle Assess. 2021, 26, 2295–2314. [Google Scholar] [CrossRef]

- Goh, B.H.; Sun, Y. The development of life-cycle costing for buildings. Build. Res. Inf. 2016, 44, 319–333. [Google Scholar] [CrossRef]

- Younis, A.; Ebead, U.; Judd, S. Life cycle cost analysis of structural concrete using seawater, recycled concrete aggregate, and GFRP reinforcement. Constr. Build. Mater. 175, 152–160. [CrossRef]

- Buyle, M.; Galle, W.; Debacker, W.; Audenaert, A. Sustainability assessment of circular building alternatives: Consequential LCA and LCC for internal wall assemblies as a case study in a Belgian context. J. Clean. Prod. 2019, 218, 141–156. [Google Scholar] [CrossRef]

- Dong, Y.H.; Ng, S.T. A modeling framework to evaluate sustainability of building construction based on LCSA. Int. J. Life Cycle Assess. 2016, 21, 555–568. [Google Scholar] [CrossRef]

- De Boeck, L.; Verbeke, S.; Audenaert, A.; De Mesmaeker, L. Improving the energy performance of residential buildings: A literature review. Renew. Sustain. Energy Rev. 2015, 52, 960–975. [Google Scholar] [CrossRef]

- Hasik, V.; Escott, E.; Bates, R.; Carlisle, S.; Faircloth, B.; Bilec, M.M. Comparative whole-building life cycle assessment of renovation and new construction. Build. Environ. 2019, 161, 106218. [Google Scholar] [CrossRef]

- Abouhamad, M.; Abu-Hamd, M. Framework for construction system selection based on life cycle cost and sustainability assessment. J. Clean. Prod. 2019, 241, 118397. [Google Scholar] [CrossRef]

- Decorte, Y.; Steeman, M.; Van Den Bossche, N.; Calle, K. Environmental evaluation of pareto optimal renovation strategies: A multidimensional life-cycle analysis. E3S Web Conf. 2020, 172, 18003. [Google Scholar] [CrossRef]

- Enshassi, A.; Kochendoerfer, B.; Rizq, E. An evaluation of environmental impacts of construction projects. Rev. Ing. De Constr. 2014, 29, 234–254. [Google Scholar] [CrossRef]

- Božiček, D.; Kunič, R.; Košir, M. Interpreting environmental impacts in building design: Application of a comparative assertion method in the context of the EPD scheme for building products. J. Clean. Prod. 2021, 279, 123399. [Google Scholar] [CrossRef]

- Osinski, M.; Selig, P.M.; Matos, F.; Roman, D.J. Methods of evaluation of intangible assets and intellectual capital. J. Intellect. Cap. 2017, 18, 470–485. [Google Scholar] [CrossRef]

- Oduyemi, O.; Okoroh, M.; Fajana, O.S. Risk assessment methods for life cycle costing in buildings. Sustain. Build. 2016, 1, 3. [Google Scholar] [CrossRef]

- Nwodo, M.N.; Anumba, C.J.; Asadi, S. BIM-Based Life Cycle Assessment and Costing of Buildings: Current Trends and Opportunities; ASCE: Seattle, WA, USA, 2017. [Google Scholar] [CrossRef]

- Nydahl, H.; Andersson, S.; Åstrand, A.P.; Olofsson, T. Extended building life cycle cost assessment with the inclusion of monetary evaluation of climate risk and opportunities. Sustain. Cities Soc. 2022, 76, 103451. [Google Scholar] [CrossRef]

- ISO 14008:1029; Monetary Valuation of Environmental Impacts and Related Environmental Aspects. ISO: Geneva, Switzerland, 2019.

- Neugebauer, S.; Forin, S.; Finkbeiner, M. From life cycle costing to economic life cycle assessment-introducing an economic impact pathway. Sustainability 2016, 8, 428. [Google Scholar] [CrossRef]

- Kambanou, M.L. Life cycle costing: Understanding how it is practised and its relationship to life cycle management-A case study. Sustainability 2020, 12, 3252. [Google Scholar] [CrossRef]

- Salvado, F.; Almeida, N.M.D.; Vale e Azevedo, A. Toward improved LCC-informed decisions in building management. Built Environ. Proj. Asset Manag. 2018, 8, 114–133. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).