Factors Leading to the Digital Transformation Dead Zone in Shipping SMEs: A Dynamic Capability Theory Perspective

Abstract

1. Introduction

2. Literature Review

2.1. The Shipping in Vietnam

2.2. Digital Transformation in Shipping

2.3. Digital Transformation Dead Zone in Shipping

2.4. The Dynamic Capabilities Theory

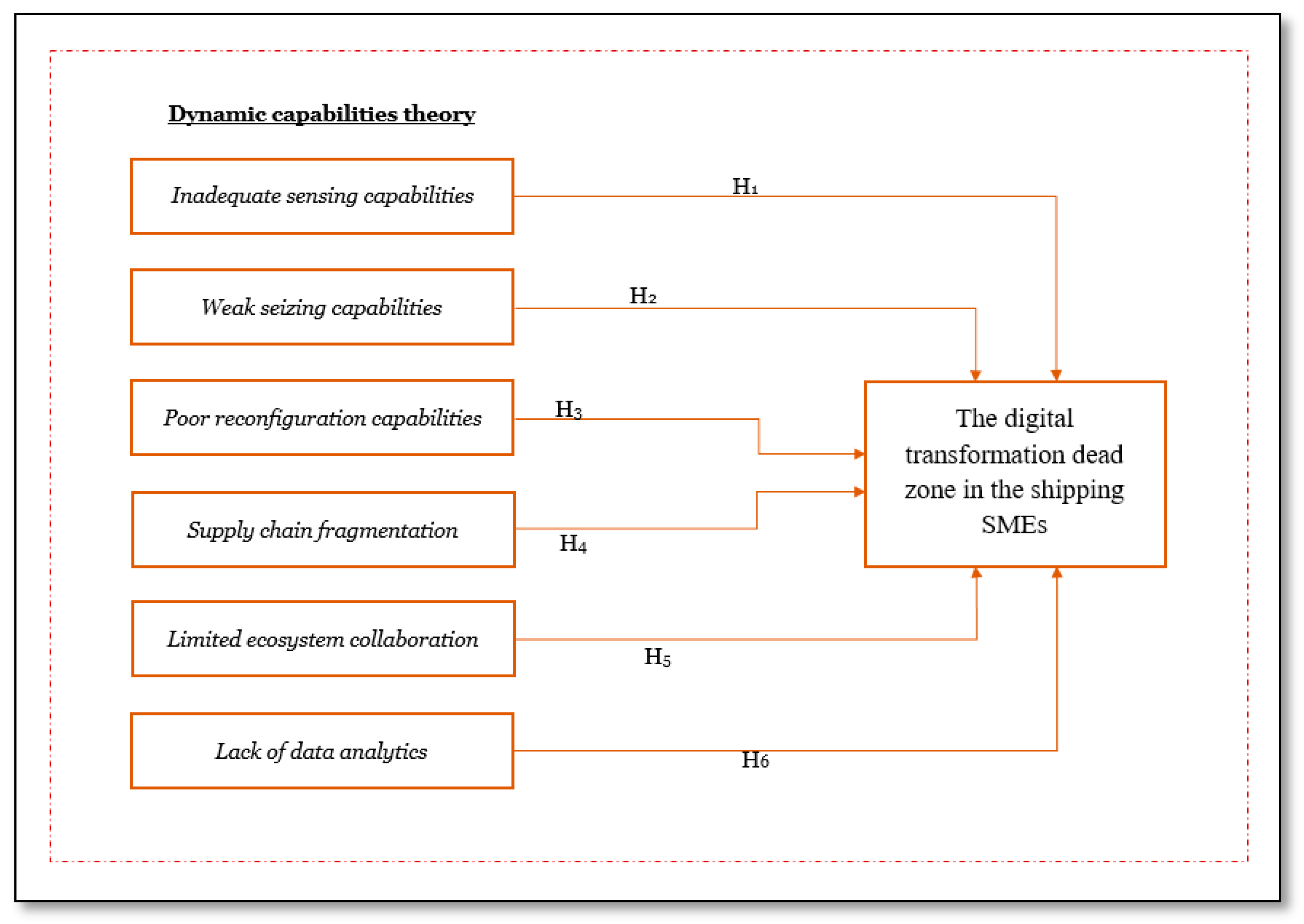

2.5. Hypothesis Development

2.5.1. Inadequate Sensing Capabilities

2.5.2. Weak Seizing Capabilities

2.5.3. Poor Reconfiguration Capabilities

2.5.4. Supply Chain Fragmentation

2.5.5. Limited Ecosystem Collaboration

2.5.6. Lack of Data Analytics

3. Methodology

3.1. Sampling and Data Collection

3.2. Scales and Measures

3.2.1. Inadequate Sensing Capabilities

3.2.2. Weak Seizing Capabilities

3.2.3. Poor Reconfiguration Capabilities

3.2.4. Supply Chain Fragmentation

3.2.5. Limited Ecosystem Collaboration

3.2.6. Lack of Data Analytics

3.2.7. Digital Transformation Dead Zone

3.3. Analyses

4. Results

4.1. Principal Components Analysis

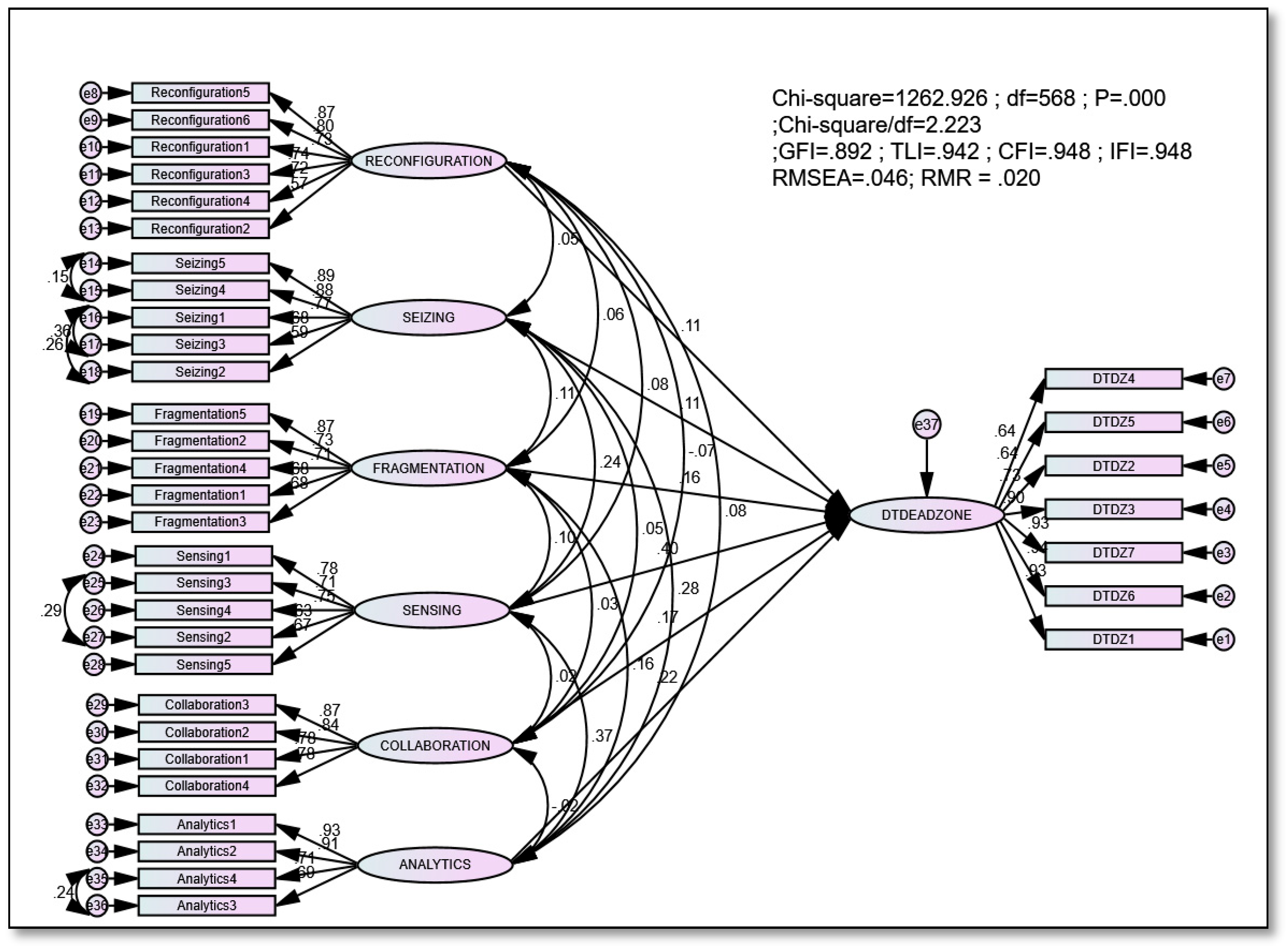

4.2. Confirmatory Factor Analysis

4.3. The Validity and Reliability

4.4. Common Method Variance

4.5. Hypotheses Testing

5. Discussion

6. Theoretical and Practical Implications

7. Limitations and Future Directions

8. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Construct | Description | Loading |

| nadequate sensing capabilities | Companies lacking real-time cargo tracking report a 25–35% delay in shipment adjustments compared to those with integrated IoT tracking. | [77,88,89,133] |

| Inadequate market sensing capabilities prevent shipping companies from adapting to digital innovations and sustainability practices. | ||

| Shipping SMEs with limited sensor deployment (e.g., engine diagnostics, fuel meters, cargo temperature monitors) are unable to detect early anomalies, increasing downtime. | ||

| Poor integration of sensing and predictive analytics tools results in higher operational risks and inefficiencies in the shipping industry. | ||

| The maritime industry’s limited adoption of holistic anomaly detection systems hinders proactive decision-making in digital transformation efforts. | ||

| Weak seizing capabilities | The company struggles to adapt and integrate new digital technologies due to inefficient decision-making structures. | [9,90,91,92] |

| There is a lack of investment in workforce training to enable effective use of digital tools. | ||

| Firms that do not implement business process reengineering (BPR) or automation audits in the last 12 months show stagnant digital adoption across functional departments. | ||

| The company fails to identify and seize market opportunities enabled by digitalization. | ||

| Projects without a clear digital roadmap, defined KPIs, or agile steering committees experience >40% delay or scope creep in digital implementation timelines. | ||

| Poor reconfiguration capabilities | Shipping companies struggle to adapt to changing digital trends due to rigid business models and insufficient dynamic capabilities. | [27,66,93,94,95,96] |

| Lack of documented process redesign initiatives and failure to adopt integrated TMS/WMS systems correlates with delayed shipments and over 15% excess inventory rates. | ||

| Lack of effective reconfiguration strategies in shipping companies hampers digital transformation, leading to operational rigidity. | ||

| Less than 30% of firms conduct quarterly alignment reviews between IT systems and strategic goals, resulting in delayed response times (>48 h) to logistics disruptions. | ||

| Limited capacity to integrate digital platforms with traditional operations slows the transition to smart shipping ecosystems. | ||

| The low adaptability of shipping companies to digital change is due to poor investment in training and system reconfiguration. | ||

| Supply chain fragmentation | The company’s supply chain lacks integration, leading to inefficiencies in tracking and managing shipments. | [43,97,98,99,100] |

| Communication and data sharing between different supply chain stakeholders are inconsistent and fragmented. | ||

| The lack of standardized digital platforms results in disconnected logistics processes across multiple regions. | ||

| Supply chain fragmentation leads to delays in decision-making and disrupts real-time logistics operations. | ||

| The company’s fragmented supply chain increases costs due to inefficiencies in procurement and shipping. | ||

| Limited ecosystem collaboration | Limited collaboration among shipping companies and digital service providers hinders the adoption of integrated digital platforms. | [77,101,102] |

| The lack of trust and transparency in data sharing between shipping industry stakeholders slows down digital transformation. | ||

| Poor ecosystem collaboration leads to fragmented supply chain visibility, reducing efficiency in maritime logistics. | ||

| The reluctance of shipping companies to engage in cross-industry partnerships limits digital innovation and transformation. | ||

| The absence of standardized digital protocols and interoperability between different stakeholders prevents seamless data exchange and collaboration. | ||

| Lack of data analytics | Our company struggles to predict market trends and operational risks due to a lack of data analytics. | [66,103] |

| The absence of structured data analytics in our company results in inefficiencies in resource allocation and logistics operations. | ||

| We lack the necessary business intelligence (BI) and machine learning (ML) tools to make data-driven decisions. | ||

| Due to the lack of data analytics, our company finds it difficult to adapt our business model to digital transformation trends. | ||

| Our company lacks skilled personnel with expertise in data analytics, limiting our ability to extract actionable insights from available data. | ||

| Digital transformation dead zone | The company’s digital transformation initiatives frequently stall due to organizational resistance to change. | [2,4,23,26] |

| We utilize automated cargo tracking and e-documentation systems across all operational departments, ensuring real-time visibility and workflow efficiency. | ||

| Our port and supply chain systems are digitally integrated with customs and partner platforms via API or blockchain interfaces. | ||

| Our company has fully implemented enterprise IT systems (e.g., ERP, CRM, cloud platforms) and maintains regular cybersecurity audits to support digital operations. | ||

| Leadership struggles to provide a clear vision and roadmap for digital transformation. | ||

| The digital transformation process is hindered by regulatory and compliance challenges in the shipping industry. | ||

| We offer digital self-service interfaces (e.g., mobile booking, customer portals), and over 50% of customer interactions occur through digital platforms. |

References

- Schallmo, D.; Williams, C.A.; Boardman, L. Digital transformation of business models—Best practice, enablers, and roadmap. Int. J. Innov. Manag. 2020, 24, 2050002. [Google Scholar]

- Vial, G. Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Wamba, S.F.; Queiroz, M.M. Blockchain in operations and supply chain management: Benefits, challenges, and future research opportunities. Int. J. Inf. Manag. 2020, 52, 102064. [Google Scholar] [CrossRef]

- Heilig, L.; Schwarze, S.; Voss, S. An analysis of digital transformation in the history and future of modern ports. In Proceedings of the 50th Hawaii International Conference on System Sciences (HICSS), Waikoloa Village, HI, USA, 4–7 January 2017; pp. 1341–1350. [Google Scholar] [CrossRef]

- International Maritime Organization (IMO). Future of Shipping: Digitalization. Maritime Perspectives Series—Jointly Organized by the International Maritime Organization (IMO) and the Maritime and Port Authority of Singapore (MPA). 8 October 2020. Available online: https://www.imo.org/en/MediaCentre/SecretaryGeneral/Pages/Digitalization-Maritime-Perspectives.aspx (accessed on 8 October 2020).

- Parviainen, P.; Kääriäinen, J.; Tihinen, M.; Teppola, S. Tackling the digitalization challenge: How to benefit from digitalization in practice. Int. J. Inf. Syst. Proj. Manag. 2017, 5, 63–77. [Google Scholar] [CrossRef]

- Kumar, V.; Verma, P.; Mittal, A.; Tuesta Panduro, J.A.; Singh, S.; Paliwal, M.; Sharma, N.K. Adoption of ICTs as an emergent business strategy during and following COVID-19 crisis: Evidence from Indian MSMEs. Benchmarking Int. J. 2023, 30, 1850–1883. [Google Scholar] [CrossRef]

- Min, H. Assessing the impact of a COVID-19 pandemic on supply chain transformation: An exploratory analysis. Benchmarking Int. J. 2023, 30, 1765–1781. [Google Scholar] [CrossRef]

- Warner, K.S.R.; Wäger, M. Building dynamic capabilities for digital transformation: An ongoing process of strategic renewal. Long Range Plan. 2019, 52, 326–349. [Google Scholar] [CrossRef]

- Moyano-Fuentes, J.; Sacristán-Díaz, M. Learning on lean: A review of thinking and research. Int. J. Oper. Prod. Manag. 2012, 32, 551–582. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Nguyen, V.H. Suggestions on goods import and export for Vietnam’s sustainable development during 2021–2030. In Directions for Strategies and Policies of Import and Export of Goods for Vietnam’s Sustainable Development Towards 2030; Vietnam Industry and Trade Information Center (VIOIT): Ha Noi City, Vietnam, 2022; pp. 7–18. Available online: https://www.vioit.vn/uploads/tiny_uploads/PDF%20file/003%20Ky%20yeu%20hoi%20thao%20ENG%2016.3.2022.pdf#page=7 (accessed on 8 October 2020).

- Le, T.H.T. Impact of exchange rate on Vietnamese import-export enterprises. Int. J. Adv. Multidiscip. Res. Stud. 2024, 4, 724–728. [Google Scholar]

- Pham, V.T. Using the vector autoregression model to determine the relationship between some macroeconomic targets and the volume of goods transported by sea in Vietnam. Int. J. e-Navig. Marit. Econ. 2019, 13, 43–49. [Google Scholar]

- Yen, V.T.H. Capital solutions to promote fleet investment in shipping in countries such as Vietnam. Int. J. Prof. Bus. Rev. 2022, 7, e0738. [Google Scholar] [CrossRef]

- Banomyong, R.; Trinh, T.T.H.; Pham, T.H. A study of logistics performance of manufacturing and import-export firms in Vietnam. J. Int. Econ. Manag. 2017, 94, 64–73. [Google Scholar]

- Lambrou, M.; Watanabe, D.; Iida, J. Shipping digitalization management. J. Shipp. Trade 2019, 4, 11. [Google Scholar] [CrossRef]

- Wijegunawardhana, N.; Hassanabadi, M.; Hassani, R.; Kamasak, R. The Digital Transformation Challenges; IGI Global: Hershey, PA, USA, 2024. [Google Scholar] [CrossRef]

- Chen, S.; Piao, L.; Zang, X.; Luo, Q.; Li, J.; Yang, J.; Rong, J. Analyzing differences of highway lane-changing behavior using vehicle trajectory data. Phys. A Stat. Mech. Its Appl. 2023, 624, 128980. [Google Scholar] [CrossRef]

- Vicentiy, A.V. Digitalization of Arctic shipping. IOP Conf. Ser. Earth Environ. Sci. 2021, 816, 012023. [Google Scholar] [CrossRef]

- Chen, X.; Wu, H.; Han, B.; Liu, W.; Montewka, J.; Liu, R.W. Orientation-aware ship detection via a rotation feature decoupling supported deep learning approach. Eng. Appl. Artif. Intell. 2023, 125, 106686. [Google Scholar] [CrossRef]

- Nkuna, N. Understanding the Motives for Digital Transformation in the Container Shipping Sector. Master’s Dissertation, World Maritime University, Malmö, Sweden, 2017. [Google Scholar]

- Parida, V.; Sjödin, D.; Lenka, S.; Wincent, J. Developing global service innovation capabilities: How global manufacturers address the challenges of market heterogeneity. J. Bus. Res. 2019, 104, 660–671. [Google Scholar] [CrossRef]

- Raza, Z.; Woxenius, J.; Altuntas Vural, C.; Lind, M. Digital transformation of maritime logistics: Exploring trends in the liner shipping segment. Comput. Ind. 2023, 145, 103811. [Google Scholar] [CrossRef]

- Jović, M.; Tijan, E.; Vidmar, D.; Pucihar, A. Factors of digital transformation in the maritime transport sector. Sustainability 2022, 14, 9776. [Google Scholar] [CrossRef]

- Fruth, M.; Teuteberg, F. Digitization in maritime logistics. Comput. Ind. 2017, 89, 22–34. [Google Scholar] [CrossRef]

- Notteboom, T.; Pallis, T.; Rodrigue, J.-P. Disruptions and resilience in global container shipping and ports: The COVID-19 pandemic versus the 2008–2009 financial crisis. Marit. Econ. Logist. 2021, 23, 179–210. [Google Scholar] [CrossRef]

- Hamisi, S. Challenges and opportunities of Tanzanian SMEs in adapting supply chain management. Afr. J. Bus. Manag. 2011, 5, 1266–1276. [Google Scholar] [CrossRef]

- Tolstoy, D.; Nordman, E.R.; Hånell, S.M.; Özbek, N. The development of international e-commerce in retail SMEs: An effectuation perspective. J. World Bus. 2021, 56, 101165. [Google Scholar] [CrossRef]

- Acquila-Natale, E.; Chaparro-Peláez, J.; Del-Río-Carazo, L.; Cuenca-Enrique, C. Do or die? The effects of COVID-19 on channel integration and digital transformation of large clothing and apparel retailers in Spain. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 439–457. [Google Scholar] [CrossRef]

- Gupta, A.; Kumar Singh, R. Managing resilience of micro, small and medium enterprises (MSMEs) during COVID-19: Analysis of barriers. Benchmarking Int. J. 2023, 30, 2062–2084. [Google Scholar] [CrossRef]

- Varma, D.; Dutta, P. Restarting MSMEs and start-ups post COVID-19: A grounded theory approach to identify success factors to tackle changed business landscape. Benchmarking Int. J. 2023, 30, 1912–1941. [Google Scholar] [CrossRef]

- Scuotto, V.; Caputo, F.; Villasalero, M.; Del Giudice, M. A multiple buyer–supplier relationship in the context of SMEs’ digital supply chain management. Prod. Plan. Control 2017, 28, 1378–1388. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Barreto, I. Dynamic capabilities: A review of past research and an agenda for the future. J. Manag. 2010, 36, 256–280. [Google Scholar] [CrossRef]

- Sreenivasan, A.; Suresh, M.; Tuesta Panduro, J.A. Modelling the resilience of start-ups during COVID-19 pandemic. Benchmarking Int. J. 2023, 30, 2085–2109. [Google Scholar] [CrossRef]

- El Khoury, R.; Nasrallah, N.; Atayah, O.F.; Dhiaf, M.M.; Frederico, G.F. The impact of green supply chain management practices on environmental performance during COVID-19 period: The case of discretionary companies in the G-20 countries. Benchmarking Int. J. 2023, 30, 2139–2165. [Google Scholar] [CrossRef]

- Qrunfleh, S.; Vivek, S.; Merz, R.; Mathivathanan, D. Mitigation themes in supply chain research during the COVID-19 pandemic: A systematic literature review. Benchmarking Int. J. 2023, 30, 1832–1849. [Google Scholar] [CrossRef]

- Yu, J.; Chavez, R.; Jacobs, M.A. Digital supply chain integration and performance in SMEs: The role of sensing and learning capabilities. Int. J. Oper. Prod. Manag. 2023, 43, 145–167. [Google Scholar]

- Hanelt, A.; Bohnsack, R.; Marz, D.; Antunes Marante, C. A systematic review of the literature on digital transformation: Insights and implications for strategy and organizational change. J. Manag. Stud. 2021, 58, 1159–1197. [Google Scholar] [CrossRef]

- Li, L.; Su, F.; Zhang, W.; Mao, J.Y. Digital transformation by SME entrepreneurs: A capability perspective. Inf. Syst. J. 2018, 28, 1129–1157. [Google Scholar] [CrossRef]

- Zhang, Q.; Chen, J.; Zhang, X. Enterprise digitization and marine economic performance: An empirical study of listed enterprises in China’s maritime economy. PLoS ONE 2024, 19, e0311021. [Google Scholar] [CrossRef]

- Wohlleber, A.J.; Bock, M.; Birkel, H.; Hartmann, E. Implementing vital dynamic capabilities to succeed in digital transformation: A multiple-case study in maritime container shipping. IEEE Trans. Eng. Manag. 2022, 71, 13627–13645. [Google Scholar] [CrossRef]

- Agostini, L.; Filippini, R. Organizational and managerial challenges in the path toward Industry 4.0. Eur. J. Innov. Manag. 2019, 22, 406–421. [Google Scholar] [CrossRef]

- Taghizadeh, N.S.K.; Rahman, S.A.; Nikbin, D.; Radomska, M. Dynamic capabilities of the SMEs for sustainable innovation performance: Role of environmental turbulence. J. Organ. Eff. People Perform. 2023, 11, 767–787. [Google Scholar] [CrossRef]

- Saeedikiya, M.; Salunke, S.; Kowalkiewicz, M. Toward a dynamic capability perspective of digital transformation in SMEs: A study of the mobility sector. J. Clean. Prod. 2024, 428, 139365. [Google Scholar] [CrossRef]

- Khurana, I.; Dutta, D.K.; Ghura, A.S. SMEs and digital transformation during a crisis: The emergence of resilience as a second-order dynamic capability in an entrepreneurial ecosystem. J. Bus. Res. 2022, 150, 623–641. [Google Scholar] [CrossRef]

- Hu, M.K.; Kee, D.M.H. SMEs and business sustainability: Achieving sustainable business growth in the new normal. In Research Anthology on Business Continuity and Navigating Times of Crisis; IGI Global: Hershey, PA, USA, 2022; pp. 21–37. [Google Scholar] [CrossRef]

- Toh, M.H. Developing a digital business ecosystem in Singapore. In Digital Transformation Management, 1st ed.; Routledge: London, UK, 2022; pp. 21–37. [Google Scholar] [CrossRef]

- Hossain, M.R.; Akhter, F.; Sultana, M.M. SMEs in COVID-19 crisis and combating strategies: A systematic literature review (SLR) and a case from emerging economy. Oper. Res. Perspect. 2022, 9, 100222. [Google Scholar] [CrossRef]

- Zia, N.U.; Shamim, S.; Zeng, J.; Awan, U.; Chromjakova, F.; Akhtar, P.; Orel, M. Avoiding crisis-driven business failure through digital dynamic capabilities. B2B distribution firms during the COVID-19 and beyond. Ind. Mark. Manag. 2023, 113, 14–29. [Google Scholar] [CrossRef]

- Tsekouras, G.; Poulis, E.; Poulis, K. Innovation and dynamic capabilities in a traditional service sector: Evidence from shipping companies. Balt. J. Manag. 2011, 6, 320–341. [Google Scholar] [CrossRef]

- Canhoto, A.I.; Quinton, S.; Pera, R.; Molinillo, S.; Simkin, L. Digital strategy aligning in SMEs: A dynamic capabilities perspective. J. Strateg. Inf. Syst. 2021, 30, 101682. [Google Scholar] [CrossRef]

- Pagoropoulos, A.; Maier, A.; McAloone, T.C. Assessing transformational change from institutionalising digital capabilities on implementation and development of Product-Service Systems: Learnings from the maritime industry. J. Clean. Prod. 2017, 166, 369–380. [Google Scholar] [CrossRef]

- Ozanne, L.K.; Chowdhury, M.; Prayag, G.; Mollenkopf, D.A. SMEs navigating COVID-19: The influence of social capital and dynamic capabilities on organizational resilience. Ind. Mark. Manag. 2022, 104, 116–135. [Google Scholar] [CrossRef]

- Henríquez Larrazábal, R.D. Digital Transformation and Business Models in Maritime Trade Supply Chains. Ph.D. Thesis, Universitat Politècnica de Catalunya, Departament de Ciència i Enginyeria Nàutiques, Barcelona, Spain, 2022. [Google Scholar] [CrossRef]

- Lamperti, S.; Cavallo, A.; Sassanelli, C. Digital servitization and business model innovation in SMEs: A model to escape from market disruption. IEEE Trans. Eng. Manag. 2023, 71, 4619–4633. [Google Scholar] [CrossRef]

- Fellenstein, J.; Umaganthan, A. Digital Transformation: How Enterprises Build Dynamic Capabilities for Business Model Innovation: A Multiple-Case Study Within the Logistics and Transportation Industry. Bachelor’s Thesis, Jönköping University, Jönköping International Business School, Jönköping, Sweden, 2019. Available online: https://www.diva-portal.org/smash/get/diva2:1320967/FULLTEXT01.pdf (accessed on 8 October 2020).

- Weaven, S.; Quach, S.; Thaichon, P.; Frazer, L.; Billot, K.; Grace, D. Surviving an economic downturn: Dynamic capabilities of SMEs. J. Bus. Res. 2021, 128, 109–123. [Google Scholar] [CrossRef]

- Gao, J.; Zhang, W.; Guan, T.; Feng, Q.; Mardani, A. Influence of digital transformation on the servitization level of manufacturing SMEs from static and dynamic perspectives. Int. J. Inf. Manag. 2023, 73, 102645. [Google Scholar] [CrossRef]

- Rupeika-Apoga, R.; Petrovska, K.; Bule, L. The effect of digital orientation and digital capability on digital transformation of SMEs during the COVID-19 pandemic. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 669–685. [Google Scholar] [CrossRef]

- Kahveci, E.; Avunduk, Z.B.; Daim, T.; Zaim, S. The role of flexibility, digitalization, and crisis response strategy for SMEs: Case of COVID-19. J. Small Bus. Manag. 2024, 63, 1198–1235. [Google Scholar] [CrossRef]

- Philipp, R.; Prause, G.; Gerlitz, L. Blockchain and smart contracts for entrepreneurial collaboration in maritime supply chains. Transp. Telecommun. 2019, 20, 365–378. [Google Scholar] [CrossRef]

- Kot, S.; Ul Haque, A.; Baloch, A. Supply chain management in SMEs: Global perspective. Montenegrin J. Econ. 2020, 16, 87–104. [Google Scholar] [CrossRef]

- Tijan, E.; Jović, M.; Aksentijević, S.; Pucihar, A. Digital transformation in the maritime transport sector. Technol. Forecast. Soc. Change 2021, 170, 120879. [Google Scholar] [CrossRef]

- Ziyadullaev, D. The Transformative Influence and Efficacy of Digital Platforms on Road Freight Logistics and Supply Chain Dynamics. Master’s Thesis, Alpen-Adria-Universität Klagenfurt, Klagenfurt am Wörthersee, Austria, 2024. [Google Scholar]

- Yuen, K.F.; Thai, V.V. Barriers to supply chain integration in the maritime logistics industry. Marit. Econ. Logist. 2017, 19, 551–572. [Google Scholar] [CrossRef]

- McCamley, C.; Gilmore, A. Aggravated fragmentation: A case study of SME behaviour in two emerging heritage tourism regions. Tour. Manag. 2017, 60, 81–91. [Google Scholar] [CrossRef]

- Ozkan, N. Fostering Digital Marketplaces in Logistics and Supply Chain: Trends and Opportunities. Master’s Thesis, Politecnico di Torino, Torino, Italy, 2020. Available online: http://webthesis.biblio.polito.it/id/eprint/14897 (accessed on 8 October 2020).

- Omowole, B.M.; Olufemi-Phillips, A.; Eyo-Udo, N.L. Barriers and drivers of digital transformation in SMEs: A conceptual analysis. Int. J. Sch. Res. Sci. Technol. 2024, 5, 19–36. [Google Scholar] [CrossRef]

- McAuliffe, B. Challenges facing technology standardization in the age of digital transformation. In Corporate Standardization Management and Innovation; Jakobs, K., Ed.; IGI Global: Hershey, PA, USA, 2019; pp. 34–45. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Göçer, F. Digital supply chain: Literature review and a proposed framework for future research. Comput. Ind. 2018, 97, 157–177. [Google Scholar] [CrossRef]

- Nguyen, T.-H. Investigating driving factors of digital transformation in the Vietnam shipping companies: Applied for TOE framework. SAGE Open 2024, 14, 21582440241301210. [Google Scholar] [CrossRef]

- Suboyin, A.; Diaz, S.; Mannan, S.; Kumar, S.; Baobaid, O.; Villasuso, F. The game-changing role of Scope 3 emissions in logistics and maritime sustainability. In Proceedings of the ADIPEC, Abu Dhabi, United Arab Emirates, 4–7 November 2024. [Google Scholar] [CrossRef]

- Liu, Z.; Sampaio, P.; Pishchulov, G.; Mehandjiev, N.; Cisneros-Cabrera, S.; Schirrmann, A.; Jiru, F.; Bnouhanna, N. The architectural design and implementation of a digital platform for Industry 4.0 SME collaboration. Comput. Ind. 2022, 138, 103623. [Google Scholar] [CrossRef]

- Piot-Lepetit, I. Editorial: Strategies of digitalization and sustainability in agrifood value chains. Front. Sustain. Food Syst. 2025, 9, 1565662. [Google Scholar] [CrossRef]

- Stroumpoulis, A.; Kopanaki, E.; Chountalas, P.T. Enhancing sustainable supply chain management through digital transformation: A comparative case study analysis. Sustainability 2024, 16, 6778. [Google Scholar] [CrossRef]

- Matenga, A.E.; Mpofu, K. Blockchain-based cloud manufacturing SCM system for collaborative enterprise manufacturing: A case study of transport manufacturing. Appl. Sci. 2022, 12, 8664. [Google Scholar] [CrossRef]

- Nazo, R. Design and Development of a Self-Service Platform for Automating Infrastructure Provisioning. Master’s Thesis, University of Padua, Padova, Italy, 2024. Available online: https://thesis.unipd.it/handle/20.500.12608/77616 (accessed on 3 December 2024).

- Rapaccini, M.; Saccani, N.; Kowalkowski, C.; Paiola, M.; Adrodegari, F. Navigating disruptive crises through service-led growth: The impact of COVID-19 on Italian manufacturing firms. Ind. Mark. Manag. 2020, 88, 225–237. [Google Scholar] [CrossRef]

- Balta, M.E.; Papadopoulos, T.; Spanaki, K. Business model pivoting and digital technologies in turbulent environments. Int. J. Entrep. Behav. Res. 2024, 30, 773–799. [Google Scholar] [CrossRef]

- Teece, D.J. Dynamic Capabilities and Strategic Management: Organizing for Innovation and Growth; Oxford University Press: Oxford, UK, 2009. [Google Scholar]

- Sahoo, S.K.; Goswami, S.S.; Sarkar, S.; Mitra, S. A review of digital transformation and Industry 4.0 in supply chain management for small and medium-sized enterprises. Spectr. Eng. Manag. Sci. 2023, 1, 58–70. [Google Scholar] [CrossRef]

- Omrani, N.; Rejeb, N.; Maalaoui, A.; Dabic, M.; Kraus, S. Drivers of digital transformation in SMEs. IEEE Trans. Eng. Manag. 2022, 71, 5030–5043. [Google Scholar] [CrossRef]

- Kim, C.-B.; Yang, H.-J.; Jeong, K.-W. Identifying and mitigating risks in the digital transformation of cold chain systems: An empirical study on South Korean SMEs. Asia Pac. J. Mark. Logist. 2025. Advance online publication. [Google Scholar] [CrossRef]

- Bhuiyan, M.R.I.; Faraji, M.R.; Rashid, M.; Bhuyan, K.; Hossain, R.; Ghose, P. Digital transformation in SMEs: Emerging technological tools and technologies for enhancing the SME’s strategies and outcomes. J. Ecohumanism 2024, 3, 211–224. [Google Scholar] [CrossRef]

- Kumar, A.; Kumar, L. Navigating the future: The ethical, societal and technological implications of artificial intelligence. Glob. J. Res. Eng. Comput. Sci. 2024, 4, 83–104. [Google Scholar] [CrossRef]

- Öster, A. A human perception view on holistic anomaly detection systems for maritime engine rooms. In Proceedings of the 34th International Ocean and Polar Engineering Conference, Rhodes, Greece, 16–21 June 2024. Paper No. ISOPE-I-24-607. [Google Scholar]

- Giel, R.; Dąbrowska, A. A digital twin framework for cyber-physical waste stream control systems: Towards reverse logistics 4.0. LogForum 2024, 20, 297–306. [Google Scholar] [CrossRef]

- Teece, D.J. Business models and dynamic capabilities. Long Range Plan. 2018, 51, 40–49. [Google Scholar] [CrossRef]

- Dagar, M.; Tate, M.; Johnstone, D. Digital transformation at Maersk: The never-ending pace of change. J. Inf. Technol. Case Appl. Res. 2024, 26, 111–143. [Google Scholar] [CrossRef]

- Oguntegbe, K.F.; Di Paola, N.; Vona, R. Dynamic capabilities for business model innovation in logistics: The role of digital technologies. J. Manag. Sustain. 2024, 14, 18–35. [Google Scholar] [CrossRef]

- Gezgin, E.; Huang, X.; Samal, P.; Silva, I. Digital Transformation: Raising Supply-Chain Performance to New Levels. McKinsey & Company, 2017. Available online: https://www.mckinsey.de/~/media/McKinsey/Business%20Functions/Operations/Our%20Insights/Digital%20transformation%20Raising%20supplychain%20performance%20to%20new%20levels/Digital-transformation-Raising-supply-chain-performance-to-new-levels.pdf (accessed on 8 October 2020).

- Poulis, K.; Galanakis, G.C.; Triantafillou, G.T.; Poulis, E. Value migration: Digitalization of shipping as a mechanism of industry dethronement. J. Shipp. Trade 2020, 5, 9. [Google Scholar] [CrossRef]

- Li, X.; Chin, J.Y.T.; Wang, X.; Yuen, K.F. Building maritime organisational competitiveness through resource, innovation, and resilience: A resource orchestration approach. Ocean Coast. Manag. 2024, 252, 107092. [Google Scholar] [CrossRef]

- Mahesh, V.; Shriya, G.; Rasagnya, G.; Nikhitha, G. Cloud integrated intelligent cargo management system. Int. J. Manag. Res. Bus. Strategy 2024, 13, 14–20. [Google Scholar]

- Kolinski, A.; Dujak, D.; Kolinska, K. Analysis of the impact of electronic platforms on the information flow efficiency in transport processes. Commun. Int. Proc. 2024, 2024, 4452424. [Google Scholar] [CrossRef]

- Oehlschläger, D.; Glas, A.H.; Eßig, M. Acceptance of digital twins of customer demands for supply chain optimisation: An analysis of three hierarchical digital twin levels. Ind. Manag. Data Syst. 2024, 124, 1050–1075. [Google Scholar] [CrossRef]

- Hijazi, A.A.; Perera, S.; Calheiros, R.N.; Alashwal, A. Stakeholder’s development stack for integrating BIM and blockchain in construction supply chain. In Proceedings of the 2024 International Conference on Electrical, Computer and Energy Technologies (ICECET), Sydney, Australia, 25–27 July 2024. [Google Scholar] [CrossRef]

- Kolade, O.; Oyinlola, M.; Ogunde, O.; Ilo, C.; Ajala, O. Digitally enabled business models for a circular plastic economy in Africa. Environ. Technol. Innov. 2024, 35, 103657. [Google Scholar] [CrossRef]

- Ding, Y.; Tabeta, S. A comprehensive index for assessing the sustainable blue economy: A Japanese application. Ocean Coast. Manag. 2024, 258, 107401. [Google Scholar] [CrossRef]

- Maulana, F.R. From traditional to digital: Exploring the online marketing transformation of culinary micro, small, and medium enterprises (MSMEs) in Karawang, Indonesia. Open Access Indones. J. Soc. Sci. 2024, 7, 1773–1788. [Google Scholar] [CrossRef]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y.; Phillips, L.W. Assessing construct validity in organizational research. Adm. Sci. Q. 1990, 36, 421–458. [Google Scholar] [CrossRef]

- Hu, L.; Bentler, P.M. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Sage Publications: New York, NY, USA, 2016. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Cheung, G.W.; Wang, C. Current approaches for assessing convergent and discriminant validity with SEM: Issues and solutions. Acad. Manag. Proc. 2017, 1. [Google Scholar] [CrossRef]

- Richardson, H.A.; Simmering, M.J.; Sturman, M.C. A tale of three perspectives: Examining post hoc statistical techniques for detection and correction of common method variance. Organ. Res. Methods 2009, 12, 762–800. [Google Scholar] [CrossRef]

- Tehseen, S.; Ramayah, T.; Sajilan, S. Testing and controlling for Common Method Variance: A review of available methods. J. Manag. Sci. 2017, 4, 142–168. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef] [PubMed]

- Bhanot, N.; Ahuja, J.; Kidwai, H.I.; Nayan, A.; Bhatti, R.S. A sustainable economic revival plan for post-COVID-19 using machine learning approach–a case study in developing economy context. Benchmarking Int. J. 2023, 30, 1782–1805. [Google Scholar] [CrossRef]

- Fares, R.; Wirtz, J.; Sousa, R. Collaboration and agility in fast-fashion supply networks. Ind. Mark. Manag. 2023, 110, 192–207. [Google Scholar] [CrossRef]

- Holmström, J.; Kostis, A.; Galariotis, E.; Roubaud, D.; Zopounidis, C. Stalled data flows in digital innovation networks: Underlying mechanisms and the role of related variety. Ind. Mark. Manag. 2024, 121, 16–26. [Google Scholar] [CrossRef]

- Zhang, J.; Long, J.; von Schaewen, A.M.E. How does digital transformation improve organizational resilience? —Findings from PLS-SEM and fsQCA. Sustainability 2021, 13, 11487. [Google Scholar] [CrossRef]

- Akter, S.; Sultana, S.; Gunasekaran, A.; Bandara, R.J.; Miah, S.J. Tackling the global challenges using data-driven innovations. Ann. Oper. Res. 2024, 333, 517–532. [Google Scholar] [CrossRef]

- Cao, Z. Ecosystem Synergies, Change and Orchestration. Doctoral Dissertation, Imperial College London, London, UK, 2023. [Google Scholar] [CrossRef]

- Ashiwaju, B.I.; Agho, M.O.; Okogwu, C.; Orikpete, O.F.; Daraojimba, C. Digital transformation in pharmaceutical supply chain: An African case. Matrix Sci. Pharma 2023, 7, 95–102. [Google Scholar] [CrossRef]

- Karimi, J.; Walter, Z. The role of dynamic capabilities in responding to digital disruption: A factor-based study of the newspaper industry. J. Manag. Inf. Syst. 2015, 32, 39–81. [Google Scholar] [CrossRef]

- Hasan, A. Digital transformation. In Construction Company Management, 1st ed.; Routledge: London, UK, 2024; p. 24. [Google Scholar]

- Wójcik, P.; Obłój, K.; Buono, A.F. Addressing social concern through business-nonprofit collaboration: Microfoundations of a firm’s dynamic capability for social responsibility. J. Bus. Res. 2022, 143, 119–139. [Google Scholar] [CrossRef]

- Pesqueira, A.; Sousa, M.J.; Pereira, R. Individual dynamic capabilities influential factors in blockchain technology innovation from hospital settings. WSEAS Trans. Biol. Biomed. 2023, 20, 275–294. [Google Scholar] [CrossRef]

- Jiao, R.; Commuri, S.; Panchal, J.; Milisavljevic-Syed, J.; Allen, J.K.; Mistree, F.; Schaefer, D. Design engineering in the age of Industry 4.0. J. Mech. Des. 2021, 143, 070801. [Google Scholar] [CrossRef]

- Vermesan, O.; Friess, P. (Eds.) Digitising the Industry: Internet of Things—Connecting the Physical, Digital and Virtual Worlds, 1st ed.; River Publishers: Aalborg, Denmark, 2016. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Guandalini, I. Sustainability through digital transformation: A systematic literature review for research guidance. J. Bus. Res. 2022, 148, 456–471. [Google Scholar] [CrossRef]

- Hallikas, J.; Immonen, M.; Brax, S. Digitalizing procurement: The impact of data analytics on supply chain performance. Supply Chain Manag. Int. J. 2021, 26, 629–646. [Google Scholar] [CrossRef]

- Kolagar, M.; Parida, V.; Sjödin, D. Ecosystem transformation for digital servitization: A systematic review, integrative framework, and future research agenda. J. Bus. Res. 2022, 146, 176–200. [Google Scholar] [CrossRef]

- Camarinha-Matos, L.M.; Fornasiero, R.; Ramezani, J.; Ferrada, F. Collaborative networks: A pillar of digital transformation. Appl. Sci. 2019, 9, 5431. [Google Scholar] [CrossRef]

- Plekhanov, D.; Franke, H.; Netland, T.H. Digital transformation: A review and research agenda. Eur. Manag. J. 2023, 41, 821–844. [Google Scholar] [CrossRef]

- Sousa-Zomer, T.T.; Neely, A.; Martinez, V. Digital transforming capability and performance: A microfoundational perspective. Int. J. Oper. Prod. Manag. 2020, 40, 1095–1128. [Google Scholar] [CrossRef]

- Pollehn, T. Evaluating Operational Effects of Innovations in Rail Freight Service Networks Using Machine Learning. Ph.D. Thesis, Gerhart-Potthoff-Bau, Dresden, Germany, 9 April 2024. Available online: https://elib.dlr.de/202183/2/976473.pdf (accessed on 28 May 2024).

| Variable | Category | Frequency | Percentage (%) | |

|---|---|---|---|---|

| 1 | Gender | Male | 386 | 65.65 |

| Female | 202 | 34.35 | ||

| 2 | Qualifications | Secondary/College | 121 | 20.58 |

| University | 264 | 44.90 | ||

| Master’s | 186 | 31.63 | ||

| PhD and above | 17 | 2.89 | ||

| 3 | Age | Under 30 years old | 142 | 24.15 |

| 30–39 years old | 265 | 45.07 | ||

| 40–49 years old | 124 | 21.09 | ||

| 50 years old and above | 57 | 9.69 | ||

| 4 | Position | Senior management & leadership | 92 | 15.65 |

| Head of information technology | 65 | 11.05 | ||

| Logistics management | 142 | 24.15 | ||

| Technical and operation staff | 241 | 40.99 | ||

| Others | 48 | 8.16 | ||

| 5 | Types of companies | Under 50 people | 56 | 9.52 |

| 51–100 people | 192 | 32.65 | ||

| 101–150 people | 123 | 20.92 | ||

| 151–200 people | 139 | 23.64 | ||

| Over 200 people | 78 | 13.27 |

| Construct | Description | Loading | Mean | SDs | CR | AVE |

|---|---|---|---|---|---|---|

| Inadequate sensing capabilities | Sensing1 | 0.778 | 3.87 | 0.655 | 0.84 | 0.52 |

| Sensing2 | 0.680 | 3.88 | 0.641 | |||

| Sensing3 | 0.758 | 3.86 | 0.660 | |||

| Sensing4 | 0.720 | 3.73 | 0.772 | |||

| Sensing5 | 0.653 | 3.90 | 0.618 | |||

| Cronbach’s α | 0.840 | |||||

| Weak seizing capabilities | Seizing1 | 0.845 | 3.96 | 0.701 | 0.89 | 0.62 |

| Seizing2 | 0.613 | 3.92 | 0.726 | |||

| Seizing3 | 0.719 | 3.96 | 0.664 | |||

| Seizing4 | 0.862 | 4.00 | 0.677 | |||

| Seizing5 | 0.867 | 4.01 | 0.630 | |||

| Cronbach’s α | 0.883 | |||||

| Poor reconfiguration capabilities | Reconfiguration1 | 0.763 | 4.03 | 0.612 | 0.88 | 0.56 |

| Reconfiguration2 | 0.575 | 4.00 | 0.631 | |||

| Reconfiguration3 | 0.750 | 4.03 | 0.585 | |||

| Reconfiguration4 | 0.736 | 4.05 | 0.627 | |||

| Reconfiguration5 | 0.851 | 4.04 | 0.622 | |||

| Reconfiguration6 | 0.772 | 3.99 | 0.647 | |||

| Cronbach’s α | 0.878 | |||||

| Supply chain fragmentation | Fragmentation1 | 0.673 | 3.75 | 1.217 | 0.85 | 0.54 |

| Fragmentation2 | 0.727 | 3.46 | 1.247 | |||

| Fragmentation3 | 0.668 | 3.48 | 1.215 | |||

| Fragmentation4 | 0.723 | 3.73 | 1.072 | |||

| Fragmentation5 | 0.868 | 3.56 | 1.221 | |||

| Cronbach’s α | 0.850 | |||||

| Limited ecosystem collaboration | Collaboration1 | 0.789 | 3.80 | 0.633 | 0.89 | 0.67 |

| Collaboration2 | 0.832 | 3.56 | 0.824 | |||

| Collaboration3 | 0.859 | 3.63 | 0.735 | |||

| Collaboration4 | 0.787 | 3.80 | 0.597 | |||

| Cronbach’s α | 0.884 | |||||

| Lack of data analytics | Analytic1 | 0.911 | 3.35 | 0.719 | 0.89 | 0.68 |

| Analytic2 | 0.890 | 3.34 | 0.679 | |||

| Analytic3 | 0.734 | 3.31 | 0.699 | |||

| Analytic4 | 0.749 | 3.33 | 0.611 | |||

| Cronbach’s α | 0.891 | |||||

| Digital transformation dead zone | Deadzone1 | 0.929 | 3.98 | 0.638 | 0.94 | 0.69 |

| Deadzone2 | 0.743 | 4.02 | 0.620 | |||

| Deadzone3 | 0.884 | 3.99 | 0.619 | |||

| Deadzone4 | 0.677 | 3.98 | 0.596 | |||

| Deadzone5 | 0.681 | 3.95 | 0.679 | |||

| Deadzone6 | 0.926 | 3.97 | 0.630 | |||

| Deadzone7 | 0.923 | 3.97 | 0.639 | |||

| Cronbach’s α | 0.936 |

| Initial Eigenvalues | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | |||||

|---|---|---|---|---|---|---|---|

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | |

| 1 | 8.366 | 23.238 | 23.238 | 8.034 | 22.315 | 22.315 | 6.884 |

| 2 | 3.751 | 10.419 | 33.657 | 3.351 | 9.309 | 31.625 | 3.574 |

| 3 | 3.097 | 8.603 | 42.259 | 2.767 | 7.687 | 39.312 | 4.117 |

| 4 | 2.954 | 8.205 | 50.464 | 2.521 | 7.003 | 46.315 | 3.226 |

| 5 | 2.825 | 7.846 | 58.311 | 2.466 | 6.850 | 53.164 | 4.673 |

| 6 | 1.970 | 5.473 | 63.783 | 1.660 | 4.611 | 57.776 | 2.858 |

| 7 | 1.737 | 4.824 | 68.607 | 1.360 | 3.777 | 61.553 | 4.557 |

| 8 | 0.801 | 2.225 | 70.832 | ||||

| 9 | 0.770 | 2.140 | 72.971 | ||||

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. Gender | 1 | |||||||||

| 2. Age | −0.068 | 1 | ||||||||

| 3. Qualifications | −0.149 ** | −0.113 ** | 1 | |||||||

| 4. Experience | −0.083 * | 0.742 ** | −0.032 | 1 | ||||||

| 5. Inadequate sensing capabilities | −0.005 | 0.070 | −0.117 ** | −0.028 | 1 | |||||

| 6. Weak seizing capabilities | 0.057 | 0.065 | −0.082 * | 0.046 | 0.208 ** | 1 | ||||

| 7. Poor reconfiguration capabilities | 0.002 | 0.037 | −0.083 * | 0.010 | 0.074 | 0.065 | 1 | |||

| 8. Supply chain fragmentation | 0.057 | −0.041 | −0.089 * | −0.071 | 0.086 * | 0.108 ** | 0.042 | 1 | ||

| 9. Limited ecosystem collaboration | 0.077 | −0.078 | 0.035 | −0.072 | 0.025 | 0.043 | −0.064 | 0.027 | 1 | |

| 10. Lack of data analytics | 0.006 | −0.001 | −0.114 ** | −0.054 | 0.346 ** | 0.289 ** | 0.075 | 0.159 ** | −0.019 | 1 |

| 11. Digital transformation dead zone | −0.008 | 0.074 | −0.126 ** | 0.087 * | 0.508 ** | 0.300 ** | 0.173 ** | 0.237 ** | 0.154 ** | 0.431 ** |

| Hy. | Independent Variable | Dependent Variable | Beta | p-Value | Support Hypothesis |

|---|---|---|---|---|---|

| 1 | Inadequate sensing capabilities | Digital transformation dead zone | 0.396 | *** | Yes |

| 2 | Weak seizing capabilities | Digital transformation dead zone | 0.108 | 0.005 | Yes |

| 3 | Poor reconfiguration capabilities | Digital transformation dead zone | 0.115 | 0.001 | Yes |

| 4 | Supply chain fragmentation | Digital transformation dead zone | 0.158 | *** | Yes |

| 5 | Limited ecosystem collaboration | Digital transformation dead zone | 0.168 | *** | Yes |

| 6 | Lack of data analytics | Digital transformation dead zone | 0.220 | *** | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, T.-N.-L.; Le, S.-T. Factors Leading to the Digital Transformation Dead Zone in Shipping SMEs: A Dynamic Capability Theory Perspective. Sustainability 2025, 17, 5553. https://doi.org/10.3390/su17125553

Nguyen T-N-L, Le S-T. Factors Leading to the Digital Transformation Dead Zone in Shipping SMEs: A Dynamic Capability Theory Perspective. Sustainability. 2025; 17(12):5553. https://doi.org/10.3390/su17125553

Chicago/Turabian StyleNguyen, Thanh-Nhat-Lai, and Son-Tung Le. 2025. "Factors Leading to the Digital Transformation Dead Zone in Shipping SMEs: A Dynamic Capability Theory Perspective" Sustainability 17, no. 12: 5553. https://doi.org/10.3390/su17125553

APA StyleNguyen, T.-N.-L., & Le, S.-T. (2025). Factors Leading to the Digital Transformation Dead Zone in Shipping SMEs: A Dynamic Capability Theory Perspective. Sustainability, 17(12), 5553. https://doi.org/10.3390/su17125553