1. Introduction

Accelerating the green transformation of the development mode and promoting the greening and decarbonization of the economy and society are key initiatives to achieve high-quality development, according to the report of the 20th Party Congress People’s Daily [

1], 2022-10-26 (01). This aligns with the findings of the International Energy Agency (IEA, 2021) [

2], which emphasizes the necessity of transitioning to sustainable energy systems to mitigate climate change impacts. In the 14th Five-Year Plan, China’s government explicitly proposes to build an ecological civilization system, and promotes the comprehensive green transformation of the economy and society as one of the key tasks. Enhancing the efficiency of enterprise green innovation is an important way to achieve the strategic goal of peak carbon and carbon neutrality, which is of great significance for accelerating the greening and low-carbonization of economic and social development. Therefore, accelerating the level of green technological innovation of enterprises has become the focus of attention of the academic community and at the decision-making level.

Environmental, social, and corporate governance (ESG) performance has become a key indicator for measuring corporate social responsibility and long-term development potential [

3]. In recent years, with the deepening understanding of ESG performance by enterprises and society, enterprises have gradually integrated improving their ESG performance into their supply chain management systems to enhance their competitive advantages [

4], solidify the foundation of their supply chains, and improve the robustness and resilience of their supply chains. With China’s “double carbon” goal of achieving peak carbon by 2030 and carbon neutrality by 2060, the urgency for enterprises to take green actions in supply chain management has been further emphasized [

5], and the impact of ESG performance on promoting green innovation has become more and more important [

6].

In order to promote green technological innovation, the state has issued a series of policy documents aimed at improving the market-oriented green technological innovation system, accelerating the research and development and popularization of energy-saving and carbon-reducing technologies, and proposing the goal of further strengthening the main body of green technological innovation in enterprises by 2025. It also puts forward the goal of realizing the further growth of enterprises’ green technology innovation by 2025 [

7]. In light of these considerations, client companies are likely to transfer environmental pressures to upstream suppliers through supply chain management in order to meet compliance requirements, thereby promoting green innovation investment. Yu Fei [

8] utilized Chinese manufacturing data to verify the hypothesis that corporate green innovation gains government support by enhancing organizational legitimacy. This, in turn, forms a virtuous cycle of “policy incentives—green innovation—new policy incentives”. Green innovation by enterprises has the double externality of a spillover effect and external environmental cost, which underpins its important role in the development of social greening. Therefore, the study of corporate green innovation should not only focus on its internal innovation activities, but should also extend to the upstream and downstream of the supply chain, and promote the diffusion of green technology through the synergistic effect of cross-fertilization, so as to obtain greater indirect benefits.

Nevertheless, while the emerging body of literature on the linkages between ESG and green innovation has yielded valuable insights, it remains predominantly confined to analyses at the level of individual firms or industries. This focus disregards a critical dimension—the potential for synergistic ESG effects within supply chains. While the significance of supply chains for sustainability is increasingly acknowledged, prevailing research largely adopts a client/core firm-centric perspective. Consequently, systematic investigations into how client ESG performance transmits to and influences supplier green innovation efficiency are notably scarce—a gap also reflected in international research. For instance, Akhtar’s study on clean technologies and environmental policy [

9], while examining regulatory impacts on green innovation, did not account for supply chain interactions.

Addressing this critical gap, our study makes a distinct and original contribution by pioneering an investigation into the empowerment effect of client ESG performance on supplier green innovation efficiency through a dedicated supply chain interaction lens. Utilizing a dataset that encompasses Chinese A-share listed clients and their suppliers from 2014 to 2023, we transcend the prevailing intra-firm or client-centric focus in two pivotal ways that define the novelty of our research. First, the specific transmission mechanisms through which high-performing ESG clients actively empower their suppliers’ green innovation capabilities are revealed. These mechanisms include knowledge spillovers, financing constraint alleviation, executive cognition, and digitalization. This multi-mechanism perspective directly addresses the paucity of research on ESG-driven innovation dynamics across firm boundaries within supply chains, offering a more profound and systemic understanding of ESG’s cross-organizational influence. Secondly, and equally innovatively, the analytical focus is shifted from the sheer quantity of green innovation to its efficiency. By adopting green innovation efficiency as the core dependent variable, we can precisely capture a supplier’s ability to optimize resource utilization, control costs, and convert inputs into valuable green outputs during the sustainability transition. This methodological decision provides a more nuanced and performance-oriented measure, as well as actionable insights for policymakers seeking to design effective green incentives and for firms formulating sustainable supply chain strategies.

The paper’s framework is structured as follows:

Section 2 reviews the extant literature on ESG and innovation, highlighting theoretical gaps in the existing body of work, with a particular focus on the supply chain and cross-organizational aspects. In

Section 3, a model is constructed that is based on stakeholder and innovation diffusion theory. This model hypothesizes the existence of mediation effects, such as knowledge spillovers and financing constraints, as well as moderation effects, including executive green cognition and digitalization. These effects are believed to influence the relationship between client environmental, social, and governance (ESG) factors and supplier innovation efficiency.

Section 4 utilizes DEA-SBM models to assess green innovation efficiency, employing A-share data from 2014 to 2023. The chapter designs baseline regression, mediation, and moderation tests.

Section 5 provides substantiation for these hypotheses, addresses endogeneity through the use of instrumental variables and propensity score matching, and conducts heterogeneity analyses (firm type/government environmental concern). The

Section 6 of this study offers a synopsis of the findings and puts forward a series of policies tailored to the specific needs of stakeholders. According to

Section 7, future research should be directed toward cross-country comparisons, dynamic ESG evaluation, and digital collaboration. This end-to-end design integrates theoretical, methodological, and policy insights, thereby establishing a systematic analytical framework for green supply chain development.

3. Theoretical Analysis and Research Hypotheses

The

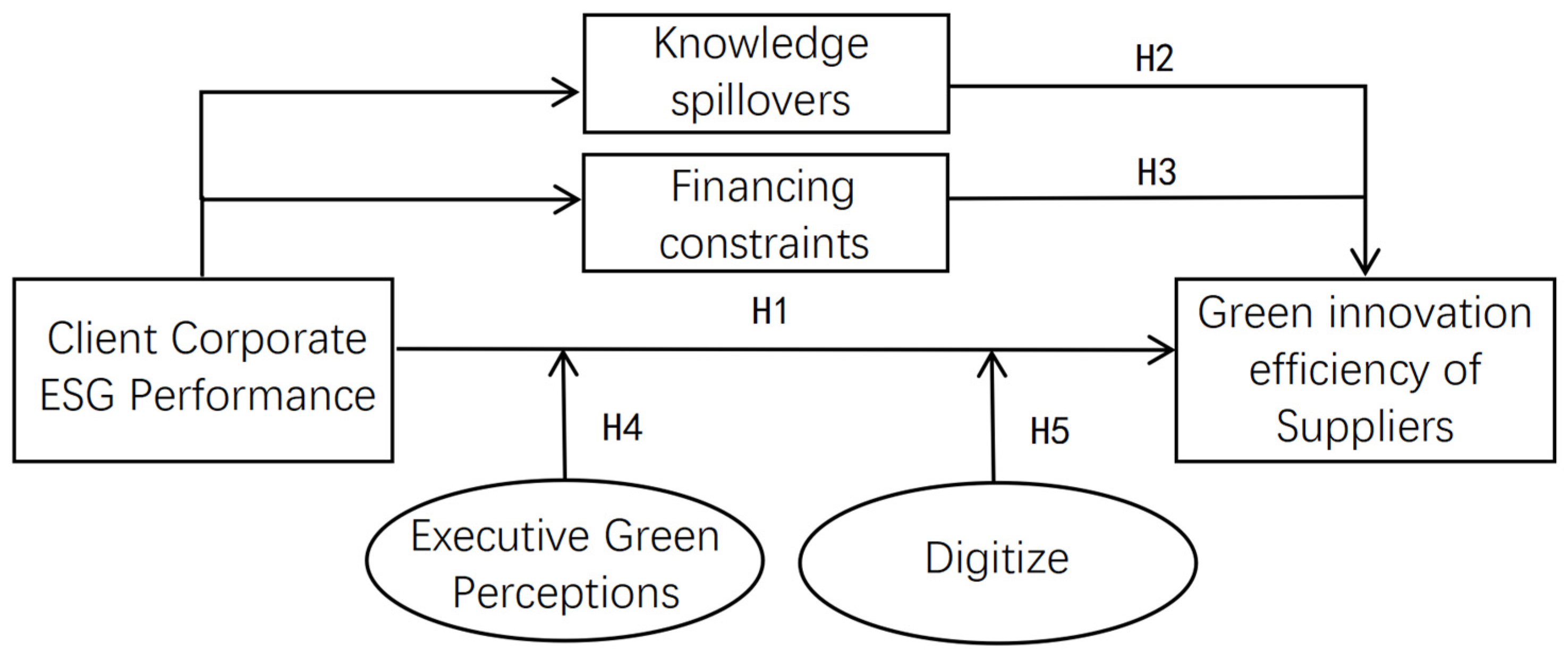

Section 3 employs a three-level progressive framework to construct a logical system (see

Figure 1). Initially, the premise that customers’ environmental, social, and governance (ESG) performance directly affects suppliers’ green innovation efficiency is established (H1). Secondly, the propagation pathways of the effects of ESG are elucidated through the “knowledge spillover–financial constraint” dual channel (H2–H3). Finally, the reinforcement mechanism of senior management’s green perceptions (H4) and customers’ digitization level (H5) on the aforementioned relationship is revealed in the “firm characteristics–technology empowerment” dimension.

(i) Customer ESG performance and supplier green innovation efficiency

According to stakeholder theory, the decisions and behaviors of enterprises are not only influenced by shareholders, but also by other stakeholders (e.g., suppliers, customers, communities, etc.) [

35]. The market incentive effect suggests that when the ESG performance of a client firm is better, the firm usually tends to choose a supplier whose ESG performance is in line with its own in order to maintain its own image and ensure the stability of its raw material supply. This change in market demand forces suppliers to adjust their strategies and increase investment in green innovation to adapt to new market trends and enhance competitiveness. It has been shown that suppliers tend to increase their investment in green technologies when faced with customer selection pressure, thus enhancing their innovation efficiency [

36] to meet client firms’ requirements for ESG performance. Client companies with high ESG performance have a higher demand for green products and services, which directly affects suppliers’ strategic choices. In order to meet customers’ green purchasing criteria, suppliers must enhance the green performance of their products through technological innovation [

37].

From the perspective of the diffusion of innovation, suppliers are often incentivized to follow in the footsteps of their client firms in green innovation when the client firms achieve significant economic and social benefits through green measures [

38]. Client companies often encourage their suppliers to adopt more environmentally friendly production methods and technologies by establishing long-term partnerships. In addition, the ESG practice experiences of client companies are disseminated to supplier companies through annual reports, sustainability reports, and industry seminars, which help suppliers learn about the latest green technologies and management methods, thus accelerating their green innovation process [

39].

Based on the above analysis, this paper proposes the following hypotheses:

Hypothesis 1. The high ESG performance of customer firms has a significant positive effect on the green innovation efficiency of supplier firms.

(ii) Mechanisms of knowledge spillovers

The “knowledge spillover effect” refers to the phenomenon of new knowledge, skills, and innovative ideas being transferred from one organization to another through informal channels. Zhang, Y. et al. showed that there is a significant positive correlation between corporate social responsibility and green innovation [

40]. Client companies with high ESG performance usually implement more stringent sustainable sourcing standards, which are not only reflected in the environmental performance of products, but also in the efficiency of resource utilization and the waste management level in the production process. In order to meet the sustainability requirements of customer companies, suppliers must improve their own green innovation efficiency. Supply chain collaboration based on trust and common goals can strengthen the knowledge spillover effect, thus promoting the realization of green innovation.

In the process of cooperation between client companies and suppliers, the environmental management knowledge and green technology experience accumulated by client companies are transferred to suppliers through training, technical support, and information sharing. Client firms with high ESG performance tend to be more willing to share their best practices in green technology and sustainable production [

41], which helps suppliers to acquire the skills needed for green innovation more quickly, thus increasing the suppliers’ green innovation efficiency. This not only enables suppliers to adapt more quickly to changes in market demand, but also helps customer firms to acquire new products and technologies that meet their sustainability criteria.

Based on this, this paper proposes the following hypothesis:

Hypothesis 2. Customer firms’ ESG performance strengthens suppliers’ green innovation efficiency through knowledge spillover effects.

(iii) Mechanism role of financing constraint

Financing constraints refer to the limitations that a firm encounters in the process of seeking capital to support its operations and development. First, financing constraints cause firms to be more cautious in their investment decisions [

42]. Compared with the characteristics of ordinary innovation such as high input and long cycle, green innovation is subject to the higher possibility and risk of capital shortage and financing constraints [

43]. When facing financial pressure, client companies will pay less attention to their own ESG performance, usually prioritize short-term return projects when making investment decisions, and take a more conservative attitude toward green technology investment. As a result, client companies, under financial constraints, will lower their green product requirements for suppliers to save costs, and at the same time reduce their support for suppliers’ green technology innovation. This will greatly dampen suppliers’ green innovation drive and affect their green innovation efficiency. Second, financing constraints also affect the timely availability of funds to suppliers by client firms. The availability of finance is an important driver for firms to innovate [

44], financial support from client firms is critical for suppliers’ green innovation. When customer firms are unable to provide timely funding to suppliers due to financing constraints, suppliers have to reduce their investment in green innovation to save money, and the lack of funding will reduce the efficiency of suppliers’ green innovation. This series of mechanisms together lead to the decline of suppliers’ green innovation efficiency.

Based on this, this paper proposes the following hypothesis:

Hypothesis 3. Financing constraints of customer firms play a negative mediating role between the ESG performance of customer firms (ESG) and the green innovation of supplier firms (GP).

(iv) Moderating effect of executives’ green cognition

Executive green cognition refers to the level of importance that corporate executives attach to environmental protection and social responsibility in their decision-making process. Executives’ backgrounds and perceptions directly affect their decision-making processes, and the level of executives’ green perceptions determines the depth of a firm’s understanding of the importance of ESG and further affects its strategic choices. Since green innovation is characterized by high investment, high risk, and long payback cycles [

45], some enterprises exhibit weak willingness in terms of green innovation. However, executives with higher green perceptions tend to view external green orientation as an opportunity and actively tilt corporate resources toward green innovation to gain sustainable competitive advantage [

46] and promote corporate performance in environmental protection and social responsibility.

When ESG becomes a strategic choice for supplier companies, the degree of suppliers’ understanding of their clients’ corporate ESG objectives will directly affect their response strategies. Studies have shown that the environmental awareness and values of executives play a crucial role in corporate sustainability strategy selection [

47]. When supplier firm executives have a clear understanding of the ESG performance of their client companies, they are more likely to take the initiative to adjust their resource investment and strategic direction to meet the green needs of their clients by improving the efficiency of green innovation, and expect to establish a long-term and stable cooperative relationship with their client companies.

In addition, executives’ green perceptions also affect the quality of cooperation between client companies and suppliers. Highly cognizant executives can promote the sharing of and cooperation on green technology and knowledge between the two parties, which further strengthens the green innovation capability within the supply chain. Research has shown that a good cooperative relationship can improve the efficiency of knowledge dissemination and enhance the innovation capability of suppliers. When supplier firm executives have strong green cognition, suppliers are more willing to establish close cooperative relationships with client companies and enhance their green innovation capability through the exchange of green knowledge and technology.

Based on this, this paper proposes the following hypotheses:

Hypothesis 4. The increased green knowledge of the supplier firm executives will strengthen the positive impact of the ESG performance of client companies on the supplier’s green innovation efficiency.

(v) Moderating effect of digitization

Digitization is a process by which an enterprise realizes business process reengineering, improves management efficiency, and promotes supply chain synergy through technological means. It is widely acknowledged that a higher level of digitization significantly enhances an enterprise’s dynamic capabilities, enabling client firms to perceive changes in the external environment more acutely, and quickly identify and capture green innovation opportunities. The enhanced dynamic capabilities enable client organizations to more effectively drive ESG practices and lay the foundation for their green transformation. The construction of digital platforms accelerates the sharing of green technologies and innovation experiences between client companies and suppliers, creating green synergies. Through digitalization, client companies are able to efficiently communicate environmental standards and sustainability requirements, enabling suppliers to respond to customer needs, adjust their strategic direction, and enhance their green innovation capabilities in a more timely manner. Digitization not only optimizes the operational efficiency and the ESG performance of customer companies, but also injects green innovation momentum for suppliers, promoting the overall sustainable development of the supply chain.

Based on this, this paper proposes the following hypotheses:

Hypothesis 5. The digitization level of customer enterprises can strengthen the positive impact of their ESG performance on suppliers’ green innovation efficiency.