To meet the sustainable development criteria, it is necessary to include in the CBA not only the market values but also the non-market goods involved in the investment process, both on the B (benefit) and C (cost) side. Therefore, it becomes necessary to assign monetary values to all benefits and costs. Assigning monetary values to benefits and costs for non-market goods is a developmental issue that conditions the effective application of the CBA method. The above analyses show that the efficiency of prosumers’ investments in PV installations largely depends on several drivers, which we broadly grouped into economic and environmental factors.

4.1. The Economic Assessment

The NPV analysis is a popular and widespread method of evaluating the economic efficiency of different projects, such as PV installations [

41,

42,

43,

44,

45,

46,

47,

48]. The results of PV’s NPV analysis depend on many factors, such as the costs of PV power installations, energy tariffs, location and solar radiation, installation size, the complexity of the distributions, the existence or not of smart meters, cash flows of revenues and costs, discount rate, etc. [

41,

46]. Due to the large number of variables influencing the result of the NPV analysis, it is not easy to compare installations. For these reasons, comparing PV installations with each other is complicated and ambiguous. Also, the lifetime of installation has a crucial role in economic effectiveness. Most PV installations are supposed to be used for 20 [

44] to 25 years. In our case, the producer declared a lifetime of 30 years, which also positively influences the economic effect of installations.

This study’s results align with those of studies by Bertsch et al. [

49], which reflect the more significant potential for profitability and return on investment when a PV system is designed to exceed the household’s energy requirements and capitalize on surplus energy production. The findings suggest that although both PV installation configurations (V1 and V2) are economically beneficial, the scale of the system plays a critical role in shaping its financial performance and overall efficiency, a conclusion that aligns with the prior research of Panagoda et al. [

50].

The higher IRR and NPV of V2 indicate that maximizing PV capacity to produce surplus energy is a more effective strategy for achieving long-term cost savings and economic sustainability, which is also supported by the findings of Tushar et al. [

51]. This highlights the importance of optimizing PV system sizing to balance household energy demand with surplus energy generation, ensuring maximum economic and environmental benefits.

Other difficulties with comparing different installations come from the installed PV power. Most of the studies considered large systems of 20, 200 kWp and 1 MWp [

42], 216 kWp [

44], 100–1500 kWp [

52], 20, 40, 60, 80, 100, and 500 kW [

45], 628–2645 kW [

46], and 1 MW [

47]. The assessment of smaller individual installations is rarely considered in the literature, e.g., 3 and 6 kWp, 5.1–8.4 kWp [

43].

Spertino et al. [

42] considered two residential, small-size PV installations of 3 kWp for Italy and 6 kWp for Germany. Despite the German installation being twice as big as the Italian one because of the significant consumption typical at these latitudes, which have less sunlight, the financial results are more profitable in Italy. The NPV (pu) is a profitability of 134% in Italy and 42% in Germany. Also, the IRR for Italy reached almost 15%, whereas Germany’s is only 6%.

A better indicator used to measure economic efficiency than NPV is DPP. DPP is the time it takes to recover all the money spent on the investment. According to this method, the payback period is when the annual net profit equals the initial investment costs, and a positive net return is achieved [

53]. Spertino et al. [

42] calculated the equivalent of DPP as Z-NPV-P (zero NPV period). For the Italian installation of 3 kWp, the time equaled 8 years. Two times bigger (6 kWp), the German installation started to be efficient after 13 years. For small installations of 5.1 and 6.8 kWp (apartments) and 5.3 and 8.4 kWp (villas), the DPP is calculated for 27 and 15 years for the apartment and villa, respectively [

43]. In our studies, the DPP levels are similar to those obtained by Spertino et al. [

42] (7 and 11 years for V1 and V2, respectively).

Another indicator of production energy cost often used is the LCOE [

54]. The LCOE is an economic assessment of the average cost to build and operate a power-generating asset over its lifetime, divided by the total energy output of the asset over that lifetime [

41]. In Europe, the LCOE for PV systems varies between EUR 0.041 and 0.144/kWh, depending on the type of system and solar irradiation, whereas the LCOE for potentially newly constructed coal-fired power plants (hard coal and lignite) exceeds EUR 0.150/kWh due to rising CO

2 certificate prices. For large hard coal power plants, the value decreases and varies between EUR 0.173 and 0.293/kWh [

55]. Small power installations installed at apartments (5.1 and 6.8 kWp) and villas (5.3 and 8.4 kWp) with two kinds of roofs (flat and tilted 24°) are considered by [

43]. They calculated the PV techno-economic efficiency as the levelized cost of electricity (LCOE) for the Kingdom of Saudi Arabia. The LCOE has similar values for both the apartment and villa. In the case of the apartment, the LCOE value decreases from USD 0.105/kWh to USD 0.060/kWh, increasing the PV lifetime from 15 to 30 years. For the villa, the LCOE decreases from USD 0.108/kWh to USD 0.062/kWh. In both cases, the decrease in the LCOE equaled 57%. The LCOE can also be regarded as the average minimum price at which electricity must be sold to break even over the project’s lifetime. It allows the comparison of different technologies (e.g., wind, solar, natural gas, etc.) of unequal life span, project size, capital cost, risk, return, and capacities [

41]. However, attention should be paid to different kinds of formulas to calculate the LCOE: without any discounting [

43,

56], with discounting the sum of equipment investment and replacement cost and cost of operations and maintenance, but without discounting the energy [

46], or with discounting both cost (investment, operations and maintenance) and energy [

44,

57]. Applying discounting to the amount of energy produced causes a reduction in the LCOE. For those reasons, comparing the values of LCOE can be confusing.

Another issue that has to be considered is the increasing price of energy. The Polish economy has encountered high levels of energy price inflation, especially in 2022, when it stood at 32.5%. Also, prosumers are not subject to any direct tax on the ownership or use of PV. Moreover, the energy produced by prosumers is exempt from income tax, regardless of the billing system applied. This means that individuals using either the net-metering or net-billing system are not required to pay income tax on the electricity generated in their micro-installations. Additionally, all prosumers are exempt from excise duty on electricity, provided that the installation does not exceed 1 MW in capacity and the energy is consumed for their own needs [

25]. On the other hand, Sadat et al. [

58] emphasize that solar PV can effectively hedge against inflation, particularly when economic feasibility and tax exemptions are in place. Their findings stress the importance of tailoring financial strategies to regional conditions and incorporating inflation projections into long-term PV system evaluations. Moreover, they highlight that even more costly PV systems with battery storage can become economically viable under inflationary pressures. Also, drawing on data from Sweden, Rydehell et al. [

59] indicate that complementary tax incentives, such as deductions for self-consumption, were found to further enhance household investment willingness. The EU states that one of the three reasons for energy poverty, apart from low income and energy efficiency, is increased energy prices [

60]. Analysis of the Environmental Policy Stringency (EPS) index, presented by Borowiec et al. [

61], i.e., established on market-based instruments, non-market-based instruments, and technology support, positively correlates with a reduction in CO

2 emissions per capita, and does so more effectively in countries with lower compared to higher per capita emissions.

From a prosumer point of view, the most important factor is the investment cost and the potential savings in energy costs. Several programs have been created to support Poles financially and encourage investment in PV for several years. It is that, combined with media promotion, that has led to the acceleration of PV investments in Poland [

15]. Using prosumer support programs can effectively reduce the investment costs of PV installations and the payback time (

Table 6). According to the socio-economic analysis by Izdebski and Kosiorek [

13], the greatest impact on the development of PV power plants in Poland is the cost of purchasing energy and EU regulations on renewable energy sources. During the lifetime of installation, economic and social conditions may undergo significant changes, including, among others, the prices of electricity purchased by network operators, the prices of purchasing electricity from PV installations fed into the power grid, and tax and legal requirements. The key point is a long-term perspective to improve stability and increase energy security for EU countries and regions. In particular, favorable, predictable financial regulations for prosumers and the optimization of the state’s participation in the economy (institutional governance) and the energy sector are needed [

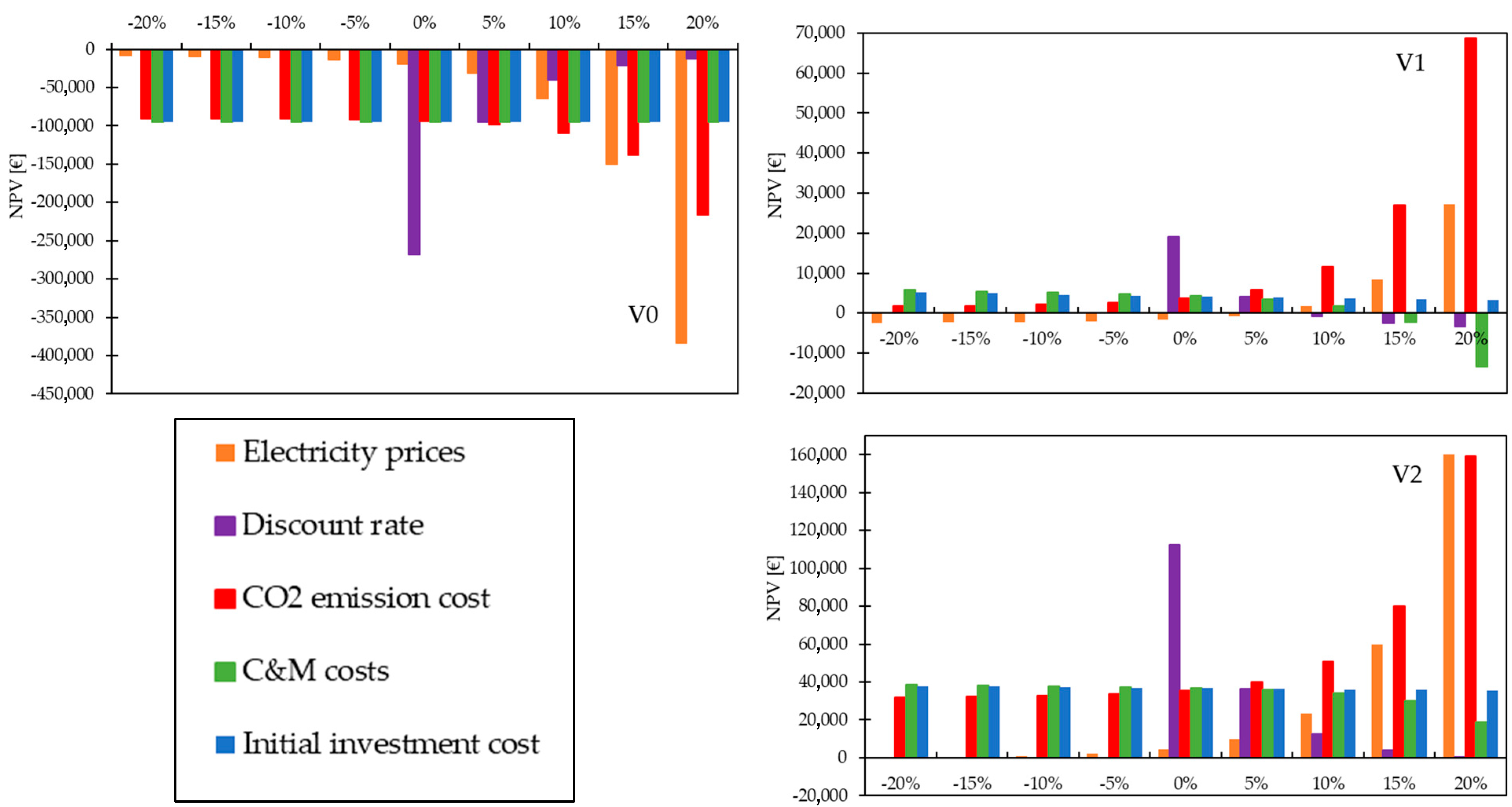

62]. Future uncertainties in electricity prices in Poland pose a significant factor affecting the payback period and overall economic attractiveness of PV investments. A sustained increase in grid electricity prices, driven by inflation, geopolitical instability, or energy market reforms, would accelerate the return on investment by increasing the value of self-consumed solar energy. Conversely, potential regulatory interventions, such as price caps or changes in net billing tariffs, could limit expected savings and extend the discounted payback period (DPP). Since market-based energy pricing is inherently volatile and difficult to forecast, scenario-based modeling and sensitivity analysis are essential for evaluating long-term investment performance in residential PV systems.

The integration of energy storage systems plays a critical role in enhancing the efficiency and profitability of PV systems, particularly in the context of prosumer energy. By storing surplus energy generated during peak sunlight hours, households can increase their self-consumption rate and reduce reliance on the grid during periods of low solar production [

63]. Home battery storage enables prosumers to shift energy use to periods with higher electricity prices, thus maximizing savings or revenues. Moreover, storage contributes to grid stability by reducing reverse power flow and evening out demand peaks [

64]. As the regulatory landscape in Poland continues to evolve, particularly with the introduction of dynamic tariffs in 2024, the strategic deployment of energy storage becomes increasingly advantageous for prosumers aiming to optimize both economic and environmental outcomes.

4.2. The Environmental Assessment

There is no doubt that, beyond economic benefits, the adoption of PV systems has significant environmental advantages, which are also highlighted by Jathar et al. [

65]. PV systems offer benefits beyond those provided by more traditional forms of energy production. In the case of greenhouse gas emissions, the PV systems emit them, especially during the production stage [

65]. Also, the PV energy is socially associated with benefits in environmental conservation, such as reducing GHG emissions and conserving natural resources [

66]. The dynamics of depletion, availability, and allocation of strategic natural resources are not included in economic analysis. Next, not all of the non-market goods involved in the investment process are incorporated. The strategy of developing energy sources from renewable and inexhaustible resources is not only a green light for zero-emission technologies but also the construction of a distributed critical infrastructure, resistant to destructive actions. The destruction of individual energy modules does not have a major impact on the functioning of the entire network. The realization of the risk of failure does not pose significant threats to life and the environment.

The environmental benefits of V1 and V2 are particularly notable. Also, V2′s larger capacity offsets household energy demands and contributes to surplus energy generation, supporting broader decarbonization efforts. It is an important issue because the Polish energy sector is heavily carbonized and emits the most CO

2 per 1 kWh in the EU. In 2023, 1 kWh of energy in Poland corresponded to 622 g CO

2 emissions, compared to the EU average of 242 g CO

2/kWh [

67]. On the contrary, for a year, Poland reduced the CO

2 emission of 111 g/kWh, and since 2000, the carbon intensity of the power sector in Poland has decreased by 35% [

34]. In our study, the possible energy production of PV installation is 4516 kWh and 6169 kWh for V1 and V2, respectively. Taking the difference between the CO

2 emissions of Poland’s energy sector and the average lifecycle emissions of PV installation, implementing the PV installation reduces by 2.6 and 3.6 Mg CO

2/year for V1 and V2, respectively. Also, producing energy from renewable sources changes the public’s perception. There is growing social support for renewable energy and recognition of the health and environmental benefits of reducing coal dependency [

68].

However, there is also a second side of PV regarding the end-of-life stage (EoL). Recycling PV modules is crucial due to the increasing volume of EoL panels. Various recycling technologies (mechanical, thermal, chemical, and hybrid approaches) have been developed to address this need, each with advantages and limitations. The mechanical recycling methods include crushing (effective for glass recovery but limited in retrieving other valuable components like silicon and metals [

69,

70]), high-voltage pulse crushing (promising, with an 85% recycling rate, offering increased material purity [

69]), and the hot knife technique (effective for glass and EVA recycling but requires expert handling and can cause potential damage [

69]). The thermal recycling methods include pyrolysis (efficient in breaking down organic materials but energy-intensive [

71,

72] and thermal delamination (preferred for separating PV glass panels, reducing climate-change impact by 23% compared to mechanical processes [

73]). The chemical methods are metal-assisted chemical etching (recovers high-purity silicon wafers with favorable properties for reuse in PV module production [

74]) and alkaline solutions with iron chloride (efficiently recovers aluminum and metallic silver with minimal environmental impact [

75]). However, it must be taken into account that all of these methods have their limitations. Mechanical methods often fail to recover high-purity silicon, which is crucial for the sustainability of PV recycling [

69,

71]. Thermal methods like pyrolysis are effective but consume significant energy, making them less environmentally friendly [

71,

72]. Chemical processes, while adept at recovering high-purity materials, face challenges related to cost and ecological impact [

71,

75]. Also, the critical issue is advocating for policies mandating producer responsibility for EoL panel collection and recycling. Countries and regions that lack adequate e-waste disposal options could face recycling dilemmas in the near future. According to Lakhouit et al., by 2030, solar PV waste is expected to account for about 14% of the total generation capacity, but this figure could rise dramatically to 80%—approximately 78 million tons—by 2050 [

76]. The EU has successfully implemented the Extended Producer Responsibility (EPR) framework [

77], which mandates producers to manage the collection and recycling of EoL PV panels. This has led to effective recycling and resource recovery [

78]. Moreover, the EU’s Waste Electrical and Electronic Equipment (WEEE) Directive [

79] includes PV panels, ensuring high recycling and recovery rates [

80].

4.3. Limitations and Future Research

While this study provides a comprehensive economic and environmental assessment of two PV on-grid systems under real and optimized scenarios, several limitations should be acknowledged.

First, the analysis is geographically limited to a single-family household located in central Poland. Although representative, the results may not be generalizable to regions with different climatic conditions, solar irradiance, or grid infrastructure. Future research should extend this analysis to other locations across Poland and Europe to evaluate regional variability in PV performance and financial outcomes. The profitability of photovoltaic systems is influenced by several factors, including the location, roof slope and orientation of the PV panels, level of self-consumption, electricity purchase prices from the grid, electricity sale prices to the grid, installation costs, and amount of subsidies.

Second, the study employs annual energy production estimates and cost assumptions based on current market conditions and government programs. These parameters are inherently dynamic and subject to rapid changes due to inflation, energy market volatility, and evolving regulatory frameworks. For example, in 2024, Poland introduced major changes to its energy settlement rules, including the implementation of dynamic tariffs in July, which allow prosumers to sell surplus energy based on hourly market prices [

29]. This reform particularly benefits PV system owners with home energy storage, enabling strategic energy use and sale. Prior to this, a monthly pricing model was used, and the net metering system, allowing the retrieval of 70–80% of produced energy, was maintained only for existing prosumers. These regulatory shifts significantly affect the financial outcomes of PV investments. Therefore, a more dynamic modeling approach incorporating scenario-based projections could improve long-term forecasts and better capture regulatory and market risks.

Third, the modeling assumes ideal PV system operation with standard degradation (0.56% per year) and does not consider variability in self-consumption patterns (the self-consumption was not modeled in this study due to limitations). Incorporating high-resolution consumption profiles and real-time energy usage data would allow a more nuanced analysis of system sizing, return on investment, and energy storage needs.

Additionally, while the analysis touches on regulatory and grid integration challenges, it does not fully explore the technical constraints imposed by distribution system operators (DSOs), such as limits on feed-in capacity, connection delays, or reverse power flow risks. These factors can significantly affect the feasibility and profitability of prosumer installations and merit further exploration.

Finally, although this study evaluates grid-connected systems, future research should examine hybrid or off-grid PV systems, particularly for rural or underserved areas. Comparative assessments of centralized vs. decentralized systems could offer deeper insights into energy resilience and policy prioritization.