Implications of Battery and Gas Storage for Germany’s National Energy Management with Increasing Volatile Energy Sources

Abstract

1. Introduction

1.1. Discussion of Other Published Scenarios

1.2. Modeling Approaches for Energy Transition Scenarios

1.3. Scope of This Investigation

2. Methods and Assumptions

2.1. Storage System Simulation

2.1.1. Simulation of Battery Storage

2.1.2. Simulation of Chemical Storage by Hydrogen in Caverns

2.1.3. Simulation of Pumped Storage

2.1.4. Demand-Side Management

2.1.5. Import and Export to the European Grid

2.1.6. Extending the Grid Beyond Europe

2.1.7. Curtailing Renewable Energy Production

2.2. Simulation of the Process

2.3. Simplifications in This Investigation

- It is assumed that the grid can transfer arbitrary amounts of energy from one location to another with no losses—the copper plate assumption [46]. In reality, the transport of wind energy from the Northern German coast to southern Germany is severely impeded by a lack of grid capacity. But when we identify problems under the copper plate assumption, they are also valid for the more complex situation.

- The power generation by hydropower, bioenergy, and waste burning (i.e., must-run capacity) is relatively small and does not vary much with time. They currently deliver a relatively constant amount of 7 GW. This corresponds with their yearly contribution of approximately 60 TWh. They are currently not contributing to balancing the volatility of wind and solar energy. But the simulation model assumes that biofuels can contribute to balancing volatility by splitting biofuel power, like nuclear power and backup power, into a constant and a variable contribution. This allows to flexibilize the production of bioenergy, but is not yet clear when such technologies will be widely available.

- Although the simulation model allows for the import and export of energy, we assume a large degree of electrical self-sufficiency of Germany. We thus do not allow for the European grid to balance German energy volatility. This assumption is motivated by considering reactions of Germany’s European neighbors during a period in 2024 when electricity prices exploded on the spot market in the autumn of 2024 because of a German dark wind lull, exporting power scarcity to its neighbors [43].

- The backup power stations are assumed to react immediately to the volatility. This is not the practice case, but with the growing availability of battery storage, the assumption is acceptable because of hybridization batteries that can smooth out the starting and stopping process of coal power plants and make gas power plants more efficient, see e.g., [47].

2.3.1. Outline of the Simulation Process

- The first candidates for supply are the power plants with fixed power. This includes hydro power, except pumped hydro. The grid requires a certain minimum inertia to prevent the grid from collapsing. Recently, ENTSO-E released guidelines for required system inertia. The guideline recommends that grid stability requires 2 s of guaranteed inertia [48]. Currently, this can only be provided by the flywheels of the synchronous generators. For the flywheels to work, the power plant must be online. But the full inertia is provided, even when the generator power is reduced. Synchronous generators have typical inertia values of 2–6 s [49]. Thermal power plants can reduce their power down to 30% of their peak power, at the cost of reduced efficiency. Therefore, a 1 GW backup power plant is simulated by a fixed part of 300 MW and a variable part of 700 MW. The simulator has 2 fields for fixed and variable power for each of the 3 types of biomass, nuclear, and other backup plants (coal, oil, or gas). Hydro generators are also in this category, but their contribution in Germany is not expected to change anymore in the future. So they are included with their unchanged actual power of the reference year.

- Due to their feed-in priority, wind and solar are next. By their volatile character, wind and solar power supply cause overshoots or deficits in comparison to the load. All the following steps must therefore deal with both overshoots and deficits.

- The directly following stages only deal with deficits, ignoring overshoots. These are the variable part of biomass plants (currently not operational in Germany), the variable part of nuclear power, and the variable part of the backup power plants.

- If there is still a deficit after the backup power plant, energy is imported from abroad up to the power in the import configuration field.

- The following storage stages handle both surplus and deficit energy. Depending on their inbound and outbound power and their state of charge, they absorb surplus energy or discharge to reduce the deficit. The tool uses pump storage first, followed by battery storage, and finally gas storage. For each storage type, the inbound and outbound flow, the capacity, and the storage efficiency are defined in the configuration.

- The remaining surplus is exported up to the limit given by the configuration.

- The final stage is to curtail wind and solar energy production. The percentage of controllable installations sets an upper limit to this. A surplus after this stage is not acceptable for a safe grid. If there are still deficits at this point, they are displayed as a histogram, indicating for how many hours how much power is missing. This deficit can only be handled by reducing the load correspondingly.

2.3.2. Simulation Details

3. Results

3.1. The Key Scenarios

3.2. Current Situation

3.3. The Plan for 2030

3.4. Scenario for 2045—Energy Transformation

3.4.1. Why Is the Agora Estimation Flawed?

- Energy yield varies from year to year. Maybe their choice of modeling year, 2012, was a year of extraordinary energy yield. 2020 was a year of exceptionally high photovoltaic yield. With careful statistics, however, and using different years for the estimation, such errors can be minimized. Ideally, at least 30 consecutive weather years should be used for modeling a strongly weather-dependent energy system. This is especially important when an estimation has so far-reaching consequences.

- Could it be that the average wind speed is slowing down in Germany? Considering the official statistics of installed wind power vs. energy yield, it must be noted that the average wind power production is growing considerably slower than the installed nominal power [51]. There are many speculations about the possible root cause of this phenomenon, one of which is that the possible extraction of wind power is entering a saturation point (“wind stilling”). A scientific investigation has been made specifically for an important location dedicated to German offshore wind parks [52]. It clearly states that the wake vortices behind wind power plants can be detectable as far as 20 to 100 km behind wind parks, where turbulence is reducing the usable wind energy much more than would be expected by the amount of energy extracted by the wind power plant. The paper summarizes that “The extractable energy per wind turbine is much smaller for large wind farms than for small wind farms due to the reduced wind speed inside the wind farms”. With the high density of wind power plants near the North Sea coast and in Eastern Germany, it is not surprising that additional wind power plants take away a significant fraction of the energy that other wind power plants produce.

- In this investigation, we ignore electric grid constraints. It is, however, an obvious fact that wind power plants in northern Germany often have to be shut down because there is an energy surplus locally, while in southern Germany, there is an energy deficit. The grid bandwidth between northern and southern Germany is far too small and can not be extended easily: immense costs and social resistance are still delaying the further construction of a powerful north–south power link.

- An important factor is that institutions involved in discussing the energy transition are not independent but have a financial interest in its implementation. Such a lobby attitude might foster ignorance over critical issues and problems, most importantly when critical voices are systematically ignored or silenced, as frequently happens in the German public discussion. Notwithstanding, the whole country will have to bear the consequences of decisions based on such questionable estimations.

3.4.2. Is There a Bridge Between KND2045 and the Real World?

4. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AKEN | Aktionskreis Energie und Naturschutz |

| ENTSO-E | European Network of Transmission System Operators for Electricity |

| KND2045 | Klimaneutrales Deutschland 2045 (climate neutral Germany 2045) |

| P2H2P | Power to Hydrogen (and back) to Power |

| PV | Photovoltaics |

| RE | Renewable energy |

| SME | Small and Medium Enterprise |

| WPP | Wind Power Plants |

Appendix A. Documentation of the Online Tool

Appendix A.1. General Description

- Capacity: Actual storage capacity of the store (GWh);

- Efficiency: Ratio of storage output vs. input;

- Inflow: Maximum possible power entering the storage device (GW);

- Outflow: Maximum possible power leaving the storage device (GW).

Appendix A.2. Data Flow Description

- Inputs (User-Defined Parameters and Datasets)The simulation begins with user inputs that define the scenario, data sources, and parameters for energy production, consumption, storage, and costs. These inputs drive the simulation logic.

- Scenario Selection:

- –

- Users select predefined scenarios (e.g., Current 2023, Projection 2030, Projection 2045, according to KND2045) or customize their own.

- –

- Each scenario specifies storage capacities (e.g., 40 GWh pumped storage for 2023, 50 TWh gas storage + 100 GWh battery for the Projection 2045 scenario) and may include baseload power like nuclear (e.g., 10 GW in 2030 with NPP scenario).

- –

- Users can download or upload scenario configurations to save or load custom settings.

- Dataset Selection:

- –

- Datasets from Fraunhofer (2023 or 2024) provide historical data for load and renewable energy production (offshore wind, onshore wind, solar, biomass, hydro).

- –

- Only load and renewable energy components are used, excluding historical fossil fuels and historical pumped storage usage.

- Time Scope Selection:

- –

- Users can choose to display results for the entire year, a specific month (January–December), or a specific day (1–31) via “Month selection” and “Day selection” dropdowns.

- –

- Calculations are performed for the full year, with visualization scaled to the selected time period.

- Renewable Energy Expansion Parameters:

- –

- Expansion factors for photovoltaic (PV), onshore wind, and offshore wind determine the scaling of installed capacities.

- –

- Installed power capacities (in GW) for PV, onshore wind, and offshore wind are derived from these factors.

- –

- A percentage of controllable renewable energy curtailment and corresponding controllable power (GW) are specified to manage surplus electricity.

- Consumption Parameters:

- –

- A consumption load expansion factor scales the total consumed energy (GWh).

- –

- Total installed wind and solar power (GW) is calculated based on the given 2023 values and expansion factors.

- Import/Export Options:

- –

- Maximum import and export capacities (GW) are set to account for energy exchange with neighboring regions.

- Storage Systems:

- –

- Parameters for pumped storage, battery storage, and gas storage (Power-to-Hydrogen-to-Power, PtH2tP) include:

- *

- Maximum flow into and out of storage (GW).

- *

- Storage efficiency (%).

- *

- Storage capacity (GWh for pumped and battery storage, TWh for gas storage).

- Baseload and Backup Power Systems:

- –

- Fixed and variable capacities (GW) for biomass, nuclear power plants (NPPs), and other backup power plants (e.g., fossil-based).

- –

- Fixed biomass can override actual biomass data if specified (volatility > 0).

- Cost Parameters:

- –

- Renewable Expansion Costs:

- *

- PV: 1 EUR/Wp (25-year lifetime, annualized to EUR/MWp).

- *

- Onshore wind: 1 EUR/Wp (20-year lifetime, annualized to EUR/MWp).

- *

- Offshore wind: EUR2/Wp (20-year lifetime, annualized to EUR/MWp).

- –

- Storage Costs:

- *

- Battery storage: Annualized capacity costs (EUR/MWh), including operation and maintenance (e.g., EUR 10,000/MWh for a 10-year lifetime system costing EUR 100,000/MWh).

- *

- Gas storage: Costs for inflow (electrolyzers, EUR/MW), outflow (gas-fired plants or engines, EUR/MW), and storage capacity (caverns, EUR/MWh).

- –

- Grid and Subsidy Costs:

- *

- Grid expansion: EUR/MWp, based on EUR34 billion/year for 30 GW/year of new renewable capacity.

- *

- Subsidies: EUR/MWh, based on EUR20 billion for 244 TWh of renewable consumption in 2024.

- –

- Baseload and Backup Costs:

- *

- Fixed costs (EUR/MW) for biomass, nuclear, and backup power plants.

- *

- Marginal costs (EUR/MWh) for biomass, nuclear, and backup power.

- *

- Nuclear reconstruction (max 10 GW): EUR2/W (40-year lifetime, annualized to EUR/MW).

- Simulation Processing

- Triggering the Simulation:

- –

- Changing the scenario automatically starts a new simulation;

- –

- Other dropdowns also start a new simulation;

- –

- Other parameter changes require clicking the “Simulation” button or pressing the “Return” key.

- Process Logic:

- –

- Load data and renewable energies are read from the provided data. They are processed with 15 min granularity.

- –

- Renewable energy production (offshore wind, onshore wind, solar) is scaled by expansion factors and combined with fixed baseload power (e.g., biomass, nuclear, fixed backup).

- –

- Hydro energy is used as provided from the dataset.

- –

- Volatility is first balanced by the provided variable power from biomass, nuclear, and other backup systems.

- –

- Further deficits are balanced with imports

- –

- Storage systems (pumped hydro, battery, gas storage) balance remaining volatility by storing surplus energy and supplying deficits, with defined inflow/outflow rates, efficiencies, and capacities.

- –

- Remaining surplus is treated with exports.

- –

- Surplus electricity after exports is managed by curtailing a specified percentage of renewable energy. Any remaining surplus indicates a scenario failure, which would cause brownouts or worse in reality.

- –

- The final remaining energy deficit, the residual power, is displayed as a histogram of required hours vs. required power (GW).

- –

- Costs are calculated annually:

- *

- Renewable expansion costs are based on installed capacity and lifetime.

- *

- Battery storage costs are derived from capacity costs (EUR/MWh), multiplied by installed capacity, and divided by energy delivered. Operational costs are assumed to be included in the capacity costs.

- *

- Gas storage costs have three components. Apart from the capacity costs, electrolyzers scale with installed inflow power, while gas power plants or gas engines scale with installed outflow power.

- *

- All costs including grid expansion and subsidies are distributed across total energy demand (EUR/MWh).

- Calculations:

- –

- Energy Balance:

- *

- Total energy demand (GWh).

- *

- Renewable production (wind, solar, hydro, biomass, nuclear) and its percentage of demand.

- *

- Wind and solar (WS) production, directly usable portion, full load hours, surplus (before/after storage), deficit (before/after storage), and curtailment (GWh, % of demand).

- *

- Reduced demand after accounting for fixed baseload supply (hydro, biomass, nuclear, fossil backup).

- *

- Import and export quantities (GWh).

- –

- Storage Energy Flow:

- *

- Energy into and out of pumped storage, battery storage, and gas storage (GWh).

- *

- Percentage of demand met by storage systems.

- –

- Cost Calculations:

- *

- Specific costs (EUR/MWh) for battery storage, gas creation, gas storage, and gas-to-electricity conversion.

- *

- Costs for biomass, nuclear, and backup energy (EUR/MWh).

- *

- Shared costs (EUR/MWh) for storage, PV, wind (onshore/offshore), biomass, nuclear, backup power, grid expansion, and subsidies.

- *

- Total shared cost of renewable energy (EUR/MWh).

- –

- Residual Power:

- *

- Hours requiring conventional (fossil) backup power, categorized by power capacity (GW).

- Outputs (Visualizations and Metrics)The simulation results are displayed in charts and tables, with options to view data for the entire year, a specific month, or a single day.

- Charts:

- –

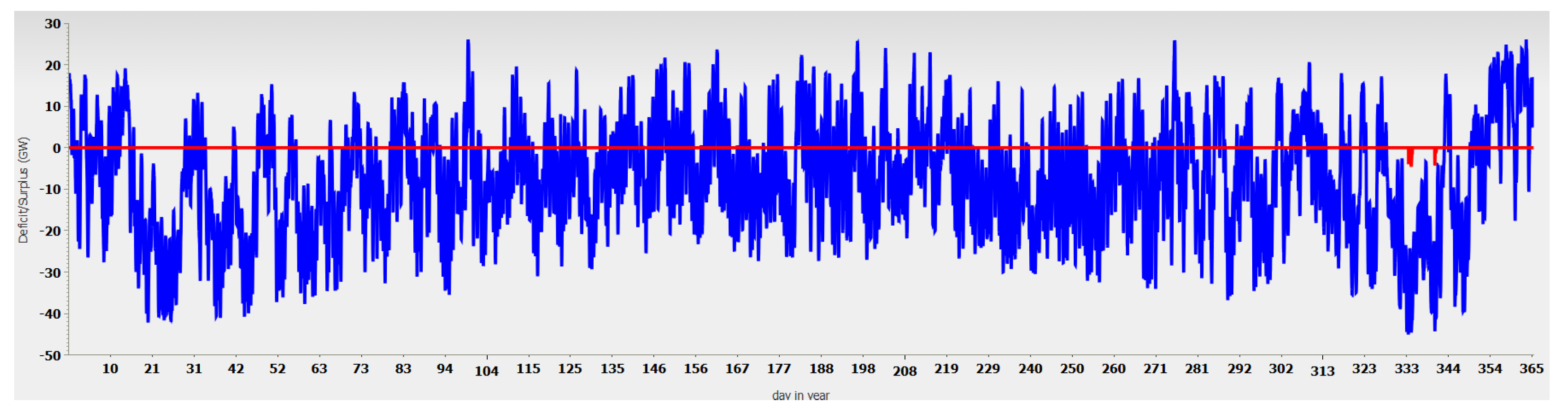

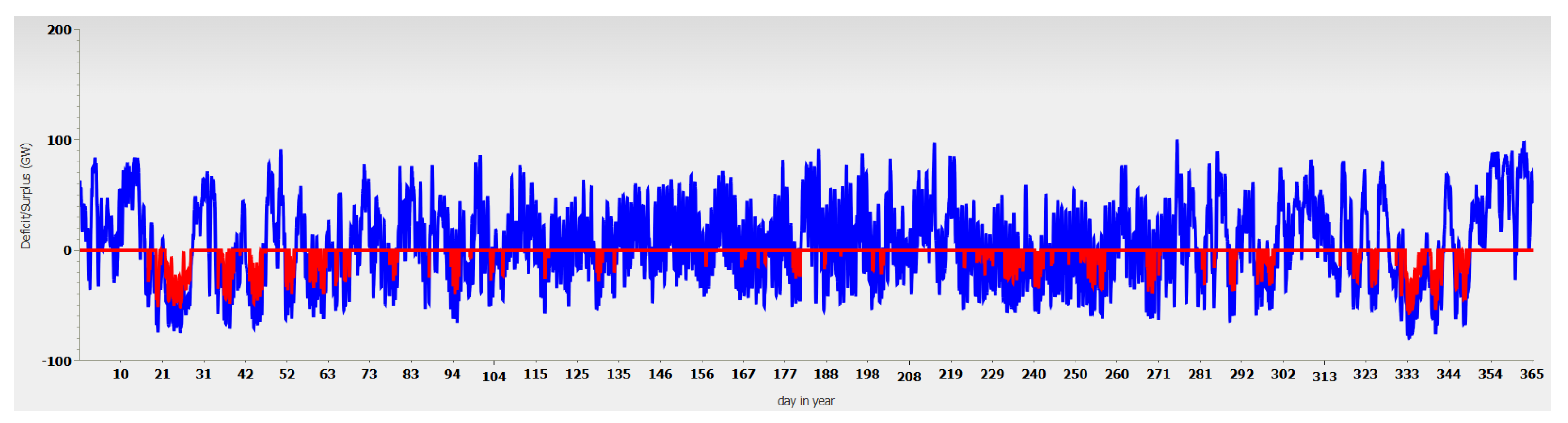

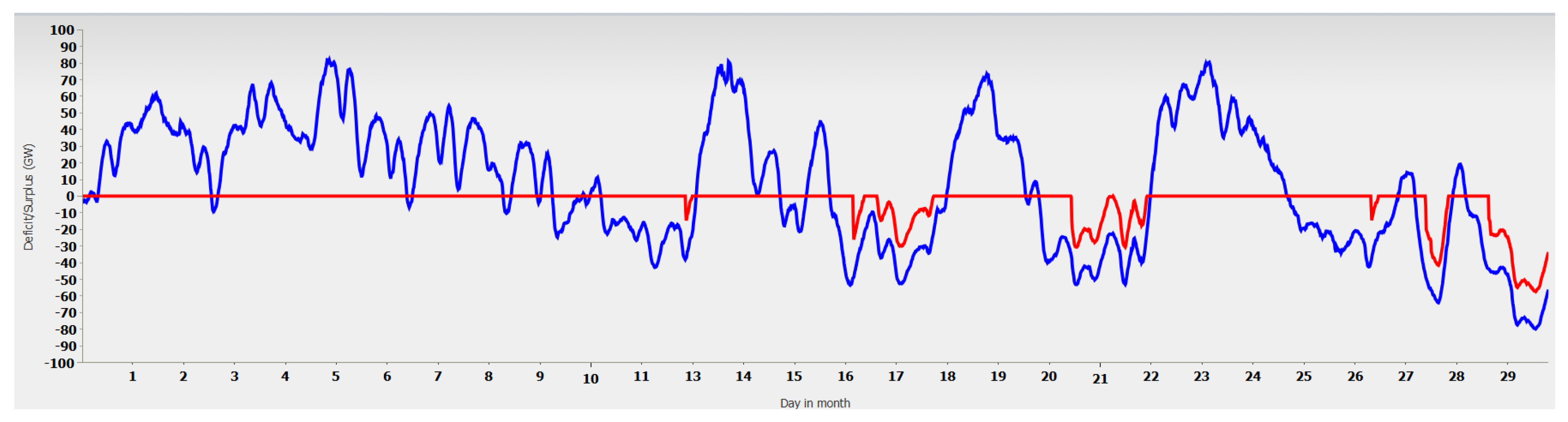

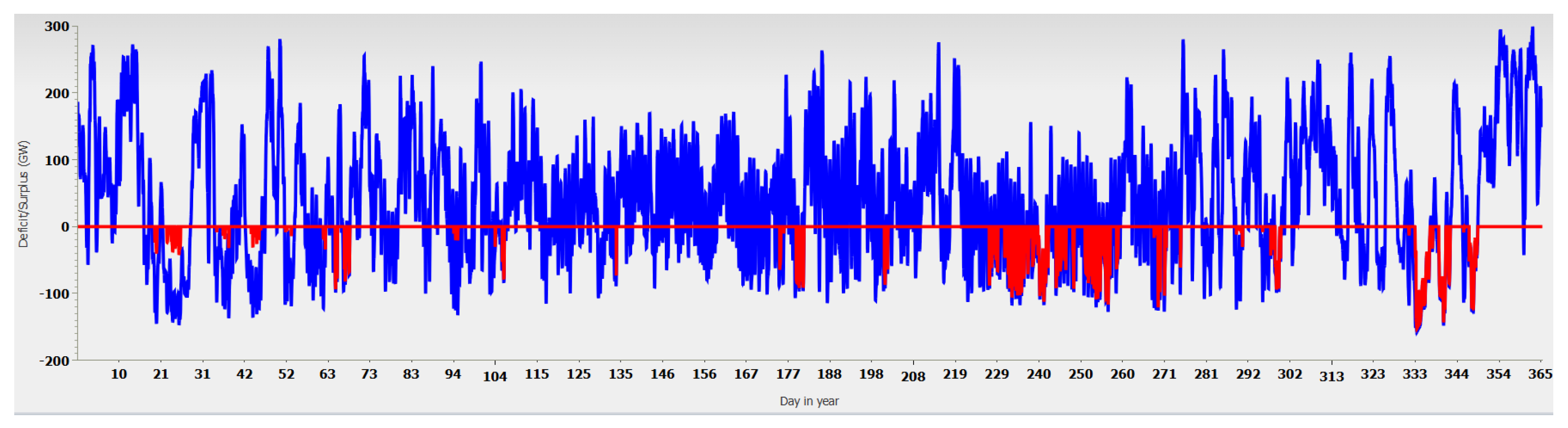

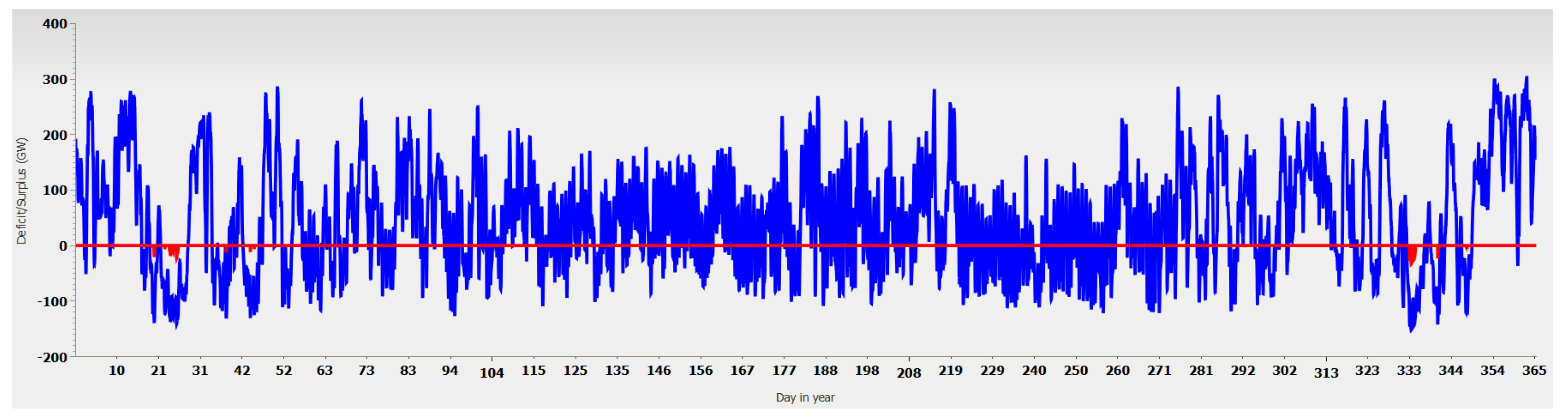

- Renewable Energy Volatility:

- *

- For each storage type (pumped, battery, gas), charts show surpluses (volatility > 0) and deficits (volatility < 0) in GW before (blue) and after (red) storage.

- –

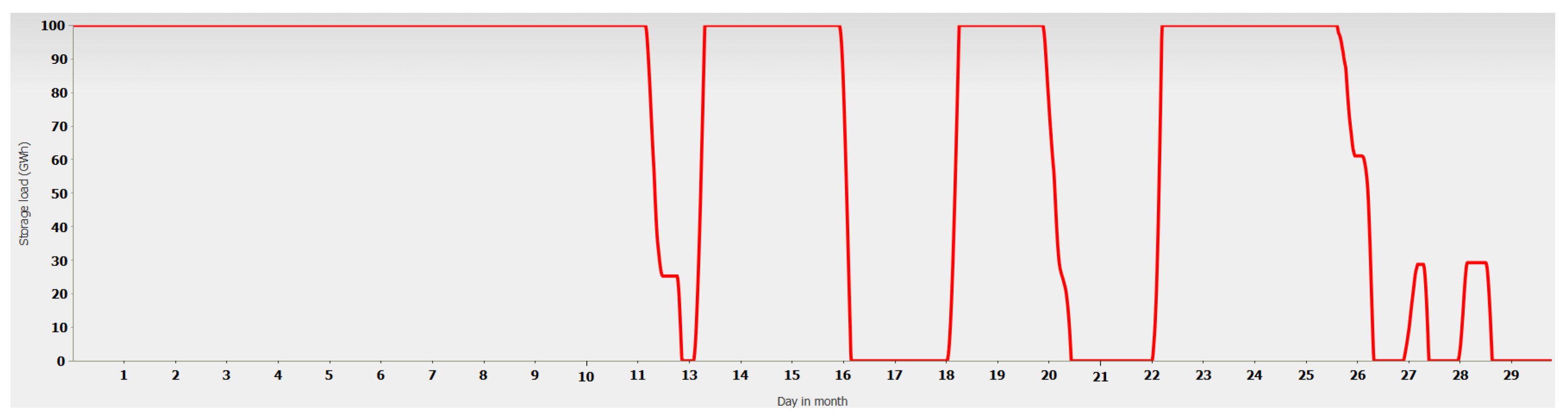

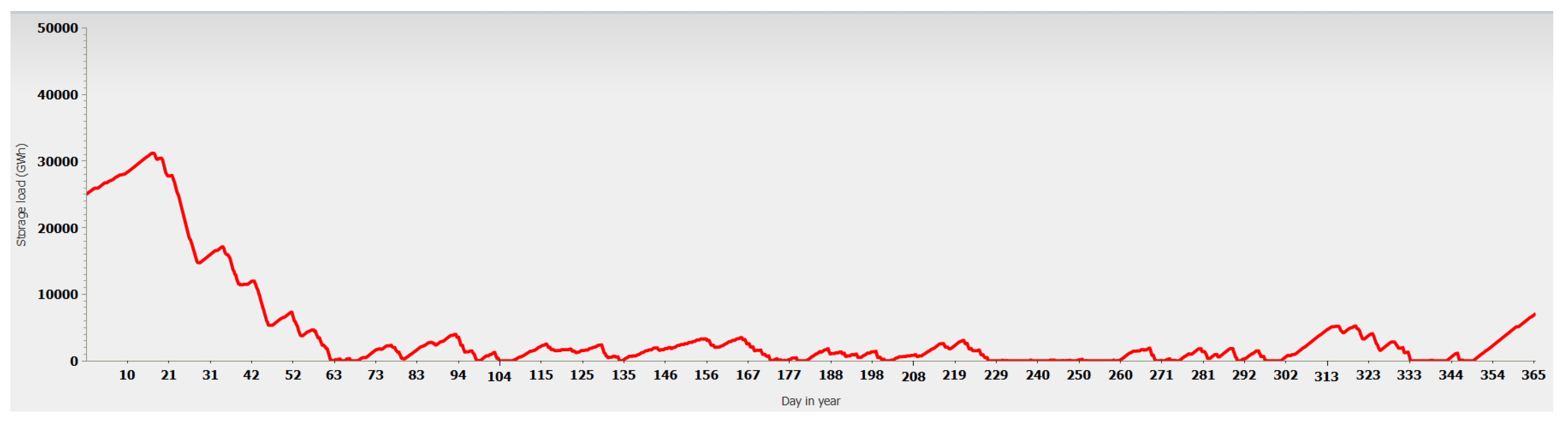

- Storage Charge Levels:

- *

- Charge levels (GWh) for pumped, battery, and gas storage over time.

- –

- Energy Flow:

- *

- Energy flow into (red) and out of (blue) storage systems (GW) for each storage type.

- –

- Residual Conventional Power Requirement:

- *

- Hours requiring conventional power, categorized by power capacity (GW).

- Tables/Metrics:

- –

- Energy Demand and Production:

- *

- Total demand (GWh).

- *

- Renewable production (total RE, wind + solar only) in GWh and % of demand.

- *

- Wind+solar directly usable, surplus (before/after storage), deficit (before/after storage), and full load hours.

- –

- Baseload and Import/Export:

- *

- Reduced demand after fixed supply (GWh).

- *

- Contributions from hydro, biomass, nuclear, fossil backup, import, and export (GWh).

- –

- Storage Metrics:

- *

- Energy flow into and out of storage systems (GWh).

- *

- Percentage of demand met by storage.

- –

- Cost Metrics:

- *

- Specific costs for battery storage, gas storage (creation, storage, conversion), nuclear, and backup energy (EUR/MWh).

- *

- Shared costs for storage, PV, wind (onshore/offshore), biomass, nuclear, backup power, grid expansion, and subsidies (EUR/MWh).

- *

- Total shared cost of renewable energy (EUR/MWh).

- User Interaction and Iteration

- Users can adjust parameters (e.g., expansion factors, storage capacities, cost assumptions) and rerun the simulation to explore different scenarios.

- The ability to drill down into monthly or daily data allows users to analyze specific periods simulation.

- Scenario download/upload functionality enables users to save and share custom configurations.

- Summary of Data Flow

- (a)

- Input Collection: Users select a scenario, dataset (Fraunhofer 2023/2024), time scope, and specify parameters for renewable expansion, consumption, storage, import/export, baseload power, and costs.

- (b)

- Simulation Execution: The tool processes inputs using a simplified model (copper plate assumption), calculating energy production, storage flows, and costs for the entire year. Surplus energy is curtailed, and storage balances volatility.

- (c)

- Output Generation: Results are displayed as charts (volatility, storage levels, energy flows) and tables (energy demand, production, storage, costs) for the selected time scope (year, month, or day).

- (d)

- Iteration: Users can modify parameters or scenarios, rerun the simulation, and download/upload configurations for further analysis.

References

- Enkard, S. Germany Records 457 Hours of Negative Electricity Prices in 2024. 2025. Available online: https://www.pv-magazine.com/2025/01/06/germany-records-457-hours-of-negative-electricity-prices-in-2024/ (accessed on 4 June 2025).

- Heimerl, S.; Kohler, B. Aktueller Stand der Pumpspeicher Kraftwerke in Deutschland. WasserWirtschaft 2017, 10, 77–79. [Google Scholar] [CrossRef]

- Weiß, M.; Wünsch, M.; Ziegenhagen, I. Klimaneutrales Deutschland 2045. 2021. Available online: https://www.agora-energiewende.de/fileadmin/Projekte/2023/2023-30_DE_KNDE_Update/A-EW_344_Klimaneutrales_Deutschland_WEB.pdf (accessed on 4 June 2025).

- Kuhlmann, A. Dena-Leitstudie Aufbruch Klimaneutralität. 2021. Available online: https://www.dena.de/infocenter/dena-leitstudie-aufbruch-klimaneutralitaet-1/ (accessed on 4 June 2025).

- Umweltbundesamt. Strommarkt und Klimaschutz: Transformation der Stromerzeugung bis 2050. 2021. Available online: https://www.umweltbundesamt.de/sites/default/files/medien/5750/publikationen/2021-02-17_cc_08-2021_transformation_stromerzeugung_2050_0.pdf (accessed on 4 June 2025).

- Wissenschaftlicher Dienst des Deutschen Bundestages. Zur Deckung des Zusätzlichen Strombedarfs Durch Erneuerbare Energien im Zuge der Energiewende. 2022. Available online: https://www.bundestag.de/resource/blob/890192/2396cb424eb80359f9d0494a563edabe/WD-5-026-22-pdf.pdf (accessed on 4 June 2025).

- Sinn, H.W. Buffering volatility: A study on the limits of Germany’s energy revolution. Eur. Econ. Rev. 2017, 99, 130–150. [Google Scholar] [CrossRef]

- Peters, B.; Watter, H.; Preusser, P.; Willner, T. Studie zur Klimaneutralität 2045: Offener Brief und Fragen zur Qualitätssicherung in öffentlichen Publikationen. 2021. Available online: https://www.energie-naturschutz.de/publikationen/studie-zur-klimaneutralitat-2045 (accessed on 4 June 2025).

- Peters, B.; Watter, H.; Preusser, P.; Willner, T. Replik auf Antwortschreiben Agora. 2021. Available online: https://www.energie-naturschutz.de/publikationen/replik-antwortschreiben-agora (accessed on 4 June 2025).

- Maier, K. Energiewende-Szenarien in Deutschland um 2045. 2025. Available online: https://magentacloud.de/s/x7LcTL7ckmcEByD (accessed on 4 June 2025).

- Maier, K. Dimensionierung Eines Ausschließlich auf Erneuerbaren Energien Basierenden Energiesystems in Deutschland. 2025. Available online: https://magentacloud.de/s/yt2eH6GacG5kBWm (accessed on 4 June 2025).

- Hansen, K.; Mathiesen, B.V.; Skov, I.R. Full energy system transition towards 100% renewable energy in Germany in 2050. Renew. Sustain. Energy Rev. 2019, 102, 1–13. [Google Scholar] [CrossRef]

- Gawel, E.; Lehmann, P.; Korte, K.; Strunz, S.; Bovet, J.; Köck, W.; Massier, P.; Löschel, A.; Schober, D.; Ohlhorst, D.; et al. The future of the energy transition in Germany. Energy Sustain. Soc. 2014, 4, 15. [Google Scholar] [CrossRef]

- Züttel, A.; Gallandat, N.; Dyson, P.; Schlapbach, L.; Gilgen, P.; Shin-ichi, O. Future Swiss Energy Economy: The Challenge of Storing Renewable Energy. Front. Energy Res. 2022, 9, 785908. [Google Scholar] [CrossRef]

- NZZ, Christoph Eisenring. Sechs Neue Kernkraftwerke? Studie der ETH Lausanne füHrt zu Einer Kontroverse. 2024. Available online: https://www.nzz.ch/wirtschaft/sechs-kernkraftwerke-studie-der-eth-lausanne-fuehrt-zu-einer-kontroverse-ld.1829743 (accessed on 4 June 2025).

- NREL. Power System Planning: Advancements in Capacity Expansion Modeling. 2021. Available online: https://www.nrel.gov/docs/fy21osti/80192.pdf (accessed on 4 June 2025).

- Nicoli, M.; Faria, V.A.D.; de Queiroz, A.R.; Savoldi, L. Modeling energy storage in long-term capacity expansion energy planning: An analysis of the Italian system. J. Energy Storage 2024, 101, 113814. [Google Scholar] [CrossRef]

- Löffler, K.; Hainsch, K.; Burandt, T.; Oei, P.Y.; Kemfert, C.; Von Hirschhausen, C. Designing a model for the global energy system—GENeSYS-MOD: An application of the open-source energy modeling system (OSeMOSYS). Energies 2017, 10, 1468. [Google Scholar] [CrossRef]

- Sarfarazi, S.; Sasanpour, S.; Cao, K. Improving energy system design with optimization models: Addressing the economic granularity gap in energy system modeling. Energy Rep. 2023, 9, 1859–1874. [Google Scholar] [CrossRef]

- Ruhnau, O.; Hirth, L.; Praktiknjo, A. Heating with wind: Economics of heat pumps and variable renewables. Energy Econ. 2020, 92, 104967. [Google Scholar] [CrossRef]

- Schöb, T.; Kullmann, F.; Linßen, J.; Stolten, D. The role of hydrogen for a greenhouse gas-neutral Germany by 2045. Int. J. Hydrogen Energy 2023, 48, 39124–39137. [Google Scholar] [CrossRef]

- Abuzayed, A.; Hartmann, N. MyPyPSA-Ger: Introducing CO2 taxes on a multi-regional myopic roadmap to a fully decarbonized German power system by 2050. Appl. Energy 2022, 310, 118576. [Google Scholar] [CrossRef]

- Brown, T.; Schlachtberger, D.; Kies, A.; Schramm, S.; Greiner, M. Synergies of sector coupling and transmission reinforcement in a cost-optimised, highly renewable European energy system. Energy 2018, 160, 720–739. [Google Scholar] [CrossRef]

- Schmidt, T.; Mangold, D.; Müller-Steinhagen, H. Seasonal Thermal Energy Storage in Germany. ISES Sol. World Congr. 2003. Available online: https://www.igte.uni-stuttgart.de/veroeffentlichungen/publikationen/publikationen_03-06.pdf (accessed on 4 June 2025).

- Popper, K.R. The Logic of Scientific Discovery; Hutchinson & Co.: London, UK, 1959. [Google Scholar]

- Peters, B.R. Schluss mit der Energiewende! Peters Coll. Beratungs-und-Beteiligungs-GmbH: Berlin, Germany, 2025. [Google Scholar]

- Peters, B. Der Erhalt von sechs Kernkraftwerken könnte den Großhandelspreis für Strom um die Hälfte absenken. ATW 2022, 68, 2–5. [Google Scholar]

- Ahlborn, D.; Ahlborn, F. Storage size estimation for volatile renewable power generation: An application of the Fokker–Planck equation. Eur. Phys. J. Plus 2023, 138, 401. [Google Scholar] [CrossRef]

- Dengler, J. Online Simulator of the German Energy Transition. 2025. Available online: https://www.cortima.com/energiewende/energytransition.html (accessed on 4 June 2025).

- Fraunhofer Institute for Solar Energy Systems ISE. Energy Charts. 2025. Available online: https://www.energy-charts.info/?l=en&c=DE (accessed on 4 June 2025).

- Battery University. BU-402: What Is C-Rate? 2021. Available online: https://batteryuniversity.com/article/bu-402-what-is-c-rate (accessed on 4 June 2025).

- Energy Information Administration. Utility-Scale Batteries and Pumped Storage Return About 80% of the Electricity They Store. 2021. Available online: https://www.eia.gov/todayinenergy/detail.php?id=46756 (accessed on 4 June 2025).

- BDEW Bundesverband der Energie- und Wasserwirtschaft e.V. Zahl der Woche/Bis zu 254,8 Milliarden Kilowattstunden Erdgas. 2023. Available online: https://www.bdew.de/presse/presseinformationen/zahl-der-woche-bis-zu-2548-milliarden-kilowattstunden-erdgas/ (accessed on 4 June 2025).

- Initiative Energie Speichern (INES). Saubere Energien in Gas und Wasserstoffspeichern. 2025. Available online: https://energien-speichern.de/positionen/umweltvertraeglichkeit/saubere-energien-in-gas-und-wasserstoffspeichern/ (accessed on 4 June 2025).

- Bossel, U. Wasserstoff löst Keine Energieprobleme. 2021. Available online: https://leibniz-institut.de/archiv/bossel_16_12_10.pdf (accessed on 4 June 2025).

- Bossel, U.; Eliasson, B.; Taylor, G. The Future of the Hydrogen Economy: Bright or Bleak? Cogener. Distrib. Gener. J. 2003, 18, 29–70. [Google Scholar] [CrossRef]

- Peters, B. Wasserstoff, Energieträger der Zukunft. Oder? 2019. Available online: https://deutscherarbeitgeberverband.de/Artikel.html?PR_ID=830 (accessed on 4 June 2025).

- Peters, B. Wasserstoffwirtschaft: Günstige Quellen müssen Her! 2020. Available online: https://deutscherarbeitgeberverband.de/Artikel.html?PR_ID=853 (accessed on 4 June 2025).

- Kopernikus-Projekte, Bundesministerium für Bildung und Forschung. Anforderungsprofile (für den Einsatz von Lastflexibilisierung). 2025. Available online: https://synergie-projekt.de/ergebnis/anforderungsprofile (accessed on 4 June 2025).

- Stede, J. Demand Response in Germany: Technical Potential, Benefits and Regulatory Challenges. 2016. Available online: https://www.diw.de/de/diw_01.c.532829.de/publikationen/roundup/2016_0096/demand_response_in_germany__technical_potential__benefits_and_regulatory_challenges.html (accessed on 4 June 2025).

- Deutsche Energie-Agentur. Flexibility Technologies and Measures in the German Power System. 2021. Available online: https://www.dena.de/fileadmin/dena/Dokumente/Projektportrait/Projektarchiv/Entrans/Flexibility_Technologies_and_Measures_in_the_German_Power_System_EN.pdf (accessed on 4 June 2025).

- Bender, J.; Fait, L.; Wetzel, H. Acceptance of demand-side flexibility in the residential heating sector—Evidence from a stated choice experiment in Germany. Energy Policy 2024, 191, 114145. [Google Scholar] [CrossRef]

- Katanich, D. Norway Aims to Cut Energy Links with Europe Due to Soaring Prices. 2024. Available online: https://www.euronews.com/business/2024/12/13/norway-aims-to-cut-energy-links-with-europe-due-to-soaring-prices (accessed on 4 June 2025).

- Czisch, G. Szenarien zur Zukünftigen Stromversorgung, Kostenoptimierte Variationen zur Versorgung Europas und Seiner Nachbarn mit Strom aus Erneuerbaren Energien. 2006. Available online: https://kobra.uni-kassel.de/items/cade2566-0243-481e-9e49-eb3ef90b27c9 (accessed on 4 June 2025).

- Loulou, R.; Goldstein, G.; Kanudia, A.; Lettila, A.; Remme, U. Documentation for the TIMES Model: Part I—Concepts and Theory. In Energy Technology Systems Analysis Programme (ETSAP); IEA-ETSAP: Paris, France, 2016. [Google Scholar]

- Hess, D.; Wetzel, M.; Cao, K.K. Representing node-internal transmission and distribution grids in energy system models. Renew. Energy 2018, 119, 874–890. [Google Scholar] [CrossRef]

- MAN Energy Solutions. Produce Greener Energy with Hybrid Power Plants. 2025. Available online: https://web.archive.org/web/20250505022054/https://www.man-es.com/energy-storage/solutions/hybrid-power (accessed on 4 June 2025).

- ENTSO-E. Frequency Stability Analysis in Long-Term Scenarios: Relevant Solutions and Mitigation Measures; Technical Report; European Network of Transmission System Operators for Electricity: Brussels, Belgium, 2023. [Google Scholar]

- Milano, F.; Dörfler, F.; Hug, G.; Hill, D.J.; Verbič, G. Foundations and Challenges of Low-Inertia Systems. In Proceedings of the 2018 Power Systems Computation Conference (PSCC), Dublin, Ireland, 11–15 June 2018; pp. 1–25. [Google Scholar] [CrossRef]

- Bundesnetzagentur. Bundesnetzagentur Publishes 2024 Electricity Market Data. 2025. Available online: https://www.bundesnetzagentur.de/SharedDocs/Pressemitteilungen/EN/2025/20250103_SMARD.html (accessed on 4 June 2025).

- Bundesverband Windenergie. Windenergie in Deutschland. 2025. Available online: https://www.wind-energie.de/themen/zahlen-und-fakten/deutschland/ (accessed on 4 June 2025).

- Maas, O.; Raasch, S. Wake properties and power output of very large wind farms for different meteorological conditions and turbine spacings: A large-eddy simulation case study for the German Bight. Wind Energy Sci. 2022, 7, 715–739. [Google Scholar] [CrossRef]

- Hilly, M.; Rettberg, N.J.; Ollington, R.; Nelson, M. Restarting Germany’s Reactors: Feasibility and Schedule; Technical Report; Radiant Energy Group: Chicago, IL, USA, 2024. [Google Scholar]

| Sector | Techn. Potential | Activation Duration | Key Technologies |

|---|---|---|---|

| Heavy Industry | 5–15 GW | 1–8 h | Aluminum smelters, cement kilns |

| SMEs | 2–7 GW | 30 min–2 h | Refrigeration, ventilation |

| Households | 3–30 GW | 15 min–4 h | Heat pumps, EVs, smart appliances |

| Description | Unit | 2023 | 2030 | 2045 |

|---|---|---|---|---|

| Installed power PV | GW | 82 | 215 | 469 |

| Installed power wind onshore | GW | 61 | 98 | 180 |

| Installed power wind offshore | GW | 8 | 26 | 73 |

| Expected Energy PV + wind + hydro | TWh | 219 | 507 | 1087 |

| Expected Energy biomass and hydrogen | TWh | 50 | 50 | 92 |

| Expected Energy others (garbage, nuclear, geothermal) | TWh | 29 | 0 | 3 |

| Expected Energy coal and natural gas | TWh | 192 | 132 | 0 |

| Expected Energy battery storage | TWh | 0 | 20 | 59 |

| Net demand | TWh | 489 | 709 | 1241 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dengler, J.; Peters, B. Implications of Battery and Gas Storage for Germany’s National Energy Management with Increasing Volatile Energy Sources. Sustainability 2025, 17, 5295. https://doi.org/10.3390/su17125295

Dengler J, Peters B. Implications of Battery and Gas Storage for Germany’s National Energy Management with Increasing Volatile Energy Sources. Sustainability. 2025; 17(12):5295. https://doi.org/10.3390/su17125295

Chicago/Turabian StyleDengler, Joachim, and Björn Peters. 2025. "Implications of Battery and Gas Storage for Germany’s National Energy Management with Increasing Volatile Energy Sources" Sustainability 17, no. 12: 5295. https://doi.org/10.3390/su17125295

APA StyleDengler, J., & Peters, B. (2025). Implications of Battery and Gas Storage for Germany’s National Energy Management with Increasing Volatile Energy Sources. Sustainability, 17(12), 5295. https://doi.org/10.3390/su17125295