Abstract

This study explores how digital technologies (DTs) drive business model innovation (BMI) in the traditional manufacturing sector of an emerging economy, focusing on the mediating roles of firm agility (FA), absorptive capacity (AC), and the moderating role of market turbulence (MT). Drawing on organizational adaptation theory and the dynamic capability view, the study develops a conceptual model tested through a survey of 479 senior managers from small and medium-sized manufacturing enterprises (SMEs) in three major industrial cities in Turkey. The results confirm that DTs have a significant positive effect on BMI, with both FA and AC partially mediating this relationship. Additionally, MT strengthens the impact of DTs on FA but does not significantly moderate its effect on AC or BMI. These findings reveal that the effectiveness of digital transformation depends not only on technological investments but also on internal organizational capabilities and external environmental conditions. The study contributes to the digital transformation literature by offering empirical evidence from an underexplored emerging market context and by demonstrating the conditional pathways through which DTs influence innovation. Practical implications highlight the importance of enhancing agility and knowledge integration to translate digital investments into strategic value under turbulent market conditions.

1. Introduction

Digital technologies (DTs) have emerged as a vital strategic tool for firms seeking innovation and competitive advantages in increasingly turbulent markets. Broadly encompassing applications such as big data analytics, the Internet of Things (IoT), artificial intelligence (AI), and cloud computing, digital technologies empower businesses to reconfigure operations, enhance decision-making, and transform traditional business practices [1,2,3]. These innovations enable firms to meet dynamic market demands, improve efficiency, and develop entirely new value propositions.

Business model innovation (BMI)—the introduction of substantial and novel changes to core components of a business model—is increasingly recognized as critical for maintaining competitiveness in the digital age [4,5]. Firms engaging in BMI must comprehensively reevaluate strategic goals and organizational structures in response to technological advancements and volatile market conditions [6]. Although existing literature generally supports a positive relationship between digital technologies and BMI [7], empirical investigations detailing specific mechanisms and contextual conditions remain limited.

Among the internal capabilities necessary for leveraging digital resources effectively, firm agility (FA) and absorptive capacity (AC) are particularly critical. Absorptive capacity—defined as an organization’s capability to acquire, assimilate, and utilize external knowledge to foster innovation [8,9]—is essential yet notably underexplored in empirical digitalization research [10]. Similarly, firm agility, the ability to rapidly sense and respond to external changes relative to competitors, is vital in exploiting digital opportunities amid market turbulence [11,12]. Despite recognizing their importance, limited empirical insights exist on how these capabilities mediate the relationship between digital technologies and business model innovation.

External factors, particularly market turbulence (MT), significantly influence firms’ ability to harness digital technologies for BMI. Market turbulence refers to unpredictable and rapid market changes affecting firms’ strategic responses and innovation processes [5,13]. However, the current literature provides limited empirical understanding regarding how market turbulence moderates the relationship between digital technologies, internal capabilities, and BMI, leaving critical contextual conditions inadequately examined.

To explore these relationships comprehensively, this study integrates organizational adaptation theory [14] and the dynamic capability view [15]. Organizational adaptation theory emphasizes timely adjustments to internal processes in response to external market pressures [5,16,17], whereas the dynamic capability view highlights the firm’s continuous reconfiguration of internal and external resources to adapt strategically [18,19,20].

In the context of Turkey’s manufacturing industry, digital transformation has been unevenly implemented across firms, especially among small- and medium-sized enterprises (SMEs). Prior to this study, Turkish manufacturing firms exhibited moderate digital maturity, constrained by limited financial resources, inadequate infrastructure, and strategic uncertainty regarding digitalization benefits [21,22,23,24]. SMEs represent more than 99% of Turkish enterprises and substantially contribute to national employment and GDP; however, their digital transformation journey remains hindered by these persistent barriers [25]. Thus, addressing how Turkish manufacturing SMEs can effectively leverage digital technologies for innovation amidst market turbulence is both timely and crucial [26,27,28].

Moreover, previous research on digital-driven BMI predominantly addresses service-oriented sectors (e.g., healthcare or smart cities) and advanced economies [29,30,31], leaving traditional manufacturing firms in emerging markets significantly understudied. Thus, this study responds to explicit calls in the literature for empirical research into the internal mechanisms (such as absorptive capacity and firm agility) and external conditions (such as market turbulence) through which digital technologies effectively drive BMI [32,33,34,35,36]. To address these identified gaps, this study specifically investigates the following research questions:

RQ1: How does DTs influence BMI?

RQ2: To what extent do FA and AC mediate the relationship between DTs and BMI?

RQ3: How does market turbulence moderate the impact of DTs on FA, AC, and BMI?

This research contributes to existing literature in several key ways. First, it provides empirical insights into digital technologies’ impact on BMI within the traditional manufacturing sector of an emerging economy (Turkey), extending the literature beyond developed-country contexts. Second, the study explicitly identifies absorptive capacity and firm agility as critical mediating mechanisms, thereby uncovering internal strategic pathways essential for effective digital transformation. Third, by integrating organizational adaptation theory and the dynamic capability view, it elucidates how market turbulence moderates these relationships, enriching theoretical knowledge of digital innovation in volatile markets. Practically, the study offers actionable implications for SME managers and policymakers in Turkey. Given SMEs’ crucial economic role and specific constraints in digital transformation, findings provide strategic recommendations to overcome barriers, capitalize on digital technologies, and foster sustainable innovation and competitiveness.

The remainder of the paper is structured as follows: Section 2 presents the theoretical background and hypotheses development. Section 3 describes the research methodology, including sampling procedures, measures, and analytical approaches. Section 4 provides empirical results, hypothesis testing, and robustness checks. Section 5 discusses key findings, theoretical contributions, managerial implications, limitations, and suggestions for future research.

2. Theoretical Background and Hypotheses Development

2.1. Underpinning Theories

The integration of organizational adaptation theory (OAT) and the dynamic capability view (DCV) provides a robust foundation for understanding the impact of DTs on BMI within traditional manufacturing industries. OAT, as articulated by Sarta et al. [37], emphasizes that organizations must continuously adjust their structures, strategies, and processes to align with external environmental changes to remain viable. This theory is pivotal in understanding how manufacturing firms can adapt to the rapid advancements in digital technologies [5,17]. Specifically, OAT posits that successful organizational adaptation involves proactive and strategic responses to external disruptions, such as technological advances or market volatility, thus ensuring sustained competitiveness and growth [38,39].

In contrast, DCV, as explained by Teece et al. [40], highlights the capacity of firms to develop, integrate, and reconfigure internal and external resources and skills to stay competitive in a rapidly evolving landscape [18,41]. DCV suggests that traditional manufacturing firms not only passively adapt to technological changes but also actively build dynamic capabilities to leverage digital advancements for innovation [42]. Central to DCV is the recognition that firms possessing strong internal dynamic capabilities, such as absorptive capacity and firm agility, can better exploit external knowledge and rapidly adapt their strategies and processes, thus transforming environmental challenges into strategic opportunities [43,44].

The complementary integration of OAT and DCV within this study provides a deeper and more nuanced understanding of DTs-driven BMI. Specifically, OAT’s external responsiveness complements DCV’s internal capability development [17]. OAT emphasizes the necessity of external strategic adaptation in response to environmental uncertainties, thereby enabling firms to effectively navigate external technological disruptions [38]. In contrast, DCV highlights the significance of building internal dynamic capabilities, such as absorptive capacity and agility, to proactively capitalize on digital advancements [43]. By combining these perspectives, the integrated theoretical framework comprehensively explains both how firms respond externally to digital and market changes and how they internally develop the capabilities required to successfully innovate their business models [5].

Moreover, the role of AC, as detailed by Cohen and Levinthal [8], remains crucial within this integrated framework for effectively integrating and utilizing new information. AC enables traditional manufacturing firms to incorporate DTs into their operations seamlessly, fostering an environment that supports ongoing innovation and growth [45,46,47]. By clearly identifying and assimilating relevant external knowledge, firms enhance their capacity to implement DTs strategically. Similarly, firm agility—defined as the ability to swiftly sense environmental shifts and strategically respond—significantly complements absorptive capacity in enabling effective business model innovation [11,33,48].

Thus, by integrating insights from OAT and DCV, this study offers comprehensive clarity regarding how manufacturing firms operating in turbulent markets can effectively leverage digital technologies to innovate their business models. This dual theoretical lens underscores the importance of concurrently developing internal strategic capabilities and continuously adapting to external environmental demands, thereby providing a holistic understanding of successful digital-driven transformation in traditional manufacturing contexts.

2.2. Digital Technologies

DTs encompass a broad array of tools that facilitate data-driven decision-making, communication, and innovation in manufacturing. Core technologies include the Internet of Things (IoT), artificial intelligence (AI), big data analytics, cloud computing, and mobile internet [5,49]. These tools are increasingly embedded across value chains to improve efficiency, responsiveness, and strategic flexibility [50,51]. Studies highlight their transformative impact, showing that DTs enhance productivity and reshape business models by replacing traditional manufacturing routines with real-time, digitally enabled processes [10,52].

For the current study, digital technologies are conceptualized to include five major tools: AI, big data analytics, cloud computing, the IoT, and mobile internet. These technologies are operationalized across three dimensions—strategic integration, intra-organizational implementation, and interorganizational collaboration—capturing their comprehensive usage in manufacturing contexts [1,5,53]. At the strategic level, DTs refer to the integration of digital tools into long-term planning by top management. Internally, DTs are applied across departments such as R&D, marketing, and operations. Externally, it supports collaboration and knowledge-sharing with partners and customers through digital interfaces and shared platforms. This multidimensional application of DTs aligns with OAT, which views technological advancement as a driver of organizational change in response to environmental volatility [5,37]. From the DCV, DTs enhance a firm’s ability to sense, seize, and reconfigure resources to stay competitive [54,55].

Empirical studies show that digitalization improves organizational agility and competitiveness by enabling asset monitoring, predictive analytics, and remote service delivery [56,57,58]. These capabilities support real-time adjustments and facilitate the delivery of new value propositions, which are critical for business model innovation in turbulent markets [59,60]. However, DT integration must be aligned with organizational structures and culture. Inflexible routines and digital overdependence can hinder innovation and strategic renewal [61,62]. This dual nature suggests that while DTs enable agility and knowledge integration, they can also constrain innovation when misaligned with internal capabilities or cultural readiness [1,5].

By defining DTs as a strategically embedded and operationally integrated construct, this study offers a comprehensive foundation for examining how digital tools influence absorptive capacity, firm agility, and, ultimately, business model innovation. This approach captures both the enabling and limiting dynamics of DTs in the evolving landscape of traditional manufacturing.

2.3. Business Model Innovation

BMI represents a strategic shift in how firms create, deliver, and capture value, particularly critical amid accelerating digital transformation [63]. In traditional manufacturing, where legacy systems and processes often constrain adaptability, BMI serves as a key response mechanism to technological disruption. Grounded in OAT, BMI reflects an organization’s capacity to realign itself in response to external changes, while the DCV frames it as the outcome of reconfiguring internal capabilities to maintain competitiveness [15,64].

Empirical studies confirm that digital technologies (DTs) significantly impact BMI. Latifi et al. [63] highlight how DTs enable SMEs to innovate their operations, while Miroshnychenko et al. [65] emphasize the role of absorptive capacity in facilitating this transformation. Kinkel et al. [66] further demonstrate that DT tools, such as AI, can streamline workflows and boost performance. These findings align with the DCV perspective, which underscores the strategic importance of internal capabilities—particularly agility and knowledge absorption—in enabling business model renewal.

BMI goes beyond product or process change; it involves redefining value creation, delivery, and capture mechanisms [4,67,68]. Despite its relevance, prior studies often treat DTs as a generic enabler, overlooking how they must be embedded within firm-level capabilities to yield sustainable innovation [5,69,70,71]. This study addresses this gap by examining how absorptive capacity and firm agility mediate the DTs–BMI relationship and how this process is shaped by market turbulence.

Importantly, the manufacturing context—especially in emerging markets—remains underexplored. Most empirical studies focus on services or high-tech sectors [72,73,74], leaving a gap in understanding how traditional manufacturers navigate digitalization. Digitalization challenges conventional assumptions, such as scale-driven efficiency, and compels firms to shift toward agile, customer-oriented models [75,76]. This shift raises urgent questions about operational alignment and innovation execution under uncertainty.

While some studies suggest that industry-level changes and internal transformation both drive BMI [16,77], these factors are rarely studied together. Moreover, large-scale empirical validations are scarce [78,79]. To address these gaps, this study proposes an integrated conceptual framework—drawing from OAT and DCV—that empirically tests how DTs influence BMI through absorptive capacity and agility and how this relationship is moderated by environmental turbulence. This framework advances a more holistic understanding of BMI as a function of digital strategy, dynamic capabilities, and contextual adaptation in traditional manufacturing.

2.4. Digital Technologies and Business Model Innovation

OAT suggests that to sustain their competitive advantage, organizations must adapt continuously to external forces, including advances in DTs [37]. DTs have become a critical environmental driver, influencing how firms design and innovate their business models. In traditional manufacturing settings, integrating digital technologies can fundamentally reshape how value is created, delivered, and captured [5]. Rachinger et al. [52] and Paiola and Gebauer [56] show that digitalization enables organizations to restructure operations and develop more adaptive business models. This is supported by Nambisan et al. [6], who argue that DTs enhance firms’ capacities to generate new value propositions and delivery methods. Bharadwaj et al. [80] further demonstrate that digital technologies improve both operational efficiency and market performance—reinforcing the connection between DTs and BMI. However, most studies treat DTs as a general construct, overlooking the distinct functions of tools such as AI, IoT, big data analytics, and cloud platforms. This limits our understanding of how different technologies affect specific elements of BMI, including value creation, delivery, and capture [4,81,82,83].

Additionally, the process of embedding DTs in traditional manufacturing is complex. Rigid organizational structures, legacy systems, and limited absorptive capacity can slow innovation and reduce DT effectiveness [59,78]. These contextual constraints are often ignored, despite their impact on digital transformation outcomes. This study advances the literature by adopting a contingent view of DTs’s role in BMI. Rather than assuming direct effects, it investigates how DTs contribute to business model innovation through the mediating roles of absorptive capacity and firm agility. The moderating influence of market turbulence is also examined, offering a more contextualized and realistic understanding of DTs-driven innovation in traditional industries. While prior research emphasizes DTs’s potential, more empirical work is needed to clarify the mechanisms through which it influences BMI, particularly in emerging market contexts. Understanding these dynamics is essential for developing strategies that enable firms to successfully implement digital technologies. Recognizing the transformative influence of digital technologies on strategic design, we hypothesize that:

H1:

Digital technologies have a positive effect on business model innovation.

2.5. Digital Technologies and Firm Agility

DTs act as key enablers of FA by providing real-time data access, supporting decentralized decision-making, and improving responsiveness. In this context, OAT emphasizes that agility is essential for organizations to respond effectively to external changes. Del Giudice et al. [50] demonstrate that DT adoption enhances agility by enabling timely responses to market shifts and internal disruptions. Similarly, Li et al. [10] show that DTs facilitate a balance between exploratory and exploitative activities, which is critical for navigating uncertainty while maintaining strategic direction. Felipe et al. [48] highlight how DTs enable the dissemination of market intelligence across departments, allowing firms to detect trends, coordinate responses, and act swiftly—core elements of agility under OAT.

However, existing research often treats DTs as a unified construct and overlooks how specific technologies—such as IoT, cloud computing, AI, and big data—individually shape different agility dimensions [84,85,86]. This study contributes by investigating how DTs impact FA through both technological enablers and organizational processes, emphasizing that agility does not automatically result from digital adoption. It also responds to the need for context-specific insights from traditional manufacturing settings, where hierarchical structures may limit adaptive capacity. Taken together, the literature supports the view that DTs enhance firm agility. Yet further empirical research is required to clarify how distinct digital tools support various agility capabilities—such as sensing, responding, and reconfiguring—in dynamic environments. Given the role of digital technologies in enhancing responsiveness and flexibility, it is expected that:

H2:

Digital technologies have a positive effect on firm agility.

2.6. Firm Agility and Business Model Innovation

Agility allows organizations to respond quickly, restructure processes, and capitalize on emerging opportunities. OAT posits that firms with higher agility are better positioned to innovate their business models in response to external changes. Latifi et al. [63] provide empirical evidence that firms with strong agile capabilities are more effective at adapting and innovating their business models. Their findings suggest that agility enhances a firm’s ability to manage technological shifts and environmental uncertainties, improving competitive positioning. Bhatti et al. [64] add that successful business model innovation requires a balance between flexibility and structural stability. Too much emphasis on agility without foundational alignment can lead to inefficiencies. While the relationship between FA and BMI is well-supported, the mechanisms by which agility drives innovation remain underexplored. Most research treats agility as a singular construct, yet it consists of multiple dimensions—strategic, operational, and technological—each influencing different aspects of BMI, such as value creation, delivery, and capture.

Moreover, studies rarely address how agility is operationalized through organizational routines such as experimentation, cross-functional collaboration, and ecosystem alignment. These internal processes are particularly important in traditional manufacturing contexts, where rigid structures may constrain innovation [87,88,89]. This study fills these gaps by viewing agility as a dynamic capability that enables proactive business model reconfiguration in turbulent environments. It offers a more detailed analysis of how different forms of agility support innovation outcomes, providing insight for firms managing both stability and change. Taken together, the literature supports that agile firms are more likely to achieve business model innovation through enhanced responsiveness and adaptability. However, further empirical work is needed to clarify how firms can strategically balance agility with operational consistency, particularly in industries where innovation must align with efficiency-driven models. Since agile firms are better equipped to reconfigure their value creation logic, it is assumed that:

H3:

Firm agility has a positive effect on business model innovation.

2.7. Digital Technologies and Absorptive Capacity

The DCV and OAT emphasize that firms must continuously adapt to new knowledge and technologies to stay competitive. In this context, DTs are expected to enhance a firm’s AC—its ability to acquire, assimilate, transform, and exploit external knowledge efficiently. Abourokbah et al. [42] demonstrate that DTs adoption significantly boosts AC by improving the speed and accuracy of knowledge assimilation. Bhatti et al. [64] further support this by showing how DTs enhance firms’ information processing and adaptability to technological shifts. Similarly, Aditiawarman and Wahyuni [90] note that the integration of DTs—through faster communication, real-time data, and interconnectivity—facilitates external knowledge absorption. Khan and Tao [91] add that DTs strengthen firms’ capabilities to exploit external insights, directly influencing innovation outcomes. Despite growing consensus, absorptive capacity is often treated as a unified construct. However, AC comprises multiple sequential stages—acquisition, assimilation, transformation, and exploitation [8]—each potentially influenced by different technologies. For instance, AI and big data may enhance acquisition and assimilation, while IoT and cloud systems may support transformation and exploitation. These differentiated effects remain underexplored both theoretically and empirically.

Moreover, in traditional manufacturing firms, knowledge flows are often siloed, and organizational routines are rigid. While Rehman et al. [92] emphasize DTs’s role in improving connectivity, more research is needed to understand how DTs restructure internal learning, knowledge-sharing routines, and inter-firm collaboration. This study addresses these gaps by conceptualizing DTs as an enabler of absorptive capacity through both technological (e.g., analytics, integration platforms) and organizational (e.g., cross-functional collaboration, digital communication) mechanisms. By drawing on OAT and DCV, the model explains how firms adapt externally while reconfiguring internal knowledge capabilities for innovation. Taken together, the literature supports a positive relationship between digital technologies and absorptive capacity. However, more nuanced insights are needed into which technologies enhance which AC dimensions and under what organizational conditions. Such findings would inform both theoretical development and practical digital strategy. As digital tools facilitate knowledge acquisition and assimilation, it is proposed that:

H4:

Digital technologies have a positive effect on absorptive capacity.

2.8. Absorptive Capacity and Business Model Innovation

AC enables organizations to integrate external knowledge, which enhances their ability to adapt to changing environments. OAT and the DCV suggest that firms with stronger AC are better positioned to innovate their business models. Chatterjee et al. [93] show that firms with robust AC are more effective at identifying opportunities and embedding new practices into business model design. Similarly, Rehman et al. [92] find that firms with higher AC respond better to market trends and are more capable of integrating innovation into operations. Felipe et al. [48] further confirm that strong assimilation and transformation capabilities within AC predict successful business model innovation (BMI).

While the role of AC in driving BMI is acknowledged, current research seldom unpacks how its components—knowledge acquisition, assimilation, transformation, and exploitation—affect distinct business model elements such as value creation, delivery, or capture [4]. Understanding these micro-mechanisms is essential to determine how AC is operationalized during business model reinvention. Additionally, contextual factors such as industry maturity, structural rigidity, or market turbulence may moderate the AC–BMI link. These influences remain underexplored, particularly in traditional manufacturing, where bureaucratic routines can hinder the translation of knowledge into innovation. This study extends the literature by framing AC as an active strategic enabler—connecting internal learning with external responsiveness. Through a DCV–OAT lens, we argue that firms must not only absorb knowledge but transform it into new business logic to sustain competitive advantage. Taken together, prior studies support the proposition that absorptive capacity drives business model innovation. However, further research should explore how different AC dimensions contribute to distinct types of innovation and under what conditions they are most impactful. Because absorptive capacity enables firms to leverage external knowledge for innovation, it is proposed that:

H5:

Absorptive capacity has a positive effect on business model innovation.

2.9. Firm Agility as a Mediator

OAT posits that FA can mediate the relationship between DTs and BMI. That is, the benefits of DTs for BMI are partly realized through the enhancement of organizational agility. Del Giudice et al. [50] show that DTs adoption improves agility by enabling faster responses to market and technological changes. Felipe et al. [48] provide further support, noting that agile organizations are better at leveraging DTs to adapt and innovate their business models. Bhatti et al. [64] reinforce this link, emphasizing that agility helps firms integrate new technologies to meet strategic objectives and sustain competitive advantage. Gillani et al. [94] add that technologies enhance agility by improving communication and coordination across teams, supporting the implementation of innovative business models. Together, these studies suggest that FA acts as a key conduit through which digital technologies translate into business model renewal.

Despite these insights, existing research often examines DTs and BMI as direct outcomes, without testing the underlying mechanisms—especially in traditional manufacturing firms within emerging economies like Turkey. This study addresses that gap by conceptualizing agility as a dynamic capability that activates the value of digital investments. It also highlights the need to examine which dimensions of agility—such as speed of decision-making, cross-functional collaboration, or resource fluidity—are most relevant in enabling business model reconfiguration. This deeper understanding can inform targeted agility-building strategies. Based on the reviewed literature and identified gaps, it is proposed that:

H6:

Firm agility mediates the relationship between digital technologies and business model innovation.

2.10. Absorptive Capacity as a Mediator

Building on the DCV, this study investigates the mediating role of AC in the relationship between DTs and BMI. DCV posits that firms must develop the capabilities to acquire, assimilate, transform, and exploit external knowledge to remain innovative and adaptive. Miroshnychenko et al. [65] emphasize that AC is crucial for converting external knowledge into innovation outcomes, supporting its role as a mediating mechanism. Abourokbah et al. [42] argue that DTs enhance AC, which in turn improves product development, managerial practices, and operational routines—key enablers of business model innovation. Chatterjee et al. [95] similarly demonstrate that firms with strong AC are more responsive to change and more effective at translating digital knowledge into innovative business practices. Aditiawarman and Wahyuni [90] highlight the distinction between potential AC (knowledge acquisition and assimilation) and realized AC (transformation and exploitation), showing that both are essential in leveraging DTs for business model renewal. Mao et al. [96] further validate AC’s mediating role by linking it to the effect of IT capabilities on organizational agility—an adjacent dynamic capability.

Despite this support, key theoretical and empirical gaps remain. Most studies treat AC as a singular construct, without examining how each of its four dimensions influences specific components of BMI (e.g., value creation, delivery, capture). This limits understanding of the precise mechanisms through which AC enables innovation. Additionally, contextual factors such as industry structure, regulatory complexity, and organizational culture—especially in traditional manufacturing settings—may significantly shape the DTs–AC–BMI pathway. These factors are often overlooked, despite their impact on knowledge flows and internal adaptation. This study addresses these gaps by conceptualizing AC as a multidimensional capability that operates through both technological and organizational channels. By using validated, multi-item constructs that distinguish between potential and realized AC, it offers a more granular understanding of how DT investments are converted into business model innovation. Based on the above, the following hypothesis is proposed:

H7:

Absorptive capacity mediates the relationship between digital technologies and business model innovation.

2.11. Market Turbulence as a Moderator

MT refers to rapid, unpredictable shifts in economic and competitive environments that disrupt organizational routines and strategic planning [97,98,99]. Pudjiarti and Hutomo [100] define MT as disruptions to supply and demand chains that increase uncertainty and instability. These conditions intensify the need for agile and adaptive responses, particularly in how DTs are leveraged. Senbeto and Hon [101] emphasize that such turbulence reshapes customer behaviors, requiring firms to adjust digital strategies quickly—supporting the idea that MT moderates the DTs–FA relationship. Kachouie et al. [102] highlight the need for firms to anticipate external shocks and reorient rapidly. In volatile markets, human capital and organizational foresight become crucial for converting digital investments into flexible capabilities [103,104]. AlQershi et al. [105] find that turbulence often accelerates technology adoption, suggesting its moderating role in the DTs–BMI relationship. Similarly, Gillani et al. [94] and Hamid et al. [106] provide evidence that environmental volatility shapes the outcomes of digital transformation. Chatterjee et al. [95] show that in turbulent contexts, firms with strong absorptive capacity are better equipped to convert digital knowledge into innovation, highlighting MT’s moderating role in the DTs–AC link.

Despite this evidence, few studies have empirically tested MT’s moderating effects across multiple internal capabilities within a single model. Even fewer have focused on traditional manufacturing, where legacy structures and rigid routines may weaken the DTs–capability link. This study addresses this gap by investigating how MT influences the relationships between DTs and FA, AC, and BMI. By adopting an integrated framework, the study offers a broader theoretical lens on how external turbulence amplifies or constrains the effectiveness of digital technologies across core dynamic capabilities. This contributes to a more holistic understanding of digital transformation under uncertainty. Based on the supporting literature and identified gaps, the following hypotheses are proposed:

H8:

Market turbulence moderates the relationship between digital technologies and firm agility.

H9:

Market turbulence moderates the relationship between digital technologies and business model innovation.

H10:

Market turbulence moderates the relationship between digital technologies and absorptive capacity.

2.12. Conceptual Research Model

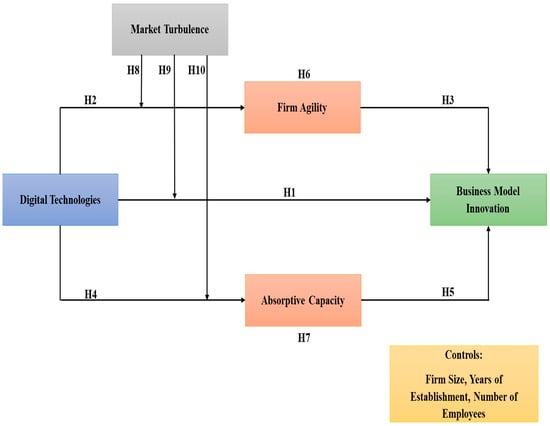

Figure 1 illustrates the proposed framework, which explores how DTs influence BMI through two mediating capabilities—FA and AC—and how these relationships are moderated by MT. This integrated perspective reflects the interplay between internal capabilities and external environmental dynamics. Empirical evidence supports the inclusion of these constructs. DTs have been shown to enhance organizational responsiveness and adaptability, aligning with the principles of OAT [5,10,107]. Additionally, Del Giudice et al. [50], Aditiawarman and Wahyuni [90], and Khan and Tao [91] confirm that DTs strengthen firms’ dynamic capabilities, consistent with the DCV. Latifi et al. [63], Miroshnychenko et al. [65], and Abourokbah et al. [42] also establish a positive association between DT adoption and business model innovation, demonstrating how digital integration facilitates the emergence of new value configurations and revenue models. This study builds on and extends these insights by simultaneously examining the mediating roles of agility and absorptive capacity and the contextual effect of market turbulence in a unified model, offering a more comprehensive understanding of digital transformation in traditional manufacturing environments.

Figure 1.

Research model. Source: Authors’ own work.

3. Methodology

3.1. Research Context

The current study investigates Turkish manufacturing enterprises to examine how digital technologies influence BMI. Turkey, the seventh-largest economy in Europe with a nominal GDP of approximately $1.32 trillion as of 2024, presents a compelling context due to its dynamic industrial landscape and ongoing digital transformation efforts [108].

The manufacturing sector contributes significantly to the national economy, accounting for 19% of the GDP in 2018, with a strategic goal to increase this to 21% by 2023 [109,110]. In response to global technological trends, the Turkish government launched the “Digital Turkey 2030” strategy, pledging investments of $1–1.5 billion to digitize the manufacturing sector. This initiative is projected to reduce annual costs by up to $10 billion and drive productivity across industrial operations [111].

To ensure industry diversity and regional representativeness, this study focuses on three leading industrial provinces: Istanbul, Kocaeli, and Izmir. Istanbul led national exports in 2023 with $127.1 billion, followed by Izmir with $17.2 billion and Kocaeli with $13 billion [112]. These cities—spread across the Marmara and Aegean regions—host a wide range of manufacturing activities and serve as critical innovation and export hubs.

3.2. Sampling and Data Collection

We employed a quantitative research design using structured questionnaires to gather data from senior managers in Turkish manufacturing firms [113]. The sampling frame targeted firms in Istanbul, Kocaeli, and Izmir—three of Türkiye’s leading industrial centers—due to their significant contributions to national exports and manufacturing output [114].

To ensure the inclusion of active and formally recognized firms, the sample was drawn from the Turkish Trade Gazette (TOBB), with support from the Small and Medium Enterprises Development Organization (KOSGEB). Only firms that had submitted an official SME declaration in 2023 were deemed eligible, ensuring alignment with the study’s digital transformation focus and consistency with research practices in emerging economies [114,115].

Data collection occurred between February and June 2023. With assistance from six trained research assistants, we distributed 870 questionnaires—approximately 290 per city—through both in-person delivery and electronic formats (email and online links). Respondents were assured of anonymity and confidentiality and were asked to reflect on their firms’ decision-making over the past 24 months. Participation was voluntary, with an emphasis that there were no right or wrong answers.

A total of 512 responses were received, of which 479 were deemed valid after removing 33 incomplete or invalid entries, yielding a response rate of 55.06%, consistent with previous research in the Turkish manufacturing context [22,116]. This robust response rate supports the generalizability of the findings within the targeted regions. The demographic characteristics of the respondents are presented in Table 1.

Table 1.

Sample attributes. Source: Authors’ elaboration based on survey data.

3.3. Measurements

All constructs in the study were measured using established, theory-based scales to ensure validity and alignment with prior research. Items were rated on a five-point Likert scale (1 = strongly disagree to 5 = strongly agree). To enhance clarity and contextual relevance, all items were translated and back-translated following Brislin’s [117] method, and a pilot test was conducted with 10 senior managers. Digital technologies usage was assessed with eight items adapted from Zhang et al. [5], capturing the extent of adoption of cloud computing, big data analytics, artificial intelligence (AI), Internet of Things (IoT), and mobile internet across strategic, operational, and inter-organizational levels. Firm agility was measured using eight items from Sambamurthy et al. [118], reflecting responsiveness to market changes and flexibility in operations. Absorptive capacity was measured with seven items from Flatten et al. [45], aligned with Cohen and Levinthal’s [8] framework, encompassing acquisition, assimilation, transformation, and exploitation of external knowledge. Market turbulence was measured using four items from Jaworski and Kohli [119], assessing variability in customer needs and market instability. Business model innovation was measured using 16 items from Futterer et al. [120], covering innovations in value creation, delivery, and capture.

3.4. Non-Response Bias and Common Method Bias

To address potential non-response bias, we followed the method proposed by Armstrong and Overton [121], comparing early and late respondents across the study’s core constructs—digital technology usage, firm agility, absorptive capacity, market turbulence, and business model innovation—using a t-test. The results showed no significant differences, confirming that non-response bias is not a concern. To control for common method bias (CMB), we implemented both procedural and statistical remedies [122]. Procedurally, the questionnaire was randomized and designed to reduce response predictability, and responses with uniform scoring were excluded. Statistically, we conducted Harman’s single-factor test, which showed that the first factor accounted for only 23.29% of the variance, below the 50% threshold. We also used the marker variable technique, which revealed correlations below 0.10 with all main variables, indicating minimal CMB [123]. Furthermore, we checked for multicollinearity, and all VIF values were below 4, suggesting no significant collinearity issues [124]. These results affirm the reliability and validity of the dataset.

3.5. Analytical Strategy

The data analysis utilized SPSS 20.0 for data preparation and correlation analysis and AMOS 24 to assess the measurement model’s reliability and validity via confirmatory factor analysis (CFA), following established procedures [125]. To examine the hypothesized relationships, Hayes’s PROCESS macro was applied [126], and Model 4 [127] was used to assess the mediating roles of AC and FA between DTs and BMI. Model 8 was employed to test the moderating effect of MT on the relationships between DTs and AC, FA, and BMI [93,95]. For robust estimation, bias-corrected bootstrapping with 5000 resamples and a 95% confidence interval was used, with significance determined by whether the interval excluded zero [128]. To reduce multicollinearity, all continuous predictors were mean-centered, and composite means for all latent variables were used in the analysis [129]. This strategy enabled the study to rigorously test its integrated mediation-moderation model within a unified analytical framework.

4. Results

4.1. Assessment of Measurement Model

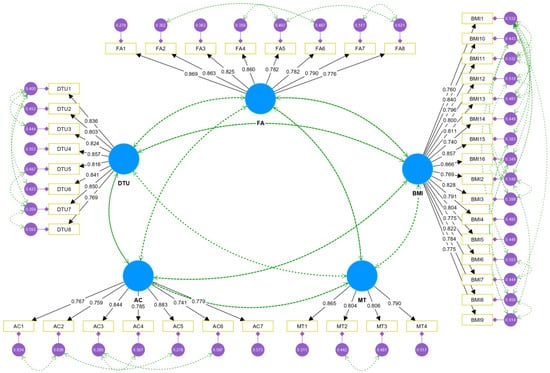

The reliability and validity of the measurement model were assessed using Cronbach’s alpha, composite reliability (CR), and average variance extracted (AVE), as shown in Table 2. Following Nunnally [130], all standardized factor loadings exceeded the threshold of 0.60. As shown in Figure 2, the results of the confirmatory factor analysis (CFA) indicated that the SFL for all items ranged from 0.741 to 0.883. Consequently, the items can be considered reliable [131]. Cronbach’s alpha values (0.889–0.948) and CR scores (0.893–0.966) surpassed the recommended threshold of 0.70, indicating strong internal consistency [132]. AVE values ranged from 0.633 to 0.680, exceeding the 0.50 benchmark, thereby supporting convergent validity [133].

Table 2.

Reliability and validity of the measurement items. Source: Authors’ elaboration based on survey data.

Figure 2.

Standardized estimates. Source: Authors’ elaboration based on survey data.

Discriminant validity was established by confirming that the square root of each construct’s AVE was greater than its inter-construct correlations (see Table 3), demonstrating that all constructs are empirically distinct [133]. This ensures the model’s constructs are both theoretically sound and statistically unique.

Table 3.

Correlation of the main constructs. Source: Authors’ elaboration based on survey data.

Model fit was evaluated using absolute, incremental, and parsimonious fit indices. As presented in Table 4, CMIN/df, RMSEA, AGFI, and GFI exceeded the recommended absolute fit thresholds [134,135]. Incremental fit indices—NFI, IFI, TLI, CFI, and RFI—were also above-accepted cutoffs, while PCFI, PGFI, and PNFI exceeded the 0.50 benchmark for parsimony fit. Collectively, these results confirm that the measurement model fits the observed data well, offering a solid foundation for testing the structural relationships.

Table 4.

Fit parameters of the research model. Source: Authors’ elaboration based on survey data.

4.2. Hypothesis Testing

To examine both direct and indirect effects, Model 4 of Hayes’s [126] PROCESS macro was employed—a method widely applied in organizational research for testing mediation structures [128]. The results, presented in Table 5, show that DTs significantly enhance FA (β = 0.901, t = 50.736, p < 0.001), supporting the premise that digital tools increase responsiveness to environmental shifts.

Table 5.

Direct and indirect hypothesis testing results. Source: Authors’ elaboration based on survey data.

DTs also had a significant positive effect on AC (β = 0.936, t = 40.638, p < 0.001), aligning with the prior theory that digitalization improves a firm’s ability to absorb external knowledge. Additionally, DTs had a direct positive impact on BMI (β = 0.106, t = 5.471, p < 0.001). Both FA (β = 0.593, t = 24.457, p < 0.001) and AC (β = 0.302, t = 15.849, p < 0.001) also significantly influenced BMI, confirming H1 through H5.

To test the mediation hypotheses, a bias-corrected bootstrapping procedure (5000 resamples) was applied. The indirect effect via FA was significant (B = 0.544, CI = [0.475, 0.614]), as was the indirect effect via AC (B = 0.282, CI = [0.222, 0.342]). Since both confidence intervals exclude zero, this confirms partial mediation, validating H6 and H7.

4.3. Moderation Analysis

To examine the conditional effects, Model 8 of Hayes’s [126] PROCESS macro was used, which is well-suited for analyzing interactions in management research [128]. Firm size and years of establishment were added as covariates, and variables were mean-centered to minimize multicollinearity [136]. The results of the moderation analyses are presented in Table 6.

Table 6.

Moderation effect results. Source: Authors’ elaboration based on survey data.

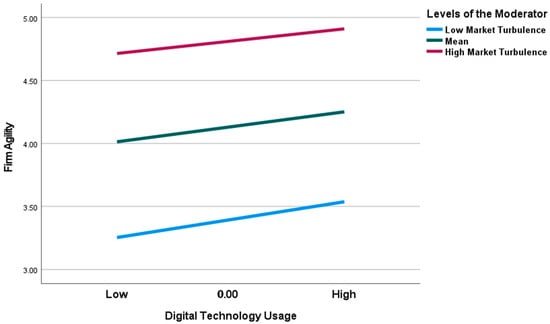

The analysis confirmed that MT significantly moderates the relationship between DTs and FA. DTs had a positive effect on FA (β = 0.129, p < 0.001), and MT strengthened this relationship (β = 0.099, p < 0.001). As presented in Figure 3, the simple slope analysis revealed that under high MT conditions, the effect of DTs on FA was stronger (β = 0.153, p < 0.001) than under low MT (β = 0.105, p < 0.001), supporting H8. These findings suggest that DTs are more impactful in enhancing agility when firms face heightened uncertainty, consistent with OAT [37].

Figure 3.

Interaction between digital technology usage and FA at different levels of market turbulence. Source: Authors’ elaboration based on survey data.

In contrast, no moderation effect was found in the DTs–BMI relationship. Although DTs positively influenced BMI (β = 0.105, p < 0.001), the interaction term with MT was non-significant (β = 0.001, p > 0.05), leading to the rejection of H9. This implies that business model changes may be more strategic and less reactive to short-term market shifts.

Similarly, the interaction between DTs and MT was not significant for AC (β = −0.017, p > 0.05). While DTs significantly influenced AC directly (β = 0.350, p < 0.001), H10 was not supported, indicating that AC may rely more on internal routines than external volatility.

4.4. Robustness Test

To verify the stability of the proposed structural relationships, this study conducted multi-group analyses across different subpopulations of Turkish manufacturing SMEs. Firms were categorized based on size (small: fewer than 50 employees vs. medium-sized: 50 or more), age (young: less than 10 years vs. mature: 10 or more), and DTs usage duration (introductory: ≤3 years vs. advanced: >3 years), following established practices [55,137]. Structural equation modeling using AMOS 24 was applied to each subgroup to assess the consistency of direct and indirect effects among DTs, FA, AC, and BMI. The results of the subgroup analyses are presented in Table 7.

Table 7.

Robustness test results. Source: Authors’ elaboration based on survey data.

The findings reveal that the direct effects of DTs on FA, AC, and BMI were consistently positive and significant across all subgroups, indicating that digital technologies enhance organizational capabilities and innovation irrespective of firm characteristics. Likewise, the indirect effects via FA and AC remained stable, confirming the robustness of the mediating mechanisms in various organizational contexts. These results validate the structural reliability of the model and reinforce that internal capabilities are key channels through which digital technologies foster innovation.

However, the moderating effect of MT varied across groups. MT significantly strengthened the DTs–FA relationship in mature and medium-sized firms, but this effect was less pronounced or non-significant in younger or smaller firms. The moderation of MT on the DTs–AC relationship was consistently negative and insignificant across all groups, and the DTs–BMI pathway was also not moderated by MT in any subgroup. These findings suggest that organizational scale and maturity may influence how environmental turbulence shapes agility, while the effects of DTs on absorptive capacity and business model innovation remain structurally consistent and largely unaffected by turbulence.

5. Conclusions and Implications

5.1. Discussion of Key Findings

This study explored how DTs drive BMI in Turkey’s traditional manufacturing sector, highlighting the mediating roles of FA and AC. The positive association between DTs and BMI aligns with previous findings [5,52] and affirms that digital adoption supports innovation. However, this study goes further by empirically unpacking how internal dynamic capabilities convert technological investments into innovation outcomes.

To illustrate this process, we draw on real-world insights from Turkish manufacturers. Case Company 1, a metal pipe producer, implemented a 12-module ERP system that improved cross-departmental collaboration and responsiveness, directly supporting its shift toward a more agile and adaptive business model. In contrast, Case Company 2, a shelf and rack producer, struggled to realize innovation gains due to mid-level managerial resistance, despite similar technology adoption [23]. These examples demonstrate how agility and leadership alignment can shape the success of digital transformation.

Our findings confirm that FA and AC mediate the DTs–BMI relationship. FA facilitates rapid decision-making and market responsiveness, while AC enables firms to absorb and leverage external knowledge [118,138]. These internal mechanisms are essential for translating digital inputs into strategic innovation, reinforcing the dynamic capability framework [15].

We also tested MT as a moderator. The relationship between DTs and FA was stronger under high MT, but no moderation was observed for AC or BMI. This suggests that agility is the most responsive capability during environmental volatility, while AC and BMI require longer-term development and stability. This distinction supports OAT, which stresses the need for responsiveness under dynamic conditions [37].

Finally, this study contributes to closing the gap in digital transformation literature by focusing on traditional manufacturers in an emerging economy. Turkey’s manufacturing firms often operate under structural rigidity, yet our findings show how they can leverage DTs for innovation through capability enhancement. This expands theoretical relevance beyond developed markets and high-tech sectors, providing grounded insights into how legacy firms in emerging economies can digitally evolve.

In conclusion, digital technologies are a necessary but not a sufficient condition for business model innovation. They must be supported by firm-level agility and knowledge capabilities to achieve strategic transformation, particularly in volatile and underexplored emerging market contexts.

5.2. Theoretical Implications

This study makes significant theoretical contributions by deepening the understanding of how DTs, FA, AC, and BMI interact in the traditional manufacturing context of an emerging economy. Grounded in the OAT and the DCV, the findings support the premise that organizations must develop adaptive capabilities to cope with environmental volatility and leverage technological change [37,40]. Importantly, this research extends these frameworks into the underexplored terrain of digitally lagging manufacturing sectors in emerging markets like Turkey, demonstrating that even structurally rigid firms can innovate when internal capabilities are properly activated.

The study highlights how DTs enhance BMI indirectly through the development of FA and AC, which act as mediating mechanisms. While FA enables flexible responses to external changes [48], AC facilitates knowledge absorption and application [138]. These findings reaffirm that innovation is not solely the result of technological adoption but of capability orchestration within dynamic and uncertain environments. Furthermore, the moderating effect of market turbulence reinforces the DCV’s assertion that the external environment shapes the strategic value of internal capabilities.

The study responds directly to gaps in the literature by focusing on traditional manufacturing firms in a non-Western, emerging economy context [5]. Previous research has largely emphasized high-tech firms in developed markets, with limited empirical testing in lower-income, digitally maturing economies [59,79]. By offering large-sample quantitative evidence from Turkey, this study adds geographic and industrial diversity to the field and shows that digital transformation requires more than infrastructure—it demands organizational readiness rooted in agility and learning capacity.

Another key theoretical contribution lies in the dual role of FA and AC as both internal enablers and strategic responses to external pressures. In doing so, the study positions digital transformation not as a linear technology adoption process, but as a dynamic organizational reconfiguration shaped by institutional complexity and market volatility—conditions typical in emerging markets. This reframing offers scholars a richer understanding of how firms evolve toward digitally enabled business models in resource-constrained settings.

Taken together, these insights contribute meaningfully to the theoretical development of OAT and DCV by showing that the effectiveness of DTs is contingent upon firm-level capabilities that must be built and adapted in response to shifting institutional and market conditions. The study invites future research to test these relationships across different country settings and industries and to explore how policy environments and organizational learning systems further mediate digital transformation success in emerging economies.

5.3. Practical Implications

This research offers actionable guidance for senior managers and decision-makers in SMEs operating within the traditional manufacturing sector of emerging markets, particularly Turkey. These firms often encounter persistent structural challenges—such as overcapacity, low profitability, and outdated production infrastructure—that inhibit competitiveness in the digital age [75]. The findings underscore that digital transformation, when paired with internal capability development, can improve responsiveness, streamline decision-making, and enhance value creation across operational, marketing, and customer-facing processes.

A central implication is that digital technology usage alone is insufficient for achieving innovation outcomes. The study reveals that firm agility and absorptive capacity are critical mediators that help translate digital investments into business model innovation. Managers should, therefore, cultivate agility through decentralized decision-making, adaptive workflows, and responsiveness to real-time customer and market feedback. Likewise, enhancing absorptive capacity requires fostering a culture of cross-functional collaboration, structured knowledge-sharing routines, and continuous learning opportunities, enabling employees to integrate external information into strategic action [138].

Illustrative case insights from the Turkish manufacturing sector reinforce these conclusions. As documented by Kırmızı and Kocaoglu [23], Case Company 1—a metal pipe manufacturer—implemented a 12-module ERP system and demonstrated strong digital maturity due to top management support, a digitally aware workforce, and flexible organizational structures. In contrast, Case Company 2, a rack manufacturer with similar technological investments, underperformed because of weak middle-management buy-in and cultural misalignment. These cases highlight that successful digitalization hinges on leadership engagement and organizational readiness—not merely technology adoption.

Moreover, this study identifies market turbulence not only as a challenge but as a strategic opportunity. In dynamic environments, agility enables firms to sense, respond, and reconfigure quickly, capitalizing on emergent shifts before competitors [93]. SME managers should, therefore, invest in real-time data systems, modular processes, and digital feedback loops that support fast experimentation and strategic pivots, especially in volatile markets.

Ultimately, the study encourages firms to shift from a technology-centric to a capability-centric transformation model. In contexts like Turkey, where SMEs may face financial and institutional constraints, the key to long-term success lies in aligning digital initiatives with organizational flexibility, learning, and cultural transformation. By developing these internal capabilities, firms can navigate the complexities of digital transformation more effectively, turning environmental disruption into a competitive advantage.

5.4. Limitations and Future Direction

While this study contributes meaningfully to the understanding of how digital technologies drive business model innovation through internal capabilities in the Turkish manufacturing sector, it is not without limitations. First, the exclusive focus on SMEs in Turkey may limit the generalizability of the findings to other institutional or economic contexts. Manufacturing ecosystems in other countries may vary in regulatory frameworks, digital readiness, or innovation culture, which could yield different outcomes. Second, the use of self-reported survey data raises potential concerns about common method bias and social desirability effects, although multiple procedural and statistical remedies were employed to mitigate these risks. Third, the study conceptualizes digital technologies as a single composite construct, overlooking the distinct contributions of tools such as AI, ERP systems, IoT, or big data analytics. Future studies should disaggregate these technologies to examine their individual and combined effects on agility, absorptive capacity, and innovation outcomes [79]. Fourth, the cross-sectional design limits insight into how digital transformation and capability building evolve over time. Longitudinal research would better capture the dynamic nature of these processes, particularly in response to changing market or institutional conditions. Finally, future research should integrate qualitative methods—such as interviews, case studies, or ethnography—to uncover the microfoundations of capability development and contextual contingencies often missed in large-scale quantitative analyses [139]. Addressing these areas would deepen theoretical understanding and provide more nuanced, actionable insights into digital transformation pathways in emerging market contexts.

5.5. Conclusions

This study investigated the impact of DTs on BMI within the traditional manufacturing sector in Turkey, with particular emphasis on the mediating roles of FA and AC and the moderating effect of market turbulence. The findings confirm that DTs positively influence BMI, FA, and AC, underscoring the transformative role of digitalization in enhancing both strategic and operational dimensions of organizational performance. However, the results also show that digital transformation alone is insufficient. Its effectiveness depends significantly on the firm’s ability to reconfigure internal resources and adapt to change. Specifically, FA and AC partially mediate the relationship between DTs and BMI, indicating that adaptive capabilities are essential conduits for innovation outcomes. This reinforces the argument that digital tools must be complemented by dynamic capabilities to generate meaningful innovation. Moreover, market turbulence was found to moderate the relationship between DTs and FA, highlighting that volatile environments can either amplify or constrain the benefits of digital investments depending on a firm’s responsiveness. Overall, this study contributes a context-sensitive understanding of digital transformation in emerging markets, showing that traditional manufacturing firms can unlock greater innovation potential by aligning digital strategies with internal capability development and external environmental realities. Strengthening agility and knowledge absorption mechanisms will enable firms to more effectively sense, respond, and adapt to the evolving demands of the digital age.

Author Contributions

Writing—original draft, H.A.; formal analysis, H.Y.A.; supervision, K.I.; project administration, K.I.; validation, H.Y.A. and H.A.; writing—review and editing, H.A. and K.I. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki and approved by the University of Mediterranean Karpasia.

Informed Consent Statement

All participants in this study provided their informed consent.

Data Availability Statement

The data supporting the findings of this study are available from the corresponding author, Hatem Abuseta, upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest related to this study.

References

- Harrmann, L.K.; Eggert, A.; Böhm, E. Digital Technology Usage as a Driver of Servitization Paths in Manufacturing Industries. Eur. J. Mark. 2022, 57, 834–857. [Google Scholar] [CrossRef]

- Enyoghasi, C.; Badurdeen, F. Industry 4.0 for Sustainable Manufacturing: Opportunities at the Product, Process, and System Levels. Resour. Conserv. Recycl. 2021, 166, 105362. [Google Scholar] [CrossRef]

- Van Wassenhove, L.N. Sustainable Innovation: Pushing the Boundaries of Traditional Operations Management. Prod. Oper. Manag. 2019, 28, 2930–2945. [Google Scholar] [CrossRef]

- Foss, N.J.; Saebi, T. Business Models and Business Model Innovation: Between Wicked and Paradigmatic Problems. Long Range Plan. 2018, 51, 9–21. [Google Scholar] [CrossRef]

- Zhang, F.; Yang, B.; Zhu, L. Digital Technology Usage, Strategic Flexibility, and Business Model Innovation in Traditional Manufacturing Firms: The Moderating Role of the Institutional Environment. Technol. Forecast. Soc. Change 2023, 194, 122726. [Google Scholar] [CrossRef]

- Nambisan, S.; Wright, M.; Feldman, M. The Digital Transformation of Innovation and Entrepreneurship: Progress, Challenges and Key Themes. Res. Policy 2019, 48, 103773. [Google Scholar] [CrossRef]

- Broekhuizen, T.L.J.; Broekhuis, M.; Gijsenberg, M.J.; Wieringa, J.E. Introduction to the Special Issue—Digital Business Models: A Multi-Disciplinary and Multi-Stakeholder Perspective. J. Bus. Res. 2021, 122, 847–852. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Ramadhan, A.; Iyiola, K.; Alzubi, A.B. Linking Absorptive Capacity to Project Success via Mediating Role of Customer Knowledge Management Capability: The Role of Environmental Complexity. Bus. Process Manag. J. 2024, 30, 939–962. [Google Scholar] [CrossRef]

- Li, H.; Wu, Y.; Cao, D.; Wang, Y. Organizational Mindfulness towards Digital Transformation as a Prerequisite of Information Processing Capability to Achieve Market Agility. J. Bus. Res. 2021, 122, 700–712. [Google Scholar] [CrossRef]

- Singh, J.; Sharma, G.; Hill, J.; Schnackenberg, A. Organizational Agility: What It Is, What It Is Not, and Why It Matters. Proceedings 2013, 2013, 11813. [Google Scholar] [CrossRef]

- Tallon, P.P.; Pinsonneault, A. Competing Perspectives on the Link Between Strategic Information Technology Alignment and Organizational Agility: Insights from a Mediation Model. MIS Q. 2011, 35, 463–486. [Google Scholar] [CrossRef]

- AlAjlouni, A.O.; Aljuhmani, H.Y. Leveraging Business Intelligence for Enhanced Financial Performance: The Mediating Effect of Supply Chain Integration. In Achieving Sustainable Business Through AI, Technology Education and Computer Science: Volume 3: Business Sustainability and Artificial Intelligence Applications; Hamdan, A., Ed.; Springer Nature: Cham, Switzerland, 2024; pp. 79–89. ISBN 978-3-031-73632-2. [Google Scholar]

- Jennings, D.F.; Seaman, S.L. High and Low Levels of Organizational Adaptation: An Empirical Analysis of Strategy, Structure, and Performance. Strateg. Manag. J. 1994, 15, 459–475. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating Dynamic Capabilities: The Nature and Microfoundations of (Sustainable) Enterprise Performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Vittori, D.; Natalicchio, A.; Panniello, U.; Messeni Petruzzelli, A.; Cupertino, F. Business Model Innovation between the Embryonic and Growth Stages of Industry Lifecycle. Technovation 2022, 117, 102592. [Google Scholar] [CrossRef]

- Yang, Z.; Guo, X.; Sun, J.; Zhang, Y.; Wang, Y. What Does Not Kill You Makes You Stronger: Supply Chain Resilience and Corporate Sustainability Through Emerging IT Capability. IEEE Trans. Eng. Manag. 2024, 71, 10507–10521. [Google Scholar] [CrossRef]

- Alsafadi, Y.; Aljuhmani, H.Y. The Influence of Entrepreneurial Innovations in Building Competitive Advantage: The Mediating Role of Entrepreneurial Thinking. Kybernetes 2023, 53, 4051–4073. [Google Scholar] [CrossRef]

- Chen, M.-J.; Michel, J.G.; Lin, W. Worlds Apart? Connecting Competitive Dynamics and the Resource-Based View of the Firm. J. Manag. 2021, 47, 1820–1840. [Google Scholar] [CrossRef]

- Xie, X.; Han, Y.; Anderson, A.; Ribeiro-Navarrete, S. Digital Platforms and SMEs’ Business Model Innovation: Exploring the Mediating Mechanisms of Capability Reconfiguration. Int. J. Inf. Manag. 2022, 65, 102513. [Google Scholar] [CrossRef]

- Asbeetah, Z.; Alzubi, A.; Khadem, A.; Iyiola, K. Harnessing Digital Transformation for Sustainable Performance: Exploring the Mediating Roles of Green Knowledge Acquisition and Innovation Performance Under Digital Transformational Leadership. Sustainability 2025, 17, 2285. [Google Scholar] [CrossRef]

- Uzkurt, C.; Ekmekcioglu, E.B.; Ceyhan, S.; Hatiboglu, M.B. Digital Technology Use of SMEs during the COVID-19 Pandemic in Turkey: Mobile Applications’ Role on Motivation and Job Performance. Kybernetes 2023, 53, 1354–1373. [Google Scholar] [CrossRef]

- Kırmızı, M.; Kocaoglu, B. Digital Transformation Maturity Model Development Framework Based on Design Science: Case Studies in Manufacturing Industry. J. Manuf. Technol. Manag. 2022, 33, 1319–1346. [Google Scholar] [CrossRef]

- Asgary, A.; Ozdemir, A.I.; Özyürek, H. Small and Medium Enterprises and Global Risks: Evidence from Manufacturing SMEs in Turkey. Int. J. Disaster Risk Sci. 2020, 11, 59–73. [Google Scholar] [CrossRef]

- Ben Ghrbeia, S.; Alzubi, A. Building Micro-Foundations for Digital Transformation: A Moderated Mediation Model of the Interplay between Digital Literacy and Digital Transformation. Sustainability 2024, 16, 3749. [Google Scholar] [CrossRef]

- Bokša, M.; Šaroch, S.; Bokšová, J. Digitalization of SMEs. Int. Adv. Econ. Res. 2020, 26, 175–177. [Google Scholar] [CrossRef]

- Andersen, T.C.K.; Aagaard, A.; Magnusson, M. Exploring Business Model Innovation in SMEs in a Digital Context: Organizing Search Behaviours, Experimentation and Decision-making. Creat. Innov. Manag. 2022, 31, 19–34. [Google Scholar] [CrossRef]

- Bouwman, H.; Nikou, S.; de Reuver, M. Digitalization, Business Models, and SMEs: How Do Business Model Innovation Practices Improve Performance of Digitalizing SMEs? Telecommun. Policy 2019, 43, 101828. [Google Scholar] [CrossRef]

- Dal Mas, F.; Massaro, M.; Rippa, P.; Secundo, G. The Challenges of Digital Transformation in Healthcare: An Interdisciplinary Literature Review, Framework, and Future Research Agenda. Technovation 2023, 123, 102716. [Google Scholar] [CrossRef]

- Iyiola, K.; Alzubi, A.; Dappa, K. The Influence of Learning Orientation on Entrepreneurial Performance: The Role of Business Model Innovation and Risk-Taking Propensity. J. Open Innov. Technol. Mark. Complex. 2023, 9, 100133. [Google Scholar] [CrossRef]

- Ramadan, J.; Alzubi, A.; Khadem, A. The Impact of Strategic Entrepreneurship Behaviors on Business Performance in Turkish SMES: The Role of Business Model Innovation and Competitive Intensity. Sustainability 2024, 16, 8035. [Google Scholar] [CrossRef]

- Tetteh, F.K.; Gyamerah, K.K.; Nyamekye, B.; Atiki, G.; Ashia, R. Digital Transformation and Business Model Innovation: The Relevance of Strategic Orientations under Varying Conditions of Competitive Intensity. J. Manuf. Technol. Manag. 2025; ahead-of-print. [Google Scholar] [CrossRef]

- Ramadan, M.; Zakhem, N.B.; Baydoun, H.; Daouk, A.; Youssef, S.; Fawal, A.E.; Elia, J.; Ashaal, A. Toward Digital Transformation and Business Model Innovation: The Nexus between Leadership, Organizational Agility, and Knowledge Transfer. Adm. Sci. 2023, 13, 185. [Google Scholar] [CrossRef]

- Müller, J.M.; Buliga, O.; Voigt, K.-I. The Role of Absorptive Capacity and Innovation Strategy in the Design of Industry 4.0 Business Models—A Comparison between SMEs and Large Enterprises. Eur. Manag. J. 2021, 39, 333–343. [Google Scholar] [CrossRef]

- Liu, K.; Zhang, Z.; Zhou, H. Openness Influences Business Model Innovation: The Mediating Role of Digital Capability. J. Organ. Change Manag. 2024, 38, 82–102. [Google Scholar] [CrossRef]

- Foss, N.J.; Saebi, T. Fifteen Years of Research on Business Model Innovation: How Far Have We Come, and Where Should We Go? J. Manag. 2017, 43, 200–227. [Google Scholar] [CrossRef]

- Sarta, A.; Durand, R.; Vergne, J.-P. Organizational Adaptation. J. Manag. 2021, 47, 43–75. [Google Scholar] [CrossRef]

- Xiao, Y.; Cen, J.; Soberg, P. THE Impact of Disruption on the Relationship Between Exploitation, Exploration, and Organizational Adaptation. Front. Sociol. 2021, 6, 757160. [Google Scholar] [CrossRef]

- Zhang, F.; Chen, J.; Zhu, L. How Does Environmental Dynamism Impact Green Process Innovation? A Supply Chain Cooperation Perspective. IEEE Trans. Eng. Manag. 2023, 70, 509–522. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic Capabilities and Strategic Management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Emeagwali, O.L.; Aljuhamni, H.Y. Introductory Chapter: Strategic Management—A Dynamic Approach. In Strategic Management—A Dynamic View; IntechOpen: London, UK, 2019; ISBN 978-1-83962-505-3. [Google Scholar]

- Abourokbah, S.H.; Mashat, R.M.; Salam, M.A. Role of Absorptive Capacity, Digital Capability, Agility, and Resilience in Supply Chain Innovation Performance. Sustainability 2023, 15, 3636. [Google Scholar] [CrossRef]

- Chirico, F.; Salvato, C. Knowledge Integration and Dynamic Organizational Adaptation in Family Firms. Fam. Bus. Rev. 2008, 21, 169–181. [Google Scholar] [CrossRef]

- Lee, S.M.; Rha, J.S. Ambidextrous Supply Chain as a Dynamic Capability: Building a Resilient Supply Chain. Manag. Decis. 2016, 54, 2–23. [Google Scholar] [CrossRef]

- Flatten, T.C.; Greve, G.I.; Brettel, M. Absorptive Capacity and Firm Performance in SMEs: The Mediating Influence of Strategic Alliances: Absorptive Capacity and Firm Performance in SMEs: The Mediating Influence of Strategic Alliances. Eur. Manag. Rev. 2011, 8, 137–152. [Google Scholar] [CrossRef]

- Kastelli, I.; Dimas, P.; Stamopoulos, D.; Tsakanikas, A. Linking Digital Capacity to Innovation Performance: The Mediating Role of Absorptive Capacity. J. Knowl. Econ. 2024, 15, 238–272. [Google Scholar] [CrossRef]

- Sherani; Zhang, J.; Shehzad, M.U.; Ali, S.; Cao, Z. Unlocking Digital Innovation: A Moderated-Mediation Approach Exploring the Knowledge Creation Processes, IT-Enabled Capabilities and Absorptive Capacity in Software SMEs. Bus. Process Manag. J. 2024, 31, 170–201. [Google Scholar] [CrossRef]

- Felipe, C.M.; Leidner, D.E.; Roldán, J.L.; Leal-Rodríguez, A.L. Impact of IS Capabilities on Firm Performance: The Roles of Organizational Agility and Industry Technology Intensity. Decis. Sci. 2020, 51, 575–619. [Google Scholar] [CrossRef]

- Alkish, I.; Iyiola, K.; Alzubi, A.B.; Aljuhmani, H.Y. Does Digitization Lead to Sustainable Economic Behavior? Investigating the Roles of Employee Well-Being and Learning Orientation. Sustainability 2025, 17, 4365. [Google Scholar] [CrossRef]

- Del Giudice, M.; Scuotto, V.; Papa, A.; Tarba, S.Y.; Bresciani, S.; Warkentin, M. A Self-Tuning Model for Smart Manufacturing SMEs: Effects on Digital Innovation. J. Prod. Innov. Manag. 2021, 38, 68–89. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Wu, F. Technological Capability, Strategic Flexibility, and Product Innovation. Strateg. Manag. J. 2010, 31, 547–561. [Google Scholar] [CrossRef]

- Rachinger, M.; Rauter, R.; Müller, C.; Vorraber, W.; Schirgi, E. Digitalization and Its Influence on Business Model Innovation. J. Manuf. Technol. Manag. 2018, 30, 1143–1160. [Google Scholar] [CrossRef]

- Verstegen, L.; Houkes, W.; Reymen, I. Configuring Collective Digital-Technology Usage in Dynamic and Complex Design Practices. Res. Policy 2019, 48, 103696. [Google Scholar] [CrossRef]

- Teece, D.J. Business Models and Dynamic Capabilities. Long Range Plan. 2018, 51, 40–49. [Google Scholar] [CrossRef]

- Neiroukh, S.; Emeagwali, O.L.; Aljuhmani, H.Y. Artificial Intelligence Capability and Organizational Performance: Unraveling the Mediating Mechanisms of Decision-Making Processes. Manag. Decis. 2024; ahead-of-print. [Google Scholar] [CrossRef]

- Paiola, M.; Gebauer, H. Internet of Things Technologies, Digital Servitization and Business Model Innovation in BtoB Manufacturing Firms. Ind. Mark. Manag. 2020, 89, 245–264. [Google Scholar] [CrossRef]

- Adrodegari, F.; Alghisi, A.; Ardolino, M.; Saccani, N. From Ownership to Service-Oriented Business Models: A Survey in Capital Goods Companies and a PSS Typology. Procedia CIRP 2015, 30, 245–250. [Google Scholar] [CrossRef]

- Cheng, C.; Wang, L. How Companies Configure Digital Innovation Attributes for Business Model Innovation? A Configurational View. Technovation 2022, 112, 102398. [Google Scholar] [CrossRef]

- Frank, A.G.; Dalenogare, L.S.; Ayala, N.F. Industry 4.0 Technologies: Implementation Patterns in Manufacturing Companies. Int. J. Prod. Econ. 2019, 210, 15–26. [Google Scholar] [CrossRef]

- Coreynen, W.; Matthyssens, P.; Van Bockhaven, W. Boosting Servitization through Digitization: Pathways and Dynamic Resource Configurations for Manufacturers. Ind. Mark. Manag. 2017, 60, 42–53. [Google Scholar] [CrossRef]

- Ceipek, R.; Hautz, J.; Petruzzelli, A.M.; De Massis, A.; Matzler, K. A Motivation and Ability Perspective on Engagement in Emerging Digital Technologies: The Case of Internet of Things Solutions. Long Range Plan. 2021, 54, 101991. [Google Scholar] [CrossRef]

- Del Vecchio, P.; Di Minin, A.; Petruzzelli, A.M.; Panniello, U.; Pirri, S. Big Data for Open Innovation in SMEs and Large Corporations: Trends, Opportunities, and Challenges. Creat. Innov. Manag. 2018, 27, 6–22. [Google Scholar] [CrossRef]

- Latifi, M.-A.; Nikou, S.; Bouwman, H. Business Model Innovation and Firm Performance: Exploring Causal Mechanisms in SMEs. Technovation 2021, 107, 102274. [Google Scholar] [CrossRef]

- Bhatti, S.H.; Santoro, G.; Khan, J.; Rizzato, F. Antecedents and Consequences of Business Model Innovation in the IT Industry. J. Bus. Res. 2021, 123, 389–400. [Google Scholar] [CrossRef]

- Miroshnychenko, I.; Strobl, A.; Matzler, K.; De Massis, A. Absorptive Capacity, Strategic Flexibility, and Business Model Innovation: Empirical Evidence from Italian SMEs. J. Bus. Res. 2021, 130, 670–682. [Google Scholar] [CrossRef]

- Kinkel, S.; Baumgartner, M.; Cherubini, E. Prerequisites for the Adoption of AI Technologies in Manufacturing—Evidence from a Worldwide Sample of Manufacturing Companies. Technovation 2022, 110, 102375. [Google Scholar] [CrossRef]

- Teece, D.J. Business Models, Business Strategy and Innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Amit, R.; Zott, C. Creating Value Through Business Model Innovation. MIT SMR. 2012. Available online: https://sloanreview.mit.edu/article/creating-value-through-business-model-innovation/ (accessed on 26 May 2025).

- Minatogawa, V.L.F.; Franco, M.M.V.; Rampasso, I.S.; Anholon, R.; Quadros, R.; Durán, O.; Batocchio, A. Operationalizing Business Model Innovation through Big Data Analytics for Sustainable Organizations. Sustainability 2020, 12, 277. [Google Scholar] [CrossRef]

- Ghezzi, A.; Cavallo, A. Agile Business Model Innovation in Digital Entrepreneurship: Lean Startup Approaches. J. Bus. Res. 2020, 110, 519–537. [Google Scholar] [CrossRef]