1. Introduction

The rapid advancement of industrialization has precipitated a series of environmental crises, including pollution, climate change, and resource depletion, posing severe threats to global ecosystems. Addressing these challenges has become an urgent priority worldwide. The United Nations Environment Programme (UNEP) has emphasized that environmental degradation not only undermines the sustainability of natural resources but also exerts profound impacts on economic development, public health, and social stability. In response to escalating ecological pressures, green development has become the core strategic goal of achieving sustainable transformation [

1] (pp. 17–25). The green economy, as an important manifestation of this, emphasizes the pursuit of economic prosperity while taking into account ecological balance and resource efficiency and strives to establish a coordination mechanism between economic growth and environmental protection. Under the international sustainability governance framework, green development not only involves emission reduction targets and resource conservation, but also increasingly relies on government governance capabilities, institutional adaptability, and dynamic adjustments in policy implementation [

2,

3] (pp. 323–340, pp. 2389–2406). At present, countries around the world are striving to move away from the traditional resource-intensive development model and accelerate the transition to a green economy. Green economy has become a global development consensus. The EU’s “Green New Deal,” the United States’ clean energy investment, and the green practices of India, Brazil and other countries have jointly promoted a global move away from the resource-intensive development path to turn to an eco-friendly economic model [

4,

5] (pp. 101–137, pp. 373–400).

As the world’s largest carbon emitter, China plays a key role in achieving green development. According to the International Energy Agency’s 2022 CO

2 Emissions Report, China’s energy-related carbon emissions reached 12.1 billion tons in 2022, accounting for 32.88% of the global total of 36.8 billion tons [

6]. Given its substantial contribution to global carbon emissions, China’s transition toward a green economy is pivotal in advancing global economic sustainability. Moreover, the 2022 Environmental Performance Index (EPI), published by Yale University and Columbia University, assessed 180 countries based on key indicators such as climate resilience, environmental quality, and ecosystem vitality. China ranked 160th, underscoring the significant challenges it faces in achieving sustainable development. For the foreseeable future, fostering green economic transformation will remain a fundamental imperative for China to seek economic growth with sustainability.

In recent years, the Chinese government has implemented a series of administrative regulations and established resource conservation mechanisms to enhance resource efficiency and internalize the externalities of environmental pollution. From the perspectives of property rights and transaction costs, these measures include the enactment of the Environmental Protection Law in 2015 and the introduction of the Environmental Protection Tax in 2018—both represent significant policy measures designed to safeguard the environment and promote sustainable green development. However, the existing administrative regulations and resource conservation mechanisms mainly emphasize end-of-pipe treatment and resource management, rather than directly limiting the total amount of emissions [

7] (pp. 173–188), making it difficult to fundamentally promote green transformation. In fact, in the process of promoting green development goals, the key reason why environmental pollution control has limited effectiveness lies in its strong externality characteristics and the lack of effective incentive and constraint mechanisms to encourage local governments and officials to actively fulfill their environmental governance responsibilities [

8] (pp. 131–166). In this context, government environmental auditing, as an institutionalized and normalized supervision tool, has become an important mechanism to promote the effective implementation of green development goals [

9] (pp. 273–274).

On the one hand, from the perspective of public trust, government environmental auditing is a form of systematic supervision and evaluation conducted by audit institutions on environmental pollution prevention and control, ecological protection policy implementation, and the use of relevant financial funds [

10] (pp. 101–109), aiming to ensure that the government, as a public agent, fulfills its responsibilities in environmental governance. On the other hand, from the perspective of supervision orientation, environmental auditing can strengthen the behavioral constraints of local governments and their leading cadres in resource allocation and ecological protection through a results-oriented supervision method, thereby alleviating the problem of “lack of incentives.” Compared with the central environmental inspection system, which is mainly based on policy supervision and mainly implements the political will of superiors, government environmental auditing operates in a complete bureaucratic system and has stronger institutional independence and audit authority [

11] (pp. 3–13). Its high degree of institutional autonomy can not only exert substantial pressure on the audited units, but also has a significant demonstration and deterrent effect on entities that are not directly audited, thereby encouraging more extensive compliance behaviors and promoting the institutionalization and normalization of environmental governance behaviors. This raises key questions: Can government environmental audits promote green development? What is the impact mechanism? Is there heterogeneity?

At present, some scholars have conducted research on the economic consequences of government environmental audits. From a regional perspective, research indicates that environmental auditing, through its integration with intergovernmental governance mechanisms and policy regulations, facilitates innovation in green governance strategies [

12] (pp. 179–196) and significantly enhances regional environmental performance [

13] pp. (1091–1106). At the corporate level, studies suggest that environmental auditing not only improves the level and quality of corporate environmental responsibility disclosures [

14] (pp. 182–189) but also encourages greater corporate investment in environmental governance [

15] (pp. 1271–1291), ultimately contributing to enhanced green economic performance. However, current research on government environmental audits mainly focuses on the evaluation of pollution control policies and energy conservation and emission reduction measures, and rarely involves audits of energy conservation and environmental protection funds [

16] (pp. 298–311). In fact, as an important part of government environmental audits, energy conservation and environmental protection fund audits evaluate environmental effects from the perspective of funds [

17] (pp. 21733–21746). Unlike general policy implementation audits, fund audits not only focus on whether environmental goals are achieved, but also focus on whether fiscal investment is reasonably allocated and whether the use of funds is efficient and transparent [

18] (pp. 33–39). However, current research on its impact and its potential mechanisms is very limited. This study aims to fill this gap and provide a new perspective on the broader role of government environmental audits in promoting green economic transformation.

This study takes the performance audit of China’s key special funds for energy conservation and environmental protection as the starting point. From December 2016 to March 2017, the National Audit Office of China (NAO) conducted a comprehensive audit of the management and use of central fiscal energy conservation and environmental protection transfer funds in 2015 and 2016 in 18 provinces, autonomous regions, and municipalities directly under the central government (hereinafter referred to as provinces), and disclosed the fund management problems and rectification status of 39 prefecture-level cities in June 2017. This is the only public disclosure of the performance audit of key energy conservation and environmental protection funds since the implementation of the Interim Measures for the Management of Energy Conservation and Emission Reduction Subsidy Funds. As a concrete manifestation of the closed-loop mechanism of “Party and Government Shared Responsibilities—Five-Year Plan—Audit,” it demonstrates China’s outstanding ecological policy implementation capabilities. In addition, as the world’s largest carbon emitter and the fastest growing green economy, China has not only achieved a balance between maintaining an average annual GDP growth rate of 6% and systematically eliminating 150 million tons of steel production capacity, but has also taken the lead in incorporating “dual carbon” indicators into the audit framework, establishing a novel “policy anchoring” paradigm, and contributing valuable inspiration to global environmental governance. Based on the practice background of key energy-saving and environmental protection fund performance audits, this study uses this type of natural experiment to empirically examine the impact of government environmental audits on the level of urban green economy and the mechanism behind it.

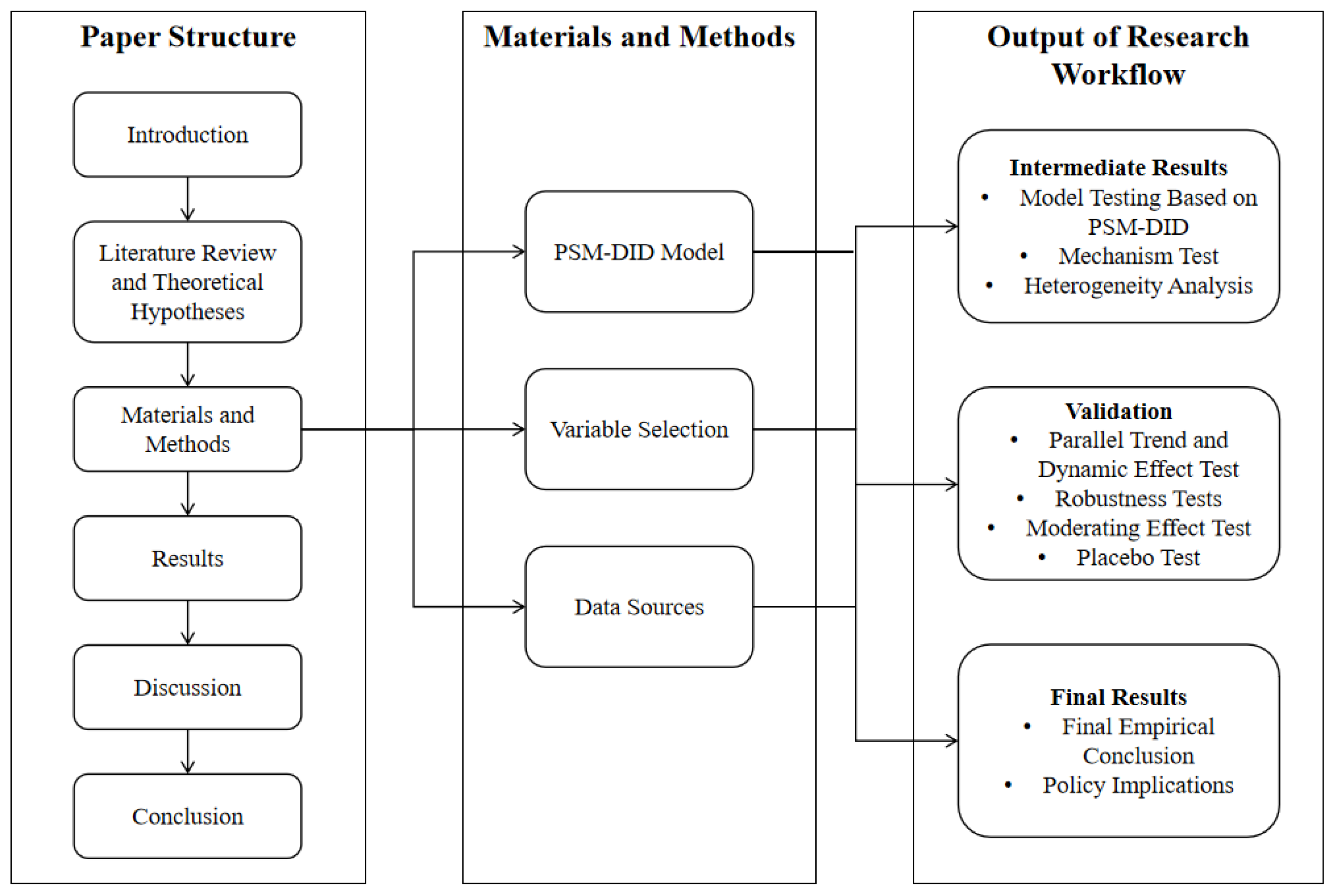

This paper is structured as follows:

Section 2 reviews literature on the green economy and government environmental auditing and proposes theoretical hypotheses.

Section 3 presents the methodology and data, while

Section 4 introduces and analyzes a series of empirical results.

Section 5 concludes with findings from

Section 4 and offers policy recommendations.

The overall research framework and analytical workflow are shown in

Figure 1.

5. Discussion

This study theoretically expands the research framework of the impact of government environmental audits on environmental governance and green economic performance, as follows:

First, this paper confirms the effectiveness of government environmental audits in improving urban green economic performance, expanding the boundaries of green economy and government audit research. Unlike Wu et al. [

54] (pp. 1213–1241) and Zhang [

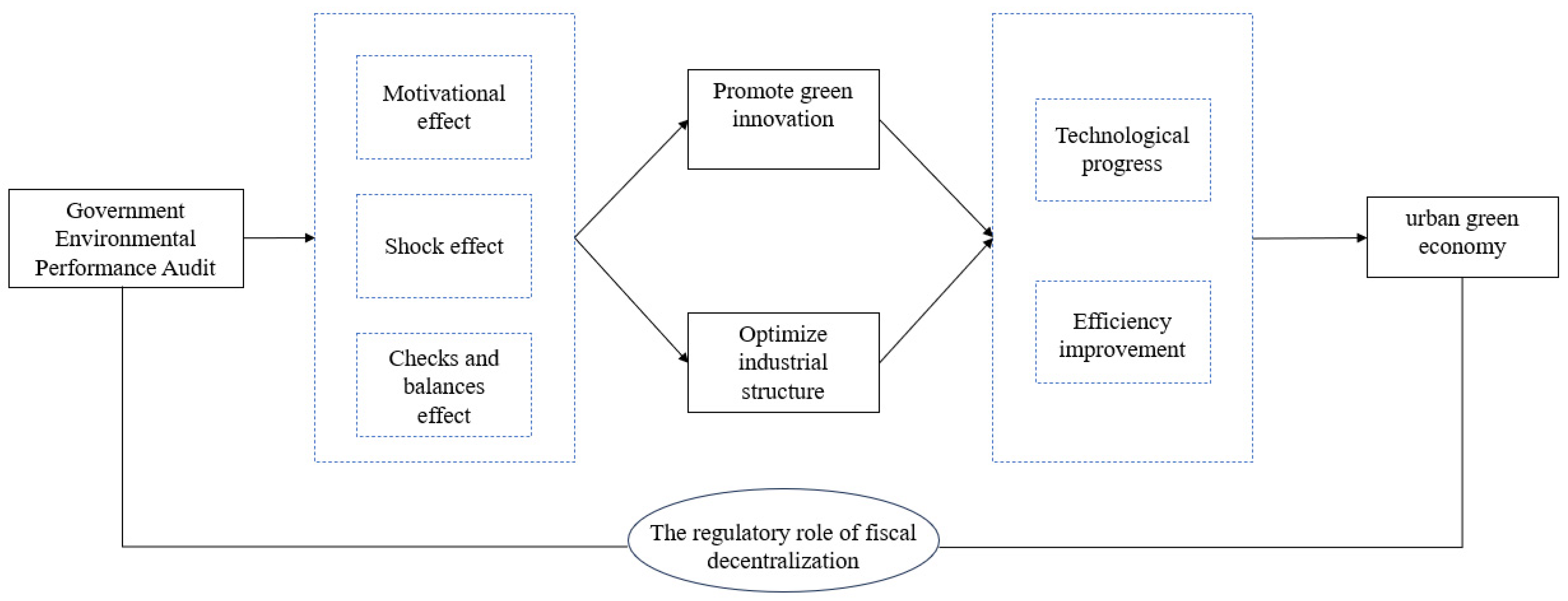

55] (pp. 813–844), who focus mainly on the impact of audits on environmental governance and resource utilization, this paper extends the research perspective to its driving role in green economic development. By constructing the PSM-DID model, this paper fills the gap in empirical research on the impact of government environmental audits on green economic performance, especially in revealing a path by which to improve urban green economic efficiency through green innovation and industrial structure optimization, providing a new perspective for green economic theory.

Secondly, we identify the internal mechanism of the government environmental audit in improving green economic performance. Compared with existing research that mainly focuses on the effectiveness of environmental policy implementation [

34] (pp. 1704–1704), this study focuses on the systematic role of government environmental auditing in promoting technological progress, improving the efficiency of capital use and optimizing industrial structure, and reveals its core function in the sustainable development of green economy from the perspective of resource allocation and performance orientation. This finding provides a solid foundation for deepening the theoretical discussion on the interactive mechanism between government audit and green development.

Third, our analysis also found, in its heterogeneity analysis, that the effects of government environmental audits in different cities are significantly different, especially in areas with low fiscal transparency and high environmental regulation intensity. This result is not only consistent with the research conclusion of Xu Jianjun et al. [

56] (pp. 86–92) on the impact of government environmental audits on green economic performance, but also echoes the OECD’s discussion on the relationship between fiscal transparency and policy effectiveness, as well as the logic of environmental regulation promoting innovation and compensation effects proposed in the “Porter hypothesis” [

57] (pp. 97–118). In summary, the above results show that the policy effect of government environmental audits has obvious contextual dependence. In order to improve the accuracy and effectiveness of green economic policies, policymakers should optimize the design and implementation of audit systems in accordance with local conditions based on the specific characteristics of cities in terms of fiscal governance and environmental regulation.

Although this study has made useful explorations in the relationship between government environmental audits and urban green economy, it still has certain limitations, which in turn also provide directions for subsequent research.

First, at the data level, this article mainly relies on public data at the prefecture or city level, and has not yet deeply examined micro-subjects such as enterprises. As the core unit of market activities, the behavior mechanism of enterprises may be significantly different from the green economic performance at the city level.

Second, in terms of mechanism analysis, this article mainly starts from the perspective of technological progress, efficiency improvement and fiscal decentralization, but lacks a more detailed identification of the evolution path and operation dynamics of the audit role.

Third, there are still omissions in the heterogeneity analysis, and other regional characteristic variables that may affect the development of the green economy have not been fully included. Subsequent research can further expand the analysis dimension.

Finally, there is still room for improvement in policy recommendations. The current recommendations mainly focus on the overall direction, and, in the future, policy tools should be further refined to enhance their pertinence and operability, so as to optimize the existing audit and green development policy system.

6. Conclusions

This paper takes the performance audit of energy-saving and environmental protection funds as the starting point, deeply analyzes the impact of government environmental audits on the development of urban green economy, and draws several important conclusions.

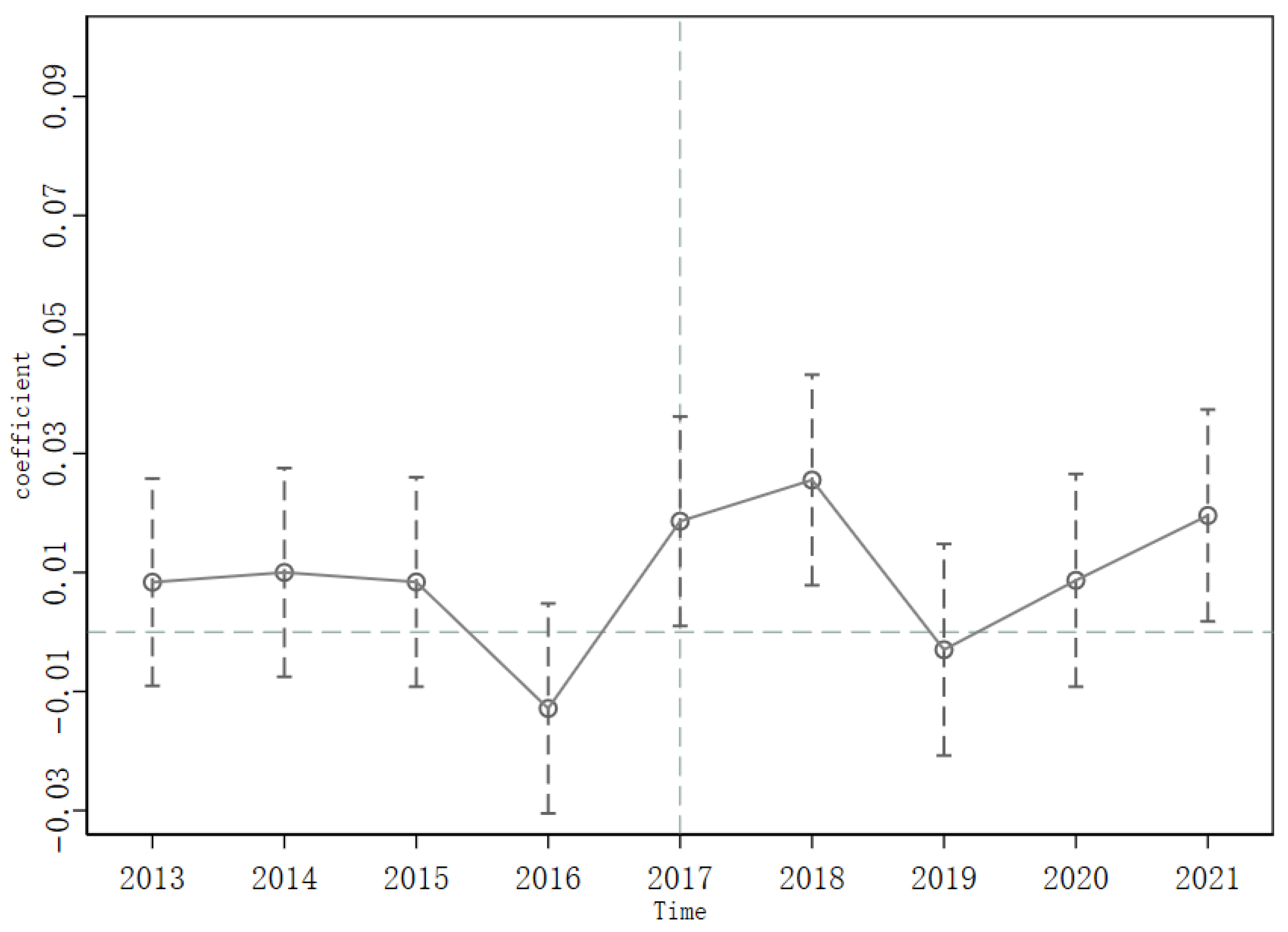

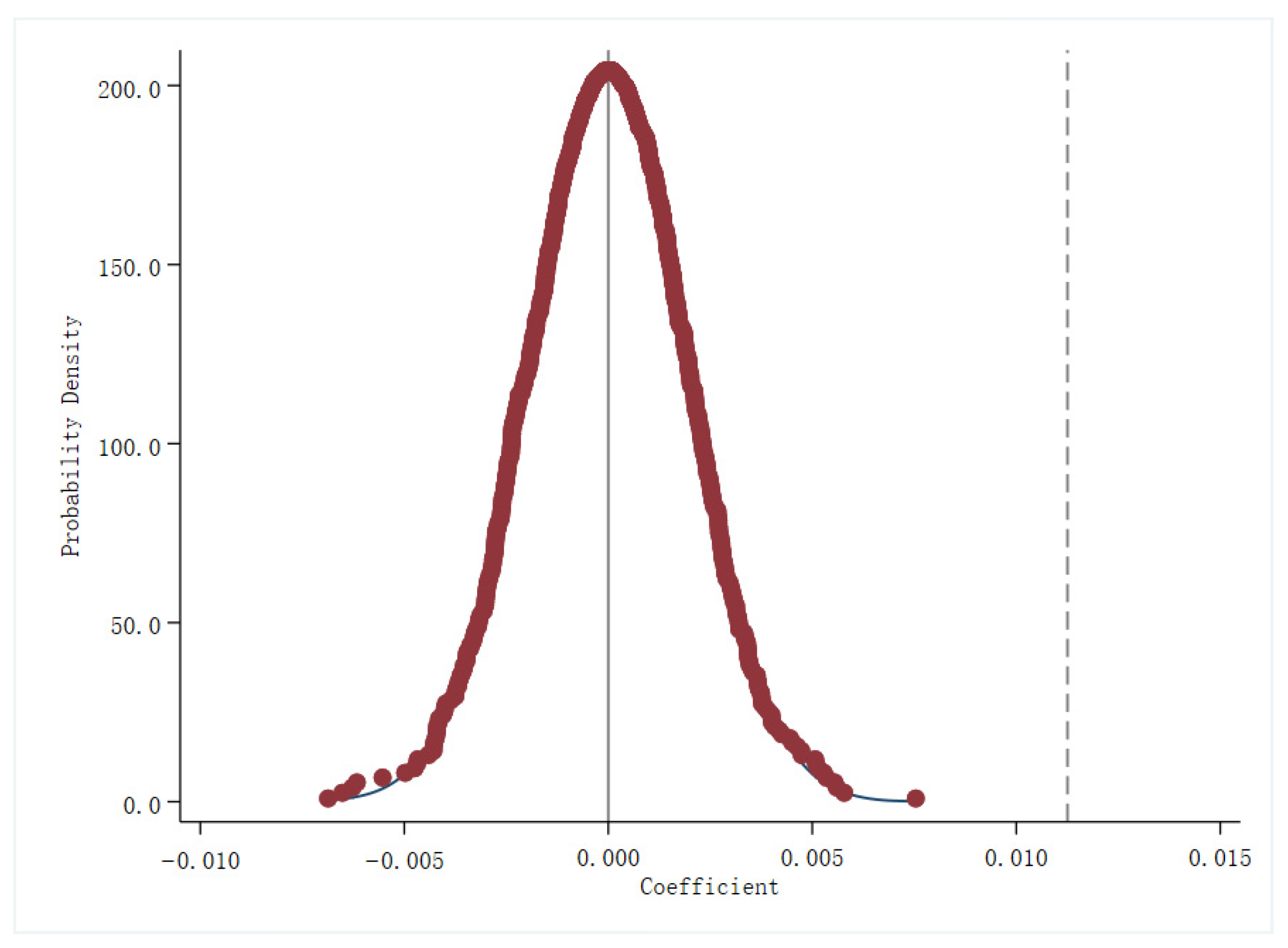

First, the empirical results show that government environmental auditing significantly improves the level of urban green economy, and this conclusion still holds after a series of robustness tests.

Second, the mechanism analysis finds that government environmental auditing effectively improves urban green economy by promoting green innovation and optimizing industrial structure.

Finally, the heterogeneity analysis shows that, in cities with low fiscal transparency and high environmental regulation level, the positive impact of government environmental audit on urban green economic performance is more significant.

Based on the above analysis, this study puts forward the following policy recommendations:

First, the authority of audit work should be enhanced. Audit departments should appropriately expand the coverage of special audits and strengthen the tracking and results disclosure of key projects, so as to enhance the binding force of an audit on risk prevention and control and policy implementation.

Second, the deterrent effect of audit work should be deepened. Government departments should innovate the form of information disclosure, flexibly use online media, broaden the channels for information disclosure, guide the public to participate in supervision, improve the transparency of fiscal information, and build a sunshine government.

Third, multiple measures should be taken to improve the degree of fiscal decentralization. Government departments should optimize the expenditure structure, strengthen performance management and improve the business environment, guide enterprises to invest and start businesses, and increase fiscal revenue.

Then, we should promote the deep integration of the environmental audit system with the international sustainable governance framework. In view of the global common characteristics of green development, the government environmental audit system should be effectively connected with the United Nations Sustainable Development Goals (SDGs), and the system should include “governance capacity improvement,” “system adaptability construction” and “long-term sustainable performance” evaluation indicators.

Finally, an audit problem rectification list system should be implemented. Government departments should clarify the responsible units for rectification, refine the rectification measures, implement the rectification results, and realize the closed-loop management of audit problems through information systems. In addition, it is necessary to strengthen the coordination and linkage between the National Audit Office, the Finance Department, and the Taxation Department, so that they may work together to promote problem rectification and strive to open up the “last mile” of audit work.

Given that this study still has limitations in terms of data level, mechanism identification and variable control, enterprise-level data and dynamic methods can be introduced in the future to further reveal the micro-path and time-effect characteristics of the audit effect. At the same time, heterogeneous variables and policy simulation analysis should be expanded to improve the accuracy and empirical support of government environmental audit intervention.