Research on the Optimization of Collaborative Decision Making in Shipping Green Fuel Supply Chains Based on Evolutionary Game Theory

Abstract

1. Introduction

- Cost-sharing mechanism: How can the costs of port infrastructure retrofitting (e.g., ammonia fuel storage tanks) be dynamically balanced between government fiscal allocations and corporate funds?

- Policy tool optimization: How can a combination of direct investments (e.g., government equity participation in port infrastructure) and indirect incentives (production-side subsidies, carbon tax exemptions) drive the rapid formation of the supply chain?

2. Literature Review

2.1. Research on the Shipping Green Fuel Supply Chain

2.2. Review on Optimization Models for Green Supply Chain Collaborative Decision Making

2.3. Review on the Application of Evolutionary Game Theory

2.4. Summary

3. Models

3.1. Model Assumptions and Symbol Definition

- (1)

- Both the government and maritime green fuel supply chain enterprises are boundedly rational and can achieve a stable state in the green shipping fuel supply chain development game through autonomous learning.

- (2)

- The government has two strategies, “Active (S1)” and “Inactive (S2),” with selection probabilities of x and (1 − x), respectively, where .

- (3)

- Maritime green fuel supply chain enterprises have two strategies, “Invest (A1)” and “Do Not Invest (A2),” with selection probabilities of y and (1 − y), respectively, where .

- (4)

- Government decisions are divided into two strategic choices: active and inactive. Under the active strategy, there are two sub-choices: incentives and penalties. The incentive strategy includes two scenarios: direct government investment in infrastructure and subsidies to relevant enterprises. The penalty strategy involves imposing carbon taxes on traditional energy suppliers.

- (5)

- Supply chain enterprise decisions are divided into two choices: increasing R&D investment for technological innovation and corresponding infrastructure construction to achieve green shipping fuel supply capabilities, or maintaining traditional fuel operations without changes.

- (6)

- The government’s revenue takes into account the overall social benefits and the carbon tax levied. The overall social benefits include the improvement of environmental benefits brought by the development of the shipping green fuel supply chain, the technological spillover effects generated by the development of the shipping green fuel supply chain, and the enhancement of the overall social and economic benefits brought by the development of regional industries.

- (7)

- The enterprises’ revenue mainly consists of two situations: the sales revenue from the supply of green fuels by shipping green fuel supply chain enterprises and the government subsidies obtained.

- denotes the environmental benefits derived from green shipping fuel supply chain development;

- represents the technological spillover effects and associated socio-economic benefits from regional industrial advancement;

- signifies the government costs for infrastructure construction and subsidy expenditures, where:

- refers to the direct infrastructure investment costs by the government;

- indicates the costs of subsidy policies;

- signifies carbon tax revenue collected from conventional energy suppliers;

- reflects potential losses due to inadequate green fuel supply capacity;

- corresponds to enterprise revenue generated from green fuel sales;

- encompasses R&D and infrastructure investment outlays by enterprises;

- designates direct subsidy income received from the government.

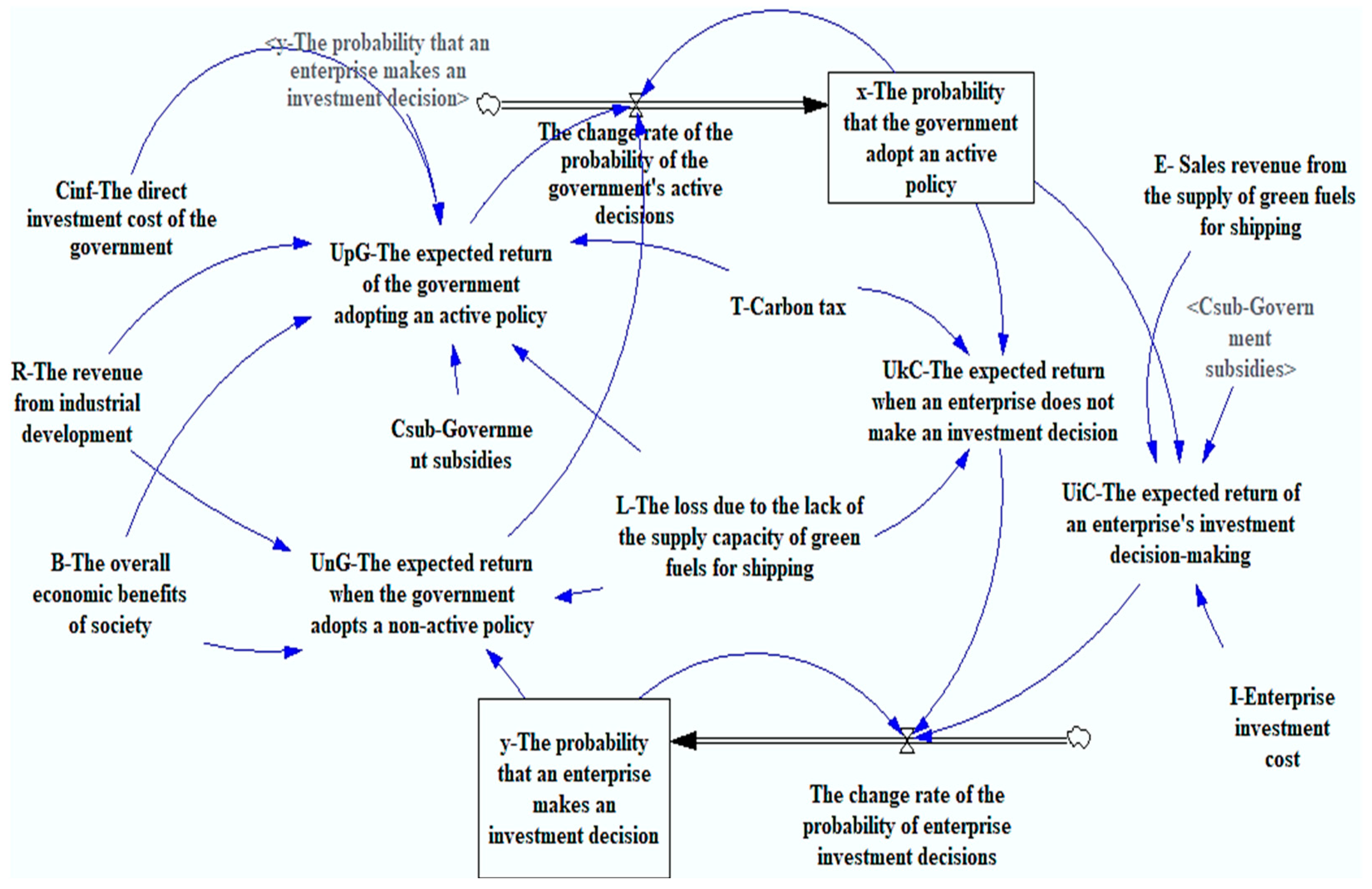

3.2. Replication Dynamic Equation Building

4. Evolutionary Game Model Simulation Analysis

4.1. Construction of the System Dynamics Simulation Model

4.2. Simulation Scenarios and Parameter Design

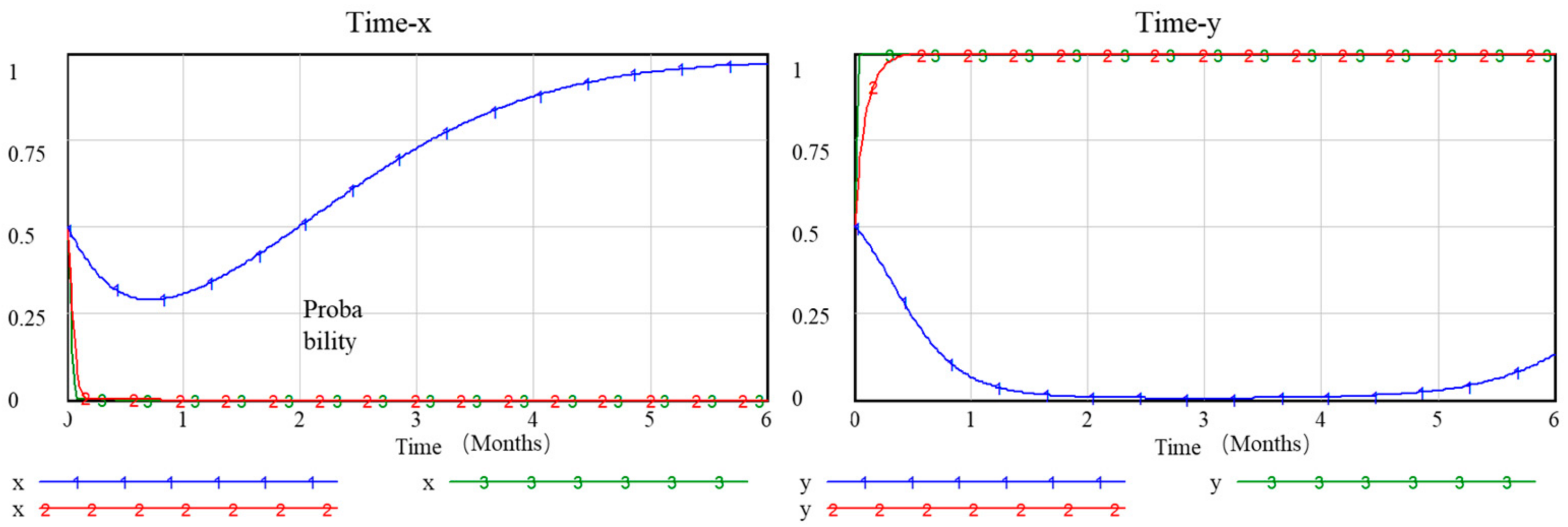

4.2.1. Temporal Scenarios

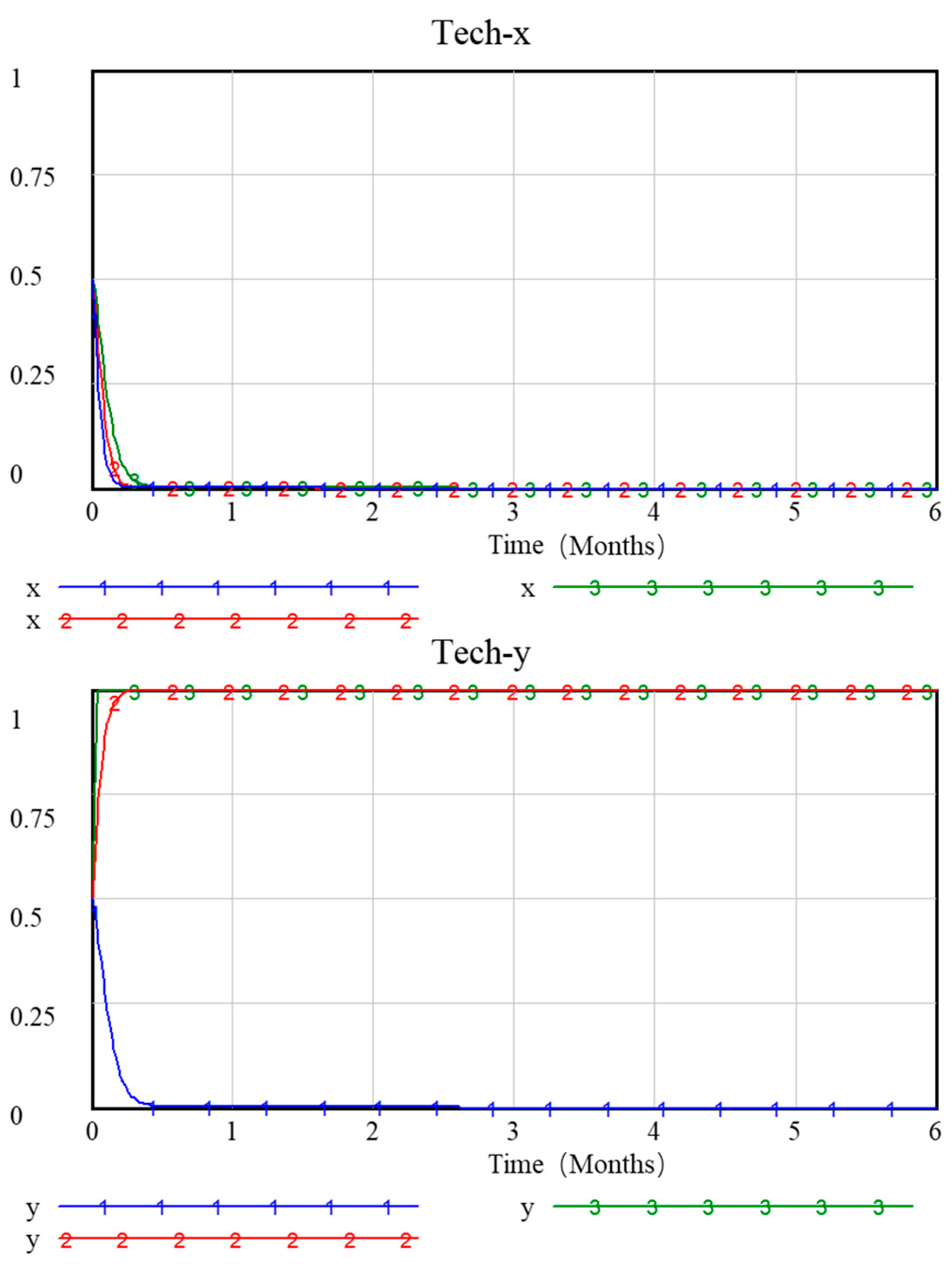

4.2.2. Technology Development Scenario

4.2.3. Social Awareness Scenario

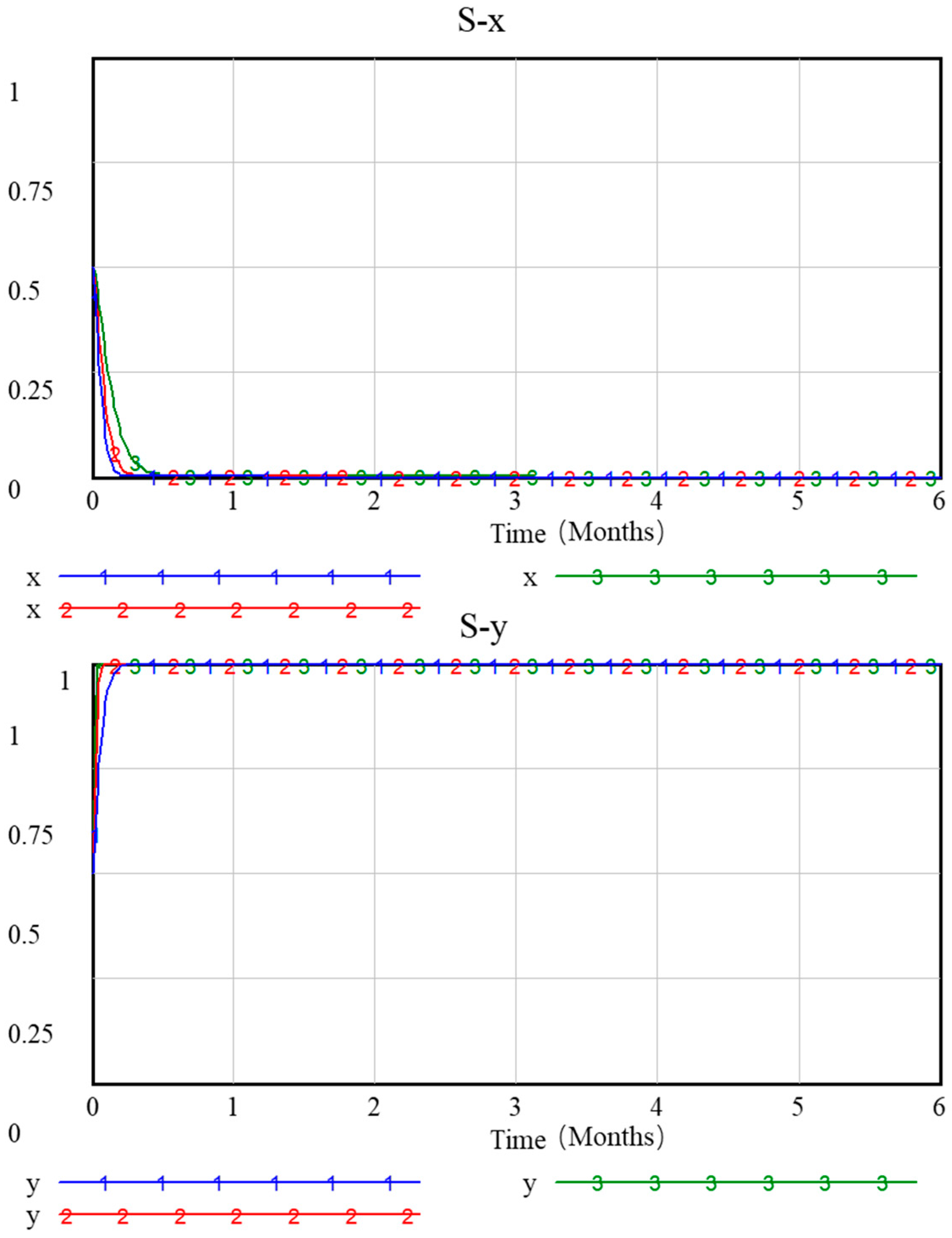

4.2.4. Policy Intensity Scenario

4.2.5. Market Competition Scenario

4.3. Scenario Simulation Results and Analysis

- (1)

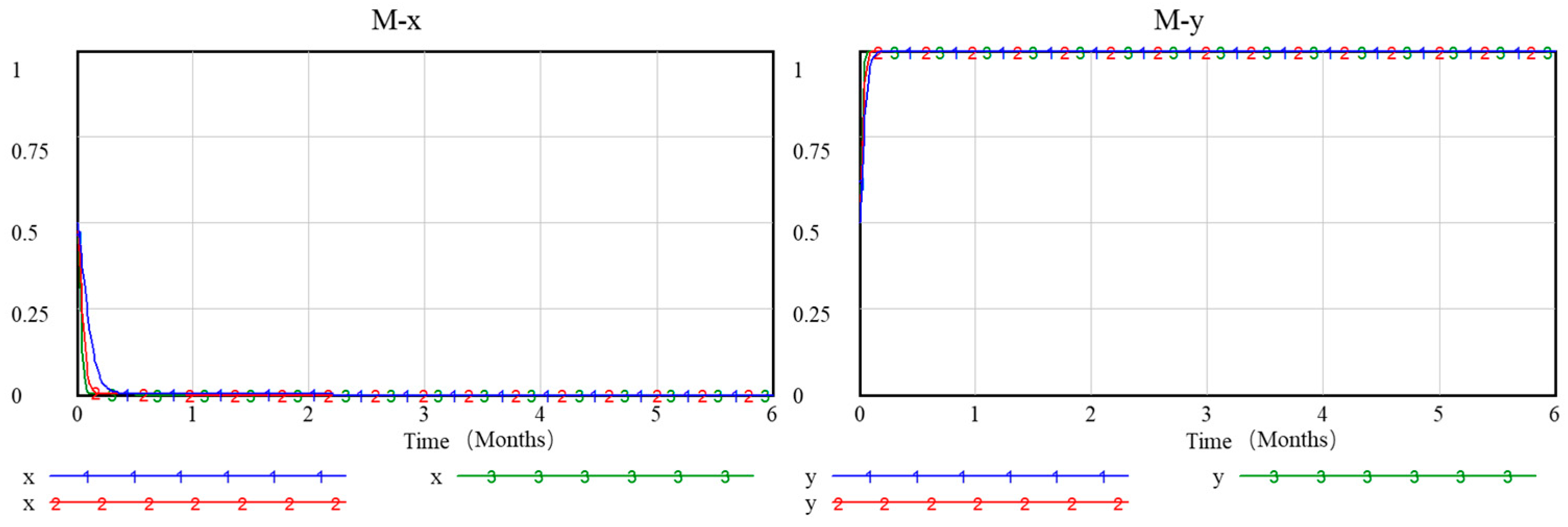

- Simulation under initial conditions

- (2)

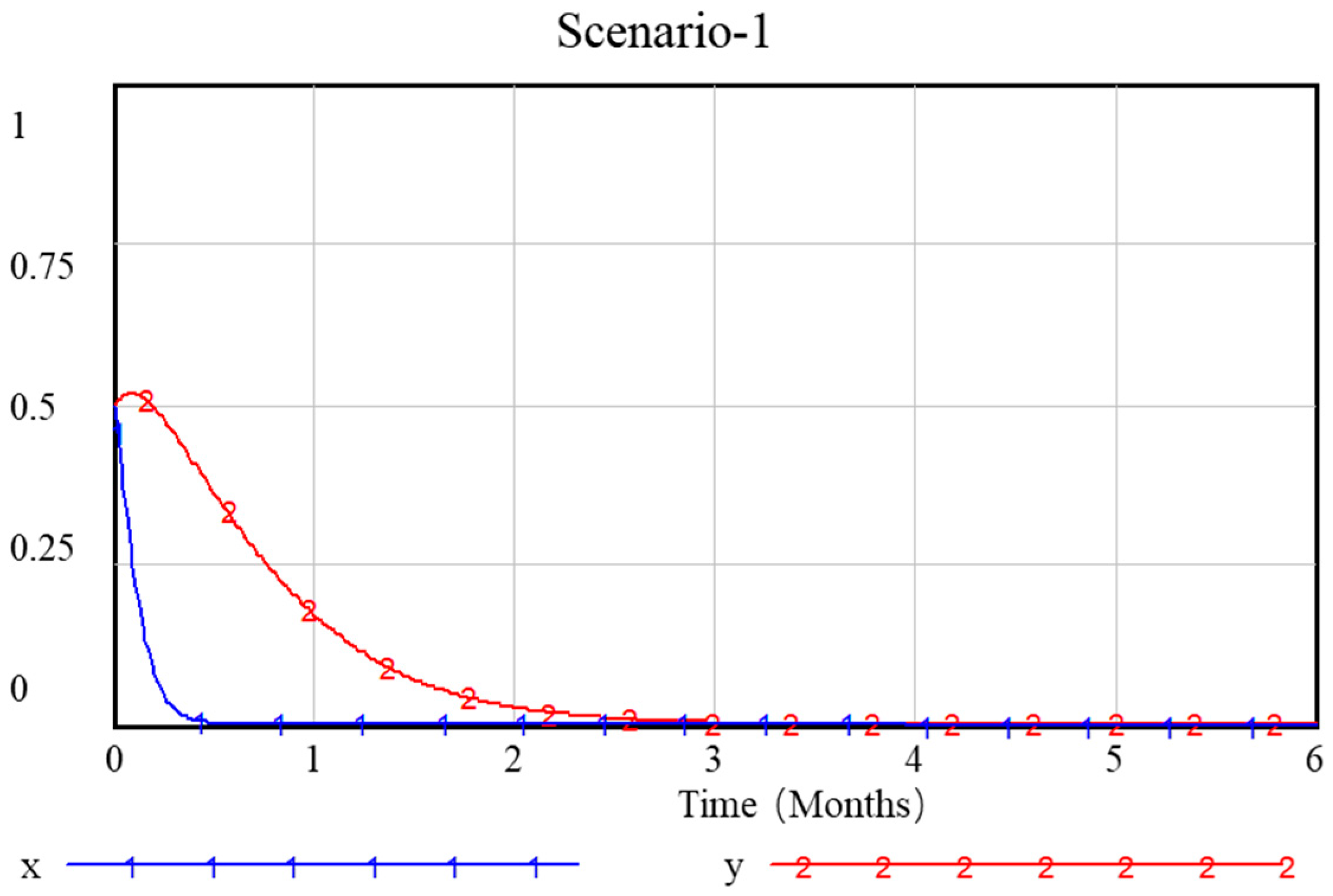

- Numerical simulation under temporal scenarios

- (3)

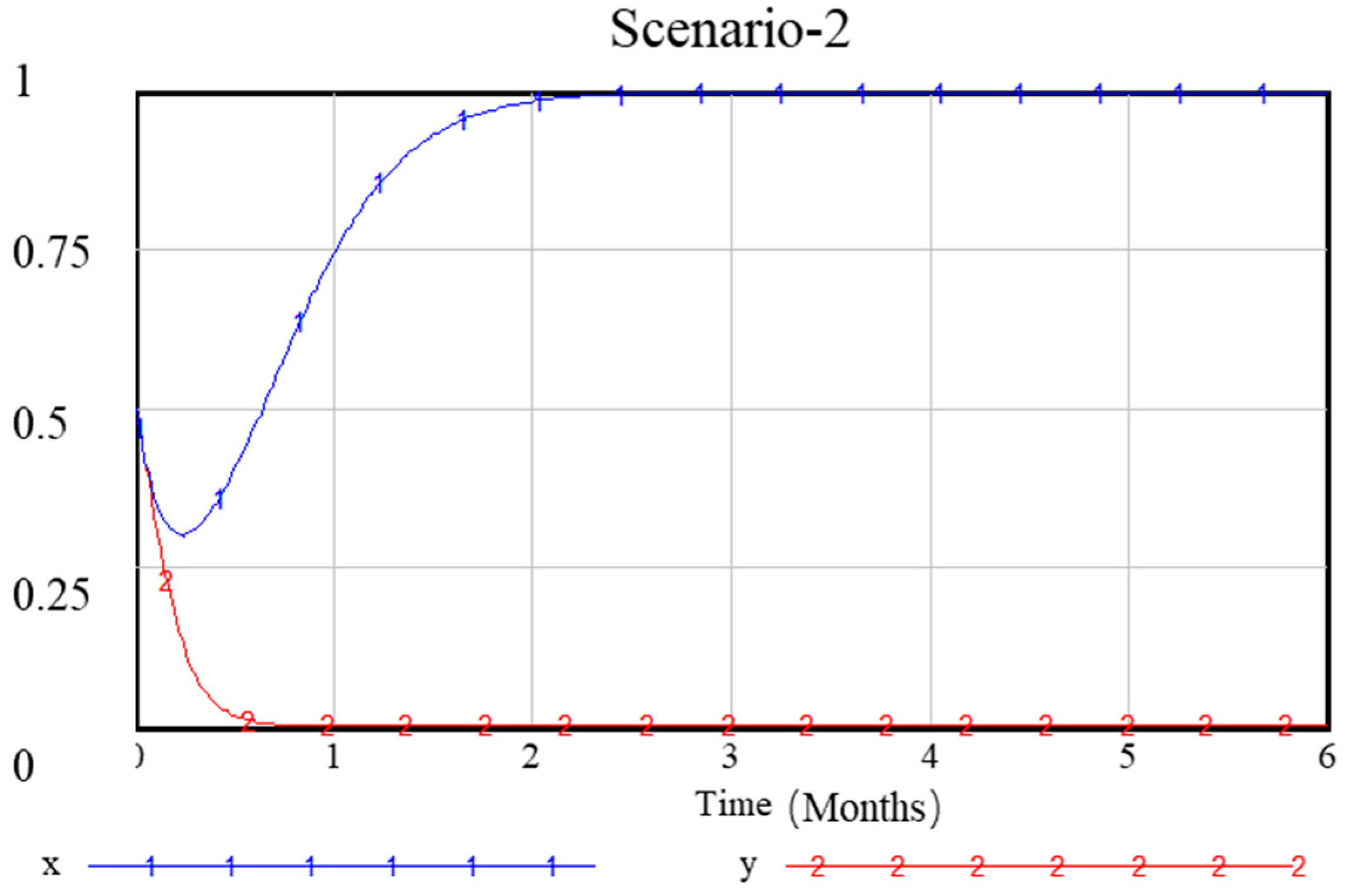

- Numerical simulation under technological scenarios

- (4)

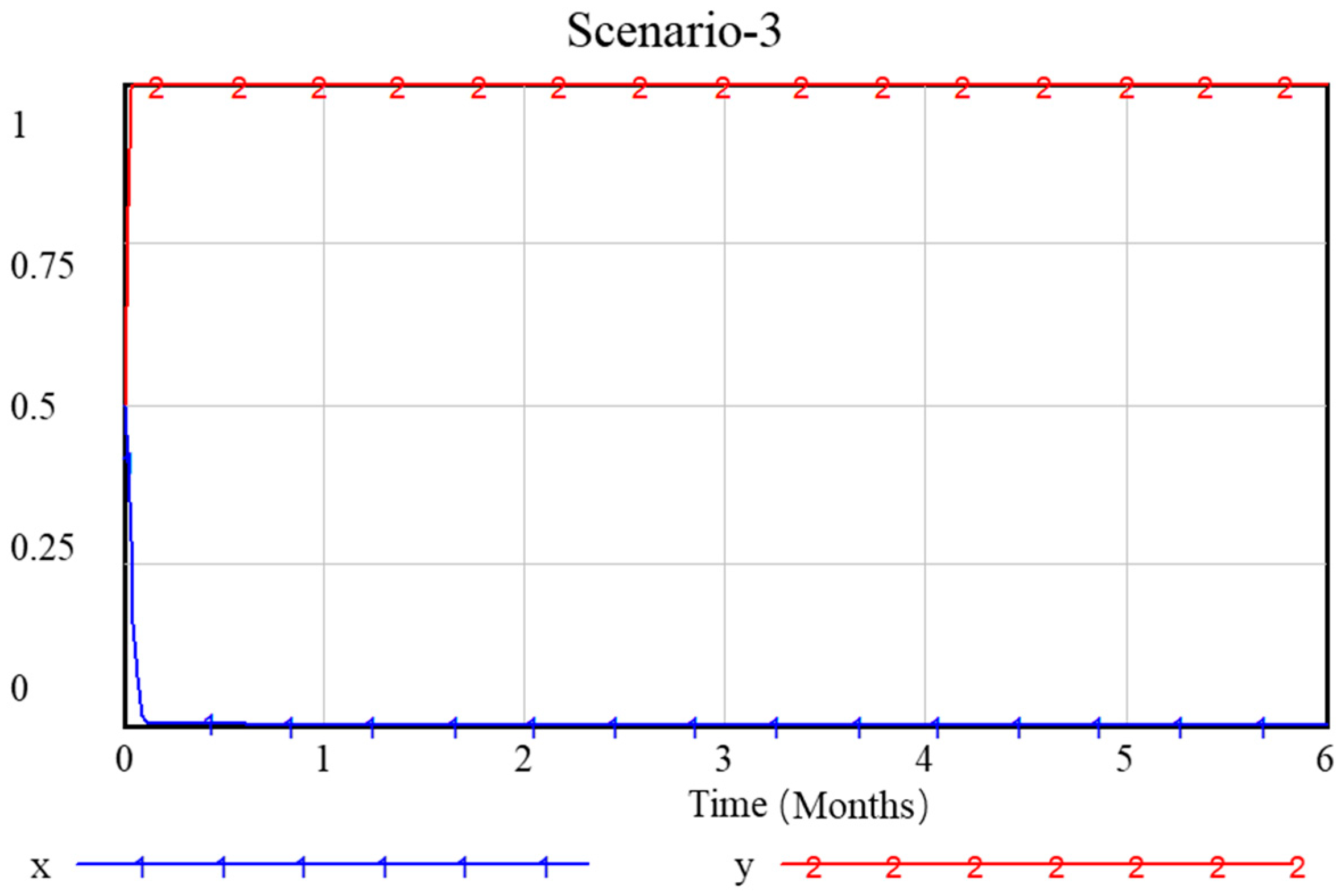

- Numerical simulation under social awareness scenarios

- (5)

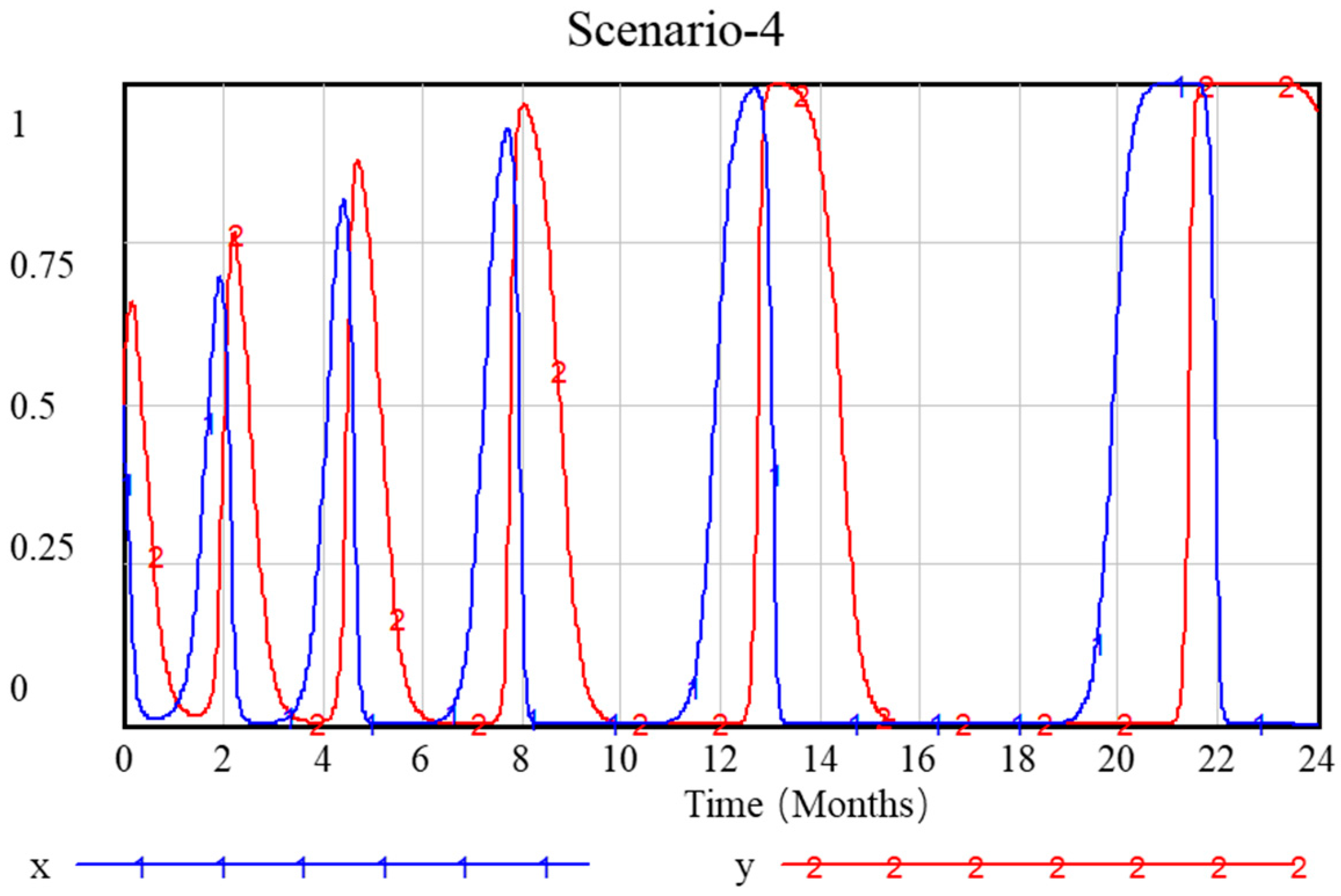

- Numerical simulation under policy intensity scenarios

- (6)

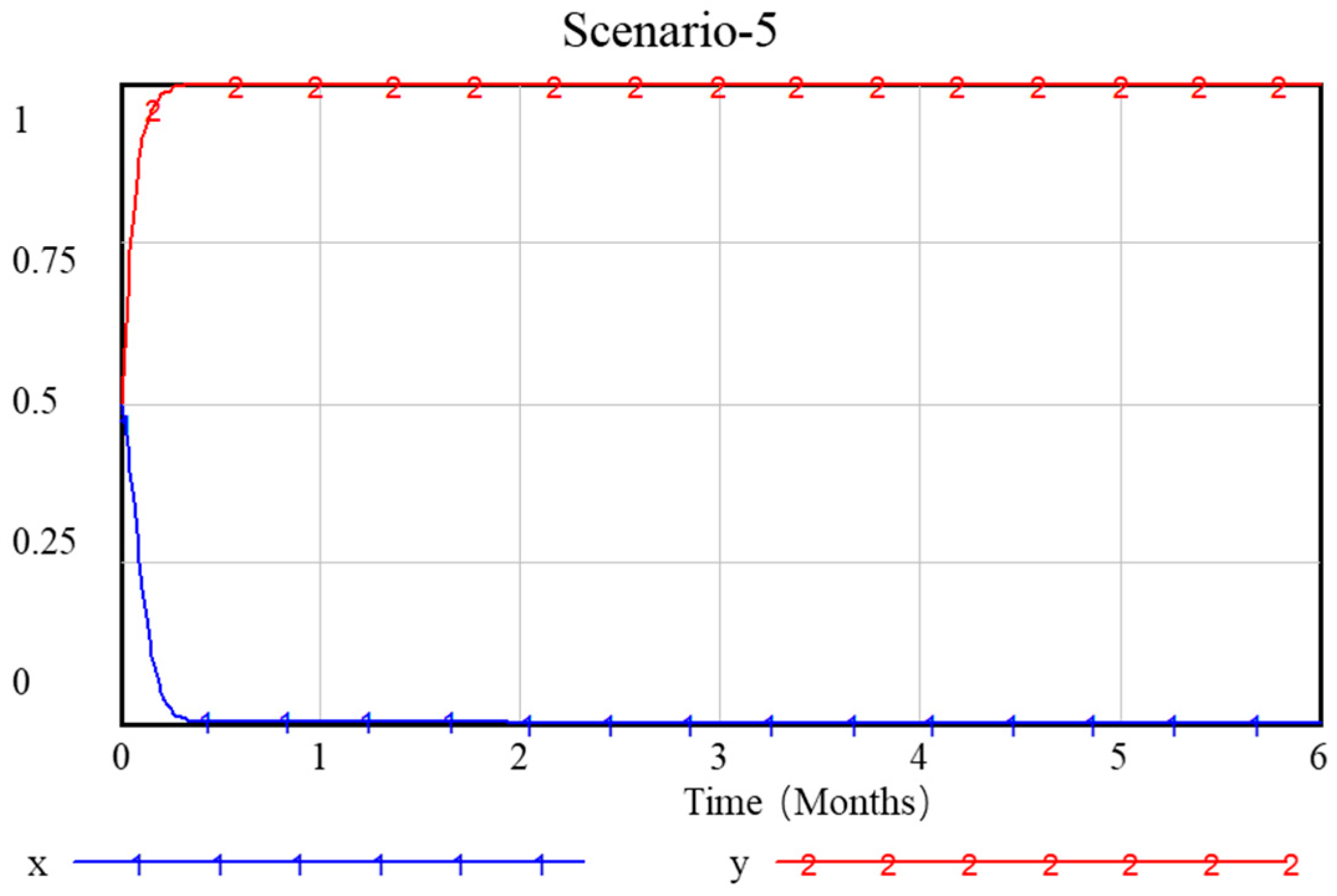

- Numerical simulation under market competition scenarios

- (7)

- Numerical simulation under comprehensive scenarios

4.4. Parameter Sensitivity Analysis

4.4.1. Infrastructure Construction Cost

4.4.2. Subsidy Costs and Carbon Tax Revenue

4.4.3. Investment Costs and Sales Revenue

5. Conclusions and Prospects

5.1. Conclusions and Recommendations

5.2. Future Directions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Nguyen, V.N.; Rudzki, K.; Dzida, M.; Pham, N.D.K.; Pham, M.T.; Nguyen, P.Q.P.; Xuan, P.N. Understanding Fuel Saving and Clean Fuel Strategies Towards Green Maritime. Pol. Marit. Res. 2023, 30, 146–164. [Google Scholar] [CrossRef]

- Wang, Y.; Iris, Ç. Transition to near-zero emission shipping fleet powered by alternative fuels under uncertainty. Transp. Res. Part D Transp. Environ. 2025, 142, 104689. [Google Scholar] [CrossRef]

- Jasper, V.; Salmon, N.; Hall, J.; Baares, R.; Alcantara, R. Optimal Fuel Supply of Green Ammonia to Decarbonise Global Shipping. Environ. Res. Infrastruct. Sustain. 2024, 4, 015001. [Google Scholar]

- Balci, G.; Phan, T.T.N.; Surucu-Balci, E.; Iris, Ç. A roadmap to alternative fuels for decarbonising shipping: The case of green ammonia. Res. Transp. Bus. Manag. 2024, 53, 101100. [Google Scholar] [CrossRef]

- Yu, G.; Yan, R.; Qi, J.; Liu, Y.; Wang, S.; Zhen, L. LNG Bunkering Infrastructure Planning at Port. Multimodal Transp. 2024, 3, 100134. [Google Scholar]

- Cagatay, I.; Lam, J.S.L. A review of energy efficiency in ports: Operational strategies, technologies and energy management systems. Renew. Sustain. Energy Rev. 2019, 112, 170–182. [Google Scholar]

- Bortnowska, M.; Zmuda, A. The Possibility of Using Hydrogen as a Green Alternative to Traditional Marine Fuels on an Offshore Vessel Serving Wind Farms. Energies 2024, 17, 5915. [Google Scholar] [CrossRef]

- Liang, C.; Sun, W.; Shi, J.; Wang, K.; Zhang, Y.; Lim, G. Decarbonizing Maritime Transport through Green Fuel Powered Vessel Retrofitting: A Game Theoretic Approach. J. Mar. Sci. Eng. 2024, 12, 1174. [Google Scholar] [CrossRef]

- Amit, K.; Kumar, K. An Uncertain Sustainable Supply Chain Network Design for Regulating Greenhouse Gas Emission and Supply Chain Cost. Clean. Logist. Supply Chain 2024, 10, 100142. [Google Scholar]

- Amar, R.; Ramudhin, A.; Amin, C.; Paquet, M. Carbon Market Sensitive Sustainable Supply Chain Network Design. Int. J. Manag. Sci. Eng. Manag. 2010, 5, 30–38. [Google Scholar]

- Gu, Y.; Wang, Y.; Iris, Ç. Integrated Green Technology Adoption, Ship Speed Optimization and Slot Management for Shipping Alliance under Emission Limits and Uncertain Fuel Prices. J. Clean. Prod. 2025, 494, 144939. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, Z.; Liu, Y.; Mou, Z. Coordination Analysis of the Recycling and Remanufacturing Closed Loop Supply Chain Considering Consumers’ Low Carbon Preference and Government Subsidy. Sustainability 2023, 15, 2167. [Google Scholar] [CrossRef]

- Yao, J.; Chen, D.; Yu, H. Decision Making and Coordination of Remanufacturing Closed Loop Supply Chain with PIR under the Different Government Subsidy Strategies. Sustainability 2022, 14, 16122. [Google Scholar] [CrossRef]

- Shi, S.; Liu, G. Pricing and Coordination Decisions in a Low Carbon Supply Chain with Risk Aversion under a Carbon Tax. Math. Probl. Eng. 2022, 2022, 7690136. [Google Scholar] [CrossRef]

- Li, N.; Deng, M.; Mou, H.; Tang, D.; Fang, Z.; Zhou, Q.; Cheng, C.; Wang, Y. Government Participation in Supply Chain Low Carbon Technology R&D and Green Marketing Strategy Optimization. Sustainability 2022, 14, 8342. [Google Scholar] [CrossRef]

- Wei, Q.; Xiao, G. Evolutionary Game Analysis of Shared Parking Market Diffusion under Government Management. Transp. Saf. Environ. 2024, 6, 17–27. [Google Scholar] [CrossRef]

- Jun, Z.; Wang, J.; Shen, A. Evolutionary Game of International Trade Network Based on Trade Policy Differences. Sci. Rep. 2025, 15, 1095. [Google Scholar]

- Qu, G.; Wang, Y.; Xu, L.; Qu, W.; Zhang, Q.; Xu, Z. Low Carbon Supply Chain Emission Reduction Strategy Considering the Supervision of Downstream Enterprises Based on Evolutionary Game Theory. Sustainability 2021, 13, 2827. [Google Scholar] [CrossRef]

- Li, G.; Yu, H.; Lu, M. Low Carbon Collaboration in the Supply Chain under Digital Transformation: An Evolutionary Game Theoretic Analysis. Processes 2022, 10, 1958. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). Developing Capacity for Long-Term Energy Policy Planning: A Roadmap; International Energy Agency: Paris, France, 2024. [Google Scholar]

- Nicholls, J.; Mawhood, B.; Gross, R. Evaluating Renewable Energy Policy: A Review of Criteria and Indicators for Assessment; IRENA & UKERC: Masdar City, United Arab Emirates, 2014. [Google Scholar]

- Dechezleprêtre, A.; Nächtigall, D.; Venmans, F. The joint impact of the European Union emissions trading system on carbon emissions and economic performance. J. Environ. Econ. Manag. 2022, 118, 102758. [Google Scholar] [CrossRef]

| Scenario Code | Government Strategy | Enterprise Strategy | Dynamic Characteristics |

|---|---|---|---|

| G1E1 | S1 | A1 | Government–enterprise synergy with strong policy-driven rapid transformation. Infrastructure sharing reduces enterprise costs, while subsidies accelerate technology implementation. The government bears the costs of infrastructure construction and enterprise subsidies, while enterprises bear investment costs such as technological research and development. |

| G1E2 | S1 | A2 | Government plays a dominant role in resource allocation but risks resource waste: idle infrastructure and ineffective subsidy conversion. When the government assumes the costs of infrastructure construction, enterprises face potential losses from market opportunities missed. |

| G2E1 | S2 | A1 | Enterprises pursue independent transformation with insufficient policy support, facing high-cost investment risks. Enterprises bear investment risks. |

| G2E2 | S2 | A2 | Locked in traditional models, stagnation in green fuel supply chain development, hindering carbon reduction targets. Both the government and enterprises face losses from backward carbon emission reduction efforts. |

| Enterprise | Government | |

|---|---|---|

| Active | Not Active | |

| Invest | (, ) | (, ) |

| Not Invest | (, ) | (, ) |

| Stage | Key Characteristics | Government Strategy Focus | Enterprise Strategy Focus |

|---|---|---|---|

| Short term (0–5 years) | Pilot verification phase, high infrastructure investment needs, policy experimentation | Targeted subsidies, port infrastructure pilots | Technology reserves, small-scale demonstration projects |

| Medium term (5–15 years) | Application diffusion phase, scaling and standardization | Tiered carbon tax, networked infrastructure deployment | Capacity expansion, vertical supply chain integration |

| Long term (>15 years) | Market maturity phase, complete market-driven substitution | Policy exit mechanisms, international regulation coordination | Global deployment, service model innovation |

| Maturity Level | Technical Characteristics | Government Decision-Making Challenges | Enterprise Risk Types |

|---|---|---|---|

| Low | Low fuel production efficiency (e.g., green ammonia synthesis energy consumption >12 kWh/kg), prominent storage and transportation safety risks | Technology pathway selection risk | Sunk cost risk |

| Medium | Key technology breakthroughs (e.g., cryogenic liquid hydrogen storage cost reduced to USD 3/kg), but insufficient industry chain coordination | Cross-departmental technical standardization | Supply chain disruption risk |

| High | Full industry chain maturity (e.g., widespread adoption of methanol–ammonia–hydrogen multi-fuel-compatible bunkering systems) | Preventing technology monopolies | Excessive market competition risk |

| Awareness Level | Public Behavior Characteristics | Government Pressure Sources | Corporate Response Strategies |

|---|---|---|---|

| Low | Environmental issues marginalized, green premium acceptance < 5% | Significant policy implementation resistance | Avoid publicity, maintain traditional operations |

| Medium | Environmental organizations exert pressure, green finance product penetration 30–50% | Balancing economic growth with emission reduction targets | Optimize ESG disclosure, selective investment |

| High | Climate activism surges (e.g., global shipping strikes), willingness to pay premium > 20% | Radical policy demands (e.g., full fleet decarbonization by 2030) | Full supply chain green certification, brand premium strategy |

| Intensity Level | Representative Policy Tools | Focus of Government–Enterprise Interaction |

|---|---|---|

| Weak | Voluntary emission reduction agreements, non-binding targets | Monitoring corporate compliance |

| Moderate | Carbon tax + partial subsidies (e.g., EU ETS covering shipping) | Fairness of subsidy distribution |

| Strong | Mandatory fuel quotas (e.g., IMO 2030 ≥ 5% ammonia fuel requirement) + infrastructure nationalization | Risks of excessive policy intervention in markets |

| Competition Level | Market Structure Characteristics | Enterprise Strategic Response |

| Low | Regional monopoly (e.g., single enterprise dominates fuel supply) | Cost control prioritization |

| Medium | Oligopolistic competition (3–5 dominant enterprises) | Differentiated technology pathways |

| High | Perfect competition (multiple fuels/enterprises competing) | Price competition and patent barriers |

| Symbol | Parameter Name | Time Dimension | Technology Development | Social Attention | Policy Intensity | Market Competition |

|---|---|---|---|---|---|---|

| Environmental Benefit | Short:50 Mid:150 Long:300 | Low:30 Med:120 High:250 | Low:80 Med:150 High:200 | Weak:50 Med:120 Strong:250 | Low:100 Med:180 High:250 | |

| Tech Spillover Effects | Short:30 Mid:100 Long:200 | Low:20 Med:80 High:150 | Low:50 Med:100 High:150 | Weak:40 Med:90 Strong:180 | Low:60 Med:120 High:180 | |

| Government Infrastructure Cost | Short:150 Mid:120 Long:80 | Low:200 Med:150 High:100 | Low:180 Med:130 High:80 | Weak:50 Med:120 Strong:200 | Low:100 Med:150 High:200 | |

| Government Subsidy Cost | Short:50 Mid:230 Long:420 | Low:100 Med:50 High:30 | Low:60 Med:100 High:140 | Weak:50 Med:130 Strong:200 | Low:50 Med:150 High:250 | |

| Carbon Tax Revenue | Short:20 Mid:80 Long:150 | Low:10 Med:60 High:120 | Low:30 Med:90 High:180 | Weak:20 Med:90 Strong:160 | Low:40 Med:80 High:120 | |

| Potential Losses | Short:100 Mid:50 Long:10 | Low:120 Med:70 High:30 | Low:150 Med:80 High:20 | Weak:130 Med:60 Strong:20 | Low:100 Med:60 High:30 | |

| Enterprise Revenue | Short:250 Mid:500 Long:1000 | Low:150 Med:400 High:800 | Low:300 Med:600 High:120 | Weak:250 Med:550 Strong:850 | Low:400 Med:700 High:1000 | |

| Enterprise Costs | Short:400 Mid:450 Long:500 | Low:400 Med:300 High:200 | Low:400 Med:350 High:250 | Weak:200 Med:350 Strong:500 | Low:250 Med:400 High:550 | |

| Environmental Benefit | Short:50 Mid:150 Long:300 | Low:30 Med:120 High:250 | Low:80 Med:150 High:200 | Weak:50 Med:120 Strong:250 | Low:100 Med:180 High:250 |

| Parameter Name | Scenario 1 (Conservative) (Short Term, Low Tech, Low Attention, Weak Policy, Low Competition) | Scenario 2 (Transition) (Mid Term, Medium Tech, Medium Attention, Medium Policy, Medium Competition) | Scenario 3 (Mature) (Long Term, High Tech, High Attention, Strong Policy, High Competition) | Scenario 4 (Policy-Driven) (Short Term, Medium Tech, High Attention, Medium Policy, Low Competition) | Scenario 5 (Market-Driven) (Mid Term, High Tech, Low Attention, Weak Policy, High Competition) |

|---|---|---|---|---|---|

| Environmental Benefit Increase | 50 | 120 | 300 | 80 | 200 |

| Technology Spillover Effects | 30 | 80 | 200 | 50 | 150 |

| Infrastructure Cost | 100 | 150 | 200 | 120 | 180 |

| Subsidy Cost | 50 | 100 | 200 | 80 | 170 |

| Carbon Tax Revenue | 20 | 80 | 150 | 180 | 40 |

| Potential Losses | 80 | 30 | 10 | 50 | 100 |

| Enterprise Revenue | 200 | 500 | 1200 | 250 | 800 |

| Enterprise Investment Cost | 300 | 400 | 600 | 350 | 500 |

| Enterprise Subsidies Received | 50 | 100 | 200 | 80 | 170 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, L.; Zhou, R.; Li, X.; Lu, S.; Liu, J. Research on the Optimization of Collaborative Decision Making in Shipping Green Fuel Supply Chains Based on Evolutionary Game Theory. Sustainability 2025, 17, 5186. https://doi.org/10.3390/su17115186

Zhu L, Zhou R, Li X, Lu S, Liu J. Research on the Optimization of Collaborative Decision Making in Shipping Green Fuel Supply Chains Based on Evolutionary Game Theory. Sustainability. 2025; 17(11):5186. https://doi.org/10.3390/su17115186

Chicago/Turabian StyleZhu, Lequn, Ran Zhou, Xiaojun Li, Shaopeng Lu, and Jingpeng Liu. 2025. "Research on the Optimization of Collaborative Decision Making in Shipping Green Fuel Supply Chains Based on Evolutionary Game Theory" Sustainability 17, no. 11: 5186. https://doi.org/10.3390/su17115186

APA StyleZhu, L., Zhou, R., Li, X., Lu, S., & Liu, J. (2025). Research on the Optimization of Collaborative Decision Making in Shipping Green Fuel Supply Chains Based on Evolutionary Game Theory. Sustainability, 17(11), 5186. https://doi.org/10.3390/su17115186