A Comprehensive Evaluation of the Impact of China’s Carbon Market on Carbon Emission Efficiency from the Total-Factor Perspective

Abstract

1. Introduction

2. Literature Review

3. Methodologies

3.1. Super-Efficiency SBM Model with an Undesirable Output

3.2. Multi-Period DID Model

3.3. Data

4. Empirics

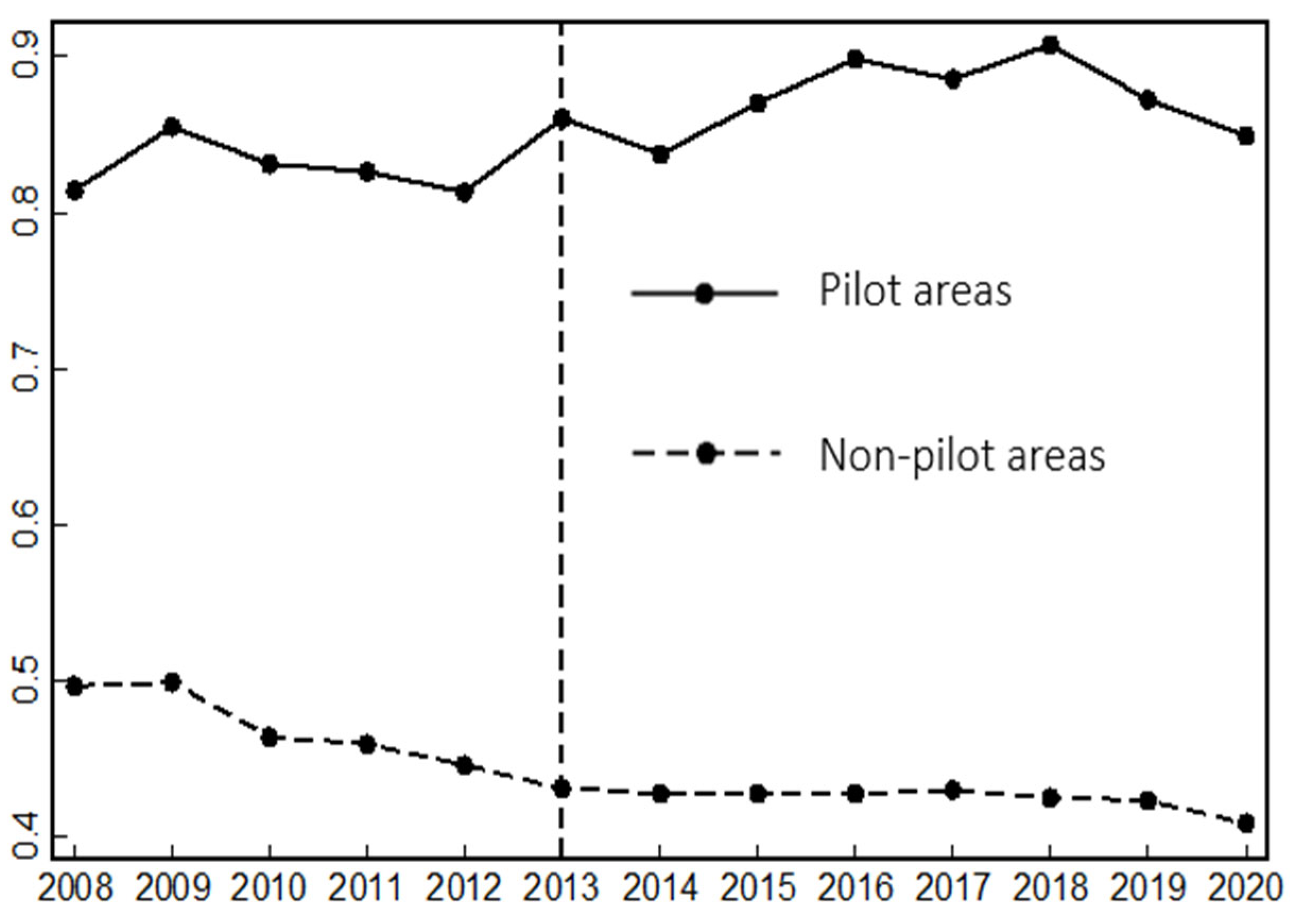

4.1. Analysis of Total-Factor Carbon Emission Efficiency

4.2. Assessing the Impact on Total-Factor Carbon Emission Efficiency

4.2.1. Baseline Regression Results

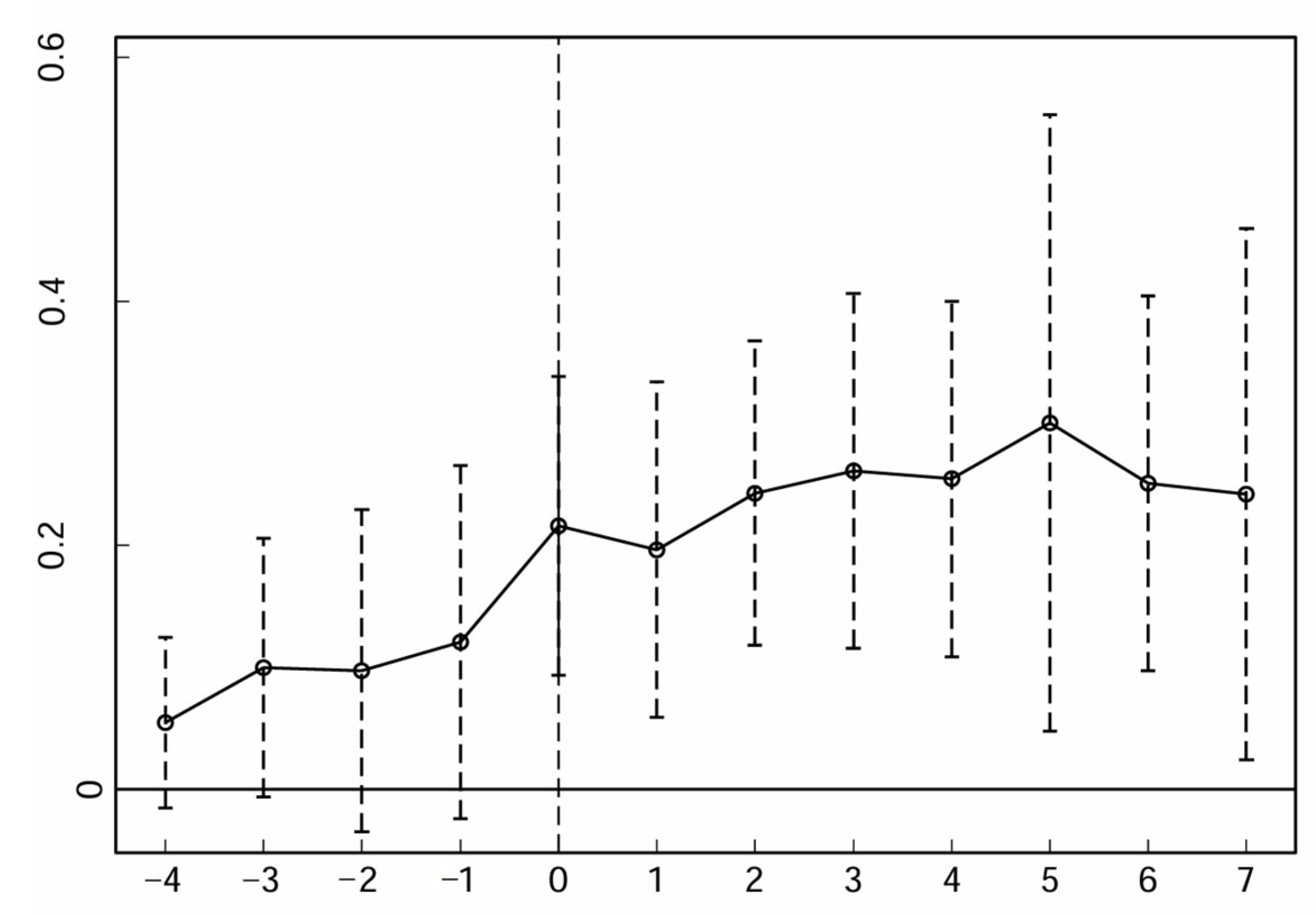

4.2.2. Parallel Trend Test

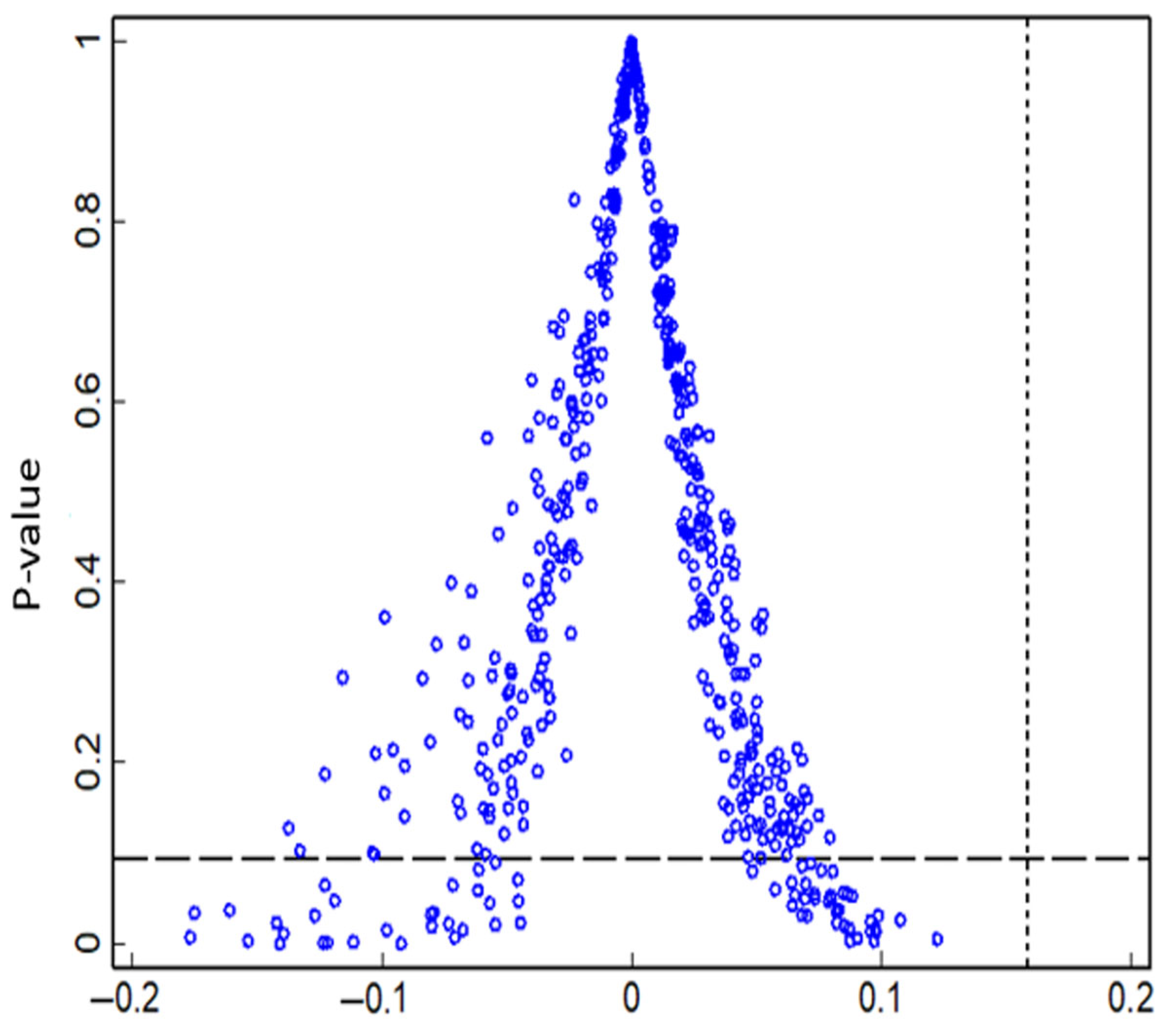

4.2.3. Placebo Test

4.2.4. Replacement of the Explained Variable

4.2.5. Eliminating the Impact of Outliers

4.2.6. Exclusion of Special Samples

4.2.7. Exclusion of Other Policies

4.3. Analysis of the Driving Mechanism

4.4. Analysis of the Action Path

4.5. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hou, J.; Shi, C.; Fan, G.; Xu, H. Research on the impact and intermediary effect of carbon emission trading policy on carbon emission efficiency in China. Atmos. Pollut. Res. 2024, 15, 102045. [Google Scholar] [CrossRef]

- Wang, K.; Lyu, C. Achievements and Prospect of China’s National Carbon Market Construction (2024). J. Beijing Inst. Technol. (Soc. Sci. Ed.) 2024, 26, 16–27. [Google Scholar] [CrossRef]

- Jiang, H.; Sun, M. Carbon Emissions Trading, Industrial Structure and Regional Emission Reduction. Mod. Econ. Res. 2021, 11, 65–73. [Google Scholar] [CrossRef]

- Ma, Y.; Fang, R.; Miao, L.; Feng, L. Analysis of the Operation Status and Countermeasures Analysis of China’s Carbon Market. J. Glob. Energy Interconnect. 2024, 7, 675–683. [Google Scholar] [CrossRef]

- Li, K.; Gu, G. Research on Coordinated Development of Carbon Market, Economic Growth and Environmental Protection in China’s Carbon Trading Pilot Areas. For. Grassl. Resour. Res. 2021, 4, 29–37. [Google Scholar] [CrossRef]

- Zhou, A.; Xin, L.; Li, J. Assessing the Impact of the Carbon Market on the Improvement of China’s Energy and Carbon Emission Performance. Energy 2022, 258, 124789. [Google Scholar] [CrossRef]

- Xuan, D.; Ma, X.; Shang, Y. Can China’s Policy of Carbon Emission Trading Promote Carbon Emission Reduction? J. Clean. Prod. 2020, 270, 122383. [Google Scholar] [CrossRef]

- Feng, X.; Zhao, Y.; Yan, R. Does carbon emission trading policy have emission reduction effect? An empirical study based on quasi-natural experiment method. J. Environ. Manag. 2024, 351, 119791. [Google Scholar] [CrossRef]

- Wang, X.; Zhang, Q. Impact of financial agglomeration on carbon emission efficiency under the economic growth pressure. China Popul. Resour. Environ. 2022, 32, 11–20. [Google Scholar] [CrossRef]

- Ramanathan, R. Combining indicators of energy consumption and CO2 emissions: A cross-country comparison. Int. J. Glob. Energy Issues 2002, 17, 214. [Google Scholar] [CrossRef]

- Wu, R.; Tan, Z.; Lin, B. Does carbon emission trading scheme really improve the CO2 emission efficiency? Evidence from China’s iron and steel industry. Energy 2023, 277, 127743. [Google Scholar] [CrossRef]

- Fan, X.; Lv, X.; Yin, J.; Tian, L.; Liang, J. Multifractality and market efficiency of carbon emission trading market: Analysis using the multifractal detrended fluctuation technique. Appl. Energy 2019, 251, 113333. [Google Scholar] [CrossRef]

- Liu, C.; Sun, Z.; Zhang, J. Research on the effect of carbon emission reduction policy in China’s carbon emissions trading pilot. China Popul. Resour. Environ. 2019, 29, 49–58. [Google Scholar]

- Streimikiene, D.; Roos, I. GHG Emission Trading Implications on Energy Sector in Baltic States. Renew. Sustain. Energy Rev. 2009, 13, 854–862. [Google Scholar] [CrossRef]

- Song, X.; Wang, D.; Zhang, X.; He, Y.; Wang, Y. A Comparison of the Operation of China’s Carbon Trading Market and Energy Market and Their Spillover Effects. Renew. Sustain. Energy Rev. 2022, 68, 112864. [Google Scholar] [CrossRef]

- Yang, S.; Jahanger, A.; Hu, J.; Awan, A. Impact of China’s Carbon Emissions Trading Scheme on Firm-Level Pollution Abatement and Employment: Evidence from a National Panel Dataset. Energy Econ. 2024, 136, 107744. [Google Scholar] [CrossRef]

- Xian, B.; Wang, Y.; Xu, Y.; Wang, J.; Li, X. Assessment of the Co-Benefits of China’s Carbon Trading Policy on Carbon Emissions Reduction and Air Pollution Control in Multiple Sectors. Econ. Anal. Policy 2024, 81, 1322–1335. [Google Scholar] [CrossRef]

- Li, G.; Zhang, W. Research on industrial carbon emissions and emissions reduction mechanism in China’s ETS. China Popul. Resour. Environ. 2017, 27, 141–148. [Google Scholar]

- Zhang, H.; Duan, M.; Deng, Z. Have China’s Pilot Emissions Trading Schemes Promoted Carbon Emission Reductions?—The Evidence from Industrial Sub-Sectors at the Provincial Level. J. Clean. Prod. 2019, 234, 912–924. [Google Scholar] [CrossRef]

- Peng, H.; Qi, S.; Cui, J. The environmental and economic effects of the carbon emissions trading scheme in China: The role of alternative allowance allocation. Sustain. Prod. Consum. 2021, 28, 105–115. [Google Scholar] [CrossRef]

- Liu, X.; Ji, Q.; Yu, J. Sustainable development goals and firm carbon emissions: Evidence from a quasi-natural experiment in China. Energy Econ. 2021, 103, 105627. [Google Scholar] [CrossRef]

- Zhou, B.; Zhang, C.; Song, H.; Wang, Q. How Does Emission Trading Reduce China’s Carbon Intensity? An Exploration Using a Decomposition and Difference-in-Differences Approach. Sci. Total Environ. 2019, 676, 514–523. [Google Scholar] [CrossRef]

- Wu, Y.; Qi, J.; Xian, Q.; Chen, J. The Carbon Emission Reduction Effect of China’s Carbon Market—From the Perspective of the Coordination between Market Mechanism and Administrative Intervention. China’s Ind. Econ. 2021, 8, 114–132. [Google Scholar] [CrossRef]

- Dai, S.; Qian, Y.; He, W.; Wang, C.; Shi, T. The spatial spillover effect of China’s carbon emissions trading policy on industrial carbon intensity: Evidence from a spatial difference-in-difference method. Struct. Change Econ. Dyn. 2022, 63, 139–149. [Google Scholar] [CrossRef]

- Cui, J.; Wang, C.; Zhang, J.; Zheng, Y. The effectiveness of China’s regional carbon market pilots in reducing firm emissions. Proc. Natl. Acad. Sci. USA 2021, 118, e2109912118. [Google Scholar] [CrossRef]

- Liu, Y.; Wen, D.; Wang, Y.; Sun, Z. Assessment of impacts of Tianjin Pilot Emission Trading Schemes in China Analysis using TermCO2 Model. Clim. Change Res. 2016, 12, 561–570. [Google Scholar]

- Zhang, Y.; Liang, T.; Jin, Y.; Shen, B. The Impact of Carbon Trading on Economic Output and Carbon Emissions Reduction in China’s Industrial Sectors. Appl. Energy 2020, 260, 114290. [Google Scholar] [CrossRef]

- Zhang, F. A Study on the Economic and Environmental Effects of Regional Carbon Emission Trading Scheme in China. Macroeconomics 2021, 9, 111–124. [Google Scholar] [CrossRef]

- Zhang, W.; Li, J.; Li, G.; Guo, S. Emission Reduction Effect and Carbon Market Efficiency of Carbon Emissions Trading Policy in China. Energy 2020, 196, 117117. [Google Scholar] [CrossRef]

- Zhou, D.; Liu, Y. Impact of China’s Carbon Emission Trading Policy on the Performance of Urban Carbon Emission and Its Mechanism. China Environ. Sci. 2020, 40, 453–464. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, S.; Luo, T.; Gao, J. The Effect of Emission Trading Policy on Carbon Emission Reduction: Evidence from an Integrated Study of Pilot Regions in China. J. Clean. Prod. 2020, 265, 121843. [Google Scholar] [CrossRef]

- Ji, X.; Yang, Z. Emission reduction effect and regional difference analysis of carbon trading based on PSM-DID and SCM. Stat. Decis. 2021, 37, 154–158. [Google Scholar] [CrossRef]

- Yang, X.; Li, J.; Guo, X. The Impact of Carbon Trading Pilots on Emission Mitigation in China: Empirical Evidence from Synthetic Control Method. J. Xi’an Jiaotong Univ. (Soc. Sci.) 2021, 41, 93–104+122. [Google Scholar] [CrossRef]

- Fei, R.; Lin, B. Energy efficiency and production technology heterogeneity in China’s agricultural sector: A meta-frontier approach. Technol. Forecast. Soc. Change 2016, 109, 25–34. [Google Scholar] [CrossRef]

- Li, J.; Cheng, Z. Study on total-factor carbon emission efficiency of China’s manufacturing industry when considering technology heterogeneity. J. Clean. Prod. 2020, 260, 121021. [Google Scholar] [CrossRef]

- Lin, B.; Huang, C. Analysis of emission reduction effects of carbon trading: Market mechanism or government intervention? Sustain. Prod. Consum. 2022, 33, 28–37. [Google Scholar] [CrossRef]

- Zhang, X.; Sun, S. Can Carbon Emission Trading Policy Promote Carbon Emission Reduction: A Study Based on Prefecture-Level City Panel Data. Nankai Econ. Stud. 2024, 2, 160–178. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Tone, K. A Slacks-Based Measure of Efficiency in Data Envelopment Analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Huang, Y.; Liu, S. Efficiency evaluation of a sustainable hydrogen production scheme based on super efficiency SBM model. J. Clean. Prod. 2020, 256, 120447. [Google Scholar] [CrossRef]

- Tone, K. A Slacks-Based Measure of Super-Efficiency in Data Envelopment Analysis. Eur. J. Oper. Res. 2002, 143, 32–41. [Google Scholar] [CrossRef]

- Sun, L.; Li, W. Has the Opening of High-Speed Rail Reduced Urban Carbon Emissions? Empirical Analysis Based on Panel Data of Cities in China. J. Clean. Prod. 2021, 321, 128958. [Google Scholar] [CrossRef]

- Jia, L.; Zhang, J.; Li, R.; Wang, L.; Wu, H.; Wang, P. Spatial corre-lation investigation of carbon emission efficiency in the Yangtze River Delta of China: The role of low-carbon pilot cities. Ecol. Indic. 2025, 172, 113282. [Google Scholar] [CrossRef]

- Peng, B.; Gao, F. Crafting the perfect policy combination: Exploring the syn-ergistic effects of dual-pilot energy policies on urban carbon emission efficiency. Urban Clim. 2025, 59, 102260. [Google Scholar] [CrossRef]

- Shan, Y.; Guan, D.; Zheng, H.; Ou, J.; Li, Y.; Meng, J.; Mi, Z.; Liu, Z.; Zhang, Q. Data Descriptor: China CO2 Emission Accounts 1997–2015. Sci. Data 2018, 5, 170201. [Google Scholar] [CrossRef]

- Shan, H. Reestimating the Capital Stock of China: 1952–2006. J. Quant. Technol. Econ. 2008, 25, 17–31. [Google Scholar]

- Qi, S.; Cheng, S.; Cui, J. Environmental and economic effects of China’s carbon market pilots: Empirical evidence based on a DID model. J. Clean. Prod. 2020, 279, 123720. [Google Scholar] [CrossRef]

- Shao, S.; Cheng, S.; Jia, R. Can Low Carbon Policies Achieve Collaborative Governance of Air Pollution? Evidence from China’s Carbon Emissions Trading Scheme Pilot Policy. Environ. Impact Assess. Rev. 2023, 103, 107286. [Google Scholar] [CrossRef]

- Zeng, S.; Li, F.; Weng, Z.; Zhong, Z. Study on the Emission Reduction Effect of China’s Carbon Trading Pilot Policy and Regional Differences. China Environ. Sci. 2022, 42, 1922–1933. [Google Scholar] [CrossRef]

- Jacobson, L.; LaLonde, R.; Sullivan, D. Earnings losses of displaced workers. Am. Econ. Rev. 1993, 83, 685–709. [Google Scholar]

- Du, M.; Wu, F.; Ye, D.; Zhao, Y.; Liao, L. Exploring the effects of energy quota trading policy on carbon emission efficiency: Quasi-experimental evidence from China. Energy Econ. 2023, 124, 106791. [Google Scholar] [CrossRef]

- Ferrara, E.; Chong, A.; Duryea, S. Soap Operas and Fertility: Evidence from Brazil. Am. Econ. J. Appl. Econ. 2012, 4, 1–31. [Google Scholar] [CrossRef]

- Song, Y.; Liu, T.; Liang, D.; Li, Y.; Song, X. A Fuzzy Stochastic Model for Carbon Price Prediction Under the Effect of Demand-Related Policy in China’s Carbon Market. Ecol. Econ. 2019, 157, 253–265. [Google Scholar] [CrossRef]

- Ma, Y.; Feng, L. Analysis of the market effectiveness of pilot carbon emission trading markets in China. Oper. Res. Manag. Sci. 2022, 31, 195–202. [Google Scholar]

- Wang, X.; Liao, Z. Market mechanism government intervention and emission reduction effect of carbon market in China. J. Arid. Land Resour. Environ. 2022, 36, 9–17. [Google Scholar] [CrossRef]

- Luo, L.; Leizhu, J. Synergetic effect of China’s carbon market policies on pollution reduction and carbon reduction. Resour. Sci. 2024, 46, 53–68. [Google Scholar] [CrossRef]

- Xue, F.; Zhou, M. Research on the Emission Reduction Effect of the Scale of China’s Carbon Trading Market. East China Econ. Manag. 2021, 35, 11–21. [Google Scholar] [CrossRef]

- Tian, H.; Zhao, T.; Wu, X.; Wang, P. The Impact of Digital Economy Development on Carbon Emissions—Based on the Perspective of Carbon Trading Market. J. Clean. Prod. 2024, 434, 140126. [Google Scholar] [CrossRef]

- Tan, X.; Gao, J.; Zeng, A.; Xing, X. Impact of the “Pilot Zones for Green Finance Reform and Innovations” Policy on Carbon Emissions. Clim. Change Res. 2023, 19, 213–226. [Google Scholar] [CrossRef]

- Liu, Z.; Xu, J. The influence and mechanism of carbon trading pilot on provincial carbon emissions equity: Empirical analysis based on multi-period DID, spatial DID and intermediary effect. J. Nat. Resour. 2024, 39, 697–711. [Google Scholar] [CrossRef]

- Zhang, H.; Meng, J. Carbon emission abatement effect of China’s carbon market from the perspective of incentives and constraints. Resour. Sci. 2022, 44, 1759–1771. [Google Scholar] [CrossRef]

- Jindal, A.; Puri, S.; Shrimali, G. Designing a prospective carbon trading market in India: Key properties, denabling features and linkages. Appl. Energy 2025, 386, 125595. [Google Scholar] [CrossRef]

- Ding, L.; Wang, Y.; Wang, K. The synergistic effect of carbon emission trading on pollution and carbon reduction and the influence mechanism. Clim. Change Res. 2023, 19, 786–798. [Google Scholar]

- Ma, H.; Dong, S. Effects of Different Types of Environmental Regulations on Carbon Emission Efficiency. J. Beijing Inst. Technol. (Soc. Sci. Ed.) 2020, 22, 1–10. [Google Scholar] [CrossRef]

| 2008 | 2012 | 2015 | 2018 | 2020 | |

|---|---|---|---|---|---|

| Beijing | 0.7546 | 1.04313 | 1.0536 | 1.0057 | 1.1153 |

| Tianjin | 0.7283 | 0.6465 | 0.7184 | 0.7021 | 1.0791 |

| Hebei | 0.4337 | 0.3811 | 0.3826 | 0.3682 | 0.3738 |

| Shanxi | 0.3144 | 0.2601 | 0.2415 | 0.2478 | 0.2472 |

| Inner Mongolia | 0.3529 | 0.3162 | 0.3290 | 0.3188 | 0.2985 |

| Liaoning | 0.5818 | 0.5171 | 0.5243 | 0.5000 | 0.4643 |

| Jilin | 0.4032 | 0.3778 | 0.4091 | 0.4447 | 0.4048 |

| Heilongjiang | 1.0040 | 1.0011 | 0.5570 | 0.5858 | 0.5496 |

| Shanghai | 1.1386 | 1.1666 | 1.1388 | 1.1409 | 1.1381 |

| Jiangsu | 0.8023 | 0.7268 | 0.7600 | 0.7275 | 0.7036 |

| Zhejiang | 0.8446 | 0.7224 | 0.7239 | 0.7089 | 0.6434 |

| Anhui | 0.5653 | 0.5133 | 0.4852 | 0.4826 | 0.4829 |

| Fujian | 1.0012 | 0.8082 | 1.0093 | 1.0122 | 0.7564 |

| Jiangxi | 0.5448 | 0.5476 | 0.5243 | 0.5167 | 0.5163 |

| Shandong | 0.5648 | 0.5244 | 0.5724 | 0.5719 | 0.5439 |

| Henan | 0.4802 | 0.4314 | 0.4435 | 0.4660 | 0.4529 |

| Hubei | 0.6037 | 0.5484 | 0.6350 | 0.6373 | 0.5738 |

| Hunan | 0.5535 | 0.5351 | 0.5604 | 0.5754 | 0.5924 |

| Guangdong | 1.0415 | 1.0228 | 1.0157 | 0.7806 | 0.7374 |

| Guangxi | 0.5050 | 0.3885 | 0.4195 | 0.4092 | 0.3701 |

| Hainan | 0.6558 | 0.4881 | 0.4546 | 0.4165 | 0.4079 |

| Chongqing | 0.4291 | 0.4536 | 0.5180 | 1.0711 | 0.5431 |

| Sichuan | 0.5441 | 0.5356 | 0.5385 | 0.6094 | 0.5873 |

| Guizhou | 0.2638 | 0.2628 | 0.2532 | 0.2513 | 0.2457 |

| Yunnan | 0.4027 | 0.3454 | 0.3583 | 0.3321 | 0.3075 |

| Shaanxi | 0.3917 | 0.3350 | 0.3374 | 0.3369 | 0.3140 |

| Gansu | 0.3526 | 0.3305 | 0.3207 | 0.3137 | 0.3052 |

| Qinghai | 0.2840 | 0.2530 | 0.2242 | 0.2084 | 0.2160 |

| Ningxia | 0.1996 | 0.1736 | 0.1602 | 0.1471 | 0.1411 |

| Xinjiang | 0.3748 | 0.2913 | 0.2599 | 0.2336 | 0.2243 |

| (1) | (2) | |

|---|---|---|

| DID | 0.1689 *** (0.0494) | 0.1584 *** (0.0329) |

| Control variables | N | Y |

| Province FE | Y | Y |

| Year FE | Y | Y |

| N | 390 | 390 |

| R2 | 0.2742 | 0.4542 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| DID | −0.1446 *** (0.0390) | 0.1656 *** (0.0334) | 0.1422 *** (0.0383) | 0.1597 *** (0.0363) | 0.1833 *** (0.0445) |

| Control variables | Y | Y | Y | Y | Y |

| Province FE | Y | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y | Y |

| N | 390 | 390 | 351 | 377 | 247 |

| R2 | 0.8545 | 0.4433 | 0.5057 | 0.4553 | 0.5234 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| DID | 0.1881 *** (0.0348) | 0.1131 *** (0.0252) | 0.1513 *** (0.0487) | 0.1660 *** (0.0294) | 0.1232 *** (0.0266) |

| DID × T | −0.0680 * (0.0351) | ||||

| DID × V | 0.0427 * (0.0224) | ||||

| DID × P | 0.0021 (0.0129) | ||||

| DID × S | −0.0019 (0.0069) | ||||

| DID × L | 0.0096 (0.0096) | ||||

| Control variables | Y | Y | Y | Y | Y |

| Province FE | Y | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y | Y |

| N | 390 | 390 | 390 | 390 | 390 |

| R2 | 0.4658 | 0.4592 | 0.4540 | 0.4543 | 0.4579 |

| F (1) | TFCEE (2) | Q (3) | TFCEE (4) | N (5) | TFCEE (6) | |

|---|---|---|---|---|---|---|

| DID | −0.0818 (0.0794) | 0.1578 *** (0.0332) | 0.0213 (0.1048) | 0.1597 *** (0.0356) | 0.0127 * (0.0071) | 0.1457 ** (0.0299) |

| F | −0.007 (0.0247) | |||||

| I | −0.0595 (0.0927) | |||||

| E | 0.9991 * (0.4992) | |||||

| Control variables | Y | Y | Y | Y | Y | Y |

| Province FE | Y | Y | Y | Y | Y | Y |

| Year FE | Y | Y | Y | Y | Y | Y |

| N | 390 | 390 | 390 | 390 | 390 | 390 |

| R2 | 0.9157 | 0.4544 | 0.8137 | 0.4604 | 0.5340 | 0.4733 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fang, R.; Ma, Y.; Feng, L. A Comprehensive Evaluation of the Impact of China’s Carbon Market on Carbon Emission Efficiency from the Total-Factor Perspective. Sustainability 2025, 17, 5101. https://doi.org/10.3390/su17115101

Fang R, Ma Y, Feng L. A Comprehensive Evaluation of the Impact of China’s Carbon Market on Carbon Emission Efficiency from the Total-Factor Perspective. Sustainability. 2025; 17(11):5101. https://doi.org/10.3390/su17115101

Chicago/Turabian StyleFang, Ruirui, Yue Ma, and Lianyong Feng. 2025. "A Comprehensive Evaluation of the Impact of China’s Carbon Market on Carbon Emission Efficiency from the Total-Factor Perspective" Sustainability 17, no. 11: 5101. https://doi.org/10.3390/su17115101

APA StyleFang, R., Ma, Y., & Feng, L. (2025). A Comprehensive Evaluation of the Impact of China’s Carbon Market on Carbon Emission Efficiency from the Total-Factor Perspective. Sustainability, 17(11), 5101. https://doi.org/10.3390/su17115101