Abstract

Incorporating economic policy uncertainty into the Melitz and Ottaviano theoretical model, this study systematically examines the impact of economic policy uncertainty on firm markups, contributing to our understanding of how macroeconomic conditions affect business sustainability. The results reveal a significant negative relationship between economic policy uncertainty and firm markups, with particularly adverse effects observed in labor-intensive industries, smaller firms, and export-driven companies. As investment irreversibility increases, so does the detrimental impact of economic policy uncertainty on business markups. Importantly, it is discovered that innovation efforts can mitigate these negative effects, promoting sustainable business practices under high policy uncertainty. This research extends the mechanism through which EPU affects markups and highlights the critical roles of investment irreversibility and innovation behavior as moderators. By exploring these dynamics, our findings contribute to the broader discourse on sustainability by identifying strategies for enhancing corporate resilience and competitiveness amidst economic uncertainties.

1. Introduction

In the context of a rapidly changing global landscape and sustained economic pressures, military conflicts are occurring frequently, prompting governments worldwide to urgently introduce or adjust economic policies in response to rising economic risks. As a result, the intertwining factors of international trade frictions, geopolitical tensions, global public health crises, and climate change have rendered the global economic environment increasingly complex and uncertain. This uncertainty challenges governments’ ability to create and implement policies and also affects corporate decisions and market expectations.

The notion of “economic policy uncertainty” (EPU) connotes that economic agents lack the capacity to precisely prognosticate whether, at what time, and in which way the government will alter the extant economic policy. Indeed, it is thought to be one of the primary causes of the sluggish economic recovery. That followed the 2008 financial crisis was followed by this recovery [1]. Several studies have demonstrated that macroeconomic conditions are significantly harmed by EPU [2]. However, research on its effect on enterprise performance remains insufficient. Existing studies mainly focus on corporate investment behavior [3,4], with only a few analyzing its influence on micro-level enterprise productivity. Yuan et al.’s research findings indicate that uncertainty regarding economic policymaking reduces enterprises’ total factor productivity by affecting resource allocation efficiency and innovation investment levels [5]. It was discovered that uncertainty regarding economic policymaking diminishes corporate productivity, with financing constraints highlighted as potential influencing mechanisms [6]. Nevertheless, productivity indicators solely reflect profitability from a production cost perspective and fail to fully capture overall enterprise performance. Firm markups measure an organization’s ability to set prices above marginal costs and encompass changes in both product price and relative marginal cost [7]. Against this backdrop, based on this assumption, this article employs a novel method to examine how EPU affects Chinese firms’ price margins, providing deeper insights into the impact of economic policy changes on their overall performance.

The idea of real options offers a strong theoretical basis for examining how EPU affects businesses’ price premiums. Investment projects are irreversible, according to conventional real options theory, which makes businesses see potential future investments as call options. The premium of these alternatives increases as EPU increases, which raises the marginal investment costs for businesses. Consequently, firms proactively adjust their current investment expenditure by either extending or reducing it [8,9]. It is also highlighted that higher EPU leads to increased asset transaction costs and delays in fixed-asset investments [10]. Such reductions in investments further impact firm productivity and markup levels. Thus, the irreversibility of investments plays a pivotal role in asset trading markets. Therefore, this paper’s goal is to examine, from a passive standpoint, how the degree of non-reversibility in investments affects the connection between corporate markup and EPU.

It is demonstrated in the existing body of literature that uncertainty related to economic policy significantly adversely affects corporate investments, dividend payouts, and borrowing costs [11,12,13]. However, it is argued that under high EPU, although innovation investment has some waiting value because of its irreversibility, waiting may allow competitors to capture the market and cause losses greater than the value of waiting and the cost of innovation [14]. If innovations are made by competitors during this waiting period, the incentive for the firm to wait will decrease, potentially dropping to zero. Therefore, under such circumstances, corporate innovation is actually promoted by EPU [15]. On the one hand, enhancing enterprise innovation levels can improve technology and production efficiency [16]; on the other hand, it can enhance product quality and command higher prices for products, thereby elevating the overall performance levels of enterprises. Several studies have confirmed that enterprises consider innovation as a means to enhance their competitiveness [17]. Hence, in the setting of high uncertainty in economic policy, this paper takes into account the innovative conduct of enterprises and assesses its influence on pricing premiums.

From the analysis provided, a theoretical model is formulated in this paper to elucidate the manner in which uncertainty in economic policy impacts firm pricing premiums, as well as the significance of investment non-reversibility and corporate innovative behavior in this connection. For this purpose, data from Chinese industrial businesses from 2008 to 2016 is used for an empirical investigation. When compared with earlier research, this work offers a few minor improvements: first, it incorporates EPU into Melitz and Ottaviano’s theoretical model (referred to as the M-O theoretical model) to examine their relationship and influencing mechanism This study uses data from Chinese industrial businesses from 2008 to 2016 for an empirical investigation. Compared with earlier research, it offers several minor improvements. First, it incorporates EPU into the Melitz and Ottaviano theoretical model (the M-O model) to examine their relationship and influencing mechanism [18]. Additionally, by taking into account diverse characteristics such as factor intensity, size, and export status of enterprises, this study, in an endeavor to scrutinize the wide-ranging and variegated effects of EPU on enterprise markups, makes recourse to the utilization of sub-sample analysis as a means of investigation. This work, which functions as a catalyst for deeper exploration, not only facilitates a more comprehensive and profound understanding of the intricate and intertwined relationship between macroeconomic policy and business performance but also serves as a driving force to impel the research pertaining to firm pricing premiums and EPU to progress and expand in hitherto unexplored directions. Second, taking into account investment irreversibility and firms’ innovation behavior within the framework of the M-O theoretical model refines our research further. Third, the EPU index used in this article to evaluate the degree of EPU in China is a comprehensive one. Unlike earlier studies that relied on indicators such as official leadership transitions and political elections, among others. This index encompasses news-related uncertainties along with those pertaining to policies, markets, and economics, thus providing a broader scope that better reflects Chinese economic policy variability [19,20,21]. Last but not least, in terms of markup calculation methodology for research purposes, a specific approach is adopted [22]. Compared with the accounting methods used earlier, this approach can resolve the endogeneity issue brought on by unmeasured factors and does not require the assumption of constant returns to scale, which can improve the accuracy of conclusions.

2. Theoretical Model

2.1. Basic Assumptions

Following the M-O theoretical model and its basic assumptions [18,23], on the one hand, the market demand function for differentiated product can be derived as follows:

L denotes consumers, represents the product price, and qᵢ is the quantity of differentiated goods consumed. are all together greater than zero, reflect the degree of substitution between the benchmark and differentiated products, represents the elasticity of substitution among differentiated products. , N stands for product categories.

On the other hand, the functions of the firm’s markup μ and profit π are as follows:

where C denotes the marginal cost of production, and represents the cost at which the firm’s profit is zero.

2.2. The Impact of Investment Irreversibility

This paper assumes that the firm’s marginal cost is a function of both EPU and the degree of investment irreversibility.

where denotes the extent of investment irreversibility, while epu signifies EPU. Both and epu are positive variables. Consequently, the following elucidates the effect of uncertainty in economic policy on corporate pricing margins.

Equation (5) suggests that the degree of investment irreversibility enhances the impact of EPU on markups. Specifically, the economic intuition behind this result is that when government policies change frequently or lack a clear direction, firms find it difficult to form stable expectations about the future market environment. This leads firms to adopt a more conservative approach in expanding production, hiring labor, or procuring raw materials, resulting in higher marginal costs and lower markups. In addition, once firms have incurred fixed costs, such as those associated with building specialized equipment or developing specific technologies—it becomes difficult to adjust or exit quickly in response to changing market conditions. Consequently, this further reinforces firms’ cautious behavior in the face of EPU, leading to an even greater decline in markups. Therefore, the following proposition is put forward.

In addition, the rise in EPU may squeeze corporate profits through dual channels of demand and competition. First, EPU heightens consumers’ concerns about the future, prompting them to increase savings and reduce non-essential consumption. As a result, this leads to a decline in aggregate market demand, particularly a significant contraction in the demand for price-sensitive durable goods and export commodities. Second, the contraction in demand intensifies market competition. Firms are forced to reduce prices or increase marketing efforts to compete for a limited customer base. Homogeneous industries (such as labor-intensive manufacturing) are prone to price wars, further compressing profit margins. Meanwhile, due to weak risk resistance and limited financing channels, firms are more likely to experience a decline in market share amid competition. Even those maintaining market share through economies of scale cannot prevent industry-wide profit rates from declining due to price competition. This ultimately leads to a simultaneous decline in quantity and price on the demand side and cost escalation on the competition side, causing synchronous impairment of firms’ revenues and markup rates and a significant reduction in profit levels.

Proposition 1.

Corporate profit margins suffer from the unpredictable nature of economic policy.

Proposition 2.

When the degree of investment irreversibility rises, the adverse effect that EPU has on the markup rates of enterprises becomes more and more pronounced.

2.3. The Impact of Business Innovation Behaviors

As uncertainty regarding economic policy increases, The marginal cost of the enterprise has increased from to , . At this juncture, the markup rate indicator for the enterprise transitions :

Innovation, as a driving force for economic growth, can enhance the profit level and market competitiveness of enterprises. By engaging in innovative activities, enterprises can improve their technology, expand the variety of products they produce, and boost productivity, thereby lowering the marginal cost of product production from to , where . However, firms are required to incur a fixed cost , for innovation, which escalates as the irreversibility of investment () intensifies. represents the increment in the fixed cost of innovation corresponding to a reduction in marginal costs. Consequently, the company’s profit is expressed as follows:

Let , and set , We can derive the equilibrium level of innovation for firms as:

At this point, the markup rate for the enterprise is:

Since , it follows that , it follows that, , indicating that in an environment where economic policy uncertainty is considerable, businesses’ creative endeavors might lessen the negative influence that economic policy uncertainty has on their markup rates. Further considering, when the markup rate level decreases after firms innovate and when , the markup rate level increases after firms innovate. Therefore, the following proposition is proposed.

Corporate innovation activities can mitigate the negative impact of EPU on markup rates through multiple channels. First, innovation drives process improvements and technological upgrades, reducing marginal production costs and alleviating the pressures of financing constraints and rising factor costs caused by EPU, thereby directly expanding the markup space from the difference between prices and costs. Second, innovation fosters product differentiation and quality enhancement, enabling firms to possess stronger market pricing power. Even in the face of demand contraction triggered by EPU, firms can maintain price rigidity through brand premiums or technological barriers. Additionally, innovation enhances firms’ flexibility in resource allocation, allowing them to rapidly adjust production capacity, supply chains, or market strategies (such as shifting to domestic demand markets or developing new product lines), thereby reducing the risk of shocks from policy changes. Therefore, the following proposition is proposed.

Proposition 3.

Innovation can mitigate the negative effects of EPU to some extent, but this is only possible when the level of innovation exceeds a certain critical threshold—that is, when cost reductions are sufficiently significant.

3. Data and Sample Description

3.1. Data Sources

This research utilizes a dataset comprising Chinese manufacturing enterprises from the period between 2008 and 2016. The database covers all legally registered industrial enterprises above a certain size, with each providing over 100 indicators of performance, identity, status, and other relevant details. It represents one of the most comprehensive datasets available in China. The data errors and omissions are handled as follows: (1) Entries with negative annual averages for employee count, total industrial output value, net capital assets, and industrial intermediary inputs are omitted from the dataset. (2) Using the industrial goods ex-factory price index, with 2008 serving as the base year, the industrial value added is adjusted for inflation. The purchase price index for industrial products is used to adjust the total industrial intermediary input for inflation, and the fixed asset investment price index is used to perform the same adjustment for the total fixed assets. All relevant price index data are sourced from the National Bureau of Statistics. Ultimately, this methodology results in a balanced panel dataset that includes 45,191 enterprises and 406,719 observations over a period of 9 years.

3.2. Measurement of Variables

3.2.1. Calculation of Markup Rate and Productivity

This paper employs the production function method to estimate the markup rate. This approach involves estimating the production function, demand function, and elasticity within the context of market equilibrium analysis. This paper uses a specific model (DLW model) to calculate the markup rate. The model uses the structural equation model method to calculate the markup rate of enterprises by solving the problem of minimizing the constructed cost [22]. The estimated equation of the DLW model is:

In particular, represents the markup rate, represents the elasticity of output of variable input factors x of enterprise i in period t, which can be labor, raw materials, electricity, etc., and represents the proportion of variable input factor x’s expenditure in total sales. The first step in estimating the markup rate is to estimate the production function, followed by calculating the output elasticity and input factor share, and finally, the markup can be obtained based on Equation (10). In estimating the production function, we use industrial added value to measure output, average number of employees to measure labor input, fixed asset total value to measure capital input, and intermediate input total to measure intermediate input. is represented by the ratio of the sum of the annual salary and welfare payments to the total main business income. In the process of estimating the production function, simultaneity problems arise when input factors and productivity shocks are related, which violates the unbiased and consistent estimation conditions of OLS, so how to control productivity shocks is a problem facing current research. A method proposed in 1996 (referred to as the OP method) used investment as a proxy for unobserved productivity. This enabled obtaining consistent parameter estimates and solved the endogeneity problem of productivity [24]. A method (referred to as the LP method) pointed out that investment is a control over state variables, and the adjustment cost of such control is high, which may lead to some estimation problems [25]. Meanwhile, the adjustment cost of intermediate inputs is lower, allowing for a more timely reflection of productivity changes, so they opted to use intermediate inputs as a substitute variable. For the estimation of the production function in this research, the LP method was utilized. The steps involved in ascertaining the substitution elasticity are detailed below.

Suppose that the firm has the same technical parameter (the quantity of inputs converted into outputs), and the Hicks-neutral technical progress production function is:

Step 1: Using the LP method, we can obtain estimates of output elasticity and productivity. Here, we calculate the output elasticity of labor by using labor input to calculate the elasticity of substitution.

Step 2: Calculate the proportion of labor expenditures in total sales. However, we can only obtain an estimate of , and we cannot obtain and . Here , and are error terms in the production function, whose estimates can be obtained through the LP method, thus allowing us to modify the expression for the share of factor expenditures as follows:

Then, the share of labor input is:

Step 3: At time t, the projected markup rate for enterprise I is written as:

3.2.2. Economic Policy Uncertainty

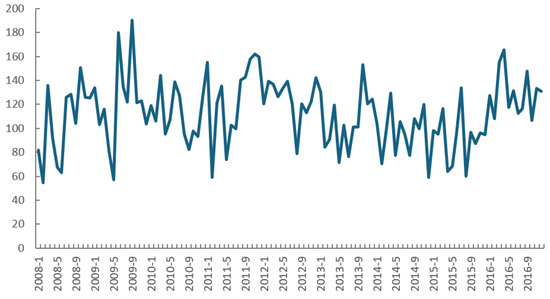

This study makes use of an EPU index, which is a widely used indicator for measuring EPU and developed by Baker et al., to measure the level of EPU [19,26]. Figure 1 shows this index effectively reflects the policy fluctuations in China. For example, In 2009, the U.S. subprime mortgage crisis evolved into a global financial crisis, causing China’s exports to plummet, forcing the government to launch a 4 trillion stimulus plan to stabilize growth. However, large-scale stimulus has exacerbated debt risks and overcapacity, and policymakers have had to make a difficult trade-off between short-term rescue and long-term structural adjustment, pushing up the EPU index. In 2016, the Brexit referendum and Trump’s election triggered a wave of anti-globalization, and the Fed’s interest rate hike led to capital outflows and a reduction in China’s foreign exchange reserves. At the same time, weak global demand forced domestic supply-side reforms, and policies such as de-capacity exacerbated market volatility in the short term. These external black swan events and internal reform pains have jointly amplified policy uncertainty. Both peaks show that the jump in China’s EPU index is often closely related to exogenous shocks breaking policy inertia, highlighting the adjustment pressure of open economies in a complex international environment.

Figure 1.

Economic policy uncertainty index of China.

Given that our study relies on annual corporate data, while our analysis is based on yearly business data, we have used the arithmetic mean approach to convert the index to annual data. The specific formula is as follows:

In this case, m represents the year, ranging from 2008 to 2016, and n represents the month, taking on a value from 1 to 12.

3.2.3. Adjusting Variables and Other Control Variables

This paper uses the proportion of fixed assets in total assets to measure the irreversibility of corporate investment (irr), where a higher value of this indicator signifies a higher degree of investment irreversibility. The level of innovation within companies is quantified by the proportion of new product output value (innov) to the overall industrial output value, where a higher ratio signifies a higher degree of innovation. Additional control variables include firm productivity (tfp), calculated using the LP method. The firm’s scale is computed through the application of the logarithm of the mean number of employees on an annual basis. The ratio of total liabilities to total assets determines the amount of corporate debt. Labor costs for the enterprise (perw) are assessed based on wages per employee, while external financing constraints (exf) are evaluated using the ratio of total corporate interest to total fixed assets. To minimize the impact of outliers on the results, winsorization has been applied to all continuous variables at the 1% threshold.

3.3. Summary Statistics for Variables

Table 1 provides summary data for all factors analyzed in this study. These data indicate that firms have an average markup rate of 0.88, accompanied by a standard deviation of 1.06, ranging from a minimum of 0.08 to a maximum of 6.70. This indicates that the markup rate in China is relatively low and varies significantly throughout the sample period. Meanwhile, the average EPU index stands at 88.54, and the standard deviation is 24.32, with the lowest value being 55.69 and the highest being 129.16. This indicates significant variations and disparities in the EPU index throughout the sample period.

Table 1.

Descriptive statistics for all variables.

4. Empirical Analysis

4.1. Setting Up the Measurement Model

A benchmark regression analysis is launched in this section, with the relationship between firms’ markup rates and EPU being examined, wherein particular attention is paid to the impact that is imposed by the latter on the former. Subsequently, we analyze the irreversibility of investment and the impact of innovation, investigating how these elements affect the connection between markup rates and the unpredictability of economic policy. Here are descriptions of the econometric model:

The dependent variable is the logged incremental rate, and to avoid endogeneity issues, this paper regresses all explanatory variables one period lagged. represents enterprise-level control variables, including enterprise total factor productivity (), enterprise size (), enterprise debt (), labor costs (), and enterprise external financing constraints (). stands for fixed effects for year, industry, and province, while represents the random error term. If in Model (21) is substantially negative, suggesting that companies’ markup is negatively impacted by EPU, it confirms Hypothesis 1. Propositions 2 and 3 suggest that the irreversibility of investment and firms’ innovative behaviors influence the correlation between firms’ markup rates and EPU. Model (22) examines how these two factors impact firm markups, where denotes the interaction term among these variables and uncertainty related to economic policies. with a primary focus on the magnitude of .

4.2. Baseline Regression Findings

Utilizing Model (16), we explored the impact of EPU on firms’ markup rates, with the benchmark regression results for comprehensive sample data spanning from 2008 to 2016 presented in Table 2. L.X denotes the first-order lag of variable X. Among them, Column (2) is the result obtained by using the Polynomial Least Squares (pols) method and adding control variable regression for comparison analysis. The results in Columns (3) and (4) represent the outcomes of a fixed effect (fe) model regression, while the control variable step-up regression method is employed for analysis. With the intention of validating the efficacy of implementing a fixed effects model, Hausman tests were conducted, whereby the p-value was established as null. This finding denotes that the fixed effects model engenders more advantageous outcomes when juxtaposed with the random effects model. Since changes in U.S. economic policies often lead to adjustments in other countries’ policies, a clear relationship exists between EPU in China and the United States. Moreover, as fluctuations in the market power of individual firms have no impact on EPU, following previous research [27], the U.S. EPU index served as a tool variable. Subsequently, the two-stage least squares method (IV-2SLS) was employed to analyze the impact of EPU on the markup of Chinese firms. The results shown in Column (5) were obtained through this method with instrumental variables. The results shown in Column (6) were obtained through the SYS-GMM method with instrumental variables. Sargan p of the Sargan test is over 10%, which means the hypothesis that all instrumental variables are valid cannot be rejected. Furthermore, our model incorporates fixed effects pertaining to the year, industry, and province. This section evaluates the coefficients related to EPU variables before conducting the regression analysis. The regression outcomes reveal that exhibits a significantly negative coefficient across pools, fe, IV-2SLS, and SYS-GMM regressions, indicating that EPU substantially diminishes firms’ markup rates. Even after accounting for control variables, this adverse effect remains statistically significant, thereby corroborating Proposition 1. Furthermore, the coefficient for firm productivity level (L.tfp) is notably positive, suggesting that higher productivity levels correlate with lower marginal production costs and elevated markup rates. This finding aligns with previous research [18,22].

Table 2.

The Impact of Uncertainty in Economic Policy on Corporate Markup Rates.

4.3. Results of Regression Analysis for Subsample Heterogeneity

Although the model does not account for differences among firms, it is desirable to further investigate whether the impact of EPU on the markup varies across firms with different characteristics. In conclusion, EPU significantly negatively affects markup rates; however, this impact can vary among different firms due to their heterogeneity. Therefore, this paper analyzes the cross-sectional differences in firms’ markup rates by dividing the sample into three categories based on factors such as factor intensity, size, and export status. It employs panel regression analysis to investigate how EPU differentially impacts markup rates.

4.3.1. The Outcomes of the Regression Analysis Based on Factor Intensity

Columns (2) to (4) of Table 3 show the regression outcomes for the earnings intensity of each component. This study builds on research from 2022 [28], which classifies industrial sectors using a resource-intensive industry framework that classifies them into labor-intensive, resource-intensive, and capital-intensive industries, with technology-intensive industries falling under the capital-intensive category. The results in Table 3 show that labor-intensive industries face the most significant negative impact of EPU on their marginal productivity, while resource-intensive and capital-intensive industries are less affected. This difference can be explained by the reliance of labor-intensive industries on both labor and raw materials in their production processes. Consequently, in periods of heightened uncertainty regarding economic policies, it is probable that these industries will implement cost-cutting measures by decreasing their use of labor or raw materials in order to mitigate potential financial losses. Thus, these industries experience a more significant adverse impact from such uncertainties. In contrast, resource-intensive industries exhibit lower levels of labor intensity, resulting in a relatively diminished negative influence from EPU.

Table 3.

Regression Results of Subsample Heterogeneity.

4.3.2. Regression Results by Sub-Enterprise Size

Columns (5) to (7) of Table 3 show the regression results segmented in accordance with enterprise magnitude. Next, drawing upon the enterprise size classification derived from the industrial enterprise database and conforming to the “Specifications for Classifying Small and Medium-sized Enterprises” co-released by the Ministry of Industry and Information Technology, the National Bureau of Statistics, the National Development and Reform Commission and the Ministry of Finance, a tripartite classification of enterprises into large-scale, medium-scale and small-scale is affected. The regression findings in Table 4 indicate that small-scale enterprises experience a more pronounced negative impact from EPU on their multiplier effect compared with the overall sample level. This outcome aligns with expectations since small-scale enterprises typically exhibit lower resilience to risk and face challenges in securing external financing, such as bank loans for productive activities; thus, their multiplier effect is more adversely affected by EPU.

Table 4.

Regression Results of Extended Analysis.

4.3.3. Sub-Enterprises Export Regression Results

The regression outcomes for a selected group of companies, categorized as either exporting or non-exporting based on whether their export sales value exceeds zero, are presented in Columns (8) to (9) of Table 3. Specifically, a firm is classified as exporting if its export delivery value exceeds zero, while a value of zero indicates a non-exporting firm. The outcomes of the regression analysis in Table 5 indicate that exporting firms experience the most significant detrimental impact on their markup rate due to EPU, exceeding the average impact observed across the entire sample. In contrast, the negative effect on non-exporting firms’ markup rates is comparatively less significant. The disparity may arise because exporting firms are influenced by uncertainties in both domestic and international economic policies. For example, foreign EPU can reduce local consumption willingness, leading to decreased demand for products from Chinese exporting firms, which in turn affects their production scale and investment motivation. As a result, during periods of heightened EPU, Chinese exporting firms face the most significant negative impacts on their markup rates.

Table 5.

Robustness test.

5. Extended Analysis

5.1. Impact of Irreversibility of Investment

The correlation between EPU and corporate markup rates, as influenced by irreversible investments, is investigated in this research. An interaction term, merging lagged EPU with irreversible investment (L.epu × irr), is included in the regression model as part of the methodology. In whichever regression method is utilized, be it the fixed-effects regression (depicted in Columns (4) and (5) of Table 4) or the pooled regression analysis (depicted in Columns (2) and (3) of Table 4), the coefficient of the interaction of the lagged EPU and the irreversible investment is significantly negative without exception. The result indicates that an increase in the degree of non-reversible investment exacerbates the negative impact of uncertainty in economic policy on the markup rate, thereby affirming Proposition 2.

5.2. The Impact of Innovative Behavior

The introduction of an interaction term between lagged EPU and the innovation variable (L.epu × innov) is implemented to examine how enterprise innovation behavior impacts the markup rate, considering prior research indicates that EPU adversely affects firms’ markup rates. The outcomes displayed in Columns (6) and (7) of Table 4 derive from a pooled regression analysis, whereas those in Columns (8) and (9) are founded on fixed effects regression. EPU and innovation suggest that innovation alleviates and mitigates the adverse effect of EPU on markup rates for businesses. Further analysis reveals that the threshold value for enterprise innovation, derived from the fixed effects regression in Column (9), is 13.0, which is quite challenging for firms to exceed.

Although innovation can mitigate the impact of EPU on corporate markups, its actual effectiveness is constrained by multiple real-world factors, making universal realization difficult. First, innovation requires sustained high investment, and enterprises often struggle to bear R&D costs because of financing constraints and short-term profit pressures. Second, the transformation of innovation outcomes involves high risks, with a high R&D failure rate, and market acceptance and competitor imitation may weaken expected returns. Additionally, environmental factors such as unstable policy incentives and weak intellectual property protection further dampen enterprises’ willingness to innovate. Therefore, the buffering effect of innovation on EPU only applies to a minority of enterprises with financial strength, technological accumulation, and policy dividends. Most enterprises still face the dilemma of wanting to innovate but finding it difficult to achieve results, which explains why the moderating effect of innovation only partially emerged in the sample period of the paper.

6. Robustness Testing

6.1. Robustness Analysis of Different Indicator Construction Methods

6.1.1. Economic Policy Uncertainty Index Calculation Indicator

The previous section witnessed the accomplishment of annualizing the EPU index via arithmetic averaging. As for this section, it is our intention to conduct the transformation of the EPU index into annual figures, and geometric averaging is to be the means by which this alteration is to be achieved. The regression results shown in Table 5 (Columns 2 to 4) are obtained by regressing the EPU index (L.epu1), calculated via the geometric mean method, against the dependent variable, utilizing fixed effects and panel instrumental variable techniques. The findings indicate that delayed EPU adversely affects company markups, aligning with the results of the benchmark regression.

6.1.2. Enterprise Markup Rate Measurement Indicators

In the preceding discussion, we employed the production function approach to compute the markup rates. To delve deeper into the influence of EPU on markup rates, we conducted an analysis using an accounting approach (lnh) proposed previously [29]. This method calculates the markup rate for firms primarily through accounting metrics such as value-added, wage expenditures, and intermediate input costs, adhering to its definition. The specific calculation formula is shown as follows.

In particular, p represents the product price, c represents the marginal cost, markups represents the markup rate, va represents the industrial value-added, pr represents wage expenditure, and ncm represents intermediate inputs. The regression outcomes utilizing the markup rate determined through the accounting method are presented in Table 5; as shown, Columns (5) to (7) are still significantly negative.

6.2. Endgenous Problem

Since all explanatory variables in the aforementioned model are lagged by one period, the endogeneity issue stemming from reverse causality is mitigated. Furthermore, the EPU index, which is currently the subject of our examination, assumes the character of a macro-level indicator, whereas the corporate markup rate functions as a micro-level indicator. Consequently, any potential reverse causality between individual corporate markup rates and the macro EPU index can be disregarded. Additionally, our model incorporates yearly, industrial, and provincial fixed effects, thereby effectively tackling the endogeneity issues related to omitted variables. To further validate our research findings, in our regression study, we used the U.S. EPU Index as an instrumental variable. The fluctuations in the uncertainty of U.S. economic policy are capable of exerting a substantial impact on the uncertainty enveloping Chinese economic policy, thereby manifesting a pronounced correlation between the two. The present markup rate of enterprises does not affect the lagged one-period U.S. EPU index, suggesting that the U.S. EPU index exhibits a degree of exogeneity. We choose, as the instrumental variable for our EPU measurement, the one-period lagged U.S. EPU index, which is in the context of the benchmark regression results illustrated in Table 5. The IV-2SLS test confirms that EPU has a considerable negative impact on markup rate.

7. Conclusions and Policy Implications

The influence of EPU on firm markups and the mechanisms underlying it are examined in this study using the M-O theoretical model. An empirical analysis is performed using data from the China Industrial Enterprise Database alongside the EPU index. The findings reveal that EPU significantly diminishes firm markups, with considerable differences, specifically based on factors such as factor intensity, company size, and export status. In particular, labor-intensive firms, smaller enterprises, and exporting companies are especially susceptible to reductions in their markup rates. Furthermore, the irreversibility of investment decisions and the innovation activities carried out by enterprises have an impact on how EPU affects firm markups. A greater degree of investment irreversibility is associated with a more significant negative impact of EPU on markups. However, it has been observed that proactive innovation efforts can help to mitigate such an adverse impact.

The policy implications of this paper are as follows: EPU significantly reduces firms’ markups through mechanisms of investment suppression and cost transmission, with particularly pronounced impacts on labor-intensive firms, small firms, and export firms. Labor-intensive and small firms are the most severely affected by EPU due to their reliance on short-term cash flows and weaker financing capabilities. In light of this, the following measures can be considered: First, the government can implement differentiated industrial policies to alleviate the vulnerability of these firms. Specifically, for labor-intensive firms, the government can provide targeted subsidies, such as wage subsidies based on a certain percentage of the number of employees, to mitigate the cost pressures faced by firms under EPU. At the same time, the government can expand the coverage of local government-led financing guarantee funds, prioritizing low-interest loans for small firms. Additionally, tax relief policies can be implemented for small-scale firms, such as reducing the corporate income tax rate or increasing the proportion of tax credits for R&D investment to ease the burden on enterprises. Second, regarding R&D tax policies, a “tiered” incentive credit system can be implemented. The current additional deduction mechanism can be replaced with a dynamic adjustment mechanism, where firms with a certain level of R&D intensity can be eligible for higher additional deduction ratios. Moreover, the scope of R&D expense additional deductions can also be further expanded, and the deduction ratio can be increased to encourage firms to increase their R&D investment. Furthermore, a special fund for the transformation of innovation achievements can be established to provide financial support for firms’ innovation transformation projects, thereby enhancing firms’ innovation returns. For export firms, the government needs to optimize export tax rebate policies by shortening the export tax rebate cycle to improve tax rebate efficiency and alleviate the financial pressure on export firms. Third, the government should streamline the asset disposal process by establishing a dedicated asset disposal service platform that offers one-stop services, including asset evaluation, transaction brokering, tax consulting, and legal support, to help firms quickly dispose of idle assets. Additionally, the government should develop detailed guidelines for simplifying the asset disposal process, clarifying the responsibilities of each department, and setting processing time limits to ensure that firms can complete asset disposal procedures quickly. Finally, the stability and transparency of macroeconomic policies are also crucial. The government should regularly publish reports interpreting macroeconomic policies and provide detailed explanations of the background, objectives, and implementation paths of policy adjustments to businesses and the general public through press conferences and policy interpretation meetings, thereby reducing policy uncertainty.

The limitation of this paper lies in the potential omitted variable problem. Although several control variables have been included, unmeasured factors such as management quality or firms’ risk response capabilities may still influence both markups and the effect of EPU on markups.

Author Contributions

Conceptualization, methodology, software, writing—original draft preparation, X.X.; writing—review and editing, X.Z. (Xinyu Zhou), X.Z. (Xiaofeng Zhang), and X.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Liaoning Provincial Social Science Federation of China, funding name: Economic and Social Development Project, funding number: 2025lslybkt-028.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Gulen, H.; Ion, M. Policy uncertainty and corporate investment. Rev. Financ. Stud. 2016, 29, 523–564. [Google Scholar] [CrossRef]

- Caggiano, G.; Castelnuovo, E.; Figueres, J.M. Economic policy uncertainty and unemployment in the united states: A nonlinear approach. Econ. Lett. 2017, 151, 31–34. [Google Scholar] [CrossRef]

- Liu, G.; Zhang, C. Economic policy uncertainty and firms’ investment and financing decisions in China. China Econ. Rev. 2020, 63, 101279. [Google Scholar] [CrossRef]

- Dibiasi, A.; Abberger, K.; Siegenthaler, M.; Sturm, J.E. The effects of policy uncertainty on investment: Evidence from the unexpected acceptance of a far-reaching referendum in Switzerland. Eur. Econ. Rev. 2018, 104, 38–67. [Google Scholar] [CrossRef]

- Yuan, B.; Li, C.; Xiong, X. Innovation and environmental total factor productivity in China: The moderating roles of economic policy uncertainty and marketization process. Environ. Sci. Pollut. Res. Int. 2021, 28, 9558–9581. [Google Scholar] [CrossRef] [PubMed]

- Li, K.; Guo, Z.; Chen, Q. The effect of economic policy uncertainty on enterprise total factor productivity based on financial mismatch: Evidence from China. Pac.-Basin Financ. J. 2021, 68, 101613. [Google Scholar] [CrossRef]

- Liu, Y.; Luo, R. Entry cost, fixed cost and markup: Theory and evidence from the impact of corruption on prices. Econ. Model 2024, 139, 106818. [Google Scholar] [CrossRef]

- An, G.; Wang, J. Can the expansion of market size increase firm markup? Evidence from China. Appl. Econ. Lett. 2024, 1–6. [Google Scholar] [CrossRef]

- Guo, A.; Wei, H.; Zhong, F.; Liu, S.; Huang, C. Enterprise sustainability: Economic policy uncertainty, enterprise investment, and profitability. Sustainability 2020, 12, 3735. [Google Scholar] [CrossRef]

- Akron, S.; Demir, E.; Díez-Esteban, J.M.; García-Gomez, C.D. Economic policy uncertainty and corporate investment: Evidence from the us hospitality industry. Tour. Manag. 2020, 77, 104019. [Google Scholar] [CrossRef]

- Bloom, N. The impact of uncertainty shocks. Econometrica 2009, 77, 623–685. [Google Scholar]

- Liu, R.; He, L.; Liang, X.; Yang, X.; Xia, Y. Is there any difference in the impact of economic policy uncertainty on the investment of traditional and renewable energy firms ?—A comparative study based on regulatory effects. J. Clean. Prod. 2020, 255, 120102. [Google Scholar] [CrossRef]

- Huang, T.; Wu, F.; Yu, J.; Zhang, B. Political uncertainty and dividend policy: Evidence from international political crises. J. Int. Bus. Stud. 2015, 46, 574–595. [Google Scholar] [CrossRef]

- Ashraf, B.N.; Shen, Y. Economic policy uncertainty and banks’ loan pricing. J. Financ. Stab. 2019, 44, 100695. [Google Scholar] [CrossRef]

- He, F.; Ma, Y.; Zhang, X. How does economic policy uncertainty affect corporate innovation? –evidence from China listed companies. Int. Rev. Econ. Financ. 2020, 67, 225–239. [Google Scholar] [CrossRef]

- Zhang, S.; Hao, W.; Sun, H.; Su, N. Technical standard regulations and firm markups: Evidence from China. Appl. Econ. 2024. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhuo, C.; Deng, F. Policy uncertainty, financialization and enterprise technological innovation: A way forward towards economic development. Front. Environ. Sci. 2022, 10, 905505. [Google Scholar] [CrossRef]

- Melitz, M.J.; Ottaviano, G.I.P. Market size, trade, and productivity. Rev. Econ. Stud. 2008, 75, 295–316. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Li, X.; Zhao, C.; Chen, B.; Liu, Z. Political uncertainty and high-quality economic development: Evidence from China. Sci. Prog. 2023, 106, 00368504231183583. [Google Scholar] [CrossRef]

- Julio, B.; Yook, Y. Political uncertainty and corporate investment cycles. J. Financ. 2012, 67, 45–83. [Google Scholar] [CrossRef]

- De Loecker, J.; Warzynski, F. Markups and firm-level export status. Am. Econ. Rev. 2012, 102, 2437–2471. [Google Scholar] [CrossRef]

- Melitz, M.J. The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 2003, 71, 1695–1725. [Google Scholar] [CrossRef]

- Olley, G.S.; Pakes, A. The dynamics of productivity in the telecommunications equipment industry. Econometrica 1996, 64, 1263–1297. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Cui, X.; Wang, C.; Liao, J.; Fang, Z.; Cheng, F. Economic policy uncertainty exposure and corporate innovation investment: Evidence from China. Pac.—Basin Financ. J. 2021, 67, 101533. [Google Scholar] [CrossRef]

- Malcomson, J.M. Uncertainty, investment and productivity with relational contracts. J. Eur. Econ. Assoc. 2024, 22, 1139–1176. [Google Scholar] [CrossRef]

- Feng, W.; Hyukku, L. Research on the Impact of China’s Environmental Regulations on Industrial Agglomeration. J. Northeast Asian Econ. Stud. 2022, 34, 63–86. [Google Scholar]

- Domowitz, I.; Hubbard, R.G.; Petersen, B.C. Business cycles and the relationship between concentration and price-cost margins. RAND J. Econ. 1986, 17, 1–17. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).