The Impact of Economic Policy Uncertainty on Firm Markups and Business Sustainability: The Moderating Effect of Irreversible Investment and Innovation

Abstract

1. Introduction

2. Theoretical Model

2.1. Basic Assumptions

2.2. The Impact of Investment Irreversibility

2.3. The Impact of Business Innovation Behaviors

3. Data and Sample Description

3.1. Data Sources

3.2. Measurement of Variables

3.2.1. Calculation of Markup Rate and Productivity

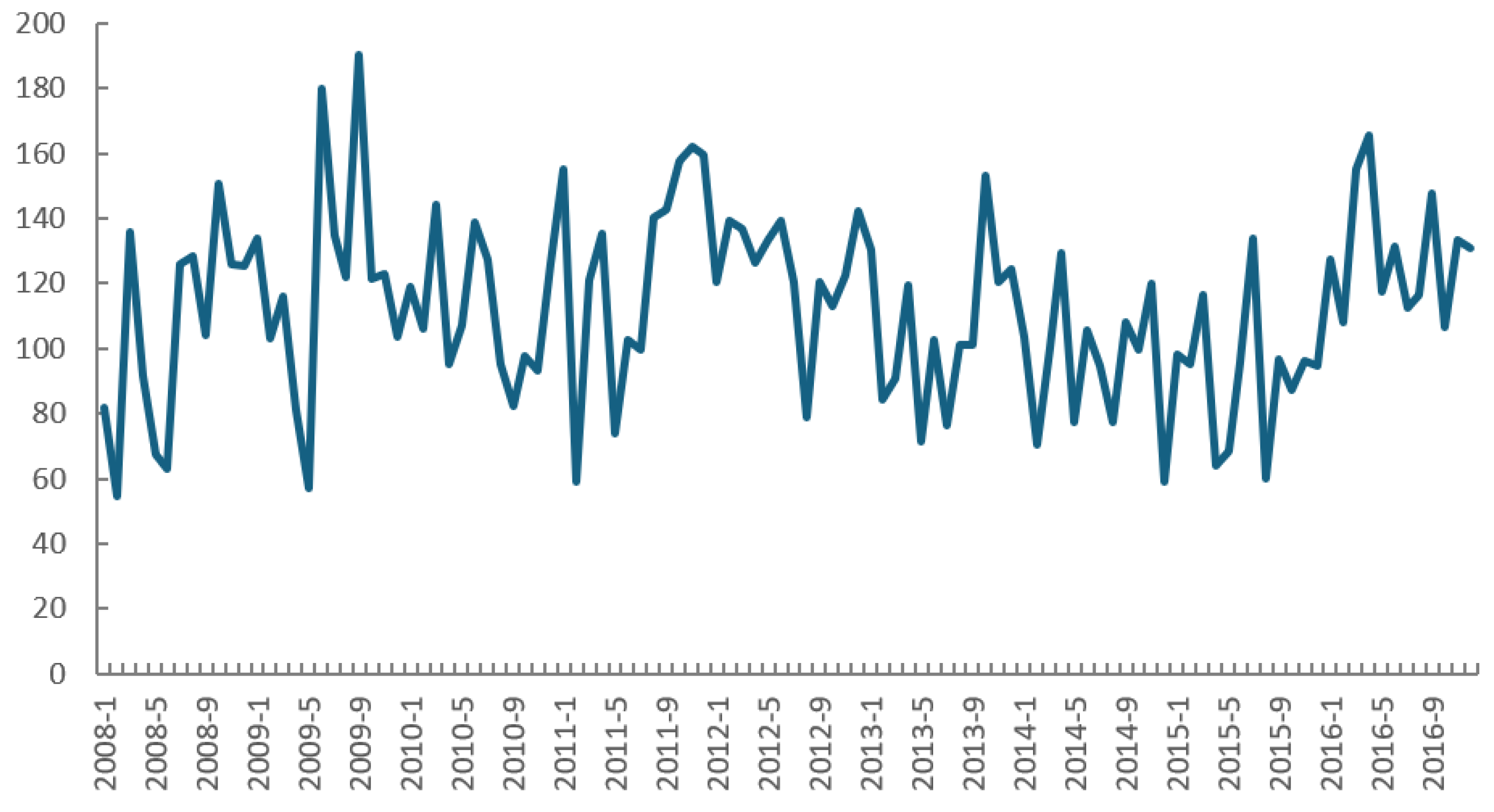

3.2.2. Economic Policy Uncertainty

3.2.3. Adjusting Variables and Other Control Variables

3.3. Summary Statistics for Variables

4. Empirical Analysis

4.1. Setting Up the Measurement Model

4.2. Baseline Regression Findings

4.3. Results of Regression Analysis for Subsample Heterogeneity

4.3.1. The Outcomes of the Regression Analysis Based on Factor Intensity

4.3.2. Regression Results by Sub-Enterprise Size

4.3.3. Sub-Enterprises Export Regression Results

5. Extended Analysis

5.1. Impact of Irreversibility of Investment

5.2. The Impact of Innovative Behavior

6. Robustness Testing

6.1. Robustness Analysis of Different Indicator Construction Methods

6.1.1. Economic Policy Uncertainty Index Calculation Indicator

6.1.2. Enterprise Markup Rate Measurement Indicators

6.2. Endgenous Problem

7. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gulen, H.; Ion, M. Policy uncertainty and corporate investment. Rev. Financ. Stud. 2016, 29, 523–564. [Google Scholar] [CrossRef]

- Caggiano, G.; Castelnuovo, E.; Figueres, J.M. Economic policy uncertainty and unemployment in the united states: A nonlinear approach. Econ. Lett. 2017, 151, 31–34. [Google Scholar] [CrossRef]

- Liu, G.; Zhang, C. Economic policy uncertainty and firms’ investment and financing decisions in China. China Econ. Rev. 2020, 63, 101279. [Google Scholar] [CrossRef]

- Dibiasi, A.; Abberger, K.; Siegenthaler, M.; Sturm, J.E. The effects of policy uncertainty on investment: Evidence from the unexpected acceptance of a far-reaching referendum in Switzerland. Eur. Econ. Rev. 2018, 104, 38–67. [Google Scholar] [CrossRef]

- Yuan, B.; Li, C.; Xiong, X. Innovation and environmental total factor productivity in China: The moderating roles of economic policy uncertainty and marketization process. Environ. Sci. Pollut. Res. Int. 2021, 28, 9558–9581. [Google Scholar] [CrossRef] [PubMed]

- Li, K.; Guo, Z.; Chen, Q. The effect of economic policy uncertainty on enterprise total factor productivity based on financial mismatch: Evidence from China. Pac.-Basin Financ. J. 2021, 68, 101613. [Google Scholar] [CrossRef]

- Liu, Y.; Luo, R. Entry cost, fixed cost and markup: Theory and evidence from the impact of corruption on prices. Econ. Model 2024, 139, 106818. [Google Scholar] [CrossRef]

- An, G.; Wang, J. Can the expansion of market size increase firm markup? Evidence from China. Appl. Econ. Lett. 2024, 1–6. [Google Scholar] [CrossRef]

- Guo, A.; Wei, H.; Zhong, F.; Liu, S.; Huang, C. Enterprise sustainability: Economic policy uncertainty, enterprise investment, and profitability. Sustainability 2020, 12, 3735. [Google Scholar] [CrossRef]

- Akron, S.; Demir, E.; Díez-Esteban, J.M.; García-Gomez, C.D. Economic policy uncertainty and corporate investment: Evidence from the us hospitality industry. Tour. Manag. 2020, 77, 104019. [Google Scholar] [CrossRef]

- Bloom, N. The impact of uncertainty shocks. Econometrica 2009, 77, 623–685. [Google Scholar]

- Liu, R.; He, L.; Liang, X.; Yang, X.; Xia, Y. Is there any difference in the impact of economic policy uncertainty on the investment of traditional and renewable energy firms ?—A comparative study based on regulatory effects. J. Clean. Prod. 2020, 255, 120102. [Google Scholar] [CrossRef]

- Huang, T.; Wu, F.; Yu, J.; Zhang, B. Political uncertainty and dividend policy: Evidence from international political crises. J. Int. Bus. Stud. 2015, 46, 574–595. [Google Scholar] [CrossRef]

- Ashraf, B.N.; Shen, Y. Economic policy uncertainty and banks’ loan pricing. J. Financ. Stab. 2019, 44, 100695. [Google Scholar] [CrossRef]

- He, F.; Ma, Y.; Zhang, X. How does economic policy uncertainty affect corporate innovation? –evidence from China listed companies. Int. Rev. Econ. Financ. 2020, 67, 225–239. [Google Scholar] [CrossRef]

- Zhang, S.; Hao, W.; Sun, H.; Su, N. Technical standard regulations and firm markups: Evidence from China. Appl. Econ. 2024. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhuo, C.; Deng, F. Policy uncertainty, financialization and enterprise technological innovation: A way forward towards economic development. Front. Environ. Sci. 2022, 10, 905505. [Google Scholar] [CrossRef]

- Melitz, M.J.; Ottaviano, G.I.P. Market size, trade, and productivity. Rev. Econ. Stud. 2008, 75, 295–316. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Li, X.; Zhao, C.; Chen, B.; Liu, Z. Political uncertainty and high-quality economic development: Evidence from China. Sci. Prog. 2023, 106, 00368504231183583. [Google Scholar] [CrossRef]

- Julio, B.; Yook, Y. Political uncertainty and corporate investment cycles. J. Financ. 2012, 67, 45–83. [Google Scholar] [CrossRef]

- De Loecker, J.; Warzynski, F. Markups and firm-level export status. Am. Econ. Rev. 2012, 102, 2437–2471. [Google Scholar] [CrossRef]

- Melitz, M.J. The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 2003, 71, 1695–1725. [Google Scholar] [CrossRef]

- Olley, G.S.; Pakes, A. The dynamics of productivity in the telecommunications equipment industry. Econometrica 1996, 64, 1263–1297. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Cui, X.; Wang, C.; Liao, J.; Fang, Z.; Cheng, F. Economic policy uncertainty exposure and corporate innovation investment: Evidence from China. Pac.—Basin Financ. J. 2021, 67, 101533. [Google Scholar] [CrossRef]

- Malcomson, J.M. Uncertainty, investment and productivity with relational contracts. J. Eur. Econ. Assoc. 2024, 22, 1139–1176. [Google Scholar] [CrossRef]

- Feng, W.; Hyukku, L. Research on the Impact of China’s Environmental Regulations on Industrial Agglomeration. J. Northeast Asian Econ. Stud. 2022, 34, 63–86. [Google Scholar]

- Domowitz, I.; Hubbard, R.G.; Petersen, B.C. Business cycles and the relationship between concentration and price-cost margins. RAND J. Econ. 1986, 17, 1–17. [Google Scholar] [CrossRef]

| Variate | Implication | Observations | Average | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|---|

| Enterprise markup rate | 404,886 | 0.88 | 1.06 | 0.08 | 6.70 | |

| epu | Economic policy uncertainty index | 406,719 | 88.54 | 24.32 | 55.69 | 129.16 |

| irr | Irreversibility of investment | 406,454 | 0.37 | 0.21 | 0.023 | 0.89 |

| innov | Innovate | 405,540 | 0.03 | 0.13 | 0 | 0.84 |

| tfp | total factor productivity | 405,540 | 6.71 | 1.09 | 4.09 | 9.70 |

| size | enterprise size | 406,570 | 5.42 | 1.12 | 3.04 | 8.58 |

| debt | enterprise debt | 406,454 | 0.58 | 0.26 | 0.03 | 1.35 |

| perw | Enterprise employment cost | 406,570 | 13.37 | 10.35 | 1.39 | 65.48 |

| exf | External financing constraint | 405,613 | 0.05 | 0.08 | −0.03 | 0.51 |

| Pols | Fe | Fe | IV-2SLS | SYS-GMM | |

|---|---|---|---|---|---|

| L.epu | −0.0002 ** | −0.0025 *** | −0.0027 *** | −0.0002 *** | −0.0003 *** |

| (−2.55) | (−8.81) | (−9.01) | (−3.49) | (−2.58) | |

| L.tfp | 0.4948 *** | 0.1447 *** | 0.1447 *** | 0.1683 *** | |

| (−348.14) | (−63.74) | (−93.85) | (−74.65) | ||

| L.size | −0.3979 *** | −0.2027 *** | −0.2027 *** | −0.1983 *** | |

| (−313.73) | (−54.09) | (−87.26) | (−27.21) | ||

| L.debt | 0.0528 *** | 0.0325 *** | 0.0325 *** | 0.0478 *** | |

| (−11.63) | (−4.39) | (−6.03) | (−12.37) | ||

| L.perw | −0.0183 *** | −0.0060 *** | −0.0060 *** | −0.0124 *** | |

| (−128.28) | (−27.23) | (−40.26) | (−28.93) | ||

| L.exf | 0.1380 *** | −0.0556 *** | −0.0556 *** | −0.0395 *** | |

| (−9.39) | (−2.94) | (−3.92) | (−12.84) | ||

| cons | −2.3068 *** | −0.6480 *** | −0.4386 *** | −0.6240 *** | −0.5943 *** |

| (−149.27) | (−7.10) | (−4.91) | (−9.93) | (−15.64) | |

| N | 359,151 | 360,029 | 359,151 | 359,151 | 359,151 |

| R2 | 0.4438 | 0.0052 | 0.0462 | 0.0462 | |

| AR (1) P | 0.0015 | ||||

| AR (2) P | 0.2328 | ||||

| Sargan P | 0.5202 |

| Component-Specific Intensity | Firm Size | Exports by Sub-Enterprises | ||||||

|---|---|---|---|---|---|---|---|---|

| Labor Intensive | Resource Intensive | Capital Intensive | Large Scale | Mid Scale | Small Scale | Export | Non-Export | |

| L.epu | −0.0034 *** | −0.0015 ** | −0.0028 *** | −0.0015 | −0.0024 *** | −0.0029 *** | −0.0061 *** | −0.0007 * |

| (−6.49) | (−2.09) | (−6.42) | (−1.03) | (−4.38) | (−7.55) | (−12.62) | (−1.67) | |

| L.tfp | 0.1474 *** | 0.1239 *** | 0.1406 *** | 0.0929 *** | 0.0899 *** | 0.1561 *** | 0.1160 *** | 0.1458 *** |

| (−35.75) | (−23.21) | (−44.16) | (−9.26) | (−17.08) | (−53.5) | (−31.71) | (−50.65) | |

| L.size | −0.2034 *** | −0.1925 *** | −0.2015 *** | −0.1811 *** | −0.1842 *** | −0.2134 *** | −0.1893 *** | −0.1901 *** |

| (−31.74) | (−20.33) | (−37.15) | (−9.07) | (−18.63) | (−43.63) | (−30.25) | (−39.19) | |

| L.debt | 0.0005 | 0.0355 ** | 0.0488 *** | 0.2749 *** | 0.0886 *** | 0.0098 | 0.1131 *** | 0.0007 |

| (−0.04) | (−2.11) | (−4.37) | (−6.25) | (−4.56) | (−1.08) | (−8.93) | (−0.08) | |

| L.perw | −0.0064 *** | −0.0059 *** | −0.0053 *** | 0.0006 | −0.0028 *** | −0.0072 *** | −0.0034 *** | −0.0064 *** |

| (−14.31) | (−12.23) | (−17.66) | −0.66 | (−5.62) | (−23.65) | (−9.96) | (−22.24) | |

| L.exf | −0.0628 * | 0.029 | −0.0626 ** | −0.032 | −0.0509 | −0.0757 *** | 0.0616 * | −0.0931 *** |

| (−1.90) | −0.57 | (−2.41) | (−0.24) | (−0.92) | (−3.39) | −1.87 | (−4.08) | |

| cons | −0.2081 *** | −0.5468 *** | −0.5047 *** | 0.1949 | −0.003 | −0.3657 *** | 0.1949 | −0.003 |

| (−3.17) | (−4.51) | (−4.52) | −0.92 | (−0.02) | (−2.65) | −0.92 | (−0.02) | |

| N | 123,058 | 64,580 | 171,470 | 17,706 | 64,169 | 232,598 | 124,513 | 234,638 |

| R2 | 0.0412 | 0.0367 | 0.0523 | 0.0745 | 0.0412 | 0.0501 | 0.0414 | 0.0502 |

| Impact of Irreversibility | Impact of Innovative Behaviors | |||||||

|---|---|---|---|---|---|---|---|---|

| L.epu | 0.0006 *** | 0.0001 | −0.0022 *** | −0.0024 *** | 0.0002 ** | −0.0001 ** | −0.0104 *** | −0.0091 *** |

| (−5.11) | (−0.5) | (−7.51) | (−7.72) | (−2.05) | (−2.18) | (−19.88) | (−17.24) | |

| L.epu × irr | −0.0011 *** | −0.0004 ** | −0.0007 *** | −0.0007 *** | ||||

| (−4.40) | (−2.02) | (−4.54) | (−4.45) | |||||

| irr | 0.1091 *** | 0.4505 *** | 0.1663 *** | 0.2050 *** | ||||

| (−4.64) | (−22.83) | (−9.21) | (−11.89) | |||||

| L.epu × innov | 0.0011 ** | 0.0008 ** | 0.0009 *** | 0.0007 *** | ||||

| (−2.4) | (−2.07) | (−3.68) | (−2.92) | |||||

| innov | −0.0972 ** | 0.0103 | −0.0537 * | −0.036 | ||||

| (−2.09) | −0.26 | (−1.96) | (−1.32) | |||||

| L.tfp | 0.5059 *** | 0.1464 *** | 0.4786 *** | 0.0479 *** | ||||

| (−355.56) | (−64.45) | (−232.15) | (−15.63) | |||||

| L.size | −0.4093 *** | −0.2037 *** | −0.4107 *** | −0.0872 *** | ||||

| (−321.63) | (−54.44) | (−227.76) | (−15.29) | |||||

| L.debt | 0.0784 *** | 0.0366 *** | 0.0447 *** | 0.0625 *** | ||||

| (−17.31) | (−4.96) | (−6.83) | (−5.91) | |||||

| L.perw | −0.0182 *** | −0.0060 *** | −0.0218 *** | 0.0030 *** | ||||

| (−128.56) | (−27.28) | (−93.48) | (−8.38) | |||||

| L.exf | 0.3026 *** | −0.0325 * | 0.0588 *** | −0.0204 | ||||

| (−20.43) | (−1.73) | (−2.85) | (−0.81) | |||||

| cons- | −1.7616 *** | −2.5195 *** | −0.7154 *** | −0.5321 *** | −1.7609 *** | −2.0799 *** | 0.4637 ** | 0.3802 ** |

| (−97.80) | (−146.20) | (−7.83) | (−5.96) | (−84.92) | (−97.63) | (−2.56) | (−2.01) | |

| N | 360,029 | 359,151 | 360,029 | 359,151 | 179,367 | 179,020 | 179,367 | 179,020 |

| R2 | 0.2125 | 0.4505 | 0.0059 | 0.0475 | 0.1976 | 0.4279 | 0.0066 | 0.0152 |

| Fe | Fe | IV-2SLS | Fe | Fe | IV-2SLS | |

|---|---|---|---|---|---|---|

| lnμ | lnμ | lnμ | lnh | lnh | lnh | |

| L.epu1 | −0.0024 *** | −0.0025 *** | −0.0002 *** | |||

| (−8.81) | (−9.01) | (−3.49) | ||||

| L.epu | −0.0003 * | −0.0005 *** | −0.0000 ** | |||

| (−2.31) | (−4.21) | (−2.11) | ||||

| Control variable | no | yes | yes | no | yes | yes |

| N | 360,029 | 359,151 | 359,151 | 361,362 | 360,341 | 360,341 |

| R2 | 0.0052 | 0.0462 | 0.0462 | 0.0049 | 0.0208 | 0.0208 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xue, X.; Zhou, X.; Zhang, X.; Yang, X. The Impact of Economic Policy Uncertainty on Firm Markups and Business Sustainability: The Moderating Effect of Irreversible Investment and Innovation. Sustainability 2025, 17, 4996. https://doi.org/10.3390/su17114996

Xue X, Zhou X, Zhang X, Yang X. The Impact of Economic Policy Uncertainty on Firm Markups and Business Sustainability: The Moderating Effect of Irreversible Investment and Innovation. Sustainability. 2025; 17(11):4996. https://doi.org/10.3390/su17114996

Chicago/Turabian StyleXue, Xingqun, Xinyu Zhou, Xiaofeng Zhang, and Xinying Yang. 2025. "The Impact of Economic Policy Uncertainty on Firm Markups and Business Sustainability: The Moderating Effect of Irreversible Investment and Innovation" Sustainability 17, no. 11: 4996. https://doi.org/10.3390/su17114996

APA StyleXue, X., Zhou, X., Zhang, X., & Yang, X. (2025). The Impact of Economic Policy Uncertainty on Firm Markups and Business Sustainability: The Moderating Effect of Irreversible Investment and Innovation. Sustainability, 17(11), 4996. https://doi.org/10.3390/su17114996