Incentivizing the Transition to Alternative Fuel Vehicles: Case Study on the California Vehicle Rebate Program

Abstract

1. Introduction

2. Literature Review

3. Methodology

3.1. Two-Level Model of Rebates

3.2. Three-Level Model of Rebates

4. Data

- Rebates from businesses in the business consumer-type category, entities in the federal government consumer-type category, entities in the local government consumer-type category, organizations in the non-profit consumer-type category, and entities in the state government consumer-type category;

- Rebates where the rebate in nominal United States dollars is zero (USD = 0);

- Rebates for vehicles in the other category.

5. Results

5.1. Diagnostics

5.2. Intraclass Correlation Coefficient (ICC)

5.3. Proportional Reduction of Error (PRE)

5.4. Two-Level Model Results

5.5. Three-Level Model Results

6. Discussion

7. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- 2023 Light-Duty Vehicle Registration Counts by State and Fuel Type. Available online: https://afdc.energy.gov/vehicle-registration (accessed on 28 May 2025).

- Electric Vehicle Registrations by States. Available online: https://afdc.energy.gov/data/10962 (accessed on 28 May 2025).

- Krupa, J.; Rizzo, D.; Eppstein, M.; Lanute, D.; Gaalema, D.; Lakkaraju, K.; Warrender, C. Analysis of a Consumer Survey on Plug-In Hybrid Electric Vehicles. Transp. Res. A-Pol. 2014, 64, 1431. [Google Scholar] [CrossRef]

- Narassimhan, E.; Johnson, C. The Role of Demand-Side Incentives and Charging Infrastructure on Plug-In Electric Vehicle Adoption: Analysis of US States. Environ. Res. Lett. 2018, 13, 074032. [Google Scholar] [CrossRef]

- Hardman, S.; Tal, G. Understanding Discontinuance Among California’s Electric Vehicle Owners. Nature Energy 2021, 6, 538–545. [Google Scholar] [CrossRef]

- Adepetu, A.; Keshav, S. The Relative Importance of Price and Driving Range of Electric Vehicle Adoption: Los Angeles Case Study. Transportation 2017, 44, 35373. [Google Scholar] [CrossRef]

- Sheldon, T.; Dua, R.; Abdullah Alharbi, O. Electric Vehicle Subsidies: Time to Accelerate or Pump the Brakes? Energ. Econ. 2023, 120, 106641. [Google Scholar] [CrossRef]

- Borenstein, S.; Davis, L. The Distributional Effects of US Clean Energy Tax Credits. Tax Pol. Econ. 2016, 30, 191–234. [Google Scholar] [CrossRef]

- Williams, B. Assessing Progress and Equity in the Distribution of Electric Vehicle Rebates Using Appropriate Comparisons. Transp. Policy 2023, 137, 141–151. [Google Scholar] [CrossRef]

- Guo, S.; Kontou, E. Disparities and Equity Issues in Electric Vehicles Rebate Allocation. Energ. Policy 2021, 154, 112291. [Google Scholar] [CrossRef]

- Rebate Statistics. Available online: https://cleanvehiclerebate.org/rebate-statistics (accessed on 28 May 2025).

- DeShazo, J.; Sheldon, T.; Carson, R. Designing Policy Incentives for Cleaner Technologies: Lessons from California’s Plug-In Electric Vehicle Rebate Program. J. Environ. Econ. Manag. 2017, 84, 18–43. [Google Scholar] [CrossRef]

- Khattak, Z.; Khattak, A. Spatial and Unobserved Heterogeneity in Consumer Preferences for Adoption of Electric and Hybrid Vehicles: A Bayesian Hierarchical Modeling Approach. Int. J. Sustain. Transp. 2023, 17, 1–14. [Google Scholar] [CrossRef]

- AB 32 Global Warming Solutions Act of 2006. Available online: https://ww2.arb.ca.gov/resources/fact-sheets/ab-32-global-warming-solutions-act-2006 (accessed on 28 May 2025).

- Rubin, D.; St-Louis, E. Evaluating the Economic and Social Implications of Participation in Clean Vehicle Rebate Programs: Who’s In, Who’s Out? Transp. Res. Record 2016, 2598, 67–74. [Google Scholar] [CrossRef]

- Johnson, C.; Williams, B. Characterizing Plug-In Hybrid Electric Vehicle Consumers Most Influenced by California’s Electric Vehicle Rebate. Transp. Res. Record 2017, 2628, 23–31. [Google Scholar] [CrossRef]

- Canepa, K.; Hardman, S.; Tal, G. An Early Look at Plug-In Electric Vehicle Adoption in Disadvantaged Communities in California. Transp. Policy 2019, 78, 19–30. [Google Scholar] [CrossRef]

- Lee, J.; Hardman, S.; Tal, G. Who is Buying Electric Vehicles in California? Characterising Early Adopter Heterogeneity and Forecasting Market Diffusion. Energy Res. Soc. Sci. 2019, 55, 218–226. [Google Scholar] [CrossRef]

- Ju, Y.; Cushing, L.; Morello-Frosch, R. An Equity Analysis of Clean Vehicle Rebate Programs in California. Clim. Change 2020, 162, 2087–2105. [Google Scholar] [CrossRef]

- Pallonetti, N.; Williams, B. Refining estimates of fuel-cycle greenhouse-gas emission reductions associated with California’s clean vehicle rebate project with program data and other case-specific inputs. Energies 2021, 14, 4640. [Google Scholar] [CrossRef]

- Williams, B.; Anderson, J. Strategically Targeting Plug-In Electric Vehicle Rebates and Outreach Using “EV Convert” Characteristics. Energies 2021, 14, 1899. [Google Scholar] [CrossRef]

- Lee, J.; Cho, M.; Tal, G.; Hardman, S. Do Plug-In Hybrid Adopters Switch to Battery Electric Vehicles (And Vice Versa)? Transport. Res. D-Transp. Environ. 2023, 119, 103752. [Google Scholar] [CrossRef]

- Williams, B.; Anderson, J. From Low Initial Interest to Electric Vehicle Adoption: “EV Converts” in New York State’s Rebate Program. Transp. Res. Record 2023, 2677, 866–882. [Google Scholar] [CrossRef]

- Faust, J.; August, L.; Bangia, K.; Galaviz, V.; Lechty, J.; Prasad, S.; Schmitz, R.; Slocombe, A.; Welling, R.; Wieland, W.; et al. CalEnvironScreen 3.0. Available online: https://oehha.ca.gov/media/downloads/calenviroscreen/report/ces3report.pdf (accessed on 28 May 2025).

- Jones, K.; Bullen, N. Contextual Models of Urban House Prices: A Comparison of Fixed-and Random-Coefficient Models Developed by Expansion. Econ. Geogr. 1994, 70, 252–272. [Google Scholar] [CrossRef]

- Raudenbush, S.; Bryk, A. Hierarchical Linear Models: Applications and Data Analysis, 2nd ed.; Sage: Thousand Oaks, CA, USA, 2002; ISBN 978-0-76191-904-9. [Google Scholar]

- California Consumer Price Index (1995–2023). Available online: https://www.cdfa.ca.gov/AHFSS/cabb/docs/202406_notice_Feb_California_Consumer_Price_Index_1955-2024.pdf (accessed on 28 May 2025).

- 2022 Incremental Purchase Cost Methodology and Results for Clean Vehicles. Available online: https://www.energy.gov/sites/default/files/2022-12/2022.12.23%202022%20Incremental%20Purchase%20Cost%20Methodology%20and%20Results%20for%20Clean%20Vehicles.pdf (accessed on 28 May 2025).

- Implementation Manual for the Clean Vehicle Rebate Project (CVRP). Available online: https://cleanvehiclerebate.org/sites/default/files/docs/nav/transportation/cvrp/documents/CVRP-Implementation-Manual.pdf (accessed on 28 May 2025).

- Alternative Fueling Station Locator. Available online: https://afdc.energy.gov/stations/#/analyze?country=US&access=public&access=private&status=E&status=P&status=T (accessed on 28 May 2025).

- Population 18 Years and Older by Race (Not Hispanic/Latino) and Hispanic/Latino: 2020 Census. Available online: https://dof.ca.gov/wp-content/uploads/sites/352/Forecasting/Demographics/Documents/2020Census_CT2_Race-HispExcl_RedistrictingFile.xlsx (accessed on 28 May 2025).

- ZEV and Infrastructure Stats Data. Available online: https://www.energy.ca.gov/files/zev-and-infrastructure-stats-data (accessed on 28 May 2025).

- Faust, J.; August, L.; Alexeef, G.; Bangia, K.; Cendak, R.; Cheung-Sutton, E.; Cushing, L.; Galaviz, V.; Kakir, T.; Lechty, J.; et al. California Communities Environmental Health Screening Tool, Version 2.0 (CalEnvironScreen 2.0). Available online: https://oehha.ca.gov/media/CES20FinalReportUpdateOct2014.pdf (accessed on 28 May 2025).

- August, L.; Bangia, K.; Plummer, L.; Prasad, S.; Ranjbar, K.; Slocombe, A.; Wieland, W. CalEnvironScreen 4.0. Available online: https://oehha.ca.gov/calenviroscreen/report/calenviroscreen-40 (accessed on 28 May 2025).

- About CalEnviroScreen. Available online: https://oehha.ca.gov/calenviroscreen/about-calenviroscreen (accessed on 28 May 2025).

- Hox, J.; Moerbeek, M.; van de Schoot, R. Multilevel Analysis: Techniques and Applications, 3rd ed.; Routledge: New York, NY, USA, 2018; ISBN 978-1-138-12140-9. [Google Scholar]

- Tranmer, M.; Steel, D. Ignoring a Level in a Multilevel Analysis: Evidence from UK Census Data. Environ. Plann. A 2001, 33, 941–948. [Google Scholar] [CrossRef]

- Snijders, T.; Bosker, R. Multilevel Analysis: An Introduction to Basic and Advanced Multilevel Modelling, 2nd ed.; Sage: Los Angeles, CA, USA, 2012; ISBN 978-1-84920-200-8. [Google Scholar]

- Blau, P. Inequality and Heterogeneity: A Primitive Theory of Social Structure, 1st ed.; Free Press: New York, NY, USA, 1977; ISBN 978-0-02903-660-0. [Google Scholar]

- California: 2020 Census. Available online: https://www.census.gov/library/stories/state-by-state/california-population-change-between-census-decade.html (accessed on 28 May 2025).

- Meyer, P.; McIntosh, S. The USA Today Index of Ethnic Diversity. Int. J. Public Opin. R. 1992, 4, 51–58. [Google Scholar] [CrossRef]

- Bolton, R. ‘Place Prosperity vs People Prosperity’ Revisited: An Old Issue with a New Angle. Urban Stud. 1992, 29, 185–203. [Google Scholar] [CrossRef]

- Hägerstrand, T. What About People in Regional Science? Pap. Reg. Sci. Assoc. 1970, 24, 7–21. [Google Scholar] [CrossRef]

- Glaeser, E.; Gottlieb, J. The Economics of Place-Making Policies. Brook. Pap. Econ. Act. 2008, 2008, 155–239. [Google Scholar] [CrossRef]

- Winnick, L. Place Prosperity vs People Prosperity: Welfare Considerations in the Geographic Distribution of Economic Activity. In Essays in Urban Land Economics; Grebler, L., Ed.; Real Estate Research Program: Los Angeles, CA, USA, 1966; pp. 273–283. [Google Scholar]

- Liu, X.; Roberts, M.; Sioshansi, R. Spatial Effects on Hybrid Electric Vehicle Adoption. Transport. Res. D-Transp. Environ. 2017, 52, 85–97. [Google Scholar] [CrossRef]

- Maas, C.; Hox, J. Sufficient Sample Sizes for Multilevel Modeling. Methodol. Eur. J. Res. Methods Behav. Soc. Sci. 2005, 1, 86–92. [Google Scholar]

| Level | Variable | Category | Description |

|---|---|---|---|

| Rebate | |||

| Rebate | Rebate in real 1 United States dollars | ||

| lnRebate | Natural log of rebate in real United States dollars | ||

| Fuel | |||

| BEV | Battery electric vehicle | ||

| FCEV | Fuel-cell electric vehicle | ||

| PHEV | Plug-in hybrid electric vehicle | ||

| Time | |||

| 29 March 2016 | If rebate application date is after 29 March 2016 then 1, otherwise 0 | ||

| 3 December 2019 | If rebate application date is after 3 December 2019 then 1, otherwise 0 | ||

| Year | |||

| 2011 | If 2011 then 1, otherwise 0 | ||

| 2012 | If 2012 then 1, otherwise 0 | ||

| 2013 | If 2013 then 1, otherwise 0 | ||

| 2014 | If 2014 then 1, otherwise 0 | ||

| 2015 | If 2015 then 1, otherwise 0 | ||

| 2016 | If 2016 then 1, otherwise 0 | ||

| 2017 | If 2017 then 1, otherwise 0 | ||

| 2018 | If 2018 then 1, otherwise 0 | ||

| 2019 | If 2019 then 1, otherwise 0 | ||

| 2020 | If 2020 then 1, otherwise 0 | ||

| 2021 | If 2021 then 1, otherwise 0 | ||

| 2022 | If 2022 then 1, otherwise 0 | ||

| Census Tract | |||

| Infrastructure | |||

| EVSE 2 + Hydrogen Stations | Total EVSE plus total hydrogen stations in 2022 | ||

| EVSE | Total EVSE in 2022 | ||

| Hydrogen Stations | Total hydrogen stations in 2022 | ||

| Race | |||

| 18 Years and Older | 18 years and older population in 2020 | ||

| White Alone, Not Hispanic | White alone, not Hispanic population in 2020 | ||

| Black or African American Alone, Not Hispanic | Black or African American alone, not Hispanic population in 2020 | ||

| American Indian and Alaska Native Alone, Not Hispanic | American Indian and Alaska Native alone, not Hispanic population in 2020 | ||

| Asian Alone, Not Hispanic | Asian alone, not Hispanic population in 2020 | ||

| Native Hawaiian and Other Pacific Islander Alone, Not Hispanic | Native Hawaiian and other Pacific Islander alone, not Hispanic population in 2020 | ||

| Some Other Race Alone, Not Hispanic | Some other race alone, not Hispanic population in 2020 | ||

| Two or More Races, Not Hispanic | Two or more races, not Hispanic population in 2020 | ||

| Hispanic/Latino | Hispanic/Latino population in 2020 | ||

| Sales | |||

| ZEV 3 | Total ZEV sales from 2011 to 2022 | ||

| BEV | Total BEV sales from 2011 to 2022 | ||

| FCEV | Total FCEV sales from 2011 to 2022 | ||

| PHEV | Total PHEV sales from 2011 to 2022 | ||

| Score | |||

| CalEnviroScreen | Mean of CalEnviroScreen Scores from 2014 to 2017 to 2021 | ||

| Pollution Burden | Mean of CalEnviroScreen Scores for pollution burden from 2014 to 2017 to 2021 | ||

| Population Characteristics | Mean of CalEnviroScreen Scores for population characteristics from 2014 to 2017 to 2021 |

| Level | Variable | Category | Mean | SD 1 | Min | Max |

|---|---|---|---|---|---|---|

| Rebate | ||||||

| Rebate (USD) | 2797.59 | 1023.64 | 109.91 | 8803.31 | ||

| lnRebate (USD) | 7.88 | 0.34 | 4.70 | 9.08 | ||

| Fuel (%) | ||||||

| BEV 2 | 67.21 | |||||

| FCEV 3 | 2.51 | |||||

| PHEV 4 | 30.28 | |||||

| Time | ||||||

| 29 March 2016 (%) | ||||||

| Before | 28.26 | |||||

| After | 71.74 | |||||

| 3 December 2019 (%) | ||||||

| Before | 73.65 | |||||

| After | 26.35 | |||||

| Year (%) | ||||||

| 2011 | 0.85 | |||||

| 2012 | 2.25 | |||||

| 2013 | 5.95 | |||||

| 2014 | 8.94 | |||||

| 2015 | 9.44 | |||||

| 2016 | 8.95 | |||||

| 2017 | 9.59 | |||||

| 2018 | 14.56 | |||||

| 2019 | 14.06 | |||||

| 2020 | 8.49 | |||||

| 2021 | 9.60 | |||||

| 2022 | 7.32 | |||||

| Census Tract | ||||||

| Infrastructure | ||||||

| EVSE 5 + Hydrogen Stations | 1.67 | 7.25 | 0 | 307 | ||

| EVSE | 1.67 | 7.24 | 0 | 307 | ||

| Hydrogen Stations | 0.01 | 0.09 | 0 | 1 | ||

| Race | ||||||

| 18 Years and Older | 3543.15 | 1274.95 | 2 | 31,280 | ||

| White Alone, Not Hispanic | 1342.55 | 1001.33 | 0 | 17,307 | ||

| Black or African American Alone, Not Hispanic | 192.02 | 296.61 | 0 | 4137 | ||

| American Indian and Alaska Native Alone, Not Hispanic | 13.07 | 26.07 | 0 | 926 | ||

| Asian Alone, Not Hispanic | 567.79 | 701.01 | 0 | 7158 | ||

| Native Hawaiian and Other Pacific Islander Alone, Not Hispanic | 12.51 | 21.06 | 0 | 380 | ||

| Some Other Race Alone, Not Hispanic | 18.59 | 12.48 | 0 | 256 | ||

| Two or More Races, Not Hispanic | 123.13 | 77.84 | 1 | 1681 | ||

| Hispanic/Latino | 1273.48 | 971.96 | 0 | 8851 | ||

| Sales | ||||||

| ZEV 6 | 1337.60 | 1249.60 | 0 | 8822 | ||

| BEV | 900.90 | 907.70 | 0 | 6775 | ||

| FCEV | 15.32 | 19.74 | 0 | 152 | ||

| PHEV | 421.38 | 350.71 | 0 | 2134 | ||

| Score | ||||||

| CalEnviroScreen | 27.37 | 15.34 | 1.88 | 92.16 | ||

| Pollution Burden | 5.08 | 1.50 | 1.29 | 9.74 | ||

| Population Characteristics | 5.15 | 1.99 | 0.69 | 9.74 |

| Level (n) | Variable | Category | Aggregate (SE 1) | Disaggregate (SE) |

|---|---|---|---|---|

| Rebate (383,345) | ||||

| Fuel | ||||

| BEV 2 | Referent | Referent | ||

| FCEV 3 | +2764.64 (10.34) *** | +2764.87 (10.35) *** | ||

| PHEV 4 | −1070.19 (3.19) *** | −1070.36 (3.19) *** | ||

| Census Tract (6713) | ||||

| Intercept | +3098.54 (3.06) *** | +3102.54 (3.15) *** | ||

| Infrastructure | ||||

| EVSE 5 + Hydrogen Stations | −0.41 (0.31) | |||

| EVSE | +0.19 (0.35) | |||

| Hydrogen Stations | +1.66 (17.84) | |||

| Race | ||||

| 18 Years and Older | −0.0049 (0.0026) * | |||

| White Alone, Not Hispanic | +0.025 (0.0065) *** | |||

| Black or African American Alone, Not Hispanic | −0.0060 (0.012) | |||

| American Indian and Alaska Native Alone, Not Hispanic | +0.31 (0.17) * | |||

| Asian Alone, Not Hispanic | +0.017 (0.0042) *** | |||

| Native Hawaiian and Other Pacific Islander Alone, Not Hispanic | −0.91 (0.16) *** | |||

| Some Other Race Alone, Not Hispanic | −0.099 (0.25) | |||

| Two or More Races, Not Hispanic | −0.47 (0.095) *** | |||

| Hispanic/Latino | +0.012 (0.0045) *** | |||

| Sales | ||||

| ZEV 6 | −0.0017 (0.0015) | |||

| BEV | +0.0029 (0.0054) | |||

| FCEV | +0.044 (0.15) | |||

| PHEV | −0.017 (0.015) | |||

| Score | ||||

| CalEnviroScreen | +4.97 (0.21) *** | |||

| Pollution Burden | +7.58 (1.86) *** | |||

| Population Characteristics | +33.45 (2.28) *** |

| Level (n) | Variable | Category | Aggregate (SE 1) | Disaggregate (SE) |

|---|---|---|---|---|

| Rebate (383,345) | ||||

| Fuel | ||||

| BEV 2 | Referent | Referent | ||

| FCEV 3 | +2840.24 (9.42) *** | +2840.46 (9.43) *** | ||

| PHEV 4 | −1176.81 (2.92) *** | −1177.61 (2.92) *** | ||

| Time (58,939) | ||||

| 29 March 2016 (After = 1) | +21.10 (10.42) ** | +21.73 (10.45) ** | ||

| 3 December 2019 (After = 1) | −21.83 (142.88) | −40.60 (142.01) | ||

| Year | ||||

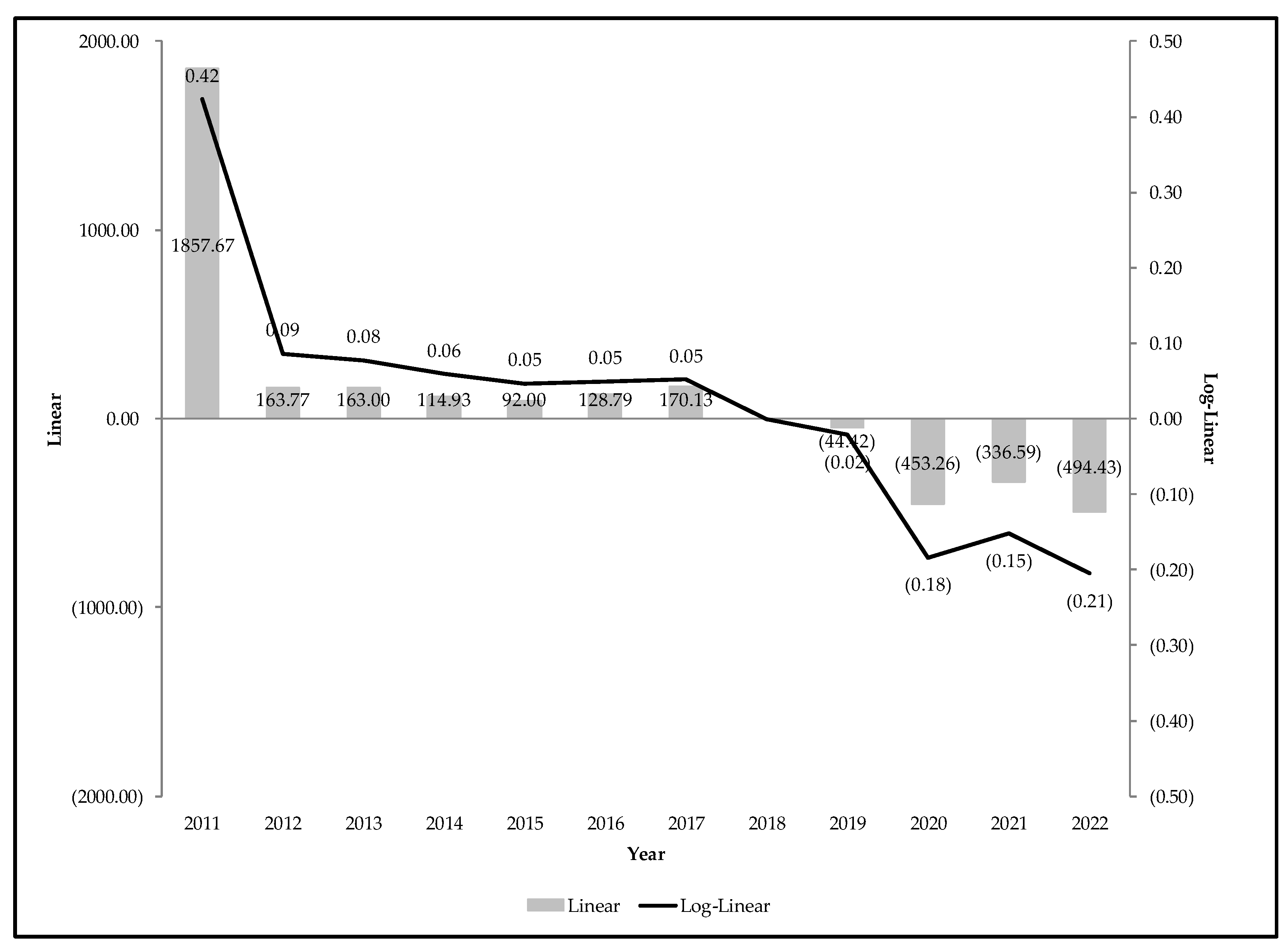

| 2011 | +1853.19 (32.97) *** | +1857.67 (32.97) *** | ||

| 2012 | +160.93 (11.29) *** | +163.77 (11.31) *** | ||

| 2013 | +160.15 (11.04) *** | +163.00 (11.06) *** | ||

| 2014 | +113.14 (10.98) *** | +114.93 (11.00) *** | ||

| 2015 | +89.91 (10.94) *** | +92.00 (10.96) *** | ||

| 2016 | +127.49 (4.22) *** | +128.79 (4.21) *** | ||

| 2017 | +169.52 (5.05) *** | +170.13 (5.04) *** | ||

| 2018 | Referent | Referent | ||

| 2019 | −43.88 (4.32) *** | −44.42 (4.32) *** | ||

| 2020 | −471.53 (143.04) *** | −453.26 (142.16) *** | ||

| 2021 | −354.02 (143.07) ** | −336.59 (142.20) ** | ||

| 2022 | −511.07 (143.15) *** | −494.43 (142.27) *** | ||

| Census Tract (6713) | ||||

| Intercept | +3200.61 (10.85) *** | +3206.65 (10.91) *** | ||

| Infrastructure | ||||

| EVSE 5 + Hydrogen Stations | −1.15 (0.39) *** | |||

| EVSE | −0.26 (0.34) | |||

| Hydrogen Stations | −10.14 (18.91) | |||

| Race | ||||

| 18 Years and Older | +0.0027 (0.0022) | |||

| White Alone, Not Hispanic | +0.020 (0.0052) *** | |||

| Black or African American Alone, Not Hispanic | −0.0056 (0.011) | |||

| American Indian and Alaska Native Alone, Not Hispanic | +0.47 (0.16) *** | |||

| Asian Alone, Not Hispanic | +0.027 (0.0043) *** | |||

| Native Hawaiian and Other Pacific Islander Alone, Not Hispanic | −0.73 (0.14) *** | |||

| Some Other Race Alone, Not Hispanic | −0.50 (0.22) ** | |||

| Two or More Races, Not Hispanic | −0.41 (0.066) *** | |||

| Hispanic/Latino | +0.032 (0.0042) *** | |||

| Sales | ||||

| ZEV 6 | +0.020 (0.0015) *** | |||

| BEV | −0.023 (0.0046) *** | |||

| FCEV | +0.41 (0.15) *** | |||

| PHEV | −0.017 (0.014) | |||

| Score | ||||

| CalEnviroScreen | +7.36 (0.21) *** | |||

| Pollution Burden | +6.47 (1.87) *** | |||

| Population Characteristics | +47.64 (2.25) *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zolnik, E.; Kan, U. Incentivizing the Transition to Alternative Fuel Vehicles: Case Study on the California Vehicle Rebate Program. Sustainability 2025, 17, 4988. https://doi.org/10.3390/su17114988

Zolnik E, Kan U. Incentivizing the Transition to Alternative Fuel Vehicles: Case Study on the California Vehicle Rebate Program. Sustainability. 2025; 17(11):4988. https://doi.org/10.3390/su17114988

Chicago/Turabian StyleZolnik, Edmund, and Unchitta Kan. 2025. "Incentivizing the Transition to Alternative Fuel Vehicles: Case Study on the California Vehicle Rebate Program" Sustainability 17, no. 11: 4988. https://doi.org/10.3390/su17114988

APA StyleZolnik, E., & Kan, U. (2025). Incentivizing the Transition to Alternative Fuel Vehicles: Case Study on the California Vehicle Rebate Program. Sustainability, 17(11), 4988. https://doi.org/10.3390/su17114988