How Oil Prices Impact the Japanese and South Korean Economies: Evidence from the Stock Market and Implications for Energy Security

Abstract

1. Introduction

2. Literature Review

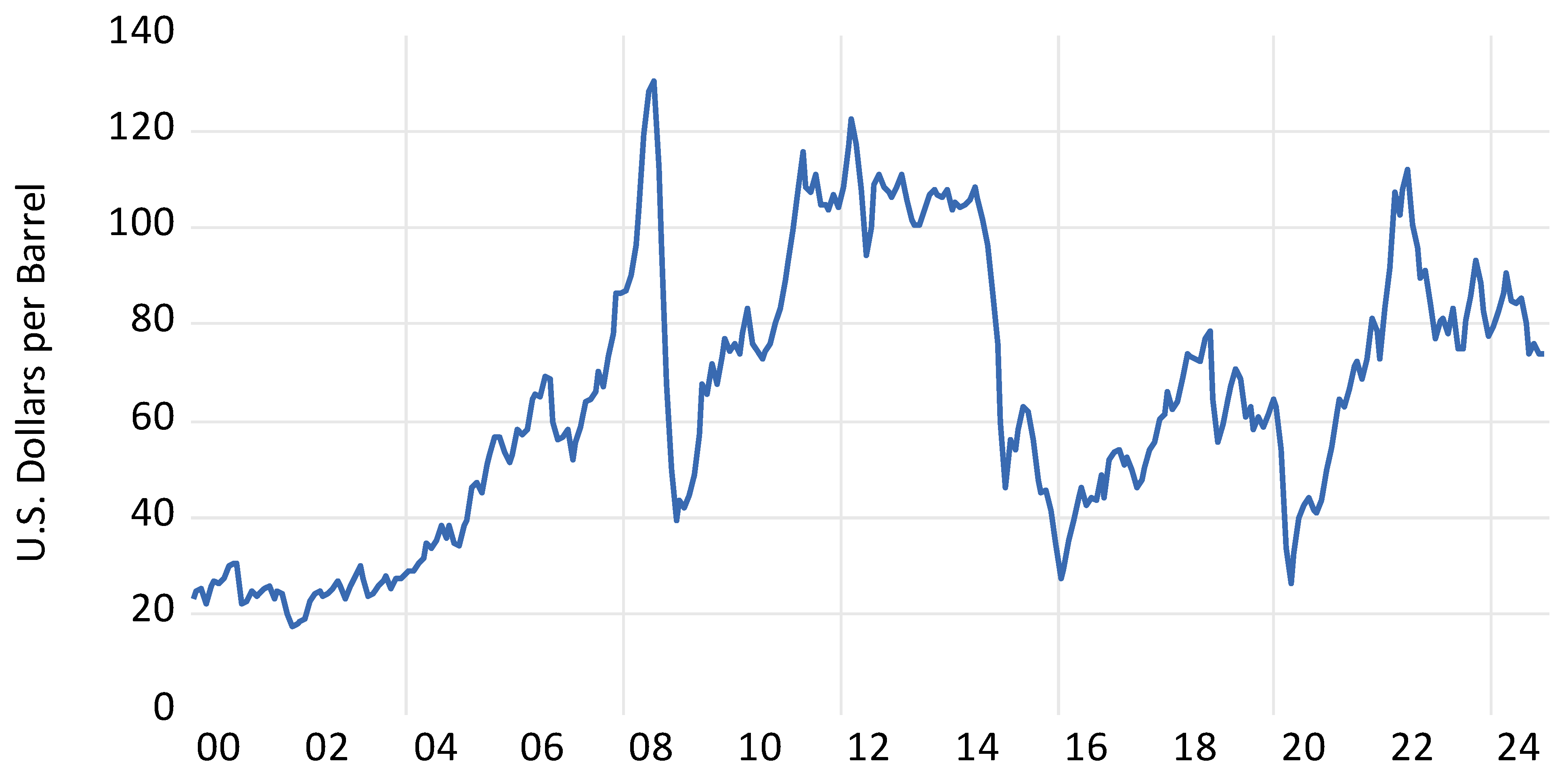

3. Materials and Methods

4. Results

4.1. Results for Japan

4.2. Results for South Korea

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| (1) | (2) | (3) | (4) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|

| Sector | Adjusted R-Squared | S.E.R. | Breusch–Godfrey Serial Correlation LM Test (2lags) | Heteroskedasticity Test: Breusch–Pagan–Godfrey | ADF Test Statistic (Intercept only) | ADF Test Statistic (Intercept and Trend) | ADF Test Statistic (No Intercept or Trend) |

| Airlines | 0.234 | 0.055 | 1.00 | 0.790 | −16.8 *** | −16.8 *** | −16.8 *** |

| Aluminum | 0.444 | 0.071 | 2.58 * | 1.66 | −14.8 *** | −14.8 *** | −14.8 *** |

| Automobiles | 0.700 | 0.036 | 1.78 | 1.06 | −14.9 *** | −14.9 *** | −14.9 *** |

| Auto Parts | 0.754 | 0.035 | 0.035 | 1.21 | −14.7 *** | −14.7 *** | −14.7 *** |

| Banks | 0.667 | 0.042 | 1.34 | 1.20 | −14.8 *** | −14.8 *** | −14.8 *** |

| Biotechnology | 0.078 | 0.129 | 1.53 | 1.14 | −16.2 *** | −16.2 *** | −16.2 *** |

| Cement | 0.342 | 0.074 | 0.06 | 1.73 | −16.5 *** | −16.5 *** | −16.6 *** |

| Chemicals | 0.830 | 0.025 | 2.42 * | 1.22 | −14.7 *** | −14.7 *** | −14.7 *** |

| Construction | 0.408 | 0.051 | 2.05 | 0.86 | −16.9 *** | −16.9 *** | −16.9 *** |

| Consumer Electronics | 0.552 | 0.058 | 0.19 | 1.75 | −14.4 *** | −14.5 *** | −14.4 *** |

| Consumer Staples | 0.857 | 0.020 | 0.16 | 2.06 * | −12.5 *** | −12.5 *** | −12.5 *** |

| Cosmetics | 0.296 | 0.051 | 0.053 | 0.34 | −15.3 *** | −15.4 *** | −15.0 *** |

| Delivery Services | 0.379 | 0.051 | 1.21 | 0.20 | −15.6 *** | −15.7 *** | −15.7 *** |

| Electronic and Electrical Equipment | 0.809 | 0.028 | 0.60 | 0.54 | −14.7 *** | −14.7 *** | −14.6 *** |

| Electronic Equipment: Controls | 0.400 | 0.063 | 041 | 1.44 | −8.6 *** | −8.6 *** | −8.6 *** |

| Electronic Equipment: Gauges | 0.754 | 0.032 | 0.08 | 0.60 | −13.1 *** | −13.2 *** | −13.0 *** |

| Electronic Equipment: Pollution | 0.279 | 0.065 | 5.88 *** | 2.83 ** | −15.0 *** | −15.0 *** | −15.0 *** |

| Electronic Office Equipment | 0.611 | 0.040 | 4.31 ** | 3.74 *** | −13.3 *** | −13.3 *** | −13.4 *** |

| Electricity | 0.144 | 0.063 | 0.93 | 1.05 | −16.2 *** | −16.1 *** | −16.2 *** |

| Electronic Component | 0.778 | 0.033 | 0.67 | 0.33 | −14.6 *** | −14.6 *** | −14.6 *** |

| Fishing and Farming | 0.319 | 0.045 | 0.09 | 0.46 | −14.4 *** | −14.4 *** | −14.4 *** |

| Fertilizers | 0.237 | 0.086 | 0.11 | 2.06 * | −13.6 *** | −13.6 *** | −13.6 *** |

| Food Producers | 0.414 | 0.030 | 0.40 | 1.49 | −17.3 *** | −17.3 *** | −17.1 *** |

| Food Retail and Wholesale | 0.382 | 0.043 | 1.41 | 0.96 | −16.3 *** | −16.4 *** | −16.3 *** |

| Gas Distribution | 0.211 | 0.038 | 0.10 | 0.72 | −15.4 *** | −15.4 *** | −15.4 *** |

| General Industrials | 0.702 | 0.040 | 0.90 | 3.91 *** | −13.7 *** | −13.6 *** | −13.7 *** |

| Health Care | 0.549 | 0.029 | 0.72 | 1.09 | −14.3 *** | −14.2 *** | −14.3 *** |

| Home Furnishings | 0.389 | 0.043 | 1.08 | 0.55 | −15.9 *** | −15.9 *** | −15.9 *** |

| Home Construction | 0.597 | 0.040 | 3.66 ** | 1.66 | −15.5 *** | −15.5 *** | −15.6 *** |

| Hotels | 0.391 | 0.055 | 0.06 | 0.81 | −14.8 *** | −14.8 *** | −14.8 *** |

| Industrial Engineering | 0.821 | 0.029 | 1.21 | 1.16 | −14.4 *** | −14.4 *** | −14.4 *** |

| Industrial Suppliers | 0.632 | 0.045 | 3.54 ** | 3.91 ** | −14.4 *** | −14.4 *** | −14.3 *** |

| Industrial Materials | 0.347 | 0.057 | 2.47 * | 2.01 | −16.0 *** | −16.0 *** | −16.0 *** |

| International Oil and Gas | 0.460 | 0.057 | 0.50 | 2.37 * | −13.8 *** | −13.8 *** | −13.8 *** |

| Iron and Steel | 0.664 | 0.047 | 0.25 | 0.57 | −14.6 *** | −14.5 *** | −14.6 *** |

| Leisure Goods | 0.703 | 0.036 | 0.21 | 1.79 | −12.7 *** | −12.7 *** | −12.7 *** |

| Luxury Items | 0.452 | 0.064 | 0.60 | 1.73 | −13.5 *** | −13.5 *** | −13.6 *** |

| Machinery: Agriculture | 0.509 | 0.063 | 9.08 *** | 1.62 | −15.3 *** | −15.3 *** | −15.2 *** |

| Machinery: Construction | 0.607 | 0.058 | 0.38 | 1.64 | −14.6 *** | −14.5 *** | −14.6 *** |

| Machinery: Industrial | 0.759 | 0.033 | 0.88 | 1.35 | −14.7 *** | −14.7 *** | −14.7 *** |

| Machinery: Specialized | 0.661 | 0.045 | 0.19 | 5.70*** | −13.8 *** | −13.8 *** | −13.8 *** |

| Machinery: Tools | 0.633 | 0.052 | 2.03 | 2.32 * | −12.9 *** | −12.8 *** | −12.9 *** |

| Marine Transport | 0.538 | 0.064 | 0.96 | 1.44 | −15.6 *** | −15.6 *** | −15.6 *** |

| Medical Equipment | 0.461 | 0.046 | 0.67 | 1.61 | −15.5 *** | −15.3 *** | −15.5 *** |

| Nonferrous Metals | 0.599 | 0.056 | 2.51 * | 0.68 | −15.3 *** | −15.3 *** | −15.3 *** |

| Oil Equipment and Services | 0.446 | 0.089 | 1.27 | 2.15 * | −14.9 *** | −14.9 *** | −15.0 *** |

| Oil Refining and Marketing | 0.319 | 0.064 | 1.34 | 1.76 | −13.1 *** | −13.1 *** | −13.2 *** |

| Oil: Crude Production | 0.492 | 0.055 | 3.57 ** | 1.49 | −14.1 *** | −14.1 *** | −14.1 *** |

| Pharmaceuticals | 0.456 | 0.034 | 2.79 * | 0.84 | −15.2 *** | −15.3 *** | −15.1 *** |

| Railroads | 0.460 | 0.031 | 0.43 | 0.25 | −16.3 *** | −16.3 *** | −16.3 *** |

| Restaurants and Bars | 0.413 | 0.032 | 1.29 | 0.44 | −14.9 *** | −15.1 *** | −14.9 *** |

| Semiconductors | 0.596 | 0.057 | 0.03 | 0.92 | −13.3 *** | −13.3 *** | −13.4 *** |

| Technology Hardware | 0.739 | 0.037 | 0.96 | 0.63 | −13.0 *** | −13.1 *** | −13.0 *** |

| Tires | 0.470 | 0.053 | 0.79 | 1.78 | −16.8 *** | −16.7 *** | −16.7 *** |

| Transport Services | 0.576 | 0.041 | 3.23 ** | 1.41 | −15.5 *** | −15.4 *** | −15.4 *** |

| Travel and Leisure | 0.542 | 0.031 | 0.32 | 1.54 | −15.2 *** | −15.3 *** | −15.2 *** |

| Trucking | 0.481 | 0.037 | 1.39 | 0.61 | −15.7 *** | −15.7 *** | −15.7 *** |

| (1) | (2) | (3) | (4) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|

| Sector | Adjusted R-Squared | S.E.R. | Breusch–Godfrey Serial Correlation LM Test (2lags) | Heteroskedasticity Test: Breusch–Pagan–Godfrey | ADF Test Statistic (Intercept Only) | ADF Test Statistic (Intercept and Trend) | ADF Test Statistic (No Intercept or Trend) |

| Airlines | 0.378 | 0.097 | 2.46 * | 1.81 | −15.5 *** | −15.5 *** | −15.4 *** |

| Asset Managers | 0.087 | 0.064 | 1.40 * | 2.36 * | −11.0 *** | −11.2 *** | −10.9 *** |

| Auto Parts | 0.423 | 0.068 | 0.33 | 0.49 | −13.7 *** | −13.8 *** | −13.5 *** |

| Automobiles | 0.408 | 0.072 | 1.07 | 2.93 ** | −14.0 *** | −14.0 *** | −14.0 *** |

| Banks | 0.642 | 0.051 | 1.13 | 6.80 *** | −14.2 *** | −14.3 *** | −14.2 *** |

| Basic Materials | 0.646 | 0.043 | 0.21 | 1.05 | −13.2 *** | −13.3 *** | −13.5 *** |

| Basic Resources | 0.536 | 0.052 | 2.32 | 1.25 | −13.9 *** | −14.0 *** | −13.8 *** |

| Biotechnology | 0.039 | 0.160 | 2.42 * | 1.22 | −12.3 *** | −12.3 *** | −12.1 *** |

| Casinos/Gambling | 0.136 | 0.076 | 2.45 * | 1.19 | −16.2 *** | −16.2 *** | −16.2 *** |

| Cement | 0.265 | 0.128 | 2.59 * | 1.47 | −16.1 *** | −16.1 *** | −16.1 *** |

| Chemicals | 0.486 | 0.069 | 1.97 | 0.70 | −13.9 *** | −14.0 *** | −13.8 *** |

| Commercial Vehicles and Parts | 0.378 | 0.094 | 1.39 | 0.43 | −16.7 *** | −16.7 *** | −16.4 *** |

| Computer Hardware | 0.262 | 0.085 | 1.37 | 0.90 | −12.8 *** | −12.9 *** | −12.8 *** |

| Computer Services | 0.061 | 0.080 | 0.48 | 0.63 | −11.1 *** | −11.3 *** | −10.9 *** |

| Consumer Digital Services | 0.296 | 0.100 | 1.05 | 0.70 | −14.9 *** | −14.9 *** | −14.6 *** |

| Construction and Materials | 0.525 | 0.023 | 2.73 * | 0.40 | −14.9 *** | −15.2 *** | −14.9 *** |

| Construction | 0.435 | 0.074 | 0.27 ** | 1.60 ** | −15.0 *** | −15.4 *** | −15.0 *** |

| Consumer Discretionary | 0.691 | 0.039 | 2.20 | 0.49 | −13.3 *** | −13.3 *** | −13.1 *** |

| Consumer Electronics | 0.49 | 0.070 | 0.45 | 0.57 | −13.6 *** | −13.5 *** | −13.6 *** |

| Consumer Products and Services | 0.519 | 0.040 | 3.46 ** | 0.26 | −13.9 *** | −13.9 *** | −13.6 *** |

| Consumer Staples | 0.672 | 0.040 | 2.73 * | 0.30 | −13.8 *** | −13.8 *** | −13.6 *** |

| Cosmetics | 0.106 | 0.095 | 0.14 | 1.55 | −15.1 *** | −15.4 *** | −14.7 *** |

| Diversified Industrials | 0.526 | 0.069 | 2.27 | 0.60 | −14.4 *** | −14.4 *** | −14.3 *** |

| Diversified Retail | 0.365 | 0.066 | 0.13 | 1.23 | −14.2 *** | −14.6 *** | −16.2 *** |

| Drug/Grocery Stores | 0.114 | 0.091 | 1.04 | 0.76 | −13.3 *** | −13.4 *** | −13.1 *** |

| Electronic Entertainment | 0.091 | 0.121 | 0.07 | 2.09 * | −14.7 *** | −14.7 *** | −14.6 *** |

| Electricity | 0.185 | 0.067 | 1.52 | 1.20 | −15.4 *** | −15.4 *** | −15.4 *** |

| Electronic Components | 0.424 | 0.074 | 0.28 | 0.76 | −13.1 *** | −13.2 *** | −13.0 *** |

| Energy | 0.443 | 0.069 | 1.37 | 0.55 | −16.2 *** | −16.3 *** | −16.1 *** |

| Financial Data Providers | 0.294 | 0.077 | 1.95 | 3.95 *** | −13.6 *** | −13.6 *** | −13.6 *** |

| Food Producers | 0.269 | 0.061 | 1.12 | 4.13 *** | −15.8 *** | −15.6 *** | −15.7 *** |

| Health Care | 0.063 | 0.111 | 2.67 * | 0.10 | −17.6 *** | −17.6 *** | −17.2 *** |

| Household Equip. Production | 0.207 | 0.091 | 2.93 * | 0.40 | −12.6 *** | −12.8 *** | −12.4 *** |

| Industrial Engineering | 0.470 | 0.082 | 0.57 | 0.39 | −15.1 *** | −15.4 *** | −15.1 *** |

| Industrial Goods and Services | 0.740 | 0.041 | 0.68 | 0.52 | −14.4 *** | −14.6 *** | −14.4 *** |

| Industrial Metals and Mines | 0.535 | 0.052 | 2.19 | 0.27 | −13.9 *** | −14.0 *** | −13.9 *** |

| Industrial Support Systems | 0.301 | 0.071 | 1.64 | 4.33 *** | −17.0 *** | −17.2 *** | −17.0 *** |

| Industrial Transport | 0.427 | 0.074 | 2.16 | 0.96 | −16.0 *** | −16.1 *** | −16.0 *** |

| Insurance | 0.439 | 0.046 | 2.19 | 0.67 | −15.2 *** | −15.6 *** | −15.1 *** |

| Investment Banks and Brokers | 0.662 | 0.059 | 0.10 | 1.12 | −16.5 *** | −16.5 *** | −16.5 *** |

| Iron and Steel | 0.495 | 0.057 | 1.78 | 1.41 | −14.0 *** | −13.9 *** | −13.9 *** |

| Leisure Goods | 0.434 | 0.067 | 2.12 | 0.13 | −13.2 *** | −13.2 *** | −13.2 *** |

| Life Insurance | 0.218 | 0.047 | 0.96 | 1.01 | −12.0 *** | −12.0 *** | −11.9 *** |

| Machinery: Industrial | 0.310 | 0.118 | 0.18 | 0.92 | −15.7 *** | −15.8 *** | −15.6 *** |

| Marine Transport | 0.418 | 0.085 | 0.03 | 0.83 | −14.4 *** | −14.5 *** | −14.4 *** |

| Nonlife Insurance | 0.402 | 0.060 | 2.15 | 0.81 | −15.5 *** | −15.7 *** | −15.3 *** |

| Oil Refining and Marketing | 0.295 | 0.081 | 0.72 | 1.45 | −15.7 *** | −13.1 *** | −13.2 *** |

| Personal Goods | 0.172 | 0.078 | 0.03 | 1.13 | −14.6 *** | −14.9 *** | −14.1 *** |

| Personal Product | 0.118 | 0.092 | 1.09 | 0.78 | −13.3 *** | −13.5 *** | −13.1 *** |

| Pharmaceutical and Biotech | 0.063 | 0.111 | 2.67 * | 0.09 | −17.6 *** | −17.6 *** | −17.2 *** |

| Pharmaceuticals | 0.038 | 0.137 | 3.36 ** | 0.15 | −8.6 *** | −8.6 *** | −8.6 *** |

| Precious Metals and Mines | 0.299 | 0.097 | 2.12 | 2.27 * | −13.1 *** | −13.1 *** | −13.0 *** |

| Retailers | 0.360 | 0.065 | 0.25 | 1.43 | −14.3 *** | −14.8 *** | −14.3 *** |

| Software and Computer Services | 0.299 | 0.096 | 0.08 | 0.99 | −15.8 *** | −15.4 *** | −15.9 *** |

| Security Systems | 0.109 | 0.071 | 6.10 *** | 8.92 *** | −18.9 *** | −19.0 *** | −19.6 *** |

| Semiconductors | 0.236 | 0.142 | 1.46 | 1.32 | −3.8 *** | −4.1 *** | −3.8 *** |

| Technology Hardware | 0.403 | 0.082 | 0.36 | 2.25 * | −13.6 *** | −13.7 *** | −13.6 *** |

| Telecommunication Equipment | 0.198 | 0.078 | 3.12 ** | 1.08 | −13.3 *** | −13.4 *** | −13.2 *** |

| Telecommunication Service Providers | 0.196 | 0.055 | 2.82 * | 0.95 | −16.7 *** | −16.7 *** | −16.7 *** |

| Tires | 0.252 | 0.083 | 0.91 | 0.76 | −16.0 *** | −16.3 *** | −15.8 *** |

| Tobacco | 0.025 | 0.061 | 1.52 | 0.83 | −16.1 *** | −15.8 *** | −16.0 *** |

| Transport Services | 0.081 | 0.071 | 0.64 | 0.35 | −12.3 *** | −12.4 *** | −12.3 *** |

| Travel and Leisure | 0.408 | 0.058 | 3.06 ** | 1.99 * | −14.8 *** | −14.9 *** | −14.8 *** |

| Trucking | 0.098 | 0.105 | 1.96 | 1.52 | −14.2 *** | −14.2 *** | −14.2 *** |

References

- Fernald, J.; Trehan, B. Why Hasn’t the Jump in Oil Prices Led to a Recession? FRBSF Economic Letter 2005-31; Federal Reserve Bank of San Francisco: San Francisco, CA, USA, 2005. [Google Scholar]

- Golub, S. Oil Prices and Exchange Rates. Econ. J. 1983, 93, 576–593. [Google Scholar] [CrossRef]

- Hamilton, J. Oil Prices as an Indicator of Global Economic Conditions. Weblog Post. Econbrowser.com, 14 December 2014. [Google Scholar]

- Black, F. Business Cycles and Equilibrium; Basil Blackwell: New York, NY, USA, 1987. [Google Scholar]

- Kilian, L. Not All Oil Price Shocks Are Alike: Disentangling Demand and Supply Shocks in the Crude Oil Market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef]

- Fukunaga, I.; Hirakata, N.; Sudo, N. The Effects of Oil Price Changes on the Industry-Level and Prices in the U.S. and Japan; NBER Working Paper 15791; National Bureau of Economic Research: Cambridge, MA, USA, 2010. [Google Scholar]

- Liu, J.; Nissim, D.; Thomas, J. Is Cash Flow King in Valuations? Financ. Anal. J. 2007, 63, 1–13. [Google Scholar] [CrossRef]

- Chatelais, N.; Stalla-Bourdillon, A.; Chinn, M. Forecasting Real Activity using Cross-Sectoral Stock Market Information. J. Int. Money Financ. 2023, 131, 102800. [Google Scholar] [CrossRef]

- McMillan, D. Predicting GDP Growth with Stock and Bond Markets: Do They Contain Different Information? Int. J. Financ. Econ. 2021, 26, 3651–3675. [Google Scholar] [CrossRef]

- Croux, C.; Reusens, P. Do Stock Prices Contain Predictive Power for the Future Economic Activity? A Granger Causality Analysis in the Frequency Domain. J. Macroecon. 2013, 35, 93–103. [Google Scholar] [CrossRef]

- Barro, R. The Stock Market and Investment. Rev. Financ. Stud. 1990, 3, 115–131. [Google Scholar] [CrossRef]

- Schwert, G. Stock Returns and Real Activity: A Century of Evidence. J. Financ. 1990, 45, 1237–1257. [Google Scholar] [CrossRef]

- Velinov, A.; Chen, W. Do Stock Prices Reflect their Fundamentals. New Evidence in the Aftermath of the Financial Crisis. J. Econ. Bus. 2015, 80, 1–20. [Google Scholar] [CrossRef]

- Abhyankar, A.; Xu, B.; Wang, J. Oil Price Shocks and the Stock Market: Evidence from Japan. Energy J. 2013, 34, 199–222. [Google Scholar] [CrossRef]

- Batten, J.A.; Kinateder, H.; Szilagyi, P.; Wagner, N. Can Stock Market Investors Hedge Energy Risk? Evidence from Asia. Energy Econ. 2017, 66, 559–570. [Google Scholar] [CrossRef]

- Kotsompolis, G.; Konstantakis, K.; Stamos, D.; Michaelides, P. Oil Prices and Developing Stock Markets: Evidence from East Asia. Dev. Sustain. Econ. Financ. 2024, 1, 1000006. [Google Scholar] [CrossRef]

- Delle Chiaie, S.; Ferrara, L.; Gianonne, D. Common Factors of Commodity Prices. J. Appl. Econ. 2022, 37, 461–474. [Google Scholar] [CrossRef]

- Matsumoto, A.; Pescatore, A.; Wang, X. Commodity Prices and Global Economic Activity. Jpn. World Econ. 2023, 66, 101177. [Google Scholar] [CrossRef]

- Hamilton, J. Measuring Global Economic Activity. J. Appl. Econ. 2021, 36, 293–303. [Google Scholar] [CrossRef]

- Demirer, R.; Ferrer, R.; Shazad, S.J.H. Oil Price Shocks, Global Financial Markets, and their Connectedness. Energy Econ. 2020, 88, 104771. [Google Scholar] [CrossRef]

- Bernanke, B. The Relationship between Stocks and Oil Prices. Weblog Post. Ben Bernanke’s Blog on Brookings, 19 February 2016. [Google Scholar]

- Campbell, J. A Variance Decomposition for Stock Returns. Econ. J. 1991, 101, 151–179. [Google Scholar] [CrossRef]

- Kilian, L.; Park, C. The Impact of Oil Price Shocks on the U.S. Stock Market. Int. Econ. Rev. 2009, 50, 1267–1287. [Google Scholar] [CrossRef]

- Ito, T.; Koibuchi, S.; Sato, K.; Shimizu, J. Exchange Rate Exposure and Risk Management: The Case of Japanese Exporting Firms. J. Jpn. Int. Econ. 2016, 41, 17–29. [Google Scholar] [CrossRef]

- Dominguez, M.; Tesar, L. Exchange Rate Exposure. J. Int. Econ. 2006, 68, 188–218. [Google Scholar] [CrossRef]

- Chen, N.; Roll, R.; Ross, S. Economic Forces and the Stock Market. J. Bus. 1986, 59, 383–403. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Rasoulinezhad, E.; Yoshino, N. Energy and Food Security: Linkages through Price Volatility. Energy Policy 2019, 128, 796–806. [Google Scholar] [CrossRef]

- Ready, R.C. Oil Prices and the Stock Market. Rev. Financ. 2017, 22, 155–176. [Google Scholar] [CrossRef]

- Hari, V. Asia is Caught in the Crossfire of Erratic U.S. Energy Policy. Nikkei Asia, 18 February 2025. [Google Scholar]

- Korea Energy Foundation. Switching to Sustainable Energy in the Republic of Korea. Nature Portfolio, 12 December 2018. [Google Scholar]

- Meng, X.; Yilmaz, S. Renewable Energy Cooperation in Northeast Asia: Incentives, Mechanisms and Challenges. Energy Strategy Rev. 2020, 29, 100468. [Google Scholar]

- Hama, M. Renewable Energy Wasted Worldwide due to Lack of Power Grids. Nikkei Asia, 14 September 2024. [Google Scholar]

- Dempsey, H. Japan’s $1.5bn Bet on Ultra-Thin Solar Cells in Challenge to China. Financial Times, 16 February 2025. [Google Scholar]

- Russell, C. Sky not the Only Limit for JAL and ANA’s Climate Goals. Japan Times, 16 February 2025. [Google Scholar]

- Terada, A. Japan Set to Welcome over 40 Million International Visitors in 2025. Honey J. Weblog. 2025. Available online: https://www.honeyj-tours.com (accessed on 25 March 2025).

- Straits Times. South Korea Tourism Surges in 2024 with Record Spending and Arrivals. Straits Times, 4 February 2025. [Google Scholar]

- Yanolja Research. South Korea’s 2025 Inbound Tourism Demand Forecast. 2025. Available online: https://www.yanolja-research.com (accessed on 25 March 2025).

- Nogueira, L.; Sherman, J.; Shultz, J. Derailing Carcinogens—Oncologists and the Ohio Train Derailment. JAMA Oncol. 2024, 10, 25–26. [Google Scholar]

- Mi, J.; Nanseki, T.; Chomei, Y.; Uenishi, Y. Determinants of ICT, Smart Farming Technology Adoption by Agricultural Corporations in Japan. J. Fac. Agric. Kyushu Univ. 2022, 67, 249–262. [Google Scholar] [CrossRef]

- Tanimoto, K. Japan’s Super Hotel Touts Net-zero Emissions with Eye on Gen Z. Nikkei Asia, 21 February 2025. [Google Scholar]

- Kim, H. Impact of Policy Incentives on Adoption of Electric Vehicles in South Korea; KDI FOCUS; Korean Development Institute: Sejong City, Republic of Korea, 2024. [Google Scholar]

- Gupta, U.; Kim, Y.; Lee, S.; Tse, J.; Lee, H.; Wei, G.; Brooks, D.; Wu, C. Chasing Carbon: The Elusive Environmental Footprint of Computing. IEEE International Symposium on High Performance Computer Architecture (HPCA). 2021. Available online: https://ieeexplore.ieee.org/document/9407142 (accessed on 15 November 2024).

- McKinsey. Sustainability in Semiconductor Operations: Towards Net-Zero Production. 2020. Available online: https://www.mckinsey.com/industries/semiconductors/our-insights/sustainability-in-semiconductor-operations-toward-net-zero-production (accessed on 15 November 2024).

- Salata Institute. Cutting the Carbon Footprint of Future Computer Chips; The Salata Institute for Climate and Sustainability at Harvard University: Cambridge, MA, USA, 2024. [Google Scholar]

- Kishida, F. Press Conference by the Prime Minister on the Measures to Address Oil Prices and Other Matters; Prime Minister’s Office of Japan: Tokyo, Japan, 2023.

- IMF. World Economic Outlook. Legacies, Clouds, Uncertainties; IMF: Washington, DC, USA, 2014. [Google Scholar]

| Country | Unit | Oil Products | Coal | Natural Gas | Electricity | Other |

|---|---|---|---|---|---|---|

| Japan | Terajoules | 5,346,282 | 746,387 | 1,161,807 | 364,210 | 95,578 |

| Japan | Percent of Total Energy Consumption | 49.4% | 6.9% | 11.7% | 30.1% | 2.9% |

| South Korea | Terajoules | 3,903,514 | 366,746 | 962,194 | 1,950,218 | 388,708 |

| South Korea | Percent of Total Energy Consumption | 51.5% | 4.8% | 12.7% | 25.7% | 5.3% |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|

| Sector | Coefficient on Dubai Oil Price Changes Driven by Aggregate Demand | S.E. | Coefficient on Dubai Oil Price Changes Driven by Oil Supply | S.E. | Coefficient on Total Dubai Oil Price Changes | S.E. | Coefficient on JPY/USD Exchange Rate | S.E. |

| Airlines | −0.235 *** | 0.082 | −0.087 * | 0.049 | −0.124 *** | 0.044 | −0.206 | 0.159 |

| Aluminum | 0.041 | 0.108 | 0.008 | 0.064 | 0.017 | 0.051 | −0.521 ** | 0.209 |

| Automobiles | 0.123 ** | 0.055 | 0.009 | 0.033 | 0.038 | 0.028 | 0.870 *** | 0.106 |

| Auto Parts | 0.155 *** | 0.053 | 0.003 | 0.031 | 0.041 | 0.034 | 0.674 *** | 0.102 |

| Banks | −0.114 * | 0.063 | 0.059 * | 0.038 | 0.015 | 0.030 | −0.301 ** | 0.123 |

| Biotechnology | 0.079 | 0.200 | −0.030 | 0.123 | −0.002 | 0.099 | 0.147 | 0.411 |

| Cement | −0.077 | 0.112 | 0.062 | 0.066 | 0.027 | 0.081 | −0.085 | 0.217 |

| Chemicals | 0.092 ** | 0.037 | −0.005 | 0.022 | 0.020 | 0.023 | 0.089 | 0.072 |

| Construction | −0.079 | 0.077 | −0.119 *** | 0.046 | −0.109 *** | 0.040 | −0.420 *** | 0.150 |

| Consumer Electronics | 0.315 *** | 0.087 | 0.004 | 0.052 | 0.082 * | 0.044 | 0.529 *** | 0.169 |

| Consumer Staples | 0.045 | 0.031 | 0.011 | 0.018 | 0.019 | 0.016 | 0.483 *** | 0.060 |

| Cosmetics | −0.134 * | 0.076 | 0.029 | 0.046 | −0.013 | 0.040 | −0.301 ** | 0.148 |

| Delivery Services | −0.211 *** | 0.077 | −0.041 | 0.046 | −0.084 ** | 0.037 | −0.113 | 0.150 |

| Electronic and Electrical Equipment | 0.191 *** | 0.043 | −0.001 | 0.025 | 0.048 ** | 0.023 | 0.394 *** | 0.083 |

| Electronic Equipment: Controls | 0.051 | 0.096 | 0.025 | 0.057 | 0.032 | 0.526 | −0.133 | 0.186 |

| Electronic Equipment: Gauges | 0.146 *** | 0.047 | −0.012 | 0.028 | 0.028 | 0.025 | 0.345 *** | 0.092 |

| Electronic Equipment: Pollution | 0.107 | 0.097 | 0.016 | 0.058 | 0.039 | 0.049 | −0.197 | 0.189 |

| Electronic Office Equipment | 0.179 *** | 0.060 | −0.061 * | 0.036 | −0.000 | 0.033 | 0.685 *** | 0.117 |

| Electricity | −0.253 *** | 0.095 | −0.104 * | 0.056 | −0.141 *** | 0.044 | −0.088 | 0.184 |

| Electronic Component | 0.213 *** | 0.050 | 0.011 | 0.030 | 0.062 ** | 0.026 | 0.324 *** | 0.096 |

| Fishing and Farming | −0.065 | 0.069 | 0.013 | 0.040 | −0.007 | 0.041 | 0.094 | 0.130 |

| Fertilizers | −0.216 * | 0.129 | −0.035 | 0.077 | −0.081 | 0.075 | 0.507 ** | 0.250 |

| Food Producers | −0.154 *** | 0.046 | −0.022 | 0.027 | −0.056 ** | 0.027 | −0.119 | 0.089 |

| Food Retail and Wholesale | −0.273 *** | 0.066 | −0.054 | 0.039 | −0.109 *** | 0.036 | −0.249 * | 0.128 |

| Gas Distribution | −0.233 *** | 0.057 | −0.040 | 0.034 | −0.089 ** | 0.035 | −0.121 | 0.111 |

| General Industrials | 0.184 *** | 0.061 | 0.026 | 0.036 | 0.066 ** | 0.033 | −0.086 | 0.118 |

| Healthcare | −0.133 *** | 0.043 | 0.013 | 0.026 | −0.023 | 0.020 | −0.140 * | 0.084 |

| Home Furnishings | −0.271*** | 0.066 | −0.021 | 0.039 | −0.083 ** | 0.033 | −0.189 | 0.127 |

| Home Construction | −0.141 ** | 0.060 | −0.082 ** | 0.036 | −0.097 *** | 0.032 | −0.224 * | 0.116 |

| Hotels | −0.285 *** | 0.083 | −0.035 | 0.050 | −0.098 ** | 0.045 | −0.223 | 0.162 |

| Industrial Engineering | 0.215 *** | 0.043 | 0.060 ** | 0.026 | 0.099 *** | 0.023 | 0.151 * | 0.084 |

| Industrial Suppliers | 0.426 *** | 0.065 | 0.148 *** | 0.038 | 0.219 *** | 0.031 | −0.021 | 0.127 |

| Industrial Materials | −0.181 ** | 0.085 | 0.123 ** | 0.050 | 0.046 | 0.060 | −0.414 ** | 0.164 |

| International Oil and Gas | 0.310 *** | 0.085 | 0.186 *** | 0.051 | 0.217 *** | 0.049 | 0.031 | 0.166 |

| Iron and Steel | 0.227 *** | 0.071 | 0.062 | 0.042 | 0.103 *** | 0.030 | 0.133 | 0.137 |

| Leisure Goods | 0.150 *** | 0.054 | 0.024 | 0.032 | 0.056 * | 0.032 | 0.287 *** | 0.105 |

| Luxury Items | 0.303 *** | 0.094 | −0.028 | 0.056 | 0.055 | 0.074 | 0.684 *** | 0.183 |

| Machinery: Agriculture | −0.068 | 0.094 | 0.033 | 0.056 | 0.007 | 0.055 | 0.221 | 0.183 |

| Machinery: Construction | 0.622 *** | 0.083 | 0.090 * | 0.049 | 0.225 *** | 0.043 | 0.589 *** | 0.160 |

| Machinery: Industrial | 0.183 *** | 0.049 | 0.053 * | 0.029 | 0.086 *** | 0.027 | 0.046 | 0.096 |

| Machinery: Specialized | 0.167 ** | 0.068 | 0.006 | 0.040 | 0.047 | 0.039 | 0.109 | 0.131 |

| Machinery: Tools | 0.224 *** | 0.078 | 0.009 | 0.047 | 0.063 | 0.043 | 0.224 | 0.152 |

| Marine Transport | 0.172 * | 0.097 | 0.101 * | 0.058 | 0.119 ** | 0.050 | 0.055 | 0.188 |

| Medical Equipment | 0.022 | 0.069 | 0.075 * | 0.041 | 0.061 * | 0.037 | 0.102 | 0.134 |

| Nonferrous Metals | 0.455 *** | 0.084 | 0.031 | 0.050 | 0.138 *** | 0.044 | −0.043 | 0.163 |

| Oil Equipment and Services | 0.283 ** | 0.139 | 0.299 *** | 0.088 | 0.295 *** | 0.063 | −0.600 | 0.282 |

| Oil Refining and Marketing | 0.220 ** | 0.096 | 0.199 *** | 0.057 | 0.204 *** | 0.055 | −0.022 | 0.187 |

| Oil: Crude Production | 0.298 *** | 0.083 | 0.289 *** | 0.049 | 0.291 *** | 0.047 | 0.194 | 0.161 |

| Pharmaceuticals | −0.163 *** | 0.050 | 0.007 | 0.030 | −0.036 | 0.023 | −0.162 * | 0.097 |

| Railroads | −0.229 *** | 0.047 | −0.018 | 0.028 | −0.071 *** | 0.021 | −0.267 *** | 0.091 |

| Restaurants and Bars | −0.251 *** | 0.049 | −0.048 * | 0.029 | −0.100 *** | 0.025 | −0.373 *** | 0.094 |

| Semiconductors | 0.166 * | 0.086 | −0.027 | 0.051 | 0.022 | 0.043 | 0.343 ** | 0.168 |

| Technology Hardware | 0.167 *** | 0.055 | −0.012 | 0.033 | 0.034 | 0.026 | 0.192 * | 0.108 |

| Tires | −0.025 | 0.080 | −0.119 ** | 0.048 | −0.096 ** | 0.042 | 0.855 *** | 0.156 |

| Transport Services | −0.191 *** | 0.061 | −0.015 | 0.037 | −0.059 * | 0.034 | −0.307 *** | 0.119 |

| Travel and Leisure | −0.264 *** | 0.046 | −0.031 | 0.027 | −0.090 *** | 0.020 | −0.285 *** | 0.089 |

| Trucking | −0.202 *** | 0.055 | −0.032 | 0.033 | −0.075 ** | 0.031 | −0.202 * | 0.107 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|

| Company | Coefficient on Dubai Oil Price Changes Driven by Aggregate Demand | S.E. | Coefficient on Dubai Oil Price Changes Driven by Oil Supply | S.E. | Coefficient on Total Dubai Oil Price Changes | S.E. | Coefficient on JPY/USD Exchange Rate | S.E. |

| Daio Paper | −0.352 ** | 0.145 | 0.155 ** | 0.075 | 0.027 | 0.081 | −0.303 | 0.264 |

| Japan Steel Works | 0.218 | 0.168 | 0.201 ** | 0.084 | 0.206 ** | 0.084 | −0.700 * | 0.383 |

| Komatsu | 0.696 *** | 0.133 | 0.107 ** | 0.045 | 0.256 *** | 0.041 | 0.626 *** | 0.187 |

| Marubeni | 0.345 *** | 0.107 | 0.185 *** | 0.065 | 0.224 *** | 0.050 | −0.497 * | 0.257 |

| Mitsui | 0.496 *** | 0.061 | 0.169 *** | 0.037 | 0.252 *** | 0.036 | −0.039 | 0.115 |

| Nikkiso | 0.029 | 0.148 | 0.190 *** | 0.069 | 0.149 ** | 0.072 | 0.036 | 0.237 |

| Nitto Boseki | 0.041 | 0.149 | 0.184 ** | 0.084 | 0.147 * | 0.078 | −0.145 | 0.231 |

| Oji Holdings | −0.112 | 0.108 | 0.153 ** | 0.070 | 0.086 | 0.067 | −0.260 | 0.219 |

| Tadano | −0.044 | 0.114 | 0.186 ** | 0.077 | 0.128 ** | 0.058 | 0.229 | 0.212 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|

| Sector | Coefficient on Dubai Oil Price Changes Driven by Aggregate Demand | S.E. | Coefficient on Dubai Oil Price Changes Driven by Oil Supply | S.E. | Coefficient on Total Dubai Oil Price Changes | S.E. | Coefficient on SKW/ USD Exchange Rate | S.E. |

| Airlines | −0.163 | 0.171 | −0.30 *** | 0.106 | −0.278 *** | 0.085 | −0.427 | 0.311 |

| Asset Managers | −0.081 | 0.075 | 0.056 | 0.042 | 0.021 | 0.038 | −0.092 | 0.069 |

| Auto Parts | −0.200 | 0.140 | 0.038 | 0.057 | −0.012 | 0.053 | 0.206 | 0.190 |

| Automobiles | −0.031 | 0.127 | 0.013 | 0.055 | 0.004 | 0.050 | 0.295 | 0.187 |

| Banks | 0.230 *** | 0.074 | 0.010 | 0.061 | 0.060 | 0.057 | −0.142 | 0.139 |

| Basic Materials | 0.282 *** | 0.075 | 0.003 | 0.035 | 0.061 ** | 0.031 | −0.262 *** | 0.083 |

| Basic Resources | 0.377 *** | 0.093 | 0.036 | 0.045 | 0.107 *** | 0.038 | −0.321 *** | 0.116 |

| Biotechnology | 0.128 | 0.354 | 0.308 | 0.293 | 0.262 | 0.274 | −0.105 | 0.498 |

| Casinos/Gambling | −0.151 | 0.108 | 0.038 | 0.078 | −0.001 | 0.064 | −0.577 ** | 0.236 |

| Cement | −0.437 ** | 0.208 | −0.063 | 0.111 | −0.141 | 0.111 | −0.838 ** | 0.385 |

| Chemicals | 0.236 * | 0.142 | −0.048 | 0.062 | 0.011 | 0.052 | −0.029 | 0.142 |

| Commercial Vehicles and Parts | 0.364 ** | 0.154 | 0.052 | 0.073 | 0.117 * | 0.067 | 0.298 | 0.173 |

| Computer Hardware | −0.061 | 0.128 | 0.009 | 0.079 | −0.008 | 0.064 | 0.247 | 0.238 |

| Computer Services | −0.235 | 0.187 | 0.015 | 0.071 | −0.027 | 0.065 | 0.040 | 0.426 |

| Consumer Digital Services | 0.009 | 0.167 | −0.013 | 0.095 | −0.009 | 0.077 | 0.090 | 0.173 |

| Construction and Materials | 0.052 | 0.102 | 0.007 | 0.054 | 0.016 | 0.045 | −0.178 | 0.173 |

| Construction | 0.073 | 0.135 | −0.000 | 0.067 | 0.015 | 0.056 | −0.120 | 0.211 |

| Consumer Discretionary | −0.176 ** | 0.058 | 0.023 | 0.026 | −0.019 | 0.023 | 0.011 | 0.080 |

| Consumer Electronics | −0.027 | 0.118 | −0.031 | 0.063 | −0.030 | 0.056 | 0.246 | 0.204 |

| Consumer Products and Services | −0.189 *** | 0.064 | 0.014 | 0.034 | −0.028 | 0.029 | −0.023 | 0.087 |

| Consumer Staples | −0.222 *** | 0.072 | −0.006 | 0.033 | −0.051 * | 0.028 | 0.139 | 0.102 |

| Cosmetics | −0.380 ** | 0.153 | 0.035 | 0.080 | −0.051 | 0.070 | −0.220 | 0.205 |

| Diversified Industrials | 0.086 | 0.112 | 0.033 | 0.060 | 0.044 | 0.054 | −0.047 | 0.150 |

| Diversified Retail | 0.031 | 0.113 | 0.058 | 0.045 | 0.052 | 0.040 | −0.078 | 0.198 |

| Drug/Grocery Stores | −0.407 *** | 0.131 | 0.021 | 0.072 | −0.068 | 0.058 | −0.252 | 0.161 |

| Electronic Entertainment | 0.104 | 0.237 | −0.156 | 0.109 | −0.102 | 0.095 | 0.118 | 0.281 |

| Electricity | −0.057 | 0.095 | −0.130 ** | 0.052 | −0.115 ** | 0.047 | −0.427 *** | 0.153 |

| Electronic Components | −0.076 | 0.116 | −0.086 | 0.073 | −0.084 | 0.059 | 0.173 | 0.132 |

| Energy | 0.283 ** | 0.141 | 0.075 | 0.069 | 0.118 * | 0.062 | −0.135 | 0.147 |

| Financial Data Providers | 0.008 | 0.187 | −0.001 | 0.063 | 0.001 | 0.059 | −0.248 | 0.299 |

| Food Producers | −0.196 ** | 0.090 | −0.000 | 0.049 | −0.041 | 0.041 | −0.454 *** | 0.171 |

| Healthcare | −0.196 | 0.198 | 0.139 | 0.085 | 0.069 | 0.091 | 0.109 | 0.211 |

| Household Equip. Production | −0.530 *** | 0.145 | 0.147 * | 0.084 | 0.004 | 0.063 | −0.192 | 0.211 |

| Industrial Engineering | 0.250 ** | 0.121 | 0.034 | 0.065 | 0.079 | 0.056 | 0.039 | 0.158 |

| Industrial Goods and Services | 0.039 | 0.069 | 0.015 | 0.034 | 0.020 | 0.027 | 0.049 | 0.096 |

| Industrial Metals and Mines | 0.376 *** | 0.093 | 0.036 | 0.045 | 0.107 *** | 0.038 | −0.319 *** | 0.116 |

| Industrial Support Svstems | 0.156 | 0.113 | 0.108 * | 0.064 | 0.118 ** | 0.058 | −0.183 | 0.168 |

| Industrial Transport | −0.057 | 0.141 | −0.158 ** | 0.070 | −0.137 ** | 0.055 | −0.046 | 0.164 |

| Insurance | 0.056 | 0.087 | −0.009 | 0.055 | 0.004 | 0.042 | 0.146 | 0.165 |

| Investment Banks and Brokers | −0.161 | 0.123 | −0.054 | 0.065 | −0.077 | 0.050 | −0.219 | 0.174 |

| Iron and Steel | 0.375 *** | 0.101 | 0.054 | 0.049 | 0.121 *** | 0.041 | −0.304 ** | 0.132 |

| Leisure Goods | −0.079 | 0.110 | −0.015 | 0.051 | −0.028 | 0.050 | 0.127 | 0.169 |

| Life Insurance | 0.197 * | 0.119 | −0.009 | 0.062 | 0.026 | 0.056 | 0.307 | 0.272 |

| Machinery: Industrial | −0.021 | 0.191 | 0.120 | 0.099 | 0.091 | 0.091 | −0.143 | 0.235 |

| Marine Transport | 0.334 ** | 0.145 | −0.008 | 0.071 | 0.063 | 0.060 | 0.022 | 0.227 |

| Nonlife Insurance | 0.089 | 0.092 | −0.026 | 0.055 | −0.002 | 0.043 | 0.112 | 0.168 |

| Oil Refining and Marketing | 0.212 | 0.161 | 0.092 | 0.072 | 0.117 * | 0.067 | −0.147 | 0.186 |

| Personal Goods | −0.422 *** | 0.129 | 0.055 | 0.061 | −0.045 | 0.051 | −0.267 * | 0.153 |

| Personal Product | −0.423 *** | 0.134 | 0.020 | 0.073 | −0.072 | 0.058 | −0.262 | 0.160 |

| Pharmaceutical and Biotech | −0.194 | 0.198 | 0.138 | 0.085 | 0.069 | 0.091 | 0.110 | 0.211 |

| Pharmaceuticals | −0.532 * | 0.319 | −0.150 | 0.122 | −0.216 * | 0.110 | −1.473 *** | 0.553 |

| Precious Metals and Mines | 0.528 *** | 0.160 | −0.077 | 0.076 | 0.049 | 0.077 | −0.121 | 0.278 |

| Retailers | −0.017 | 0.109 | 0.069 | 0.047 | 0.051 | 0.042 | −0.117 | 0.188 |

| Software and Computer Services | 0.073 | 0.140 | 0.018 | 0.085 | 0.030 | 0.076 | 0.085 | 0.155 |

| Security Systems | −0.017 | 0.127 | 0.041 | 0.060 | 0.029 | 0.058 | 0.073 | 0.212 |

| Semi-conductors | −0.459 | 0.309 | −0.054 | 0.148 | −0.139 | 0.108 | 0.426 | 0.269 |

| Technology Hardware | −0.218 | 0.138 | −0.005 | 0.064 | −0.050 | 0.057 | 0.402 ** | 0.171 |

| Telecommunication Equipment | −0.485 | 0.344 | −0.218 | 0.153 | −0.274 * | 0.141 | −1.253 *** | 0.419 |

| Telecommunication Service Providers | −0.101 | 0.099 | −0.054 | 0.053 | −0.064 | 0.049 | −0.094 | 0.118 |

| Tires | −0.101 | 0.150 | −0.043 | 0.060 | −0.055 | 0.052 | 0.213 | 0.204 |

| Tobacco | −0.107 | 0.088 | 0.079 | 0.065 | 0.040 | 0.052 | 0.178 | 0.129 |

| Transport Services | −0.239 | 0.227 | −0.080 | 0.073 | −0.120 * | 0.064 | −0.118 | 0.185 |

| Travel and Leisure | −0.215 ** | 0.101 | 0.034 | 0.058 | −0.018 | 0.054 | −0.424 *** | 0.163 |

| Trucking | −0.117 | 0.294 | −0.039 | 0.105 | −0.059 | 0.098 | 0.050 | 0.276 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Thorbecke, W. How Oil Prices Impact the Japanese and South Korean Economies: Evidence from the Stock Market and Implications for Energy Security. Sustainability 2025, 17, 4794. https://doi.org/10.3390/su17114794

Thorbecke W. How Oil Prices Impact the Japanese and South Korean Economies: Evidence from the Stock Market and Implications for Energy Security. Sustainability. 2025; 17(11):4794. https://doi.org/10.3390/su17114794

Chicago/Turabian StyleThorbecke, Willem. 2025. "How Oil Prices Impact the Japanese and South Korean Economies: Evidence from the Stock Market and Implications for Energy Security" Sustainability 17, no. 11: 4794. https://doi.org/10.3390/su17114794

APA StyleThorbecke, W. (2025). How Oil Prices Impact the Japanese and South Korean Economies: Evidence from the Stock Market and Implications for Energy Security. Sustainability, 17(11), 4794. https://doi.org/10.3390/su17114794