The Synergistic Effect of Foreign Direct Investment and Renewable Energy Consumption on Environmental Pollution Mitigation: Evidence from Developing Countries

Abstract

1. Introduction

2. Theoretical, Empirical Literature and Study Hypotheses

2.1. FDI and Environmental Pollution

2.2. REC and Environmental Pollution

2.3. Government Effectiveness and Environmental Pollution

2.4. Economic Growth and Environmental Pollution

3. Data and Methodology

3.1. Data

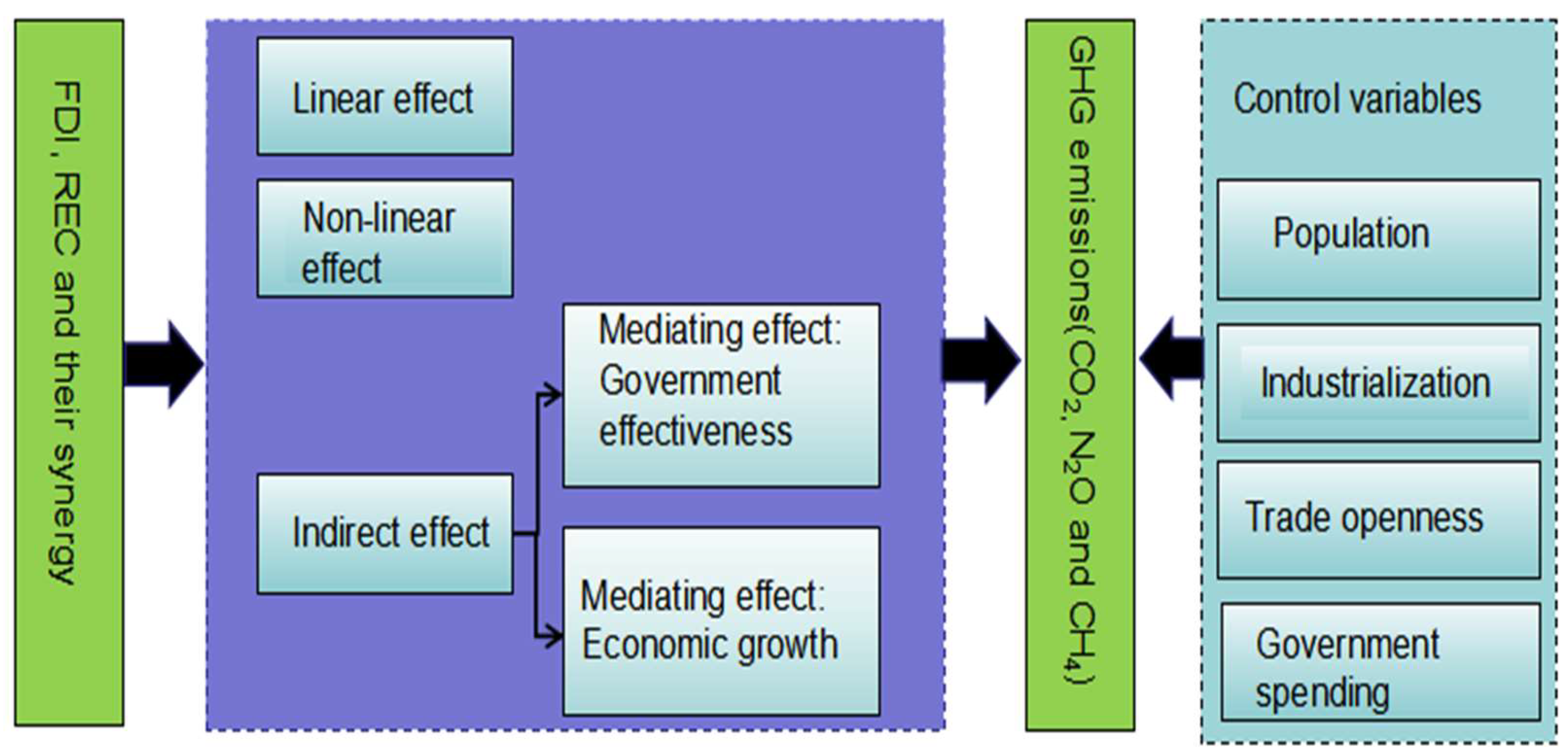

3.2. Research Framework

3.3. Data Normalization

3.4. Model Specification

4. Results and Discussions

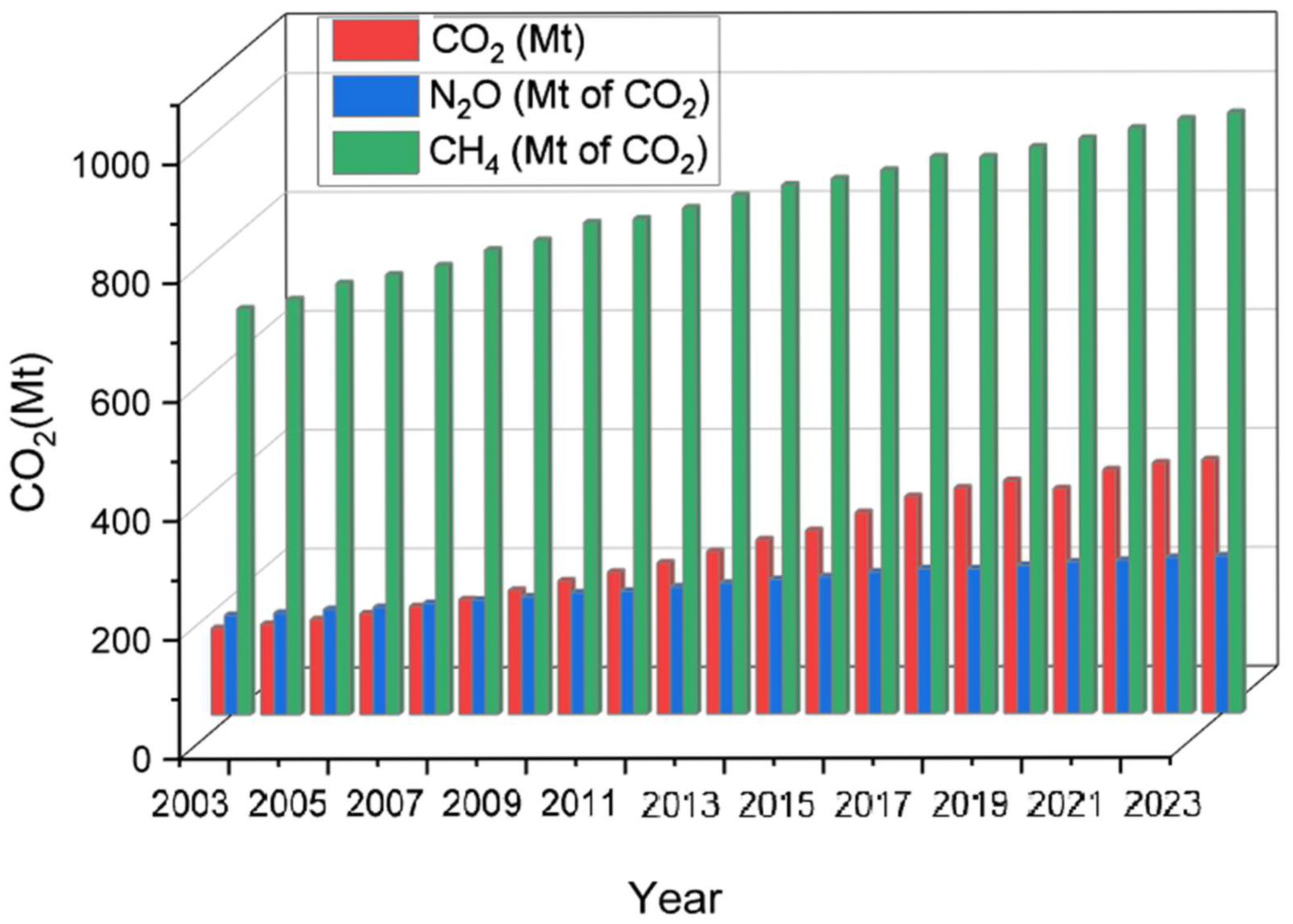

4.1. Preliminary Analysis—Trends

4.2. Descriptive Statistics, Multicollinearity, Unit Root, Cross-Sectional Dependency and Cointegration Tests

4.3. General Group-Level Analysis

4.3.1. Regression Analysis for Developing Countries

4.3.2. Non-Linear Regression Analysis for Developing Countries

4.3.3. Mediating Effect of Government Effectiveness and Economic Growth for Developing Countries

4.4. Regional Variation Analysis

4.4.1. Linear Regression of the Regional Variation

4.4.2. Non-Linear Regression of the Regional Variation

5. Conclusions, Implication and Recommendation

5.1. Conclusions

5.2. Theoretical Implication of the Study

5.3. Practical Implication of the Study

5.4. Recommendations

5.5. Limitations and Further Studies

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhang, Z.; Zhao, Y.; Cai, H.; Ajaz, T. Influence of renewable energy infrastructure, Chinese outward FDI, and technical efficiency on ecological sustainability in belt and road node economies. Renew. Energy 2023, 205, 608–616. [Google Scholar] [CrossRef]

- Marques, A.C.; Caetano, R. The impact of foreign direct investment on emission reduction targets: Evidence from high- and middle-income countries. Struct. Change Econ. Dyn. 2020, 55, 107–118. [Google Scholar] [CrossRef] [PubMed]

- Demena, B.A.; Afesorgbor, S.K. The effect of FDI on environmental emissions: Evidence from a meta-analysis. Energy Policy 2020, 138, 111192. [Google Scholar] [CrossRef]

- Boamah, V.; Tang, D.; Zhang, Q.; Zhang, J. Do FDI Inflows into African Countries Impact Their CO2 Emission Levels? Sustainability 2023, 15, 3131. [Google Scholar] [CrossRef]

- Yang, J.; Jin, M.; Chen, Y. Has the synergistic development of urban cluster improved carbon productivity? Empirical evidence from China. J. Clean. Prod. 2023, 414, 137535. [Google Scholar] [CrossRef]

- Bui, H.M.; Van Nguyen, S.; Huynh, A.T.; Bui, H.N.; Nguyen, H.T.T.; Perng, Y.S.; Bui, X.-T.; Nguyen, H.T. Correlation between nitrous oxide emissions and economic growth in Vietnam: An autoregressive distributed lag analysis. Environ. Technol. Innov. 2023, 29, 102989. [Google Scholar] [CrossRef]

- Tian, H.; Xu, R.; Canadell, J.G.; Thompson, R.L.; Winiwarter, W.; Suntharalingam, P.; Davidson, E.A.; Ciais, P.; Jackson, R.B.; Janssens-Maenhout, G.; et al. A comprehensive quantification of global nitrous oxide sources and sinks. Nature 2020, 586, 248–256. [Google Scholar] [CrossRef]

- Pazienza, P.; De Lucia, C. How does FDI in the “agricultural and fishing” sector affect methane emission? Evidence from the OECD countries. Econ. Politica 2020, 37, 441–462. [Google Scholar] [CrossRef]

- United Nations Environment Program. Methane Emissions Are Driving Climate Change. Here’s How to Reduce Them. 2021. Available online: https://www.unep.org/news-and-stories/story/methane-emissions-are-driving-climate-change-heres-how-reduce-them (accessed on 12 January 2025).

- Nguyen, H.T.; Van Nguyen, S.; Dau, V.-H.; Le, A.T.H.; Nguyen, K.V.; Nguyen, D.P.; Bui, X.-T.; Bui, H.M. The nexus between greenhouse gases, economic growth, energy and trade openness in Vietnam. Environ. Technol. Innov. 2022, 28, 102912. [Google Scholar] [CrossRef]

- Haider, A.; Ul Husnain, M.I.; Rankaduwa, W.; Shaheen, F. Nexus between Nitrous Oxide Emissions and Agricultural Land Use in Agrarian Economy: An ARDL Bounds Testing Approach. Sustainability 2021, 13, 2808. [Google Scholar] [CrossRef]

- Liu, Y.; Lin, B.; Xu, B. Modeling the impact of energy abundance on economic growth and CO2 emissions by quantile regression: Evidence from China. Energy 2021, 227, 120416. [Google Scholar] [CrossRef]

- Paul, S.C.; Rosid, H.O.; Sharif, M.J.; Rajonee, A.A. Foreign direct investment and CO2, CH4, N2O, greenhouse gas emissions: A cross-country study. Int. J. Econ. Financ. Issues 2021, 11, 97–104. [Google Scholar] [CrossRef]

- Islam Md, M.; Khan, M.K.; Tareque, M.; Jehan, N.; Dagar, V. Impact of globalization, foreign direct investment, and energy consumption on CO2 emissions in Bangladesh: Does institutional quality matter? Environ. Sci. Pollut. Res. 2021, 28, 48851–48871. [Google Scholar] [CrossRef]

- Sheng, X.; Yi, R.; Tang, D.; Lansana, D.D.; Obuobi, B. The severity of foreign direct investment components on China’s carbon productivity. J. Clean. Prod. 2023, 424, 138929. [Google Scholar] [CrossRef]

- Opoku, E.E.O.; Adams, S.; Aluko, O.A. The foreign direct investment-environment nexus: Does emission disaggregation matter? Energy Rep. 2021, 7, 778–787. [Google Scholar] [CrossRef]

- Abbasi, M.A.; Nosheen, M.; Rahman, H.U. An approach to the pollution haven and pollution halo hypotheses in Asian countries. Environ. Sci. Pollut. Res. 2023, 30, 49270–49289. [Google Scholar] [CrossRef]

- Ozcelik, O.; Bardakci, H.; Barut, A.; Usman, M.; Das, N. Testing the validity of pollution haven and pollution halo hypotheses in BRICMT countries by Fourier Bootstrap AARDL method and Fourier Bootstrap Toda-Yamamoto causality approach. Air Qual. Atmos. Health 2024, 17, 1491–1504. [Google Scholar] [CrossRef]

- Ozkan, O.; Coban, M.N.; Iortile, I.B.; Usman, O. Reconsidering the environmental Kuznets curve, pollution haven, and pollution halo hypotheses with carbon efficiency in China: A dynamic ARDL simulations approach. Environ. Sci. Pollut. Res. 2023, 30, 68163–68176. [Google Scholar] [CrossRef]

- Chiriluș, A.; Costea, A. The Effect of FDI on Environmental Degradation in Romania: Testing the Pollution Haven Hypothesis. Sustainability 2023, 15, 10733. [Google Scholar] [CrossRef]

- Liu, P.; Ur Rahman, Z.; Jóźwik, B.; Doğan, M. Determining the environmental effect of Chinese FDI on the Belt and Road countries CO2 emissions: An EKC-based assessment in the context of pollution haven and halo hypotheses. Environ. Sci. Eur. 2024, 36, 48. [Google Scholar] [CrossRef]

- Liu, Y.; Guo, M. The impact of FDI on haze pollution: “Pollution paradise” or “pollution halo?”–Spatial analysis of PM2.5 concentration raster data in 283 cities. Front. Environ. Sci. 2023, 11, 1133178. [Google Scholar] [CrossRef]

- Apergis, N.; Pinar, M.; Unlu, E. How do foreign direct investment flows affect carbon emissions in BRICS countries? Revisiting the pollution haven hypothesis using bilateral FDI flows from OECD to BRICS countries. Environ. Sci. Pollut. Res. 2023, 30, 14680–14692. [Google Scholar] [CrossRef] [PubMed]

- Bello, M.O.; Jimoh, S.O.; Ch’ng, K.S.; Oyerinola, D.S. Environmental sustainability in ASEAN: What roles do energy consumption, economic growth, and foreign direct investment play? Environ. Dev. Sustain. 2024, 1–27. [Google Scholar] [CrossRef]

- Olatunde, A.D.; Ogunleye, O.E. Determinants of Environmental Pollution in SubSahara Africa. Int. J. Res. Innov. Soc. Sci. 2022, 6, 631–642. [Google Scholar] [CrossRef]

- Abdul-Mumuni, A.; Amoh, J.K.; Mensah, B.D. Does foreign direct investment asymmetrically influence carbon emissions in sub-Saharan Africa? Evidence from nonlinear panel ARDL approach. Environ. Sci. Pollut. Res. 2022, 30, 11861–11872. [Google Scholar] [CrossRef]

- Xu, C.; Zhao, W.; Zhang, M.; Baodong, C. Pollution haven or halo? The role of the energy transition in the impact of FDI on SO2 emissions. Sci. Total Environ. 2021, 763, 143002. [Google Scholar] [CrossRef] [PubMed]

- Yang, Y.; Xia, S.; Huang, P.; Qian, J. Energy transition: Connotations, mechanisms and effects. Energy Strategy Rev. 2024, 52, 101320. [Google Scholar] [CrossRef]

- Hassan, Q.; Viktor, P.; Al-Musawi, T.J.; Ali, B.M.; Algburi, S.; Alzoubi, H.M.; Al-Jiboory, A.K.; Sameen, A.Z.; Salman, H.M.; Jaszczur, M. The renewable energy role in the global energy Transformations. Renew. Energy Focus 2024, 48, 100545. [Google Scholar] [CrossRef]

- Huang, P.; Liu, Y. Toward just energy transitions in authoritarian regimes: Indirect participation and adaptive governance. J. Environ. Plan. Manag. 2021, 64, 1–21. [Google Scholar] [CrossRef]

- López González, D.M.; Garcia Rendon, J. Opportunities and challenges of mainstreaming distributed energy resources towards the transition to more efficient and resilient energy markets. Renew. Sustain. Energy Rev. 2022, 157, 112018. [Google Scholar] [CrossRef]

- Potrč, S.; Čuček, L.; Martin, M.; Kravanja, Z. Sustainable renewable energy supply networks optimization—The gradual transition to a renewable energy system within the European Union by 2050. Renew. Sustain. Energy Rev. 2021, 146, 111186. [Google Scholar] [CrossRef]

- Donkor, M.; Kong, Y.; Manu, E.K.; Musah, M. Does policy integration in renewable energy deployment enhance environmental sustainability in Africa? Energy Sources Part B: Econ. Plan. Policy 2025, 20, 2439409. [Google Scholar] [CrossRef]

- Azam, A.; Rafiq, M.; Shafique, M.; Zhang, H.; Yuan, J. Analyzing the effect of natural gas, nuclear energy and renewable energy on GDP and carbon emissions: A multi-variate panel data analysis. Energy 2021, 219, 119592. [Google Scholar] [CrossRef]

- Gierałtowska, U.; Asyngier, R.; Nakonieczny, J.; Salahodjaev, R. Renewable Energy, Urbanization, and CO2 Emissions: A Global Test. Energies 2022, 15, 3390. [Google Scholar] [CrossRef]

- Zeeshan, M.; Han, J.; Rehman, A.; Ullah, I.; Mubashir, M. Exploring the Role of Information Communication Technology and Renewable Energy in Environmental Quality of South-East Asian Emerging Economies. Front. Environ. Sci. 2022, 10, 917468. [Google Scholar] [CrossRef]

- Asongu, S.A.; Odhiambo, N.M. Enhancing governance for environmental sustainability in sub-Saharan Africa. Energy Explor. Exploit. 2021, 39, 444–463. [Google Scholar] [CrossRef]

- Donkor, M.; Kong, Y.; Manu, E.K. Natural resource abundance, governance, and government expenditure: Empirical insights from environmental sustainability. Sustain. Dev. 2024, 33, 733–757. [Google Scholar] [CrossRef]

- Adekunle, I.A. On the search for environmental sustainability in Africa: The role of governance. Environ. Sci. Pollut. Res. 2021, 28, 14607–14620. [Google Scholar] [CrossRef]

- Dincă, G.; Bărbuță, M.; Negri, C.; Dincă, D.; Săndulescu, L.-S.M. The impact of governance quality and educational level on environmental performance. Front. Environ. Sci. 2022, 10, 950683. [Google Scholar] [CrossRef]

- Simionescu, M.; Szeles, M.R.; Gavurova, B.; Mentel, U. The Impact of Quality of Governance, Renewable Energy and Foreign Direct Investment on Sustainable Development in Cee Countries. Front. Environ. Sci. 2021, 9, 765927. [Google Scholar] [CrossRef]

- Byaro, M.; Rwezaula, A.; Mafwolo, G. Does institutional quality play a role in mitigating the impact of economic growth, population growth and renewable energy use on environmental sustainability in Asia? Environ. Dev. Sustain. 2024, 1–29. [Google Scholar] [CrossRef]

- Donkor, M.; Kong, Y.; Manu, E.K.; Ntarmah, A.H.; Appiah-Twum, F. Economic Growth and Environmental Quality: Analysis of Government Expenditure and the Causal Effect. Int. J. Environ. Res. Public Health 2022, 19, 10629. [Google Scholar] [CrossRef]

- Xue, C.; Shahbaz, M.; Ahmed, Z.; Ahmad, M.; Sinha, A. Clean energy consumption, economic growth, and environmental sustainability: What is the role of economic policy uncertainty? Renew. Energy 2022, 184, 899–907. [Google Scholar] [CrossRef]

- Yang, X.; Khan, I. Dynamics among economic growth, urbanization, and environmental sustainability in IEA countries: The role of industry value-added. Environ. Sci. Pollut. Res. 2022, 29, 4116–4127. [Google Scholar] [CrossRef]

- Espoir, D.K.; Sunge, R.; Bannor, F. Exploring the dynamic effect of economic growth on carbon dioxide emissions in Africa: Evidence from panel PMG estimator. Environ. Sci. Pollut. Res. 2023, 30, 112959–112976. [Google Scholar] [CrossRef]

- Yuan, M.; Zhong, H.; Hao, Z.; Tang, D.; Atsi, E.R. The Influence of the Digital Economy on the Foreign Trade Competitiveness of Hunan Province in China. Sustainability 2024, 17, 2. [Google Scholar] [CrossRef]

- Mejia, S.A. Foreign Direct Investment Dependence and the Neglected Greenhouse Gas: A Cross-National Analysis of Nitrous Oxide Emissions in Developing Countries, 1990–2014. Sociol. Perspect. 2021, 64, 223–237. [Google Scholar] [CrossRef]

- Mercom. India’s Top Five Solar Energy Funding Deals in 2023. 2023. Available online: https://www.mercomindia.com/indias-top-five-solar-energy-funding-infographics (accessed on 12 January 2025).

- Wanjala, P. Noor Ouarzazate Solar Complex in Morocco, World’s Largest Concentrated Solar Power Plant. Construction Review. 2024. Available online: https://constructionreviewonline.com/construction-projects/noor-ouarzazate-solar-complex-worlds-largest-concentrated-solar-power-plant/ (accessed on 13 January 2025).

| Variable | Description | Unit | Sources |

|---|---|---|---|

| CO2 | Carbon dioxide emissions | Metric tons | WDI (2025) |

| N2O | Nitrous oxide emissions | Metric tons of CO2 equivalent | WDI (2025) |

| CH4 | Methane emissions | Metric tons of CO2 equivalent | WDI (2025) |

| FDI | Foreign direct investment | Total FDI inflows (USD) | WDI (2025) |

| REC | Renewable energy consumption | Percentage of total final energy consumption | WDI (2025) |

| FR | Synergy of FDI and REC | A combination of FDI and REC | WDI (2025) |

| GOVE | Government effectiveness | Percentile rank | WGI (2025) |

| GDP | Gross Domestic Product (current) | USD | WDI (2025) |

| IND | Industrialization | Percentage of GDP | WDI (2025) |

| TOP | Trade openness | Trade (% of GDP) | WDI (2025) |

| POP | Total population | Total | WDI (2025) |

| GOVS | Government spending | Percentage of GDP | WDI (2025) |

| Variables | Mean | Std Dev | Skewness | Kurtosis |

|---|---|---|---|---|

| CO2 | 0.019 | 0.086 | 8.529 | 80.844 |

| N2O | 0.043 | 0.124 | 5.757 | 39.128 |

| CH4 | 0.042 | 0.113 | 5.573 | 38.329 |

| FDI | 0.122 | 0.064 | 8.226 | 83.435 |

| REC | 0.637 | 0.292 | −0.559 | 2.104 |

| FR | 0.080 | 0.066 | 5.316 | 48.647 |

| TOP | 0.364 | 0.168 | 0.710 | 2.953 |

| IND | 0.367 | 0.150 | 1.539 | 6.067 |

| POP | 0.046 | 0.144 | 5.650 | 34.817 |

| GOVS | 0.302 | 0.132 | 1.419 | 7.398 |

| GOVE | 0.539 | 0.245 | −0.036 | 2.033 |

| GDP | 0.017 | 0.069 | 10.109 | 120.872 |

| OBS | 1701 | |||

| Variables | VIF | CD | 1st Difference | ||

|---|---|---|---|---|---|

| ADF | IPS | PESCADF | |||

| CO2 | 111.89 *** | −3.440 *** | −19.605 *** | −4.388 *** | |

| N2O | 144.879 *** | −2.921 *** | −21.036 *** | −2.883 *** | |

| CH4 | 78.793 *** | −6.687 *** | −18.602 *** | −3.257 *** | |

| FDI | 4.29 | 41.597 *** | −7.092 *** | −21.845 *** | −6.125 *** |

| REC | 1.74 | 22.257 *** | −3.428 *** | −21.625 *** | −3.640 *** |

| FR | 6.43 | 40.93 *** | −5.635 *** | −21.029 *** | −5.043 *** |

| TOP | 1.50 | 35.811 *** | −6.118 *** | −18.698 *** | −3.287 *** |

| IND | 1.22 | 26.187 *** | −4.604 *** | −18.852 *** | −3.429 *** |

| POP | 2.48 | 138.764 *** | 4.883 *** | 23.210 *** | 2.469 *** |

| GOVS | 1.27 | 30.692 *** | −3.677 *** | −19.951 *** | −3.584 *** |

| GOVE | 1.59 | 0.135 | −3.474 *** | −21.199 *** | −4.545 *** |

| GDP | 4.44 | 216.821 *** | −6.720 *** | −16.207 *** | −2.481 *** |

| Tests | Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) |

|---|---|---|---|

| Kao test: | |||

| augmented Dickey–Fuller t | 9.058 *** | −1.672 *** | 9.414 *** |

| Pedroni test: | |||

| modified Phillips Perron t | 11.962 *** | 10.685 *** | 11.398 *** |

| Phillips Perron t | −3.003 *** | −10.538 *** | −3.843 *** |

| Augmented Dickey–Fuller t | −2.534 *** | −9.296 *** | −4.255 *** |

| Variables | Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) | |||

|---|---|---|---|---|---|---|

| FMOLS | CCR | FMOLS | CCR | FMOLS | CCR | |

| C | 0.139 *** (0.024) | 0.139 *** (0.024) | −0.204 *** (0.026) | −0.204 *** (0.027) | −0.190 *** (0.032) | −0.190 *** (0.032) |

| FDI | −1.473 *** (0.214) | −1.465 *** (0.220) | 1.959 *** (0.236) | 1.964 *** (0.243) | 1.780 *** (0.289) | 1.783 *** (0.297) |

| REC | −0.288 *** (0.027) | −0.287 *** (0.028) | 0.162 *** (0.030) | 0.162 *** (0.031) | 0.148 *** (0.037) | 0.147 *** (0.037) |

| FR | 2.745 *** (0.247) | 2.740 *** (0.253) | −1.475 *** (0.272) | −1.478 *** (0.279) | −1.241 *** (0.332) | −1.243 *** (0.342) |

| TOP | −0.007 (0.011) | −0.006 (0.011) | −0.034 *** (0.012) | −0.034 *** (0.013) | −0.063 *** (0.015) | −0.063 *** (0.015) |

| IND | 0.007 (0.011) | 0.007 (0.012) | −0.003 (0.013) | −0.003 (0.013) | 0.026 * (0.015) | 0.026 * (0.016) |

| POP | 0.233 *** (0.016) | 0.232 *** (0.017) | 0.570 *** (0.018) | 0.569 *** (0.019) | 0.464 *** (0.022) | 0.463 *** (0.023) |

| GOVS | 0.035 *** (0.013) | 0.035 ** (0.014) | 0.037 *** (0.015) | 0.038 *** (0.015) | 0.044 ** (0.018) | 0.044 ** (0.019) |

| Obs. | 1700 | |||||

| Sample | 2003–2023 | |||||

| Cross-section | 81 | |||||

| Variables | Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) |

|---|---|---|---|

| C | 0.151 *** (0.010) | −0.193 *** (0.010) | −0.178 *** (0.011) |

| FDI | −1.567 *** (0.091) | 1.880 *** (0.087) | 1.691 *** (0.096) |

| REC | −0.299 *** (0.012) | 0.152 *** (0.011) | 0.135 *** (0.122) |

| FR | 2.828 *** (0.105) | −1.411 *** (0.100) | −1.158 *** (0.111) |

| TOP | −0.009 * (0.005) | −0.033 *** (0.005) | −0.058 *** (0.005) |

| IND | 0.008 * (0.005) | −0.001 (0.005) | 0.030 *** (0.005) |

| POP | 0.241 *** (0.007) | 0.576 *** (0.007) | 0.465 *** (0.007) |

| GOVS | 0.037 *** (0.006) | 0.031 *** (0.005) | 0.034 *** (0.006) |

| Variables | Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) | |||

|---|---|---|---|---|---|---|

| FMOLS | CCR | FMOLS | CCR | FMOLS | CCR | |

| C | 0.357 *** (0.071) | 0.358 *** (0.077) | −0.246 *** (0.074) | −0.246 *** (0.080) | −0.203 ** (0.083) | −0.203 ** (0.089) |

| FDI | −3.927 *** (0.786) | −3.940 *** (0.852) | 2.535 *** (0.814) | 2.532 *** (0.880) | 2.021 ** (0.915) | 2.021 ** (0.990) |

| FDI2 | 3.882 *** (1.116) | 3.920 *** (1.231) | −1.328 (1.156) | −1.310 (1.270) | −0.861 (1.299) | −0.865 (1.428) |

| REC | −0.580 *** (0.099) | −0.580 *** (0.106) | 0.167 (0.102) | 0.167 (0.110) | 0.121 (0.115) | 0.121 (0.123) |

| REC2 | 0.067 ** (0.027) | 0.068 ** (0.029) | −0.002 (0.029) | −0.002 (0.030) | 0.001 (0.032) | 0.001 (0.033) |

| FR | 5.426 *** (0.932) | 5.437 *** (1.007) | −1.696 * (0.966) | −1.697 * (1.041) | −1.140 (1.086) | −1.135 (1.171) |

| FR2 | −4.991 *** (1.505) | −5.031 *** (1.648) | 1.159 * (1.558) | 1.142 * (1.701) | 0.626 (1.752) | 0.626 (1.913) |

| TOP | −0.008 (0.012) | −0.007 (0.012) | −0.028 ** (0.012) | −0.028 ** (0.012) | −0.055 *** (0.014) | −0.055 *** (0.014) |

| IND | 0.004 (0.013) | 0.004 (0.013) | −0.005 (0.013) | −0.005 (0.013) | 0.028 *** (0.015) | 0.028 *** (0.015) |

| POP | 0.248 *** (0.018) | 0.247 *** (0.019) | 0.556 *** (0.018) | 0.556 *** (0.019) | 0.453 *** (0.021) | 0.452 *** (0.021) |

| GOVS | 0.034 ** (0.014) | 0.034 ** (0.014) | 0.034 *** (0.014) | 0.034 *** (0.015) | 0.041 *** (0.016) | 0.041 *** (0.017) |

| Obs. | 1700 | |||||

| Sample | 2003–2023 | |||||

| Cross-section | 81 | |||||

| Variables | Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) |

|---|---|---|---|

| C | 0.374 *** (0.028) | −0.231 *** (0.027) | 0.199 *** (0.030) |

| FDI | −4.052 *** (0.313) | 2.412 *** (0.296) | 1.998 *** (0.334) |

| FDI2 | 3.947 *** (0.444) | −1.260 *** (0.420) | −0.824 * (0.474) |

| REC | −0.605 *** (0.039) | 0.146 *** (0.037) | 0.114 *** (0.042) |

| REC2 | 0.075 *** (0.011) | 0.004 (0.010) | 0.007 (0.012) |

| FR | 5.556 *** (0.371) | −1.566 *** (0.351) | −1.146 *** (0.396) |

| FR2 | −5.090 *** (0.598) | 1.059 * (0.566) | 0.603 (0.639) |

| TOP | −0.009 ** (0.005) | −0.029 *** (0.004) | −0.055 *** (0.005) |

| IND | 0.005 (0.005) | −0.003 (0.005) | 0.028 *** (0.005) |

| POP | 0.255 *** (0.007) | 0.563 *** (0.007) | 0.455 *** (0.007) |

| GOVS | 0.035 *** (0.006) | 0.033 *** (0.005) | 0.036 *** (0.006) |

| Mediation Effect of Government Effectiveness | Mediation Effect of Economic Growth | |||||||

|---|---|---|---|---|---|---|---|---|

| Variables | (1) GOVE | (2) CO2 | (3) N2O | (4) CH4 | (5) GDP | (6) CO2 | (7) N2O | (8) CH4 |

| GOVE | 0.004 * (0.009) | 0.008 * (0.009) | 0.022 ** (0.011) | |||||

| GDP | 0.672 *** (0.039) | 0.136 *** (0.051) | 0.372 *** (0.058) | |||||

| FDI | −3.687 * (2.607) | −1.452 *** (0.225) | 1.996 *** (0.244) | 1.851 *** (0.280) | 0.054 * (0.095) | −1.532 *** (0.172) | 1.942 *** (0.227) | 1.701 *** (0.258) |

| REC | −0.855 *** (0.330) | −0.282 *** (0.029) | 0.170 *** (0.031) | 0.164 *** (0.036) | −0.080 *** (0.012) | −0.236 *** (0.022) | 0.171 *** (0.029) | 0.170 *** (0.033) |

| FR | 3.615 * (3.005) | 2.721 *** (0.260) | −1.512 *** (0.281) | −1.312 *** (0.322) | 0.811 *** (0.109) | 2.221 *** (0.201) | −1.574 *** (0.265) | −1.485 *** (0.301) |

| TOP | −0.435 *** (0.135) | −0.005 (0.012) | −0.030 ** (0.013) | −0.052 *** (0.015) | −0.018 *** (0.005) | 0.006 (0.009) | −0.031 *** (0.012) | −0.055 *** (0.013) |

| IND | 0.149 (0.140) | 0.005 (0.012) | −0.005 (0.013) | 0.024 * (0.015) | 0.002 (0.005) | 0.005 (0.009) | −0.005 (0.012) | 0.027 *** (0.014) |

| POP | 0.025 (0.201) | 0.234 *** (0.017) | 0.569 *** (0.019) | 0.463 *** (0.021) | 0.117 *** (0.007) | 0.156 *** (0.014) | 0.553 *** (0.019) | 0.423 *** (0.021) |

| GOVS | −0.100 (0.163) | 0.035 ** (0.014) | 0.036 ** (0.015) | 0.047 *** (0.017) | 0.023 *** (0.006) | 0.020 *** (0.011) | 0.031 ** (0.014) | 0.038 *** (0.016) |

| Obs. | 1700 | |||||||

| sample | 2003–2023 | |||||||

| cross-section | 81 | |||||||

| Mediation Effect of Government Effectiveness | Mediation Effect of Economic Growth | |||||||

|---|---|---|---|---|---|---|---|---|

| Variables | (1) GOVE | (2) CO2 | (3) N2O | (4) CH4 | (5) GDP | (6) CO2 | (7) N2O | (8) CH4 |

| GOVE | 0.004 * (0.009) | 0.008 * (0.009) | 0.022 ** (0.011) | |||||

| GDP | 0.669 *** (0.049) | 0.132 ** (0.065) | 0.372 *** (0.074) | |||||

| FDI | −3.747 * (2.681) | −1.446 *** (0.233) | 2.001 *** (0.252) | 1.855 *** (0.288) | 0.056 * (0.098) | −1.528 *** (0.177) | 1.947 *** (0.233) | 1.701 *** (0.266) |

| REC | −0.859 *** (0.338) | −0.282 *** (0.030) | 0.170 *** (0.032) | 0.165 *** (0.037) | −0.080 *** (0.012) | −0.236 *** (0.023) | 0.171 *** (0.030) | 0.170 *** (0.034) |

| FR | 3.663 * (3.083) | 2.717 *** (0.267) | −1.515 *** (0.289) | −1.315 *** (0.331) | 0.810 *** (0.112) | 2.221 *** (0.208) | −1.573 *** (0.274) | −1.484 *** (0.312) |

| TOP | −0.438 *** (0.139) | −0.005 (0.012) | −0.030 ** (0.013) | −0.052 *** (0.015) | −0.018 *** (0.005) | 0.006 (0.009) | −0.031 *** (0.012) | −0.055 *** (0.013) |

| IND | 0.151 (0.142) | 0.005 (0.012) | −0.006 (0.013) | 0.024 * (0.015) | 0.002 (0.005) | 0.005 (0.009) | −0.005 (0.012) | 0.027 * (0.014) |

| POP | 0.033 (0.209) | 0.233 *** (0.018) | 0.568 *** (0.019) | 0.463 *** (0.022) | 0.117 *** (0.008) | 0.156 *** (0.014) | 0.552 *** (0.019) | 0.423 *** (0.022) |

| GOVS | −0.094 (0.168) | 0.035 *** (0.015) | 0.036 ** (0.016) | 0.048 *** (0.018) | 0.023 *** (0.006) | 0.020 *** (0.011) | 0.031 ** (0.014) | 0.038 ** (0.017) |

| Obs. | 1700 | |||||||

| sample | 2003–2023 | |||||||

| cross-section | 81 | |||||||

| Variables | Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) | |||

|---|---|---|---|---|---|---|

| FMOLS | CCR | FMOLS | CCR | FMOLS | CCR | |

| Low-income countries | ||||||

| FDI | 0.089 (0.085) | 0.106 (0.093) | −0.304 *** (0.083) | −0.307 *** (0.090) | −0.300 *** (0.063) | −0.299 *** (0.069) |

| REC | 0.456 *** (0.057) | 0.460 *** (0.060) | −0.071 * (0.056) | −0.074 * (0.058) | −0.092 ** (0.043) | −0.094 ** (0.044) |

| FR | 1.356 *** (0.253) | 1.326 *** (0.271) | 2.668 *** (0.249) | 2.685 *** (0.261) | 2.576 *** (0.332) | 2.587 *** (0.199) |

| TOP | −0.362 *** (0.055) | −0.359 *** (0.060) | −0.216 *** (0.053) | −0.212 *** (0.056) | −0.160 *** (0.041) | −0.156 *** (0.043) |

| IND | −0.067 (0.049) | −0.074 (0.052) | −0.083 * (0.048) | −0.083 * (0.050) | −0.044 (0.036) | −0.046 (0.038) |

| POP | 0.570 *** (0.059) | 0.563 *** (0.062) | 1.052 *** (0.058) | 1.053 *** (0.061) | 1.074 *** (0.022) | 1.072 *** (0.046) |

| GOVS | −0.068 * (0.039) | −0.070 * (0.042) | 0.020 (0.038) | 0.021 (0.041) | 0.159 (0.029) | 0.016 (0.031) |

| Middle-income countries | ||||||

| FDI | −1.533 *** (0.247) | −1.528 *** (0.254) | 2.035 *** (0.299) | 2.043 *** (0.307) | 1.849 *** (0.301) | 1.855 *** (0.310) |

| REC | −0.292 *** (0.032) | −0.292 *** (0.033) | 0.178 *** (0.039) | 0.178 *** (0.040) | 0.165 *** (0.039) | 0.165 *** (0.040) |

| FR | 2.813 *** (0.284) | 2.810 *** (0.291) | −1.553 *** (0.343) | −1.559 *** (0.352) | −1.307 *** (0.346) | −1.310 *** (0.356) |

| TOP | −0.007 (0.014) | −0.007 (0.015) | −0.030 * (0.017) | −0.029 * (0.018) | −0.063 *** (0.017) | −0.063 *** (0.018) |

| IND | 0.003 (0.018) | 0.003 (0.018) | 0.014 (0.021) | 0.013 (0.022) | 0.058 *** (0.022) | 0.058 *** (0.022) |

| POP | 0.231 *** (0.019) | 0.230 *** (0.020) | 0.559 *** (0.023) | 0.558 *** (0.024) | 0.442 *** (0.023) | 0.441 *** (0.024) |

| GOVS | 0.040 *** (0.017) | 0.040 *** (0.018) | 0.039 * (0.021) | 0.039 * (0.022) | 0.052 ** (0.021) | 0.051 *** (0.022) |

| High-income countries | ||||||

| FDI | −1.643 *** (0.471) | −1.780 *** (0.549) | −0.235 * (0.451) | −0.213 * (0.511) | −1.886 *** (0.564) | −2.059 *** (0.656) |

| REC | −0.303 * (0.172) | −0.334 * (0.194) | −0.282 * (0.165) | −0.286 * (0.184) | −0.386 ** (0.206) | −0.427 ** (0.233) |

| FR | 2.049 *** (0.645) | 2.249 *** (0.778) | 0.482 * (0.617) | 0.469 * (0.726) | 2.254 *** (0.772) | 2.501 *** (0.932) |

| TOP | −0.026 (0.085) | −0.032 (0.088) | 0.148 * (0.081) | 0.150 * (0.084) | −0.141 (0.101) | −0.147 (0.105) |

| IND | 0.165 (0.116) | 0.166 (0.122) | 0.005 (0.111) | 0.014 (0.116) | 0.307 ** (0.139) | 0.309 (0.146) |

| POP | 0.618 *** (0.093) | 0.609 *** (0.102) | 0.771 *** (0.089) | 0.771 *** (0.097) | 0.531 *** (0.111) | 0.522 *** (0.122) |

| GOVS | 0.200 *** (0.087) | 0.196 ** (0.091) | −0.067 (0.084) | −0.067 (0.041) | 0.054 (0.104) | 0.048 (0.109) |

| Variables | Low-Income Countries | Middle-Income Countries | High-Income Countries | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) | Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) | Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) | |

| FDI | −0.078 (0.074) | −0.207 *** (0.054) | −0.244 *** (0.050) | −1.566 *** (0.112) | 1.987 *** (0.103) | 1.818 *** (0.114) | −1.289 *** (0.167) | −0.189 (0.155) | −1.412 *** (0.204) |

| REC | 0.330 *** (0.053) | −0.015 (0.039) | −0.048 (0.036) | −0.299 *** (0.051) | 0.170 *** (0.013) | 0.156 *** (0.015) | −0.230 *** (0.062) | −0.297 *** (0.057) | −0.274 *** (0.074) |

| FR | 1.895 *** (0.223) | 2.340 *** (0.164) | 2.388 *** (0.151) | 2.845 *** (0.128) | −1.515 *** (0.119) | −1.281 *** (0.131) | 1.547 *** (0.230) | 0.463 *** (0.213) | 1.594 *** (0.208) |

| TOP | −0.289 *** (0.048) | −0.211 *** (0.035) | −0.156 *** (0.032) | −0.010 (0.007) | −0.038 *** (0.006) | −0.069 *** (0.007) | 0.008 (0.032) | 0.143 *** (0.029) | −0.111 *** (0.039) |

| IND | −0.078 * (0.042) | −0.097 *** (0.031) | −0.056 ** (0.028) | 0.009 (0.008) | 0.022 *** (0.007) | 0.062 *** (0.008) | 0.155 *** (0.043) | 0.064 * (0.040) | 0.304 *** (0.052) |

| POP | 0.599 *** (0.050) | 1.036 *** (0.036) | 1.070 *** (0.034) | 0.234 *** (0.009) | 0.564 *** (0.008) | 0.446 *** (0.009) | 0.651 *** (0.033) | 0.785 *** (0.031) | 0.582 *** (0.040) |

| GOVS | −0.128 *** (0.036) | 0.028 (0.026) | 0.028 (0.024) | 0.042 *** (0.008) | 0.045 *** (0.007) | 0.051 *** (0.008) | 0.192 *** (0.033) | −0.023 (0.030) | 0.009 (0.040) |

| Variables | Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) | |||

|---|---|---|---|---|---|---|

| FMOLS | CCR | FMOLS | CCR | FMOLS | CCR | |

| Low-income countries | ||||||

| FDI | 0.200 (0.368) | 0.246 (0.432) | −0.630 *** (0.207) | −0.674 *** (0.242) | −0.549 *** (0.190) | −0.589 *** (0.069) |

| FDI2 | −0.101 (0.287) | −0.121 (0.337) | 0.280 * (0.162) | 0.314 * (0.190) | 0.193 (0.149) | 0.225 (0.174) |

| REC | 0.806 *** (0.301) | 0.788 ** (0.352) | 0.282 * (0.170) | 0.230 * (0.197) | 0.190 ** (0.156) | 0.134 ** (0.044) |

| REC2 | −0.409 * (0.234) | −0.380 * (0.260) | −0.479 *** (0.132) | −0.446 *** (0.146) | −0.383 (0.121) | −0.346 (0.133) |

| FR | 0.839 (1.411) | 0.748 (1.753) | 3.712 *** (0.795) | 3.967 *** (0.261) | 3.444 *** (0.730) | 3.695 *** (0.890) |

| FR2 | 1.983 (3.768) | 2.225 (4.695) | −4.267 ** (2.123) | −4.886 * (2.615) | −3.307 * (1.949) | −3.896 * (2.390) |

| TOP | −0.388 *** (0.085) | −0.373 *** (0.090) | −0.293 *** (0.048) | −0.285 *** (0.050) | −0.216 *** (0.044) | −0.207 *** (0.046) |

| IND | −0.062 (0.075) | −0.071 (0.080) | −0.058 (0.042) | −0.058 (0.045) | −0.017 (0.039) | −0.018 (0.041) |

| POP | 0.590 *** (0.089) | 0.581 *** (0.095) | 1.093 *** (0.050) | 1.090 *** (0.053) | 1.121 *** (0.046) | 1.116 *** (0.049) |

| GOVS | −0.101 * (0.061) | −0.097 * (0.065) | −0.024 (0.034) | −0.024 (0.037) | −0.009 (0.031) | −0.009 (0.034) |

| Middle-income countries | ||||||

| FDI | −4.327 *** (0.643) | −4.328 *** (0.695) | 2.543 *** (0.538) | 2.542 *** (0.580) | 2.284 *** (0.699) | 2.282 *** (0.754) |

| FDI2 | 4.199 *** (0.902) | 4.203 *** (0.995) | −1.464 ** (0.755) | −1.461 ** (0.828) | −1.230 (0.981) | −1.225 (1.077) |

| REC | −0.657 *** (0.082) | −0.656 *** (0.088) | 0.159 ** (0.069) | 0.159 *** (0.074) | 0.141 (0.090) | 0.141 (0.096) |

| REC2 | 0.089 *** (0.027) | 0.089 *** (0.027) | −0.002 (0.022) | −0.003 (0.023) | 0.001 (0.029) | 0.001 (0.029) |

| FR | 5.962 *** (0.762) | 5.961 *** (0.821) | −1.600 *** (0.637) | −1.600 *** (0.685) | −1.319 (0.828) | −1.316 (0.890) |

| FR2 | −5.521 *** (1.210) | −5.524 *** (1.324) | 1.194 (1.013) | 1.191 (1.014) | 0.966 (1.316) | 0.958 (1.435) |

| TOP | −0.013 (0.010) | −0.013 (0.011) | −0.033 *** (0.009) | −0.033 *** (0.009) | −0.063 *** (0.017) | −0.063 *** (0.018) |

| IND | 0.004 (0.013) | 0.003 (0.018) | 0.015 (0.011) | 0.015 (0.011) | 0.058 *** (0.022) | 0.058 *** (0.022) |

| POP | 0.250 *** (0.014) | 0.250 *** (0.015) | 0.548 *** (0.012) | 0.548 *** (0.013) | 0.430 *** (0.016) | 0.430 *** (0.016) |

| GOVS | 0.043 *** (0.013) | 0.043 *** (0.013) | 0.046 *** (0.011) | 0.046 *** (0.011) | 0.049 *** (0.014) | 0.049 *** (0.014) |

| High-income countries | ||||||

| FDI | −0.380 *** (0.918) | −0.767 (1.413) | −0.783 (0.931) | −0.666 (1.432) | −0.205 (1.082) | −0.739 (1.661) |

| FDI2 | −0.596 (0.729) | −0.376 (1.061) | 0.769 (0.739) | 0.719 (1.077) | −0.633 (0.859) | −0.3168 (1.249) |

| REC | −0.717 ** (0.303) | −0.811 ** (0.389) | −0.527 * (0.308) | −0.286 * (0.184) | −1.256 *** (0.358) | −1.377 *** (0.459) |

| REC2 | 0.587 *** (0.209) | 0.599 *** (0.220) | 0.219 (0.212) | 0.482 (0.394) | 1.110 *** (0.246) | 1.125 *** (0.258) |

| FR | 0.447 (1.296) | 1.042 (1.977) | 0.759 (1.314) | 0.531 (2.005) | −0.095 (1.527) | 0.666 (2.324) |

| FR2 | 0.939 (1.273) | 0.466 (1.868) | −0.696 (0.290) | −0.520 (1.898) | 1.276 (1.500) | 0.673 (0.199) |

| TOP | 0.026 (0.068) | 0.020 (0.071) | 0.138 ** (0.069) | 0.140 ** (0.072) | −0.070 (0.080) | −0.077 (0.083) |

| IND | 0.008 (0.109) | 0.012 (0.116) | −0.042 (0.110) | −0.042 (0.117) | 0.014 (0.128) | 0.017 (0.136) |

| POP | 0.652 *** (0.076) | 0.642 *** (0.085) | 0.801 *** (0.077) | 0.808 *** (0.085) | 0.607 *** (0.089) | 0.598 *** (0.100) |

| GOVS | 0.189 *** (0.070) | 0.190 *** (0.073) | −0.038 (0.070) | −0.040 (0.074) | 0.049 (0.082) | 0.049 (0.085) |

| Variables | Low-Income Countries | Middle-Income Countries | High-Income Countries | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) | Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) | Model 1 (CO2) | Model 2 (N2O) | Model 3 (CH4) | |

| FDI | −0.029 (0.224) | −0.320 ** (0.145) | −0.288 ** (0.137) | −4.292 *** (0.388) | 0.289 *** (0.351) | 2.404 *** (0.396) | −0.199 (0.039) | −0.621 * (0.380) | 0.082 (0.433) |

| FDI2 | −0.023 (0.174) | 0.085 (0.113) | 0.024 (0.107) | 4.155 *** (0.545) | −1.641 *** (0.493) | −1.398 ** (0.555) | −0.582 * (0.314) | 0.626 ** (0.299) | −0.608 * (0.340) |

| REC | 0.685 *** (0.181) | 0.474 *** (0.117) | 0.388 *** (0.111) | −0.671 *** (0.050) | 0.166 *** (0.045) | 0.151 *** (0.051) | −0.552 *** (0.130) | −0.715 *** (0.124) | −1.053 *** (0.141) |

| REC2 | −0.340 ** (0.135) | −0.549 *** (0.087) | −0.477 *** (0.082) | 0.099 *** (0.016) | 0.001 (0.014) | 0.001 (0.016) | 0.508 *** (0.089) | 0.371 *** (0.085) | 1.030 *** (0.096) |

| FR | 1.394 * (0.846) | 2.585 *** (0.547) | 2.505 *** (0.517) | 5.944 *** (0.460) | −1.740 *** (0.416) | −1.445 *** (0.468) | −0.027 (0.564) | 0.838 (0.537) | −0.592 (0.612) |

| FR2 | 0.603 (2.232) | −2.282 * (1.443) | −1.832 (1.365) | −5.483 *** (0.730) | 1.408 ** (0.661) | 1.180 * (0.744) | 1.207 ** (0.553) | −0.762 (0.526) | 1.385 ** (0.600) |

| TOP | −0.336 *** (0.050) | −0.295 *** (0.033) | −0.228 *** (0.031) | 0.011 * (0.006) | −0.033 *** (0.006) | −0.064 *** (0.006) | 0.040 *** (0.030) | 0.153 *** (0.029) | −0.053 (0.033) |

| IND | −0.067 (0.043) | −0.068 ** (0.028) | −0.034 (0.027) | 0.007 (0.008) | 0.016 ** (0.007) | 0.057 *** (0.008) | −0.003 (0.048) | −0.045 (0.045) | −0.007 (0.052) |

| POP | 0.634 *** (0.051) | 1.096 *** (0.032) | 1.120 *** (0.031) | 0.248 *** (0.009) | 0.544 *** (0.007) | 0.429 *** (0.009) | 0.674 *** (0.032) | 0.800 *** (0.031) | 0.623 *** (0.035) |

| GOVS | −0.138 *** (0.037) | −0.005 (0.024) | 0.002 (0.023) | 0.045 *** (0.008) | 0.048 *** (0.007) | 0.054 *** (0.008) | 0.198 *** (0.031) | −0.017 (0.030) | 0.026 (0.034) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pan, Y.; Atsi, E.R.; Tang, D.; He, D.; Donkor, M. The Synergistic Effect of Foreign Direct Investment and Renewable Energy Consumption on Environmental Pollution Mitigation: Evidence from Developing Countries. Sustainability 2025, 17, 4732. https://doi.org/10.3390/su17104732

Pan Y, Atsi ER, Tang D, He D, Donkor M. The Synergistic Effect of Foreign Direct Investment and Renewable Energy Consumption on Environmental Pollution Mitigation: Evidence from Developing Countries. Sustainability. 2025; 17(10):4732. https://doi.org/10.3390/su17104732

Chicago/Turabian StylePan, Yuhan, Eugene Ray Atsi, Decai Tang, Dongmei He, and Mary Donkor. 2025. "The Synergistic Effect of Foreign Direct Investment and Renewable Energy Consumption on Environmental Pollution Mitigation: Evidence from Developing Countries" Sustainability 17, no. 10: 4732. https://doi.org/10.3390/su17104732

APA StylePan, Y., Atsi, E. R., Tang, D., He, D., & Donkor, M. (2025). The Synergistic Effect of Foreign Direct Investment and Renewable Energy Consumption on Environmental Pollution Mitigation: Evidence from Developing Countries. Sustainability, 17(10), 4732. https://doi.org/10.3390/su17104732