1. Introduction

To protect against systemic risks in agriculture and ensure stable agricultural production is crucial for national food security, rural stability, and the continued growth of farmers’ incomes. In 2023, China’s paramount policy document, the No.1 Central Document, specifically advocated for the creation and enhancement of an agricultural risk protection mechanism. This initiative aims to bolster the capacity to fend off systemic risks, thereby safeguarding the safety and stability of agricultural production. In the face of a complex and volatile international economic landscape, characterized by strategic competition among major powers, regional conflicts, escalating trade barriers for agricultural products, and unstable market supply and demand, the global agricultural system’s operation and stability are under significant strain. As a vital pillar of the global economic system, agriculture is increasingly susceptible to systemic risks. The globalization-driven accumulation and transmission of risks have amplified the uncertainty facing China’s agricultural system, introducing new challenges in agricultural production, trade, food security, and the stability of the agricultural system itself. Systemic risk research has long been a focal point in social, financial, and management sciences, with scholars extensively exploring systems in economics, finance, and public administration. However, the agricultural sector’s systemic risks have received relatively little attention. Considering the agricultural system’s critical importance to global food security and social stability, this study zeroes in on agriculture. It delves into the risk spillover and absorption effects across different sectors of the agricultural system, examines the mechanisms and characteristics of risk transmission, and offers targeted policy recommendations.

In recent years, scholars have increasingly turned their attention to the interconnectedness and transmission of risks within macroeconomic and financial systems, especially in the wake of risk shocks. However, the exploration of similar dynamics within agricultural systems has not received the same level of scrutiny. This oversight has become more pronounced as regional conflicts escalate and protectionist policies in agricultural trade gain traction, amplifying the interconnectedness of risks within agricultural systems. Consequently, these developments have paved the way for more intricate pathways of cross-regional risk transmission, thereby posing a significant threat to global food security and the sustainable growth of agriculture.

In the field of agriculture, research on risk management and efficiency assessment increasingly relies on diverse econometric methods. These methods examine agricultural production efficiency and risk from various perspectives, providing profound insights and practical tools to address numerous challenges. For instance, data envelopment analysis (DEA) is employed to compare the inputs and outputs of different production units, assessing the efficiency and risk levels of agricultural production [

1]. Structural equation modeling (SEM), on the other hand, reveals the internal structure of agricultural systems and the complex relationships between variables, aiding in the identification and understanding of risk factors [

2]. Spatial autoregressive models comprehensively consider the influence of geographical factors, analyzing the spread of risk and correlations between different agricultural regions [

3]. Meanwhile, regression analysis explores the relationships between different variables in agricultural risk data through statistical methods [

4]. A combination of the Value at Risk (VaR) model and the autoregressive conditional heteroskedasticity (ARCH) model is utilized to evaluate risk in agricultural markets [

5]. Additionally, univariate statistical methods, including descriptive statistics and time series analysis, are employed to study the risk levels of individual agricultural products [

6]. In terms of parameter estimation, ordinary least squares (OLS) is applied to fit agricultural risk models and make predictions [

7]. The Susceptible–Infectious–Recovered (SIR) model is applied to risk management in agricultural production [

8]. Evaluation methods are also evolving, including composite index assessment, propensity score matching, multi-attribute comprehensive evaluation, the EES index, and multiple trend moving average cross-analysis, providing multidimensional risk assessment tools [

9,

10,

11,

12].

With the rise in complex network research in agricultural risk management, various models and analysis methods have been proposed, such as Bayesian networks, the TailVaR model, weighted risk correlation networks, complex network analysis, and hybrid causality testing methods. These approaches enhance our understanding of the interactions between factors in agricultural systems, thereby providing strong support for risk management [

13,

14,

15,

16,

17,

18].

Research on agricultural systems primarily focuses on risk linkage and transmission. The importance of various factors in the propagation of agricultural risks is typically ranked as follows: market risk, policy risk, natural risk, technological risk, and managerial risk [

19]. Research indicates that exogenous variables, including spot markets for agricultural products, macroeconomic volumes, and international market transactions, substantially influence the risk spillover effects of soybean futures between China and the U.S. [

20] Furthermore, a specific risk transmission mechanism has been identified between China’s corn export prices and Brent crude oil spot prices [

21]. Notably, the gender of farmers plays a role in the efficiency of risk transmission [

22], and the accuracy of temperature readings over time is critical for assessing risks within the agricultural ecosystem model [

23]. The lack of necessary analytical skills among technical workers can exacerbate risks in agricultural production [

24]. Additionally, abiotic factors are becoming increasingly significant in the risks associated with crop growth [

25].

Various risk types exhibit different transmission pathways that ultimately influence the prices of agricultural products [

26]. Extreme fluctuations in the prices of crop cultivation can disrupt the balance of risks in the market [

27]. Commonalities exist between the risk points and types in livestock farming and the overall risks in the agricultural system [

28]. Natural disasters, such as wildfires, not only result in economic losses and degradation of ecosystem services but also elevate risks to the agricultural sector [

29]. The longer the duration of agricultural pests, the broader the impact range of their risk transmission [

30]. Financial risks in the soybean futures market exhibit distinct transmission mechanisms upstream and downstream [

31]. Additionally, various types of risks encountered in the bio-breeding supply chain contribute to heightened risk across the entire industry chain [

32].

While the existing body of literature has delved into the exploration of risk linkages and their transmission within agricultural systems, it has not been without its potential shortcomings. Initially, the focus of research on risks within agricultural systems has been predominantly one-dimensional, concentrating on singular relationships such as those between crop growth and climate change, soil quality and crop yield, pest outbreaks and biodiversity, and the impact of agricultural inputs on environmental pollution. This narrow scope falls short of fully capturing the diversity, complexity, and interdependence that characterize systemic risks in agriculture. Furthermore, although the multi-layer network theory has laid a groundwork in the realm of agricultural risk research, it frequently neglects the intricate multi-level interactions among various sectors within the agricultural system and how these interactions contribute to the systemic risk linkages and their contagion properties. The application of multi-layer network models, with their comprehensive attributes and diverse structural characteristics, not only deepens the understanding of the internal dynamics within agricultural systems but also sheds light on potential mechanisms of risk transmission across different agricultural sectors, thereby broadening the utility of multi-layer network structures in research endeavors. Additionally, the predominant focus of existing studies has been on macro-level risks tied to industry or supply chains, overlooking the critical analysis from pivotal nodes and the absence of dynamic studies on the indicators and variables involved in risk transmission.

This study zeroes in on the CSI Industry Indexes and utilizes the DCC-t-Copula-CoVaR model to evaluate the systemic risk effects within the agricultural sector. By crafting a multi-layer network structure and selecting structural indicators for analysis, coupled with the employment of the Mixed Data Sampling (MIDAS) approach, it aims to unravel the linkages and transmission pathways of industry risks. The innovative contributions of this paper can be summarized in three key areas: firstly, leveraging multi-layer network theory, it devises a spectrum of attribute- and type-based models to assess agricultural system risks from an industry standpoint, elucidating the spillover and absorption effects of risk. Secondly, by conducting mixed-frequency regression analysis with high-frequency data, it uncovers the mechanisms of industry risk transmission within a multi-layer network framework. Lastly, the study delves into the dynamic evolution characteristics of pivotal nodes, examining the time-varying attributes of individual nodes under various types of risk transmission, thereby providing a more tangible understanding of the mechanisms at play.

The application of multi-layer network models, with their comprehensive attributes and diverse structural characteristics, not only deepens the understanding of the internal dynamics within agricultural systems but also sheds light on potential mechanisms of risk transmission across different agricultural sectors, thereby broadening the utility of multi-layer network structures in research endeavors. Trade frictions, geopolitical conflicts, and policy adjustments are significant factors affecting international economic activities in the context of globalization [

33]. Traditional risk correlation analysis methods, such as single-layer network analysis, often focus on only one type of connection, overlooking the multifaceted interrelations within the agricultural system [

34,

35,

36]. Additionally, the predominant focus of existing studies has been on macro-level risks tied to industry or supply chains, overlooking the critical analysis from pivotal nodes and the absence of dynamic studies on the indicators and variables involved in risk transmission.

2. Materials and Methods

2.1. Model Construction

This study constructs a DCC-t-Copula-CoVaR model applied to measure the risk spillover, risk absorption, and related indicators among sectors in the agricultural system [

37,

38,

39]. This multifaceted approach not only accurately seizes the dynamic correlations and the likelihood of extreme event occurrences but also significantly bolsters the model’s predictive precision and interpretability.

In this context, represents the risk spillover level of industry at time t, while denotes the risk spillover from industry to industry . Conversely, measures the risk absorption capacity of industry at time , and indicates the risk absorption from industry to industry . The variable n stands for the total number of industries. signifies the inherent risk value within the system for a single sector , is the time-varying coefficient within the system, and and are the time-varying conditional variances for sectors and , respectively, determined by their marginal distributions. The confidence level q is typically set at 0.95; represents the probability distribution function of losses. Given that , the risk value .

2.2. Questionnaire Development and Pre-Testing

This study constructs a multi-layer network model, using various levels as key nodes, and the interrelationships between industries as the connecting lines [

40,

41]. The formula for computation is outlined as follows:

In this context, A represents the contemporaneous correlation matrix between endogenous variables, while stands for the common factors. is the vector of observed returns at time , with an expected value denoted by . The term captures the risk exposure of the returns to the common factors. is the vector of structural idiosyncratic residuals, which has a diagonal covariance matrix represented by .

Assuming that A is invertible, the equation can be expressed as follows:

In the formula,

represents the number of layers in the network and

is the diagonal parameter matrix;

denotes the weights of each layer of the network, and they satisfy the relationship

, with

. The computation formula for the multi-layer network is as follows:

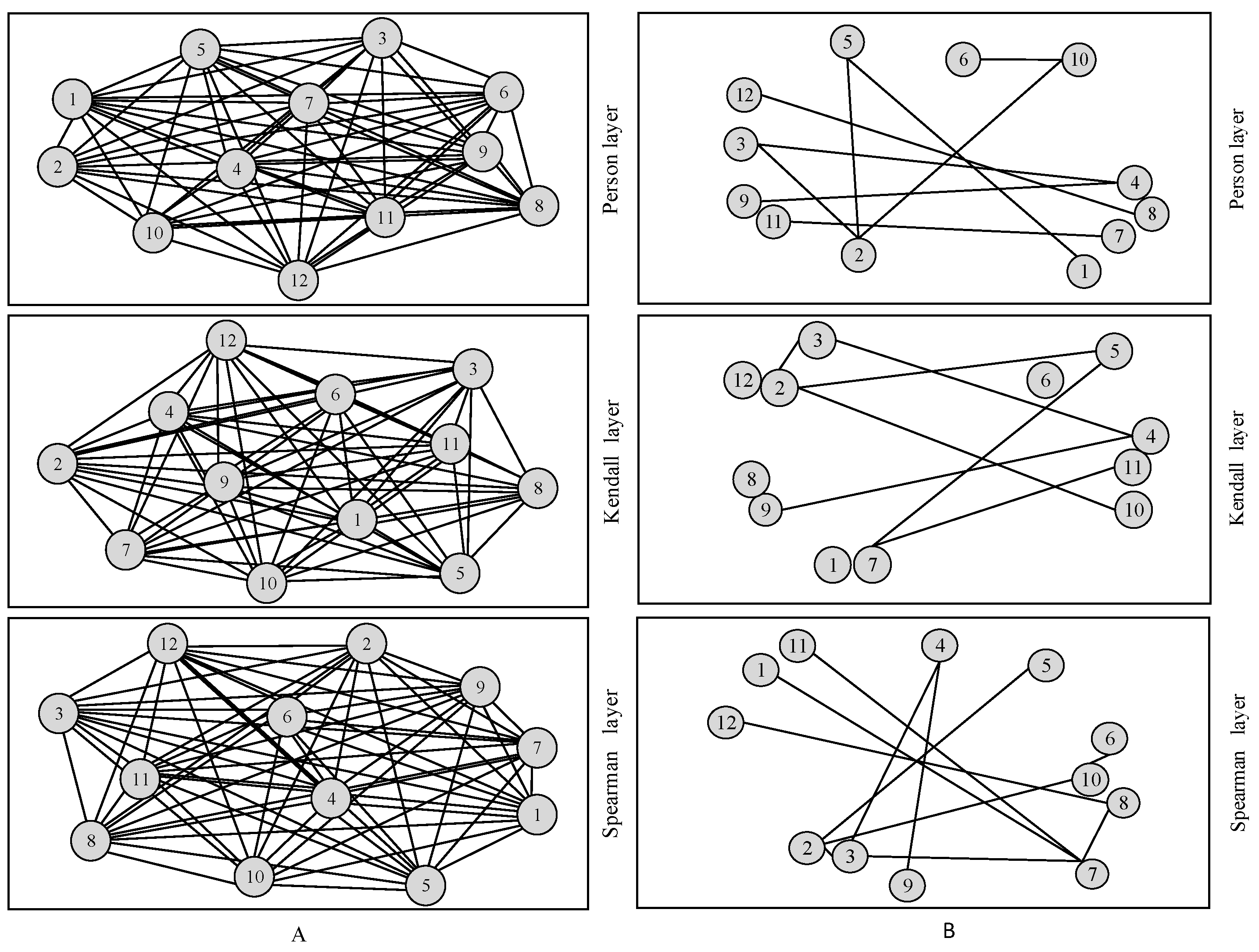

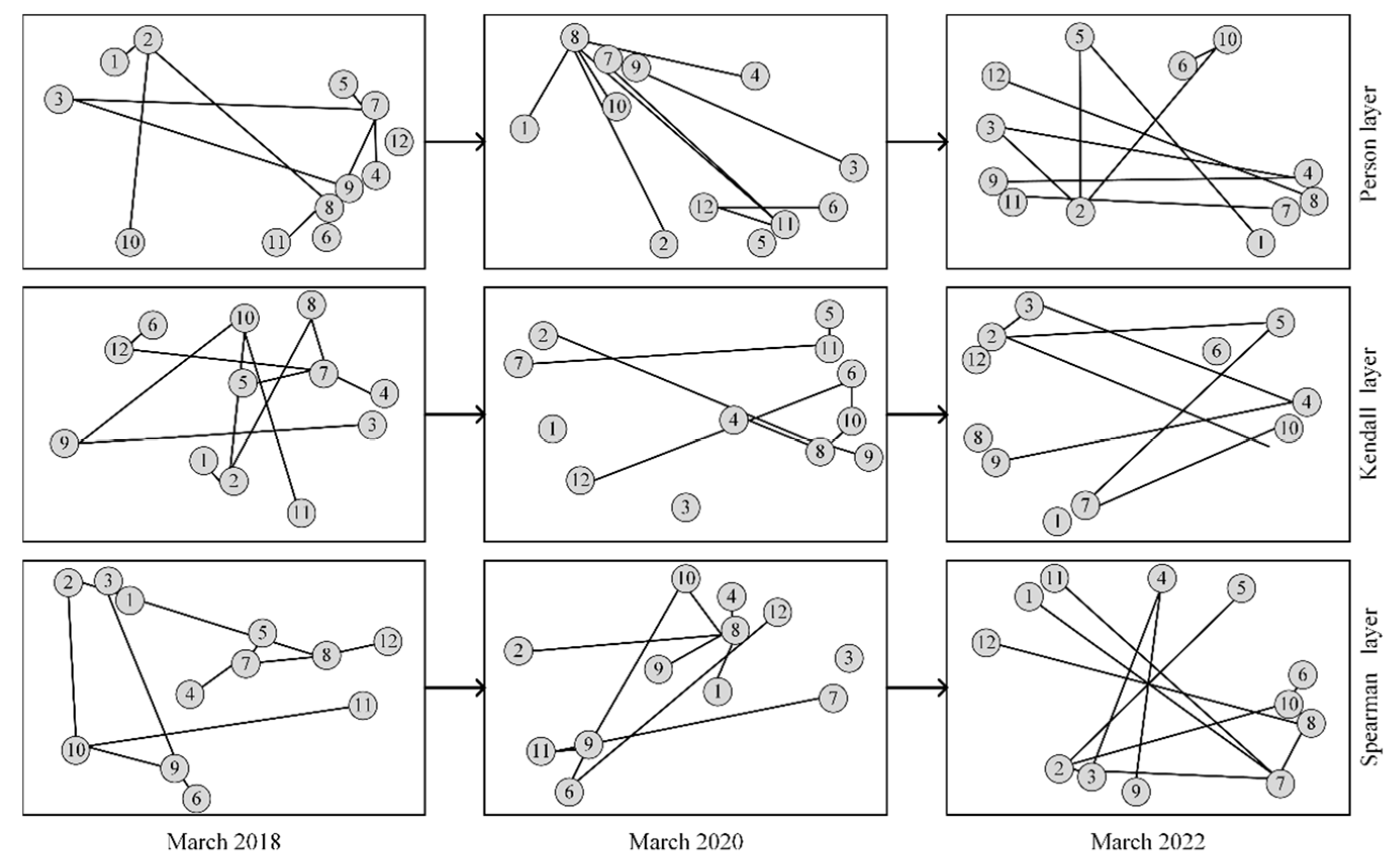

This study employs Pearson, Kendall, and Spearman correlation coefficients to describe the inter-industry associations. Additionally, it utilizes centrality measures such as degree centrality, betweenness centrality, closeness centrality, eigenvector centrality, and an improved version of eigenvector centrality to assess the importance of nodes.

After calculating the structural indicators of each level, a synthesis of the indicators of different levels within the same observation window was conducted [

42]. For instance, the formula for degree centrality is as follows:

2.3. Construct Measurement

This study conducts mixed-frequency regression analysis on the MIDAS method [

43]. The computational formula is as follows:

In this context, represents the high-frequency explanatory variable, where m is the sampling frequency of high-frequency relative to low-frequency. For example, if monthly data are used to explain quarterly data, then . denotes the number of lags, and are their weights. The core of mixed-frequency regression is to address the weighting issue in high-frequency data science. U-MIDAS, Step, Almon Polynomial, Exponential Almon weighting, Beta weighting, etc., are some commonly used weighting strategies.

2.4. Sample and Data Collection Procedures

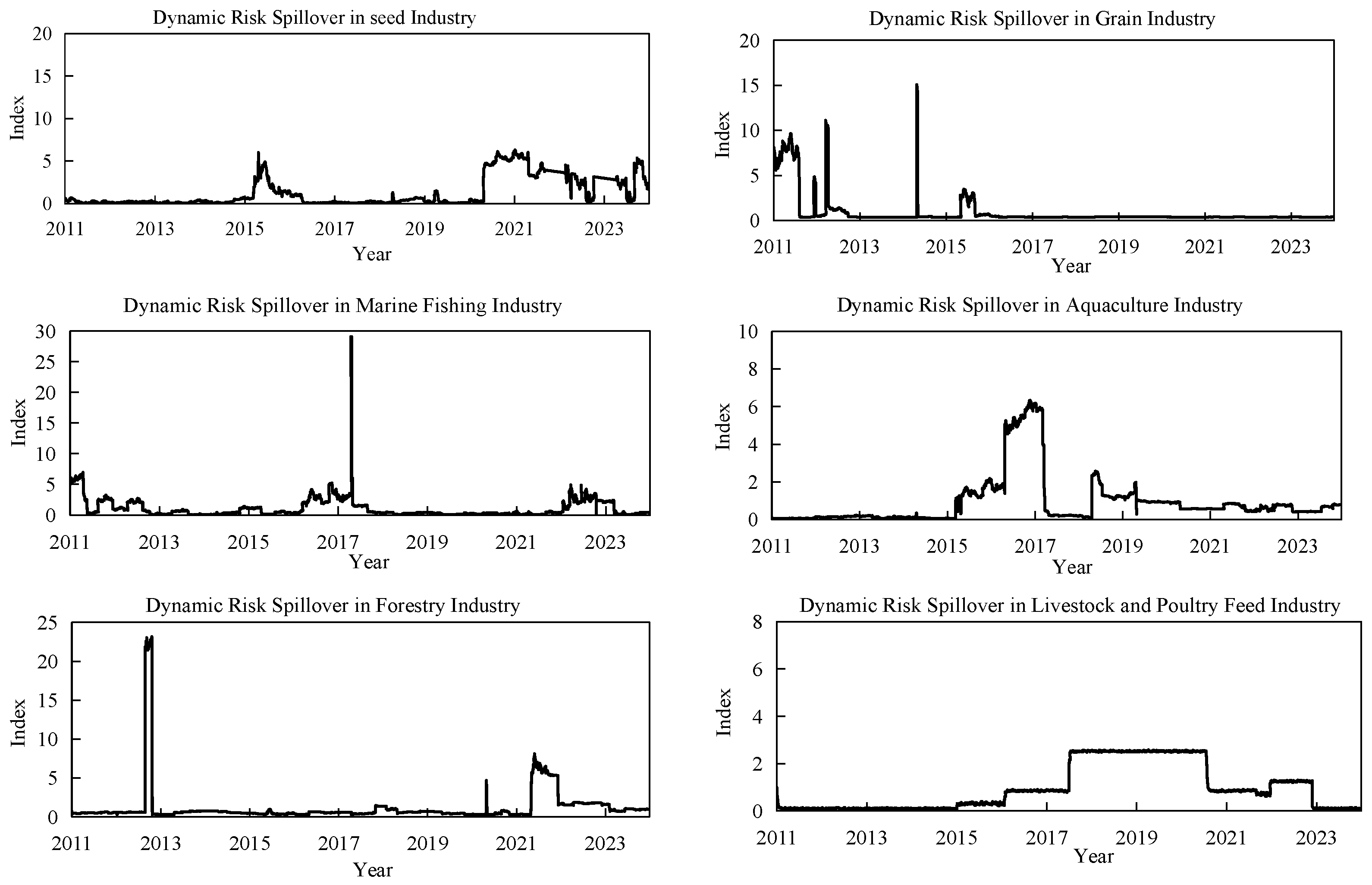

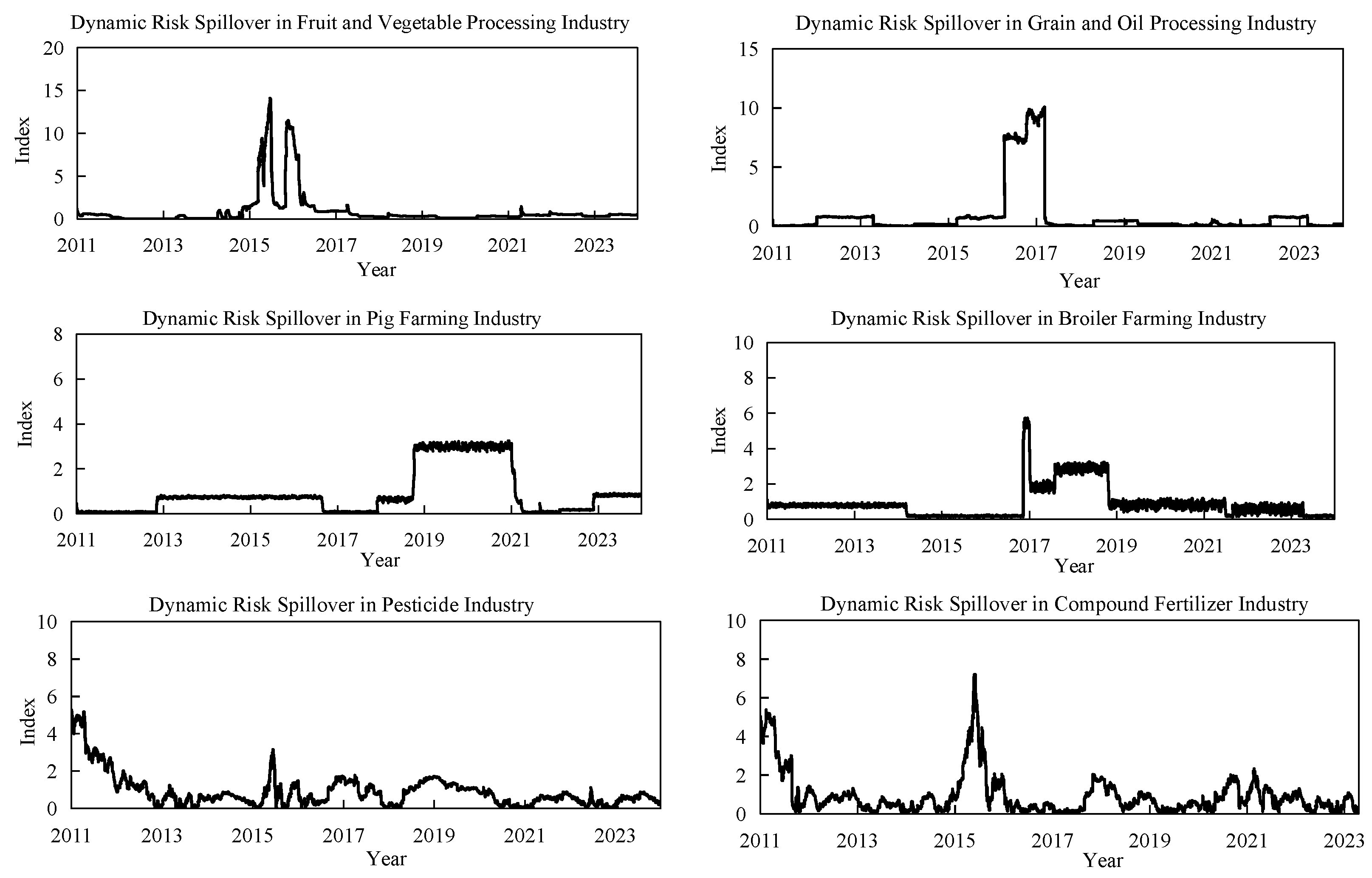

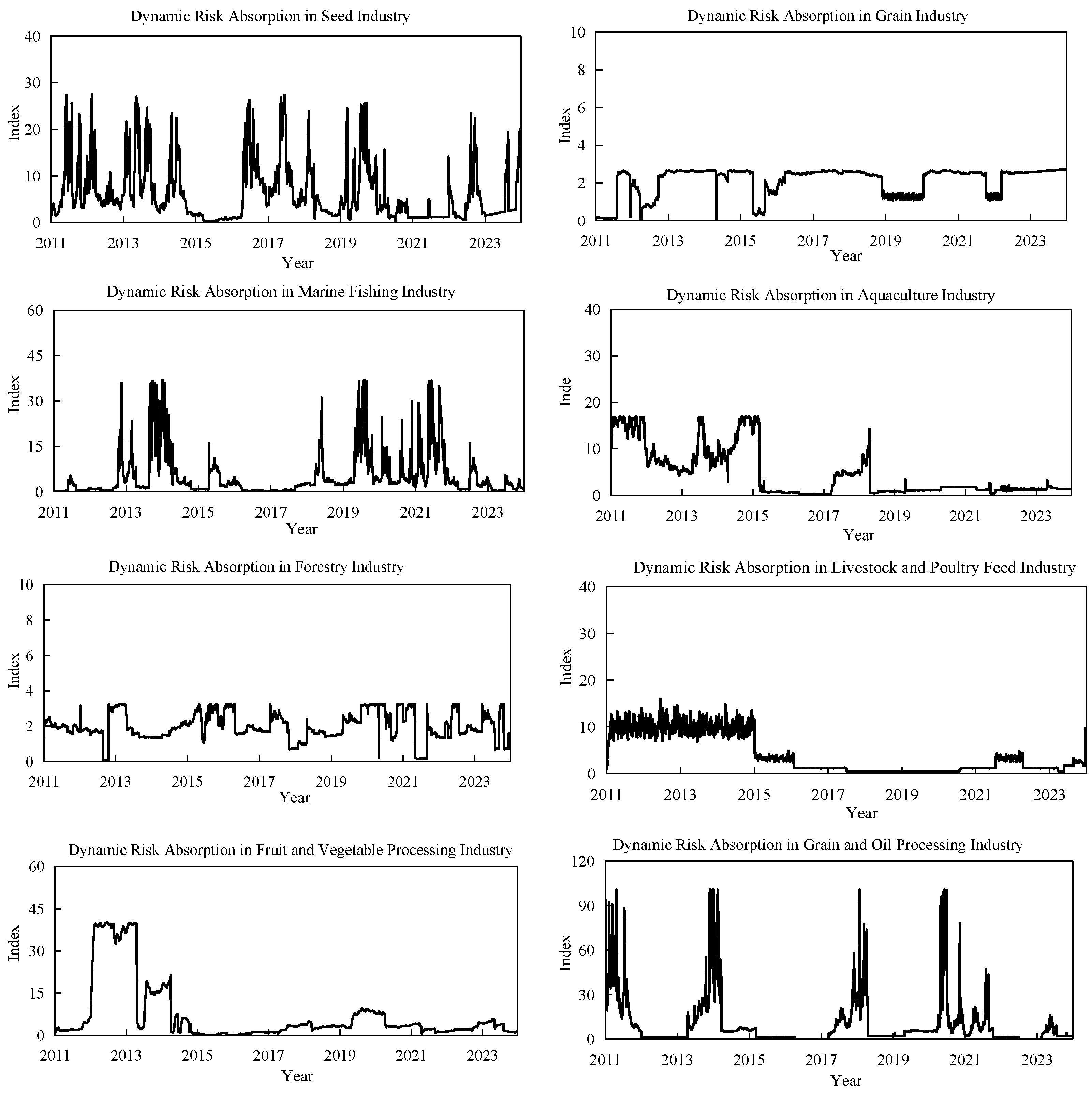

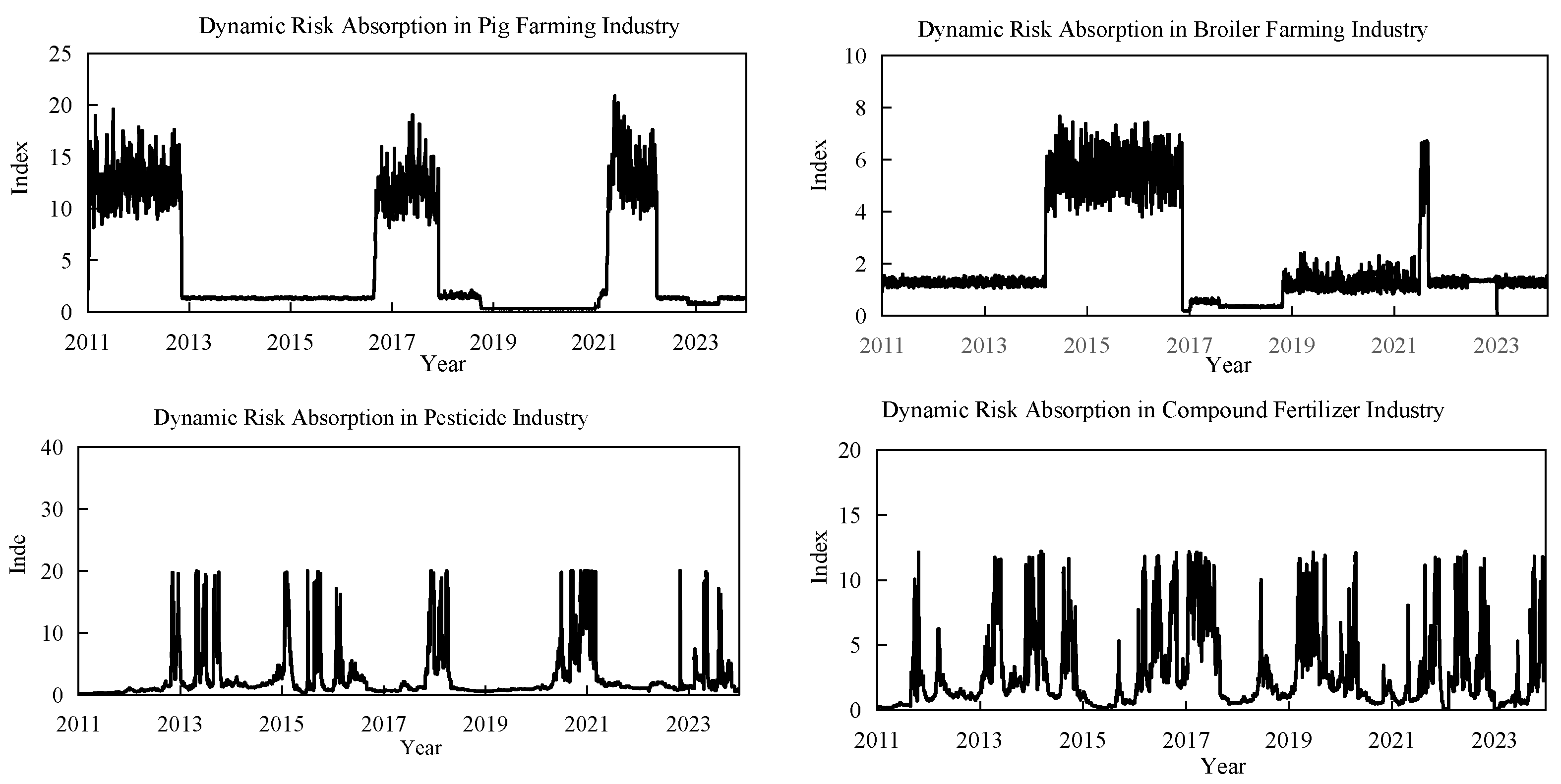

To accurately reflect the development status and market dynamics across various sectors within the agricultural system, this study selects the Shenwan Securities tertiary agricultural industry indices from the iFinD financial database as research indicators. These indices include the seed index, grain planting index, marine fishing index, aquaculture index, forestry index, livestock and poultry feed index, fruit and vegetable processing index, grain and oil processing index, hog farming index, broiler farming index, pesticide index, and compound fertilizer index. For ease of reference, they are sequentially labeled as indices 1 to 12. The sample period spans from 1 January 2010 to 31 December 2023. This timeframe encompasses major events such as the 2015 stock market volatility, the 2018 China–U.S. trade friction, and the 2020 COVID-19 pandemic, providing a robust basis for further analyzing risk transmission pathways and interconnected risk mechanisms among agricultural sectors. The findings offer empirical support for risk management and policy formulation in the agricultural supply chain. The logarithmic returns are derived by calculating the exponential series of daily closing prices, with the formula as follows:

In the formula, represents the daily return rate of the industry index, where and denote the closing prices on consecutive trading days.

When examining the impact of multi-layer network structures on inter-industry risk linkages, the degree of risk spillover and absorption between industries at a quarterly frequency is selected as the dependent variable, while the nodes at a monthly frequency serve as the explanatory variables. Additionally, monthly industry transaction prices and price-to-earnings ratios are considered. Macro-level control variables encompass the quarterly economic year-over-year growth rate and the year-over-year growth rate of the money supply. The calculation formula is as follows:

In this context, and represent the indicators of risk spillover and risk absorption for industry i at time t, respectively. denotes the nodal importance indicator, refers to the micro-level control variables, signifies the macro-level control variables, and is the stochastic error term.

4. Discussion

From a vertical perspective, analyzing the risk transmission pathways and intensities between upstream production industries—such as seeds, fertilizers, and pesticides—and downstream industries, including agricultural product processing and breeding, illuminates key areas for risk management. This differentiation often ties back to the unique characteristics of each industry, the structure of the market, and the surrounding policy environment. On a horizontal level, the analysis uncovers the variances in factors impacting different industries and the degree of risk variation. These differences may stem from market sensitivity, technological advancements, and the industry’s adaptability. The complex web of transmission pathways and the stability of risk propagation between industries, coupled with fluctuations in risk intensity at the same level across various time frames, reveal a dynamic risk linkage structure within the agricultural system. This dynamism is likely influenced by seasonal factors, shifts in market demand, and international trade policies. The transmissibility of risk and the vulnerability of inter-industry nodes, together with the observed positive correlation between connectivity and risk, underscore the critical role of regulatory bodies in risk prevention and control, as well as the importance of inter-industry collaboration.

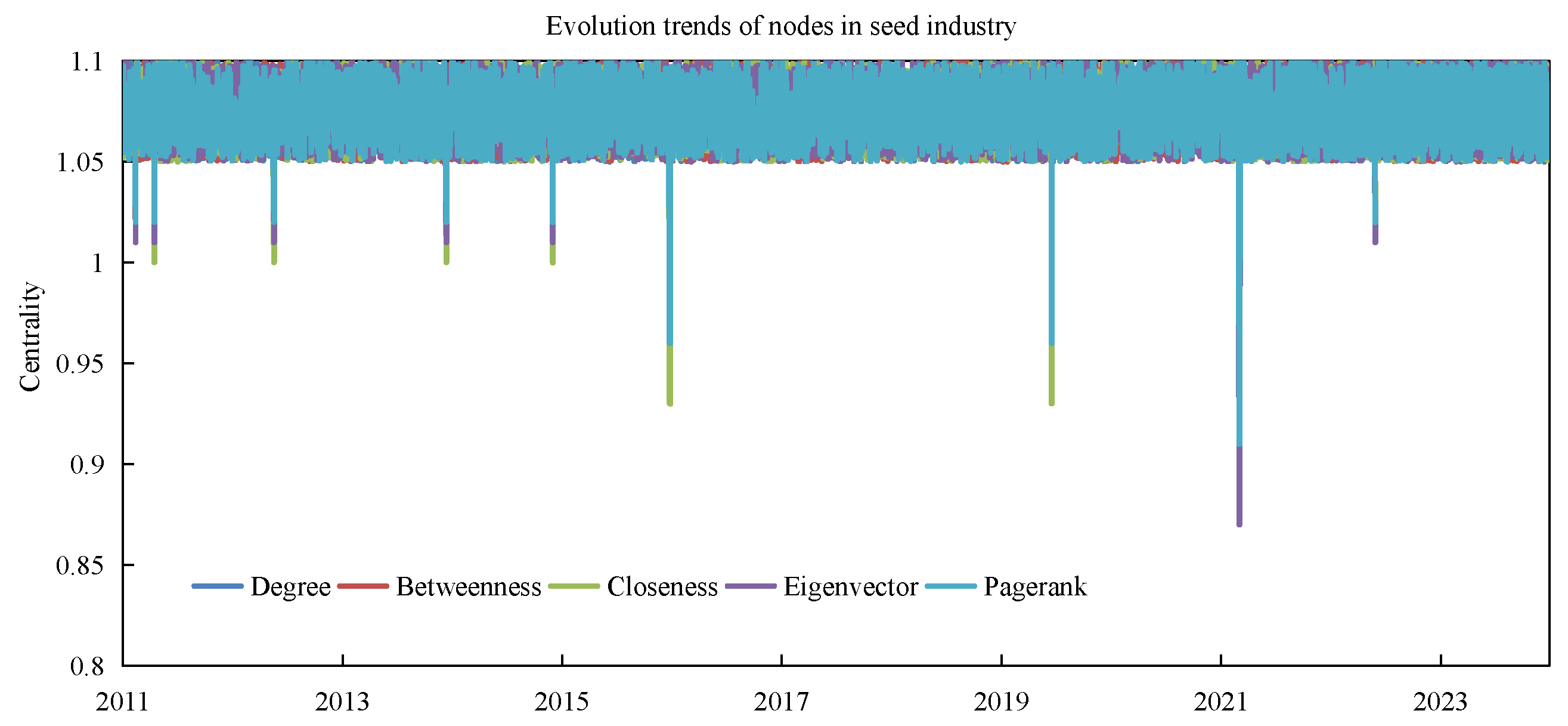

From the standpoint of industry risk spillover, the positive correlation between the intensity of close inter-industry connections and the potential for extreme risk spillover effects signals that regulators and industry stakeholders must be vigilant about the interlinking effects between industries. In terms of risk absorption, the positive correlation between an industry’s centrality and its capacity to absorb risk, along with the buffering role of industries with high indirect centrality in mitigating risk transmission, opens new avenues for internal risk management strategies within industries. The discovery of eigenvector centrality, which suggests that inter-industry linkages aid in risk diversification, lays a theoretical foundation for establishing a collective risk-sharing mechanism.

Despite the fresh insights this study offers into the mechanisms of risk propagation within the agricultural system, it is not without its limitations. For instance, the model may not fully capture all the factors influencing risk propagation, particularly those that are challenging to quantify, like policy shifts and technological breakthroughs. Additionally, due to constraints in data availability, this study might not encompass all pertinent industries. Future research could broaden its scope to include more industries, providing a more comprehensive understanding of risk propagation.

5. Conclusions

This study employed the DCC-t-Copula-CoVaR model, multi-layer network structures, and the mixed-frequency regression MIDAS model to explore risk spillover, absorption effects, and transmission mechanisms within the agricultural sector from an industry standpoint. The key findings are as follows:

There is notable heterogeneity in risk spillover and absorption among different sectors within the agricultural system, with industries generally possessing a greater capacity to absorb risks than to generate spillovers. As a whole, the agricultural system demonstrates intrinsic risk-buffering traits. Vertically, the risk transmission pathways and intensity differ between industries involved in the production of seeds, fertilizers, and pesticides (upstream) and those engaged in agricultural product processing and breeding (downstream). Horizontally, varying factors influence industries, leading to different levels of risk fluctuation.

The transmission of risk between industries within the agricultural system features multi-centric pathways and maintains a degree of stability. The intensity of risk transmission among industries at the same level fluctuates over time. Inter-industry nodes exhibit both risk propagation and vulnerability, with stronger connections leading to higher risks.

Regarding industry risk spillover, the intensity of close inter-industry connections directly correlates with the magnitude of extreme risk spillover; risks can swiftly propagate through complex trading networks, with significant risks in the agricultural system mainly stemming from resonance across multiple industries. From the risk absorption perspective, an industry’s degree of centrality is positively linked to its capacity to absorb risks. Conversely, industries with high indirect centrality can mitigate risk transmission, while those with high closeness centrality are more exposed to risks. Eigenvector centrality suggests that inter-industry connections facilitate risk dispersion, creating a collective risk-sharing mechanism.

Limitations and recommendations for further study. Even with the deployment of sophisticated tools like the DCC-t-Copula-CoVaR model, multi-layer network structures, and the mixed-frequency regression MIDAS model in risk analysis, these instruments can encounter constraints due to their inherent model assumptions when applied in real-world scenarios. For example, the static nature of the CoVaR model might not adequately capture the dynamic aspects of risk evolution. Furthermore, the representativeness of research findings can be compromised by the scope and periodicity of the data employed, particularly if the data are predominantly sourced from specific locales or time frames. This limitation could render the identified patterns of risk dissemination and stability conclusions inapplicable in a broader global context. Concurrently, there is a tendency in the existing literature to concentrate on the interplay of risks across industries, while the influence of individual firms’ risk management and decision-making processes on the overall stability of the agricultural sector is often overlooked. To deepen and broaden the scope of research, future endeavors might consider several enhancements. Firstly, incorporating time-variant parameter models or nonlinear approaches could significantly improve the detection of risk dynamics. Secondly, broadening the data spectrum to include a wider array of international market information and varying data frequencies could bolster the robustness of the models and the generalizability of the findings. Thirdly, a closer examination of microeconomic entities and their role in risk interplay could yield more nuanced risk management strategies. Additionally, employing long-term data to scrutinize risk transmission mechanisms and stability would provide a more profound comprehension of these dynamics. Lastly, marrying quantitative methodologies with qualitative insights—gleaned from expert interviews and case studies—would offer a more holistic evaluation of the efficacy and socio-economic repercussions of risk management systems.