Abstract

Evaluating the competitiveness of electricity is the most important issue. The main aim of this study was to determine the cost-effectiveness of renewable energy production in the European Union (EU) using the levelized cost competitiveness of renewable energy sources. The weighted average cost of capital (WACC) for onshore wind was calculated for European (EU) countries. The levelized cost of electricity (LCOE) approach was used to evaluate the energy costs of renewable energy sources. Energy production costs were compared across different technologies. The capital expenditures associated with solar PV are expected to decrease from USD 810/kW in 2021 to USD 360/kW in 2050. The power factor will remain stable at 14% during the analyzed period. Fuel, CO2, and operation and maintenance (O&M) costs will be maintained at USD 10/MWh at all three time points of the analysis (2021, 2030, and 2050), whereas the LCOE will decrease from USD 50/MWh in 2021 to USD 25/MWh in 2050. The capital expenditures associated with onshore wind energy will decrease from USD 1590/kW in 2021 to USD 1410/kW in 2050. The power factor will increase from 29% to 30%, and fuel, CO2, and O&M costs will reach USD 15/MWh in all three years. The LCOE will decrease from USD 55/MWh in 2021 to USD 45/MWh in 2050. In offshore wind projects, capital expenditures are expected to decrease considerably from USD 3040/kW in 2021 to USD 1320/kW in 2050.

1. Introduction

One renewable energy source will not fulfill the demand for electricity. The most efficient approach is hybrid systems using two or more renewable energy sources. That is why it is important to analyze the technical and economic aspects of hybrid systems for the efficient utilization of renewable energy sources [1].

Electricity system technology has different competitiveness, which depends on the technology costs of the lifetime economic value. Capital, fuel, and operation and maintenance (O&M) costs are examples of the total technology costs. Such costs can be measured by LCOE [2].

The cost of electricity production is estimated by LCOE generation. Calculating the LCOE costs in the world is difficult because of the different costs of technology [3]. The costs estimated by LCOE differ between technologies. It is estimated that LCOE onshore wind is cheaper than natural gas technologies [3]. Moreover, PV installations are less economically competitive than fossil fuels and wind, even though the PV sector is rapidly growing [4,5]. The EU and China are the fastest-growing markets for photovoltaics. Installation is still expensive; however, the development of technology decreases the prices [6]. The most important costs include the costs of key raw materials, i.e., silicon and transport, prices of modules, and others [7,8].

Wind cost efficiency depends on the cost of foundations, offshore electrical infrastructure, energy yield, and others [9]. The other important costs include foundation supply, foundation installation, turbine supply, turbine installation, intra-array cables, decommissioning, operations and maintenance, and offshore transmission assets [10,11].

In biodiesel production, access and the cost of biocomponents represent threats to energy sector development. Other factors determining the profitability of biofuels are subsidies, import taxes, and governmental regulations [12,13].

Larsson et al. [14] analyzed the LCOE, which is commonly used worldwide. The cost of the energy-generating system and the energy produced during its lifespan must be taken into account when calculating the LCOE. The discount rate, average system price, financing method, average system lifespan, and deterioration of energy output over time are the primary assumptions used in the LCOE calculation [15].

The LCOE method was calculated by different authors using different technologies of renewable energy sources (RES). The High resolution of annual energy production (AEP) potential, which is obtained from a high-resolution wind speed model, was combined with additional spatially resolved cost dependencies, such as distance to the coast, ocean depth, and technology-specific features, using the LCOE technique. For every nation, the WACC, which represents the cost of financing, was also estimated [16].

The LCOE, which is used to assess the cost of a power system or producing plant, was calculated by Lai et al. [17]. To determine the LCOE for the environmental energy solutions (EES), a novel metric called the levelized cost of delivery (LCOD) was put forth in their study. The definitions of photovoltaic (PV) hybrid energy systems in the LCOE were reviewed. For case studies, national load data from Kenya and four years’ worth of sun irradiance data from Johannesburg were acquired.

The WACC, or high capital costs, is used in calculating the LCOE. A high WACC of RES tends to promote the usage of fossil fuels. Therefore, nations with high capital costs must put a larger price on carbon emissions than those with low capital costs in order to achieve the same level of decarbonization. Given that capital costs are often greater in developing and emerging economies than in wealthy ones, this is especially important [18].

Shen et al. [19] examined the LCOE for renewable energy by taking into account factors like enhancing conventional approaches for assessing and lowering the LCOE of variable renewable energy. The current approaches to enhance the precision of the conventional LCOE have been categorized into four areas: costs related to investment, costs associated with operation, formulas for plant efficiency, and costs concerning uncertainty and risk.

Shea and Ramgolan [20] examined the small island of Mauritius along with its local renewable resource capabilities and expenses to assess the LCOE for different technologies. The authors found that solar and offshore wind are expected to produce above-average energy potential, while wave energy, sugarcane residue, and municipal solid waste-to-energy show average potential. In contrast, onshore wind offers below-average potential, and hydropower and geothermal are deemed unfeasible. The authors found that the energy potential of every renewable energy system is directly linked to its capacity factor, which has been identified as the most significant LCOE.

Idel [21] utilized the LCOE, consolidating various proportions of fixed and variable costs into one cost metric. They have faced criticism for overlooking the impacts of intermittency and non-dispatchability. The author of the paper presented the Levelized Full System Costs of Electricity (LFSCOE), an innovative assessment measure that evaluates the expenses of supplying the entire market with only one source, combined with storage.

Samadi [22] examined decommissioning expenses, generally accounted for within capital costs. Although these costs can be considerable during decommissioning, particularly for nuclear power plants, they are only incurred at the conclusion of a plant’s operational life. In the LCOE approach, these decommissioning expenses become trivial (approximately 1% or lower) when discounted at any widely utilized rate.

Sels et al. [23] examined the capital expenditures (CAPEX) for photovoltaic plants, onshore, and offshore wind turbines for the years 2030 and 2050, utilizing the experience curve theory. Using this information, the LCOE for 2020, 2030, and 2050 was calculated, analyzed for their sensitivity, and contrasted with fossil fuel-powered plants.

The authors of the paper have not studied the topic of levelized costs of electricity (LCOE) previously. Bórawski et al. [24] measured the perspectives of electricity production from biomass and changes in gross nuclear electricity production [25].

The most important innovative aspect of this research is the presentation of research concerning the LCOE. This topic has been relatively rarely recognized in the literature. Aoun et al. [26] used a novel optimization algorithm to balance supply and demand while minimizing the LCOE. Tahir et al. [27] also measured the LCOE. They found that excluding often-overlooked peripheral devices could lead to a 27.7% error in LCOE evaluation, while the impact on LCOE was less than 1%. Our intention was to present biomass, onshore wind and offshore wind, and photovoltaics, which are difficult to find in the literature.

The main aim of this study was to determine the cost-effectiveness of renewable energy production in the European Union (EU) using the LCOE. The detailed research objectives were to:

- Assess the structure of electricity generation costs.

- Determine the global weighted average cost of capital (WACC) for onshore wind.

The following research questions were formulated:

- What are the costs of renewable energy production?

- What is the structure of electricity generation costs?

Hypothesis 1 (H1):

Plant biomass is the cheapest source of energy compared with other renewable energy sources.

The paper is organized as follows: The first section presents the theory of ecological economics and the competitiveness of RES. The aim of this study and the research methods are described in the first section. In the second chapter, we present our literature review. The results of the LCOE analysis are presented in the third section and discussed in the fourth section. The final section summarizes the key findings in relation to the research objectives and questions.

2. Literature Review

2.1. Ecological Economics

Ecological economics (EE) was established in 1989 and is a rather new concept embedding social and economic systems in the biophysical world [28]. Ecological economics (EE) is a transdisciplinary field of study, with a different range of disciplines and topics [29]. Conventional (neoclassical) economics is focused on consumer preferences weighted by their purchasing power and pays no attention to resources or goods and services in nature, whereas ecological economics is more transdisciplinary and focused on climate change, renewable energy sources, nuclear waste, biodiversity loss, and other challenges [30]. EE focuses on the possibilities of material reduction in economies without worsening growth while increasing the efficiency of using raw materials [31].

EE is also compared to traditional Environmental Resources Economics (ERE). Ecological economics is more closely tied to conventional resource economics, which deals with renewable resources like forests, water, and wind, than it is to environmental economics in the strict sense of the economy of pollution [32]. Ecological economics places a strong focus on sectoral and geographical adjustments to economic activity in order to achieve a minimal amount of environmental pressure brought on by the flow of materials and substances. Waste management, recycling and reuse, and improving product durability must all be balanced [33]. Renewable energy is especially important for developing and less developed nations’ sustainable economic growth in order to draw in foreign investment [34]. RES play a key role in sustainable development and ecological economics. The long-term objective is to boost energy efficiency, and increasing the proportion of renewable energy sources is crucial to achieving sustainable energy [35]. The use of renewable energy sources, such as biomass, solar PV systems, wind turbines, and concentrated solar power plants, could greatly aid in the development of a low-carbon sustainable economy [36,37].

Ecological economics is a field of academic research that focuses on limits to substitution between various economic inputs and the irreversible depletion of natural resources, such as certain species of flora and fauna. It emphasizes the need for intergenerational equity and highlights the risks associated with ecosystem degradation. Ecological economics rejects the notion that income is the only criterion for development and posits that human welfare should be measured in terms of the quality of life [38,39,40,41].

Environmental issues have been incorporated into contemporary economic theories to a varied extent, and they are addressed in interdisciplinary debates conducted at various levels of management [42]. The role of environmental factors in the economy can be interpreted with the use of two approaches. The first approach is an ecological paradigm that focuses on the relationship between ecosystems and economies, whereas the second approach is referred to as the economization of the environment [43,44].

Unlike traditional economic theories, the ecological paradigm prioritizes ecological factors and environmental goals of economic growth. It recognizes that the economic progress achieved does not sufficiently address social, economic, and environmental problems. An ecological approach to economic growth is needed, where natural capital resources are the main limits to economic development and where the main goal of economic growth should be to conserve the environment or at least to prevent further environmental degradation [43,45,46].

Ecological economics, a new discipline of social and economic sciences, focuses on ecological sustainability. This approach is based on physical flows, and it rejects utility, social preferences, and the substitutability between natural capital and social capital. In turn, the economization paradigm relies on economic tools such as prices, taxes, and the emissions trading system to solve environmental problems. It promotes sustainable development by combining environmental protection with economic efficiency [43,47].

In addition to environmental economics and ecological economics, the economics of environmental conservation is yet another concept that has emerged in the literature. This discipline is similar to environmental economics in its theoretical underpinnings, as it also studies the relationship between the economy and the environment, but it also draws upon ecological economics [43,48,49].

In economic theories, ecological issues are examined not only in terms of resource depletion or environmental pollution. The influence of spatial and territorial factors, namely distance and the occupied area, on economic development is also considered. Therefore, the economics of environmental conservation is a discipline that combines environmental economics and ecological economics and draws upon various schools of economic thought. It focuses on environmental management and the effectiveness of environmental protection strategies, and it recognizes the importance of both microeconomic and macroeconomic aspects, as well as spatial and territorial factors underpinning economic development [43,50].

Initially, economists focused mainly on natural resources that are essential in the production process, particularly land. Other environmental factors that affect economic development, including the depletion of non-renewable resources, environmental degradation, and spatial and territorial constraints, were also incorporated into economic analyses over time. As a result, environmental considerations were brought to the forefront in economic decision-making. The ecological theory of the environment became an established field of modern economic research [43,51]. Most of the global land resources are used in agriculture, the sector of the economy with the greatest territorial impact. Recent years have witnessed the decoupling of food production and land use. Each state has to decide on the proportions of land that are allocated to food and non-food production. State authorities rely on various instruments to shape land use, including policies that indirectly affect the sale of agricultural land, as well as targeted incentives that stimulate land use [52].

Ecological economics has evolved as a critical approach to the existing models of economic development by integrating diverse perspectives from numerous scientific disciplines. By relying on a broader scientific perspective, ecological economics promotes a new approach to economic analyses and processes, and it is considered a normative science. Ecological economics attempts to integrate uncertainty, ecological values, and diverse analytical perspectives into the cognitive process, and it is increasingly relevant in the context of contemporary environmental challenges [53,54,55].

2.2. Competitiveness of RES

Access to electricity is important for the development of modern economies. Economic growth and social development depend on access to electricity. Many people in Africa and South Asia still have limited access to electricity [56]. Competitiveness relates to the energy sector, including renewable energy sources. Current development requires a constant supply of energy from fossil fuels, causing an increase in GHG. These gases cause climate change, negatively affecting the environment, human life, and the future [57]. CO2 emissions and other GHG emissions have a relationship with economic growth, trade development, and foreign direct investment [58]. The competitiveness of the energy sector is shaped by the development of power facilities in renewable energy and combined generation of electric power and heat. It is important to measure and evaluate the efficiency of electricity supply from different generation sources, including renewable energy sources. The price of electricity depends on the structure of generating capacities [59].

The competitiveness of the energy sector is shaped by investments. However, high costs of investment are an important obstacle. The capacity for renewable installation has increased due to better technologies [60]. The increase in energy prices may reduce investment, so it is an important factor in competitiveness [61]. Moreover, the costs of renewable energy technologies (RETs) have decreased due to the massive scale of production. China is famous for its massive production of photovoltaic panels and for selling them to other parts of the world [62]. The most mature technologies in electricity production are large biomass co-firing, wind, and biogas [63].

Another important issue stimulating the development of renewable energy sources is the high cost of fossil fuels. These costs include transport, utilization, etc. [64]. The costs of energy have an impact on almost all costs in the economy. Energy price changes have an impact on household expenditure and determine inflation changes in different countries [65].

Energy systems differ in terms of water, land use, GHG emissions, and material use. Renewable energy source technology development means an increasing demand for certain materials. An important role is played by supply chains, both for energy and the supply and demand of resources [66]. RES technologies require the use of critical materials, which increases prices. Another issue is the social acceptance of RES. More environmentally friendly technologies change household attitudes toward purchasing clean and green energy [67].

Biomass, which is the most widely accessible renewable energy, is carbon dioxide-neutral. This means that this source of energy assimilates carbon dioxide for plant growth and releases a similar amount into the atmosphere during combustion. However, it requires water for the growth of the plant. Moreover, biomass is not competitive in terms of its carbon footprint.

Photovoltaics require a large amount of materials for panel production. Semiconductor materials are mainly used to produce photovoltaic cells. The most commonly used semiconductor material is silicon (Si), which has very good photovoltaic properties and is the basic component of most photovoltaic panels on the market. Using photovoltaics has a positive impact on the environment, such as no reductions in sulfur oxides or nitrogen oxides and reduced fossil fuels. Photovoltaics does not use water during operation, but the panels need to be placed somewhere. When they are placed on land, problems with land use for agricultural purposes occur. Photovoltaic panels have a carbon footprint, although solar energy’s life cycle emissions are about 12 times lower than natural gas and 20 times lower than coal.

Wind energy may also cause disturbances in the market in the case of special materials. Steel and other materials are used for the production of wind fans and turbines, which account for 89.1% of wind turbine materials [68]. Some people do not accept wind farms close to their buildings, which is why they have to be installed 700 m from buildings in Poland. Recently, this has been changed to 500 m from buildings. Wind energy has a hidden footprint. However, unlike burning fossil fuels, there is a huge opportunity to significantly reduce the carbon footprint of solar panels.

3. Materials and Methods

3.1. Data Sources

Various research methods were used in the analytical process. Data were collected via the use of a critical review of the literature, deductive reasoning, and an analysis of the attractiveness of renewable energy generation technologies. The collected data were analyzed using the LCOE approach. We used the International Renewable Energy Agency (IRENA) data in the paper. The IRENA report usually does not provide detailed data on wind speed or solar radiation for each of the European Union (EU) countries. These data are often presented as regional or global averages, making it difficult to accurately represent local conditions.

3.2. Methods

There are several methods for calculating the cost of producing power. The so-called LCOE, also known as the average lifetime levelized generation cost (ALLGC) or levelized cost of generation (LCG), is a generally acknowledged method [44]. However, the most used is the LCOE method.

The energy production costs in the compared renewable energy generation technologies were estimated with the LCOE method. The competitiveness of the analyzed technologies was assessed mainly based on the LCOE, which was calculated using the following formula [69].

- where:

- LCOE—levelized cost of electricity over the lifetime of an energy asset, expressed in USD/KWh.

- t—time interval, usually one year; t = 0 is the first year of investment.

- T—lifespan of the system.

- —capital expenditures in year t.

- —operating expenses and financial costs in year t.

- —energy output in year t [KWh].

- —discount rate (cost of capital).

- —total fuel expenses in year t.

Figure 1 presents the topic, methods, and sources of analysis presented in the paper. Using the literature review method, we present the ecological economics rules. Using the WACC, we present the renewable energy production, and using the LCOE, we describe the cost of electricity. Finally, using our own research results and literature sources, we present the discussion and conclusions of the paper.

Figure 1.

Flowchart of the research process. Source: own elaboration.

The LCOE method was used to calculate reference rates in the amendment to the Renewable Energy Act (transposing the provisions of Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the promotion of the use of energy from renewable sources (RED II) into national law). The above formula can be applied to both conventional and renewable energy generation technologies to compare energy production costs across different systems.

Fixed Operations and Maintenance (FOM) costs denote the expenditure associated with maintaining a generating unit, including repairs, overhauls, and salaries. Variable Operations and Maintenance (VOM) costs include material expenditure, environmental fees, and consumables associated directly with energy production.

4. Results

Capital Expenditures in Renewable Energy

Capital expenditure is not the only cost associated with electricity generation systems, and operating costs are also important in analyses examining the competitiveness of different renewable energy technologies. Capital expenditure and operating costs are lowest in onshore wind farms. Solar PV systems are characterized by similar operating costs but higher capital investments [70,71].

The income tax and value-added tax (VAT) were not included in the analysis because they affect energy prices rather than production costs. Carbon credits are considered an internalized external cost, and they can affect the competitiveness of different energy generation technologies. The external costs associated with the emissions of pollutants other than carbon dioxide were also included in the analysis. These costs cover the entire supply chain, from resource extraction to plant decommissioning and waste management. These costs are not borne by power plant owners, and the negative impacts of power generation, including environmental pollution, its effects on public health, and damage to buildings and materials, are passed on to society [72].

The LCOE is calculated based on the real discount rate, namely the WACC, for infrastructure projects, which represents the proportion of equity and debt financing [72]:

- where:

- EQ—market value of equity [€].

- DB—market value of debt [€].

- ROE—annual return on equity.

- RDB—annual return on debt [60].

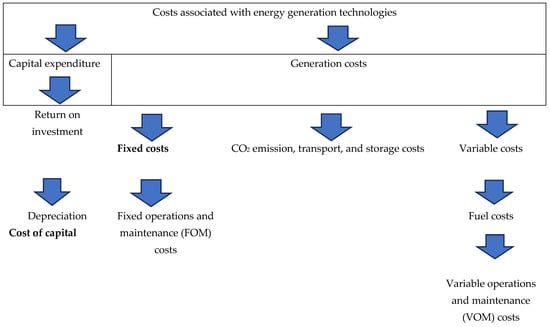

Therefore, the operating costs should be analyzed to assess the competitiveness of various energy generation technologies. The structure of costs in different energy production systems is presented in Figure 2. The energy generation costs procedure is presented in Figure 2. The costs associated with energy generation technologies are divided into capital expenditure and generation costs. The capital investment costs have been represented by return on investment, depreciation, and the cost of capital. The generation costs are represented by fixed costs, CO2 emission, transport and storage costs, and variable costs.

Figure 2.

Structure of electricity generation costs. Source: own elaboration based on the “Update to a comparative analysis of electricity generation costs in nuclear, coal-fired, and gas-fired plants, and renewable power plants” [72].

The WACC is a very popular tool in evaluating investments. For investors, the WACC has an impact on the minimum rate of return of investment. For entrepreneurs, the WACC represents the price of obtaining capital. The weak point of the WACC is the interest rate, which is not stable [73].

The same discount rate was adopted in the analysis based on the assumption that the external factors were identical for all of the energy generation technologies compared. The effect of the discount rate is examined in sensitivity analyses. It was assumed that the increase in operating costs would not exceed the rate of inflation [72].

The following technologies were compared in the analysis:

- Generation III+ water-cooled nuclear reactors (Gen III+ nuclear).

- Biomass power plants (BM).

- Onshore wind farms.

- Offshore wind farms.

- Solar photovoltaic plants (PV) [72].

The WACC has been calculated by different authors. Hirth and Steckel [48] assessed the effects of high capital costs on the energy system’s transformation under climate policy, using a computational techno-economic model of the power system. The efficiency of carbon pricing can be considerably diminished by high capital costs. For example, if carbon emissions are taxed at USD 50 per ton, the WACC is relatively high [28].

Investment in renewable energy sources is also risky, which is why scientists evaluate financial feasibility and sensitivity to help identify factors that affect the value of indicators. The list of financial models and indicators is long. Scientists have used financial models, including the WACC, internal rate of return (IRR), return on equity (ROE), debt service coverage ratio (DSCR), and net profit [74].

Solar PV is an important source of renewable energy. It has no fuel costs, which is why it i considered very clean. The production of electricity in PV installations is highest during the day and on sunny days. The capacity factor determines the daytime utilization of electricity [74].

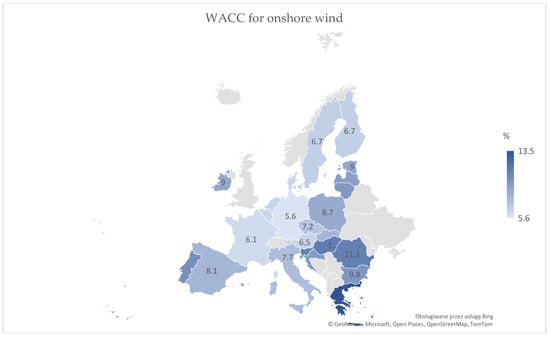

The WACC for onshore wind is diversified in the European Union (EU) (Figure 3). The WACC for onshore wind was calculated by Vartiainen et al. [75]. The authors found that the lowest WACC for onshore wind was achieved by Germany (5.6%), France (6.1%), Sweden, and Finland (6.7%). The highest WACC was achieved by Greece (13.5%), Hungary (11.3%), and Portugal (10.2%).

Figure 3.

WACC for onshore wind in the EU countries (%). Source: own elaborations based on [76].

The WACC is a very important analysis, shaping the competitiveness of investment in renewable energy sources. Countries with high costs of capital have difficulty with investments in renewable energy sources. These particularly concern companies engaged in organizing big companies delivering energy for energy systems. Each year, it is more and more popular to finance investments using leasing rather than credits. This source of capital for financing investment in RES takes place after credits and other traditional sources of capital. It is clear from Figure 3 that countries belonging to the Eurozone have a cheaper WACC. This means that the Euro, as a currency, is cheaper for credit takers. Countries such as Germany, France, Sweden, and Finland have the lowest WACC, which means that the capital is cheaper because of lower credit rates, and these countries have a higher share of RES. Countries in which the energy system is still based on coal have higher WACC and lower investment in RES.

The WACC for wind (onshore), wind (offshore), and solar PV for European Union (EU) countries was calculated by Steffen [76], Steffen et al. [77], and Egli [78]. Several European Union (EU) countries achieved WACC above 10% for wind power projects, for example, Hungary, Romania, Slovenia, Greece, and Croatia. The WACC for solar PV was the smallest, followed by onshore wind, with the highest value observed for offshore wind. Solar PV is characterized by the lowest operational risk. The differences in WACC values for EU countries are very important for policymakers in preparing strategies for RES development, financing costs, and competitiveness. The different costs of capital across countries in the EU and technologies will allow policymakers to design appropriate policy interventions [79].

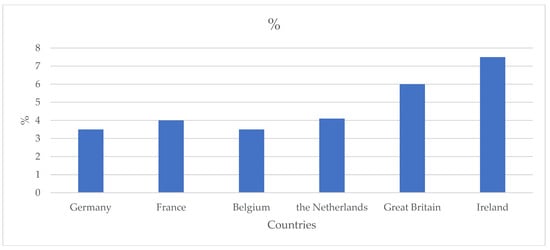

Offshore wind is characterized by different WACC levels in Germany (3.5–9%), France (4–4.3%), Belgium (3.5–4%), the Netherlands (4.1–5.9%), Great Britain (6.0%), and Ireland (7.5–8%) (Figure 4). The differences in offshore wind are the result of the different risk profiles of each country with this source of renewable energy [80].

Figure 4.

Onshore wind WACC levels. Source: own elaboration based on literature [80].

The WACC for solar PV is also characterized by different values for France (2.3–4.3%), Spain (3.0–9.0%), Portugal (3.0–9.0%), Czech Republic (5.0–7.0%), Slovakia (5.5%), Hungary (4.4–6.1%), Romania (7.5–8.0%), Bulgaria (3.8–6.7%), Greece (5.5–6.5%), Estonia (5–10%), and Latvia (12.1%). These results resemble the wind onshore results [80].

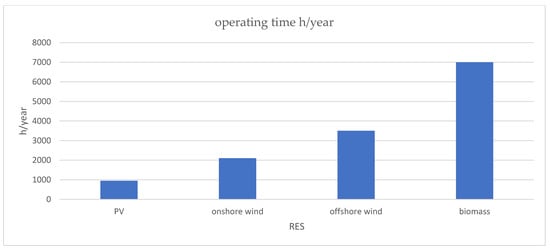

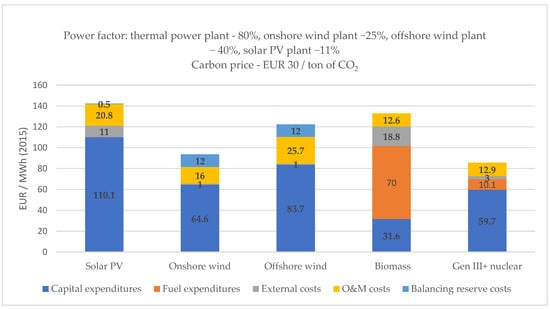

According to a 2016 report by the Energy Market Agency (ARE), the annual number of full-load hours is 7000 h for geothermal power plants, 2190 h for onshore wind farms, 3500 h for offshore wind farms, and 950 h for solar PV farms (Figure 5). These data indicate that capital expenditure is lowest in biomass plants. However, biomass plants are the only renewable energy systems that require fuel purchases, and if fuel expenditure is taken into consideration, the generation costs are lowest in onshore (EUR 93.6/MWh) and offshore wind farms (EUR 122.4/MWh).

The WACC cost was calculated at the level of 7%. Two different parameters were used in the calculations for electricity generation: (1) the capital expenditure necessary to build the power plant, and (2) the unit costs of generating energy. Investment outlays include contract outlays (OVN—overnight investment costs) and the cost of equity and external capital incurred by the investor during construction (IDC—interest during construction). Capital expenditure is reflected in costs through asset depreciation and capital costs [81].

Figure 5.

Operating time of RES. Source: own elaboration based on Energy Market Agency data [74,75,82,83].

Capital expenditure included the total capital expenditure per unit of capacity, representing the sum of current or contractual expenditure and capital costs during construction. They were determined based on current literature data.

O&M costs included fixed costs such as labor costs, external services, taxes, insurance, management and administration, building operation, maintenance and renovations, and contributions to the liquidation fund. These costs depend on the type of technology.

External costs include personnel costs for the movement of raw materials and energy, own needs, auxiliary materials, and costs of environmental use.

Fuel costs play a key role in the choice of electricity generation technology. Biomass prices determined for Polish conditions are based on the current price levels. The cost of nuclear fuel is relatively small compared to the total cost of producing electricity in a nuclear power plant.

Onshore wind and offshore wind have lower external costs, whereas their capital expenditure costs are quite high. This is due to the big investments necessary to cover all services for the devices.

For PV installations, the following assumptions were made: operating time of 950 h/year, capital expenditure of 1100 EUR thousand/MW, O&M fixed costs of 20.8 EUR/MW, and balancing reserve costs of 0.5.

For onshore wind installations, the assumptions were as follows: operating time of 2100 h/year, capital expenditure of 6460 EUR thousand/MW, O&M fixed costs of 16 EUR/MW, and balancing reserve costs of 12.

For offshore wind installations, the assumptions were as follows: operating time of 3500 h/year, capital expenditure of 87.3 EUR thousand/MW, O&M fixed costs of 25.7 EUR/MW, and balancing reserve costs of 12.

For biomass installations, the assumptions were as follows: operating time of 7000 h/year, capital expenditure of 31.6 EUR thousand/MW, O&M fixed costs of 12.6 EUR/MW, and fuel expenditure of 70%.

For Gen III+ nuclear, the assumptions were as follows: capital expenditure of 51.7 EUR thousand/MW, O&M fixed costs of 12.9 EUR/MW, fuel expenditure of 10.1%, and external costs of 3.

According to the data presented in Figure 6, biomass had the lowest cost of capital expenditure. This is due to the massive scale of biomass and its high accessibility. Biomass has the highest cost of fuel expenditure, which proves that its composition can only be created with additional costs.

Figure 6.

Average electricity generation cost (per MWh) in plants commissioned for use in 2020. Source: own elaboration based on Energy Market Agency data [74,75,82,83].

Despite the fact that the capital expenditure of biomass plants is higher due to fuel (raw material) purchases, these plants are characterized by the highest number of full-load hours per year (around 8000 h), and they constitute a stable source of energy relative to other renewable power plants [84]. The annual operating hours of renewable power plants are presented in Table 1.

Table 1.

Full-load hours of renewable power plants per year.

The renewable energy generation costs in the European Union in 2022 were used to predict their changes in 2021, 2030, and 2050 (Table 2). Four categories of costs were analyzed: capital expenditure; power factor; fuel, CO2, and operation and maintenance (O&M) costs; and the LCOE.

Table 2.

Renewable energy generation costs based on the EU’s renewable energy targets.

Table 2 shows the average data for the EU, taking into account conditions specific to the European region, such as sunlight and wind speed. They may be more similar to the realities of Poland, but there is no detailed description of the methodology for adapting these data.

The Announced Pledges Scenario (APS) takes into account all climate commitments made by governments around the world, including Nationally Defined Contributions (NDCs) and long-term net-zero emissions targets, and assumes that they will be fully implemented on time. Global trends in this scenario represent the cumulative scale of the world’s ambition to combat climate change as of mid-2022.

The capital expenditure associated with solar PV is expected to decrease from USD 810/kW in 2021 to USD 360/kW in 2050. The power factor will remain stable at 14% during the analyzed period. Fuel, CO2, and O&M costs will be maintained at USD 10/MWh at all three time points of the analysis (2021, 2030, and 2050), whereas the LCOE will decrease from USD 50/MWh in 2021 to USD 25/MWh in 2050.

PV installations were also investigated in remote villages. Based on the literature, we found that solar solutions increase competitiveness when the village is located in remote areas [61].

The capital expenditure associated with onshore wind energy will decrease from USD 1590/kW in 2021 to USD 1410/kW in 2050. The power factor will increase from 29% to 30%, and fuel, CO2, and O&M costs will reach USD 15/MWh in all years. The LCOE will decrease from USD 55/MWh in 2021 to USD 45/MWh in 2050.

In offshore wind projects, capital expenditure is expected to decrease significantly from USD 3040/kW in 2021 to USD 1320/kW in 2050. The power factor will increase from 51% in 2021 to 59% in 2050. The fuel, CO2, and O&M costs will decrease from USD 15/MWh in 2021 to USD 5/MWh in 2050, whereas the LCOE will decrease from USD 60/MWh in 2021 to USD 25/MWh in 2050.

The LCOE is the average cost of electricity generation over the lifetime of an energy asset, and it is used to compare the cost-effectiveness of various energy generation technologies. The LCOE accounts for capital expenditure, operating costs, fuel expenditure, external costs, and balancing reserve costs.

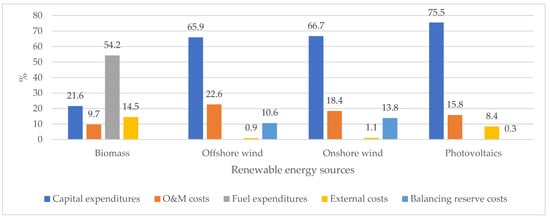

An analysis of the data presented in Figure 7 indicates that the structure of electricity generation costs differs across renewables. Fuel costs have the highest share of total costs in biomass plants (54.20%). This is not surprising because biomass is a fuel that has to be transported and incinerated, which generates additional costs.

Figure 7.

Structure of renewable energy generation costs, by source (LCOE). Source: own elaboration based on Energy Market Agency data [72].

Capital expenditure is high in offshore and onshore wind farms, as well as in solar PV plants (65.90%, 66.70%, and 75.50%, respectively). In these technologies, construction and equipment costs account for a large proportion of capital expenditures. However, these renewables are characterized by minimal fuel costs (wind farms) or no fuel costs (solar PV).

Reserve balancing costs play an important role in the operation of wind farms, particularly in offshore wind farms (10.60%). Power balancing implies that another source of energy is needed to balance the energy demand under low wind conditions. The structure of costs differs across renewables, and the attractiveness of various technologies varies subject to local conditions and the investors’ priorities.

Photovoltaics does not have balancing costs. This is due to the system, which is less demanding in the case of services. Moreover, nowadays, installations have batteries, which are charged during the day and discharged during the night.

These results are meaningful and indicate that the RES share will shape the competitiveness of the economy of the EU and specific countries. East EU countries have energy systems based on coal, and the share of biomass is the highest. This means that the energy systems of these countries are technologically backward and require high investment in RES, particularly wind energy and photovoltaics, which will be responsible for about 80% of electricity production in the future. East EU countries have the most expensive energy used for electricity and heat because their energy systems are based on coal and biomass. Such technologies require a constant supply of fuel, whereas countries whose energy systems are based on wind and photovoltaics have almost no fuel costs.

The changes in the total installation costs, efficiency, and LCOE of renewable energy projects between 2010 and 2021 are presented in Table 3.

Table 3.

Global weighted average total installation costs, energy efficiency, and LCOE of renewables in 2010–2021.

Biomass exhibited a minor decrease in installation costs (−13%), efficiency (−6%), and LCOE (−14%) in the analyzed period. The observed changes are relatively small, which suggests that biomass-based power generation technologies have attained a high level of technical sophistication without significant changes in efficiency.

In the geothermal energy sector, a significant increase was noted in the installation costs (47%) and the LCOE (34%), whereas efficiency decreased by 11%.

In the hydraulic power sector, installation costs increased by 62%, the LCOE increased by 24%, and efficiency remained fairly unchanged during the analyzed period.

The greatest decrease in installation costs (−82%) and the LCOE (−88%) was observed for the solar PV market, where the efficiency increased by 25%. These data clearly indicate that significant progress has been made in photovoltaics in the last decade.

In onshore and offshore wind farms, a significant decrease was noted in installation costs (−35% and −41%, respectively) and the LCOE (−68% and −60%, respectively), whereas efficiency increased by 44% in onshore wind and by only 3% in offshore wind projects.

These results indicate that renewable energy generation costs decreased significantly in the last decade and that energy efficiency increased in the solar PV and wind sectors. These observations confirm that renewables are increasingly cost-competitive, compared with conventional energy sources.

Table 3 contains the LCOE values for 2021 from the IRENA report, but these are the average values for the whole world. The IRENA report gives an LCOE of $33/MWh and a range of $20 to $64/MWh.

Table 3 is based on global average data from the IRENA report, which covers a wide range of conditions and technologies around the world. These values are averaged and represent a global picture of costs, which may cause differences in relation to the data in Table 2.

Our analysis proved the differences in the levelized cost of technology (LCOE). Our results are similar to those achieved by Mowers et al. [12], which proved that LCOE values are different across technologies due to input costs, fuel prices, and carbon costs.

Based on the data from Table 3, we can observe the global trends in energy systems. Biomass, which is the most popular source of RES in Eastern EU countries, decreased the total installation costs and energy efficiency. This is why installations in biomass, despite being the most popular, will disappear from the market in the long term. The leading role will be played by solar PV and onshore wind, which increase the efficiency and decrease the total installation cost. This is the result of technology developments delivered by China, which are cheaper compared to EU technologies.

5. Discussion

The profitability of power generation technologies that rely on renewable energy sources is determined by production costs per unit of generated energy. Electricity generation costs are expected to change by 2030. In particular, production costs will increase in coal-fired plants but will remain fairly stable in biogas-fired plants. Electricity costs will continue to decrease in onshore wind farms and solar PV systems, thus increasing their competitiveness with coal. However, the development and competitiveness of these energy sectors will be determined by financial support schemes [89,90].

Biomass has high variable costs. Biomass costs include wood from trees, grasses, and agricultural crops. To generate heat and electricity, biomass needs to be acquired every time. The combustion of biomass also generates technology and service costs. PV and wind do not cover the costs of materials in the process of energy production, but have higher investment costs at the beginning. Biomass generates high costs of feedstock, which represent 40–50% of the total cost of electricity production. The price of biomass and its preparation for fueling the power plant is also important. The price of biomass depends not only on wood and straw but also on the trade of pellets and other products. Poland not only imports these products from European Union (EU) countries but also from eastern European countries such as Belarus, Lithuania, Czechia, and Slovakia [91].

The benefits of biomass as a renewable energy source are numerous, among which is preserving biodiversity, maintaining soil fertility, improving soil quality, and lowering greenhouse gas emissions [92].

O&M costs (operation and maintenance costs) are represented by fixed and variable costs. These costs in biomass include labor, scheduled maintenance, routine component (boilers, gasifiers, and feedstock handling equipment) insurance, and others [93].

PV and wind have generation costs that are straightforward and fixed over the life of the plant. Photovoltaics and wind costs are particularly high at the beginning, but the variable costs are lower compared to biomass plants because they do not include fuel. PV costs include fixed and variable costs. The fixed costs include site visits, design, equipment and materials, permits, and fees, whereas variable costs include equipment and materials and installation labor.

One of the important issues in the proper management of wind and PV is uncertainty. Nowadays, technological advantages, industry innovation, and the reduced dependence on the import of electricity should be enhanced [11]. The aim of eliminating uncertainty is to minimize energy loss. PV produces energy during the summer, while in winter, production is very low. Wind farms produce energy during the winter, while in summer, production is lower. This is why these two systems can be compatible. Other problems may appear with power generation, load demand, and electricity prices. A reduction in the unpredictable effect of renewable energy plants could be achieved by using the weighted sum approach. The aim is to achieve an electrical network that is stable, reliable, efficient, and flexible [94].

Reliability is another problem that can be modeled and discussed regarding wind–photovoltaic power systems. These two kinds of RES provide outstanding clean energy from common, massive resources in nature. Systems of PV and wind should be integrated to achieve improved utilization. The production of electricity by these two systems differs during the day and the night. The output from PV and wind should be loaded to a battery via the controller, which ensures the proper utilization of wind and solar. It is automatic and should be controlled. Moreover, the failure costs differ, and the strategies of operations should be adjusted to the particular situation [95].

Another important issue is the reliability of wind and solar electricity systems, which should not jeopardize the system’s ability to meet the demand at all times. A reduction in lost load should be achieved by different systems of electricity [96].

Systems like the 14 and 57 bus systems have also been described in the literature [97,98]. Such systems analyze the voltage, angle, active and reactive power profiles, power system stability, enhancement, etc. [97]. Such systems are improving the power network and enhancing reliability [98].

The problem of harmonics in the microgrid system, either connected or not connected (islanded) to the grid, is also important when we analyze photovoltaics and wind energy. Abadi et al. [99] found that the solar irradiation, wind speed, inverter/converter, and generator are important in these systems.

The use of the life cycle assessment (LCA) approach for the different options of renewable energy sources is also important. Solar photovoltaic power plants have a minimal environmental impact, particularly in the case of large facilities. The majority of environmental issues arise from the production phase, particularly due to heavy materials like steel, iron, copper, silicon, and aluminum, which necessitate significant energy consumption [100]. The lifecycle of photovoltaics involves significant energy consumption and emissions throughout different stages, such as producing solar cells, assembling PV modules, manufacturing parts, transporting materials, assembling and upgrading the PV system, and waste management or recycling [101].

Large-scale hydropower facilities have a lower adverse environmental impact, followed by small-scale reservoirs, while run-of-river hydropower ranks last with the greatest detrimental effect. However, large hydropower plants have more summer smog and a higher global warming potential (GWP). In comparison to hydropower and geothermal energy, onshore wind power plants exhibit a greater overall environmental impact, yet they have the lowest GWP. Among these energy sources, geothermal power plants are associated with the most significant acidification effects [102,103,104].

The LCA for biomass has been analyzed for various uses based on their environmental, economic, and social effects, as outlined below. The LCA has focused on biomass-integrated gasification combined cycle (BIGCC) power plants with respect to their potential contributions to global warming. LCA depends on different technologies for biomass gasification, carbon dioxide management, and the combustion of synthesis gas. The external combustion of synthesis gas shows superior performance compared to internal combustion in terms of global warming potential, human toxicity, and ozone depletion [105].

Biogas also has its own problems in LCA. It is produced from the waste or organic fertilizers of farms. Farmers who utilize generated digestate as organic fertilizer typically do not incur costs for it; consequently, it can be viewed as waste, and the ecological effects of its management should be attributed to the anaerobic digestion process. This creates a significant issue when using digestate on farmland; although the emissions from mineral fertilizers or livestock manure are completely assigned to agricultural outputs, emissions from the digestate would be assigned to the biogas system [106].

In wind power plants, environmental credits are allocated solely for the recycling of metals, such as using Worldsteel (2010) data [107] to assess the value of steel scrap. It has also been presumed that all materials entering the production system originate from primary sources; however, for iron, steel, aluminum, and copper, the secondary (or scrap metal) inputs to primary production have been modified to allocate the burden to all secondary metal inputs (utilizing primary production or the world steel ‘scrap value’ for these burdens) [108].

The emissions throughout the life cycle are significantly higher in conventional sources than in renewable sources. In traditional sources, only electricity generation from nuclear power has lower emissions into the environment; however, the disposal of radioactive waste inflicts greater harm on its surroundings [109].

Renewable energy is typically produced in decentralized systems that operate independently of large power plants or high-voltage power grids [110]. As a result, energy can be generated in the proximity of households and other energy consumers, and power generation is no longer the sole responsibility of the state and large power plants. Renewable energy systems are becoming increasingly available to consumers who can install these devices on roofs and in gardens and generate green electricity not only for their own needs but also for their neighbors and local communities [111].

The process of meeting the EU’s targets for the share of renewable energy in overall energy consumption will entail significant costs. The costs associated with the transition to clean energy are expected to reach around PLN 83.5 billion by 2030. This value accounts for investments in electricity and heat generation, as well as the cost of market regulations. However, the external costs of electricity production will be considerably reduced as coal-derived energy is replaced by renewable energy [112,113].

The principles of ecological economics are aptly summarized by the Earth Charter. The key principles of the Earth Charter are:

- Nations have the right to own, manage, and use natural resources, but also the duty to prevent environmental harm and protect the rights of people.

- Environmental conservation and rehabilitation are integral to all development initiatives.

- Nations have common but differentiated responsibilities for protecting and restoring ecosystem health.

- Non-sustainable patterns of production and consumption should be eliminated, and responsible demographic policies should be promoted.

- Everyone has the right to receive information on environmental matters and participate in the decision-making process.

- Effective environmental laws and standards that meet human development needs should be implemented.

- Nations should collaborate to prevent the spread of hazardous activities and substances to other countries.

- A precautionary approach should be applied to address environmental issues, and countries affected by environmental degradation should receive assistance.

- A real-time notification system for alerting other countries about real or potential environmental emergencies should be established.

- Environmental disputes should be resolved peacefully.

- International environmental law should be observed during armed conflict.

- The natural environment and natural resources should be protected in territories that are oppressed or occupied by hostile forces [114].

In evaluating the LCOE, costs differ in technologies due to input costs, fuel prices, and carbon costs. The diversification of costs across different technologies depends on the technological production of assets. PV has high costs of production due to panel preparation. However, the electricity production costs are the cheapest. A similar situation can be observed in onshore and offshore wind production costs, where they are the highest at the beginning. Biomass production is cheap at the beginning, whereas in the long term, production costs increase due to the purchasing and maintenance of furnaces. Moreover, the cost of logistics and storage of biomass increases with increasing quantities.

This concept of WACC was used in corporate finance. The formula of WACC based on the average cost of capital, which stems from equity and debt, is important but changeable due to changing economic variables [115,116,117]. The WACC in European Union countries used in designing power systems was evaluated by Schyska et al. [118] and Noothout et al. [119]. The authors found that Germany had the lowest WACC at 4%, whereas in South-Eastern Europe, it reached 12%.

The production of green hydrogen using PV, wind, and other RES should be considered and promoted. The potential of hydrogen production from RES should be evaluated. PV installations and wind energy are useful in hydrogen production [120]. Hydrogen is a carbon-neutral fuel that can help in achieving carbon neutrality by 2050. The existing infrastructure of transport and storage can be adopted for the production of hydrogen [121]. Hydrogen usage plays a crucial role in achieving CO2 emission targets and can be produced via electrolysis using RES [122].

The costs of hydrogen-based PV systems, such as fuel cells, PV, electrolyzers, and hydrogen tanks, differ in each country. Water electrolysis is described as the process of decomposing water using electrical energy. P-Si technology is characterized by the lowest LCOE with a value of 0.0021$/kWh, followed by a-Si technology, achieving an LCOE of 0.027 $/kWh. The highest LCOE of 0.032$/kWh is presented by m-Si technology [123].

Research on hydrogen was carried out by Ademollo et al. [124]. The current levelized cost of hydrogen (LCOH) (factoring in incentive contributions) accounting for plants connected to the grid in Italy that utilize PV for P2H fluctuate around 8.6 €/kg (Sicily) and 9.8 €/kg (North), with an ideal ratio of PV to electrolyzer size generally between 1.8 and 2.1 and an H2 tank intended for daily storage. Sardinia displays the highest greenhouse gas emissions rate of 6.84 kgCO2/kgH2.

Building on the approach established in this research, upcoming studies should more deeply investigate the economic and environmental viability of RES-based P2H systems, particularly the effect of combining renewable energies.

6. Conclusions

The cost-effectiveness of plant biomass was compared with other renewable energy sources using the LCOE to determine the average production cost per unit of generated energy over the system’s lifetime in EU countries. The analysis did not conclusively confirm that biomass is the most competitive source of energy. Considerable fluctuations in biomass prices decrease the attractiveness of this substrate for energy production. However, preliminary observations and analyses indicate that biomass could be one of the cheapest sources of energy if it is acquired from local farms, produced on site, or if waste biomass is used in energy generation. In such cases, a short supply chain may considerably decrease transportation costs and total energy generation costs, making plant biomass a competitive substrate relative to other renewable energy sources. It has been proven that agriculture and cereal and animal production are also responsible for climate change, accounting for about 24% of the global GHG emissions [125,126].

In conclusion, although biomass is not always the most competitive substrate relative to other renewable energy sources on the market, it could be an attractive option if it is sourced locally. The potential of biomass can be fully harnessed by optimizing local supply chains and effectively managing resources [127].

The WACC is part of the LCOE. The WACC is a good tool for assessing investment risks and evaluating the cost of capital [128]. The WACC for onshore wind in European Union countries was calculated in the paper. The analysis showed that Germany is the country with the lowest WACC at approximately 4% of the LCOE. In the European Union, the countries with the highest share of WACC in the LCOE are Greece (13.5%) and Hungary (11.3%). Developing countries have much higher shares of WACC in the LCOE and can reach levels of almost 50% [129].

The results of this study disprove Hypothesis 1, stating that plant biomass is the cheapest substrate relative to other sources of renewable energy:

- Biomass plants have the lowest capital expenditure. Nonetheless, biomass plants are the only renewable energy installations necessitating fuel procurement, and when factoring in fuel costs, onshore (EUR 93.6/MWh) and offshore wind farms (EUR 122.4/MWh) have the lowest generation expenses.

- The anticipated reduction in capital costs for solar PV is projected to go from $810/kW in 2021 to $360/kW in 2050. The power factor is expected to stay consistent at 14% throughout the period under review. Throughout the analysis, at the three time points (2021, 2030, and 2050), the expenses for fuel, CO2, and O&M will stay constant at USD 10/MWh. Meanwhile, the LCOE will drop from USD 50/MWh in 2021 to USD 25/MWh in 2050. The factors that have an impact on solar PV LCOE are financial parameters, nominal WACC, and inflation, with location also having a smaller impact [52].

- The costs for capital investments in onshore wind power will decrease from USD 1590/kW in 2021 to USD 1410/kW in 2050. The power factor is set to rise from 29% to 30%, with fuel, CO2, and O&M expenses remaining at USD 15/MWh each year. The LCOE is set to drop from $55/MWh in 2021 to $45/MWh in 2050.

- Installation costs decreased significantly in onshore and offshore wind farms, with onshore wind seeing a 35% decrease and offshore wind seeing a 41% decrease. The LCOE also dropped by 68% in onshore and 60% in offshore wind farms, while efficiency increased by 44% in onshore and only 3% in offshore projects.

- Solar PV installations are considered to be the cheapest form of electricity generation. Solar installations located on rooftops and battery storage are the most popular solutions in many countries of the European Union (EU) [62].

7. Policy Implications

LCOE and WACC analyses may have important policy implications. The production of electricity depends on various costs. PV and onshore and offshore wind installations seem to be decisive in renewable energy acquisition in the future, in both the EU and the world. These types of renewable energy result in the highest return on invested capital.

New EU member states, such as those that entered in 2004, require more capital for their energy transformation. These countries’ energy systems, such as in Poland, are based on fossil fuels, including coal. These regions of the EU need more capital for their energy transformation to achieve more renewable energy sources from photovoltaics and onshore and offshore wind. Financial incentives should be extended to enable countries in Central and Eastern Europe to cope with the energy transformation and the reduction in CO2 emissions.

Fuel expenditure, external costs, and O&M costs are found to be the cheapest in nuclear energy. Capital expenditure costs are very high, which means the investment outputs in nuclear electricity are high. However, the technology of nuclear power plants is increasing, causing a reduction in costs. The useful life of a nuclear power plant is long compared to other renewable energy sources, which translates into long-term economic benefits. Moreover, energy security in countries that have nuclear energy is greater than in countries that do not use it. Therefore, it is important to increase energy safety by promoting nuclear energy, which, together with renewable energy sources, can ensure the supply of clean and safe energy and energy security.

The energy mix of energy should also include biodiesel, especially in EU countries [130]. The possibility of producing biodiesel from feedstock including rapeseed, palm oil, sunflower oil, etc., has an impact on the optimization of production costs. Large land resources in EU countries can contribute to reducing costs, which can be further reduced by importing raw materials from Ukraine [131]. A wider use of biodiesel may increase the efficiency of agriculture as a sector and improve the cost competitiveness of farms engaged in the production of rapeseed [132,133]. The wide range of biofuels, including first, second, third, and fourth generations, represents the chance for better utilization of existing materials and increases in energy security [134].

Two of the biggest problems that RES face are storage integration and RES intermittency. During the initial phase of the RES integration process, relatively small and very effective storage systems are adequate. Seasonal storage devices are also necessary, integrating extremely high proportions of RES, thus achieving a system that is nearly 100% RES. Alternatively, excess capacities might be implemented to achieve a 100% RES system while needing less storage capacity. Therefore, a balance must be struck between the creation of excess capacities and the establishment of storage capacities [135].

Ultimately, a balance must be achieved between the installation of extra generation capacities and storage capacities. In this context, it is also important to consider the necessary power of the storage converters, which is economically significant [136].

Hybrid solutions can also facilitate the incorporation of renewables by addressing various needs, like using electrochemical solutions for intra-day energy time shifts and thermal and other solutions for inter-week energy shifts [137]. It is evident from the thorough review conducted that all storage technologies can facilitate green energy production over the next 10–20 years [138]. Modern energy systems should include different characteristics, such as environmental concerns, safety, energy/power densities, responsiveness, efficiency, durability, and cost [139].

This research has certain limitations. The first problem is access to the most recent information. Data concerning the costs of renewable energy sources are rarely available. Moreover, our analysis based on the newest information can be compared to earlier years.

There is a strong need to compare different countries in the EU in terms of the cost of RES production. Such an analysis would increase the awareness of EU member states in the case of cheaper energy production.

Access to cheaper credits would increase the cost competitiveness of RES. At present, cheaper credits are available in the euro zone. Research analyzing the impact of the cheapest credits on investment in RES should be conducted. Such research would be useful for policymakers to develop more economically friendly energy policies.

Financing for Eastern EU states is important, such as EU funding mechanisms like the Just Transition Fund (JTF). The JTF seeks to guarantee a fair transition to a sustainable, carbon-neutral future by 2050. It supplies a portion of the resources required to assist the areas most impacted by the transition, and it delivers strategic aid. The traits and present critiques of the JTF are outlined below. The primary objective of the JTF is “to empower regions and individuals to tackle the social, economic, and environmental effects of the shift to a climate-neutral economy,” [140]. The JTF seeks to guarantee a fair transition to a sustainable, carbon-neutral future by 2050 by offering some of the funding and strategic assistance necessary for the regions that are most impacted by the transition [141].

Poland did not approve the European Green Deal (EGD) during the European Council meeting on 12 December 2019, which is a significant socio-economic reform initiative aimed at tackling climate change. In April 2021, the European Climate Law received approval. This establishes the pledge to attain climate neutrality (zero net greenhouse gas emissions) by 2050, along with the interim aim of cutting net greenhouse gas emissions by 55% by 2030 relative to 1990 levels [142]. To reach this goal, the Commission launched its ‘Fit For 55’ set of 13 measures in July 2021, encouraging decarbonization, which includes implementing carbon-related import tariffs, expanding the EU Emissions Trading System (EU-ETS), and supporting reforestation efforts [143]. Secondly, to ready the EU’s economy for this process, the EGD’s investment strategy seeks to mobilize public investment from 2021 to 2030 and facilitate the release of private funds via EU financial instruments, particularly Invest EU, totaling at least €1 trillion [144]. Thirdly, recognizing that initiatives to combat climate change must be socially acceptable, the EGD seeks to alleviate some of the difficult social impacts of the green transition by establishing a Just Transition Fund (JTF), which will direct €17.5 billion to regions and sectors most impacted by decarbonization, and the Social Climate Fund (SCF), which, based on the initial Commission proposal, will allocate €72.2 billion to assist low-income households in transitioning to more carbon-efficient devices. While the SCF serves as a compensation tool intended to offer income assistance to people, the JTF emphasizes the employment, regional, and industrial policy impacts of the green transition, aiming to aid shifts in development models that still rely on fossil fuels [145].

Author Contributions

Conceptualization, R.W., P.B., and A.B.-B., methodology, R.W., P.B., and A.B.; software, R.W. and P.B.; validation, R.W. and P.B.; formal analysis, R.W. and P.B.; investigation, R.W. and P.B.; resources, R.W., A.B.-B., P.B., and A.B.; data curation, R.W., A.B.-B., and P.B.; writing—original draft preparation, R.W., A.B.-B., P.B., A.B., M.W. (Marcin Wysokiński), and M.W. (Magdalena Wiluk); writing—review and editing, R.W., A.B.-B., P.B., A.B., M.W. (Marcin Wysokiński), and M.W. (Magdalena Wiluk); visualization, R.W., A.B.-B., and P.B.; supervision, R.W., A.B.-B., and P.B.; project administration, A.B.-B. and P.B.; funding acquisition, A.B.-B. and P.B. All authors have read and agreed to the published version of the manuscript.

Funding

The results presented in this paper were obtained as part of a comprehensive study funded by the Faculty of Agriculture and Forestry, Department of Agrotechnology and Agribusiness (grant. No 30.610.012-110).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

Nomenclature

| APS | Announced Pledges Scenario |

| ARE | Energy Market Agency |

| BIGCC | Biomass integrated gasification combined cycle, |

| CAPEX | Capital expenditures |

| CO2 | Carbon dioxide |

| DB | Market value of debt |

| EE | Ecological economics |

| EGD | European Green Deal |

| ERE | Environmental resource economics |

| EQ | Market value of equity |

| EU ETS | EU Emissions Trading System |

| FOM | Fixed Operations and Maintenance |

| GHG | Greenhouse gases |

| GWP | Global warming potential |

| IEA | International Energy Association |

| IRENA | International Renewable Energy Agency |

| JTF | Just Transition Fun |

| KW | Kilowatt |

| LCA | Life cycle assessment |

| LCOE | Levelized cost of electricity |

| LCOD | Levelized cost of delivery, |

| LCOH | Levelized cost of hydrogen |

| LFSCOE | Levelized Full System Costs of Electricity |

| MWh | Megawatt-hour |

| NDCs | National Defined Contributions |

| O&M | Operation and maintenance costs |

| RDB | Annual return on debt |

| RES | Renewable energy sources |

| ROE | Annual return on equity |

| SCF | Social Climate Fund |

| USD | United States Dollar |

| VAT | Value Added Tax |

| VOM | Variable Operations and Maintenance |

| WACC | Weighted Average Cost of Capital |

References

- Jung, J.; Villaran, M. Optimal planning and design og hybrid renewable energy systems for microgrids. Renew. Sustain. Energy Rev. 2017, 75, 180–191. [Google Scholar] [CrossRef]

- Mowers, M.; Mignone, B.K.; Steinberg, D.C. Quantifying value and representing competitiveness of electricity system technologies in economic models. Appl. Energy 2023, 329, 120132. [Google Scholar] [CrossRef]

- Choi, D.G.; Park, S.Y.; Park, N.-B.; Homg, J.C. Is the concept of ‘grid parity’ defined appropriately to evaluate the cost-competitiveness of renewable energy technologies? Energy Policy 2015, 86, 718–728. [Google Scholar] [CrossRef]

- Gan, P.Y.; Li, Z. Quantitative study on long term global solar photovoltaic market. Renew. Sustain. Energy Rev. 2015, 46, 88–99. [Google Scholar] [CrossRef]

- European Photovoltaic Industry Associations (EPIA). Solar Photovoltaic Competing in the Energy Sector 2011. Available online: http://www.epia.org/publication/epiapublications/connectingthesun.html (accessed on 13 December 2024).

- Ruhang, X. Characteristics and perspective of China’s PV development route: Based on data of world PV industry 2000–2010. Renew. Sustain. Energy Rev. 2016, 56, 1032–1043. [Google Scholar] [CrossRef]

- Bórawski, P.; Holden, L.; Bełdycka-Bórawska, A. Perspectives of photovoltaic energy market development in the European Union. Energy 2023, 270, 126804. [Google Scholar] [CrossRef]

- Chel, A.; Kaushik, G. Renewable energy technologies for sustainable development of energy efficient building. Alex Eng. J. 2018, 57, 655–669. [Google Scholar] [CrossRef]

- Gonzalez-Rodriguez, A.; Serrano-Gonzalez, J.; Burgos-Payan, M.; Riquelme-Santos, J. Multi-objective optimalization od a uniformly distributed offshore wind farm considering both economic factors and visual impact. Sustain. Energy Technol. Assess. 2022, 52, 102148. [Google Scholar] [CrossRef]

- Pillai, A.C.; Chick, J.; Khorasanchi, M.; Barbouchi, S.; Johanning, L. Application of an offshore wind farm layout optimization methodology at Middelgrunden wind farm. Ocean. Eng. 2017, 139, 287–297. [Google Scholar] [CrossRef]

- Bórawski, P.; Bełdycka-Bórawska, A.; Jankowski, K.J.; Dubis, B.; Dunn, J.W. Development of wind energy market in the European Union. Renew. Energy 2020, 161, 691–700. [Google Scholar] [CrossRef]

- Kupczyk, A.; Mączyńska, J.; Sikora, M.; Tucki, K.; Żelaziński, T. Stan i perspektywy oraz uwarunkowania prawne funkcjonowania sektorów biopaliw transportowych w Polsce. Rocz. Nauk. Ekon. Rol. Rozw. Obsz. Wiej. 2017, 104, 39–55. [Google Scholar]

- Bórawski, P.; Holden, L.; Bórawski, M.B.; Mickiewicz, B. Perspectives of Biodiesel Development in Poland against the Background of the European Union. Energies 2022, 15, 4332. [Google Scholar] [CrossRef]

- Larsson, S.; Fantazzini, D.; Davidsson, S.; Kullander, S.; Höök, M. Reviewing electricity production cost assessments. Renew. Sustain. Energy Rev. 2014, 30, 170–183. [Google Scholar] [CrossRef]

- Branker, K.; Pathak, M.J.M.; Pearce, J.M. A review of solar photovoltaic levelized cost of electricity. Renew. Sustain. Energy Rev. 2011, 15, 4470–4482. [Google Scholar] [CrossRef]

- Bosch, J.; Staffell, I.; Hawkes, A.D. Global levelised cost of electricity from offshore wind. Energy 2019, 189, 116357. [Google Scholar] [CrossRef]

- Lai, C.S.; McCulloch, M.D. Levelized cost of electricity for solar photovoltaic and electrical energy storage. Appl. Energy 2017, 190, 191–203. [Google Scholar] [CrossRef]

- Hirth, L.; Steckel, J.C. The role of capital costs in decarbonizing the electricity sector. Environ. Res. Lett. 2016, 11, 11. [Google Scholar] [CrossRef]

- Shen, W.; Chen, X.; Qiu, J.; Hayward, J.A.; Sayeef, S.; Osman, P.; Meng, K.; Dong, Z.Y. A comprehensive review of variable renewable energy levelized cost of electricity. Renew. Sustain. Energy Rev. 2020, 133, 110301. [Google Scholar] [CrossRef]

- Shea, R.P.; Ramgolam, Y.K. Applied levelized cost of electricity for energy technologies in a small island developing state: A case study in Mauritius. Renew. Energy 2019, 132, 1415–1424. [Google Scholar] [CrossRef]

- Idel, R. Levelized Full System Costs of Electricity. Energy 2022, 259, 124905. [Google Scholar] [CrossRef]

- Samadi, S. The Social Costs of Electricity Generation—Categorising Different Types of Costs and Evaluating Their Respective Relevance. Energies 2017, 10, 356. [Google Scholar] [CrossRef]

- Sels, L.; Neuling, U.; Kaltschmitt, M. Capital expenditure and levelized cost of electricity of photovoltaic plants and wind turbines—Development by 2050. Renew. Energy 2022, 185, 525–537. [Google Scholar] [CrossRef]

- Bórawski, P.; Bełdycka-Bórawska, A.; Kapsdorferová, Z.; Rokicki, T.; Parzonko, A.; Holden, L. Perspectives of Electricity Production from Biogas in the European Union. Energies 2024, 17, 1169. [Google Scholar] [CrossRef]

- Bórawski, P.; Bełdycka-Bórawska, A.; Klepacki, B.; Holden, L.; Rokicki, T.; Parzonko, A. Changes in Gross Nuclear Electricity Production in the European Union. Energies 2024, 17, 3554. [Google Scholar] [CrossRef]

- Aoun, A.; Adda, M.; Ilinca, A.; Ghandour, M.; Ibrahim, H. Optimizing Virtual Power Plant Management: A Novel MILP Algorithm to Minimize Levelized Cost of Energy, Technical Losses, and Greenhouse Gas Emissions. Energies 2024, 17, 4075. [Google Scholar] [CrossRef]

- Tahir, M.; Hu, S.; Zhu, H. Advanced Levelized Cost Evaluation Method for Electric Vehicle Stations Concurrently Producing Electricity and Hydrogen. Energies 2024, 17, 2682. [Google Scholar] [CrossRef]

- Melgar-Melgar, R.E.; Hall, C.A.S. Why ecological economics needs to return to its roots: The biophysical foundation of socio-economic systems. Ecol. Econ. 2020, 169, 106567. [Google Scholar] [CrossRef]

- Costanza, R.; Howarth, R.B.; Kubiszewski, I.; Liu, S.; Ma, C.; Plumecoc, A.G.; Stern, D.I. Influential publications in ecological economics revisited. Ecol. Econ. 2016, 123, 68–76. [Google Scholar] [CrossRef]

- Anderson, B.; M’Gonigl, M. Does ecological economics have a future?: Contradiction and reinvention in the age of climate change. Ecol. Econ. 2012, 84, 37–48. [Google Scholar] [CrossRef]

- Perkins, P.E. Feminist Ecological Economics and Sustainability. J. Bioeconomics 2007, 9, 227–244. [Google Scholar] [CrossRef]

- Turner, R.K.; Perrings, C.; Folke, C. Ecological economics: Paradigm or perspective. In Economy and Ecosystems in Change: Analytical and Historical Approaches; van den Bergh, J.C.J.M., van der Straaten, J., Eds.; Edward Elgar: Cheltenham, UK, 1997. [Google Scholar]

- Ayres, R.U. Industrial metabolism: Work in progress. In Theory and Implementation of Economic Models for Sustainable Development; van den Bergh, J.C.J.M., Hofkes, M.W., Eds.; Kluwer: Dordrecht, The Netherlands, 1998. [Google Scholar]

- Anser, M.K.; Shabbir, M.S.; Tabash, M.I.; Ali Shah, S.H.; Ahmad, M.; Yao-Ping Peng, M.; Lopez, L.B. Do renewable energy sources improve clean environmental-economic growth? Empirical investigation from South Asian economies. Energy Explor. Exploit. 2021, 39, 1491–1514. [Google Scholar] [CrossRef]

- Niekurzak, M. The Potential of Using Renewable Energy Sources in Poland Taking into Account the Economic and Ecological Conditions. Energies 2021, 14, 7525. [Google Scholar] [CrossRef]

- Huang, B.; Xing, K.; Pullen, S.; Liao, L.; Huang, K. Ecological—Economic assessment of renewable energy deployment in sustainable built environment. Renew. Energy 2020, 161, 1328–1340. [Google Scholar] [CrossRef]

- Van den Bergh, J.C.J.M. Ecological economics: Themes, approaches, and differences with environmental economics. Reg Environ. Change 2001, 2, 13–23. [Google Scholar] [CrossRef]

- Atkinson, G.; Dietz, S.; Neumayer, E.; Agarwala, M. Handbook of Sustainable Development; Edward Elgar Publishing: Glos, UK, 2014. [Google Scholar] [CrossRef]

- Armatas, C.A.; Borrie, W.T. A pragmatist ecological economics—Normative foundations and a framework for actionable knowledge. Ecol. Econ. 2025, 227, 108422. [Google Scholar] [CrossRef]

- Zegar, J.S. Podstawowe Zagadnienia Rozwoju Zrównoważonego; WSBiF w Bielsku-Białej: Bielsko-Biała, Poland, 2007. [Google Scholar]