1. Introduction

Driven by the global digital wave and the modernization of state governance, China’s new urbanization process and the construction of “digital China” form a historic intersection. According to the data from the National Bureau of Statistics in 2023, the urbanization rate in China had reached 66.16% (

https://data.stats.gov.cn/files/html/vchart/vchart_001/vchart_001.html accessed on 6 March 2025), but the “urban disease” caused by the mismatch of land resources still plagues new first-tier cities. At the same time, the People’s Republic of China’s Outline of the 14th Five-Year Plan and the 2035 Vision of the National Economic and Social Development suggests “expanding the safe and orderly opening of basic public information data” to facilitate the orderly circulation of public information data. This will speed up the sharing and exchange of public data and encourage the thorough docking of public and enterprise data. In December 2022, the Central Committee of the Communist Party of China and the State Council noted in their Opinions on Building a Data Base System to Maximize a Better Role of Data Elements that “for public data generated by Party and government organs at all levels, enterprises and institutions in the course of performing their duties by the law or in the course of providing public services, we shall strengthen the convergence, sharing and open development, reinforce the integrated authorized use and management, promote interconnection and interoperability, and break down the data silos.” In December 2023, the National Data Bureau released the Data Elements X Three-Year Action Plan (2024–2026), which also noted the importance of “expanding the supply of public data resources” and optimizing the distribution of data resources. In this context, public data elements, as the key media connecting physical space and digital twins, are reconstructing a new urban governance paradigm of “people–land–production” coordinated development, which provides a new way to solve the structural contradiction between the tight constraints of land resources and high-quality development requirements in the process of urbanization. Therefore, the realization of a high-quality supply of public data elements is of great significance for better releasing data value, reshaping urban spatial patterns, and promoting sustainable land use.

The rational allocation of urban land resources depends on the construction of smart cities [

1,

2]. The Guiding Opinions on Deepening the Development of Smart Cities and Promoting the Digital Transformation of Cities, issued by the National Development and Reform Commission, aims to promote the digital transformation and intelligent development of cities, emphasizing data integration, development, and utilization as the core and progressing through the digital transformation and construction of cities. As the micro-subject of urban economic activities, enterprises should digitize the operational data accumulated by enterprises, such as those regarding industrial agglomeration, land use efficiency, carbon emissions, etc., to provide a scientific basis for decision making for the government, to help optimize the development of existing land, and to reduce inefficient land use and resource waste [

3]. In October 2024, the Central Network Information Office and other departments compiled the Implementation Guide for the Collaborative Transformation and Development of Digital Greening, aiming to better guiding enterprises to carry out the collaborative transformation and development of digital greening. It can be said that strengthening the digital transformation of enterprises is not only related to the remodeling of their own operating models, but it also has important strategic significance for China’s urban planning and land resources management and the realization of green and sustainable development [

4].

A public data element is a data element that is provided by the government and utilized by enterprises in their production. It has two characteristics. First, from the perspective of public resources, public data elements display public attributes, which can significantly reduce the threshold of enterprise access to resources. Second, from the perspective of the value of data elements, public data exhibits the high value of data elements, which can effectively empower enterprise production. It is worth noting that at this stage, the data management ability of Chinese enterprises is relatively low compared to the management efficiency of the production and operation organization process, and the emergence of the government’s open data platform makes it possible for enterprises to obtain high-quality data resources. Data resources are one of the important assets driving the digital transformation of enterprises, and the two characteristics of public data elements aid in the integration of data elements into the production and operation of enterprises. The question remains regarding whether public data elements can promote enterprise digital transformation. What is the mechanism behind this process? Until now, there has been little corresponding research published in the literature. The study of the elements influencing the digital transformation of businesses is one of two major areas in the literature strongly tied to the findings presented in this paper. In the era of digital economy, the digital transformation of enterprises is not only related to their own survival and development, but also to the rational use of urban land. “Digital transformation” describes how businesses integrate computing, communication, connection, and information technology to alter organizational characteristics and eventually achieve organizational transformation. Three broad categories can be used to classify the determinants of enterprise digital transformation. The first is the institutional environment factors, which can speed up the digital transformation of businesses. These include mixed ownership reform [

5], intellectual property administrative protection [

6], business environment [

7], regional digital infrastructure policy [

8], state-owned participation [

9], low carbon development policy [

10], and more. The second aspect is the industrial environment; according to Verhoef et al. (2021) [

11], the shift in industrial form will encourage businesses to go digital. According to Liu et al. (2024) [

12], consolidating the digital services sector successfully lowers operating expenses for businesses and boosts their investment in innovation, eventually encouraging digital transformation. As a final consideration of the social environment, non-family shareholders facilitate the digital transformation of businesses, primarily through their human and capital effects in family businesses [

13]. Furthermore, according to some academics, labor protection can help businesses acquire top-notch human capital, which will support business digital transformation [

14].

The second area includes studies on how public data elements affect the economy. Scholars have primarily examined the macro-level impact of public data on economic development, pointing out that it can significantly boost economic growth [

15,

16]; at the meso-level, it can improve government governance efficiency and increase the vitality of innovation and entrepreneurship, which is conducive to improving the resilience of the urban industrial chain and enhancing the ability to withstand risk [

17]; at the micro-level, some researchers empirically tested the impact of public data elements on corporate stock dividends [

18], total factor productivity [

19], and the contribution of new quality productivity [

20]. In fact, public data elements have initially empowered the actual economy. Retail entrepreneurs use the New York City Business Atlas database to advise their funding and site selection [

16], but currently, there is no standardized measurement method for choosing indicators for different types of public data. Some researchers employ the progressive twofold difference approach to empirically examine the economic effects of public data elements, using the “government data platform online” as a quasi-natural experiment [

17,

19]. In order to measure public data elements, some researchers have also employed comprehensive indicators. For example, they have developed an assessment framework for public data openness from the viewpoint of regular citizens based on the organizational requirements and characteristics of government datasets [

21] and have evaluated the World Justice Project (WJP) Index [

22]. In conclusion, few papers have thoroughly examined the mechanism and influence of public data elements on the digital transformation of organizations, even though previous research began to focus on the micro impact of these elements.

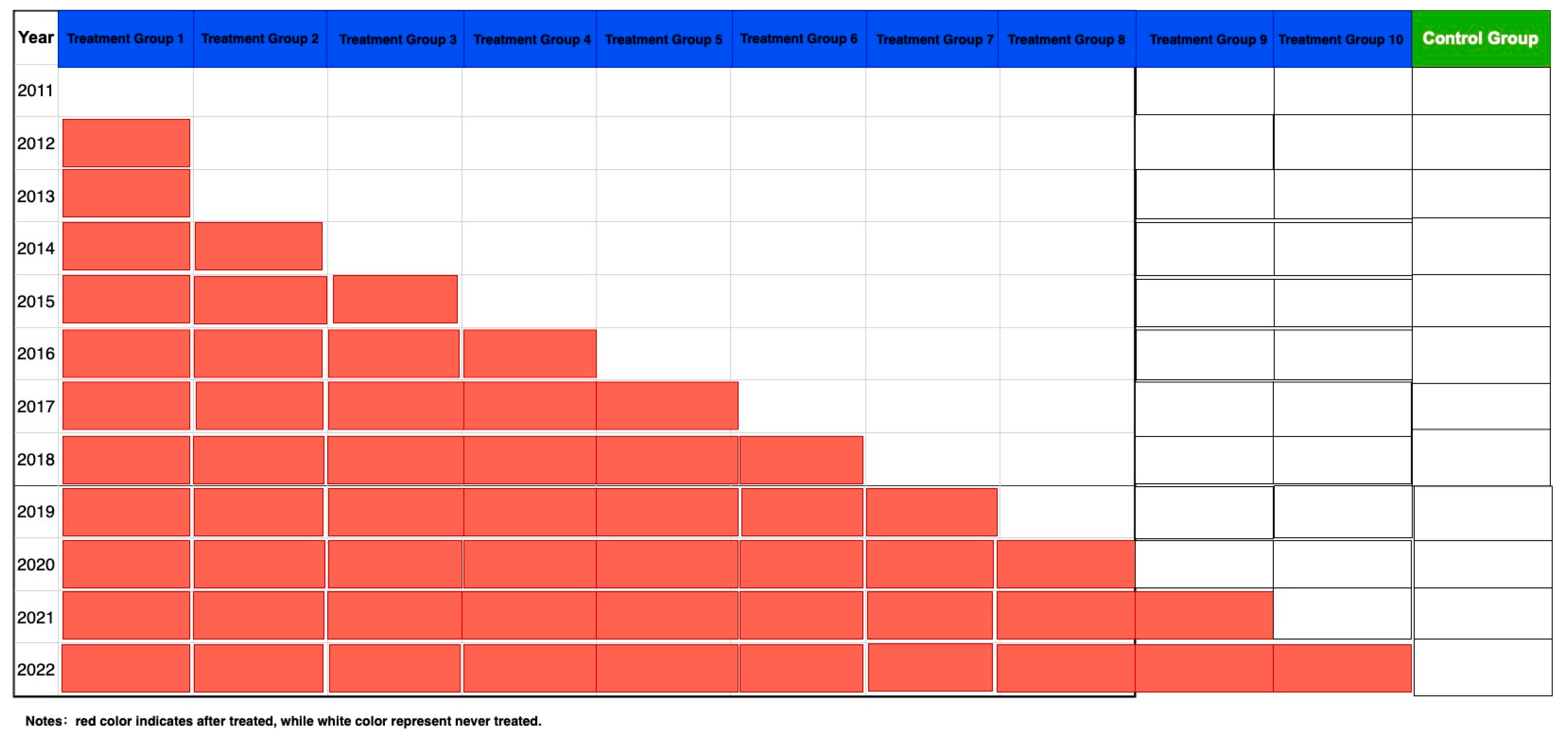

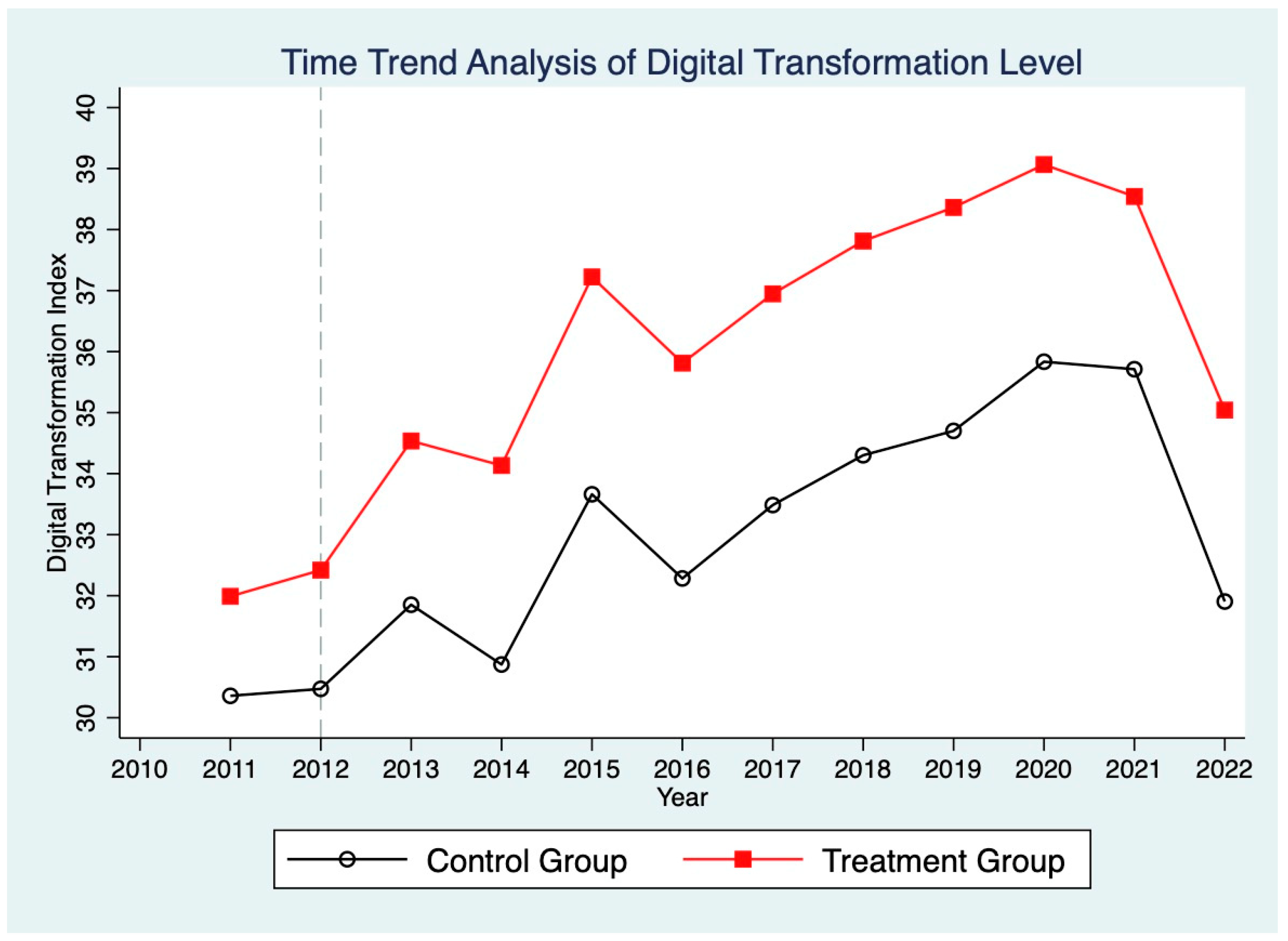

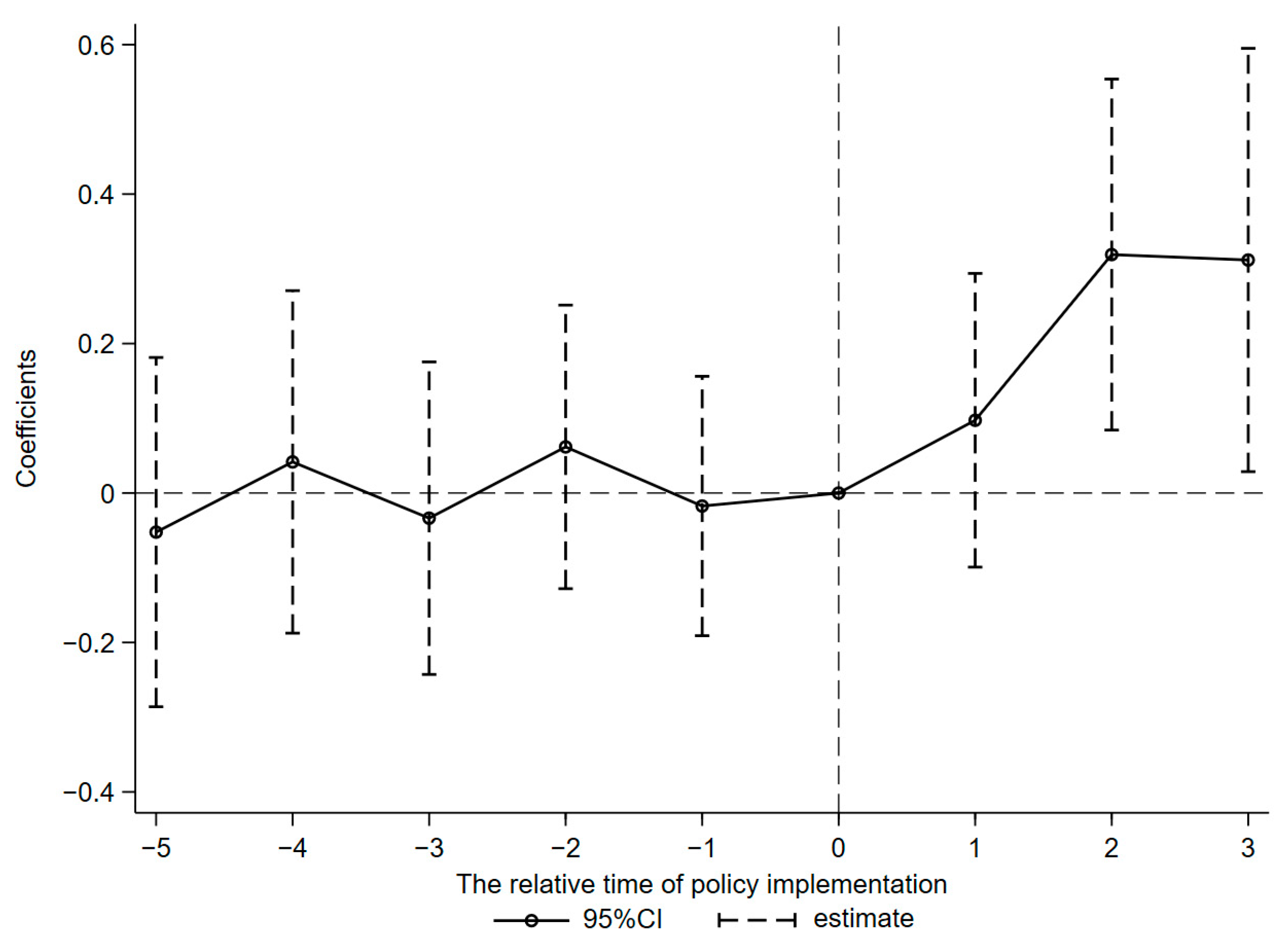

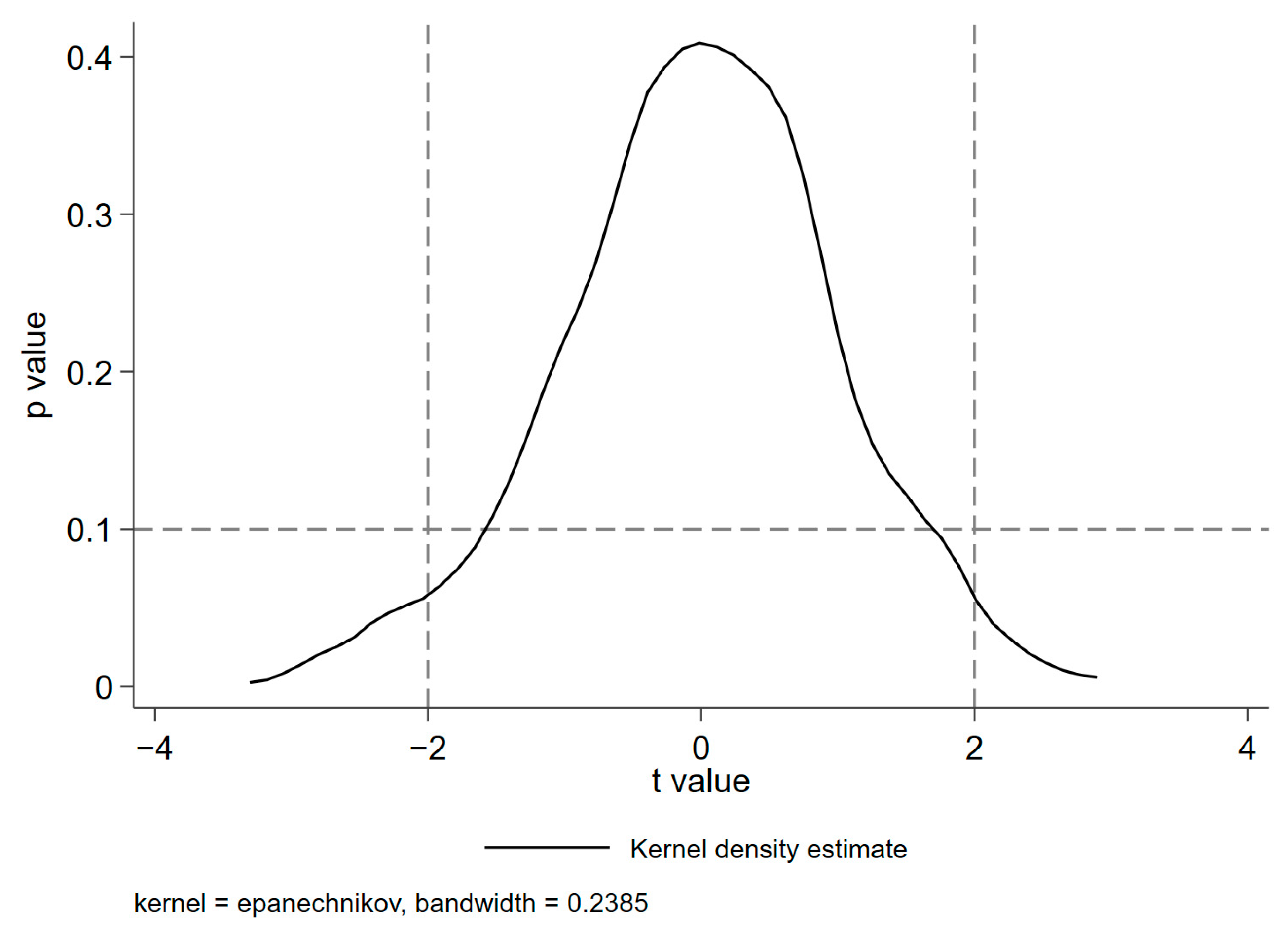

To empirically examine the impact of public data elements on enterprise digital transformation, this study exploits a quasi-natural experiment based on the staggered launch of municipal-level government data platforms across China from 2011 to 2022. A multi-period difference-in-differences (DID) approach is employed to estimate the causal effect of public data availability on firm-level digital transformation outcomes. This empirical strategy enables us to control for time-invariant unobserved heterogeneity and common shocks across regions and years.

Our findings reveal that public data elements can inspire companies to undergo digital transformation. Its transmission mechanism lies in the fact that public data elements enhance the level of digital transformation of enterprises by sharing information resources and alleviating financing constraints. Heterogeneity analysis shows that in regards to high-quality data openness, areas with high-energy digital economy experiencing growth and maturity of enterprises, the role of public data elements in promoting enterprises’ digital transformation is more significant. Analysis of the regulatory role of public data found that complete digital infrastructure and advanced digital products positively regulate the role of public data elements in promoting the digital transformation of enterprises. In addition, corporate investment plays a negative regulatory role, while innovative investment plays a positive regulatory role.

This article systematically analyzes the role and mechanism of public data elements in promoting the digital transformation of enterprises using the incremental difference method. Firstly, in terms of research perspective, previous studies have not yet given enough attention to the impact of public data elements on enterprise digital transformation [

18,

19,

20]. Secondly, in terms of the impact mechanism, this article proposes and verifies that public data elements mainly influence digital transformation through information resource sharing effects and financing constraint mitigation effects, which helps clarify the mechanism of the role of public data elements in digital transformation. Thirdly, the role of the carrier was examined. Previous studies have typically focused on the public data elements themselves, neglecting the prerequisite conditions for the public data elements to play a role [

17,

19]. This paper further explores the requirements for the public data elements to play a role through the moderating effect and notes that public data elements can contribute to the economic growth of enterprises. Through the moderating impact, this study further examines the prerequisites for the function of public data components. It highlights that the role of public data elements necessitates a comprehensive digital infrastructure and cutting-edge digital products to accompany it.

2. Background Information from Institution and Theoretical Theories

2.1. The Setting of the Institution

The goal of creating a single, open platform for national government data by the end of 2018 was stated in the State Council’s Outline of Action for Promoting the Development of Big Data, which was released in September 2015. In the context of big data governance, the building of digital government has become the foundation for the open data platform’s efficient operation. In June of 2022, the State Council released the Guiding Opinions on Strengthening the Construction of Digital Government, pledging to develop the systematic architecture of data openness, realize the download and service of open data, and transform the form of digital government. The Central Committee of the Communist Party of China and the State Council released their Opinions on Building a Data Base System to Maximize a Better Role of Data Elements in December of that year. This document adopts explicitly “adhering to the sharing of common use and releasing the value dividend” as the working principle. It investigates the creation of a mechanism for the equitable distribution of the advantages of opening up public data resources in order to assist businesses in managing the risks and difficulties associated with the digitalization transformation process. To activate the potential of data elements and support the sustainable development of the economy, the National Data Bureau and other departments released the Three-Year Action Plan for Data Elements X (2024–2026) in December 2023. This plan encourages the organization of public data authorization and operation mechanisms in key areas and relevant regions.

The creation of public data elements is a top priority for national policy. Local governments have responded favorably by implementing region-specific plans and actions for developing public data, establishing high-quality, high-level, and high-standard public data open platforms and enabling the market and social actors to develop and use data, thus making available the benefits of government data. The “digital divide” is lessened when data publishers, such as government departments, can publish data more methodically and effectively through open government data platforms, and data acquirers, such as businesses, research institutions, and the general public, can access and use the data. This is because open government data platforms offer market participants services that are both widely available and free from prejudice. Second, the open government data platform’s high-quality data has reduced the threshold for use and enhanced data use convenience. As of August 2023, excluding Hong Kong, Macao, and Taiwan, 226 provincial and local governments had set up open platforms for local government data (the data comes from the Research Report on Open Data Utilization of China Government (2023), published by School of Information Management, Huazhong Normal University). As an illustration, consider Beijing’s public data open platform, which is currently accessed by 115 data-providing units and comprises 18,573 datasets, totaling over 7186 million pieces of data. Regarding data usage, the platform has opened 15,014 interfaces, with over 320 million platform accesses and over 370,000 downloads and usages, with the most extensive dataset possessing a capacity of over 840,000 pieces of data (

https://data.beijing.gov.cn/index.html, accessed on 6 March 2025). The public data open platform’s extensive coverage and facilitation have reduced the “access gap” between businesses and public data, enabling the digital transformation of businesses.

2.2. Analysis of the Impact of Public Data Elements on Enterprise Digital Transformation

Information economics focuses on the economic phenomena of incomplete information and asymmetric information. The analysis of incomplete information can be divided into optimal information search theory and information dissemination theory [

23]. The analysis of asymmetric information is usually based on the time dimension. Among the typical early manifestations of asymmetric information are adverse selection and signal transmission. The later manifestation of asymmetric information mainly involves moral hazard and principal-agent issues. As mentioned above, the two important sectors of information economics are incomplete information and asymmetric information, but the existence of these two sectors usually leads to increased expenditure in the process of completing the prefetch goal, which is information friction.

Public data elements have two characteristics: one is their public attributes, which can significantly reduce the threshold for enterprises to obtain resources. The other is that public data displays the high-value attributes of data elements, which can effectively empower enterprise production.

The impact of public data elements on enterprise digital transformation can be explained from two aspects, i.e., the incentive effect and reverse pressure effect. First, at the incentive level, the acquisition and utilization of public data by enterprises helps to enhance the endogenous driving force of their digital transformation. Initially, from the perspective of public attributes, digital transformation relies on a large number of high-quality data resources as its basis. The opening of public data provides enterprises with basic data resources with strong authority, wide coverage, and high versatility. It not only significantly reduces the cost of enterprises to obtain information, but also promotes the efficient flow of data elements, effectively supplementing the shortcomings inherent in the internal data of enterprises, thereby providing key support for enterprise digital transformation [

24]. Based on the theory of information economics, the openness of public data elements effectively reduces the cost of enterprises to obtain external information and improves the openness and transparency of this information, thereby alleviating the problem of information asymmetry in the market, to a certain extent. The reduction in information friction not only optimizes the company’s perception of the external environment, but also enhances the company’s confidence and willingness to make digital transformation decisions under uncertain conditions [

25]. Secondly, from the perspective of high-value attributes, public data elements can be deeply integrated with traditional production factors such as land, labor, and capital, reshaping the approach of enterprises to allocating production factors and the logic of value creation. By embedding the entire production process, public data not only improves resource allocation efficiency, but also promotes the intelligence, refinement, and coordination of production methods, thereby injecting new impetus into the digital transformation of enterprises [

26,

27]. Public data elements promote enterprises to change their production management models, make up for the management’s shortcomings regarding cognition and information processing, reduce information frictions faced by management, improve information transparency and decision-making efficiency between organizational levels, and thus reduce opportunity cost losses caused by planning errors [

24]. Finally, by reducing information friction, public data elements significantly promote digital technology innovation in enterprises, thus promoting the digital transformation of enterprises. Digital technology innovation provides a technical foundation for and reduces the difficulty of enterprise digital transformation. On the one hand, the opening of public data has improved the accessibility of enterprises to acquire and process digital resources such as high-quality data, metadata, and technical documents, fundamentally reducing the difficulty of data access and integration and effectively alleviating information asymmetry and processing obstacles. This reduction in information friction is of great significance to the rapid development and efficient deployment of digital technology innovation [

28]. On the other hand, public data elements also exhibit certain governance functions in the governance structure, which helps alleviate the delegation–agent problems within the enterprise [

29]. By providing improved information transparency and enhanced supervisory capacity, public data helps mitigate managerial short-termism and self-interest, streamlines resource allocation processes, and reduces inefficient behaviors such as defensive management, thereby facilitating greater investment in digital innovation initiatives by firms.

Second, the widespread application of public data elements by competing companies has significantly aggravated the intensity of market competition, which in turn forces companies to accelerate the pace of digital transformation [

30]. The sharing and inclusiveness of public data effectively breaks through the high entry threshold of traditional production factors, significantly lowers market entry barriers, and allows more emerging companies to quickly enter the market, thereby intensifying competition among market entities. On the other hand, public data elements have improved the transparency and service efficiency of government operations, optimized the business environment, and promoted the formation of a more fair and efficient market order. This optimization of the institutional environment has further attracted external enterprises to enter the market and increased the overall competitiveness [

31]. Against this background, if traditional enterprises respond slowly in digital transformation, they will face the risk of being marginalized or even eliminated from the market, and their survival pressure will increase significantly [

32]. Therefore, the intensification of market competition has become an important external driving force for motivating enterprises to accelerate digital transformation, making enterprises pay more attention to improving profitability and maintaining competitive advantages through digital means [

33]. Accordingly, this paper proposes the following hypothesis:

H1. Public data elements can facilitate enterprise digital transformation.

2.3. Mechanism Analysis

In the age of the digital economy, digital transformation is an inevitable trend that must be embraced for enterprises to adapt to the sustainable development of the economy, and its secret is the complete use of data. However, information friction increases the difficulty of digital transformation. Relying on the basic theory of information economics, this paper divides the types of information friction that hinder the digital transformation of enterprises into two categories: one is friction with the public system, such as the increase in costs caused by redundant administrative approvals, and the other is friction with market entities, such as the deterioration of financing capacity due to uncertainty in the market environment. Public data elements comprise a type of universal and shared public resource that can lower market costs and lessen friction with the public system by increasing the degree of data sharing. On the other hand, public data elements are still fundamentally data elements, and the economic value they release can maximize business cash flow, ease financing constraints, and lessen friction with market entities. Thus, from the standpoint of information friction and in conjunction with the economic properties of public data, this research examines the theoretical mechanism of public data elements influencing the digital transformation of organizations.

2.3.1. Effects of Information Resource Sharing

The digital transformation of businesses can be facilitated by public data elements that optimize the external information environment of businesses, improve transparency, and lessen the congestion of production resources brought on by governmental information lag. According to previous research, enhancing the external information environment reduces information barriers to digital transformation by improving the availability, validity, and integrity of data resources [

34]. As an essential public resource, public data elements are non-scarce data elements comprising public goods in the market [

35], which can simultaneously maximize resource sharing within the government and information resource sharing between the government and businesses. This is why the information resource-sharing effect exists. The government will first be compelled to restructure the government informatization system due to the openness of public data elements. This will make internal information communication within government departments more efficient and information transmission more truthful, which can significantly improve the transparency of government operations [

31,

36]. Second, the limited and subpar internal datasets of businesses and their inability to handle data have emerged as significant barriers to digital transformation. The public data factors it offers can help to improve the level of data resources, continuously promote the flow and sharing of data factors, facilitate the overflow of high-quality data resources to enterprises, lower the threshold of data factor use, and empower the digital transformation of enterprises. The government data platform, established by government departments, is crucial in promoting and perfecting the data factor market service system.

2.3.2. Effects of Mitigating Financial Constraints

In order to improve the degree of enterprise digital transformation, public data elements can assist businesses in overcoming the crowding-out problem of financial resources through the relieving effect of financing constraints. According to existing research, enterprise digital transformation depends on resolving the enterprise funding constraint challenges. The primary reason for the existence of the financing constraint relief effect is that, as a type of data element, the acquisition of public data elements first and foremost lowers the cost of businesses looking for high-value data [

24]. It also directly improves the business’s operational and management capabilities, which in turn increases the business’s negotiating power in financing activities. Additionally, public data elements offer an opportunity screening mechanism [

37] that enables firms to prioritize “generally better candidates” [

38] when making investment decisions. That is, enterprises rely on public data to identify the most profitable projects from a large amount of information. Promising initiatives are typically more profitable, and when businesses can give investors precise and reliable information, they are more likely to back these promising projects, which increases the possibility of receiving corporate financing. Last but not least, financial institutions can better understand an enterprise’s solvency and risk levels by analyzing public data, such as industrial and commercial administrative penalties, enterprise registration information, and enterprise credit status. Financial institutions can create a thorough and accurate enterprise portrait, lower the assessment cost and financing risk rating of an enterprise, and then tend to provide enterprises with more significant amounts of financing or more favorable financing conditions, thereby relieving the financing constraints of enterprises. Businesses may now access more liquid capital and use it more loosely, thanks to removing financing restrictions, which is improves digital transformation. As a result, one crucial mechanism of action for public data elements to support businesses’ digital transformation is the relief of financial constraints.

Based on the above analysis, this paper proposes the following hypotheses:

H2. Regarding friction with the public system, public data elements can facilitate enterprises’ digital transformation through the information resource sharing effect.

H3. Regarding friction with market players, public data elements can facilitate firms’ digital transformation through financing constraint mitigation effects.

2.4. Public Data Elements and Enterprise Digital Transformation: Heterogeneity Analysis

The impact of public data elements on enterprise digital transformation has varying effects based on the level of high and low open data quality, high and low digital economy market dynamics, and the enterprise growth cycle because there are differences in the efficiency of businesses regarding their use of public data elements, i.e., different open data quality, different growth cycles, and different digital economy dynamics.

Firstly, the extant research generally agrees that the quality of data openness has a robust correlation with its economic value regarding the impact of public data elements on the digital transformation of enterprises with varying data openness quality [

39]. Higher data openness means that the government provides businesses with better public data elements. High-quality public data elements have clear advantages over low-quality data in terms of data accuracy, timeliness, and completeness, i.e., accurate data can give businesses a solid information base and help them make the right decisions and take appropriate actions; complete data can give them comprehensive information and help them better understand business operations and customer needs; timely data can increase the operational efficiency and response speed of businesses; and timely data can reduce incorrect decisions and losses caused by information lag. Therefore, businesses can better construct their digital transformation when they employ high-quality public data elements.

Second, the degree of advanced digital technology development and corresponding technology use capabilities are significant factors for the emergence of heterogeneity regarding the influence of public data elements on the digital transformation of enterprises in regions with varying levels of digital economy vitality. On the one hand, areas with a high digital economic vitality display more developed digital technology innovation s. Digital technology innovation will first emerge in regions with high digital economic vitality characterized by significant economic strength and risk-taking capacity. This is because implementing digital technology innovation is extremely risky and requires entities to make significant expenditures and bear unknown risks. In addition, regions with high digital economic vitality exhibit greater integration between the digital and physical economies, which can consistently lead to the emergence of new business models and forms. This makes these regions ideal for the long-term growth of digital innovation technology. Local business digital transformation will be aided by the rise and advancement of digital technological breakthroughs. However, areas with a high level of digital economic vitality are better able to use technology. Innovative technology’s contribution to digital transformation is contingent upon the infrastructure that supports it. Highly active regions have more substantial technical usage capabilities and a more comprehensive infrastructure related to digital aspects, allowing them to discover more significant value in public data, supporting the digital transformation of businesses.

Furthermore, the layered integration of data elements is more economically useful due to the incremental returns to scale of the data elements. Enterprise digital transformation can be facilitated by the rich accumulation of data elements in areas with strong digital economic vitality, providing more technological use possibilities [

40]. Therefore, public data elements display a more evident function in boosting the digital transformation of businesses in high digital economic vitality regions than in low digital economic vitality regions.

Last but not least, the absorption and transformation of digital resources are key to the digital transformation of organizations in terms of the impact of public data elements on the digital transformation of enterprises in various growth cycles [

41]. Public data elements, an essential digital resource outside the company, can be absorbed and transformed in multiple ways by businesses in varying stages of development. While businesses in the decline period typically rely on internal data for decision making and are insensitive to external data and information, businesses in the growth and maturity periods must depend more on public data for pertinent decision making and analysis, which lowers exploration and transaction costs. However, it is possible to effectively alter and use public data elements, which requires businesses to exhibit strong financial standing and cutting-edge innovation skills. In the age of the digital economy, businesses in the growth phase are typically founded with venture capital and other forms of financial support, and they are naturally creative and adaptable, which allows them to make effective use of public data elements; businesses in the mature phase have a certain amount of financial strength and concentrate on ongoing innovation to keep their competitive advantages; they can set up a system that effectively transforms the value of public data elements for their own digital transformation. Businesses in the decline phase may encounter operational challenges and financial limitations, which make it challenging to absorb and transform the economic value of public data elements. Thus, the following theories are proposed in this paper:

H4. The impact of public data elements on enterprise digital transformation is heterogeneous regarding data quality, digital economic dynamism, and life cycle heterogeneity. The impact of public data elements on enterprise digital transformation is more significant in areas of high digital economic dynamism, more prominent in cases of high-quality data, and more important in terms of the growth and maturity of enterprises.

2.5. Public Data Elements and Enterprise Digital Transformation: Regulatory Role

Data factors exhibit a certain level of dependence and require using the Internet and other carriers to generate greater value, in contrast to traditional production elements like labor, capital, and land, which can independently engage in the production process [

42]. The development of a digital infrastructure and the use of digital products can enhance the role of public data elements in advancing enterprise digital transformation. This is because in order for public data elements to fully release their economic value, they must be based on a comprehensive digital infrastructure and cutting-edge digital products. First, from the perspective of how digital infrastructure is regulated, improving the effectiveness of public data element use is a key area of focus for increasing their influence on businesses’ digital transformation. Digital infrastructure, which serves as the foundation for data element operation, can significantly increase the effectiveness of businesses’ use of public data elements. The Internet and 5G base stations are new-generation information and communication infrastructures that can lower data transmission costs and increase data transmission efficiency. Second, computing infrastructure, such as supercomputing and bright computing centers, meet the computing power requirements of enterprise digital transformation at a lower cost and assist in data analysis. The economic value of public data elements can only be effectively released and provide a greater impetus for digital transformation via sufficiently advanced digital products. From the perspective of the regulating effect of digital products, public data elements are essentially public resources. This means that the more sophisticated the digital product, the more it can utilize the information resource sharing and financing constraint alleviation effects of public data elements. Thus, the role of public data elements in promoting the digital transformation of enterprises depends on the advanced level of the digital products.

In exploring the regulatory role of public data elements in enterprise digital transformation, the enterprise resource allocation method is a key regulatory variable. Traditional enterprise investment (such as fixed asset investment) and innovative investment (such as R&D investment) represent the different development strategies and resource tendencies of enterprises, and the two play completely different regulatory roles in the use of public data elements. On the one hand, corporate investment has a strong path dependence and is often concentrated in “heavy asset” areas such as expanding production capacity and building infrastructure. This type of investment displays strong sunk costs and low flexibility, which may lead to slow response in the face of a rapidly changing digital environment, inhibiting the effective integration of emerging technologies and data resources, thereby weakening the positive role of public data elements in promoting the digital transformation of enterprises. More importantly, excessive reliance on traditional capital investment may cause enterprises to strategically stick to their original development paths and ignore the transformation logic based on data-driven alternatives, thus showing a negative regulation effect. On the other hand, innovation investment focuses on technological research and development, data capacity building, and organizational innovation, reflecting the forward-looking layout of enterprises for future uncertainty and emerging capabilities. This type of investment helps enterprises establish technical absorption and organizational adaptability that matches public data elements, allowing enterprises to more effectively explore, analyze, and apply open data resources and to realize the digital and intelligent reconstruction of business processes. Therefore, innovative investment can enhance the driving force of public data elements toward the digital transformation of enterprises and show a significant positive regulatory effect. Therefore, the different types of resource allocation strategies of enterprises display differentiated regulatory effects regarding the use of public data elements.

H5. Digital infrastructure and digital goods positively moderate public data elements related to business digital transformation.

H6. In the regulatory role of public data elements influencing the digital transformation of enterprises, corporate investment plays a negative role, while innovative investment plays a positive role.

6. Conclusions and Policy Recommendations

Releasing the value of public data elements to drive the digital transformation of enterprises can promote the construction of smart city planning systems, thus achieving efficient allocation and sustainable use of land resources. Theoretical analysis shows that public data elements can be effectively integrated into enterprise production and operation to promote enterprise digital transformation. Based on the quasi-natural experiment with government data platforms launched online from 2011 to 2022, this paper empirically examines the relationship between public data elements and enterprise digital transformation, along with its mechanism of influence. The main conclusions are as follows: First, public data elements facilitate the level of enterprise digital transformation. Second, public data elements mainly affect enterprise digital transformation through two mechanisms, i.e., the information sharing effect and the financing constraint alleviation effect, as the public attributes of public data elements and the high value of data elements reduce the friction between the enterprise and the public system and market players. Third, the heterogeneity analysis finds that the enhancing effect of public data elements on enterprise digital transformation mainly exists in the case of high-quality data openness, high digital economic vitality regions, and enterprises experiencing growth and maturity. Fourth, a complete digital infrastructure and advanced digital products positively moderate the facilitating effect of public data elements on a firm’s digital transformation. In addition, corporate investment plays a negative regulatory role, while innovative investment plays a positive regulatory role.

The following policy recommendations are suggested in the article, based on the study’s findings.

The government should first play a significant role in releasing public data elements to encourage the conversion of public data into factors of production and to support the digital transformation of enterprises. Currently, the primary obstacle to opening public data elements is the lack of clarity regarding who owns the data and the uniformity of the opening mode, which results in a limited degree of opening. Therefore, the government must encourage the implementation of the public data rights authorization mechanism, attempt to clarify who owns the resources of public data, encourage the vitality of data opening, increase the effective supply of public data, and adopt the three open modes, i.e., unconditional openness without compensation, conditional openness without compensation, and conditional openness with compensation.

Second, to better support the digital transformation of businesses, policymakers should implement several measures to strengthen the financing constraint-relieving effect and the information resource-sharing effect. On the one hand, the government should encourage cross-industry and cross-departmental data integration and sharing, break down data barriers between departments, and maximize the use of public data resources. On the other hand, through policy guidance, the government can encourage financial institutions to use public data elements to implement data-driven financing products and services and investigate creative financing models that utilize public data elements to continuously optimize the financing environment for businesses.

Moreover, based on the circumstances of various regions and businesses, the government should implement unique and dynamic strategies to increase the success rate of businesses’ digital transformation. Since the driving force behind the digital transformation of low digital economy vitality regions and declining businesses has not yet been fully explored, the government should offer special funds and tax exemptions to companies with weaker digital technology capabilities to encourage them to introduce and adopt advanced digital technologies. At the same time, it should make it easier for businesses to access and use public data, provide low-tech companies with easily navigable tools and platforms, and offer them specialized technical support so they can easily apply data to their actual business, get past the challenges of digital transformation, optimize the allocation of land resources, and promote sustainable development.

Finally, the government should focus on digital infrastructure construction and digital product research and development to provide support for public data elements to help enterprises in digital transformation. Current challenges include insufficient capital investment in digital infrastructure construction and digital product research and development, difficulty breaking through technical bottlenecks, and a lack of digital talents. Therefore, the relevant governments should do the following: First, guide private capital to participate in digital infrastructure construction through PPP (government–social capital cooperation) and other means and increase investment in digital infrastructure construction. Based on the national Eastern Data Western Computing project hub node, pilot PPP projects in new infrastructure fields such as computing power centers and 5G base stations should be introduced. Second, provide R&D subsidies, tax incentives, and other policies to encourage enterprises to increase R&D investment in digital technology, strengthen technological innovation, and break through the technological bottlenecks. In particular, in the fields of artificial intelligence, industrial Internet, and other choke points, enterprises with more than 8% of R&D investment should be subsidized, step by step. Third, encourage colleges, universities, and scientific research institutions to enhance digital talent training, while enabling the introduction of overseas high-level talents and promoting the emergence of high-quality digital training. They should also establish a digital talent “special zone” in the national level digital economy demonstration zone, implement the “dual mentor system” for master’s and doctoral training, and require top enterprises (such as Alibaba Cloud) to take on no less than 100 targeted trainees annually.

Compared to existing research, this article has made significant progress in revealing the mechanisms by which public data elements drive digital transformation in enterprises. The existing literature mainly focuses on the endogenous digital transformation path of enterprises, while this article, through a quasi-natural experimental design, systematically demonstrates, for the first time, the causal effect of government data openness as an exogenous policy on enterprise digital transformation. This study found that public data elements have a dual empowering effect on enterprise digital transformation through information resource channels and financing constraint channels, deepening relevant research on enterprise digital transformation.

This study exhibits two limitations. Firstly, due to the regional segmentation attribute of the data open platforms, this article failed to delve into the synergistic effect of cross-regional data element flow, possibly underestimating the multiplier effect of infrastructure interconnection on digital transformation. Secondly, the lack of the dynamic assessment of potential risks in regards to the operation of public data authorization may weaken the constraining effect of institutional deficiencies on policy effectiveness.

The future research direction lies in the following: on the one hand, it is necessary to deepen the integration research of data elements and new infrastructure, construct a “data computing algorithm” trinity analysis framework, and deeply analyze the improvement space for infrastructure upgrading in regards to enterprise digital transformation. On the other hand, with the accelerated improvement in data infrastructure, the deep integration of public data openness, the industrial Internet, and the AI big model will reshape the underlying logic of enterprise digital transformation.