The Impact of Environmental Information Disclosure on Corporate Sustainability: The Mediating Role of Profitability

Abstract

1. Introduction

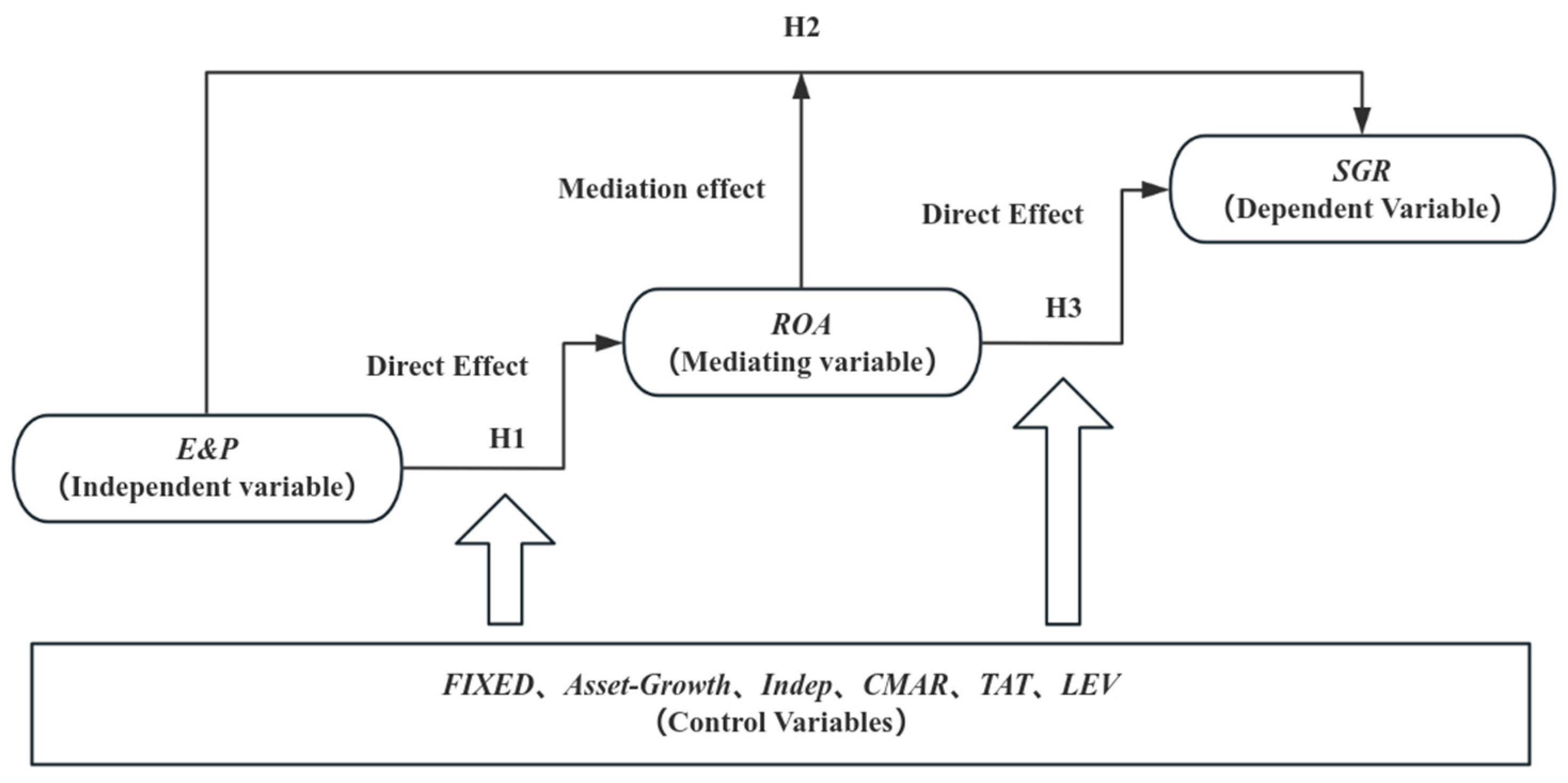

2. Literature Review and Research Hypothesis

2.1. Environmental Information Disclosure and Corporate Profitability

2.2. Environmental Information Disclosure and Corporate Sustainability

3. Study Design

3.1. Sample Selection and Data Sources

- (1)

- The sample of listed companies labeled as ST, S*ST, PT and ST* by the SEC is excluded;

- (2)

- Excluding the financial sector;

- (3)

- Excluding extreme values of attributes and applying Winsorization to continuous variables;

- (4)

- Excluding missing values for the dependent variable sustainable growth rate (SGR) and the explanatory variable EID.

3.2. Variable Definition and Description

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Mediating Variable

3.2.4. Other Control Variables

3.2.5. Model Construction

4. Empirical Results and Analysis

4.1. Descriptive Statistics

4.2. Correlation Test

4.3. Multicollinearity Analysis

4.4. Fixed Effects Model Test

4.5. Benchmark Regression Results Analysis

4.6. Mediation Effect Analysis

4.7. Endogeneity Test

4.8. Robustness Test

4.9. Mediation Effect Test

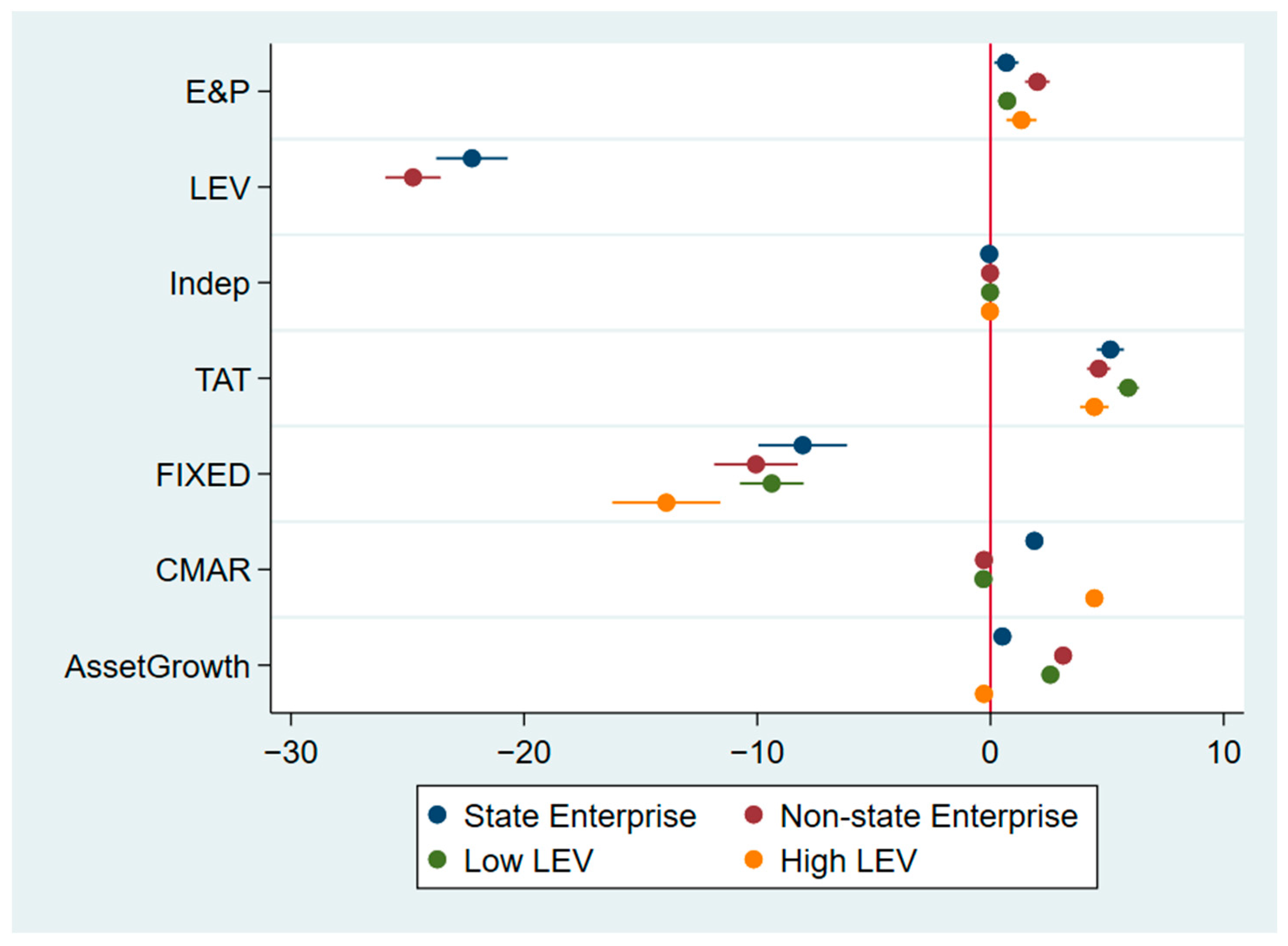

4.10. Heterogeneity Test

4.10.1. Heterogeneity Test Based on Leverage Ratio

4.10.2. Heterogeneity Test Based on the Nature of Property Rights

5. Results and Discussion

6. Conclusions and Recommendations

6.1. Conclusions

6.2. Recommendations

6.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| EID | environmental information disclosure |

| CSMAR | China Stock Market & Accounting Research Database |

| ROA | Return on Assets |

| SGR | sustainable growth rate |

References

- Xinhua News Agency. How to Understand the Reform of Deepening the Legal Disclosure System of Environmental Information. October 2024. Available online: https://www.gov.cn/zhengce/202410/content_6983907.htm (accessed on 4 April 2025).

- Evans, M.F.; Gilpatric, S.M.; Liu, L. Regulation with direct benefits of information disclosure and imperfect monitoring. J. Environ. Econ. Manag. 2009, 57, 284–292. [Google Scholar] [CrossRef]

- Zeng, S.X.; Xu, X.D.; Yin, H.T.; Tam, C.M. Factors that drive Chinese listed companies in voluntary disclosure of environmental information. J. Bus. Ethics 2012, 109, 309–321. [Google Scholar] [CrossRef]

- Guangzhou Regional Low Carbon Economy Research Base. Policy Overview Issue 8: Environmental Information Disclosure. 2 August 2021. Available online: https://lcerc.jnu.edu.cn/2021/0802/c32143a640239/page.htm (accessed on 4 April 2025).

- Ding, J.; Lu, Z.; Yu, C.-H. Environmental information disclosure and firms’ green innovation: Evidence from China. Int. Rev. Econ. Financ. 2022, 81, 147–159. [Google Scholar] [CrossRef]

- Sumiani, Y.; Haslinda, Y.; Lehman, G. Environmental reporting in a developing country: A case study on status and implementation in Malaysia. J. Clean. Prod. 2007, 15, 895–901. [Google Scholar] [CrossRef]

- Plumlee, M.; Brown, D.; Hayes, R.M.; Marshall, R.S. Voluntary environmental disclosure quality and firm value: Further evidence. J. Account. Public Policy 2015, 34, 336–361. [Google Scholar] [CrossRef]

- Chen, Y.; Chen, L. Does pollution information disclosure affect corporate employment? Evidence from China. Sustainability 2025, 17, 875. [Google Scholar] [CrossRef]

- People’s Daily Online. Read the Third Plenary Session of the Central Committee of the Communist Party of China (CPC) ④: Knowledge Behind 8 Sets of ‘Green Buzzwords’. 3 August 2024. Available online: http://finance.people.com.cn/n1/2024/0803/c1004-40291755.html (accessed on 4 April 2025).

- The United Nations. Sustainable Development Goals: 17 Goals to Transform the World. Available online: https://www.un.org/zh/70001/page/180631 (accessed on 4 April 2025).

- European Commission. Implementing and Delegated Acts—CSRD. Available online: https://finance.ec.europa.eu/regulation-and-supervision/financial-services-legislation/implementing-and-delegated-acts/corporate-sustainability-reporting-directive_en (accessed on 4 May 2025).

- Balsanek, K.; Anagnosti, E.; Cloud, W.; Baker, J.; Gumabon-Greaver, S. SEC Climate Disclosure Rules: Four Potential Paths Under President Trump. DLA Piper. 2024. Available online: https://www.dlapiper.com/en-us/insights/publications/2025/02/sec-climate-disclosure-rules-four-potential-paths-under-president-trump (accessed on 4 May 2025).

- Ezhilarasi, G.; Kabra, K.C. The impact of corporate governance attributes on environmental disclosures: Evidence from India. Indian J. Corp. Gov. 2017, 10, 24–43. [Google Scholar] [CrossRef]

- Ruchita, V.; Dhanraj, S.; Hayatullah, J. Impact of corporate governance on environmental information disclosure: Evidence from India. Orissa J. Commer. 2021, 42, 16–28. [Google Scholar] [CrossRef]

- Zhou, Y.; Shi, Z.; Lei, F.; Sun, W.; Zhang, J. Effect of Environmental information disclosure on the financing efficiency of enterprises—Evidence from China’s listed energy companies. Sustainability 2022, 14, 16699. [Google Scholar] [CrossRef]

- Zhu, C.; Li, N.; Ma, J. Environmental backgrounds of CEOs and corporate environmental management information disclosure: The mediating effects of financing constraints and media attention. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 2885–2905. [Google Scholar] [CrossRef]

- Zhao, X.; Zhu, R.; Li, Q.; Hu, J. Unleashing the impact of environmental information disclosure on corporate green innovation: The role of audit quality and media attention. Environ. Dev. 2024, 52, 101078. [Google Scholar] [CrossRef]

- Luo, Y.; Xiong, G.; Mardani, A. Environmental information disclosure and corporate innovation: The “Inverted U-shaped” regulating effect of media attention. J. Bus. Res. 2022, 146, 453–463. [Google Scholar] [CrossRef]

- Meng, X.; Tang, M.; Kong, F.; Li, S. The effect of environmental information disclosure on green total factor productivity: Evidence from quasi-natural experiments on cities in China. Sustainability 2022, 14, 13079. [Google Scholar] [CrossRef]

- Wang, Y. Impact of environmental information disclosure on environmental regulation intensity: Evidence from 113 cities in China. Sci. Rep. 2024, 14, 25357. [Google Scholar] [CrossRef] [PubMed]

- Hsu, A.; de Sherbinin, A.; Shi, H. Seeking truth from facts: The challenge of environmental indicator development in China. Environ. Dev. 2012, 3, 39–51. [Google Scholar] [CrossRef]

- Mol, A.P.J. Environmental governance in the information age: The emergence of informational governance. Environ. Plan. C Gov. Policy 2006, 24, 497–514. [Google Scholar] [CrossRef]

- Radej, B.; Zakotnik, I. Environment as a factor of national competitiveness in manufacturing. In Technological Choices for Sustainability; Sikdar, S.K., Glavič, P., Jain, R., Eds.; Springer: Berlin/Heidelberg, Germany, 2004; pp. 283–298. [Google Scholar] [CrossRef]

- Mol, A.P.J.; He, G.; Zhang, L. Information disclosure in environmental risk management: Developments in China. J. Curr. Chin. Aff. 2011, 40, 163–192. [Google Scholar] [CrossRef]

- Solikhah, B.; Maulina, U. Factors influencing environment disclosure quality and the moderating role of corporate governance. Cogent Bus. Manag. 2021, 8, 1876543. [Google Scholar] [CrossRef]

- Chen, X.; Li, X.; Huang, X. The impact of corporate characteristics and external pressure on environmental information disclosure: A model using environmental management as a mediator. Environ. Sci. Pollut. Res. 2022, 29, 12797–12809. [Google Scholar] [CrossRef]

- Liu, X.; Anbumozhi, V. Determinant factors of corporate environmental information disclosure: An empirical study of Chinese listed companies. J. Clean. Prod. 2009, 17, 593–600. [Google Scholar] [CrossRef]

- Li, X.; Wang, R.; Wang, M.; Xu, S.; Li, L. The relationship between environmental information disclosure and financing constraints: Evidence from heavily polluted listed companies in China. In Proceedings of the International Conference on Decision Science & Management (ICDSM ‘24), Association for Computing Machinery, Hong Kong, China, 26–28 April 2024; pp. 37–46. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Branco, M.C.; Rodrigues, L.L. Social responsibility disclosure: A study of proxies for the public visibility of Portuguese banks. Br. Account. Rev. 2008, 40, 161–181. [Google Scholar] [CrossRef]

- Hu, S.; Zhang, C.; Ji, Y.; Zhang, C. Does environmental information disclosure tone affect corporate green innovation in China? Based on the institutional perspective. Environ. Dev. Sustain. 2024, 26, 12239–12282. [Google Scholar] [CrossRef]

- Shen, S.; Xie, J.; Fujii, H.; Keeley, A.R.; Managi, S. Does environmental materiality matter to corporate financial performance: Evidence from 34 countries. Corp. Soc. Responsib. Environ. Manag. 2024, 32, 2390–2411. [Google Scholar] [CrossRef]

- Malik, F.; Wang, F.; Li, J.; Naseem, M.A. Impact of environmental disclosure on firm performance: The mediating role of green innovation. Rev. Contab. 2023, 26, 14–26. [Google Scholar] [CrossRef]

- Wang, D.; Li, X.; Tian, S.; He, L.; Xu, Y.; Wang, X. Quantifying the dynamics between environmental information disclosure and firms’ financial performance using functional data analysis. Sustain. Prod. Consum. 2021, 28, 192–205. [Google Scholar] [CrossRef]

- Li, J.; Tang, D.; Tenkorang, A.P.; Shi, Z. Research on environmental regulation and green total factor productivity in Yangtze River Delta: From the perspective of financial development. Int. J. Environ. Res. Public Health 2021, 18, 12453. [Google Scholar] [CrossRef]

- Rabaya, A.J.; Saleh, N.M. The moderating effect of IR framework adoption on the relationship between environmental, social, and governance (ESG) disclosure and a firm’s competitive advantage. Environ. Dev. Sustain. 2022, 24, 2037–2055. [Google Scholar] [CrossRef]

- Ahmad, N.; Li, H.-Z.; Tian, X.-L. Increased firm profitability under a nationwide environmental information disclosure program? Evidence from China. J. Clean. Prod. 2019, 230, 1176–1187. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Notation | Description of Definitions |

|---|---|---|---|

| Dependent Variable | The sustainable development of the enterprise | SGR | Larger values represent the greater potential for growth in sales and profits that the firm can realize without adding additional capital, and the greater its sustainability. Values are taken as percentages. |

| Independent variable | Environmental information disclosure | E&P | Disclosed environmental information takes the value of 1, otherwise it is 0; the data are obtained from the social responsibility reports of listed companies. |

| Mediating variable | Profitability | ROA | The profitability of the announced enterprises during the reporting period. |

| Control variables | Fixed Asset Ratio | FIXED | Net fixed assets/total assets. |

| Total Asset Growth Rate | Asset-Growth | (Closing value of total assets for the period—Opening value of total assets for the period)/(Opening value of total assets for the period). | |

| The proportion of independent directors | Indep | Number of independent directors/total number of directors. | |

| Capital Preservation and Appreciation Rate | CMAR | Closing value of the period/(Total owner’s equity) Opening value of the period. | |

| Total Asset Turnover Ratio | TAT | Closing balance of operating income/total assets; | |

| Leverage Ratio | LEV | Total liabilities/total assets. |

| VarName | Obs | Mean | SD | Min | Median | Max |

|---|---|---|---|---|---|---|

| SGR | 42,009 | 3.347 | 11.397 | −88.6 | 4.39 | 31 |

| E&P | 42,009 | 0.284 | 0.451 | 0 | 0 | 1 |

| ROA | 42,009 | 0.030 | 0.076 | −2.12 | 0.0336 | 0.418 |

| LEV | 42,009 | 0.428 | 0.205 | 0.0071 | 0.422 | 0.994 |

| Indep | 42,009 | 37.672 | 5.608 | 0 | 36.4 | 80 |

| TAT | 42,009 | 0.611 | 0.513 | −0.0583 | 0.507 | 12.1 |

| FIXED | 42,009 | 0.210 | 0.161 | 0 | 0.177 | 0.971 |

| CMAR | 42,009 | 1.141 | 2.129 | 0.114 | 1.06 | 366 |

| Asset-Growth | 42,009 | 0.144 | 0.581 | −0.907 | 0.0783 | 45.5 |

| SGR | E&P | ROA | LEV | Indep | TAT | FIXED | CMAR | AssetGrowth | |

|---|---|---|---|---|---|---|---|---|---|

| SGR | 1 | ||||||||

| E&P | 0.089 *** | 1 | |||||||

| ROA | 0.821 *** | 0.071 *** | 1 | ||||||

| LEV | −0.186 *** | 0.145 *** | −0.292 *** | 1 | |||||

| Indep | −0.026 *** | 0.005 | −0.033 *** | −0.012 ** | 1 | ||||

| TAT | 0.104 *** | 0.027 *** | 0.079 *** | 0.141 *** | −0.027 *** | 1 | |||

| FIXED | −0.045 *** | 0.061 *** | −0.025 *** | 0.078 *** | −0.049 *** | 0.008 * | 1 | ||

| CMAR | 0.056 *** | −0.007 | 0.045 *** | −0.028 *** | −0.007 | −0.012 ** | −0.026 *** | 1 | |

| Asset-Growth | 0.131 *** | −0.024 *** | 0.116 *** | 0.019 *** | −0.005 | −0.028 *** | −0.077 *** | 0.563 *** | 1 |

| VIF | 1/VIF | |

|---|---|---|

| Asset-Growth | 1.272 | 0.786 |

| CMAR | 1.215 | 0.823 |

| LEV | 1.199 | 0.834 |

| ROA | 1.168 | 0.856 |

| E&P | 1.045 | 0.957 |

| TAT | 1.045 | 0.957 |

| FIXED | 1.032 | 0.969 |

| Indep | 1.005 | 0.995 |

| Mean VIF | 1.122 | 0.000 |

| Models | Test Type | p-Value | Test Statistic |

|---|---|---|---|

| Model 2 | F-test | 0 | 3.45 |

| Hausman test | 0 | 2539.43 | |

| Model 1 | F-test | 0 | 3.81 |

| Hausman test | 0 | 623.68 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| SGR | SGR | SGR | SGR | |

| E&P | 2.238 *** | 3.106 *** | 1.412 *** | 1.441 *** |

| (18.23) | (26.06) | (6.92) | (7.50) | |

| LEV | −12.524 *** | −25.875 *** | ||

| (−47.17) | (−55.61) | |||

| Indep | −0.054 *** | −0.022 | ||

| (−5.70) | (−1.63) | |||

| TAT | 3.019 *** | 5.046 *** | ||

| (28.85) | (25.71) | |||

| FIXED | −1.814 *** | −10.006 *** | ||

| (−5.45) | (−14.98) | |||

| CMAR | −0.217 *** | −0.170 *** | ||

| (−7.17) | (−6.06) | |||

| Asset-Growth | 3.188 *** | 2.716 *** | ||

| (28.67) | (26.04) | |||

| _cons | 2.710 *** | 8.192 *** | 2.961 *** | 13.728 *** |

| (41.39) | (20.85) | (38.91) | (23.91) | |

| Yearfixed | NO | NO | Yes | Yes |

| Firmfixed | NO | NO | Yes | Yes |

| N | 42,009 | 42,009 | 41,560 | 41,560 |

| R2 | 0.008 | 0.088 | 0.318 | 0.395 |

| (1) | (2) | (3) | |

|---|---|---|---|

| SGR | ROA | SGR | |

| E&P | 1.441 *** | 0.009 *** | 0.352 *** |

| (7.50) | (7.22) | (2.95) | |

| LEV | −25.875 *** | −0.169 *** | −5.162 *** |

| (−55.61) | (−56.73) | (−17.16) | |

| Indep | −0.022 | −0.000 *** | 0.014 * |

| (−1.63) | (−3.44) | (1.72) | |

| TAT | 5.046 *** | 0.023 *** | 2.240 *** |

| (25.71) | (18.22) | (18.32) | |

| FIXED | −10.006 *** | −0.057 *** | −2.994 *** |

| (−14.98) | (−13.37) | (−7.21) | |

| CMAR | −0.170 *** | −0.001 *** | −0.012 |

| (−6.06) | (−7.18) | (−0.69) | |

| Asset-Growth | 2.716 *** | 0.018 *** | 0.542 *** |

| (26.04) | (26.56) | (8.31) | |

| ROA | 122.331 *** | ||

| (243.04) | |||

| Yearfixed | Yes | Yes | Yes |

| Firmfixed | Yes | Yes | Yes |

| N | 41,560 | 41,560 | 41,560 |

| R2 | 0.395 | 0.439 | 0.768 |

| (1) | (2) | |

|---|---|---|

| First | Second | |

| E&P_lag1 | 0.485 *** | |

| (103.23) | ||

| E&P | 0.072 | |

| (0.15) | ||

| LEV | −25.8720 *** | |

| (−23.51) | ||

| Indep | −0.0213 | |

| (−1.13) | ||

| TAT | 5.0370 *** | |

| (5.93) | ||

| FIXED | −10.0740 *** | |

| (−8.03) | ||

| CMAR | −0.1698 | |

| (−1.22) | ||

| Asset-Growth | 2.7093 *** | |

| (4.31) | ||

| _cons | 8.201 *** | |

| (18.38) | ||

| N | 41,560 | 41,560 |

| Kleibergen–Paap rk LM statistic | 795.28 *** | |

| (Kleibergen–Paap rk Wald F statistic): | 2885.200 | |

| R2 | 0.224 | 0.154 |

| Variant | (1) SGR | (2) SGR | (3) SGR | (4) SGR |

|---|---|---|---|---|

| E&P | 1.441 *** | 0.352 *** | 0.594 *** | |

| (7.50) | (2.95) | (4.75) | ||

| E&P-2 | 1.763 *** | |||

| (6.50) | ||||

| ROA | 122.331 *** | |||

| (243.04) | ||||

| ROE | 27.334 *** | |||

| (224.08) | ||||

| Constant | 13.728 *** | 14.042 *** | 0.486 | 3.838 *** |

| (23.91) | (24.56) | (1.35) | (10.20) | |

| N | 41,560 | 41,560 | 41,560 | 41,560 |

| R2 | 0.395 | 0.395 | 0.768 | 0.744 |

| (1) | (2) | |

|---|---|---|

| ROA | SGR | |

| E&P | 0.009 *** | 0.352 *** |

| (7.22) | (2.95) | |

| LEV | −0.169 *** | −5.162 *** |

| (−56.73) | (−17.16) | |

| Indep | −0.000 *** | 0.014 * |

| (−3.44) | (1.72) | |

| TAT | 0.023 *** | 2.240 *** |

| (18.22) | (18.32) | |

| FIXED | −0.057 *** | −2.994 *** |

| (−13.37) | (−7.21) | |

| CMAR | −0.001 *** | −0.012 |

| (−7.18) | (−0.69) | |

| Asset-Growth | 0.018 *** | 0.542 *** |

| (26.56) | (8.31) | |

| ROA | 122.331 *** | |

| (243.04) | ||

| Sobel test | 1.089 *** (z = 7.215) | |

| Goodman-1 test | 1.089 *** (z = 7.214) | |

| Goodman-2 test | 1.089 *** (z = 7.215) | |

| Indirect effect coefficient | 1.089 *** (z = 7.214) | |

| Direct effect coefficient | 0.352 *** (z = 2.953) | |

| Total effect coefficient | 1.440 *** (z = 7.493) | |

| Proportion of intermediary effects | 3.091 | |

| Bootstrap(ind_eff) | 2.483 *** [2.307724, 2.659053] | |

| Bootstrap(dir_eff) | 0.627 *** [0.4856511, 0.7839608] | |

| Yearfixed | Yes | Yes |

| Firmfixed | Yes | Yes |

| N | 41,560 | 41,560 |

| R2 | 0.439 | 0.768 |

| Variant | Heterogeneity Test for Leverage Ratio | |

|---|---|---|

| Low LEV | High LEV | |

| SGR | SGR | |

| E&P | 0.716 *** | 1.328 *** |

| (3.69) | (4.03) | |

| Indep | −0.014 | −0.023 |

| (−1.04) | (−1.01) | |

| TAT | 5.906 *** | 4.455 *** |

| (24.88) | (14.20) | |

| FIXED | −9.378 *** | −13.901 *** |

| (−13.43) | (−11.76) | |

| CMAR | −0.301 *** | 4.457 *** |

| (−12.58) | (26.33) | |

| Asset-Growth | 2.569 *** | −0.280 |

| (19.49) | (−1.55) | |

| Yearfixed | Yes | Yes |

| Firmfixed | Yes | Yes |

| N | 20,296 | 20,591 |

| R2 | 0.471 | 0.425 |

| (1) State Enterprise | (2) Non-State Enterprise | |

|---|---|---|

| SGR | SGR | |

| E&P | 0.681 ** | 2.009 *** |

| (2.56) | (7.44) | |

| LEV | −22.238 *** | −24.766 *** |

| (−28.42) | (−40.92) | |

| Indep | −0.055 *** | −0.016 |

| (−2.91) | (−0.87) | |

| TAT | 5.140 *** | 4.644 *** |

| (17.21) | (18.10) | |

| FIXED | −8.052 *** | −10.058 *** |

| (−8.30) | (−10.99) | |

| CMAR | 1.884 *** | −0.279 *** |

| (13.36) | (−9.27) | |

| Asset-Growth | 0.511 *** | 3.116 *** |

| (2.82) | (24.14) | |

| Yearfixed | Yes | Yes |

| Firmfixed | Yes | Yes |

| N | 14,799 | 26,701 |

| R2 | 0.435 | 0.416 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, X.; Liang, W.; Ying, Q.; Dai, H.; Chen, H.; Jiang, J. The Impact of Environmental Information Disclosure on Corporate Sustainability: The Mediating Role of Profitability. Sustainability 2025, 17, 4603. https://doi.org/10.3390/su17104603

Wu X, Liang W, Ying Q, Dai H, Chen H, Jiang J. The Impact of Environmental Information Disclosure on Corporate Sustainability: The Mediating Role of Profitability. Sustainability. 2025; 17(10):4603. https://doi.org/10.3390/su17104603

Chicago/Turabian StyleWu, Xinyue, Wenqian Liang, Qinglei Ying, Hongwei Dai, Haixin Chen, and Jie Jiang. 2025. "The Impact of Environmental Information Disclosure on Corporate Sustainability: The Mediating Role of Profitability" Sustainability 17, no. 10: 4603. https://doi.org/10.3390/su17104603

APA StyleWu, X., Liang, W., Ying, Q., Dai, H., Chen, H., & Jiang, J. (2025). The Impact of Environmental Information Disclosure on Corporate Sustainability: The Mediating Role of Profitability. Sustainability, 17(10), 4603. https://doi.org/10.3390/su17104603