Balancing Growth and Sustainability: Can Green Innovation Curb the Ecological Impact of Resource-Rich Economies?

Abstract

1. Introduction

2. Literature Review

2.1. The Ecological Effects of Natural Resource Dependence

2.2. The Ecological Effects of Green Innovation

2.3. The Institutional Effects of Green Innovation

2.4. Empirical Gaps

3. Methodology

3.1. Data and Sources

3.2. Variables: Economic Intuition Behind the Measurement of Variables and Justification Within the STIRPAT Framework

3.3. Theoretical and Empirical Model

3.4. Econometric Procedure

3.4.1. Slope Homogeneity (SH) and Cross-Sectional Dependence (CD)

3.4.2. Unit Root and Cointegration

3.4.3. The Augment Mean Group (AMG) Estimator

3.4.4. System Generalized Method of Moment

4. Result Presentation and Discussion

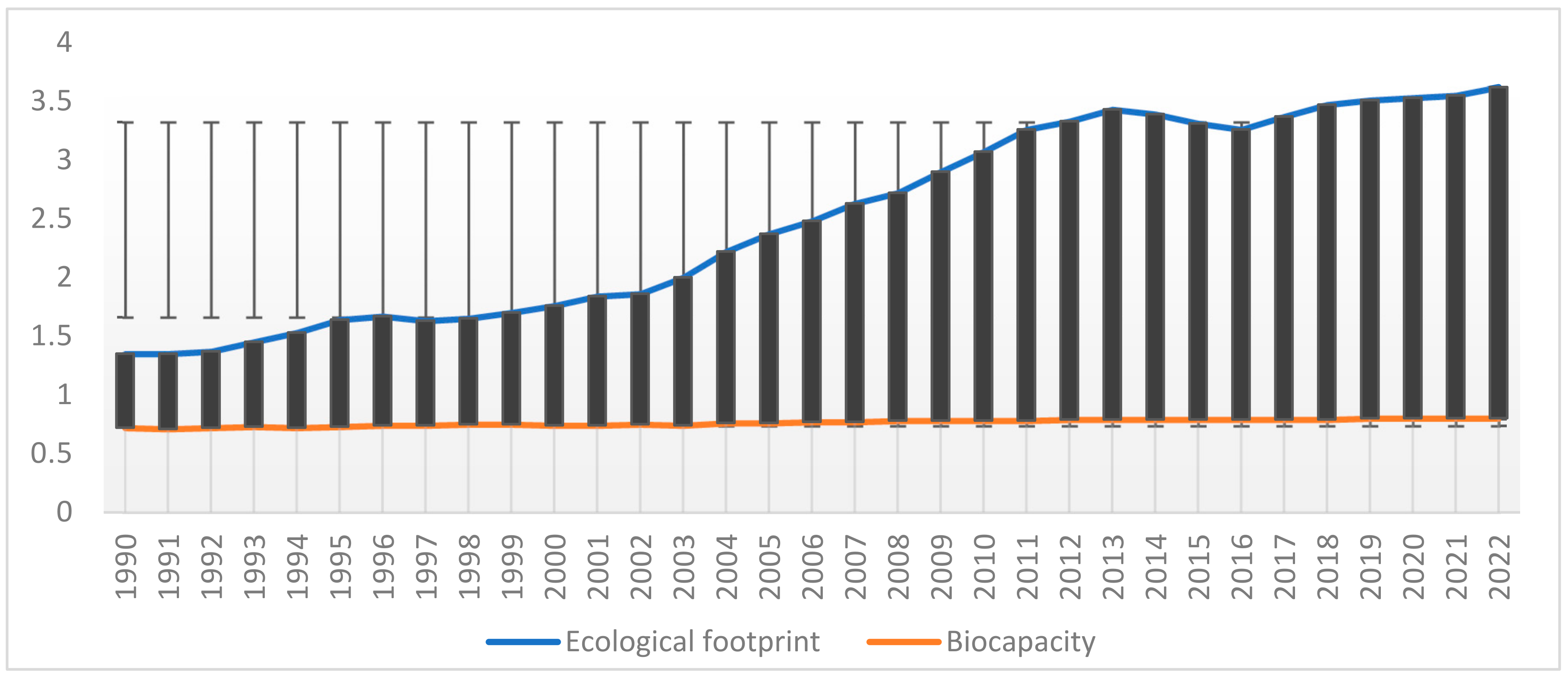

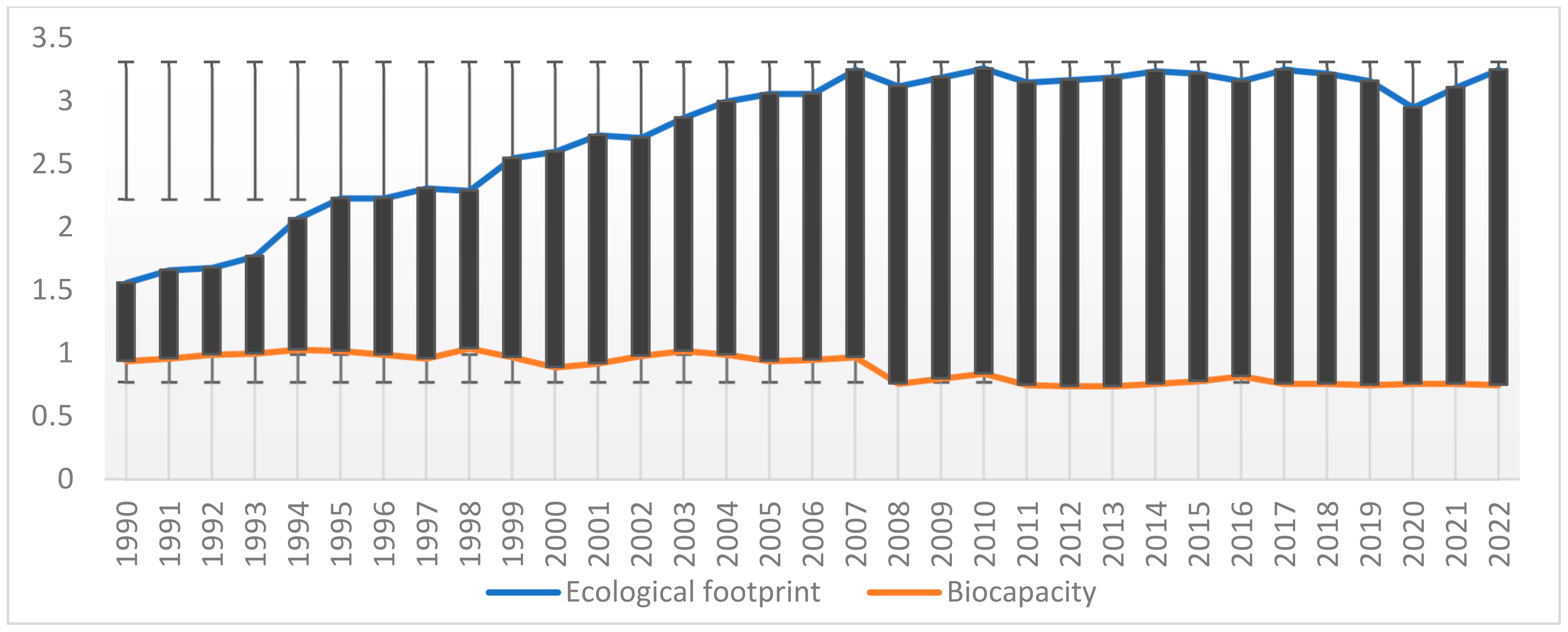

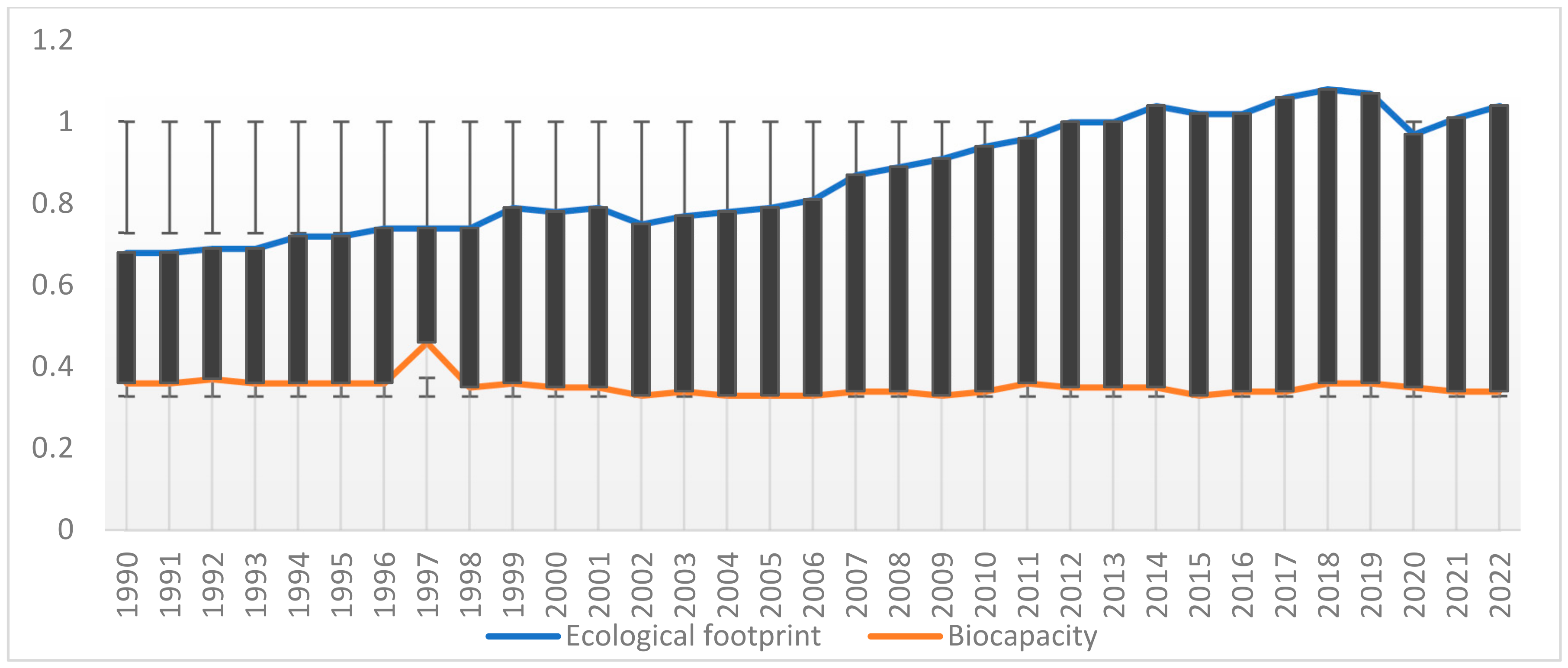

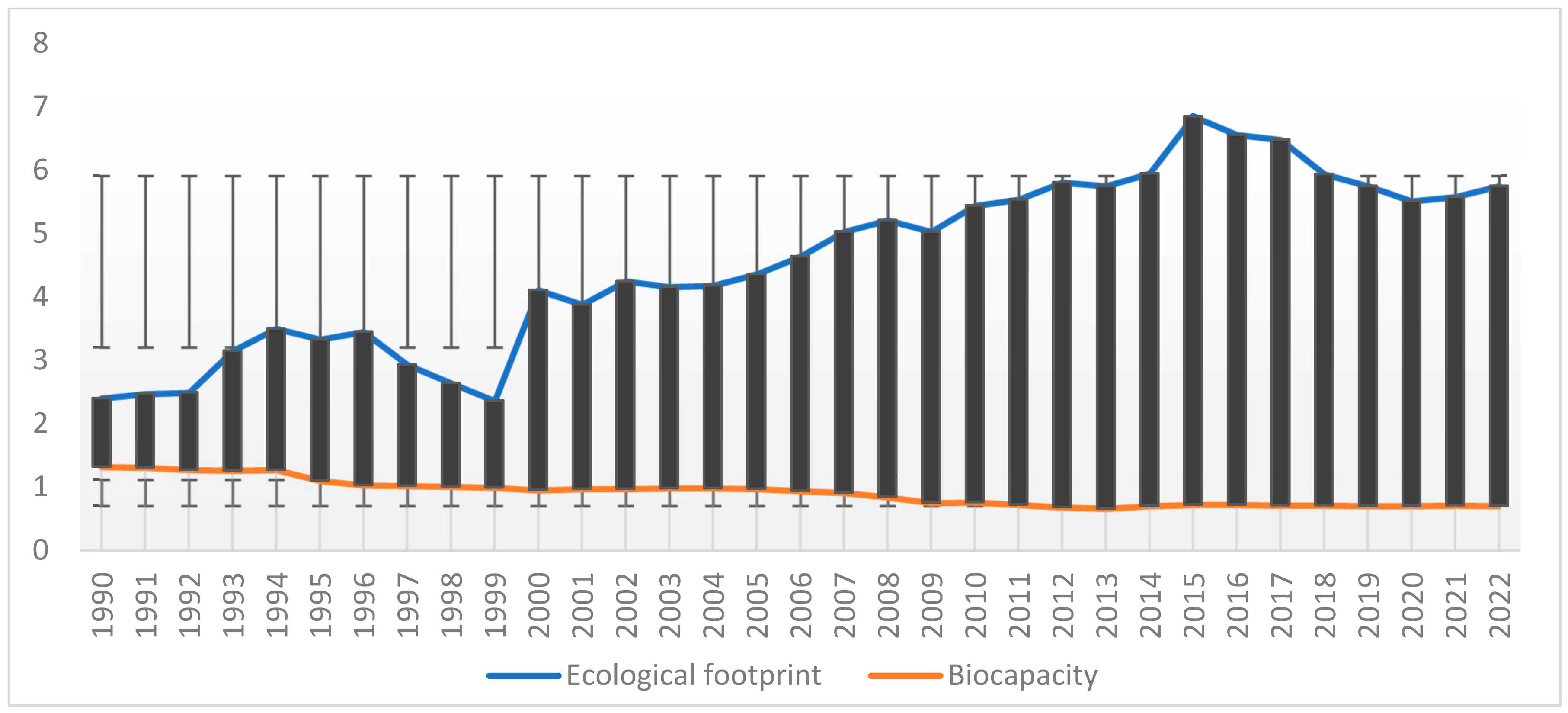

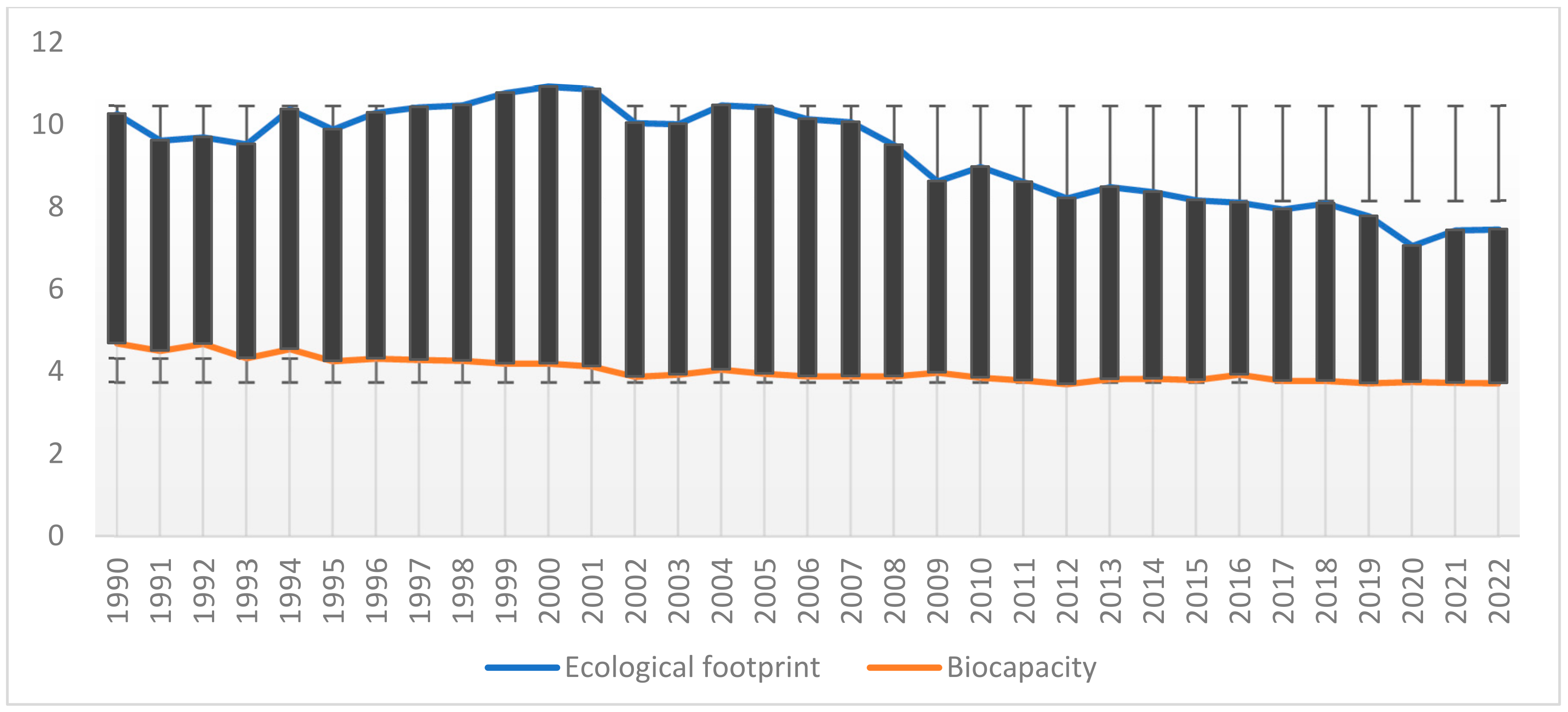

4.1. Descriptive Statistical Analysis of Key Economic and Environmental Indicators in Resource-Rich Countries

4.2. Pre-Estimation Tests

4.3. Long-Run Estimation Outcomes

4.4. Short-Run Estimation Outcomes

4.5. Accounting for Heterogeneity Effects in the Resource-Dependent Model

- i.

- Oil-rich countries include Saudi Arabia, Iran, Venezuela, and Russia, where crude oil and natural gas exports dominate total resource rents;

- ii.

- Mineral-rich countries include Australia, Canada, and Brazil, where metal ores and minerals contribute the largest share of resource rents;

- iii.

- Countries with a mixed or diversified resource base, such as China, India, and the United States, serve as the reference group in the regression.

5. Conclusions, Policy Recommendation, and Limitations

5.1. Conclusions

5.2. Policy Recommendations

- i.

- To sustain the enhancing roles of green innovation on environmental sustainability, the government should promote investment in clean technology through the provision of tax incentives, technology transfer agreements, and government-supported research and development initiatives. More so, policymakers should ensure that advancements in technology are aligned with sustainable production and consumption practices by incorporating green innovation within the principles of a circular economy. It is equally fundamental that the government should establish legislative frameworks that encourage businesses to adopt energy-efficient and low-carbon technologies, thereby improving the efficacy of green innovation in addressing environmental degradation;

- ii.

- Specifically, China and India should increase government financing for renewable energy research and development, as well as adopt smart grid systems to improve energy efficiency. The United States and Australia must increase incentives for private-sector-driven green innovation, particularly in carbon capture and storage (CCS) and advanced renewable technologies. Concurrently, Saudi Arabia and Iran should form technology transfer agreements to speed up the adoption of clean energy and reduce their reliance on fossil fuels in their oil-dependent economies;

- iii.

- The evidence indicates that renewable energy (RE) contributes to a reduction in ecological footprint (EF), while non-renewable energy (NRE) intensifies environmental harm. Therefore, policy measures should prioritize the rapid adoption of RE and implement stricter environmental regulations on fossil fuel companies. Governments ought to offer financial incentives for green energy initiatives, implement carbon pricing strategies, and promote upgrades to the energy grid to facilitate more efficient integration of RE. Additionally, a global transition to sustainable energy can be expedited by removing subsidies for fossil fuels and fostering research and development in clean technologies;

- iv.

- Considering the dichotomy of energy mix across the sample countries, national policies should be customized to align with the unique energy mix of each country. Nations that are significantly dependent on fossil fuels, such as Saudi Arabia, Russia, Iran, and Venezuela, are encouraged to diversify their economic frameworks and gradually reduce their reliance on fossil fuels by utilizing green finance and introducing tax incentives for renewable energy initiatives. Countries with elevated emission levels, including China and India, ought to prioritize the establishment of more ambitious renewable energy goals, implement stricter coal regulations, and cultivate public–private partnerships to advance green technology development. Nations rich in renewable energy resources, such as Canada and Brazil, should focus on enhancing energy storage capabilities, ensuring sustainable management of hydropower, and increasing the adoption of renewable energy in the transportation and industrial sectors. Mixed-energy economies, like the United States and Australia, should work toward improving carbon taxation, increasing investments in next-generation renewable technologies such as hydrogen, and providing incentives for comprehensive decarbonization across various industries. These targeted strategies will promote environmental sustainability while effectively addressing the specific energy challenges encountered by each nation;

- v.

- The escalating adverse ecological impacts of natural resource exploitation must be deliberately tackled to reduce environmental harm through sustainable management practices. To improve sustainable resource management, governance structures must be established to ensure that proceeds from natural resource extraction are reinvested in renewable energy projects and sustainability initiatives. Fiscal policies, such as resource taxation and the development of sovereign wealth funds, can help to reduce reliance on extractive sectors while also encouraging economic diversity. Furthermore, tougher environmental laws for mining, deforestation, and resource extraction are required to avoid long-term ecological damage;

- vi.

- Strategies adapted to specific countries must adhere to these basic principles. Russia and Venezuela should concentrate on implementing resource taxation and creating sovereign wealth funds to reinvest extraction proceeds in clean energy projects. Canada and Brazil must strengthen their forest conservation rules and adopt sustainable mining techniques to reduce environmental damage. Simultaneously, Saudi Arabia and Iran should aim to reduce their dependency on oil by investing in economic diversification and green infrastructure projects, helping the transition to a more sustainable economy;

- vii.

- Advancing green finance initiatives is essential for accelerating the transition to sustainability, as empirical studies have demonstrated the significant impact of financial development. To ensure that capital is directed toward clean technologies, renewable energy sources, and sustainable infrastructure, policies must promote green bonds, sustainability-linked loans, and requirements for ESG investments. Additionally, regulations should limit financing for fossil fuel projects and redirect resources toward environmentally friendly alternatives. By enhancing financial inclusion programs, businesses and communities, particularly in developing economies, will gain access to funding for sustainable initiatives;

- viii.

- Strategies tailored to individual countries must align with these financial priorities. China and India should enhance their green bond markets to finance extensive renewable energy and infrastructure initiatives. The United States and Canada should implement more stringent sustainability-linked lending practices to limit funding for fossil fuel-dependent industries. Concurrently, Brazil and Australia should prioritize green microfinance efforts, aiding small clean energy enterprises and community-driven sustainability projects;

- ix.

- To moderate the effects of FDI on green ecology, the government should implement policies that will enhance regulations on the compliance of multinational corporations (MNCs) with sustainability standards. Specifically, green foreign direct investment (GFDI) policies noted to be effective in drawing funding for climate adaptation, renewable energy, and green technology initiatives to promote environmental sustainability should be intentionally promoted. In particular, public–private partnerships (PPPs) in the sample economies can amplify the benefits of foreign direct investment (FDI) for sustainable development. Brazil and Canada should focus on sustainable agriculture and bioenergy projects that include rigorous environmental impact assessments, whereas Saudi Arabia and Russia ought to emphasize foreign direct investment (FDI) in solar, wind, and hydrogen sectors to reduce their dependence on oil. Meanwhile, China and India should enhance regulatory oversight of multinational corporations (MNCs) to prevent environmentally harmful investments and ensure corporate accountability;

- x.

- The role of globalization unveils the inevitability of enhancing global environmental governance. It is essential to implement institutional reforms that foster transparency, strengthen anti-corruption initiatives, and bolster the enforcement of international laws. The adoption of digital governance solutions can facilitate the monitoring of emissions, deforestation, and pollution, thereby enhancing accountability. Nations ought to align their policies with international climate agreements, such as the Paris Agreement and activities associated with COP, to ensure effective compliance with sustainability standards. The United States and Australia should reinforce their climate commitments and introduce carbon tariffs on imports with high emissions, while China and India need to adjust their trade practices to conform to global sustainability standards. Concurrently, Russia and Iran should establish renewable energy trading partnerships to reduce reliance on fossil fuels and support a transition to cleaner global energy sources;

- xi.

- The findings of the resource heterogeneity model indicate that a country’s dependence on a specific resource significantly influences the environmental consequences of natural resource rents. Notably, the interaction terms reveal that the ecological footprint increases sharply in relation to oil rents, with the most severe environmental degradation observed in nations reliant on oil. This situation calls for targeted policy interventions in countries like Russia, Saudi Arabia, Iran, and Venezuela. These nations should prioritize reinvesting oil revenues into the development of clean energy, implementing stricter environmental regulations within the oil sector, and promoting carbon pricing mechanisms to account for the environmental costs associated with oil extraction and consumption as they transition away from oil dependency;

- xii.

- Countries abundant in minerals, such as Canada, Brazil, and Australia, are experiencing a slight yet significant rise in their ecological footprint attributed to mineral rents. Policy responses in this sector should prioritize the rehabilitation of mined areas, improved environmental impact assessments, and the adoption of sustainable mining practices. Additionally, these nations could benefit from implementing resource certification programs and environmental taxes to encourage compliance with eco-friendly extraction standards. In summary, environmental policies tend to be more effective when tailored to the specific resource characteristics of each country, as this ensures that mitigation strategies directly tackle the unique challenges posed by different types of natural resource exploitation.

5.3. Limitations and Future Research Opportunities

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Adebayo, T.S.; Eweade, B.S.; Özkan, O.; Ozsahin, D.U. Effects of energy security and financial development on load capacity factor in the USA: A wavelet kernel-based regularized least squares approach. Clean Technol. Environ. Policy 2025, 1–18. [Google Scholar] [CrossRef]

- Manigandan, P.; Alam, S.; Murshed, M.; Ozturk, I.; Altuntas, S.; Alam, M.M. Promoting sustainable economic growth through natural resources management, green innovations, environmental policy deployment, and financial development: Fresh evidence from India. Resour. Policy 2024, 90, 104681. [Google Scholar] [CrossRef]

- Yu, C.; Moslehpour, M.; Tran, T.K.; Trung, L.M.; Ou, J.P.; Tien, N.H. Impact of non-renewable energy and natural resources on economic recovery: Empirical evidence from selected developing economies. Resour. Policy 2023, 80, 103221. [Google Scholar] [CrossRef]

- Calder, J. Chapter 1. What’s Special about Natural Resource Revenue Administration? In Administering Fiscal Regimes for Extractive Industries; International Monetary Fund: Washington, DC, USA, 2014; Available online: https://www.elibrary.imf.org/display/book/9781475575170/ch001.xml (accessed on 30 April 2024).

- Shrestha, S.; Kotani, K.; Kakinaka, M. The relationship between trade openness and government resource revenue in resource-dependent countries. Resour. Policy 2021, 74, 102332. [Google Scholar] [CrossRef]

- Chasek, P. Stockholm and the Birth of Environmental Diplomacy. Available online: https://www.iisd.org/articles/deep-dive/stockholm-and-birth-environmental-diplomacy (accessed on 28 April 2024).

- Jia, Z.; Alharthi, M.; Haijun, T.; Mehmood, S.; Hanif, I. Relationship between natural resources, economic growth, and carbon emissions: The role of fintech, information technology and corruption to achieve the targets of COP-27. Resour. Policy 2024, 90, 104751. [Google Scholar] [CrossRef]

- Jiang, L.; Jiang, H. Analysis of predictions considering mineral prices, residential energy, and environmental risk: Evidence from the USA in COP 26 perspective. Resour. Policy 2023, 82, 103431. [Google Scholar] [CrossRef]

- Huo, J.; Peng, C. Depletion of natural resources and environmental quality: Prospects of energy use, energy imports, and economic growth hindrances. Resour. Policy 2023, 86, 104049. [Google Scholar] [CrossRef]

- Dou, S.; Wang, X.; Shi, J.; Gbolo, S.S. The role of trade openness and labour productivity on mineral rents: Evidence from East Asian countries. Appl. Econ. 2024, 1–12. [Google Scholar] [CrossRef]

- Dogan, B.; Nketiah, E.; Ghosh, S.; Nassani, A.A. The impact of the green technology on the renewable energy innovation: Fresh pieces of evidence under the role of research & development and digital economy. Renew. Sustain. Energy Rev. 2025, 210, 115193. [Google Scholar] [CrossRef]

- Li, L.; Liu, W.; Khalid, S.; Mahmood, H. Investigating the Role of Natural Resource Depletion and Consumption Expenditures in Escalating Carbon Inequality. Int. J. Finance Econ. 2025. [Google Scholar] [CrossRef]

- Zheng, X.; Huang, Z.; Jiang, K.; Dong, Y. Sustainable Growth: Unveiling the Impact of Government Attention on Corporate Environmental Performance. Bus. Ethic Environ. Responsib. 2025. [Google Scholar] [CrossRef]

- Alsagr, N. Are natural resources a blessing or a curse for digital infrastructure development? The role of financial sector development. J. Clean. Prod. 2025, 491, 144828. [Google Scholar] [CrossRef]

- Du, J.; Rasool, Y.; Kashif, U. Asymmetric Impacts of Environmental Policy, Financial, and Trade Globalization on Ecological Footprints: Insights from G9 Industrial Nations. Sustainability 2025, 17, 1568. [Google Scholar] [CrossRef]

- Onat, N.C.; Mandouri, J.; Kucukvar, M.; Kutty, A.A.; Al-Muftah, A.A. Driving Sustainable Business Practices with Carbon Accounting and Reporting: A Holistic Framework and Empirical Analysis. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 2795–2814. [Google Scholar] [CrossRef]

- Ahmed, Z.; Zhang, B.; Cary, M. Linking economic globalization, economic growth, financial development, and ecological footprint: Evidence from symmetric and asymmetric ARDL. Ecol. Indic. 2021, 121, 107060. [Google Scholar] [CrossRef]

- Ashraf, A.; Nguyen, C.P.; Doytch, N. The impact of financial development on ecological footprints of nations. J. Environ. Manag. 2022, 322, 116062. [Google Scholar] [CrossRef]

- Guo, A.-J.; Ahmed, S.F.; Mohsin, A.; Rahman, A.; Abdullah, S.N.; Onn, C.W.; Islam, M.S. Investigating the crowding effect of FDI on domestic investments: Evidence from Bangladesh. Heliyon 2024, 10, e31092. [Google Scholar] [CrossRef]

- Kihombo, S.; Ahmed, Z.; Chen, S.; Adebayo, T.S.; Kirikkaleli, D. Linking financial development, economic growth, and ecological footprint: What is the role of technological innovation? Environ. Sci. Pollut. Res. 2021, 28, 61235–61245. [Google Scholar] [CrossRef]

- Awosusi, A.A.; Ozdeser, H.; Seraj, M.; Adegboye, O.R. Achieving carbon neutrality in energy transition economies: Exploring the environmental efficiency of natural gas efficiency, coal efficiency, and resources efficiency. Clean Technol. Environ. Policy 2024, 1–16. [Google Scholar] [CrossRef]

- Bashir, M.F.; Pan, Y.; Shahbaz, M.; Ghosh, S. How energy transition and environmental innovation ensure environmental sustainability? Contextual evidence from Top-10 manufacturing countries. Renew. Energy 2023, 204, 697–709. [Google Scholar] [CrossRef]

- Li, R.; Hu, S.; Wang, Q. Reexamining the impact of natural resource rent and corruption control on environmental quality: Evidence from carbon emissions and ecological footprint in 152 countries. Nat. Resour. Forum 2024, 48, 636–660. [Google Scholar] [CrossRef]

- Dao, N.B.; Truong, H.H.D.; Shahbaz, M.; Chu, L.K. The impacts of natural resources rents diversification, uncertainty, and environmental technologies on ecological sustainability: Empirical evidence from OECD countries. Resour. Policy 2024, 91, 104895. [Google Scholar] [CrossRef]

- Ma, F.; Saleem, H.; Ding, X.; Nazir, S.; Tariq, S. Do natural resource rents, green technological innovation, and renewable energy matter for ecological sustainability? Role of green policies in testing the environmental kuznets curve hypothesis. Resour. Policy 2024, 91, 104844. [Google Scholar] [CrossRef]

- Ali, M.; Joof, F.; Samour, A.; Tursoy, T.; Balsalobre-Lorente, D.; Radulescu, M. Testing the impacts of renewable energy, natural resources rent, and technological innovation on the ecological footprint in the USA: Evidence from Bootstrapping ARDL. Resour. Policy 2023, 86, 104139. [Google Scholar] [CrossRef]

- Ulucak, R.; Danish; Ozcan, B. Relationship between energy consumption and environmental sustainability in OECD countries: The role of natural resources rents. Resour. Policy 2020, 69, 101803. [Google Scholar] [CrossRef]

- Randhawa, A.A.; Famanta, M.; Nassani, A.A.; Radulescu, M. Green horizons: Synergized green technological innovation and green energy consumption on ecological degradation. Energy Environ. 2025, 36, 448–470. [Google Scholar] [CrossRef]

- Musah, M.; Gyamfi, B.A.; Onifade, S.T.; Sackey, F.G. Assessing the roles of green innovations and renewables in environmental sustainability of resource-rich Sub-Saharan African states: A financial development perspective. Nat. Resour. Forum 2024, 49, 461–490. [Google Scholar] [CrossRef]

- Dou, S.; Dong, M.; Shi, J.; Sadowski, B.M.; Gbolo, S.S. The impact of ICT goods exports and environmental technology innovation on mineral rents: Evidence from OECD countries. PLoS ONE 2024, 19, e0308143. [Google Scholar] [CrossRef]

- Obuobi, B.; Awuah, F.; Nketiah, E.; Adu-Gyamfi, G.; Shi, V.; Hu, G. The dynamics of green innovation, environmental policy and energy structure for environmental sustainability; Evidence from AfCFTA countries. Renew. Sustain. Energy Rev. 2024, 197, 114409. [Google Scholar] [CrossRef]

- Appiah, M.; Gyamfi, B.A.; Adebayo, T.S.; Bekun, F.V. Do financial development, foreign direct investment, and economic growth enhance industrial development? Fresh evidence from Sub-Sahara African countries. Port. Econ. J. 2023, 22, 203–227. [Google Scholar] [CrossRef]

- Li, X.; Aghazadeh, S.; Liaquat, M.; Nassani, A.A.; Eweade, B.S. Transforming Costa Rica’s environmental quality: The role of renewable energy, rule of law, corruption control, and foreign direct investment in building a sustainable future. Renew. Energy 2025, 239, 121993. [Google Scholar] [CrossRef]

- Almulhim, A.A.; Inuwa, N.; Chaouachi, M.; Samour, A. Testing the Impact of Renewable Energy and Institutional Quality on Consumption-Based CO2 Emissions: Fresh Insights from MMQR Approach. Sustainability 2025, 17, 704. [Google Scholar] [CrossRef]

- Qayyum, M.; Zhang, Y.; Ali, M.; Kirikkaleli, D. Towards environmental sustainability: The role of information and communication technology and institutional quality on ecological footprint in MERCOSUR nations. Environ. Technol. Innov. 2024, 34, 103523. [Google Scholar] [CrossRef]

- Addai, G.; Amegavi, G.B.; Robinson, G. Advancing environmental sustainability: The dynamic relationship between renewable energy, institutional quality, and ecological footprint in the N-11 countries. Sustain. Dev. 2024, 32, 7397–7408. [Google Scholar] [CrossRef]

- Raza, A.; Habib, Y.; Hashmi, S.H. Impact of technological innovation and renewable energy on ecological footprint in G20 countries: The moderating role of institutional quality. Environ. Sci. Pollut. Res. 2023, 30, 95376–95393. [Google Scholar] [CrossRef]

- Global Footprint Network. Ecological Footprint Per Person. Available online: http://data.footprintnetwork.org/#/ (accessed on 3 April 2025).

- World Bank. World Development Indicators. Available online: https://databank.worldbank.org/id/c4511412 (accessed on 3 April 2025).

- International Monetary Fund. Financial Development Index Database. Available online: https://data.imf.org/?sk=f8032e80-b36c-43b1-ac26-493c5b1cd33b&sId=1480712464593 (accessed on 6 November 2024).

- Gygli, S.; Haelg, F.; Potrafke, N.; Sturm, J.-E. The KOF Globalisation Index–revisited. Rev. Int. Organ. 2019, 14, 543–574, Erratum in Rev. Int. Organ. 2019, 14, 575. [Google Scholar] [CrossRef]

- Zheng, X.; Yang, S.; Huai, J. Integrating Ecological Footprint into Regional Ecological Well-Being Evaluation: A Case Study of the Guanzhong Plain Urban Agglomeration, China. Land 2025, 14, 688. [Google Scholar] [CrossRef]

- Jiang, R.; Fei, L.; Kang, S. Analysis and prediction of urban agglomeration ecological footprint based on improved three-dimensional ecological footprint and shared socioeconomic pathways. Ecol. Indic. 2025, 170, 113079. [Google Scholar] [CrossRef]

- Saxena, V. Water Quality, Air Pollution, and Climate Change: Investigating the Environmental Impacts of Industrialization and Urbanization. Water Air Soil Pollut. 2025, 236, 1–40. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Özkan, O.; Eweade, B.S. Do energy efficiency R&D investments and information and communication technologies promote environmental sustainability in Sweden? A quantile-on-quantile KRLS investigation. J. Clean. Prod. 2024, 440, 140832. [Google Scholar] [CrossRef]

- Zhou, H.; Awosusi, A.A.; Dagar, V.; Zhu, G.; Abbas, S. Unleashing the asymmetric effect of natural resources abundance on carbon emissions in regional comprehensive economic partnership: What role do economic globalization and disaggregating energy play? Resour. Policy 2023, 85, 103914. [Google Scholar] [CrossRef]

- Imran, M.; Khan, M.K.; Wahab, S.; Ahmed, B.; Jijian, Z. The paradox of resource-richness: Unraveling the effects on financial markets in natural resource abundant economies. Financial Innov. 2025, 11, 1–30. [Google Scholar] [CrossRef]

- Rahman, M.; Hossain, E. Synergy of governance, finance, and technology for sustainable natural resource management. J. Open Innov. Technol. Mark. Complex. 2025, 11, 100468. [Google Scholar] [CrossRef]

- Dingru, L.; Ramzan, M.; Irfan, M.; Gülmez, Ö.; Isik, H.; Adebayo, T.S.; Husam, R. The Role of Renewable Energy Consumption Towards Carbon Neutrality in BRICS Nations: Does Globalization Matter? Front. Environ. Sci. 2021, 9, 796083. [Google Scholar] [CrossRef]

- Murtaza, G.; Luqman, M. Chapter 10—Environmental banking, renewable energy projects, and private investments crowd out. In Renewable Energy Projects and Investments; Dinçer, H., Yüksel, S., Eds.; Elsevier: Amsterdam, The Netherlands, 2025; pp. 177–200. [Google Scholar] [CrossRef]

- Dietz, T.; Rosa, E.A. Effects of Population and Affluence on CO2 Emissions. Proc. Natl. Acad. Sci. USA 1997, 94, 175–179. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, X.; Ibrahim, R.L.; Al-Faryan, M.A.S. Unveiling the criticality of digitalization, eco-innovation, carbon tax, and environmental regulation in G7 quest for carbon footprint mitigation: Insights for sustainable development. Nat. Resour. Forum 2024. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. J. Econ. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Swamy, P.A.V.B. Efficient Inference in a Random Coefficient Regression Model. Econometrica 1970, 38, 311–323. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Ullah, A.; Yamagata, T. A bias-adjusted LM test of error cross-section independence. Econ. J. 2008, 11, 105–127. [Google Scholar] [CrossRef]

- Uddin, I.; Ullah, A.; Saqib, N.; Kousar, R.; Usman, M. Heterogeneous role of energy utilization, financial development, and economic development in ecological footprint: How far away are developing economies from developed ones. Environ. Sci. Pollut. Res. 2023, 30, 58378–58398. [Google Scholar] [CrossRef]

- Zeb, A.; Shuhai, N.; Ullah, O. Navigating sustainability and economic growth: The dual influence of green economic growth and technological innovation on environmental outcomes in South Asia. Environ. Dev. Sustain. 2025, 1–26. [Google Scholar] [CrossRef]

- Westerlund, J.; Edgerton, D.L. New Improved Tests for Cointegration with Structural Breaks. J. Time Ser. Anal. 2007, 28, 188–224. [Google Scholar] [CrossRef]

- Adeshola, I.; Usman, O.; Agoyi, M.; Awosusi, A.A.; Adebayo, T.S. Digitalization and the environment: The role of information and communication technology and environmental taxes in European countries. Nat. Resour. Forum 2023, 48, 1088–1108. [Google Scholar] [CrossRef]

- Eberhardt, M.; Bond, S. Cross-Section Dependence in Nonstationary Panel Models: ANovel Estimator. Available online: https://ideas.repec.org//p/pra/mprapa/17692.html (accessed on 18 March 2025).

- Dumitrescu, E.-I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Nickell, S. Biases in Dynamic Models with Fixed Effects. Econometrica 1981, 49, 1417. [Google Scholar] [CrossRef]

- Anderson, T.; Hsiao, C. Formulation and estimation of dynamic models using panel data. J. Econ. 1982, 18, 47–82. [Google Scholar] [CrossRef]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error-components models. J. Econ. 1995, 68, 29–51. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econ. 1998, 87, 115–143. [Google Scholar] [CrossRef]

- Tchamyou, V.S.; Erreygers, G.; Cassimon, D. Inequality, ICT and financial access in Africa. Technol. Forecast. Soc. Chang. 2019, 139, 169–184. [Google Scholar] [CrossRef]

- Huang, Y.; Bebi, B.B.; Ladtakoun, S. Does financial development have an impact on mineral resource rents? Evidence from China. Miner. Econ. 2025, 1–21. [Google Scholar] [CrossRef]

- Fakher, H.A.; Ahmed, Z.; Acheampong, A.O.; Nathaniel, S.P. Renewable energy, nonrenewable energy, and environmental quality nexus: An investigation of the N-shaped Environmental Kuznets Curve based on six environmental indicators. Energy 2023, 263, 125660. [Google Scholar] [CrossRef]

- Weng, F.; Cheng, D.; Zhuang, M.; Lu, X.; Yang, C. The effects of governance quality on renewable and nonrenewable energy consumption: An explainable decision frame. J. Forecast. 2024, 43, 2146–2162. [Google Scholar] [CrossRef]

- Zhou, F.; bin Samsurijan, M.S.; Ibrahim, R.L.; Ajide, K.B. The conditioning role of institutions in the nonrenewable and renewable energy, trade openness, and sustainable environment nexuses: A roadmap towards sustainable development. Environ. Dev. Sustain. 2024, 26, 19597–19626. [Google Scholar] [CrossRef]

- Akadiri, S.S.; Olasehinde-Willams, G.; Haouas, I.; Lawal, G.O.; Fatigun, A.S.; Sadiq-Bamgbopa, Y. Natural resource rent, financial globalization, and environmental degradation: Evidence from a resource rich country. Energy Environ. 2023, 35, 2911–2934. [Google Scholar] [CrossRef]

- Udemba, E.N.; Khan, N.-U.; Shah, S.A.R. Demographic change effect on ecological footprint: A tripartite study of urbanization, aging population, and environmental mitigation technology. J. Clean. Prod. 2024, 437, 140406. [Google Scholar] [CrossRef]

| Variable | Denotation | Measurements | Source |

|---|---|---|---|

| Ecological Footprint | EFP | Global hectares per capita | [38] |

| Green Innovation | GIN | number of patent applications | [39] |

| Research and development expenditure (% of GDP) | [39] | ||

| Natural Resource Rents | NRR | Total Natural Resource Rents % of GDP | [39] |

| Control of Corruption | CC | Estimate | [39] |

| Non-RenewableEnergy | NRE | Fossil Fuels % of total final energy | [39] |

| Renewable Energy | RE | Renewable energy of total final energy | [39] |

| Financial Development | FDV | Index of financial depth, access, and efficiency | [40] |

| Globalization | GLO | KOF globalization index | [41] |

| Economic Growth | GDPPC | GDP per capita constant 2010 USD | [39] |

| Urbanization | URBN | Urban population % of total population | [39] |

| Mean | Std. Dev. | Skewness | Kurtosis | Jarque–Bera | Probability | |

|---|---|---|---|---|---|---|

| EFP | 4.81 | 2.76 | 0.43 | 2.01 | 19.18 | 0.00 |

| GINPA | 3.75 | 1.10 | 0.03 | 2.68 | 1.21 | 0.55 |

| GINRD | 1.22 | 0.80 | 0.59 | 2.60 | 17.57 | 0.00 |

| NRR | 10.23 | 13.02 | 0.94 | 4.70 | 72.18 | 0.00 |

| CC | 0.15 | 1.11 | 0.57 | 1.87 | 28.82 | 0.00 |

| NRE | 84.30 | 13.44 | −0.57 | 2.62 | 16.18 | 0.00 |

| RE | 16.35 | 15.53 | 0.86 | 2.46 | 36.34 | 0.00 |

| FDV | 0.53 | 0.22 | 0.36 | 1.97 | 17.74 | 0.00 |

| GLO | 46.59 | 13.25 | −0.01 | 2.21 | 7.05 | 0.03 |

| GDPPC | 3.98 | 0.58 | −0.40 | 2.26 | 13.19 | 0.00 |

| URBN | 72.17 | 18.04 | −1.43 | 3.67 | 97.12 | 0.00 |

| Variables | Breusch–Pagan LM | Pesaran Scaled LM | Pesaran CD |

|---|---|---|---|

| EFP | 11.043 a | 15.423 a | 14.033 a |

| GINPA | 9.225 a | 13.244 a | 15.003 a |

| GINRD | 8.112 a | 7.211 a | 19.133 a |

| NRR | 13.511 a | 19.003 a | 14.013 a |

| CC | 6.005 a | 9.855 a | 8.083 a |

| NRE | 22.066 a | 17.776 a | 13.003 a |

| RE | 15.332 a | 14.116 a | 15.553 a |

| FDV | 17.399 a | 13.322 a | 12.044 a |

| GLO | 11.043 a | 10.003 a | 14.229 a |

| GDPPC | 22.117 a | 25.100 a | 21.033 a |

| URBN | 10.032 a | 9.988 a | 13.013 a |

| Slope Heterogeneity | |||

| Models | Delta tilde | () | |

| Model One | 11.025 a | 13.044 a | |

| Model Two | 9.355 a | 12.112 a | |

| Variables | CIPS | CADF | ||

|---|---|---|---|---|

| I(0) | I(1) | I(0) | I(1) | |

| EFP | −0.226 | −4.114 a | −2.033 | −4.055 a |

| GINPA | −1.005 | −3.662 b | −0.255 | −4.066 a |

| GINRD | −1.215 | −4.055 a | −1.087 | −3.327 b |

| NRR | −1.313 | −3.869 b | −2.053 | −5.369 a |

| CC | −0.226 | −4.628 a | −1.211 | −3.526 b |

| NRE | −1.228 | −4.712 a | −2.412 | −4.782 a |

| RE | −0.199 | −4.119 a | −1.267 | −5.235 a |

| FDV | −1.558 | −3.211 b | −1.322 | −3.166 b |

| GLO | −0.882 | −4.336 a | −2.060 | −3.220 b |

| GDPPC | −2.188 | −3.922 b | −1.103 | −4.211 a |

| URBN | −2.022 | −4.099 a | −1.325 | −6.335 a |

| Value | z-Value | Probability | |

|---|---|---|---|

| Model 1 | |||

| Gt | −3.154 b | −2.257 | 0.012 |

| Ga | −5.711 a | 3.065 | 0.002 |

| Pt | −8.446 a | −4.911 | 0.000 |

| Pa | −9.809 a | −2.587 | 0.005 |

| Model 2 | |||

| Gt | −3.446 a | −3.144 | 0.001 |

| Ga | −4.035 a | 2.974 | 0.045 |

| Pt | −12.188 a | −5.641 | 0.000 |

| Pa | −15.792 a | −6.834 | 0.004 |

| Variables | Outcome Variable: Ecological Footprint (EFP) | |||

|---|---|---|---|---|

| AMG | CCEMG | |||

| Model 1 | Model 2 | Model 1 | Model 2 | |

| NRR | 1.243 a (0.335) | 1.099 a (0.244) | 0.988 a (0.116) | 0.663 b (0.315) |

| GINPA | −0.923 a (0.215) | −0.522 b (0.235) | ||

| GINRD | −1.083 a (0.331) | −0.863 a (0.422) | ||

| GIN × NRR | −0.218 b (0.035) | −0.705 a (0.117) | −0.158 b (0.065) | −0.332 b (0.145) |

| CC | −0.092 b (0.039) | −0.065 (0.037) | −0.119 a (0.034) | −0.077 b (0.029) |

| NRE | 2.055 a (0.522) | 1.021 b (0.422) | 2.631 a (0.633) | 0.788 b (0.369) |

| RE | −0.269 a (0.053) | −0.355 a (0.055) | −0.219 a (0.043) | −0.390 a (0.068) |

| FDV | 0.558 a (0.155) | 0.338 b (0.145) | 0.224 (0.133) | 0.412 a (0.116) |

| GLO | 0.862 a (0.233) | 0.612 a (0.103) | 0.792 a (0.099) | 0.695 a (0.225) |

| GDPPC | 2.221 a (0.312) | 2.822 a (0.448) | 2.566 a (0.184) | 1.447 b (0.511) |

| URBN | 2.177 a (0.561) | 3.980 a (1.011) | 2.773 a (0.412) | 3.727 a (1.208) |

| Outcome Variable: Ecological Footprint (EFP) | ||

|---|---|---|

| Variables | Model 1 | Model 2 |

| L.EFP | 0.319 b (0.152) | 1.061 a (0.152) |

| NRR | 0.112 a (0.051) | 0.119 a (0.032) |

| GINPA | −0.958 (0.633) | |

| GINRD | −1.972 a (0.655) | |

| GIN × NRR | −0.519 (0.295) | −1.255 a (0.317) |

| CC | −0.110 (0.095) | −0.088 (0.075) |

| NRE | 0.588 a (0.153) | 1.005 b (0.142) |

| RE | −0.129 b (0.062) | −0.105 a (0.033) |

| FDV | 0.226 a (0.044) | 0.318 a (0.048) |

| GLO | 0.162 b (0.063) | 0.212 a (0.053) |

| GDPPC | 1.008 a (0.442) | 1.652 a (0.338) |

| URBN | 0.757 a (0.061) | 0.922 a (0.211) |

| Constant | −14.557 a (2.361) | 21.728 a (3.461) |

| AR(1) | 0.005 | 0.011 |

| AR(2) | 0.137 | 0.256 |

| Hansen | 0.334 | 0.412 |

| Fisher | 26.321 a | 23.323 a |

| Variables | AMG | CCEMG |

|---|---|---|

| NRR | 1.513 b− 0.585 | 1.503 a− 0.476 |

| NRR × Oil_dummy | 1.722 a− 0.442 | 1.334 a− 0.278 |

| NRR × Mineral_dummy | 0.628 b− 0.311 | 0.592 b− 0.268 |

| GINPA | −0.335 b −0.125 | −0.229 −0.135 |

| GINRD | −0.836 a −0.241 | −0.559 a −0.142 |

| CC | −0.085 b −0.035 | −0.089 b −0.044 |

| NRE | 1.265 a −0.322 | 1.771 a −0.453 |

| RE | −1.088 a −0.473 | −1.133 a −0.253 |

| FDV | 1.923 a −0.635 | 1.152 b −0.516 |

| GLO | 0.862 a −0.233 | 0.781 b −0.359 |

| GDPPC | 3.055 a −1.114 | 2.447 a −0.984 |

| URBN | 1.255 b −0.641 | 1.355 a −0.412 |

| Constant | −11.366 a −3.066 | 14.268 a −2.731 |

| Fisher Statistic | 32.322 a | 13.823 a |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hassan, A.; Ibrahim, R.L.; Raimi, L.; Omokanmi, O.J.; S Senathirajah, A.R.B. Balancing Growth and Sustainability: Can Green Innovation Curb the Ecological Impact of Resource-Rich Economies? Sustainability 2025, 17, 4579. https://doi.org/10.3390/su17104579

Hassan A, Ibrahim RL, Raimi L, Omokanmi OJ, S Senathirajah ARB. Balancing Growth and Sustainability: Can Green Innovation Curb the Ecological Impact of Resource-Rich Economies? Sustainability. 2025; 17(10):4579. https://doi.org/10.3390/su17104579

Chicago/Turabian StyleHassan, Abul, Ridwan Lanre Ibrahim, Lukman Raimi, Olatunde Julius Omokanmi, and Abdul Rahman Bin S Senathirajah. 2025. "Balancing Growth and Sustainability: Can Green Innovation Curb the Ecological Impact of Resource-Rich Economies?" Sustainability 17, no. 10: 4579. https://doi.org/10.3390/su17104579

APA StyleHassan, A., Ibrahim, R. L., Raimi, L., Omokanmi, O. J., & S Senathirajah, A. R. B. (2025). Balancing Growth and Sustainability: Can Green Innovation Curb the Ecological Impact of Resource-Rich Economies? Sustainability, 17(10), 4579. https://doi.org/10.3390/su17104579