Retail Investors’ Social Media Interaction and Corporate Green Innovation: Evidence from China Listed Companies in Heavily Polluting Industries

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Background

2.1.1. Legitimacy Theory

2.1.2. Upper Echelons Theory

2.1.3. Information Asymmetry Theory

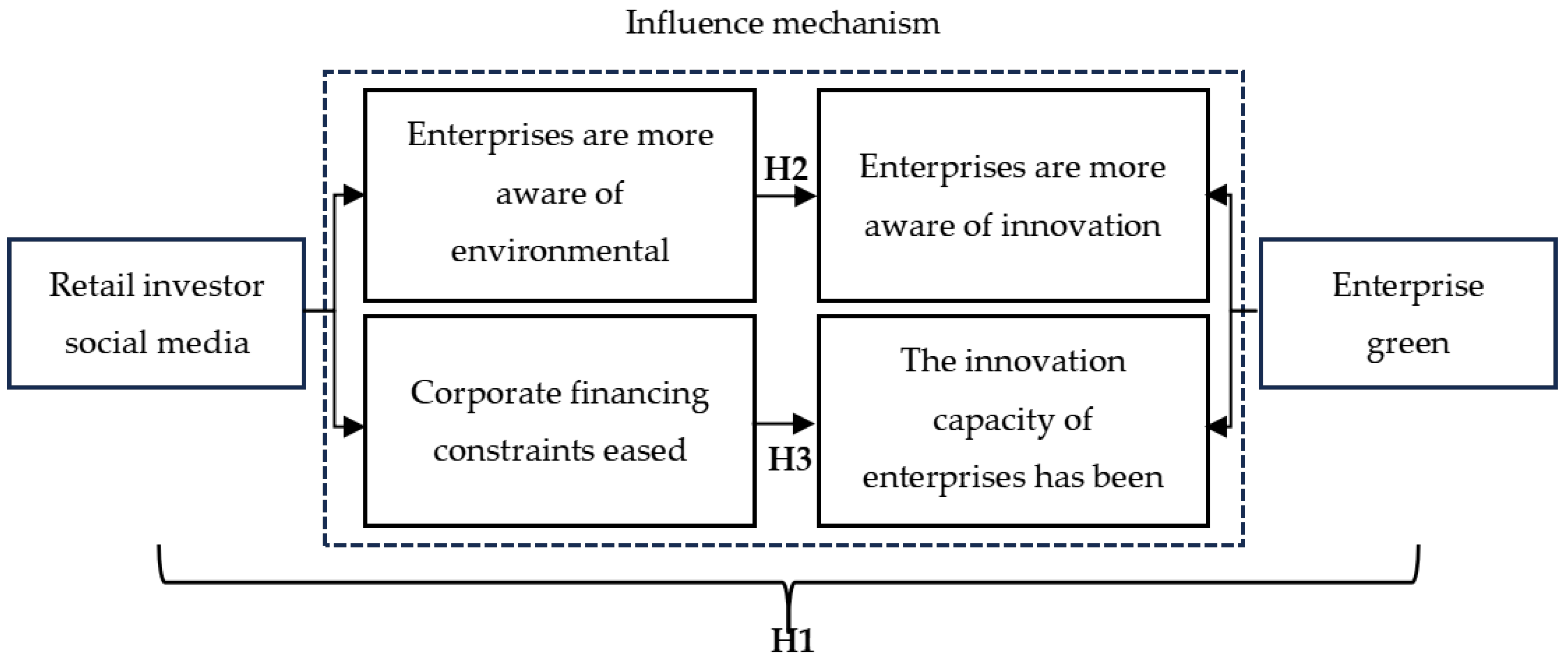

2.2. Previous Studies and Hypothesis Development

2.2.1. Effect of Social Media Interaction of Retail Investors on Corporate Green Innovation

2.2.2. Social Media Interaction of Retail Investors, Innovation Awareness and Corporate Green Innovation

2.2.3. Social Media Interaction of Retail Investors, Innovation Ability and Corporate Green Innovation

3. Research Design

3.1. Sample Selection and Data Source

3.2. Definitions of Variables

3.2.1. Explained Variable: Corporate Green Innovation (Green)

3.2.2. Explanatory Variable: Retail Investors’ Social Media Interactions (Post/Read/Comment)

3.2.3. Intermediate Variables

- Environmental awareness (EnvAware)

- Financing constraints (WW)

3.2.4. Control Variables

3.3. Model Construction

4. Empirical Test Results and Analysis

4.1. Descriptive Statistics of Variables

4.2. Correlation Analysis

4.3. Hypothesis Testing

4.3.1. Reference Regression Test

4.3.2. Mechanism Test

- Mechanism test based on innovation consciousness

- Mechanism test based on innovation ability

4.3.3. Robustness Test

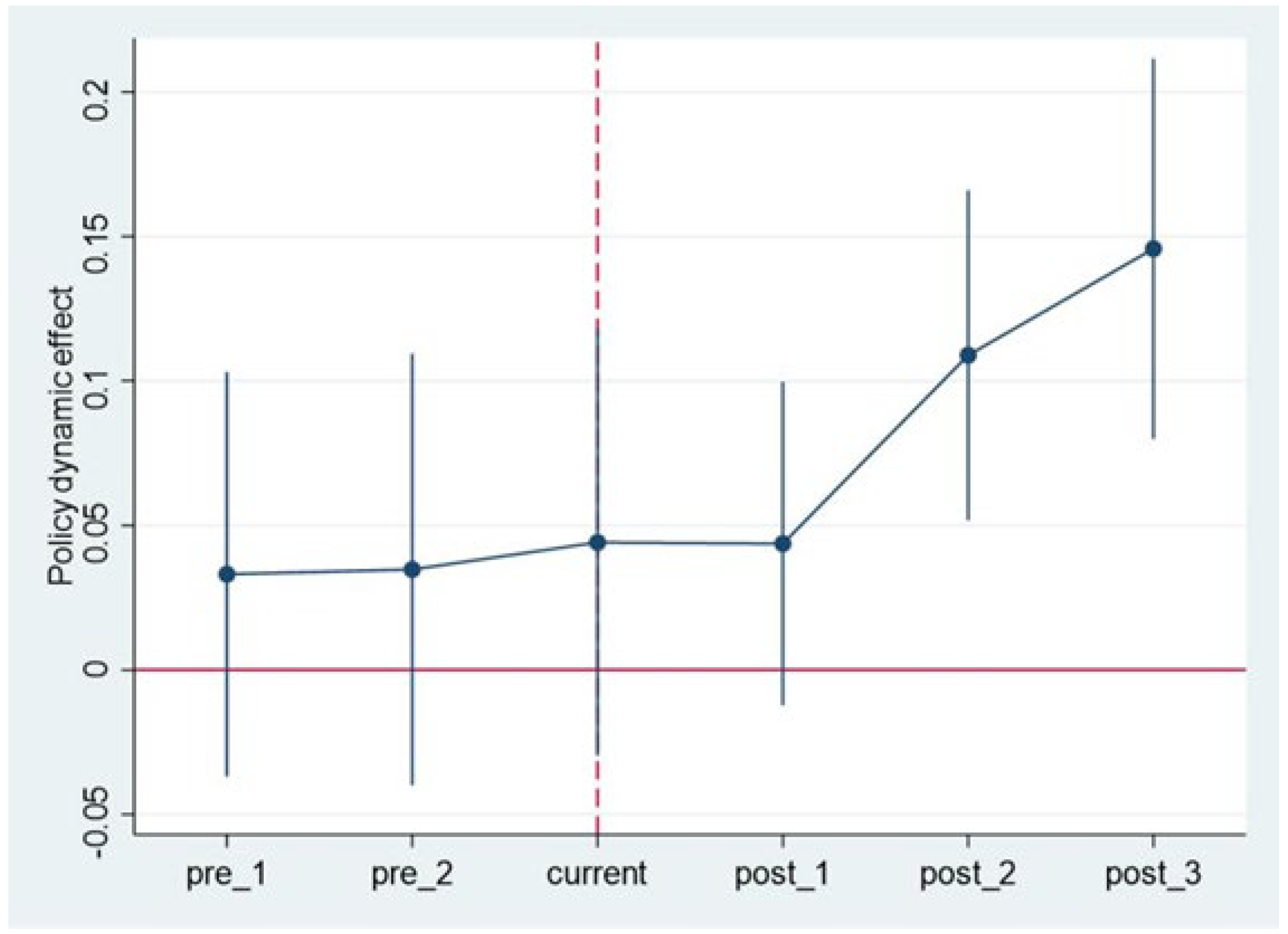

- Difference-in-difference test

- Propensity score matching

- Remeasurement of the argument

- Change how the dependent variable is measured

- Change measurement model

- Change time series

5. An Examination of the Moderating Effects of Social Media Environment

5.1. Testing the Moderating Effect of Information Environment Remediation on Information Quality of Social Media

5.2. Examining the Moderating Effect of the Emotional Environment Caused by Social Media Information

6. Heterogeneity Test of External Institutional Environment

6.1. Heterogeneity Test Based on Environmental Information Regulation

6.2. Heterogeneity Test Based on Regional Investor Protection

7. Conclusions and Implications

7.1. Research Conclusions

7.2. Policy Suggestions and Managerial Implications

7.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lee, K.H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clear. Prod. 2015, 108, 534–542. [Google Scholar]

- Huang, M.; Li, M.Y.; Liao, Z.H. Do politically connected CEOs promote Chinese listed industrial firms’ green innovation? The mediating role of external governance environments. J. Clean. Prod. 2021, 278, 123634. [Google Scholar] [CrossRef]

- Huang, J.W.; Li, Y.H. Green innovation and performance: The view of organization capability and social reciprocity. J. Bus. Ethics 2017, 145, 309–324. [Google Scholar] [CrossRef]

- Liu, J.; Xiao, Y. China’s Environmental Protection Tax and Green Innovation: Incentive Effect or Crowding-out Effect? Econ. Res. J. 2022, 57, 72–88. [Google Scholar]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The environment and directed technical change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef] [PubMed]

- Li, Q.; Xiao, Z. Heterogeneous Environmental Regulation Tools and Green Innovation Incentives: Evidence from Green Patents of Listed Companies. Econ. Res. J. 2020, 55, 192–208. [Google Scholar]

- Jin, M. The Preference of Green Innovation Preference of Institutional Investors. Financ. Theory Pract. 2022, 65–75. [Google Scholar] [CrossRef]

- Jin, C.; Monfort, A.; Chen, F.; Xia, N.; Wu, B. Institutional investor ESG activism and corporate green innovation against climate change: Exploring differences between digital and non-digital firms. Technol. Forecast. Soc. Change 2024, 200, 123129. [Google Scholar] [CrossRef]

- Zhang, L.; Xie, Y.; Xu, D. Green Investor Holdings and Corporate Green Technological Innovation. Sustainability 2024, 16, 4292. [Google Scholar] [CrossRef]

- Yang, Z.; Chen, J.; Ling, H. Media Attention, Environmental Policy Uncertainty and Firm’s Green Technology: Empirical Evidence from Chinese A-share Listed Firms. J. Ind. Eng. Eng. Manag. 2023, 37, 1–15. [Google Scholar]

- Cai, C.; Fan, M.; Dong, X.; Zhang, J. The Effect of Environmental Protection-Related Media Coverage on Corporate Green Innovation. Sustainability 2024, 16, 10887. [Google Scholar] [CrossRef]

- Gao, X.; Zhang, G. Media coverage and corporate green innovation. Financ. Res. Lett. 2025, 74, 106740. [Google Scholar] [CrossRef]

- He, F.; Guo, X.; Yue, P. Media coverage and corporate ESG performance: Evidence from China. Int. Rev. Financ. Anal. 2024, 91, 103003. [Google Scholar] [CrossRef]

- Das, S.R.; Chen, M.Y. Yahoo! for Amazon: Sentiment extraction from small talk on the web. Manag. Sci. 2007, 53, 1375–1388. [Google Scholar] [CrossRef]

- Cade, N.L. Corporate social media: How two-way disclosure channels influence investors. Account. Organ. Soc. 2018, 68, 63–79. [Google Scholar] [CrossRef]

- Xiong, X.; Di, J.; Gao, Y. The Influence of Green Concerns on the Green Innovation of Listed Companies—Based on the Investor Interactive Platforms. Syst. Eng.-Theory Pract. 2023, 43, 1873–1893. [Google Scholar]

- Li, Y.; Zhang, W. The power of retail Investor voice: The effect of online discussions on corporate innovation. Br. J. Manag. 2023, 34, 1811–1831. [Google Scholar] [CrossRef]

- Pan, A.; Zhang, Q.; Li, G. Does Retail Investors’ Environmental Concerns Affect the Green M&A of Heavy Polluting Enterprises? Nankai Bus. Rev. 2024, 135–147. Available online: https://nbr.nankai.edu.cn/nkglpl/article/abstract/230206218 (accessed on 14 April 2025).

- Ang, J.S.; Hsu, C.; Tang, D.; Wu, C. The role of social media in corporate governance. Account. Rev. 2021, 96, 1–32. [Google Scholar] [CrossRef]

- Lepore, L.; Landriani, L.; Pisano, S.; D’Amore, G.; Pozzoli, S. Corporate governance in the digital age: The role of social media and board independence in CSR disclosure. Evidence from Italian listed companies. J. Manag. Gov. 2023, 27, 749–785. [Google Scholar] [CrossRef]

- Dimaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Tornikoski, E.T.; Newbert, S.L. Exploring the determinants of organizational emergence: A legitimacy perspective. J. Bus. Ventur. 2007, 22, 311–335. [Google Scholar] [CrossRef]

- Shu, C.; Zhou, K.Z.; Xiao, Y.; Gao, S. How green management influences product innovation in China: The role of institutional benefits. J. Bus. Ethics 2016, 133, 471–485. [Google Scholar] [CrossRef]

- Xie, X.; Huo, J.; Qi, G.; Zhu, K.X. Green process innovation and financial performance in emerging economics: Moderating effects of absorptive capacity and green subsidies. IEEE Trans. Eng. Manag. 2016, 63, 101–112. [Google Scholar] [CrossRef]

- Xie, X.; Zhu, Q. How Can Green Innovation Solve the Dilemmas of “Harmonious Coexistence”? J. Manag. World 2021, 37, 128–149+9. [Google Scholar]

- Li, D.; Song, J.; Chen, L.; Li, D. Can the Media Pressure Foster Corporate Green Innovation? RD Manag. 2018, 30, 23–33. [Google Scholar]

- Han, G.; Gan, Y. Can Investors’ Attention Promote Green Innovation Performance? The Mediating Effect of Financing Constraints and the Moderating Effect of Environmental Regulation. Sci. Technol. Prog. Policy 2023, 40, 89–98. [Google Scholar]

- Dai, W.; Lu, W. The Impact of Environmental Public Opinion Pressure on Manufacturing Firm’s Green Innovation Capability: The Chain Mediating Role of Leader Environmental Awareness and Organizational Green Learning. Sci. Technol. Prog. Policy 2020, 37, 131–137. [Google Scholar]

- Yao, S.; Pan, Y.; Wang, L.; Sensoy, A.; Cheng, F. Building eco-friendly corporations: The role of minority shareholders. J. Bus. Ethics 2023, 182, 933–966. [Google Scholar] [CrossRef]

- Liu, Y.W.; Chen, X.J.; Gao, J.L.; Tan, H.Z. Media Attention and Green Technology Innovation in Heavily Polluting Enterprises. China Soft Sci. 2023, 9, 30–40. [Google Scholar]

- Petkova, A.; Wadhwa, A.; Yao, X.; Jain, S. Reputation and decision making under ambiguity: A study of US venture capital firms’ investments in the emerging clean energy sector. Acad. Manag. J. 2014, 57, 1077–1093. [Google Scholar] [CrossRef]

- Horbach, J.; Rammer, C.; Rennings, K. Determinants of eco-innovations by type of environmental impact—The role of regulatory push/pull, technology push and market pull. Ecol. Econ. 2012, 78, 112–122. [Google Scholar] [CrossRef]

- Yang, F.; Zhang, Y. Investors’ “Posting Information” via Social Media and Corporate Technical Innovation—A Study Based on Information Effect and Governance Effect. J. Shanxi Univ. Financ. Econ. 2021, 43, 115–126. [Google Scholar]

- Manso, G. Motivating innovation. J. Financ. 2011, 66, 1823–1860. [Google Scholar] [CrossRef]

- Myerss, C.; Majlufn, S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Ni, J.; Kong, L. Environmental Information Disclosure, Bank Credit Decisions and Debt Financing Cost: Evidence from the Listed Company in Heavy Polluting Industries of A-Shares in Shanghai Stork Market and Shenzhen Stork Market. Econ. Rev. 2016, 1, 147–156+160. [Google Scholar]

- Wang, Y.; Dong, T.; Lu, C. The Impact of Minority Shareholders’ Voice in Social Media on Investment Efficiency. Bus. Manag. J. 2022, 44, 115–132. [Google Scholar]

- Sun, K.; Wang, D.; Xiao, X. Internet Scrutiny and Corporate Governance Effect of Social Media. J. Manag. World 2020, 36, 106–132. [Google Scholar]

- Kaplan, S.N.; Zingales, L. Do investment-cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 1997, 112, 169–215. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, G. Financial constraints risk. Rev. Financ. Stud. 2006, 19, 531–559. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, R. New evidence on measuring financial constraints: Moving beyond the KZ index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Wu, C.; Tang, D. Intellectual Property Rights Enforcement, Corporate Innovation and Operating Performance: Evidence from China’s Listed Companies. Econ. Res. J. 2016, 51, 125–139. [Google Scholar]

- Jiang, X.; Zhu, L.; Yi, Z. Internet Public Opinion and Corporate Innovation. China Econ. Q. 2021, 21, 113–134. [Google Scholar]

- Wen, Z.; Ye, B. Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Li, X.; Zhu, H. Limited Attention and Information Processing. J. Financ. Res. 2011, 8, 128–142. [Google Scholar]

- Yang, J.; Shen, Y.; Li, P. The Role of Internet Negative Criticism in Enhancing the Efficiency and Fairness of the Management Compensation. Bus. Manag. J. 2017, 39, 117–134. [Google Scholar]

- Zhao, Y.; Lyu, W. The Impact of Individual Shareholder Activism on Auditor Decision. Audit. Res. 2022, 80–91. [Google Scholar] [CrossRef]

- Bednar, M.K. Watchdog or lapdog? A behavioral view of the media as a corporate governance mechanism. Acad. Manag. J. 2012, 55, 131–150. [Google Scholar] [CrossRef]

- Dai, L.; Parwada, J.T.; Zhang, B. The governance effect of the media’s news dissemination role: Evidence from insider trading. J. Account. Res. 2015, 53, 331–366. [Google Scholar] [CrossRef]

- Liu, B.; McConnell, J. The role of the media in corporate governance: Do the media influence managers’ capital allocation decisions? J. Financ. Econ. 2013, 110, 1–17. [Google Scholar] [CrossRef]

- Dyck, A.; Morse, A.; Zingales, L. Who blows the whistle on corporate fraud. J. Financ. 2010, 65, 2223–2253. [Google Scholar] [CrossRef]

- Chen, Q.; Chen, X.; Schipper, K.; Xu, Y.; Xue, J. The Sensitivity of Corporate Cash Holdings to Corporate Governance. Rev. Financ. Stud. 2012, 25, 3610–3644. [Google Scholar] [CrossRef]

- Gentzkow, M.; Shapiro, J.M. Media bias and reputation. J. Political Econ. 2006, 114, 280–316. [Google Scholar] [CrossRef]

- Wang, D.; Sun, K.; Gao, H. The Impact of “Voting with Your Mouth” on Management Voluntary Disclosure. J. Financ. Res. 2020, 11, 188–206. [Google Scholar]

- You, J.; Wu, J. Spiral of Silence: Media Sentiment and the Asset Mispricing. Econ. Res. J. 2012, 47, 141–152. [Google Scholar]

- Lv, K. Medai Coverage and Corporate Innovation: A study Based on the Dual Effect of Media. Master’s Thesis, Southwestern University of Finance and Economics, Chengdu, China, 2023. [Google Scholar]

- Tian, G.; Li, X.; Si, Y.; Qin, L. Option Incentives, Media Coverage and Tax Aggressive: The Corporate Governance Mechanism of Media from Coverage Mode Perspective. J. Ind. Eng. Eng. Manag. 2019, 33, 1–11. [Google Scholar]

- Antweiler, W.; Frank, M.Z. Is all that just noise? The information content of internet stock message boards. J. Financ. 2004, 59, 1259–1294. [Google Scholar] [CrossRef]

- Yang, X.; Shen, H.; Zhu, Y. The Effect of Local Bias in Investor Attention and Inveator Sentiment on Stork Market: Evidence from Online Forum. J. Financ. Res. 2016, 12, 143–158. [Google Scholar]

- Dai, Y.; Pan, Y.; Chen, F. Media Coverage, Government Governance and Auditor Switch. Account. Res. 2013, 89–95+97. [Google Scholar] [CrossRef]

- Wan, L.; Luo, Y. Equilibrium Model of Corporate Social Responsibility. China Ind. Econ. 2006, 117–124. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as mother of ‘green’ inventions: Institutional pressures and environmental innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Shen, H.; Feng, J. Media Monitoring, Government Supervision, and Corporate Environmental Disclosure. Account. Res. 2012, 72–78+97. [Google Scholar] [CrossRef]

- Luo, J.; Dou, C. Does the Social Media “Voice” of Minority Shareholders Affect Corporate M&A Preference? Evidence Based on Interactive Platforms. J. Shanghai Univ. Financ. Econ. 2022, 24, 123–137. [Google Scholar]

- Dou, C.; Luo, J.B. Minority Shareholders’ Voice on Social Media and the Effectiveness of Executive Compensation Contracts. Financ. Trade Econ. 2020, 41, 85–100. [Google Scholar]

- Liu, L.; Ge, M.; Ding, Z. Impacts of online media and investor attention on enterprise green innovation. Int. Rev. Econ. Financ. 2024, 96, 103569. [Google Scholar] [CrossRef]

- Lu, C.; Zhu, T.; Xia, X.; Zhao, Z.; Zhao, Y. Common institutional ownership and corporate green investment: Evidence from China. Int. Rev. Econ. Financ. 2024, 91, 1123–1149. [Google Scholar] [CrossRef]

- He, J.; Shen, X. Institutional investor cross-ownership networks and green innovation: Evidence from China. Int. Rev. Econ. Financ. 2024, 96, 103657. [Google Scholar] [CrossRef]

- Zhao, J.; Qu, J.; Wei, J.; Yin, H.; Xi, X. The effects of institutional investors on firms’ green innovation. J. Prod. Innov. Manag. 2023, 40, 195–230. [Google Scholar] [CrossRef]

- Wang, J. The impact of investor communication on enterprise green innovation. Financ. Res. Lett. 2023, 57, 104158. [Google Scholar] [CrossRef]

- Wang, H.; Lin, W.; Xie, R.; Ma, C.; Gong, L. Can environmental investors stimulate corporate green technological innovation?—Evidence from China. Appl. Econ. 2024, 6, 1–7. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Variable Symbol | Variable Definition | Source Literature |

|---|---|---|---|---|

| Explained variable | Green innovation | Green | The natural logarithm of the company’s total green invention patent applications plus 1 | Li et al. [26] |

| Explanatory variables | Retail investors Social media interaction | Post | The natural logarithm of the total number of posts posted by the company’s stock bar | Wang et al. [37]; Sun et al. [38] |

| Read | The natural logarithm of the total number of posts read by the company’s stock bar | |||

| Comment | The natural logarithm of the total number of comments on posts posted by the company’s stock bar | |||

| Intermediate variables | Environmental awareness | EnvAware | The natural logarithm of word frequency plus 1 for environment-related keywords in corporate annual reports | Liu et al. [30] |

| Financing constraint | WW | WW index | ||

| Control variables | News media attention | Media | The natural logarithm of the total number of times a company appears in a news headline | Wu&Tang [42] |

| Enterprise scale | Size | The natural logarithm of the number of employees in a business | Jiang et al. [43]; Li&Xiao [6]; Yang et al. [10] | |

| Capital structure | Lev | Total liabilities/total assets | ||

| Profitability | Roa | Net profit/total assets | ||

| Enterprise age | Age | The natural logarithm of the number of years a business has been established | ||

| Capital intensity | Ppe | Net fixed assets/total assets | ||

| Cash flow | Ocf | Net cash flow from operating activities/total assets | ||

| Property right nature | Soe | Whether the listed company is state-owned; state-owned enterprise is 1, otherwise 0 | ||

| Dual function | Dual | Whether the chairman concurrently serves as the general manager; if concurrently, the value is 1, otherwise it is 0 | ||

| Annual fixed effect | Year | Annual fixed effect | ||

| Industry fixed effect | Industry | Industry fixed effect | ||

| Provincial fixed effect | Province | Provincial fixed effect |

| Variables | Observed Value | Mean Value | Mid-Value | Standard Deviation | Maximum Value | Minimum Value |

|---|---|---|---|---|---|---|

| Green | 8755 | 0.224 | 0.000 | 0.549 | 2.773 | 0.000 |

| Post | 8755 | 8.694 | 8.702 | 0.867 | 10.860 | 6.480 |

| Read | 8755 | 15.600 | 15.600 | 1.036 | 17.990 | 13.250 |

| Comment | 8755 | 9.275 | 9.293 | 1.095 | 12.010 | 6.666 |

| Media | 8755 | 4.511 | 4.564 | 1.140 | 11.170 | 0.000 |

| Size | 8755 | 7.906 | 7.828 | 1.188 | 10.850 | 5.283 |

| Lev | 8755 | 0.430 | 0.429 | 0.204 | 0.894 | 0.052 |

| Roa | 8755 | 0.046 | 0.040 | 0.061 | 0.233 | −0.165 |

| Age | 8755 | 2.805 | 2.833 | 0.355 | 3.466 | 1.609 |

| Ppe | 8755 | 0.313 | 0.287 | 0.166 | 0.766 | 0.036 |

| Ocf | 8755 | 0.061 | 0.059 | 0.071 | 0.659 | −0.670 |

| Soe | 8755 | 0.444 | 0.000 | 0.497 | 1.000 | 0.000 |

| Dual | 8755 | 0.203 | 0.000 | 0.402 | 1.000 | 0.000 |

| Variables | Green | Post | Read | Comment | Media | Size | Lev |

|---|---|---|---|---|---|---|---|

| Green | 1 | ||||||

| Post | 0.183 *** | 1 | |||||

| Read | 0.133 *** | 0.811 *** | 1 | ||||

| Comment | 0.101 *** | 0.683 *** | 0.722 *** | 1 | |||

| Media | 0.139 *** | 0.299 *** | 0.327 *** | 0.344 *** | 1 | ||

| Size | 0.278 *** | 0.289 *** | 0.278 *** | 0.288 *** | 0.203 *** | 1 | |

| Lev | 0.121 *** | 0.136 *** | 0.153 *** | 0.216 *** | 0.050 *** | 0.413 *** | 1 |

| Roa | −0.006 | −0.045 *** | −0.063 *** | −0.069 *** | 0.109 *** | −0.038 *** | −0.462 *** |

| Age | 0.054 *** | 0.322 *** | 0.132 *** | −0.045 *** | 0.041 *** | 0.057 *** | 0.077 *** |

| Ppe | 0.123 *** | 0.054 *** | 0.091 *** | 0.130 *** | −0.036 *** | 0.277 *** | 0.403 *** |

| Ocf | 0.069 *** | 0.038 *** | 0.006 | 0.001 | 0.032 *** | 0.119 *** | −0.161 *** |

| Soe | 0.167 *** | 0.109 *** | 0.134 *** | 0.223 *** | 0.000 | 0.363 *** | 0.349 *** |

| Dual | −0.081 *** | −0.072 *** | −0.107 *** | −0.143 *** | −0.021 ** | −0.213 *** | −0.135 *** |

| Variables | Roa | Age | Ppe | Ocf | Soe | Dual | |

| Roa | 1 | ||||||

| Age | −0.052 *** | 1 | |||||

| Ppe | −0.232 *** | 0.028 *** | 1 | ||||

| Ocf | 0.456 *** | 0.035 *** | 0.154 *** | 1 | |||

| Soe | −0.186 *** | 0.072 *** | 0.380 *** | 0.022 ** | 1 | ||

| Dual | 0.075 *** | 0.00500 | −0.164 *** | −0.010 | −0.272 *** | 1 | |

| Variables | Green | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Post | 0.097 *** | 0.042 *** | ||||

| (5.62) | (2.81) | |||||

| Read | 0.099 *** | 0.046 *** | ||||

| (6.12) | (3.33) | |||||

| Comment | 0.067 *** | 0.030 ** | ||||

| (5.06) | (2.56) | |||||

| Media | 0.042 *** | 0.042 *** | 0.042 *** | |||

| (3.73) | (3.67) | (3.72) | ||||

| Size | 0.096 *** | 0.094 *** | 0.098 *** | |||

| (6.15) | (6.03) | (6.24) | ||||

| Lev | −0.037 | −0.035 | −0.036 | |||

| (−0.40) | (−0.38) | (−0.39) | ||||

| Roa | 0.114 | 0.112 | 0.109 | |||

| (0.68) | (0.66) | (0.64) | ||||

| Age | −0.069 | −0.072 | −0.067 | |||

| (−1.39) | (−1.46) | (−1.35) | ||||

| Ppe | 0.098 | 0.101 | 0.098 | |||

| (1.01) | (1.05) | (1.01) | ||||

| Ocf | 0.273 ** | 0.270 ** | 0.272 ** | |||

| (2.56) | (2.53) | (2.55) | ||||

| Soe | 0.092 *** | 0.093 *** | 0.093 *** | |||

| (2.90) | (2.91) | (2.92) | ||||

| Dual | −0.013 | −0.013 | −0.013 | |||

| (−0.71) | (−0.68) | (−0.70) | ||||

| Constant | −0.539 *** | −0.935 *** | −1.239 *** | −1.255 *** | −0.417 *** | −0.902 *** |

| (−4.25) | (−5.20) | (−5.69) | (−5.59) | (−3.48) | (−5.03) | |

| N | 7524 | 7524 | 7524 | 7524 | 7524 | 7524 |

| Adj_R2 | 0.138 | 0.187 | 0.141 | 0.188 | 0.135 | 0.187 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Province | Yes | Yes | Yes | Yes | Yes | Yes |

| Variables | EnvAware | Green | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Post | 0.056 ** | 0.039 *** | ||||

| (2.41) | (2.59) | |||||

| Read | 0.053 ** | 0.042 *** | ||||

| (2.35) | (3.09) | |||||

| Comment | 0.037 ** | 0.028 ** | ||||

| (2.07) | (2.38) | |||||

| EnvAware | 0.033 *** | 0.033 *** | 0.034 *** | |||

| (2.76) | (2.75) | (2.78) | ||||

| Media | 0.001 | 0.001 | 0.001 | 0.042 *** | 0.041 *** | 0.042 *** |

| (0.07) | (0.04) | (0.08) | (3.68) | (3.63) | (3.67) | |

| Size | 0.251 *** | 0.250 *** | 0.254 *** | 0.087 *** | 0.086 *** | 0.089 *** |

| (10.77) | (10.72) | (10.94) | (5.42) | (5.30) | (5.50) | |

| Lev | 0.279 ** | 0.282 ** | 0.281 ** | −0.043 | −0.041 | −0.042 |

| (2.17) | (2.19) | (2.18) | (−0.47) | (−0.45) | (−0.46) | |

| Roa | −0.169 | −0.177 | −0.179 | 0.113 | 0.111 | 0.108 |

| (−0.51) | (−0.54) | (−0.54) | (0.66) | (0.65) | (0.63) | |

| Age | −0.043 | −0.044 | −0.039 | −0.063 | −0.066 | −0.062 |

| (−0.48) | (−0.49) | (−0.44) | (−1.28) | (−1.35) | (−1.25) | |

| Ppe | 0.699 *** | 0.702 *** | 0.699 *** | 0.077 | 0.080 | 0.077 |

| (4.31) | (4.32) | (4.31) | (0.79) | (0.83) | (0.79) | |

| Ocf | −0.121 | −0.123 | −0.122 | 0.271 ** | 0.269 ** | 0.270 ** |

| (−0.56) | (−0.57) | (−0.56) | (2.53) | (2.50) | (2.52) | |

| Soe | 0.031 | 0.032 | 0.032 | 0.090 *** | 0.090 *** | 0.091 *** |

| (0.54) | (0.55) | (0.56) | (2.85) | (2.86) | (2.87) | |

| Dual | −0.115 ** | −0.114 ** | −0.115 ** | −0.010 | −0.009 | −0.010 |

| (−2.46) | (−2.44) | (−2.45) | (−0.53) | (−0.50) | (−0.52) | |

| Constant | −0.832 *** | −1.164 *** | −0.774 *** | −0.901 *** | −1.199 *** | −0.873 *** |

| (−2.82) | (−3.16) | (−2.66) | (−5.03) | (−5.37) | (−4.88) | |

| N | 7491 | 7491 | 7491 | 7491 | 7491 | 7491 |

| Sobel-Z (p-Value) | 0.003 | 0.003 | 0.008 | |||

| Adj_R2 | 0.574 | 0.574 | 0.574 | 0.189 | 0.190 | 0.189 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Province | Yes | Yes | Yes | Yes | Yes | Yes |

| Variables | WW | Green | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Post | −0.006 *** | 0.038 ** | ||||

| (−5.99) | (2.47) | |||||

| Read | −0.007 *** | 0.042 *** | ||||

| (−6.89) | (3.00) | |||||

| Comment | −0.005 *** | 0.028 ** | ||||

| (−6.06) | (2.38) | |||||

| WW | −1.379 *** | −1.356 *** | −1.379 *** | |||

| (−4.78) | (−4.72) | (−4.81) | ||||

| Media | −0.004 *** | −0.004 *** | −0.004 *** | 0.038 *** | 0.038 *** | 0.038 *** |

| (−5.02) | (−4.85) | (−4.96) | (3.30) | (3.25) | (3.29) | |

| Size | −0.038 *** | −0.038 *** | −0.039 *** | 0.038 ** | 0.037 ** | 0.039 ** |

| (−29.53) | (−29.32) | (−29.81) | (2.14) | (2.09) | (2.21) | |

| Lev | −0.014 * | −0.014 ** | −0.014 * | −0.073 | −0.070 | −0.071 |

| (−1.90) | (−1.97) | (−1.94) | (−0.74) | (−0.71) | (−0.72) | |

| Roa | −0.315 *** | −0.314 *** | −0.315 *** | −0.271 | −0.265 | −0.274 |

| (−20.31) | (−20.34) | (−20.29) | (−1.37) | (−1.33) | (−1.38) | |

| Age | 0.009 ** | 0.010 ** | 0.009 ** | −0.055 | −0.059 | −0.054 |

| (2.33) | (2.49) | (2.32) | (−1.08) | (−1.16) | (−1.06) | |

| Ppe | 0.020 ** | 0.019 ** | 0.020 ** | 0.143 | 0.145 | 0.143 |

| (2.54) | (2.49) | (2.53) | (1.43) | (1.45) | (1.43) | |

| Ocf | −0.037 *** | −0.036 *** | −0.036 *** | 0.239 ** | 0.237 ** | 0.237 ** |

| (−3.26) | (−3.22) | (−3.22) | (2.18) | (2.16) | (2.17) | |

| Soe | 0.002 | 0.002 | 0.002 | 0.093 *** | 0.093 *** | 0.094 *** |

| (0.88) | (0.87) | (0.85) | (2.83) | (2.84) | (2.85) | |

| Dual | −0.002 | −0.002 | −0.002 | −0.019 | −0.018 | −0.019 |

| (−0.77) | (−0.82) | (−0.78) | (−0.93) | (−0.90) | (−0.92) | |

| Constant | −0.659 *** | −0.608 *** | −0.659 *** | −1.842 *** | −2.125 *** | −1.826 *** |

| (−47.66) | (−34.81) | (−48.04) | (−6.29) | (−6.46) | (−6.19) | |

| Sobel-Z (p-Value) | 0.000 | 0.000 | 0.000 | |||

| N | 6764 | 6764 | 6764 | 6764 | 6764 | 6764 |

| Adj_R2 | 0.696 | 0.698 | 0.697 | 0.206 | 0.206 | 0.205 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Province | Yes | Yes | Yes | Yes | Yes | Yes |

| Variables | Green | |

|---|---|---|

| (1) | (2) | |

| 2010–2019 | 2012–2017 | |

| Treat × Post | 0.244 *** | 0.110 *** |

| (6.38) | (3.26) | |

| Treat | 0.002 | 0.037 |

| (0.06) | (1.21) | |

| Media | 0.043 *** | 0.039 *** |

| (3.55) | (2.88) | |

| Size | 0.098 *** | 0.093 *** |

| (6.05) | (5.03) | |

| Lev | −0.039 | 0.001 |

| (−0.42) | (0.01) | |

| Roa | 0.036 | 0.165 |

| (0.20) | (0.67) | |

| Age | −0.052 | −0.080 |

| (−1.08) | (−1.42) | |

| Ppe | 0.069 | 0.091 |

| (0.71) | (0.82) | |

| Ocf | 0.302 ** | 0.215 * |

| (2.57) | (1.69) | |

| Soe | 0.089 *** | 0.081 ** |

| (2.65) | (2.07) | |

| Dual | −0.017 | −0.011 |

| (−0.87) | (−0.44) | |

| Constant | −0.667 *** | −0.465 ** |

| (−3.94) | (−2.30) | |

| N | 6381 | 3818 |

| Adj_R2 | 0.172 | 0.161 |

| Year | Yes | Yes |

| Industry | Yes | Yes |

| Province | Yes | Yes |

| Variables | Green | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| All | PSM | All | PSM | All | PSM | |

| Post | 0.042 *** | 0.030 * | ||||

| (2.81) | (1.93) | |||||

| Read | 0.046 *** | 0.032 ** | ||||

| (3.33) | (2.35) | |||||

| Comment | 0.030 ** | 0.022 ** | ||||

| (2.56) | (2.05) | |||||

| Media | 0.042 *** | 0.044 *** | 0.042 *** | 0.033 *** | 0.042 *** | 0.032 *** |

| (3.73) | (3.94) | (3.67) | (2.84) | (3.72) | (2.96) | |

| Size | 0.096 *** | 0.082 *** | 0.094 *** | 0.089 *** | 0.098 *** | 0.095 *** |

| (6.15) | (5.45) | (6.03) | (5.67) | (6.24) | (5.88) | |

| Lev | −0.037 | −0.021 | −0.035 | −0.057 | −0.036 | 0.002 |

| (−0.40) | (−0.23) | (−0.38) | (−0.65) | (−0.39) | (0.02) | |

| Roa | 0.114 | 0.021 | 0.112 | 0.074 | 0.109 | 0.168 |

| (0.68) | (0.12) | (0.66) | (0.45) | (0.64) | (0.96) | |

| Age | −0.069 | −0.093 * | −0.072 | −0.039 | −0.067 | 0.003 |

| (−1.39) | (−1.78) | (−1.46) | (−0.81) | (−1.35) | (0.06) | |

| Ppe | 0.098 | 0.042 | 0.101 | 0.122 | 0.098 | 0.069 |

| (1.01) | (0.44) | (1.05) | (1.37) | (1.01) | (0.78) | |

| Ocf | 0.273 ** | 0.143 | 0.270 ** | 0.227 ** | 0.272 ** | 0.120 |

| (2.56) | (1.27) | (2.53) | (2.01) | (2.55) | (1.07) | |

| Soe | 0.092 *** | 0.078 *** | 0.093 *** | 0.081 ** | 0.093 *** | 0.078 ** |

| (2.90) | (2.63) | (2.91) | (2.57) | (2.92) | (2.47) | |

| Dual | −0.013 | −0.049 *** | −0.013 | −0.018 | −0.013 | −0.012 |

| (−0.71) | (−2.74) | (−0.68) | (−0.97) | (−0.70) | (−0.63) | |

| Constant | −0.935 *** | −0.670 *** | −1.255 *** | −1.109 *** | −0.902 *** | −0.941 *** |

| (−5.20) | (−3.66) | (−5.59) | (−4.78) | (−5.03) | (−5.00) | |

| N | 7524 | 5202 | 7524 | 5183 | 7524 | 4999 |

| Adj_R2 | 0.187 | 0.147 | 0.188 | 0.168 | 0.187 | 0.156 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Province | Yes | Yes | Yes | Yes | Yes | Yes |

| Variables | Green | ||

|---|---|---|---|

| (1) | (2) | (3) | |

| Question_Num | 0.018 * | ||

| (1.89) | |||

| GreenQues_Num | 0.073 *** | ||

| (3.71) | |||

| GreenQues_Ratio | 1.999 *** | ||

| (3.45) | |||

| Media | 0.044 *** | 0.045 *** | 0.046 *** |

| (3.50) | (3.54) | (3.63) | |

| Size | 0.110 *** | 0.108 *** | 0.110 *** |

| (6.23) | (6.13) | (6.29) | |

| Lev | −0.023 | −0.031 | −0.036 |

| (−0.24) | (−0.33) | (−0.38) | |

| Roa | 0.139 | 0.092 | 0.114 |

| (0.77) | (0.52) | (0.63) | |

| Age | −0.027 | −0.027 | −0.031 |

| (−0.52) | (−0.52) | (−0.60) | |

| Ppe | 0.115 | 0.111 | 0.114 |

| (1.10) | (1.07) | (1.10) | |

| Ocf | 0.280 ** | 0.280 ** | 0.262 ** |

| (2.11) | (2.12) | (1.97) | |

| Soe | 0.095 *** | 0.095 *** | 0.090 *** |

| (2.71) | (2.74) | (2.59) | |

| Dual | −0.019 | −0.019 | −0.020 |

| (−0.95) | (−0.93) | (−0.99) | |

| Constant | −0.912 *** | −0.872 *** | −0.890 *** |

| (−4.59) | (−4.47) | (−4.61) | |

| N | 6072 | 6072 | 6072 |

| Adj_R2 | 0.191 | 0.197 | 0.197 |

| Year | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes |

| Province | Yes | Yes | Yes |

| Variables | Green_application | Green_grant | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Post | 0.039 ** | 0.031 ** | ||||

| (2.06) | (2.00) | |||||

| Read | 0.046 *** | 0.036 ** | ||||

| (2.65) | (2.54) | |||||

| Comment | 0.029 ** | 0.024 ** | ||||

| (2.00) | (2.02) | |||||

| Media | 0.054 *** | 0.053 *** | 0.054 *** | 0.043 *** | 0.042 *** | 0.043 *** |

| (3.78) | (3.72) | (3.76) | (3.59) | (3.54) | (3.57) | |

| Size | 0.137 *** | 0.135 *** | 0.138 *** | 0.110 *** | 0.108 *** | 0.111 *** |

| (6.88) | (6.76) | (6.96) | (6.66) | (6.55) | (6.74) | |

| Lev | −0.007 | −0.005 | −0.005 | −0.002 | 0.000 | −0.000 |

| (−0.06) | (−0.04) | (−0.05) | (−0.02) | (0.00) | (−0.01) | |

| Roa | 0.290 | 0.290 | 0.286 | 0.249 | 0.249 | 0.246 |

| (1.38) | (1.38) | (1.36) | (1.44) | (1.43) | (1.42) | |

| Age | −0.103 | −0.107 * | −0.102 | −0.103 ** | −0.107 ** | −0.103 ** |

| (−1.64) | (−1.72) | (−1.62) | (−1.97) | (−2.04) | (−1.96) | |

| Ppe | 0.293 ** | 0.297** | 0.294 ** | 0.306 *** | 0.309 *** | 0.307 *** |

| (2.35) | (2.39) | (2.36) | (2.96) | (2.99) | (2.96) | |

| Ocf | 0.194 | 0.191 | 0.193 | 0.066 | 0.064 | 0.065 |

| (1.48) | (1.46) | (1.47) | (0.61) | (0.59) | (0.60) | |

| Soe | 0.084 ** | 0.084 ** | 0.084 ** | 0.056 * | 0.056 * | 0.056 * |

| (2.10) | (2.10) | (2.11) | (1.71) | (1.71) | (1.72) | |

| Dual | −0.021 | −0.020 | −0.021 | −0.025 | −0.024 | −0.025 |

| (−0.85) | (−0.82) | (−0.84) | (−1.25) | (−1.22) | (−1.24) | |

| Constant | −1.191 *** | −1.530 *** | −1.172 *** | −0.936 *** | −1.201 *** | −0.925 *** |

| (−5.26) | (−5.44) | (−5.16) | (−4.92) | (−5.11) | (−4.86) | |

| N | 7524 | 7524 | 7524 | 7524 | 7524 | 7524 |

| Adj_R2 | 0.226 | 0.227 | 0.226 | 0.212 | 0.212 | 0.212 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Province | Yes | Yes | Yes | Yes | Yes | Yes |

| Variables | Green | ||

|---|---|---|---|

| (1) | (2) | (3) | |

| Post | 0.155 ** | ||

| (2.56) | |||

| Read | 0.167 *** | ||

| (3.03) | |||

| Comment | 0.081 * | ||

| (1.76) | |||

| Media | 0.140 *** | 0.136 *** | 0.143 *** |

| (2.99) | (2.92) | (3.04) | |

| Size | 0.414 *** | 0.406 *** | 0.426 *** |

| (7.06) | (6.92) | (7.29) | |

| Lev | 0.010 | 0.022 | 0.012 |

| (0.03) | (0.06) | (0.03) | |

| Roa | 0.792 | 0.773 | 0.752 |

| (0.97) | (0.95) | (0.92) | |

| Age | −0.371 | −0.380 | −0.358 |

| (−1.59) | (−1.63) | (−1.53) | |

| Ppe | 0.179 | 0.187 | 0.175 |

| (0.45) | (0.47) | (0.44) | |

| Ocf | 1.204 ** | 1.195 ** | 1.204 ** |

| (2.28) | (2.27) | (2.28) | |

| Soe | 0.370 *** | 0.370 *** | 0.374 *** |

| (2.70) | (2.70) | (2.73) | |

| Dual | −0.073 | −0.071 | −0.073 |

| (−0.69) | (−0.66) | (−0.69) | |

| Constant | −6.251 *** | −7.419 *** | −5.939 *** |

| (−8.12) | (−7.72) | (−7.81) | |

| N | 7524 | 7524 | 7524 |

| Adj_R2 | 0.130 | 0.131 | 0.130 |

| Year | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes |

| Province | Yes | Yes | Yes |

| Variables | Green | |||||

|---|---|---|---|---|---|---|

| Two Lag Periods | Three Lag Periods | |||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Post | 0.044 *** | 0.060 *** | ||||

| (2.61) | (3.16) | |||||

| Read | 0.046 *** | 0.056 *** | ||||

| (2.97) | (3.21) | |||||

| Comment | 0.030 ** | 0.041 *** | ||||

| (2.37) | (2.95) | |||||

| Media | 0.041 *** | 0.040 *** | 0.041 *** | 0.042 *** | 0.042 *** | 0.043 *** |

| (3.44) | (3.41) | (3.44) | (3.48) | (3.46) | (3.50) | |

| Size | 0.105 *** | 0.103 *** | 0.107 *** | 0.112 *** | 0.111 *** | 0.114 *** |

| (6.23) | (6.11) | (6.30) | (6.06) | (6.00) | (6.17) | |

| Lev | −0.029 | −0.025 | −0.028 | −0.033 | −0.028 | −0.031 |

| (−0.29) | (−0.25) | (−0.27) | (−0.30) | (−0.26) | (−0.29) | |

| Roa | 0.095 | 0.093 | 0.089 | 0.172 | 0.173 | 0.162 |

| (0.53) | (0.51) | (0.49) | (0.87) | (0.87) | (0.82) | |

| Age | −0.070 | −0.073 | −0.067 | −0.097 | −0.099 | −0.093 |

| (−1.26) | (−1.32) | (−1.22) | (−1.52) | (−1.54) | (−1.46) | |

| Ppe | 0.093 | 0.096 | 0.094 | 0.087 | 0.092 | 0.088 |

| (0.89) | (0.91) | (0.89) | (0.76) | (0.80) | (0.77) | |

| Ocf | 0.317 ** | 0.316 ** | 0.313 ** | 0.361 ** | 0.361 ** | 0.362 ** |

| (2.48) | (2.47) | (2.45) | (2.55) | (2.55) | (2.56) | |

| Soe | 0.092 *** | 0.093 *** | 0.093 *** | 0.102 *** | 0.104 *** | 0.104 *** |

| (2.74) | (2.75) | (2.77) | (2.87) | (2.91) | (2.92) | |

| Dual | −0.018 | −0.018 | −0.018 | −0.023 | −0.024 | −0.023 |

| (−0.91) | (−0.91) | (−0.90) | (−1.06) | (−1.08) | (−1.06) | |

| Constant | −1.014 *** | −1.323 *** | −0.973 *** | −1.077 *** | −1.431 *** | −1.027 *** |

| (−4.83) | (−5.10) | (−4.69) | (−4.53) | (−4.92) | (−4.37) | |

| N | 6614 | 6614 | 6614 | 5765 | 5765 | 5765 |

| Adj_R2 | 0.192 | 0.192 | 0.191 | 0.204 | 0.204 | 0.203 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Province | Yes | Yes | Yes | Yes | Yes | Yes |

| Variables | Green | ||

|---|---|---|---|

| (1) | (2) | (3) | |

| Post | 0.021 | ||

| (1.05) | |||

| Post × Policy | 0.040 | ||

| (1.60) | |||

| Read | 0.020 | ||

| (1.14) | |||

| Read × Policy | 0.048 ** | ||

| (2.02) | |||

| Comment | 0.009 | ||

| (0.60) | |||

| Comment y× Policy | 0.032 * | ||

| (1.69) | |||

| Media | 0.042 *** | 0.041 *** | 0.042 *** |

| (3.72) | (3.65) | (3.73) | |

| Size | 0.096 *** | 0.094 *** | 0.098 *** |

| (6.14) | (6.01) | (6.27) | |

| Lev | −0.038 | −0.036 | −0.037 |

| (−0.41) | (−0.39) | (−0.40) | |

| Roa | 0.114 | 0.115 | 0.107 |

| (0.67) | (0.67) | (0.63) | |

| Age | −0.064 | −0.066 | −0.062 |

| (−1.28) | (−1.32) | (−1.23) | |

| Ppe | 0.098 | 0.102 | 0.097 |

| (1.02) | (1.06) | (1.01) | |

| Ocf | 0.269 ** | 0.265 ** | 0.268 ** |

| (2.53) | (2.49) | (2.53) | |

| Soe | 0.093 *** | 0.093 *** | 0.093 *** |

| (2.91) | (2.93) | (2.94) | |

| Dual | −0.013 | −0.012 | −0.013 |

| (−0.71) | (−0.65) | (−0.69) | |

| Constant | −0.784 *** | −0.899 *** | −0.734 *** |

| (−4.41) | (−3.70) | (−4.20) | |

| N | 7524 | 7524 | 7524 |

| Adj_R2 | 0.188 | 0.189 | 0.187 |

| Year | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes |

| Province | Yes | Yes | Yes |

| Variables | Green | ||

|---|---|---|---|

| (1) | (2) | (3) | |

| Post | 0.047 *** | ||

| (2.88) | |||

| Post × Sentiment | 0.071 ** | ||

| (2.17) | |||

| Read | 0.048 *** | ||

| (3.36) | |||

| Read × Sentiment | 0.060 ** | ||

| (2.45) | |||

| Comment | 0.029 ** | ||

| (2.53) | |||

| Comment × Sentiment | 0.034 * | ||

| (1.83) | |||

| Sentiment | 0.040 | 0.037 | 0.042 |

| (1.31) | (1.28) | (1.30) | |

| Media | 0.042 *** | 0.041 *** | 0.042 *** |

| (3.75) | (3.69) | (3.74) | |

| Size | 0.095 *** | 0.094 *** | 0.098 *** |

| (6.13) | (6.04) | (6.25) | |

| Lev | −0.033 | −0.030 | −0.032 |

| (−0.37) | (−0.33) | (−0.35) | |

| Roa | 0.074 | 0.075 | 0.068 |

| (0.43) | (0.43) | (0.39) | |

| Age | −0.067 | −0.070 | −0.066 |

| (−1.35) | (−1.43) | (−1.35) | |

| Ppe | 0.095 | 0.099 | 0.097 |

| (0.99) | (1.03) | (1.01) | |

| Ocf | 0.274 ** | 0.271 ** | 0.270 ** |

| (2.57) | (2.54) | (2.53) | |

| Soe | 0.089 *** | 0.091 *** | 0.092 *** |

| (2.80) | (2.86) | (2.88) | |

| Dual | −0.013 | −0.013 | −0.013 |

| (−0.71) | (−0.68) | (−0.69) | |

| Constant | −1.023 *** | −1.345 *** | −0.955 *** |

| (−5.30) | (−5.52) | (−5.11) | |

| N | 7524 | 7524 | 7524 |

| Adj_R2 | 0.190 | 0.190 | 0.188 |

| Year | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes |

| Province | Yes | Yes | Yes |

| Variables | Green | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Weak Supervision | Strong Supervision | Weak Supervision | Strong Supervision | Weak Supervision | Strong Supervision | |

| Post | 0.010 | 0.080 ** | ||||

| (0.52) | (2.51) | |||||

| Read | 0.021 | 0.094 *** | ||||

| (1.17) | (3.22) | |||||

| Comment | 0.014 | 0.056 ** | ||||

| (0.84) | (2.35) | |||||

| Media | 0.038 ** | 0.078 *** | 0.037 ** | 0.074 *** | 0.037 ** | 0.077 *** |

| (2.49) | (3.03) | (2.43) | (2.97) | (2.45) | (3.00) | |

| Size | 0.068 *** | 0.114 *** | 0.066 *** | 0.111 *** | 0.067 *** | 0.118 *** |

| (3.32) | (4.30) | (3.23) | (4.16) | (3.31) | (4.37) | |

| Lev | −0.046 | −0.161 | −0.046 | −0.159 | −0.046 | −0.162 |

| (−0.30) | (−0.93) | (−0.30) | (−0.93) | (−0.30) | (−0.94) | |

| Roa | −0.032 | 0.314 | −0.027 | 0.313 | −0.025 | 0.307 |

| (−0.14) | (0.81) | (−0.12) | (0.81) | (−0.11) | (0.79) | |

| Age | −0.081 | 0.001 | −0.085 | −0.007 | −0.084 | 0.006 |

| (−1.53) | (0.02) | (−1.62) | (−0.07) | (−1.60) | (0.06) | |

| Ppe | −0.100 | 0.364 * | −0.096 | 0.365 * | −0.097 | 0.367 * |

| (−0.77) | (1.80) | (−0.74) | (1.82) | (−0.75) | (1.82) | |

| Ocf | 0.555 *** | 0.237 | 0.551 *** | 0.230 | 0.551 *** | 0.229 |

| (2.89) | (1.17) | (2.88) | (1.14) | (2.89) | (1.13) | |

| Soe | 0.145 *** | 0.047 | 0.144 *** | 0.047 | 0.144 *** | 0.049 |

| (3.60) | (0.74) | (3.59) | (0.76) | (3.58) | (0.79) | |

| Dual | −0.031 | −0.030 | −0.030 | −0.029 | −0.031 | −0.030 |

| (−1.02) | (−0.80) | (−1.01) | (−0.79) | (−1.02) | (−0.79) | |

| Constant | −0.598 ** | −1.581 *** | −0.789 ** | −2.279 *** | −0.627 ** | −1.523 *** |

| (−2.51) | (−4.64) | (−2.57) | (−4.94) | (−2.58) | (−4.58) | |

| Difference between groups (p-Value) | 0.007 | 0.003 | 0.031 | |||

| N | 2194 | 2101 | 2194 | 2101 | 2194 | 2101 |

| Adj_R2 | 0.195 | 0.249 | 0.195 | 0.252 | 0.195 | 0.248 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Province | Yes | Yes | Yes | Yes | Yes | Yes |

| Variables | Green | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Weak Protection | Strong Protection | Weak Protection | Strong Protection | Weak Protection | Strong Protection | |

| Post | 0.023 | 0.066 *** | ||||

| (1.51) | (2.73) | |||||

| Read | 0.029 * | 0.065 *** | ||||

| (1.94) | (2.97) | |||||

| Comment | 0.018 | 0.046 ** | ||||

| (1.40) | (2.49) | |||||

| Media | 0.027 ** | 0.061 *** | 0.026 ** | 0.060 *** | 0.027 ** | 0.061 *** |

| (2.26) | (3.64) | (2.23) | (3.59) | (2.26) | (3.61) | |

| Size | 0.052 *** | 0.134 *** | 0.051 *** | 0.132 *** | 0.053 *** | 0.137 *** |

| (3.24) | (5.70) | (3.14) | (5.64) | (3.31) | (5.79) | |

| Lev | 0.133 | −0.197 * | 0.135 | −0.193 * | 0.134 | −0.192 * |

| (1.19) | (−1.77) | (1.21) | (−1.75) | (1.19) | (−1.73) | |

| Roa | 0.440 ** | −0.124 | 0.440 * | −0.128 | 0.439 * | −0.133 |

| (1.97) | (−0.58) | (1.96) | (−0.59) | (1.95) | (−0.61) | |

| Age | −0.092 | −0.033 | −0.096 | −0.036 | −0.092 | −0.030 |

| (−1.58) | (−0.50) | (−1.64) | (−0.54) | (−1.57) | (−0.45) | |

| Ppe | −0.051 | 0.287 ** | −0.048 | 0.292 ** | −0.051 | 0.292 ** |

| (−0.42) | (2.27) | (−0.39) | (2.31) | (−0.42) | (2.29) | |

| Ocf | 0.362 ** | 0.239 * | 0.358 ** | 0.237 * | 0.359 ** | 0.242 * |

| (2.40) | (1.72) | (2.38) | (1.71) | (2.39) | (1.73) | |

| Soe | 0.150 *** | 0.012 | 0.150 *** | 0.014 | 0.150 *** | 0.014 |

| (3.67) | (0.27) | (3.68) | (0.31) | (3.68) | (0.31) | |

| Dual | −0.019 | −0.014 | −0.019 | −0.012 | −0.018 | −0.014 |

| (−0.68) | (−0.55) | (−0.68) | (−0.49) | (−0.67) | (−0.56) | |

| Constant | −0.371 * | −1.488 *** | −0.594 ** | −1.913 *** | −0.362 | −1.433 *** |

| (−1.70) | (−5.61) | (−2.19) | (−5.45) | (−1.64) | (−5.44) | |

| Difference between groups (p-Value) | 0.020 | 0.039 | 0.048 | |||

| N | 3961 | 3563 | 3961 | 3563 | 3961 | 3563 |

| Adj_R2 | 0.194 | 0.217 | 0.195 | 0.217 | 0.194 | 0.216 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes |

| Province | Yes | Yes | Yes | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, M.; Zhang, Z.; Su, Y. Retail Investors’ Social Media Interaction and Corporate Green Innovation: Evidence from China Listed Companies in Heavily Polluting Industries. Sustainability 2025, 17, 4558. https://doi.org/10.3390/su17104558

Zhang M, Zhang Z, Su Y. Retail Investors’ Social Media Interaction and Corporate Green Innovation: Evidence from China Listed Companies in Heavily Polluting Industries. Sustainability. 2025; 17(10):4558. https://doi.org/10.3390/su17104558

Chicago/Turabian StyleZhang, Min, Zuxiang Zhang, and Yu Su. 2025. "Retail Investors’ Social Media Interaction and Corporate Green Innovation: Evidence from China Listed Companies in Heavily Polluting Industries" Sustainability 17, no. 10: 4558. https://doi.org/10.3390/su17104558

APA StyleZhang, M., Zhang, Z., & Su, Y. (2025). Retail Investors’ Social Media Interaction and Corporate Green Innovation: Evidence from China Listed Companies in Heavily Polluting Industries. Sustainability, 17(10), 4558. https://doi.org/10.3390/su17104558