China’s Industry–Finance Collaboration Pilot in Stimulating Corporate Green Innovation

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Literature Review

2.1.1. Green Finance

2.1.2. Digital Finance

2.2. Hypothesis Development

2.2.1. Governmental Green Guidance

2.2.2. Digital Finance Empowerment

3. Research Design

3.1. Model Setup

- First batch of 37 cities announced on 29 December 2016;

- Second batch of 51 cities announced on 16 December 2020;

- Third batch of 66 cities announced on 14 June 2024.

3.2. Variables and Data

3.2.1. Variables and Measurement

- (1)

- Dependent Variable

- (2)

- Core Explanatory Variable

- (3)

- Control Variables

3.2.2. Data and Sample

- (1)

- Data Sources

- (2)

- Sample Selection

4. Empirical Results

4.1. Descriptive Statistics

4.2. Baseline Regression

4.3. Robustness Test

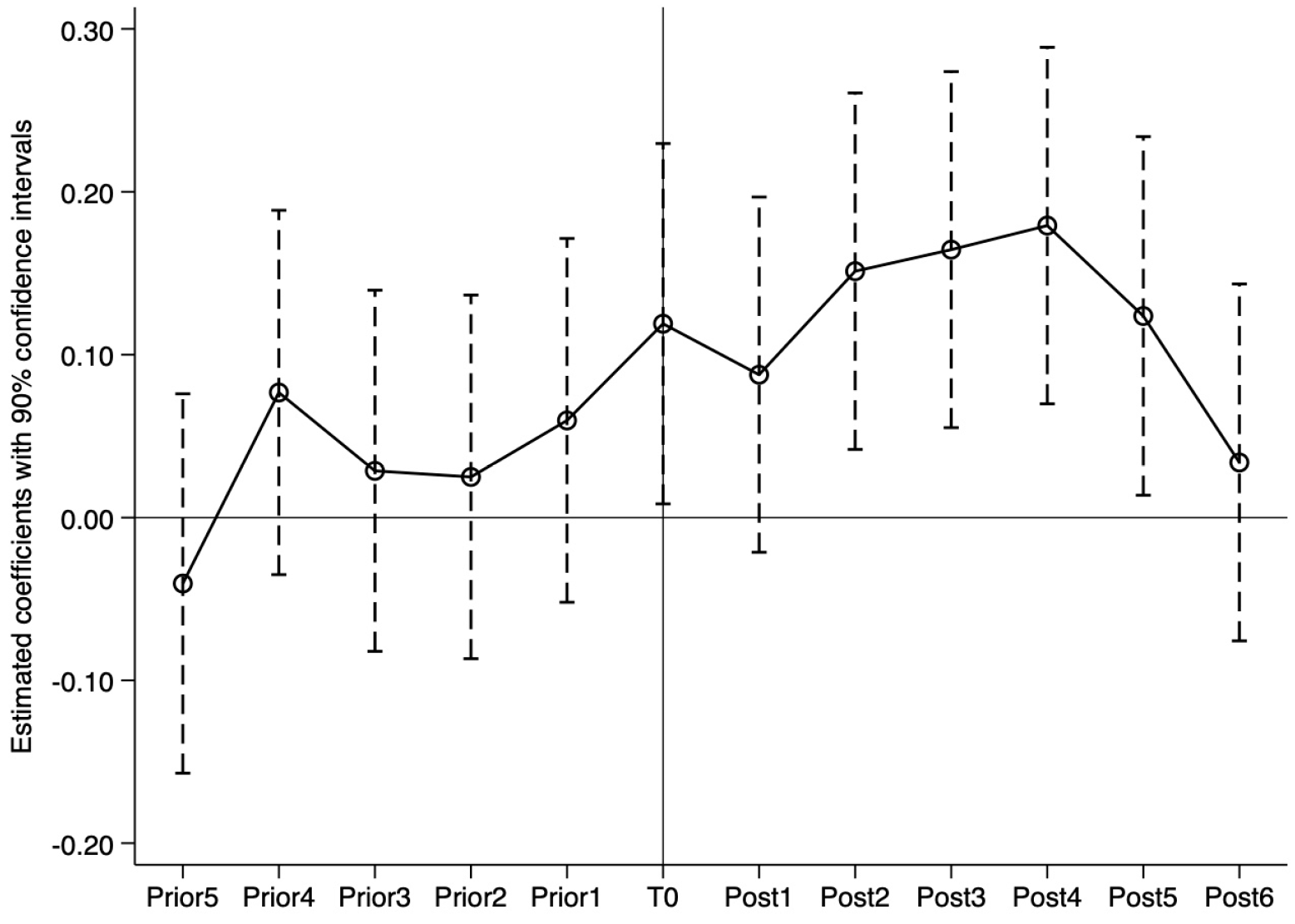

4.3.1. Parallel Trend Test

4.3.2. Substitution of the Dependent Variable

4.3.3. Cluster Robustness

4.3.4. Sample Changes

4.3.5. City Fixed Effects

4.3.6. Propensity Score Matching (PSM)

4.3.7. Exclusion of Alternative Policies

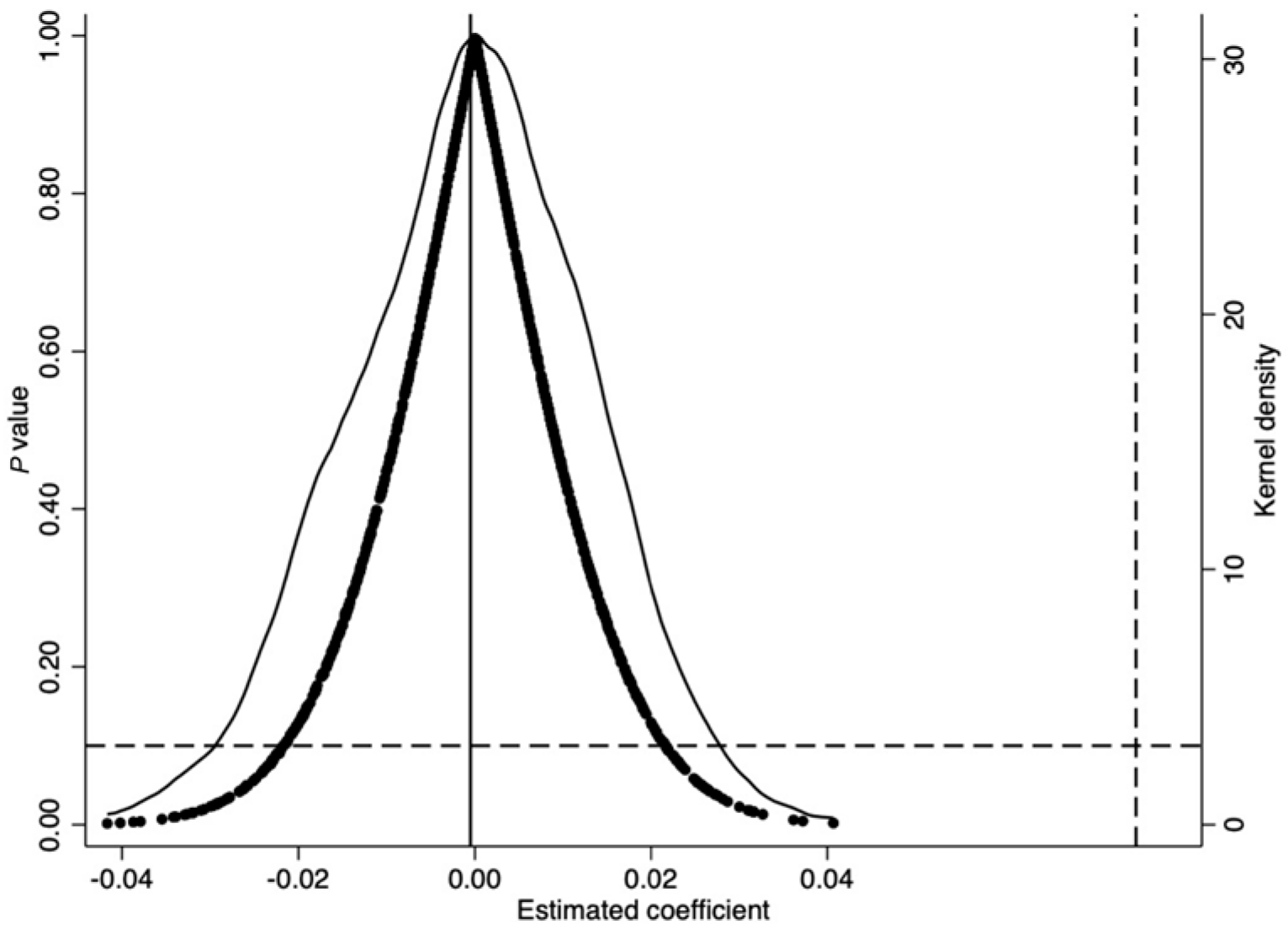

4.3.8. Placebo Test

5. Further Analysis

5.1. Mechanism Analysis

5.1.1. Governmental Green Guidance

- (1)

- Fiscal Funds as Catalytic Capital

- (2)

- Environmental Disclosure and Agency Costs

5.1.2. Digital Finance Empowerment

5.2. Heterogeneity Analysis

5.2.1. Regional Level: Environmental Regulation Intensity

5.2.2. Industry Level: Pollution Intensity

5.2.3. Firm Level: Asset Size

5.3. Extended Analysis

6. Conclusions and Discussion

6.1. Conclusions

6.2. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| (1) | |

|---|---|

| Variable | LnGrePata |

| Prior5 | −0.041 |

| (−0.57) | |

| Prior4 | 0.077 |

| (1.13) | |

| Prior3 | 0.029 |

| (0.43) | |

| Prior2 | 0.025 |

| (0.37) | |

| Prior1 | 0.060 |

| (0.88) | |

| T0 | 0.119 * |

| (1.77) | |

| Post1 | 0.088 |

| (1.32) | |

| Post2 | 0.151 ** |

| (2.27) | |

| Post3 | 0.164 ** |

| (2.48) | |

| Post4 | 0.179 *** |

| (2.70) | |

| Post5 | 0.124 * |

| (1.85) | |

| Post6 | 0.034 |

| (0.51) | |

| Controls | YES |

| Constant | 0.087 |

| (0.28) | |

| Year/Firm | YES |

| Observations | 14,013 |

| R-squared | 0.0360 |

Appendix B

| Variable | Unmatched Matched | Mean | Bias (%) | p > |t| | V(T)/V(C) | |

|---|---|---|---|---|---|---|

| Treat = 1 | Treat = 0 | |||||

| Size | U | 8.316 | 8.295 | 1.700 | 0.421 | 0.980 |

| M | 8.316 | 8.307 | 0.700 | 0.270 | 0.789 | |

| Lev | U | 0.428 | 0.409 | 9.300 | 0 | 1.020 |

| M | 0.427 | 0.419 | 4.500 | 1.690 | 0.0900 | |

| ROA | U | 0.0389 | 0.0425 | −5.300 | 0.0120 | 1.040 |

| M | 0.0391 | 0.0412 | −3.200 | −1.190 | 0.232 | |

| Growth | U | 0.179 | 0.164 | 3.900 | 0.0680 | 0.970 |

| M | 0.179 | 0.176 | 0.800 | 0.280 | 0.776 | |

| CFO | U | 0.0512 | 0.0535 | −3.200 | 0.131 | 0.990 |

| M | 0.0513 | 0.0519 | −0.900 | −0.350 | 0.727 | |

| PPE | U | 0.226 | 0.246 | −13.80 | 0 | 0.950 |

| M | 0.226 | 0.222 | 3 | 1.140 | 0.256 | |

| LnListAge | U | 2.167 | 2.132 | 4.400 | 0.0400 | 0.85 * |

| M | 2.166 | 2.171 | −0.700 | −0.270 | 0.790 | |

| Top1 | U | 0.332 | 0.341 | −6.500 | 0.00300 | 0.89 * |

| M | 0.332 | 0.336 | −2.800 | −1.040 | 0.299 | |

| LnBoard | U | 2.089 | 2.131 | −20.90 | 0 | 1.23 * |

| M | 2.090 | 2.091 | −0.800 | −0.270 | 0.785 | |

| IndDr | U | 0.384 | 0.374 | 19.10 | 0 | 1.16 * |

| M | 0.384 | 0.386 | −3.300 | −1.190 | 0.233 | |

| Dual | U | 0.386 | 0.281 | 22.50 | 0 | . |

| M | 0.386 | 0.378 | 1.700 | 0.630 | 0.528 | |

| POE | U | 0.728 | 0.651 | 16.70 | 0 | . |

| M | 0.727 | 0.713 | 3.100 | 1.190 | 0.235 | |

| LnGDP | U | 9.224 | 8.625 | 57.20 | 0 | 0.71 * |

| M | 9.223 | 9.245 | −2.100 | −0.850 | 0.394 | |

| FinDep | U | 1.763 | 1.642 | 16.50 | 0 | 0.67 * |

| M | 1.764 | 1.789 | −3.400 | −1.400 | 0.163 | |

| Mrkt | U | 9.909 | 9.627 | 15.30 | 0 | 1.12 * |

| M | 9.910 | 9.852 | 3.200 | 1.240 | 0.213 | |

References

- Okabe, M. Cross Shareholdings in Japan: A New Unified Perspective of the Economic System; Edward Elgar Publishing Ltd.: Cheltenham, UK, 2002; ISBN 978-1-84064-976-5. [Google Scholar]

- Franzoni, F.; Giannetti, M. Costs and Benefits of Financial Conglomerate Affiliation: Evidence from Hedge Funds. J. Financ. Econ. 2019, 134, 355–380. [Google Scholar] [CrossRef]

- Nagarajan, V.; Mohanty, P.; Khatua, A. Financing Effects of Corporate Diversification: A Review. Rev. Manag. Sci. 2023, 17, 2555–2585. [Google Scholar] [CrossRef]

- Almeida, H.; Kim, C.-S.; Kim, H.B. Internal Capital Markets in Business Groups: Evidence from the Asian Financial Crisis. J. Financ. 2015, 70, 2539–2586. [Google Scholar] [CrossRef]

- Deng, M.; Fang, X.; Lyu, Q.; Luo, W. How Does Corporate Financialization Affect Operational Risk? Evidence from Chinese Listed Companies. Econ. Res.-Ekon. Istraživanja 2023, 36, 1–21. [Google Scholar] [CrossRef]

- Liu, L.; Li, Y. Enterprise Financialization and Stock Price Crash Risk. Financ. Res. Lett. 2024, 60, 104878. [Google Scholar] [CrossRef]

- Ghisetti, C.; Quatraro, F. Green Technologies and Environmental Productivity: A Cross-Sectoral Analysis of Direct and Indirect Effects in Italian Regions. Ecol. Econ. 2017, 132, 1–13. [Google Scholar] [CrossRef]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef]

- Andreoni, J.; Levinson, A. The Simple Analytics of the Environmental Kuznets Curve. J. Public Econ. 2001, 80, 269–286. [Google Scholar] [CrossRef]

- Gray, W.B.; Shadbegian, R.J. Plant Vintage, Technology, and Environmental Regulation. J. Environ. Econ. Manag. 2003, 46, 384–402. [Google Scholar] [CrossRef]

- Liu, S.; Wang, Y. Green Innovation Effect of Pilot Zones for Green Finance Reform: Evidence of Quasi Natural Experiment. Technol. Forecast. Soc. Change 2023, 186, 122079. [Google Scholar] [CrossRef]

- Andersen, D.C. Do Credit Constraints Favor Dirty Production? Theory and Plant-Level Evidence. J. Environ. Econ. Manag. 2017, 84, 189–208. [Google Scholar] [CrossRef]

- Polzin, F. Mobilizing Private Finance for Low-Carbon Innovation—A Systematic Review of Barriers and Solutions. Renew. Sustain. Energy Rev. 2017, 77, 525–535. [Google Scholar] [CrossRef]

- Ebrahimi, P.; Mirbargkar, S.M. Green Entrepreneurship and Green Innovation for SME Development in Market Turbulence. Eurasian Bus. Rev. 2017, 7, 203–228. [Google Scholar] [CrossRef]

- Tassey, G. Policy Issues for R&D Investment in a Knowledge-Based Economy. J. Technol. Transf. 2004, 29, 153–185. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Gomez-Mejia, L.R. Necessity as the Mother of ‘Green’ Inventions: Institutional Pressures and Environmental Innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- Han, F.; Mao, X.; Yu, X.; Yang, L. Government Environmental Protection Subsidies and Corporate Green Innovation: Evidence from Chinese Microenterprises. J. Innov. Knowl. 2024, 9, 100458. [Google Scholar] [CrossRef]

- Feng, S.; Zhang, R.; Li, G. Environmental Decentralization, Digital Finance and Green Technology Innovation. Struct. Change Econ. Dyn. 2022, 61, 70–83. [Google Scholar] [CrossRef]

- Yu, C.-H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for Green Finance: Resolving Financing Constraints on Green Innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Gilbert, S.; Zhou, L. The Knowns and Unknowns of China’s Green Finance. Available online: https://newclimateeconomy.net/content/knowns-and-unknowns-chinas-green-finance-0 (accessed on 14 May 2025).

- Xing, C.; Zhang, Y.; Tripe, D. Green Credit Policy and Corporate Access to Bank Loans in China: The Role of Environmental Disclosure and Green Innovation. Int. Rev. Financ. Anal. 2021, 77, 101838. [Google Scholar] [CrossRef]

- Zhou, G.; Liu, C.; Luo, S. Resource Allocation Effect of Green Credit Policy: Based on DID Model. Mathematics 2021, 9, 159. [Google Scholar] [CrossRef]

- Omarini, A. Banks and Fintechs: How to Develop a Digital Open Banking Approach for the Bank’s Future. Int. Bus. Res. 2018, 11, 23–36. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of Digital Finance on Financial Inclusion and Stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Hu, G.; Wang, X.; Wang, Y. Can the Green Credit Policy Stimulate Green Innovation in Heavily Polluting Enterprises? Evidence from a Quasi-Natural Experiment in China. Energy Econ. 2021, 98, 105134. [Google Scholar] [CrossRef]

- Demertzis, M.; Merler, S.; Wolff, G.B. Capital Markets Union and the Fintech Opportunity. J. Financ. Regul. 2018, 4, 157–165. [Google Scholar] [CrossRef]

- Gomber, P.; Koch, J.-A.; Siering, M. Digital Finance and FinTech : Current Research and Future Research Directions. J. Bus. Econ. 2017, 87, 537–580. [Google Scholar] [CrossRef]

- Chen, M.A.; Wu, Q.; Yang, B. How Valuable Is FinTech Innovation? Rev. Financ. Stud. 2019, 32, 2062–2106. [Google Scholar] [CrossRef]

- Bazarbash, M. FinTech in Financial Inclusion: Machine Learning Applications in Assessing Credit Risk; International Monetary Fund: Washington, DC, USA, 2019. [Google Scholar] [CrossRef]

- Nassiry, D. The Role of Fintech in Unlocking Green Finance: Policy Insights for Developing Countries; Asian Development Bank Institute (ADBI): Tokyo, Japan, 2018. [Google Scholar]

- Kong, T.; Sun, R.; Sun, G.; Song, Y. Effects of Digital Finance on Green Innovation Considering Information Asymmetry: An Empirical Study Based on Chinese Listed Firms. Emerg. Mark. Financ. Trade 2022, 58, 4399–4411. [Google Scholar] [CrossRef]

- Li, X.; Shao, X.; Chang, T.; Albu, L.L. Does Digital Finance Promote the Green Innovation of China’s Listed Companies? Energy Econ. 2022, 114, 106254. [Google Scholar] [CrossRef]

- Hossain, M.R.; Rao, A.; Sharma, G.D.; Dev, D.; Kharbanda, A. Empowering Energy Transition: Green Innovation, Digital Finance, and the Path to Sustainable Prosperity through Green Finance Initiatives. Energy Econ. 2024, 136, 107736. [Google Scholar] [CrossRef]

- Zhang, D. Can Digital Finance Empowerment Reduce Extreme ESG Hypocrisy Resistance to Improve Green Innovation? Energy Econ. 2023, 125, 106756. [Google Scholar] [CrossRef]

- Lee, C.-C.; Lee, C.-C. How Does Green Finance Affect Green Total Factor Productivity? Evidence from China. Energy Econ. 2022, 107, 105863. [Google Scholar] [CrossRef]

- Zhao, X.; Benkraiem, R.; Abedin, M.Z.; Zhou, S. The Charm of Green. Finance: Can Green Finance Reduce Corporate Carbon Emissions? Energy Econ. 2024, 134, 107574. [Google Scholar] [CrossRef]

- Chen, Y.-S. The Driver of Green Innovation and Green Image—Green Core Competence. J. Bus. Ethics 2008, 81, 531–543. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary Nonfinancial Disclosure and the Cost of Equity Capital: The Initiation of Corporate Social Responsibility Reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Zhao, S.; Abbassi, W.; Hunjra, A.I.; Zhang, H. How Do Government R&D Subsidies Affect Corporate Green Innovation Choices? Perspectives from Strategic and Substantive Innovation. Int. Rev. Econ. Financ. 2024, 93, 1378–1396. [Google Scholar] [CrossRef]

- Luo, Y.; Xiong, G.; Mardani, A. Environmental Information Disclosure and Corporate Innovation: The “Inverted U-Shaped” Regulating Effect of Media Attention. J. Bus. Res. 2022, 146, 453–463. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R. Industry Growth and Capital Allocation: Does Having a Market- or Bank-Based System Matter? J. Financ. Econ. 2002, 64, 147–180. [Google Scholar] [CrossRef]

- Liu, Y.; Yang, Y.; Li, H.; Zhong, K. Digital Economy Development, Industrial Structure Upgrading and Green Total Factor Productivity: Empirical Evidence from China’s Cities. Int. J. Environ. Res. Public Health 2022, 19, 2414. [Google Scholar] [CrossRef]

- Falcone, P.M.; Morone, P.; Sica, E. Greening of the Financial System and Fuelling a Sustainability Transition: A Discursive Approach to Assess Landscape Pressures on the Italian Financial System. Technol. Forecast. Soc. Change 2018, 127, 23–37. [Google Scholar] [CrossRef]

- UNEP. The Financial System We Need: Aligning the Financial System with Sustainable Development. Available online: https://www.uncclearn.org/wp-content/uploads/library/the_financial_system_we_need_aligning_the_financial_system_with_sustainable_development-2015the_financial_system_we_need_ch.pdf.pdf (accessed on 30 April 2025).

- He, L.; Liu, R.; Zhong, Z.; Wang, D.; Xia, Y. Can Green Financial Development Promote Renewable Energy Investment Efficiency? A Consideration of Bank Credit. Renew. Energy 2019, 143, 974–984. [Google Scholar] [CrossRef]

- Goldstein, I.; Jiang, W.; Karolyi, G.A. To FinTech and Beyond. Rev. Financ. Stud. 2019, 32, 1647–1661. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Chahal, S. Navigating Financial Evolution: Business Process Optimization and Digital Transformation in the Finance Sector. Int. J. Financ. 2023, 8, 67–81. [Google Scholar] [CrossRef]

- Zhou, D.; Kautonen, M.; Dai, W.; Zhang, H. Exploring How Digitalization Influences Incumbents in Financial Services: The Role of Entrepreneurial Orientation, Firm Assets, and Organizational Legitimacy. Technol. Forecast. Soc. Change 2021, 173, 121120. [Google Scholar] [CrossRef]

- Ma, K. Digital Inclusive Finance and Corporate Green Technology Innovation. Financ. Res. Lett. 2023, 55, 104015. [Google Scholar] [CrossRef]

- Liu, J.; Jiang, Y.; Gan, S.; He, L.; Zhang, Q. Can Digital Finance Promote Corporate Green Innovation? Environ. Sci. Pollut. Res. 2022, 29, 35828–35840. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Feng, J.; Yuan, Y. Green Investors and Corporate ESG Performance: Evidence from China. Financ. Res. Lett. 2024, 60, 104892. [Google Scholar] [CrossRef]

- Jiang, F.; Jiang, Z.; Huang, J.; Kim, K.A.; Nofsinger, J.R. Bank Competition and Leverage Adjustments. Financ. Manag. 2017, 46, 995–1022. [Google Scholar] [CrossRef]

- Jaffee, D.M.; Russell, T. Imperfect Information, Uncertainty, and Credit Rationing. Q. J. Econ. 1976, 90, 651–666. [Google Scholar] [CrossRef]

- Stiglitz, J.; Weiss, A. Credit Rationing in Markets with Imperfect Information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Myers, S.C.; Majluf, N.S. Corporate Financing and Investment Decisions When Firms Have Information That Investors Do Not Have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Norden, L.; Silva Buston, C.; Wagner, W. Financial Innovation and Bank Behavior: Evidence from Credit Markets. J. Econ. Dyn. Control 2014, 43, 130–145. [Google Scholar] [CrossRef]

- Lee, C.-C.; Li, X.; Yu, C.-H.; Zhao, J. Does Fintech Innovation Improve Bank Efficiency? Evidence from China’s Banking Industry. Int. Rev. Econ. Financ. 2021, 74, 468–483. [Google Scholar] [CrossRef]

- Lin, B.; Ma, R. How Does Digital Finance Influence Green Technology Innovation in China? Evidence from the Financing Constraints Perspective. J. Environ. Manag. 2022, 320, 115833. [Google Scholar] [CrossRef]

- Ming, W.; Zhou, Z.; Ai, H.; Bi, H.; Zhong, Y. COVID-19 and Air Quality: Evidence from China. In Research on Pandemics; Routledge: Oxfordshire, UK, 2021; ISBN 978-1-003-21468-7. [Google Scholar]

- Du, K.; Cheng, Y.; Yao, X. Environmental Regulation, Green Technology Innovation, and Industrial Structure Upgrading: The Road to the Green Transformation of Chinese Cities. Energy Econ. 2021, 98, 105247. [Google Scholar] [CrossRef]

- Feng, Y.; Wang, X.; Liang, Z. How Does Environmental Information Disclosure Affect Economic Development and Haze Pollution in Chinese Cities? The Mediating Role of Green Technology Innovation. Sci. Total Environ. 2021, 775, 145811. [Google Scholar] [CrossRef]

- Shao, Y.; Chen, Z. Can Government Subsidies Promote the Green Technology Innovation Transformation? Evidence from Chinese Listed Companies. Econ. Anal. Policy 2022, 74, 716–727. [Google Scholar] [CrossRef]

- Ang, J.S.; Cole, R.A.; Lin, J.W. Agency Costs and Ownership Structure. J. Financ. 2000, 55, 81–106. [Google Scholar] [CrossRef]

- Kim, O.; Verrecchia, R.E. The Relation among Disclosure, Returns, and Trading Volume Information. Account. Rev. 2001, 76, 633–654. [Google Scholar] [CrossRef]

- Song, M.; Wang, S.; Zhang, H. Could Environmental Regulation and R&D Tax Incentives Affect Green Product Innovation? J. Clean. Prod. 2020, 258, 120849. [Google Scholar] [CrossRef]

- Chen, Z.; Kahn, M.E.; Liu, Y.; Wang, Z. The Consequences of Spatially Differentiated Water Pollution Regulation in China. J. Environ. Econ. Manag. 2018, 88, 468–485. [Google Scholar] [CrossRef]

- Liu, Z.; Tang, Y.; Wilson, J.; Tao, X.; Lv, B.; Wang, Z.; Xu, Y.; Zhang, Z.; Zhang, Y.; Zhao, W. Influence of Government Attention on Environmental Quality: An Analysis of 30 Provinces in China. Environ. Impact Assess. Rev. 2023, 100, 107084. [Google Scholar] [CrossRef]

- Porter, M.E. America’ s Green Strategy. Sci. Am. 1991, 264, 168. [Google Scholar] [CrossRef]

- Trinugroho, I.; Pamungkas, P.; Wiwoho, J.; Damayanti, S.M.; Pramono, T. Adoption of Digital Technologies for Micro and Small Business in Indonesia. Financ. Res. Lett. 2022, 45, 102156. [Google Scholar] [CrossRef]

- Li, G.; Xue, Q.; Qin, J. Environmental Information Disclosure and Green Technology Innovation: Empirical Evidence from China. Technol. Forecast. Soc. Change 2022, 176, 121453. [Google Scholar] [CrossRef]

- Tang, C.; Xu, Y.; Hao, Y.; Wu, H.; Xue, Y. What Is the Role of Telecommunications Infrastructure Construction in Green Technology Innovation? A Firm-Level Analysis for China. Energy Econ. 2021, 103, 105576. [Google Scholar] [CrossRef]

- Sheng, D.; Guyot, O.; Sheng, D.; Guyot, O. Market Power, Internal and External Monitoring, and Firm Distress in the Chinese Market. Data Sci. Financ. Econ. 2024, 4, 285–308. [Google Scholar] [CrossRef]

| Core Initiatives | Main Elements and Objectives | Implications |

|---|---|---|

| Establish industry–finance collaboration platforms | Enhance information exchange efficiency; Issue policy guidance to orient financial institutions. | Reduce information asymmetry and transaction costs; Improve credit accessibility |

| Innovate financial support | Develop customized financing services; Innovate sector-specific credit instruments (e.g., industrial, ICT); Develop financial tools for Dual E&I (entrepreneurship and innovation). | Diversify financing channels; Lower financing costs. |

| Enhance supply chain finance | Support group-affiliated finance company establishment; Expand pilots for supply chain finance; Promote financial leasing for advanced equipment. | |

| Develop financing information lists for key firms and projects | Screen financing needs based on policy and sector priorities; Guide bank–firm matchmaking. | Regulate financial resource allocation. |

| Category-specific and precision-based support | Define and prioritize key sectors; Provide sector-specific financial guidance; Rationalize credit to support orderly market exit. | Promote targeted financial support. |

| Improve corporate governance for financing | Improve management of platform-integrated firms; Enhance financial literacy training for target firms; Promote environmental and other multidimensional disclosures to reduce bank–firm information asymmetry. | Improve information disclosure; Mitigate agency problems. |

| Reinforce safeguards | Leverage fiscal funds as catalytic capital to facilitate bank–firm matchmaking and industry–finance collaboration. | Increase fiscal support; Leverage private capital. |

| Variable | Description | Measurement |

|---|---|---|

| LnGrePata | Firms’ GI | ln(1 + number of green patent applications) |

| TP | Initiation of the IFCP policy | Equals 1 if IFCP is implemented in firm’s region; 0 otherwise |

| Size | Asset size | ln(Assets) |

| Lev | Leverage ratio | Liabilities ÷ Assets |

| ROA | Return on assets | Net profit ÷ Average assets |

| Growth | Operating income growth | (Operating income in t ÷ Operating income in t − 1) − 1 |

| CFO | Cash flow | Net cash flow from operating activities ÷ Average assets |

| PPE | Capital intensity | Net PPE ÷ Assets |

| LnListAge | Years since listing | ln(Current year − IPO year) |

| Top1 | Ownership concentration | Largest shareholder stake |

| LnBoard | Board size | ln(1 + number of board members) |

| IndDr | Independent director ratio | Independent directors ÷ Total board members |

| Dual | CEO duality | Equals 1 if chairman and GM are the same person; 0 otherwise |

| POE | Property rights nature | Equals 1 for private firms; 0 otherwise |

| LnGDP | City economic output | ln(1 + urban GDP) |

| FinDep | Financial development level | Total loans from urban financial institutions ÷ Urban GDP |

| Mrkt | Marketization level | Marketization index |

| Variable | N | Mean | SD | Min | Median | Max |

|---|---|---|---|---|---|---|

| LnGrePata | 14,013 | 0.500 | 0.899 | 0 | 0 | 3.892 |

| Treat | 14,013 | 0.201 | 0.401 | 0 | 0 | 1 |

| TP | 14,013 | 0.123 | 0.328 | 0 | 0 | 1 |

| Size | 14,013 | 8.320 | 1.249 | 5.844 | 8.134 | 12.115 |

| Lev | 14,013 | 0.415 | 0.199 | 0.050 | 0.407 | 0.967 |

| ROA | 14,013 | 0.042 | 0.066 | −0.264 | 0.040 | 0.234 |

| Growth | 14,013 | 0.168 | 0.377 | −0.575 | 0.111 | 2.591 |

| CFO | 14,013 | 0.053 | 0.071 | −0.168 | 0.051 | 0.263 |

| PPE | 14,013 | 0.243 | 0.147 | 0.010 | 0.214 | 0.682 |

| LnListAge | 14,013 | 2.145 | 0.800 | 0.000 | 2.303 | 3.367 |

| Top1 | 14,013 | 0.343 | 0.145 | 0.088 | 0.321 | 0.743 |

| LnBoard | 14,013 | 2.126 | 0.194 | 1.609 | 2.197 | 2.639 |

| IndDr | 14,013 | 0.376 | 0.053 | 0.333 | 0.353 | 0.571 |

| Dual | 14,013 | 0.295 | 0.456 | 0 | 0 | 1 |

| POE | 14,013 | 0.654 | 0.476 | 0 | 1 | 1 |

| LnGDP | 14,013 | 8.730 | 1.134 | 6.191 | 8.699 | 10.707 |

| FinDep | 14,013 | 1.662 | 0.778 | 0.289 | 1.621 | 4.488 |

| Mrkt | 14,013 | 9.646 | 1.831 | 4.076 | 10.053 | 12.864 |

| (1) | (2) | |

|---|---|---|

| Variable | LnGrePata | LnGrePata |

| TP | 0.066 *** | 0.075 *** |

| (2.78) | (3.08) | |

| Size | 0.079 *** | |

| (6.24) | ||

| Lev | 0.056 | |

| (1.08) | ||

| ROA | 0.350 *** | |

| (3.29) | ||

| Growth | 0.025 * | |

| (1.83) | ||

| CFO | −0.060 | |

| (−0.70) | ||

| PPE | 0.014 | |

| (0.21) | ||

| LnListAge | −0.054 ** | |

| (−2.50) | ||

| Top1 | −0.068 | |

| (−0.79) | ||

| LnBoard | −0.061 | |

| (−1.11) | ||

| IndDr | 0.158 | |

| (0.95) | ||

| Dual | 0.002 | |

| (0.12) | ||

| POE | 0.013 | |

| (0.41) | ||

| LnGDP | −0.019 | |

| (−0.63) | ||

| FinDep | −0.028 * | |

| (−1.75) | ||

| Mrkt | −0.003 | |

| (−0.26) | ||

| Constant | 0.323 *** | 0.051 |

| (14.90) | (0.17) | |

| Year | YES | YES |

| Firm | YES | YES |

| Obs. | 14,013 | 14,013 |

| R-squared | 0.0278 | 0.0344 |

| (1) | (2) | |

|---|---|---|

| Variable | LnGrePatg | LnGrePata |

| TP | 0.099 *** | 0.075 * |

| (4.69) | (1.74) | |

| Controls | YES | YES |

| Constant | −0.362 | 0.051 |

| (−1.34) | (0.11) | |

| Year/Firm | YES | YES |

| Cluster standard error | NO | YES |

| Obs. | 14,013 | 14,013 |

| R-squared | 0.0417 | 0.0344 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Add Exited Initial Cities | Add 2nd Batch Cities | Exited Initial Cities | City Fixed | |

| Variable | LnGrePata | LnGrePata | LnGrePata | LnGrePata |

| TP | 0.049 *** | 0.045 *** | 0.024 | 0.066 *** |

| (2.64) | (2.79) | (1.07) | (2.67) | |

| Controls | YES | YES | YES | YES |

| Constant | 0.088 | 0.089 | 0.257 | −0.434 |

| (0.32) | (0.35) | (0.86) | (−0.98) | |

| Year/Firm | YES | YES | YES | YES |

| City | NO | NO | NO | YES |

| Obs. | 16,917 | 19,253 | 14,095 | 14,013 |

| R-squared | 0.0328 | 0.0340 | 0.0283 | 0.0388 |

| (1) | |

|---|---|

| Variable | LnGrePata |

| TP | 0.087 *** |

| (2.85) | |

| Controls | YES |

| Constant | −0.625 |

| (−1.29) | |

| Year/Firm | YES |

| Obs. | 7152 |

| R-squared | 0.0438 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variable | LnGrePata | LnGrePata | LnGrePata |

| TP | 0.073 *** | 0.073 *** | 0.075 *** |

| (3.01) | (2.98) | (3.10) | |

| Gcres | −0.088 * | ||

| (−1.89) | |||

| GreFin | −0.043 | ||

| (−0.94) | |||

| EpTax | 0.031 | ||

| (1.44) | |||

| Controls | YES | YES | YES |

| Constant | 0.028 | 0.043 | 0.032 |

| (0.09) | (0.14) | (0.10) | |

| Year/Firm | YES | YES | YES |

| Obs. | 14,013 | 14,013 | 14,013 |

| R-squared | 0.0347 | 0.0345 | 0.0346 |

| (1) | (2) | |

|---|---|---|

| Variable | GreFisSub | GreInvHld |

| TP | 1.002 *** | 0.025 * |

| (5.31) | (1.78) | |

| Controls | YES | YES |

| Constant | 0.996 | 0.182 |

| (0.41) | (1.01) | |

| Year/Firm | YES | YES |

| Obs. | 14,013 | 14,013 |

| R-squared | 0.2708 | 0.0181 |

| (1) | (2) | |

|---|---|---|

| Variable | ED | AC |

| TP | 0.011 *** | −0.009 *** |

| (2.98) | (−3.33) | |

| Controls | YES | YES |

| Constant | 3.756 *** | 0.220 *** |

| (78.40) | (6.72) | |

| Year/Firm | YES | YES |

| Obs. | 14,013 | 14,011 |

| R-squared | 0.1396 | 0.1594 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | CC | GC | KV | TC |

| TP | −0.090 *** | 0.013 *** | −0.021 *** | −0.632 ** |

| (−2.83) | (2.89) | (−2.91) | (−2.54) | |

| Controls | YES | YES | YES | YES |

| Constant | 1.760 *** | 0.210 *** | −0.345 *** | 8.154 *** |

| (4.40) | (3.68) | (−3.67) | (2.60) | |

| Year/Firm | YES | YES | YES | YES |

| Obs. | 12,966 | 14,013 | 13,405 | 12,063 |

| R-squared | 0.0306 | 0.0233 | 0.2178 | 0.0119 |

| Regulation Intensity | Pollution Intensity | Asset Size | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| High | Low | High | Low | Large | Small | |

| Variable | LnGrePata | LnGrePata | LnGrePata | LnGrePata | LnGrePata | LnGrePata |

| TP | 0.096 ** | 0.027 | 0.087 ** | 0.058 * | 0.004 | 0.085 ** |

| (2.18) | (0.68) | (2.16) | (1.83) | (0.10) | (2.51) | |

| Controls | YES | YES | YES | YES | YES | YES |

| Constant | 0.964 * | −0.490 | 1.047 ** | −0.686 | 1.006 ** | 0.541 |

| (1.79) | (−1.08) | (2.20) | (−1.55) | (2.10) | (1.36) | |

| Year/Firm | YES | YES | YES | YES | YES | YES |

| Obs. | 6139 | 7719 | 5313 | 8700 | 7073 | 6940 |

| R-squared | 0.0342 | 0.0366 | 0.0296 | 0.0446 | 0.0464 | 0.0209 |

| Substantive GI | Tactical GI | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Variable | LnGreInva | LnGreInvg | LnGreUma | LnGreUmg |

| TP | 0.014 | 0.018 | 0.095 *** | 0.108 *** |

| (0.71) | (1.24) | (4.91) | (5.44) | |

| Controls | YES | YES | YES | YES |

| Constant | −0.465 * | −0.701 *** | 0.461 * | 0.080 |

| (−1.82) | (−3.68) | (1.86) | (0.32) | |

| Year/Firm | YES | YES | YES | YES |

| Obs. | 14,013 | 14,013 | 14,013 | 14,013 |

| R-squared | 0.0276 | 0.0336 | 0.0265 | 0.0283 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, X.; Li, J.; Zheng, J. China’s Industry–Finance Collaboration Pilot in Stimulating Corporate Green Innovation. Sustainability 2025, 17, 4508. https://doi.org/10.3390/su17104508

Xu X, Li J, Zheng J. China’s Industry–Finance Collaboration Pilot in Stimulating Corporate Green Innovation. Sustainability. 2025; 17(10):4508. https://doi.org/10.3390/su17104508

Chicago/Turabian StyleXu, Xinyan, Jieyu Li, and Jianming Zheng. 2025. "China’s Industry–Finance Collaboration Pilot in Stimulating Corporate Green Innovation" Sustainability 17, no. 10: 4508. https://doi.org/10.3390/su17104508

APA StyleXu, X., Li, J., & Zheng, J. (2025). China’s Industry–Finance Collaboration Pilot in Stimulating Corporate Green Innovation. Sustainability, 17(10), 4508. https://doi.org/10.3390/su17104508