Transition Pathways for Low-Carbon Steel Manufacture in East Asia: The Role of Renewable Energy and Technological Collaboration

Abstract

1. Background

2. Methodology

2.1. Scenario Setting

2.2. Model Description

2.3. H-DRI Transport

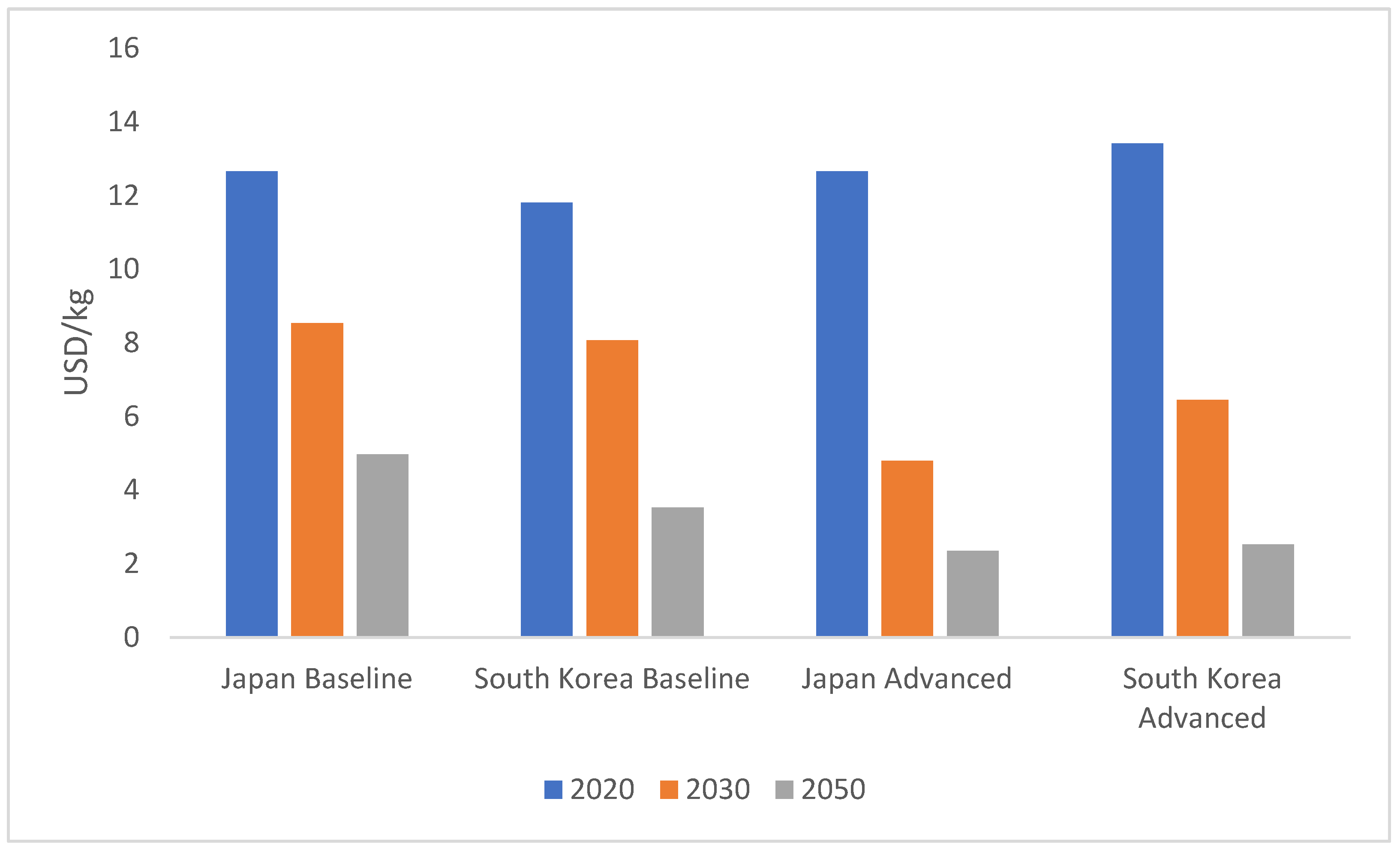

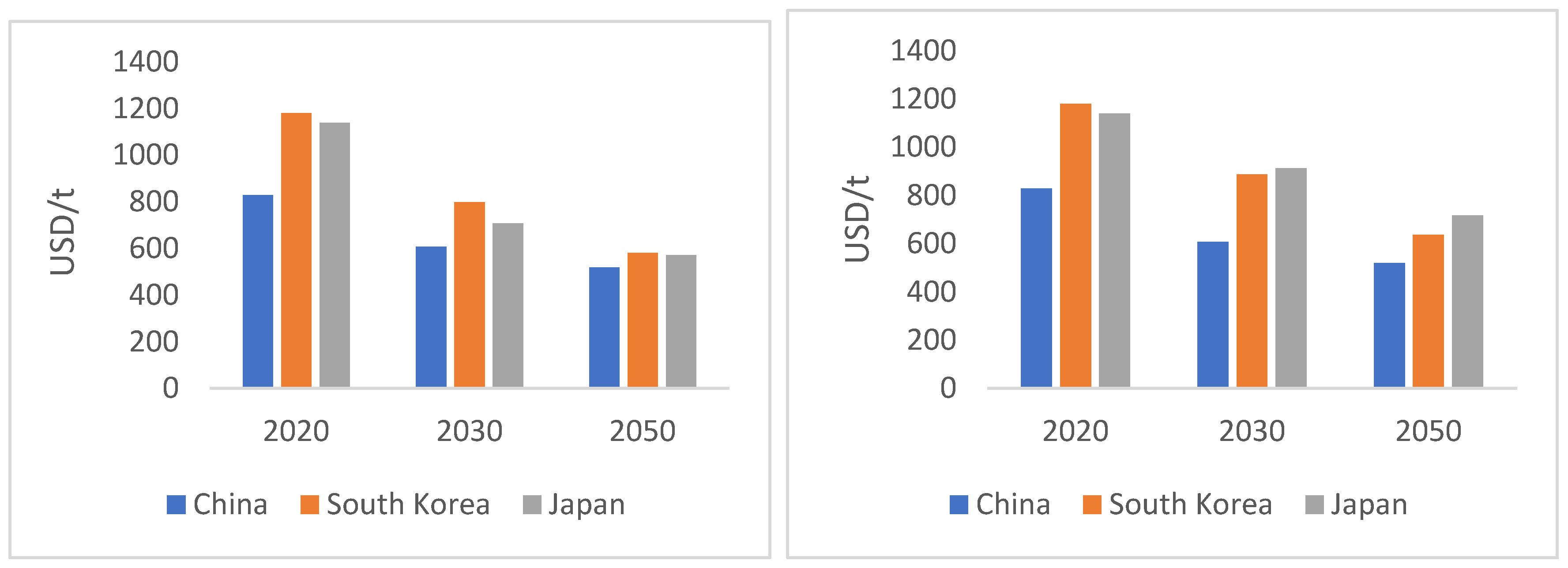

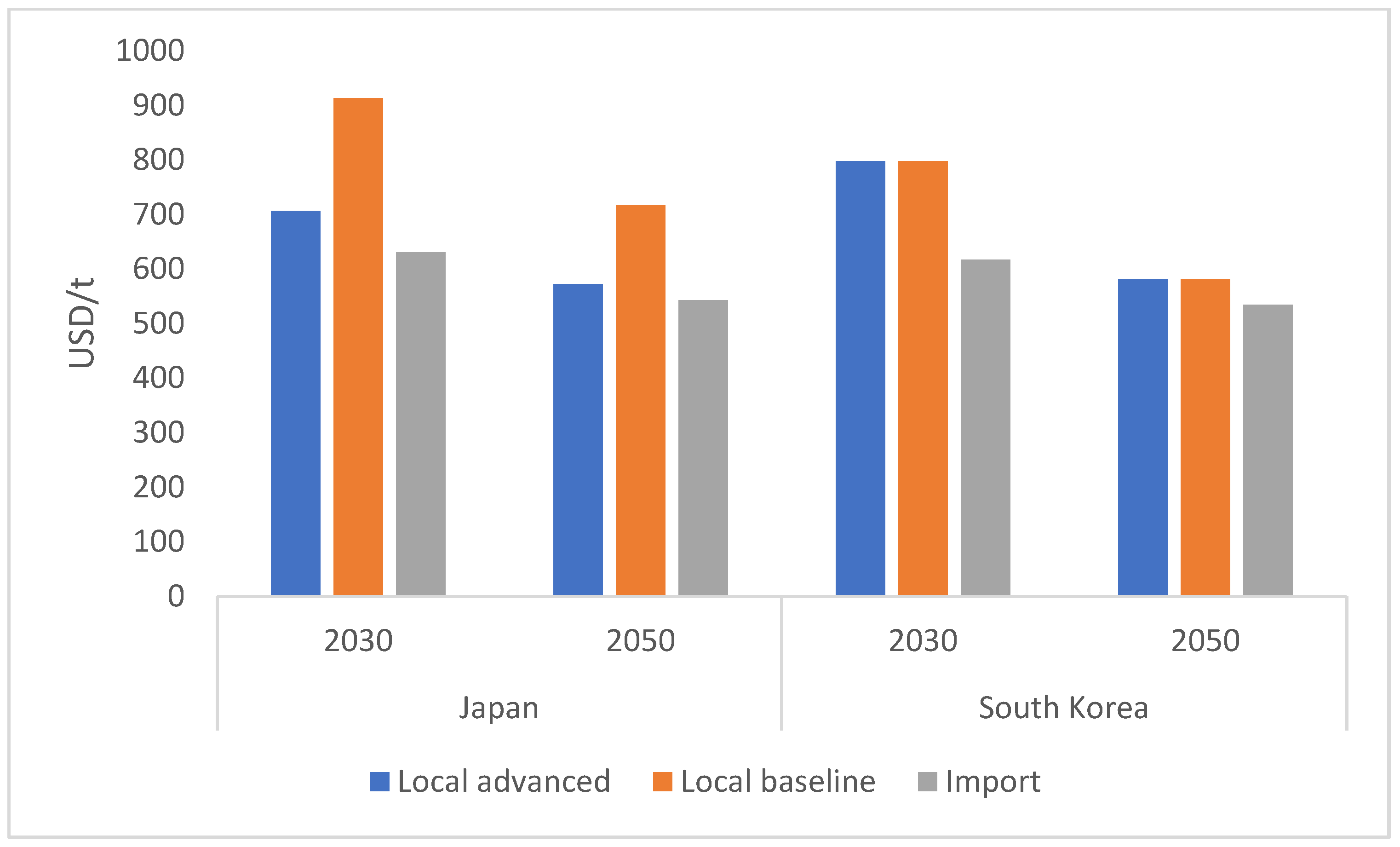

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhang, J.; Shen, H.; Chen, Y.; Meng, J.; Li, J.; He, J.; Guo, P.; Dai, R.; Zhang, Y.; Xu, R.; et al. Iron and steel industry emissions: A global analysis of trends and drivers. Environ. Sci. Technol. 2023, 57, 16477–16488. [Google Scholar] [CrossRef] [PubMed]

- Worldsteel. Crude Steel Production and 2023 Global Crude Steel Production Totals. 2023. Available online: https://worldsteel.org/ (accessed on 1 January 2025).

- Zhang, X.; Jiao, K.; Zhang, J.; Guo, Z. A review on low carbon emissions projects of steel industry in the World. J. Clean. Prod. 2021, 306, 127259. [Google Scholar] [CrossRef]

- Jiang, W.; Jung, T.; Dai, H.; Xiang, P. Technology portfolio assessment for near-zero emission iron and steel industry in China. Adv. Clim. Change Res. 2023, 143, 469478. [Google Scholar] [CrossRef]

- Ren, M.; Lu, P.; Liu, X.; Hossain, M.; Fang, Y.; Hanaoka, T.; O’Gallachoir, B.; Glynn, J.; Dai, H. Decarbonizing China’s iron and steel industry from the supply and demand sides for carbon neutrality. Appl. Energy 2021, 298, 117209. [Google Scholar] [CrossRef]

- Ren, L.; Zhou, S.; Peng, T.; Ou, X. A review of CO2 emissions reduction technologies and low-carbon development in the iron and steel industry focusing on China. Renew. Sustain. Energy Rev. 2021, 143, 110846. [Google Scholar] [CrossRef]

- Pimm, A.; Cockerill, T.; Gale, W. Energy system requirements of fossil-free steelmaking using hydrogen direct reduction. J. Clean. Prod. 2021, 312, 127665. [Google Scholar] [CrossRef]

- Toktarova, A.; Göransson, L.; Johnsson, F. Design of clean steel production with hydrogen: Impact of electricity system composition. Energies 2021, 14, 8349. [Google Scholar] [CrossRef]

- Lopez, G.; Farfan, J.; Breyer, C. Trends in the global steel industry: Evolutionary projections and defossilisation pathways through power-to-steel. J. Clean. Prod. 2022, 375, 134182. [Google Scholar] [CrossRef]

- Trollip, H.; McCall, B.; Bataille, C. How green primary iron production in South Africa could help global decarbonization. Clim. Policy. 2022, 22, 236–247. [Google Scholar] [CrossRef]

- Gielen, D.; Saygin, D.; Taibi, E.; Birat, J. Renewables-based decarbonization and relocation of iron and steel making: A case study. J. Ind. Ecol. 2020, 24, 1113–1125. [Google Scholar] [CrossRef]

- Wood, T.; Dundas, G.; Ha, J. Start with Steel. 2020. Available online: https://grattan.edu.au/wp-content/uploads/2020/05/2020-06-Start-with-steel.pdf (accessed on 1 January 2025).

- Devlin, A.; Kossen, J.; Goldie-Jones, H.; Yang, A. Global green hydrogen-based steel opportunities surrounding high quality renewable energy and iron ore deposits. Nat. Commun. 2023, 14, 2578. [Google Scholar] [CrossRef] [PubMed]

- GeoScience_Australia. Australian Energy Resource Assessment. 2014. Available online: https://arena.gov.au/assets/2018/08/australian-energy-resource-assessment.pdf (accessed on 1 January 2023).

- Cao, T.; Sugiyama, M.; Ju, Y. Prospects of regional supply chain relocation for iron & steel industry decarbonization: A case study of Japan and Australia. Resour. Conserv. Recycl. 2024, 209, 107804. [Google Scholar]

- Choi, H.; Lee, H.; Han, J.; Roh, K. Revisiting the cost analysis of importing liquefied green hydrogen. Int. J. Hydrog. Energy 2024, 82, 817–827. [Google Scholar] [CrossRef]

- Jiang, W. Decarbonization Pathways, Regional Layout Analysis of Chinese Iron and Steel Industry Under Carbon Neutrality Goals. Ph.D. Thesis, Yonsei University, Seoul, Republic of Korea, 2025. Available online: https://library.yonsei.ac.kr/search/detail/CATTOT000002229499 (accessed on 24 February 2025).

- Karim, S.; Faissal, A. National renewable energy laboratory. In Handbook of Algal Biofuels; Elsevier: Amsterdam, The Netherlands, 2022; pp. 599–613. [Google Scholar]

- Jiang, K.; Xiang, P.; He, C.; Feng, S.; Liu, C.; Tan, X.; Chen, S.; Dai, C.; Deng, L. Analysis of the impact of zero carbon power on China’s industrial sector layout. Glob. Energy Internet 2021, 4, 511. [Google Scholar] [CrossRef]

- Shields, M.; Beiter, P.; Nunemaker, J.; Cooperman, A.; Duffy, P. Impacts of turbine and plant upsizing on the levelized cost of energy for offshore wind. Appl. Energy 2021, 298, 117189. [Google Scholar] [CrossRef]

- Lee, J.; Xydis, G. Floating offshore wind projects development in South Korea without government subsidies. Clean Technol. Environ. Policy 2024, 26, 1587–1602. [Google Scholar] [CrossRef]

- Song, S.; Lin, H.; Sherman, P.; Yang, X.; Nielsen, C.P.; Chen, X.; McElroy, M. Production of hydrogen from offshore wind in China and cost-competitive supply to Japan. Nat. Commun. 2021, 12, 6953. [Google Scholar] [CrossRef]

- Johnston, B.; Foley, A.; Doran, J.; Littler, T. Levelised cost of energy, A challenge for offshore wind. Renew. Energy 2020, 160, 876–885. [Google Scholar] [CrossRef]

- Martinez, A.; Iglesias, G. Site selection of floating offshore wind through the levelised cost of energy: A case study in Ireland. Energy Convers. Manag. 2022, 266, 115802. [Google Scholar] [CrossRef]

- Yoon, S.; Kim, S.; Yoon, G.; Yi, J. Comparison of LCOE of the Southwest Offshore Wind Farm According to Types and Construction Methods of Supporting Structures. J. Korean Soc. Coast. Ocean. Eng. 2023, 35, 57–66. [Google Scholar] [CrossRef]

- Hussein, N.; Abokersh, M.; Christoph, K.; Schlegl, T. Electricity Cost from Renewable Energy Technologies in Egypt; Raunhofer Institute for Solar Energy Systems ISE: Freiburg, Germany, 2016. [Google Scholar]

- Tu, C. Economic Analysis and Development Policy Research of Wind Power Projects. Master’s Thesis, North China Electric Power University, Beijing, China, 2019. [Google Scholar]

- Kost, C.; Shammugam, S.; Fluri, V.; Peper, D.; Memar, A.D.; Schlegl, T. Levelized Cost of Electricity Renewable Energy Technologies; Fraunhofer ISE: Freiburg, Germany, 2021. [Google Scholar]

- Wang, Y. Technology cost curve for climate change mitigation in electric power sector. In Low Carbon Technology and Policy in China Power Sector; Kwan Kung Press: Beijing, China, 2011. [Google Scholar]

- Minutillo, M.; Perna, A.; Forcina, A.; Di Micco, S.; Jannelli, E. Analyzing the levelized cost of hydrogen in refueling stations with on-site hydrogen production via water electrolysis in the Italian scenario. Int. J. Hydrogen Energy 2021, 46, 13667–13677. [Google Scholar] [CrossRef]

- Xiang, P.; Jiang, K.; Wang, J.; He, C.; Chen, S.; Jiang, W. Evaluation of LCOH of conventional technology, energy storage coupled solar PV electrolysis, and HTGR in China. Appl. Energy 2024, 353, 122086. [Google Scholar] [CrossRef]

- Millner, R.; Rothberger, J.; Rammer, B.; Boehm, C.; Sterrer, W.; Ofner, H.; Chevrier, V. MIDREX H2—The Road to CO2-Free Direct Reduction. In Proceedings of the AISTech, 2021, Nashville, TN, USA, 29 June–1 July 2021; 2021. [Google Scholar]

- Robert, L. South Korea Offshore Wind Market Overview. Analyst Presentation. 2017. Available online: https://www.asiawind.org/wp-content/uploads/2018/01/07-MAKE-Consulting-Robert-Liew-20-slides.pdf (accessed on 1 January 2025).

- The Ministry of Economy Trade and Industry of Japan (METI). The Strategic Road Map for Hydrogen and Fuel Cells. 2019. Available online: https://www.eu-japan.eu/sites/default/files/publications/docs/hydrogen_and_fuel_cells_in_japan.pdf (accessed on 26 February 2025).

- IEA. International Energy Agency. Offshore Wind Outlook 2019. World Energy Outlook Special Report; IEA: Paris, France, 2019. [Google Scholar]

- Papadopoulos, P.; Fallahi, F.; Yildirim, M.; Ezzat, A.A. Joint optimization of production and maintenance in offshore wind farms: Balancing the short-and long-term needs of wind energy operation. IEEE Trans. Sustain. Energy 2023, 15, 835–846. [Google Scholar] [CrossRef]

- Armijo, J.; Philibert, C. Flexible production of green hydrogen and ammonia from variable solar and wind energy. Case study of Chile and Argentina. Int. J. Hydrogen Energy 2020, 45, 1541–1558. [Google Scholar] [CrossRef]

- Ministry of Environment, Study of Potential for the Introduction of Renewable Energy (2011) Summary. Available online: https://www.env.go.jp/earth/report/h23-03/summary_en.pdf (accessed on 15 January 2023).

- Oda, J.; Akimoto, K.; Tomoda, T. Long-term global availability of steel scrap. Resour. Conserv. Recycl. 2013, 81, 81–91. [Google Scholar] [CrossRef]

- Rezaei, M.; Akimov, A.; Gray, E.M. Techno-economics of renewable hydrogen export: A case study for Australia-Japan. Appl. Energy 2024, 374, 124015. [Google Scholar] [CrossRef]

| Scenario | Renewable Energy | Hydrogen Production |

|---|---|---|

| Baseline | CAPEX decrease 30% | CAPEX decrease 30% |

| Advanced | CAPEX decrease 60% | CAPEX decrease 60% |

| China Fujian Province | South Korea (South Sea) | Japan | |

|---|---|---|---|

| Average annual utilization hours (h) | 3100 | 2600 | 2500 |

| Average annual wind speed (m/s) | 10.89 | 8.5 | 8.4 |

| Water depth | 50–100 | 5–30 | 50–100 |

| Wind power density/m2 | >500 | >500 | >500 |

| South Korea | Japan | |

|---|---|---|

| Electricity (USD/KWh) | LCOE | LCOE |

| Water (USD/t) | 0.56 | 0.6 |

| Labor(USD/full time) | 36000 | 36000 |

| 2020 | 2030 | 2050 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| China | S. Korea | Japan | China | S. Korea | Japan | China | S. Korea | Japan | |

| Wind (USD/KW) | 1700 | 4500 | 5000 | 1200 | 2100 | 2700 | 1200 | 1500 | 1700 |

| Electrolyze (USD/KW) | 1200 | 1200 | 1287 | 800 | 830 | 830 | 450 | 480 | 480 |

| SF-EAF (USD/t) | 33.52 | ||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, W.; Jung, T.; Dai, H.; Xiang, P.; Chen, S. Transition Pathways for Low-Carbon Steel Manufacture in East Asia: The Role of Renewable Energy and Technological Collaboration. Sustainability 2025, 17, 4280. https://doi.org/10.3390/su17104280

Jiang W, Jung T, Dai H, Xiang P, Chen S. Transition Pathways for Low-Carbon Steel Manufacture in East Asia: The Role of Renewable Energy and Technological Collaboration. Sustainability. 2025; 17(10):4280. https://doi.org/10.3390/su17104280

Chicago/Turabian StyleJiang, Weiyi, Taeyong Jung, Hancheng Dai, Pianpian Xiang, and Sha Chen. 2025. "Transition Pathways for Low-Carbon Steel Manufacture in East Asia: The Role of Renewable Energy and Technological Collaboration" Sustainability 17, no. 10: 4280. https://doi.org/10.3390/su17104280

APA StyleJiang, W., Jung, T., Dai, H., Xiang, P., & Chen, S. (2025). Transition Pathways for Low-Carbon Steel Manufacture in East Asia: The Role of Renewable Energy and Technological Collaboration. Sustainability, 17(10), 4280. https://doi.org/10.3390/su17104280