Index Insurance for Forage, Pasture, and Rangeland: A Review of Developed (USA and Canada) and Developing (Kenya and Ethiopia) Countries

Abstract

1. Introduction

2. Methods, Approach Used and Literature Search

- -

- “Forage index insurance in the USA”

- -

- “Index insurance for pasture + Canada”

- -

- “Index insurance for pasture + USA”

- -

- “Index insurance for rangelands in Canada”

- -

- “Index insurance for rangelands in the USA”

- -

- “Index insurance for prairies in North America”

Synthesis of Results

3. Index-Based Insurance

4. Existing Index Insurance Regimes in Developed (USA and Canada) and Developing (Kenya and Ethiopia) Regions

4.1. FPRI-Developed Region (USA and Canada)

- a.

- April–June;

- b.

- May–July;

- c.

- June–August;

- d.

- July–September;

- e.

- August–October.

4.1.1. Index and Grid

4.1.2. Grid Area, Dollar Coverage Levels, and Coverage Periods

4.1.3. Premiums, Subsidies, Losses, and Indemnities

- Coverage value: This is the dollar value for each forage stand, multiplied by the number of stands covered;

- Coverage level: To sign-up, producers have a choice of choosing a minimum of CAD 2000 or total forage crop value;

- Coverage alternative: Can either be the base plan, monthly weighting, bi-monthly, or three-month alternatives.

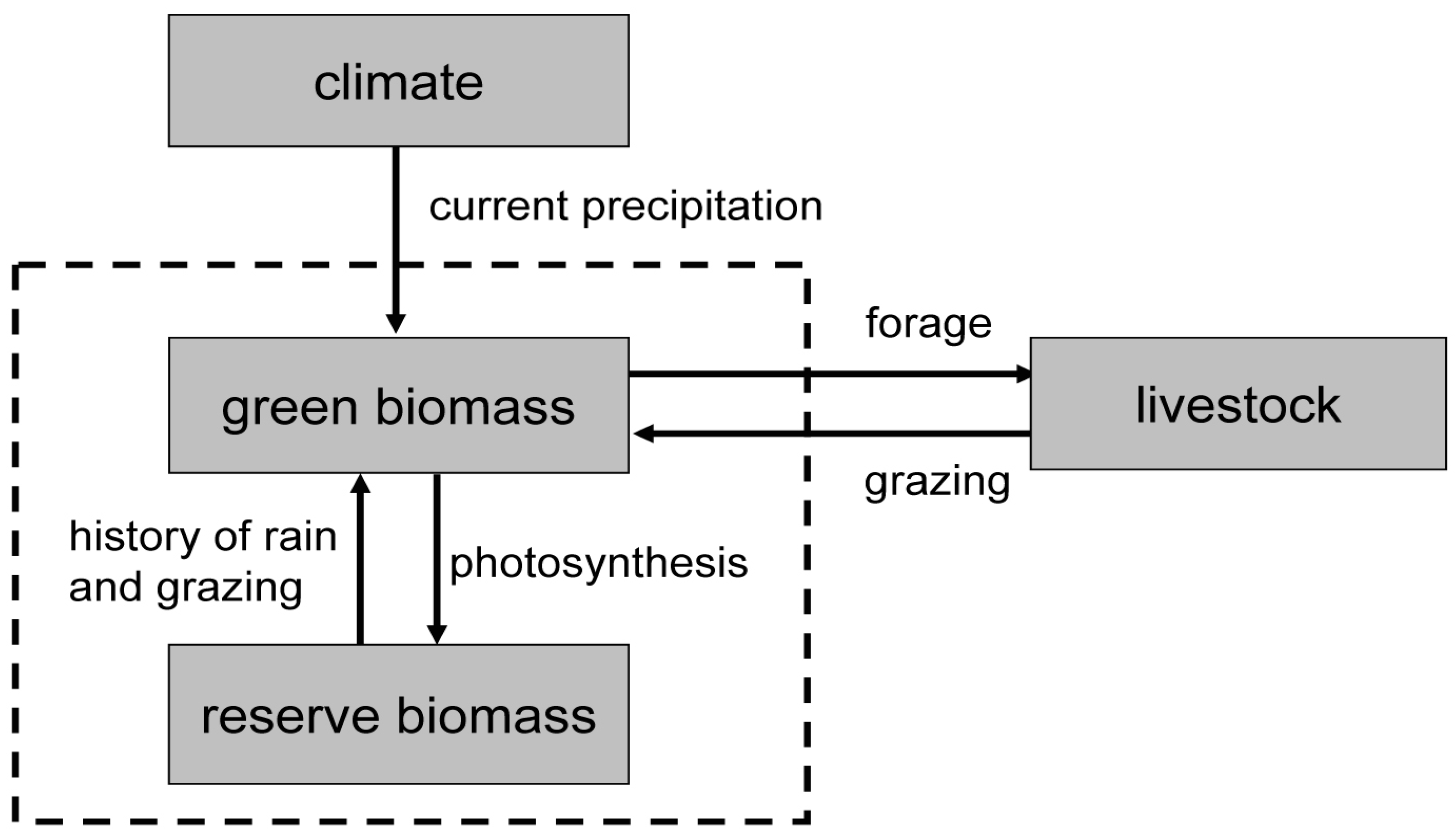

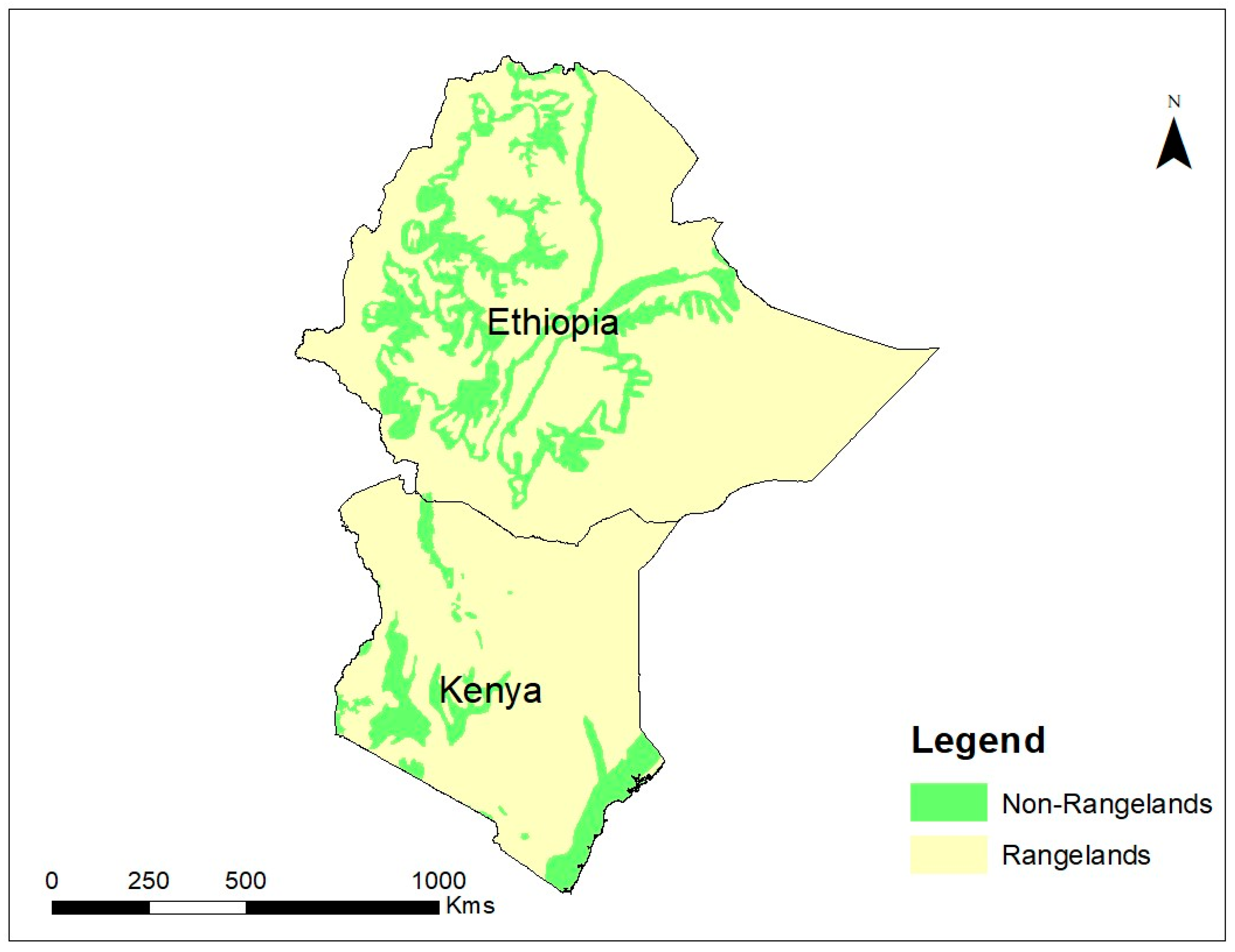

4.2. Index Insurance in Kenya and Ethiopia

- October-December: short rain.

- January-February: short, dry.

- March-May: long rain.

- June-September: long, dry.

5. Assessment of Two Regions’ Index Insurance Regimes

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Havstad, K.M.; Peters, D.P.; Skaggs, R.; Brown, J.; Bestelmeyer, B.; Fredrickson, E.; Herrick, J.; Wright, J. Ecological Services to and from Rangelands of the United States. Ecol. Econ. 2007, 64, 261–268. [Google Scholar] [CrossRef]

- Menke, J.; Bradford, G.E. Rangelands. Agric. Ecosyst. Environ. 1992, 42, 141–163. [Google Scholar] [CrossRef]

- West, N.E. Biodiversity of Rangelands. Rangel. Ecol. Manag. Range Manag. Arch. 1993, 46, 2–13. [Google Scholar]

- Prowse, T.A.; Johnson, C.N.; Cassey, P.; Bradshaw, C.J.; Brook, B.W. Ecological and Economic Benefits to Cattle Rangelands of Restoring an Apex Predator. J. Appl. Ecol. 2015, 52, 455–466. [Google Scholar] [CrossRef]

- Brunson, M.W.; Huntsinger, L.; Kreuter, U.P.; Ritten, J.P. Usable Socio-Economic Science for Rangelands. Rangelands 2016, 38, 85–89. [Google Scholar] [CrossRef]

- Derner, J.D.; Schuman, G.E. Carbon Sequestration and Rangelands: A Synthesis of Land Management and Precipitation Effects. J. Soil Water Conserv. 2007, 62, 77–85. Available online: https://www.jswconline.org/content/62/2/77 (accessed on 9 August 2023).

- Vroege, W.; Dalhaus, T.; Finger, R. Index Insurances for Grasslands—A Review for Europe and North-America. Agric. Syst. 2019, 168, 101–111. [Google Scholar] [CrossRef]

- Bengtsson, J.; Bullock, J.; Egoh, B.; Everson, C.; Everson, T.; O’connor, T.; O’farrell, P.; Smith, H.; Lindborg, R. Grasslands—More Important for Ecosystem Services than You Might Think. Ecosphere 2019, 10, e02582. [Google Scholar] [CrossRef]

- Egoh, B.N.; Reyers, B.; Rouget, M.; Richardson, D.M. Identifying Priority Areas for Ecosystem Service Management in South African Grasslands. J. Environ. Manag. 2011, 92, 1642–1650. [Google Scholar] [CrossRef]

- Mills, D.; Blech, R.; Gillam, B.; Martin, M.; Fithardinge, G.; Davies, J.; Campbell, S.; Woodhams, L. Rangelands: People, Perceptions and Perspectives. In Global Rangelands: Progress and Prospects; CAB International: Wallingford, UK, 2002; pp. 43–54. [Google Scholar] [CrossRef]

- Ridges, M.; Kelly, M.; Simpson, G.; Leys, J.; Booth, S.; Friedel, M.; Country, N. Understanding How Aboriginal Culture Can Contribute to the Resilient Future of Rangelands—The Importance of Aboriginal Core Values. Rangel. J. 2020, 42, 247–251. [Google Scholar] [CrossRef]

- Scasta, J.D.; Weir, J.R.; Stambaugh, M.C. Droughts and Wildfires in Western US Rangelands. Rangelands 2016, 38, 197–203. [Google Scholar] [CrossRef]

- Easterling, D.R.; Wallis, T.W.; Lawrimore, J.H.; Heim, R.R., Jr. Effects of Temperature and Precipitation Trends on US Drought. Geophys. Res. Lett. 2007, 34. [Google Scholar] [CrossRef]

- Polley, H.W.; Briske, D.D.; Morgan, J.A.; Wolter, K.; Bailey, D.W.; Brown, J.R. Climate Change and North American Rangelands: Trends, Projections, and Implications. Rangel. Ecol. Manag. 2013, 66, 493–511. [Google Scholar] [CrossRef]

- Hoffman, T.; Vogel, C. Climate Change Impacts on African Rangelands. Rangelands 2008, 30, 12–17. [Google Scholar] [CrossRef]

- Carvalho, M.; Johnson, M.; Hagerman, A. Is Rainfall Index Pasture, Rangeland and Forage Insurance Right for You? Oklahoma Cooperative Extension Service: Durant, OK, USA, 2019; Available online: https://pods.okstate.edu/fact-sheets/L-471.pdf (accessed on 27 July 2023).

- Collins, W. Potential Changes to Improve the Pasture, Rangeland, Forage Insurance Program. 2022. Available online: http://ageconsearch.umn.edu/record/322574 (accessed on 22 September 2023).

- Jimenez Maldonado, A.J. Developing Decision Rules for the Rainfall Index Insurance Program: An Application to Pennsylvania Producers. 2011. Available online: https://etda.libraries.psu.edu/catalog/11969 (accessed on 2 August 2023).

- Olbrich, R.; Quaas, M.F.; Baumgärtner, S. Characterizing Commercial Cattle Farms in Namibia: Risk, Management and Sustainability. 2014. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2141051 (accessed on 23 December 2023).

- Huho, J.M.; Mugalavai, E.M. The Effects of Droughts on Food Security in Kenya. Int. J. Clim. Chang. Impacts Responses 2010, 2, 61. [Google Scholar] [CrossRef]

- Leister, A.M.; Lee, J.G.; Paarlberg, P.L. Dynamic Effects of Drought on the US Livestock Sector. 2013. Available online: https://ageconsearch.umn.edu/record/149946 (accessed on 13 November 2023).

- Bonan, G.B.; Levis, S.; Sitch, S.; Vertenstein, M.; Oleson, K.W. A Dynamic Global Vegetation Model for Use with Climate Models: Concepts and Description of Simulated Vegetation Dynamics. Glob. Chang. Biol. 2003, 9, 1543–1566. [Google Scholar] [CrossRef]

- Johnson, L. Rescaling Index Insurance for Climate and Development in Africa. Econ. Soc. 2021, 50, 248–274. [Google Scholar] [CrossRef]

- Bhattacharya, H.; Osgood, D. Index Insurance and Common Property Pastures; Working Paper. 2008. Available online: https://www.econ.utah.edu/research/publications/2008_21.pdf (accessed on 12 August 2023).

- Kahiu, N.; Anchang, J.; Alulu, V.; Fava, F.; Jensen, N.; Hanan, N. Does Forage Type Matter? Exploring Opportunities for Improved Index-Based Livestock Insurance Using Browse and Grazing Forage Estimates. 2023. Available online: https://assets.researchsquare.com/files/rs-3775024/v1/4c3e08b7-b20d-45a7-9a5d-3321991952a5.pdf?c=1703747765 (accessed on 3 February 2024).

- Singh, P. Weather Index Insurance Viability in Mitigation of Climate Change Impact Risk: A Systematic Review and Future Agenda. J. Sci. Technol. Policy Manag. 2024, 15, 142–163. [Google Scholar] [CrossRef]

- Zapata, S.D.; García, J.M. Risk-Efficient Coverage Selection Strategies for the Pasture, Rangeland, Forage (PRF) Insurance Program. J. Agric. Appl. Econ. 2022, 54, 286–305. [Google Scholar] [CrossRef]

- Hrozencik, R.A.; Perez-Quesada, G. Drought and the US Livestock Sector: Assessing the Impact of the Livestock Forage Program. 2023. Available online: https://ideas.repec.org/p/ags/aaea22/335468.html (accessed on 23 January 2023).

- Binswanger-Mkhize, H.P. Is There Too Much Hype about Index-Based Agricultural Insurance? J. Dev. Stud. 2012, 48, 187–200. [Google Scholar] [CrossRef]

- Chantarat, S.; Barrett, C.B.; Mude, A.G. Developing Index Based Livestock Insurance for Managing Livestock Asset Risks in Northern Kenya. 2010. Available online: https://hdl.handle.net/10568/3305 (accessed on 15 July 2023).

- Bucheli, J.; Dalhaus, T.; Finger, R. The Optimal Drought Index for Designing Weather Index Insurance. Eur. Rev. Agric. Econ. 2021, 48, 573–597. [Google Scholar] [CrossRef]

- Jensen, N.; Barrett, C. Agricultural Index Insurance for Development. Appl. Econ. Perspect. Policy 2017, 39, 199–219. [Google Scholar] [CrossRef]

- Zhang, J.; Tan, K.S.; Weng, C. Index Insurance Design. ASTIN Bull. J. IAA 2019, 49, 491–523. [Google Scholar] [CrossRef]

- Adeyinka, A.A.; Kath, J.; Nguyen-Huy, T.; Mushtaq, S.; Souvignet, M.; Range, M.; Barratt, J. Global Disparities in Agricultural Climate Index-Based Insurance Research. Clim. Risk Manag. 2022, 35, 100394. [Google Scholar] [CrossRef]

- Clement, K.Y.; Botzen, W.W.; Brouwer, R.; Aerts, J.C. A Global Review of the Impact of Basis Risk on the Functioning of and Demand for Index Insurance. Int. J. Disaster Risk Reduct. 2018, 28, 845–853. [Google Scholar] [CrossRef]

- Hazell, P.; Hess, U. Beyond Hype: Another Look at Index-Based Agricultural Insurance. In Agriculture and Rural Development in a Globalizing World; Routledge: London, UK, 2017; pp. 211–226. [Google Scholar] [CrossRef]

- Tyagi, N.K.; Joshi, P.K. Index-Based Insurance for Mitigating Flood Risks in Agriculture: Status, Challenges and Way Forward. In Climate Smart Agriculture in South Asia: Technologies, Policies and Institutions; Springer: Singapore, 2019; pp. 183–204. [Google Scholar] [CrossRef]

- Di Marcantonio, F.; Kayitakire, F. Review of Pilot Projects on Index-Based Insurance in Africa: Insights and Lessons Learned. In Renewing Local Planning to Face Climate Change in the Tropics; 2017; Springer: Cham, Switzerland; pp. 323–341. [Google Scholar] [CrossRef]

- Goodrich, B.; Yu, J.; Vandeveer, M. Participation Patterns of the Rainfall Index Insurance for Pasture, Rangeland and Forage Programme. Geneva Pap. Risk Insur.-Issues Pract. 2020, 45, 29–51. [Google Scholar] [CrossRef]

- Mahato, S.; Saha, A. Weather Index Insurance: An Alternative Approach towards Protecting Farmer’s Income in the Face of Weather Aberration. ICJ’S 2019, 7, 551–560. [Google Scholar] [CrossRef]

- Skees, J.R. Challenges for Use of Index-Based Weather Insurance in Lower Income Countries. Agric. Financ. Rev. 2008, 68, 197. [Google Scholar] [CrossRef]

- Kumar, P.; Rao, V. Wheather Index Based Insurance for Risk Management in Agriculture. Book New Vistas Clim. Resilient Agric. 2020, 217–232. Available online: https://www.researchgate.net/publication/343836459_Weather_Index_based_Insurance_for_Risk_Management_in_Agriculture (accessed on 2 June 2023).

- Maestro, T.; Garrido, A.; Bielza, M. Drought Insurance. Drought Sci. Policy. 2018. Available online: https://onlinelibrary.wiley.com/doi/abs/10.1002/9781119017073.ch8 (accessed on 13 September 2023).

- Smith, V.H.; Watts, M. Index Based Agricultural Insurance in Developing Countries: Feasibility, Scalability and Sustainability. Gates Open Res 2019, 3, 65. [Google Scholar] [CrossRef]

- World Bank. Weather Index Insurance for Agriculture: Guidance for Development Practitioners; World Bank: Washington, DC, USA, 2011; Available online: http://www.worldbank.org/rural (accessed on 13 July 2023).

- Courtney, W. Indemnities in Insurance. J. Contract Law 2021, 37, 167–191. [Google Scholar] [CrossRef]

- Hlaing, Z.C. Contract of Indemnity. Contract Indemn. 2020, 16, 219–237. Available online: https://www.maas.edu.mm/Research/Admin/pdf/11.%20Dr%20Zar%20Chi%20Hlaing%20(219-238).pdf (accessed on 10 December 2023).

- Reinecke, M. The Basis of Insurance: The Indemnity Theory Revisited. J. S. Afr. L. 2001. Available online: https://scholar.google.com/scholar?hl=en&as_sdt=0%2C32&q=48.%09Reinecke%2C+M.+The+Basis+of+Insurance%3A+The+Indemnity+Theory+Revisited.+J.+S.+Afr.+L+2001&btnG= (accessed on 10 December 2023).

- MarketLinks. How Agricultural Index Insurance Works for Sustainable Development and Resilience. 2018. Available online: https://www.marketlinks.org/blogs/how-agricultural-index-insurance-works-sustainable-development-and-resilience (accessed on 14 January 2023).

- Alderman, H.; Haque, T. Insurance against Covariate Shocks. 2008. Available online: https://ideas.repec.org/b/wbk/wbpubs/6736.html (accessed on 10 December 2023).

- Barnett, B.J. Agricultural Index Insurance Products: Strengths and Limitations. 2004. Available online: https://ideas.repec.org/p/ags/usaofo/32971.html (accessed on 11 May 2023).

- Choudhury, A.; Jones, J.; Okine, A.; Choudhury, R. Drought-Triggered Index Insurance Using Cluster Analysis of Rainfall Affected by Climate Change. J. Insur. Issues 2016, 39, 169–186. Available online: https://www.jstor.org/stable/43921956 (accessed on 17 January 2023).

- Hess, U. Weather Index Insurance for Coping with Risks in Agricultural Production. In Managing Weather and Climate Risks in Agriculture; Springer: Berlin/Heidelberg, Germany, 2007; pp. 377–405. Available online: https://link.springer.com/chapter/10.1007/978-3-540-72746-0_22 (accessed on 12 December 2023).

- Miranda, M.J.; Farrin, K. Index Insurance for Developing Countries. Appl. Econ. Perspect. Policy 2012, 34, 391–427. [Google Scholar] [CrossRef]

- Wu, S.; Goodwin, B.K.; Coble, K. Moral Hazard and Subsidized Crop Insurance. Agric. Econ. 2020, 51, 131–142. [Google Scholar] [CrossRef]

- Just, R.E.; Calvin, L.; Quiggin, J. Adverse Selection in Crop Insurance: Actuarial and Asymmetric Information Incentives. Am. J. Agric. Econ. 1999, 81, 834–849. [Google Scholar] [CrossRef]

- Dougherty, J.P.; Gallenstein, R.A.; Mishra, K. Impact of Index Insurance on Moral Hazard in the Agricultural Credit Market: Theory and Evidence from Ghana. J. Afr. Econ. 2021, 30, 418–446. [Google Scholar] [CrossRef]

- Nieto, J.D.; Cook, S.E.; Läderach, P.; Fisher, M.J.; Jones, P.G. Rainfall Index Insurance to Help Smallholder Farmers Manage Drought Risk. Clim. Dev. 2010, 2, 233–247. [Google Scholar] [CrossRef]

- Feed the Future. Feed Future Innov. Lab Mark. Risk Resil; 2019. Available online: https://www.feedthefuture.gov/feed-the-future-innovation-labs/ (accessed on 11 November 2023).

- Miranda, M.J.; Mulangu, F.M. Index Insurance for Agricultural Transformation in Africa. In African Transformation Report 2016. 2016, pp. 1–30. Available online: https://jicari.repo.nii.ac.jp/records/859 (accessed on 18 October 2023).

- Di Marcantonio, F. Index-Based Insurance Challenges and Socio-Economic Considerations: The Ibli-Kenya Case. Geopress J. 2016, 3, 31–48. Available online: https://www.geoprogress.eu/wp-content/uploads/2017/07/GPJ-2015-Vol-3-I-5DiMarcantonio.pdf (accessed on 13 December 2023).

- Hammonds, T.; Banerjee, R.R. A Business Strategy for the Distribution of Index-Based Livestock Insurance to Urban Professionals–Insights from Kenya. ILRI Res. Brief. 2018. Available online: https://ecommons.cornell.edu/server/api/core/bitstreams/abe4b695-0fb5-42a3-bb6f-e304ba497424/ (accessed on 11 November 2023).

- Mude, A.G.; Chantarat, S.; Barrett, C.B.; Carter, M.R.; Ikegami, M.; McPeak, J.G. Insuring against Drought-related Livestock Mortality: Piloting Index Based Livestock Insurance in Northern Kenya. Available SSRN 1844745. 2010. Available online: https://surface.syr.edu/ecn/75/ (accessed on 13 December 2023).

- Osumba, J.J.; Recha, J.W.; Demissie, T.; Shilomboleni, H.; Radeny, M.A.; Solomon, D. State of Index-Based Crop Insurance Services in East Africa: Findings from a Scoping Study to Establish the State of Index-Based Crop Insurance Services in Kenya, Tanzania and Uganda. 2020. Available online: https://hdl.handle.net/10568/110122 (accessed on 3 June 2013).

- German Development Institute. Weather Index Insurance: Promises and Challenges; German Development Institute: Bonn, Germany, 2021. [Google Scholar] [CrossRef]

- Čolović, V.; Petrović, N.M. Crop Insurance–Risks and Models of Insurance. Екoнoмика Пoљoпривреде 2014, 61, 561–573. [Google Scholar] [CrossRef]

- Goodwin, B.K. Challenges in the Design of Crop Revenue Insurance. Agric. Financ. Rev. 2015, 75, 19–30. [Google Scholar] [CrossRef]

- Rao, K.N. Index Based Crop Insurance. Agric. Agric. Sci. Procedia 2010, 1, 193–203. [Google Scholar] [CrossRef]

- Sarker, D. Weather Index Insurance for Agriculture in Bangladesh: Significance of Implementation and Some Challenges. Weather 2013, 5, 74–79. [Google Scholar] [CrossRef]

- Vedenov, D.V.; Miranda, M.J. Rainfall Insurance for Midwest Crop Production. 2001. Available online: https://ageconsearch.umn.edu/record/20458/?v=pdf (accessed on 18 October 2023).

- Afshar, M.H.; Foster, T.; Higginbottom, T.P.; Parkes, B.; Hufkens, K.; Mansabdar, S.; Ceballos, F.; Kramer, B. Improving the Performance of Index Insurance Using Crop Models and Phenological Monitoring. Remote Sens. 2021, 13, 924. [Google Scholar] [CrossRef]

- Murphy, D.J.; Ichinkhorloo, B. Index Insurance and the Moral Economy of Pastoral Risk Management in Mongolia. J. Peasant Stud. 2023. Available online: https://www.researchgate.net/profile/Daniel-Murphy-25/publication/376613643_Index_insurance_and_the_moral_economy_of_pastoral_risk_management_in_Mongolia/links/6580c5a12468df72d3b6fcb8/Index-insurance-and-the-moral-economy-of-pastoral-risk-management-in-Mongolia.pdf (accessed on 3 January 2024).

- Vosper, S. Insure or Unsure? The Role of Negative and Positive Basis Risk in Weather Index Insurance Uptake in Kenya. Role Negat. Posit. Basis Risk Weather Index Insur. Uptake Kenya. 2023. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4522902 (accessed on 5 January 2024).

- Lay, B.; Bunyasiri, I.; Suchato, R. Farmers’ Willingness to Purchase Weather Index Crop Insurance: Evidence from Battambang, Cambodia. J. Risk Financ. Manag. 2023, 16, 498. [Google Scholar] [CrossRef]

- Westerhold, A.; Walters, C.; Brooks, K.; Vandeveer, M.; Volesky, J.; Schacht, W. Risk Implications from the Selection of Rainfall Index Insurance Intervals. Agric. Financ. Rev. 2018, 78, 514–531. [Google Scholar] [CrossRef]

- ShalekBriski, A.; Brorsen, W.; Rogers, J.K.; Biermacher, J.T.; Marburger, D.; Edwards, J. Design of the Rainfall Index Annual Forage Program. Agric. Financ. Rev. 2021, 81, 114–131. [Google Scholar] [CrossRef]

- Roznik, M. Factors Affecting the Use of Forage Insurance. Master’s Thesis, 2018. Available online: https://www.emerald.com/insight/content/doi/10.1108/AFR-02-2019-0022/full/html (accessed on 10 June 2023).

- Selasco, E.J.; Hungerford, A.E. Examining the Design and Use of the Pasture, Rangeland, Forage (PRF) Program. West. Econ. Forum 2018, 16, 55–61. [Google Scholar] [CrossRef]

- Beutler, M. Pasture, Rangeland, and Forage Pilot Insurance Program in South Dakota. 2010. Available online: https://openprairie.sdstate.edu/extension_extra/184 (accessed on 12 October 2023).

- Simpson, A. An Analysis of Rainfall Weather Index Insurance: The Case of Forage Crops in Canada. 2016. Available online: http://hdl.handle.net/1993/31247 (accessed on 15 September 2023).

- Cho, W.; Brorsen, B.W. Design of the Rainfall Index Crop Insurance Program for Pasture, Rangeland, and Forage. J. Agric. Resour. Econ. 2021, 46, 85–100. [Google Scholar] [CrossRef]

- Vandeveer, M.; Berger, A.; Stockton, M. Pasture, Rangeland and Forage Insurance for Nebraskans’: An Insurance Pilot Program to Protect Livestock and Hay Producers. 2013. Available online: https://digitalcommons.unl.edu/agecon_cornhusker/653/ (accessed on 12 September 2023).

- Williams, T.M. Drought Index-Based Insurance for the US Cattle Ranching Industry. 2018. Available online: https://scholar.colorado.edu/concern/graduate_thesis_or_dissertations/vt150j599 (accessed on 16 October 2023).

- Shrum, T.R.; Travis, W.R. Experiments in Ranching: Rain-index Insurance and Investment in Production and Drought Risk Management. Appl. Econ. Perspect. Policy 2022, 44, 1513–1533. [Google Scholar] [CrossRef]

- Zhou, R.; Li, J.S.-H.; Pai, J. Evaluating Effectiveness of Rainfall Index Insurance. Agric. Financ. Rev. 2018, 78, 611–625. [Google Scholar] [CrossRef]

- Larsen, R.; Anderson, S. Pasture, Rangeland, Forage Rainfall Index Insurance: What Is RI-PRF? 2019. Available online: https://www.emerald.com/insight/content/doi/10.1108/AFR-11-2017-0102/full/html (accessed on 18 October 2023).

- Campiche, J.; Jones, J. Annual Forage (AF) Pilot Program; Oklahoma Cooperative Extension Service: Durant, OK, USA, 2014. [Google Scholar] [CrossRef]

- Walker, J. Pasture Rangeland and Forage Insurance for Good Range Management. Ranch Rural Living 2013, 94, 7. Available online: https://www.uaex.uada.edu/publications/pdf/FSA81.pdf (accessed on 7 September 2023).

- Keller, J.B.; Saitone, T.L. Basis Risk in the Pasture, Rangeland, and Forage Insurance Program: Evidence from California. Am. J. Agric. Econ. 2022, 104, 1203–1223. [Google Scholar] [CrossRef]

- Parsons, J. Annual Forage Production Insurance. 2016. Available online: https://www.researchgate.net/publication/317817507_Annual_Forage_Production_Insurance (accessed on 12 October 2023).

- DelCurto, M.J. Determinants of Participation and Coverage Level Choices in the Pasture, Rangeland and Forage Insurance Program. 2020. Available online: https://scholarworks.montana.edu/xmlui/handle/1/15870 (accessed on 12 December 2023).

- Yu, J.; Vandeveer, M.; Volesky, J.D.; Harmoney, K. Estimating the Basis Risk of Rainfall Index Insurance for Pasture, Rangeland, and Forage. J. Agric. Resour. Econ. 2019, 44, 179–193. [Google Scholar] [CrossRef]

- Boyd, M.; Porth, B.; Porth, L.; Seng Tan, K.; Wang, S.; Zhu, W. The Design of Weather Index Insurance Using Principal Component Regression and Partial Least Squares Regression: The Case of Forage Crops. N. Am. Actuar. J. 2020, 24, 355–369. [Google Scholar] [CrossRef]

- Goodrich, B.K.; Davidson, K.A. Enrollment in Pasture, Rangeland, and Forage Rainfall Index Insurance: Awareness Matters. J. Agric. Resour. Econ. 2024, 1–23. [Google Scholar] [CrossRef]

- Milhollin, R.; Massey, R.; Horner, J. Pasture, Rangeland, Forage (PRF) Insurance in Missouri. 2022. Available online: https://extension.missouri.edu/media/wysiwyg/Extensiondata/Pub/pdf/agguides/agecon/g00457.pdf (accessed on 4 July 2023).

- Jones, D.; Bevers, S.; Thompson, B. Rainfall Index-Annual Forage Insurance. Panhand. Econ. Focus Tex. AM Agrilife Ext. PEF 2013, 2. Available online: https://agecoext.tamu.edu/wp-content/uploads/2013/08/AnnualPastureInsurance.pdf (accessed on 23 August 2023).

- Feuz, R.; Bosworth, R.; Larsen, R.; Larsen, R.; Klein, S.; Shapero, M.W.; Rao, D.R.; Althouse, L.; Striby, K. Expanding on Basis Risk Estimates for Pasture, Rangeland, and Forage Insurance. J. Appl. Farm Econ. 2023, 6, 1. [Google Scholar] [CrossRef]

- Boyd, M.; Porth, B.; Porth, L.; Turenne, D. The Impact of Spatial Interpolation Techniques on Spatial Basis Risk for Weather Insurance: An Application to Forage Crops. N. Am. Actuar. J. 2019, 23, 412–433. [Google Scholar] [CrossRef]

- Wang, S. The Design of Weather Index Insurance for Forage: The Case of Basis Risk for the Canadian Province of Ontario. 2015. Available online: http://hdl.handle.net/1993/30835 (accessed on 4 July 2023).

- Frank, T. Grassland Biophysical Parameters Estimation Using Remote Sensing Products to Support Pasture Insurance. Can. J. Remote Sens. 2022, 48, 633–648. [Google Scholar] [CrossRef]

- Van Orden, C.; Willis, B.; Bosworth, R.; Larsen, R.; McCarty, T.; Kim, M.-K. Weather Station Locations Are Significant for Drought Insurance. Choices 2020, 35, 1–5. [Google Scholar] [CrossRef]

- Piao, S.; Liu, Q.; Chen, A.; Janssens, I.A.; Fu, Y.; Dai, J.; Liu, L.; Lian, X.; Shen, M.; Zhu, X. Plant Phenology and Global Climate Change: Current Progresses and Challenges. Glob. Chang. Biol. 2019, 25, 1922–1940. [Google Scholar] [CrossRef]

- Atlas, R. Dryland Types Found in Rangelands Globally. 2024. Available online: https://www.rangelandsdata.org/atlas/maps/dryland-types-found-rangelands-globally (accessed on 14 October 2023).

- Anderson, W.; Baethgen, W.; Capitanio, F.; Ciais, P.; Cook, B.I.; da Cunha, C.G.; Goddard, L.; Schauberger, B.; Sonder, K.; Podestá, G. Climate Variability and Simultaneous Breadbasket Yield Shocks as Observed in Long-Term Yield Records. Agric. For. Meteorol. 2023, 331, 109321. [Google Scholar] [CrossRef]

- Bedasa, Y.; Bedemo, A. The Effect of Climate Change on Food Insecurity in the Horn of Africa. Geojournal 2023, 88, 1829–1839. [Google Scholar] [CrossRef]

- Timu, A.G.; Gustafson, C.R.; Mieno, T. The Gendered Impacts of Index-Insurance on Food-Consumption: Evidence from Southern Ethiopia. Clim. Serv. 2023, 30, 100355. [Google Scholar] [CrossRef]

- McPeak, J.; Chantarat, S.; Mude, A. Explaining Index-based Livestock Insurance to Pastoralists. Agric. Financ. Rev. 2010, 70, 333–352. [Google Scholar] [CrossRef]

- Miranda, M.J.; Nadolnyak, D. 12. Index Insurance for Developing Countries: A Primer. In Handbook of Microfinance, Financial Inclusion and Development; Edward Elgar Publishing: Cheltenham, UK, 2023; pp. 194–210. Available online: https://ideas.repec.org/h/elg/eechap/19107_12.html (accessed on 19 February 2024).

- Carter, M.R.; De Janvry, A.; Sadoulet, E.; Sarris, A. Index-Based Weather Insurance for Developing Countries: A Review of Evidence and a Set of Propositions for Up-Scaling. 2014. Available online: https://ideas.repec.org/p/fdi/wpaper/1800.html (accessed on 10 October 2023).

- Carter, M.R.; Janzen, S.A. Coping with Drought: Assessing the Impacts of Livestock Insurance in Kenya. I4 Index Insur. Innov. Initiat. BASIS Brief. 2012. Available online: https://agris.fao.org/search/en/providers/122432/records/6473a38196fdec8b71b46ba5 (accessed on 2 January 2023).

- Greatrex, H.; Hansen, J.; Garvin, S.; Diro, R.; Le Guen, M.; Blakeley, S.; Rao, K.; Osgood, D. Scaling up Index Insurance for Smallholder Farmers: Recent Evidence and Insights. CCAFS Report. 2015. Available online: https://cgspace.cgiar.org/bitstream/handle/10568/53101/CCAFS_Report14.pdf (accessed on 4 September 2023).

- Matsuda, A.; Takahashi, K.; Ikegami, M. Direct and Indirect Impact of Index-Based Livestock Insurance in Southern Ethiopia. Geneva Pap. Risk Insur.-Issues Pract. 2019, 44, 481–502. [Google Scholar] [CrossRef]

- Takahashi, K.; Ikegami, M.; Sheahan, M.; Barrett, C.B. Experimental Evidence on the Drivers of Index-Based Livestock Insurance Demand in Southern Ethiopia. World Dev. 2016, 78, 324–340. [Google Scholar] [CrossRef]

- Chantarat, S.; Mude, A.G.; Barrett, C.B.; Carter, M.R. Designing Index-based Livestock Insurance for Managing Asset Risk in Northern Kenya. J. Risk Insur. 2013, 80, 205–237. Available online: https://www.jstor.org/stable/23354973 (accessed on 17 August 2023). [CrossRef]

- Mude, A.; Barrett, C.B.; Carter, M.R.; Chantarat, S.; Ikegami, M.; McPeak, J.G. Index Based Livestock Insurance for Northern Kenya’s Arid and Semi-Arid Lands: The Marsabit Pilot. 2009. Available online: https://www.researchgate.net/publication/256010082_Index_Based_Livestock_Insurance_for_Northern_Kenya's_Arid_and_Semi-Arid_Lands_The_Marsabit_Pilot (accessed on 23 November 2023).

- Banerjee, R.R.; Gobu, W.; Zewdie, Y. Evaluating the Service Delivery Model for Index-Based Livestock Insurance (IBLI): Insights from Ethiopia. International Livestock Research Institute Research Brief. 2020. Available online: https://hdl.handle.net/10568/109880 (accessed on 12 July 2023).

- Ntukamazina, N.; Onwonga, R.N.; Sommer, R.; Rubyogo, J.C.; Mukankusi, C.M.; Mburu, J.; Kariuki, R. Index-Based Agricultural Insurance Products: Challenges, Opportunities and Prospects for Uptake in Sub-Sahara Africa. 2017. Available online: http://nbn-resolving.de/urn:nbn:de:hebis:34-2017042052372 (accessed on 3 August 2023).

- Jensen, N.D.; Barrett, C.B.; Mude, A.G. Index Insurance Quality and Basis Risk: Evidence from Northern Kenya. Am. J. Agric. Econ. 2016, 98, 1450–1469. [Google Scholar] [CrossRef]

- Thomson Reuters Foundation. Insurance Designed for Muslim Herders Makes First Payout in Kenya. 2024. Available online: https://news.trust.org/item/20140404092416-mrtb9 (accessed on 5 February 2024).

- Banerjee, R.R.; Mude, A.; Wandera, B. IBLI Practice Note. Sage J. 2017, 48, 1–13. [Google Scholar] [CrossRef]

- Jensen, N.D.; Mude, A.G.; Barrett, C.B. How Basis Risk and Spatiotemporal Adverse Selection Influence Demand for Index Insurance: Evidence from Northern Kenya. Food Policy 2018, 74, 172–198. [Google Scholar] [CrossRef]

- Taye, M. Livestock Insurance in Southern Ethiopia: Calculating Risks, Responding to Uncertainties. Pastor. Uncertain. Dev. 2023, 55, 93. [Google Scholar]

- Amare, A.; Simane, B.; Nyangaga, J.; Defisa, A.; Hamza, D.; Gurmessa, B. Index-Based Livestock Insurance to Manage Climate Risks in Borena Zone of Southern Oromia, Ethiopia. Clim. Risk Manag. 2019, 25, 100191. [Google Scholar] [CrossRef]

- Dinku, T.; Giannini, A.; Hansen, J.W.; Holthaus, E.; Ines, A.V.M.; Kaheil, Y.; Karnauskas, K.B.; Lyon, B.; Madajewicz, M.; McLaurin, M. Designing Index-Based Weather Insurance for Farmers in Adi Ha, Ethiopia: Report to OXFAM America, July 2009; International Research Institute for Climate and Society: Palisades, NJ, USA, 2009; Available online: https://academiccommons.columbia.edu/doi/10.7916/D8CF9WZN (accessed on 18 October 2023).

- Gebrekidan, T.; Guo, Y.; Bi, S.; Wang, J.; Zhang, C.; Wang, J.; Lyu, K. Effect of Index-Based Livestock Insurance on Herd Offtake: Evidence from the Borena Zone of Southern Ethiopia. Clim. Risk Manag. 2019, 23, 67–77. [Google Scholar] [CrossRef]

- Jensen, N.D.; Barrett, C.B.; Mude, A.G. The Favourable Impacts of Index-Based Livestock Insurance: Evaluation Results from Ethiopia and Kenya. International Livestock Research Institute Research Brief. 2015. Available online: https://www.researchgate.net/publication/281407537_The_favourable_impacts_of_Index-Based_Livestock_Insurance_Evaluation_results_from_Ethiopia_and_Kenya (accessed on 15 October 2023).

- Johnson, L.; Shariff Mohamed, T.; Scoones, I.; Taye, M. Uncertainty in the Drylands: Rethinking in/Formal Insurance from Pastoral East Africa. Environ. Plan. Econ. Space 2023, 55, 1928–1950. [Google Scholar] [CrossRef]

- Davidson, K.A.; Goodrich, B.K. Nudge to Insure: Can Informational Nudges Increase Enrollment in Pasture, Rangeland and Forage Rainfall Index Insurance? Appl. Econ. Perspect. Policy 2023, 45, 534–554. [Google Scholar] [CrossRef]

- Larsen, R.; Anderson, S. Pasture, Rangeland, Forage Rainfall Index Insurance: What Is RI-PRF? 2019. Available online: https://digitalcommons.usu.edu/extension_curall/2011 (accessed on 12 November 2023).

- Chantarat, S.; Mude, A.G.; Barrett, C.B.; Turvey, C.G. Welfare Impacts of Index Insurance in the Presence of a Poverty Trap. World Dev. 2017, 94, 119–138. [Google Scholar] [CrossRef]

- Clarke, D.J. A Theory of Rational Demand for Index Insurance. Am. Econ. J. Microecon. 2016, 8, 283–306. [Google Scholar] [CrossRef]

- Chelang’a, P.K.; Banerjee, R.R.; Mude, A.G. Index-Based Livestock Insurance (IBLI) Lessons in Extension and Outreach: A Case of Wajir County. International Livestock Research Institute Research Brief. 2015. Available online: https://www.researchgate.net/publication/301788763_Index-Based_Livestock_Insurance_IBLI-Lessons_in_extension_and_outreach_A_case_of_Wajir_County (accessed on 11 October 2023).

- Iremashvili, K. Insurable Interest Doctrine and Analysis of Its Critics. J. Law 2013, 51. Available online: https://scholar.google.com/scholar?hl=en&as_sdt=0%2C32&q=153.%09Iremashvili%2C+K.+Insurable+Interest+Doctrine+and+Analysis+of+Its+Critics.+J.+Law+2013&btnG= (accessed on 14 February 2024).

- Arnold, C.A. The Reconstitution of Property: Property as a Web of Interests. Harv. Envtl. Rev. 2002, 26, 281. Available online: https://ssrn.com/abstract=1024244 (accessed on 23 February 2023).

- Ellickson, R.C. Property in Land. Yale Law J. 1993, 102, 1315. [Google Scholar] [CrossRef]

- Freyfogle, E.T. Ownership and Ecology. Case W Res. Rev. 1992, 43, 1269. Available online: https://scholarlycommons.law.case.edu/caselrev/vol43/iss4/41 (accessed on 17 December 2023).

- Bentley, J.M.; Oberhofer, T. Property Rights and Economic Development. Rev. Soc. Econ. 1981, 39, 51–65. [Google Scholar] [CrossRef]

- Bulte, E.; Haagsma, R. The Welfare Effects of Index-Based Livestock Insurance: Livestock Herding on Communal Lands. Environ. Resour. Econ. 2021, 78, 587–613. [Google Scholar] [CrossRef]

- Hardin, G. Extensions of the Tragedy of the Commons. Science 1998, 280, 682–683. [Google Scholar] [CrossRef]

| Category | Exclusion Criteria |

|---|---|

| Time | Studies not within 1990–2024 |

| Relevance | Publications not addressing the topic: index insurance for forage, pasture, and rangeland |

| Shallowness | Publications considered as “too shallow” in terms of index insurance |

| Insurance | Advantages | Disadvantages |

|---|---|---|

| Indemnity | Can cover multiple agricultural perils. | Within farms, assessment of losses makes it costly. |

| Can be tailor-made to fit individual needs. | Ineffective in case of covariate losses. | |

| Index insurance | Can overcome market failures such as adverse selection and moral hazards. | It does not consider individual insurance needs. |

| Measuring index independently makes it transparent. | An index can have a weak correlation with loss sources resulting in insufficient payouts (basis risk). |

| Selection | Description |

|---|---|

| Crop type | Either haying or grazing |

| Grid IDs | Based on actual location |

| Coverage Level | 70, 75, 80, 85, or 90 percent. Subsidy level is 59 percent for 70–75 percent coverage, 55 percent for 80–85 percent coverage, and 51 percent for 90 percent coverage. |

| Productivity Factor | 60 to 150 percent of county base value in 1 percent increments |

| Index Intervals | Producers select the intervals when precipitation or plant growth is most critical to the producer. |

| Irrigated Practice | Irrigated or non-irrigated |

| Insured Acres | Total number of perennial haying and/or grazing acres. Insurance cover from any other insurance plan is prohibited for haying or grazing, by USDA programs. |

| Province | Program | Index | Temporal | Grid Size | Commencement Year |

|---|---|---|---|---|---|

| Alberta | Satellite | NDVI | Annual | 1 km × 1 km | 2001 |

| Saskatchewan | Forage rainfall | Rainfall | April to July | Depends on weather stations | 2001 |

| Country | Region | Month | Year |

|---|---|---|---|

| Kenya | Marsabit | January | 2010 |

| Kenya | Isiolo | August | 2013 |

| Kenya | Wajir | August | 2013 |

| Kenya | Garissa | January | 2015 |

| Kenya | Mandera | January | 2015 |

| Ethiopia | Borena | July | 2012 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Maina, S.; Miller, M.; Torell, G.L.; Hanan, N.; Anchang, J.; Kahiu, N. Index Insurance for Forage, Pasture, and Rangeland: A Review of Developed (USA and Canada) and Developing (Kenya and Ethiopia) Countries. Sustainability 2024, 16, 3571. https://doi.org/10.3390/su16093571

Maina S, Miller M, Torell GL, Hanan N, Anchang J, Kahiu N. Index Insurance for Forage, Pasture, and Rangeland: A Review of Developed (USA and Canada) and Developing (Kenya and Ethiopia) Countries. Sustainability. 2024; 16(9):3571. https://doi.org/10.3390/su16093571

Chicago/Turabian StyleMaina, Simon, Maryfrances Miller, Gregory L. Torell, Niall Hanan, Julius Anchang, and Njoki Kahiu. 2024. "Index Insurance for Forage, Pasture, and Rangeland: A Review of Developed (USA and Canada) and Developing (Kenya and Ethiopia) Countries" Sustainability 16, no. 9: 3571. https://doi.org/10.3390/su16093571

APA StyleMaina, S., Miller, M., Torell, G. L., Hanan, N., Anchang, J., & Kahiu, N. (2024). Index Insurance for Forage, Pasture, and Rangeland: A Review of Developed (USA and Canada) and Developing (Kenya and Ethiopia) Countries. Sustainability, 16(9), 3571. https://doi.org/10.3390/su16093571