1. Introduction

In recent years, with the frequent occurrence of uncertainty in events such as the trade disputes between China and the United States, and the Russia–Ukraine conflict in 2022, “VUCA” (standing for Volatility, Uncertainty, Complexity, and Ambiguity) is synonymous with current environmental characteristics, which make higher demands on the innovation system, and resilience has become an essential trait for innovation systems to overcome crises. Innovation system refers to the overall structure within an organization consisting of various elements, mechanisms, and interactive relationships collectively driving and supporting innovation activities. As the main body of the innovation system, enterprise innovation resilience is essential for the steady far-reaching of national innovation systems. Only if micro-enterprises can quickly adjust and push the enterprise innovation system to a higher level in adversity will the innovation outcomes continue to be created and the sustainable impetus for the evolution of innovative systems be provided. Therefore, it is urgent to explore influencing factors of enterprise innovation resilience and its improvement path, which is of practical significance for enterprise sustainable development in the “VUCA” era.

The resource base provides a competitive advantage for enterprises engaging in innovation activities and fostering sustainable development. According to the production process of innovation, enterprise innovation ability not only depends on its own innovation resources and conditions, but it is also affected by the inflow of external production factors [

1,

2]. As an important carrier for the spatial flow of production factors, transportation infrastructure can quickly shorten the temporal–spatial distance and facilitate the dissemination and exchange of knowledge and technology between regions, which is conducive to promoting mutual exchange and learning among regions and enhancing enterprise innovation ability [

3,

4,

5]. The Report to the 20th National Congress of the Communist Party of China once again emphasized building a modern comprehensive transportation system that is safe, convenient, efficient, green, and economical; and building a transportation system that satisfies the people, provides strong guarantees, and is at the forefront of the world. Then, against the backdrop of frequent external shocks, will transportation infrastructure construction still play an important role in enhancing enterprise innovation resilience? If yes, what are the mechanisms? The answers to these questions not only help to reveal the formation mechanism of enterprise innovation resilience, but also provide direction for enterprise innovation activities and enterprise sustainable development in the VUCA era.

The academic circle has conducted valuable explorations of the connotations, measurement, and influencing factors of innovation resilience. Resilience is derived from physics and refers to the ability of the system to recover its original state. Innovation system refers to the innovation network formed by the interaction between relevant departments within an organization. As an expansion of the concept of resilience in the field of innovation, scholars generally agree that enterprise innovation resilience refers to the adaptive adjustment ability of enterprise innovation systems under external shocks [

6,

7]. For the measurement of innovation resilience, there are two methods in existing research. One is—according to the characteristics of resilience—to construct an index evaluation system from the perspective of diversity, liquidity, buffering, etc. [

7,

8]; and the other is to analyze the differences between variables in practice and counterfactual conditions using counterfactual analysis [

9,

10], referring to the measurement of economic resilience. For driving factors of innovation resilience, existing studies have found that diverse talents and industries, innovation input, technical resources, government support, etc., have a positive effect on innovation resilience [

7,

9]; while administrative monopoly and pollution caused by gas emissions inhibit innovation resilience. Based on the structural equation modeling analysis, Lisdiono et al. (2022) [

11] revealed that leadership capabilities play a significant role in improving enterprise resilience. Putritamara et al. (2023) [

12] found that dynamic capabilities can enhance MSMEs’ resilience through improving digital transformation.

The studies mentioned above have provided valuable insights for us, but there are still areas for improvement. Based on the research perspective, although improving innovation resilience has become a key issue in practice, research on the origin of innovation resilience is obviously lagging and most research mainly conducts empirical research on innovation resilience from the macro perspective, while few studies focus on enterprise innovation resilience, and even fewer focus on the perspective of transportation infrastructure construction. External business uncertainty requires enterprises to have sufficient resource support, and timely access to external resources is crucial for enterprise survival and sustainable development. Through promoting factor mobility, transportation infrastructure can broaden channels for enterprise resource acquisition, but this effect may be constrained by factors such as urban resource endowment and enterprise characteristics. For example, if a city faces a shortage of financial resources and is close to a nearby HSR station, the government’s blind construction of HSR may worsen the regional business environment and have a negative impact on enterprise production and operation. Moreover, as the number of HSR lines increases, the disparity between cities opening or not opening HSR is gradually diminishing, leading to an expansion of distance between cities that have opened HSR. Therefore, a deeper analysis of the direction and extent of the impact of transportation infrastructure on enterprise innovation resilience is necessary, especially in the context of intensified competition among cities for HSR construction.

From the perspective of research method, the index evaluation system method easily confuses causality [

13], does not easily portray the adjustment process under the shock, and implicitly assumes that the external shock is fixed and the response of different innovation systems to external shocks is homogeneous, which is even more inconsistent with the actual situation. The counterfactual approach needs to subjectively set “resistance periods” and “recovery periods”, and focuses on a single shock. A more reasonable way is to abide by the connotation of resilience (“external shock” and “adaptive adjustment”) to measure innovation resilience. Unfortunately, the existing literature on the measurement of innovation resilience is limited.

In this paper, we match the data of listed companies and the construction of HSR in China, employ the common factor model to calculate enterprise innovation resilience, and explore the causal effect of transportation infrastructure construction on enterprise innovation resilience. This study contributes to the literature in four aspects. Firstly, we provide a new research perspective for understanding enterprise innovation resilience. From the perspective of the flow of production factors, we explore the impact of transportation infrastructure construction on enterprise innovation resilience, providing new empirical evidence for understanding enterprise innovation resilience and offering a quantitative reference for the construction of innovation resilience theory.

Secondly, we expand the measurement of enterprise innovation resilience. In contrast with previous studies, we adopt the common factor model to estimate the response coefficient of the enterprise innovation system to different external shocks, making up for the limitation that the “index system method” and the “counterfactual analysis method” do not easily reflect the core connotation of resilience.

Thirdly, we provide new empirical evidence for clarifying the formation mechanism of enterprise innovation resilience. Previous studies have mostly revealed the mechanism of system resilience from the perspective of case studies or empirical induction and proposed that redundant resources are the core of system resilience construction [

14,

15,

16]. Large-sample empirical research is relatively rare, especially in innovation system resilience. From the perspective of enterprise resource acquisition and resource allocation, we have revealed the impact mechanism of transport infrastructure construction on enterprise innovation resilience, which helps to open the “black box” of the generation of enterprise innovation resilience.

Fourthly, we carry on a systematical test for the resilience effect of HSR. The study of “high-speed rail economics” usually only focuses on the impact of whether cities open HSR and ignores the heterogeneity characteristics of the construction of urban HSR [

17]. We comprehensively identify the causal effect of HSR construction on enterprise innovation resilience from three dimensions: the opening of HSR, the optimal radius of the HSR effect, and the HSR network; enriching the research on the economic effect of HSR.

7. Conclusions

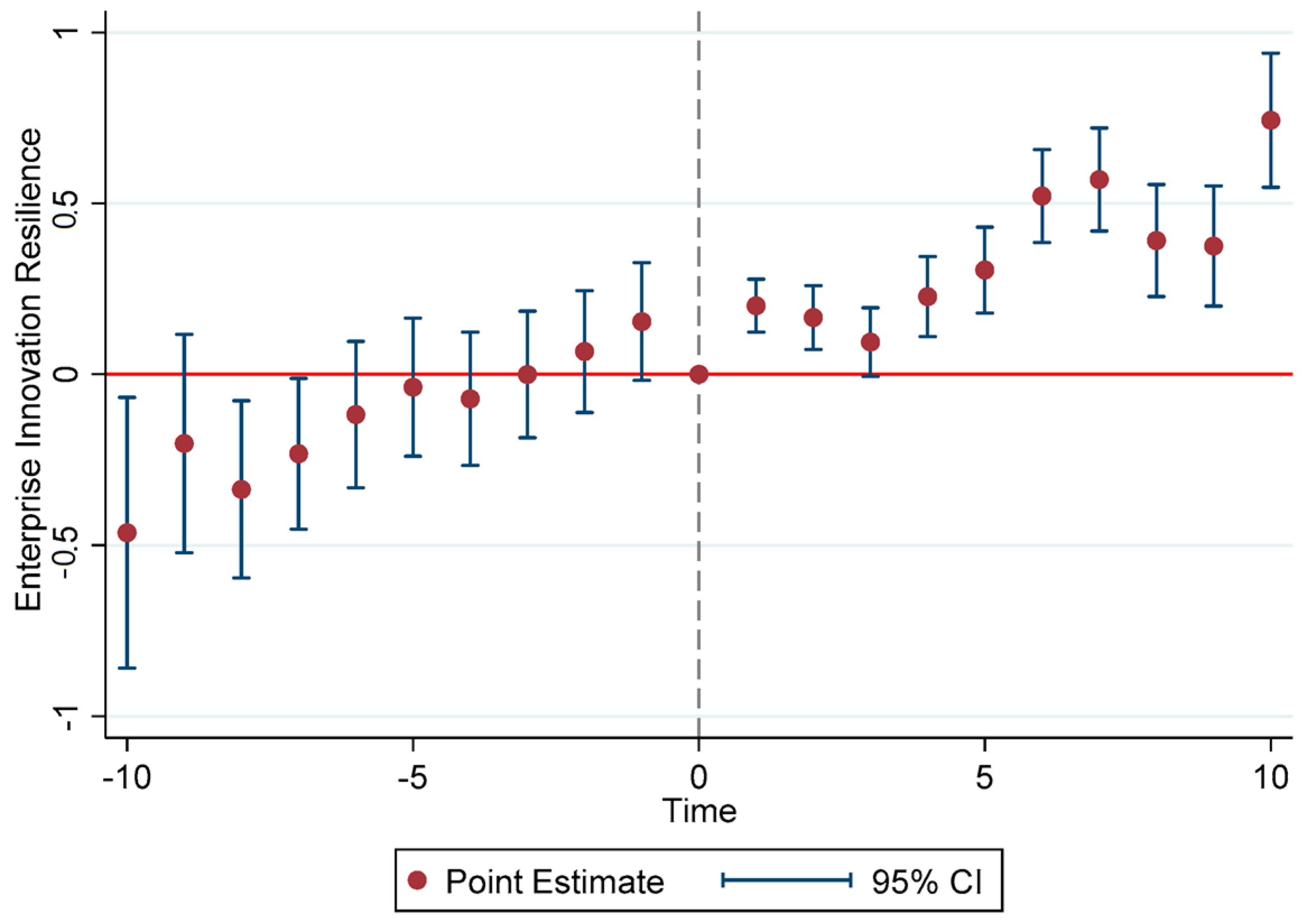

Taking the panel data of listed companies and cities in China from 2007 to 2021 as the research sample, based on the quasi-natural experiment of the opening of HSR, we empirically explore the impact of transportation infrastructure construction on enterprise innovation resilience. The results show that firstly, enterprise innovation resilience shows an overall upward trend, and the innovation resilience of enterprises in eastern and central regions is higher than that in non-eastern and non-central regions. Secondly, Benchmark regression results show that transportation infrastructure construction, represented by HSR, is conducive to enterprise innovation resilience and the conclusions are very stable after a series of robustness tests. Thirdly, the promotion effect of transportation infrastructure construction on enterprise innovation resilience varies across different regions, enterprises, and HSR networks. (1) At the regional level, the promotion effect is more obvious in eastern regions, central cities, and non-central cities within 107 km and 764 km away from the central city. (2) At the enterprise level, compared to state-owned enterprises and non-high-tech industries, transportation infrastructure construction has a greater effect in non-state-owned enterprises and high-tech industries. (3) With the continuous construction of the HSR network, the higher the degree centrality and closeness centrality, the more obvious the role of HSR construction in enhancing enterprise innovation resilience. Fourthly, transportation infrastructure construction will promote enterprise innovation resilience by promoting the gathering of highly educated talents, alleviating enterprises’ financing constraints, and improving enterprises’ total factor productivity. Based on the above conclusions, we put forward the following policy recommendations.

First of all, on the whole, governments at all levels should use a combination of HSR construction and heterogeneous policies to improve enterprise innovation resilience. For cities that have opened HSR, local governments should formulate a talent introduction policy based on the characteristics of local industries, absorb more productive and creative high-quality talents into the enterprise, and fully release the allocation optimization effect and technological progress effect of HSR to improve the level of enterprise innovation resilience. For cities that do not have HSR, local governments should continue to promote and deepen cooperation between cities and improve accessibility by improving transportation infrastructure. At the same time, the central government should accelerate the layout of the “eight horizontal and eight vertical” HSR network, so that these cities that have not opened HSR can narrow the innovation resilience gap with other cities.

Secondly, attention should be paid to the heterogeneous impact of urban HSR on enterprise innovation resilience, so as to narrow the gap between different cities in enterprise innovation resilience. For central cities, eastern regions, non-SOEs, and high-tech industries, the opening of HSR has an obvious promoting effect on the innovation resilience of enterprises along the route. To this end, it is necessary for cities that open HSR to seize the opportunities brought by the opening of HSR, and tap the advantages of local resources; thereby improving enterprise technological innovation capabilities, reinforcing the talent foundation for enterprise sustainable development, and strengthening enterprise ability to adapt, adjust, and innovate to external shocks. China’s deepening of the layout of the HSR network should also focus on the coverage density of the HSR in non-eastern regions, non-central cities, SOEs, and non-high-tech industries, and increase the HSR lines in the above areas as much as possible.

Thirdly, there should be an increase in the accessibility of HSR, thereby enhancing enterprise innovation resilience. Local governments should strive to seize the opportunity of market accessibility brought by the construction of transportation infrastructure, provide a good environment to attract the inflow of capital, technology, and talent, and then provide a guarantee for enterprises to respond to external uncertainties. For example, connecting more HSR cities in terms of breadth, or shortening the transportation distance between cities should accelerate the flow speed and upgrading of production factors in cities along the route, and ensure the silent operation of the innovation entities in the crisis.

The limitations of this paper are mainly reflected in two aspects. Firstly, transportation infrastructure includes many aspects, and HSR is just one representative of them. In this paper, we mainly explored the impact of transportation infrastructure construction on enterprise innovation resilience from the perspective HSR construction, ignoring the economic benefits of other infrastructure construction, and future research could explore how emerging technologies (e.g., 5G, IoT) might interplay with transportation infrastructure to influence innovation resilience. Secondly, this paper mainly analyzes the mechanism of transportation infrastructure construction on enterprise innovation resilience from the perspective of resource basis, including resource acquisition and resource allocation; and future research could explore the mechanisms from other aspects.